UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-03091

Name of Fund: BlackRock Series Fund, Inc.

BlackRock Balanced Capital Portfolio

BlackRock Capital Appreciation Portfolio

BlackRock Global Allocation Portfolio

BlackRock High Yield Portfolio

BlackRock Large Cap Core Portfolio

BlackRock Money Market Portfolio

BlackRock Total Return Portfolio

BlackRock U.S. Government Bond Portfolio

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Series Fund,

Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 12/31/2014

Date of reporting period: 12/31/2014

Item 1 – Report to Stockholders

DECEMBER 31, 2014

BlackRock Series Fund, Inc.

„ BlackRock Balanced Capital Portfolio

„ BlackRock Capital Appreciation Portfolio

„ BlackRock Global Allocation Portfolio

„ BlackRock High Yield Portfolio

„ BlackRock Large Cap Core Portfolio

„ BlackRock Money Market Portfolio

„ BlackRock Total Return Portfolio

„ BlackRock U.S. Government Bond Portfolio

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

| | | | | | |

| 2 | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | |

Dear Shareholder,

After an extended period of calm, market volatility increased over the course of 2014, driven largely by higher valuations in risk assets (such as equities and high yield bonds), rising geopolitical risks and expectations around global central bank policies. Several key trends drove strong performance in U.S. markets, particularly large-cap stocks, Treasuries and municipal bonds, while markets outside the U.S. were more challenged.

Investors began the year in search of relatively safer assets due to heightened risks in emerging markets, slowing growth in China and weakening U.S. economic data. As a result, equities globally declined in January while bond markets strengthened despite the expectation that interest rates would rise as the U.S. Federal Reserve had begun reducing its asset purchase programs. Strong demand for relatively safer assets pushed U.S. Treasury bond prices higher and thus kept rates low in the United States. This surprising development, as well as increasing evidence that the soft patch in U.S. economic data had been temporary and weather-related, brought equity investors racing back to the market in February.

In the months that followed, interest rates trended lower in a modest growth environment and more investors turned to equities in search of yield. Markets remained relatively calm despite rising tensions in Russia and Ukraine and further signs of decelerating growth in China. Strong corporate earnings, increased merger and acquisition activity and signs of a strengthening recovery in the U.S. and other developed economies kept equity prices moving higher. Not all segments benefited from these trends, however, as investors ultimately became wary of high valuations, resulting in a broad rotation into cheaper assets.

Volatility ticked up in the summer as geopolitical tensions escalated and investors feared that better U.S. economic indicators may compel the Fed to increase short-term interest rates sooner than previously anticipated. Global credit markets tightened as the U.S. dollar strengthened, ultimately putting a strain on investor flows, and financial markets broadly weakened in the third quarter.

Several themes dominated the markets in the fourth quarter, resulting in higher levels of volatility and the outperformance of U.S. markets versus other areas of the world. Economic growth strengthened considerably in the United States while the broader global economy showed signs of slowing. The European Central Bank and the Bank of Japan took aggressive measures to stimulate growth while the Fed moved toward tighter policy. This divergence in central bank policy caused further strengthening in the U.S. dollar versus other currencies. Oil prices, which had been falling gradually since the summer, plummeted in the fourth quarter due to a global supply-and-demand imbalance. Energy stocks sold off sharply and oil-exporting economies suffered, resulting in the poor performance of emerging market stocks.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of December 31, 2014 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index) | | | 6.12 | % | | | 13.69 | % |

U.S. small cap equities

(Russell 2000® Index) | | | 1.65 | | | | 4.89 | |

International equities

(MSCI Europe, Australasia, Far East Index) | | | (9.24 | ) | | | (4.90 | ) |

Emerging market equities

(MSCI Emerging Markets Index) | | | (7.84 | ) | | | (2.19 | ) |

3-month Treasury bill

(BofA Merrill Lynch

3-Month Treasury

Bill Index) | | | 0.01 | | | | 0.03 | |

U.S. Treasury securities

(BofA Merrill Lynch

10-Year U.S. Treasury

Index) | | | 4.33 | | | | 10.72 | |

U.S. investment grade

bonds (Barclays U.S.

Aggregate Bond Index) | | | 1.96 | | | | 5.97 | |

Tax-exempt municipal

bonds (S&P Municipal Bond Index) | | | 3.00 | | | | 9.25 | |

U.S. high yield bonds

(Barclays US Corporate

High Yield 2% Issuer

Capped Index) | | | (2.84 | ) | | | 2.46 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | | | |

Fund Summary as of December 31, 2014 | | | BlackRock Balanced Capital Portfolio | |

BlackRock Balanced Capital Portfolio’s (the “Fund”) investment objective is to seek high total investment return.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the 12-month period ended December 31, 2014, the Fund returned 11.07%, outperforming its blended benchmark (60% Russell 1000® Index/40% Barclays U.S. Aggregate Bond Index), which returned 10.36% for the period. The Russell 1000® Index advanced 13.24%, while the Barclays U.S. Aggregate Bond Index returned 5.97%. |

What factors influenced performance?

| Ÿ | | From a broad asset allocation perspective, the Fund’s overweight to equities relative to the blended benchmark contributed positively to performance as equities outperformed core fixed income during the period. |

| Ÿ | | Positive relative performance within the fixed income portion of the Fund was largely due to yield curve positioning. The Fund held a curve flattening bias (being overweight to longer maturities and underweight to shorter ones), which contributed to performance as longer-term yields declined (bond prices generally rise as rates fall). Another positive contributor was security selection and an overweight in securitized assets, notably commercial mortgage-backed securities (“CMBS”) and asset-backed securities (“ABS”). A non-benchmark allocation to non-agency residential mortgage-backed securities (“MBS”) contributed to overall returns as well. Low supply of and investor demand for yield led to compressed spreads and positive returns across these sectors. Within equities, positive contributions to relative performance were led by the Fund’s consumer discretionary and industrials holdings, as well as positioning within consumer staples. Overall, home-improvement and off-price retailers delivered standout results relative to the broader retail universe, benefiting from consumer spending shifts towards durables and branded value, respectively. Within industrials, holdings of airlines benefited from a combination of industry consolidation, capacity discipline and healthy domestic demand growth. A decline in jet-fuel prices, typically an airline’s largest expense, provided an additional tailwind in the latter part of the reporting period. Selection in the industrial conglomerates segment also proved advantageous. |

| Ÿ | | Positioning within financials detracted from relative performance on the equity side, particularly selection among insurers and an underweight in real estate investment trusts (“REITs”). Positioning within information technology (“IT”) also hindered relative returns, with weakness most |

| | | pronounced within internet software & services. The weakness in energy over the period impacted the Fund as well, notably through its weighting toward energy services companies whose stock prices tend to be correlated to the lower price of oil. Within fixed income, the Fund’s positioning within the investment grade corporate bond sector and an underweight relative to the benchmark index in agency debentures detracted modestly from results. |

Describe recent portfolio activity.

