Note 1. Organization

The Auxier Focus Fund (the "Fund") is a diversified portfolio of Forum Funds (the "Trust"). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940, as amended (the "Act"). Under its Trust Instrument, the Trust is authorized to issue an unlimited number of the Fund's shares of beneficial interest without par value.

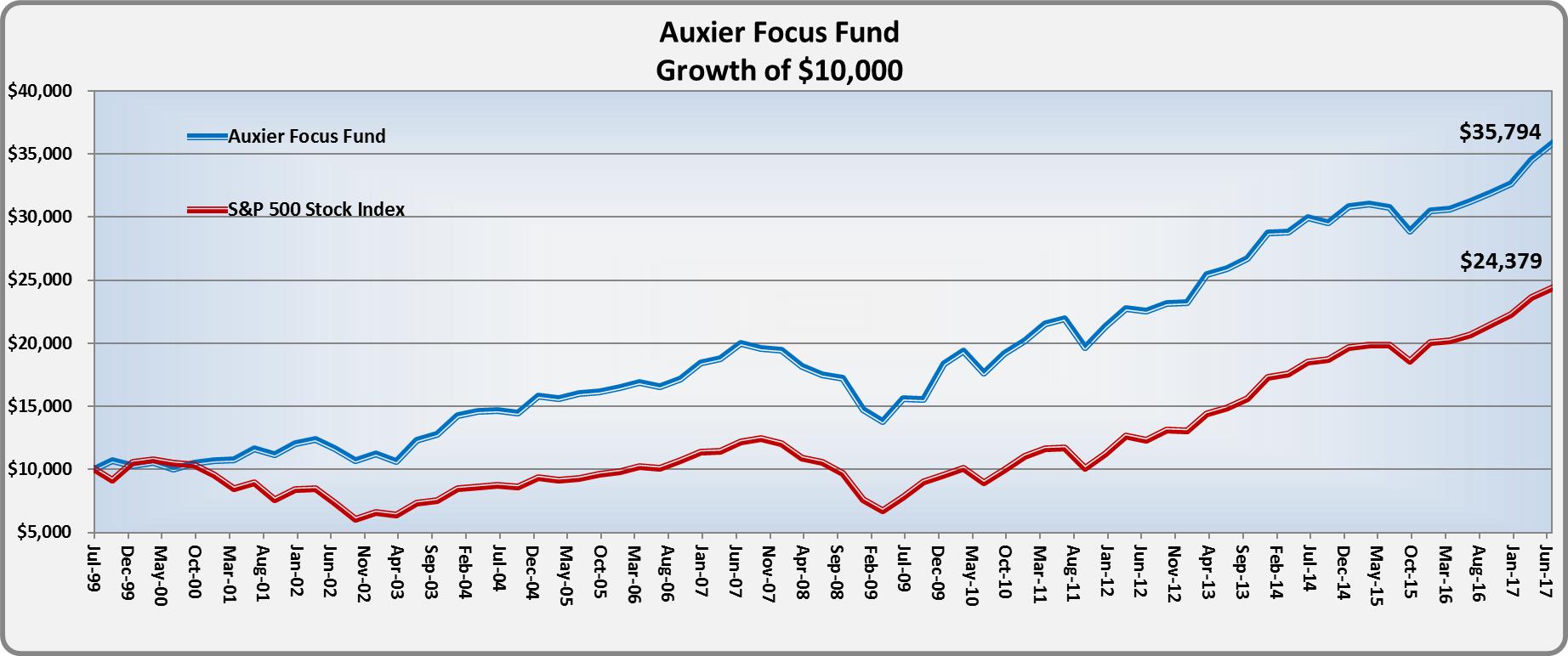

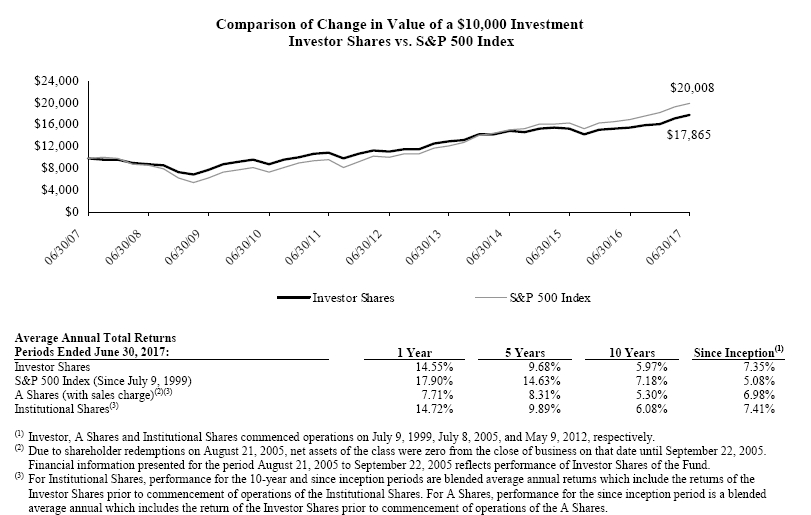

The Fund currently offers three classes of shares: Investor Shares, A Shares and Institutional Shares. A Shares are offered at net asset value plus a maximum sales charge of 5.75%. A Shares are also subject to contingent deferred sales charge ("CDSC") of 1.00% on purchases without an initial sales charge and redeemed less than one year after they are purchased. Investor Shares and Institutional Shares are not subject to a sales charge. Investor Shares, A Shares and Institutional Shares commenced operations on July 9, 1999, July 8, 2005 and May 9, 2012, respectively. The Fund's investment objective is to provide long-term capital appreciation.

Note 2. Summary of Significant Accounting Policies

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 946, "Financial Services-Investment Companies". These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the fiscal period. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation – Securities are valued at market prices using the last quoted trade or official closing price from the principal exchange where the security is traded, as provided by independent pricing services on each Fund business day. In the absence of a last trade, securities are valued at the mean of the last bid and ask price provided by the pricing service. Debt securities may be valued at prices supplied by a fund's pricing agent based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics such as rating, interest rate and maturity. Shares of non-exchange-traded open-end mutual funds are valued at net asset value ("NAV"). Short-term investments that mature in 60 days or less may be valued at amortized cost.

The Fund values its investments at fair value pursuant to procedures adopted by the Trust's Board of Trustees (the "Board") if (1) market quotations are not readily available or (2) the Adviser, as defined in Note 4, believes that the values available are unreliable. The Trust's Valuation Committee, as defined in the Fund's registration statement, performs certain functions as they relate to the administration and oversight of the Fund's valuation procedures. Under these procedures, the Valuation Committee convenes on a regular and ad hoc basis to review such investments and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

