| | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811-03061) | |

| | |

| Exact name of registrant as specified in charter: | Putnam Global Natural Resources Fund |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| | |

| Copy to: | | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | 800 Boylston Street |

| | Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | | |

| Date of fiscal year end: August 31, 2011 | | |

| |

| Date of reporting period: September 1, 2010 — February 28, 2011 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Putnam Global

Natural Resources

Fund

Semiannual report

2 | 28 | 11

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the fund | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio managers | 5 | | |

| | |

| Your fund’s performance | 10 | | |

| | |

| Your fund’s expenses | 12 | | |

| | |

| Terms and definitions | 14 | | |

| | |

| Other information for shareholders | 15 | | |

| | |

| Financial statements | 16 | | |

| | |

Message from the Trustees

Dear Fellow Shareholder:

The U.S. economy and stock market continue to show resilience, even in the face of rising head winds around the globe. On March 9, 2011, U.S. equities marked the two-year anniversary of the beginning of the most powerful bull market since the 1950s, with the S&P 500 Index doubling from its 2009 low.

While Putnam maintains a positive outlook for U.S. equities and the overall economy in 2011, we believe volatility will punctuate the year ahead. Civil unrest in the Middle East and North Africa, high unemployment, rising oil prices, and Japan’s earthquake, tsunami, and nuclear crisis have all created a climate of uncertainty. In addition, the U.S. fixed-income market continues to struggle, as yields have risen and bond prices have fallen. We believe that Putnam’s active, research-intensive approach is well suited to uncovering opportunities in this environment.

In developments affecting oversight of your fund, we wish to thank Richard B. Worley and Myra R. Drucker, who have retired from the Board of Trustees, for their many years of dedicated and thoughtful leadership.

Lastly, we would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

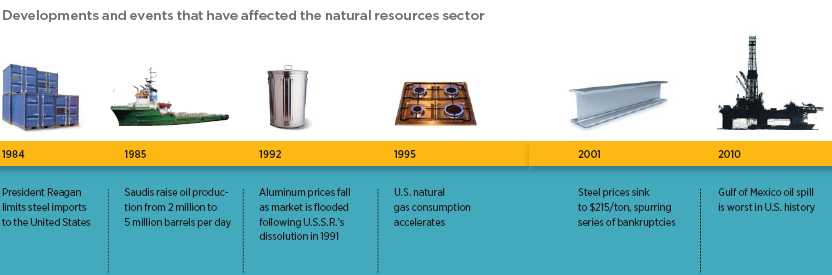

About the fund

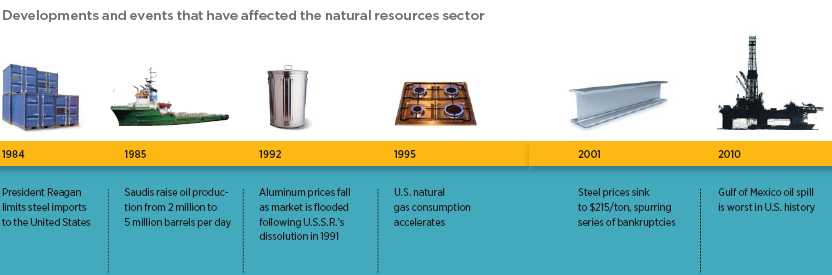

Investing in the natural resources sector for over 30 years

From the OPEC-driven oil crisis of the 1970s to the more recent commodities boom, the balance of geopolitical stability, technological development, and economic growth has shaped natural resources markets.

For more than 30 years, Putnam Global Natural Resources Fund has sought to capitalize on that ever-changing balance by investing in stocks of companies that can profit from the global demand for natural resources.

The fund’s diversification sets it apart in two respects: First, its view of natural resources industries is broader and includes energy, metals and mining, paper, chemical, and natural resource equipment and infrastructure companies; and second, it has a global scope. Stock prices in the natural resources sector rise and fall with supply and demand imbalances, so this strategy helps offset that volatility while enabling the fund’s managers to pursue a wider field of opportunities.

From chemicals, construction, and railroads to forest products and packaging, the portfolio managers consider stocks in a wide array of areas, with support from a team of analysts. Among the promising stocks the managers have targeted recently are those of fertilizer, seed, and agrochemical companies. These companies may offer strong growth potential as world population has increased, wealth has grown in emerging markets, and demand for high-protein food has risen along with a greater need for fertilizer that can make land and crops more productive.

Another benefit for investors is the fund’s flexible strategy, which allows the fund to own growth- or value-style stocks, as it seeks to deliver competitive returns no matter which style is in favor.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. The use of derivatives involves special risks and may result in losses. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. The use of short selling may result in losses if the securities appreciate in value. The fund’s non-diversified status, which means the fund may invest in fewer issuers, can increase the fund’s vulnerability to common economic forces and may result in greater losses and volatility.

Sector investing at Putnam

In recent decades, innovation and business growth have propelled stocks in different industries to market-leading performance. Finding these stocks, many of which are in international markets, requires rigorous research and in-depth knowledge of global markets.

Putnam’s sector funds invest in nine sectors worldwide and offer active management, risk controls, and the expertise of dedicated sector analysts. The funds’ managers invest with flexibility and precision, using fundamental research to hand select stocks for the portfolios.

All sectors in one fund:

Putnam Global Sector Fund

A portfolio of individual Putnam Global Sector Funds that provides exposure to all sectors of the MSCI World Index.

Individual sector funds:

Global Consumer Fund

Retail, hotels, restaurants, media, food and beverages

Global Energy Fund

Oil and gas, energy equipment and services

Global Financials Fund

Commercial banks, insurance, diversified financial services, mortgage finance

Global Health Care Fund

Pharmaceuticals, biotechnology, health-care services

Global Industrials Fund

Airlines, railroads, trucking, aerospace and defense, construction, commercial services

Global Natural Resources Fund

Metals, chemicals, oil and gas, forest products

Global Technology Fund

Software, computers, Internet services

Global Telecommunications Fund

Diversified and wireless telecommunications services

Global Utilities Fund

Electric, gas, and water utilities

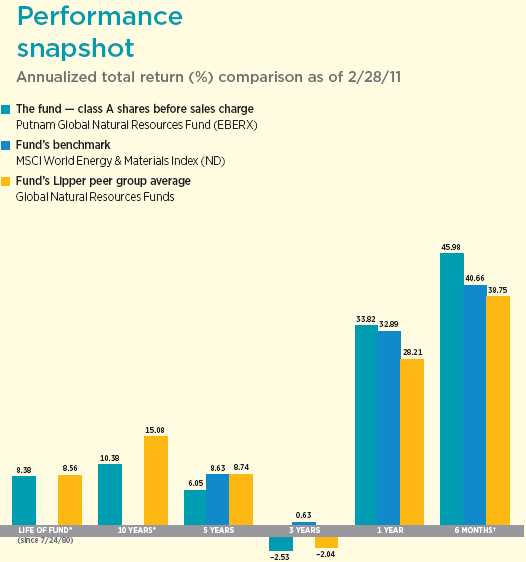

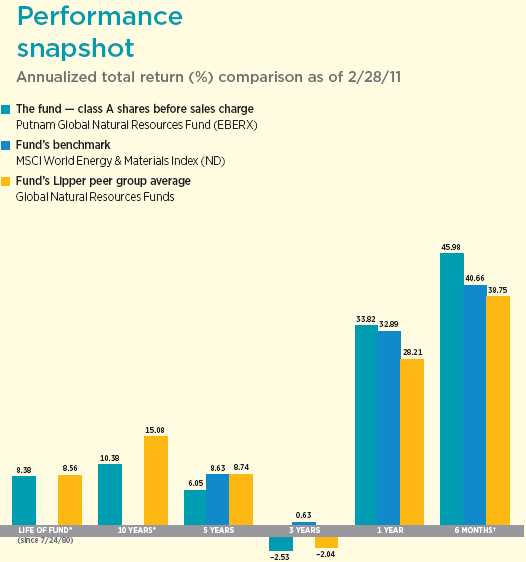

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 5 and 10–11 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the MSCI World Energy & Materials Index (ND), was introduced on 6/1/05, which post-dates the inception of the fund’s class A shares.

† Returns for the six-month period are not annualized, but cumulative.

