As filed with the Securities and Exchange Commission on June 1, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: March 31

Date of reporting period: April 1, 2016 – March 31, 2017

ITEM 1. REPORT TO STOCKHOLDERS.

The views in this report were those of Absolute Strategies Fund and Absolute Capital Opportunities Fund's (each a "Fund" and collectively the "Funds") adviser as of March 31, 2017, and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and do not constitute investment advice. None of the information presented should be construed as an offer to sell or recommendation of any security mentioned herein.

Since the Funds utilize multi-manager strategies with multiple sub-advisers, they may be exposed to varying forms of risk. These risks include, but are not limited to, general market risk, multi-manager risk, focused portfolio risk, small company risk, foreign risk, interest rate risk, credit risk, prepayment risk, IPO risk, liquidity risk, high turnover risk, leverage risk, derivatives risk and cash and cash equivalents holdings risk. For a complete description of the Funds' principal investment risks, please refer to each Fund's prospectus.

Beta is a measure of an asset's sensitivity to broad market moves, as measured for instance by the S&P 500® Index. A fund with a realized beta of 0.5 with respect to the S&P 500®Index infers that about 50% of the fund's returns were explained by the performance of the index (the rest of the performance was independent of the index). Standard deviation indicates the volatility of a fund's total returns and is useful because it identifies the spread of a fund's short-term fluctuations. The HFR Indices are equally weighted performance indexes, utilized by numerous hedge fund managers as a benchmark for their own hedge funds. One cannot invest directly in an index.

Absolute Strategies Fund, Absolute Funds, and Absolute Investment Advisers are registered service marks of Absolute Investment Advisers LLC ("AIA" and "Absolute") and the respective logos and Absolute Capital Opportunities Fund are service marks of AIA; and other marks referred to herein are the trademarks, service marks or registered trademarks of their respective owners.

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2017 |

Dear Shareholder,

We are pleased to present the Annual Report for the Absolute Strategies Fund (the "Fund") for the year ended March 31, 2017.

In this regard, The Fund seeks to provide long-term capital appreciation with an emphasis on absolute (positive) returns and low sensitivity to traditional financial market indices such as the Standard & Poor's 500® Index ("S&P 500® Index"). Achieving this over the course of an investment cycle often means constructing a portfolio of investments that looks very different from other investment funds, including alternative ones. It requires being defensive at times when others are overly aggressive. It requires looking for value in areas of the market that are over-looked or unloved by other investors. Achieving these goals also means that the Fund's performance is likely to go through periods of under-performance as well as out-performance versus other strategies. Over time the uniqueness of this creates significant diversification properties. In this regard, the Fund (Institutional Shares) returned -3.40% over the 12 months ended March 31. By comparison, the HRFX Global Hedge Fund Index returned 6.19% and the S&P 500 Index returned 17.17%.

We believe that recent dynamics have resulted in a market that is narrow and highly inefficient (see more below). While this has been frustrating, we are excited in that this type of inefficiency creates an opportunity to set up a portfolio that can generate significant performance once the latest cycle of abnormal market conditions exhausts itself. We believe it may be setting up for an extensive long/short opportunity.

During the year, the Fund has maintained a balance of long and short exposures. Net exposure has been at the low end of its historical range and sensitivity to traditional equity indices has been negative. Allocations have been concentrated around a diverse, but limited, number of equity strategies with a moderate allocation to convertible arbitrage. The Fund has also employed certain opportunistic trades. These trades may be short-term in nature and expressed through purchases and sales of index related securities. The trades have individual merits but also can allow the Fund to take advantage of spikes of volatility.

In general, many of the Fund's long securities haven't had a big story or theme attached to them and may not have been a major part of an index. The Fund's short securities were deemed to be expensive and/or exhibiting low growth with significant economic sensitivity. Equity index securities were also used on the short side to create relative-value arbitrage opportunities versus Fund long securities. Certain of the Fund's derivative positions were used to achieve this positioning as well as to control the Fund's broader market sensitivity.

Sub-adviser strategies based on long equity exposure were the Fund's top performers over the last year. Energy related securities, which were somewhat new to the Fund in 2016, did particularly well. Long exposure to precious metals related securities provided modest returns during the period. Convertible arbitrage also performed well during the period. This was notable because the strategy typically exhibits low sensitivity to equity markets. Strategies that included short exposure were the largest detractors. Shorting has been particularly difficult as few things seemed to have gone down in price regardless of how poorly a company or group of companies performed. The Fund's short exposure remains flexible and has varied over the past year as large spikes in volatility have offered opportunities to monetize short term gains. During periods of low volatility the Fund has maintained a large amount of short exposure due to historically high valuations and weak fundamentals (see below). The timing is uncertain but we believe the payoff in short opportunities could be significant. Long periods of low volatility and high valuations have historically given way to periods of high volatility, leading to market valuations reverting to the mean.

We remain steadfast in our investment philosophy. Fundamental bias, patience, and diversification are our discipline. For anyone with a similar philosophy, this environment has been punishing. Passive investing and risk-parity strategies are the crowd themes for this cycle. While many have chosen to maintain a passive bias, not one investor or advisor we've met with is actively betting client capital on another asset bubble. No, this current situation has been created by a willingness to ignore inflated prices and continue to hope for another year of escape. Asset allocation has become the antithesis of the "efficient market hypothesis." What analysis is actually being performed? Who is left to perform individual stock selection and to allocate capital based on all available information? Most of the survivors left in the active management industry do not focus on alpha; they are marketing behemoths. We believe, much of the world of investment management have decided fundamental research is no longer necessary. As such, the overall market structure has become even narrower and more inefficient. How ironic.

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2017 |

The following are just some of the insights we note when evaluating the current environment:

| · | The cumulative market cap of the Russell 2500 has grown 16% since 2014, while net income has dropped 20%. (FPA LLC, Bloomberg) |

| · | The S&P 500 Price to Sales ratio is at September 2000 levels, 25% higher than 2007 peak. (Bloomberg) |

| · | The S&P 500 Enterprise Value to Earnings before Interest, Taxes, Depreciation and Amortization ("EBITDA") is at September 2000 levels. (Bloomberg) |

· The Russell 2000 Enterprise Value to EBITDA is 80% above its previous record level. (Bloomberg)

| · | The S&P 500 Median Price to Earnings ratio is over 24; the median since 1965 is 17. (Ned Davis Research) |

| · | The S&P 500 Median Price to Sales is 35% above the previous record in 2007. (Ned Davis Research) |

| · | The S&P 500 (ex financials) Debt to EBITDA is higher than both the 2002 and 2009 recession peaks. (Citigroup) |

· The CBOE SPX Volatility Index recently broke below 10, a level last reached in 2007. (Bloomberg)

· Stock market capitalization to GDP is the highest in history outside the 2000 bubble.

| · | The Shiller Cyclically Adjusted Price-to-Earnings Ratio ("CAPE") ratio recently hit 29, nearly the same level as the 1929 peak. |

| · | Three of the largest consumer credit companies in the U.S., have all recently reported sharply higher net charge-offs (NCOs). (Bloomberg) |

| · | Auto sales and auto lending also appear to have peaked and are turning down while loan delinquencies have risen. (Bloomberg) |

| · | Home Capital Group, the largest non-bank mortgage lender in Canada, appears to be having a Bear Stearns moment; risk is now spreading to others. Bear Stearns, of course, collapsed quickly when mortgages it owned started to become delinquent and sources of funding dried up. |

We have a market environment that combines some of the highest valuation levels in history with an aggregate collection of price-insensitive buyers. Couple that with structurally low growth, record high corporate leverage, central banks that desire raising rates and shrinking balance sheets, extremely low levels of volatility, cresting auto sales, deteriorating consumer credit, and a potentially hostile geo-political environment and you have the potential for severe volatility dead ahead.

At some point, we believe most everything currently driving frothy, overvalued market conditions could suddenly stop working and reverse. As such, we are maintaining a negative beta bias. Certainly there is a risk that this abnormal market cycle can go on longer. If so, we plan to remain flexible around sizable bumps in volatility. However, at this point we believe the risk is more likely to be a final, short-term upside thrust. Our long portfolio includes very cheap out-of-the-money call option protection should this event happen.

We continue to believe our disciplined approach is rare in today's crowded financial market landscape. The active alternatives space has already gone through a significant bear market relative to major market indices; this experience is not dissimilar from that of value investors in the late 1990s. In addition, it has proven that very few strategies are providing any source of return outside of beta. Should market forces and volatility awaken again, it's clear from drawdown studies that almost no combination of these competing products will diversify away market risk. The allocation math is quite simple. Even a small allocation to a strategy positioned for alpha like ours would likely provide much more diversification potential vs funds that provide correlated market performance. The potential for upside returns during critical drawdown periods cannot be understated during periods of historically high valuations. When asset prices cheapen again, we will most certainly participate. If the current environment is indeed similar to 1999 or 2007 (as the above insights may suggest), then we could have a generational long/short opportunity at hand.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

ABSOLUTE STRATEGIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2017 |

The following charts reflect the change in the value of a hypothetical $1,000,000 investment in Institutional Shares and a $250,000 investment in R Shares, including reinvested dividends and distributions, in Absolute Strategies Fund (the "Fund") compared with the performance of the benchmark, S&P 500 Index ("S&P 500"), Barclays Capital U.S. Aggregate Bond Index ("Barclays Index"), the HFRX Global Hedge Fund Index ("HFRX") and the MSCI World Index ("MSCI World"), over the past ten fiscal years. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Barclays Index covers the U.S. dollar-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The MSCI World measures the performance of a diverse range of 24 developed countries' stock markets including the United States, Canada, Europe, the Middle East and the Pacific. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $1,000,000 Investment

Absolute Strategies Fund - Institutional Shares vs. S&P 500 Index,

Barclays Capital U.S. Aggregate Bond Index,

HFRX Global Hedge Fund Index and MSCI World Index

| Average Annual Total Returns | | | | | | | |

| Periods Ended March 31, 2017 | | One Year | | Five Years | | Ten Years | |

| Absolute Strategies Fund - Institutional Shares | | -3.40 | % | | -0.34 | % | | 1.10 | % | |

| S&P 500 Index | | 17.17 | % | | 13.30 | % | | 7.51 | % | |

| Barclays Capital U.S. Aggregate Bond Index | | 0.44 | % | | 2.34 | % | | 4.27 | % | |

| HFRX Global Hedge Fund Index | | 6.19 | % | | 1.35 | % | | (0.57 | )% | |

| MSCI World Index | | 14.77 | % | | 9.37 | % | | 4.21 | % | |

ABSOLUTE STRATEGIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2017 |

Comparison of Change in Value of a $250,000 Investment

Absolute Strategies Fund - R Shares vs. S&P 500 Index, Barclays Capital U.S. Aggregate Bond Index,

HFRX Global Hedge Fund Index and MSCI World Index

| Average Annual Total Returns | | | | | | | |

| Periods Ended March 31, 2017 | | One Year | | Five Years | | Ten Years | |

| Absolute Strategies Fund - R Shares | | -3.89 | % | | -0.82 | % | | 0.65 | % | |

| S&P 500 Index | | 17.17 | % | | 13.30 | % | | 7.51 | % | |

| Barclays Capital U.S. Aggregate Bond Index | | 0.44 | % | | 2.34 | % | | 4.27 | % | |

| HFRX Global Hedge Fund Index | | 6.19 | % | | 1.35 | % | | (0.57 | )% | |

| MSCI World Index | | 14.77 | % | | 9.37 | % | | 4.21 | % | |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (888) 992-2765. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Institutional Shares and R Shares are 2.68% and 3.26%, respectively. Excluding the effect of expenses attributable to dividends and interest on short sales and acquired fund fees and expenses, the Fund's total annual operating expense ratios would be 1.85% and 2.41% for Institutional Shares and R Shares, respectively. To the extent that the Fund invests in any investment company or exchange-traded fund sponsored by the Fund's adviser or its affiliates, the adviser may waive certain fees and expenses. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

ABSOLUTE CAPITAL OPPORTUNITIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2017 |

Dear Shareholder,

For the period ending March 31, 2017, the Absolute Capital Opportunities Fund (the "Fund") returned 7.44%. By comparison, the HFRX Equity Hedge Index returned 5.90%.

