UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00483

Elfun Trusts

(Exact name of registrant as specified in charter)

1600 Summer Street

Stamford, Connecticut 06905

(Address of principal executive offices)(Zip code)

GE Asset Management, Inc.

1600 Summer Street

Stamford, Connecticut 06905

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: 800-242-0134

Date of fiscal year end: 12/31

Date of reporting period: 12/31/15

| Item 1. | Reports to Stockholders |

Elfun Funds

Annual Report

December 31, 2015

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current summary prospectus or prospectus.

Information on the following performance pages relates to the Elfun Funds.

Total returns take into account changes in share price and assume reinvestment of all dividends and capital gains distributions, if any. Total returns shown are net of Fund expenses.

The performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Periods less than one year are not annualized. Please call toll-free (800) 242-0134 or visit the Funds’ website at http://www.geam.com for the most recent month-end performance data.

A portion of the Elfun Tax-Exempt Income Fund’s income may be subject to state, federal and/or alternative minimum tax. Capital gains, if any, are subject to capital gains tax.

An investment in a Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. An investment in a Fund is subject to risk, including possible loss of principal invested.

The Standard & Poor’s (“S&P”) 500® Composite Price Index of stocks (S&P 500 Index), Morgan Stanley Capital International Europe, Australasia, Far East Index (MSCI EAFE® Index), MSCI® ACWI ex-U.S. Index, Barclays U.S. Aggregate Bond Index, the Barclays U.S. Municipal Bond Index, and the 90 Day U.S. T-Bill are unmanaged indices and do not reflect the actual cost of investing in the instruments that comprise each index. The results shown for the foregoing indices assume the reinvestment of net dividends or interest and do not reflect the fees, expenses or taxes.

S&P 500 Index is an unmanaged, market capitalization-weighted index of stocks of 500 large U.S. companies, which is widely used as a measure of large-cap U.S. stock market performance.

MSCI® EAFE® Index is a market capitalization-weighted index of equity securities of companies domiciled in various countries. The index is designed to represent the performance of developed stock markets outside the U.S. and Canada and excludes certain market segments unavailable to U.S. based investors.

MSCI ACWI Ex-U.S. Index is a market-capitalization weighted index designed to provide a broad measure of stock performance throughout the world, with the exception of U.S. based companies. The MSCI ACWI Ex-U.S. Index includes both developed and emerging markets.

Barclays U.S. Aggregate Bond Index is a market value-weighted index of taxable investment-grade debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of one year or more. This index is designed to represent the performance of the U.S. investment-grade first-rate bond market.

Barclays U.S. Municipal Bond Index is an unmanaged index comprised of investment-grade, fixed rate securities with maturities of at least eight years and less than twelve years.

The 90 Day U.S. T-Bill is an unmanaged measure/index of the performance of the most recently auctioned 90 Day U.S. Treasury bills (i.e. having a total maturity of 90 days) currently available in the marketplace.

The peer universe of underlying funds used for the peer group average annual total return calculation is based on the blend of Morningstar peer categories, as shown. Morningstar is an independent mutual fund rating service. A Fund’s performance may be compared to or ranked within a universe of mutual funds with investment objectives and policies similar but not necessarily identical to the Fund.

©2016 Morningstar, Inc. All Rights Reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damage or losses relating from any use of this information. Past performance is no guarantee of future results.

The views, expressed in this document reflect our judgment as of the publication date and are subject to change at any time without notice.

GE Investment Distributors, Inc., member of FINRA, is the principal underwriter and distributor of the Elfun Funds and a wholly owned subsidiary of GE Asset Management Incorporated, the investment adviser of the Funds.

1

(Unaudited)

Ralph R. Layman

Executive Vice President and

Chief Investment

Officer Emeritus

Michael J. Solecki

Senior Vice President and Chief Investment Officer International Equities

The Elfun International Equity Fund is co-managed by Ralph R. Layman and Michael J. Solecki. Messrs. Layman and Solecki both manage the Fund as a collaborative team. Both portfolio managers have the authority to increase or decrease existing positions in the Fund. See portfolio managers’ biographical information beginning on page 98.

| Q. | How did the Elfun International Equity Fund perform compared to its benchmark and Morningstar peer group for the twelve-month period ended December 31, 2015? |

| A. | For the twelve-month period ended December 31, 2015, the Elfun International Equity Fund returned -0.18%. The MSCI EAFE Index, the Fund’s benchmark, returned -0.81% and the Fund’s Morningstar peer group of 821 Foreign Large Blend Funds returned an average of -1.64% over the same period. The Fund performed better than 63% of its Morningstar peer group in 2015. |

| Q. | What market factors affected the Fund’s performance? |

| A. | 2015 began on an optimistic note, with international equity markets surging strongly ahead, as central banks around the world eased monetary conditions in the face of very low inflation. Fears of slowing global growth, volatility in China, and various geo-political tensions soon began to weigh on the equity markets, which reached a high for the year in mid-May. From peak to trough in mid-September, the MSCI EAFE Index fell over 17%, narrowly avoiding the 20% pull-back that typically defines a bear market (a threshold it would pass in early 2016). The market recovered a bit from its September low but nevertheless finished the year down, the second year in a row of negative returns for the MSCI EAFE Index and the third year in a row that the international developed markets have lagged U.S. large caps. |

| | Underneath the overall market performance number was a significant amount of |

| | variability by region and industry. Japan, where the Fund was overweight relative to the MSCI EAFE Index, continued to be a bright spot, returning just under 10% and outperforming the broader index for the third year in a row. By contrast, the U.K. and the Pacific region excluding Japan were weak being more exposed to energy and emerging markets. By industry, the energy and materials sectors were predictably the weakest in 2015, impacted by plummeting commodity prices, while the relatively defensive consumer staples and healthcare enjoyed modest positive returns. In the currency markets, the U.S. dollar strengthened in 2015 against all major currencies, reducing realized returns for U.S. based investors in international equities. |

| Q. | What were the primary drivers of Fund performance? |

| A. | Among sectors, industrials was the biggest contributor to Fund returns, perhaps surprisingly given the negative sentiment around economic growth that existed much of the year. Within industrials, the Fund was overweight relative to the MSCI EAFE Index in areas such as aerospace, airlines, and building products, all of which had solid positive returns. Another positive area was the financial sector, where the Fund did well in insurance and banks both in Japan and the Eurozone. Geographically, the Fund benefitted from its large weight in Japan, where it held just under 30% of its assets on average during 2015, a significantly higher weight than the MSCI EAFE Index. Within Japan, the Fund’s holdings underperformed the MSCI EAFE Index, but still did better than the rest of the world and so helped overall performance. |

| | Hurting performance this year were the Fund’s holdings in energy and mining. The Fund held only a small percent of its assets in these areas and a lower weight than the MSCI EAFE Index, but any exposure was painful, as the fall in commodity prices hurt |

2

(Unaudited)

| | the sector. Related to this, the emerging markets region was under pressure in 2015 and another source of negative returns for the Fund. The Fund had both direct exposure, holding a small weight in companies based in emerging markets, and indirect exposure through developed market companies that sell into emerging market countries. |

| Q. | Were there any significant changes to the Fund during the period? |

| A. | Geographically, the Fund’s weights in Japan, Canada, and the Eurozone were reduced in 2015, while Continental Europe outside of the Eurozone and the U.K. were increased. These changes did not impact the Fund’s positioning relative to the MSCI EAFE Index, where the Fund’s biggest overweights remain Japan and the emerging markets region and biggest underweights remain the U.K. and the Pacific Basin. |

| | Similarly the Fund’s sector positioning relative to the Index changed little in 2015. The biggest changes were in industrials, which was reduced from a modest to a slight overweight, consumer discretionary, from a slight overweight to modest underweight, and consumer staples, where the Fund’s large underweight was reduced. Within industrials, machinery and professional services were reduced in favor of building products. In consumer discretionary, auto exposure was reduced in favor of leisure. In healthcare, while the overall weight didn’t change significantly, pharma was reduced in favor of healthcare equipment and services. |

3

(Unaudited)

Understanding Your Fund’s Expenses

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in units of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended December 31, 2015.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given under the heading “Expenses paid during

the period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

July 1, 2015 – December 31, 2015

| | | | | | | | | | | | |

| | | Account value at

the beginning of

the period ($) | | | Account value

at the end of

the period ($) | | | Expenses

paid during

the period ($)* | |

Actual Fund Return | | | 1,000.00 | | | | 918.90 | | | | 1.79 | |

Hypothetical 5% Return

(2.5% for the period) | | | 1,000.00 | | | | 1,023.34 | | | | 1.89 | |

| * | | Expenses are equal to the Fund’s annualized net expense ratio of 0.37%** (for the period July 1, 2015 – December 31, 2015), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | | May differ from expense ratio disclosed in the financial highlights, which is calculated based on the entire fiscal year’s data. |

4

(Unaudited)

A mutual fund designed for investors who seek long-term growth of capital and future income by investing principally in foreign securities consistent with prudent investment management and the preservation of capital. The Fund seeks to achieve its investment objectives by investing at least 80% of its net assets under normal circumstances in equity securities, such as common and preferred stocks and invests primarily (meaning at least 65%) in companies in both developed and emerging market countries outside the United States.