4

Interview with your fund’s portfolio managers

Steven Curbow and John Morgan

How did Putnam Global Natural Resources Fund perform for the semiannual period?

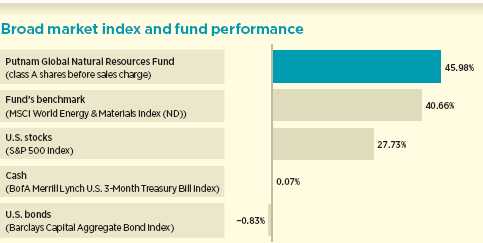

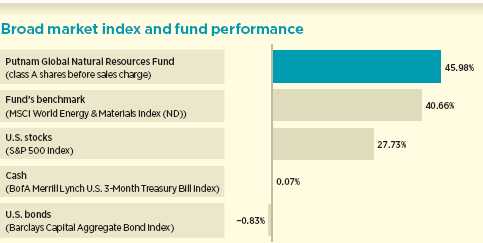

Steve: For the six months ending February 28, 2011, we are pleased to report that the fund’s class A shares at net asset value (NAV) increased 45.98%, ahead of the 40.66% advance of its benchmark, the MSCI World Energy & Materials Index (ND), and the 38.75% average return of its Lipper peers. Performance was helped by fundamental research within the energy and natural resources sectors, and our strategy of identifying basic materials that we believed would perform well during the period.

During the past six months, nearly all basic materials and natural resources have experienced significant price increases. What’s driving this growth?

John: The primary reason is that the world has returned to an economic growth mode, and the areas that are growing the most, namely China and India, are in need of many of these commodities. Demand has been growing across the board on all commodities for the past 18 months. Metallurgical, or “met,” coal, which is used in steel production, experienced a significant run up in price during the period. Price increases also occurred in iron ore, copper, and base metals such as zinc and nickel.

Agriculture-based commodities also rose in price, due, in large part, to a global food shortage in 2010. Demand for protein such as beef, chicken, and pork has been increasing in places like China and India, where improving economic conditions are leading people to add more meat to their diets. Grain and other animal feeds are key components in raising the livestock needed to support this demand. Last summer, a near “perfect storm” occurred with crop production around the world. First, severe forest fires and drought caused Russia, one of

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 2/28/11. See pages 4 and 10–11 for additional fund performance information. Index descriptions can be found on page 14.

5

the world’s largest suppliers of wheat, to ban grain exports. Then, last summer’s heavy rains in the U.S. Midwest led to significantly lower crop yields in wheat and soybeans.

Which holdings within the basic materials portion of the portfolio affected performance?

John: An overweight to Teck Resources, the world’s second-largest producer of met coal, was the fund’s number one contributor. We bought Teck, based in Canada, at attractive price levels after an industry-wide sell-off. The company performed well, and its share price rallied strongly as global demand for met coal, particularly from China, increased. Over the past five years, China has built up a huge steel industry, which now represents more than 50% of the world’s steel consumption and production. Another overweight, JSR Corporation, a Japan-based manufacturer of synthetic rubber, benefited from rising demand among automakers in China and elsewhere around the world who use synthetic rubber in car tires.

As for detractors, an underweight to U.S.-based Freeport-McMoRan, an international mining company, hurt performance. The company’s shares appreciated as prices for copper, gold, and molybdenum, an element used in steel alloys, rose during the period and because we held less than the benchmark the fund’s returns were held back on a relative basis. Another detractor was an overweight position to Fortescue Metals Group, an Australian iron-ore mining company whose shares lost value during the period because the company missed its production figures during the fourth quarter.

The price of oil rose steadily throughout the period, but toward the end of the period prices spiked because of civil unrest in the Middle East and North Africa. How did you manage the fund in this volatile environment?

Steve: By the end of February, the price of Brent oil had shot up to $111.80 per barrel from $82.31 at the start of the period, driven by civil unrest in the Middle East and North Africa and

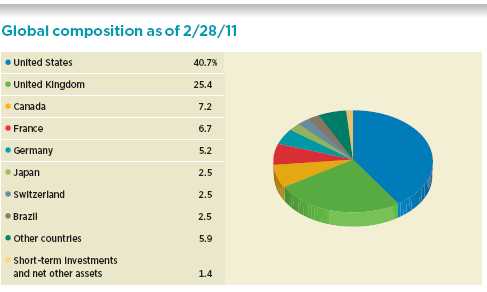

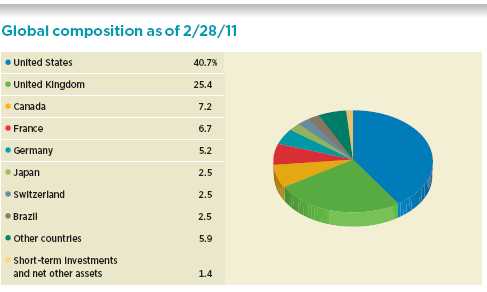

Country/territory allocations are shown as a percentage of the fund’s net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Weightings will vary over time.

6

increasing global demand. For most of the period, demand growth took place in global economies, which contributed to the steady increase in oil prices. This helped oil stocks across the board, because investors grew confident that the companies would continue to invest in this environment. In late January and early February, however, civil unrest raised concerns about disruptions in the supply of oil in the Middle East. As a result, we made some short-term adjustments and adopted a more defensive posture, reducing the portfolio’s exposure to companies that we perceived as having substantial risks to their assets.

Within the energy portion of the portfolio, which holdings affected performance?

Steve: The fund’s overweight to Schlumberger, with offices in the United States and Europe, was the top contributor in energy. An exploration and production company, Schlumberger saw an increase in business as oil prices rose during the period. Our overweight position to National Oilwell Varco, a provider of land-based and offshore drilling rigs and related equipment and services, also helped performance. Rising oil prices during the period gave rig operators the capital and opportunity to upgrade their fleets, and the Houston-based company benefited.

Our overweight to Cairn Energy, an oil exploration and production company based in the United Kingdom, was the top detractor among the fund’s energy holdings. In 2010, Vedanta Resources, another U.K.-based company held by the fund, bid for a majority stake in Cairn’s Indian subsidiary. However, government regulators in India have prolonged approval of this transaction, and Cairn shares suffered. Petroleo Brasileiro (Petrobras) is an out-of-benchmark holding that hurt performance. The company held a large secondary offering

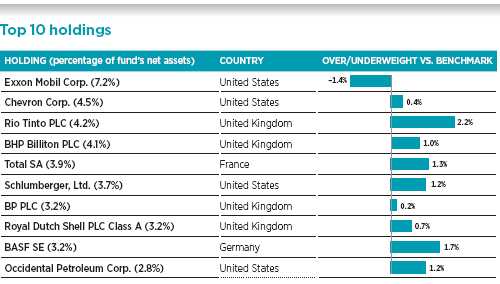

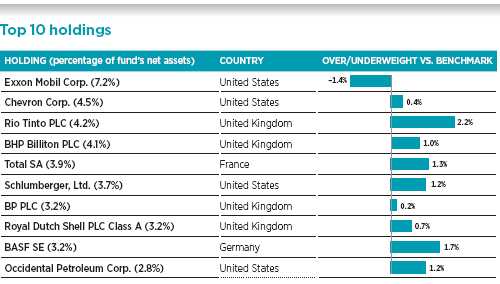

This table shows the fund’s top 10 holdings by percentage of the fund’s net assets as of 2/28/11. Short-term holdings are excluded. Holdings will vary over time.

7

of stock in 2010 to raise money to fund drilling and development activities offshore of Brazil. There was concern among investors that the offering had a dilutive effect on shares of the Brazil-based Petrobras and would hurt liquidity of its shares.

What is your outlook for the basic materials sector in 2011?

John: Barring anything out of the ordinary, I believe that we are not going to see much in the way of commodity price increases in 2011 on a year-to-year basis. Still, the outlook for the sector is good. Our strategy will not change — we will continue to identify companies that we believe have good production growth, regardless of the pricing of the underlying commodity. We will also continue to target those companies that supply the resources that China and India are lacking — met coal and copper, among other resources. As for the global economic outlook, I believe growth will remain healthy and emerging markets will continue to expand at a high rate.