The Fund combines two Sub-Advisers with a flexible approach to equity investing. Both managers typically invest in a concentrated number of positions on the long side, balanced with different hedging methods. St James Investment Company will opportunistically utilize cash levels as a hedge. Kovitz Investment Group will opportunistically utilize individual stocks, ETFs, or options to hedge. The result is a Fund that maintains a positive net long bias but with exposures that change and the ability to avoid being fully exposed to equity market risk at all times.

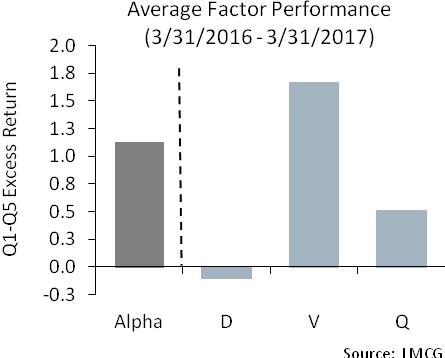

Over the last year, Fund performance benefitted from maintaining a net long bias in a market that generally trended higher. The two Sub-Advisers' focus on value oriented positions also helped as value out-performed growth (as measured by the Russell 3000 Value & Growth Indices) for the first time in several years (fiscal periods). Being disciplined and not chasing high flying stocks also was a plus - poor market timing seems to be one of the factors that has created negative alpha in many hedge fund strategies in recent years.

We believe the Fund is well positioned well for a variety of market environments.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

ABSOLUTE CAPITAL OPPORTUNITIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2017 |

The following chart reflects the change in the value of a hypothetical $1,000,000 investment, including reinvested dividends and distributions, in Absolute Capital Opportunities Fund (the "Fund") compared with the performance of the benchmark, the HFRX Equity Hedge Fund Index ("HFRX Equity") and the S&P 500 Index ("S&P 500"), since inception. HFRX Equity tracks strategies that maintain positions both long and short in primarily equity and equity derivative securities. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The total return of the index includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the index does not include expenses. The Fund is professionally managed, while the index is unmanaged and is not available for investment.

Comparison of Change in Value of a $1,000,000 Investment

Absolute Capital Opportunities Fund vs. HFRX Equity Hedge Index

and S&P 500 Index

| Average Annual Total Returns | | | | Since Inception |

| Periods Ended March 31, 2017 | | One Year | | 12/30/15 |

| Absolute Capital Opportunities Fund - Shares | | 7.44 | % | | 7.67 | % |

| HFRX Equity Hedge Index | | 5.90 | % | | 2.08 | % |

| S&P 500 Index | | 17.17 | % | | 13.85 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (888) 992-2765. As stated in the Fund's prospectus, the annual operating expense ratio (gross) is 4.37%. Excluding the effect of expenses attributable to dividends and interest on short sales, the Fund's total annual operating expense ratio would be 4.12%. However, the Fund's adviser has agreed to contractually waive a portion of its fees and to reimburse expenses such that total operating expenses (excluding all taxes, interest, portfolio transaction expenses, dividend and interest expenses on short sales, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.85% on net assets up to $100 million, 1.75% on net assets between $100 million and $200 million, and 1.65% on net assets over $200 million through August 1, 2019 (the "Expense Cap"). The adviser may be reimbursed by the Fund for fees waived and expenses reimbursed pursuant to the Expense Cap if such payment is made within three years of the fee waiver or expense reimbursement and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap, or (ii) the expense cap in place at the time the fees/expenses were waived or reimbursed. During the period, certain fees were waived and/or expenses reimbursed; otherwise returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

ABSOLUTE STRATEGIES FUND PORTFOLIO HOLDINGS SUMMARY (Unaudited) MARCH 31, 2017 |

| Portfolio Breakdown (% of Net Assets) |

| Long Positions |

| Equity Securities | 34.5% | |

| Asset Backed Obligations | 0.2% | |

| Corporate Convertible Bonds | 13.7% | |

| Corporate Non-Convertible Bonds | 5.2% | |

| Exchange Traded Notes | 0.0% | |

| Syndicated Loans | 0.5% | |

| Investment Companies | 17.7% | |

| Money Market Fund | 20.6% | |

| Purchased Options | 1.4% | |

| Short Positions |

| Equity Securities | -29.4% | |

| Investment Companies | -9.5% | |

| Written Options | -0.2% | |

| Other Assets less Liabilities* | 45.3% | |

| | 100.0% | |

*Consists of deposits with the custodian and/or brokers for securities sold short, cash, foreign currency, prepaid expenses, receivables, payables and accrued liabilities. Deposits with the custodian and/or brokers for securities sold short represents 41.3% of net assets. See Note 2 of the accompanying Notes to Financial Statements.

| | (% of Equity Holdings) |

| Sector Breakdown | Long | Short |

| Consumer Discretionary | 13.0% | 17.0% | |

| Consumer Staples | 18.6% | 14.0% | |

| Energy | 21.7% | 3.3% | |

| Financial | 17.3% | 24.7% | |

| Healthcare | 1.6% | 1.5% | |

| Industrial | 10.5% | 24.3% | |

| Information Technology | 3.5% | 11.2% | |

| Materials | 9.6% | 2.2% | |

| Telecommunication Services | 2.8% | 1.7% | |

| Utilities | 1.4% | 0.1% | |

| | 100.0% | 100.0% | |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2017 |

