UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Zachary Tackett, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end June 30

Date of reporting period: July 1, 2024 – December 31, 2024

ITEM 1. REPORT TO SHAREHOLDERS.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (“Act”), is attached hereto.

DF Dent Premier Growth Fund

Semi-Annual Shareholder Report - December 31, 2024

This semi-annual shareholder report contains important information about the DF Dent Premier Growth Fund for the period of July 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://dfdent.com/literature/. You can also request this information by contacting us at (866) 233-3368.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| DF Dent Premier Growth Fund | $51 | 0.99% |

|---|

How did the Fund perform in the last six months?

During the period from July 2024 to December 2024, the DF Dent Premier Growth Fund underperformed its benchmark, the S&P 500 Index. The underperformance was influenced by both sector allocation and stock selection. The largest detractors were stock selection in Industrials and Information Technology and an overweight to Health Care. Within Information Technology, our position in semiconductors has broadly detracted from performance. Both stock selection and our underweight to Consumer Discretionary also detracted from performance. Notably, the Real Estate and Health Care sectors contributed positively to the portfolio’s performance, as did an underweight in the Energy sector.

The Consumer Discretionary and Financials sectors were the largest contributors to the benchmark’s return. In the Fund, the Consumer Discretionary sector underperformed, driven by both stock selection and sector allocation. Similarly, the Industrials sector underperformed in the portfolio due to stock selection. The Energy and Health Care sectors detracted the most from the benchmark’s performance.

The Fund experienced fluctuating performance relative to the S&P 500 Index, starting with a positive July, followed by losses through October. A slight recovery was observed in November, but the year concluded with a significant decline in December. Initially the outperformance was driven by positive stock selection and favorable sector allocation, but the subsequent months, particularly December, showed a reversal with both stock selection and sector allocation contributing to the underperformance.

CBRE Group, Inc., Class A

Mastercard, Inc., Class A

Monolithic Power Systems, Inc.

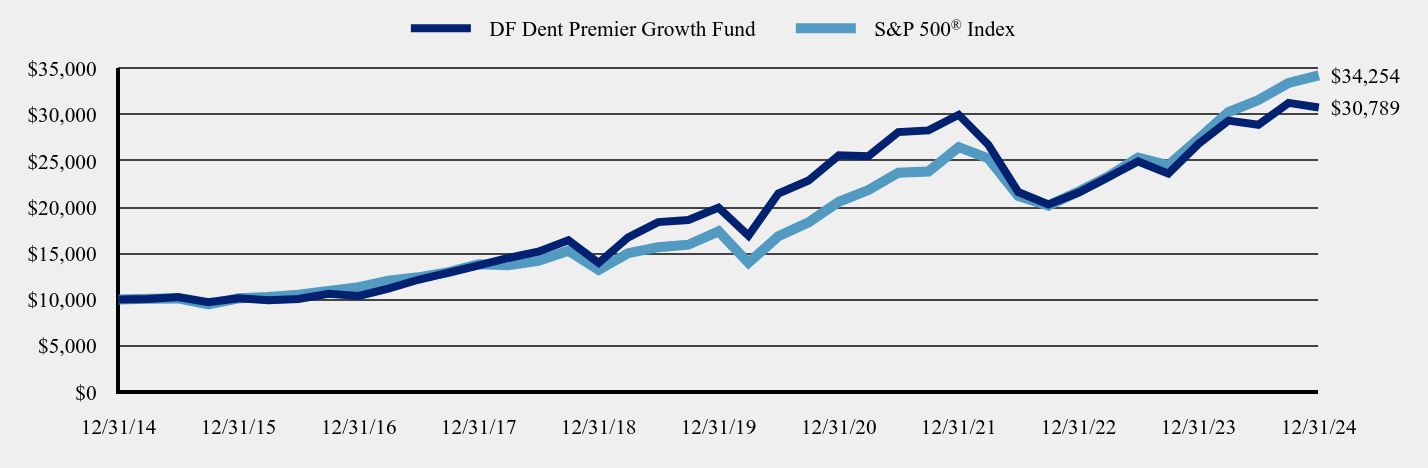

Total Return Based on a $10,000 Investment

| Date | DF Dent Premier Growth Fund | S&P 500® Index |

|---|

| 12/31/14 | $10,000 | $10,000 |

|---|

| 03/31/15 | $10,073 | $10,095 |

|---|

| 06/30/15 | $10,279 | $10,123 |

|---|

| 09/30/15 | $9,706 | $9,471 |

|---|

| 12/31/15 | $10,154 | $10,138 |

|---|

| 03/31/16 | $9,919 | $10,275 |

|---|

| 06/30/16 | $10,067 | $10,527 |

|---|

| 09/30/16 | $10,624 | $10,933 |

|---|

| 12/31/16 | $10,401 | $11,351 |

|---|

| 03/31/17 | $11,197 | $12,039 |

|---|

| 06/30/17 | $12,144 | $12,411 |

|---|

| 09/30/17 | $12,914 | $12,967 |

|---|

| 12/31/17 | $13,712 | $13,829 |

|---|

| 03/31/18 | $14,505 | $13,724 |

|---|

| 06/30/18 | $15,176 | $14,195 |

|---|

| 09/30/18 | $16,418 | $15,290 |

|---|

| 12/31/18 | $13,967 | $13,223 |

|---|

| 03/31/19 | $16,739 | $15,027 |

|---|

| 06/30/19 | $18,384 | $15,674 |

|---|

| 09/30/19 | $18,610 | $15,940 |

|---|

| 12/31/19 | $19,958 | $17,386 |

|---|

| 03/31/20 | $16,917 | $13,979 |

|---|

| 06/30/20 | $21,476 | $16,850 |

|---|

| 09/30/20 | $22,889 | $18,355 |

|---|

| 12/31/20 | $25,612 | $20,585 |

|---|

| 03/31/21 | $25,516 | $21,856 |

|---|

| 06/30/21 | $28,125 | $23,724 |

|---|

| 09/30/21 | $28,306 | $23,862 |

|---|

| 12/31/21 | $29,997 | $26,494 |

|---|

| 03/31/22 | $26,763 | $25,276 |

|---|

| 06/30/22 | $21,644 | $21,206 |

|---|

| 09/30/22 | $20,294 | $20,170 |

|---|

| 12/31/22 | $21,583 | $21,696 |

|---|

| 03/31/23 | $23,237 | $23,322 |

|---|

| 06/30/23 | $24,951 | $25,361 |

|---|

| 09/30/23 | $23,626 | $24,531 |

|---|

| 12/31/23 | $26,853 | $27,399 |

|---|

| 03/31/24 | $29,370 | $30,291 |

|---|

| 06/30/24 | $28,912 | $31,589 |

|---|

| 09/30/24 | $31,283 | $33,448 |

|---|

| 12/31/24 | $30,789 | $34,254 |

|---|

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| DF Dent Premier Growth Fund | 14.66% | 9.06% | 11.90% |

|---|

S&P 500® Index | 25.02% | 14.53% | 13.10% |

|---|

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $229,987,612 |

|---|

| # of Portfolio Holdings | 40 |

|---|

| Portfolio Turnover Rate | 7% |

|---|

| Investment Advisory Fees (Net of fees waived) | $1,012,285 |

|---|

Top Ten Holdings

(% total investments)*

| Amazon.com, Inc. | 6.10% |

| Visa, Inc., Class A | 5.18% |

| Mastercard, Inc., Class A | 4.99% |

| Alphabet, Inc., Class C | 4.67% |

| Microsoft Corp. | 4.08% |

| S&P Global, Inc. | 3.86% |

| HEICO Corp., Class A | 3.59% |

| TransDigm Group, Inc. | 3.41% |

| Guidewire Software, Inc. | 3.20% |

| Danaher Corp. | 3.16% |

* excluding cash equivalents

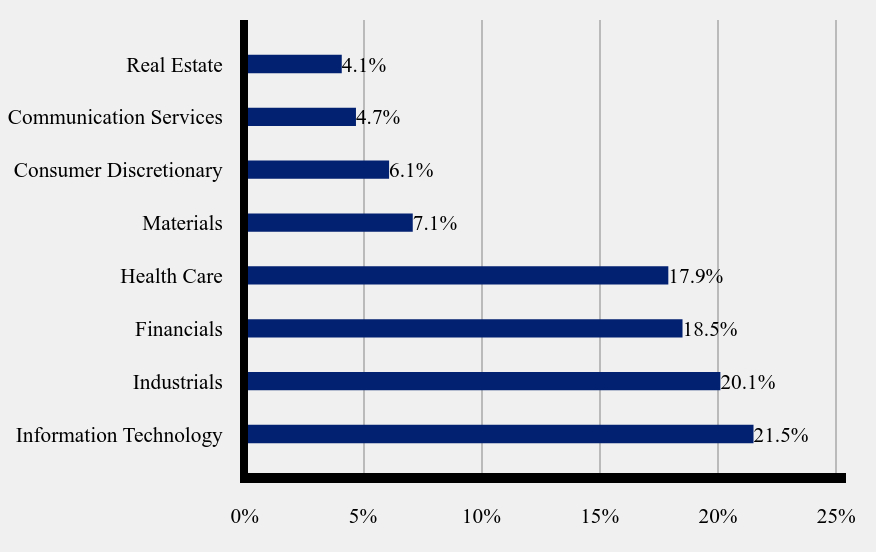

Sector Weightings

(% total investments)*

| Value | Value |

|---|

| Information Technology | 21.5% |

| Industrials | 20.1% |

| Financials | 18.5% |

| Health Care | 17.9% |

| Materials | 7.1% |

| Consumer Discretionary | 6.1% |

| Communication Services | 4.7% |

| Real Estate | 4.1% |

* excluding cash equivalents

Where can I find additional information about the fund?

Additional information is available by scanning the QR code or at https://dfdent.com/literature/, including its:

prospectus

financial information

holdings

proxy information

DF Dent Premier Growth Fund

Semi-Annual Shareholder Report - December 31, 2024

DF Dent Midcap Growth Fund

Semi-Annual Shareholder Report - December 31, 2024

This semi-annual shareholder report contains important information about the DF Dent Midcap Growth Fund for the period of July 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://dfdent.com/literature/. You can also request this information by contacting us at (866) 233-3368.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Shares | $47 | 0.90% |

|---|

How did the Fund perform in the last six months?

During the period from July 2024 to December 2024, the DF Dent Midcap Growth Fund outperformed the Russell 2500 Index while underperforming the Russell Midcap Growth Index.

The outperformance relative to the Russell 2500 Index was driven primarily by stock selection within Real Estate and Financials. Being overweight Technology and underweight Energy also contributed to performance. This was offset by stock selection in Industrials and our overweight to Life Sciences within Health Care as they detracted from performance.

The underperformance relative to the Russell Midcap Growth Index was primarily due to our cautious view towards AI-driven investment themes. Not owning AI winners Palantir Technologies, Inc. (PLTR) and AppLovin Corp. (APP) alone accounted for our portfolio’s shortfall for the past 6 months. Stock selection in Industrials and Technology and our overweight to Materials and Healthcare also detracted from performance. On the positive side, stock selection within Financials, Real Estate, and Health Care and being underweight in both Consumer Staples and Consumer Discretionary were the largest contributors to performance.

The Fund experienced fluctuating performance relative to the Russell 2500 Index, starting with a positive July and August followed by losses through November. A slight recovery was observed in December.

The Fund experienced fluctuating performance relative to the Russell Midcap Growth Index, starting with a positive July, followed by losses through October. A slight recovery was observed in November, but the year concluded with a significant decline in December.

Goosehead Insurance, Inc., Class A

CBRE Group, Inc., Class A

Veeva Systems, Inc., Class A

Edwards Lifesciences Corp.

Microchip Technology, Inc.

Mettler-Toledo International, Inc.