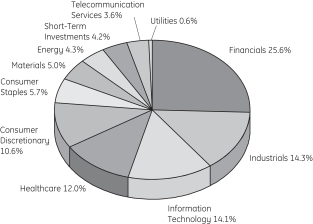

(as a % of Fair Value of Investments of $233,852 (in thousands) on December 31, 2015) (a)(b)

| | | | |

Roche Holding AG | | | 3.11% | |

AIA Group Ltd. | | | 2.43% | |

Nidec Corp. | | | 2.43% | |

Continental AG | | | 2.34% | |

Sanofi | | | 2.12% | |

Baidu Inc. ADR | | | 2.09% | |

Vodafone Group PLC | | | 2.05% | |

Anheuser-Busch InBev S.A. | | | 1.99% | |

BNP Paribas S.A. | | | 1.88% | |

Toyota Motor Corp. | | | 1.85% | |

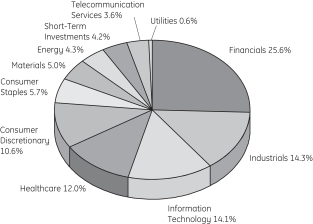

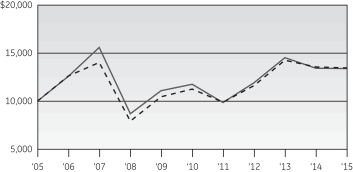

Portfolio composition as a % of Fair Value of Investments of $233,852 (in thousands) on December 31, 2015 (a)(b)

|

| Morningstar Performance Comparison |

Based on average annual returns for periods ended December 31, 2015

| | | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | |

Number of funds in peer group | | | 821 | | | | 699 | | | | 529 | |

Peer group average annual total return | | | -1.64 | % | | | 2.54 | % | | | 2.56 | % |

Morningstar Category in peer group: U.S. Foreign Large Blend | |

|

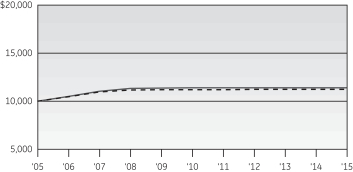

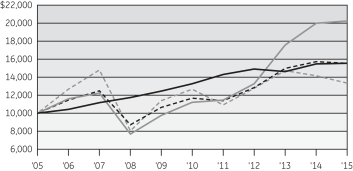

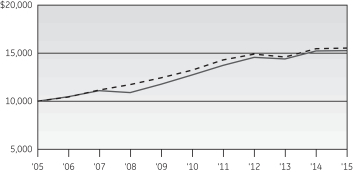

| Change in Value of a $10,000 Investment |

|

| Average Annual Total Return |

For the periods ended December 31, 2015

| | | | | | | | | | | | | | | | | | | | |

| (Inception date: 1/1/88) | | | | | | |

| | | One

Year | | Five

Year | | Ten

Year | | Ending Value of a

$10,000

Investment |

Elfun International

Equity Fund | | | | -0.18% | | | | | 2.67% | | | | | 2.99% | | | | | $13,424 | |

MSCI EAFE Index | | | | -0.81% | | | | | 3.61% | | | | | 3.03% | | | | | $13,479 | |

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund Premier Class. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

See Notes to Performance beginning on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

5

| | |

Elfun International Equity Fund | | December 31, 2015 |

| | | | |

| Elfun International Equity Fund |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

Common Stock — 95.5%† | | | |

| |

Australia — 1.3% | | | |

| | | |

Insurance Australia Group Ltd. | | | 746,565 | | | $ | 3,019,988 | | | |

| | | |

Belgium — 2.0% | | | | | | | | | | |

| | | |

Anheuser-Busch InBev S.A. | | | 37,415 | | | | 4,649,664 | | | |

| | | |

Canada — 1.3% | | | | | | | | | | |

| | | |

Brookfield Asset Management Inc., Class A | | | 33,715 | | | | 1,059,434 | | | |

Cenovus Energy Inc. | | | 166,236 | | | | 2,094,255 | | | |

| | | | 3,153,689 | | | |

| | | |

China — 2.1% | | | | | | | | | | |

| | | |

Baidu Inc. ADR | | | 25,824 | | | | 4,881,769 | | | (a) |

| | | |

France — 13.4% | | | | | | | | | | |

| | | |

Airbus Group SE | | | 18,642 | | | | 1,255,550 | | | |

AXA S.A. | | | 142,904 | | | | 3,916,620 | | | |

BNP Paribas S.A. | | | 77,637 | | | | 4,404,925 | | | |

Credit Agricole S.A. | | | 182,632 | | | | 2,158,518 | | | |

Safran S.A. | | | 26,294 | | | | 1,810,048 | | | |

Sanofi | | | 58,134 | | | | 4,963,666 | | | |

Schneider Electric SE | | | 42,171 | | | | 2,407,793 | | | |

Technip S.A. | | | 62,762 | | | | 3,118,137 | | | |

Total S.A. | | | 53,505 | | | | 2,398,424 | | | |

Vivendi S.A. | | | 103,570 | | | | 2,234,411 | | | |

Zodiac Aerospace | | | 109,834 | | | | 2,621,896 | | | |

| | | | 31,289,988 | | | |

| | | |

Germany — 8.9% | | | | | | | | | | |

| | | |

Bayer AG | | | 29,829 | | | | 3,752,296 | | | |

Continental AG | | | 22,430 | | | | 5,471,320 | | | |

Fresenius SE & Company KGaA | | | 50,928 | | | | 3,649,664 | | | |

HeidelbergCement AG | | | 33,256 | | | | 2,731,848 | | | |

Linde AG | | | 17,354 | | | | 2,524,236 | | | |

SAP SE | | | 35,063 | | | | 2,794,966 | | | |

| | | | 20,924,330 | | | |

| | | |

Hong Kong — 2.4% | | | | | | | | | | |

| | | |

AIA Group Ltd. | | | 946,962 | | | | 5,693,881 | | | |

| | | |

India — 2.0% | | | | | | | | | | |

| | | |

ICICI Bank Ltd. | | | 561,369 | | | | 2,214,716 | | | |

Larsen & Toubro Ltd. | | | 61,477 | | | | 1,186,677 | | | |

Power Grid Corporation of India Ltd. | | | 621,316 | | | | 1,331,266 | | | |

| | | | 4,732,659 | | | |

| | | |

Ireland — 0.8% | | | | | | | | | | |

| | | |

Kerry Group PLC, Class A | | | 22,199 | | | | 1,840,198 | | | |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | |

Italy — 1.4% | | | | | | | | | | |

| | | |

Intesa Sanpaolo S.p.A. | | | 962,834 | | | $ | 3,229,821 | | | |

| | | |

Japan — 28.0% | | | | | | | | | | |

| | | |

Astellas Pharma Inc. | | | 134,800 | | | | 1,940,282 | | | |

East Japan Railway Co. | | | 30,200 | | | | 2,874,517 | | | |

FANUC Corp. | | | 18,900 | | | | 3,311,958 | | | |

Fast Retailing Company Ltd. | | | 5,266 | | | | 1,866,597 | | | |

Fuji Heavy Industries Ltd. | | | 46,600 | | | | 1,947,364 | | | |

Hitachi Ltd. | | | 631,000 | | | | 3,627,221 | | | |

Japan Post Holdings Company Ltd. | | | 76,000 | | | | 1,178,270 | | | (a) |

Kao Corp. | | | 50,500 | | | | 2,625,857 | | | |

Keyence Corp. | | | 4,800 | | | | 2,676,620 | | | |

Mitsubishi Estate Company Ltd. | | | 179,459 | | | | 3,764,618 | | | |

Mitsubishi Heavy Industries Ltd. | | | 559,000 | | | | 2,478,197 | | | |

Mitsubishi UFJ Financial Group Inc. | | | 630,700 | | | | 3,969,433 | | | |

Mitsui Fudosan Company Ltd. | | | 167,118 | | | | 4,245,502 | | | |

Murata Manufacturing Company Ltd. | | | 17,597 | | | | 2,570,176 | | | |

Nidec Corp. | | | 77,500 | | | | 5,693,233 | | | |

Rakuten Inc. | | | 217,597 | | | | 2,537,833 | | | (a) |

Secom Company Ltd. | | | 24,600 | | | | 1,685,058 | | | |

Shimano Inc. | | | 8,700 | | | | 1,349,532 | | | |

SoftBank Group Corp. | | | 72,701 | | | | 3,710,141 | | | |

Sumitomo Mitsui Financial Group Inc. | | | 93,000 | | | | 3,560,896 | | | |

Tokio Marine Holdings Inc. | | | 91,500 | | | | 3,584,089 | | | |

Toyota Motor Corp. | | | 69,482 | | | | 4,325,044 | | | |

| | | | 65,522,438 | | | |

| | | |

Mexico — 0.4% | | | | | | | | | | |

| | | |

Grupo Financiero Banorte SAB de C.V., Class O | | | 173,832 | | | | 954,150 | | | |

| | | |

Netherlands — 3.0% | | | | | | | | | | |

| | | |

ASML Holding N.V. | | | 42,813 | | | | 3,839,216 | | | |

ING Groep N.V. | | | 239,758 | | | | 3,242,591 | | | |

| | | | 7,081,807 | | | |

| | | |

Norway — 1.1% | | | | | | | | | | |

| | | |

Statoil ASA | | | 178,582 | | | | 2,495,732 | | | |

| | | |

South Korea — 0.9% | | | | | | | | | | |

| | | |

Samsung Electronics Company Ltd. | | | 1,955 | | | | 2,100,806 | | | |

| | | |

Spain — 0.6% | | | | | | | | | | |

| | | |

Banco Bilbao Vizcaya Argentaria S.A. | | | 199,324 | | | | 1,459,166 | | | |

| | | |

Sweden — 5.0% | | | | | | | | | | |

| | | |

Assa Abloy AB, Class B | | | 153,618 | | | | 3,243,423 | | | |

Hexagon AB, Class B | | | 82,026 | | | | 3,062,864 | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