| Shares | | Security Description | | Value | |

| Long Positions - 93.8% |

| Equity Securities - 34.5% |

| Common Stock - 34.5% |

| Consumer Discretionary - 4.5% |

| | 28,449 | | American Airlines Group, Inc. (a)(b) | $ | 1,203,393 | |

| | 5,026 | | Buffalo Wild Wings, Inc. (c) | | 767,722 | |

| | 4,632 | | CarMax, Inc. (c) | | 274,307 | |

| | 58,795 | | CVS Health Corp. | | 4,615,407 | |

| | 173,506 | | Drive Shack, Inc. (a) | | 720,050 | |

| | 26,109 | | Extended Stay America, Inc. (a) | | 416,177 | |

| | 83,774 | | Freshpet, Inc. (c) | | 921,514 | |

| | 51,404 | | General Motors Co. (a) | | 1,817,645 | |

| | 83,774 | | Green Plains Partners LP (a) | | 1,683,857 | |

| | 14,589 | | Harley-Davidson, Inc. (a)(b)(d) | | 882,635 | |

| | 15,359 | | Lithia Motors, Inc., Class A (a) | | 1,315,498 | |

| | 185,699 | | Luby's, Inc. (c) | | 577,524 | |

| | 27,349 | | Macy's, Inc. (a) | | 810,624 | |

| | 21,416 | | Motorcar Parts of America, Inc. (c) | | 658,114 | |

| | 15,949 | | Nexeo Solutions, Inc. (a)(c) | | 141,308 | |

| | 3,909 | | Panera Bread Co., Class A (c) | | 1,023,650 | |

| | 23,946 | | Robert Half International, Inc. | | 1,169,283 | |

| | 57,246 | | The Habit Restaurants, Inc., Class A (a)(c) | | 1,013,254 | |

| | 7,984 | | The Walt Disney Co. | | 905,306 | |

| | 35,000 | | VF Corp. | | 1,923,950 | |

| | 5,910 | | Walgreens Boots Alliance, Inc. | | 490,826 | |

| | | 23,332,044 | |

| Consumer Staples - 6.4% |

| | 3,170 | | AMERCO (c) | | 1,208,372 | |

| | 19,547 | | Calavo Growers, Inc. | | 1,184,548 | |

| | 46,000 | | Diageo PLC, ADR | | 5,316,680 | |

| | 17,333 | | Lamb Weston Holdings, Inc., Class A (a) | | 729,026 | |

| | 80,000 | | Nestle SA, ADR | | 6,152,000 | |

| | 116,800 | | Nomad Foods, Ltd. (a)(c) | | 1,337,360 | |

| | 37,202 | | PFSweb, Inc. (c) | | 242,929 | |

| | 32,113 | | Phibro Animal Health Corp., Class A | | 902,375 | |

| | 22,000 | | Philip Morris International, Inc. | | 2,483,800 | |

| | 71,208 | | Pilgrim's Pride Corp. (a)(c) | | 1,602,536 | |

| | 19,827 | | Post Holdings, Inc. (a)(c) | | 1,735,259 | |

| | 110,000 | | Sanofi, ADR | | 4,977,500 | |

| | 53,057 | | Sprouts Farmers Market, Inc. (a)(c) | | 1,226,678 | |

| | 36,157 | | SUPERVALU, Inc. (c) | | 139,566 | |

| | 25,132 | | The Hain Celestial Group, Inc. (b)(c) | | 934,911 | |

| | 27,925 | | Tyson Foods, Inc., Class A (a) | | 1,723,252 | |

| | 29,321 | | Zoetis, Inc. (a) | | 1,564,862 | |

| | | 33,461,654 | |

| Energy - 7.5% |

| | 11,470 | | Anadarko Petroleum Corp. | | 711,140 | |

| | 21,866 | | California Resources Corp. (a)(c) | | 328,865 | |

| | 30,076 | | Cheniere Energy, Inc. (c) | | 1,421,692 | |

| | 34,763 | | Comstock Resources, Inc. (c) | | 320,862 | |

| | 128,800 | | Cone Midstream Partners LP (a) | | 3,040,968 | |

| | 17,093 | | Devon Energy Corp. | | 713,120 | |

| | 10,142 | | Dominion Midstream Partners LP | | 324,037 | |

| | 108,240 | | Enbridge, Inc. | | 4,528,762 | |

| | 53,640 | | Energy Transfer Equity LP | | 1,058,317 | |

| | 39,598 | | Energy Transfer Partners LP | | 1,446,119 | |

| | 85,927 | | EnLink Midstream Partners LP | | 1,572,464 | |

| | 80,848 | | Enterprise Products Partners LP (a) | | 2,232,213 | |

| | 51,661 | | Green Plains, Inc. (a) | | 1,278,610 | |

| | 52,806 | | Halliburton Co. (a)(d) | | 2,598,583 | |

| | 71,389 | | Kinder Morgan, Inc. | | 1,551,997 | |

| | 9,634 | | Marathon Petroleum Corp. | | 486,902 | |

| Shares | | Security Description | | Value | |

| | 44,592 | | MPLX LP | $ | 1,608,879 | |

| | 23,377 | | Patterson-UTI Energy, Inc. | | 567,360 | |

| | 6,319 | | Phillips 66 Partners LP | | 324,481 | |

| | 77,614 | | Plains All American Pipeline LP | | 2,453,379 | |

| | 7,014 | | Plains GP Holdings LP, Class A | | 219,258 | |

| | 35,299 | | Rice Energy, Inc. (c) | | 836,586 | |

| | 83,307 | | Rice Midstream Partners LP | | 2,101,003 | |

| | 21,193 | | Schlumberger, Ltd. | | 1,655,173 | |

| | 11,586 | | Sprague Resources LP | | 313,981 | |

| | 30,296 | | Targa Resources Corp. | | 1,814,730 | |

| | 5,692 | | The Williams Cos., Inc. | | 168,426 | |

| | 27,529 | | TransMontaigne Partners LP | | 1,229,996 | |

| | 22,208 | | Western Gas Partners LP | | 1,342,474 | |

| | 18,380 | | Williams Partners LP | | 750,455 | |

| | | 39,000,832 | |

| Financial - 6.0% |

| | 24,010 | | American Express Co. (a)(d) | | 1,899,431 | |

| | 14,154 | | Aon PLC (a) | | 1,679,938 | |

| | 89,592 | | Bank of America Corp. (a) | | 2,113,475 | |

| | 41,515 | | Berkshire Hathaway, Inc., Class B (a)(c) | | 6,919,720 | |

| | 110,000 | | Brookfield Asset Management, Inc., Class A | | 4,010,600 | |

| | 41,572 | | CBRE Group, Inc., Class A (a)(c) | | 1,446,290 | |

| | 23,951 | | Citigroup, Inc. (a) | | 1,432,749 | |

| | 29,167 | | JPMorgan Chase & Co. (a) | | 2,562,029 | |

| | 64,448 | | Leucadia National Corp. (a) | | 1,675,648 | |

| | 61,595 | | Medical Properties Trust, Inc. REIT (a) | | 793,960 | |

| | 80,000 | | The Bank of New York Mellon Corp. | | 3,778,400 | |

| | 40,000 | | WR Berkley Corp. | | 2,825,200 | |

| | | 31,137,440 | |

| Healthcare - 0.5% |

| | 17,481 | | Allscripts Healthcare Solutions, Inc. (c) | | 221,659 | |

| | 7,000 | | Becton Dickinson and Co. | | 1,284,080 | |

| | 9,400 | | McKesson Corp. | | 1,393,644 | |

| | | 2,899,383 | |

| Industrial - 3.6% |

| | 69,812 | | Briggs & Stratton Corp. (a) | | 1,567,279 | |

| | 8,377 | | Deere & Co. | | 911,920 | |

| | 16,218 | | Delta Air Lines, Inc. (b) | | 745,379 | |

| | 7,231 | | Dycom Industries, Inc. (a)(c) | | 672,122 | |

| | 57,000 | | Expeditors International of Washington, Inc. | | 3,219,930 | |

| | 29,542 | | Forterra, Inc. (a)(c) | | 576,069 | |

| | 28,185 | | Jacobs Engineering Group, Inc. (a) | | 1,558,067 | |

| | 7,540 | | John Bean Technologies Corp. | | 663,143 | |

| | 15,018 | | MasTec, Inc. (a)(c) | | 601,471 | |

| | 79,398 | | Quanta Services, Inc. (a)(c)(d) | | 2,946,460 | |

| | 11,414 | | The Boeing Co. (a)(b)(d) | | 2,018,680 | |

| | 29,321 | | Trimble, Inc. (c) | | 938,565 | |

| | 5,951 | | United Parcel Service, Inc., Class B (a) | | 638,542 | |

| | 11,094 | | Valmont Industries, Inc. (a) | | 1,725,117 | |

| | | 18,782,744 | |

| Information Technology - 1.2% |

| | 22,946 | | Apple, Inc. (a)(b) | | 3,296,422 | |

| | 14,645 | | BroadSoft, Inc. (a)(c) | | 588,729 | |

| | 83,171 | | Nuance Communications, Inc. (a)(c) | | 1,439,690 | |

| | 16,199 | | Silicon Motion Technology Corp., ADR | | 757,303 | |

| | 20,212 | | Unisys Corp. (c) | | 281,958 | |

| | | 6,364,102 | |

| Materials - 3.3% |

| | 12,566 | | Agrium, Inc. (a) | | 1,200,681 | |

| | 597,595 | | Atlas Iron, Ltd. (c) | | 13,697 | |

See Notes to Financial Statements. | 8 | |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2017 |

| Shares | | Security Description | | Value | |

| | 87,000 | | Cameco Corp. | $ | 963,090 | |

| | 82,587 | | Constellium NV, Class A (c) | | 536,816 | |

| | 25,807 | | Fairmount Santrol Holdings, Inc. (c) | | 189,165 | |

| | 55,611 | | Monsanto Co. (a) | | 6,295,165 | |

| | 25,000 | | Praxair, Inc. | | 2,965,000 | |

| | 65,000 | | Royal Gold, Inc. | | 4,553,250 | |

| | 18,837 | | Westlake Chemical Partners LP | | 473,751 | |

| | | 17,190,615 | |

| Telecommunication Services - 1.0% |

| | 1,244 | | Alphabet, Inc., Class A (c) | | 1,054,663 | |

| | 419 | | Alphabet, Inc., Class C (c) | | 347,586 | |

| | 90,864 | | Attunity, Ltd. (a)(c) | | 719,643 | |

| | 28,203 | | CBS Corp., Class B, Non-Voting Shares (a) | | 1,956,160 | |

| | 71,796 | | Harmonic, Inc. (c) | | 427,186 | |

| | 71,106 | | Spark Networks, Inc. (a)(c) | | 73,239 | |

| | 15,857 | | Twenty-First Century Fox, Inc., Class A (a) | | 513,609 | |

| | | 5,092,086 | |

| Utilities - 0.5% |

| | 86,392 | | Vistra Energy Corp. (c) | | 1,408,190 | |

| | 22,583 | | Western Gas Equity Partners LP | | 1,041,076 | |

| | | 2,449,266 | |

| Total Common Stock (Cost $139,031,121) | | 179,710,166 | |

| Total Equity Securities (Cost $139,031,121) | | 179,710,166 | |

| | Principal | | Security Description | | Rate | | Maturity | | Value | |

| Fixed Income Securities - 19.6% |

| Asset Backed Obligations - 0.2% |

| $ | 64,207 | | Adjustable Rate Mortgage Trust, Series 2005-12 2A1 (e) | | 3.49 | % | 03/25/36 | | 56,292 | |

| | 40,410 | | Adjustable Rate Mortgage Trust, Series 2006-1 3A3 (e) | | 3.31 | | 03/25/36 | | 33,591 | |

| | 30,332 | | Banc of America Funding Corp., Series 2006-E 2A1 (e) | | 3.32 | | 06/20/36 | | 25,277 | |

| | 69,117 | | Banc of America Funding Corp., Series 2007-E 4A1 (e) | | 3.05 | | 07/20/47 | | 57,202 | |

| | 78,294 | | CitiMortgage Alternative Loan Trust, Series 2006-A7 1A12 | | 6.00 | | 12/25/36 | | 69,503 | |

| | 30,250 | | CitiMortgage Alternative Loan Trust, Series 2007-A4 1A6 | | 5.75 | | 04/25/37 | | 26,093 | |

| | 35,333 | | Countrywide Alternative Loan Trust, Series 2005-50CB 1A1 | | 5.50 | | 11/25/35 | | 34,206 | |

| | 178,889 | | Countrywide Alternative Loan Trust, Series 2006-36T2 1A1 (e) | | 1.30 | | 12/25/36 | | 90,754 | |

| | Principal | | Security Description | | Rate | | Maturity | | Value | |

| $ | 49,338 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2007-HY5 1A1 (e) | | 3.30 | % | 09/25/47 | $ | 45,027 | |

| | 59,129 | | Indymac Index Mortgage Loan Trust, Series 2006-AR25 3A1 (e) | | 3.39 | | 09/25/36 | | 48,923 | |

| | 29,056 | | JP Morgan Mortgage Trust, Series 2007-A2 4A1M (e) | | 3.31 | | 04/25/37 | | 26,836 | |

| | 131,825 | | Lehman XS Trust, Series 2005-6 1A1 (e) | | 1.50 | | 11/25/35 | | 89,433 | |

| | 134,449 | | Residential Accredit Loans, Inc., Series 2006-QS17 A4 | | 6.00 | | 12/25/36 | | 114,160 | |

| | 109,701 | | Residential Accredit Loans, Inc., Series 2007-QS5 A1 | | 5.50 | | 03/25/37 | | 87,792 | |

| | 1,052,847 | | Residential Asset Securitization Trust, Series 2007-A5 1A2 (e) | | 1.38 | | 05/25/37 | | 223,907 | |

| | 42,156 | | Structured Adjustable Rate Mortgage Loan Trust, Series 2007-3 3A1 (e) | | 3.35 | | 04/25/47 | | 33,027 | |