| Ÿ | | Within equities, the Fund’s weighting increased in the IT sector, particularly within the semiconductor industry, and in the consumer staples sector, within the beverage industry. Conversely, the Fund’s weighting in health care decreased, particularly within pharmaceuticals and health care equipment & supplies. Within energy, exposure to major oil & gas companies and refiners was reduced. |

| Ÿ | | Within fixed income, the Fund’s corporate credit exposure was reduced late in the period given the low yields and expected high supply in the investment grade market. In keeping with the Fund’s curve flattening bias, an overweight position was implemented in 30-year MBS versus 15-year MBS, with a tilt toward higher coupons. Towards the end of the period, the Fund moved to a modest underweight in agency MBS. The Fund maintained overweights in CMBS and ABS as the demand for yield continues to support tightening credit spreads in these sectors. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the blended benchmark, the Fund ended the period overweight in equities relative to fixed income. The Fund’s equity allocation was overweight relative to the Russell 1000® Index most notably in IT, followed by financials, while utilities was the most significant underweight. In fixed income, the Fund was generally underweight relative to the Barclays U.S. Aggregate Bond Index in government-owned/ government-related sectors in favor of non-government spread sectors. Within spread sectors, the Fund was most significantly overweight in CMBS and ABS, while maintaining an underweight in investment grade credit. Within the government sectors, the Fund was underweight agency debentures and agency MBS. The Fund also held non-benchmark allocations in high yield debt, non-agency residential MBS, collateralized loan obligations and municipal bonds. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Portfolio Composition | | Percent of Long-Term Investments |

| | | | |

Common Stocks | | | 62 | % |

U.S. Government Sponsored Agency Securities | | | 15 | |

Corporate Bonds | | | 8 | |

U.S. Treasury Obligations | | | 7 | |

Asset-Backed Securities | | | 4 | |

Non-Agency Mortgage-Backed Securities | | | 3 | |

Foreign Government Obligations | | | 1 | |

| | | | | | |

| 4 | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

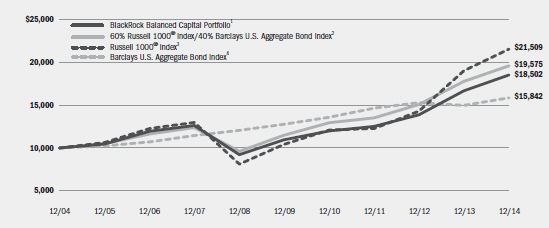

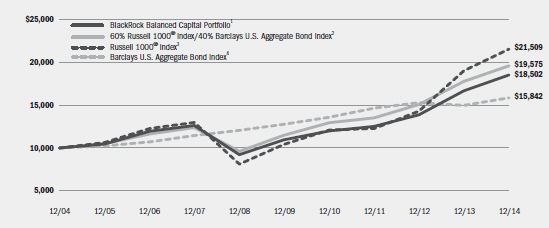

| | | | BlackRock Balanced Capital Portfolio | |

|

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. The Fund invests in U.S. and foreign equity and fixed income securities of any maturity. |

| | 2 | The Fund compares its performance to that of a customized weighted index comprised of the returns of the Russell 1000® Index (60%) and Barclays U.S. Aggregate Bond Index (40%). |

| | 3 | The index measures the performance of the large cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The index represents approximately 92% of the total market capitalization of the Russell 3000® Index. |

| | 4 | A widely recognized unmanaged market-weighted index comprised of investment-grade corporate bonds rated BBB or better, mortgages and U.S. Treasury and U.S. Government agency issues with at least one year to maturity. |

| | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended December 31, 2014 | | | | | | | | | | | | | | | | |

| | | | | | | Average Annual Total Returns5 | |

| | |

| 6-Month

Total Returns5 |

| | | 1 Year | | | | 5 Years | | | | 10 Years | |

BlackRock Balanced Capital Portfolio | | | 5.41 | % | | | 11.07 | % | | | 11.11 | % | | | 6.35 | % |

60% Russell 1000® Index/40% Barclays U.S. Aggregate Bond Index | | | 4.13 | | | | 10.36 | | | | 11.30 | | | | 6.95 | |

Russell 1000® Index | | | 5.57 | | | | 13.24 | | | | 15.64 | | | | 7.96 | |

Barclays U.S. Aggregate Bond Index | | | 1.96 | | | | 5.97 | | | | 4.45 | | | | 4.71 | |

| | 5 | | Cumulative and average annual total investment returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on the ex-dividend date. Insurance related fees and expenses are not reflected in these returns. |

| | | | Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical7 | | |

| | | Beginning Account Value

July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period6 | | Beginning Account Value

July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period6 | | Annualized Expense Ratio |

BlackRock U.S. Government Bond Portfolio | | $1,000.00 | | $1,054.10 | | $2.43 | | $1,000.00 | | $1,022.84 | | $2.40 | | 0.47% |

| | 6 | | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 7 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 20 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | 5 |

| | | | |

| Fund Summary as of December 31, 2014 | | | BlackRock Capital Appreciation Portfolio | |

BlackRock Capital Appreciation Portfolio’s (the “Fund”) investment objective is to seek long-term growth of capital.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the 12-month period ended December 31, 2014, the Fund returned 9.12%, underperforming its benchmark, the Russell 1000® Growth Index, which returned 13.05%, and the broad-market S&P 500® Index, which returned 13.69%. The following discussion of relative performance pertains to the Russell 1000® Growth Index. |

What factors influenced performance?

| Ÿ | | For financial reporting purposes, the values of certain investments were updated to incorporate information relative to those investments as of the report date. Accordingly, the net asset value (“NAV”) per share and total return performance presented herein are different than the information previously published on December 31, 2014. |

| Ÿ | | Overall, strong relative performance in the second half of 2014 was not enough to offset the weakness experienced in March and April, when investors fled growth-and momentum-oriented stocks. At the sector level, selection within consumer discretionary was the leading detractor from relative performance, with the internet & catalog retail segment accounting for the majority of the shortfall. Selection within telecommunication services (“telecom”), information technology (“IT”) and industrials also detracted from Fund returns. |

| Ÿ | | The largest detractor at the individual stock level was Japanese internet and telecom conglomerate SoftBank Corp. The stock lost ground as investors worried that continued weak results in the company’s Sprint subsidiary would require significant cash infusions. The Fund exited the position as the magnitude of Sprint’s ongoing cash needs was difficult to quantify. Holdings in industrial components manufacturer Precision Castparts Corp. and Chinese online media company SINA Corp. also hindered relative returns. Precision Castparts Corp. missed earnings expectations in three of its last four quarters. Further, following several years of expanding aerospace industry backlogs, concerns arose over the prospect of longer product cycles going forward, limiting multiple expansion for the entire complex of aerospace suppliers. SINA Corp. shares lost ground amid a confluence of factors in the first half of the period, including China growth concerns, the slump in U.S. technology shares, worries about user growth for the company’s social media platform Weibo and overall margins for 2014, and turmoil in emerging markets. The position was ultimately sold. Lastly, an underweight in Apple, Inc. early in the 12-month period detracted, as the stock recorded strong gains following solid earnings reports. The Fund reestablished a position in Apple, Inc. during the second quarter of 2014, given increasing confidence around upcoming product cycles, emerging markets penetration and gross margin stabilization. |

| Ÿ | | Conversely, relative performance was supported by selection within health care, with notable strength among pharmaceutical and biotechnology holdings. The largest individual |

| | | contributor was Regeneron Pharmaceuticals, Inc. The stock climbed after the company’s leading drug Eylea was approved for a second indication, the treatment of diabetic macular edema. In addition, the stock was supported by multinational pharmaceutical firm Sanofi’s increased stake in the company and positive clinical results for several drugs. A position in pharmaceutical company AbbVie, Inc. also outperformed, as the market began to appreciate the much better-than-expected growth and sales of top-selling drug Humira, as well as the company’s strong pipeline of drugs, including therapies for hepatitis C, liquid tumors and multiple sclerosis. Moreover, the company continues to trade at a discount relative to its pharmaceutical peers in the United States and Europe. Elsewhere in the portfolio, Union Pacific Corp. added to performance, benefiting from both an improving domestic economy and tight capacity in freight markets, which is a boon for rail pricing. In addition, the company was viewed as a relatively safe holding given very low oil and gas industry exposure and a largely domestic footprint, which helped to further support its valuation. An additional contribution came from the Fund’s lack of exposure to International Business Machines Corp., as its ongoing commoditization by the cloud, mobile and infrastructure markets resulted in the company’s worst earnings miss in 10 years. The Fund remains underweight the stock as these secular headwinds, along with the company’s underinvestment over the last several years, will likely make it difficult to show material growth. |