The Valuation Committee may work with the Adviser to provide valuation inputs. In determining fair valuations, inputs may include market-based analytics that may consider related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant investment information. Adviser inputs may include an income-based approach in which the anticipated future cash flows of the investment are discounted in determining fair value. Discounts may also be applied based on the nature or duration of any restrictions on the disposition of the investments. The Valuation Committee performs regular reviews of valuation methodologies, key inputs and assumptions, disposition analysis and market activity.

Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security's market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

GAAP has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various "inputs" used to determine the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

AUXIER FOCUS FUNDNOTES TO FINANCIAL STATEMENTS JUNE 30, 2017

|

Level 1 — quoted prices in active markets for identical assets and liabilities

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The aggregate value by input level, as of June 30, 2017, for the Fund's investments is included at the end of the Fund's Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after determining the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted using the effective interest method. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Foreign Currency Translations – Foreign currency amounts are translated into U.S. dollars as follows: (1) assets and liabilities at the rate of exchange at the end of the respective period; and (2) purchases and sales of securities and income and expenses at the rate of exchange prevailing on the dates of such transactions. The portion of the results of operations arising from changes in the exchange rates and the portion due to fluctuations arising from changes in the market prices of securities are not isolated. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Distributions to Shareholders – The Fund declares any dividends from net investment income and pays them annually. Any net capital gains realized by the Fund are distributed at least annually. Distributions to shareholders are recorded on the ex-dividend date. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund.

