UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Zachary Tackett, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end April 30

Date of reporting period: May 1, 2024 – October 31, 2024

ITEM 1. REPORT TO SHAREHOLDERS.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (“Act”), is attached hereto.

Semi-Annual Shareholder Report - October 31, 2024

Monongahela All Cap Value Fund

This semi-annual shareholder report contains important information about the Monongahela All Cap Value Fund for the period of May 1, 2024, to October 31, 2024. You can find additional information about the Fund at www.Moncapfund.com. You can also request this information by contacting us at (855) 392-9331.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Monongahela All Cap Value Fund | $44 | 0.85% |

How did the Fund perform in the last six months?

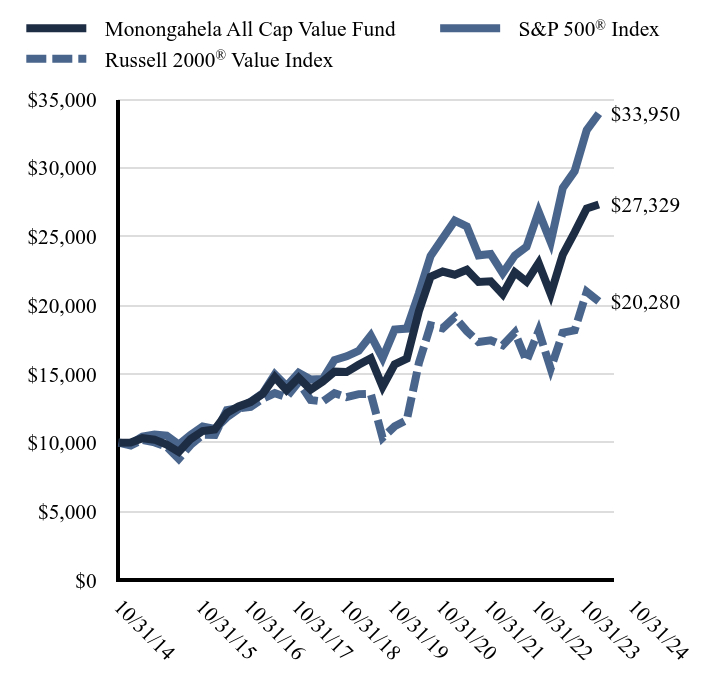

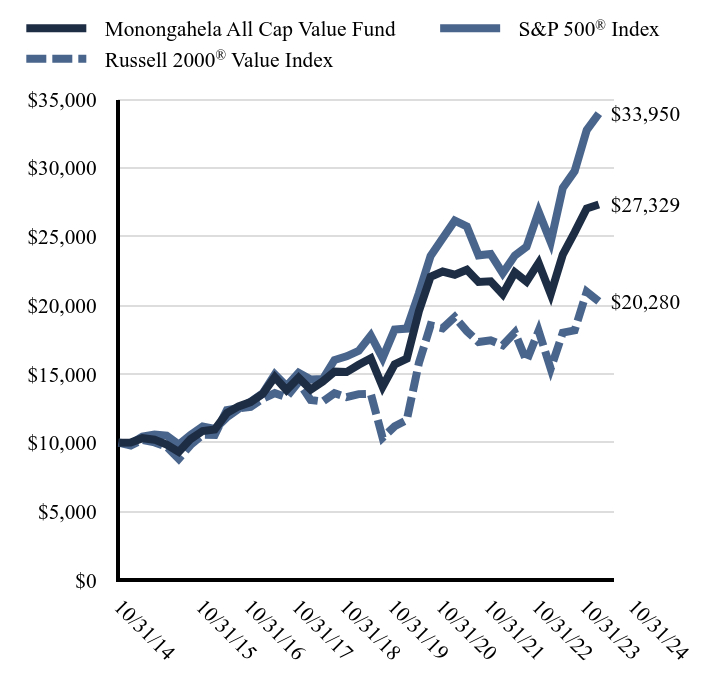

We offer this semi-annual report for the Monongahela All Cap Value Fund (the “Fund”) for the period from May 1, 2024 to October 31, 2024 (the “period”). During the period the Fund was up 8.01%, the S&P 500 Index (an index of the 500 largest publicly traded companies in the US weighted by market capitalization) was up 14.08% and the Russell 2000 Value Index (an Index that tracks the performance of small capitalization value companies) was up 11.59%.

The Fund underperformed the S&P 500 Index and the Russell 2000 Value Index for the period primarily due to sector weighting.