6

| | |

Elfun International Equity Fund | | December 31, 2015 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

Svenska Cellulosa AB SCA, Class B | | | 53,416 | | | $ | 1,561,816 | | | |

Telefonaktiebolaget LM Ericsson, Class B | | | 405,238 | | | | 3,955,957 | | | |

| | | | 11,824,060 | | | |

| | | |

Switzerland — 7.5% | | | | | | | | | | |

| | | |

Geberit AG | | | 6,967 | | | | 2,367,805 | | | |

Givaudan S.A. | | | 1,726 | | | | 3,143,355 | | | |

Nestle S.A. | | | 33,800 | | | | 2,517,273 | | | |

Roche Holding AG | | | 26,338 | | | | 7,272,551 | | | |

The Swatch Group AG | | | 6,219 | | | | 2,175,718 | | | |

| | | | 17,476,702 | | | |

| | | |

Taiwan — 1.4% | | | | | | | | | | |

| | | |

Taiwan Semiconductor Manufacturing Company Ltd. | | | 777,900 | | | | 3,386,602 | | | |

| | | |

United Kingdom — 12.0% | | | | | | | | | | |

| | | |

Barclays PLC | | | 1,193,380 | | | | 3,850,282 | | | |

BHP Billiton PLC | | | 113,574 | | | | 1,272,215 | | | |

Capita PLC | | | 58,199 | | | | 1,036,217 | | | |

HSBC Holdings PLC | | | 185,477 | | | | 1,465,834 | | | |

International Consolidated Airlines Group S.A. | | | 166,964 | | | | 1,502,369 | | | |

Johnson Matthey PLC | | | 51,013 | | | | 1,997,747 | | | |

Prudential PLC | | | 129,932 | | | | 2,931,969 | | | |

Shire PLC | | | 38,222 | | | | 2,646,638 | | | |

Smith & Nephew PLC | | | 218,499 | | | | 3,890,312 | | | |

Vodafone Group PLC | | | 1,474,875 | | | | 4,804,139 | | | |

WPP PLC | | | 122,925 | | | | 2,831,831 | | | |

| | | | 28,229,553 | | | |

| | | |

Total Common Stock

(Cost $218,447,011) | | | | | | | 223,947,003 | | | |

| | | | | | | | | | |

Short-Term Investments — 4.2% | | | |

| | | |

State Street Institutional U.S. Government Money Market Fund — Premier Class | | | | | | | | | | |

0.09% | | | | | | $ | 9,904,614 | | | (d,h,p) |

(Cost $9,904,614) | | | | | | | | | | |

| | | |

Total Investments

(Cost $228,351,625) | | | | | | | 233,851,617 | | | |

| | | |

Other Assets and Liabilities, net — 0.3% | | | | | | | 596,201 | | | |

| | | | | | | | | | |

| | | |

NET ASSETS — 100.0% | | | | | | $ | 234,447,818 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

The Fund had the following long futures contracts open at December 31, 2015:

| | | | | | | | | | | | | | | | | |

| Description | | Expiration

date | | Number

of

Contracts | | Current

Notional

Value | | Unrealized

Appreciation |

EURO Stoxx 50 Index Futures | | March 2016 | | | | 65 | | | | $ | 2,317,404 | | | | $ | 12,171 | |

FTSE 100 Index Futures | | March 2016 | | | | 7 | | | | | 639,466 | | | | | 17,173 | |

Topix Index Futures | | March 2016 | | | | 12 | | | | | 1,543,705 | | | | | 25,723 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | $ | 55,067 | |

| | | | | | | | | | | | | | | | | |

The Fund was invested in the following sectors at December 31, 2015 (unaudited):

| | | | | |

| Sector | | Percentage

(based on

Fair Value) |

Diversified Banks | | | | 13.05% | |

Pharmaceuticals | | | | 8.80% | |

Life & Health Insurance | | | | 4.19% | |

Electronic Equipment & Instruments | | | | 4.01% | |

Diversified Real Estate Activities | | | | 3.88% | |

Wireless Telecommunication Services | | | | 3.64% | |

Electrical Components & Equipment | | | | 3.46% | |

Integrated Oil & Gas | | | | 2.99% | |

Property & Casualty Insurance | | | | 2.82% | |

Automobile Manufacturers | | | | 2.68% | |

Industrial Machinery | | | | 2.48% | |

Aerospace & Defense | | | | 2.43% | |

Building Products | | | | 2.40% | |

Auto Parts & Equipment | | | | 2.34% | |

Specialty Chemicals | | | | 2.20% | |

Internet Software & Services | | | | 2.09% | |

Brewers | | | | 1.99% | |

Packaged Foods & Meats | | | | 1.86% | |

Communications Equipment | | | | 1.69% | |

Multi-Line Insurance | | | | 1.67% | |

Healthcare Equipment | | | | 1.66% | |

Semiconductor Equipment | | | | 1.64% | |

Healthcare Services | | | | 1.56% | |

Semiconductors | | | | 1.45% | |

Oil & Gas Equipment & Services | | | | 1.33% | |

Railroads | | | | 1.23% | |

Advertising | | | | 1.21% | |

Application Software | | | | 1.19% | |

Construction Materials | | | | 1.17% | |

Personal Products | | | | 1.12% | |

Electronic Components | | | | 1.10% | |

Internet Retail | | | | 1.09% | |

Industrial Gases | | | | 1.08% | |

Movies & Entertainment | | | | 0.96% | |

Apparel, Accessories & Luxury Goods | | | | 0.93% | |

See Notes to Schedules of Investments and Notes to Financial Statements.

7

| | |

Elfun International Equity Fund | | December 31, 2015 |

| | | | | |

| | | | | |

Technology Hardware, Storage & Peripherals | | | | 0.90% | |

Apparel Retail | | | | 0.80% | |

Security & Alarm Services | | | | 0.72% | |

Household Products | | | | 0.67% | |

Airlines | | | | 0.64% | |

Leisure Products | | | | 0.58% | |

Electric Utilities | | | | 0.57% | |

Diversified Metals & Mining | | | | 0.54% | |

Construction & Engineering | | | | 0.51% | |

Human Resource & Employment Services | | | | 0.44% | |

| | | | | |

| | | | 95.76% | |

| | | | | |

| | | | | |

| Short-Term Investments | | |

Short-Term Investments | | | | 4.24% | |

| | | | | |

| | | | 4.24% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

8

(Unaudited)

David B. Carlson

Chief Investment Officer – U.S. Equities

The Elfun Trusts is managed by David B. Carlson. See portfolio managers’ biographical information beginning on page 98.

| Q. | How did the Elfun Trusts Fund perform compared to its benchmark and Morningstar peer group for the twelve-month period ended December 31, 2015? |

| A. | For the twelve-month period ended December 31, 2015, the Elfun Trusts Fund returned 1.70%. The S&P 500® Index (S&P 500 Index), the Fund’s benchmark, returned 1.38% and the Fund’s Morningstar peer group of 1,744 U.S. Large Cap Growth Funds returned an average of 3.57% over the same period. |

| Q. | What market factors affected the Fund’s performance? |

| A. | The overall market as measured by the S&P 500 was only up 1.4%, but the dividend yield was approximately 2%, so prices were generally lower for the year. More stocks declined in price than gained for the year. Earnings growth for the S&P 500 was flattish. Energy sector earnings were down sharply and the rest of the market’s earnings grew modestly. Elfun Trusts’ return was slightly better than the S&P 500 Index, but we trailed the median return of our Morningstar peer group of growth funds. In January of this year, Barron’s magazine recognized Elfun Trusts in an article on long term performance noting that Elfun Trusts was one of a small number of funds that have beaten the S&P 500 on a 1, 3, 5, 10, 15, and 25 rolling year basis. |

| Q. | What were the primary drivers of Fund performance? |

| A. | We look at performance in two buckets: sector allocation and stock selection. Last year, we did better in sector allocation than we did in stock selection, meaning our decision to underweight energy and overweight healthcare was more beneficial than our stock selection within sectors. Energy stocks were down about 20% last year and we owned less than the market. |

| | Healthcare stocks were up about 6% and make up 20% of the portfolio vs. 15% for the market. We were helped by our overweight in financial stocks which were up about 3% for the year. |

| | The technology sector is our largest weight representing 27% of the portfolio compared with 21% of the S&P 500. Stocks within the tech sector had a very wide range of performance and that was true of our holdings as well. Our holdings of Amazon (+118%) and Google (+45%) helped while our holdings of Qualcomm (-31%) and Baidu (-17%) hurt performance. Our decision to underweight energy, materials, utilities and industrials helped relative performance as all four sectors declined for the year. |

| Q. | Were there any significant changes to the Fund during the period? |

| A. | Changes in the portfolio were modest and our turnover rate remained below 20%. We continue to focus on the long term in our stock selection. We ended the year with 53 names in the portfolio, up from 51 at the start. We continue to have a growth tilt with overweights in the technology, healthcare and consumer-discretionary sectors. We have a growing weight in internet companies as we believe we are in an era of significant disruption to traditional business models. We are underweighted in cyclicals such as energy, materials and industrials. We have no holdings in the utility sector. It’s been six years since the last recession and bear market, and it’s been the slowest recovery on record in terms of economic growth. We think the slow growth continues and we are concentrated in companies with above-average organic growth, meaning they don’t need a strong economy to meet our growth expectations. We also favor financial strength, market leadership and great management teams. We believe this combination of high-quality characteristics in our companies will lead to long term outperformance in their share prices. |