Describe recent portfolio activity.

| Ÿ | | On a sector basis, the Fund’s weighting in health care significantly increased over the 12-month period, most notably in pharmaceuticals, health care providers & services and biotechnology. The allocation to IT increased as well, mainly within hardware. The Fund’s weighting decreased in industrials, particularly electrical equipment and aerospace & defense. Exposure to consumer discretionary also declined, largely within internet & catalog retail and media, with reductions in telecom as well. |

Describe portfolio positioning at period end.

| Ÿ | | The Fund’s largest sector overweights relative to the Russell 1000® Growth Index were health care, in particular pharmaceuticals and biotechnology, and IT, with an emphasis on internet software & services. Consumer discretionary was also a sizable over- weight, especially media and internet & catalog retail. The Fund’s largest underweight remained consumer staples. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Sector Allocation | | Percent of

Long-Term Investments |

| | | | |

Information Technology | | | 35 | % |

Consumer Discretionary | | | 23 | |

Health Care | | | 23 | |

Industrials | | | 7 | |

Financials | | | 5 | |

Consumer Staples | | | 3 | |

Energy | | | 3 | |

Materials | | | 1 | |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine sector sub classifications for reporting ease.

| | | | | | |

| 6 | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

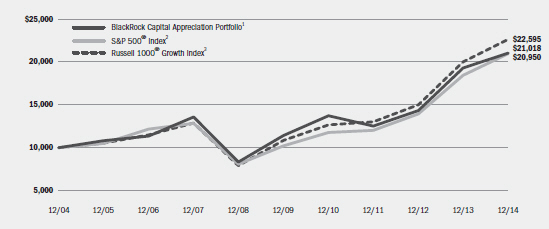

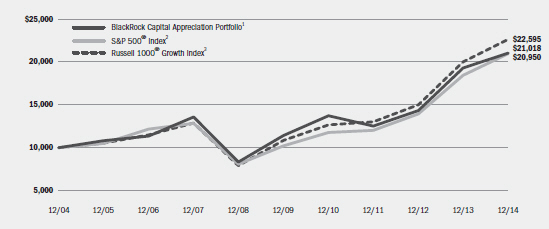

| | | | BlackRock Capital Appreciation Portfolio | |

|

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. The Fund invests primarily in a diversified portfolio consisting primarily of common stock of U.S. companies that the investment advisor believes have shown above-average growth rates in earnings over the long term. |

| | 2 | This unmanaged index covers 500 leading companies and captures approximately 80% coverage of available market capitalization. |

| | 3 | This unmanaged index measures the performance of the large cap growth segment of the U.S. equity universe and consists of those Russell 1000® securities with higher price-to-book ratios and higher forecasted growth values. |

| | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended December 31, 2014 | | | | | | | | | | | | | | | | |

| | | | | | | Average Annual Total Returns4 | |

| | |

| 6-Month

Total Returns4 |

| | | 1 Year | | | | 5 Years | | | | 10 Years | |

BlackRock Capital Appreciation Portfolio | | | 8.23 | % | | | 9.12 | % | | | 13.00 | % | | | 7.71 | % |

S&P 500® Index | | | 6.12 | | | | 13.69 | | | | 15.45 | | | | 7.68 | |

Russell 1000® Growth Index | | | 6.34 | | | | 13.05 | | | | 15.81 | | | | 8.49 | |

| | 4 | | Cumulative and average annual total investment returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on the ex-dividend date. Insurance related fees and expenses are not reflected in these returns. |

| | | | Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical6 | | |

| | | Beginning Account Value

July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period5 | | Beginning Account Value

July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period5 | | Annualized Expense Ratio |

BlackRock Capital Appreciation Portfolio | | $1,000.00 | | $1,082.30 | | $2.73 | | $1,000.00 | | $1,022.58 | | $2.65 | | 0.52% |

| | 5 | | Expenses are equal to the annualized net expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 6 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 20 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | 7 |

| | | | |

| Fund Summary as of December 31, 2014 | | | BlackRock Global Allocation Portfolio | |

BlackRock Global Allocation Portfolio’s (the “Fund”) investment objective is to seek high total investment return.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the 12-month period ended December 31, 2014, the Fund returned 2.52%, underperforming its Reference Benchmark, which returned 4.17%, and the broad based all-equity benchmark, the FTSE World Index, which returned 4.77%. The Reference Benchmark is comprised as follows: 36% S&P 500® Index; 24% FTSE World (ex-U.S.) Index; 24% BofA Merrill Lynch Current 5-Year U.S. Treasury Index; and 16% Citigroup Non-US Dollar World Government Bond Index. The Fund invests in both equities and bonds, and therefore, the Reference Benchmark provides a more accurate representation of the Fund’s composition and is a more comparable means for measurement. The following discussion of relative performance pertains to the Reference Benchmark. |

What factors influenced performance?

| Ÿ | | For financial reporting purposes, the values of certain investments were updated to incorporate information relative to those investments as of the report date. Accordingly, the NAV per share and total return performance presented herein are different than the information previously published on December 31, 2014. |

| Ÿ | | Within equities, stock selection and an underweight in the United States, as well as stock selection in Canada and Europe, notably France and Germany, detracted from performance. From a sector perspective, stock selection and an overweight in materials and industrials as well as stock selection in financials and information technology (“IT”) detracted from the Fund’s returns. An overweight to gold-related securities detracted. The Fund’s cash position also resulted in relatively lower returns. |

| Ÿ | | Conversely, stock selection and an overweight in Japan contributed to performance. From a sector perspective, an overweight and stock selection in health care was additive. The Fund’s underweight to fixed income also helped relative results. Within fixed income, an underweight to Japanese government bonds as well as an overweight to emerging market sovereign bonds contributed to performance. From a currency perspective, an overweight to the U.S. dollar positively impacted performance. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, the Fund’s overall equity allocation decreased from 63% to 57% of net assets. Within equities, the Fund decreased exposure to the United States and Europe, and increased exposure to Japan. From a sector perspective, the |

| | | Fund decreased exposure to financials, industrials, consumer staples, IT, consumer discretionary, materials, telecommunication services (“telecom”) and energy. |

| Ÿ | | The Fund’s overall allocation to fixed income increased from 21% to 25% of net assets. Within fixed income, the Fund increased exposure to government and corporate bonds. Within government bonds, the Fund increased its exposure in Mexico, Australia and Poland, and decreased its exposure to European sovereign bonds. |

| Ÿ | | Reflecting the above changes, the Fund’s cash and cash equivalent holdings increased from 16% to 18% of net assets. During the 12-month period, the Fund’s cash position helped mitigate portfolio volatility and served as a source of funds for new investments. In addition, the cash position helped the Fund maintain low overall portfolio duration (sensitivity to interest rate movements). |

| Ÿ | | The Fund uses derivatives, which may include options, futures, swaps and forward contracts both to enhance returns of the Fund and to hedge (or protect) against adverse movements in currency exchange rates, interest rates and movements in the securities markets. During the period, the Fund’s use of derivatives had a positive impact on the absolute performance of the Fund. |

Describe portfolio positioning at period end.