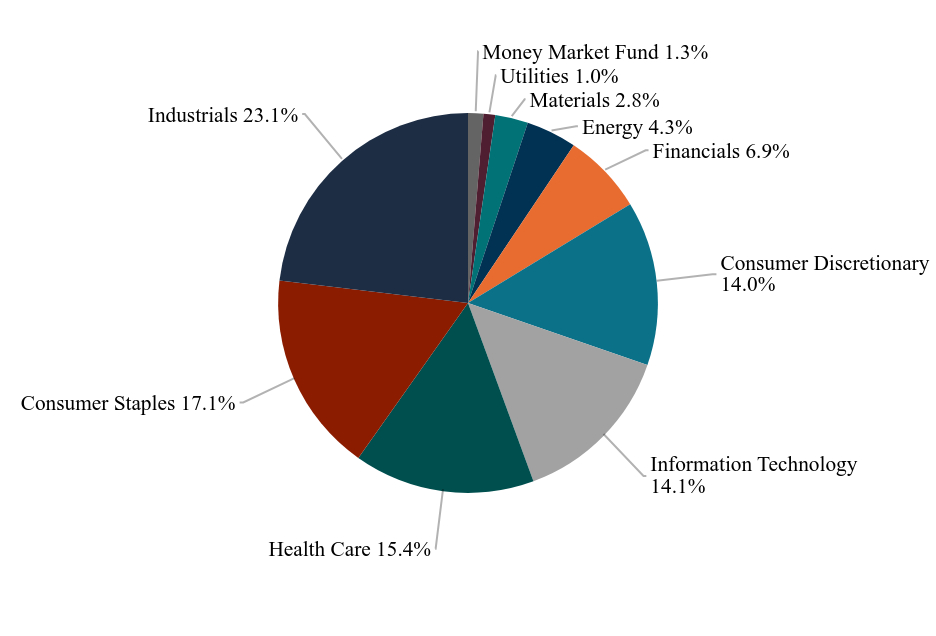

Compared to the S&P 500 Index, the Fund was underweighted in Information Technology and Financials sectors and overweighted in Consumer Staples and Industrials sectors.

Compared to the Russell 2000 Value Index, the Fund was significantly underweighted in the Financial sector (6.9% vs. 28.14%) and overweighted in the Consumer Staples Sector (17.1% vs 2.06%).

With our bottom-up approach to security analysis, we try to identify equities trading below intrinsic value and priced with a margin of safety. In that view, we have increased our exposure to Consumer Staples, adding The Estee Lauder Cos., Inc, The Hershey Co. and increasing our position in Lamb Weston Holdings Inc. and WK Kellogg Co. We have added Coherent Corp. to our Information Technology sector. Leadership is a key metric for us and we were pleased with the appointment of James Anderson as the new CEO for Coherent Corp. on June 3rd, 2024.

Our current allocation reflects our perception of value going forward, mindful of risk.

Total Return Based on a $10,000 Investment

| Date | Monongahela All Cap Value Fund | S&P 500® Index | Russell 2000® Value Index |

|---|

| 10/31/14 | $10,000 | $10,000 | $10,000 |

| 01/31/15 | $10,008 | $9,936 | $9,800 |

| 04/30/15 | $10,326 | $10,440 | $10,205 |

| 07/31/15 | $10,220 | $10,586 | $10,019 |

| 10/31/15 | $9,858 | $10,520 | $9,712 |

| 01/31/16 | $9,331 | $9,869 | $8,826 |

| 04/30/16 | $10,264 | $10,566 | $9,827 |

| 07/31/16 | $10,848 | $11,181 | $10,579 |

| 10/31/16 | $10,955 | $10,994 | $10,568 |

| 01/31/17 | $12,158 | $11,847 | $12,376 |

| 04/30/17 | $12,643 | $12,459 | $12,498 |

| 07/31/17 | $12,955 | $12,974 | $12,612 |

| 10/31/17 | $13,550 | $13,593 | $13,190 |

| 01/31/18 | $14,778 | $14,976 | $13,608 |

| 04/30/18 | $13,826 | $14,112 | $13,314 |

| 07/31/18 | $14,728 | $15,081 | $14,424 |

| 10/31/18 | $13,867 | $14,591 | $13,112 |

| 01/31/19 | $14,457 | $14,629 | $12,994 |

| 04/30/19 | $15,170 | $16,016 | $13,606 |

| 07/31/19 | $15,138 | $16,286 | $13,311 |

| 10/31/19 | $15,668 | $16,681 | $13,534 |

| 01/31/20 | $16,142 | $17,802 | $13,563 |

| 04/30/20 | $14,069 | $16,154 | $10,361 |

| 07/31/20 | $15,696 | $18,233 | $11,194 |

| 10/31/20 | $16,120 | $18,301 | $11,650 |

| 01/31/21 | $19,562 | $20,872 | $15,789 |

| 04/30/21 | $22,079 | $23,582 | $18,543 |

| 07/31/21 | $22,452 | $24,878 | $18,324 |

| 10/31/21 | $22,226 | $26,155 | $19,141 |

| 01/31/22 | $22,587 | $25,734 | $18,119 |

| 04/30/22 | $21,698 | $23,632 | $17,322 |

| 07/31/22 | $21,747 | $23,724 | $17,451 |

| 10/31/22 | $20,798 | $22,334 | $17,087 |

| 01/31/23 | $22,391 | $23,619 | $18,024 |

| 04/30/23 | $21,716 | $24,262 | $15,938 |

| 07/31/23 | $23,079 | $26,812 | $18,139 |

| 10/31/23 | $20,811 | $24,599 | $15,391 |

| 01/31/24 | $23,695 | $28,536 | $18,007 |

| 04/30/24 | $25,301 | $29,760 | $18,174 |

| 07/31/24 | $27,039 | $32,750 | $20,983 |

| 10/31/24 | $27,329 | $33,950 | $20,280 |

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Monongahela All Cap Value Fund | 31.32% | 11.77% | 10.58% |

S&P 500® Index | 38.02% | 15.27% | 13.00% |

Russell 2000® Value Index | 31.77% | 8.42% | 7.33% |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $33,716,277 |

| # of Portfolio Holdings | 56 |

| Portfolio Turnover Rate | 7% |

| Investment Advisory Fees (Net of fees waived) | $27,263 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Money Market Fund | 1.3% |

| Utilities | 1.0% |

| Materials | 2.8% |

| Energy | 4.3% |

| Financials | 6.9% |

| Consumer Discretionary | 14.0% |

| Information Technology | 14.1% |

| Health Care | 15.4% |

| Consumer Staples | 17.1% |

| Industrials | 23.1% |

Top Ten Holdings

(% of total investments)

| Curtiss-Wright Corp. | 4.09% |

| Williams-Sonoma, Inc. | 3.98% |

| Westinghouse Air Brake Technologies Corp. | 3.63% |

| Revvity, Inc. | 3.61% |

| MetLife, Inc. | 3.38% |

| Rockwell Automation, Inc. | 3.36% |

| Merck & Co., Inc. | 3.19% |

| Hubbell, Inc. | 3.17% |

| Hologic, Inc. | 3.12% |

| Lindsay Corp. | 3.11% |

Where can I find additional information about the fund?