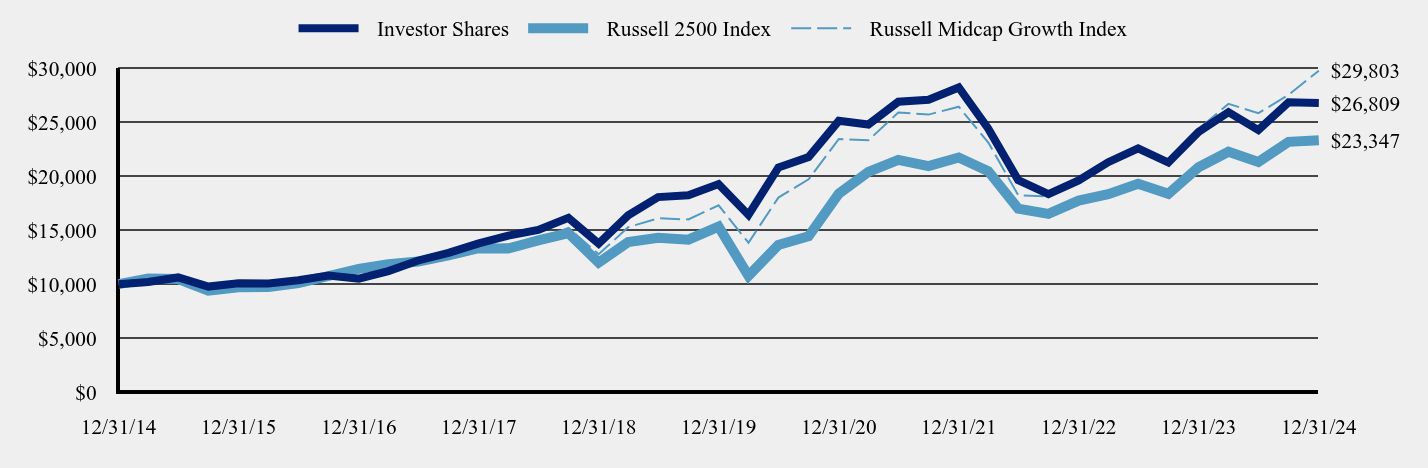

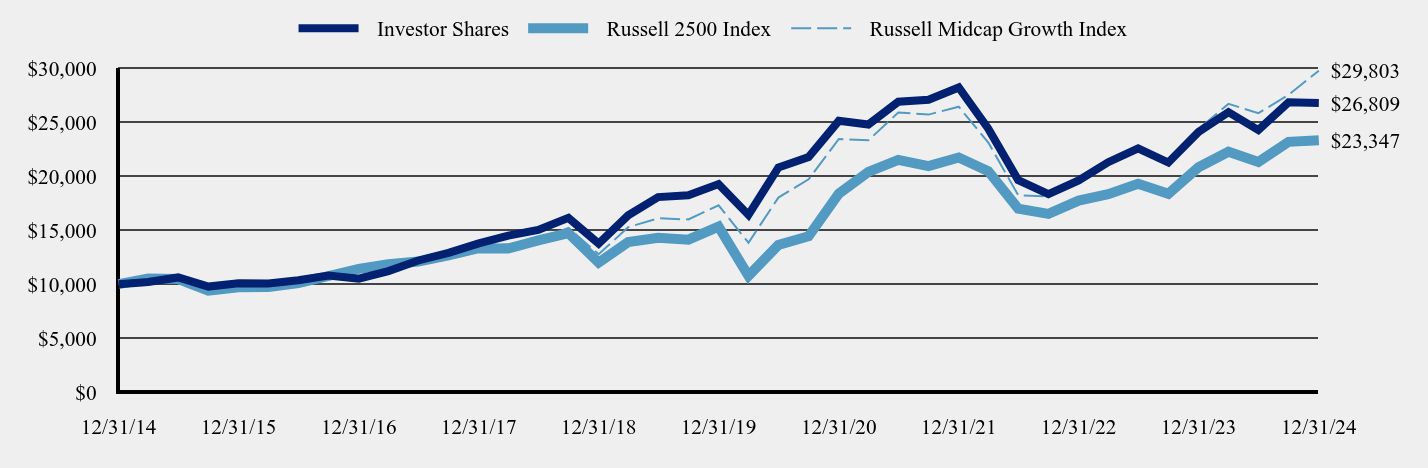

Total Return Based on a $10,000 Investment

| Date | Investor Shares | Russell 2500 Index | Russell Midcap Growth Index |

|---|

| 12/31/14 | $10,000 | $10,000 | $10,000 |

|---|

| 03/31/15 | $10,209 | $10,517 | $10,538 |

|---|

| 06/30/15 | $10,627 | $10,481 | $10,418 |

|---|

| 09/30/15 | $9,778 | $9,402 | $9,585 |

|---|

| 12/31/15 | $10,079 | $9,710 | $9,980 |

|---|

| 03/31/16 | $10,059 | $9,748 | $10,038 |

|---|

| 06/30/16 | $10,362 | $10,096 | $10,195 |

|---|

| 09/30/16 | $10,800 | $10,759 | $10,663 |

|---|

| 12/31/16 | $10,506 | $11,418 | $10,711 |

|---|

| 03/31/17 | $11,215 | $11,847 | $11,450 |

|---|

| 06/30/17 | $12,200 | $12,099 | $11,932 |

|---|

| 09/30/17 | $12,902 | $12,673 | $12,563 |

|---|

| 12/31/17 | $13,786 | $13,337 | $13,418 |

|---|

| 03/31/18 | $14,510 | $13,305 | $13,710 |

|---|

| 06/30/18 | $15,031 | $14,065 | $14,143 |

|---|

| 09/30/18 | $16,148 | $14,725 | $15,214 |

|---|

| 12/31/18 | $13,760 | $12,003 | $12,781 |

|---|

| 03/31/19 | $16,392 | $13,902 | $15,288 |

|---|

| 06/30/19 | $18,079 | $14,313 | $16,114 |

|---|

| 09/30/19 | $18,240 | $14,130 | $16,005 |

|---|

| 12/31/19 | $19,283 | $15,336 | $17,314 |

|---|

| 03/31/20 | $16,424 | $10,778 | $13,844 |

|---|

| 06/30/20 | $20,816 | $13,641 | $18,033 |

|---|

| 09/30/20 | $21,790 | $14,443 | $19,724 |

|---|

| 12/31/20 | $25,150 | $18,402 | $23,475 |

|---|

| 03/31/21 | $24,810 | $20,413 | $23,342 |

|---|

| 06/30/21 | $26,921 | $21,524 | $25,927 |

|---|

| 09/30/21 | $27,112 | $20,947 | $25,730 |

|---|

| 12/31/21 | $28,244 | $21,748 | $26,463 |

|---|

| 03/31/22 | $24,426 | $20,483 | $23,134 |

|---|

| 06/30/22 | $19,660 | $17,005 | $18,259 |

|---|

| 09/30/22 | $18,348 | $16,526 | $18,140 |

|---|

| 12/31/22 | $19,624 | $17,753 | $19,392 |

|---|

| 03/31/23 | $21,314 | $18,355 | $21,163 |

|---|

| 06/30/23 | $22,597 | $19,314 | $22,483 |

|---|

| 09/30/23 | $21,285 | $18,390 | $21,308 |

|---|

| 12/31/23 | $24,120 | $20,846 | $24,408 |

|---|

| 03/31/24 | $25,956 | $22,289 | $26,726 |

|---|

| 06/30/24 | $24,295 | $21,336 | $25,867 |

|---|

| 09/30/24 | $26,867 | $23,202 | $27,559 |

|---|

| 12/31/24 | $26,809 | $23,347 | $29,803 |

|---|

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. Effective June 1, 2024, the Fund changed its primary benchmark index from the Russell Midcap Growth Index to the Russell 2500 Index due to regulatory requirements. The Fund retained the Russell Midcap Growth Index as a secondary benchmark because the Russell Midcap Growth Index more closely reflects the market sectors in which the Fund invests.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Investor Shares | 11.15% | 6.81% | 10.36% |

|---|

| Russell 2500 Index | 12.00% | 8.77% | 8.85% |

|---|

| Russell Midcap Growth Index | 22.10% | 11.47% | 11.54% |

|---|

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $407,379,623 |

|---|

| # of Portfolio Holdings | 39 |

|---|

| Portfolio Turnover Rate | 25% |

|---|

| Investment Advisory Fees (Net of fees waived) | $1,608,046 |

|---|

Top Ten Holdings

(% total investments)*

| Vulcan Materials Co. | 5.21% |

| Ecolab, Inc. | 4.69% |

| Veeva Systems, Inc., Class A | 4.55% |

| CoStar Group, Inc. | 4.20% |

| CBRE Group, Inc., Class A | 4.09% |

| Veralto Corp. | 4.02% |

| Markel Group, Inc. | 3.97% |

| Bio-Techne Corp. | 3.79% |

| HEICO Corp., Class A | 3.79% |

| Old Dominion Freight Line, Inc. | 3.78% |

* excluding cash equivalents

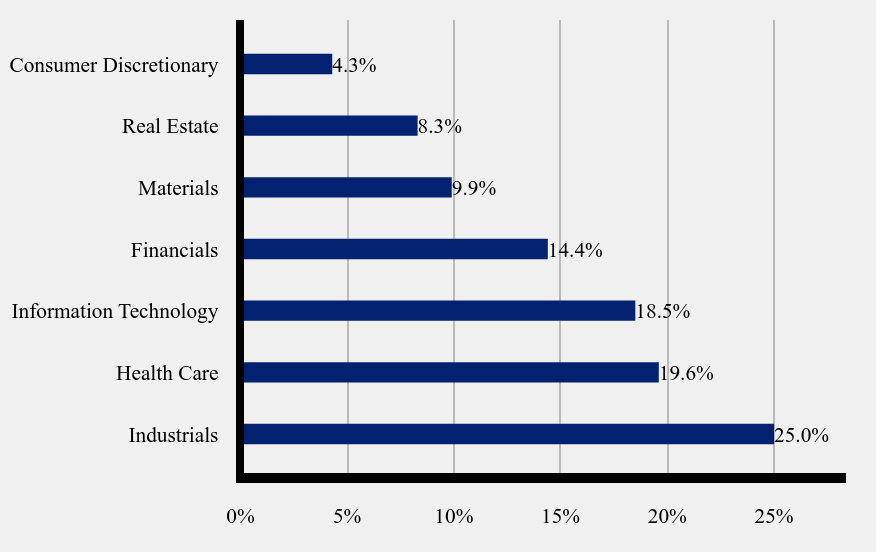

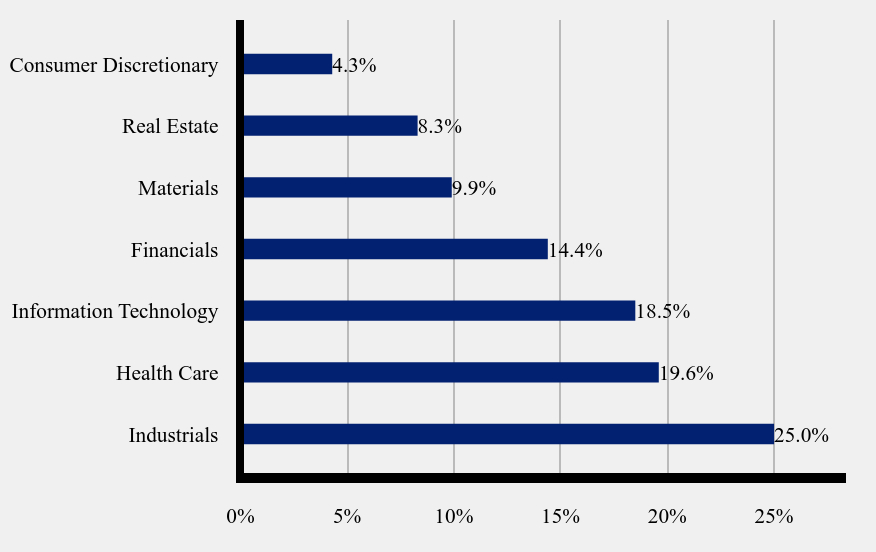

Sector Weightings

(% total investments)*

| Value | Value |

|---|

| Industrials | 25.0% |

| Health Care | 19.6% |

| Information Technology | 18.5% |

| Financials | 14.4% |

| Materials | 9.9% |

| Real Estate | 8.3% |

| Consumer Discretionary | 4.3% |

* excluding cash equivalents

Where can I find additional information about the fund?

Additional information is available by scanning the QR code or at https://dfdent.com/literature/, including its:

prospectus

financial information

holdings

proxy information

DF Dent Midcap Growth Fund

Semi-Annual Shareholder Report - December 31, 2024

DF Dent Midcap Growth Fund

Semi-Annual Shareholder Report - December 31, 2024

This semi-annual shareholder report contains important information about the DF Dent Midcap Growth Fund for the period of July 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://dfdent.com/literature/. You can also request this information by contacting us at (866) 233-3368.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $45 | 0.85% |

|---|

How did the Fund perform in the last six months?

During the period from July 2024 to December 2024, the DF Dent Midcap Growth Fund outperformed the Russell 2500 Index while underperforming the Russell Midcap Growth Index.