| Ÿ | | Compared to its Reference Benchmark, the Fund ended the period underweight in equities, significantly underweight in fixed income and overweight in cash and cash equivalents. Within the equity segment, the Fund was overweight in Japan and underweight the United States. Within Europe, the Fund was overweight France and the Netherlands, and underweight the United Kingdom and Spain. On a sector basis, the Fund was overweight materials, health care, industrials and energy, and underweight consumer staples, financials, consumer discretionary, IT and telecom. Within fixed income, the Fund was underweight U.S. Treasuries, European sovereign debt and Japanese government bonds, and overweight government bonds in Australia, Mexico, Brazil and Poland. In addition, the Fund was overweight corporate and convertible bonds. As for currency exposure, relative to its benchmark, the Fund was overweight the U.S. dollar, Mexican peso, Indian rupee, Singapore dollar and Brazilian real, along with select emerging Asian currencies. The Fund was underweight the euro, Japanese yen, Canadian dollar, Korean won and Taiwan dollar. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | | | |

| Portfolio Composition | | Percent of

Net Assets | | | Reference

Benchmark4

Percentage | |

U.S. Equities | | | 26 | %1 | | | 36 | % |

European Equities | | | 13 | 1 | | | 12 | |

Asian-Pacific Equities | | | 14 | 1 | | | 9 | |

Other Equities | | | 4 | 1 | | | 3 | |

Total Equities | | | 57 | 2 | | | 60 | |

U.S. Dollar Denominated Fixed Income Securities | | | 17 | | | | 24 | |

U.S. Issuers | | | 13 | | | | — | |

Non-U.S. Issuers | | | 4 | | | | — | |

Non-U.S. Dollar Denominated Fixed Income Securities | | | 8 | | | | 16 | |

Total Fixed Income Securities | | | 25 | | | | 40 | |

Cash & Cash Equivalents3 | | | 18 | | | | — | |

| | 1 | | Includes value of financial futures contracts. |

| | 2 | | Includes preferred stock. |

| | 3 | | Cash & cash equivalents are reduced by the market (or nominal) value of long financial futures contracts. |

| | 4 | | The Reference Benchmark is an unmanaged weighted index comprised as follows: 36% S&P 500 Index; 24% FTSE World (ex U.S.) Index; 24% BofA Merrill Lynch Current 5-Year U.S. Treasury Index; and 16% Citigroup Non-U.S. Dollar World Government Bond Index. |

| | | | | | |

| 8 | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

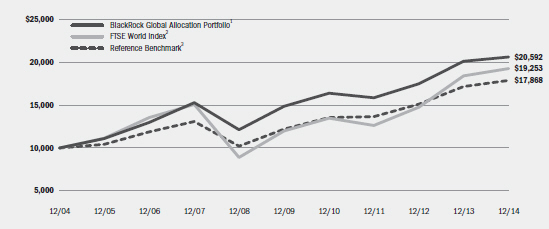

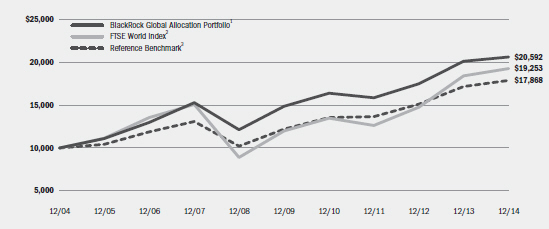

| | | | BlackRock Global Allocation Portfolio | |

|

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. The Fund invests in a portfolio of equity, debt and money market securities. |

| | 2 | This broad-based capitalization-weighted index is comprised of 2,545 equities from 35 countries in 4 regions, including the United States. |

| | 3 | The Reference Benchmark is an unmanaged weighted index comprised as follows: 36% S&P 500® Index; 24% FTSE World (ex U.S.) Index; 24% BofA Merrill Lynch Current 5-Year U.S. Treasury Index; and 16% Citigroup Non-U.S. Dollar World Government Bond Index. |

| | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended December 31, 2014 | | | | | | | | | | | | | | | | |

| | | | | | | Average Annual Total Returns4 | |

| | |

| 6-Month

Total Returns4 |

| | | 1 Year | | | | 5 Years | | | | 10 Years | |

BlackRock Global Allocation Portfolio | | | (1.26 | )% | | | 2.52 | % | | | 6.76 | % | | | 7.49 | % |

FTSE World Index | | | (1.70 | ) | | | 4.77 | | | | 10.00 | | | | 6.77 | |

Reference Benchmark | | | (1.22 | ) | | | 4.17 | | | | 7.99 | | | | 5.98 | |

U.S. Stocks: S&P 500® Index5 | | | 6.12 | | | | 13.69 | | | | 15.45 | | | | 7.68 | |

Non-U.S. Stocks: FTSE World (ex U.S.) Index6 | | | (9.15 | ) | | | (3.74 | ) | | | 5.12 | | | | 5.65 | |

U.S. Bonds: BofA Merrill Lynch Current 5-Year U.S. Treasury Index7 | | | 0.99 | | | | 2.93 | | | | 3.67 | | | | 4.26 | |

Non-U.S. Bonds: Citigroup Non-U.S. Dollar World Government Bond Index8 | | | (8.14 | ) | | | (2.68 | ) | | | 0.85 | | | | 2.64 | |

| | 4 | | Cumulative and average annual total investment returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on the ex-dividend date. Insurance related fees and expenses are not reflected in these returns. |

| | 5 | | This unmanaged index covers 500 leading companies and captures approximately 80% coverage of available market capitalization. |

| | 6 | | An unmanaged capitalization-weighted index comprised of over 1,888 equities from 34 countries, excluding the United States. |

| | 7 | | This unmanaged index is designed to track the total return of the current coupon five-year U.S. Treasury bond. |

| | 8 | | This unmanaged market capitalization-weighted index tracks 22 government bond indexes, excluding the United States. |

| | | | Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical10 | | |

| | | Beginning Account Value July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period9 | | Beginning Account Value July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period9 | | Annualized Expense Ratio |

BlackRock Global Allocation Portfolio | | $1,000.00 | | $987.40 | | $2.86 | | $1,000.00 | | $1,022.33 | | $2.91 | | 0.57% |

| | 9 | | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 10 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 20 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | 9 |

| | | | |

| Fund Summary as of December 31, 2014 | | | BlackRock High Yield Portfolio | |

BlackRock High Yield Portfolio’s (the “Fund”) investment objective is to seek to maximize total return, consistent with income generation and prudent investment management.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the 12-month period ended December 31, 2014, the Fund returned 1.88%, underperforming its benchmark, the Barclays U.S. Corporate High Yield 2% Issuer Capped Index, which returned 2.46%. |

What factors influenced performance?

| Ÿ | | The Fund, which has the ability to invest anywhere in an issuer’s capital structure, held an underweight in high yield bonds during the past year. This positioning aided returns as high yield bonds underperformed other fixed income assets, particularly higher duration sectors. (Duration is a measure of interest rate sensitivity). Specifically, out-of-benchmark positions in equity-like instruments boosted results. While bank loans underperformed high yield bonds in 2014, the Fund’s position in select issues within the asset class also was additive to outperformance. An underweight in energy aided relative performance as weakness in oil prices caused the sector to underperform. The Fund’s positions in the gaming and automotive sectors contributed positively as well. |

| Ÿ | | The Fund’s underweight in high yield bonds rated BB detracted from relative performance as this market segment outperformed the middle and lower quality segments. The Fund’s allocations to the electric utilities and health care sectors also detracted. While the Fund’s exposure to select equity investments generated positive returns, the net impact of the Fund’s equity exposure combined with derivatives used to manage risk (specifically, a short position in S&P 500 futures contracts), detracted from results. |

| Ÿ | | The Fund may utilize credit default swaps (CDS) and currency forward contracts from time to time. Currency forwards are intermittently employed in the portfolio to manage the currency risk of non-dollar denominated bonds. CDS are normally used as hedging vehicles, but are also used to express credit views and as a means to put capital to work in moving markets. On occasion, the Fund will utilize S&P futures as an additional mechanism to hedge portfolio beta and general market volatility. The Fund’s exposure to derivatives did not have a material impact on performance. |