Total Asset Backed Obligations (Cost $1,218,912) | | 1,062,023 | |

| Corporate Convertible Bonds - 13.7% |

| Consumer Discretionary - 0.6% |

| | 1,000,000 | | Horizon Global Corp. | | 2.75 | | 07/01/22 | | 910,625 | |

| | 1,200,000 | | JAKKS Pacific, Inc. (a)(f) | | 4.88 | | 06/01/20 | | 1,087,500 | |

| | 1,000,000 | | M/I Homes, Inc. | | 3.25 | | 09/15/17 | | 1,132,500 | |

| | | 3,130,625 | |

| Consumer Staples - 3.5% |

| | 2,000,000 | | Acorda Therapeutics, Inc. (a) | | 1.75 | | 06/15/21 | | 1,710,000 | |

| | 2,250,000 | | Albany Molecular Research, Inc. (a) | | 2.25 | | 11/15/18 | | 2,459,531 | |

| | 700,000 | | Ascent Capital Group, Inc. (a) | | 4.00 | | 07/15/20 | | 539,000 | |

| | 2,100,000 | | Carriage Services, Inc. (a) | | 2.75 | | 03/15/21 | | 2,737,875 | |

| | 450,000 | | Ctrip.com International, Ltd. (a)(f) | | 1.25 | | 09/15/22 | | 468,000 | |

| | 1,500,000 | | Depomed, Inc. (a) | | 2.50 | | 09/01/21 | | 1,406,250 | |

See Notes to Financial Statements. | 9 | |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2017 |

| | Principal | | Security Description | | Rate | | Maturity | | Value | |

| $ | 2,000,000 | | Ironwood Pharmaceuticals, Inc. (a) | | 2.25 | % | 06/15/22 | $ | 2,496,250 | |

| | 700,000 | | Macquarie Infrastructure Corp. | | 2.00 | | 10/01/23 | | 689,500 | |

| | 1,600,000 | | Sucampo Pharmaceuticals, Inc. (f) | | 3.25 | | 12/15/21 | | 1,591,000 | |

| | 500,000 | | The Spectranetics Corp. | | 2.63 | | 06/01/34 | | 572,188 | |

| | 500,000 | | Theravance Biopharma, Inc. | | 3.25 | | 11/01/23 | | 633,125 | |

| | 1,750,000 | | Tivity Health, Inc. (a) | | 1.50 | | 07/01/18 | | 2,698,281 | |

| | | 18,001,000 | |

| Energy - 1.5% |

| | 1,500,000 | | Clean Energy Fuels Corp. (a)(f) | | 5.25 | | 10/01/18 | | 1,457,813 | |

| | 1,700,000 | | Ensco Jersey Finance, Ltd. (a)(f) | | 3.00 | | 01/31/24 | | 1,662,812 | |

| | 1,000,000 | | Newpark Resources, Inc. (f) | | 4.00 | | 12/01/21 | | 1,136,250 | |

| | 3,000,000 | | Renewable Energy Group, Inc. (f) | | 4.00 | | 06/15/36 | | 3,401,250 | |

| | | 7,658,125 | |

| Financial - 0.7% |

| | 2,700,000 | | Encore Capital Group, Inc. (a) | | 3.00 | | 07/01/20 | | 2,559,938 | |

| | 1,000,000 | | Encore Capital Group, Inc. (f) | | 3.25 | | 03/15/22 | | 923,750 | |

| | | 3,483,688 | |

| Healthcare - 0.9% |

| | 2,000,000 | | Quidel Corp. | | 3.25 | | 12/15/20 | | 2,058,750 | |

| | 2,000,000 | | Repligen Corp. | | 2.13 | | 06/01/21 | | 2,562,500 | |

| | | 4,621,250 | |

| Industrial - 1.4% |

| | 1,550,000 | | Echo Global Logistics, Inc.(a) | | 2.50 | | 05/01/20 | | 1,467,656 | |

| | 2,400,000 | | Fluidigm Corp. (a) | | 2.75 | | 02/01/34 | | 1,644,000 | |

| | 500,000 | | Golar LNG, Ltd. (f) | | 2.75 | | 02/15/22 | | 506,875 | |

| | 1,500,000 | | Kaman Corp. (a)(f) | | 3.25 | | 11/15/17 | | 2,168,438 | |

| | 1,000,000 | | TTM Technologies, Inc. | | 1.75 | | 12/15/20 | | 1,764,375 | |

| | | 7,551,344 | |

| Information Technology - 2.4% |

| | 1,400,000 | | Advanced Micro Devices, Inc. (a) | | 2.13 | | 09/01/26 | | 2,768,500 | |

| | 2,300,000 | | Avid Technology, Inc. (a) | | 2.00 | | 06/15/20 | | 1,634,438 | |

| | 834,000 | | Ciena Corp. | | 0.88 | | 06/15/17 | | 834,521 | |

| | 2,500,000 | | Envestnet, Inc. (a) | | 1.75 | | 12/15/19 | | 2,335,937 | |

| | 975,000 | | Nuance Communi-cations, Inc. | | 2.75 | | 11/01/31 | | 982,922 | |

| | 1,300,000 | | ON Semiconductor Corp. (f) | | 1.63 | | 10/15/23 | | 1,354,438 | |

| | 2,200,000 | | Quantum Corp. | | 4.50 | | 11/15/17 | | 2,194,500 | |

| | Principal | | Security Description | | Rate | | Maturity | | Value | |

| $ | 300,000 | | Veeco Instruments, Inc. | | 2.70 | % | 01/15/23 | $ | 314,625 | |

| | | 12,419,881 | |

| Materials - 0.9% |

| | 1,300,000 | | Aceto Corp. (a) | | 2.00 | | 11/01/20 | | 1,194,375 | |

| | 200,000 | | Pretium Resources, Inc. (f) | | 2.25 | | 03/15/22 | | 201,875 | |

| | 3,500,000 | | Silver Standard Resources, Inc. | | 2.88 | | 02/01/33 | | 3,438,750 | |

| | | 4,835,000 | |

| Telecommunication Services - 1.3% |

| | 716,000 | | Clearwire Commun-ications, LLC/Clearwire Finance, Inc. (f) | | 8.25 | | 12/01/40 | | 743,745 | |

| | 2,250,000 | | Global Eagle Entertainment, Inc. (a) | | 2.75 | | 02/15/35 | | 1,144,687 | |

| | 2,350,000 | | Harmonic, Inc. (a) | | 4.00 | | 12/01/20 | | 2,937,500 | |

| | 2,000,000 | | Pandora Media, Inc. | | 1.75 | | 12/01/20 | | 2,015,000 | |

| | | 6,840,932 | |

| Utilities - 0.5% |

| | 3,350,000 | | EnerNOC, Inc. (a) | | 2.25 | | 08/15/19 | | 2,803,531 | |

Total Corporate Convertible Bonds (Cost $66,354,405) | | 71,345,376 | |

| | Principal | | Security Description | | Rate | | Maturity | | Value | |

| Industrial - 0.5% |

| $ | 500,000 | | Park-Ohio Industries, Inc. | | 8.13 | % | 04/01/21 | $ | 516,035 | |

| | 1,561,000 | | USG Corp. | | 8.25 | | 01/15/18 | | 1,642,953 | |

| | 303,000 | | XPO CNW, Inc. | | 7.25 | | 01/15/18 | | 313,605 | |

| | | 2,472,593 | |

| Information Technology - 0.3% |

| | 1,667,000 | | NXP BV / NXP Funding, LLC (f) | | 3.75 | | 06/01/18 | | 1,704,508 | |

| Materials - 0.2% |

| | 980,000 | | International Wire Group, Inc. (f) | | 10.75 | | 08/01/21 | | 955,500 | |

| Teleommunication Services - 1.7% |

| | 1,471,000 | | CSC Holdings, LLC | | 7.88 | | 02/15/18 | | 1,537,195 | |

| | 400,000 | | DISH DBS Corp. | | 4.63 | | 07/15/17 | | 403,500 | |

| | 1,290,000 | | FairPoint Commun-ications, Inc. (f) | | 8.75 | | 08/15/19 | | 1,330,828 | |

| | 925,000 | | iHeartCommunications, Inc. | | 9.00 | | 12/15/19 | | 789,719 | |

| | 2,024,000 | | Level 3 Financing, Inc. (e) | | 4.76 | | 01/15/18 | | 2,035,385 | |

| | 895,000 | | Sprint Commun-ications, Inc. (f) | | 9.00 | | 11/15/18 | | 976,669 | |

| | 520,000 | | T-Mobile USA, Inc. | | 6.46 | | 04/28/19 | | 521,950 | |

| | 520,000 | | T-Mobile USA, Inc. | | 6.54 | | 04/28/20 | | 531,050 | |

| | 749,000 | | ViaSat, Inc. | | 6.88 | | 06/15/20 | | 768,661 | |

| | | 8,894,957 | |

| Utilities - 0.1% |

| | 538,000 | | NRG Energy, Inc. | | 7.63 | | 01/15/18 | | 558,175 | |

Total Corporate Non-Convertible Bonds (Cost $27,479,577) | | 27,242,223 | |

| Exchange Traded Notes - 0.0% |

| | 250 | | iPATH S&P 500 VIX Mid-Term Futures ETN (a)(c) (Cost $9,104) | | 6,575 | |

| Syndicated Loans - 0.5% |

| | 471,736 | | Atlas Iron, Ltd. (e) | | 5.58 | | 04/30/21 | | 449,918 | |

| | 2,000,000 | | Energy Future Intermediate Holding Co., LLC (e) | | 4.25 | | 06/30/17 | | 2,002,083 | |

| Total Syndicated Loans (Cost $2,472,370) | | 2,452,001 | |

Total Fixed Income Securities (Cost $97,534,368) | | 102,108,198 | |

| | Shares | | Security Description | | Value | |

| Investment Companies - 17.7% |

| | 1,289,545 | | Absolute Capital Opportunities Fund (c)(g) | | 14,146,311 | |

| | 306,535 | | SPDR S&P 500 ETF Trust (a)(b) | | 72,262,561 | |

| | 258,000 | | VanEck Vectors Gold Miners ETF | | 5,884,980 | |

| Total Investment Companies (Cost $52,603,576) | | 92,293,852 | |

| | Shares | | Security Description | | Value | |

| Money Market Fund - 20.4% |

| | 106,669,534 | | State Street Institutional Treasury Money Market Fund, Premier Share Class, 0.55% (e) (Cost $106,669,534) | $ | 106,669,534 | |

| | Contracts | | Security Description | | | Strike Price | | Exp. Date | | Value | |

| Purchased Options - 1.4% |

| Call Options Purchased - 1.3% |

| | 24,933,410 | | Atlas Iron, Ltd. | | $ | 0.08 | | 08/17 | | 19,049 | |

| | 5,122 | | SPDR S&P 500 ETF Trust | | | 265.00 | | 01/18 | | 407,199 | |

| | 2,290 | | SPDR S&P 500 ETF Trust | | | 255.00 | | 01/18 | | 551,890 | |

| | 20,000 | | VanEck Vectors Gold Miners ETF | | | 28.00 | | 01/18 | | 2,620,000 | |

| | 10,000 | | VanEck Vectors Gold Miners ETF | | | 23.00 | | 01/18 | | 3,050,000 | |