What is your outlook for the energy sector?

Steve: With the situation still fluid in the Middle East and oil prices staying elevated, it’s difficult to predict what will happen. As fund managers, we will continue to select stocks that we believe have favorable investment potential and maintain a somewhat defensive stance. We are buying bigger, integrated energy companies like Exxon, which have better balance sheets and more diversified business models. Oil companies tend to do well as oil prices increase, but when prices get too high, it raises concerns about future demand. It is not easy to determine at which price this could happen, but we will continue to monitor this.

As for the global economy, if the price of oil does hit a certain level, consumers and businesses will likely start cutting back on use. When consumers decide not to go to the mall or out to eat because of the price of gasoline, this affects consumer spending. This could hurt the energy sector and the economic recovery. If tensions do ease, we could see oil drop down to the $90-to-$100 per-barrel

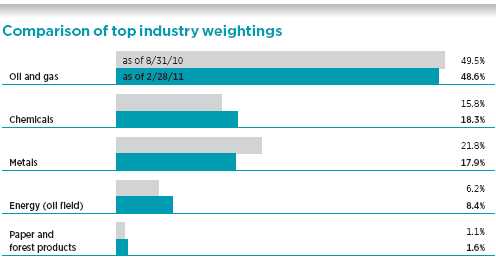

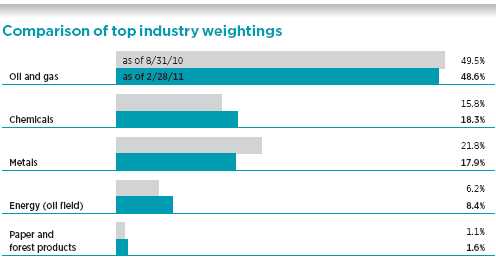

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings will vary over time.

8

range, which we believe is a fundamentally manageable price. But this is a process that will likely take months, not days or weeks. We think the situation will be volatile over the next several months, at least.

Thank you, Steve and John, for bringing us up to date.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Steven Curbow is Energy and Basic Materials Sector Team Leader at Putnam. He has an M.B.A. from The University of Chicago Booth School of Business and a B.S. from the University of Southern California. Steven joined Putnam in 2008 and has been in the investment industry since 1996.

Portfolio Manager John Morgan has an M.B.A. from the Johnson School of Management at Cornell University and a B.A. from Denison University. A Certified Financial Planner, John has been in the investment industry since he joined Putnam in 1994.

IN THE NEWS

The U.S. bull market that hit its two-year anniversary on March 9, 2011, was the sharpest since 1955. As measured by the S&P 500 Index, U.S. stocks rose 103.68% from their March 9, 2009 nadir, adding more than $28 trillion to global share values. Prior to hitting their low two years ago, U.S. stocks were dragged down by the subprime mortgage collapse, global credit crisis, and worldwide recession. Even after hitting its recent milestone, the S&P 500’s two-year return remains 36 percentage points below the average bull-market gain of 131% since 1962, according to data compiled by Bloomberg and Birinyi Associates. While no one knows where the market will head from here, data suggest that this bull may have more room to run.

9

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended February 28, 2011, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 2/28/11

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (7/24/80) | (2/1/94) | (7/26/99) | (7/3/95) | (12/1/03) | (10/4/05) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 8.38% | 8.17% | 7.50% | 7.50% | 7.57% | 7.57% | 7.77% | 7.64% | 8.11% | 8.43% |

|

| 10 years | 168.37 | 152.99 | 148.99 | 148.99 | 148.90 | 148.90 | 155.34 | 146.38 | 162.08 | 172.18 |

| Annual average | 10.38 | 9.73 | 9.55 | 9.55 | 9.55 | 9.55 | 9.83 | 9.44 | 10.11 | 10.53 |

|

| 5 years | 34.13 | 26.44 | 29.23 | 27.68 | 29.21 | 29.21 | 30.91 | 26.32 | 32.49 | 35.88 |

| Annual average | 6.05 | 4.80 | 5.26 | 5.01 | 5.26 | 5.26 | 5.53 | 4.78 | 5.79 | 6.32 |

|

| 3 years | –7.40 | –12.74 | –9.42 | –11.68 | –9.44 | –9.44 | –8.74 | –11.92 | –8.05 | –6.64 |

| Annual average | –2.53 | –4.44 | –3.24 | –4.06 | –3.25 | –3.25 | –3.00 | –4.14 | –2.76 | –2.26 |

|

| 1 year | 33.82 | 26.10 | 32.86 | 27.86 | 32.82 | 31.82 | 33.20 | 28.52 | 33.55 | 34.16 |

|

| 6 months | 45.98 | 37.62 | 45.45 | 40.45 | 45.49 | 44.49 | 45.66 | 40.60 | 45.92 | 46.19 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns (public offering price, or POP) for class A and M shares reflect a maximum 5.75% and 3.50% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus.

10

Comparative index returns For periods ended 2/28/11

| | |

| | MSCI World Energy & | Lipper Global Natural Resources |

| | Materials Index (ND) | Funds category average† |

|

| Annual average (life of fund) | —* | 8.56% |

|

| 10 years | —* | 327.25 |

| Annual average | —* | 15.08 |

|

| 5 years | 51.25% | 52.69 |

| Annual average | 8.63 | 8.74 |

|

| 3 years | 1.89 | –5.00 |

| Annual average | 0.63 | –2.04 |

|

| 1 year | 32.89 | 28.21 |

|

| 6 months | 40.66 | 38.75 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* The fund’s benchmark, the MSCI World Energy & Materials Index (ND), was introduced on 6/1/05, which post-dates the inception of the fund’s class A shares.

† Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 2/28/11, there were 134, 131, 87, 53, 32, and 3 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 2/28/11

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.403 | $0.255 | $0.278 | $0.314 | $0.364 | $0.454 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.403 | $0.255 | $0.278 | $0.314 | $0.364 | $0.454 |

|

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 8/31/10 | $16.62 | $17.63 | $14.87 | $15.20 | $15.82 | $16.39 | $16.31 | $16.73 |

|

| 2/28/11 | 23.82 | 25.27 | 21.35 | 21.81 | 22.70 | 23.52 | 23.40 | 23.96 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

Fund performance as of most recent calendar quarter

Total return for periods ended 3/31/11

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (7/24/80) | (2/1/94) | (7/26/99) | (7/3/95) | (12/1/03) | (10/4/05) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 8.40% | 8.19% | 7.51% | 7.51% | 7.58% | 7.58% | 7.78% | 7.66% | 8.13% | 8.45% |

|

| 10 years | 182.55 | 166.24 | 162.08 | 162.08 | 161.95 | 161.95 | 168.69 | 159.27 | 175.93 | 186.66 |

| Annual average | 10.95 | 10.29 | 10.11 | 10.11 | 10.11 | 10.11 | 10.39 | 10.00 | 10.68 | 11.11 |

|

| 5 years | 29.52 | 22.07 | 24.78 | 23.29 | 24.73 | 24.73 | 26.35 | 21.92 | 28.00 | 31.26 |

| Annual average | 5.31 | 4.07 | 4.53 | 4.28 | 4.52 | 4.52 | 4.79 | 4.04 | 5.06 | 5.59 |

|

| 3 years | –3.04 | –8.61 | –5.16 | –7.52 | –5.20 | –5.20 | –4.50 | –7.85 | –3.74 | –2.26 |

| Annual average | –1.02 | –2.96 | –1.75 | –2.57 | –1.76 | –1.76 | –1.52 | –2.69 | –1.26 | –0.76 |

|

| 1 year | 25.55 | 18.35 | 24.69 | 19.69 | 24.61 | 23.61 | 24.98 | 20.58 | 25.31 | 25.90 |

|

| 6 months | 30.97 | 23.47 | 30.49 | 25.49 | 30.43 | 29.43 | 30.58 | 25.99 | 30.82 | 31.17 |

|

11

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses for the fiscal year | | | | | | |

| ended 8/31/10* | 1.35% | 2.10% | 2.10% | 1.85% | 1.60% | 1.10% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 2/28/11 | 1.27% | 2.02% | 2.02% | 1.77% | 1.52% | 1.02% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* Restated to reflect projected expenses under a management contract effective 1/1/10.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from September 1, 2010, to February 28, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $7.75 | $12.29 | $12.30 | $10.78 | $9.27 | $6.23 |

|

| Ending value (after expenses) | $1,459.80 | $1,454.50 | $1,454.90 | $1,456.60 | $1,459.20 | $1,461.90 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/11. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