Describe recent portfolio activity.

| Ÿ | | While the Fund actively adjusted its risk exposure throughout the period, |

| | | it generally reduced risk, particularly in the latter half of the year as investors’ risk appetite waned and volatility in the energy sector spiked. In this transition, the Fund gradually reduced the portfolio’s equity risk, increased its underweight in the energy sector and increased its weighting in cash. |

| Ÿ | | Although the Fund retained a positive view on bank loans, it reduced exposure to the asset class during the period. The Fund’s core issuer biases remained generally consistent based on cash flow considerations, the identification of a specific catalyst or an idiosyncratic characteristic. The Fund continued to favor select equity and equity-like investments that offer more upside potential compared to high yield bonds rated CCC, while actively using liquid derivative instruments to help protect against equity market volatility. |

| Ÿ | | The Fund maintained a shorter duration bias (lower sensitivity to interest rate movements) during the period in anticipation of higher interest rates by the end of 2014. |

| Ÿ | | From a sector perspective, the Fund increased exposure to the banking and aerospace-defense sectors and decreased exposure to chemicals and oil field services. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the Barclays U.S. Corporate High Yield 2% Issuer Capped Index, the Fund ended the period underweight in debt rated BB, while it was overweight in the B-rated space. Although the Fund was slightly overweight in select issues rated CCC, it is important to note that the Fund remained underweight in the riskier, higher-beta names within the CCC-quality universe. From an individual issuer perspective, the Fund’s highest-conviction holdings included American Capital Ltd. (non-captive diversified financials), HD Supply, Inc. (building materials), and Ally Financial, Inc. (banking). The Fund maintained an underweight bias to issuers with unstable cash flow streams, less appealing risk-reward profiles, and/or unfavorable industry dynamics. In addition to high yield bonds, the Fund held floating rate loan interests (bank loans) and common stocks, with the remainder invested in investment grade credits and convertible and preferred securities. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Credit Quality Allocation1 | | Percent of Long-Term Investments |

| | | | |

BBB/Baa | | | 3 | % |

BB/Ba | | | 32 | |

B | | | 38 | |

CCC/Caa | | | 12 | |

N/R | | | 15 | |

| | 1 | | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P’s”) or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | | | | | |

| 10 | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

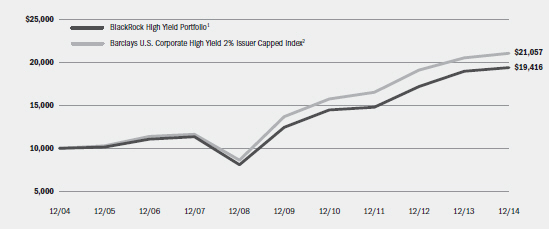

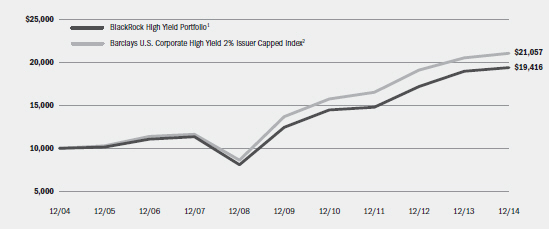

| | | | BlackRock High Yield Portfolio | |

|

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. The Fund invests primarily in non-investment grade bonds with maturities of ten years or less. The Fund’s total returns prior to October 1, 2011 are the returns of the Fund when it followed a different investment objective and different investment strategies under the name “BlackRock High Income Fund.” |

| | 2 | This unmanaged index is comprised of issues that meet the following criteria: at least $150 million par value outstanding; maximum credit rating of Ba1; at least one year to maturity; and no issuer represents more than 2% of the index. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended December 31, 2014 | |

| | | | | | | | | | | | Average Annual Total Returns4 | |

| | | Standardized 30-Day Yield3 | | | Unsubsidized 30-Day Yield3 | | | 6-Month Total Returns4 | | | 1 Year | | | 5 Years | | | 10 Years | |

BlackRock High Yield Portfolio | | | 5.85 | % | | | 5.59 | % | | | (3.34 | )% | | | 1.88 | % | | | 9.13 | % | | | 6.86 | % |

Barclays U.S. Corporate High Yield 2% Issuer Capped Index | | | — | | | | — | | | | (2.84 | ) | | | 2.46 | | | | 8.98 | | | | 7.73 | |

| | 3 | | The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waivers and/or reimbursements. |

| | 4 | | Cumulative and average annual total investment returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on the ex-dividend/payable date. Insurance related fees and expenses are not reflected in these returns. |

| | | | Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | | | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical7 |

| | | | | | | Including

Interest Expense | | Excluding

Interest Expense | | | | Including Interest Expense | | Excluding Interest Expense |

| | | Beginning

Account Value

July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period5 | | Expenses Paid

During the Period6 | | Beginning

Account Value

July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period5 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period6 |

BlackRock High Yield Portfolio | | $1,000.00 | | $966.60 | | $2.53 | | $2.48 | | $1,000.00 | | $1,022.63 | | $2.60 | | $1,022.68 | | $2.55 |

| | 5 | | Expenses are equal to the annualized expense ratio (0.51%), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 6 | | Expenses are equal to the annualized expense ratio (0.50%), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 7 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 20 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | 11 |

| | | | |

| Fund Summary as of December 31, 2014 | | | BlackRock Large Cap Core Portfolio | |

BlackRock Large Cap Core Portfolio’s (the “Fund”) investment objective is to seek long-term growth of capital and income, and moderate current income.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the 12-month period ended December 31, 2014, the Fund returned 12.79%, underperforming its benchmark, the Russell 1000® Index, which returned 13.24%. |

What factors influenced performance?

| Ÿ | | The Fund’s position within financials detracted from relative performance, particularly with respect to insurers, as Genworth Financial, Inc. was the leading individual detractor for the 12-month period. The company announced reserve charges related to its long-term care business that caused its shares to sharply decline. In addition, the Fund’s underweight in real estate investment trusts (“REITs”) detracted, as the industry benefited from declining interest rates. |

| Ÿ | | The Fund’s position within information technology (“IT”) also hindered relative returns, with weakness most pronounced within internet software & services. In particular, internet infrastructure and security firm VeriSign, Inc. disappointed on earnings early in the period, while internet bellwether Google, Inc. underperformed later in the period. Exposure to AOL Inc. was an additional drag on performance. |

| Ÿ | | The weakness in energy over the period impacted the Fund as well, notably through its weighting toward energy services companies whose stock prices tend to be correlated with the price of oil. The Fund’s position in Halliburton Co. was a particular laggard, as its shares were further impacted by the market’s negative reaction to its plan to purchase competitor Baker Hughes. |

| Ÿ | | Performance was positively impacted by the Fund’s consumer discretionary and industrials holdings, as well as positioning within consumer staples. Within the consumer discretionary sector, specialty retailers Lowe’s Cos., Inc. and Ross Stores, Inc. outperformed on better-than-expected earnings. Overall, home-improvement and off-price retailers delivered standout results relative to the broader retail universe, benefiting from consumer spending shifts towards durables and branded value, respectively. Auto |

| | | components holding TRW Automotive Holdings Corp. was an additional contributor in the sector, with shares rising on Germany-based ZF Friedrichshafen’s unsolicited all-cash bid for the company. |

| Ÿ | | Within industrials, exposure to airlines United Continental Holdings, Inc. and Southwest Airlines Co. added to relative returns, with the former finishing as the leading individual contributor within the Fund over the 12-month period. Both airlines benefited from the optimal combination of industry consolidation, capacity discipline and healthy domestic demand growth. A decline in jet-fuel prices, typically an airline’s largest expense, provided an additional tailwind in the latter part of the reporting period. Selection in the industrial conglomerates segment also proved advantageous. |

| Ÿ | | A position in CVS Health Corp. helped drive outperformance in consumer staples. The pharmacy chain benefited from consistently strong earnings reports, market share gains and a robust business outlook. |