Total Call Options Purchased (Premiums Paid $9,923,690) | | 6,648,138 | |

| Put Options Purchased - 0.1% |

| | 189 | | Altisource Portfolio Solutions SA | | | 25.00 | | 07/17 | | 27,405 | |

| | 10 | | iShares Russell 2000 ETF | | | 135.00 | | 05/17 | | 2,075 | |

| | 33 | | SPDR S&P 500 ETF Trust | | | 226.00 | | 04/17 | | 1,056 | |

| | 83 | | SPDR S&P 500 ETF Trust | | | 225.00 | | 04/17 | | 2,241 | |

| | 30 | | SPDR S&P 500 ETF Trust | | | 227.00 | | 06/17 | | 7,035 | |

| | 859 | | SPDR S&P 500 ETF Trust | | | 200.00 | | 01/18 | | 282,611 | |

| | 128 | | The Hain Celestial Group, Inc. | | | 25.00 | | 08/17 | | 128 | |

| | 5,000 | | VanEck Vectors Semiconductor ETF | | | 70.00 | | 05/17 | | 150,000 | |

Total Put Options Purchased (Premiums Paid $3,089,219) | | 472,551 | |

Total Purchased Options (Premiums Paid $13,012,909) | | 7,120,689 | |

Total Long Positions - 93.6% (Cost $408,851,508)* | | 487,902,439 | |

Total Short Positions - (38.9)% (Proceeds $(207,621,258))* | | (202,573,125 | ) |

Total Written Options - (0.2)%

(Premiums Received $(1,720,115))* | | (1,011,209 | ) |

| Other Assets & Liabilities, Net – 45.5% | | 236,871,575 | |

| Net Assets – 100.0% | $ | 521,189,680 | |

See Notes to Financial Statements. | 11 | |

ABSOLUTE STRATEGIES FUND SCHEDULE OF SECURITIES SOLD SHORT MARCH 31, 2017 |

| Shares | | Security Description | | Value |

| Short Positions - (38.9)% |

| Common Stock - (29.4)% |

| Consumer Discretionary - (5.0)% |

| | (1,250) | | Amazon.com, Inc. | $ | (1,108,175) |

| | (3,406) | | Best Buy Co., Inc. | | (167,405) |

| | (1,912) | | Big Lots, Inc. | | (93,076) |

| | (26,529) | | Bojangles', Inc. | | (543,845) |

| | (9,215) | | Brinker International, Inc. | | (405,091) |

| | (5,258) | | CarMax, Inc. | | (311,379) |

| | (16,500) | | Carnival Corp. | | (972,015) |

| | (1,676) | | Chipotle Mexican Grill, Inc., Class A | | (746,692) |

| | (2,793) | | Cracker Barrel Old Country Store, Inc. | | (444,785) |

| | (26,529) | | Del Frisco's Restaurant Group, Inc. | | (478,848) |

| | (48,400) | | DR Horton, Inc. | | (1,612,204) |

| | (71,000) | | Fiat Chrysler Automobiles NV | | (776,364) |

| | (15,359) | | Fiesta Restaurant Group, Inc. | | (371,688) |

| | (180,752) | | Ford Motor Co. | | (2,103,953) |

| | (59,400) | | General Motors Co. | | (2,100,384) |

| | (39,600) | | HD Supply Holdings, Inc. | | (1,628,550) |

| | (23,300) | | Horizon Global Corp. | | (323,404) |

| | (63,100) | | JAKKS Pacific, Inc. | | (347,050) |

| | (36,000) | | Leggett & Platt, Inc. | | (1,811,520) |

| | (4,857) | | LGI Homes, Inc. | | (164,701) |

| | (25,645) | | M/I Homes, Inc. | | (628,303) |

| | (5,026) | | McDonald's Corp. | | (651,420) |

| | (6,950) | | Mohawk Industries, Inc. | | (1,594,955) |

| | (5,890) | | Movado Group, Inc. | | (146,956) |

| | (67,019) | | Noodles & Co. | | (385,359) |

| | (11,270) | | PetMed Express, Inc. | | (226,978) |

| | (5,585) | | Texas Roadhouse, Inc. | | (248,700) |

| | (3,389) | | The Cheesecake Factory, Inc. | | (214,727) |

| | (6,980) | | The Home Depot, Inc. | | (1,024,873) |

| | (560) | | The Priceline Group, Inc. | | (996,783) |

| | (20,943) | | Titan International, Inc. | | (216,551) |

| | (8,377) | | Tractor Supply Co. | | (577,762) |

| | (3,250) | | Ulta Beauty, Inc. | | (926,998) |

| | (20,943) | | Vista Outdoor, Inc. | | (431,216) |

| | (59,500) | | Volvo AB, Class B | | (878,491) |

| | (2,562) | | Williams-Sonoma, Inc. | | (137,374) |

| | (1,011) | | WW Grainger, Inc. | | (235,320) |

| | | (26,033,895) |

| Consumer Staples - (4.1)% |

| | (6,795) | | Abaxis, Inc. | | (329,557) |

| | (23,100) | | Acorda Therapeutics, Inc. | | (485,100) |

| | (41,200) | | AerCap Holdings NV | | (1,893,964) |

| | (83,900) | | Albany Molecular Research, Inc. | | (1,177,117) |

| | (37,707) | | Amira Nature Foods, Ltd. | | (202,109) |

| | (41,664) | | Amplify Snack Brands, Inc. | | (349,978) |

| | (13,962) | | Archer-Daniels-Midland Co. | | (642,810) |

| | (2,100) | | Ascent Capital Group, Inc., Class A | | (29,673) |

| | (8,859) | | Avis Budget Group, Inc. | | (262,049) |

| | (71,500) | | Carriage Services, Inc. | | (1,939,080) |

| | (5,543) | | Cenveo, Inc. | | (27,826) |

| | (6,404) | | CoreLogic, Inc. | | (260,771) |

| | (3,250) | | Ctrip.com International, Ltd., ADR | | (159,737) |

| | (51,100) | | Depomed, Inc. | | (641,305) |

| | (5,864) | | Dr. Pepper Snapple Group, Inc. | | (574,203) |

| | (15,100) | | FleetCor Technologies, Inc. | | (2,286,593) |

| | (29,321) | | Flowers Foods, Inc. | | (569,121) |

| | (8,936) | | General Mills, Inc. | | (527,313) |

| | (36,764) | | Hostess Brands, Inc. | | (583,445) |

| | (5,306) | | Ingredion, Inc. | | (639,002) |

| Shares | | Security Description | | Value |

| | (94,700) | | Ironwood Pharmaceuticals, Inc. | $ | (1,615,582) |

| | (1,000) | | Macquarie Infrastructure Corp. | | (80,580) |

| | (31,761) | | Pacific Biosciences of California, Inc. | | (164,204) |

| | (5,864) | | PepsiCo, Inc. | | (655,947) |

| | (11,558) | | Sanderson Farms, Inc. | | (1,200,183) |

| | (55,400) | | Sucampo Pharmaceuticals, Inc., Class A | | (609,400) |

| | (11,000) | | The Spectranetics Corp. | | (320,375) |

| | (10,900) | | Theravance Biopharma, Inc. | | (401,338) |

| | (72,800) | | Tivity Health, Inc. | | (2,118,480) |

| | (3,630) | | TreeHouse Foods, Inc. | | (307,316) |

| | (7,801) | | USANA Health Sciences, Inc. | | (449,338) |

| | | (21,503,496) |

| Energy - (1.0)% |

| | (9,324) | | Antero Midstream Partners LP | | (309,184) |

| | (18,113) | | Enbridge Energy Partners LP | | (344,147) |

| | (7,769) | | Enbridge, Inc. | | (325,055) |

| | (87,500) | | Ensco PLC, Class A | | (783,125) |

| | (71,600) | | Newpark Resources, Inc. | | (579,960) |

| | (224,600) | | Renewable Energy Group, Inc. | | (2,347,070) |

| | (7,484) | | Spectra Energy Partners LP | | (326,751) |

| | | (5,015,292) |

| Financial - (7.3)% |

| | (2,925,000) | | Agricultural Bank of China, Ltd., Class H | | (1,347,423) |

| | (31,500) | | Air Lease Corp. | | (1,220,625) |

| | (13,500) | | Ameriprise Financial, Inc. | | (1,750,680) |

| | (309,942) | | Banco Santander SA, ADR | | (1,881,348) |

| | (97,550) | | Bank of America Corp. | | (2,301,204) |

| | (2,648,000) | | Bank of China, Ltd., Class H | | (1,315,226) |

| | (1,282,000) | | Bank of Communications Co., Ltd., Class H | | (996,369) |

| | (2,005,000) | | China CITIC Bank Corp., Ltd., Class H | | (1,328,669) |

| | (1,531,000) | | China Construction Bank Corp., Class H | | (1,231,262) |

| | (1,020,000) | | China Galaxy Securities Co., Ltd., Class H | | (941,054) |

| | (439,000) | | China Merchants Bank Co., Ltd., Class H | | (1,160,838) |

| | (469,000) | | CITIC Securities Co., Ltd., Class H | | (965,579) |

| | (34,500) | | Citigroup, Inc. | | (2,063,790) |

| | (2,850) | | Credit Acceptance Corp. | | (568,319) |

| | (71,600) | | Deutsche Bank AG | | (1,228,656) |

| | (37,000) | | Encore Capital Group, Inc. | | (1,139,600) |

| | (47,200) | | Erste Group Bank AG | | (1,537,024) |

| | (9,700) | | Home Capital Group, Inc. | | (189,864) |

| | (1,988,000) | | Industrial & Commercial Bank of China, Ltd., Class H | | (1,299,497) |