9

(Unaudited)

Understanding Your Fund’s Expenses

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in units of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended December 31, 2015.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given under the heading “Expenses paid during

the period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

July 1, 2015 – December 31, 2015

| | | | | | | | | | | | |

| | | Account value at

the beginning of

the period ($) | | | Account value

at the end of

the period ($) | | | Expenses

paid during

the period ($)* | |

Actual Fund Return | | | 1,000.00 | | | | 994.40 | | | | 0.75 | |

Hypothetical 5% Return

(2.5% for the period) | | | 1,000.00 | | | | 1,024.45 | | | | 0.77 | |

| * | | Expenses are equal to the Fund’s annualized net expense ratio of 0.15%** (for the period July 1, 2015 – December 31, 2015), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | | May differ from expense ratio disclosed in the financial highlights, which is calculated based on the entire fiscal year’s data. |

10

(Unaudited)

A mutual fund designed for investors who seek long-term growth of capital and future income rather than current income. The Fund seeks to achieve its investment objectives by investing in equity securities of U.S. companies, such as common and preferred stocks.

(as a % of Fair Value of Investments of $2,359,040 (in thousands) on December 31, 2015) (a)(b)

| | | | |

Visa Inc., Class A | | | 4.57% | |

Allergan PLC | | | 4.50% | |

PepsiCo Inc. | | | 4.07% | |

Amazon.com Inc. | | | 4.01% | |

Baidu Inc. ADR | | | 3.69% | |

CME Group Inc. | | | 3.57% | |

State Street Corp. | | | 3.38% | |

Amgen Inc. | | | 3.37% | |

Liberty Global PLC, Class C | | | 3.37% | |

Comcast Corp., Class A | | | 3.35% | |

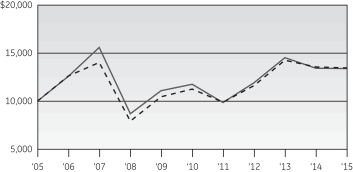

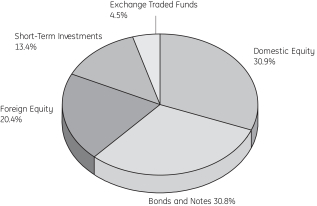

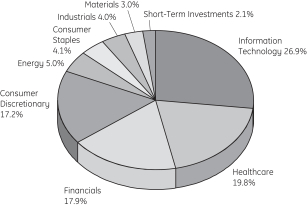

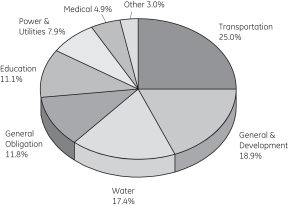

Portfolio composition as a % of Fair Value of Investments of $2,359,040 (in thousands) on December 31, 2015 (a)(b)

|

| Morningstar Performance Comparison |

Based on average annual returns for periods ended December 31, 2015

| | | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | |

Number of funds in peer group | | | 1,744 | | | | 1,547 | | | | 1,330 | |

Peer group average annual total return | | | 3.57 | % | | | 11.37 | % | | | 6.70 | % |

Morningstar Category in peer group: U.S. Large Growth | |

|

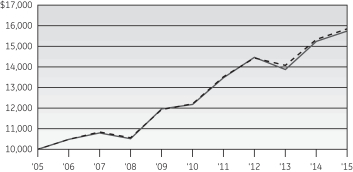

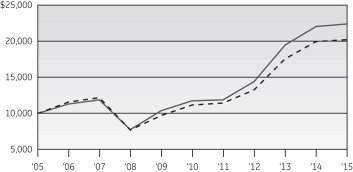

| Change in Value of a $10,000 Investment |

|

| Average Annual Total Return |

For the periods ended December 31, 2015

| | | | | | | | | | | | | | | | | | | | |

| (Inception date: 5/27/35) | | | | | | |

| | | One

Year | | Five

Year | | Ten

Year | | Ending Value of a

$10,000

Investment |

Elfun Trusts | | | | 1.70% | | | | | 13.80% | | | | | 8.41% | | | | | $22,425 | |

S&P 500 Index | | | | 1.38% | | | | | 12.57% | | | | | 7.31% | | | | | $20,242 | |

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund Premier Class. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

See Notes to Performance beginning on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

| | |

Elfun Trusts | | December 31, 2015 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair Value | | | |

Common Stock — 97.7%† | | | |

| |

Aerospace & Defense — 1.0% | | | |

| | | |

Hexcel Corp. | | | 130,000 | | | $ | 6,038,500 | | | |

Honeywell International Inc. | | | 160,000 | | | | 16,571,200 | | | |

| | | | 22,609,700 | | | |

| |

Air Freight & Logistics — 1.0% | | | |

| | | |

United Parcel Service Inc., Class B | | | 250,000 | | | | 24,057,500 | | | |

| |

Application Software — 2.2% | | | |

| | | |

Intuit Inc. | | | 550,000 | | | | 53,075,000 | | | |

|

Asset Management & Custody Banks — 3.4% |

| | | |

State Street Corp. | | | 1,200,000 | | | | 79,632,000 | | | (e) |

| |

Biotechnology — 7.0% | | | |

| | | |

Alexion Pharmaceuticals Inc. | | | 160,000 | | | | 30,520,000 | | | (a) |

Amgen Inc. | | | 490,000 | | | | 79,541,700 | | | |

Gilead Sciences Inc. | | | 550,000 | | | | 55,654,500 | | | |

| | | | 165,716,200 | | | |

| |

Broadcasting — 0.6% | | | |

| | | |

Discovery Communications Inc.,

Class C | | | 550,000 | | | | 13,871,000 | | | (a) |

| | | |

Cable & Satellite — 7.5% | | | | | | | | | | |

| | | |

Comcast Corp., Class A | | | 1,400,000 | | | | 79,002,000 | | | |

Liberty Global PLC, Class C | | | 1,950,000 | | | | 79,501,500 | | | (a) |

Sirius XM Holdings Inc. | | | 4,500,000 | | | | 18,315,000 | | | (a) |

| | | | 176,818,500 | | | |

| |

Casinos & Gaming — 0.6% | | | |

| | | |

Las Vegas Sands Corp. | | | 350,000 | | | | 15,344,000 | | | |

|

Communications Equipment — 2.5% |

| | | |

QUALCOMM Inc. | | | 1,200,000 | | | | 59,982,000 | | | |

|

Data Processing & Outsourced Services — 7.5% |

| | | |

Automatic Data Processing Inc. | | | 200,000 | | | | 16,944,000 | | | |

Paychex Inc. | | | 170,000 | | | | 8,991,300 | | | |

PayPal Holdings Inc. | | | 1,150,000 | | | | 41,630,000 | | | (a) |

Square Inc. Class A | | | 60,000 | | | | 785,400 | | | (a) |

Visa Inc., Class A | | | 1,390,000 | | | | 107,794,500 | | | |

| | | | 176,145,200 | | | |

| | | |

Diversified Banks — 3.2% | | | | | | | | | | |

| | | |

JPMorgan Chase & Co. | | | 1,150,000 | | | | 75,934,500 | | | |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair Value | | | |