12

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended February 28, 2011, use the following calculation method. To find the value of your investment on September 1, 2010, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $6.36 | $10.09 | $10.09 | $8.85 | $7.60 | $5.11 |

|

| Ending value (after expenses) | $1,018.50 | $1,014.78 | $1,014.78 | $1,016.02 | $1,017.26 | $1,019.74 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/11. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

13

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

MSCI World Energy & Materials Index (ND) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets in the energy and materials sector.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

14

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2010, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of February 28, 2011, Putnam employees had approximately $372,000,000 and the Trustees had approximately $69,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

15

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

16

The fund’s portfolio 2/28/11 (Unaudited)

| | |

| COMMON STOCKS (98.7%)* | Shares | Value |

|

| Chemicals (18.0%) | | |

| Agrium, Inc. (Canada) | 59,200 | $5,615,801 |

|

| Albemarle Corp. | 34,100 | 1,962,796 |

|

| Arkema (France) † | 67,833 | 4,956,766 |

|

| BASF SE (Germany) | 180,821 | 15,040,126 |

|

| Celanese Corp. Ser. A | 67,800 | 2,810,310 |

|

| CF Industries Holdings, Inc. S | 34,700 | 4,902,416 |

|

| Dow Chemical Co. (The) | 168,900 | 6,276,324 |

|

| Huntsman Corp. | 198,600 | 3,505,290 |

|

| JSR Corp. (Japan) | 234,200 | 5,034,073 |

|

| Lanxess AG (Germany) | 50,106 | 3,727,795 |

|

| LyondellBasell Industries NV Class A (Netherlands) † | 137,900 | 5,251,232 |

|

| Nitto Denko Corp. (Japan) | 92,300 | 5,583,376 |

|

| Petronas Chemicals Group Bhd (Malaysia) † | 3,241,700 | 6,713,505 |

|

| Syngenta AG (Switzerland) † | 20,971 | 7,030,975 |

|

| TSRC Corp. (Taiwan) | 842,000 | 1,953,701 |

|

| Uralkali (Russia) † | 645,167 | 5,224,737 |

|

| | | 85,589,223 |

| Coal (1.4%) | | |

| CONSOL Energy, Inc. | 86,800 | 4,401,628 |

|

| Patriot Coal Corp. † S | 101,200 | 2,388,320 |

|

| | | 6,789,948 |

| Construction (1.0%) | | |

| HeidelbergCement AG (Germany) | 66,865 | 4,682,062 |

|

| | | 4,682,062 |

| Containers (1.1%) | | |

| Crown Holdings, Inc. † | 134,700 | 5,183,256 |

|

| | | 5,183,256 |

| Energy (oil field) (8.4%) | | |

| Cameron International Corp. † | 51,000 | 3,015,630 |

|

| Global Geophysical Services, Inc. † | 119,927 | 1,687,373 |

|

| Helix Energy Solutions Group, Inc. † S | 152,000 | 2,340,800 |

|

| National Oilwell Varco, Inc. S | 126,700 | 10,081,519 |

|

| Schlumberger, Ltd. | 189,609 | 17,713,273 |

|

| Weatherford International, Ltd. (Switzerland) † S | 204,500 | 4,944,810 |

|

| | | 39,783,405 |

| Forest products and packaging (1.5%) | | |

| International Paper Co. | 184,400 | 5,122,632 |

|

| Rock-Tenn Co. Class A S | 16,100 | 1,105,265 |

|

| Smurfit-Stone Container Corp. † | 29,300 | 1,126,292 |

|

| | | 7,354,189 |

| Metals (18.3%) | | |

| ArcelorMittal (France) | 57,047 | 2,096,505 |

|

| BHP Billiton PLC (United Kingdom) | 497,697 | 19,702,917 |

|

| Fortescue Metals Group, Ltd. (Australia) † | 796,434 | 5,447,488 |

|

| Freeport-McMoRan Copper & Gold, Inc. Class B | 145,600 | 7,709,520 |

|

| Nucor Corp. S | 70,300 | 3,371,588 |

|

| Rio Tinto PLC (United Kingdom) | 283,560 | 19,879,526 |

|

| Teck Resources, Ltd. Class B (Canada) | 142,700 | 7,898,388 |

|

| Vale SA Class A (Preference) (Brazil) | 121,000 | 3,605,864 |

|

17

| | |

| COMMON STOCKS (98.7%)* cont. | Shares | Value |

|

| Metals cont. | | |

| Vedanta Resources PLC (United Kingdom) | 168,871 | $6,617,989 |

|

| Xstrata PLC (United Kingdom) | 456,383 | 10,431,336 |

|

| | | 86,761,121 |

| Natural gas utilities (0.4%) | | |

| Enterprise Products Partners LP | 38,300 | 1,669,880 |

|

| | | 1,669,880 |

| Oil and gas (48.6%) | | |

| Apache Corp. | 52,200 | 6,505,164 |

|

| BG Group PLC (United Kingdom) | 513,492 | 12,500,995 |

|

| BP PLC (United Kingdom) | 1,875,654 | 15,094,850 |

|

| Cairn Energy PLC (United Kingdom) † | 975,640 | 6,778,808 |

|

| Canadian Natural Resources, Ltd. (Canada) | 173,000 | 8,702,554 |

|

| Chevron Corp. S | 207,600 | 21,538,500 |

|

| Devon Energy Corp. | 74,000 | 6,766,560 |

|

| El Paso Pipeline Partners, LP (Units) | 49,800 | 1,877,460 |

|

| Exxon Mobil Corp. | 400,938 | 34,292,227 |

|

| Gazprom OAO (Russia) | 276,815 | 2,023,725 |

|

| Hess Corp. | 73,200 | 6,370,596 |

|

| Linn Energy, LLC (Units) | 44,106 | 1,712,636 |

|

| Marathon Oil Corp. | 62,500 | 3,100,000 |

|

| Nexen, Inc. (Canada) S | 369,222 | 10,079,369 |

|

| Noble Energy, Inc. | 49,400 | 4,577,404 |

|

| Occidental Petroleum Corp. | 131,206 | 13,379,076 |

|

| OGX Petroleo e Gas Participacoes SA (Brazil) † | 145,800 | 1,703,803 |

|

| Petrohawk Energy Corp. † | 177,500 | 3,834,000 |

|

| Petroleo Brasileiro SA ADR (Brazil) | 118,176 | 4,706,950 |

|

| Petroleo Brasileiro SA ADR (Preference) (Brazil) S | 47,900 | 1,684,643 |

|

| QEP Resources, Inc. | 34,400 | 1,360,520 |

|

| Royal Dutch Shell PLC Class A (United Kingdom) | 419,125 | 15,078,727 |

|

| Royal Dutch Shell PLC Class B (United Kingdom) | 343,404 | 12,281,912 |

|

| Swift Energy Co. † | 42,200 | 1,812,490 |

|

| Technip SA (France) | 62,448 | 6,166,532 |

|

| Total SA (France) | 299,847 | 18,380,358 |

|

| Tullow Oil PLC (United Kingdom) | 359,243 | 8,392,221 |

|

| | | 230,702,080 |

| | | |

| Total common stocks (cost $379,632,502) | | $468,515,164 |

| |

| |

| SHORT-TERM INVESTMENTS (6.2%)* | Principal amount/shares | Value |

|

| Putnam Cash Collateral Pool, LLC 0.21% d | 23,174,162 | $23,174,162 |

|

| Putnam Money Market Liquidity Fund 0.17% e | 4,192,141 | 4,192,141 |

|

| SSgA Prime Money Market Fund 0.12% i P | 180,000 | 180,000 |

|

| U.S. Treasury Bills with an effective yield of 0.23%, | | |

| November 17, 2011 | $181,000 | 180,710 |

|

| U.S. Treasury Bills with effective yields ranging from | | |

| 0.26% to 0.29%, March 10, 2011 ## | 659,000 | 658,955 |

|

18

| | |

| SHORT-TERM INVESTMENTS (6.2%)* cont. | Principal amount/shares | Value |

|

| U.S. Treasury Bills with effective yields ranging from | | |

| 0.20% to 0.25%, October 20, 2011 ## | $1,048,000 | $1,046,636 |

|

| Total short-term investments (cost $29,432,555) | | $29,432,604 |

| |

| |

| TOTAL INVESTMENTS | | |

|

| Total investments (cost $409,065,057) | | $497,947,768 |

Key to holding’s abbreviations

| |

| ADR | American Depository Receipts |

| OAO | Open Joint Stock Company |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from September 1, 2010 through February 28, 2011 (the reporting period).