If you wish to view additional information about the Fund; including but not limited to its prospectus, holdings, financial information, and proxy information, please visit www.Moncapfund.com.

Monongahela All Cap Value Fund

Semi-Annual Shareholder Report - October 31, 2024

(b) Not applicable.

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

(a) Included as part of financial statements filed under Item 7(a).

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

(a)

MONONGAHELA

ALL

CAP

VALUE

FUND

Semi-Annual

Financials

and

Other

Information

October

31,

2024

(Unaudited)

MONONGAHELA

ALL

CAP

VALUE

FUND

SCHEDULE

OF

INVESTMENTS

October

31,

2024

See

Notes

to

Financial

Statements.

The

following

is

a

summary

of

the

inputs

used

to

value

the

Fund's investments

as

of

October

31,

2024.

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risks

associated

with

investing

in

those

securities.

For

more

information

on

valuation

inputs,

and

their

aggregation

into

the

levels

used

in

the

table

below,

please

refer

to

the

Security

Valuation

section

in

Note

2

of

the

accompanying

Notes

to

Financial

Statements.

The

Level

1

value

displayed

in

this

table

is

Common

Stock

and

a

Money

Market

Fund.

Refer

to

this

Schedule

of

Investments

for

a

further

breakout

of

each

security

by

industry.

Shares

Security

Description

Value

Common

Stock

-

98.6%

Consumer

Discretionary

-

14.0%

10,000

Cracker

Barrel

Old

Country

Store,

Inc.

$

475,700

7,500

eBay,

Inc.

431,325

52,500

El

Pollo

Loco

Holdings,

Inc.

(a)

641,550

20,000

Garrett

Motion,

Inc.

(a)

148,600

15,000

H&R

Block,

Inc.

895,950

5,000

Johnson

Outdoors,

Inc.,

Class A

158,100

3,000

Mohawk

Industries,

Inc.

(a)

402,810

4,500

Tapestry,

Inc.

213,525

10,000

Williams-Sonoma,

Inc.

1,341,300

4,708,860

Consumer

Staples

-

17.1%

10,350

Alico,

Inc.

253,679

10,000

Archer-Daniels-Midland

Co.

552,100

10,500

General

Mills,

Inc.

714,210

17,500

Kenvue,

Inc.

401,275

4,500

Kimberly-Clark

Corp.

603,810

5,000

Kirin

Holdings

Co.,

Ltd.,

ADR

73,700

12,500

Lamb

Weston

Holdings,

Inc.

971,125

3,000

Target

Corp.

450,120

6,000

The

Estee

Lauder

Cos.,

Inc.

413,640

750

The

Hershey

Co.

133,185

2,750

The

Procter

&

Gamble

Co.

454,245

5,000

Tootsie

Roll

Industries,

Inc.

145,850

2,500

United-Guardian,

Inc.

33,175

35,000

WK

Kellogg

Co.

582,050

5,782,164

Energy

-

4.3%

10,500

ONEOK,

Inc.

1,017,240

3,500

Phillips

66

426,370

1,443,610

Financials

-

6.9%

12,000

Equitable

Holdings,

Inc.

544,080

2,500

Farmers

National

Banc

Corp.

34,400

14,500

MetLife,

Inc.

1,137,090

17,500

Old

Republic

International

Corp.

611,275

2,326,845

Health

Care

-

15.4%

3,000

Abbott

Laboratories

340,110

14,500

Baxter

International,

Inc.

517,650

10,000

Bristol-Myers

Squibb

Co.

557,700

13,000

Hologic,

Inc.

(a)

1,051,310

10,500

Merck

&

Co.,

Inc.

1,074,360

10,250

Revvity,

Inc.

1,215,547

4,000

Zimmer

Biomet

Holdings,

Inc.

427,680

5,184,357

Industrials

-

23.0%

4,000

Curtiss-Wright

Corp.

1,379,840

8,250

Emerson

Electric

Co.

893,227

5,000

Fortune

Brands

Innovations,

Inc.

416,650

2,500

Hubbell,

Inc.

1,067,575

8,750

Lindsay

Corp.

1,047,375

10,053

MillerKnoll,

Inc.

224,785

4,250

Rockwell

Automation,

Inc.

1,133,518

10,500

The

Gorman-Rupp

Co.

387,975

6,500

Westinghouse

Air

Brake

Technologies

Corp.

1,221,870

7,772,815

Shares

Security

Description

Value

Information

Technology

-

14.1%

7,500

Cognizant

Technology

Solutions

Corp.,

Class A

$

559,425

10,000

Coherent

Corp.

(a)

924,400

12,500

Corning,

Inc.

594,875

3,500

F5,

Inc.

(a)

818,580

14,000

Kulicke

&

Soffa

Industries,

Inc.

628,040

25,000

NetScout

Systems,

Inc.

(a)

525,750

3,500

Texas

Instruments,

Inc.

711,060

4,762,130

Materials

-

2.8%

1,000

Air

Products

and

Chemicals,

Inc.

310,530

5,000

PPG

Industries,

Inc.

622,550

933,080

Utilities

-

1.0%

3,500

WEC

Energy

Group,

Inc.