Describe recent portfolio activity.

| Ÿ | | Due to a combination of portfolio trading activity and market movement during the 12-month period, the Fund’s weighting increased in the IT sector, particularly within the semiconductor industry, and in the consumer staples sector, within the beverage industry. Conversely, the Fund’s weighting in health care decreased, particularly within pharmaceuticals and health care equipment & supplies. Within energy, exposure to major oil & gas companies and refiners was reduced. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the Russell 1000® Index, the Fund ended the period with its largest sector overweight in IT, followed by financials. The utilities sector was the most significant underweight. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Sector Allocation | | Percent of Long-Term Investments |

| | | | |

Information Technology | | | 26 | % |

Financials | | | 21 | |

Health Care | | | 15 | |

Industrials | | | 11 | |

Consumer Discretionary | | | 11 | |

Energy | | | 7 | |

Consumer Staples | | | 7 | |

Materials | | | 2 | |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine sector sub classifications for reporting ease.

| | | | | | |

| 12 | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

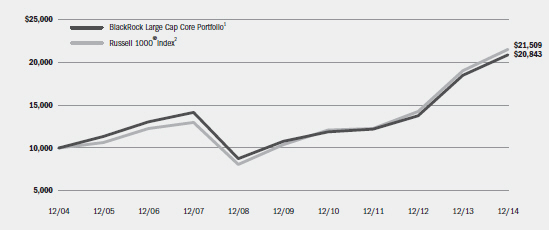

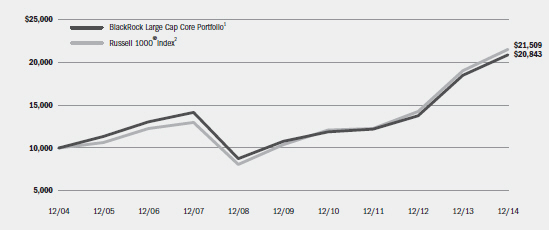

| | | | BlackRock Large Cap Core Portfolio | |

|

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. Under normal circumstances, the Fund invests at least 80% of its assets in a diversified portfolio of equity securities, primarily common stocks, of large capitalization companies included at the time of purchase in the Russell 1000® Index. |

| | 2 | The index measures the performance of the large cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The index represents approximately 92% of the total market capitalization of the Russell 3000® Index. |

| | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended December 31, 2014 | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns3 | |

| | | 6-Month

Total Returns3 | | | 1 Year | | | 5 Years | | | 10 Years | |

BlackRock Large Cap Core Portfolio | | | 6.80 | % | | | 12.79 | % | | | 14.08 | % | | | 7.62 | % |

Russell 1000® Index | | | 5.57 | | | | 13.24 | | | | 15.64 | | | | 7.96 | |

| | 3 | | Cumulative and average annual total investment returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on the ex-dividend date. Insurance related fees and expenses are not reflected in these returns. |

| | | | Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical5 | | |

| | | Beginning

Account Value

July 1, 2014 | | Ending

Account Value

December 31, 2014 | | Expenses Paid

During the Period4 | | Beginning

Account Value

July 1, 2014 | | Ending

Account Value

December 31, 2014 | | Expenses Paid

During the Period4 | | Annualized

Expense Ratio |

BlackRock Large Cap Core Portfolio | | $1,000.00 | | $1,068.00 | | $2.55 | | $1,000.00 | | $1,022.74 | | $2.50 | | 0.49% |

| | 4 | | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 5 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 20 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | 13 |

| | | | |

| Fund Summary as of December 31, 2014 | | | BlackRock Money Market Portfolio | |

|

| For the 12-Month Period Ended December 31, 2014 |

The Federal Open Market Committee (“FOMC”) maintained the federal funds rate in the target range of 0.00% to 0.25% during the 12-month period ended December 31, 2014. U.S. economic performance gained momentum as the year progressed. While the economy contracted by 2.1% in the first quarter of 2014, the factors that were hindering growth proved to be temporary. U.S. gross domestic product rebounded strongly growing at seasonally adjusted rates of 4.6% and 5.0% in the second and third quarters, respectively. The job market improved markedly, with the unemployment rate falling to 5.8% in November, a level not seen since before the financial crisis. In the latter part of 2014, U.S. policymakers became increasingly concerned that tumultuous financial markets, a strengthening dollar and economic weakness overseas, particularly in Europe, would present headwinds to growth in the United States. Despite these reservations, the FOMC decided that enough progress had been made toward attaining its dual objectives of maximum employment within the context of price stability to proceed with its plan to end its asset purchase program in October.

In the eurozone, slow economic growth combined with falling inflation measures continued to disappoint policymakers. In an effort to spur growth and combat deflationary pressures, the European Central Bank (“ECB”) cut its key rates by 0.10% in July, and again by an additional 0.10% in September, boldly taking the deposit rate to a negative 0.20%. The central bank also implemented an asset purchase program focused on asset-backed securities and covered bonds. In December, falling energy prices pushed the consumer price index lower on a year-over-year basis for the first time in five years. Mounting pressure on the ECB to pull out all stops in its battle with deflation raised expectations for large-scale purchases of government bonds in early 2015.

London Interbank Offered Rates (“LIBOR”) remained virtually unchanged over the period amid highly accommodative monetary policy. The benchmark three-month LIBOR ended the period at 0.26%, just one basis point higher than it was at the end of 2013. U.S. Treasury bills outstanding declined by $134 billion over the same period as the federal budget deficit improved and the Treasury Department cut the size of its weekly bill auctions to make room for the issuance of two-year floating rate notes (“FRNs”) – the first new structure issued in nearly 17 years. Treasury FRN issuance totaled $164 billion in 2014. After capping its fixed-rate reverse repurchase agreement program (“RRP”) at $300 billion in September, the Fed offered an additional $300 billion in collateral to facility participants in December through term repo operations that matured on January 5, 2015. These operations were well received by money market participants, who purchased $226 billion at rates ranging from 0.07% to 0.10%.

In the short-term tax-exempt market, conditions remained stable, with strong demand and low supply. During the 12-month period, the benchmark Securities Industry and Financial Markets Association (“SIFMA”) Index, which represents the average rate on seven-day, high-quality, tax-exempt variable rate demand notes (“VRDNs”) (as calculated by Municipal Market Data) ranged between a high of 0.12% and an all-time low of 0.03%, averaging just 0.05% for the period. As monetary policy continued to be accommodative and rates on taxable overnight repos remained low by historical measures for much of the period, tax-exempt VRDNs were generally an attractive investment alternative for taxable money funds. This cross-over demand, coupled with the natural demand from tax-exempt money funds, has placed additional downward pressure on VRDN yields as evidenced by the prolonged low levels of the SIFMA Index.

Tax-exempt money funds experienced large outflows in April, which is a seasonal trend driven by shareholders redeeming shares to pay their federal and state income tax bills. Tax season rolls into “note season” in June, when municipalities typically issue one-year tax and revenue anticipation notes. Given the continued austerity measures at state and local municipalities, spending has been limited as well as the need to issue debt. As such, the supply of new-issue, one-year fixed-rate notes has continued to decline year-over-year, keeping rates low. One-year note yields ended 2014 at 0.14%, down three basis points for the year. Generally speaking, municipal money market funds seek to take advantage of note season to extend their weighted average maturity, pick up yield, and diversify beyond bank exposure in the form of credit enhancement. This year, overall note issuance was approximately 16% lower versus 2013. This lower supply contributed not only to lower one-year rates in the tax-exempt space, but also to additional downward pressure on VRDN rates as investors sought to reinvest their maturing 2013 notes. Given expectations that a change to the FOMC’s monetary policy is on the horizon, issuers will soon need to offer greater yield premiums to entice buyers to extend out to the full year maturity, thereby steepening the yield curve.