Federal Taxes – The Fund intends to continue to qualify each year as a regulated investment company under Subchapter M of Chapter 1, Subtitle A, of the Internal Revenue Code of 1986, as amended ("Code"), and to distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all of its net investment income and capital gains, if any, the Fund will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required. The Fund files a U.S. federal income and excise tax return as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service for a period of three fiscal years after they are filed. As of June 30, 2017, there are no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

The Fund's class-specific expenses are charged to the operations of that class of shares. Income and expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on the class' respective net assets to the total net assets of the Fund.

Redemption Fees – A shareholder who redeems shares within 180 days of purchase will incur a redemption fee of 2.00% of the current net asset value of shares redeemed, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

AUXIER FOCUS FUNDNOTES TO FINANCIAL STATEMENTS JUNE 30, 2017

|

Commitments and Contingencies – In the normal course of business, the Fund enters into contracts that provide general indemnifications by the Fund to the counterparty to the contract. The Fund's maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 3. Cash – Concentration in Uninsured Account

For cash management purposes, the Fund may concentrate cash with the Fund's custodian. This typically results in cash balances exceeding the Federal Deposit Insurance Corporation ("FDIC") insurance limits. As of June 30, 2017, the Fund had $10,974,343 at MUFG Union Bank, N.A. that exceeded the FDIC insurance limit.

Note 4. Fees and Expenses

Investment Adviser – Auxier Asset Management LLC (the "Adviser") is the investment adviser to the Fund. Pursuant to an investment advisory agreement, the Adviser receives an advisory fee, payable monthly, from the Fund at an annual rate of 0.80% of the Fund's average daily net assets. Prior to November 1, 2016, the Adviser received an advisory fee from the Fund at an annual rate of 1.00% of the Fund's average daily assets.

Distribution – Foreside Fund Services, LLC serves as the Fund's distributor (the "Distributor"). The Distributor is not affiliated with the Adviser or Atlantic Fund Administration, LLC (d/b/a Atlantic Fund Services) ("Atlantic") or their affiliates. The Fund has adopted a Distribution Plan (the "Plan") for A Shares of the Fund in accordance with Rule 12b-1 of the Act. Under the Plan, the Fund pays the Distributor and/or any other entity as authorized by the Board a fee of up to 0.25% of the average daily net assets of A Shares. The Distributor has no role in determining the investment policies or which securities are to be purchased or sold by the Trust or its Funds.

For the year ended June 30, 2017, there were no front-end sales charges assessed on the sale of A Shares and no contingent deferred sales charges were assessed on the sale of A Shares.

Other Service Providers – Atlantic provides fund accounting, fund administration, compliance and transfer agency services to the Fund. The fees related to these services are included in Fund services fees within the Statement of Operations. Atlantic also provides certain shareholder report production and EDGAR conversion and filing services. Atlantic provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each independent Trustee an annual retainer fee of $50,000 for service to the Trust ($66,000 for the Chairman). The Audit Committee Chairman and Vice Chairman receive an additional $6,000 annually. The Trustees and Chairman may receive additional fees for special Board meetings. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with his duties as a Trustee, including travel and related expenses incurred in attending Board meetings. The amount of Trustees' fees attributable to the Fund is disclosed in the Statement of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from the Fund.

Note 5. Expense Reimbursements and Fees Waived

The Adviser has contractually agreed to waive a portion of its fees and/or reimburse expenses through October 31, 2017, to the extent necessary to maintain the total operating expenses (excluding all taxes, interest, portfolio transaction expenses, dividend expenses on short sales, and extraordinary expenses) at 0.98%, 1.25% and 0.80% of average daily net assets of the Investor Shares, A Shares and Institutional Shares, respectively. These contractual waivers may only be raised or eliminated with consent of the Board. Prior to November 1, 2016, the expense cap was 1.14%, 1.25% and 1.00% of average daily assets of the Investor Shares, A Shares and Institutional Shares, respectively. Other fund service providers have voluntarily agreed to waive a portion of their fees. These voluntary reductions may be reduced or eliminated at any time. For the year ended June 30, 2017, fees waived and expenses reimbursed were as follows:

