As filed with the Securities and Exchange Commission on February 2, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: November 30

Date of reporting period: April 14, 2015 – November 30, 2015

ITEM 1. REPORT TO STOCKHOLDERS.

EXCEED DEFINED SHIELD INDEX FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

Overview

2015 saw two very different market environments – the first half of the year (which actually lasted until August) saw relatively placid markets with both implied and actual volatility remaining low. A frequent topic of discussion among “talking heads” was when the Fed might begin raising rates, and how that might affect the market. As it turns out, initial market stresses would be driven by other factors. In late August, the market was jolted by a quick descent in Chinese markets which resulted in the S&P 500 Index (“S&P 500”) dropping approximately 12% from its highs earlier in the year. Particularly jarring to investors was August 24th, when the market opened down over 6% from the prior day’s close. After a second pull-back in late September, the market proceeded to go on a record run in October, leading to just barely positive 11-month performance for the S&P 500 at 3.01%.

This roller coaster illustrates two themes which speak to the very purpose of the Exceed Defined Shield Index Fund (“Shield Fund”), an index fund which seeks to track the NASDAQ Exceed Structured Protection Index (“EXPROT”) using option strategies to provide controlled exposure to the S&P 500 with tail risk protection (see footnote 1 for a recap of the Shield Fund’s parameters). The first theme is gap risk – the possibility of the market opening up so far below the prior day’s close that investors may miss the opportunity to exit before taking a big hit, or conversely markets opening so far above the prior day’s close that investors may miss the opportunity to enter at a reasonable price. (Note there is reason to believe market opening gaps may become more common – see footnote 2) The second theme is market timing – how many investors, both retail and institutional, got shaken out by the August/September drops and missed the October record run?

There are few ways to mitigate exposure to gap risk – the risk that the price of a particular investment security can change significantly without any market trading taking place - when markets open down, you can’t exit with a small loss (vs. yesterday’s value) as there is no opportunity to sell with a small loss (vs. yesterday’s value), and the same is true regarding purchasing when markets open up. An investment product which may be effective at mitigating gap risk are options. Options provide a contractual level where you can purchase or sell an underlying security regardless of where that security may be trading. For example, if you buy a “put” option on the S&P 500 giving you the right to sell the S&P 500 at 1900, and the S&P 500 declines overnight to 1800, you would save yourself the drop from 1900 to 1800 because you can force a sale at 1900.

The Shield Fund’s goal is to employ downside put options at all times in order to seek to limit downside exposure. These puts are purchased proactively in order to position the Shield Fund for any negative market movement – whether a slow drift down or a large gap. The Shield Fund similarly employs call options at all times to pursue pre-defined upside exposure.

Getting shaken out by the market roller coaster is a classic investor challenge. Investors are generally risk and ambiguity averse, and markets do not play well. Exceed Advisory, LLC’s (“Exceed”) senior management has written several pieces on behavioral finance and investing, which addresses these issues). Fear creeps up when markets decline, and particularly when markets drop materially and/or quickly. Advisors are tasked with coaching and planning ahead of these events, but they, their clients, and their chosen fund managers often show a tendency of leaving the market when they should stay in, and vice versa. The proper use of defensive options can mitigate this tendency by allowing investors to stay in the market, knowing their investment is shielded from catastrophic events. The Shield Fund attempts to provide such protection levels to enable investors to stay the course.

Performance Summary: Market Context

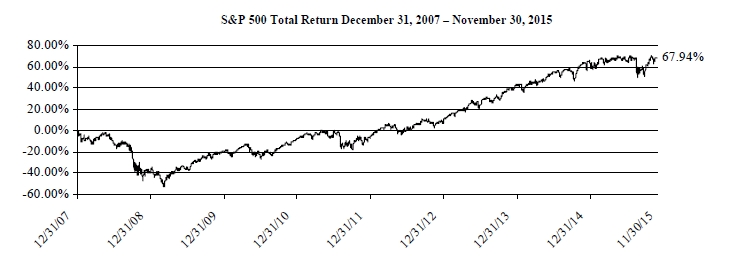

Over the 11-month period ended November 30, 2015, the S&P 500 essentially finished positive (up 3.01%) after experiencing two different points in the year when they were significantly down (-8.07% on August 25th and -7.07% on September 29th). This fairly flat year has been an anomaly in recent times – we just finished a 6-year bull run, which saw the S&P with a cumulative increase of 157.93% from January 1, 2009 to December 31, 2014. Prior to the bull run, a disastrous 2008 saw the S&P decrease 36.79%. Cumulative performance for the S&P during this 7-year time frame was 67.94%.

1

EXCEED DEFINED SHIELD INDEX FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

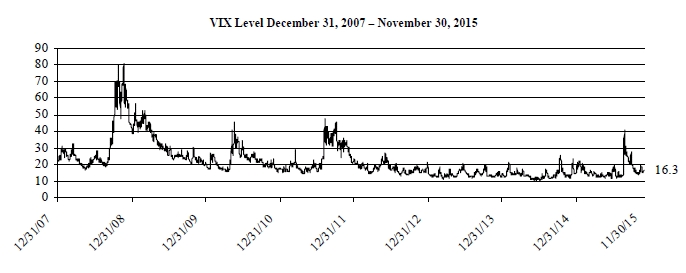

Market volatility as measured by the Chicago Board Options Exchange Volatility Index (the “VIX”) spent the first half of the year at historically low levels, similar to 2013 and 2014. For January to July 2014, the VIX had an average level of 15.01 and never closed above 22.39. However, the VIX reached a multi-year high during the market drop in August, registering 40.74, a level not seen since 2011. Since then, the VIX has not been able to pierce 14 on the downside. The VIX finished the period ended November 30, 2015 at 16.3.

Performance Summary: Shield Fund

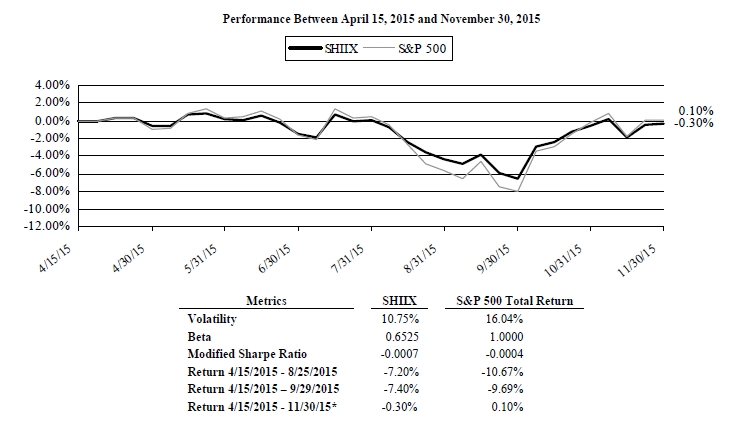

The Exceed Defined Shield Fund (SHIIX) launched on April 14, 2015. For the period April 15, 2015 through November 30, 2015, Institutional shares of the Shield Fund returned -0.30% at net asset value as compared to -0.10% for the S&P 500 Index. Past performance is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares when redeemed may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month end performance, please call (844) 800-5092. Returns showing less than one year are cumulative. Investor Shares redeemed within 30 days of purchase are subject to a 1.00% redemption fee. The Total (Gross) Annual Fund Operating Expenses of Institutional Shares is 3.96%. Exceed has contractually agreed to waive its fee and/or reimburse Fund expenses as necessary to ensure that the Net Annual Fund Operating Expenses of Institutional Shares do not exceed 1.20% through at least April 1, 2017.

Volatility for the Shield Fund for the period April 15, 2015 through November 30, 2015, was 10.75%, as compared to 16.04% for the S&P 500.

2

EXCEED DEFINED SHIELD INDEX FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

Past performance is no guarantee of future results.

*Fiscal year end.

Understanding the Shield Fund’s Performance in 2015

The Shield Fund seeks to generate returns by purchasing call spreads on the S&P 500, which are funded by both writing put spreads as well as the interest income earned from a credit portfolio. The Shield Fund seeks to outperform the S&P 500 in down markets, participate in up markets, and provide a hedge to limit losses in extreme markets.

The targeted net effect to the investor is annual exposure to the S&P 500:

| · | Seeks to provide protection from losses below approximately -12.5% |

| · | Not participating in gains above approximately 15% |

Since the S&P 500 stayed within the bounds of +15% and -12.5% over the course of the year, performance of the Shield Fund was fairly similar to performance for the S&P 500 overall. A notable exception was during the nadir of S&P 500 performance: between July 20 and August 25, the S&P 500 return was -11.91%, while the Shield Fund performance was -7.84% over the same time period. This notable outperformance by the Shield Fund was due to the fact that; as the S&P 500 performance declines to points near the approximately -12.5% protection boundary, the exposure of the long downside put becomes more meaningful, reducing downside exposure within the overall portfolio. Once the -12.5% limit is crossed, further exposure for the Shield Fund becomes very limited and eventually approaches zero.

Outlook

The Shield Fund is rules-based for a reason: predicting the markets with any sort of accuracy is a mirage which many pursue and fail, and it is not the business that Exceed is in. Rather, Exceed looks to provide a defined risk/reward exposure in all market environments, be they bull, bear, or something in between. Our value add is managing to a sophisticated index, which calls upon our expertise in options as well as our sub-advisor’s expertise in credit instruments (see footnote 3 for more information on our subadvisor, First Principles Capital Management). The end result is a controlled and relatively

3

EXCEED DEFINED SHIELD INDEX FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

straightforward investment experience for our investors.

With that said, we hear many “talking heads” discuss meaningful potential for both implied and realized volatility to increase, as well as for interest rates to increase, in 2016. These increases can easily disrupt the relatively smooth ride the market has had since 2009, resulting in increased anxiety due to large market swings and ambiguity in regards to the interest rate environment.

Increases in volatility and interest rates are generally positive for the EXPROT, as well as the Shield Fund which follows that index. As volatility and rates increase, the index methodology is designed to provide the opportunity to reach the max 15% upside cap while increasing the Shield Fund’s overall protection level.

Sincerely,

Joseph Halpern

Chief Executive Officer, Exceed Advisory LLC

Footnotes:

| 1. | The Shield Fund seeks to generate returns by purchasing call spreads (the simultaneous purchase and sale of options on equal amounts of underlying shares but with different strike prices, with the strike price difference between the two sets of options being the “spread”) on the S&P 500, which are funded by both writing put spreads as well as the interest income earned from a credit portfolio the fund invests in. |

The targeted net effect to the investor is annual exposure to the S&P 500:

| · | Seeks to provide protection from losses below approximately -12.5% |

| · | Not participating in gains above approximately 15% |

| 2. | There are a number of reasons to believe that market opening gaps may increase in the future. First, the world is increasingly interconnected resulting in international events having a larger effect on our markets. If an event happens outside of trading hours, the result may be a gap. Second, there are an increasing number of trading programs that are reactive to the market. Post August 24th, some blame was placed on risk parity strategies, whereby different asset classes are kept in “parity” regarding risk. As a result, moves can spiral in one way or another as automated trading programs go to work. Third, there is a seeming lack of liquidity in the marketplace. Floor traders, termed Specialists or Designated Market Makers used to be the liquidity providers of last resort with explicit rules regarding updating bid-ask and market spread. Those rules have been materially relaxed over the last decade. The major banks, due to regulation after 2008, also have less impetus to provide liquidity in size. |

| 3. | First Principles Capital Management, LLC (“FPCM”) provides fixed income investment management services for financial institutions, endowments and foundations, corporations, family offices and trusts, and individuals. As of 12/31/2015, FPCM managed approximately $10.1 billion in customized separately managed accounts and commingled funds. FPCM was acquired by AIG in 2015. |

Important Information and Risk Disclosure:

Effective October 5, 2015, the Shield Fund changed its name from “Exceed Structured Shield Index Strategy Fund” to “Exceed Defined Shield Index Fund”.

4

EXCEED DEFINED SHIELD INDEX FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

An investment in the Shield Fund is subject to risk, including the possible loss of principal. The Shield Fund may enter into financial instruments or transactions with counterparty risk. A counterparty may become bankrupt or otherwise fail to perform its obligations due to financial difficulties, jeopardizing the value of the Shield Fund’s investment. Derivative instruments, including options, may entail investment exposures that are greater than their cost would suggest, meaning that a small investment in a derivative could risk a large potential impact on the performance of the Shield Fund. Gains or losses from positions in hedging instruments, such as options, may be much greater than the instrument’s original cost. If a security or derivative is linked to the performance of an index, it may be subject to the risks associated with changes in that index. The Shield Fund may not be able to dispose of restricted, thinly traded and/or illiquid securities promptly or at reasonable prices. This may result in a loss to the Shield Fund. Performance of a non-diversified fund, which invests in fewer securities at any given time than a diversified fund, may be more affected by a decline or default by a single security than a diversified portfolio.

Options risk exists because the price of an option, which is a function of interest rates, volatility, dividends, the exercise price, stock price and other market factors, may change rapidly over time. The Shield Fund could experience a loss if securities underlying the options do not perform as anticipated. There may be an imperfect correlation between the prices of options and movements in the price of the securities, stock indexes or exchange traded funds hedged or used for cover which may cause a given hedge not to achieve its objective. Passive management risk exists as the Shield Fund is not “actively” managed. Therefore, the Shield Fund would not necessarily sell a security if the security’s issuer was in financial trouble or defaulted, or whose credit rating was downgraded, unless that security is removed from the relevant index. The Shield Fund is newly created and does not have a full calendar year performance record. There can be no guarantee that the investment objective will be met.

The Shield Fund does not attempt to, and should not be expected to, reflect the return of the S&P 500 though the value of shares may be influenced by multiple factors including, but not limited to, the return, volatility and/or dividend rate of the S&P 500.

The put options used in the Shield Fund’s strategy do not protect against declines between 0% and 12.5% and investors will bear all such losses. Further, while the EXPROT (and, thus the Shield Fund) seeks to limit losses to 12.5% on an annualized basis, there is no guarantee that it will do so. The level of the upside cap (approximately 15%) will be affected by the timing of options purchases, sales or expirations, volatility and interest rates, among other factors. A put is an option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying asset or index at a set price within a specific time. A call is an option contract giving the owner the right, but not the obligation, to buy a specified amount of an underlying security at a specified price within a specified time.

The EXPROT is designed to provide investment returns that are correlated with, but less volatile than, those of the S&P 500 and to allow an investment tracking the EXPROT to mitigate losses when the S&P 500 declines in exchange for accepting a limit on gains when the S&P 500 increases. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The total return of the S&P 500 includes the reinvestment of dividends and income. One cannot invest directly in an index.

The views in this report were those of the Shield Fund managers as of November 30, 2015 and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the Shield Fund and do not constitute investment advice. This letter may contain discussions about certain investments both held and not held in the portfolio. All current and future holdings are subject to risk and to change.