| | (336,500) | | Intesa Sanpaolo SpA | | (913,958) |

| | (51,750) | | Morgan Stanley | | (2,216,970) |

| | (120,800) | | Nordea Bank AB | | (1,379,123) |

| | (89,975) | | OTP Bank PLC | | (2,517,082) |

| | (90,400) | | Swedbank AB, Class A | | (2,094,384) |

| | (84,400) | | The Blackstone Group LP | | (2,506,680) |

| | (39,000) | | The Charles Schwab Corp. | | (1,591,590) |

| | (14,900) | | UniCredit SpA | | (229,687) |

| | | (37,916,501) |

| Healthcare - (0.4)% |

| | (27,900) | | Quidel Corp. | | (631,656) |

See Notes to Financial Statements. | 12 | |

ABSOLUTE STRATEGIES FUND SCHEDULE OF SECURITIES SOLD SHORT MARCH 31, 2017 |

| Shares | | Security Description | | Value |

| | (45,500) | | Repligen Corp. | $ | (1,601,600) |

| | | | | | (2,233,256) |

| Industrial - (7.1)% |

| | (8,400) | | Acuity Brands, Inc. | | (1,713,600) |

| | (12,751) | | American Outdoor Brands Corp. | | (252,597) |

| | (27,100) | | Atlas Copco AB, Class A | | (956,597) |

| | (3,037) | | Caterpillar, Inc. | | (281,712) |

| | (26,200) | | Eaton Corp. PLC | | (1,942,730) |

| | (14,000) | | Echo Global Logistics, Inc. | | (298,900) |

| | (42,000) | | Emerson Electric Co. | | (2,514,120) |

| | (18,200) | | Fluidigm Corp. | | (103,558) |

| | (46,500) | | Fluor Corp. | | (2,446,830) |

| | (90,600) | | General Electric Co. | | (2,699,880) |

| | (8,450) | | Golar LNG, Ltd. | | (236,009) |

| | (18,900) | | IDEX Corp. | | (1,767,339) |

| | (12,050) | | Illinois Tool Works, Inc. | | (1,596,264) |

| | (43,500) | | Kaman Corp. | | (2,093,655) |

| | (4,600) | | Martin Marietta Materials, Inc. | | (1,003,950) |

| | (2,064) | | OSI Systems, Inc. | | (150,651) |

| | (8,377) | | Raven Industries, Inc. | | (243,352) |

| | (27,500) | | Sensata Technologies Holding NV | | (1,200,925) |

| | (40,000) | | SKF AB, Class B | | (791,460) |

| | (33,075) | | Spirit AeroSystems Holdings, Inc., Class A | | (1,915,704) |

| | (4,452) | | Sturm Ruger & Co., Inc. | | (238,405) |

| | (54,100) | | Textron, Inc. | | (2,574,619) |

| | (14,650) | | The Boeing Co. | | (2,590,999) |

| | (13,900) | | The Middleby Corp. | | (1,896,655) |

| | (1,607) | | TransDigm Group, Inc. | | (353,797) |

| | (92,500) | | TTM Technologies, Inc. | | (1,492,025) |

| | (11,900) | | Vulcan Materials Co. | | (1,433,712) |

| | (33,700) | | Wartsila OYJ Abp | | (1,802,950) |

| | (30,717) | | Welbilt, Inc. | | (602,975) |

| | | (37,195,970) |

| Information Technology - (3.3)% |

| | (158,800) | | Advanced Micro Devices, Inc. | | (2,310,540) |

| | (10,600) | | Akamai Technologies, Inc. | | (632,820) |

| | (7,175) | | Alliance Data Systems Corp. | | (1,786,575) |

| | (12,050) | | Autodesk, Inc. | | (1,041,963) |

| | (40,100) | | Avid Technology, Inc. | | (186,866) |

| | (68,400) | | CA, Inc. | | (2,169,648) |

| | (8,234) | | Envestnet, Inc. | | (265,958) |

| | (78,600) | | Intel Corp. | | (2,835,102) |

| | (12,300) | | International Business Machines Corp. | | (2,141,922) |

| | (2,674) | | Medidata Solutions, Inc. | | (154,263) |

| | (36,100) | | ON Semiconductor Corp. | | (559,189) |

| | (24,600) | | Oracle Corp. | | (1,097,406) |

| | (94,900) | | Quantum Corp. | | (82,563) |

| | (20,400) | | salesforce.com, Inc. | | (1,682,796) |

| | (6,630) | | Sigma Designs, Inc. | | (41,438) |

| | (4,600) | | Veeco Instruments, Inc. | | (137,310) |

| | | (17,126,359) |

| Materials - (0.7)% |

| | (13,700) | | Aceto Corp. | | (216,597) |

| | (90,755) | | AgroFresh Solutions, Inc. | | (396,599) |

| | (27,925) | | American Vanguard Corp. | | (463,555) |

| | (15,359) | | CF Industries Holdings, Inc. | | (450,787) |

| | (5,585) | | Compass Minerals International, Inc. | | (378,942) |

| | (4,189) | | FMC Corp. | | (291,512) |

| | (29,321) | | Potash Corp. of Saskatchewan, Inc. | | (500,803) |

| Shares | | Security Description | | Value |

| | (6,100) | | Pretium Resources, Inc. | $ | (65,331) |

| | (56,396) | | Silver Standard Resources, Inc. | | (598,362) |

| | | (3,362,488) |

| Telecommunication Services - (0.5)% |

| | (37,500) | | Global Eagle Entertainment, Inc. | | (119,625) |

| | (285,400) | | Harmonic, Inc. | | (1,698,130) |

| | (59,300) | | Pandora Media, Inc. | | (700,333) |

| | (2,606) | | WebMD Health Corp. | | (137,284) |

| | | (2,655,372) |

| Utilities - (0.0)% |

| | (31,400) | | EnerNOC, Inc. | | (188,400) |

Total Common Stock

(Proceeds $(158,075,222)) | | (153,231,029) |

| Investment Companies - (9.5)% |

| | (16,148) | | iShares Russell 2000 ETF | | (2,220,027) |

| | (199,890) | | SPDR S&P 500 ETF Trust | | (47,122,069) |

Total Investment Companies

(Proceeds $(49,546,036)) | | (49,342,096) |

Total Short Positions - (38.9)%

(Proceeds $(207,621,258)) | $ | (202,573,125) |

See Notes to Financial Statements. | 13 | |

ABSOLUTE STRATEGIES FUND SCHEDULE OF CALL AND PUT OPTIONS WRITTEN MARCH 31, 2017 |

| Contracts | | Security Description | | | Strike Price | | Exp. Date | | Value |

| Written Options - (0.2)% |

| Call Options Written - (0.1)% |

| (121) | | American Express Co. | | $ | 80.00 | | 01/18 | $ | (63,525) |

| (205) | | Halliburton Co. | | | 55.00 | | 01/18 | | (49,713) |

| (88) | | Harley-Davidson, Inc. | | | 50.00 | | 01/18 | | (111,100) |

| (382) | | Quanta Services, Inc. | | | 39.00 | | 08/17 | | (71,625) |

| (57) | | The Boeing Co. | | | 185.00 | | 01/18 | | (46,170) |

Total Call Options Written

(Premiums Received $(320,175)) | | (342,133) |

| Put Options Written - (0.1)% |

| (114) | | American Airlines Group, Inc. | | | 42.00 | | 01/18 | | (55,290) |

| (53) | | Apple, Inc. | | | 75.00 | | 01/18 | | (795) |

| (62) | | AutoNation, Inc. | | | 40.00 | | 10/17 | | (15,190) |

| (106) | | Delta Air Lines, Inc. | | | 45.00 | | 01/18 | | (45,580) |

| (88) | | Harley-Davidson, Inc. | | | 40.00 | | 01/18 | | (8,624) |

| (10) | | iShares Russell 2000 ETF | | | 120.00 | | 05/17 | | (260) |

| (42) | | Johnson & Johnson | | | 105.00 | | 01/18 | | (7,014) |

| (126) | | Patterson Cos., Inc. (h) | | | 35.00 | | 07/17 | | (126) |

| (18) | | SPDR S&P 500 ETF Trust | | | 215.00 | | 04/17 | | (216) |

| (33) | | SPDR S&P 500 ETF Trust | | | 210.00 | | 04/17 | | (330) |

| (65) | | SPDR S&P 500 ETF Trust | | | 205.00 | | 04/17 | | (455) |

| (15) | | SPDR S&P 500 ETF Trust | | | 212.00 | | 06/17 | | (1,215) |

| (15) | | SPDR S&P 500 ETF Trust | | | 205.00 | | 06/17 | | (780) |

| (859) | | SPDR S&P 500 ETF Trust | | | 215.00 | | 01/18 | | (477,174) |

| (61) | | The Boeing Co. | | | 100.00 | | 01/18 | | (4,057) |

| (128) | | The Hain Celestial Group, Inc. | | | 35.00 | | 08/17 | | (22,400) |

| (42) | | Time Warner, Inc. | | | 90.00 | | 01/19 | | (24,570) |

| (5,000) | | VanEck Vectors Semiconductor ETF | | | 55.00 | | 05/17 | | (5,000) |

Total Put Options Written

(Premiums Received $(1,399,940)) | | (669,076) |

Total Written Options - (0.2)%

(Premiums Received $(1,720,115)) | $ | (1,011,209) |

See Notes to Financial Statements. | 14 | |

ABSOLUTE STRATEGIES FUND NOTES TO SCHEDULES OF INVESTMENTS, SECURITIES SOLD SHORT AND CALL AND PUT OPTIONS WRITTEN MARCH 31, 2017 |

ADR American Depositary Receipt

ETF Exchange Traded Fund

ETN Exchange Traded Note

LLC Limited Liability Company

LP Limited Partnership

PLC Public Limited Company

REIT Real Estate Investment Trust

(a) All or a portion of this security is held as collateral for securities sold short.

(b) Subject to put option written by the Fund.

(c) Non-income producing security.

(d) Subject to call option written by the Fund.

(e) Variable rate security. Rate presented is as of March 31, 2017.

(f) Security exempt from registration under Rule 144A under the Securities Act of 1933. At the period end, the value of these securities amounted to $26,225,063 or 5.0% of net assets.

(g) Affiliated Company.

(h) Security fair valued in accordance with procedures adopted by the Board of Trustees. At the period end, the value of these securities amounted to $(126) or (0.0)% of net assets.

Credit Default Swaps – Buy Protection

(1) Credit spreads are an indication of the seller's performance risk, related to the likelihood of a credit event occurring that would require a seller to make payment to a buyer. Credit spreads are used to determine the value of swap contracts and reflect the cost of buying/selling protection, which may include upfront payments made to enter into the contract.