* Percentages indicated are based on net assets of $474,773,709.

† Non-income-producing security.

## These securities, in part or in entirety, were pledged and segregated with the custodian for collateral on certain derivatives contracts at the close of the reporting period.

d See Note 1 to the financial statements regarding securities lending. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

e See Note 6 to the financial statements regarding investments in Putnam Money Market Liquidity Fund. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

i Security purchased with cash or security received, that was pledged to the fund for collateral on certain derivatives contracts (Note 1).

P The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

S Securities on loan, in part or in entirety, at the close of the reporting period.

At the close of the reporting period, the fund maintained liquid assets totaling $54,449 to cover certain derivatives contracts.

ADR after the name of a foreign holding represents ownership of foreign securities on deposit with a custodian bank.

| | | | |

| DIVERSIFICATION BY COUNTRY | | | | |

|

| Distribution of investments by country of risk at the close of the reporting period (as a percentage of Portfolio Value): |

| | | | |

| United States | 42.1% | | Japan | 2.2% |

| |

|

| United Kingdom | 26.7 | | Russia | 1.5 |

| |

|

| Canada | 6.8 | | Malaysia | 1.4 |

| |

|

| France | 6.7 | | Australia | 1.1 |

| |

|

| Germany | 5.0 | | Netherlands | 1.1 |

| |

|

| Switzerland | 2.5 | | Taiwan | 0.4 |

| |

|

| Brazil | 2.5 | | Total | 100.0% |

| | | |

19

FORWARD CURRENCY CONTRACTS at 2/28/11 (aggregate face value $193,679,552) (Unaudited)

| | | | | | |

| | | | | | Unrealized |

| | Contract | Delivery | | Aggregate | appreciation/ |

| Counterparty | Currency | type | date | Value | face value | (depreciation) |

|

| Bank of America, N.A. | | | | | |

|

| Australian Dollar | Sell | 3/16/11 | $5,089,645 | $5,051,144 | $(38,501) |

|

| British Pound | Sell | 3/16/11 | 6,408,622 | 6,359,393 | (49,229) |

|

| Canadian Dollar | Buy | 3/16/11 | 2,667,326 | 2,604,832 | 62,494 |

|

| Euro | Sell | 3/16/11 | 4,506,761 | 4,489,195 | (17,566) |

|

| Swiss Franc | Buy | 3/16/11 | 804,157 | 798,034 | 6,123 |

|

| Barclays Bank PLC | | | | | |

|

| Australian Dollar | Buy | 3/16/11 | 2,339,750 | 2,321,636 | 18,114 |

|

| British Pound | Sell | 3/16/11 | 2,406,222 | 2,388,567 | (17,655) |

|

| Canadian Dollar | Buy | 3/16/11 | 2,091,756 | 2,046,739 | 45,017 |

|

| Japanese Yen | Sell | 3/16/11 | 654,264 | 657,486 | 3,222 |

|

| Swiss Franc | Sell | 3/16/11 | 756,347 | 751,154 | (5,193) |

|

| Citibank, N.A. | | | | | |

|

| British Pound | Sell | 3/16/11 | 2,284,715 | 2,260,353 | (24,362) |

|

| Euro | Sell | 3/16/11 | 1,643,753 | 1,642,292 | (1,461) |

|

| Hong Kong Dollar | Sell | 3/16/11 | 1,197,224 | 1,197,588 | 364 |

|

| Singapore Dollar | Sell | 3/16/11 | 708 | 708 | — |

|

| Swiss Franc | Sell | 3/16/11 | 476,163 | 472,810 | (3,353) |

|

| Credit Suisse AG | | | | | |

|

| British Pound | Sell | 3/16/11 | 9,955,575 | 9,879,527 | (76,048) |

|

| Canadian Dollar | Buy | 3/16/11 | 8,925,503 | 8,734,385 | 191,118 |

|

| Euro | Sell | 3/16/11 | 1,412,046 | 1,410,502 | (1,544) |

|

| Japanese Yen | Buy | 3/16/11 | 16,939,746 | 17,023,061 | (83,315) |

|

| Norwegian Krone | Buy | 3/16/11 | 1,437,434 | 1,404,081 | 33,353 |

|

| Deutsche Bank AG | | | | | |

|

| Australian Dollar | Buy | 3/16/11 | 1,411,152 | 1,398,049 | 13,103 |

|

| Canadian Dollar | Buy | 3/16/11 | 1,686,767 | 1,649,469 | 37,298 |

|

| Euro | Sell | 3/16/11 | 1,926,244 | 1,924,934 | (1,310) |

|

| Swedish Krona | Buy | 3/16/11 | 1,377,399 | 1,352,186 | 25,213 |

|

| Goldman Sachs International | | | | | |

|

| British Pound | Sell | 3/16/11 | 3,847,385 | 3,818,091 | (29,294) |

|

| Euro | Buy | 3/16/11 | 1,105,541 | 1,104,316 | 1,225 |

|

| Japanese Yen | Sell | 3/16/11 | 1,322,806 | 1,329,271 | 6,465 |

|

| Norwegian Krone | Buy | 3/16/11 | 1,695,018 | 1,656,280 | 38,738 |

|

| HSBC Bank USA, National Association | | | | |

|

| Australian Dollar | Buy | 3/16/11 | 20,796,589 | 20,633,750 | 162,839 |

|

| British Pound | Sell | 3/16/11 | 6,732,639 | 6,681,170 | (51,469) |

|

| Hong Kong Dollar | Buy | 3/16/11 | 2,660,953 | 2,662,042 | (1,089) |

|

| Norwegian Krone | Buy | 3/16/11 | 2,436,588 | 2,380,342 | 56,246 |

|

| JPMorgan Chase Bank, N.A. | | | | | |

|

| Australian Dollar | Buy | 3/16/11 | 3,532,659 | 3,504,790 | 27,869 |

|

| British Pound | Buy | 3/16/11 | 377,370 | 374,493 | 2,877 |

|

| Canadian Dollar | Buy | 3/16/11 | 4,827,025 | 4,721,835 | 105,190 |

|

| Euro | Sell | 3/16/11 | 8,470,480 | 8,461,832 | (8,648) |

|

20

FORWARD CURRENCY CONTRACTS at 2/28/11 (aggregate face value $193,679,552) (Unaudited) cont.