5

EXCEED DEFINED SHIELD INDEX FUNDPERFORMANCE CHART AND ANALYSIS (Unaudited)

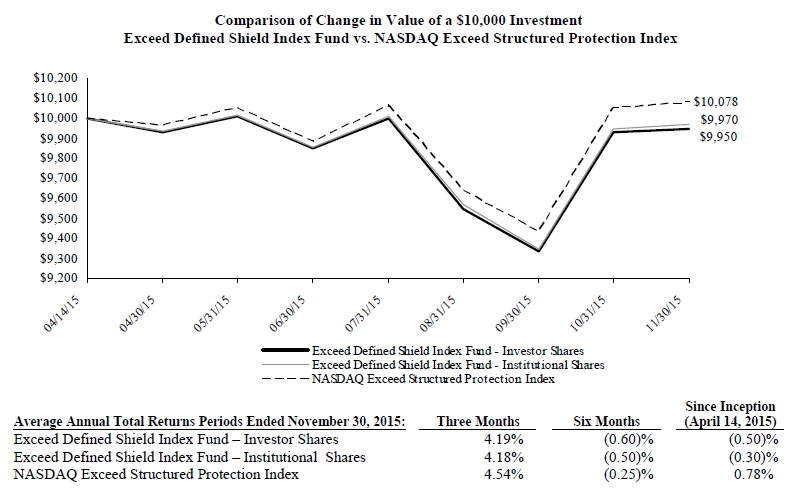

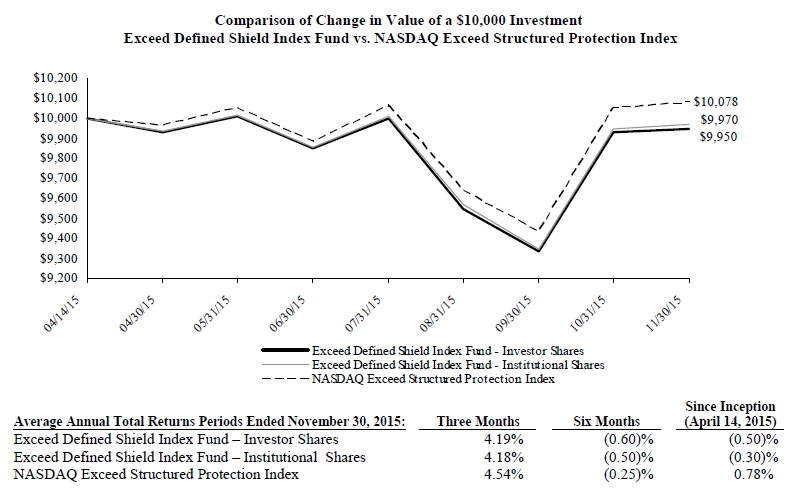

The following chart reflects the change in the value of a hypothetical $10,000 investment in Investor Shares and Institutional Shares, including reinvested dividends and distributions, in Exceed Defined Shield Index Fund (the “Fund”) compared with the performance of the benchmark, NASDAQ Exceed Structured Protection Index (EXPROT) (“EXPROT Index”), since inception. The total return of the EXPROT Index includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the EXPROT Index does not include expenses. The Fund is professionally managed while the EXPROT Index is unmanaged and is not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Investor Shares and Institutional Shares are 4.21% and 3.96%, respectively. However, the Fund's advisor has agreed to contractually waive its fees and/or reimburse expenses such that total operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.45% and 1.20% for Investor Shares and Institutional Shares, respectively through at least April 1, 2017. The Advisor may be reimbursed by the Fund for fees waived and expenses reimbursed by the Advisor pursuant to the expense cap if such payment is made within three years of the fee waiver or expense reimbursement and does not cause the Net Annual Fund Operating Expenses of a class to exceed the expense cap in place at the time the fees were waived. Shares redeemed or exchanged within 30 days of purchase will be charged a 1.00% redemption fee. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6

EXCEED DEFINED SHIELD INDEX FUNDSCHEDULE OF INVESTMENTS

AFA

| Shares | | Security Description | | Value |

Investment Companies (a) - 83.1% |

| | 30,598 | | iShares 1-3 Year Credit Bond ETF | $ | 3,214,320 |

| | 134,685 | | SPDR Barclays Short Term Corporate Bond ETF | | 4,117,320 |

Total Investment Companies (Cost $7,347,570) | | 7,331,640 |

| Money Market Fund - 14.3% |

| | 1,260,428 | | Invesco STIC Prime Portfolio, Institutional Class, 0.08% (b) (Cost $1,260,428) | 1,260,428 |

| Contracts | | Security Description | | | Strike Price | | Exp. Date | | Value | |

| Purchased Options - 7.3% |

| Call Options Purchased - 5.0% |

| | 66 | | SPDR S&P 500 ETF | $ | 202.00 | 02/16 | 65,637 |

| | 39 | | SPDR S&P 500 ETF | | 201.00 | 02/16 | 41,749 |

| | 9 | | SPDR S&P 500 ETF | | 210.00 | 03/16 | 5,126 |

| | 23 | | SPDR S&P 500 ETF | | 205.00 | 03/16 | 20,378 |

| | 18 | | SPDR S&P 500 ETF | | 213.00 | 06/16 | 12,924 |

| | 20 | | SPDR S&P 500 ETF | | 212.00 | 06/16 | 15,440 |

| | 21 | | SPDR S&P 500 ETF | | 210.00 | 06/16 | 17,924 |

| | 53 | | SPDR S&P 500 ETF | | 205.00 | 06/16 | 61,427 |

| | 33 | | SPDR S&P 500 ETF | | 215.00 | 09/16 | 26,614 |

| | 34 | | SPDR S&P 500 ETF | | 210.00 | 09/16 | 36,346 |

| | 95 | | SPDR S&P 500 ETF | | 210.00 | 12/16 | 119,795 |

| | 13 | | SPDR S&P 500 ETF | | 205.00 | 12/16 | 20,215 |

Total Call Options Purchased (Premiums Paid $464,560) | 443,575 |

| Put Options Purchased - 2.3% |

| | 45 | | SPDR S&P 500 ETF | 177.00 | 02/16 | 3,960 |

| | 60 | | SPDR S&P 500 ETF | 176.00 | 02/16 | 4,980 |

| | 4 | | SPDR S&P 500 ETF | 185.00 | 03/16 | 914 |

| | 29 | | SPDR S&P 500 ETF | 180.00 | 03/16 | 5,162 |

| | 11 | | SPDR S&P 500 ETF | 193.00 | 06/16 | 7,277 |

| | 27 | | SPDR S&P 500 ETF | 192.00 | 06/16 | 17,226 |

| | 9 | | SPDR S&P 500 ETF | 185.00 | 06/16 | 4,190 |

| | 64 | | SPDR S&P 500 ETF | 180.00 | 06/16 | 24,704 |

| | 4 | | SPDR S&P 500 ETF | 190.00 | 09/16 | 3,156 |

| | 63 | | SPDR S&P 500 ETF | 185.00 | 09/16 | 42,556 |

| | 11 | | SPDR S&P 500 ETF | 185.00 | 12/16 | 9,542 |

| | 97 | | SPDR S&P 500 ETF | 183.00 | 12/16 | 79,346 |

Total Put Options Purchased (Premiums Paid $250,505) | 203,013 |

Total Purchased Options (Premiums Paid $715,065) | 646,588 |

Total Investments in Securities - 104.7% (Cost $9,323,063)* | 9,238,656 |

| | |

| Contracts | | Security Description | | | Strike Price | | Exp. Date | | Value | |

Written Options - (5.7)% | |

Call Options Written - (0.3)% | |

| (87) | | SPDR S&P 500 ETF | $ | 229.00 | | 02/16 | | | (609) |

| (18) | | SPDR S&P 500 ETF | | | 228.00 | | 02/16 | | | (153) |

| (2) | | SPDR S&P 500 ETF | | | 235.00 | | 03/16 | | | (12) |

| (30) | | SPDR S&P 500 ETF | | | 230.00 | | 03/16 | | | (390) |

| (33) | | SPDR S&P 500 ETF | | | 245.00 | | 06/16 | | | (380) |

| (12) | | SPDR S&P 500 ETF | | | 240.00 | | 06/16 | | | (252) |

| (5) | | SPDR S&P 500 ETF | | | 240.00 | | 06/16 | | | (122) |

| (62) | | SPDR S&P 500 ETF | | | 235.00 | | 06/16 | | | (2,976) |

| (58) | | SPDR S&P 500 ETF | | | 245.00 | | 09/16 | | | (2,204) |

| (9) | | SPDR S&P 500 ETF | | | 240.00 | | 09/16 | | | (675) |

| Contracts | | Security Description | | | Strike Price | | Exp. Date | | Value | |

| (97) | | SPDR S&P 500 ETF | $ | 240.00 | | 12/16 | $ | | (16,150) |

| (11) | | SPDR S&P 500 ETF | | | 235.00 | | 12/16 | | | (2,893) |

Total Call Options Written (Premiums Received $(50,148)) | | | | | | | | (26,816) |

