As filed with the Securities and Exchange Commission on June 4, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: March 31

Date of reporting period: April 1, 2017 – March 31, 2018

ITEM 1. REPORT TO STOCKHOLDERS.

ANNUAL REPORT

MARCH 31, 2018

The views in this report were those of Absolute Investment Advisers LLC (“AIA” and “Absolute”), the investment adviser to the Absolute Strategies Fund, Absolute Capital Opportunities Fund and Absolute Convertible Arbitrage Fund (each a “Fund” and collectively the “Funds”) as of March 31, 2018, and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and do not constitute investment advice. None of the information presented should be construed as an offer to sell or recommendation of any security mentioned herein.

The Absolute Strategies Fund utilizes multi-manager strategies with multiple sub-advisers, they may be exposed to varying forms of risk. These risks include, but are not limited to, general market risk, multi-manager risk, focused portfolio risk, small company risk, foreign risk, interest rate risk, credit risk, prepayment risk, IPO risk, liquidity risk, high turnover risk, leverage risk, derivatives risk and cash and cash equivalents holdings risk. For a complete description of the Funds’ principal investment risks, please refer to each Fund’s prospectus.

Beta is a measure of an asset’s sensitivity to broad market moves, as measured for instance by the S&P 500® Index. A fund with a realized beta of 0.5 with respect to the S&P 500® Index infers that about 50% of the fund’s returns were explained by the performance of the index (the rest of the performance was independent of the index). The HFR Indices are equally weighted performance indexes, utilized by numerous hedge fund managers as a benchmark for their own hedge funds. One cannot invest directly in an index.

Absolute Strategies Fund, Absolute Funds, and Absolute Investment Advisers are registered service marks. Other marks referred to herein are the trademarks, service marks or registered trademarks of their respective owners.

ABSOLUTE STRATEGIES FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2018

Dear Shareholder,

We are pleased to present the Annual Report for the Absolute Strategies Fund (the “Fund”) for the year ended March 31, 2018.

Capital preservation/downside protection through unique risk and return positioning that helps diversify traditional portfolios are important themes of the Fund. Achieving these over the course of an investment cycle often means constructing a portfolio of investments that looks very different from other investment funds, including alternative ones. It requires being defensive at times when others are overly aggressive. It requires looking for value in areas of the market that are over-looked or unloved by other investors. Achieving these goals also means that the Fund’s performance is likely to go through periods of under-performance as well as out-performance versus other strategies. We believe that over time the uniqueness of the strategy creates significant non-correlation and diversification characteristics. The markets provided favorable conditions for the Fund during the volatile months of February and March of 2018. For those two months the Fund (Institutional Shares) returned 3.46% vs. -3.38% and -6.13% for the HRFX Global Hedge Fund Index and the S&P 500 Index respectively. For much of the remainder of the Fund’s fiscal year, however, extreme low levels of volatility hindered our ability to generate performance and the Fund (Institutional Shares) returned -4.45% over the 12 months ended March 31, 2018. By comparison, the HRFX Global Hedge Fund Index returned 3.20% and the S&P 500 Index returned 13.99%.

We believe that recent dynamics have resulted in a market that is narrow and highly inefficient. Since the introduction of asset purchases by central banks (also known as quantitative easing), financial assets have become increasingly expensive and highly correlated; price-discovery and volatility are artificially suppressed. We believe that constructing a portfolio of various industry-favored hedge fund strategies will not achieve the risk-adjusted results we desire. Traditional assets classes and most hedge fund strategies have become a correlated beta trade that acts in unison with the overall equity markets. We believe there is little, if any, potential for a diversified portfolio of typical hedge fund strategies to produce anything other than the returns of a traditional portfolio. In effect, the entire hedge fund universe has become as crowded as the ETF universe, and both are taking nearly the same risks that also require abnormally low levels of volatility. A repricing of financial markets caused by artificially suppressed interest rates would very likely result in large losses across equities, fixed income and many alternative investments. To produce alpha within such an environment would require an investment strategy to do something very different including, at times, to take the other side. While this approach has been frustrating over the past few years, we believe the eventual unwind of correlated asset risks creates an opportunity to set up a portfolio that can generate significant outperformance. We believe markets are setting up for an extensive long/short opportunity that takes advantage of confusion and continuous volatility. In fact, it may have already begun. Extended periods of extreme low levels of volatility are an historical anomaly. We believe the long-awaited return to normal levels of market volatility will provide a much improved environment for the Fund’s performance while creating challenges for funds geared toward passive market beta.

During the year, our discipline and process was preserved and the Fund maintained a balance of long and short exposures. We continue to allocate capital based on opportunities to be long and short. The challenge has come from a market cycle that has been skewed by central bank intrusions. In this regard, as prudent investors who view markets through a lens of capital at risk, we must take into account what we believe are extreme levels of high valuations, the proliferation of momentum/trend investing, and artificially suppressed volatility when constructing the Fund’s portfolio. All of these have been coiled against us in both time and price. From a long/short perspective, we tend to favor underpriced or out of favor long ideas vs a short portfolio of overpriced or crowded areas. Many of these positions are simply relative-value relationships that revert to the mean as assets begin to seek value once areas of perfection eventually turn out to be illusory. Volatility is used to help monetize these relationships over time. Our performance has been directly impacted by a lack of volatility, and an extreme turn of the market cycle that has punished out-of-favor longs while rewarding crowded, over-valued indexing. This has created a large spread between our long and short positions that has pushed our overall portfolio to opportunity levels we have not seen since 2009. We are now currently positioned for extensive mean reversion opportunities that have been stretched over several

ABSOLUTE STRATEGIES FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2018

years and have recently reached historic levels. Details of these opportunities along with recent performance are outlined below.

Value vs Growth. One major side effect from all of the central bank activity and momentum chasing is that value investing is currently stuck in one of the worst stretches on record. Value stocks have significantly lagged growth stocks over the past year, compounding a gap that has persisted since the end of the financial crisis almost ten years ago. Growth has outperformed value by 14% over the past 12 months and by approximately 70% since 2007. This has caused the bulk of our poor returns this year. However, the last time value underperformed growth to this degree was in 1999. During the next three years, value outperformed growth by more than 100%. We believe this is a significant market-neutral, risk/reward opportunity. Approximately 40-45% of our portfolio is positioned for this mean reversion idea of long value, short growth/indices.

Short Equity. Market indices are trading at valuation levels only seen near 1929 and 2000 peaks. The median price/ sales for the S&P 500 is over 2.5x, or nearly 50% higher than the prior peak in 2007. The Russell 2000 Index trades for a P/E near 100. The Nasdaq Composite P/E is over 50. While having a net short equity allocation has had a negative impact on Fund performance, we believe many securities in various global markets and sectors are at risk of significant repricing, some upwards of 50% or more. Approximately 20% of the portfolio is currently positioned net short equity securities.

Convertible Arbitrage. Convertible arbitrage is one of few areas of the financial markets that is not flooded with excess capital and has provided modest returns. Hedged convertible securities currently offer attractive return and risk characteristics relative to most other areas of the bond market. This strategy also offers a relatively steady return profile to diversify away from other areas of our portfolio. Approximately 20% of the portfolio is allocated to convertible arbitrage.

Energy. Energy is another area that is seeing significant divergence as compared to the overall market. The energy sector is close to its lowest weighting in the S&P 500 on record of only 4-5%; this was last seen near the 2000 bubble peak. Oil services companies recently traded near 2009 financial crisis lows. Relative underperformance of energy year to date versus the S&P 500 is -25%, and this has contributed to negative performance. However, following the last low weighting in the S&P in 2000, energy companies outperformed the S&P by over 50% during the next three years and over 150% during the next six years. Approximately 10-12% of our portfolio is positioned long energy vs short market indices.

Commodities. Other commodities are also at an extreme low vs overall equity market indices. The CRB Commodity Index has underperformed the S&P 500 by 40% over the last few years, a deficit nearly identical to that during the late 1990s. The ratio of commodities/S&P 500 is also on par with the early 1970s, a period that preceded significant commodity inflation. Both time periods saw commodities outperform the S&P 500 by over 100% during the following three years. A more modest 5-7% of our portfolio is targeted for long commodity-sensitive securities vs market indices.

Volatility. Up until very recently, volatility has never been more compressed than it is today. The US equity market recently set a record for the number of days without a 3% dip in prices. Market players across financial markets are now using volatility as an input for risk taking. This is most certainly the case with risk parity strategies, but institutions and retail investors are also using short volatility trading to generate income or excess yield. This is very similar to the idea of selling credit default swaps (selling insurance) during the housing bubble which then led to the financial crisis. It is estimated that risk parity, quants and Commodity Trading Adviser (CTA) strategies amount to $1 trillion in implicit short volatility strategies. Additionally, tens of billions are being bet directly on short volatility through ETFs. Volatility has never been more suppressed and, as seen in recent months, can return quickly. We believe our overall portfolio is set up to benefit from an increase in volatility and should be able to capitalize on large spikes in market movements both long and short.

In summary, many of the Fund’s long securities don’t have a big story or theme attached to them and may not be a major part of an index. The Fund’s short securities may be expensive and/or exhibiting low growth with significant economic

ABSOLUTE STRATEGIES FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2018

sensitivity. Equity index securities are also used on the short side to create relative-value arbitrage opportunities versus Fund long securities. Sub-adviser strategies based on long equity exposure were the Fund’s top performers over the last year with the exception of energy related securities, which provided negative performance. Convertible arbitrage also performed well during the period. This is notable because the strategy typically exhibits low sensitivity to equity markets. Strategies that included short exposure were the largest detractors. Shorting has been particularly difficult as few things seemed to have gone down in price regardless of how poorly a company or group of companies performed. The Fund’s short exposure remains flexible and has varied over the past year as large spikes in volatility have offered opportunities to monetize short term gains. During periods of low volatility the Fund has maintained a large amount of short exposure due to historically high valuations and weak fundamentals (see below). The timing is uncertain but we believe the payoff in short opportunities could be significant. Long periods of low volatility and high valuations have historically given way to periods of high volatility, leading to market valuations reverting to the mean.