See Notes to Financial Statements. | 15 | |

ABSOLUTE STRATEGIES FUND NOTES TO SCHEDULES OF INVESTMENTS, SECURITIES SOLD SHORT AND CALL AND PUT OPTIONS WRITTEN MARCH 31, 2017 |

At March 31, 2017, the Fund held the following exchange traded futures contracts:

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Liabilities |

| Securities Sold Short |

| Common Stock | | $ | (153,231,029 | ) | | $ | - | | | $ | - | | | $ | (153,231,029 | ) |

| Investment Companies | | | (49,342,096 | ) | | | - | | | | - | | | | (49,342,096 | ) |

| Total Securities Sold Short | | $ | (202,573,125 | ) | | $ | - | | | $ | - | | | $ | (202,573,125 | ) |

| Other Financial Instruments** |

| Written Options | | | (158,111 | ) | | | (852,972 | ) | | | (126 | ) | | | (1,011,209 | ) |

| Credit Default Swaps | | | - | | | | (981,271 | ) | | | - | | | | (981,271 | ) |

| Futures | | | (2,913,974 | ) | | | - | | | | - | | | | (2,913,974 | ) |

| Total Other Financial Instruments** | | $ | (3,072,085 | ) | | $ | (1,834,243 | ) | | $ | (126 | ) | | $ | (4,906,454 | ) |

| Total Liabilities | | $ | (205,645,210 | ) | | $ | (1,834,243 | ) | | $ | (126 | ) | | $ | (207,479,579 | ) |

** Other Financial Instruments are derivative instruments not reflected in the Schedule of Investments and Schedule of Securities Sold Short, such as credit default swaps and futures, which are valued at the unrealized appreciation/(depreciation) of the instrument. Written options are reported at their market value at year end.

The following is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value.

| Portfolio Breakdown (% of Net Assets) |

| Long Positions |

| Common Stock | 54.3% | |

| Money Market Fund | 44.3% | |

| Purchased Options | 0.7% | |

| Short Positions |

| Investment Companies | -35.5% | |

| Written Options | -0.7% | |

| Other Assets less Liabilities* | 36.9% | |

| | 100.0% | |

* Consists of deposits with the custodian and/or brokers for securities sold short, cash, foreign currency, prepaid expenses, receivables, payables and accrued liabilities. Deposits with the custodian and/or brokers for securities sold short represent 37.1% of net assets. See Note 2 of the accompanying Notes to Financial Statements.

See Notes to Financial Statements. | 18 | |

ABSOLUTE CAPITAL OPPORTUNITIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2017 |

| Shares | | Security Description | | Value | |

| Long Positions - 99.3% |

| Common Stock - 54.3% |

| Consumer Discretionary - 6.7% |

| | 2,835 | | American Airlines Group, Inc. (a)(b) | $ | 119,921 | |

| | 385 | | CarMax, Inc. (a)(c) | | 22,800 | |

| | 3,235 | | CVS Health Corp. | | 253,947 | |

| | 1,800 | | Delta Air Lines, Inc. (b) | | 82,728 | |

| | 4,305 | | General Motors Co. (a) | | 152,225 | |

| | 1,560 | | Harley-Davidson, Inc. (a)(b)(d) | | 94,380 | |

| | 2,315 | | Macy's, Inc. (a) | | 68,617 | |

| | 1,985 | | VF Corp. | | 109,115 | |

| | 565 | | Walgreens Boots Alliance, Inc. | | 46,923 | |

| | | 950,656 | |

| Consumer Staples - 12.5% |

| | 330 | | AMERCO | | 125,793 | |

| | 2,475 | | Diageo PLC, ADR | | 286,060 | |

| | 1,025 | | McKesson Corp. | | 151,966 | |

| | 4,500 | | Nestle SA, ADR | | 346,050 | |

| | 1,460 | | Philip Morris International, Inc. | | 164,834 | |

| | 8,360 | | Quanta Services, Inc. (a)(c)(d) | | 310,240 | |

| | 2,300 | | Robert Half International, Inc. | | 112,309 | |

| | 6,140 | | Sanofi, ADR | | 277,835 | |

| | | 1,775,087 | |

| Energy - 3.5% |

| | 4,792 | | Enbridge, Inc. | | 200,497 | |

| | 3,480 | | Halliburton Co. (a)(d) | | 171,251 | |

| | 700 | | National Oilwell Varco, Inc. (a) | | 28,063 | |

| | 1,255 | | Schlumberger, Ltd. (a) | | 98,015 | |

| | | 497,826 | |

| Financial - 14.4% |

| | 2,030 | | American Express Co. (a)(d) | | 160,593 | |

| | 1,275 | | Aon PLC (a) | | 151,330 | |

| | 9,460 | | Bank of America Corp. (a) | | 223,162 | |

| | 2,500 | | Berkshire Hathaway, Inc., Class B (a)(c) | | 416,700 | |

| | 6,055 | | Brookfield Asset Management, Inc., Class A | | 220,765 | |

| | 3,875 | | CBRE Group, Inc., Class A (a)(c) | | 134,811 | |

| | 2,010 | | Citigroup, Inc. (a) | | 120,238 | |

| | 2,590 | | JPMorgan Chase & Co. (a) | | 227,506 | |

| | 4,800 | | The Bank of New York Mellon Corp. | | 226,704 | |

| | 2,200 | | WR Berkley Corp. | | 155,386 | |

| | | 2,037,195 | |

| Healthcare - 0.5% |

| | 410 | | Becton Dickinson and Co. | | 75,210 | |

| Industrial - 6.3% |

| | 3,000 | | Expeditors International of Washington, Inc. | | 169,470 | |

| | 2,935 | | Jacobs Engineering Group, Inc. (a) | | 162,247 | |

| | 5,765 | | Leucadia National Corp. (a) | | 149,890 | |

| | 1,200 | | The Boeing Co. (a)(b)(d) | | 212,232 | |

| | 500 | | United Parcel Service, Inc., Class B (a) | | 53,650 | |

| | 930 | | Valmont Industries, Inc. (a) | | 144,615 | |

| | | 892,104 | |

| Information Technology - 2.1% |

| | 2,095 | | Apple, Inc. (a)(b) | | 300,968 | |

| Materials - 5.6% |

| | 4,830 | | Cameco Corp. | | 53,468 | |

| | 2,390 | | Monsanto Co. | | 270,548 | |

| | 1,595 | | Praxair, Inc. | | 189,167 | |

| Shares | | Security Description | | Value |

| Short Positions - (35.5)% |

| Investment Companies - (35.5)% |

| | (21,363) | | SPDR S&P 500 ETF Trust (Proceeds $(5,056,911)) | $ | (5,036,114) |

Total Short Positions - (35.5)%

(Proceeds $(5,056,911)) | $ | (5,036,114) |

See Notes to Financial Statements. | 20 | |

ABSOLUTE CAPITAL OPPORTUNITIES FUND SCHEDULE OF CALL AND PUT OPTIONS WRITTEN MARCH 31, 2017 |

| | | | | | | | | | |

| Contracts | | Security Description | | | Strike Price | | Exp. Date | | Value |

| Written Options - (0.7)% |

| Call Options Written - (0.2)% |

| (13) | | American Express Co. | | $ | 80.00 | | 01/18 | $ | (6,825) |

| (21) | | Halliburton Co. | | | 55.00 | | 01/18 | | (5,093) |

| (7) | | Harley-Davidson, Inc. | | | 50.00 | | 01/18 | | (8,837) |

| (41) | | Quanta Services, Inc. | | | 39.00 | | 08/17 | | (7,688) |

| (6) | | The Boeing Co. | | | 185.00 | | 01/18 | | (4,860) |

Total Call Options Written

(Premiums Received $(32,419)) | | (33,303) |

| Put Options Written - (0.5)% |

| (12) | | American Airlines Group, Inc. | | | 42.00 | | 01/18 | | (5,820) |

| (5) | | Apple, Inc. | | | 75.00 | | 01/18 | | (75) |

| (7) | | AutoNation, Inc. | | | 40.00 | | 10/17 | | (1,715) |

| (12) | | Delta Air Lines, Inc. | | | 45.00 | | 01/18 | | (5,160) |

| (7) | | Harley-Davidson, Inc. | | | 40.00 | | 01/18 | | (686) |

| (5) | | Johnson & Johnson | | | 105.00 | | 01/18 | | (835) |

| (14) | | Patterson Cos., Inc. (f) | | | 35.00 | | 07/17 | | (14) |

| (92) | | SPDR S&P 500 ETF Trust | | | 215.00 | | 01/18 | | (51,106) |

| (5) | | The Boeing Co. | | | 100.00 | | 01/18 | | (333) |

| (13) | | The Hain Celestial Group, Inc. | | | 35.00 | | 08/17 | | (2,275) |

| (5) | | Time Warner, Inc. | | | 90.00 | | 01/19 | | (2,925) |

Total Put Options Written

(Premiums Received $(99,602)) | | (70,944) |

Total Written Options - (0.7)%

(Premiums Received $(132,021)) | $ | (104,247) |

See Notes to Financial Statements. | 21 | |

ABSOLUTE CAPITAL OPPORTUNITIES FUND NOTES TO SCHEDULES OF INVESTMENTS, SECURITIES SOLD SHORT AND CALL AND PUT OPTIONS WRITTEN MARCH 31, 2017 |

ADR American Depositary Receipt

ETF Exchange Traded Fund

PLC Public Limited Company

(a) All or a portion of this security is held as collateral for securities sold short.

(b) Subject to put option written by the Fund.

(c) Non-income producing security.

(d) Subject to call option written by the Fund.

(e) Variable rate security. Rate presented is as of March 31, 2017.

(f) Security fair valued in accordance with procedures adopted by the Board of Trustees. At year end, the value of these securities amounted to $(14) or (0.0%) of net assets.

* Cost for federal income tax purposes is $7,177,867 and net unrealized appreciation consists of:

The following is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value.