Put Options Written - (5.4)% | |

| (66) | | SPDR S&P 500 ETF | | | 202.00 | | 02/16 | | | (26,928) |

| (39) | | SPDR S&P 500 ETF | | | 201.00 | | 02/16 | | | (14,937) |

| (9) | | SPDR S&P 500 ETF | | | 210.00 | | 03/16 | | | (7,515) |

| (23) | | SPDR S&P 500 ETF | | | 205.00 | | 03/16 | | | (14,743) |

| (18) | | SPDR S&P 500 ETF | | | 213.00 | | 06/16 | | | (24,435) |

| (20) | | SPDR S&P 500 ETF | | | 212.00 | | 06/16 | | | (26,160) |

| (21) | | SPDR S&P 500 ETF | | | 210.00 | | 06/16 | | | (24,864) |

| (53) | | SPDR S&P 500 ETF | | | 205.00 | | 06/16 | | | (51,887) |

| (33) | | SPDR S&P 500 ETF | | | 215.00 | | 09/16 | | | (55,787) |

| (34) | | SPDR S&P 500 ETF | | | 210.00 | | 09/16 | | | (49,419) |

| (95) | | SPDR S&P 500 ETF | | | 210.00 | | 12/16 | | | (161,310) |

| (13) | | SPDR S&P 500 ETF | | | 205.00 | | 12/16 | | | (19,383) |

Total Put Options Written (Premiums Received $(567,351)) | | | | | | | | (477,368) |

Total Written Options - (5.7)% (Premiums Received $(617,499))* | | | | | | $ | | (504,184) |

| Other Assets & Liabilities, Net - 1.0% | | | | | | | | 91,433 |

| Net Assets – 100.0% | | | | | | $ | | 8,825,905 |

| | | | | | | | | |

| (a) | All or a portion of these securities are pledged as collateral for written options. |

| (b) | Variable rate security. Rate presented is as of November 30, 2015. |

| * | Cost for federal income tax purposes is $8,711,653 and net unrealized appreciation consists of: |

| Gross Unrealized Appreciation | | $ | 152,295 | |

| Gross Unrealized Depreciation | | | (129,476 | ) |

| Net Unrealized Appreciation | | $ | 22,819 | |

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2015.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| Valuation Inputs | | Investments in Securities | | Other Financial Instruments** |

| Level 1 - Quoted Prices | | $ | 7,658,911 | | | $ | (209,187 | ) |

| Level 2 - Other Significant Observable Inputs | | | 1,579,745 | | | | (294,997 | ) |

| Level 3 - Significant Unobservable Inputs | | | - | | | | - | |

| Total | | $ | 9,238,656 | | | $ | (504,184 | ) |

**Other Financial Instruments are derivative instruments not reflected in the Total Investments In Securities, such as written options, which are valued at their market value at period end.

See Notes to Financial Statements. 7

EXCEED DEFINED SHIELD INDEX FUNDSCHEDULE OF INVESTMENTS

The Level 1 value displayed in the Investments in Securities column of this table includes Investment Companies and Purchased Options. The Level 2 value displayed in the Investments In Securities column of this table includes a Money Market Fund and Purchased Options. Refer to this Schedule of Investments for a further breakout of each security by type.

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the period ended November 30, 2015.

AFA

| PORTFOLIO HOLDINGS | | | |

| % of Net Assets | | | |

| Investment Companies | | | 83.1 | % |

| Money Market Fund | | | 14.3 | % |

| Purchased Options | | | 7.3 | % |

| Written Options | | | (5.7 | )% |

| Other Assets & Liabilities | | | 1.0 | % |

| | | | 100.0 | % |

AFA

See Notes to Financial Statements. 8

EXCEED DEFINED SHIELD INDEX FUNDSTATEMENT OF ASSETS AND LIABILITIES

| | | | | | | |

| ASSETS | | | | |

| | Total investments, at value (Cost $9,323,063) | | $ | 9,238,656 | |

| | Deposits with brokers | | | 50,550 | |

| | Receivables: | | | | |

| | | Fund shares sold | | | 6,696 | |

| | | Dividends | | | 83 | |

| | From investment advisor | | | 101,079 | |

| | Prepaid expenses | | | 9,937 | |

| | Deferred offering costs | | | 34,089 | |

| Total Assets | | | 9,441,090 | |

| | | | | | | |

| LIABILITIES | | | | |

| | Call options written, at value (Premiums received $50,148) | | | 26,816 | |

| | Put options written, at value (Premiums received $567,351) | | | 477,368 | |

| | Payables: | | | | |

| | | Investment securities purchased | | | 36,654 | |

| | | Fund shares redeemed | | | 40,460 | |

| | Accrued Liabilities: | | | | |

| | | Fund services fees | | | 9,649 | |

| | | Other expenses | | | 24,238 | |

| Total Liabilities | | | 615,185 | |

| | | | | | | |

| NET ASSETS | | $ | 8,825,905 | |

| | | | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| | Paid-in capital | | $ | 8,790,600 | |

| | Accumulated net realized gain | | | 6,397 | |

| | Net unrealized appreciation | | | 28,908 | |

| NET ASSETS | | $ | 8,825,905 | |

| | | | | | | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | | |

| | Investor Shares | | | 272,552 | |

| | Institutional Shares | | | 613,341 | |

| | | | | | | |

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE* | | | | |

| | Investor Shares (based on net assets of $2,711,526) | | $ | 9.95 | |

| | Institutional Shares (based on net assets of $6,114,379) | | $ | 9.97 | |

| * | Shares redeemed or exchanged within 30 days of purchase are charged a 1.00% redemption fee. | | | | |

See Notes to Financial Statements. 9

EXCEED DEFINED SHIELD INDEX FUNDSTATEMENT OF OPERATIONS

PERIOD ENDED NOVEMBER 30, 2015*

| | | | | | | | |

| INVESTMENT INCOME | | | | | |

| | Dividend income | | $ | 42,023 | | |

| Total Investment Income | | | 42,023 | | |

| Advisor | | | | | |

| EXPENSES | | | | | |

| | Investment advisor fees | | | 32,406 | | |

| | Fund services fees | | | 115,512 | | |

| | Transfer agent fees: | | | | | |

| | Investor Shares | | | 196 | | |

| | Institutional Shares | | | 2,484 | | |

| | Distribution fees: | | | | | |

| | Investor Shares | | | 2,686 | | |

| | Custodian fees | | | 9,750 | | |

| | Registration fees: | | | | | |

| | Investor Shares | | | 8,653 | | |

| | Institutional Shares | | | 11,359 | | |

| | Professional fees | | | 46,431 | | |

| | Trustees' fees and expenses | | | 211 | | |

| | Offering costs: | | | | | |

| | Investor Shares | | | 23,054 | | |

| | Institutional Shares | | | 45,125 | | |

| | Interest expense | | | 962 | 0 | |

| | Miscellaneous expenses | | | 28,914 | | |

| Total Expenses | | | 327,743 | | |

| | Fees waived and expenses reimbursed | | | (280,887 | ) | |

| Net Expenses | | | 46,856 | | |

| | | | | | | | |

| NET INVESTMENT LOSS | | | (4,833 | ) | |

| | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | | |

| | Net realized gain (loss) on: | | | | | |

| | Investments | | | (108,118 | ) | |

| | Written options | | | 119,348 | | |

| | Net realized gain | | | 11,230 | | |

| | Net change in unrealized appreciation (depreciation) on: | | | | | |

| | Investments | | | (84,407 | ) | |

| | Written options | | | 113,315 | | |

| | Net change in unrealized appreciation (depreciation) | | | 28,908 | | |

| NET REALIZED AND UNREALIZED GAIN | | | 40,138 | | |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 35,305 | | |