| | | | | | |

| | | | | | Unrealized |

| | Contract | Delivery | | Aggregate | appreciation/ |

| Counterparty | Currency | type | date | Value | face value | (depreciation) |

|

| JPMorgan Chase Bank, N.A. cont. | | | | | |

|

| Hong Kong Dollar | Sell | 3/16/11 | $1,931,041 | $1,931,644 | $603 |

|

| Japanese Yen | Sell | 3/16/11 | 1,986,205 | 1,996,207 | 10,002 |

|

| Swiss Franc | Buy | 3/16/11 | 1,938,786 | 1,924,660 | 14,126 |

|

| Royal Bank of Scotland PLC (The) | | | | | |

|

| Australian Dollar | Sell | 3/16/11 | 652,592 | 647,154 | (5,438) |

|

| British Pound | Sell | 3/16/11 | 1,923,774 | 1,909,324 | (14,450) |

|

| Canadian Dollar | Buy | 3/16/11 | 1,625,514 | 1,592,119 | 33,395 |

|

| Euro | Sell | 3/16/11 | 1,855,311 | 1,853,914 | (1,397) |

|

| Israeli Shekel | Buy | 3/16/11 | 332,984 | 327,330 | 5,654 |

|

| Japanese Yen | Sell | 3/16/11 | 238,894 | 240,095 | 1,201 |

|

| State Street Bank and Trust Co. | | | | | |

|

| Australian Dollar | Buy | 3/16/11 | 1,958,690 | 1,943,754 | 14,936 |

|

| Canadian Dollar | Buy | 3/16/11 | 8,781,276 | 8,594,190 | 187,086 |

|

| Euro | Buy | 3/16/11 | 3,601,876 | 3,598,219 | 3,657 |

|

| Israeli Shekel | Buy | 3/16/11 | 333,012 | 327,501 | 5,511 |

|

| UBS AG | | | | | |

|

| Australian Dollar | Buy | 3/16/11 | 4,562,243 | 4,524,905 | 37,338 |

|

| British Pound | Sell | 3/16/11 | 5,017,070 | 4,979,702 | (37,368) |

|

| Euro | Buy | 3/16/11 | 10,593,103 | 10,588,351 | 4,752 |

|

| Israeli Shekel | Buy | 3/16/11 | 333,012 | 327,190 | 5,822 |

|

| Norwegian Krone | Buy | 3/16/11 | 854,279 | 835,083 | 19,196 |

|

| Westpac Banking Corp. | | | | | |

|

| Australian Dollar | Sell | 3/16/11 | 1,319,929 | 1,309,594 | (10,335) |

|

| British Pound | Sell | 3/16/11 | 1,927,840 | 1,913,037 | (14,803) |

|

| Euro | Buy | 3/16/11 | 5,301,243 | 5,296,676 | 4,567 |

|

| Japanese Yen | Sell | 3/16/11 | 1,862,875 | 1,872,566 | 9,691 |

|

| Total | | | | | $700,577 |

TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/11 (Unaudited)

| | | | | | |

| | | | | Fixed payments | Total return | |

| Swap counterparty / | Termination | | received (paid) by | received by | Unrealized |

| Notional amount | date | | fund per annum | or paid by fund | appreciation |

|

| Goldman Sachs International | | | | | |

| baskets | 17,161 | 9/14/11 | | (1 month USD- | A basket | $78,679 |

| | | | | LIBOR-BBA | (GSGLPMIN) | |

| | | | | plus 60 bp) | of common stocks | |

|

| Total | | | | | | $78,679 |

21

Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures (ASC 820) establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1 — Valuations based on quoted prices for identical securities in active markets.

Level 2 — Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3 — Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | | | | |

| | | | | Valuation inputs | |

|

| Investments in securities: | | Level 1 | Level 2 | Level 3 |

|

| Common stocks: | | | | |

|

| Basic materials | | $159,654,452 | $24,732,143 | $— |

|

| Capital goods | | 5,183,256 | — | — |

|

| Energy | | 277,275,433 | — | —�� |

|

| Utilities and power | | 1,669,880 | — | — |

|

| Total common stocks | | 443,783,021 | 24,732,143 | — |

| | | | | |

| Short-term investments | | 4,372,141 | 25,060,463 | — |

|

| Totals by level | | $448,155,162 | $49,792,606 | $— |

| | | | | |

| | | | | Valuation inputs | |

|

| Other financial instruments: | | Level 1 | Level 2 | Level 3 |

|

| Forward currency contracts | | $— | $700,577 | $— |

|

| Total return swap contracts | | — | 78,679 | — |

|

| Totals by level | | $— | $779,256 | $— |

The accompanying notes are an integral part of these financial statements.

22

Statement of assets and liabilities 2/28/11 (Unaudited)

| |

| ASSETS | |

|

| Investment in securities, at value, including $22,790,647 of securities on loan (Note 1): | |

| Unaffiliated issuers (identified cost $381,698,754) | $470,581,465 |

| Affiliated issuers (identified cost $27,366,303) (Notes 1 and 6) | 27,366,303 |

|

| Foreign currency (cost $8,768) (Note 1) | 8,676 |

|

| Dividends, interest and other receivables | 886,572 |

|

| Receivable for shares of the fund sold | 1,556,619 |

|

| Receivable for investments sold | 15,847,982 |

|

| Unrealized appreciation on swap contracts (Note 1) | 78,679 |

|

| Unrealized appreciation on forward currency contracts (Note 1) | 1,194,405 |

|

| Total assets | 517,520,701 |

|

| |

| LIABILITIES | |

|

| Payable for investments purchased | 17,482,511 |

|

| Payable for shares of the fund repurchased | 706,292 |

|

| Payable for compensation of Manager (Note 2) | 224,549 |

|

| Payable for investor servicing fees (Note 2) | 104,016 |

|

| Payable for custodian fees (Note 2) | 21,607 |

|

| Payable for Trustee compensation and expenses (Note 2) | 88,206 |

|

| Payable for administrative services (Note 2) | 1,642 |

|

| Payable for distribution fees (Note 2) | 204,874 |

|

| Unrealized depreciation on forward currency contracts (Note 1) | 493,828 |

|

| Collateral on securities loaned, at value (Note 1) | 23,174,162 |

|

| Collateral on certain derivative contracts, at value (Note 1) | 180,000 |

|

| Other accrued expenses | 65,305 |

|

| Total liabilities | 42,746,992 |

| |

| Net assets | $474,773,709 |

|

| |

| REPRESENTED BY | |

|

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $482,696,825 |

|

| Distributions in excess of net investment income (Note 1) | (29,989) |

|

| Accumulated net realized loss on investments and foreign currency transactions (Note 1) | (97,559,603) |

|

| Net unrealized appreciation of investments and assets and liabilities in foreign currencies | 89,666,476 |

|

| Total — Representing net assets applicable to capital shares outstanding | $474,773,709 |

|

| |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

|

| Net asset value and redemption price per class A share ($388,796,183 divided by 16,318,873 shares) | $23.82 |

|

| Offering price per class A share (100/94.25 of $23.82)* | $25.27 |

|

| Net asset value and offering price per class B share ($27,268,861 divided by 1,276,938 shares)** | $21.35 |

|

| Net asset value and offering price per class C share ($20,345,265 divided by 932,744 shares)** | $21.81 |

|

| Net asset value and redemption price per class M share ($7,338,519 divided by 323,305 shares) | $22.70 |

|

| Offering price per class M share (100/96.50 of $22.70)* | $23.52 |

|

| Net asset value, offering price and redemption price per class R share | |

| ($18,450,504 divided by 788,479 shares) | $23.40 |

|

| Net asset value, offering price and redemption price per class Y share | |

| ($12,574,377 divided by 524,733 shares) | $23.96 |

|

* On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced.

** Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

23

Statement of operations Six months ended 2/28/11 (Unaudited)

| |

| INVESTMENT INCOME | |

|

| Dividends (net of foreign tax of $181,642) | $3,008,155 |

|

| Interest (including interest income of $4,042 from investments in affiliated issuers) (Note 6) | 5,135 |

|

| Securities lending (Note 1) | 59,735 |

|

| Total investment income | 3,073,025 |

|

| |

| EXPENSES | |

|

| Compensation of Manager (Note 2) | 1,318,486 |

|

| Investor servicing fees (Note 2) | 689,299 |

|

| Custodian fees (Note 2) | 27,524 |

|

| Trustee compensation and expenses (Note 2) | 21,269 |

|

| Administrative services (Note 2) | 3,581 |

|

| Distribution fees — Class A (Note 2) | 430,477 |

|

| Distribution fees — Class B (Note 2) | 124,933 |

|

| Distribution fees — Class C (Note 2) | 83,697 |

|

| Distribution fees — Class M (Note 2) | 23,831 |

|

| Distribution fees — Class R (Note 2) | 36,592 |

|

| Other | 64,274 |

|

| Total expenses | 2,823,963 |

| | |

| Expense reduction (Note 2) | (16,144) |

|

| Net expenses | 2,807,819 |

| |

| Net investment income | 265,206 |

|

| |

| Net realized gain on investments (Notes 1 and 3) | 49,743,183 |

|

| Net realized gain on swap contracts (Note 1) | 564,987 |

|

| Net realized gain on foreign currency transactions (Note 1) | 3,572,026 |

|

| Net unrealized appreciation of assets and liabilities in foreign currencies during the period | 732,368 |

|

| Net unrealized appreciation of investments and swap contracts during the period | 98,511,540 |

|

| Net gain on investments | 153,124,104 |

| |

| Net increase in net assets resulting from operations | $153,389,310 |

|

The accompanying notes are an integral part of these financial statements.