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| | | | | | |

| 14 | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| | | | BlackRock Money Market Portfolio | |

BlackRock Money Market Portfolio’s (the “Fund”) investment objective is to seek to preserve capital, to maintain liquidity and achieve the highest possible current income consistent with the foregoing.

| | | | | | | | |

Yields | |

7-Day SEC Yield | | |

7-Day Yield | |

BlackRock Money Market Portfolio | | | 0.00 | % | | | 0.00 | % |

| | |

| Portfolio Composition | | Percent of

Net Assets |

| | | | |

Commercial Paper | | | 42 | % |

Certificates of Deposit | | | 28 | |

Repurchase Agreements | | | 11 | |

Municipal Bonds | | | 7 | |

U.S. Treasury Obligations | | | 4 | |

Corporate Notes | | | 4 | |

Time Deposits | | | 3 | |

U.S. Government Sponsored Agency Obligations | | | 1 | |

Total | | | 100 | % |

The 7-Day SEC Yields may differ from the 7-Day Yield shown above due to the fact that the 7-Day SEC Yield excludes distributed capital gains.

Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical2 | | |

| | | Beginning

Account Value

July 1, 2014 | | Ending

Account Value

December 31, 2014 | | Expenses Paid

During the Period1 | | Beginning

Account Value

July 1, 2014 | | Ending

Account Value

December 31, 2014 | | Expenses Paid

During the Period1 | | Annualized

Expense Ratio |

BlackRock Money Market Portfolio | | $1,000.00 | | $1,000.10 | | $1.16 | | $1,000.00 | | $1,024.05 | | $1.17 | | 0.23% |

| | 1 | | Expenses are equal to the annualized expense, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 2 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 20 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | 15 |

| | | | |

| Fund Summary as of December 31, 2014 | | | BlackRock Total Return Portfolio | |

BlackRock Total Return Portfolio’s (the “Fund”) investment objective is to seek to maximize total return, consistent with income generation and prudent investment management.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the 12-month period ended December 31, 2014, the Fund returned 6.90%, outperforming its benchmark, the Barclays U.S. Aggregate Bond Index, which returned 5.97%. |

What factors influenced performance?

| Ÿ | | The Fund outperformed the benchmark index largely due to its yield curve positioning. Going into 2014, the U.S. yield curve appeared steep, as short-term rates did not fully reflect the risk of the U.S. Federal Reserve normalizing rate policy and long-term rates seemed high given the outlook for growth. The Fund held a curve flattening bias (being overweight to longer maturities and underweight to shorter ones), which contributed to performance (bond prices generally rise as rates fall). Another positive contributor was security selection and an overweight in securitized assets, notably commercial mortgage-backed securities (“CMBS”) and asset-backed securities (“ABS”). A non-benchmark allocation to non-agency residential mortgage-backed securities (“MBS”) added to returns as well. Negative supply and investor demand for yield led to compressed spreads and positive returns across these sectors. |

| Ÿ | | An emphasis on the U.S. dollar versus the euro and the yen helped performance, as global monetary policy and economic growth trends diverged. Positioning in the 10-year portion of the Australian yield curve was also a positive contributor, as it benefited from a decline in yields. |

| Ÿ | | The Fund’s municipal bond position was another contributor to performance. The allocation was made in view of favorable tax-exempt yields relative to taxable yields, and longer-term municipals benefited as the U.S. yield curve flattened. In addition, the asset class benefited from a positive supply/demand backdrop. |

| Ÿ | | On the downside, the Fund’s positioning within the investment grade corporate bond sector and an underweight relative to the benchmark index in agency debentures detracted modestly from results. |

Describe recent portfolio activity.

| Ÿ | | The Fund’s corporate credit exposure was reduced late in the period given the low all-in yields and expected high supply in the investment grade market. In keeping with the Fund’s curve flattening bias, an overweight position was implemented in 30-year MBS versus 15-year MBS, with a tilt toward higher coupons. Toward the end of the period, the Fund moved to a modest underweight in agency MBS. The Fund maintained overweights in CMBS and ABS as the demand for yield continues to support tightening credit spreads in these sectors. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the Barclays U.S. Aggregate Bond Index, the Fund ended the period generally underweight in government-related sectors in favor of non-government spread sectors. Within spread sectors, the Fund was most significantly overweight in CMBS and ABS, and maintained an underweight in investment grade corporate credit. Within the government space, the Fund was underweight in agency debentures and agency MBS. The Fund also held allocations to sectors not represented in the benchmark index, including high yield debt, non-agency residential MBS, collateralized loan obligations and municipal bonds. The Fund ended the period with a modestly shorter duration (lower interest rate sensitivity) than that of the benchmark. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Portfolio Composition | | Percent of Long-Term Investments |

| | | | |

U.S. Government Sponsored Agency Securities | | | 36 | % |

U.S. Treasury Obligations | | | 20 | |

Corporate Bonds | | | 20 | |

Asset-Backed Securities | | | 11 | |

Non-Agency Mortgage-Backed Securities | | | 9 | |

Foreign Government Obligations | | | 3 | |

Taxable Municipal Bonds | | | 1 | |

| | |

| Credit Quality Allocation1 | | Percent of Long-Term Investments |

| | | | |

AAA/Aaa2 | | | 57 | % |

AA/Aa | | | 5 | |

A | | | 12 | |

BBB/Baa | | | 10 | |

BB/Ba | | | 3 | |

B | | | 2 | |

CCC/Caa | | | 1 | |

N/R | | | 10 | |

| | 1 | | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | 2 | | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment advisor has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

| | | | | | |

| 16 | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

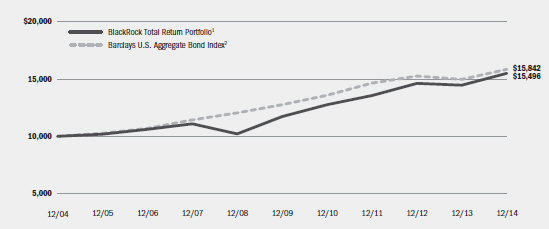

| | | | BlackRock Total Return Portfolio | |

|

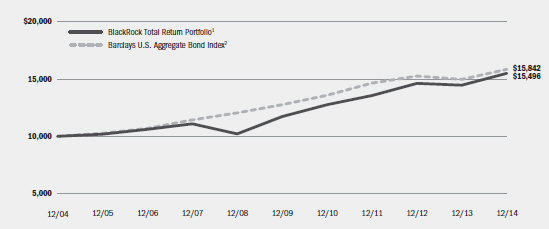

| Total Return Based on a $10,000 Investment |

| | |

| | 1 Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. The Fund, under normal circumstances, will invest at least 80%, and typically invests 90% or more, of its assets in fixed-income securities such as corporate bonds and notes, mortgage-backed securities, asset-backed securities, convertible securities, preferred securities and government obligations. |

| | 2 | | A widely recognized unmanaged market-weighted index, comprised of investment-grade corporate bonds rated BBB or better, mortgages and U.S. Treasury and U.S. Government agency issues with at least one year to maturity. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended December 31, 2014 | |

| | | | | | | | | | | | | | | Average Annual Total Returns4 | |

| | |

| Standardized

30-Day Yield3 |

| |

| Unsubsidized

30-Day Yield3 |

| |

| 6-Month

Total Returns4 |

| | | 1 Year | | | | 5 Years | | | | 10 Years | |

BlackRock Total Return Portfolio | | | 2.77 | % | | | 2.40 | % | | | 1.70 | % | | | 6.90 | % | | | 5.64 | % | | | 4.48 | % |