| | | | | | | | |

| * | Commencement of operations was April 14, 2015. | | | | | |

See Notes to Financial Statements. 10

EXCEED DEFINED SHIELD INDEX FUNDSTATEMENT OF CHANGES IN NET ASSETS

| | | November 30, 2015 | # | | 42338 | # | # |

| | | | | April 14, 2015* Through November 30, 2015 | |

| OPERATIONS | | | | | |

| | Net investment loss | | $ | (4,833 | ) | |

| | Net realized gain | | | 11,230 | | |

| | Net change in unrealized appreciation (depreciation) | | | 28,908 | | |

| Increase in Net Assets Resulting from Operations | | | 35,305 | | |

| | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | |

| | Sale of shares: | | | | | |

| | | Investor Shares | | | 2,851,397 | | |

| | | Institutional Shares | | | 6,655,459 | | |

| | Redemption of shares: | | | | | |

| | 1 | Investor Shares | | | (157,187 | ) | |

| | 2 | Institutional Shares | | | (560,344 | ) | |

| | Redemption fees | | | 1,275 | | |

| Increase in Net Assets from Capital Share Transactions | | | 8,790,600 | | |

| Increase in Net Assets | | | 8,825,905 | | |

| | | | | | | | |

| NET ASSETS | | | | | |

| | Beginning of Period | | | - | | |

| | End of Period | | $ | 8,825,905 | | |

| | | | | | | | |

| SHARE TRANSACTIONS | | | | | |

| | Sale of shares: | | | | | |

| | | Investor Shares | | | 288,388 | | |

| | | Institutional Shares | | | 670,256 | | |

| | Redemption of shares: | | | | | |

| | | Investor Shares | | | (15,836 | ) | |

| | | Institutional Shares | | | (56,915 | ) | |

| Increase in Shares | | | 885,893 | | |

| | | | | | | | |

| * | Commencement of operations. | | | | | |

See Notes to Financial Statements. 11

EXCEED DEFINED SHIELD INDEX FUNDFINANCIAL HIGHLIGHTS

| These financial highlights reflect selected data for a share outstanding throughout the period. |

| | | April 14, 2015 (a) through November 30, 2015 | |

| INVESTOR SHARES | | | | |

| NET ASSET VALUE, Beginning of Period | $ | 10.00 | | |

| INVESTMENT OPERATIONS | | | | |

| Net investment loss (b) | | (0.02 | ) | |

| Net realized and unrealized gain (loss) | | (0.03 | )(c) |

| Total from Investment Operations | | (0.05 | ) | |

| REDEMPTION FEES (b) | | — | (d) |

| NET ASSET VALUE, End of Period | $ | 9.95 | | |

| TOTAL RETURN | | (0.50 | )%(e) |

| RATIOS/SUPPLEMENTARY DATA | | | | |

| Net Assets at End of Period (000's omitted) | $2,712 | | |

| Ratios to Average Net Assets: | | | | |

| Net investment loss | | (0.30 | )%(f) |

| Net expenses | | 1.48 | %(f) |

| Interest expense | | 0.03 | %(f) |

| Net expenses without interest expense | | 1.45 | %(f) |

| Gross expenses (g) | | 10.32 | %(f) |

| PORTFOLIO TURNOVER RATE | | 41 | %(e) |

| INSTITUTIONAL SHARES | | | | |

| NET ASSET VALUE, Beginning of Period | $ | 10.00 | | |

| INVESTMENT OPERATIONS | | | | |

| Net investment loss (b) | | — | (d) |

| Net realized and unrealized gain (loss) | | (0.03 | )(c) |

| Total from Investment Operations | | (0.03 | ) | |

| REDEMPTION FEES (b) | | — | (d) |

| NET ASSET VALUE, End of Period | $ | 9.97 | | |

| TOTAL RETURN | | (0.30 | )%(e) |

| RATIOS/SUPPLEMENTARY DATA | | | | |

| Net Assets at End of Period (000's omitted) | $6,114 | | |

| Ratios to Average Net Assets: | | | | |

| Net investment loss | | (0.06 | )%(f) |

| Net expenses | | 1.23 | %(f) |

| Interest expense | | 0.03 | %(f) |

| Net expenses without interest expense | | 1.20 | %(f) |

| Gross expenses (g) | | 8.59 | %(f) |

| PORTFOLIO TURNOVER RATE | | 41 | %(e) |

| | | | | | |

| | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Per share amount does not reflect the actual net realized and unrealized gain/(loss) for the period due to the timing of Fund share sales and the amount of per share realized and unrealized gains and losses at such time. |

| (d) | Less than $0.01 per share. |

| (e) | Not annualized. |

| (f) | Annualized. |

| (g) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements. 12

EXCEED DEFINED SHIELD INDEX FUNDNOTES TO FINANCIAL STATEMENTS

Note 1. Organization

The Exceed Defined Shield Index Fund (the “Fund”) is a non-diversified portfolio of Forum Funds (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940 (the “Act”), as amended. Under its Trust Instrument, the Trust is authorized to issue an unlimited number of the Fund’s shares of beneficial interest without par value. The Fund currently offers two classes of shares: Investor Shares and Institutional Shares. Each class commenced operations on April 14, 2015. The Fund’s investment objective is to track, before fees and expenses, the performance of the NASDAQ Exceed Structured Protection Index.

Note 2. Summary of Significant Accounting Policies

These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the fiscal period. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation – Exchange-traded securities and over-the-counter securities are valued using the last quoted trade or official closing price, provided by independent pricing services as of the close of trading on the market or exchange for which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and ask price provided by independent pricing services. Non-exchange-traded securities for which quotations are available are valued using the last quoted sales price, or in the absence of a sale, at the mean of the last bid and ask prices provided by independent pricing services. Exchange-traded options for which the last quoted sale price is outside the closing bid and ask price, will be valued at the mean of the closing bid and ask price. Shares of open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in 60 days or less may be valued at amortized cost.

The Fund values its investments at fair value pursuant to procedures adopted by the Trust's Board of Trustees (the "Board") if (1) market quotations are insufficient or not readily available or (2) the advisor believes that the values available are unreliable. The Trust’s Valuation Committee, as defined in the Fund’s registration statement, performs certain functions as they relate to the administration and oversight of the Fund’s valuation procedures. Under these procedures, the Valuation Committee convenes on a regular and ad-hoc basis to review such investments and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

The Valuation Committee may work with the advisor to provide valuation inputs. In determining fair valuations, inputs may include market-based analytics which may consider related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant investment information. Advisor inputs may include an income-based approach in which the anticipated future cash flows of the investment are discounted in determining fair value. Discounts may also be applied based on the nature or duration of any restrictions on the disposition of the investments. The Valuation Committee performs regular reviews of valuation methodologies, key inputs and assumptions, disposition analysis and market activity.

Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different Net Asset Value ("NAV") than a NAV determined by using market quotes.

The Fund has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets and liabilities

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

13

EXCEED DEFINED SHIELD INDEX FUNDNOTES TO FINANCIAL STATEMENTS

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The aggregate value by input level, as of November 30, 2015, for the Fund’s investments is included at the end of the Fund’s Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted using the effective interest method. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Purchased Options – When a fund purchases an option, an amount equal to the premium paid by the fund is recorded as an investment and is subsequently adjusted to the current value of the option purchased. If an option expires on the stipulated expiration date or if the fund enters into a closing sale transaction, a gain or loss is realized. If a call option is exercised, the cost of the security acquired is increased by the premium paid for the call. If a put option is exercised, a gain or loss is realized from the sale of the underlying security, and the proceeds from such sale are decreased by the premium originally paid. Purchased options are non-income producing securities.

The values of each individual purchased option outstanding as of November 30, 2015, are disclosed in the Fund’s Schedule of Investments.

Written Options – When a fund writes an option, an amount equal to the premium received by the fund is recorded as a liability and is subsequently adjusted to the current value of the option written. Premiums received from writing options that expire unexercised are treated by the fund on the expiration date as realized gain from written options. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether the fund has realized a gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the fund. The fund, as writer of an option, bears the market risk of an unfavorable change in the price of the security underlying the written option. Written options are non-income producing securities.