We believe markets move in cycles over time. Occasionally cycles reach extremes, which has actually been a common occurrence over the past 20 years. Additionally, some markets may be nearing the end of an extreme bull cycle while others may be ending an extreme bear cycle. It is very difficult to know the timing of when a market cycle turns, and patience can be especially tested when both long and short positions are fighting the last trend.

In late 2008, it seemed as if the market would never stop going down. Price-insensitive sellers dominated the market. Yet, we removed the bulk of our shorts and increased our net long position to the largest ever at the time. We were early, but the opportunity was very large. Today, we see the inverse of that cycle. The market seems as if it will never go down and price-insensitive buyers are dominating the market. Again, we may be early but the opportunity warrants our positioning.

Comment on recent market volatility and positioning:

In a prior commentary, we stressed that much of the distortions in asset prices were being leveraged further by large momentum players betting on short volatility, which could contribute a spark for an eventual market turbulence and we were well positioned for this turbulence in early 2018:

“We have witnessed historic financial market intrusions by central banks that has created extreme distortions in asset prices and caused volatility to collapse. A lack of volatility has led risk-parity strategies, quant funds and momentum players to bet further on these extremes. We are even witnessing a massive bet on “short volatility” which is essentially a replay of the “selling of insurance” gravy train that led up to the financial crisis. Is this a permanent new paradigm? Is it really different this time? Those questions have been repeated throughout history and the predictions have always proved incorrect.”

We continue to remind investors of what we see as extreme market risks in our dialogue, and it should, at a minimum, serve as a warning for what could eventually materialize into a much larger problem. It is hard to tell exactly where we go from here but we feel certain that downside risks are as great as anything we can analyze historically. At this time, we are maintaining our positioning. Should markets experience a large drawdown, there may be a short term opportunity to reduce some of our net short exposure. Option positions have also been utilized opportunistically for

ABSOLUTE STRATEGIES FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2018

both upside and downside tail risk. In effect, the Fund may capitalize on either significant spikes up or down in market indices.

The volatility shock of February 2018 should serve as a glimpse of what we believe is likely to come in the future. Just as the sub-prime and CDS crisis, it may not happen all at once. Sometimes a slower progression with large intermediate swings in asset prices can hurt just the same as an undiversified portfolio erodes over time.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

ABSOLUTE STRATEGIES FUNDPERFORMANCE CHART AND ANALYSIS (Unaudited)

MARCH 31, 2018

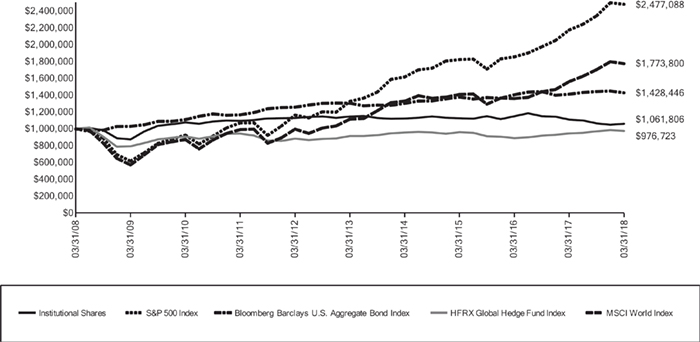

The following charts reflect the change in the value of a hypothetical $1,000,000 investment in Institutional Shares and a $250,000 investment in R Shares, including reinvested dividends and distributions, in Absolute Strategies Fund (the “Fund”) compared with the performance of the benchmarks, S&P 500 Index (“S&P 500”), Bloomberg Barclays U.S. Aggregate Bond Index (“Barclays Index”), the HFRX Global Hedge Fund Index (“HFRX”) and the MSCI World Index (“MSCI World”), over the past ten fiscal years. The S&P 500 is a broad-based, measurement of the U.S. stock market based on the performance of 500 widely held large capitalization common stocks. The Barclays Index is a broad based measurement of the U.S. dollar-denominated, investment-grade, fixed-rate, SEC registered taxable bond market. The HFRX is a broad-based measurement of the performance of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The MSCI World measures the performance of a diverse range of 24 developed countries’ stock markets including the United States and Canada, and countries in Europe, the Middle East; Asia and the Pacific. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $1,000,000 Investment

Absolute Strategies Fund - Institutional Shares vs. S&P 500 Index, Bloomberg Barclays U.S. Aggregate Bond Index,

HFRX Global Hedge Fund Index and MSCI World Index

| | Average Annual Total Returns Periods Ended March 31, 2018 | One Year | Five Year | Ten Year | |

| | Absolute Strategies Fund - Institutional Shares | -4.45% | -1.54% | 0.60% | |

| | S&P 500 Index | 13.99% | 13.31% | 9.49% | |

| | Bloomberg Barclays U.S. Aggregate Bond Index | 1.20% | 1.82% | 3.63% | |

| | HFRX Global Hedge Fund Index | 3.20% | 1.29% | -0.24% | |

| | MSCI World Index | 13.59% | 9.70% | 5.90% | |

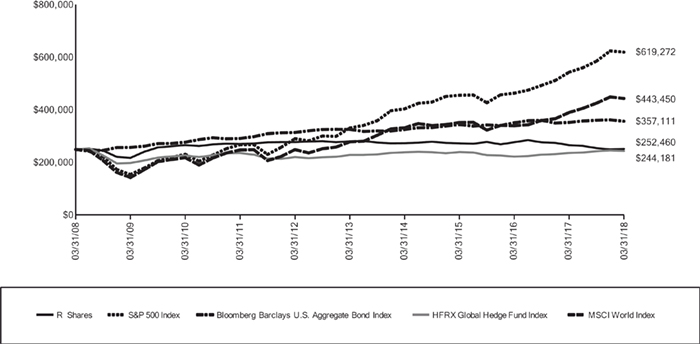

ABSOLUTE STRATEGIES FUNDPERFORMANCE CHART AND ANALYSIS (Unaudited)

MARCH 31, 2018

Comparison of Change in Value of a $250,000 Investment

Absolute Strategies Fund - R Shares vs. S&P 500 Index, Bloomberg Barclays U.S. Aggregate Bond Index,

HFRX Global Hedge Fund Index and MSCI World Index

| | Average Annual Total Returns Periods Ended March 31, 2018 | One Year | Five Year | Ten Year | |

| | Absolute Strategies Fund - R Shares | -5.30% | -2.12% | 0.10% | |

| | S&P 500 Index | 13.99% | 13.31% | 9.49% | |

| | Bloomberg Barclays U.S. Aggregate Bond Index | 1.20% | 1.82% | 3.63% | |

| | HFRX Global Hedge Fund Index | 3.20% | 1.29% | -0.24% | |

| | MSCI World Index | 13.59% | 9.70% | 5.90% | |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratios (gross) for Institutional Shares and R Shares are 2.94% and 3.56%, respectively. Excluding the effect of expenses attributable to dividends and interest on short sales and acquired fund fees and expenses, the Fund's total annual operating expense ratios for Institutional Shares and R Shares would be 1.94% and 2.51%, respectively. However, the Fund’s adviser has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, dividend and interest expenses on short sales, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.99% and 2.24% for Institutional Shares and R Shares, respectively, through August 1, 2019 (the “Expense Cap”). The adviser may be reimbursed by the Fund for fees waived and expenses reimbursed by the adviser pursuant to the Expense Cap if such payment is made within three years of the fee waiver or expense reimbursement, and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap, or (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. To the extent that the Fund invests in another fund sponsored by the Fund's adviser or its affiliates, the adviser may waive certain fees and expenses. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (888) 992-2765.

ABSOLUTE CAPITAL OPPORTUNITIES FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2018

Dear Shareholder,

For the year ending March 31, 2018, the Absolute Capital Opportunities Fund (the “Fund”) returned 14.13%. By comparison, the HFRX Equity Hedge Index returned 8.35%.

Over the past year, the Fund has been positioned defensively but has also owned broad market equity options, mostly on the S&P 500 Index, that should benefit from increased stock market volatility regardless of direction. Much of the Fund’s return was generated from these options in the first quarter of 2018 when market volatility returned. The options also detracted from performance in parts of 2017 when volatility was muted.

Kovitz Investment Group Partners, LLC (“Kovitz”), the Fund’s subadviser, utilizes a core equity long-short portfolio with opportunistic tail hedging, both upside and downside. This hedging allowed the Fund to generate a solid return, despite maintaining a value bias on the long side, in an environment where value under-performed growth by a significant margin (as measured by Russell 3000 Value and Growth Indices).

The Fund continues to be positioned much as it was in the first quarter of 2018. The Fund continues to be well hedged toward the downside. Kovitz believes the level of defensive positioning is prudent given the heightened starting valuations, low but potentially rising interest rates, and the potential (not probable) for geopolitical missteps. It is worth noting that the Fund does own a portfolio of competitively advantaged businesses generally trading at 12-16 times Kovitz’ estimation of normalized earnings, and call options designed to benefit from continued upside volatility or a generally rising stock market.

We believe the Fund is positioned well for a variety of market environments, particularly if equity markets remain volatile.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

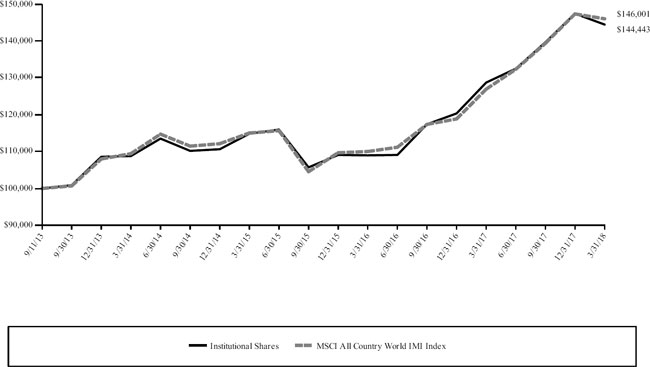

ABSOLUTE CAPITAL OPPORTUNITIES FUNDPERFORMANCE CHART AND ANALYSIS (Unaudited)

MARCH 31, 2018

The following chart reflects the change in the value of a hypothetical $1,000,000 investment, including reinvested dividends and distributions, in the Absolute Capital Opportunities Fund (the “Fund”) compared with the performance of the benchmarks, the HFRX Equity Hedge Index (“HFRX Equity”) and the S&P 500 Index (“S&P 500”), since inception. HFRX Equity measures the performance of strategies that maintain positions both long and short in primarily equity and equity derivative securities. The S&P 500 is a broad-based measurement of the U.S. stock market based on the performance of 500 widely held large capitalization common stocks. The total return of the indices includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $1,000,000 Investment

Absolute Capital Opportunities Fund vs. HFRX Equity Hedge Index

and S&P 500 Index

Average Annual Total Returns Periods Ended March 31, 2018 | One Year | Since Inception 12/30/15 |

| Absolute Capital Opportunities Fund | 14.13% | 10.49% |

| HFRX Equity Hedge Index | 8.35% | 4.82% |

| S&P 500 Index | 13.99% | 13.91% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratio (gross) is 3.51%. Excluding the effect of expenses attributable to dividends and interest on short sales, the Fund's total annual operating expense ratio would be 2.81%. However, the Fund’s adviser has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, dividend and interest expenses on short sales, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.75%, through August 1, 2019 (the “Expense Cap”). The adviser may be reimbursed by the Fund for fees waived and expenses reimbursed by the adviser pursuant to the Expense Cap if such payment is made within three years of the fee waiver or expense reimbursement, and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap, or (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (888) 992-2765.

ABSOLUTE CONVERTIBLE ARBITRAGE FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2018

Dear Shareholder,

For the period ending March 31, 2018, the Absolute Convertible Arbitrage Fund (the “Fund”) returned 5.94%. By comparison, the HFRX Fixed Income Convertible Arbitrage Index returned 4.71%.

The Fund’s subadviser, Mohican Financial Management, LLC (“Mohican”), executes a convertible arbitrage strategy with a particular focus on small and mid-cap issues. Even though convertible bonds are hybrid securities, they are fixed income securities with some exposure to interest rates. Interest rates rose steadily during the period which put downward pressure on valuations.

Performance can be classified as “slow and steady” over the past year. Returns in each month were positive and the Fund exhibited extremely low volatility. Sensitivity to broad equity and fixed income markets has also been very low.

Mohican believes that the convertible asset class today looks healthy in terms of credit quality, short durations, security profile and liquidity. There were no convertible defaults in the first quarter following a year where the default rate was less than 1%. The average duration for the asset class is about 3 years, which we believe provides investors significant protection against interest rate fluctuations. Despite the recent drawdowns in equities, stock prices remain overvalued which means the convertible market continues to offer ample supply of “in-the-money”, heavier hedged, volatility arbitrage opportunities, and we expect liquidity to steadily improve.

Mohican also notes that convertible new issuance in the first quarter of 2018 was strong. 32 deals were priced which annualizes to 128 – well in excess of the 104 deals priced in 2017. Importantly, 30 of the 32 deals were issued by small and mid- cap companies and 31 of the 32 deals were not rated by the rating agencies. Mohican believes non-rated, small and mid-cap convertibles offer a consistent source of inefficiencies and value in the convertibles marketplace where returns can be extracted.

We believe the Fund is positioned for a variety of market environments, particularly if credit markets remain volatile.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

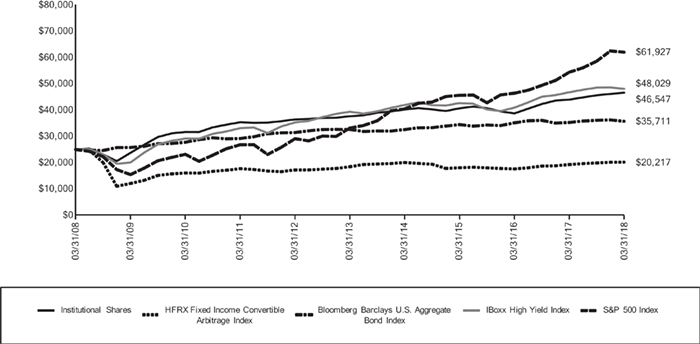

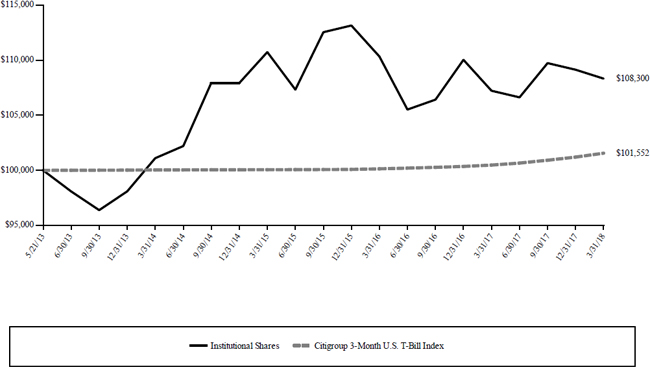

ABSOLUTE CONVERTIBLE ARBITRAGE FUNDPERFORMANCE CHART AND ANALYSIS (Unaudited)

MARCH 31, 2018

The following chart reflects the change in the value of a hypothetical $25,000 investment, including reinvested dividends and distributions, in Absolute Convertible Arbitrage Fund (the “Fund”) compared with the performance of the benchmarks, HFRX Fixed Income Convertible Arbitrage Index ("HFRX Fixed Income"), Bloomberg Barclays U.S. Aggregate Bond Index ('Barclays Index'), IBoxx High Yield Index ("iBoxx Index") and the S&P 500 Index ("S&P 500"), over the past ten fiscal years. The HFRX Fixed Income measures the performance of hedge fund strategies that are predicated on realizing of a spread between related instruments at least one of which is a convertible fixed income instrument. The iBoxx Index consists of liquid USD high yield bonds, selected to provide a balanced representation of the broad USD high yield corporate bond universe. The S&P 500 is a broad-based measurement of the U.S. stock market based on the performance of 500 widely held large capitalization common stocks. The Barclays Index is a broad based measurement of the U.S. dollar-denominated, investment-grade, fixed-rate, SEC registered taxable bond market. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $25,000 Investment

Absolute Convertible Arbitrage Fund vs. HFRX Fixed Income Convertible Arbitrage Index, Bloomberg Barclays U.S. Aggregate Bond Index,

iBoxx High Yield Index and S&P 500 Index

| | Average Annual Total Returns Periods Ended March 31, 2018 | One Year | Five Year | Ten Year | |

| | Absolute Convertible Arbitrage Fund - Institutional Shares | 5.94% | 4.35% | 6.41% | |

| | HFRX Fixed Income Convertible Arbitrage Index | 4.71% | 1.82% | -2.10% | |

| | Bloomberg Barclays U.S. Aggregate Bond Index | 1.20% | 1.82% | 3.63% | |

| | IBoxx High Yield Index | 2.83% | 4.07% | 6.75% | |

| | S&P 500 Index | 13.99% | 13.31% | 9.49% | |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratio (gross) is 2.83%. Excluding the effect of expenses attributable to dividends and interest on short sales, the Fund's total annual operating expense ratio would be 2.58%. However, the Fund’s adviser has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, dividend and interest on short sales, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.60%, through August 1, 2019 (the “Expense Cap”). The adviser may be reimbursed by the Fund for fees waived and expenses reimbursed by the adviser pursuant to the Expense Cap if such payment is made within three years of the fee waiver or expense reimbursement, and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap, or (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the

ABSOLUTE CONVERTIBLE ARBITRAGE FUNDPERFORMANCE CHART AND ANALYSIS (Unaudited)

MARCH 31, 2018

deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (888) 992-2765.

In August 2017, a hedge fund managed by Mohican Financial Management LLC reorganized into the Fund. The Fund’s performance for periods prior to the commencement of operations is that of the hedge fund and is based on calculations that are different from the standardized method of calculations adopted by the SEC. The performance of the hedge fund was calculated net of the hedge fund’s fees and expenses. The performance of the hedge fund is not the performance of the Fund, has not been restated to reflect the fees, estimated expenses and fee waivers and/or expense limitations of the Fund, and is not necessarily indicative of the Fund’s future performance. If the performance of the hedge fund had been restated to reflect the applicable fees and expenses of the Fund, the performance may have been lower. The hedge fund was not registered under the Investment Company Act of 1940 (“1940 Act”) and was not subject to certain investment limitations, diversification requirements and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, which, if applicable, may have adversely affected its performance.

ABSOLUTE STRATEGIES FUND

PORTFOLIO HOLDINGS SUMMARY (Unaudited)

MARCH 31, 2018

| Portfolio Breakdown (% of Net Assets) |

| Long Positions |

| Common Stock | 29.7% |

| Asset Backed Obligations | 0.2% |

| Investment Companies | 38.0% |

| Money Market Fund | 24.3% |

| Purchased Options | 0.4% |

| Short Positions |

| Common Stock | (17.6)% |

| Investment Company | (1.4)% |

Other Assets & Liabilities, Net * | 26.4% |

| | 100.0% |

| * | Consists of deposits with the custodian and/or brokers for securities sold short, cash, foreign currency, prepaid expenses, receivables, payables and accrued liabilities. Deposits with the custodian and/or brokers for securities sold short represent 24.6% of net assets. See Note 2 of the accompanying Notes to Financial Statements. |

| | (% of Equity Holdings) |

| Sector Breakdown | Long | Short |

| Consumer Discretionary | 11.9% | 31.5% |

| Consumer Staples | 10.9% | 13.8% |

| Energy | 32.8% | 0.0% |

| Financial | 12.9% | 23.9% |

| Healthcare | 5.1% | 0.0% |

| Industrial | 8.9% | 19.6% |

| Information Technology | 1.9% | 7.4% |

| Materials | 11.5% | 0.8% |

| Telecommunication Services | 2.1% | 3.0% |

| Utilities | 2.0% | 0.0% |

| | 100.0% | 100.0% |

| See Notes to Financial Statements. | 12 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2018

| Shares | | Security Description | | Value | |

| Long Positions - 92.6% | |

| Common Stock - 29.7% | |

| Consumer Discretionary - 3.6% | |

| | 7,000 | | Anheuser-Busch InBev SA/NV, ADR | | $ | 769,580 | |

| | 20,000 | | CVS Health Corp. | | | 1,244,200 | |

| | 39,630 | | Freshpet, Inc. (a)(b) | | | 651,914 | |

| | 52,588 | | Green Plains Partners LP (a) | | | 915,031 | |

| | 6,859 | | Lithia Motors, Inc., Class A (a) | | | 689,467 | |

| | 106,698 | | Luby's, Inc. (b) | | | 296,620 | |

| | 12,194 | | PetIQ, Inc. (a)(b) | | | 324,360 | |

| | 14,600 | | The TJX Cos., Inc. | | | 1,190,776 | |

| | | | | | | 6,081,948 | |

| Consumer Staples - 3.2% | |

| | 8,383 | | Calavo Growers, Inc. (a) | | | 772,912 | |

| | 16,767 | | General Mills, Inc. | | | 755,521 | |

| | 10,000 | | Nestle SA, ADR | | | 790,500 | |

| | 31,247 | | Pilgrim's Pride Corp. (a)(b) | | | 768,989 | |

| | 11,432 | | Post Holdings, Inc. (a)(b) | | | 866,088 | |

| | 28,961 | | Sprouts Farmers Market, Inc. (a)(b) | | | 679,715 | |

| | 12,194 | | Tyson Foods, Inc., Class A (a) | | | 892,479 | |

| | | | | | | 5,526,204 | |

| Energy - 9.7% | | | | | | |

| | 5,221 | | Andeavor | | | 525,024 | |

| | 9,833 | | Antero Midstream GP LP | | | 157,230 | |

| | 11,791 | | Antero Resources Corp. (b) | | | 234,051 | |

| | 33,872 | | Cabot Oil & Gas Corp. | | | 812,251 | |

| | 23,434 | | Centennial Resource Development, Inc., Class A (b) | | | 430,014 | |

| | 18,270 | | Cheniere Energy, Inc. (b) | | | 976,532 | |

| | 2,627 | | Cimarex Energy Co. | | | 245,624 | |

| | 2,029 | | Concho Resources, Inc. (b) | | | 305,019 | |

| | 10,562 | | Continental Resources, Inc./OK (b) | | | 622,630 | |

| | 12,389 | | Devon Energy Corp. | | | 393,846 | |

| | 5,070 | | Diamondback Energy, Inc. (b) | | | 641,456 | |

| | 60,000 | | Enbridge, Inc. | | | 1,888,200 | |

| | 17,991 | | Energy Transfer Partners LP | | | 291,814 | |

| | 9,455 | | EOG Resources, Inc. | | | 995,328 | |

| | 18,127 | | EQT Corp. | | | 861,214 | |

| | 8,082 | | FTS International, Inc. (b) | | | 148,628 | |

| | 9,566 | | Halliburton Co. | | | 449,028 | |

| | 6,177 | | HollyFrontier Corp. | | | 301,808 | |

| | 9,716 | | Keane Group, Inc. (b) | | | 143,797 | |

| | 6,424 | | Marathon Petroleum Corp. | | | 469,659 | |

| | 12,774 | | MPLX LP | | | 422,053 | |

| | 6,347 | | ONEOK, Inc. | | | 361,271 | |

| | 1,929 | | Phillips 66 | | | 185,030 | |

| | 1,750 | | Pioneer Natural Resources Co. | | | 300,615 | |

| | 16,965 | | Plains GP Holdings, LP | | | 368,989 | |

| | 13,980 | | ProPetro Holding Corp. (b) | | | 222,142 | |

| | 11,681 | | RSP Permian, Inc. (b) | | | 547,605 | |

| | 15,000 | | Schlumberger, Ltd. | | | 971,700 | |

| | 29,190 | | Tallgrass Energy GP LP | | | 555,194 | |

| | 13,401 | | Targa Resources Corp. | | | 589,644 | |

| | 37,865 | | The Williams Cos., Inc. | | | 941,324 | |

| | 20,860 | | WPX Energy, Inc. (b) | | | 308,311 | |

| | | | | | | 16,667,031 | |

| Financial - 3.8% | | | | | | |

| | 6,600 | | Berkshire Hathaway, Inc., Class B (b) | | | 1,316,568 | |

| | 35,000 | | Brookfield Asset Management, Inc., Class A | | | 1,365,000 | |

| | 20,000 | | Loews Corp. | | | 994,600 | |

| | 25,000 | | The Bank of New York Mellon Corp. | | | 1,288,250 | |

| | 3,000 | | The Howard Hughes Corp. (b) | | | 417,390 | |

| | 16,000 | | WR Berkley Corp. | | | 1,163,200 | |

| | | | | | | 6,545,008 | |

| See Notes to Financial Statements. | 13 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2018

| Shares | | Security Description | | Value | |

| Healthcare - 1.5% | | | |

| | 45,000 | | Sanofi, ADR | | $ | 1,803,600 | |

| | 9,603 | | Zoetis, Inc. (a) | | | 801,947 | |

| | | | | | | 2,605,547 | |

| Industrial - 2.7% | | | | |

| | 6,432 | | Alamo Group, Inc. | | | 706,877 | |

| | 32,771 | | Briggs & Stratton Corp. (a) | | | 701,627 | |

| | 6,097 | | Deere & Co. (a) | | | 946,986 | |

| | 10,000 | | Expeditors International of Washington, Inc. | | | 633,000 | |

| | 6,402 | | John Bean Technologies Corp. (a) | | | 725,987 | |

| | 22,102 | | Trimble, Inc. (a)(b) | | | 793,019 | |

| | | | | | | 4,507,496 | |

| Information Technology - 0.6% | | | | |

| | 53,000 | | Conduent, Inc. (b) | | | 987,920 | |

| Materials - 3.4% | | | | |

| | 21,000 | | Axalta Coating Systems, Ltd. (b) | | | 633,990 | |

| | 60,000 | | Cameco Corp. | | | 545,400 | |

| | 8,383 | | Compass Minerals International, Inc. | | | 505,495 | |

| | 8,383 | | Innophos Holdings, Inc. | | | 337,080 | |

| | 5,000 | | Monsanto Co. | | | 583,450 | |

| | 14,327 | | Nutrien, Ltd. (a) | | | 677,094 | |

| | 19,500 | | Royal Gold, Inc. | | | 1,674,465 | |

| | 8,534 | | US Silica Holdings, Inc. | | | 217,788 | |

| | 5,911 | | Westlake Chemical Corp. | | | 657,008 | |

| | | | | | | 5,831,770 | |

| Telecommunication Services - 0.6% | | | | |

| | 25,000 | | Liberty Global PLC, Class C (b) | | | 760,750 | |

| | 20,000 | | News Corp., Class A | | | 316,000 | |

| | | | | | | 1,076,750 | |

| | Utilities - 0.6% | | | | | | |

| | 14,900 | | Dominion Energy, Inc. | | | 1,004,707 | |

| | | | | | | | |

| Total Common Stock (Cost $44,295,545) | | | 50,834,381 | |

| Principal | | Security Description | | Rate | | Maturity | | Value | |

| Asset Backed Obligations - 0.2% | | | | | | | |

| $ | 48,385 | | Adjustable Rate Mortgage Trust, Series 2005-12 2A1 (c) | | 3.74 | % | 03/25/36 | | | 44,586 | |

| | 35,424 | | Adjustable Rate Mortgage Trust, Series 2006-1 3A3 (c) | | 3.58 | | 03/25/36 | | | 31,456 | |

| | 22,655 | | Banc of America Funding Corp., Series 2006-E 2A1 (c) | | 3.70 | | 06/20/36 | | | 22,192 | |

| | 44,630 | | Banc of America Funding Corp., Series 2007-E 4A1 (c) | | 3.54 | | 07/20/47 | | | 37,523 | |

| | 65,788 | | CitiMortgage Alternative Loan Trust, Series 2006-A7 1A12 | | 6.00 | | 12/25/36 | | | 62,377 | |

| | 25,202 | | CitiMortgage Alternative Loan Trust, Series 2007-A4 1A6 | | 5.75 | | 04/25/37 | | | 23,952 | |

| | 28,238 | | Countrywide Alternative Loan Trust, Series 2005-50CB 1A1 | | 5.50 | | 11/25/35 | | | 26,332 | |

| | 38,397 | | Countrywide Home Loan Mortgage Pass-Through Trust, Series 2007-HY5 1A1 (c) | | 3.80 | | 09/25/47 | | | 37,424 | |

| | 50,643 | | IndyMac Index Mortgage Loan Trust, Series 2006-AR25 3A1 (c) | | 3.65 | | 09/25/36 | | | 43,875 | |

| | 22,714 | | JPMorgan Mortgage Trust, Series 2007-A2 4A1M (c) | | 3.61 | | 04/25/37 | | | 21,936 | |

| | 32,375 | | Structured Adjustable Rate Mortgage Loan Trust, Series 2007-3 3A1 (c) | | 3.63 | | 04/25/47 | | | 24,894 | |

| Total Asset Backed Obligations (Cost $249,667) | | | | | | | 376,547 | |

| Shares | | Security Description | | Value | |

| Investment Companies - 38.0% | | | | |

| | 1,529,930 | | Absolute Capital Opportunities Fund (b)(d) | | | 19,154,722 | |

| | 2,840,976 | | Absolute Convertible Arbitrage Fund (d) | | | 29,233,640 | |

| | 52,835 | | SPDR S&P 500 ETF Trust | | | 13,903,530 | |

| | 125,000 | | VanEck Vectors Gold Miners ETF | | | 2,747,500 | |

| Total Investment Companies (Cost $53,720,351) | | | 65,039,392 | |

| Shares | | Security Description | | Value | |

| Money Market Fund - 24.3% | | | | |

| | 41,734,470 | | State Street Institutional Treasury Money Market Fund, Premier Share Class, 1.50% (e)

(Cost $41,734,470) | | | 41,734,470 | |

| See Notes to Financial Statements. | 14 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2018

| Contracts | | Security Description | | Strike Price | | | Exp. Date | | | Notional Contract Value | | | Value | |

| Purchased Options - 0.4% | |

| Call Options Purchased - 0.0% | |

| | 3,429 | | PowerShares DB Commodity Index Tracking Fund ETF

(Premiums Paid $97,315) | | $ | 17.00 | | | | 04/18 | | | $ | 5,829,300 | | | $ | 68,580 | |

| Put Options Purchased - 0.4% | | | | | | | | | | | | | | | | |

| | 1,860 | | iShares Russell 2000 ETF (Premiums Paid $574,187) | | | 150.00 | | | | 05/18 | | | | 28,240,380 | | | | 619,380 | |

| Total Purchased Options (Premiums Paid $671,502) | | | | | | | | | | | | | | | 687,960 | |

| Total Long Positions - 92.6% (Cost $140,671,535) | | | | | | | | | | | | | | | 158,672,750 | |

| Total Short Positions - (19.0)% (Proceeds $(34,589,488)) | | | | | | | | | | | | | | | (32,481,023 | ) |

| Other Assets & Liabilities, Net - 26.4% | | | | | | | | | | | | | | | 45,132,462 | |

| Net Assets - 100.0% | | | | | | | | | | | | | | $ | 171,324,189 | |

| See Notes to Financial Statements. | 15 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF SECURITIES SOLD SHORT

MARCH 31, 2018

| Shares | | Security Description | | Value | |

| Short Positions - (19.0)% | |

| Common Stock - (17.6)% | |

| Consumer Discretionary - (5.5)% | |

| (365 | ) | Amazon.com, Inc. | | $ | (528,279 | ) |

| | (21,035 | ) | Bojangles', Inc. | | | (291,335 | ) |

| | (6,859 | ) | Brinker International, Inc. | | | (247,610 | ) |

| | (7,050 | ) | Carnival Corp. | | | (462,339 | ) |

| | (1,067 | ) | Chipotle Mexican Grill, Inc. | | | (344,758 | ) |

| | (1,981 | ) | Cracker Barrel Old Country Store, Inc. | | | (315,375 | ) |

| | (6,402 | ) | Dave & Buster's Entertainment, Inc. | | | (267,220 | ) |

| | (2,439 | ) | Dollarama, Inc. | | | (296,425 | ) |

| | (13,250 | ) | DR Horton, Inc. | | | (580,880 | ) |

| | (18,291 | ) | Duluth Holdings, Inc., Class B | | | (342,590 | ) |

| | (6,097 | ) | Dunkin' Brands Group, Inc. | | | (363,930 | ) |

| | (10,200 | ) | Fiat Chrysler Automobiles NV | | | (207,110 | ) |

| | (8,688 | ) | Fiesta Restaurant Group, Inc. | | | (160,728 | ) |

| | (4,400 | ) | HD Supply Holdings, Inc. | | | (166,936 | ) |

| | (2,743 | ) | LCI Industries | | | (285,684 | ) |

| | (8,470 | ) | Leggett & Platt, Inc. | | | (375,729 | ) |

| | (5,680 | ) | Lowe's Cos., Inc. | | | (498,420 | ) |

| | (2,290 | ) | Mohawk Industries, Inc. | | | (531,784 | ) |

| | (36,582 | ) | Noodles & Co. | | | (276,194 | ) |

| | (6,097 | ) | Red Robin Gourmet Burgers, Inc. | | | (353,626 | ) |

| | (6,707 | ) | Shake Shack, Inc. | | | (279,212 | ) |

| | (21,993 | ) | The Habit Restaurants, Inc., Class A | | | (193,538 | ) |

| | (2,830 | ) | The Home Depot, Inc. | | | (504,419 | ) |

| | (9,000 | ) | Tractor Supply Co. | | | (567,180 | ) |

| | (820 | ) | Ulta Beauty, Inc. | | | (167,501 | ) |

| | (15,242 | ) | Vista Outdoor, Inc. | | | (248,750 | ) |

| | (14,700 | ) | Volvo AB, Class B | | | (268,039 | ) |

| | (1,219 | ) | WW Grainger, Inc. | | | (344,087 | ) |

| | | | | | | (9,469,678 | ) |

| Consumer Staples - (2.4)% | |

| | (8,530 | ) | AerCap Holdings NV | | | (432,642 | ) |

| | (20,582 | ) | Amira Nature Foods, Ltd. | | | (85,827 | ) |

| | (8,993 | ) | Archer-Daniels-Midland Co. | | | (390,026 | ) |

| | (1,829 | ) | Dr. Pepper Snapple Group, Inc. | | | (216,517 | ) |

| | (2,050 | ) | FleetCor Technologies, Inc. | | | (415,125 | ) |

| | (15,242 | ) | Flowers Foods, Inc. | | | (333,190 | ) |

| | (20,882 | ) | Hostess Brands, Inc. | | | (308,845 | ) |

| | (2,591 | ) | Ingredion, Inc. | | | (334,032 | ) |

| | (10,670 | ) | Macquarie Infrastructure Corp. | | | (394,043 | ) |

| | (3,201 | ) | McCormick & Co., Inc., Non-Voting Shares | | | (340,554 | ) |

| | (3,201 | ) | PepsiCo., Inc. | | | (349,389 | ) |

| | (2,591 | ) | Sanderson Farms, Inc. | | | (308,381 | ) |

| | (3,811 | ) | The Kraft Heinz Co. | | | (237,387 | ) |

| | | | | | | (4,145,958 | ) |

| Financial - (4.2)% | | | | |

| | (330,000 | ) | Agricultural Bank of China, Ltd., Class H | | | (187,535 | ) |

| | (8,840 | ) | Air Lease Corp. | | | (376,761 | ) |

| | (2,025 | ) | Alliance Data Systems Corp. | | | (431,041 | ) |

| | (3,280 | ) | Ameriprise Financial, Inc. | | | (485,243 | ) |

| | (71,158 | ) | Banco Santander SA, ADR | | | (466,085 | ) |

| | (18,550 | ) | Bank of America Corp. | | | (556,315 | ) |

| | (338,000 | ) | Bank of China, Ltd., Class H | | | (181,745 | ) |

| | (228,000 | ) | Bank of Communications Co., Ltd., Class H | | | (178,666 | ) |

| | (245,000 | ) | China CITIC Bank Corp., Ltd., Class H | | | (167,326 | ) |

| | (177,000 | ) | China Construction Bank Corp., Class H | | | (181,778 | ) |

| | (232,000 | ) | China Galaxy Securities Co., Ltd., Class H | | | (154,309 | ) |

| | (47,000 | ) | China Merchants Bank Co., Ltd., Class H | | | (192,536 | ) |

| | (76,000 | ) | CITIC Securities Co., Ltd., Class H | | | (173,921 | ) |

| | (20,800 | ) | Deutsche Bank AG | | | (290,784 | ) |

| | (7,100 | ) | Fastighets AB Balder | | | (178,227 | ) |

| | (237,000 | ) | Industrial & Commercial Bank of China, Ltd., Class H | | | (203,234 | ) |

| | (61,700 | ) | Intesa Sanpaolo SpA | | | (224,226 | ) |

| See Notes to Financial Statements. | 16 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF SECURITIES SOLD SHORT

MARCH 31, 2018

| Shares | | Security Description | | Value | |

| Financial - (4.2)% (continued) | | | |

| | (2,650 | ) | M&T Bank Corp. | | $ | (488,554 | ) |

| | (4,775 | ) | OTP Bank PLC | | | (214,814 | ) |

| | (9,300 | ) | Swedbank AB, Class A | | | (208,280 | ) |

| | (16,200 | ) | Synchrony Financial | | | (543,186 | ) |

| | (17,900 | ) | The Blackstone Group LP | | | (571,905 | ) |

| | (10,250 | ) | The Charles Schwab Corp. | | | (535,255 | ) |

| | | | | | | (7,191,726 | ) |

| Industrial - (3.4)% | | | | |

| | (3,811 | ) | AGCO Corp. | | | (247,143 | ) |

| | (5,800 | ) | Atlas Copco AB, Class A | | | (250,899 | ) |

| | (6,530 | ) | Eaton Corp. PLC | | | (521,812 | ) |

| | (5,200 | ) | Emerson Electric Co. | | | (355,160 | ) |

| | (3,060 | ) | Illinois Tool Works, Inc. | | | (479,380 | ) |

| | (7,800 | ) | Jacobs Engineering Group, Inc. | | | (461,370 | ) |

| | (1,430 | ) | Martin Marietta Materials, Inc. | | | (296,439 | ) |

| | (16,700 | ) | Peab AB | | | (150,204 | ) |

| | (11,900 | ) | SKF AB, Class B | | | (242,994 | ) |

| | (1,905 | ) | Snap-on, Inc. | | | (281,064 | ) |

| | (6,725 | ) | Spirit AeroSystems Holdings, Inc., Class A | | (562,882 | ) |

| | (4,800 | ) | Textron, Inc. | | | (283,056 | ) |

| | (1,160 | ) | The Boeing Co. | | | (380,341 | ) |

| | (5,704 | ) | The Middleby Corp. | | | (706,098 | ) |

| | (2,170 | ) | Vulcan Materials Co. | | | (247,749 | ) |

| | (5,300 | ) | Wartsila OYJ Abp | | | (117,059 | ) |

| | (15,395 | ) | Welbilt, Inc. | | | (299,433 | ) |

| | | | | | | (5,883,083 | ) |

| Information Technology - (1.3)% | | | | |

| | (2,170 | ) | Autodesk, Inc. | | | (272,508 | ) |

| | (9,600 | ) | CA, Inc. | | | (325,440 | ) |

| | (9,000 | ) | Intel Corp. | | | (468,720 | ) |

| | (1,440 | ) | NVIDIA Corp. | | | (333,490 | ) |

| | (6,600 | ) | Oracle Corp. | | | (301,950 | ) |

| | (4,430 | ) | salesforce.com, Inc. | | | (515,209 | ) |

| | | | | | | (2,217,317 | ) |

| Materials - (0.2)% | | | | |

| | (12,194 | ) | American Vanguard Corp. | | | (246,319 | ) |

| Telecommunication Services - (0.6)% | | | | |

| | (175 | ) | Booking Holdings, Inc. | | | (364,068 | ) |

| | (3,460 | ) | Facebook, Inc., Class A | | | (552,874 | ) |

| | | | | | | (916,942 | ) |

| Total Common Stock (Proceeds $(32,569,391)) | | | (30,071,023 | ) |

| Shares | | Security Description | | Value | |

| Investment Company - (1.4)% | |

| | (20,000 | ) | First Trust Dow Jones Internet Index Fund ETF (Proceeds $(2,020,097)) | | | (2,410,000 | ) |

| Total Short Positions - (19.0)% (Proceeds $(34,589,488)) | | $ | (32,481,023 | ) |

| See Notes to Financial Statements. | 17 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

NOTES TO SCHEDULES OF INVESTMENTS AND SECURITIES SOLD SHORT

MARCH 31, 2018

| ADR | American Depositary Receipt |

| ETF | Exchange Traded Fund |

| LP | Limited Partnership |

| PLC | Public Limited Company |

| (a) | All or a portion of this security is held as collateral for securities sold short. |

| (b) | Non-income producing security. |

| (c) | Variable rate security, the interest rate of which adjusts periodically based on changes in current interest rates. Rate represented is as of March 31, 2018. |

| (e) | Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of March 31, 2018. |

At March 31, 2018, the Fund held the following exchange traded futures contracts:

| Contracts | | Type | | Expiration Date | | Notional Contract Value | | | Value | | | Net Unrealized Appreciation (Depreciation) | |

(150 | ) | CME E-Mini Russell Future | | 06/15/18 | | $ | (11,373,647 | ) | | $ | (11,484,000 | ) | | $ | (110,353 | ) |

(475 | ) | S&P 500 E-mini Future | | 06/15/18 | | | (64,716,974 | ) | | | (62,771,250 | ) | | | 1,945,724 | |

25 | | Silver Future | | 05/29/18 | | | 2,075,692 | | | | 2,033,500 | | | | (42,192 | ) |

| | | | | | | $ | (74,014,929 | ) | | $ | (72,221,750 | ) | | $ | 1,793,179 | |

Affiliated investments are investments that are managed by the adviser, and are noted in the Absolute Strategies Fund’s Schedule of Investments. Transactions during the year with affiliates were as follows:

| Investment Companies | | | | | | | | | | | | | | | | | | | | | |

| Absolute Capital Opportunities Fund | | Balance 3/31/2017 | | | Gross Additions | | | Gross Reductions | | | Change in Unrealized Appreciation | | | Balance 3/31/2018 | | | Realized Gain/(Loss) | | | Investment Income | |

| Shares/Principal | | | 1,289,545 | | | | 240,385 | | | | – | | | | – | | | | 1,529,930 | | | | | | | |

| Cost | | $ | 13,010,000 | | | $ | 3,000,000 | | | $ | – | | | $ | – | | | $ | 16,010,000 | | | $ | – | | | $ | – | |

| Value | | | 14,146,311 | | | | – | | | | – | | | | 2,008,411 | | | | 19,154,722 | | | | | | | | | |

| Absolute Convertible Arbitrage Fund | | Balance 3/31/2017 | | | Gross Additions | | | Gross Reductions | | | Change in Unrealized Appreciation | | | Balance 3/31/2018 | | | Realized Gain/(Loss) | | | Investment Income | |

| Shares/Principal | | | – | | | | 2,840,976 | | | | – | | | | – | | | | 2,840,976 | | | | | | | | | |

| Cost | | $ | – | | | $ | 29,047,189 | | | $ | – | | | $ | – | | | $ | 29,047,189 | | | $ | – | | | $ | 47,189 | |

| Value | | | – | | | | – | | | | – | | | | 186,451 | | | | 29,233,640 | | | | | | | | | |

The following is a summary of the inputs used to value the Fund's investments and other financial instruments and liabilities as of March 31, 2018.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Investments at Value | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | | | |

| Consumer Discretionary | | $ | 6,081,948 | | | $ | – | | | $ | – | | | $ | 6,081,948 | |

| Consumer Staples | | | 5,526,204 | | | | – | | | | – | | | | 5,526,204 | |

| Energy | | | 16,667,031 | | | | – | | | | – | | | | 16,667,031 | |

| Financial | | | 6,545,008 | | | | – | | | | – | | | | 6,545,008 | |

| Healthcare | | | 2,605,547 | | | | – | | | | – | | | | 2,605,547 | |

| Industrial | | | 4,507,496 | | | | – | | | | – | | | | 4,507,496 | |

| Information Technology | | | 987,920 | | | | – | | | | – | | | | 987,920 | |

| Materials | | | 5,831,770 | | | | – | | | | – | | | | 5,831,770 | |

| Telecommunication Services | | | 1,076,750 | | | | – | | | | – | | | | 1,076,750 | |

| Utilities | | | 1,004,707 | | | | – | | | | – | | | | 1,004,707 | |

| Asset Backed Obligations | | | – | | | | 376,547 | | | | – | | | | 376,547 | |

| Investment Companies | | | 65,039,392 | | | | – | | | | – | | | | 65,039,392 | |

| Money Market Fund | | | – | | | | 41,734,470 | | | | – | | | | 41,734,470 | |

| See Notes to Financial Statements. | 18 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

NOTES TO SCHEDULES OF INVESTMENTS AND SECURITIES SOLD SHORT

MARCH 31, 2018

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Purchased Options | | $ | 687,960 | | | $ | – | | | $ | – | | | $ | 687,960 | |

| Investments at Value | | $ | 116,561,733 | | | $ | 42,111,017 | | | $ | – | | | $ | 158,672,750 | |

| Other Financial Instruments* | | | | | | | | | | | | | | | | |

| Futures | | | 1,945,724 | | | | – | | | | – | | | | 1,945,724 | |

| Total Other Financial Instruments* | | $ | 1,945,724 | | | $ | – | | | $ | – | | | $ | 1,945,724 | |

| Total Assets | | $ | 118,507,457 | | | $ | 42,111,017 | | | $ | – | | | $ | 160,618,474 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Securities Sold Short | | | | | | | | | | | | | | | | |

| Common Stock | | $ | (30,071,023 | ) | | $ | – | | | $ | – | | | $ | (30,071,023 | ) |

| Investment Company | | | (2,410,000 | ) | | | – | | | | – | | | | (2,410,000 | ) |

| Securities Sold Short | | $ | (32,481,023 | ) | | $ | – | | | $ | – | | | $ | (32,481,023 | ) |

| Other Financial Instruments* | | | | | | | | | | | | | | | | |

| Futures | | | (152,545 | ) | | | – | | | | – | | | | (152,545 | ) |

| Total Liabilities | | $ | (32,633,568 | ) | | $ | – | | | $ | – | | | $ | (32,633,568 | ) |

| * | Other Financial Instruments are derivatives not reflected in the Schedule of Investments and Schedule of Securities Sold Short, such as futures, which are valued at the unrealized appreciation/(depreciation) at year end. |

The following is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value.

| | | | Written Options | | |

| | Balance as of 03/31/17 | | $ | (126 | ) | |

| | Change in Unrealized Appreciation /(Depreciation) | | | (26,271 | ) | |

| | Sales/Covers | | | 229 | | |

| | Realized Gain (Loss) | | | 26,168 | | |

| | Balance as of 03/31/18 | | $ | - | | |

| | Net change in unrealized appreciation / (depreciation) from investments held as of 03/31/18 | | $ | - | | |

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the year ended March 31, 2018.

| See Notes to Financial Statements. | 19 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUNDPORTFOLIO HOLDINGS SUMMARY (Unaudited)

MARCH 31, 2018

| Portfolio Breakdown (% of Net Assets) | |

| Long Positions | |

| Common Stock | 60.1% |

| Money Market Fund | 29.5% |

| Purchased Options | 2.1% |

| Short Positions | |

| Common Stock | (1.0)% |

| Investment Company | (36.6)% |

| Written Options | (0.4)% |

| Other Assets & Liabilities, Net * | 46.3% |

| | 100.0% |

| * | Consists of deposits with the custodian and/or brokers for securities sold short, cash, prepaid expenses, receivables, payables and accrued liabilities. Deposits with the custodian and/or brokers for securities sold short represent 45.0% of net assets. See Note 2 of the accompanying Notes to Financial Statements. |

| See Notes to Financial Statements. | 20 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUNDSCHEDULE OF INVESTMENTS