334,355

Total

Common

Stock

(Cost

$24,182,111)

33,248,216

Shares

Security

Description

Value

Money

Market

Fund

-

1.3%

450,594

First

American

Treasury

Obligations

Fund,

Class X,

4.73%

(b)

(Cost

$450,594)

450,594

Investments,

at

value

-

99.9%

(Cost

$24,632,705)

$

33,698,810

Other

Assets

&

Liabilities,

Net

-

0.1%

17,467

Net

Assets

-

100.0%

$

33,716,277

ADR

American

Depositary

Receipt

(a)

Non-income

producing

security.

(b)

Dividend

yield

changes

daily

to

reflect

current

market

conditions.

Rate

was

the

quoted

yield

as

of

October

31,

2024.

Valuation

Inputs

Investments

in

Securities

Level

1

-

Quoted

Prices

$

33,698,810

Level

2

-

Other

Significant

Observable

Inputs

–

Level

3

-

Significant

Unobservable

Inputs

–

Total

$

33,698,810

MONONGAHELA

ALL

CAP

VALUE

FUND

STATEMENT

OF

ASSETS

AND

LIABILITIES

October

31,

2024

See

Notes

to

Financial

Statements.

ASSETS

Investments,

at

value

(Cost

$24,632,705)

$

33,698,810

Receivables:

Dividends

35,055

Prepaid

expenses

11,671

Total

Assets

33,745,536

LIABILITIES

Accrued

Liabilities:

Investment

Adviser

fees

4,977

Trustees’

fees

and

expenses

820

Fund

services

fees

9,806

Other

expenses

13,656

Total

Liabilities

29,259

NET

ASSETS

$

33,716,277

COMPONENTS

OF

NET

ASSETS

Paid-in

capital

$

22,893,534

Distributable

Earnings

10,822,743

NET

ASSETS

$

33,716,277

SHARES

OF

BENEFICIAL

INTEREST

AT

NO

PAR

VALUE

(UNLIMITED

SHARES

AUTHORIZED)

1,624,488

NET

ASSET

VALUE,

OFFERING

AND

REDEMPTION

PRICE

PER

SHARE*

$

20.76

*

Shares

redeemed

or

exchanged

within

60

days

of

purchase

are

charged

a

1.00%

redemption

fee.

MONONGAHELA

ALL

CAP

VALUE

FUND

STATEMENT

OF

OPERATIONS

SIX

MONTHS

ENDED

OCTOBER

31,

2024

See

Notes

to

Financial

Statements.

INVESTMENT

INCOME

Dividend

income

(Net

of

foreign

withholding

taxes

of

$107)

$

315,740

Interest

income

2,274

Total

Investment

Income

318,014

EXPENSES

Investment

adviser

fees

122,289

Fund

services

fees

91,920

Custodian

fees

2,632

Registration

fees

8,511

Professional

fees

24,991

Trustees'

fees

and

expenses

4,708

Other

expenses

23,305

Total

Expenses

278,356

Fees

waived

(139,763)

Net

Expenses

138,593

NET

INVESTMENT

INCOME

179,421

NET

REALIZED

AND

UNREALIZED

GAIN

(LOSS)

Net

realized

gain

on

investments

120,508

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

2,174,560

NET

REALIZED

AND

UNREALIZED

GAIN

2,295,068

INCREASE

IN

NET

ASSETS

RESULTING

FROM

OPERATIONS

$

2,474,489

MONONGAHELA

ALL

CAP

VALUE

FUND

STATEMENTS

OF

CHANGES

IN

NET

ASSETS

See

Notes

to

Financial

Statements.

For

the

Six

Months

Ended

October

31,

2024

For

the

Year

Ended

April

30,

2024

OPERATIONS

Net

investment

income

$

179,421

$

419,487

Net

realized

gain

120,508

1,541,706

Net

change

in

unrealized

appreciation

(depreciation)

2,174,560

2,490,427

Increase

in

Net

Assets

Resulting

from

Operations

2,474,489

4,451,620

DISTRIBUTIONS

TO

SHAREHOLDERS

Total

Distributions

Paid

–

(919,708)

CAPITAL

SHARE

TRANSACTIONS

Sale

of

shares

1,764,793

7,361,247

Reinvestment

of

distributions

–

907,832

Redemption

of

shares

(752,564)

(7,732,973)

Redemption

fees

–

1,207

Increase

in

Net

Assets

from

Capital

Share

Transactions

1,012,229

537,313

Increase

in

Net

Assets

3,486,718

4,069,225

NET

ASSETS

Beginning

of

Period

30,229,559

26,160,334

End

of

Period

$

33,716,277

$

30,229,559

SHARE

TRANSACTIONS

Sale

of

shares

88,777

416,384

Reinvestment

of

distributions

–

50,522

Redemption

of

shares

(37,137)

(429,713)

Increase

in

Shares

51,640

37,193

MONONGAHELA

ALL

CAP

VALUE

FUND

FINANCIAL

HIGHLIGHTS

See

Notes

to

Financial

Statements.

These

financial

highlights

reflect

selected

data

for

a

share

outstanding

throughout

each

period

.