The outperformance relative to the Russell 2500 Index was driven primarily by stock selection within Real Estate and Financials. Being overweight Technology and underweight Energy also contributed to performance. This was offset by stock selection in Industrials and our overweight to Life Sciences within Health Care as they detracted from performance.

The underperformance relative to the Russell Midcap Growth Index was primarily due to our cautious view towards AI-driven investment themes. Not owning AI winners Palantir Technologies, Inc. (PLTR) and AppLovin Corp. (APP) alone accounted for our portfolio’s shortfall for the past 6 months. Stock selection in Industrials and Technology and our overweight to Materials and Healthcare also detracted from performance. On the positive side, stock selection within Financials, Real Estate, and Health Care and being underweight in both Consumer Staples and Consumer Discretionary were the largest contributors to performance.

The Fund experienced fluctuating performance relative to the Russell 2500 Index, starting with a positive July and August followed by losses through November. A slight recovery was observed in December.

The Fund experienced fluctuating performance relative to the Russell Midcap Growth Index, starting with a positive July, followed by losses through October. A slight recovery was observed in November, but the year concluded with a significant decline in December.

Goosehead Insurance, Inc., Class A

CBRE Group, Inc., Class A

Veeva Systems, Inc., Class A

Edwards Lifesciences Corp.

Microchip Technology, Inc.

Mettler-Toledo International, Inc.

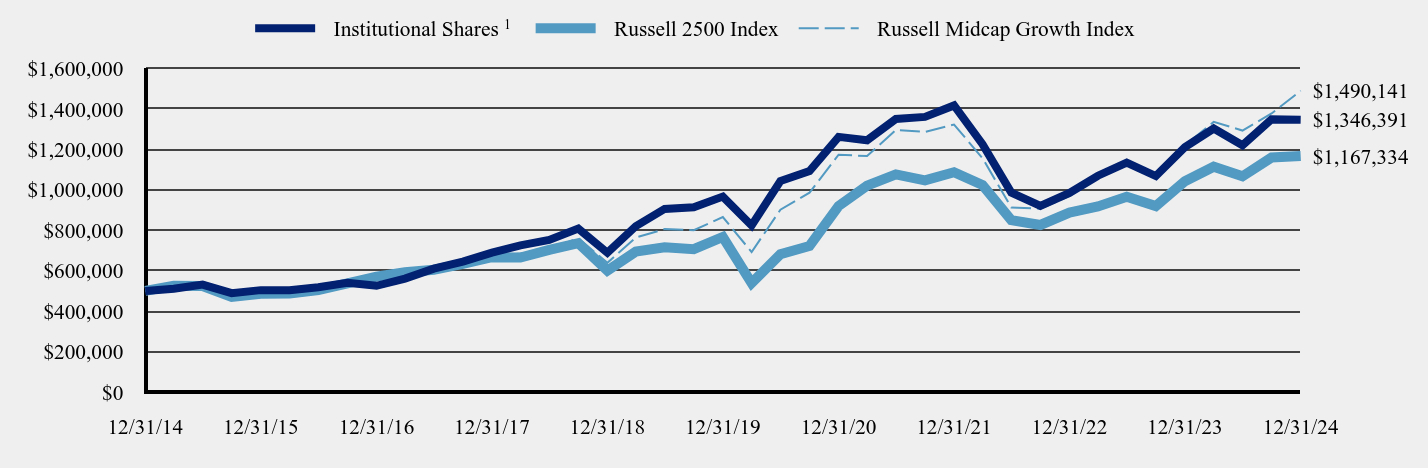

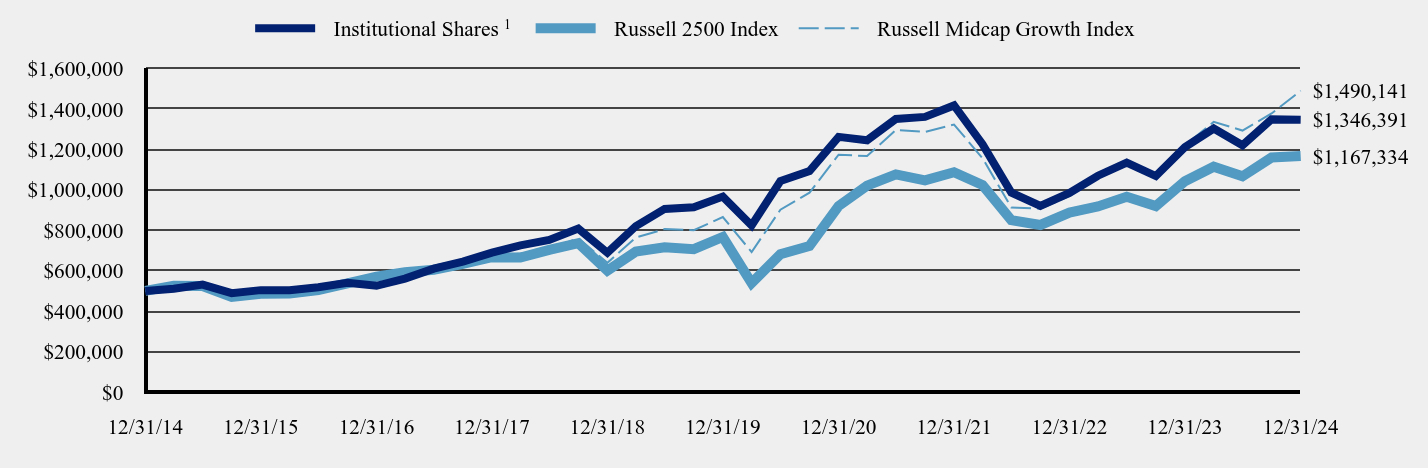

Total Return Based on a $500,000 Investment

| Date | Institutional SharesFootnote Reference1 | Russell 2500 Index | Russell Midcap Growth Index |

|---|

| 12/31/14 | $500,000 | $500,000 | $500,000 |

|---|

| 3/31/15 | $510,451 | $525,842 | $526,890 |

|---|

| 6/30/15 | $531,352 | $524,044 | $520,880 |

|---|

| 9/30/15 | $488,896 | $470,084 | $479,264 |

|---|

| 12/31/15 | $503,947 | $485,492 | $499,001 |

|---|

| 3/31/16 | $502,936 | $487,399 | $501,890 |

|---|

| 6/30/16 | $518,105 | $504,812 | $509,732 |

|---|

| 9/30/16 | $540,015 | $537,941 | $533,139 |

|---|

| 12/31/16 | $525,308 | $570,886 | $535,571 |

|---|

| 3/31/17 | $560,734 | $592,329 | $572,493 |

|---|

| 6/30/17 | $609,992 | $604,972 | $596,625 |

|---|

| 9/30/17 | $645,080 | $633,658 | $628,144 |

|---|

| 12/31/17 | $689,307 | $666,854 | $670,897 |

|---|

| 3/31/18 | $725,515 | $665,260 | $685,485 |

|---|

| 6/30/18 | $751,910 | $703,238 | $707,129 |

|---|

| 9/30/18 | $808,083 | $736,265 | $760,691 |

|---|

| 12/31/18 | $688,694 | $600,156 | $639,026 |

|---|

| 3/31/19 | $820,624 | $695,086 | $764,409 |

|---|

| 6/30/19 | $905,661 | $715,667 | $805,701 |

|---|

| 9/30/19 | $913,710 | $706,490 | $800,274 |

|---|

| 12/31/19 | $966,588 | $766,796 | $865,686 |

|---|

| 3/31/20 | $823,612 | $538,890 | $692,203 |

|---|

| 6/30/20 | $1,043,901 | $682,045 | $901,670 |

|---|

| 9/30/20 | $1,093,325 | $722,166 | $986,189 |

|---|

| 12/31/20 | $1,262,037 | $920,104 | $1,173,753 |

|---|

| 3/31/21 | $1,245,040 | $1,020,661 | $1,167,119 |

|---|

| 6/30/21 | $1,350,918 | $1,076,207 | $1,296,343 |

|---|

| 9/30/21 | $1,360,833 | $1,047,346 | $1,286,492 |

|---|

| 12/31/21 | $1,417,427 | $1,087,397 | $1,323,151 |

|---|

| 3/31/22 | $1,225,814 | $1,024,144 | $1,156,695 |

|---|

| 6/30/22 | $986,844 | $850,234 | $912,959 |

|---|

| 9/30/22 | $920,908 | $826,277 | $906,997 |

|---|

| 12/31/22 | $985,022 | $887,651 | $969,593 |

|---|

| 3/31/23 | $1,069,900 | $917,745 | $1,058,174 |

|---|

| 6/30/23 | $1,134,378 | $965,696 | $1,124,143 |

|---|

| 9/30/23 | $1,068,443 | $919,516 | $1,065,418 |

|---|

| 12/31/23 | $1,211,242 | $1,042,308 | $1,220,396 |

|---|

| 3/31/24 | $1,303,406 | $1,114,431 | $1,336,291 |

|---|

| 6/30/24 | $1,220,349 | $1,066,793 | $1,293,352 |

|---|

| 9/30/24 | $1,349,306 | $1,160,123 | $1,377,954 |

|---|

| 12/31/24 | $1,346,391 | $1,167,334 | $1,490,141 |

|---|

| Footnote | Description |

Footnote1 | Institutional Shares commenced operations on November 29, 2017. Performance for the periods prior to November 29, 2017 are a blended average annual return which includes the returns of Investor Shares prior to the commencement of operations of Institutional Shares. |

The above chart represents historical performance of a hypothetical $500,000 investment over the past 10 years. Effective June 1, 2024, the Fund changed its primary benchmark index from the Russell Midcap Growth Index to the Russell 2500 Index due to regulatory requirements. The Fund retained the Russell Midcap Growth Index as a secondary benchmark because the Russell Midcap Growth Index more closely reflects the market sectors in which the Fund invests.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

Institutional SharesFootnote Reference1 | 11.16% | 6.85% | 10.41% |

|---|

| Russell 2500 Index | 12.00% | 8.77% | 8.85% |

|---|

| Russell Midcap Growth Index | 22.10% | 11.47% | 11.54% |

|---|

| Footnote | Description |

Footnote1 | Institutional Shares commenced operations on November 29, 2017. Performance for the 10 year period is a blended average annual return which includes the returns of Investor Shares prior to the commencement of operations of Institutional Shares. |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $407,379,623 |

|---|

| # of Portfolio Holdings | 39 |

|---|

| Portfolio Turnover Rate | 25% |

|---|

| Investment Advisory Fees (Net of fees waived) | $1,608,046 |

|---|

Top Ten Holdings

(% total investments)*

| Vulcan Materials Co. | 5.21% |

| Ecolab, Inc. | 4.69% |

| Veeva Systems, Inc., Class A | 4.55% |

| CoStar Group, Inc. | 4.20% |

| CBRE Group, Inc., Class A | 4.09% |

| Veralto Corp. | 4.02% |

| Markel Group, Inc. | 3.97% |

| Bio-Techne Corp. | 3.79% |

| HEICO Corp., Class A | 3.79% |

| Old Dominion Freight Line, Inc. | 3.78% |

* excluding cash equivalents

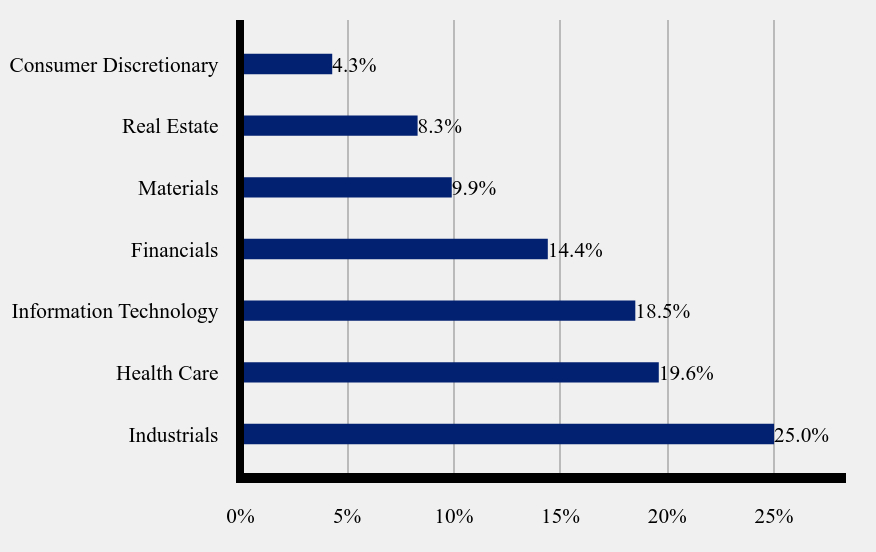

Sector Weightings

(% total investments)*

| Value | Value |

|---|

| Industrials | 25.0% |

| Health Care | 19.6% |

| Information Technology | 18.5% |

| Financials | 14.4% |

| Materials | 9.9% |

| Real Estate | 8.3% |

| Consumer Discretionary | 4.3% |

* excluding cash equivalents

Where can I find additional information about the fund?

Additional information is available by scanning the QR code or at https://dfdent.com/literature/, including its:

prospectus

financial information

holdings

proxy information

DF Dent Midcap Growth Fund

Semi-Annual Shareholder Report - December 31, 2024

DF Dent Midcap Growth Fund

: Institutional Plus Shares

Semi-Annual Shareholder Report - December 31, 2024

This semi-annual shareholder report contains important information about the DF Dent Midcap Growth Fund for the period of July 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://dfdent.com/literature/. You can also request this information by contacting us at (866) 233-3368.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Plus Shares | $42 | 0.79% |

|---|

How did the Fund perform in the last six months?

During the period from July 2024 to December 2024, the DF Dent Midcap Growth Fund outperformed the Russell 2500 Index while underperforming the Russell Midcap Growth Index.

The outperformance relative to the Russell 2500 Index was driven primarily by stock selection within Real Estate and Financials. Being overweight Technology and underweight Energy also contributed to performance. This was offset by stock selection in Industrials and our overweight to Life Sciences within Health Care as they detracted from performance.

The underperformance relative to the Russell Midcap Growth Index was primarily due to our cautious view towards AI-driven investment themes. Not owning AI winners Palantir Technologies, Inc. (PLTR) and AppLovin Corp. (APP) alone accounted for our portfolio’s shortfall for the past 6 months. Stock selection in Industrials and Technology and our overweight to Materials and Healthcare also detracted from performance. On the positive side, stock selection within Financials, Real Estate, and Health Care and being underweight in both Consumer Staples and Consumer Discretionary were the largest contributors to performance.

The Fund experienced fluctuating performance relative to the Russell 2500 Index, starting with a positive July and August followed by losses through November. A slight recovery was observed in December.

The Fund experienced fluctuating performance relative to the Russell Midcap Growth Index, starting with a positive July, followed by losses through October. A slight recovery was observed in November, but the year concluded with a significant decline in December.

Goosehead Insurance, Inc., Class A

CBRE Group, Inc., Class A

Veeva Systems, Inc., Class A

Edwards Lifesciences Corp.

Microchip Technology, Inc.

Mettler-Toledo International, Inc.

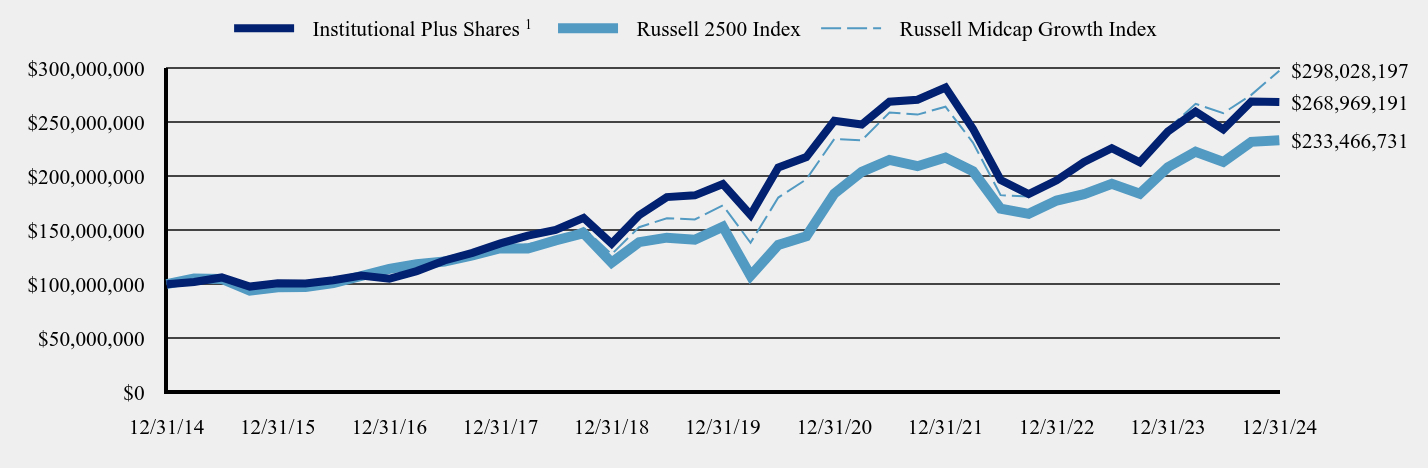

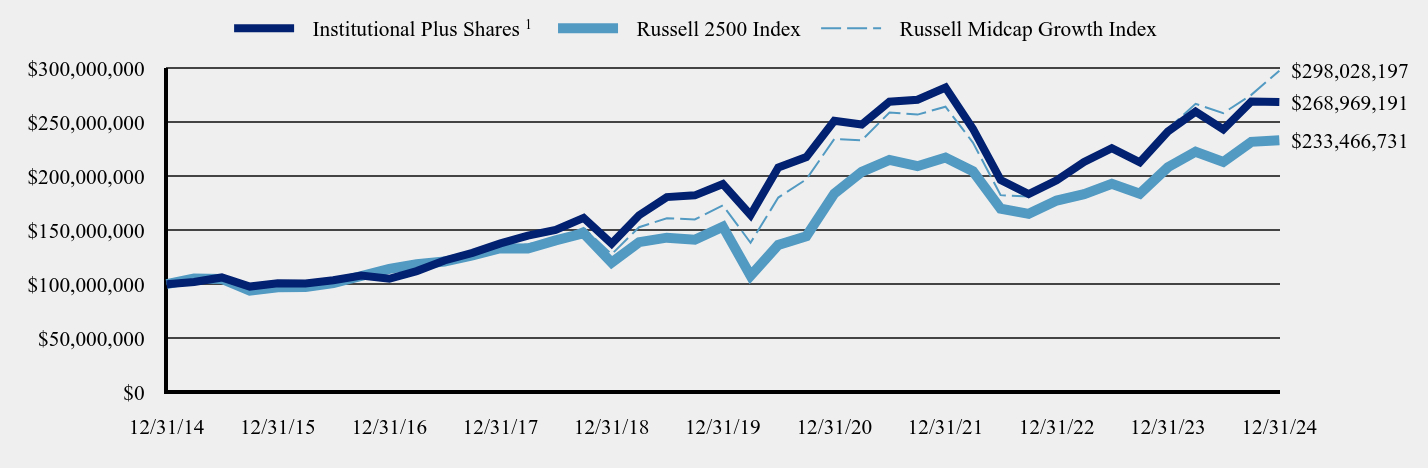

Total Return Based on a $100,000,000 Investment

| Date | Institutional Plus SharesFootnote Reference1 | Russell 2500 Index | Russell Midcap Growth Index |

|---|

| 12/31/14 | $100,000,000 | $100,000,000 | $100,000,000 |

|---|

| 3/31/15 | $102,090,137 | $105,168,412 | $105,377,989 |

|---|

| 6/30/15 | $106,270,411 | $104,808,744 | $104,176,040 |

|---|

| 9/30/15 | $97,779,229 | $94,016,866 | $95,852,849 |

|---|

| 12/31/15 | $100,789,386 | $97,098,350 | $99,800,149 |

|---|

| 3/31/16 | $100,587,133 | $97,479,890 | $100,377,918 |

|---|

| 6/30/16 | $103,620,927 | $100,962,356 | $101,946,419 |

|---|

| 9/30/16 | $108,003,074 | $107,588,277 | $106,627,770 |

|---|

| 12/31/16 | $105,061,698 | $114,177,137 | $107,114,138 |

|---|

| 3/31/17 | $112,146,783 | $118,465,819 | $114,498,691 |

|---|

| 6/30/17 | $121,998,426 | $120,994,435 | $119,324,957 |

|---|

| 9/30/17 | $129,016,035 | $126,731,512 | $125,628,798 |

|---|

| 12/31/17 | $137,861,394 | $133,370,799 | $134,179,307 |

|---|

| 3/31/18 | $145,103,009 | $133,052,018 | $137,097,065 |

|---|

| 6/30/18 | $150,314,265 | $140,647,646 | $141,425,811 |

|---|

| 9/30/18 | $161,481,241 | $147,253,032 | $152,138,219 |

|---|

| 12/31/18 | $137,603,339 | $120,031,167 | $127,805,140 |

|---|

| 3/31/19 | $163,920,153 | $139,017,169 | $152,881,789 |

|---|

| 6/30/19 | $180,788,111 | $143,133,308 | $161,140,194 |

|---|

| 9/30/19 | $182,397,916 | $141,297,905 | $160,054,888 |

|---|

| 12/31/19 | $192,833,442 | $153,359,134 | $173,137,239 |

|---|

| 3/31/20 | $164,236,758 | $107,778,014 | $138,440,592 |

|---|

| 6/30/20 | $208,155,616 | $136,409,026 | $180,333,970 |

|---|

| 9/30/20 | $217,899,672 | $144,433,279 | $197,237,743 |

|---|

| 12/31/20 | $251,502,680 | $184,020,875 | $234,750,683 |

|---|

| 3/31/21 | $248,103,038 | $204,132,117 | $233,423,756 |

|---|

| 6/30/21 | $269,209,149 | $215,241,318 | $259,268,696 |

|---|

| 9/30/21 | $271,121,447 | $209,469,124 | $257,298,408 |

|---|

| 12/31/21 | $282,395,878 | $217,479,404 | $264,630,251 |

|---|

| 3/31/22 | $244,220,542 | $204,828,732 | $231,338,909 |

|---|

| 6/30/22 | $196,682,814 | $170,046,720 | $182,591,721 |

|---|

| 9/30/22 | $183,619,011 | $165,255,474 | $181,399,433 |

|---|

| 12/31/22 | $196,392,507 | $177,530,134 | $193,918,553 |

|---|

| 3/31/23 | $213,375,451 | $183,548,932 | $211,634,755 |

|---|

| 6/30/23 | $226,221,524 | $193,139,262 | $224,828,682 |

|---|

| 9/30/23 | $213,085,145 | $183,903,193 | $213,083,677 |

|---|

| 12/31/23 | $241,607,781 | $208,461,688 | $244,079,145 |

|---|

| 3/31/24 | $260,042,259 | $222,886,158 | $267,258,249 |

|---|

| 6/30/24 | $243,494,775 | $213,358,648 | $258,670,326 |

|---|

| 9/30/24 | $269,477,228 | $232,024,654 | $275,590,769 |

|---|

| 12/31/24 | $268,969,191 | $233,466,731 | $298,028,197 |

|---|

| Footnote | Description |

Footnote1 | Institutional Plus Shares commenced operations on December 3, 2021. Performance for the periods prior to December 3, 2021 are a blended average annual return which includes the returns of Investor Shares prior to the commencement of operations of Institutional Plus Shares. |

The above chart represents historical performance of a hypothetical $100,000,000 investment over the past 10 years. Effective June 1, 2024, the Fund changed its primary benchmark index from the Russell Midcap Growth Index to the Russell 2500 Index due to regulatory requirements. The Fund retained the Russell Midcap Growth Index as a secondary benchmark because the Russell Midcap Growth Index more closely reflects the market sectors in which the Fund invests.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

Institutional Plus SharesFootnote Reference1 | 11.32% | 6.88% | 10.40% |

|---|

| Russell 2500 Index | 12.00% | 8.77% | 8.85% |

|---|

| Russell Midcap Growth Index | 22.10% | 11.47% | 11.54% |

|---|

| Footnote | Description |

Footnote1 | Institutional Plus Shares commenced operations on December 3, 2021. Performance for the 5 year and 10 year periods is a blended average annual return which includes the returns of Investor Shares prior to the commencement of operations of Institutional Plus Shares. |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $407,379,623 |

|---|

| # of Portfolio Holdings | 39 |

|---|

| Portfolio Turnover Rate | 25% |

|---|

| Investment Advisory Fees (Net of fees waived) | $1,608,046 |

|---|

Top Ten Holdings

(% total investments)*

| Vulcan Materials Co. | 5.21% |

| Ecolab, Inc. | 4.69% |

| Veeva Systems, Inc., Class A | 4.55% |

| CoStar Group, Inc. | 4.20% |

| CBRE Group, Inc., Class A | 4.09% |

| Veralto Corp. | 4.02% |

| Markel Group, Inc. | 3.97% |

| Bio-Techne Corp. | 3.79% |

| HEICO Corp., Class A | 3.79% |

| Old Dominion Freight Line, Inc. | 3.78% |

* excluding cash equivalents

Sector Weightings

(% total investments)*

| Value | Value |

|---|

| Industrials | 25.0% |

| Health Care | 19.6% |

| Information Technology | 18.5% |

| Financials | 14.4% |

| Materials | 9.9% |

| Real Estate | 8.3% |

| Consumer Discretionary | 4.3% |

* excluding cash equivalents

Where can I find additional information about the fund?

Additional information is available by scanning the QR code or at https://dfdent.com/literature/, including its:

prospectus

financial information

holdings

proxy information

DF Dent Midcap Growth Fund

: Institutional Plus Shares

Semi-Annual Shareholder Report - December 31, 2024

DF Dent Small Cap Growth Fund

Semi-Annual Shareholder Report - December 31, 2024

This semi-annual shareholder report contains important information about the DF Dent Small Cap Growth Fund for the period of July 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://dfdent.com/literature/. You can also request this information by contacting us at (866) 233-3368.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Shares | $55 | 1.04% |

|---|

How did the Fund perform in the last six months?

During the period from July 2024 to December 2024, the DF Dent Small Cap Growth Fund outperformed both its benchmarks, the Russell 2000 Index and the Russell 2000 Growth Index.

The outperformance relative to the Russell 2000 Index was driven primarily by sector allocation. Notably, being underweight the benchmark in the Energy sector and overweight the benchmark in the Information Technology sector contributed to the Fund’s performance, as did stock selection in the Financials and Materials sectors. Stock selection in the Consumer Staples, Industrials, and Information Technology sectors detracted the most from performance.

The outperformance relative to the Russell 2000 Growth Index was also driven primarily by sector allocation. Notably, being underweight the benchmark in the Energy sector and overweight the benchmark in the Financials sector contributed to the Fund’s performance, as did stock selection in the Financials and Materials sectors. Stock selection in the Consumer Discretionary, Information Technology, and Industrials sectors detracted the most from performance.

Financials, Industrials, and Information Technology were the top performing sectors in the Russell 2000 Index. All the benchmark’s sectors, other than Energy, contributed to performance with the Materials sector contributing the least.

Financials, Industrials, Information Technology, and Consumer Discretionary were the top performing sectors in the Russell 2000 Growth Index. All the benchmark’s sectors, other than Energy, contributed to performance with the Utilities sector contributing the least.

Goosehead Insurance, Inc., Class A

Perimeter Solutions, Inc.

Hamilton Lane, Inc., Class A

Charles River Laboratories International, Inc.

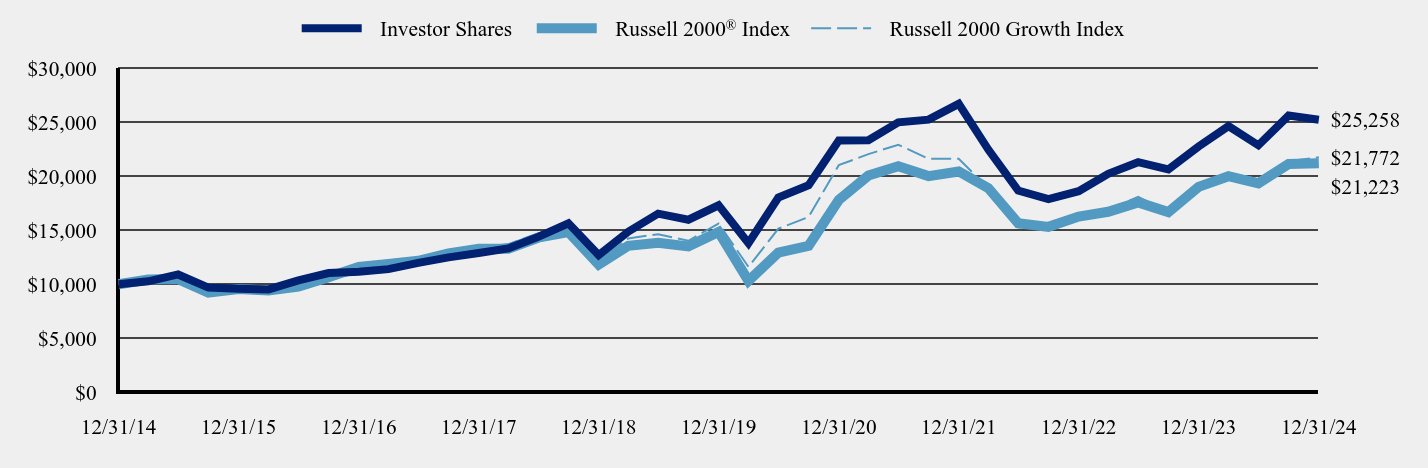

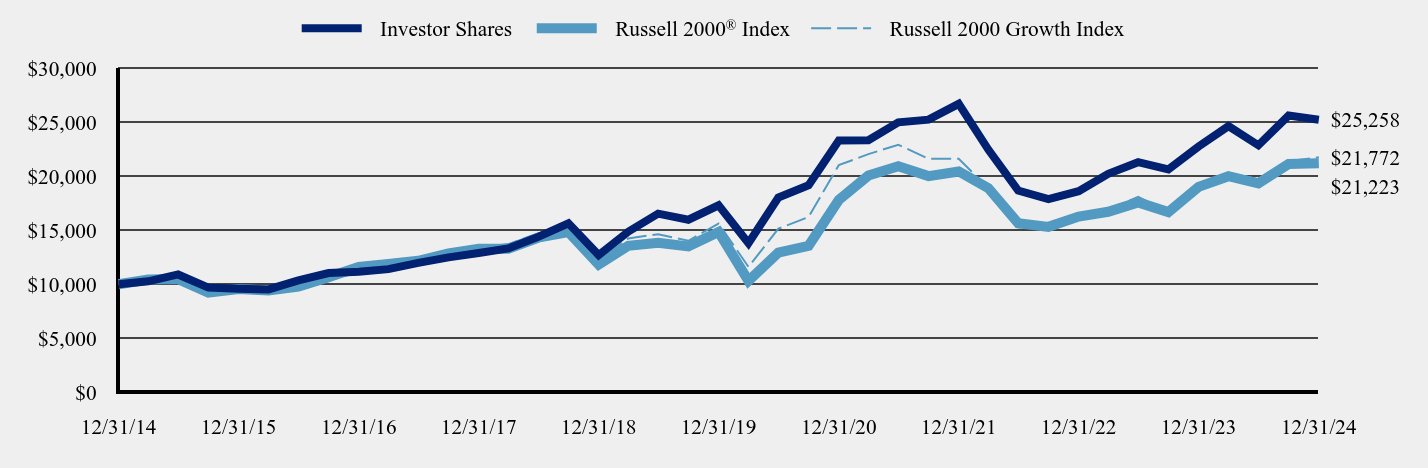

Total Return Based on a $10,000 Investment

| Date | Investor Shares | Russell 2000® Index | Russell 2000 Growth Index |

|---|

| 12/31/14 | $10,000 | $10,000 | $10,000 |

|---|

| 03/31/15 | $10,268 | $10,432 | $10,663 |

|---|

| 06/30/15 | $10,901 | $10,475 | $10,874 |

|---|

| 09/30/15 | $9,679 | $9,227 | $9,453 |

|---|

| 12/31/15 | $9,584 | $9,559 | $9,862 |

|---|

| 03/31/16 | $9,512 | $9,413 | $9,400 |

|---|

| 06/30/16 | $10,349 | $9,770 | $9,705 |

|---|

| 09/30/16 | $11,034 | $10,654 | $10,600 |

|---|

| 12/31/16 | $11,160 | $11,595 | $10,978 |

|---|

| 03/31/17 | $11,394 | $11,881 | $11,565 |

|---|

| 06/30/17 | $11,971 | $12,174 | $12,073 |

|---|

| 09/30/17 | $12,484 | $12,864 | $12,823 |

|---|

| 12/31/17 | $12,899 | $13,294 | $13,411 |

|---|

| 03/31/18 | $13,322 | $13,283 | $13,720 |

|---|

| 06/30/18 | $14,385 | $14,312 | $14,712 |

|---|

| 09/30/18 | $15,646 | $14,824 | $15,525 |

|---|

| 12/31/18 | $12,703 | $11,830 | $12,163 |

|---|

| 03/31/19 | $14,870 | $13,555 | $14,248 |

|---|

| 06/30/19 | $16,543 | $13,839 | $14,640 |

|---|

| 09/30/19 | $15,982 | $13,507 | $14,029 |

|---|

| 12/31/19 | $17,319 | $14,849 | $15,628 |

|---|

| 03/31/20 | $13,804 | $10,303 | $11,601 |

|---|

| 06/30/20 | $18,045 | $12,922 | $15,149 |

|---|

| 09/30/20 | $19,184 | $13,559 | $16,234 |

|---|

| 12/31/20 | $23,325 | $17,813 | $21,040 |

|---|

| 03/31/21 | $23,356 | $20,075 | $22,066 |

|---|

| 06/30/21 | $25,010 | $20,937 | $22,930 |

|---|

| 09/30/21 | $25,261 | $20,024 | $21,634 |

|---|

| 12/31/21 | $26,727 | $20,453 | $21,636 |

|---|

| 03/31/22 | $22,486 | $18,914 | $18,904 |

|---|

| 06/30/22 | $18,677 | $15,661 | $15,264 |

|---|

| 09/30/22 | $17,886 | $15,319 | $15,301 |

|---|

| 12/31/22 | $18,626 | $16,273 | $15,933 |

|---|

| 03/31/23 | $20,238 | $16,718 | $16,901 |

|---|

| 06/30/23 | $21,316 | $17,589 | $18,093 |

|---|

| 09/30/23 | $20,638 | $16,687 | $16,769 |

|---|

| 12/31/23 | $22,774 | $19,028 | $18,906 |

|---|

| 03/31/24 | $24,663 | $20,013 | $20,340 |

|---|

| 06/30/24 | $22,887 | $19,357 | $19,746 |

|---|

| 09/30/24 | $25,638 | $21,152 | $21,407 |

|---|

| 12/31/24 | $25,258 | $21,223 | $21,772 |

|---|

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. Effective June 1, 2024, the Fund changed its primary benchmark index from the Russell 2000 Growth Index to the Russell 2000 Index due to regulatory requirements. The Fund retained the Russell 2000 Growth Index as a secondary benchmark because the Russell 2000 Growth Index more closely reflects the market sectors in which the Fund invests.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Investor Shares | 10.91% | 7.84% | 9.71% |

|---|

Russell 2000® Index | 11.54% | 7.40% | 7.82% |

|---|

| Russell 2000 Growth Index | 15.15% | 6.86% | 8.09% |

|---|

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $217,513,780 |

|---|

| # of Portfolio Holdings | 49 |

|---|

| Portfolio Turnover Rate | 18% |

|---|

| Investment Advisory Fees (Net of fees waived) | $869,720 |

|---|

Top Ten Holdings

(% total investments)*

| Core & Main, Inc., Class A | 3.68% |

| HEICO Corp., Class A | 3.47% |

| Hamilton Lane, Inc., Class A | 3.32% |

| Bio-Techne Corp. | 3.30% |

| Goosehead Insurance, Inc., Class A | 3.28% |

| Murphy USA, Inc. | 3.20% |

| Kinsale Capital Group, Inc. | 3.19% |

| Guidewire Software, Inc. | 3.11% |

| Appfolio, Inc. | 3.10% |

| Repligen Corp. | 2.91% |

* excluding cash equivalents

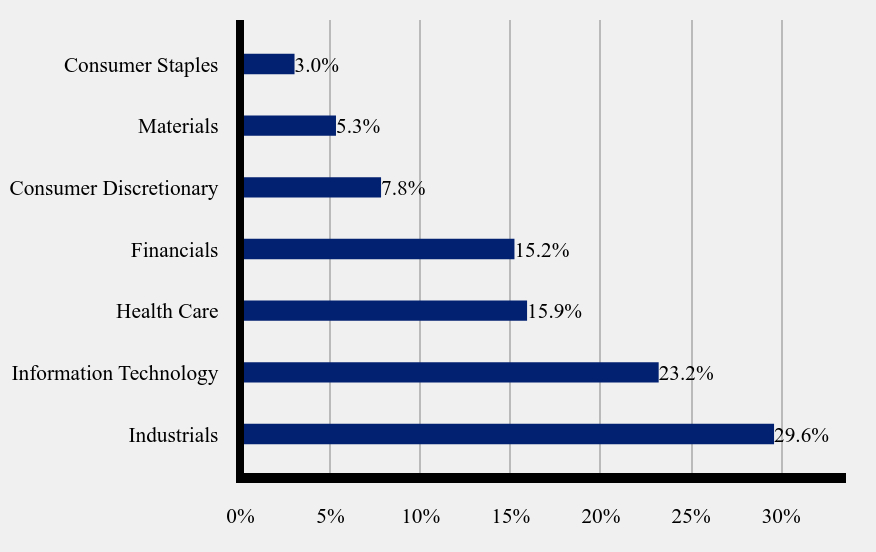

Sector Weightings

(% total investments)*

| Value | Value |

|---|

| Industrials | 29.6% |

| Information Technology | 23.2% |

| Health Care | 15.9% |

| Financials | 15.2% |

| Consumer Discretionary | 7.8% |

| Materials | 5.3% |

| Consumer Staples | 3.0% |

* excluding cash equivalents

Where can I find additional information about the fund?

Additional information is available by scanning the QR code or at https://dfdent.com/literature/, including its:

prospectus

financial information

holdings

proxy information

DF Dent Small Cap Growth Fund

Semi-Annual Shareholder Report - December 31, 2024

DF Dent Small Cap Growth Fund

Semi-Annual Shareholder Report - December 31, 2024

This semi-annual shareholder report contains important information about the DF Dent Small Cap Growth Fund for the period of July 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://dfdent.com/literature/. You can also request this information by contacting us at (866) 233-3368.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $50 | 0.94% |

|---|

How did the Fund perform in the last six months?

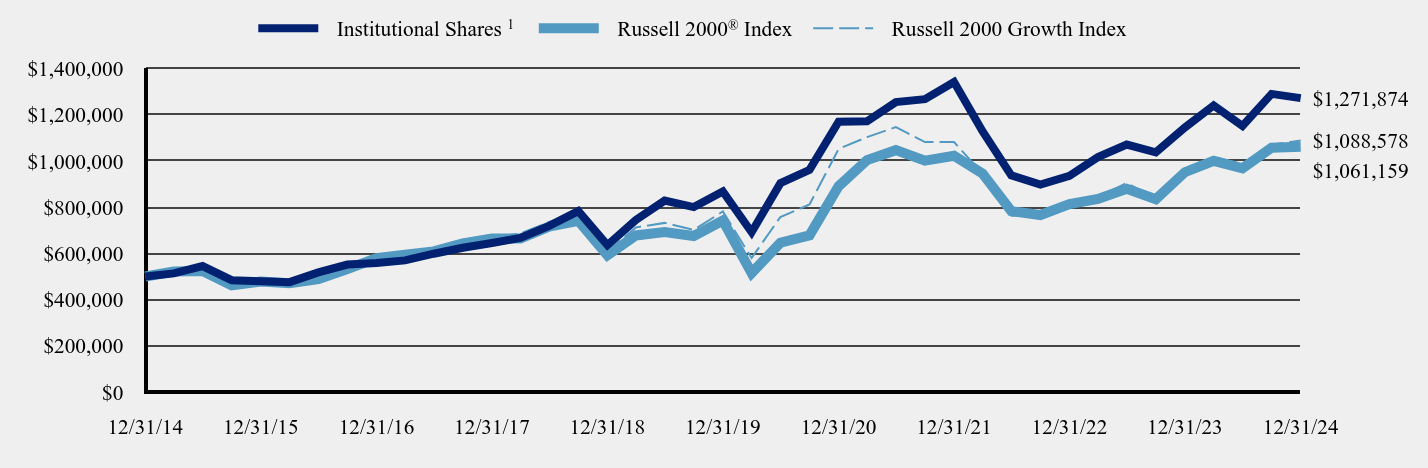

During the period from July 2024 to December 2024, the DF Dent Small Cap Growth Fund outperformed both its benchmarks, the Russell 2000 Index and the Russell 2000 Growth Index.

The outperformance relative to the Russell 2000 Index was driven primarily by sector allocation. Notably, being underweight the benchmark in the Energy sector and overweight the benchmark in the Information Technology sector contributed to the Fund’s performance, as did stock selection in the Financials and Materials sectors. Stock selection in the Consumer Staples, Industrials, and Information Technology sectors detracted the most from performance.

The outperformance relative to the Russell 2000 Growth Index was also driven primarily by sector allocation. Notably, being underweight the benchmark in the Energy sector and overweight the benchmark in the Financials sector contributed to the Fund’s performance, as did stock selection in the Financials and Materials sectors. Stock selection in the Consumer Discretionary, Information Technology, and Industrials sectors detracted the most from performance.

Financials, Industrials, and Information Technology were the top performing sectors in the Russell 2000 Index. All the benchmark’s sectors, other than Energy, contributed to performance with the Materials sector contributing the least.

Financials, Industrials, Information Technology, and Consumer Discretionary were the top performing sectors in the Russell 2000 Growth Index. All the benchmark’s sectors, other than Energy, contributed to performance with the Utilities sector contributing the least.

Goosehead Insurance, Inc., Class A

Perimeter Solutions, Inc.

Hamilton Lane, Inc., Class A

Charles River Laboratories International, Inc.

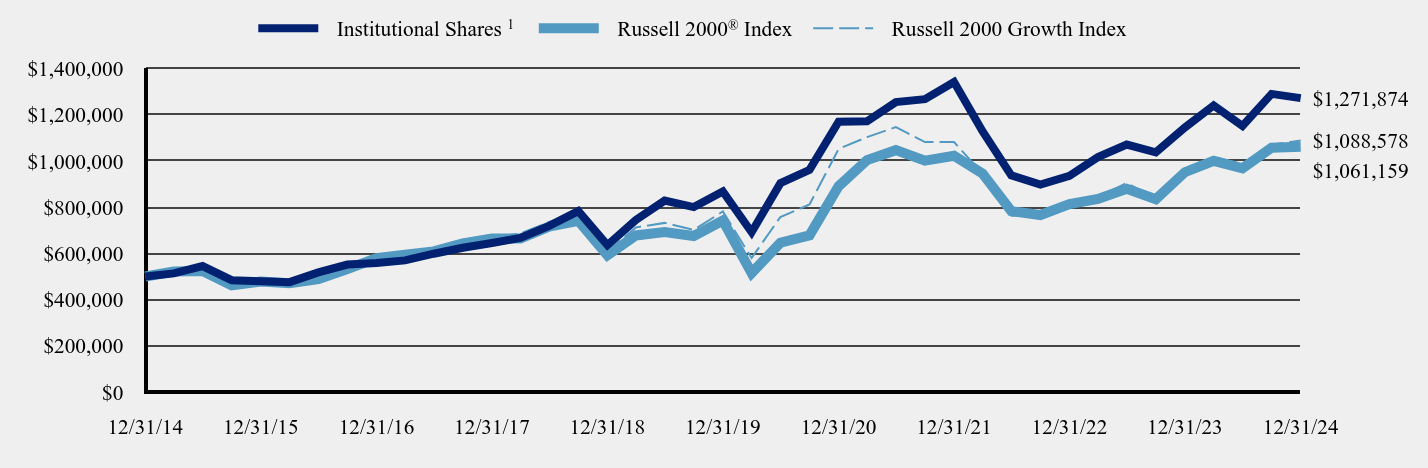

Total Return Based on a $500,000 Investment

| Date | Institutional SharesFootnote Reference1 | Russell 2000® Index | Russell 2000 Growth Index |

|---|

| 12/31/14 | $500,000 | $500,000 | $500,000 |

|---|

| 3/31/15 | $513,381 | $521,577 | $533,149 |

|---|

| 6/30/15 | $545,049 | $523,772 | $543,689 |

|---|

| 9/30/15 | $483,943 | $461,350 | $472,674 |

|---|

| 12/31/15 | $479,191 | $477,930 | $493,092 |

|---|

| 3/31/16 | $475,588 | $470,672 | $470,001 |

|---|

| 6/30/16 | $517,472 | $488,519 | $485,234 |

|---|

| 9/30/16 | $551,700 | $532,710 | $529,979 |

|---|

| 12/31/16 | $558,005 | $579,767 | $548,900 |

|---|

| 3/31/17 | $569,715 | $594,063 | $578,260 |

|---|

| 6/30/17 | $598,538 | $608,699 | $603,639 |

|---|

| 9/30/17 | $624,209 | $643,203 | $641,175 |

|---|

| 12/31/17 | $644,926 | $664,687 | $670,573 |

|---|

| 3/31/18 | $666,544 | $664,127 | $685,992 |

|---|

| 6/30/18 | $719,237 | $715,622 | $735,608 |

|---|

| 9/30/18 | $783,189 | $741,215 | $776,237 |

|---|

| 12/31/18 | $635,580 | $591,478 | $608,157 |

|---|

| 3/31/19 | $744,412 | $677,740 | $712,424 |

|---|

| 6/30/19 | $828,576 | $691,939 | $732,002 |

|---|

| 9/30/19 | $800,521 | $675,327 | $701,455 |

|---|

| 12/31/19 | $867,835 | $742,453 | $781,381 |

|---|

| 3/31/20 | $691,618 | $515,153 | $580,059 |

|---|

| 6/30/20 | $904,159 | $646,097 | $757,465 |

|---|

| 9/30/20 | $961,589 | $677,963 | $811,684 |

|---|

| 12/31/20 | $1,169,627 | $890,653 | $1,051,991 |

|---|

| 3/31/21 | $1,171,633 | $1,003,757 | $1,103,278 |

|---|

| 6/30/21 | $1,254,855 | $1,046,844 | $1,146,499 |

|---|

| 9/30/21 | $1,267,389 | $1,001,198 | $1,081,692 |

|---|

| 12/31/21 | $1,341,679 | $1,022,638 | $1,081,813 |

|---|

| 3/31/22 | $1,128,673 | $945,676 | $945,208 |

|---|

| 6/30/22 | $937,738 | $783,066 | $763,215 |

|---|

| 9/30/22 | $898,216 | $765,938 | $765,061 |

|---|

| 12/31/22 | $935,685 | $813,647 | $796,674 |

|---|

| 3/31/23 | $1,016,781 | $835,923 | $845,054 |

|---|

| 6/30/23 | $1,071,187 | $879,435 | $904,652 |

|---|

| 9/30/23 | $1,037,311 | $834,337 | $838,443 |

|---|

| 12/31/23 | $1,145,097 | $951,388 | $945,321 |

|---|

| 3/31/24 | $1,240,565 | $1,000,671 | $1,016,994 |

|---|

| 6/30/24 | $1,151,257 | $967,872 | $987,306 |

|---|

| 9/30/24 | $1,290,352 | $1,057,622 | $1,070,340 |

|---|

| 12/31/24 | $1,271,874 | $1,061,159 | $1,088,578 |

|---|

| Footnote | Description |

Footnote1 | Institutional Shares commenced operations on November 20, 2017. Performance for the periods prior to November 20, 2017 are a blended average annual return which includes the returns of Investor Shares prior to the commencement of operations of Institutional Shares. |

The above chart represents historical performance of a hypothetical $500,000 investment over the past 10 years. Effective June 1, 2024, the Fund changed its primary benchmark index from the Russell 2000 Growth Index to the Russell 2000 Index due to regulatory requirements. The Fund retained the Russell 2000 Growth Index as a secondary benchmark because the Russell 2000 Growth Index more closely reflects the market sectors in which the Fund invests.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

Institutional SharesFootnote Reference1 | 11.07% | 7.94% | 9.79% |

|---|

Russell 2000® Index | 11.54% | 7.40% | 7.82% |

|---|

| Russell 2000 Growth Index | 15.15% | 6.86% | 8.09% |

|---|

| Footnote | Description |

Footnote1 | Institutional Shares commenced operations on November 20, 2017. Performance for the 10 year period is a blended average annual return which includes the returns of Investor Shares prior to the commencement of operations of Institutional Shares. |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $217,513,780 |

|---|

| # of Portfolio Holdings | 49 |

|---|

| Portfolio Turnover Rate | 18% |

|---|

| Investment Advisory Fees (Net of fees waived) | $869,720 |

|---|

Top Ten Holdings

(% total investments)*

| Core & Main, Inc., Class A | 3.68% |

| HEICO Corp., Class A | 3.47% |

| Hamilton Lane, Inc., Class A | 3.32% |

| Bio-Techne Corp. | 3.30% |

| Goosehead Insurance, Inc., Class A | 3.28% |

| Murphy USA, Inc. | 3.20% |

| Kinsale Capital Group, Inc. | 3.19% |

| Guidewire Software, Inc. | 3.11% |

| Appfolio, Inc. | 3.10% |

| Repligen Corp. | 2.91% |

* excluding cash equivalents

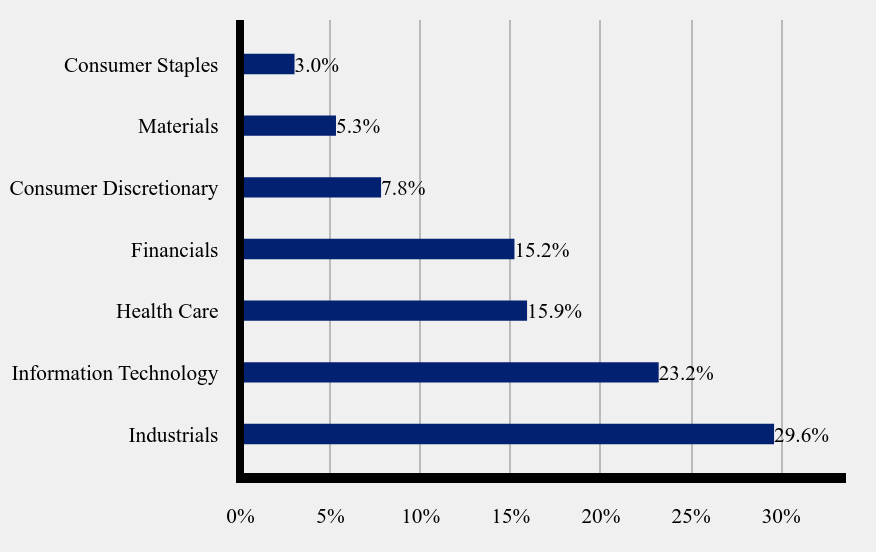

Sector Weightings

(% total investments)*

| Value | Value |

|---|

| Industrials | 29.6% |

| Information Technology | 23.2% |

| Health Care | 15.9% |

| Financials | 15.2% |

| Consumer Discretionary | 7.8% |

| Materials | 5.3% |

| Consumer Staples | 3.0% |

* excluding cash equivalents

Where can I find additional information about the fund?

Additional information is available by scanning the QR code or at https://dfdent.com/literature/, including its:

prospectus

financial information

holdings

proxy information

DF Dent Small Cap Growth Fund

Semi-Annual Shareholder Report - December 31, 2024

(b) Not applicable.

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

(a) Included as part of financial statements filed under Item 7(a).

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

(a)

SEMI-ANNUAL

FINANCIALS

AND

OTHER

INFORMATION

(Unaudited)

DF

DENT

GROWTH

FUNDS

TABLE

OF

CONTENTS

DECEMBER

31,

2024

DF

Dent

Premier

Growth

Fund

Schedule

of

Investments

1

Statement

of

Assets

and

Liabilities

3

Statement

of

Operations

4

Statements

of

Changes

in

Net

Assets

5

Financial

Highlights

6

DF

Dent

Midcap

Growth

Fund

Schedule

of

Investments

7

Statement

of

Assets

and

Liabilities

9

Statement

of

Operations

10

Statements

of

Changes

in

Net

Assets

11

Financial

Highlights

12

DF

Dent

Small

Cap

Growth

Fund

Schedule

of

Investments

15

Statement

of

Assets

and

Liabilities

17

Statement

of

Operations

18

Statements

of

Changes

in

Net

Assets

19

Financial

Highlights

20

DF

Dent

Growth

Funds

Notes

to

Financial

Statements

22

Other

Information

28

See

Notes

to

Financial

Statements.

DF

DENT

PREMIER

GROWTH

FUND

SCHEDULE

OF

INVESTMENTS

DECEMBER

31,

2024

The

following

is

a

summary

of

the

inputs

used

to

value

the

Fund's investments

as

of

December

31,

2024.

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risks

associated

with

investing

in

those

securities.

For

more

information

on

valuation

inputs,

and

their

aggregation

into

the

levels

used

in

the

table

below,

please

refer

to

the

Security

Valuation

section

in

Note

2

of

the

accompanying

Notes

to

Financial

Statements.

The

Level

1

value

displayed

in

this

table

is

Common

Stock

and

a

Money

Market

Fund.

Refer

to

this

Schedule

of

Investments

for

a

further

breakout

of

each

security

by

industry.

Shares

Security

Description

Value

Common

Stock

-

98.2%

Communication

Services

-

4.6%

55,417

Alphabet,

Inc.,

Class C

$

10,553,613

Consumer

Discretionary

-

6.0%

62,761

Amazon.com,

Inc.

(a)

13,769,136

Financials

-

18.2%

8,283

Kinsale

Capital

Group,

Inc.

3,852,672

21,400

Mastercard,

Inc.,

Class A

11,268,598

13,356

Moody's

Corp.

6,322,330

17,527

S&P

Global,

Inc.

(a)

8,728,972

36,992

Visa,

Inc.,

Class A

11,690,951

41,863,523

Health

Care

-

17.6%

85,000

Bio-Techne

Corp.

6,122,550

31,077

Danaher

Corp.

7,133,725

12,771

Intuitive

Surgical,

Inc.

(a)

6,665,951

10,950

Thermo

Fisher

Scientific,

Inc.

5,696,519

28,327

Veeva

Systems,

Inc.,

Class A

(a)

5,955,752

18,000

West

Pharmaceutical

Services,

Inc.

5,896,080

18,481

Zoetis,

Inc.

3,011,109

40,481,686

Industrials

-

19.7%

53,226

Copart,

Inc.

(a)

3,054,640

54,254

Fastenal

Co.

3,901,405

43,532

HEICO

Corp.,

Class A

8,100,435

35,836

Old

Dominion

Freight

Line,

Inc.

6,321,470

16,000

SiteOne

Landscape

Supply,

Inc.

(a)

2,108,320

6,070

TransDigm

Group,

Inc.

(a)

7,692,390

40,323

Uber

Technologies,

Inc.

(a)

2,432,283

56,652

Veralto

Corp.

5,770,006

34,386

Waste

Connections,

Inc.

5,899,950

45,280,899

Information

Technology

-

21.1%

20,000

ANSYS,

Inc.

(a)

6,746,600

2,730

ASML

Holding

NV

1,892,108

12,701

Atlassian

Corp.,

Class A

(a)

3,091,169

11,450

Cadence

Design

Systems,

Inc.

(a)

3,440,267

42,912

Guidewire

Software,

Inc.

(a)

7,234,105

7,636

Intuit,

Inc.

4,799,226

10,100

Manhattan

Associates,

Inc.

(a)

2,729,424

21,874

Microsoft

Corp.

9,219,891

8,165

Monolithic

Power

Systems,

Inc.

4,831,231

3,150

ServiceNow,

Inc.

(a)

3,339,378

2,315

Tyler

Technologies,

Inc.

(a)

1,334,922

48,658,321

Shares

Security

Description

Value

Materials

-

7.0%

20,247

Ecolab,

Inc.

$

4,744,277

13,216

The

Sherwin-Williams

Co.

4,492,515

26,673

Vulcan

Materials

Co.

6,861,096

16,097,888

Real

Estate

-

4.0%

44,590

CBRE

Group,

Inc.,

Class A

(a)

5,854,221

45,990

CoStar

Group,

Inc.

(a)

3,292,424

9,146,645

Total

Common

Stock

(Cost

$95,933,290)

225,851,711

Money

Market

Fund

-

0.4%

804,441

First

American

Treasury

Obligations

Fund,

Class X,

4.37%

(b)

(Cost

$804,441)

804,441

Investments,

at

value

-

98.6%

(Cost

$96,737,731)

$

226,656,152

Other

Assets

&

Liabilities,

Net

-

1.4%

3,331,460

Net

Assets

-

100.0%

$

229,987,612

(a)

Non-income

producing

security.

(b)

Dividend

yield

changes

daily

to

reflect

current

market

conditions.

Rate

was

the

quoted

yield

as

of

December

31,

2024.

Valuation

Inputs

Investments

in

Securities

Level

1

-

Quoted

Prices

$

226,656,152

Level

2

-

Other

Significant

Observable

Inputs

–

Level

3

-

Significant

Unobservable

Inputs

–

Total

$

226,656,152

See

Notes

to

Financial

Statements.

DF

DENT

PREMIER

GROWTH

FUND

SCHEDULE

OF

INVESTMENTS

DECEMBER

31,

2024

PORTFOLIO

HOLDINGS

%

of

Total

Net

Assets

Communication

Services

4.6%

Consumer

Discretionary

6.0%

Financials

18.2%

Health

Care

17.6%

Industrials

19.7%

Information

Technology

21.1%

Materials

7.0%

Real

Estate

4.0%

Money

Market

Fund

0.4%

Other

Assets

&

Liabilities,

Net

1.4%

100.0%

See

Notes

to

Financial

Statements.

DF

DENT

PREMIER

GROWTH

FUND

STATEMENT

OF

ASSETS

AND

LIABILITIES

DECEMBER

31,

2024

ASSETS

Investments,

at

value

(Cost

$96,737,731)

$

226,656,152

Receivables:

Fund

shares

sold

1,153

Investment

securities

sold

3,852,446

Dividends

50,008

Prepaid

expenses

11,157

Total

Assets

230,570,916

LIABILITIES

Payables:

Fund

shares

redeemed

47,851

Accrued

Liabilities:

Investment

adviser

fees

509,549

Fund

services

fees

11,807

Other

expenses

14,097

Total

Liabilities

583,304

NET

ASSETS

$

229,987,612

COMPONENTS

OF

NET

ASSETS

Paid-in

capital

$

97,242,610

Distributable

Earnings

132,745,002

NET

ASSETS

$

229,987,612

SHARES

OF

BENEFICIAL

INTEREST

AT

NO

PAR

VALUE

(UNLIMITED

SHARES

AUTHORIZED)

6,192,397

NET

ASSET

VALUE,

OFFERING

AND

REDEMPTION

PRICE

PER

SHARE

$

37.14

See

Notes

to

Financial

Statements.

DF

DENT

PREMIER

GROWTH

FUND

STATEMENT

OF

OPERATIONS

SIX

MONTHS

ENDED

DECEMBER

31,

2024

INVESTMENT

INCOME

Dividend

income

(Net

of

foreign

withholding

taxes

of

$5,159)

$

938,117

Total

Investment

Income

938,117

EXPENSES

Investment

adviser

fees

1,175,703

Fund

services

fees

88,920

Custodian

fees

18,128

Registration

fees

10,151

Professional

fees

28,528

Trustees'

fees

and

expenses

7,367

Other

expenses

30,238

Total

Expenses

1,359,035

Fees

waived

(184,163)

Net

Expenses

1,174,872

NET

INVESTMENT

LOSS

(236,755)

NET

REALIZED

AND

UNREALIZED

GAIN

(LOSS)

Net

realized

gain

on

investments

14,006,137

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

1,062,565

NET

REALIZED

AND

UNREALIZED

GAIN

15,068,702

INCREASE

IN

NET

ASSETS

RESULTING

FROM

OPERATIONS

$

14,831,947

See

Notes

to

Financial

Statements.

DF

DENT

PREMIER

GROWTH

FUND

STATEMENTS

OF

CHANGES

IN

NET

ASSETS

For

the

Six

Months

Ended

December

31,

2024

For

the

Year

Ended

June

30,

2024

OPERATIONS

Net

investment

loss

$

(236,755)

$

(826,765)

Net

realized

gain

14,006,137

30,137,857

Net

change

in

unrealized

appreciation

(depreciation)

1,062,565

2,428,258

Increase

in

Net

Assets

Resulting

from

Operations

14,831,947

31,739,350

DISTRIBUTIONS

TO

SHAREHOLDERS

Total

Distributions

Paid

(30,116,196)

(36,525,907)

CAPITAL

SHARE

TRANSACTIONS

Sale

of

shares

1,851,394

13,503,081

Reinvestment

of

distributions

28,195,477

34,549,001

Redemption

of

shares

(16,168,669)

(59,143,595)

Increase

(Decrease)

in

Net

Assets

from

Capital

Share

Transactions

13,878,202

(11,091,513)

Decrease

in

Net

Assets

(1,406,047)

(15,878,070)

NET

ASSETS

Beginning

of

Period

231,393,659

247,271,729

End

of

Period

$

229,987,612

$

231,393,659

SHARE

TRANSACTIONS

Sale

of

shares

45,086

342,232

Reinvestment

of

distributions

722,405

984,863

Redemption

of

shares

(397,965)

(1,529,032)

Increase

(Decrease)

in

Shares

369,526

(201,937)

See

Notes

to

Financial

Statements.

DF

DENT

PREMIER

GROWTH

FUND

FINANCIAL

HIGHLIGHTS

These

financial

highlights

reflect

selected

data

for

a

share

outstanding

throughout

each

period

.

For

the

Six

Months

Ended

December

31,

2024

For

the

Years

Ended

June

30,

2024

2023

2022

2021

2020

NET

ASSET

VALUE,

Beginning

of

Period

$

39.74

$

41.04

$

35.60

$

49.79

$

38.91

$

35.75

INVESTMENT

OPERATIONS

Net

investment

loss

(a)

(0.04)

(0.14)

(0.11)

(0.27)

(0.25)

(0.11)

Net

realized

and

unrealized

gain

(loss)

2.88

5.74

5.55

(10.28)

12.16

5.88

Total

from

Investment

Operations

2.84

5.60

5.44

(10.55)

11.91

5.77

DISTRIBUTIONS

TO

SHAREHOLDERS

FROM

Net

realized

gain

(5.44)

(6.90)

–

(3.64)

(1.03)

(2.61)

Total

Distributions

to

Shareholders

(5.44)

(6.90)

–

(3.64)

(1.03)

(2.61)

REDEMPTION

FEES(a)

–

–

–

0.00(b)

0.00(b)

–

NET

ASSET

VALUE,

End

of

Period

$

37.14

$

39.74

$

41.04

$

35.60

$

49.79

$

38.91

TOTAL

RETURN

6.50%(c)

15.87%

15.28%

(23.05)%

30.96%

16.82%

RATIOS/SUPPLEMENTARY

DATA

Net

Assets

at

End

of

Period

(000s

omitted)

$

229,988

$

231,394

$

247,272

$

278,936

$

430,924

$

343,711

Ratios

to

Average

Net

Assets:

Net

investment

loss

(0.20)%(d)

(0.36)%

(0.30)%

(0.58)%

(0.57)%

(0.30)%

Net

expenses

0.99%(d)

0.99%

0.99%

0.99%

0.99%

1.00%

Gross

expenses

(e)

1.14%(d)

1.14%

1.13%

1.10%

1.11%

1.15%

PORTFOLIO

TURNOVER

RATE

7%(c)

19%

20%

18%

14%

23%

footertext

(a)

Calculated

based

on

average

shares

outstanding

during

each

period.

(b)

Less

than

$0.01

per

share.

(c)

Not

annualized.

(d)

Annualized.

(e)

Reflects

the

expense

ratio

excluding

any

waivers

and/or

reimbursements.

Expense

waivers

and/or

reimbursements

would

decrease

the

total

return

had

such

reductions

not

occurred.

See

Notes

to

Financial

Statements.

DF

DENT

MIDCAP

GROWTH

FUND

SCHEDULE

OF

INVESTMENTS

DECEMBER

31,

2024

The

following

is

a

summary

of

the

inputs

used

to

value

the

Fund's investments

as

of

December

31,

2024.

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risks

associated

with

investing

in

those

securities.

For

more

information

on

valuation

inputs,

and

their

aggregation

into

the

levels

used

in

the

table

below,

please

refer

to

the

Security

Valuation

section

in

Note

2

of

the

accompanying

Notes

to

Financial

Statements.

The

Level

1

value

displayed

in

this

table

is

Common

Stock

and

a

Money

Market

Fund.

Refer

to

this

Schedule

of

Investments

for

a

further

breakout

of

each

security

by

industry.

Shares

Security

Description

Value

Common

Stock

-

97.1%

Consumer

Discretionary

-

4.2%

126,774

CarMax,

Inc.

(a)

$

10,365,043

68,436

Floor

&

Decor

Holdings,

Inc.,

Class A

(a)

6,823,069

17,188,112

Financials

-

13.9%

135,757

Goosehead

Insurance,

Inc.,

Class A

(a)

14,555,866

18,984

Kinsale

Capital

Group,

Inc.

8,830,028

9,098

Markel

Group,

Inc.

(a)

15,705,241

20,523

Moody's

Corp.

9,714,972

13,253

MSCI,

Inc.

7,951,932

56,758,039

Health

Care

-

19.1%

208,251

Bio-Techne

Corp.

15,000,320

105,905

Edwards

Lifesciences

Corp.

(a)

7,840,147

16,176

Medpace

Holdings,

Inc.

(a)

5,374,153

7,290

Mettler-Toledo

International,

Inc.

(a)

8,920,627

69,686

Repligen

Corp.

(a)

10,030,603

85,632

Veeva

Systems,

Inc.,

Class A

(a)

18,004,128

38,315

West

Pharmaceutical

Services,

Inc.

12,550,461

77,720,439

Industrials

-

24.2%

49,009

Fastenal

Co.

3,524,237

80,554

HEICO

Corp.,

Class A

14,989,488

29,640

IDEX

Corp.

6,203,356

84,862

Old

Dominion

Freight

Line,

Inc.

14,969,657

50,163

SiteOne

Landscape

Supply,

Inc.

(a)

6,609,978

9,752

TransDigm

Group,

Inc.

(a)

12,358,515

155,972

Veralto

Corp.

15,885,748

16,580

Verisk

Analytics,

Inc.

4,566,629

66,763

Waste

Connections,

Inc.

11,455,196

172,264

WNS

Holdings,

Ltd.

(a)

8,163,591

98,726,395

Information

Technology

-

18.0%

26,794

ANSYS,

Inc.

(a)

9,038,420

52,933

Appfolio,

Inc.

(a)

13,059,630

28,236

Atlassian

Corp.,

Class A

(a)

6,872,078

27,486

Cadence

Design

Systems,

Inc.

(a)

8,258,443

98,230

Endava

PLC,

ADR

(a)

3,035,307

56,838

Entegris,

Inc.

5,630,372

63,762

Guidewire

Software,

Inc.

(a)

10,748,998

97,923

Microchip

Technology,

Inc.

5,615,884

11,137

Monolithic

Power

Systems,

Inc.

6,589,763

7,636

Tyler

Technologies,

Inc.

(a)

4,403,223

73,252,118

Shares

Security

Description

Value

Materials

-

9.6%

79,073

Ecolab,

Inc.

$

18,528,385

80,169

Vulcan

Materials

Co.

20,621,872

39,150,257

Real

Estate

-

8.1%

123,293

CBRE

Group,

Inc.,

Class A

(a)

16,187,138

232,294

CoStar

Group,

Inc.

(a)

16,629,927

32,817,065

Total

Common

Stock

(Cost

$268,498,425)

395,612,425

Money

Market

Fund

-

2.9%

11,961,320

First

American

Treasury

Obligations

Fund,

Class X,

4.37%

(b)

(Cost

$11,961,320)

11,961,320

Investments,

at

value

-

100.0%

(Cost

$280,459,745)

$

407,573,745

Other

Assets

&

Liabilities,

Net

-

0.0%

(194,122)

Net

Assets

-

100.0%

$

407,379,623

ADR

American

Depositary

Receipt

PLC

Public

Limited

Company

(a)

Non-income

producing

security.

(b)

Dividend

yield

changes

daily

to

reflect

current

market

conditions.

Rate

was

the

quoted

yield

as

of

December

31,

2024.

Valuation

Inputs

Investments

in

Securities

Level

1

-

Quoted

Prices

$

407,573,745

Level

2

-

Other

Significant

Observable

Inputs

–

Level

3

-

Significant

Unobservable

Inputs

–

Total

$

407,573,745

See

Notes

to

Financial

Statements.

DF

DENT

MIDCAP

GROWTH

FUND

SCHEDULE

OF

INVESTMENTS

DECEMBER

31,

2024

PORTFOLIO

HOLDINGS

%

of

Total

Net

Assets

Consumer

Discretionary

4.2%

Financials

13.9%

Health

Care

19.1%

Industrials

24.2%

Information

Technology

18.0%

Materials

9.6%

Real

Estate

8.1%

Money

Market

Fund

2.9%

Other

Assets

&

Liabilities,

Net

0.0%

100.0%

See

Notes

to

Financial

Statements.

DF

DENT

MIDCAP

GROWTH

FUND

STATEMENT

OF

ASSETS

AND

LIABILITIES

DECEMBER

31,

2024

ASSETS

Investments,

at

value

(Cost

$280,459,745)

$

407,573,745

Receivables:

Fund

shares

sold

230,457

Investment

securities

sold

360,086

Dividends

151,648

Prepaid

expenses

31,062

Total

Assets

408,346,998

LIABILITIES

Payables:

Fund

shares

redeemed

180,094

Accrued

Liabilities:

Investment

adviser

fees

762,301

Fund

services

fees

21,951

Other

expenses

3,029

Total

Liabilities

967,375

NET

ASSETS

$

407,379,623

COMPONENTS

OF

NET

ASSETS

Paid-in

capital

$

295,372,339

Distributable

Earnings

112,007,284

NET

ASSETS

$

407,379,623

SHARES

OF

BENEFICIAL

INTEREST

AT

NO

PAR

VALUE

(UNLIMITED

SHARES

AUTHORIZED)

Investor

Shares

3,522,776

Institutional

Shares

6,312,149

Institutional

Plus

Shares

1,199,569

NET

ASSET

VALUE,

OFFERING

AND

REDEMPTION

PRICE

PER

SHARE

Investor

Shares

(based

on

net

assets

of

$129,593,856)

$

36.79

Institutional

Shares

(based

on

net

assets

of

$233,333,346)

$

36.97

Institutional

Plus

Shares

(based

on

net

assets

of

$44,452,421)

$

37.06

See

Notes

to

Financial

Statements.

DF

DENT

MIDCAP

GROWTH

FUND

STATEMENT

OF

OPERATIONS

SIX

MONTHS

ENDED

DECEMBER

31,

2024

INVESTMENT

INCOME

Dividend

income

(Net

of

foreign

withholding

taxes

of

$7,147)

$

1,631,175

Total

Investment

Income

1,631,175

EXPENSES

Investment

adviser

fees

1,668,791

Fund

services

fees

162,950

Transfer

agent

fees:

Investor

Shares

13,668

Institutional

Shares

3,716

Institutional

Plus

Shares

2,295

Custodian

fees

27,298

Registration

fees:

Investor

Shares

8,093

Institutional

Shares

8,141

Institutional

Plus

Shares

7,936

Professional

fees

38,806

Trustees'

fees

and

expenses

10,848

Other

expenses

54,379

Total

Expenses

2,006,921

Fees

waived

(111,293)

Net

Expenses

1,895,628

NET

INVESTMENT

LOSS

(264,453)

NET

REALIZED

AND

UNREALIZED

GAIN

(LOSS)

Net

realized

gain

on

investments

51,611,702

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

(9,934,807)

NET

REALIZED

AND

UNREALIZED

GAIN

41,676,895

INCREASE

IN

NET

ASSETS

RESULTING

FROM

OPERATIONS

$

41,412,442

See

Notes

to

Financial

Statements.

DF

DENT

MIDCAP

GROWTH

FUND

STATEMENTS

OF

CHANGES

IN

NET

ASSETS

For

the

Six

Months

Ended

December

31,

2024

For

the

Year

Ended

June

30,

2024

OPERATIONS

Net

investment

loss

$

(264,453)

$

(1,319,495)

Net

realized

gain

51,611,702

29,664,974

Net

change

in

unrealized

appreciation

(depreciation)

(9,934,807)

9,987,698

Increase

in

Net

Assets

Resulting

from

Operations

41,412,442

38,333,177

CAPITAL

SHARE

TRANSACTIONS

Sale

of

shares:

Investor

Shares

2,730,501

9,054,453

Institutional

Shares

18,755,962

15,648,066

Institutional

Plus

Shares

11,015,743

23,347,127

Redemption

of

shares:

Investor

Shares

(19,297,612)

(48,679,959)

Institutional

Shares

(26,604,791)

(58,573,179)

Institutional

Plus

Shares

(149,753,881)

(38,141,409)

Decrease

in

Net

Assets

from

Capital

Share

Transactions

(163,154,078)

(97,344,901)

Decrease

in

Net