| | | | | | ABSOLUTE STRATEGIES FUND | | | | ABSOLUTE CAPITAL OPPORTUNITIES FUND | |

| ASSETS | | | | | | | | |

| . | Total investments, at value (Cost $395,841,508 and $12,362,185, respectively) | $ | 473,756,128 | | | $ | 14,091,327 | |

| | Total investment in affiliates, at value (Cost $13,010,000 and $0, respectively) | | 14,146,311 | | | | - | |

| | Total investments | | 487,902,439 | | | | 14,091,327 | |

| | Deposits with brokers | | | 215,327,547 | | | | 5,257,004 | |

| | Cash | | | 22,339,250 | | | | - | |

| | Foreign currency (Cost $4,819,830 and $0, respectively) | | | 4,897,718 | | | | - | |

| | Receivables: | | | | | | | | |

| | | Fund shares sold | | | 1,455,552 | | | | - | |

| | | Investment securities sold | | | 7,018,985 | | | | - | |

| | | Dividends and interest | | | 1,660,933 | | | | 11,890 | |

| | Swap premiums paid | | | 940,225 | | | | - | |

| | Prepaid expenses | | | 10,748 | | | | 10,870 | |

| Total Assets | | | 741,553,397 | | | | 19,371,091 | |

| | | | | | | | | | | |

| LIABILITIES | | | | | | | | |

| | Swap premiums received | | | 321,198 | | | | - | |

| | Unrealized loss on swap agreements | | | 981,271 | | | | - | |

| | Securities sold short, at value (Proceeds $207,621,258 and $5,056,911, respectively) | | | 202,573,125 | | | | 5,036,114 | |

| | Call options written, at value (Premiums received $320,175 and $32,419, respectively) | | | 342,133 | | | | 33,303 | |

| | Put options written, at value (Premiums received $1,399,940 and $99,602, respectively) | | | 669,076 | | | | 70,944 | |

| | Payables: | | | | | | | | |

| | | Investment securities purchased | | | 10,932,366 | | | | - | |

| | | Fund shares redeemed | | | 3,268,848 | | | | - | |

| | | Dividends on securities sold short | | | 244,869 | | | | - | |

| | | Other | | | 10,064 | | | | 454 | |

| | Accrued Liabilities: | | | | | | | | |

| | | Investment adviser fees | | | 715,786 | | | | 10,387 | |

| | | Trustees' fees and expenses | | | 1,935 | | | | 50 | |

| | | Fund services fees | | | 61,273 | | | | 3,582 | |

| | | Other expenses | | | 241,773 | | | | 28,553 | |

| Total Liabilities | | | 220,363,717 | | | | 5,183,387 | |

| | | | | | | | | | | |

| NET ASSETS | | $ | 521,189,680 | | | $ | 14,187,704 | |

| | | | | | | | | | | |

| COMPONENTS OF NET ASSETS | | | | | | | | |

| | Paid-in capital | | $ | 527,202,008 | | | $ | 12,865,861 | |

| | Accumulated net investment loss | | | (2,836,297 | ) | | | (40,691 | ) |

| | Accumulated net realized loss | | | (84,627,315 | ) | | | (415,179 | ) |

| | Net unrealized appreciation | | | 81,451,284 | | | | 1,777,713 | |

| NET ASSETS | | $ | 521,189,680 | | | $ | 14,187,704 | |

| | | | | | | | | | | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | | | | | | |

| | Institutional Shares | | | 57,273,110 | | | | 1,293,233 | |

| | R Shares | | | 2,276,358 | | | | - | |

| | | | | | | | | | | |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | | | | | | | | |

| | Institutional Shares (based on net assets of $501,865,916 and $14,187,704, respectively) | | $ | 8.76 | | | $ | 10.97 | |

| | R Shares (Based on net assets of $19,323,764 and $0, respectively) | | $ | 8.49 | | | $ | - | |

See Notes to Financial Statements. | 24 | |

ABSOLUTE FUNDS STATEMENTS OF OPERATIONS YEAR ENDED MARCH 31, 2017 |

| | | | | | ABSOLUTE STRATEGIES FUND | | | | ABSOLUTE CAPITAL OPPORTUNITIES FUND | | |

| INVESTMENT INCOME | | | | | | | | | | |

| | Dividend income (Net of foreign withholding taxes of $224,439 and $3,420, respectively) | . | | $ | 8,339,796 | | | $ | 140,739 | | |

| | Interest income | | | 6,657,721 | | | | - | | |

| Total Investment Income | | | | 14,997,517 | | | | 140,739 | | |

| Adviser | | | | | | | | | | |

| EXPENSES | | | | | | | | | | |

| | Investment adviser fees | | | 12,694,831 | | | | 207,310 | | |

| | Fund services fees | | | 654,129 | | | | 40,110 | | |

| | Transfer agent fees: | | | | | | | | | |

| | Institutional Shares | | | 112,145 | | | | - | | |

| | R Shares | | | 59,200 | | | | - | | |

| | Distribution fees: | | | | | | | | | |

| | R Shares | | | 58,864 | | | | - | | |

| | Custodian fees | | | 745,892 | | | | 15,326 | | |

| | Registration fees: | | | | | | | | | |

| | Institutional Shares | | | 33,924 | | | | 10,025 | | |

| | R Shares | | | 15,235 | | | | - | | |

| | Professional fees | | | 193,065 | | | | 29,530 | | |

| | Trustees' fees and expenses | | | 48,064 | | | | 6,397 | | |

| | Offering costs | | | - | | | | 59,679 | | |

| | Dividend expense on securities sold short | | | 5,647,161 | # | | | 49,827 | # | |

| | Interest expense on securities sold short | | | 1,950,603 | 0 | | | 40,751 | 0 | |

| | Miscellaneous expenses | | | 881,441 | | | | 21,729 | | |

| Total Expenses | | | | 23,094,554 | | | | 480,684 | | |

| | Fees waived | | | (206,518 | ) | | | (140,851 | ) | |

| Net Expenses | | | | 22,888,036 | | | | 339,833 | | |

| | | | | | | | | | | | |

| NET INVESTMENT LOSS | | | | (7,890,519 | ) | | | (199,094 | ) | |

| | | | | | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | | | | | | | |

| | Net realized gain (loss) on: | | | | | | | | | |

| | Investments | | | 60,399,563 | | | | 423,470 | | |

| | Foreign currency transactions | | | 268,593 | | | | - | | |

| | Futures | | | (30,425,853 | ) | | | - | | |

| | Securities sold short | | | (28,628,264 | ) | | | (658,513 | ) | |

| | Written options | | | 4,118,973 | | | | 165,441 | | |

| | Swaps | | | (2,135,277 | ) | | | - | | |

| | Net realized gain (loss) | | | 3,597,735 | | | | (69,602 | ) | |

| | Net change in unrealized appreciation (depreciation) on: | | | | | | | | | |

| | Investments in unaffiliated issuers | | | 10,935,577 | | | | 1,140,476 | | |

| | Investments in affiliated issuers | | | 928,058 | | | | - | | |

| | Foreign currency translations | | | (745,384 | ) | | | - | | |

| | Futures | | | 5,211,320 | | | | - | | |

| | Securities sold short | | | (31,556,366 | ) | | | 55,068 | | |

| | Written options | | | 80,289 | | | | (1,899 | ) | |

| | Swaps | | | (1,282,681 | ) | | | - | | |

| | Net change in unrealized appreciation (depreciation) | | | (16,429,187 | ) | | | 1,193,645 | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | (12,831,452 | ) | | | 1,124,043 | | |

| INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | $ | (20,721,971 | ) | | $ | 924,949 | | |

See Notes to Financial Statements. | 25 | |

ABSOLUTE FUNDS STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | ABSOLUTE STRATEGIES FUND | | ABSOLUTE CAPITAL OPPORTUNITIES FUND |

| | | | | For the Year Ended March 31, 2017 | | | For the Year Ended March 31, 2016 | | For the Year Ended March 31, 2017 | | | December 30, 2015* Through March 31, 2016 |

| OPERATIONS | | | | | | | | | | | | | | | | | | |

| | Net investment loss | | $ | (7,890,519 | ) | | | $ | (12,395,892 | ) | | $ | (199,094 | ) | | | $ | (27,991 | ) |

| | Net realized gain (loss) | | | 3,597,735 | | | | | 163,750,355 | | | | (69,602 | ) | | | | (345,570 | ) |

| | Net change in unrealized appreciation (depreciation) | | | (16,429,187 | ) | | | | (135,984,502 | ) | | | 1,193,645 | | | | | 584,068 | |

| Increase (Decrease) in Net Assets Resulting from Operations | | | (20,721,971 | ) | | | | 15,369,961 | | | | 924,949 | | | | | 210,507 | |

| | | | �� | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | |

| | Net realized gain: | | | | | | | | | | | | | | | | | | |

| | | Institutional Shares | | | (85,840,670 | ) | | | | (80,762,590 | ) | | | - | | | | | - | |

| | | R Shares | | | (3,055,044 | ) | | | | (2,260,518 | ) | | | - | | | | | - | |

| Total Distributions to Shareholders | | | (88,895,714 | ) | | | | (83,023,108 | ) | | | - | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | | | | | | | |

| | Sale of shares: | | | | | | | | | | | | | | | | | | |

| | | Institutional Shares | | | 245,205,577 | | | | | 215,827,423 | | | | 1,042,238 | | | | | 12,010,010 | |

| | | R Shares | | | 12,641,234 | | | | | 15,701,944 | | | | - | | | | | - | |

| | Reinvestment of distributions: | | | | | | | | | | | | | | | | | | |

| | | Institutional Shares | | | 78,733,255 | | | | | 72,366,513 | | | | - | | | | | - | |

| | | R Shares | | | 2,739,828 | | | | | 2,150,061 | | | | - | | | | | - | |

| | Redemption of shares: | | | | | | | | | | | | | | | | | | |

| | 1 | Institutional Shares | | | (633,166,321 | ) | | | | (898,554,282 | ) | | | - | | | | | - | |

| | 2 | R Shares | | | (18,077,731 | ) | | | | (38,555,236 | ) | | | - | | | | | - | |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | (311,924,158 | ) | | | | (631,063,577 | ) | | | 1,042,238 | | | | | 12,010,010 | |

| Increase (Decrease) in Net Assets | | | (421,541,843 | ) | | | | (698,716,724 | ) | | | 1,967,187 | | | | | 12,220,517 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | | | | | | | | | |

| | Beginning of Year | | | 942,731,523 | | | | | 1,641,448,247 | | | | 12,220,517 | | | | | - | |

| | End of Year (Including line (a)) | | $ | 521,189,680 | | | | $ | 942,731,523 | | | $ | 14,187,704 | | | | $ | 12,220,517 | |

| | | | | | | | | | | | | | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | | | | | | | | | | | |

| | Sale of shares: | | | | | | | | | | | | | | | | | | |

| | | Institutional Shares | | | 24,990,146 | | | | | 20,104,305 | | | | 96,537 | | | | | 1,196,696 | |

| | | R Shares | | | 1,377,012 | | | | | 1,473,324 | | | | - | | | | | - | |

| | Reinvestment of distributions: | | | | | | | | | | | | | | | | | | |

| | | Institutional Shares | | | 8,846,433 | | | | | 7,150,841 | | | | - | | | | | - | |

| | | R Shares | | | 317,110 | | | | | 216,740 | | | | - | | | | | - | |

| | Redemption of shares: | | | | | | | | | | | | | | | | | | |

| | | Institutional Shares | | | (64,717,097 | ) | | | | (83,374,581 | ) | | | - | | | | | - | |

| | | R Shares | | | (1,972,440 | ) | | | | (3,601,304 | ) | | | - | | | | | - | |

| Increase (Decrease) in Shares | | | (31,158,836 | ) | | | | (58,030,675 | ) | | | 96,537 | | | | | 1,196,696 | |

| | | | | | | | | | | | | | | | | | | | | |

| (a) | Accumulated net investment loss | | $ | (2,836,297 | ) | | | $ | (291,374 | ) | | $ | (40,691 | ) | | | $ | (11,075 | ) |

| * | Commencement of operations. | | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements. | 26 | |