AUXIER FOCUS FUNDNOTES TO FINANCIAL STATEMENTS JUNE 30, 2017

|

| Investment Adviser Fees Waived | | Investment Adviser Expenses Reimbursed | | | Other Waivers | | Total Fees Waived |

| $ | 258,679 | | $ | 94,817 | | | $ | 64,882 | | $ | 418,378 |

The Fund may repay the Adviser for fees waived and expenses reimbursed pursuant to the expense cap if such payment is made within three years of the fee waiver or expense reimbursement and the resulting expenses do not exceed the lesser of (i) the then-current expense cap, or (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. As of June 30, 2017, $218,876 is subject to recapture by the Adviser. Other Waivers are not eligible for recoupment.

Note 6. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments, during the year ended June 30, 2017 were $11,499,503 and $30,973,301, respectively.

Note 7. Federal Income Tax

Distributions paid during the fiscal years ended as noted were characterized for tax purposes as follows:

| Ordinary Income | | $ | 3,396,865 | | $ | 2,683,607 |

| Long-Term Capital Gain | | | 3,410,098 | | | 11,388,179 |

| | | $ | 6,806,963 | | $ | 14,071,786 |

As of June 30, 2017, distributable earnings (accumulated loss) on a tax basis were as follows:

| Undistributed Ordinary Income | | $ | 1,507,104 | |

| Undistributed Long-Term Gain | | | 9,528,987 | |

| Unrealized Appreciation | | | 98,330,482 | |

| Total | | $ | 109,366,573 | |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales and equity return of capital.

On the Statement of Assets and Liabilities, as a result of permanent book to tax differences, certain amounts have been reclassified for the year ended June 30, 2017. The following reclassification was the result of equity return of capital sold and has no impact on the net assets of the Fund.

| Accumulated Net Investment Income (Loss) | | $ | (5,560 | ) |

| Undistributed Net Realized Gain (Loss) | | | 5,560 | |

Note 8. Recent Accounting Pronouncements

In October 2016, the U.S. Securities and Exchange Commission ("SEC") issued a new rule, Investment Company Reporting Modernization, which, among other provisions, amends Regulation S-X to require standardized enhanced disclosures, particularly related to derivatives, in investment company financial statements. The compliance date for the amendments to Regulation S-X is for reporting periods ending after August 1, 2017. Management has reviewed the requirements and believes the adoption of the amendments to Regulation S-X will not have a material impact on the Fund's financial statements and related disclosures.

AUXIER FOCUS FUNDNOTES TO FINANCIAL STATEMENTS JUNE 30, 2017

|

Note 9. Subsequent Events

Subsequent events occurring after the date of this report through the date these financial statements were issued have been evaluated for potential impact, and the Fund has had no such events.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

To the Board of Trustees of Forum Funds

and the Shareholders of Auxier Focus Fund

We have audited the accompanying statement of assets and liabilities of Auxier Focus Fund, a series of shares of beneficial interest in Forum Funds, (the "Fund") including the schedule of investments, as of June 30, 2017, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2017 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Auxier Focus Fund as of June 30, 2017, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

August 21, 2017

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund's portfolio is available, without charge and upon request, by calling (877) 328-9437, on the Fund's website at www.auxierasset.com and on the SEC's website at www.sec.gov. The Fund's proxy voting record for the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling (877) 328-9437 and on the SEC's website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. These filings are available, without charge and upon request on the SEC's website at www.sec.gov or may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments on certain classes, redemption fees, exchange fees, and CDSC fees, and (2) ongoing costs, including management fees, 12b-1 fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2017, through June 30, 2017.