For

the

Six

Months

Ended

October

31,

2024

For

the

Years

Ended

April

30,

2024

2023

2022

2021

2020

NET

ASSET

VALUE,

Beginning

of

Period

$

19.22

$

17.04

$

17.83

$

19.56

$

12.62

$

14.03

INVESTMENT

OPERATIONS

Net

investment

income

(a)

0.11

0.26

0.34

0.28

0.23

0.28

Net

realized

and

unrealized

gain

(loss)

1.43

2.51

(0.33)

(0.56)

6.92

(1.22)

Total

from

Investment

Operations

1.54

2.77

0.01

(0.28)

7.15

(0.94)

DISTRIBUTIONS

TO

SHAREHOLDERS

FROM

Net

investment

income

–

(0.30)

(0.30)

(0.25)

(0.20)

(0.27)

Net

realized

gain

–

(0.29)

(0.50)

(1.20)

(0.01)

(0.20)

Total

Distributions

to

Shareholders

–

(0.59)

(0.80)

(1.45)

(0.21)

(0.47)

REDEMPTION

FEES(a)

–

0.00(b)

0.00(b)

0.00(b)

0.00(b)

0.00(b)

NET

ASSET

VALUE,

End

of

Period

$

20.76

$

19.22

$

17.04

$

17.83

$

19.56

$

12.62

TOTAL

RETURN

8.01%(c)

16.51%

0.08%

(1.73)%

56.94%

(7.26)%

RATIOS/SUPPLEMENTARY

DATA

Net

Assets

at

End

of

Period

(000s

omitted)

$

33,716

$

30,230

$

26,160

$

25,243

$

24,426

$

12,755

Ratios

to

Average

Net

Assets:

Net

investment

income

1.10%(d)

1.48%

2.00%

1.47%

1.41%

2.01%

Net

expenses

0.85%(d)

0.85%

0.85%

0.85%

0.85%

0.85%

Gross

expenses

(e)

1.70%(d)

1.77%

1.90%

1.83%

2.21%

2.57%

PORTFOLIO

TURNOVER

RATE

7%(c)

37%

27%

30%

32%

47%

(a)

Calculated

based

on

average

shares

outstanding

during

each

period.

(b)

Less

than

$0.01

per

share.

(c)

Not

annualized.

(d)

Annualized.

(e)

Reflects

the

expense

ratio

excluding

any

waivers

and/or

reimbursements.

MONONGAHELA

ALL

CAP

VALUE

FUND

NOTES

TO

FINANCIAL

STATEMENTS

October

31,

2024

Note

1. Organization

The

Monongahela

All

Cap

Value

Fund

(the

“Fund”)

is

a

diversified

portfolio

of

Forum

Funds

(the

“Trust”).

The

Trust

is

a

Delaware

statutory

trust

that

is

registered

as

an

open-end,

management

investment

company

under

the

Investment

Company

Act

of

1940,

as

amended

(the

“Act”).

Under

its

Trust

Instrument,

the

Trust

is

authorized

to

issue

an

unlimited

number

of

the

Fund’s

shares

of

beneficial

interest

without

par

value.

The

Fund

commenced

operations

on

July

1,

2013.

The

Fund

seeks

total

return

through

long-term

capital

appreciation

and

income.

Note

2. Summary

of

Significant

Accounting

Policies

The

Fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

under

Financial

Accounting

Standards

Board

Accounting

Standards

Codification

Topic

946,

“Financial

Services

–

Investment

Companies.”

These

financial

statements

are

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(“GAAP”),

which

require

management

to

make

estimates

and

assumptions

that

affect

the

reported

amounts

of

assets

and

liabilities,

the

disclosure

of

contingent

liabilities

at

the

date

of

the

financial

statements,

and

the

reported

amounts

of

increases

and

decreases

in

net

assets

from

operations

during

the

fiscal

period.

Actual

amounts

could

differ

from

those

estimates.

The

following

summarizes

the

significant

accounting

policies

of

the

Fund:

Security

Valuation

–

Securities

are

recorded

at

fair

value

using

last

quoted

trade

or

official

closing

price

from

the

principal

exchange

where

the

security

is

traded,

as

provided

by

independent

pricing

services

on

each

Fund

business

day.

In

the

absence

of

a

last

trade,

securities

are

valued

at

the

mean

of

the

last

bid

and

ask

price

provided

by

the

pricing

service.

Short-

term

investments

that

mature

in

sixty

days

or

less

may

be

recorded

at

amortized

cost,

which

approximates

fair

value.

Pursuant

to

Rule

2a-5

under

the

Investment

Company

Act,

the

Trust’s

Board

of

Trustees

(the

“Board”)

has

designated

the

Adviser,

as

defined

in

Note

3,

as

the

Fund’s

valuation

designee

to

perform

any

fair

value

determinations

for

securities

and

other

assets

held

by

the

Fund.

The

Adviser

is

subject

to

the

oversight

of

the

Board

and

certain

reporting

and

other

requirements

intended

to

provide

the

Board

the

information

needed

to

oversee

the

Adviser’s

fair

value

determinations.

The

Adviser

is

responsible

for

determining

the

fair

value

of

investments

for

which

market

quotations

are

not

readily

available

in

accordance

with

policies

and

procedures

that

have

been

approved

by

the

Board.

Under

these

procedures,

the

Adviser

convenes

on

a

regular

and

ad

hoc

basis

to

review

such

investments

and

considers

a

number

of

factors,

including

valuation

methodologies

and

significant

unobservable

inputs,

when

arriving

at

fair

value.

The

Board

has

approved

the

Adviser’s

fair

valuation

procedures

as

a

part

of

the

Fund’s

compliance

program

and

will

review

any

changes

made

to

the

procedures.

The

Adviser

provides

fair

valuation

inputs.

In

determining

fair

valuations,

inputs

may

include

market-based

analytics

that

may

consider

related

or

comparable

assets

or

liabilities,

recent

transactions,

market

multiples,

book

values

and

other

relevant

investment

information.

Adviser

inputs

may

include

an

income-based

approach

in

which

the

anticipated

future

cash

flows

of

the

investment

are

discounted

in

determining

fair

value.

Discounts

may

also

be

applied

based

on

the

nature

or

duration

of

any

restrictions

on

the

disposition

of

the

investments.