|

Environmental & Facilities Services — 0.2% |

| | | |

Stericycle Inc. | | | 45,000 | | | $ | 5,427,000 | | | (a) |

|

Fertilizers & Agricultural Chemicals — 3.0% |

| | | |

Monsanto Co. | | | 720,000 | | | | 70,934,400 | | | |

|

Healthcare Equipment — 4.1% |

| | | |

Abbott Laboratories | | | 600,000 | | | | 26,946,000 | | | |

Medtronic PLC | | | 900,000 | | | | 69,228,000 | | | |

| | | | 96,174,000 | | | |

| | | |

Healthcare Supplies — 1.2% | | | | | | | | | | |

| | | |

The Cooper Companies Inc. | | | 210,000 | | | | 28,182,000 | | | |

|

Home Improvement Retail — 3.1% |

| | | |

Lowe’s Companies Inc. | | | 960,000 | | | | 72,998,400 | | | |

| | | |

Industrial Machinery — 0.7% | | | | | | | | | | |

| | | |

Dover Corp. | | | 275,000 | | | | 16,860,250 | | | |

| | | |

Integrated Oil & Gas — 1.3% | | | | | | | | | | |

| | | |

Chevron Corp. | | | 330,000 | | | | 29,686,800 | | | |

| | | |

Internet Retail — 4.0% | | | | | | | | | | |

| | | |

Amazon.com Inc. | | | 140,000 | | | | 94,624,600 | | | (a) |

|

Internet Software & Services — 11.4% |

| | | |

Alibaba Group Holding Ltd. ADR | | | 80,000 | | | | 6,501,600 | | | (a) |

Alphabet Inc., Class A | | | 38,000 | | | | 29,564,380 | | | (a) |

Alphabet Inc., Class C | | | 83,000 | | | | 62,987,040 | | | (a) |

Baidu Inc. ADR | | | 460,000 | | | | 86,958,400 | | | (a) |

eBay Inc. | | | 1,700,000 | | | | 46,716,000 | | | (a) |

Facebook Inc., Class A | | | 190,000 | | | | 19,885,400 | | | (a) |

LinkedIn Corp., Class A | | | 70,000 | | | | 15,755,600 | | | (a) |

| | | | 268,368,420 | | | |

|

Investment Banking & Brokerage — 2.6% |

| | | |

The Charles Schwab Corp. | | | 1,880,000 | | | | 61,908,400 | | | |

|

Movies & Entertainment — 1.3% |

| | | |

The Walt Disney Co. | | | 300,000 | | | | 31,524,000 | | | |

|

Oil & Gas Equipment & Services — 3.1% |

| | | |

Schlumberger Ltd. | | | 1,050,000 | | | | 73,237,500 | | | |

|

Oil & Gas Exploration & Production — 0.7% |

| | | |

Anadarko Petroleum Corp. | | | 330,000 | | | | 16,031,400 | | | |

|

Pharmaceuticals — 7.5% |

| | | |

Allergan PLC | | | 340,000 | | | | 106,250,000 | | | (a) |

Johnson & Johnson | | | 460,000 | | | | 47,251,200 | | | |

Merck & Company Inc. | | | 250,000 | | | | 13,205,000 | | | |

Pfizer Inc. | | | 300,000 | | | | 9,684,000 | | | |

| | | | 176,390,200 | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

12

| | |

Elfun Trusts | | December 31, 2015 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair Value | | | |

| | | |

Reinsurance — 0.4% | | | | | | | | | | |

| | | |

Alleghany Corp. | | | 20,000 | | | $ | 9,558,600 | | | (a) |

| | | |

Soft Drinks — 4.1% | | | | | | | | | | |

| | | |

PepsiCo Inc. | | | 960,000 | | | | 95,923,200 | | | |

|

Specialized Finance — 5.6% |

| | | |

CME Group Inc. | | | 930,000 | | | | 84,258,000 | | | |

McGraw Hill Financial Inc. | | | 500,000 | | | | 49,290,000 | | | |

| | | | 133,548,000 | | | |

|

Specialized REITs — 2.6% |

| | | |

American Tower Corp. | | | 640,000 | | | | 62,048,000 | | | |

|

Technology Hardware, Storage & Peripherals — 3.2% |

| | | |

Apple Inc. | | | 720,000 | | | | 75,787,200 | | | |

|

Trading Companies & Distributors — 1.1% |

| | | |

United Rentals Inc. | | | 360,000 | | | | 26,114,400 | | | (a) |

| | | |

Total Common Stock

(Cost $1,368,999,454) | | | | | | | 2,308,512,370 | | | |

| | | | | | | | | | |

Short-Term Investments — 2.1% | | | |

| | | |

State Street Institutional U.S. Government Money Market

Fund — Premier Class | | | | | | | | | | |

0.09% | | | | | | $ | 50,527,506 | | | (d,p) |

(Cost $50,527,506) | | | | | | | | | | |

| | | |

Total Investments

(Cost $1,419,526,960) | | | | | | | 2,359,039,876 | | | |

| | | |

Other Assets and Liabilities,

net — 0.2% | | | | | | | 5,279,602 | | | |

| | | | | | | | | | |

| | | |

NET ASSETS — 100.0% | | | | | | $ | 2,364,319,478 | | | |

| | | | | | | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

13

(Unaudited)

David Wiederecht

President and

Chief Investment

Officer – Investment Solutions

Jeffrey Palma

Senior Vice President and Chief Market Strategist

The Elfun Diversified Fund is managed by Jeffrey Palma and David Wiederecht. Messrs. Palma and Wiederecht are vested with oversight authority for determining asset allocations for the Fund. Each of the U.S. equity, international equity and fixed income portions of the Fund are managed by separate teams of portfolio managers and analysts. The sub-portfolios underlying the Fund are managed independently of each other, and the portfolio managers have full discretion over their particular sub-portfolio; however, the portfolio management team is collaborative to ensure strict adherence to seek the Fund’s objective. See portfolio managers’ biographical information beginning on page 98.

| Q. | How did the Elfun Diversified Fund perform compared to its benchmark and Morningstar peer group for the twelve-month period ended December 31, 2015? |

| A. | For the twelve-month period ended December 31, 2015, the Elfun Diversified Fund returned -1.25%. The Fund’s broad based benchmarks, the S&P 500® Index (S&P 500 Index), the MSCI All Country World ex-U.S. Index, and the Barclays U.S. Aggregate Bond Index, returned 1.38%, -5.66%, and 0.55%, respectively. The Fund’s Morningstar peer group of 967 U.S. Moderate Allocation funds returned an average of -1.98% over the same period. |

| Q. | What market factors affected the Fund’s performance? |

| A. | 2015 was a challenging year for markets across asset classes. Indeed, returns were negative or only slightly positive in both equity and fixed income markets. Overall, global growth trends were challenging in 2015 with Global GDP expected to have decelerated to just 3.1% (from 3.4% in 2014). The US and Japan showed little change, Europe fared a bit better, but China and the emerging market complex was clearly weaker. For most of the second half of the year, economic growth surprised to the downside in the US, while Europe was a bit more resilient. |

| | Global equity market returns for the year were lackluster with only low single-digit total returns in most markets. The overhang of macro and policy uncertainty, weakness in energy markets, and weak earnings (and a strong dollar for US companies) were contributing fundamental factors. Further, PE multiples were unable to provide the support to drive gains. With valuations already above long-term averages, this is not particularly surprising, but underscores an ongoing headwind for equity returns moving forward. Indeed, it is difficult to count on valuations to drive returns higher at this advanced stage of the cycle. |

| | In 2015, most of the major fixed income markets saw rates move higher. In credit, returns struggled all year. With investment grade and high yield spreads both wider through 2015, returns were under pressure, while the rise in Treasury yields further depressed returns. |

| | On top of challenging returns, volatility across markets also presented a difficult market backdrop. The combination of macro weakness and uncertainty, policy shift from the Fed, weakness in commodity and credit markets, and geopolitical unrest created an unsettled environment. Alongside valuations and fundamentals, this combination resulted in low aggregate returns and weak returns in stocks and bonds. |

| Q. | What were the primary drivers of Fund performance? |

| A. | Soft returns in US equities acted as the biggest drag on performance. Moreover, an underweight allocation to fixed income markets was also a headwind as returns, though modest, were positive. Returns on cash were positive courtesy of tactical asset allocation positions taken on crude oil during the year and downside equity market hedges put in place in the second half of 2015. |

14

(Unaudited)

| Q. | Were there any significant changes to the Fund during the period? |

| A. | Over the course of 2015, our allocation to equity markets declined slightly as we reduced our overweight position in US equity markets to neutral. Our positioning in international equities was relatively constant, though we did add a bit to Emerging Market equities towards the end of the year. |

| | We have maintained an underweight allocation to fixed income markets and a matching overweight position in cash for some time based on our view that valuations in bond markets are relatively unattractive and that tighter Fed policy could exert some upward pressure on bond yields. To that end, we have preferred to hold a larger position in cash than in our benchmark to reflect this view. Looking ahead, we expect another volatile and challenging environment in 2016. As a result, we have reduced our long-standing overweight allocation to equity markets back towards neutral. We believe there will be opportunities to take advantage of volatility through the year but managing downside risk will be a critical element of tactical asset allocation in the year ahead. |

15

(Unaudited)

Understanding Your Fund’s Expenses

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in units of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended December 31, 2015.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given under the heading “Expenses paid during

the period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

July 1, 2015 – December 31, 2015

| | | | | | | | | | | | |

| | | Account value at

the beginning of

the period ($) | | | Account value

at the end of

the period ($) | | | Expenses paid during

the period ($)* | |

Actual Fund Return | | | 1,000.00 | | | | 964.90 | | | | 1.78 | |

Hypothetical 5% Return

(2.5% for the period) | | | 1,000.00 | | | | 1,023.39 | | | | 1.84 | |

| * | | Expenses are equal to the Fund’s annualized net expense ratio of 0.36%** (for the period July 1, 2015 – December 31, 2015), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | | May differ from expense ratio disclosed in the financial highlights, which is calculated based on the entire fiscal year’s data. |

16

(Unaudited)

A mutual fund designed for investors who seek the highest total return, composed of income and capital appreciation, as is consistent with prudent investment management and the preservation of capital. The Fund seeks to achieve its investment objective by investing primarily in a combination of U.S. and foreign (non-U.S.) equity and debt securities and cash. The Fund’s asset allocation process utilizes information from GE Asset Management’s Asset Allocation Committee to diversify holdings across these asset classes and to adjust the asset class weightings based on market and economic conditions.