Actual Expenses – The first line under each share class of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes – The second line under each share class of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments on certain classes, redemption fees, exchange fees, and CDSC fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | | Ending | | Expenses | | Annualized |

| | Account Value | | Account Value | | Paid During | | Expense |

| | January 1, 2017 | | June 30, 2017 | | Period* | | Ratio* |

| Investor Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,096.95 | | $ | 5.10 | | 0.98 | % |

| Hypothetical (5% return before expenses) | $ | 1,000.00 | | $ | 1,019.93 | | $ | 4.91 | | 0.98 | % |

| A Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,095.07 | | $ | 6.49 | | 1.25 | % |

| Hypothetical (5% return before expenses) | $ | 1,000.00 | | $ | 1,018.60 | | $ | 6.26 | | 1.25 | % |

AUXIER FOCUS FUND ADDITIONAL INFORMATION (Unaudited) JUNE 30, 2017

|

| | Beginning | | Ending | | Expenses | | Annualized |

| | Account Value | | Account Value | | Paid During | | Expense |

| | January 1, 2017 | | June 30, 2017 | | Period* | | Ratio* |

| Institutional Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,097.49 | | $ | 4.16 | | 0.80 | % |

| Hypothetical (5% return before expenses) | $ | 1,000.00 | | $ | 1,020.83 | | $ | 4.01 | | 0.80 | % |

| | | | | | | | | | | | |

| * | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181) divided by 365 to reflect the half-year period. |

Federal Tax Status of Dividends Declared during the Fiscal Year

For federal income tax purposes, dividends from short-term capital gains are classified as ordinary income. The Fund designates 100.00% of its income dividend distributed as qualifying for the corporate dividends-received deduction (DRD) and 100.00% for the qualified dividend rate (QDI) as defined in Section 1(h)(11) of the Code. The Fund also designates 1.07% of its income dividends as qualified interest income exempt from U.S. tax for foreign shareholders (QII) and 16.98% of its income dividends as qualified short-term gain exempt from U.S. tax for foreign shareholders (QSD).

Trustees and Officers of the Trust

The Board is responsible for oversight of the management of the Trust's business affairs and of the exercise of all the Trust's powers except those reserved for the shareholders. The following table provides information about each Trustee and certain officers of the Trust. Each Trustee and officer holds office until the person resigns, is removed, or is replaced. Unless otherwise noted, the persons have held their principal occupations for more than five years. The address for all Trustees and officers is Three Canal Plaza, Suite 600, Portland, Maine 04101. Mr. Keffer is considered an Interested Trustee due to his affiliation with Atlantic. The Fund's Statement of Additional Information includes additional information about the Trustees and is available, without charge and upon request, by calling (877) 328-9437.

| Name and Year of Birth | Position(s) with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Series of Fund Complex¹ Overseen by Trustee | Other Directorships Held by Trustee |

| Independent Trustees | | | | | |

J. Michael Parish Born: 1943 | Chairman of the Board; Trustee; Chairman, Nominating Committee and Qualified Legal Compliance Committee | Since 1989 (Chairman since 2004) | Retired since 2003; formerly, Partner, Wolf, Block, Schorr and Solis-Cohen, LLP (law firm) 2002-2003; Partner, Thelen Reid & Priest LLP (law firm) 1995-2002. | 23 | None |

Costas Azariadis Born: 1943 | Trustee | Since 1989 | Professor of Economics, Washington University since 2006. | 23 | None |

James C. Cheng Born: 1942 | Trustee; Chairman, Audit Committee | Since 1989 | President, Technology Marketing Associates (marketing company for small- and medium-sized businesses in New England) since 1991. | 23 | None |

David Tucker Born: 1958 | Trustee; Vice Chairman | Since 2011 (Vice Chairman since 2015) | Director, Blue Sky Experience (a charitable endeavor) since 2008; Senior Vice President & General Counsel, American Century Companies (an investment management firm) 1998-2008. | 46 | Trustee, Forum Funds II, Forum ETF Trust and U.S. Global Investors Funds |

1The Fund Complex includes the Trust, Forum Funds II, Forum ETF Trust and U.S. Global Investors Funds and is overseen by different Boards of Trustees. |