The

Adviser

performs

regular

reviews

of

valuation

methodologies,

key

inputs

and

assumptions,

disposition

analysis

and

market

activity.

Fair

valuation

is

based

on

subjective

factors

and,

as

a

result,

the

fair

value

of

an

investment

may

differ

from

the

security’s

market

price

and

may

not

be

the

price

at

which

the

asset

may

be

sold.

Fair

valuation

could

result

in

a

different

Net

Asset

Value

(“NAV”)

than

a

NAV

determined

by

using

market

quotes.

GAAP

has

a

three-tier

fair

value

hierarchy.

The

basis

of

the

tiers

is

dependent

upon

the

level

of

various

“inputs”

used

to

determine

the

value

of

the

Fund’s

investments.

These

inputs

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

-

Quoted

prices

in

active

markets

for

identical

assets

and

liabilities.

Level

2

-

Prices

determined

using

significant

other

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

prepayment

speeds,

credit

risk,

etc.).

Short-term

securities

are

valued

at

amortized

cost,

which

approximates

market

value,

are

categorized

as

Level

2

in

the

hierarchy.

Municipal

securities,

long-term

U.S.

government

obligations

and

corporate

debt

securities

are

valued

in

accordance

with

the

evaluated

price

supplied

by

a

pricing

service

and

generally

categorized

as

Level

2

in

the

hierarchy.

Other

securities

that

are

categorized

as

Level

2

in

the

hierarchy

include,

but

are

not

limited

to,

warrants

that

do

not

trade

on

an

exchange,

securities

valued

at

the

mean

between

the

last

reported

bid

and

ask

quotation

MONONGAHELA

ALL

CAP

VALUE

FUND

NOTES

TO

FINANCIAL

STATEMENTS

October

31,

2024

and

international

equity

securities

valued

by

an

independent

third

party

with

adjustments

for

changes

in

value

between

the

time

of

the

securities’

respective

local

market

closes

and

the

close

of

the

U.S.

market.

Level

3

-

Significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

in

determining

the

fair

value

of

investments).

The

aggregate

value

by

input

level,

as

of

October

31,

2024,

for

the

Fund’s

investments

is

included

in

the

Fund’s

Schedule

of

Investments.

Security

Transactions,

Investment

Income

and

Realized

Gain

and

Loss

–

Investment

transactions

are

accounted

for

on

the

trade

date.

Dividend

income

is

recorded

on

the

ex-dividend

date.

Foreign

dividend

income

is

recorded

on

the

ex-

dividend

date

or

as

soon

as

possible

after

determining

the

existence

of

a

dividend

declaration

after

exercising

reasonable

due

diligence.

Income

and

capital

gains

on

some

foreign

securities

may

be

subject

to

foreign

withholding

taxes,

which

are

accrued

as

applicable.

Interest

income

is

recorded

on

an

accrual

basis.

Premium

is

amortized

to

the

next

call

date

above

par,

and

discount

is

accreted

to

maturity

using

the

effective

interest

method

and

included

in

interest

income.

Identified

cost

of

investments

sold

is

used

to

determine

the

gain

and

loss

for

both

financial

statement

and

federal

income

tax

purposes.

Distributions

to

Shareholders

–

The

Fund

declares

any

dividends

from

net

investment

income

and

pays

them

annually.

Any

net

capital

gains

and

net

foreign

currency

gains

realized

by

the

Fund

are

distributed

at

least

annually.

Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date.

Distributions

are

based

on

amounts

calculated

in

accordance

with

applicable

federal

income

tax

regulations,

which

may

differ

from

GAAP.

These

differences

are

due

primarily

to

differing

treatments

of

income

and

gain

on

various

investment

securities

held

by

the

Fund,

timing

differences

and

differing

characterizations

of

distributions

made

by

the

Fund.

Federal

Taxes

–

The

Fund

intends

to

continue

to

qualify

each

year

as

a

regulated

investment

company

under

Subchapter

M

of

Chapter

1,

Subtitle

A,

of

the

Internal

Revenue

Code

of

1986,

as

amended

(“Code”),

and

to

distribute

all

of

its

taxable

income

to

shareholders.

In

addition,

by

distributing

in

each

calendar

year

substantially

all

of

its

net

investment

income

and

capital

gains,

if

any,

the

Fund

will

not

be

subject

to

a

federal

excise

tax.

Therefore,

no

federal

income

or

excise

tax

provision

is

required.

The

Fund

recognizes

interest

and

penalties,

if

any,

related

to

unrecognized

tax

benefits

as

income

tax

expense

in

the

Statement

of

Operations.

During

the

period,

the

Fund

did

not

incur

any

interest

or

penalties.

The

Fund

files

a

U.S.

federal

income

and

excise

tax

return

as

required.

The

Fund’s

federal

income

tax

returns

are

subject

to

examination

by

the

Internal

Revenue

Service

for

a

period

of

three

years

after

they

are

filed.

As

of

October

31,

2024,

there

are

no

uncertain

tax

positions

that

would

require

financial

statement

recognition,

de-recognition

or

disclosure.

Income

and

Expense

Allocation

–

The

Trust

accounts

separately

for

the

assets,

liabilities

and

operations

of

each

of

its

investment

portfolios.

Expenses

that

are

directly

attributable

to

more

than

one

investment

portfolio

are

allocated

among

the

respective

investment

portfolios

in

an

equitable

manner.

Redemption

Fees

–

A

shareholder

who

redeems

or

exchanges

shares

within

60

days

of

purchase

will

incur

a

redemption

fee

of

1.00%

of

the

current

NAV

of

shares

redeemed

or

exchanged,

subject

to

certain

limitations.

The

fee

is

charged

for

the

benefit

of

the

remaining

shareholders

and

will

be

paid

to

the

Fund

to

help

offset

transaction

costs.

The

fee

is

accounted

for

as

an

addition

to

paid-in

capital.

The

Fund

reserves

the

right

to

modify

the

terms

of

or

terminate

the

fee

at

any

time.

There

are

limited

exceptions

to

the

imposition

of

the

redemption

fee.

Redemption

fees

incurred

for

the

Fund,

if

any,

are

reflected

on

the

Statements

of

Changes

in

Net

Assets.

Commitments

and

Contingencies

–

In

the

normal

course

of

business,

the

Fund

enters

into

contracts

that

provide

general

indemnifications

by

the

Fund

to

the

counterparty

to

the

contract.

The

Fund’s

maximum

exposure

under

these

arrangements

is

dependent

on

future

claims

that

may

be

made

against

the

Fund

and,

therefore,

cannot

be

estimated;

however,

based

on

experience,

the

risk

of

loss

from

such

claims

is

considered

remote.

The

Fund

has

determined

that

none

of

these

arrangements

requires

disclosure

on

the

Fund’s

statement

of

assets

and

liabilities.

MONONGAHELA

ALL

CAP

VALUE

FUND

NOTES

TO

FINANCIAL

STATEMENTS

October

31,

2024

Note

3. Fees

and

Expenses

Investment

Adviser

–

Monongahela

Capital

Management

(the

“Adviser”)

is

the

investment

Adviser

to

the

Fund.

Pursuant

to

an

investment

advisory

agreement,

the

Adviser

receives

an

advisory

fee,

payable

monthly,

from

the

Fund

at

an

annual

rate

of

0.75%

of

the

Fund’s

average

daily

net

assets.

Distribution

–

Foreside

Fund

Services,

LLC,

a

wholly

owned

subsidiary

of

Foreside

Financial

Group,

LLC

(d/b/a

ACA

Group)

(the

“Distributor”),

acts

as

the

agent

of

the

Trust

in

connection

with

the

continuous

offering

of

shares

of

the

Fund.

The

Fund

does

not

have

a

distribution

(12b-1)

plan;

accordingly,

the

Distributor

does

not

receive

compensation

from

the

Fund

for

its

distribution

services.

The

Adviser

compensates

the

Distributor

directly

for

its

services.

The

Distributor

is

not

affiliated

with

the

Adviser

or

Atlantic

Fund

Administration,

LLC,

a

wholly

owned

subsidiary

of

Apex

US

Holdings

LLC

(d/b/a

Apex

Fund

Services)

(“Apex”)

or

their

affiliates.

Other

Service

Providers

–

Apex

provides

fund

accounting,

fund

administration,

compliance

and

transfer

agency

services

to

the

Fund.

The

fees

related

to

these

services

are

included

in

Fund

services

fees

within

the

Statement

of

Operations.

Apex

also

provides

certain

shareholder

report

production

and

EDGAR

conversion

and

filing

services.

Pursuant

to

an

Apex

Services

Agreement,

the

Fund

pays

Apex

customary

fees

for

its

services.

Apex

provides

a

Principal

Executive

Officer,

a

Principal

Financial

Officer,

a

Chief

Compliance

Officer

and

an

Anti-Money

Laundering

Officer

to

the

Fund,

as

well

as

certain

additional

compliance

support

functions.

Trustees

and

Officers

–

Each

Independent

Trustee’s

annual

retainer

is

$45,000

($55,000

for

the

Chairman).

The

Audit

Committee

Chairman

receives

an

additional

$2,000

annually.

The

Trustees

and

the

Chairman

may

receive

additional

fees

for

special

Board

meetings.

Each

Trustee

is

also

reimbursed

for

all

reasonable

out-of-pocket

expenses

incurred

in

connection

with

his

or

her

duties

as

a

Trustee,

including

travel

and

related

expenses

incurred

in

attending

Board

meetings.

The

amount

of

Trustees’

fees

attributable

to

the

Fund

is

disclosed

in

the

Statement

of

Operations.

Certain

officers

of

the

Trust

are

also

officers

or

employees

of

the

above

named

service

providers,

and

during

their

terms

of

office

received

no

compensation

from

the

Fund.

Note

4. Expense

Reimbursements

and

Fees

Waived

The

Adviser

has

contractually

agreed

to

waive

its

fee

and/or

reimburse

Fund

expenses

to

limit

Total

Annual

Fund

Operating

Expenses

After

Fee

Waiver

and/or

Expense

Reimbursement

(excluding

all

taxes,

interest,

portfolio

transaction

expenses,

dividend

and

interest

expenses

on

short

sales,

acquired

fund

fees

and

expenses,

proxy

expenses

and

extraordinary

expenses

)

to

0.85%

,

through

at

least

September

1,

2025

(“Expense

Cap”).

Other

Fund

service

providers

have

agreed

to

waive

a

portion

of

their

fees

and

such

waivers

may

be

changed

or

eliminated

with

the

approval

of

the

Board

of

Trustees

of

the

Trust.

The

Expense

Cap

may

only

be

raised

or

eliminated

with

the

consent

of

the

Board

of

Trustees.