Barclays U.S. Aggregate Bond Index | | | — | | | | — | | | | 1.96 | | | | 5.97 | | | | 4.45 | | | | 4.71 | |

| | 3 | | The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waivers and/or reimbursements. |

| | 4 | | Cumulative and average annual total investment returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on the ex-dividend/payable date. Insurance-related fees and expenses are not reflected in these returns. |

| | | | Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | | | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical7 |

| | | | | | | Including

Interest Expense | | Excluding

Interest Expense | | | | Including Interest Expense | | Excluding Interest Expense |

| | | Beginning

Account Value

July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period5 | | Expenses Paid

During the Period6 | | Beginning

Account Value

July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period5 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period6 |

BlackRock Total Return Portfolio | | $1,000.00 | | $1,017.00 | | $2.90 | | $2.54 | | $1,000.00 | | $1,022.33 | | $2.91 | | $1,022.68 | | $2.55 |

| | 5 | | Expenses are equal to the annualized expense ratio (0.57%), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 6 | | Expenses are equal to the annualized expense ratio (0.50%), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 7 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 20 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | 17 |

| | | | |

| Fund Summary as of December 31, 2014 | | | BlackRock U.S. Government Bond Portfolio | |

BlackRock U.S. Government Bond Portfolio’s (the “Fund”) investment objective is to seek to maximize total return, consistent with income generation and prudent investment management.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the 12-month period ended December 31, 2014, the Fund returned 5.95%, outperforming its benchmark, the Barclays U.S. Government/ Mortgage Index, which returned 5.41%. |

| Ÿ | | The Fund’s outperformance versus the benchmark index was supported in large part by its yield curve positioning. Specifically, the Fund was positioned to benefit from the flattening of the yield curve (which occurs when the differential between longer-term and shorter-term yields narrows). Within agency mortgage-backed securities (“MBS”), the Fund’s overweight in 30-year versus an underweight in 15-year MBS benefited returns. Additionally, the Fund’s allocation to commercial mortgage-backed securities (“CMBS”) interest-only issues added to results. Finally, an overweight position in the U.S. dollar versus foreign currencies, specifically the euro and the Japanese yen, was also a significant contributor as global monetary policies diverged during the second half of 2014. |

| Ÿ | | Conversely, the Fund’s below benchmark stance with respect to duration (interest rate sensitivity) detracted from performance as interest rates declined over the 12 month period (bond prices generally rise when rates fall). |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, the Fund tactically managed duration in consideration of interest rate expectations. Relative to the benchmark index, the Fund moved from a modestly higher duration in the beginning of the period to a modestly lower one at the end of the period. |

| Ÿ | | Throughout the first half of 2014, the Fund was overweight in MBS, as the sector benefited from subdued rate volatility, a benign prepayment |

| | | landscape and a better-than-expected supply-and-demand backdrop. As the period progressed, the Fund moved to a modest MBS underweight as mortgage rates revisited their recent lows, raising the prospect of increased prepayments. In addition, a shift toward higher coupon, lower duration mortgages was implemented as unemployment edged downward towards the U.S. Federal Reserve’s target. |

| Ÿ | | In securitized sectors, the Fund increased exposure to CMBS and asset-backed securities (“ABS”) in the first half of the period to add income at reasonable valuations. As spreads in these sectors tightened, the Fund reduced these weightings. |

| Ÿ | | The Fund held cash that was committed for pending transactions. The cash balance did not have a material impact on performance. |

| Ÿ | | The Fund uses derivatives as a part of its investment strategy. Derivatives are used by the portfolio management team as a means to manage risk and/or gain or reduce exposure to interest rates, credit risk and/or foreign exchange positions in the Fund. During the period, the Fund’s use of derivatives had a net positive impact on performance. |

Describe Fund positioning at period end.

| Ÿ | | The Fund uses derivatives as a part of its investment strategy. Derivatives are used by the portfolio management team as a means to manage risk and/or gain or reduce exposure to interest rates, credit risk and/or foreign exchange positions in the Fund. During the period, the Fund’s use of derivatives had a net positive impact on performance. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Portfolio Composition | | Percent of

Long-Term Investments |

| | | | |

U.S. Government Sponsored Agency Securities | | | 63 | % |

U.S. Treasury Obligations | | | 30 | |

Corporate Bonds | | | 2 | |

Non-Agency Mortgage-Backed Securities | | | 2 | |

Asset-Backed Securities | | | 1 | |

Foreign Government Obligations | | | 1 | |

Foreign Agency Obligations | | | 1 | |

| | | | | | |

| 18 | | BLACKROCK SERIES FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

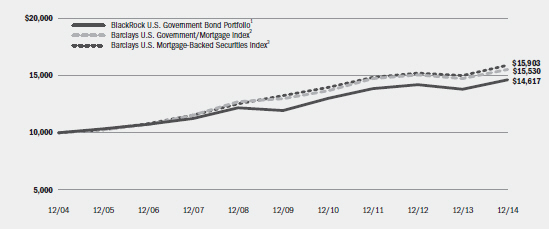

| | | | BlackRock U.S. Government Bond Portfolio | |

|

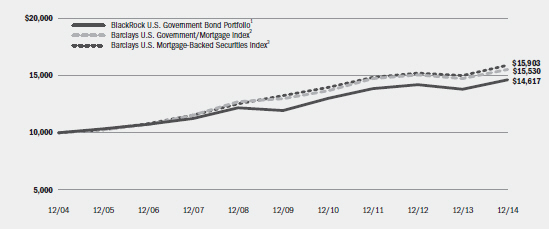

| Total Return Based on a $10,000 Investment |

| | |

| | 1 Assuming transaction costs and other operating expenses, including investment advisory fees, if any. Does not include insurance-related fees and expenses. The Fund, under normal circumstances, will invest at least 80% of its assets in bonds that are issued or guaranteed by the U.S. government and its agencies. The Fund’s total returns prior to October 1, 2011 are the returns of the Fund when it followed a different investment objective and different investment strategies under the name “BlackRock Government Income Portfolio”. 2 This index measures debt issued by the U.S. Government, and its agencies, as well as mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae and Freddie Mac. |

| | 3 | | This unmanaged index includes the mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae and Freddie Mac that meet certain maturity and liquidity criteria. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended December 31, 2014 | |

| | | | | | | | | | | | Average Annual Total Returns5 | |

| | | Standardized

30-Day Yield4 | | | Unsubsidized

30-Day Yield4 | | | 6-Month

Total Returns5 | | | 1 Year | | | 5 Years | | | 10 Years | |

BlackRock U.S. Government Bond Portfolio | | | 2.07 | % | | | 1.87 | % | | | 2.09 | % | | | 5.95 | % | | | 4.06 | % | | | 3.87 | % |

Barclays U.S. Government/Mortgage Index | | | — | | | | — | | | | 2.10 | | | | 5.41 | | | | 3.69 | | | | 4.50 | |

Barclays U.S. Mortgage-Backed Securities Index | | | — | | | | — | | | | 1.97 | | | | 6.08 | | | | 3.73 | | | | 4.75 | |

| | 4 | | The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waivers and/or reimbursements. |

| | 5 | | Cumulative and average annual total investment returns are based on changes in net asset value for the periods shown and assume reinvestment of all distributions at net asset value on the ex-dividend/payable date. Insurance-related fees and expenses are not reflected in these returns. |

| | | | Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | | | | | | | | | | | | | | | |

| Expense Example |