MARCH 31, 2018

| Shares | | Security Description | | Value | |

| Long Positions - 91.7% | | | |

| Common Stock - 60.1% | | | |

| Consumer Discretionary - 7.9% | | | |

| | 9,556 | | American Airlines Group, Inc. (a) | | $ | 496,530 | |

| | 1,838 | | CarMax, Inc. (a)(b) | | | 113,846 | |

| | 20,382 | | General Motors Co. (a)(c) | | | 740,682 | |

| | 7,328 | | Harley-Davidson, Inc. (a)(c)(d) | | | 314,224 | |

| | 7,595 | | Robert Half International, Inc. | | | 439,674 | |

| | 4,276 | | The Cheesecake Factory, Inc. | | | 206,189 | |

| | 2,529 | | The Walt Disney Co. (a)(c) | | | 254,013 | |

| | | | | | | 2,565,158 | |

| Consumer Staples - 1.6% | |

| | 1,473 | | AMERCO (b) | | | 508,332 | |

| | | | | | | | |

| Energy - 2.7% | |

| | 14,559 | | Halliburton Co. (a) | | | 683,400 | |

| | 2,850 | | Schlumberger, Ltd. (a) | | | 184,623 | |

| | | | | | | 868,023 | |

| Financial - 18.1% | |

| | 4,221 | | American Express Co. (a) | | | 393,735 | |

| | 3,584 | | Aon PLC (a) | | | 502,943 | |

| | 29,019 | | Bank of America Corp. (a) | | | 870,280 | |

| | 5,756 | | Berkshire Hathaway, Inc., Class B (a)(b) | | | 1,148,207 | |

| | 13,833 | | CBRE Group, Inc., Class A (a)(b) | | | 653,194 | |

| | 6,792 | | Citigroup, Inc. (a) | | | 458,460 | |

| | 8,238 | | JPMorgan Chase & Co. (a) | | | 905,933 | |

| | 13,593 | | The Blackstone Group LP | | | 434,296 | |

| | 1,991 | | The Goldman Sachs Group, Inc. | | | 501,453 | |

| | | | | | | 5,868,501 | |

| Healthcare - 3.8% | |

| | 2,757 | | Bayer AG | | | 311,384 | |

| | 9,449 | | Henry Schein, Inc. (b) | | | 635,067 | |

| | 2,044 | | McKesson Corp. | | | 287,938 | |

| | | | | | | 1,234,389 | |

| Industrial - 9.0% | |

| | 5,881 | | Delta Air Lines, Inc. | | | 322,338 | |

| | 16,995 | | General Electric Co. | | | 229,092 | |

| | 12,767 | | Jacobs Engineering Group, Inc. (a) | | | 755,168 | |

| | 25,542 | | Quanta Services, Inc. (a)(b) | | | 877,368 | |

| | 1,284 | | The Boeing Co. (a) | | | 420,998 | |

| | 2,785 | | United Parcel Service, Inc., Class B (a) | | | 291,478 | |

| | | | | | | 2,896,442 | |

| Information Technology - 6.6% | |

| | 5,899 | | Analog Devices, Inc. | | | 537,576 | |

| | 7,185 | | Apple, Inc. (a) | | | 1,205,499 | |

| | 613 | | IBM | | | 94,053 | |

| | 2,145 | | Intel Corp. | | | 111,712 | |

| | 2,145 | | Micron Technology, Inc. (b)(d) | | | 111,840 | |

| | 1,379 | | QUALCOMM, Inc. | | | 76,410 | |

| | | | | | | 2,137,090 | |

| Materials - 1.3% | |

| | 3,754 | | PPG Industries, Inc. | | | 418,946 | |

| | | | | | | | |

| Telecommunication Services - 9.1% | |

| | 491 | | Alphabet, Inc., Class A (a)(b) | | | 509,236 | |

| | 327 | | Alphabet, Inc., Class C (a)(b) | | | 337,395 | |

| | 22,715 | | CBS Corp., Class B (a) | | | 1,167,324 | |

| | 2,298 | | Comcast Corp., Class A | | | 78,523 | |

| | 1,838 | | DISH Network Corp., Class A (b) | | | 69,642 | |

| | 4,202 | | Facebook, Inc., Class A (b)(c) | | | 671,437 | |

| | 1,225 | | Omnicom Group, Inc. | | | 89,021 | |

| | 2,449 | | Spark Networks SE, ADR (b) | | | 36,490 | |

| | | | | | | 2,959,068 | |

| Total Common Stock (Cost $18,794,321) | | | 19,455,949 | |

| See Notes to Financial Statements. | 21 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUNDSCHEDULE OF INVESTMENTS

MARCH 31, 2018

| Shares | | Security Description | | Value | |

| Money Market Fund - 29.5% | | | |

| | 9,538,969 | | State Street Institutional Treasury Money Market Fund, Premier Share Class, 1.50% (e)

(Cost $9,538,969) | | $ | 9,538,969 | |

| Contracts | | Security Description | | Strike Price | | | Exp. Date | | | Notional Contract Value | | | Value | |

| Purchased Options - 2.1% | | | | | | | | | | | | |

| Call Options Purchased - 0.4% | | | | | | | | | | | | |

| | 42 | | Caterpillar, Inc. | | $ | 200.00 | | | 01/19 | | | $ | 840,000 | | | | 6,762 | |

| | 455 | | General Motors Co. | | | 65.00 | | | 01/19 | | | | 2,957,500 | | | | 910 | |

| | 400 | | General Motors Co. | | | 55.00 | | | 01/19 | | | | 2,200,000 | | | | 4,400 | |

| | 239 | | Harley-Davidson, Inc. | | | 65.00 | | | 01/19 | | | | 1,553,500 | | | | 5,497 | |

| | 3,084 | | SPDR S&P 500 ETF Trust | | | 285.00 | | | 04/18 | | | | 87,894,000 | | | | 24,672 | |

| | 72 | | United Continental Holdings, Inc. | | | 65.00 | | | 01/19 | | | | 468,000 | | | | 82,800 | |

| Total Call Options Purchased (Premiums Paid $345,244) | | | | | | | | | | | | | | 125,041 | |

| Put Options Purchased - 1.7% | | | | | | | | | | | | | | | |

| | 22 | | Comcast Corp. | | | 40.00 | | | 01/20 | | | | 75,174 | | | | 18,040 | |

| | 19 | | DISH Network Corp. | | | 47.50 | | | 01/20 | | | | 71,991 | | | | 25,080 | |

| | 7 | | IBM | | | 165.00 | | | 01/20 | | | | 107,401 | | | | 18,410 | |

| | 21 | | Intel Corp. | | | 42.00 | | | 01/20 | | | | 109,368 | | | | 6,615 | |

| | 21 | | Micron Technology, Inc. | | | 42.00 | | | 01/20 | | | | 109,494 | | | | 13,493 | |

| | 12 | | Omnicom Group, Inc. | | | 72.50 | | | 01/20 | | | | 87,204 | | | | 10,440 | |

| | 13 | | QUALCOMM, Inc. | | | 65.00 | | | 01/20 | | | | 72,033 | | | | 20,150 | |

| | 472 | | SPDR S&P 500 ETF Trust | | | 271.00 | | | 04/18 | | | | 12,420,680 | | | | 432,824 | |

| Total Put Options Purchased (Premiums Paid $519,902) | | | 545,052 | |

| Total Purchased Options (Premiums Paid $865,146) | | | 670,093 | |

| Total Long Positions - 91.7% (Cost $29,198,436) | | | 29,665,011 | |

| Total Short Positions - (37.6)% (Proceeds $(12,506,272)) | | | (12,139,511 | ) |

| Total Written Options - (0.4)% (Premiums Received $(138,666)) | | | (141,259 | ) |

| Other Assets & Liabilities, Net - 46.3% | | | 14,953,693 | |

| Net Assets - 100.0% | | $ | 32,337,934 | |

| See Notes to Financial Statements. | 22 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUNDSCHEDULE OF SECURITIES SOLD SHORT

MARCH 31, 2018

| Shares | | Security Description | | Value | |

| Short Positions - (37.6)% | | | |

| Common Stock - (1.0)% | | | |

| Industrial - (1.0)% | | | |

| | (2,065 | ) | Caterpillar, Inc. (Proceeds $(294,377)) | | $ | (304,340 | ) |

| Investment Company - (36.6)% | | | | |

| | (44,975 | ) | SPDR S&P 500 ETF Trust (Proceeds $(12,211,895)) | | | (11,835,171 | ) |

| Total Short Positions - (37.6)% (Proceeds $(12,506,272)) | | $ | (12,139,511 | ) |

| See Notes to Financial Statements. | 23 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUNDSCHEDULE OF CALL AND PUT OPTIONS WRITTEN

MARCH 31, 2018

| Contracts | | Security Description | | Strike Price | | | Exp. Date | | | Notional Contract Value | | | Value | |

| Written Options - (0.4)% | | | | | | | | | | | | |

| Call Options Written - (0.1)% | | | | | | | | | | | | |

| | (215 | ) | Harley-Davidson, Inc. | | $ | 75.00 | | | 01/19 | | | $ | 921,920 | | | $ | (215 | ) |

| | (21 | ) | Micron Technology, Inc. | | | 70.00 | | | 01/20 | | | | 109,494 | | | | (17,955 | ) |

| | (72 | ) | United Continental Holdings, Inc. | | | 100.00 | | | 01/19 | | | | 500,184 | | | | (8,280 | ) |

| Total Call Options Written (Premiums Received $(30,459)) | | | | | | | | | | | | | | (26,450 | ) |

| Put Options Written - (0.3)% | | | | | | | | | | | | | | | |

| | (16 | ) | Facebook, Inc., Class A | | | 165.00 | | | 01/19 | | | | 264,000 | | | | (30,640 | ) |

| | (33 | ) | General Motors Co. | | | 45.00 | | | 01/20 | | | | 148,500 | | | | (36,795 | ) |

| | (14 | ) | Harley-Davidson, Inc. | | | 55.00 | | | 01/20 | | | | 77,000 | | | | (20,685 | ) |

| | (42 | ) | NIKE, Inc., Class B | | | 45.00 | | | 01/19 | | | | 189,000 | | | | (2,940 | ) |

| | (55 | ) | The Kroger Co. | | | 22.00 | | | 04/18 | | | | 121,000 | | | | (935 | ) |

| | (12 | ) | The Walt Disney Co. | | | 90.00 | | | 01/19 | | | | 108,000 | | | | (4,410 | ) |

| | (20 | ) | Time Warner, Inc. | | | 90.00 | | | 01/19 | | | | 180,000 | | | | (10,700 | ) |

| | (72 | ) | United Continental Holdings, Inc. | | | 45.00 | | | 01/19 | | | | 324,000 | | | | (7,704 | ) |

| Total Put Options Written (Premiums Received $(108,207)) | | | | (114,809 | ) |

| Total Written Options - (0.4)% (Premiums Received $(138,666)) | | | $ | (141,259 | ) |

| See Notes to Financial Statements. | 24 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUNDNOTES TO SCHEDULES OF INVESTMENTS, SECURITIES SOLD SHORT AND CALL AND PUT OPTIONS WRITTEN

MARCH 31, 2018

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| (a) | All or a portion of this security is held as collateral for securities sold short. |

| (b) | Non-income producing security. |

| (c) | Subject to put option written by the Fund. |

| (d) | Subject to call option written by the Fund. |

| (e) | Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of March 31, 2018. |

The following is a summary of the inputs used to value the Fund's investments and other financial instruments and liabilities as of March 31, 2018.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Investments at Value | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | | | |

| Consumer Discretionary | | $ | 2,565,158 | | | $ | – | | | $ | – | | | $ | 2,565,158 | |

| Consumer Staples | | | 508,332 | | | | – | | | | – | | | | 508,332 | |

| Energy | | | 868,023 | | | | – | | | | – | | | | 868,023 | |

| Financial | | | 5,868,501 | | | | – | | | | – | | | | 5,868,501 | |

| Healthcare | | | 1,234,389 | | | | – | | | | – | | | | 1,234,389 | |

| Industrial | | | 2,896,442 | | | | – | | | | – | | | | 2,896,442 | |

| Information Technology | | | 2,137,090 | | | | – | | | | – | | | | 2,137,090 | |

| Materials | | | 418,946 | | | | – | | | | – | | | | 418,946 | |

| Telecommunication Services | | | 2,959,068 | | | | – | | | | – | | | | 2,959,068 | |

| Money Market Fund | | | – | | | | 9,538,969 | | | | – | | | | 9,538,969 | |

| Purchased Options | | | 140,976 | | | | 529,117 | | | | – | | | | 670,093 | |

| Investments at Value | | $ | 19,596,925 | | | $ | 10,068,086 | | | $ | – | | | $ | 29,665,011 | |

| Total Assets | | $ | 19,596,925 | | | $ | 10,068,086 | | | $ | – | | | $ | 29,665,011 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Securities Sold Short | | | | | | | | | | | | | | | | |

| Common Stock | | $ | (304,340 | ) | | $ | – | | | $ | – | | | $ | (304,340 | ) |

| Investment Company | | | (11,835,171 | ) | | | – | | | | – | | | | (11,835,171 | ) |

| Securities Sold Short | | $ | (12,139,511 | ) | | $ | – | | | $ | – | | | $ | (12,139,511 | ) |

| Other Financial Instruments* | | | | | | | | | | | | | | | | |

| Written Options | | | (105,249 | ) | | | (36,010 | ) | | | – | | | | (141,259 | ) |

| Total Liabilities | | $ | (12,244,760 | ) | | $ | (36,010 | ) | | $ | – | | | $ | (12,280,770 | ) |

| * | Other Financial Instruments are derivatives not reflected in the Schedule of Investments and Schedule of Securities Sold Short, such as written options, which are reported at their market value at year end. |

The following is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value.

| | | Written Options | |

| Balance as of 03/31/17 | | $ | (14 | ) |

| Change in Unrealized Appreciation/(Depreciation) | | | (2,919 | ) |

| Sales/Covers | | | - | |

| Realized Gain (Loss) | | | 2,933 | |

| Balance as of 03/31/18 | | $ | - | |

| Net change in unrealized appreciation/(depreciation) from investments held as of 03/31/18 | | $ | - | |

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the year ended March 31, 2018.

| See Notes to Financial Statements. | 25 | ABSOLUTE FUNDS |

ABSOLUTE CONVERTIBLE ARBITRAGE

PORTFOLIO HOLDINGS SUMMARY (Unaudited)

MARCH 31, 2018

| Portfolio Breakdown (% of Net Assets) | |

| Long Positions | |

| Corporate Convertible Bonds | 78.8% |

| Money Market Fund | 60.4% |

| Short Positions | |

| Common Stock | (38.5)% |

| Other Assets & Liabilities, Net * | (0.7)% |

| | 100.0% |

| * | Consists of prepaid expenses, deferred offering costs, receivables, payables and accrued liabilities. See Note 2 of the accompanying Notes to Financial Statements. |

| See Notes to Financial Statements. | 26 | ABSOLUTE FUNDS |

ABSOLUTE CONVERTIBLE ARBITRAGESCHEDULE OF INVESTMENTS

MARCH 31, 2018

| Principal | | Security Description | | Rate | | Maturity | | Value | |

| Long Positions - 139.2% (a) | | | | | | | |

| Corporate Convertible Bonds - 78.8% | | | | | | | |

| Consumer Discretionary - 3.0% | | | | | | | |

| $ | 500,000 | | Horizon Global Corp. | | 2.75 | % | 07/01/22 | | $ | 412,326 | |

| | 1,000,000 | | Live Nation Entertainment, Inc. (b) | | 2.50 | | 03/15/23 | | | 1,011,681 | |

| | 250,000 | | Marriott Vacations Worldwide Corp. (b) | | 1.50 | | 09/15/22 | | | 274,231 | |

| | | | | | | | | | | 1,698,238 | |

| Consumer Staples - 1.7% | | | | | | | | |

| | 600,000 | | Carriage Services, Inc. | | 2.75 | | 03/15/21 | | | 789,404 | |

| | 125,000 | | Flexion Therapeutics, Inc. (b) | | 3.38 | | 05/01/24 | | | 142,639 | |

| | | | | | | | | | | 932,043 | |

| Energy - 4.2% | | | | | | | | | | |

| | 250,000 | | Bristow Group, Inc. | | 4.50 | | 06/01/23 | | | 276,737 | |

| | 150,000 | | Helix Energy Solutions Group, Inc. | | 4.25 | | 05/01/22 | | | 142,377 | |

| | 500,000 | | Helix Energy Solutions Group, Inc. | | 4.13 | | 09/15/23 | | | 506,512 | |

| | 500,000 | | Newpark Resources, Inc. (b) | | 4.00 | | 12/01/21 | | | 581,250 | |

| | 750,000 | | Renewable Energy Group, Inc. | | 2.75 | | 06/15/19 | | | 843,119 | |

| | | | | | | | | | | 2,349,995 | |

| Financial - 1.7% | | | | | | | | | | |

| | 300,000 | | Encore Capital Group, Inc. | | 3.00 | | 07/01/20 | | | 344,100 | |

| | 628,000 | | Encore Capital Group, Inc. | | 2.88 | | 03/15/21 | | | 629,884 | |

| | | | | | | | | | | 973,984 | |

| Healthcare - 21.0% | | | | | | | | |

| | 500,000 | | Accelerate Diagnostics, Inc. (b) | | 2.50 | | 03/15/23 | | | 484,816 | |

| | 1,000,000 | | Accuray, Inc. (b) | | 3.75 | | 07/15/22 | | | 1,140,000 | |

| | 1,300,000 | | Alder Biopharmaceuticals, Inc. | | 2.50 | | 02/01/25 | | | 1,201,534 | |

| | 500,000 | | Avadel Finance Cayman, Ltd. (b) | | 4.50 | | 02/01/23 | | | 505,750 | |

| | 500,000 | | DexCom, Inc. (b) | | 0.75 | | 05/15/22 | | | 515,681 | |

| | 1,000,000 | | Exact Sciences Corp. | | 1.00 | | 01/15/25 | | | 893,388 | |

| | 1,400,000 | | Insmed, Inc. | | 1.75 | | 01/15/25 | | | 1,237,898 | |

| | 700,000 | | Insulet Corp. (b) | | 1.38 | | 11/15/24 | | | 802,915 | |

| | 400,000 | | Ironwood Pharmaceuticals, Inc. | | 2.25 | | 06/15/22 | | | 472,848 | |

| | 750,000 | | Jazz Investments I, Ltd. (b) | | 1.50 | | 08/15/24 | | | 734,147 | |

| | 650,000 | | Novavax, Inc. | | 3.75 | | 02/01/23 | | | 462,790 | |

| | 500,000 | | Pacira Pharmaceuticals, Inc. | | 2.38 | | 04/01/22 | | | 458,125 | |

| | 750,000 | | Quidel Corp. | | 3.25 | | 12/15/20 | | | 1,301,025 | |

| | 750,000 | | Repligen Corp. | | 2.13 | | 06/01/21 | | | 976,564 | |

| | 100,000 | | Senseonics Holdings, Inc. | | 5.25 | | 02/01/23 | | | 107,900 | |

| | 500,000 | | Theravance Biopharma, Inc. | | 3.25 | | 11/01/23 | | | 508,423 | |

| | | | | | | | | | | 11,803,804 | |

| Industrial - 10.6% | | | | | | | | |

| | 750,000 | | Fluidigm Corp. | | 2.75 | | 02/01/34 | | | 688,428 | |

| | 461,000 | | Fluidigm Corp. | | 2.75 | | 02/01/34 | | | 393,606 | |

| | 1,150,000 | | II-VI, Inc. (b) | | 0.25 | | 09/01/22 | | | 1,273,050 | |

| | 1,100,000 | | Kaman Corp. (b) | | 3.25 | | 05/01/24 | | | 1,253,385 | |

| | 1,000,000 | | Team, Inc. (b) | | 5.00 | | 08/01/23 | | | 992,562 | |

| | 350,000 | | TimkenSteel Corp. | | 6.00 | | 06/01/21 | | | 514,745 | |

| | 500,000 | | TTM Technologies, Inc. | | 1.75 | | 12/15/20 | | | 833,438 | |

| | | | | | | | | | | 5,949,214 | |

| Information Technology - 26.1% | | | | | | | | |

| | 1,048,000 | | Advanced Micro Devices, Inc. | | 2.13 | | 09/01/26 | | | 1,536,158 | |

| | 700,000 | | Apptio, Inc. (b) | | 0.88 | | 04/01/23 | | | 690,900 | |

| | 500,000 | | Avid Technology, Inc. | | 2.00 | | 06/15/20 | | | 421,750 | |