The values of each individual written option outstanding as of November 30, 2015, are disclosed in the Fund’s Schedule of Investments.

| | | Calls | | Puts |

| | | Number of | | | | | | Number of | | | | |

| | | Contracts | | | Premiums | | Contracts | | Premiums |

| Options Outstanding, April 14, 2015 | | - | | | $ | - | | | - | | | $ | - | |

| Options written | | (784 | ) | | | (150,341 | ) | | (789 | ) | | | (727,265 | ) |

| Options terminated in closing transactions | | 197 | | | 65,479 | | 185 | | | 130,482 | |

| Options exercised | | - | | | | - | | | - | | | | - | |

| Options expired | | 163 | | | 34,714 | | 180 | | | 29,432 | |

| Options Outstanding, November 30, 2015 | | (424 | ) | | $ | (50,148 | ) | | (424 | ) | | $ | (567,351 | ) |

| | | | | | | | | | | | | | | |

Distributions to Shareholders – Distributions to shareholders of net investment income and net capital gains, if any, are declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund. On December 15, 2015, the Fund paid a distribution of $0.01175 per share in short term capital gains related to the fiscal period ended November 30, 2015.

Federal Taxes – The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code and to distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all of its net investment income and capital gains, if any, the Fund will not be subject to a federal excise tax. Therefore, no federal income or excise tax

14

EXCEED DEFINED SHIELD INDEX FUNDNOTES TO FINANCIAL STATEMENTS

provision is required. The Fund will file a U.S. federal income and excise tax return as required. A fund’s federal income tax returns are subject to examination by the Internal Revenue Service for a period of three fiscal years after they are filed. As of November 30, 2015, there are no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

The Fund’s class-specific expenses are charged to the operations of that class of shares. Income and expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on the class’ respective net assets to the total net assets of the Fund.

Redemption Fees – A shareholder who redeems or exchanges shares within 30 days of purchase will incur a redemption fee of 1.00% of the current net asset value of shares redeemed or exchanged, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

Commitments and Contingencies – In the normal course of business, the Fund enters into contracts that provide general indemnifications by the Fund to the counterparty to the contract. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Offering Costs – Offering costs for the Fund of $102,268 consisted of fees related to the mailing and printing of the initial prospectus, certain startup legal costs, and initial registration filings. Such costs are amortized over a twelve-month period beginning with the commencement of operations of the Fund.

Note 3. Fees and Expenses

Investment Advisor – Exceed Advisory LLC (the “Advisor”) is the investment advisor to the Fund. Pursuant to an investment advisory agreement, the Advisor receives an advisory fee from the Fund at an annual rate of 0.90% of the Fund’s average daily net assets.

The sub-advisory fee, calculated as a percentage of the Fund’s average daily net assets, is paid by the Advisor.

Distribution – Foreside Fund Services, LLC serves as the Fund’s distributor (the “Distributor”). The Distributor is not affiliated with the Advisor or Atlantic Fund Administration, LLC (d/b/a Atlantic Fund Services) (“Atlantic”) or their affiliates. The Fund has adopted a Distribution Plan (the “Plan”) for Investor Shares in accordance with Rule 12b-1 of the Act. Under the Plan, the Fund pays the Distributor and/or any other entity as authorized by the Board a fee of up to 0.25% of the average daily net assets of Investor Shares.

Other Service Providers – Atlantic provides fund accounting, fund administration, compliance and transfer agency services to the Fund. Atlantic also provides certain shareholder report production, and EDGAR conversion and filing services. Atlantic provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer, and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each independent Trustee an annual retainer fee of $50,000 for service to the Trust ($66,000 for the Chairman). The Vice Chairman and Audit Committee Chairman receive an additional $6,000 annually. The Trustees and Chairman may receive additional fees for special Board meetings. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with his duties as a Trustee, including travel and related expenses incurred in attending Board meetings. The amount of Trustees’ fees attributable to the Fund is disclosed in the Statement of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from the Fund.

15

EXCEED DEFINED SHIELD INDEX FUNDNOTES TO FINANCIAL STATEMENTS

Note 4. Expense Reimbursements and Fees Waived

The Advisor has contractually agreed to waive a portion of its fees and reimburse expenses to limit total annual fund operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, and extraordinary expenses) of Investor Shares to 1.45%, and Institutional Shares to 1.20%, through at least April 1, 2017. Other fund service providers have voluntarily agreed to waive a portion of their fees. The contractual waivers may be changed or eliminated at any time with the consent of the Board and voluntary fee waivers and expense reimbursements may be reduced or eliminated at any time. For the period April 14, 2015, through November 30, 2015, fees waived and expenses reimbursed were as follows:

| Investment Advisor Fees Waived | | | Investment Advisory Expenses Reimbursed | | | Other Waivers | | | Total Fees Waived and Expenses Reimbursed | |

| $ | 32,406 | | | $ | 203,176 | | | $ | 45,305 | | | $ | 280,887 | |

The Fund may repay the Advisor for fees waived and expenses reimbursed pursuant to the expense cap if such payment is made within three years of the fees waived or expense reimbursement and the resulting expenses do not exceed the expense caps. As of November 30, 2015, the amount of waived fees and reimbursed expenses subject to recapture by the Advisor are as follows:

| | | Amount of Fees Waived and/or Expenses Reimbursed | | Expiration Date to Recoup Fees Waived and/or Expenses Reimbursed | | Fees Recouped |

| November 30, 2015 | | $ | 235,582 | | November 30, 2018 | | $ | - |

Note 5. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments during the period ended November 30, 2015, were $9,916,167 and $2,135,905, respectively.

Note 6. Summary of Derivative Activity

The volume of open derivative positions may vary on a daily basis as the Fund transacts derivative contracts in order to achieve the exposure desired by the Advisor. The notional value of activity for the period ended November 30, 2015, for any derivative type that was held during the period is as follows:

| Purchased Options | | $ | 1,542,267 | |

| Written Options | | | (877,605 | ) |

The Fund’s use of derivatives during the period ended November 30, 2015, was limited to written options and purchased options.

Following is a summary of the effect of derivatives on the Statement of Assets and Liabilities as of November 30, 2015:

| Location: | | EquityContracts | |

| Asset derivatives: | | | | | |

| Total investments, at value | | $ | 646,588 | | |

| Total asset derivatives | | $ | 646,588 | | |

| | | | | | |

| Liability derivatives: | | | | | |

| Call options written, at value | | $ | (26,816 | ) | |

| Put options written, at value | | | (477,368 | ) | |

| Total liability derivatives | | $ | (504,184 | ) | |

16

EXCEED DEFINED SHIELD INDEX FUNDNOTES TO FINANCIAL STATEMENTS

Realized and unrealized gains and losses on derivatives contracts during the period ended November 30, 2015, by the Fund are recorded in the following locations on the Statement of Operations:

| Location: | | Equity Contracts | |

| Net realized gain (loss) on: | | | | | |

| Investments | | $ | (105,273 | ) | |

| Written options | | | 119,348 | | |

| Total net realized gain | | $ | 14,075 | | |

| | | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | | |

| Investments | | $ | (68,477 | ) | |

| Written options | | | 113,315 | | |

| Total net change in unrealized appreciation (depreciation) | | $ | 44,838 | | |

Asset (Liability) amounts shown in the table below represent amounts for derivative related investments at November 30, 2015. These amounts may be collateralized by cash or financial instruments.

| | | Gross Asset (Liability) as Presented in the Statement of Assets and Liabilities | | Financial Instruments (Received) Pledged** | | Cash Collateral (Received) Pledged** | | Net Amount |

| Assets: | | | | | | | | | | | | | | | | |

| Over-the-counter derivatives* | | $ | 646,588 | | | $ | - | | | $ | - | | | $ | 646,588 | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Over-the-counter derivatives* | | | (504,184 | ) | | | 504,184 | | | | - | | | | - | |

| * | Over-the-counter derivatives may consist of purchased and written options contracts. The amounts disclosed above represent the exposure to one or more counterparties. For further detail on individual derivative contracts and the corresponding unrealized appreciation (depreciation), see the Schedule of Investments. |

| ** | The actual financial instruments and cash collateral (received) pledged may be in excess of the amounts shown in the table. The table only reflects collateral amounts up to the amount of the financial instrument disclosed on the Statement of Assets and Liabilities. |

Note 7. Federal Income Tax

As of November 30, 2015, distributable earnings on a tax basis were as follows:

| Undistributed Ordinary Income | | $ | 12,486 | |

| Unrealized Appreciation | | | 22,819 | |

| Total | | $ | 35,305 | |

On the Statement of Assets and Liabilities, as a result of permanent book to tax differences, certain amounts have been reclassified for the period ended November 30, 2015. The following reclassification was the result of net operating losses offsetting short-term gains and has no impact on the net assets of the Fund.

| Accumulated Net Investment Loss | | $ | 4,833 | |

| Accumulated Net Realized Gain | | | (4,833 | ) |

Note 8. Recent Accounting Pronouncements

In May 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update 2015-07 (“ASU 2015-07”) eliminating the requirement for investments measured at net asset value to be categorized within the fair value hierarchy under GAAP and requiring the disclosure of sufficient information to reconcile the fair value of the remaining assets categorized within the fair value hierarchy to the financial statements. ASU 2015-07 is effective for interim and annual reporting periods beginning after December 15, 2015. Management has reviewed the requirements and believes the adoption of ASU 2015-07 will not have a material impact on the financial statements.

17

EXCEED DEFINED SHIELD INDEX FUNDNOTES TO FINANCIAL STATEMENTS

Note 9. Subsequent Events

Following the date of this report, the NASDAQ Exceed Structured Protection Index was renamed to the NASDAQ Exceed Defined Protection Index.

Subsequent events occurring after the date of this report through the date these financial statements were issued have been evaluated for potential impact and, except as set forth above, there are no material subsequent events requiring financial statement disclosure.

18

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Forum Funds

and the Shareholders of Exceed Defined Shield Index Fund

We have audited the accompanying statement of assets and liabilities of the Exceed Defined Shield Index Fund, a series of shares of beneficial interest in the Forum Funds (the “Fund”), including the schedule of investments, as of November 30, 2015, and the related statements of operations and changes in net assets and the financial highlights for the period April 14, 2015 (commencement of operations) to November 30, 2015. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2015 by correspondence with the custodian and brokers, or by other appropriate auditing procedures where replies from brokers were not received.. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Exceed Defined Shield Index Fund as of November 30, 2015, and the results of its operations, the changes in its net assets and its financial highlights for the period April 14, 2015 to November 30, 2015, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

January 27, 2016

19

EXCEED DEFINED SHIELD INDEX FUNDADDITIONAL INFORMATION (Unaudited)

Investment Advisory Agreement Approval

At the Board meeting held on September 11, 2015, the Board, including the Independent Trustees, considered the approval of an interim investment subadvisory agreement (“Interim Agreement”) and a new investment subadvisory agreement (“New Agreement” and together with the Interim Agreement, the “Subadvisory Agreements”) between the Exceed Advisory, LLC (“Advisor”) and First Principles Capital Management, LLC (“Subadvisor”) with respect to the investment subadvisory services to be provided to Fund. The Subadvisory Agreements were considered in connection with the anticipated termination of the existing investment subadvisory agreement between the Advisor and Subadvisor due to a transaction as a result of which the Subadvisor would undergo a change in control. In preparation for its deliberations, the Board reviewed information furnished by the Subadvisor with respect to the investment subadvisory services to be provided to a portion of the Fund’s portfolio (the “Managed Portion”). The Board also discussed the materials with Fund Counsel and, as necessary, with the Trust’s administrator, Atlantic Fund Services. During its deliberations, the Board received an oral presentation from representatives of the Advisor and Subadvisor, and was assisted by the advice of Trustee Counsel.

At the meeting, the Board reviewed, among other matters: (1) the nature, extent and quality of the services expected to be provided to the Fund by the Subadvisor, including information on the investment performance of similar accounts managed; (2) the costs of the services provided and projected profitability of the Subadvisor from the relationship with the Fund; (3) the subadvisory fee, advisory fee and total expense ratio of the Fund; and (4) other benefits expected to be received by the Subadvisor from its relationship with the Fund. In particular, the Board focused on the following factors and made the following conclusions in considering approval of the Subadvisory Agreements:

Nature, Extent and Quality of Services

Based on written materials received, a presentation from senior representatives of the Advisor and Subadvisor, a discussion with the Subadvisor about the personnel, operations and financial condition of the Subadvisor, and a discussion with the Trust CCO about the compliance functions of the Subadvisor, the Board considered the quality of services expected to be provided by the Subadvisor under the Subadvisory Agreements with respect to the Managed Portion. In this regard, the Board considered information regarding the experience, qualifications and professional background of the portfolio managers and other personnel at the Subadvisor who would have principal responsibility for the Fund, as well as the investment philosophy and decision-making process of such professionals and the capability and integrity of the Subadvisor’s senior management and staff. The Board also considered that there had been no material changes to the investment subadvisory services provided to the Fund since the approval of the original subadvisory agreement, and that there had been no material changes to the existing personnel at the Subadvisor servicing the Fund. The Board further considered the Advisor’s representation that the portfolio managers of the Subadvisor who were responsible for the Managed Portion would continue in that role following the change in control transaction.

The Board considered also the adequacy of the Subadvisor’s resources including whether staffing levels remained adequate to provide high-quality investment advisory services. Based on the presentation and the materials provided by the Advisor and Subadvisor in connection with the Board’s consideration of the approval of the Subadvisory Agreements, the Board concluded that, overall, it was satisfied with the nature, extent and quality of services to be provided to the Fund under the Subadvisory Agreements.

Performance

In connection with a presentation by the Subadvisor regarding its approach to managing the Fund, the Board reviewed the historical performance of the portfolio managers of the Subadvisor in managing accounts in a style substantially similar to that of the Fund. The Board also gave weight to the Advisor’s recommendation regarding the Subadvisor and the Advisor’s representation that the reappointment of the Subadvisor would positively contribute to the Advisor’s successful execution of the Fund’s overall strategy. Based on the foregoing, the Board determined that the Fund and its shareholders could expect to benefit from the Subadvisor’s management under the Subadvisory Agreements.

20

EXCEED DEFINED SHIELD INDEX FUNDADDITIONAL INFORMATION (Unaudited)

Compensation

The Board reviewed the Subadvisor’s proposed compensation for providing subadvisory services to the Fund under the Subadvisory Agreements and noted that the total advisory fee paid by the Fund would not change because the subadvisory fees are paid by the Advisor and not the fund. Further, the Board noted that the subadvisory fee paid by the Advisor to the Subadvisor would be no greater than the compensation paid under the original subadvisory agreement. Under these circumstances, the Board concluded that the compensation paid to the Subadvisor was not a material factor in determining whether to approve the Subadvisory Agreements.

Cost of Services and Profitability

The Board noted that the Advisor, and not the Fund, was responsible for paying the subadvisory fees due under the Subadvisory Agreements. The Board thus did not consider information regarding the costs of services provided or profits realized by the Subadvisor from its relationship with the Fund, noting instead the arms-length nature of the relationship between the Advisor and the Subadvisor with respect to the negotiation of the subadvisory fee rate on behalf of the Fund. Under these circumstances, the Board concluded that the Subadvisor’s profitability was not a material factor in determining whether or not to approve the Subadvisory Agreements.

Economies of Scale

The Board considered whether the Fund would benefit from any economies of scale with respect to the Subadvisory Agreements. The Board determined that because the Advisor, and not the Fund, pays the subadvisory fee, shareholders would not benefit from any economies of scale in the form of breakpoints in the subadvisory fee rate. Based on the foregoing information, the Board concluded that economies of scale were not a material factor in approving the Subadvisory Agreements.

Other Benefits

The Board noted the Subadvisor’s representation that it would not receive significant ancillary benefits as a result of its relationship with the Fund. As a result, other benefits accrued by the Subadvisor were not a material factor in approving the Subadvisory Agreements.