For

the

period

ended

October

31,

2024

,

fees

waived

and

expenses

reimbursed

were

as

follows:

The

Adviser

may

be

reimbursed

by

the

Fund

for

fees

(excluding

all

taxes,

interest,

portfolio

transaction

expenses,

dividend

and

interest

expenses

on

short

sales,

acquired

fund

fees

and

expenses,

proxy

expenses

and

extraordinary

expenses)

and

expenses

reimbursed

by

the

Adviser

pursuant

to

the

Expense

Cap

if

such

payment

is

made

within

three

years

of

the

fee

waiver

or

expense

reimbursement,

and

does

not

cause

the

Total

Annual

Fund

Operating

Expenses

After

Fee

Waiver

and/or

Expense

Reimbursement

to

exceed

the

lesser

of

(i)

the

then-current

expense

cap,

or

(ii)

the

expense

cap

in

place

at

the

time

the

fees/expenses

were

waived/reimbursed.

As

of

October

31,

2024,

$535,155

is

subject

to

recapture

by

the

Adviser

.

Other

waivers

are

not

eligible

for

recoupment.

In

addition,

other

Fund

service

providers

may

waive

all

or

any

portion

of

their

fees

and

may

reimburse

certain

expenses

of

the

Fund.

Note

5. Security

Transactions

The

cost

of

purchases

and

proceeds

from

sales

of

investment

securities

(including

maturities),

other

than

short-term

investments,

during

the

period

ended

October

31,

2024

were

$4,856,349

and

$2,288,698,

respectively.

Investment

Adviser

Fees

Waived

Other

Waivers

Total

Fees

Waived

and

Expenses

Reimbursed

$

95,026

$

44,737

$

139,763

MONONGAHELA

ALL

CAP

VALUE

FUND

NOTES

TO

FINANCIAL

STATEMENTS

October

31,

2024

Note

6. Federal

Income

Tax

As

of

October

31,

2024,

cost

of

investments

for

federal

income

tax

purposes

is

substantially

the

same

for

financial

statement

purposes

and

net

unrealized

appreciation

consists

of:

As

of

April

30,

2024,

distributable

earnings

on

a

tax

basis

were

as

follows:

The

difference

between

components

of

distributable

earnings

on

a

tax

basis

and

the

amounts

reflected

in

the

Statement

of

Assets

and

Liabilities

are

primarily

due

to

wash

sales

and

equity

return

of

capital.

Note

7. Subsequent

Events

Subsequent

events

occurring

after

the

date

of

this

report

through

the

date

these

financial

statements

were

issued

have

been

evaluated

for

potential

impact,

and

the

Fund

has

had

no

such

events.

Gross

Unrealized

Appreciation

$

9,543,051

Gross

Unrealized

Depreciation

(476,946)

Net

Unrealized

Appreciation

$

9,066,105

Undistributed

Ordinary

Income

$

111,494

Undistributed

Long-Term

Gain

1,292,184

Net

Unrealized

Appreciation

6,944,576

Total

$

8,348,254

MONONGAHELA

ALL

CAP

VALUE

FUND

OTHER

INFORMATION

October

31,

2024

Changes

in

and

Disagreements

with

Accountants

(Item

8

of

Form

N-CSR)

N/A

Proxy

Disclosure

(Item

9

of

Form

N-CSR)

N/A

Remuneration

Paid

to

Directors,

Officers,

and

Others

(Item

10

of

Form

N-CSR)

Please

see

financial

statements

in

Item

7.

Statement

Regarding

the

Basis

for

the

Board’s

Approval

of

Investment

Advisory

Contract

(Item

11

of

Form

N-CSR)

N/A

MONONGAHELA

ALL

CAP

VALUE

FUND

FOR

MORE

INFORMATION:

P.O.

Box

588

Portland,

ME

04112

(855)

392-9331

(toll

free)

monongahela.ta@apexfs.com

www.Moncapfund.com

INVESTMENT

ADVISER

Monongahela

Capital

Management

223

Mercer

Street

Harmony,

PA

16037

TRANSFER

AGENT

Apex

Fund

Services

P.O.

Box

588

Portland,

ME

04112

www.apexgroup.com

This

report

is

submitted

for

the

general

information

of

the

shareholders

of

the

Fund.

It

is

not

authorized

for

distribution

to

prospective

investors

unless

preceded

or

accompanied

by

an

effective

prospectus,

which

includes

information

regarding

the

Fund’s

risks,

objectives,

fees

and

expenses,

experience

of

its

management,

and

other

information.

211-SAR-1024

(b) Included as part of financial statements filed under Item 7(a).

ITEM 8. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PROXY DISCLOSURES FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 10. REMUNERATION PAID TO DIRECTORS, OFFICERS, AND OTHERS OF OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Included as part of financial statements filed under Item 7(a).

ITEM 11. STATEMENT REGARDING BASIS FOR APPROVAL OF INVESTMENT ADVISORY CONTRACT.

Not applicable.

ITEM 12. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 13. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 14. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 15. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

The Registrant does not accept nominees to the Board of Trustees from shareholders.

ITEM 16. CONTROLS AND PROCEDURES

(a) The Registrant’s Principal Executive Officer and Principal Financial Officer have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act are effective, based on their evaluation of the controls and procedures required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as of a date within 90 days of the filing date of this report.

(b) There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the Reporting Period that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

ITEM 17. DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 18. RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION.

Not applicable.

ITEM 19. EXHIBITS.

(a)(1) Not applicable.

(a)(2) Not applicable.

(a)(4) Not applicable.

(a)(5) Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Registrant Forum Funds

| By: | /s/ Zachary Tackett | |

| | Zachary Tackett, Principal Executive Officer | |

| | | |

| Date: | December 18, 2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | /s/ Zachary Tackett | |

| | Zachary Tackett, Principal Executive Officer | |

| | | |

| Date: | December 18, 2024 | |

| By: | /s/ Karen Shaw | |

| | Karen Shaw, Principal Financial Officer | |

| | | |

| Date: | December 18, 2024 | |