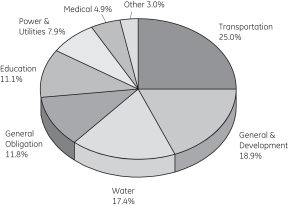

|

| Top Ten Largest Equity Holdings |

(as a % of Fair Value of Investments of $212,685 (in thousands) on December 31, 2015) (a)(b)

| | | | |

Allergan PLC | | | 1.14% | |

Comcast Corp., Class A | | | 0.94% | |

Amgen Inc. | | | 0.93% | |

JPMorgan Chase & Co. | | | 0.87% | |

Apple Inc. | | | 0.82% | |

Baidu Inc. ADR | | | 0.80% | |

Johnson & Johnson | | | 0.74% | |

Exxon Mobil Corp. | | | 0.73% | |

Cisco Systems Inc. | | | 0.72% | |

Medtronic PLC | | | 0.70% | |

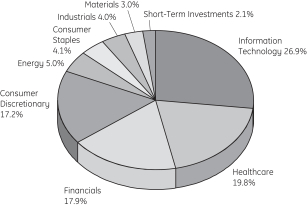

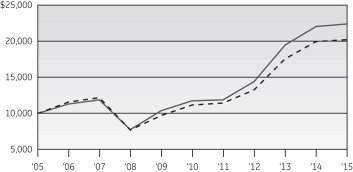

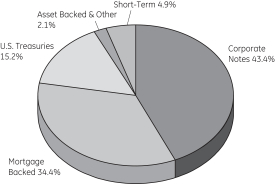

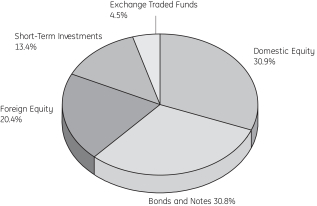

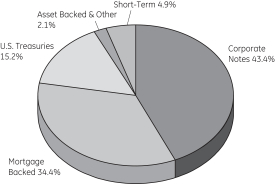

Portfolio composition as a % of Fair Value of Investments of $212,685 (in thousands) on December 31, 2015 (a)(b)

|

| Morningstar Performance Comparison |

Based on average annual returns for periods ended December 31, 2015

| | | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | |

Number of funds in peer group | | | 967 | | | | 834 | | | | 670 | |

Peer group average annual total return | | | -1.98 | % | | | 6.05 | % | | | 4.64 | % |

Morningstar Category in peer group: U.S. Moderate Allocation | |

|

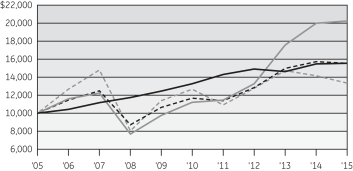

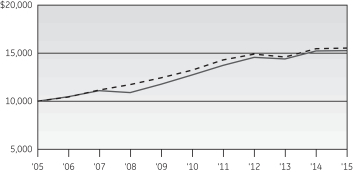

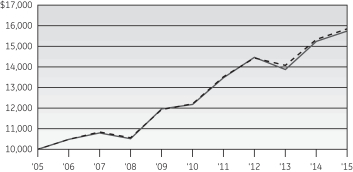

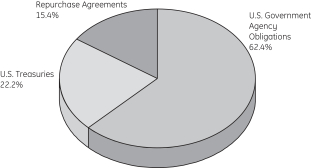

| Change in Value of a $10,000 Investment |

|

| Average Annual Total Return |

For the periods ended December 31, 2015

| | | | | | | | | | | | | | | | | | | | |

(Inception date: 1/1/88) |

| | | One

Year | | Five

Year | | Ten

Year | | Ending Value of a

$10,000

Investment |

Elfun Diversified Fund | | | | -1.25% | | | | | 5.86% | | | | | 4.50% | | | | | $15,525 | |

S&P 500 Index | | | | 1.38% | | | | | 12.57% | | | | | 7.31% | | | | | $20,242 | |

MSCI All Country World Index ex-U.S. | | | | -5.66% | | | | | 1.06% | | | | | 2.92% | | | | | $13,338 | |

Barclays U.S. Aggregate Bond Index | | | | 0.55% | | | | | 3.25% | | | | | 4.51% | | | | | $15,552 | |

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund Premier Class. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

See Notes to Performance beginning on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

17

| | |

Elfun Diversified Fund | | December 31, 2015 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

Domestic Equity — 31.3%† | | | | | | | | | | |

| | | |

Common Stock — 31.3% | | | | | | | | | | |

| | | |

Aerospace & Defense — 1.1% | | | | | | | | | | |

| | | |

General Dynamics Corp. | | | 4,206 | | | $ | 577,736 | | | |

Hexcel Corp. | | | 11,596 | | | | 538,634 | | | |

Honeywell International Inc. | | | 8,411 | | | | 871,127 | | | |

The Boeing Co. | | | 2,443 | | | | 353,234 | | | |

| | | | | | | 2,340,731 | | | |

| | | |

Agricultural Products — 0.3% | | | | | | | | | | |

| | | |

Archer-Daniels-Midland Co. | | | 16,134 | | | | 591,795 | | | |

| | | |

Air Freight & Logistics — 0.1% | | | | | | | | | | |

| | | |

United Parcel Service Inc., Class B | | | 2,474 | | | | 238,073 | | | |

| | | |

Airlines — 0.4% | | | | | | | | | | |

| | | |

Delta Air Lines Inc. | | | 14,843 | | | | 752,392 | | | |

| | |

Application Software — 0.2% | | | | | | | |

| | | |

Intuit Inc. | | | 5,566 | | | | 537,119 | | | |

| |

Asset Management & Custody Banks — 1.4% | | | |

| | | |

Ameriprise Financial Inc. | | | 7,886 | | | | 839,228 | | | |

Invesco Ltd. | | | 31,184 | | | | 1,044,040 | | | |

State Street Corp. | | | 15,400 | | | | 1,021,944 | | | (e) |

| | | | | | | 2,905,212 | | | |

| | |

Automobile Manufacturers — 0.2% | | | | | | | |

| | | |

Ford Motor Co. | | | 30,924 | | | | 435,719 | | | |

| | | |

Automotive Retail — 0.1% | | | | | | | | | | |

| | | |

Advance Auto Parts Inc. | | | 928 | | | | 139,673 | | | |

| | |

Biotechnology — 1.8% | | | | | | | |

| | | |

Alexion Pharmaceuticals Inc. | | | 3,463 | | | | 660,567 | | | (a) |

Amgen Inc. | | | 12,215 | | | | 1,982,861 | | | |

Gilead Sciences Inc. | | | 12,265 | | | | 1,241,096 | | | |

| | | | | | | 3,884,524 | | | |

| | | |

Broadcasting — 0.1% | | | | | | | | | | |

| | | |

CBS Corp., Class B | | | 4,020 | | | | 189,463 | | | |

| | | |

Cable & Satellite — 1.5% | | | | | | | | | | |

| | | |

Comcast Corp., Class A | | | 35,431 | | | | 1,999,372 | | | |

Liberty Global PLC, Class C | | | 19,482 | | | | 794,281 | | | (a) |

Sirius XM Holdings Inc. | | | 80,402 | | | | 327,236 | | | (a) |

| | | | | | | 3,120,889 | | | |

| | | |

Casinos & Gaming — 0.1% | | | | | | | | | | |

| | | |

Las Vegas Sands Corp. | | | 5,133 | | | | 225,031 | | | |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | |

Communications Equipment — 1.3% | | | | | | | |

| | | |

Cisco Systems Inc. | | | 56,436 | | | $ | 1,532,520 | | | |

QUALCOMM Inc. | | | 22,861 | | | | 1,142,707 | | | |

| | | | | | | 2,675,227 | | | |

| | | |

Consumer Finance — 0.5% | | | | | | | | | | |

| | | |

Discover Financial Services | | | 18,400 | | | | 986,608 | | | |

| |

Data Processing & Outsourced Services — 0.7% | | | |

| | | |

PayPal Holdings Inc. | | | 11,133 | | | | 403,015 | | | (a) |

Visa Inc., Class A | | | 13,606 | | | | 1,055,145 | | | |

| | | | | | | 1,458,160 | | | |

| | | |

Diversified Banks — 2.3% | | | | | | | | | | |

| | | |

Bank of America Corp. | | | 82,033 | | | | 1,380,616 | | | |

Citigroup Inc. | | | 3,711 | | | | 192,044 | | | |

JPMorgan Chase & Co. | | | 27,938 | | | | 1,844,746 | | | |

Wells Fargo & Co. | | | 25,976 | | | | 1,412,055 | | | |

| | | | | | | 4,829,461 | | | |

| | |

Diversified Chemicals — 0.1% | | | | | | | |

| | | |

The Dow Chemical Co. | | | 2,165 | | | | 111,454 | | | |

| | | |

Drug Retail — 0.1% | | | | | | | | | | |

| | | |

CVS Health Corp. | | | 1,546 | | | | 151,152 | | | |

| | | |

Electric Utilities — 0.2% | | | | | | | | | | |

| | | |

NextEra Energy Inc. | | | 4,720 | | | | 490,361 | | | |

| | |

Fertilizers & Agricultural Chemicals — 0.3% | | | | | | | |

| | | |

Monsanto Co. | | | 6,494 | | | | 639,789 | | | |

| | |

General Merchandise Stores — 0.3% | | | | | | | |

| | | |

Dollar General Corp. | | | 9,092 | | | | 653,442 | | | |

| | | |

Healthcare Distributors — 0.2% | | | | | | | | | | |

| | | |

Cardinal Health Inc. | | | 5,566 | | | | 496,877 | | | |

| | | |

Healthcare Equipment — 0.9% | | | | | | | | | | |

| | | |

Abbott Laboratories | | | 14,843 | | | | 666,599 | | | |

Boston Scientific Corp. | | | 51,643 | | | | 952,297 | | | (a) |

Stryker Corp. | | | 2,714 | | | | 252,239 | | | |

| | | | 1,871,135 | | | |

| | | |

Healthcare Supplies — 0.2% | | | | | | | | | | |

| | | |

The Cooper Companies Inc. | | | 3,031 | | | | 406,760 | | | |

| | | |

Home Improvement

Retail — 0.6% | | | | | | | | | | |

| | | |

Lowe’s Companies Inc. | | | 16,173 | | | | 1,229,795 | | | |

| | | |

Household Products — 0.1% | | | | | | | | | | |

| | | |

The Procter & Gamble Co. | | | 2,448 | | | | 194,396 | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