AUXIER FOCUS FUND ADDITIONAL INFORMATION (Unaudited) JUNE 30, 2017

|

| Name and Year of Birth | Position(s) with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Series of Fund Complex¹ Overseen by Trustee | Other Directorships Held by Trustee |

| Interested Trustee | | | | | |

John Y. Keffer2 Born: 1942 | Trustee; Vice Chairman | Since 1989 | Chairman, Atlantic since 2008; President, Forum Investment Advisors, LLC since 2011; President, Forum Foundation (a charitable organization) since 2005; President, Forum Trust, LLC (a non-depository trust company chartered in the State of Maine) since 1997. | 46 | Director, Wintergreen Fund, Inc.; Trustee, Forum Funds II, Forum ETF Trust and U.S. Global Investors Funds |

| Officers | | | | | |

Jessica Chase Born: 1970 | President; Principal Executive Officer | Since 2015 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Karen Shaw Born: 1972 | Treasurer; Principal Financial Officer | Since 2008 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Zachary Tackett Born: 1988 | Vice President; Secretary; Anti-Money Laundering Compliance Officer | Since 2014 | Counsel, Atlantic since 2014; Intern Associate, Coakley & Hyde, PLLC, 2010-2013. | N/A | N/A |

Michael J. McKeen Born: 1971 | Vice President | Since 2009 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Timothy Bowden Born: 1969 | Vice President | Since 2009 | Manager, Atlantic since 2008. | N/A | N/A |

Geoffrey Ney Born: 1975 | Vice President | Since 2013 | Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013. | N/A | N/A |

Todd Proulx Born: 1978 | Vice President | Since 2013 | Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013. | N/A | N/A |

Carlyn Edgar Born: 1963 | Vice President | Since 2008 | Senior Vice President, Atlantic since 2008; Chief Compliance Officer, 2008-2016. | N/A | N/A |

Dennis Mason Born: 1967 | Chief Compliance Officer | Since 2016 | Fund Compliance Officer, Atlantic since 2013; Senior Specialist, Atlantic 2011-2013; Senior Analyst, Atlantic 2008-2011. | N/A | N/A |

1The Fund Complex includes the Trust, Forum Funds II, Forum ETF Trust and U.S. Global Investors Funds and is overseen by different Boards of Trustees. 2Atlantic is a subsidiary of Forum Holdings Corp. I, a Delaware corporation that is wholly owned by Mr. Keffer. |

Auxier Focus Fund

FOR MORE INFORMATION

P.O. Box 588

Portland, Maine 04112

(877) 3AUXIER

(877) 328-9437

INVESTMENT ADVISER

Auxier Asset Management LLC

15668 NE Eilers Road

Aurora, Oregon 97002

TRANSFER AGENT

Atlantic Fund Services

P.O. Box 588

Portland, Maine 04112

www.atlanticfundservices.com

DISTRIBUTOR

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, Maine 04101

www.foreside.com

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for

distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes

information regarding the Fund's risks, objectives, fees and expenses, experience of its management, and other

information.

204-ANR-0617

DF DENT GROWTH FUNDSTABLE OF CONTENTS |

| DF Dent Premier Growth Fund | |

| A Message to Our Shareholders (Unaudited) | 1 |

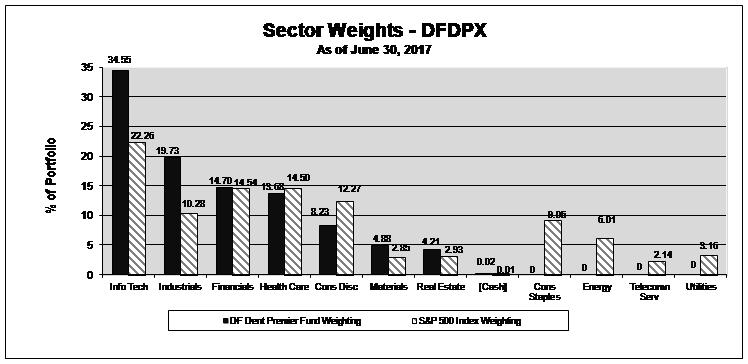

| Management Discussion of Fund Performance (Unaudited) | 9 |

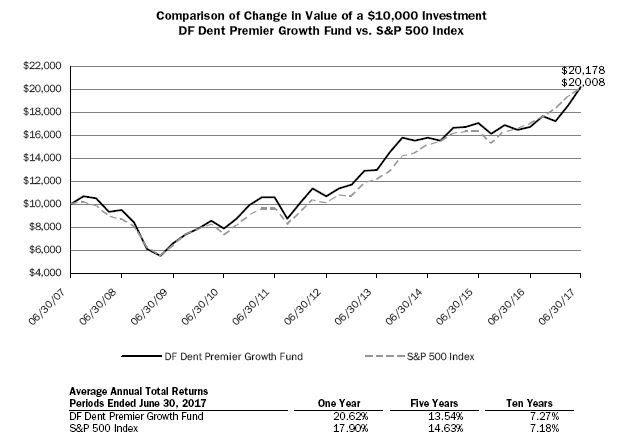

| Performance Chart and Analysis (Unaudited) | 14 |

| Schedule of Investments | 15 |

| Statement of Assets and Liabilities | 17 |

| Statement of Operations | 18 |

| Statements of Changes in Net Assets | 19 |

| Financial Highlights | 20 |

| | |

| DF Dent Midcap Growth Fund | |

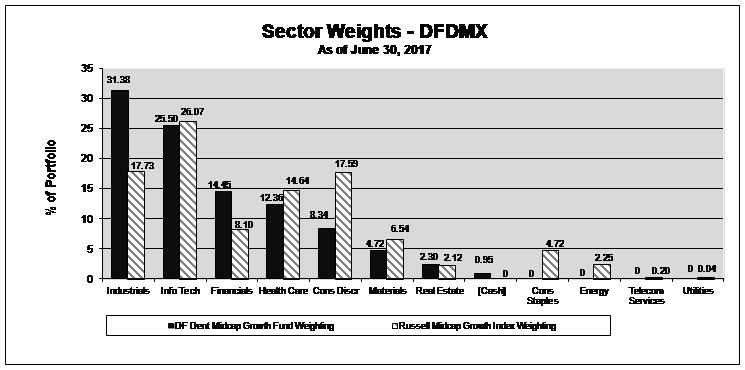

| A Message to Our Shareholders (Unaudited) | 21 |

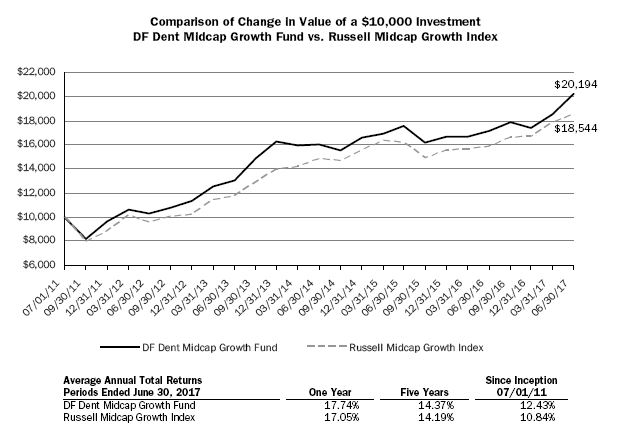

| Performance Chart and Analysis (Unaudited) | 26 |

| Schedule of Investments | 27 |

| Statement of Assets and Liabilities | 29 |

| Statement of Operations | 30 |

| Statements of Changes in Net Assets | 31 |

| Financial Highlights | 32 |

| | |

| DF Dent Small Cap Growth Fund | |

| A Message to Our Shareholders (Unaudited) | 33 |

| Performance Chart and Analysis (Unaudited) | 39 |

| Schedule of Investments | 40 |

| Statement of Assets and Liabilities | 42 |

| Statement of Operations | 43 |

| Statements of Changes in Net Assets | 44 |

| Financial Highlights | 45 |

| | |

| DF Dent Growth Funds | |

| Notes to Financial Statements | 46 |

| Report of Independent Registered Public Accounting Firm | 52 |

| Additional Information (Unaudited) | 53 |