24

Statement of changes in net assets

| | |

| INCREASE (DECREASE) IN NET ASSETS | Six months ended 2/28/11* | Year ended 8/31/10 |

|

| Operations: | | |

| Net investment income | $265,206 | $2,538,891 |

|

| Net realized gain on investments and foreign | | |

| currency transactions | 53,880,196 | 55,579,563 |

|

| Net unrealized appreciation (depreciation) of investments | | |

| and assets and liabilities in foreign currencies | 99,243,908 | (56,939,941) |

|

| Net increase in net assets resulting from operations | 153,389,310 | 1,178,513 |

|

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | | |

|

| Class A | (6,537,764) | (3,744,786) |

|

| Class B | (334,168) | (137,638) |

|

| Class C | (240,868) | (85,731) |

|

| Class M | (100,316) | (46,266) |

|

| Class R | (256,967) | (109,392) |

|

| Class Y | (230,734) | (146,008) |

|

| Redemption fees (Note 1) | 9,264 | 19,914 |

|

| Decrease from capital share transactions (Note 4) | (15,703,682) | (45,610,374) |

|

| Total increase (decrease) in net assets | 129,994,075 | (48,681,768) |

|

| |

| NET ASSETS | | |

|

| Beginning of period | 344,779,634 | 393,461,402 |

|

| End of period (including distributions in excess of net investment | |

| income of $29,989 and undistributed net investment income | | |

| of $7,405,622, respectively) | $474,773,709 | $344,779,634 |

|

* Unaudited

The accompanying notes are an integral part of these financial statements.

25

Financial highlights (For a common share outstanding throughout the period)

| | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | LESS DISTRIBUTIONS: | | | | | RATIOS AND SUPPLEMENTAL DATA: | | |

|

| | | | | | | | | | | | | | Ratio | | |

| | | | | | | | | | | | | | of expenses | | |

| | | | | | | | | | | | | | to average | Ratio | |

| | Net asset | | Net realized | | | | | | | | | Ratio | net assets, | of net investment | |

| | value, | | and unrealized | Total from | From | From | | | | Total return | Net assets, | of expenses | excluding | income (loss) | |

| | beginning | Net investment | gain (loss) | investment | net investment | net realized gain | Total | Redemption | Net asset value, | at net asset | end of period | to average | interest expense | to average | Portfolio |

| Period ended | of period | income (loss) a | on investments | operations | income | on investments | distributions | fees | end of period | value (%) b | (in thousands) | net assets (%) c | (%) c | net assets (%) | turnover (%) |

|

| Class A | | | | | | | | | | | | | | | |

| February 28, 2011** | $16.62 | .02 | 7.58 | 7.60 | (.40) | — | (.40) | — d | $23.82 | 45.98 * | $388,796 | .63* | .63* | .11* | 51* |

| August 31, 2010 | 16.87 | .13 | (.18) | (.05) | (.20) | — | (.20) | — d | 16.62 | (.44) | 284,668 | 1.39 | 1.39 | .71 | 107 |

| August 31, 2009 | 27.99 | .19 | (9.21) | (9.02) | — | (2.10) | (2.10) | — d | 16.87 | (29.64) | 321,830 | 1.44 e,f | 1.43 f | 1.22 f | 92 |

| August 31, 2008 | 35.18 | .29 | (.54) | (.25) | (.08) | (6.87) | (6.95) | .01 | 27.99 | (2.76) | 559,989 | 1.18 f | 1.18 f | .87 f | 99 |

| August 31, 2007 | 31.31 | .17 | 7.36 | 7.53 | (.42) | (3.25) | (3.67) | .01 | 35.18 | 26.01 | 557,614 | 1.23 f | 1.23 f | .52 f | 64 |

| August 31, 2006 | 31.01 | .14 g | 4.04 | 4.18 | (.03) | (3.86) | (3.89) | .01 | 31.31 | 14.92 | 471,531 | 1.20 f,g | 1.20 f,g | .45 f,g | 56 |

|

| Class B | | | | | | | | | | | | | | | |

| February 28, 2011** | $14.87 | (.05) | 6.79 | 6.74 | (.26) | — | (.26) | — d | $21.35 | 45.45 * | $27,269 | 1.00* | 1.00* | (.27)* | 51* |

| August 31, 2010 | 15.11 | (.01) | (.15) | (.16) | (.08) | — | (.08) | — d | 14.87 | (1.15) | 21,418 | 2.14 | 2.14 | (.05) | 107 |

| August 31, 2009 | 25.66 | .06 | (8.51) | (8.45) | — | (2.10) | (2.10) | — d | 15.11 | (30.18) | 30,849 | 2.19 e,f | 2.18 f | .45 f | 92 |

| August 31, 2008 | 32.93 | .02 | (.43) | (.41) | — | (6.87) | (6.87) | .01 | 25.66 | (3.52) | 70,360 | 1.93 f | 1.93 f | .08 f | 99 |

| August 31, 2007 | 29.48 | (.07) | 6.91 | 6.84 | (.15) | (3.25) | (3.40) | .01 | 32.93 | 25.05 | 98,246 | 1.98 f | 1.98 f | (.24) f | 64 |

| August 31, 2006 | 29.58 | (.10) g | 3.85 | 3.75 | — | (3.86) | (3.86) | .01 | 29.48 | 14.11 | 121,924 | 1.95 f,g | 1.95 f,g | (.33) f,g | 56 |

|

| Class C | | | | | | | | | | | | | | | |

| February 28, 2011** | $15.20 | (.05) | 6.94 | 6.89 | (.28) | — | (.28) | — d | $21.81 | 45.49 * | $20,345 | 1.00* | 1.00* | (.26)* | 51* |

| August 31, 2010 | 15.47 | (.01) | (.16) | (.17) | (.10) | — | (.10) | — d | 15.20 | (1.21) | 13,292 | 2.14 | 2.14 | (.04) | 107 |

| August 31, 2009 | 26.18 | .07 | (8.68) | (8.61) | — | (2.10) | (2.10) | — d | 15.47 | (30.18) | 14,156 | 2.19 e,f | 2.18 f | .47 f | 92 |

| August 31, 2008 | 33.46 | .04 | (.45) | (.41) | — | (6.87) | (6.87) | — d | 26.18 | (3.49) | 25,383 | 1.93 f | 1.93 f | .12 f | 99 |

| August 31, 2007 | 29.90 | (.07) | 7.02 | 6.95 | (.15) | (3.25) | (3.40) | .01 | 33.46 | 25.07 | 24,489 | 1.98 f | 1.98 f | (.24) f | 64 |

| August 31, 2006 | 29.96 | (.10) g | 3.89 | 3.79 | — | (3.86) | (3.86) | .01 | 29.90 | 14.06 | 24,107 | 1.95 f,g | 1.95 f,g | (.33) f,g | 56 |

|

| Class M | | | | | | | | | | | | | | | |

| February 28, 2011** | $15.82 | (.03) | 7.22 | 7.19 | (.31) | — | (.31) | — d | $22.70 | 45.66 * | $7,339 | .88* | .88* | (.14)* | 51* |

| August 31, 2010 | 16.08 | .04 | (.17) | (.13) | (.13) | — | (.13) | — d | 15.82 | (.91) | 5,141 | 1.89 | 1.89 | .20 | 107 |

| August 31, 2009 | 27.00 | .11 | (8.93) | (8.82) | — | (2.10) | (2.10) | — d | 16.08 | (30.03) | 5,609 | 1.94 e,f | 1.93 f | .73 f | 92 |

| August 31, 2008 | 34.22 | .12 | (.48) | (.36) | — | (6.87) | (6.87) | .01 | 27.00 | (3.20) | 9,172 | 1.68 f | 1.68 f | .36 f | 99 |

| August 31, 2007 | 30.55 | — d | 7.17 | 7.17 | (.26) | (3.25) | (3.51) | .01 | 34.22 | 25.36 | 9,283 | 1.73 f | 1.73 f | .01 f | 64 |