18

| | |

Elfun Diversified Fund | | December 31, 2015 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| |

Independent Power Producers & Energy Traders — 0.1% | | | |

| | | |

Calpine Corp. | | | 9,252 | | | $ | 133,876 | | | (a) |

| | | |

Industrial Machinery — 0.4% | | | | | | | | | | |

| | | |

Ingersoll-Rand PLC | | | 16,699 | | | | 923,288 | | | |

| | | |

Integrated Oil & Gas — 1.5% | | | | | | | | | | |

| | | |

Chevron Corp. | | | 7,267 | | | | 653,740 | | | |

Exxon Mobil Corp. | | | 20,038 | | | | 1,561,962 | | | |

Occidental Petroleum Corp. | | | 14,192 | | | | 959,521 | | | |

| | | | 3,175,223 | | | |

| |

Integrated Telecommunication Services — 0.2% | | | |

| | | |

Verizon Communications Inc. | | | 8,659 | | | | 400,219 | | | |

| | | |

Internet Retail — 0.5% | | | | | | | | | | |

| | | |

Amazon.com Inc. | | | 1,608 | | | | 1,086,831 | | | (a) |

| | |

Internet Software & Services — 1.8% | | | | | | | |

| | | |

Alphabet Inc., Class A | | | 1,273 | | | | 990,407 | | | (a) |

Alphabet Inc., Class C | | | 1,546 | | | | 1,173,228 | | | (a) |

eBay Inc. | | | 26,986 | | | | 741,575 | | | (a) |

Facebook Inc., Class A | | | 5,257 | | | | 550,198 | | | (a) |

LinkedIn Corp., Class A | | | 1,484 | | | | 334,019 | | | (a) |

| | | | 3,789,427 | | | |

| | |

Investment Banking & Brokerage — 0.3% | | | | | | | |

| | | |

The Charles Schwab Corp. | | | 22,265 | | | | 733,186 | | | |

| | |

IT Consulting & Other Services — 0.1% | | | | | | | |

| | | |

Cognizant Technology Solutions Corp., Class A | | | 4,112 | | | | 246,802 | | | (a) |

| | | |

Life & Health Insurance — 0.2% | | | | | | | | | | |

| | | |

Lincoln National Corp. | | | 6,803 | | | | 341,919 | | | |

| | | |

Movies & Entertainment — 0.7% | | | | | | | | | | |

| | | |

The Walt Disney Co. | | | 5,937 | | | | 623,860 | | | |

Time Warner Inc. | | | 13,452 | | | | 869,941 | | | |

| | | | 1,493,801 | | | |

| | | |

Multi-Line Insurance — 0.7% | | | | | | | | | | |

| | | |

American International Group Inc. | | | 6,497 | | | | 402,619 | | | |

The Hartford Financial Services Group Inc. | | | 22,977 | | | | 998,581 | | | |

| | | | 1,401,200 | | | |

| | | |

Multi-Utilities — 0.3% | | | | | | | | | | |

| | | |

Dominion Resources Inc. | | | 8,102 | | | | 548,019 | | | |

| | |

Oil & Gas Equipment & Services — 0.5% | | | | | | | |

| | | |

Schlumberger Ltd. | | | 13,827 | | | | 964,433 | | | |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | |

Oil & Gas Exploration & Production — 0.4% | | | | | | | |

| | | |

Hess Corp. | | | 14,952 | | | $ | 724,873 | | | |

Marathon Oil Corp. | | | 12,354 | | | | 155,537 | | | |

| | | | 880,410 | | | |

| |

Packaged Foods & Meats — 0.4% | | | |

| | | |

Mondelez International Inc., Class A | | | 17,317 | | | | 776,494 | | | |

| | | |

Paper Packaging — 0.1% | | | | | | | | | | |

| | | |

Packaging Corporation of America | | | 2,165 | | | | 136,503 | | | |

| | | |

Pharmaceuticals — 2.9% | | | | | | | | | | |

| | | |

Allergan PLC | | | 7,789 | | | | 2,434,062 | | | (a) |

Johnson & Johnson | | | 15,342 | | | | 1,575,930 | | | |

Merck & Company Inc. | | | 24,430 | | | | 1,290,393 | | | |

Pfizer Inc. | | | 24,275 | | | | 783,597 | | | |

| | | | 6,083,982 | | | |

| | | |

Railroads — 0.1% | | | | | | | | | | |

| | | |

CSX Corp. | | | 5,257 | | | | 136,419 | | | |

| | | |

Regional Banks — 0.1% | | | | | | | | | | |

| | | |

First Republic Bank | | | 2,288 | | | | 151,145 | | | |

| |

Research & Consulting Services — 0.4% | | | |

| | | |

Nielsen Holdings PLC | | | 19,502 | | | | 908,793 | | | |

| |

Semiconductor Equipment — 0.4% | | | |

| | | |

Applied Materials Inc. | | | 42,056 | | | | 785,186 | | | |

| | | |

Soft Drinks — 0.7% | | | | | | | | | | |

| | | |

PepsiCo Inc. | | | 14,503 | | | | 1,449,140 | | | |

| |

Specialized Finance — 0.7% | | | |

| | | |

CME Group Inc. | | | 8,349 | | | | 756,419 | | | |

McGraw Hill Financial Inc. | | | 7,422 | | | | 731,661 | | | |

| | | | | | | 1,488,080 | | | |

| | | |

Specialized REITs — 0.7% | | | | | | | | | | |

| | | |

American Tower Corp. | | | 12,988 | | | | 1,259,187 | | | |

Extra Space Storage Inc. | | | 2,474 | | | | 218,231 | | | |

| | | | | | | 1,477,418 | | | |

| | | |

Systems Software — 0.5% | | | | | | | | | | |

| | | |

Microsoft Corp. | | | 8,195 | | | | 454,659 | | | |

Oracle Corp. | | | 12,679 | | | | 463,164 | | | |

VMware Inc., Class A | | | 3,808 | | | | 215,418 | | | (a) |

| | | | | | | 1,133,241 | | | |

| |

Technology Hardware, Storage & Peripherals — 1.3% | | | |

| | | |

Apple Inc. | | | 16,637 | | | | 1,751,211 | | | |

HP Inc. | | | 36,800 | | | | 435,712 | | | |

Western Digital Corp. | | | 9,741 | | | | 584,947 | | | |

| | | | | | | 2,771,870 | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

19

| | |

Elfun Diversified Fund | | December 31, 2015 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| |

Trading Companies & Distributors — 0.2% | | | |

| | | |

United Rentals Inc. | | | 7,422 | | | $ | 538,392 | | | (a) |

| | | |

Total Common Stock

(Cost $58,095,321) | | | | | | | 65,510,535 | | | |

| | | | | | | | | | |

Preferred Stock — 0.0%* | | | | | | | | | | |

| | | |

Diversified Banks — 0.0%* | | | | | | | | | | |

| | | |

Wells Fargo & Co. | | | 2,735 | | | | 71,438 | | | |

| | | |

Total Preferred Stock

(Cost $68,375) | | | | | | | 71,438 | | | |

| | | |

Total Domestic Equity

(Cost $58,163,696) | | | | | | | 65,581,973 | | | |

| | | | | | | | | | |

Foreign Equity — 20.7% | | | | | | | | | | |

| | | |

Common Stock — 20.7% | | | | | | | | | | |

| | | |

Advertising — 0.2% | | | | | | | | | | |

| | | |

WPP PLC | | | 21,736 | | | | 500,734 | | | |

| | | |

Aerospace & Defense — 0.5% | | | | | | | | | | |

| | | |

Airbus Group SE | | | 3,296 | | | | 221,988 | | | |

Safran S.A. | | | 4,649 | | | | 320,032 | | | |

Zodiac Aerospace | | | 19,421 | | | | 463,607 | | | |

| | | | | | | 1,005,627 | | | |

| | | |

Airlines — 0.1% | | | | | | | | | | |

| | | |

International Consolidated Airlines Group S.A. | | | 29,523 | | | | 265,653 | | | |

| | | |

Apparel Retail — 0.2% | | | | | | | | | | |

| | | |

Fast Retailing Company Ltd. | | | 914 | | | | 323,978 | | | |

| |

Apparel, Accessories & Luxury Goods — 0.2% | | | |

| | | |

The Swatch Group AG | | | 1,100 | | | | 384,835 | | | |

| | | |

Application Software — 0.2% | | | | | | | | | | |

| | | |

SAP SE | | | 6,200 | | | | 494,219 | | | |

| | | |

Auto Parts & Equipment — 0.7% | | | | | | | | | | |

| | | |

Continental AG | | | 3,966 | | | | 967,421 | | | |

Delphi Automotive PLC | | | 5,659 | | | | 485,146 | | | |

| | | | | | | 1,452,567 | | | |

| | |

Automobile Manufacturers — 0.5% | | | | | | | |

| | | |

Fuji Heavy Industries Ltd. | | | 8,200 | | | | 342,669 | | | |

Toyota Motor Corp. | | | 12,330 | | | | 767,505 | | | |

| | | | | | | 1,110,174 | | | |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | |

Brewers — 0.4% | | | | | | | | | | |

| | | |

Anheuser-Busch InBev S.A. | | | 6,616 | | | $ | 822,188 | | | |

| | | |

Building Products — 0.5% | | | | | | | | | | |

| | | |

Assa Abloy AB, Class B | | | 27,163 | | | | 573,508 | | | |

Geberit AG | | | 1,232 | | | | 418,707 | | | |

| | | | | | | 992,215 | | | |

| | |

Communications Equipment — 0.3% | | | | | | | |

| | | |

Telefonaktiebolaget LM Ericsson, Class B | | | 71,656 | | | | 699,510 | | | |

| |

Construction & Engineering — 0.1% | | | |

| | | |

Larsen & Toubro Ltd. | | | 10,870 | | | | 209,821 | | | |

| | | |

Construction Materials — 0.2% | | | | | | | | | | |

| | | |

HeidelbergCement AG | | | 5,880 | | | | 483,019 | | | |

| | | |

Diversified Banks — 2.6% | | | | | | | | | | |

| | | |

Banco Bilbao Vizcaya Argentaria S.A. | | | 35,245 | | | | 258,014 | | | |

Barclays PLC | | | 211,017 | | | | 680,818 | | | |

BNP Paribas S.A. | | | 13,747 | | | | 779,970 | | | |

Credit Agricole S.A. | | | 32,294 | | | | 381,681 | | | |

Grupo Financiero Banorte SAB de C.V., Class O | | | 30,737 | | | | 168,713 | | | |

HSBC Holdings PLC | | | 32,797 | | | | 259,196 | | | |

ICICI Bank Ltd. | | | 99,263 | | | | 391,613 | | | |

ING Groep N.V. | | | 42,395 | | | | 573,368 | | | |

Intesa Sanpaolo S.p.A. | | | 170,251 | | | | 571,106 | | | |

Mitsubishi UFJ Financial Group Inc. | | | 111,500 | | | | 701,747 | | | |

Sumitomo Mitsui Financial Group Inc. | | | 16,400 | | | | 627,943 | | | |

| | | | | | | 5,394,169 | | | |

| |

Diversified Metals & Mining — 0.1% | | | |

| | | |

BHP Billiton PLC | | | 20,083 | | | | 224,963 | | | |

| |

Diversified Real Estate Activities — 0.8% | | | |

| | | |

Brookfield Asset Management Inc., Class A | | | 5,962 | | | | 187,345 | | | |

Mitsubishi Estate Company Ltd. | | | 31,918 | | | | 669,563 | | | |

Mitsui Fudosan Company Ltd. | | | 29,306 | | | | 744,496 | | | |

| | | | | | | 1,601,404 | | | |

| | | |

Electric Utilities — 0.1% | | | | | | | | | | |

| | | |

Power Grid Corporation of India Ltd. | | | 109,861 | | | | 235,394 | | | |

| |

Electrical Components & Equipment — 0.7% | | | |

| | | |

Nidec Corp. | | | 13,700 | | | | 1,006,417 | | | |

Schneider Electric SE | | | 7,457 | | | | 425,764 | | | |

| | | | | | | 1,432,181 | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

20

| | |

Elfun Diversified Fund | | December 31, 2015 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | |

Electronic Components — 0.2% | | | | | | | | | | |

| | | |

Murata Manufacturing Company Ltd. | | | 3,100 | | | $ | 452,779 | | | |

| |

Electronic Equipment & Instruments — 0.8% | | | |

| | | |

Hexagon AB, Class B | | | 14,504 | | | | 541,582 | | | |

Hitachi Ltd. | | | 111,500 | | | | 640,943 | | | |

Keyence Corp. | | | 900 | | | | 501,866 | | | |

| | | | | | | 1,684,391 | | | |

| | | |

Healthcare Equipment — 1.0% | | | | | | | | | | |

| | | |

Medtronic PLC | | | 19,296 | | | | 1,484,248 | | | |

Smith & Nephew PLC | | | 38,636 | | | | 687,903 | | | |

| | | | | | | 2,172,151 | | | |

| | | |

Healthcare Services — 0.3% | | | | | | | | | | |

| | | |

Fresenius SE & Company KGaA | | | 9,005 | | | | 645,327 | | | |

| | | |

Household Products — 0.1% | | | | | | | | | | |

| | | |

Svenska Cellulosa AB SCA, Class B | | | 9,445 | | | | 276,160 | | | |

| |

Human Resource & Employment Services — 0.1% | | | |

| | | |

Capita PLC | | | 10,291 | | | | 183,228 | | | |

| | | |

Industrial Gases — 0.2% | | | | | | | | | | |

| | | |

Linde AG | | | 3,069 | | | | 446,403 | | | |

| | | |

Industrial Machinery — 0.5% | | | | | | | | | | |

| | | |

FANUC Corp. | | | 3,300 | | | | 578,278 | | | |

Mitsubishi Heavy Industries Ltd. | | | 99,000 | | | | 438,894 | | | |

| | | | | | | 1,017,172 | | | |

| | | |

Integrated Oil & Gas — 0.8% | | | | | | | | | | |

| | | |

Cenovus Energy Inc. | | | 29,506 | | | | 372,366 | | | |

Cenovus Energy Inc. | | | 29,394 | | | | 370,308 | | | |

Statoil ASA | | | 31,577 | | | | 441,297 | | | |

Total S.A. | | | 9,461 | | | | 424,100 | | | |

| | | | | | | 1,608,071 | | | |

| | | |

Internet Retail — 0.2% | | | | | | | | | | |

| | | |

Rakuten Inc. | | | 38,500 | | | | 449,025 | | | |

| |

Internet Software & Services — 0.8% | | | |

| | | |

Baidu Inc. ADR | | | 9,016 | | | | 1,704,385 | | | (a) |

| | | |

Leisure Products — 0.1% | | | | | | | | | | |

| | | |

Shimano Inc. | | | 1,500 | | | | 232,678 | | | |

| | | |

Life & Health Insurance — 0.8% | | | | | | | | | | |

| | | |

AIA Group Ltd. | | | 167,387 | | | | 1,006,463 | | | |

Japan Post Holdings Company Ltd. | | | 13,200 | | | | 204,647 | | | (a) |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

Prudential PLC | | | 22,975 | | | $ | 518,440 | | | |

| | | | | | | 1,729,550 | | | |

| | | |

Movies & Entertainment — 0.2% | | | | | | | | | | |

| | | |

Vivendi S.A. | | | 18,314 | | | | 395,105 | | | |

| | | |

Multi-Line Insurance — 0.3% | | | | | | | | | | |

| | | |

AXA S.A. | | | 25,269 | | | | 692,556 | | | |

| | |

Oil & Gas Equipment & Services — 0.3% | | | | | | | |

| | | |

Technip S.A. | | | 11,098 | | | | 551,370 | | | |

| | | |

Packaged Foods & Meats — 0.4% | | | | | | | | | | |

| | | |

Kerry Group PLC, Class A | | | 3,981 | | | | 330,007 | | | |

Nestle S.A. | | | 5,977 | | | | 445,140 | | | |

| | | | | | | 775,147 | | | |

| | | |

Personal Products — 0.2% | | | | | | | | | | |

| | | |

Kao Corp. | | | 8,900 | | | | 462,775 | | | |

| | | |

Pharmaceuticals — 1.7% | | | | | | | | | | |

| | | |

Astellas Pharma Inc. | | | 23,800 | | | | 342,572 | | | |

Bayer AG | | | 5,274 | | | | 663,435 | | | |

Roche Holding AG | | | 4,657 | | | | 1,285,909 | | | |

Sanofi | | | 10,279 | | | | 877,654 | | | |

Shire PLC | | | 6,759 | | | | 468,019 | | | |

| | | | | | | 3,637,589 | | | |

| | |

Property & Casualty Insurance — 0.9% | | | | | | | |

| | | |

ACE Ltd. | | | 5,556 | | | | 649,219 | | | |

Insurance Australia Group Ltd. | | | 132,010 | | | | 534,004 | | | |

Tokio Marine Holdings Inc. | | | 16,200 | | | | 634,560 | | | |

| | | | | | | 1,817,783 | | | |

| | | |

Railroads — 0.3% | | | | | | | | | | |

| | | |

East Japan Railway Co. | | | 5,300 | | | | 504,468 | | | |

| |

Security & Alarm Services — 0.2% | | | |

| | | |

Secom Company Ltd. | | | 4,300 | | | | 294,543 | | | |

| |

Semiconductor Equipment — 0.3% | | | |

| | | |

ASML Holding N.V. | | | 7,570 | | | | 678,833 | | | |

| | | |

Semiconductors — 0.3% | | | | | | | | | | |

| | | |

Taiwan Semiconductor Manufacturing Company Ltd. | | | 137,484 | | | | 598,539 | | | |

| | | |