Conclusion

The Board did not identify any single factor as being of paramount importance, and different Trustees may have given different weight to different factors; however, in light of the fact that the Advisor identifies subadvisors whose strategies it seeks to combine to achieve the Fund’s investment objective, the Board gave significant weight to the Advisor’s recommendation that the Subadvisor be appointed as the subadvisor to the Fund and to the Advisor’s representation that the appointment of the Subadvisor would positively contribute to the Advisor’s successful execution of the overall strategy of the Fund. The Board reviewed a memorandum from Fund Counsel discussing the legal standards applicable to its consideration of the Subadvisory Agreements. Based on its review, including consideration of each of the factors referenced above, the Board determined, in the exercise of its reasonable business judgment, that the subadvisory arrangements, as outlined in the Subadvisory Agreements, were fair and reasonable in light of the services performed or to be performed, expenses incurred or to be incurred and such other matters as the Board considered relevant.

Shareholder Proxy Vote

The Board of Trustees of the Trust called a special meeting (the “Special Meeting”) of the shareholders of the Fund, a series of the Trust, to approve a new investment subadvisory agreement with respect to the Fund (the “New Agreement”) between the Advisor and the Subadvisor. The Special Meeting was held on November 24, 2015.

As reported at the Special Meeting, 368,358.678 shares of the outstanding 712,898.198 shares were voted, accounting for 51.671% of the Fund’s issued and outstanding shares as of the record date of September 28, 2015 (“Record Date”). Of that amount, 366,513.678 (51.412%) of the Fund’s total outstanding shares were voted in favor of the proposal to approve the New Agreement. In addition, 311.000 (0.044%) of the Fund’s total outstanding shares voted against the proposal and 1,534.000 shares (0.215%) of the Fund’s total outstanding shares voted to abstain. As a result, the proposal was approved by a majority of the Fund’s total outstanding shares and the New Agreement was approved.

21

EXCEED DEFINED SHIELD INDEX FUNDADDITIONAL INFORMATION (Unaudited)

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (844) 800-5092 and on the U.S. Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov. The Fund’s proxy voting record for the period from the Fund’s commencement of operations to June 30 is available, without charge and upon request, by calling (844) 800-5092 and on the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. These filings are available, without charge and upon request on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, 12b-1 fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from June 1, 2015, through November 30, 2015.

Actual Expenses – The first line under each share class of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes – The second line under each share class of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | | Ending | | Expenses | | Annualized |

| | Account Value | | Account Value | | Paid During | | Expense |

| | June 1, 2015 | | November 30, 2015 | | Period* | | Ratio* |

| Investor Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 994.01 | | $ | 7.40 | | 1.48 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,017.65 | | $ | 7.49 | | 1.48 | % |

| Institutional Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 995.01 | | $ | 6.15 | | 1.23 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,018.90 | | $ | 6.23 | | 1.23 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 to reflect the half-year period. |

22

EXCEED DEFINED SHIELD INDEX FUNDADDITIONAL INFORMATION (Unaudited)

Trustees and Officers of the Trust

The Board is responsible for oversight of the management of the Trust’s business affairs and of the exercise of all the Trust’s powers except those reserved for the shareholders. The following table provides information about each Trustee and certain officers of the Trust. Each Trustee and officer holds office until the person resigns, is removed, or is replaced. Unless otherwise noted, the persons have held their principal occupations for more than five years. The address for all Trustees and officers is Three Canal Plaza, Suite 600, Portland, Maine 04101. Mr. Keffer is considered an Interested Trustee due to his affiliation with Atlantic. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge and upon request, by calling (844) 800-5092.

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Series of Fund Complex¹ Overseen by Trustee | Other Directorships Held by Trustee |

Independent Trustees | | | | | |

J. Michael Parish Born: 1943 | Chairman of the Board; Trustee; Chairman, Nominating Committee and Qualified Legal Compliance Committee | Since 1989 (Chairman since 2004) | Retired since 2003; formerly, Partner, Wolf, Block, Schorr and Solis-Cohen, LLP (law firm) 2002-2003; Partner, Thelen Reid & Priest LLP (law firm) 1995-2002. | 26 | None |

Costas Azariadis Born: 1943 | Trustee | Since 1989 | Professor of Economics, Washington University since 2006. | 26 | None |

James C. Cheng Born: 1942 | Trustee; Chairman, Audit Committee | Since 1989 | President, Technology Marketing Associates (marketing company for small- and medium-sized businesses in New England) since 1991. | 26 | None |

David Tucker Born: 1958 | Trustee; Vice Chairman | Since 2011 (Vice Chairman since 2015) | Director, Blue Sky Experience since 2008; Senior Vice President & General Counsel, American Century Companies 1998-2008. | 37 | Trustee, Forum Funds II and Forum ETF Trust |

Interested Trustee | | | | | |

John Y. Keffer2 Born: 1942 | Trustee; Vice Chairman | Since 1989 | Chairman, Atlantic since 2008; President, Forum Investment Advisors, LLC since 2011; President, Forum Foundation (a charitable organization) since 2005; President, Forum Trust, LLC (a non-depository trust company chartered in the State of Maine) since 1997. | 37 | Director, Wintergreen Fund, Inc.; Trustee, Forum Funds II, Forum ETF Trust and ALTMFX Trust |

Officers | | | | | |

Jessica Chase Born: 1970 | President; Principal Executive Officer | Since 2015 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Karen Shaw Born: 1972 | Treasurer; Principal Financial Officer | Since 2008 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Zachary Tackett Born: 1988 | Vice President; Secretary; Anti-Money Laundering Compliance Officer | Since 2014 | Associate Counsel, Atlantic since 2014; Intern Associate, Coakley & Hyde, PLLC, 2010-2013. | N/A | N/A |

Michael J. McKeen Born: 1971 | Vice President | Since 2009 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Timothy Bowden Born: 1969 | Vice President | Since 2009 | Manager, Atlantic since 2008. | N/A | N/A |

Geoffrey Ney Born: 1975 | Vice President | Since 2013 | Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013. | N/A | N/A |

Todd Proulx Born: 1978 | Vice President | Since 2013 | Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013. | N/A | N/A |

1The Fund Complex includes the Trust, Forum Funds II and Forum ETF Trust and is overseen by different Boards of Trustees. 2Atlantic is a subsidiary of Forum Holdings Corp. I, a Delaware corporation that is wholly owned by Mr. Keffer. |

23

ITEM 2. CODE OF ETHICS.

| (a) | As of the end of the period covered by this report, Forum Funds (the “Registrant”) has adopted a code of ethics, which applies to its Principal Executive Officer and Principal Financial Officer (the “Code of Ethics”). |

| (c) | There have been no amendments to the Registrant’s Code of Ethics during the period covered by this report. |

| (d) | There have been no waivers to the Registrant’s Code of Ethics during the period covered by this report. |

(f) (1) A copy of the Code of Ethics is being filed under Item 12(a) hereto.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The Board of Trustees has determined that no member of the Audit Committee is an "audit committee financial expert" as that term is defined under applicable regulatory guidelines.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees - The aggregate fees billed for each of the last two fiscal years (the “Reporting Periods”) for professional services rendered by the Registrant’s principal accountant for the audit of the Registrant’s annual financial statements, or services that are normally provided by the principal accountant in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $0 in 2014 and $11,200 in 2015.

(b) Audit-Related Fees – The aggregate fees billed in the Reporting Periods for assurance and related services rendered by the principal accountant that were reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item 4 were $0 in 2014 and $0 in 2015.

(c) Tax Fees - The aggregate fees billed in the Reporting Periods for professional services rendered by the principal accountant to the Registrant for tax compliance, tax advice and tax planning were $0 in 2014 and $3,000 in 2015. These services consisted of review or preparation of U.S. federal, state, local and excise tax returns.

(d) All Other Fees - The aggregate fees billed in the Reporting Periods for products and services provided by the principal accountant to the Registrant, other than the services reported in paragraphs (a) through (c) of this Item, were $0 in 2014 and $0 in 2015.