| August 31, 2006 | 30.46 | (.01) g | 3.95 | 3.94 | — | (3.86) | (3.86) | .01 | 30.55 | 14.35 | 8,036 | 1.70 f,g | 1.70 f,g | (.04) f,g | 56 |

|

| Class R | | | | | | | | | | | | | | | |

| February 28, 2011** | $16.31 | — d | 7.45 | 7.45 | (.36) | — | (.36) | — d | $23.40 | 45.92 * | $18,451 | .75* | .75* | (.01)* | 51* |

| August 31, 2010 | 16.58 | .09 | (.19) | (.10) | (.17) | — | (.17) | — d | 16.31 | (.72) | 11,192 | 1.64 | 1.64 | .48 | 107 |

| August 31, 2009 | 27.64 | .15 | (9.11) | (8.96) | — | (2.10) | (2.10) | — d | 16.58 | (29.82) | 9,966 | 1.69 e,f | 1.68 f | 1.00 f | 92 |

| August 31, 2008 | 34.87 | .22 | (.53) | (.31) | (.06) | (6.87) | (6.93) | .01 | 27.64 | (2.99) | 10,129 | 1.43 f | 1.43 f | .69 f | 99 |

| August 31, 2007 | 31.09 | .08 | 7.31 | 7.39 | (.37) | (3.25) | (3.62) | .01 | 34.87 | 25.69 | 5,684 | 1.48 f | 1.48 f | .25 f | 64 |

| August 31, 2006 | 30.89 | .10 g | 3.98 | 4.08 | (.03) | (3.86) | (3.89) | .01 | 31.09 | 14.62 | 2,370 | 1.45 f,g | 1.45 f,g | .28 f,g | 56 |

|

| Class Y | | | | | | | | | | | | | | | |

| February 28, 2011** | $16.73 | .05 | 7.63 | 7.68 | (.45) | — | (.45) | — d | $23.96 | 46.19 * | $12,574 | .50* | .50* | .23* | 51* |

| August 31, 2010 | 16.97 | .18 | (.18) | — d | (.24) | — | (.24) | — d | 16.73 | (.16) | 9,069 | 1.14 | 1.14 | .95 | 107 |

| August 31, 2009 | 28.07 | .23 | (9.23) | (9.00) | — | (2.10) | (2.10) | — d | 16.97 | (29.47) | 11,052 | 1.19 e,f | 1.18 f | 1.48 f | 92 |

| August 31, 2008 | 35.26 | .38 | (.54) | (.16) | (.17) | (6.87) | (7.04) | .01 | 28.07 | (2.51) | 16,306 | .93 f | .93 f | 1.16 f | 99 |

| August 31, 2007 | 31.38 | .25 | 7.37 | 7.62 | (.50) | (3.25) | (3.75) | .01 | 35.26 | 26.30 | 17,390 | .98 f | .98 f | .77 f | 64 |

| August 31, 2006† | 32.74 | .22 g | 2.31 | 2.53 | (.04) | (3.86) | (3.90) | .01 | 31.38 | 9.14 * | 14,795 | .87*f,g | .87*f,g | .73*f,g | 56 |

|

See notes to financial highlights at the end of this section.

The accompanying notes are an integral part of these financial statements.

Financial highlights (Continued)

* Not annualized.

** Unaudited.

† For the period October 4, 2005 (commencement of operations) to August 31, 2006.

a Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

b Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

c Includes amounts paid through expense offset and brokerage/service arrangements (Note 2).

d Amount represents less than $0.01 per share.

e Includes interest accrued in connection with certain terminated derivatives contracts, which amounted to 0.01% of average net assets for the period ended August 31, 2009.

f Reflects an involuntary contractual expense limitation and/or waivers of certain fund expenses in connection with investments in Putnam Prime Money Market Fund in effect during the period. As a result of such limitation and/or waivers, the expenses of each class reflect a reduction of the following amounts:

| |

| | Percentage of |

| | average net assets |

|

| August 31, 2009 | 0.05% |

|

| August 31, 2008 | <0.01 |

|

| August 31, 2007 | <0.01 |

|

| August 31, 2006 | <0.01 |

|

g Reflects a non-recurring reimbursement from Putnam Investments relating to the calculation of certain amounts paid by the fund to Putnam in previous years for transfer agent services, which amounted to less than $0.01 per share and 0.01% of average net assets for the period ended August 31, 2006.

The accompanying notes are an integral part of these financial statements.

28

Notes to financial statements 2/28/11 (Unaudited)

Note 1: Significant accounting policies

Putnam Global Natural Resources Fund (the fund), is a Massachusetts business trust, which is registered under the Investment Company Act of 1940, as amended, as a non-diversified open-end management investment company. The investment objective of the fund is to seek capital appreciation by investing primarily in common stocks of large and midsized companies worldwide in the energy and other natural resources industries that Putnam Investment Management, LLC (Putnam Management), the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC, believes have favorable investment potential. The fund concentrates its investments in one sector, which involves more risk than a fund that invests more broadly.

The fund offers class A, class B, class C, class M, class R and class Y shares. Class A and class M shares are sold with a maximum front-end sales charge of 5.75% and 3.50%, respectively, and generally do not pay a contingent deferred sales charge. Class B shares, which convert to class A shares after approximately eight years, do not pay a front-end sales charge and are subject to a contingent deferred sales charge if those shares are redeemed within six years of purchase. Class C shares have a one-year 1.00% contingent deferred sales charge and do not convert to class A shares. Class R shares, which are not available to all investors, are sold at net asset value. The expenses for class A, class B, class C, class M and class R shares may differ based on the distribution fee of each class, which is identified in Note 2. Class Y shares, which are sold at net asset value, are generally subject to the same expenses as class A, class B, class C, class M and class R shares, but do not bear a distribution fee. Class Y shares are not available to all investors.

A 1.00% redemption fee may apply on any shares that are redeemed (either by selling or exchanging into another fund) within 90 days of purchase. The redemption fee is accounted for as an addition to paid-in-capital.

Investment income, realized and unrealized gains and losses and expenses of the fund are borne pro-rata based on the relative net assets of each class to the total net assets of the fund, except that each class bears expenses unique to that class (including the distribution fees applicable to such classes). Each class votes as a class only with respect to its own distribution plan or other matters on which a class vote is required by law or determined by the Trustees. If the fund were liquidated, shares of each class would receive their pro-rata share of the net assets of the fund. In addition, the Trustees declare separate dividends on each class of shares.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. Unless otherwise noted, the “reporting period” represents the period from September 1, 2010 through February 28, 2011.

A) Security valuation Investments for which market quotations are readily available are valued at the last reported sales price on their principal exchange, or official closing price for certain markets, and are classified as Level 1 securities. If no sales are reported — as in the case of some securities traded over-the-counter — a security is valued at its last reported bid price and is generally categorized as a Level 2 security.

Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange and therefore the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the New York Stock Exchange. Accordingly, on certain days, the fund will fair value foreign equity securities taking into account multiple factors including movements in the U.S. securities markets, currency valuations and comparisons to the valuation of American Depository Receipts, exchange-traded funds and futures contracts. These securities, which will generally represent a transfer from a Level 1 to a Level 2 security, will be classified as Level 2. The number of days on which fair value prices will be used will depend on market activity and it is possible that fair value prices will be used by the fund to a significant extent. At the close of the reporting period, fair value pricing was used for certain foreign securities in the portfolio. Securities quoted in foreign currencies, if any, are translated into U.S. dollars at the current exchange rate.

29

To the extent a pricing service or dealer is unable to value a security or provides a valuation that Putnam Management does not believe accurately reflects the security’s fair value, the security will be valued at fair value by Putnam Management. Certain investments, including certain restricted and illiquid securities and derivatives, are also valued at fair value following procedures approved by the Trustees. These valuations consider such factors as significant market or specific security events such as interest rate or credit quality changes, various relationships with other securities, discount rates, U.S. Treasury, U.S. swap and credit yields, index levels, convexity exposures and recovery rates. These securities are classified as Level 2 or as Level 3 depending on the priority of the significant inputs.

Such valuations and procedures are reviewed periodically by the Trustees. The fair value of securities is generally determined as the amount that the fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time. By its nature, a fair value price is a good faith estimate of the value of a security in a current sale and does not reflect an actual market price, which may be different by a material amount.

B) Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis.