As filed with the Securities and Exchange Commission on October 27, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: August 31

Date of reporting period: September 1, 2016 – August 31, 2017

ITEM 1. REPORT TO STOCKHOLDERS.

IMPORTANT INFORMATION

The views expressed in this report are those of the MAI Managed Volatility Fund (the "Fund") managers as of August 31, 2017, and may not reflect their views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders of the Fund in understanding their investments in the Fund and do not constitute investment advice.

An investment in the Fund is subject to risk, including the possible loss of principal amount invested. The Fund may invest in securities issued by smaller and medium-sized companies, which typically involves greater risk than investing in larger, more established companies. Selling call options risk occurs if the Fund is required to sell an underlying security and forego gains if the market price exceeds the exercise price before the expiration date. Selling put options risk occurs if the Fund is required to buy an underlying security and forego gains if the market price is below the exercise price before the expiration date. Option risks include, but are not limited to, the possibility of an imperfect correlation between the movement in the options' prices and that of the securities/indices hedged (or used for cover), which may render a given hedge unable to achieve its objective; possible loss of the premium paid for options; and potential inability to benefit from the appreciation of an underlying security above the exercise price. ADRs (American Depositary Receipt) may be subject to international trade, currency, political, regulatory and diplomatic risks. The Fund is also subject to other risks, such as fixed-income securities risk, which are detailed in the Fund's prospectus. Diversification does not assure a profit or protect against a loss in a declining market.

A put is an option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time. A cash-secured put is a put for which the writer deposits an amount of cash equal to the option's exercise price. A call is an option contract giving the owner the right (but not the obligation) to buy a specified amount of an underlying security at a specified price within a specified time. A covered call is an options strategy whereby an investor holds a (long) position in an asset and writes (sells) call options on that same asset in an effort to, potentially, generate increased income from the asset. A call option is out-of-the-money if the stock price is below its strike price and a put option is out-of-the-money if the stock price is above its strike price. The spread to strike price is the difference between the current price of the security and the strike price. Strike price is the price at which a specific options contract can be exercised. Beta is a measure of a fund's sensitivity to market movements. A portfolio with a beta greater than 1 is more volatile than the market, and a portfolio with a beta less than 1 is less volatile than the market. Premium realized through the sale of options is not distributable as quarterly income. Sharpe ratio measures risk-adjusted performance. The greater a portfolio's sharpe ratio, the better its risk-adjusted performance has been. Standard deviation is a statistical measure of the volatility of the fund's returns. In general, the higher the standard deviation, the greater the volatility of the return.

Dear Shareholder,

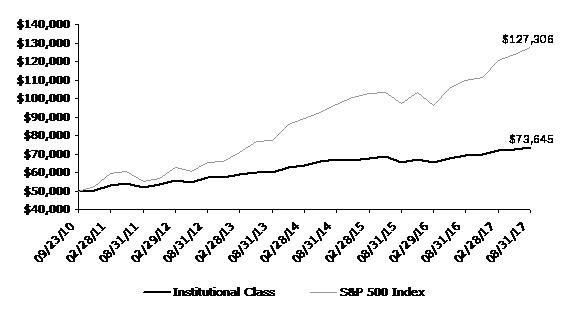

Over the fiscal year ending August 31, 2017, the MAI Managed Volatility Income Fund's (the "Fund") Institutional Class returned 6.20%. Over the same period, the S&P 500® Index (the "S&P 500") gained 16.23%. Volatility of the Fund's monthly returns, as measured by standard deviation, was 2.07% compared to 5.59% for the S&P 500 enabling the Fund and market to exhibit similar risk-adjusted returns with Sharpe ratios of 2.72 and 2.80 respectively.

Equity markets continued to advance relentlessly with no pullbacks or corrections that are often described as healthy consolidations. In fact, the S&P 500 has not experienced a 3% pullback since last November 4th. This is the second longest streak of all-time and the longest in over 20 years. If markets like this were predictable, one would be better served by a long only equity fund, using leverage to increase returns.

However, most investors diversify across fixed income, equity and alternatives seeking to make their portfolios more resilient with potential to advance in some areas if others falter due to recession, inflation or disaster.

The Fund seeks to achieve capital appreciation and income; however we differ from a traditional long equity fund in our equity exposure and use of an option overlay strategy. Option writing revenue enables the Fund to have a potential source of return not dependent on economic growth.

Writing options through a low volatility period is like writing insurance for wind damage after a decade without windstorms. One has to be careful not to compete too hard for business expecting those loss rates to always be low. We have managed this risk in a number of ways, including by diversifying across expiration points and strike prices while avoiding longer contracts, e.g. 6 months or more during which the market could change dramatically.

We noted last year that at certain times it was not compelling to sell puts on a specific individual equity that we believe is still worth holding because it is attractively valued, offers good dividend growth potential and should be an attractive candidate for option writing at other times. We began to become more selective in writing puts on individual equities while maintaining the revenue generation rate by writing puts on indexes. We believe that this has worked very well. In fact, a disappointment of the past year will help us illustrate why we are expanding the Fund's option strategy to write call options on indexes too.

During the fourth quarter of 2016, the election results fueled a 20%+ rally in the financial sector. Given the low premiums that had been available for writing options on financial stocks, the Fund incurred significant opportunity cost. It could have achieved similar rates of revenue from writing options on the broad market which did not rise as sharply during this period. Even if the broad market did rise that sharply, we believe that our overall portfolio is designed to participate. While not wanting to dwell on politics, we believe that political risk for investors and issuers has risen. Recently large corporations have found themselves targets in Congressional committees and on social media. A market that has not figured out how to price insurance for these risks has become more challenging to navigate.

Index options are another important tool for managing volatility. Using cash settled index options gives the Fund the opportunity to write fully collateralized options without changing the Fund's equity strategy to one that owns Exchange Traded Funds or potentially all the stocks in an index. Like our options on individual stocks, we intend to fully secure the liability of index contract exposure to aid with navigating stormy markets.

On a final note, investors continue to shift equity assets toward passive strategies tracking indexes. This has produced a challenge for active stock picking strategies. Our rationale for picking stocks is at least as much risk mitigation as an effort to achieve higher total return performance. Statistically speaking, the non-diversification risk starts to tail off above 25 so we have defined our portfolio as holding at least 25 equity securities and up to 50. We will continue to maintain a diversified equity portfolio, however going forward the equity portfolio may go beyond 50 holdings.

We thank you for your support.

Sincerely,

ITEM 2. CODE OF ETHICS.

| (a) | As of the end of the period covered by this report, Forum Funds (the "Registrant") has adopted a code of ethics, which applies to its Principal Executive Officer and Principal Financial Officer (the "Code of Ethics"). |

| (b) | There have been no amendments to the Registrant's Code of Ethics during the period covered by this report. |

| (c) | There have been no waivers to the Registrant's Code of Ethics during the period covered by this report. |

(f) (1) A copy of the Code of Ethics is being filed under Item 12(a) hereto.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The Board of Trustees has determined that no member of the Audit Committee is an "audit committee financial expert" as that term is defined under applicable regulatory guidelines.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees - The aggregate fees billed for each of the last two fiscal years (the "Reporting Periods") for professional services rendered by the Registrant's principal accountant for the audit of the Registrant's annual financial statements, or services that are normally provided by the principal accountant in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $14,500 in 2016 and $15,000 in 2017.

(b) Audit-Related Fees – The aggregate fees billed in the Reporting Periods for assurance and related services rendered by the principal accountant that were reasonably related to the performance of the audit of the Registrant's financial statements and are not reported under paragraph (a) of this Item 4 were $0 in 2016 and $0 in 2017.

(c) Tax Fees - The aggregate fees billed in the Reporting Periods for professional services rendered by the principal accountant to the Registrant for tax compliance, tax advice and tax planning were $3,000 in 2016 and $3,000 in 2017. These services consisted of review or preparation of U.S. federal, state, local and excise tax returns.

(d) All Other Fees - The aggregate fees billed in the Reporting Periods for products and services provided by the principal accountant to the Registrant, other than the services reported in paragraphs (a) through (c) of this Item, were $0 in 2016 and $0 in 2017.

(e) (1) The Audit Committee reviews and approves in advance all audit and "permissible non-audit services" (as that term is defined by the rules and regulations of the Securities and Exchange Commission) to be rendered to a series of the Registrant (each, a "Series"). In addition, the Audit Committee reviews and approves in advance all "permissible non-audit services" to be provided to an investment adviser (not including any sub-adviser) of a Series, or an affiliate of such investment adviser, that is controlling, controlled by or under common control with the investment adviser and provides on-going services to the Registrant ("Affiliate"), by the Series' principal accountant if the engagement relates directly to the operations and financial reporting of the Series. The Audit Committee considers whether fees paid by a Series' investment adviser or an Affiliate to the Series' principal accountant for audit and permissible non-audit services are consistent with the principal accountant's independence.

(e) (2) No services included in (b) - (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable

(g) The aggregate non-audit fees billed by the principal accountant for services rendered to the Registrant for the Reporting Periods were $0 in 2016 and $0 in 2017. There were no fees billed in either of the Reporting Periods for non-audit services rendered by the principal accountant to the Registrant's investment adviser or any Affiliate.

(h) During the Reporting Period, the Registrant's principal accountant provided no non-audit services to the investment advisers or any entity controlling, controlled by or under common control with the investment advisers to the series of the Registrant to which this report relates.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

| (a) | Included as part of report to shareholders under Item 1. |

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END

MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

The Registrant does not accept nominees to the board of trustees from shareholders.

ITEM 11. CONTROLS AND PROCEDURES

(a) The Registrant's Principal Executive Officer and Principal Financial Officer have concluded that the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the "Act")) are effective, based on their evaluation of the controls and procedures required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as of a date within 90 days of the filing date of this report.

(b) There were no changes in the Registrant's internal control over financial reporting (as defined in

Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) Code of Ethics (Exhibit filed herewith).

(a)(2) Certifications pursuant to Rule 30a-2(a) of the Act, and Section 302 of the Sarbanes-Oxley Act of 2002. (Exhibits filed herewith)

(a)(3) Not applicable.

(b) Certifications pursuant to Rule 30a-2(b) of the Act, and Section 906 of the Sarbanes-Oxley Act of 2002. (Exhibit filed herewith)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Registrant Forum Funds

By /s/ Jessica Chase

Jessica Chase, Principal Executive Officer

Date October 24, 2017

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

By /s/ Jessica Chase

Jessica Chase, Principal Executive Officer

Date October 24, 2017

By /s/ Karen Shaw

Karen Shaw, Principal Financial Officer

Date October 24, 2017