UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | October 31, 2019 |

Item 1.

Reports to Stockholders

Fidelity® Series Global ex U.S. Index Fund

Annual Report

October 31, 2019

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship MSCI has with Fidelity and any related funds.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2019 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

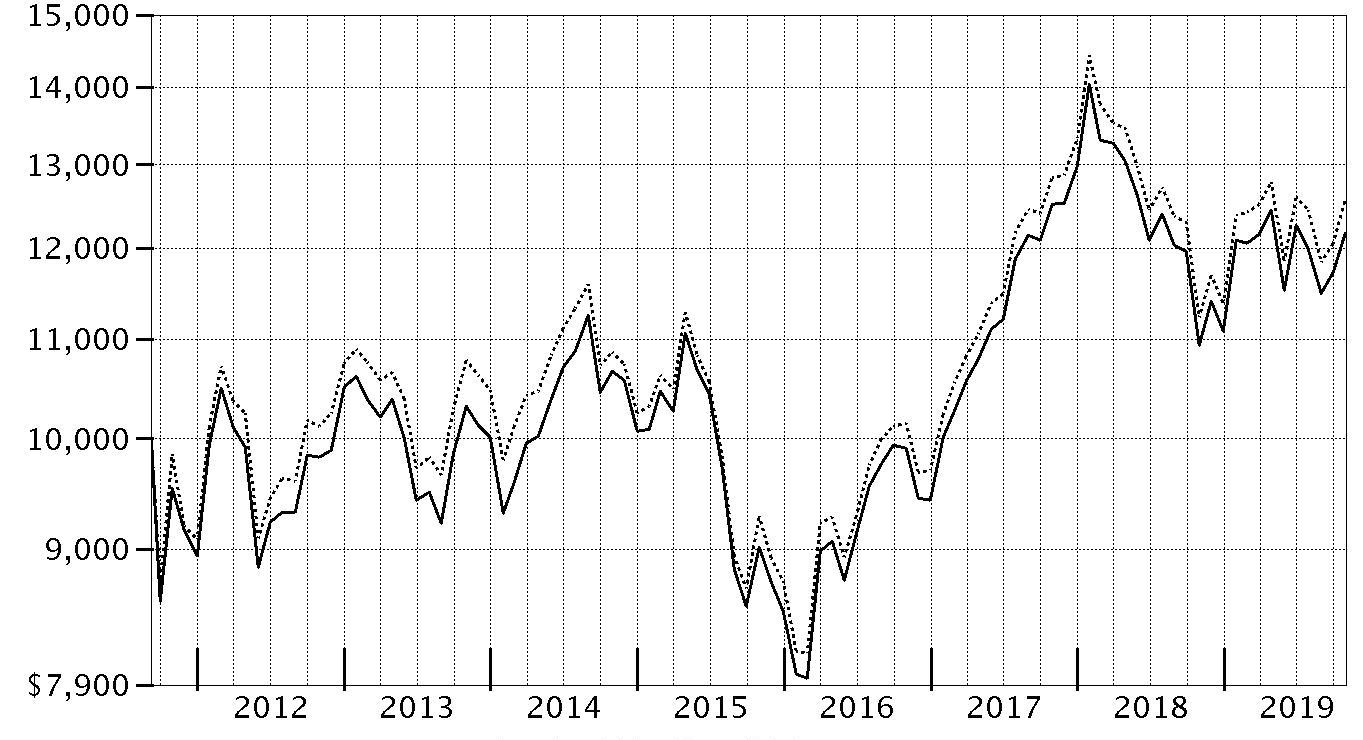

Average Annual Total Returns

| For the periods ended October 31, 2019 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Series Global ex U.S. Index Fund | 11.36% | 3.73% | 4.97% |

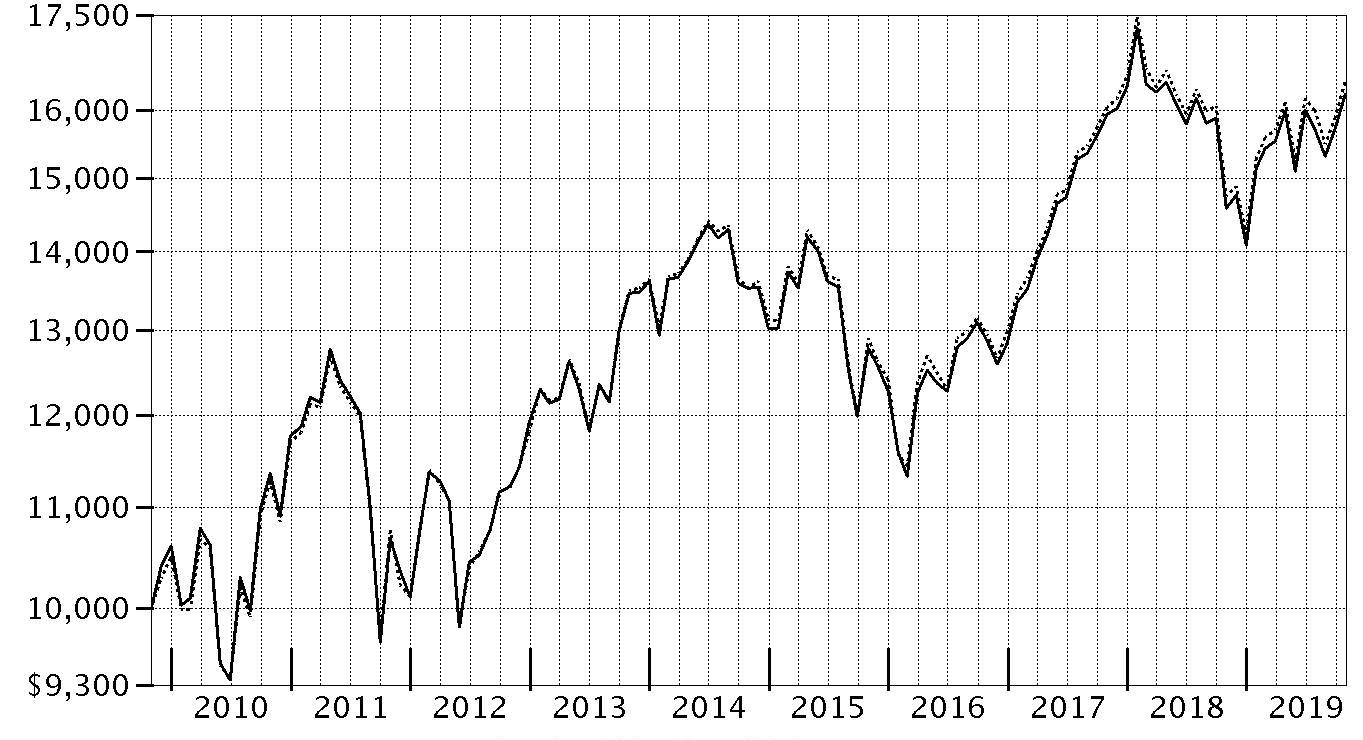

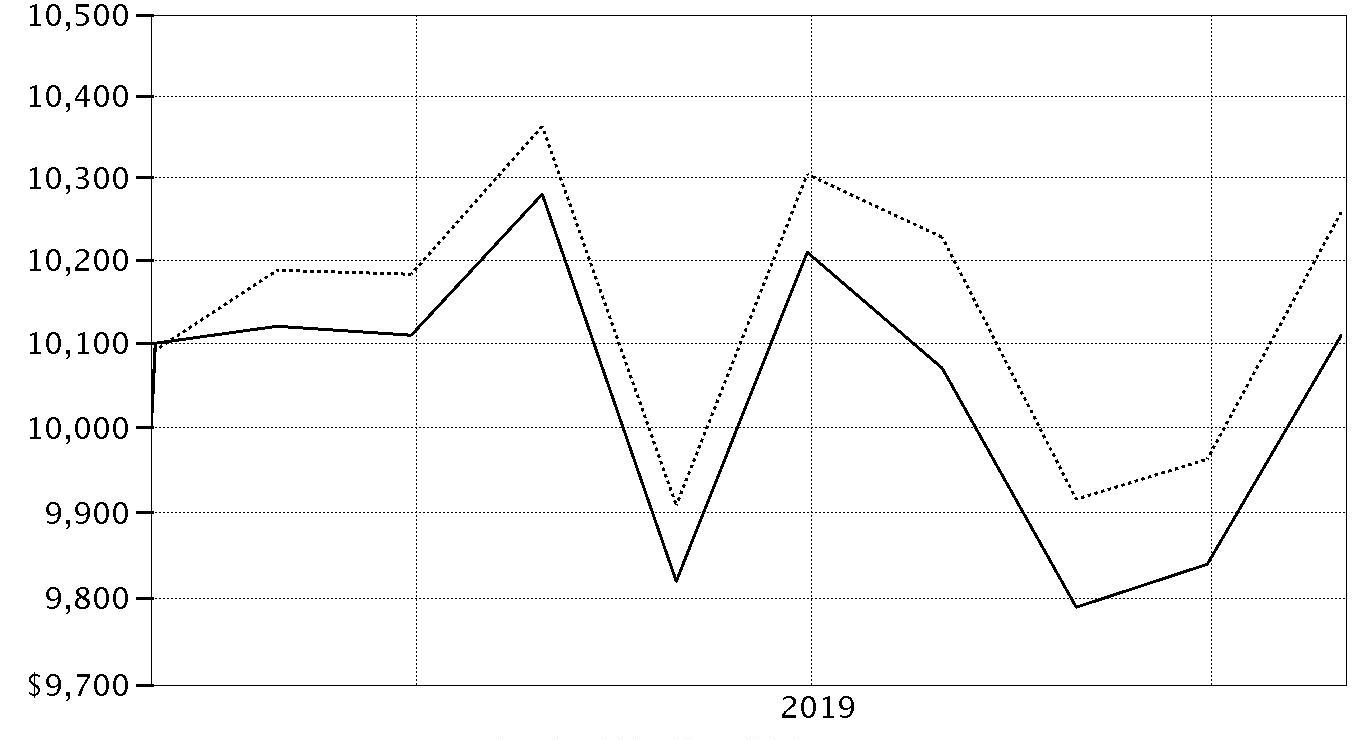

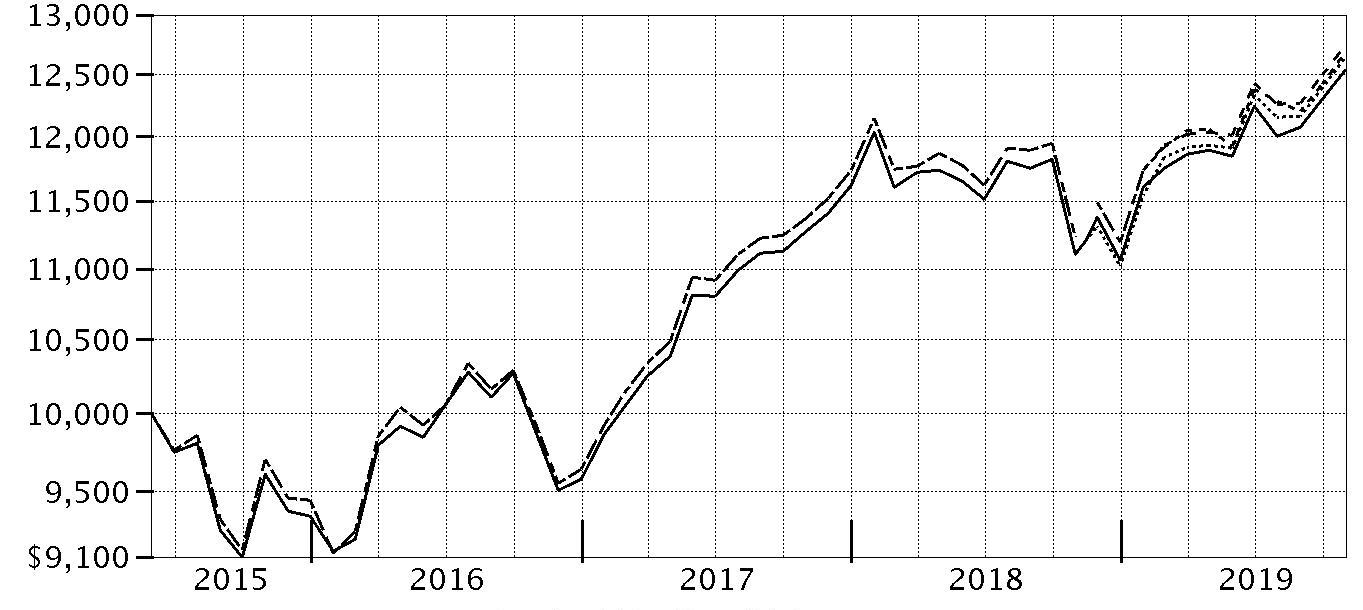

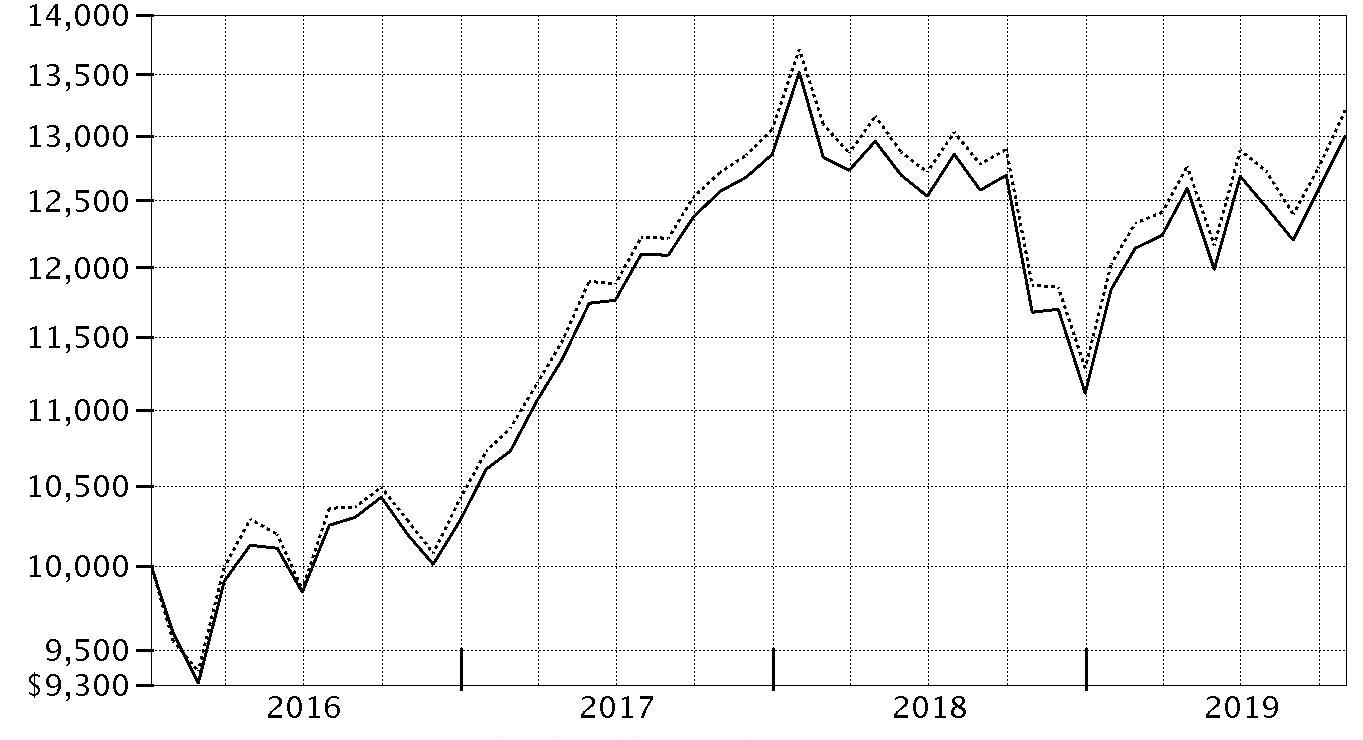

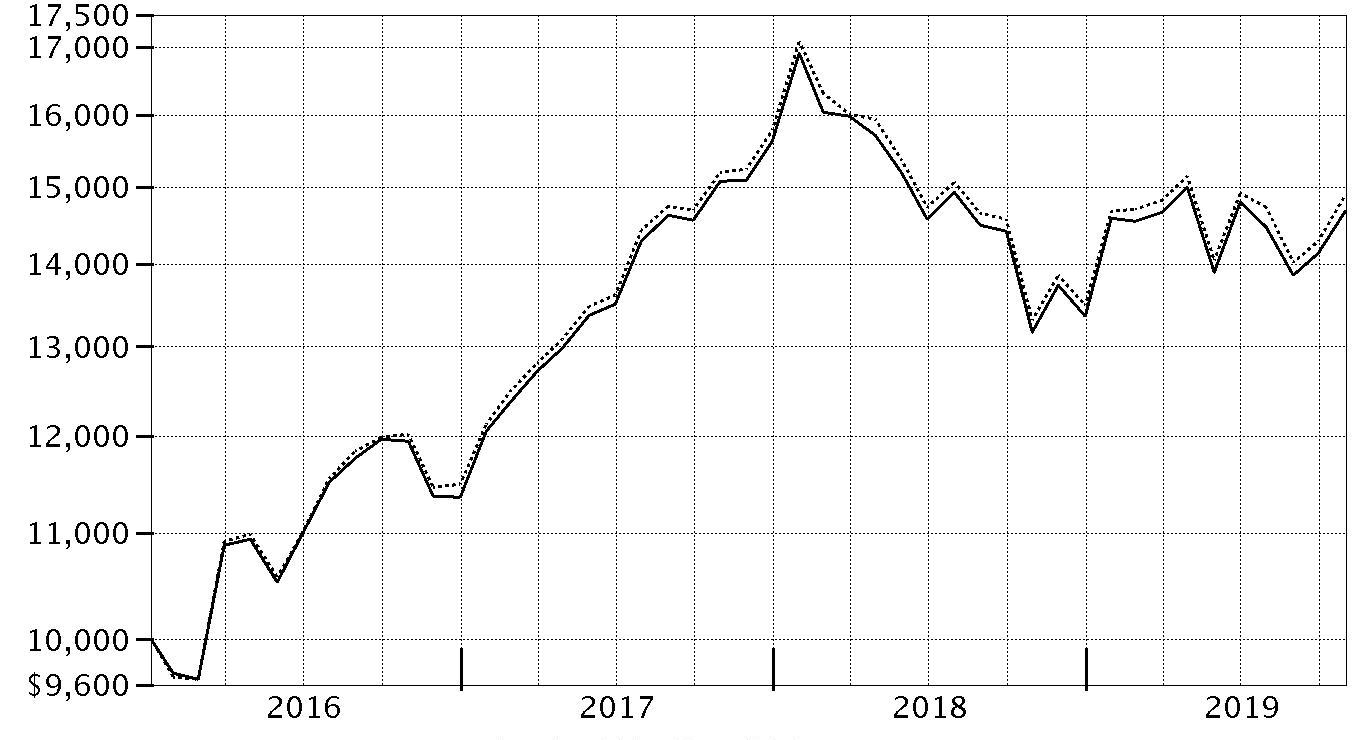

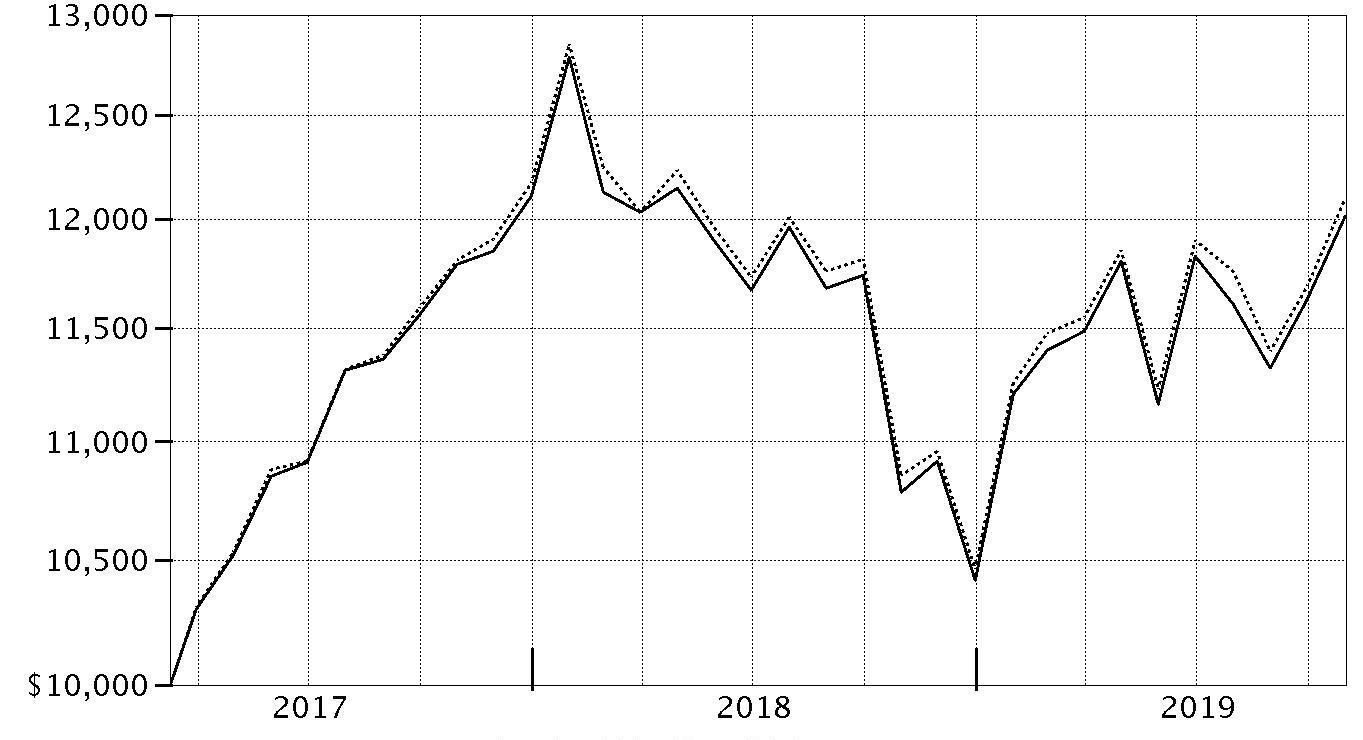

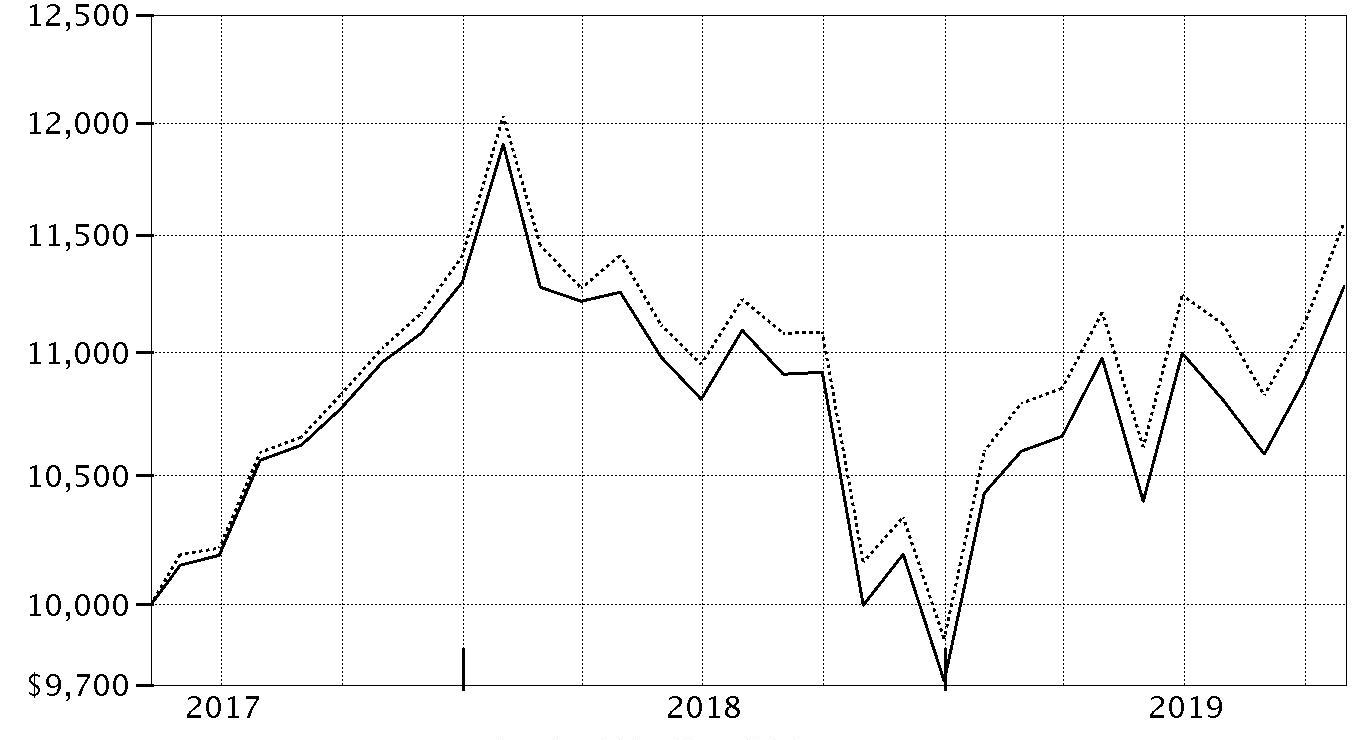

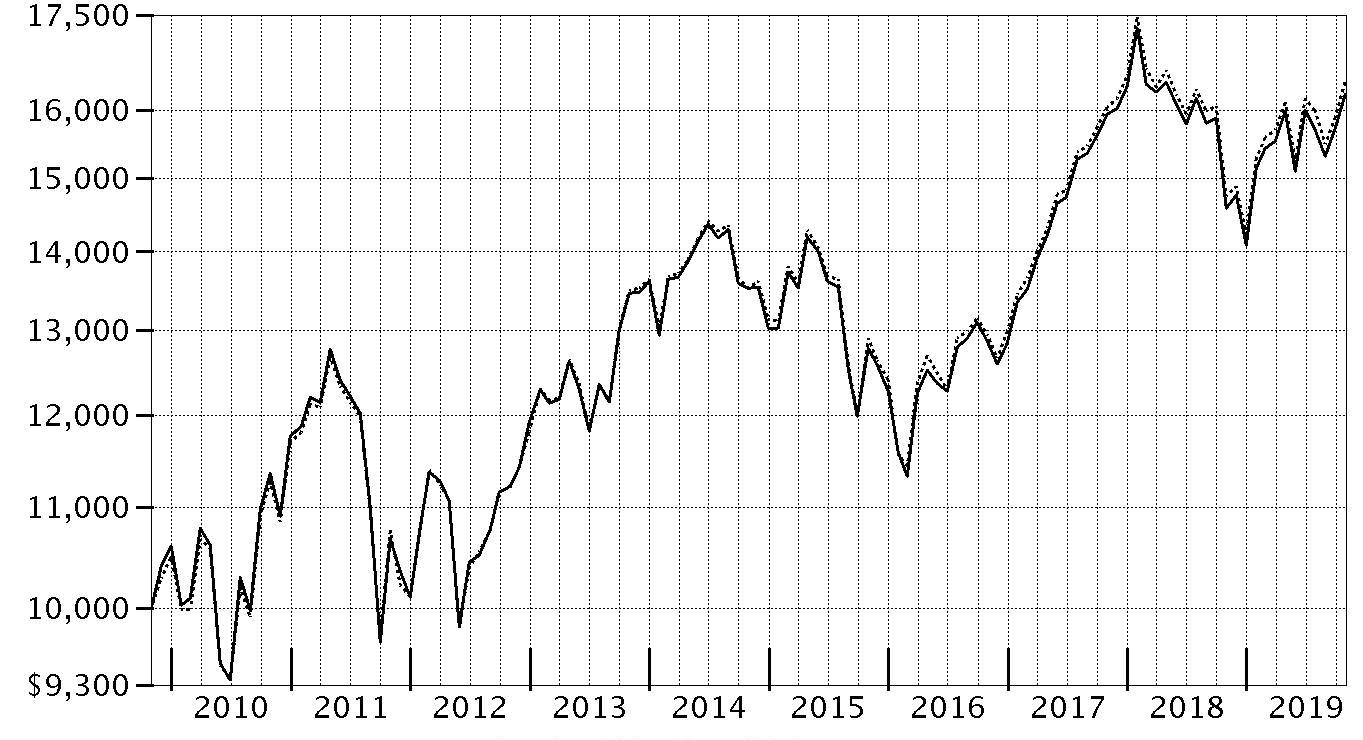

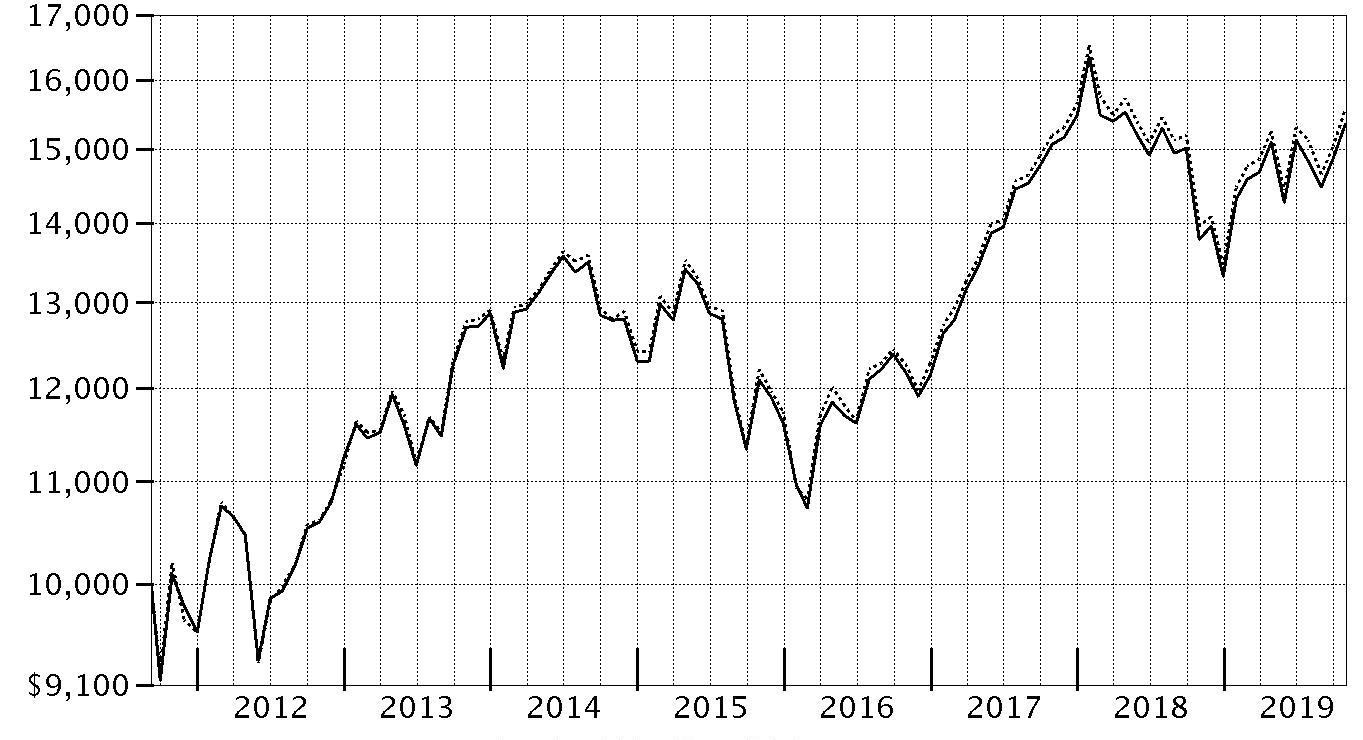

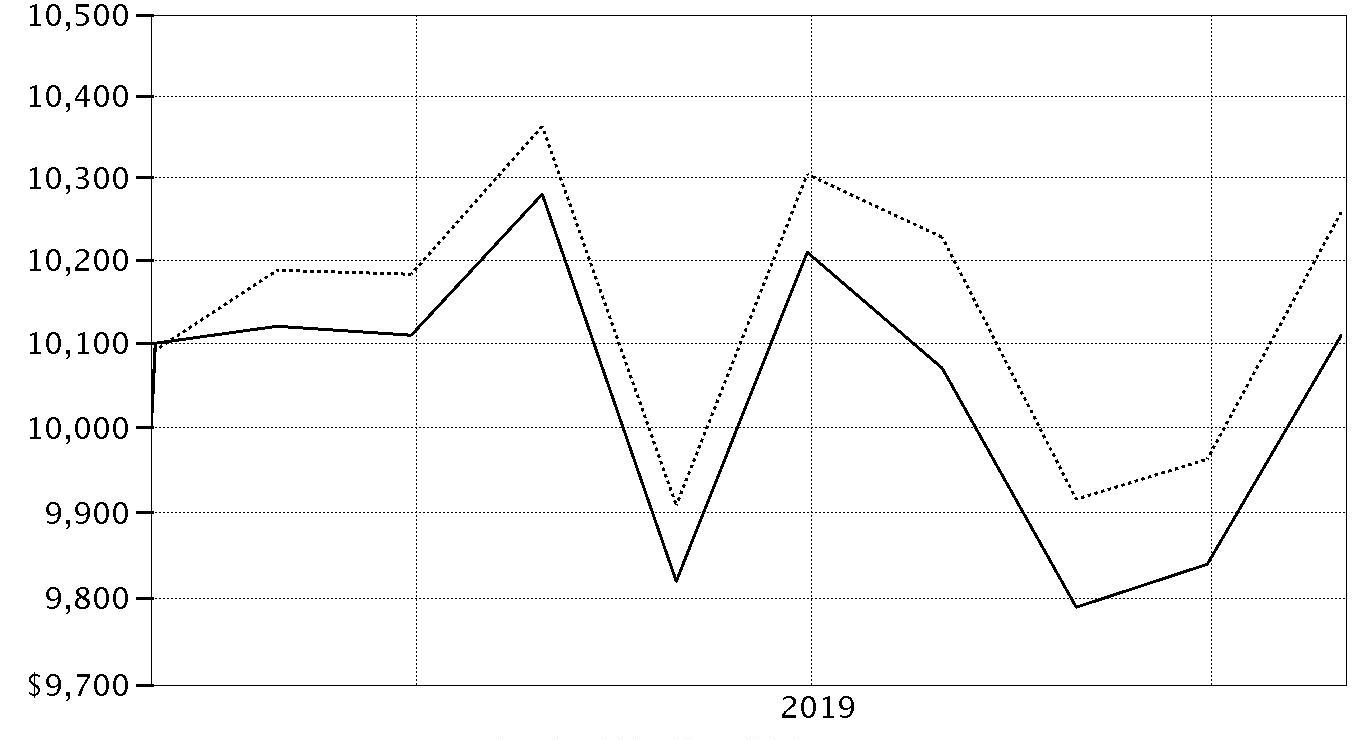

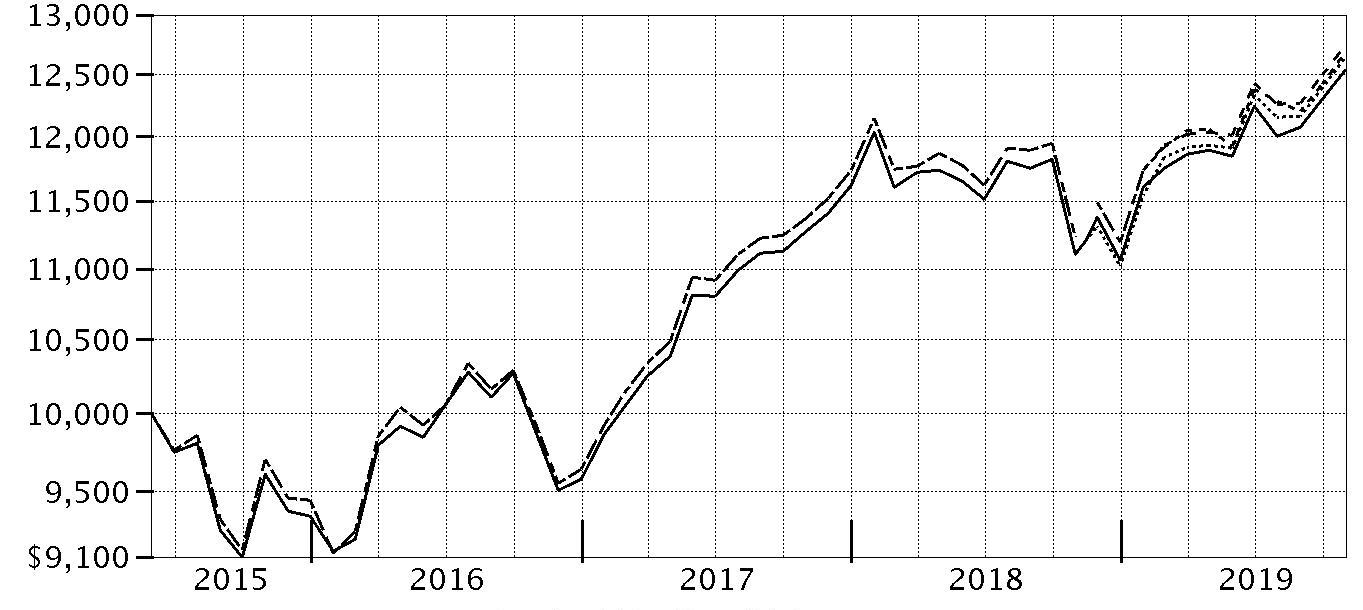

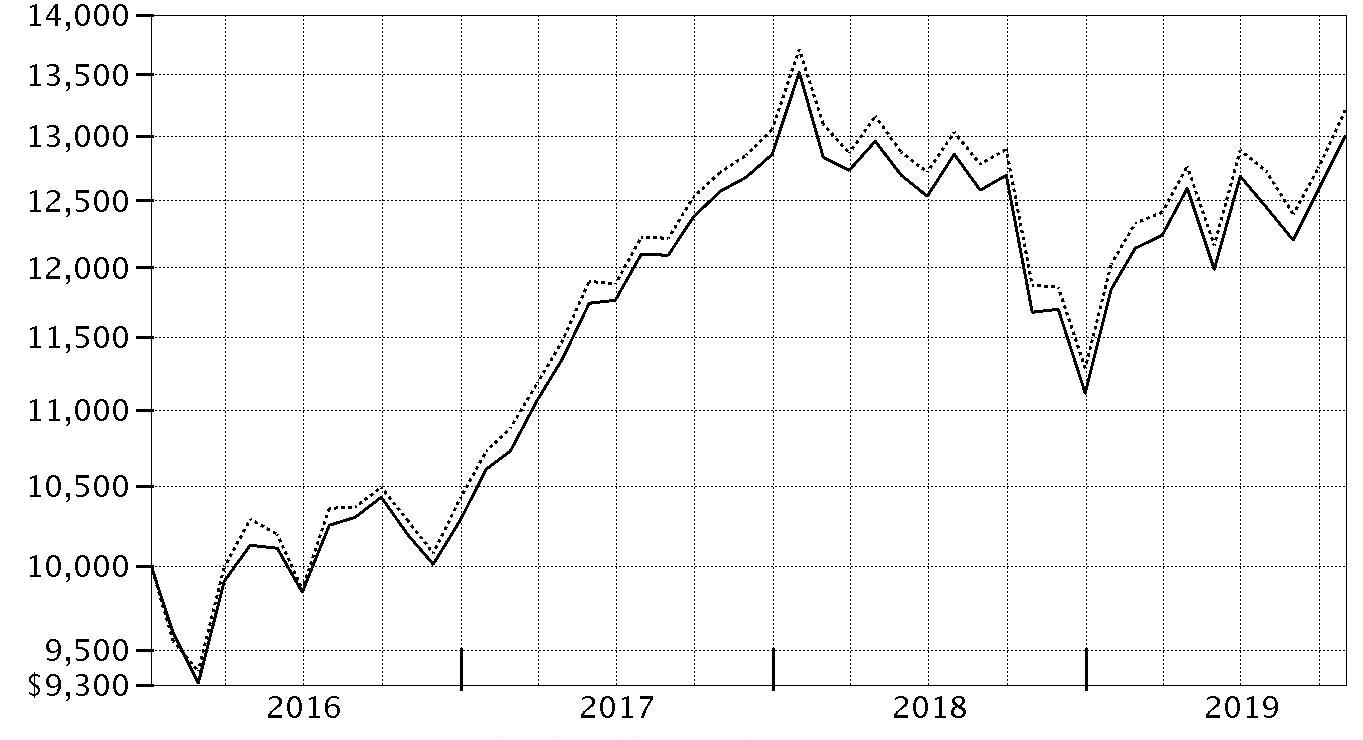

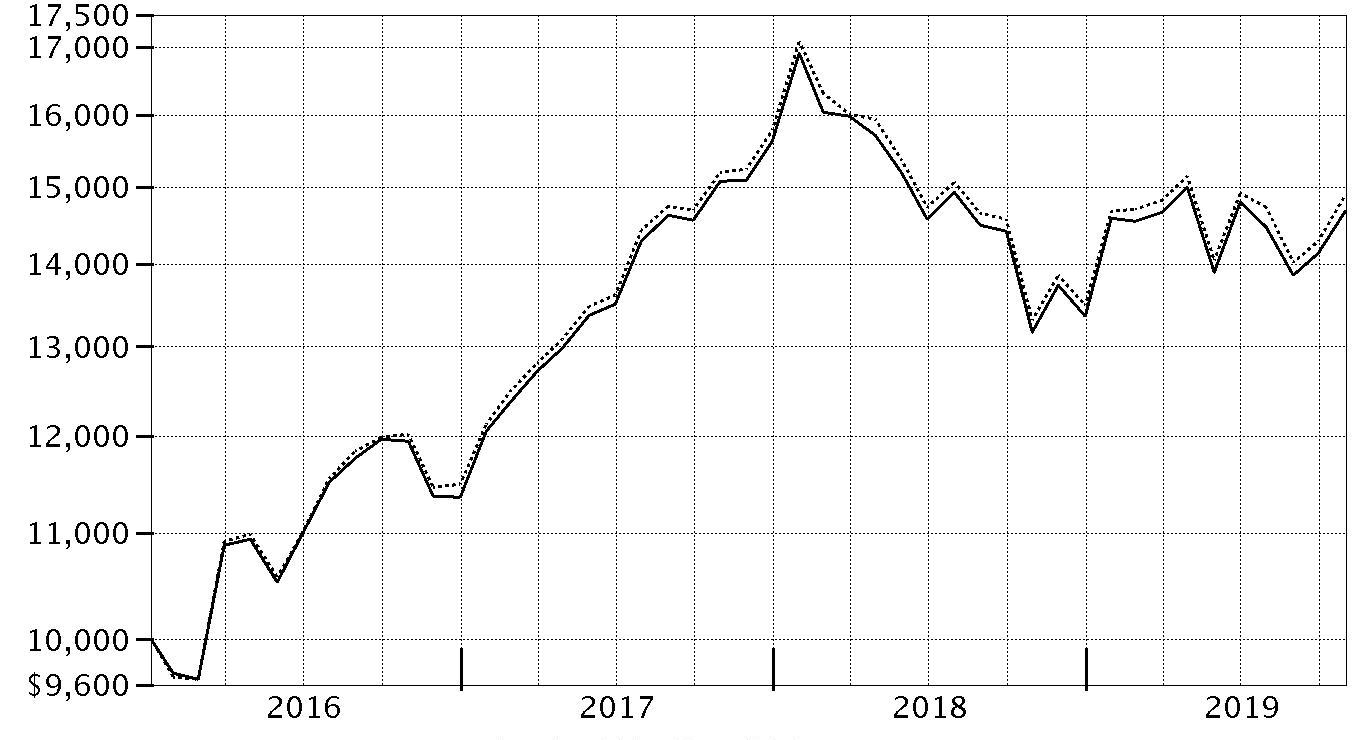

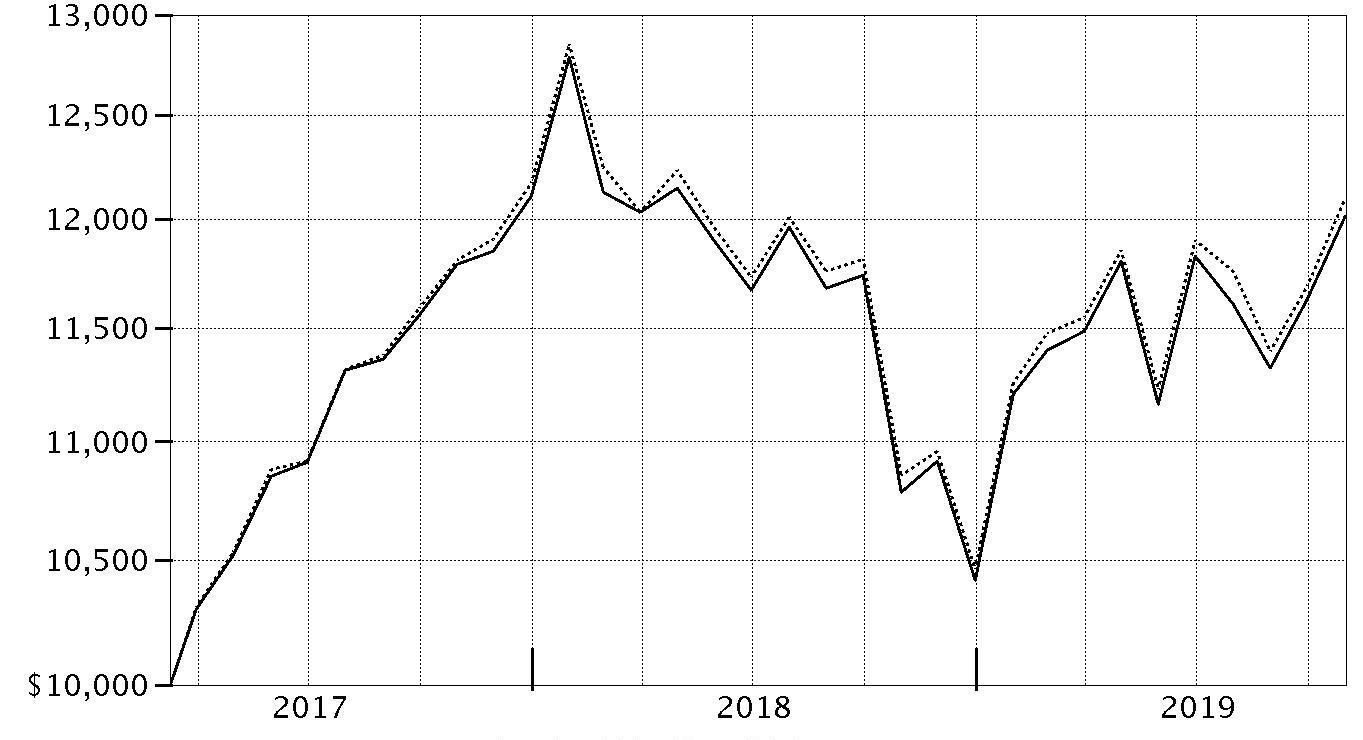

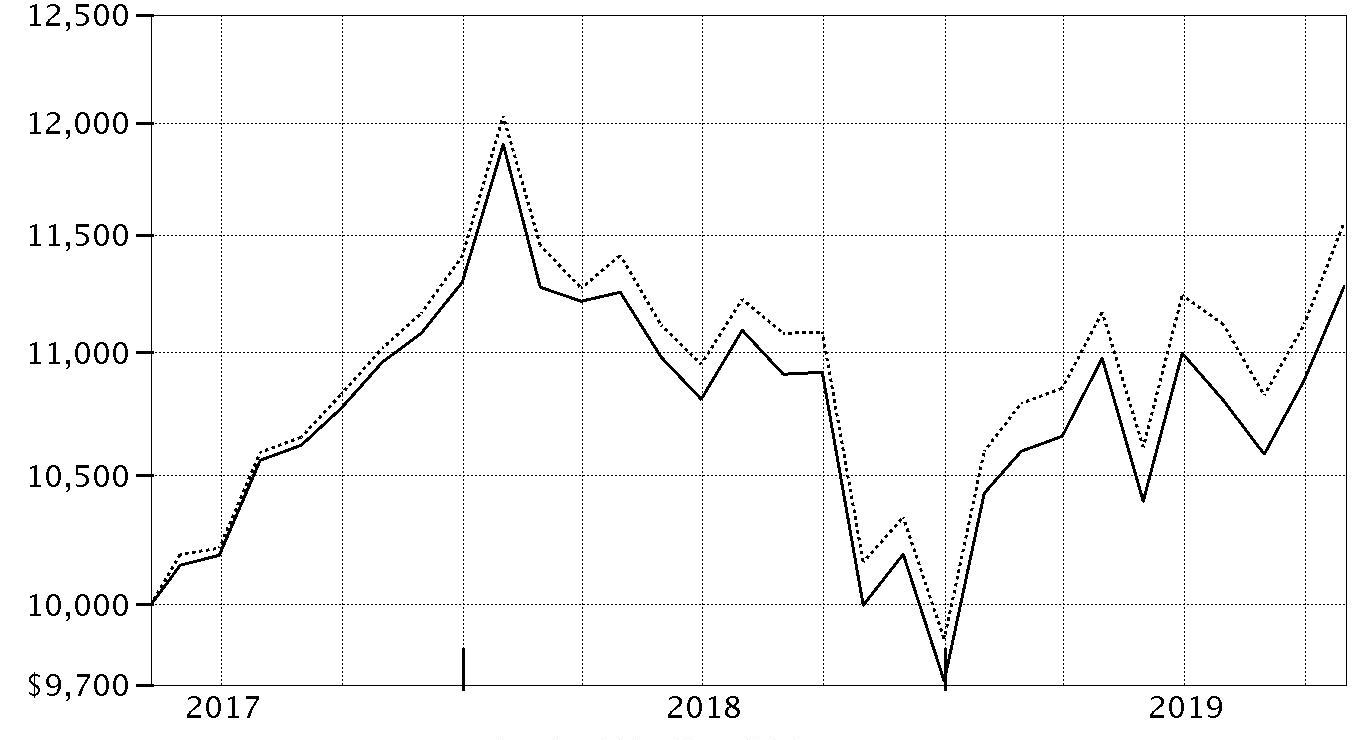

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Series Global ex U.S. Index Fund on October 31, 2009.

The chart shows how the value of your investment would have changed, and also shows how the MSCI ACWI (All Country World Index) ex USA Index performed over the same period.

| Period Ending Values |

| $16,240 | Fidelity® Series Global ex U.S. Index Fund |

| $16,440 | MSCI ACWI (All Country World Index) ex USA Index |

Management's Discussion of Fund Performance

Market Recap: The MSCI ACWI (All Country World Index) ex USA Index gained 11.47% for the 12 months ending October 31, 2019, as international stocks reflected a confluence of factors, including escalating trade tension, and moderating but still positive global economic growth. Currency fluctuations were largely modest and varied by region, muting the overall impact on international equity returns. In late December, the U.S. Federal Reserve shifted from raising interest rates to a more dovish policy in 2019, joining many foreign central banks. In June, international stocks rose 6.03%, as policy stimulus in China stabilized that country’s economic growth. The Fed cut its policy rate in July for the first time since 2008. However, the index returned -1.21% for the month, followed by -3.08% in August. In September, the Fed cut its policy rate another quarter point, citing concerns about slowing economic growth and muted inflation, and did the same in October, leading to monthly gains of 2.59% and 3.49%, respectively. For the full 12 months, the growth-oriented information technology sector (+22%) led the way, followed by utilities (+20%) and real estate (+18%), two high-dividend-yielding categories. Conversely, energy was roughly flat, while materials (+6%) and communication services (7%) also lagged. By region, Asia Pacific ex Japan (+16%), Europe ex U.K (+13%), Canada (+12%) and emerging markets (+12%) fared best. Meanwhile, the U.K. (+7%) and Japan (+10%) trailed the broader market.

Comments from the Geode Capital Management, LLC, passive equity index team: For the fiscal year, the fund gained 11.36%, compared with an increase of 11.47% for the benchmark MSCI ACWI (All Country World Index) ex USA Index.

(Note: The fund's performance relative to the index can be affected by Fidelity's methodologies for valuing certain foreign stocks and for incorporating foreign exchange rates, which differ from those used by the index.) Individually, Nestle (+29%) contributed meaningfully to the fund's performance this period, as the Swiss packaged-foods giant reported favorable sales growth. Semiconductor foundry Taiwan Semiconductor Manufacturing (+34%) also performed well, reflecting the firm's better-than-expected quarterly financial results. Chinese e-commerce company Alibaba Group Holding (+24%) announced strong quarterly earnings. Healthy sales lifted LVMH Moet Hennessy Louis Vuitton (+42%), a French luxury goods conglomerate, while Dutch semiconductor equipment supplier ASML Holding (+55%) reported higher third-quarter revenue. French pharmaceutical manufacturer Roche Holdings (+27%) and Chinese internet gaming company Tencent Holdings (+20%) also boosted the fund's performance. In contrast, China-based Baidu (-46%) struggled, as the company anticipated continued challenges for its core online search-advertising business. British American Tobacco (-13%) struggled, partly reflecting investors' concern about weakness in tobacco companies' core cigarette business. Brazilian mining firm Vale (-23%) saw its shares plunge in January, as a dam collapsed at one of its mines, resulting in several casualties and significant financial losses. Israeli drug maker Teva Pharmaceutical Industries (-59%) also detracted.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Note to Shareholders: On March 22, 2019, Pat Waddell retired and is no longer a portfolio manager with Geode Capital Management.

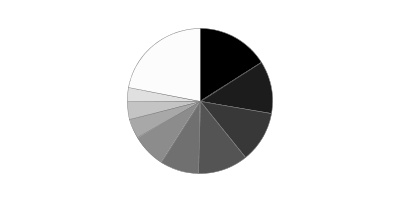

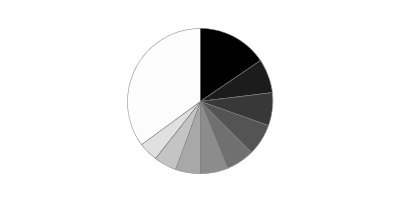

Investment Summary (Unaudited)

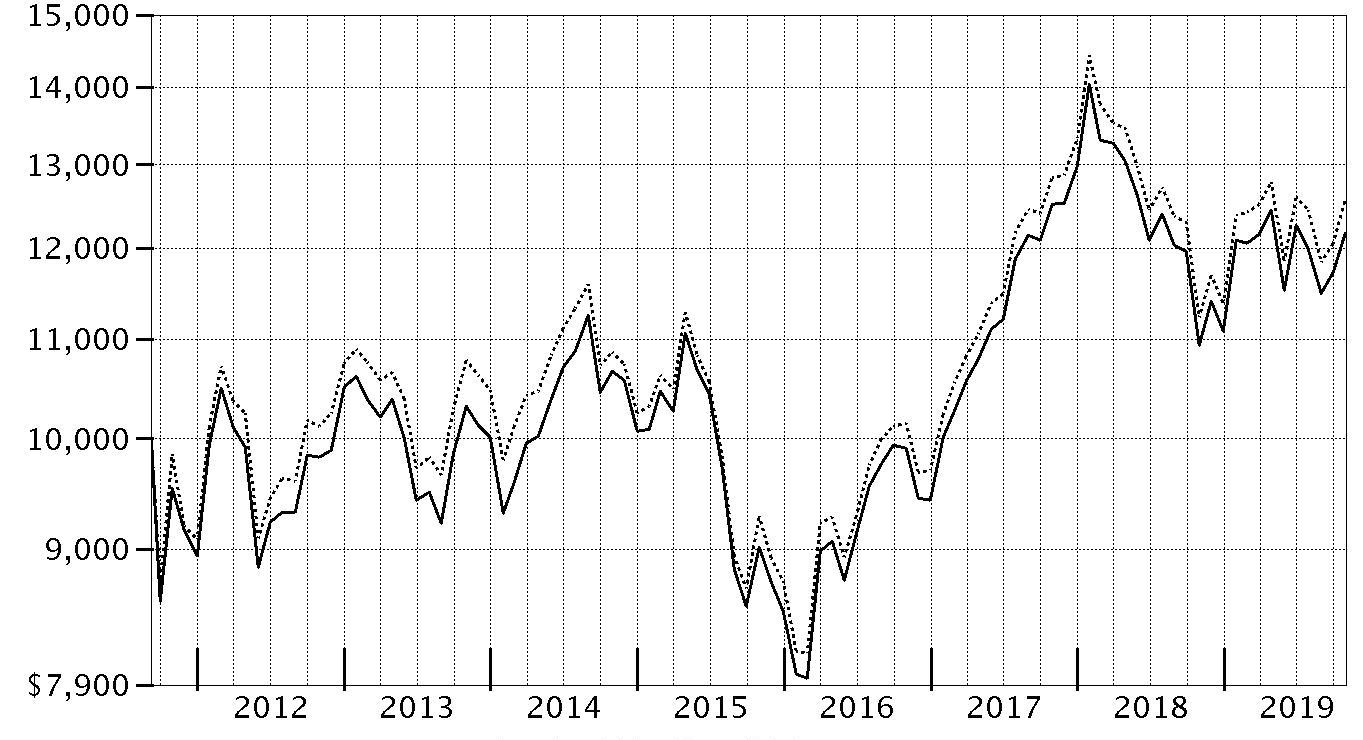

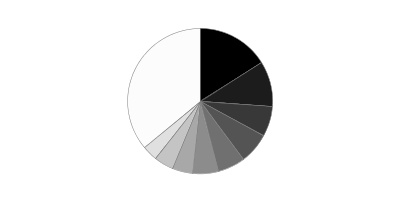

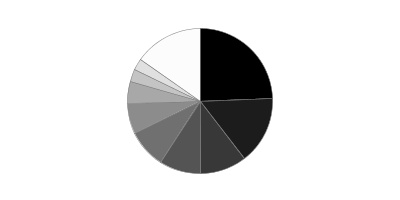

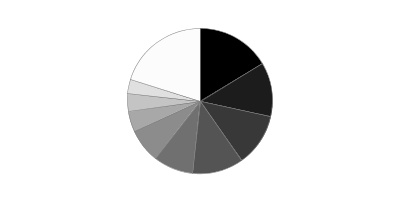

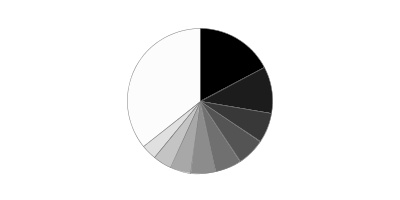

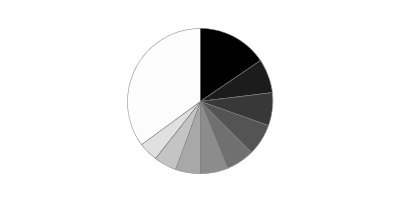

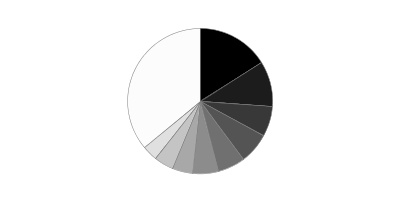

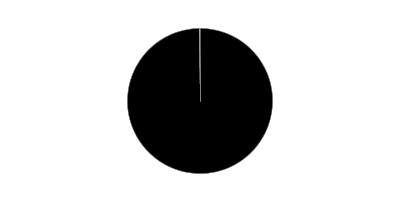

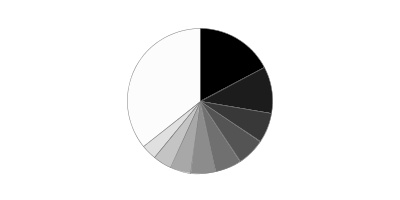

Geographic Diversification (% of fund's net assets)

| As of October 31, 2019 |

| | Japan | 16.0% |

| | United Kingdom | 10.0% |

| | Canada | 6.8% |

| | France | 6.6% |

| | Switzerland | 6.0% |

| | Germany | 5.6% |

| | Cayman Islands | 4.6% |

| | Australia | 4.4% |

| | United States of America* | 3.7% |

| | Other | 36.3% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

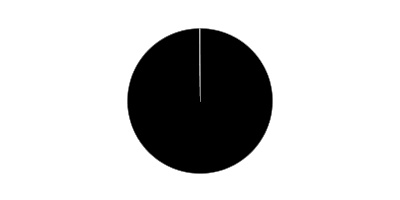

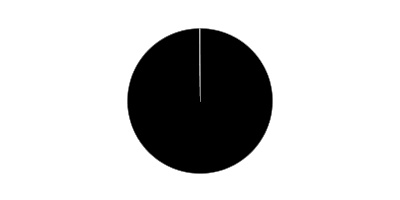

Asset Allocation as of October 31, 2019

| | % of fund's net assets |

| Stocks and Equity Futures | 100.0 |

Top Ten Stocks as of October 31, 2019

| | % of fund's net assets |

| Nestle SA (Reg. S) (Switzerland, Food Products) | 1.5 |

| Alibaba Group Holding Ltd. sponsored ADR (Cayman Islands, Internet & Direct Marketing Retail) | 1.2 |

| Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan, Semiconductors & Semiconductor Equipment) | 1.1 |

| Tencent Holdings Ltd. (Cayman Islands, Interactive Media & Services) | 1.1 |

| Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 1.0 |

| Samsung Electronics Co. Ltd. (Korea (South), Technology Hardware, Storage & Peripherals) | 0.9 |

| Novartis AG (Switzerland, Pharmaceuticals) | 0.9 |

| Toyota Motor Corp. (Japan, Automobiles) | 0.7 |

| HSBC Holdings PLC (United Kingdom) (United Kingdom, Banks) | 0.7 |

| Royal Dutch Shell PLC Class A (United Kingdom) (United Kingdom, Oil, Gas & Consumable Fuels) | 0.6 |

| | 9.7 |

Top Market Sectors as of October 31, 2019

| | % of fund's net assets |

| Financials | 21.7 |

| Consumer Discretionary | 11.2 |

| Industrials | 10.6 |

| Consumer Staples | 9.7 |

| Information Technology | 8.9 |

| Health Care | 8.3 |

| Energy | 6.6 |

| Materials | 6.5 |

| Communication Services | 6.5 |

| Utilities | 3.3 |

Schedule of Investments October 31, 2019

Showing Percentage of Net Assets

| Common Stocks - 94.7% | | | |

| | | Shares | Value |

| Argentina - 0.0% | | | |

| Banco Macro SA sponsored ADR | | 32,528 | $744,891 |

| BBVA Banco Frances SA sponsored ADR | | 29,345 | 102,708 |

| Grupo Financiero Galicia SA sponsored ADR | | 54,477 | 629,754 |

| Pampa Holding SA sponsored ADR (a) | | 24,859 | 387,055 |

| Telecom Argentina SA Class B sponsored ADR | | 32,053 | 288,477 |

| Transportadora de Gas del Sur SA Class B sponsored ADR | | 28,556 | 215,883 |

| YPF SA Class D sponsored ADR | | 78,494 | 734,704 |

|

| TOTAL ARGENTINA | | | 3,103,472 |

|

| Australia - 4.4% | | | |

| AGL Energy Ltd. | | 350,459 | 4,783,981 |

| Alumina Ltd. | | 1,278,316 | 1,995,595 |

| AMP Ltd. | | 1,853,343 | 2,341,775 |

| APA Group unit | | 635,397 | 5,103,672 |

| Aristocrat Leisure Ltd. | | 303,358 | 6,614,733 |

| ASX Ltd. | | 106,159 | 6,025,783 |

| Aurizon Holdings Ltd. | | 1,074,263 | 4,370,358 |

| Australia & New Zealand Banking Group Ltd. | | 1,542,128 | 28,339,870 |

| Bank of Queensland Ltd. | | 293,151 | 1,829,573 |

| Bendigo & Adelaide Bank Ltd. | | 248,940 | 1,826,998 |

| BHP Billiton Ltd. | | 1,609,693 | 39,457,533 |

| BlueScope Steel Ltd. | | 296,460 | 2,713,850 |

| Boral Ltd. | | 602,169 | 2,090,681 |

| Brambles Ltd. | | 872,068 | 7,209,430 |

| Caltex Australia Ltd. | | 138,766 | 2,608,609 |

| Challenger Ltd. | | 313,655 | 1,720,308 |

| Cimic Group Ltd. | | 50,788 | 1,157,403 |

| Coca-Cola Amatil Ltd. | | 331,685 | 2,327,649 |

| Cochlear Ltd. | | 31,070 | 4,532,806 |

| Coles Group Ltd. | | 608,880 | 6,301,222 |

| Commonwealth Bank of Australia | | 963,122 | 52,220,583 |

| Computershare Ltd. | | 276,441 | 3,017,483 |

| Crown Ltd. | | 223,452 | 1,919,590 |

| CSL Ltd. | | 249,887 | 44,069,150 |

| DEXUS Property Group unit | | 585,800 | 4,830,782 |

| Flight Centre Travel Group Ltd. | | 28,737 | 844,198 |

| Fortescue Metals Group Ltd. | | 759,823 | 4,650,593 |

| Goodman Group unit | | 900,092 | 8,937,252 |

| Harvey Norman Holdings Ltd. (b) | | 294,644 | 831,344 |

| Incitec Pivot Ltd. | | 856,040 | 2,036,896 |

| Insurance Australia Group Ltd. | | 1,268,221 | 6,948,674 |

| Lendlease Group unit | | 302,153 | 3,905,544 |

| Macquarie Group Ltd. | | 177,316 | 16,372,904 |

| Magellan Financial Group Ltd. | | 69,564 | 2,307,295 |

| Medibank Private Ltd. | | 1,478,858 | 3,446,810 |

| Mirvac Group unit | | 2,090,720 | 4,632,783 |

| National Australia Bank Ltd. | | 1,529,969 | 30,031,993 |

| Newcrest Mining Ltd. | | 422,737 | 9,227,644 |

| Orica Ltd. | | 203,138 | 3,210,333 |

| Origin Energy Ltd. | | 941,712 | 5,105,454 |

| QBE Insurance Group Ltd. | | 727,739 | 6,331,611 |

| Ramsay Health Care Ltd. | | 91,278 | 4,312,945 |

| realestate.com.au Ltd. | | 29,117 | 2,185,213 |

| Rio Tinto Ltd. | | 203,998 | 12,756,613 |

| Santos Ltd. | | 949,019 | 5,308,353 |

| Scentre Group unit | | 2,977,240 | 7,866,303 |

| SEEK Ltd. | | 197,394 | 3,089,222 |

| Sonic Healthcare Ltd. | | 243,615 | 4,797,997 |

| South32 Ltd. | | 2,757,468 | 4,825,380 |

| SP AusNet | | 920,154 | 1,175,376 |

| Stockland Corp. Ltd. unit | | 1,280,023 | 4,321,321 |

| Suncorp Group Ltd. | | 699,819 | 6,497,473 |

| Sydney Airport unit | | 590,535 | 3,576,544 |

| Tabcorp Holdings Ltd. | | 1,142,018 | 3,784,245 |

| Telstra Corp. Ltd. | | 2,236,488 | 5,386,461 |

| The GPT Group unit | | 1,032,333 | 4,237,450 |

| TPG Telecom Ltd. | | 190,507 | 858,648 |

| Transurban Group unit | | 1,454,802 | 14,900,006 |

| Treasury Wine Estates Ltd. | | 386,258 | 4,682,662 |

| Vicinity Centres unit | | 1,872,302 | 3,446,391 |

| Washington H. Soul Pattinson & Co. Ltd. | | 56,006 | 837,191 |

| Wesfarmers Ltd. | | 621,005 | 17,062,061 |

| Westpac Banking Corp. | | 1,876,504 | 36,433,263 |

| Woodside Petroleum Ltd. | | 515,096 | 11,416,313 |

| Woolworths Group Ltd. | | 694,259 | 17,902,265 |

| WorleyParsons Ltd. | | 174,336 | 1,636,358 |

|

| TOTAL AUSTRALIA | | | 531,526,799 |

|

| Austria - 0.2% | | | |

| Andritz AG | | 42,766 | 1,921,232 |

| Erste Group Bank AG | | 163,876 | 5,788,355 |

| OMV AG | | 79,683 | 4,649,702 |

| Raiffeisen International Bank-Holding AG | | 86,658 | 2,131,125 |

| Verbund AG | | 34,136 | 1,846,486 |

| Voestalpine AG | | 76,607 | 1,918,123 |

|

| TOTAL AUSTRIA | | | 18,255,023 |

|

| Bailiwick of Jersey - 0.5% | | | |

| Experian PLC | | 496,905 | 15,628,208 |

| Ferguson PLC | | 126,615 | 10,812,077 |

| Glencore Xstrata PLC | | 6,037,495 | 18,223,458 |

| Polymetal International PLC | | 118,237 | 1,939,808 |

| WPP PLC | | 673,135 | 8,400,427 |

|

| TOTAL BAILIWICK OF JERSEY | | | 55,003,978 |

|

| Belgium - 0.6% | | | |

| Ageas | | 103,116 | 5,938,872 |

| Anheuser-Busch InBev SA NV | | 416,509 | 33,619,545 |

| Colruyt NV | | 28,535 | 1,586,162 |

| Groupe Bruxelles Lambert SA | | 45,744 | 4,590,625 |

| KBC Groep NV | | 138,117 | 9,686,154 |

| Proximus | | 79,714 | 2,447,555 |

| Solvay SA Class A | | 41,206 | 4,480,813 |

| Telenet Group Holding NV | | 23,408 | 1,149,228 |

| Titan Cement International Trading SA (a) | | 14,199 | 296,453 |

| UCB SA | | 70,073 | 5,647,294 |

| Umicore SA (b) | | 105,639 | 4,355,775 |

|

| TOTAL BELGIUM | | | 73,798,476 |

|

| Bermuda - 0.4% | | | |

| Alibaba Health Information Technology Ltd. (a) | | 2,064,000 | 2,077,406 |

| Alibaba Pictures Group Ltd. (a) | | 7,430,000 | 1,218,645 |

| Beijing Enterprises Water Group Ltd. | | 3,116,000 | 1,624,147 |

| Brilliance China Automotive Holdings Ltd. | | 1,572,000 | 1,733,560 |

| Cheung Kong Infrastructure Holdings Ltd. | | 345,500 | 2,486,470 |

| China Gas Holdings Ltd. | | 999,400 | 4,257,384 |

| China Oriental Group Co. Ltd. (H Shares) | | 392,000 | 136,807 |

| China Resource Gas Group Ltd. | | 504,000 | 3,038,771 |

| Cosco Shipping Ports Ltd. | | 973,623 | 765,453 |

| Credicorp Ltd. (United States) | | 37,516 | 8,029,925 |

| Dairy Farm International Holdings Ltd. | | 195,430 | 1,177,918 |

| GOME Electrical Appliances Holdings Ltd. (a) | | 5,462,418 | 493,778 |

| Haier Electronics Group Co. Ltd. | | 657,000 | 1,875,793 |

| HengTen Networks Group Ltd. (a) | | 6,300,000 | 90,652 |

| Hongkong Land Holdings Ltd. | | 658,289 | 3,616,241 |

| Jardine Matheson Holdings Ltd. | | 123,171 | 7,022,104 |

| Jardine Strategic Holdings Ltd. | | 121,801 | 3,933,177 |

| Kerry Properties Ltd. | | 332,500 | 1,075,193 |

| Kunlun Energy Co. Ltd. | | 2,172,000 | 2,021,561 |

| Luye Pharma Group Ltd. (c) | | 680,500 | 502,992 |

| Nine Dragons Paper (Holdings) Ltd. | | 946,000 | 820,621 |

| NWS Holdings Ltd. | | 899,515 | 1,338,730 |

| Shangri-La Asia Ltd. | | 690,000 | 708,225 |

| Shenzhen International Holdings Ltd. | | 531,719 | 1,081,001 |

| Sihuan Pharmaceutical Holdings Group Ltd. | | 1,587,000 | 207,929 |

| Yue Yuen Industrial (Holdings) Ltd. | | 367,000 | 1,034,275 |

|

| TOTAL BERMUDA | | | 52,368,758 |

|

| Brazil - 1.2% | | | |

| Ambev SA | | 1,983,330 | 8,595,007 |

| Atacadao Distribuicao Comercio e Industria Ltda | | 194,200 | 925,361 |

| B2W Companhia Global do Varejo (a) | | 125,374 | 1,588,081 |

| Banco Bradesco SA | | 422,159 | 3,457,904 |

| Banco do Brasil SA | | 470,000 | 5,642,813 |

| Banco Santander SA (Brasil) unit | | 214,700 | 2,519,332 |

| BB Seguridade Participacoes SA | | 389,200 | 3,296,627 |

| BM&F BOVESPA SA | | 1,135,125 | 13,693,392 |

| BR Malls Participacoes SA | | 387,630 | 1,483,636 |

| Brasil Foods SA (a) | | 226,200 | 2,002,833 |

| BTG Pactual Participations Ltd. unit | | 120,900 | 1,958,276 |

| CCR SA | | 700,600 | 2,871,927 |

| Centrais Eletricas Brasileiras SA (Electrobras) (a) | | 158,900 | 1,567,407 |

| Cielo SA | | 709,614 | 1,337,659 |

| Companhia de Saneamento Basico do Estado de Sao Paulo (SABESP) | | 187,700 | 2,556,333 |

| Companhia Siderurgica Nacional SA (CSN) | | 376,000 | 1,106,296 |

| Cosan SA Industria e Comercio | | 83,300 | 1,200,326 |

| Drogasil SA | | 131,900 | 3,617,753 |

| Embraer SA | | 368,200 | 1,609,412 |

| Energisa SA unit | | 93,500 | 1,117,197 |

| ENGIE Brasil Energia SA | | 99,750 | 1,125,716 |

| Equatorial Energia SA | | 92,200 | 2,342,186 |

| Hypermarcas SA | | 198,400 | 1,697,815 |

| IRB Brasil Resseguros SA | | 379,700 | 3,577,824 |

| JBS SA | | 579,700 | 4,089,194 |

| Klabin SA unit | | 347,100 | 1,369,186 |

| Kroton Educacional SA | | 759,592 | 1,831,506 |

| Localiza Rent A Car SA | | 328,554 | 3,537,455 |

| Lojas Renner SA | | 446,223 | 5,646,632 |

| M. Dias Branco SA | | 57,300 | 539,353 |

| Magazine Luiza SA | | 334,100 | 3,718,794 |

| Multiplan Empreendimentos Imobiliarios SA | | 145,956 | 1,063,053 |

| Natura Cosmeticos SA | | 197,500 | 1,534,497 |

| Notre Dame Intermedica Participacoes SA | | 191,800 | 2,869,468 |

| Petrobras Distribuidora SA | | 409,200 | 2,885,470 |

| Petroleo Brasileiro SA - Petrobras (ON) | | 1,067,711 | 8,705,685 |

| Porto Seguro SA | | 49,500 | 708,465 |

| Rumo SA (a) | | 610,900 | 3,473,013 |

| Sul America SA unit | | 120,337 | 1,448,965 |

| Suzano Papel e Celulose SA | | 307,871 | 2,505,650 |

| TIM Participacoes SA | | 413,303 | 1,176,891 |

| Ultrapar Participacoes SA | | 406,800 | 1,914,055 |

| Vale SA (a) | | 1,301,386 | 15,316,150 |

| Vale SA sponsored ADR (a) | | 446,303 | 5,239,597 |

| Weg SA | | 427,366 | 2,717,325 |

|

| TOTAL BRAZIL | | | 143,181,517 |

|

| Canada - 6.5% | | | |

| Agnico Eagle Mines Ltd. (Canada) | | 126,666 | 7,784,992 |

| Air Canada (a) | | 67,285 | 2,395,920 |

| Alimentation Couche-Tard, Inc. Class B (sub. vtg.) | | 482,202 | 14,461,301 |

| AltaGas Ltd. | | 144,390 | 2,100,457 |

| ATCO Ltd. Class I (non-vtg.) | | 41,684 | 1,465,317 |

| Aurora Cannabis, Inc. (a)(b) | | 370,176 | 1,326,574 |

| Bank of Montreal (b) | | 350,200 | 25,924,000 |

| Bank of Nova Scotia | | 664,650 | 38,119,855 |

| Barrick Gold Corp. (Canada) | | 974,180 | 16,922,966 |

| Bausch Health Cos., Inc. (Canada) (a) | | 177,625 | 4,415,339 |

| BCE, Inc. | | 80,534 | 3,820,336 |

| BlackBerry Ltd. (a) | | 266,895 | 1,402,258 |

| Bombardier, Inc. Class B (sub. vtg.) (a) | | 1,066,533 | 1,344,199 |

| Brookfield Asset Management, Inc. Class A | | 485,883 | 26,867,253 |

| CAE, Inc. | | 142,819 | 3,581,590 |

| Cameco Corp. | | 225,030 | 2,009,227 |

| Canadian Imperial Bank of Commerce | | 244,443 | 20,843,818 |

| Canadian National Railway Co. | | 395,652 | 35,386,687 |

| Canadian Natural Resources Ltd. | | 658,433 | 16,602,050 |

| Canadian Pacific Railway Ltd. | | 77,640 | 17,655,422 |

| Canadian Tire Ltd. Class A (non-vtg.) | | 34,649 | 3,735,336 |

| Canadian Utilities Ltd. Class A (non-vtg.) | | 72,830 | 2,123,909 |

| CCL Industries, Inc. Class B | | 81,343 | 3,347,964 |

| Cenovus Energy, Inc. (Canada) | | 575,242 | 4,900,323 |

| CGI Group, Inc. Class A (sub. vtg.) (a) | | 134,468 | 10,452,383 |

| CI Financial Corp. | | 134,556 | 1,958,423 |

| Constellation Software, Inc. | | 11,155 | 11,017,203 |

| Cronos Group, Inc. (a)(b) | | 96,596 | 790,604 |

| Dollarama, Inc. | | 165,080 | 5,553,637 |

| Emera, Inc. (b) | | 136,124 | 5,635,747 |

| Empire Co. Ltd. Class A (non-vtg.) | | 91,872 | 2,439,271 |

| Enbridge, Inc. | | 1,100,976 | 40,098,564 |

| Encana Corp. (Toronto) | | 741,948 | 2,906,728 |

| Fairfax Financial Holdings Ltd. (sub. vtg.) | | 14,999 | 6,354,447 |

| First Capital Realty, Inc. | | 87,933 | 1,455,424 |

| First Quantum Minerals Ltd. | | 383,046 | 3,236,886 |

| Fortis, Inc. | | 236,110 | 9,809,384 |

| Franco-Nevada Corp. | | 103,068 | 10,000,828 |

| George Weston Ltd. | | 44,654 | 3,575,100 |

| Gildan Activewear, Inc. | | 115,258 | 2,944,675 |

| Great-West Lifeco, Inc. | | 148,958 | 3,622,447 |

| H&R (REIT) unit | | 77,113 | 1,304,440 |

| Husky Energy, Inc. | | 176,906 | 1,235,696 |

| Hydro One Ltd. (c) | | 184,020 | 3,421,646 |

| iA Financial Corp, Inc. | | 61,105 | 2,942,746 |

| IGM Financial, Inc. | | 52,355 | 1,477,515 |

| Imperial Oil Ltd. | | 157,853 | 3,931,044 |

| Intact Financial Corp. | | 75,809 | 7,822,066 |

| Inter Pipeline Ltd. | | 224,321 | 3,765,650 |

| Keyera Corp. | | 110,692 | 2,565,809 |

| Kinross Gold Corp. (a) | | 675,270 | 3,281,245 |

| Kirkland Lake Gold Ltd. | | 109,649 | 5,149,032 |

| Loblaw Companies Ltd. | | 100,214 | 5,344,341 |

| Lundin Mining Corp. | | 341,273 | 1,723,078 |

| Magna International, Inc. Class A (sub. vtg.) | | 166,251 | 8,939,257 |

| Manulife Financial Corp. | | 1,080,502 | 20,123,540 |

| Methanex Corp. | | 34,724 | 1,315,826 |

| Metro, Inc. Class A (sub. vtg.) | | 140,829 | 5,955,641 |

| National Bank of Canada | | 185,907 | 9,600,937 |

| Nutrien Ltd. | | 321,067 | 15,359,830 |

| Onex Corp. (sub. vtg.) | | 48,709 | 2,863,517 |

| Open Text Corp. | | 153,081 | 6,185,537 |

| Pembina Pipeline Corp. | | 280,795 | 9,885,707 |

| Power Corp. of Canada (sub. vtg.) | | 169,313 | 3,918,199 |

| Power Financial Corp. | | 143,980 | 3,366,930 |

| PrairieSky Royalty Ltd. | | 121,692 | 1,188,186 |

| Quebecor, Inc. Class B (sub. vtg.) | | 92,524 | 2,151,002 |

| Restaurant Brands International, Inc. | | 118,560 | 7,756,674 |

| Restaurant Brands International, Inc. | | 13,873 | 907,849 |

| RioCan (REIT) | | 83,065 | 1,666,850 |

| Rogers Communications, Inc. Class B (non-vtg.) | | 194,371 | 9,151,124 |

| Royal Bank of Canada | | 778,055 | 62,759,520 |

| Saputo, Inc. | | 125,716 | 3,646,155 |

| Shaw Communications, Inc. Class B | | 264,459 | 5,397,204 |

| Shopify, Inc. Class A (a) | | 54,353 | 17,043,344 |

| Smart (REIT) | | 43,841 | 1,059,826 |

| SNC-Lavalin Group, Inc. (b) | | 100,373 | 1,814,502 |

| Sun Life Financial, Inc. | | 325,294 | 14,593,898 |

| Suncor Energy, Inc. | | 859,714 | 25,561,005 |

| TC Energy Corp. | | 503,104 | 25,359,559 |

| Teck Resources Ltd. Class B (sub. vtg.) | | 275,172 | 4,349,769 |

| TELUS Corp. | | 113,003 | 4,019,581 |

| The Stars Group, Inc. (a) | | 118,658 | 2,581,989 |

| The Toronto-Dominion Bank | | 996,622 | 56,909,833 |

| Thomson Reuters Corp. | | 109,605 | 7,365,529 |

| Tourmaline Oil Corp. | | 132,878 | 1,140,021 |

| Vermilion Energy, Inc. (b) | | 98,252 | 1,297,992 |

| West Fraser Timber Co. Ltd. | | 27,900 | 1,290,039 |

| Wheaton Precious Metals Corp. | | 246,047 | 6,897,013 |

| WSP Global, Inc. | | 60,586 | 3,780,243 |

|

| TOTAL CANADA | | | 781,556,780 |

|

| Cayman Islands - 4.6% | | | |

| 3SBio, Inc. (a)(c) | | 884,000 | 1,646,678 |

| 51job, Inc. sponsored ADR (a) | | 13,082 | 1,030,469 |

| 58.com, Inc. ADR (a) | | 49,623 | 2,620,591 |

| AAC Technology Holdings, Inc. | | 418,500 | 2,708,237 |

| Agile Property Holdings Ltd. | | 586,000 | 789,850 |

| Airtac International Group | | 61,000 | 835,055 |

| Alibaba Group Holding Ltd. sponsored ADR (a) | | 776,939 | 137,261,813 |

| Anta Sports Products Ltd. | | 575,000 | 5,624,720 |

| ASM Pacific Technology Ltd. | | 157,200 | 2,194,957 |

| Autohome, Inc. ADR Class A (a)(b) | | 33,383 | 2,822,866 |

| Baidu.com, Inc. sponsored ADR (a) | | 152,970 | 15,579,995 |

| Baozun, Inc. sponsored ADR (a)(b) | | 19,697 | 857,213 |

| BeiGene Ltd. ADR (a)(b) | | 20,957 | 2,899,191 |

| Bosideng International Holdings Ltd. | | 1,466,000 | 758,083 |

| Budweiser Brewing Co. APAC Ltd. (a)(c) | | 670,100 | 2,432,886 |

| Chailease Holding Co. Ltd. | | 661,475 | 2,982,255 |

| Cheung Kong Property Holdings Ltd. | | 1,418,116 | 9,866,839 |

| China Aoyuan Property Group Ltd. | | 647,000 | 826,821 |

| China Conch Venture Holdings Ltd. | | 956,000 | 3,740,718 |

| China Education Group Holdings Ltd. | | 357,000 | 533,280 |

| China First Capital Group Ltd. (a) | | 1,266,000 | 359,978 |

| China Hongqiao Group Ltd. | | 741,500 | 411,822 |

| China Huishan Dairy Holdings Co. Ltd. (a)(d) | | 958,000 | 25,674 |

| China Investment Fund International Holdings Co. Ltd. (d) | | 320,000 | 471,264 |

| China Literature Ltd. (a)(b)(c) | | 138,600 | 542,973 |

| China Medical System Holdings Ltd. | | 724,000 | 981,834 |

| China Mengniu Dairy Co. Ltd. | | 1,505,000 | 6,000,052 |

| China Resources Cement Holdings Ltd. | | 1,220,000 | 1,336,011 |

| China Resources Land Ltd. | | 1,504,465 | 6,398,306 |

| China State Construction International Holdings Ltd. | | 1,081,750 | 996,241 |

| China Zhongwang Holdings Ltd. | | 548,800 | 227,841 |

| CIFI Holdings Group Co. Ltd. | | 1,497,898 | 999,062 |

| CK Hutchison Holdings Ltd. | | 1,487,116 | 13,730,667 |

| Country Garden Holdings Co. Ltd. | | 4,128,537 | 5,731,356 |

| Country Garden Services Holdings Co. Ltd. | | 613,000 | 2,077,073 |

| Ctrip.com International Ltd. ADR (a) | | 257,098 | 8,481,663 |

| Dali Foods Group Co. Ltd. (c) | | 1,052,000 | 719,232 |

| ENN Energy Holdings Ltd. | | 429,600 | 4,901,112 |

| Evergrande Real Estate Group Ltd. | | 936,000 | 2,278,464 |

| Future Land Development Holding Ltd. | | 832,000 | 876,775 |

| GDS Holdings Ltd. ADR (a)(b) | | 34,744 | 1,448,130 |

| Geely Automobile Holdings Ltd. | | 2,753,000 | 5,209,260 |

| Genscript Biotech Corp. (a) | | 458,000 | 1,097,343 |

| Greentown Service Group Co. Ltd. | | 574,000 | 651,243 |

| Haidilao International Holding Ltd. (c) | | 168,000 | 813,303 |

| Haitian International Holdings Ltd. | | 324,000 | 764,547 |

| Hengan International Group Co. Ltd. | | 417,000 | 2,911,495 |

| Huazhu Group Ltd. ADR | | 74,877 | 2,834,843 |

| Hutchison China Meditech Ltd. sponsored ADR (a) | | 30,122 | 569,306 |

| iQIYI, Inc. ADR (a)(b) | | 61,269 | 1,067,919 |

| JD.com, Inc. sponsored ADR (a) | | 407,284 | 12,686,897 |

| Kaisa Group Holdings Ltd. | | 1,299,000 | 568,066 |

| Kingboard Chemical Holdings Ltd. | | 361,000 | 962,030 |

| Kingboard Laminates Holdings Ltd. | | 637,000 | 583,163 |

| Kingdee International Software Group Co. Ltd. | | 1,319,000 | 1,445,294 |

| Kingsoft Corp. Ltd. (a) | | 423,000 | 973,509 |

| KWG Property Holding Ltd. | | 877,000 | 883,123 |

| Lee & Man Paper Manufacturing Ltd. | | 483,000 | 268,580 |

| Li Ning Co. Ltd. | | 1,056,500 | 3,582,404 |

| Lijun International Pharmaceutical Holding Ltd. | | 768,000 | 640,505 |

| Logan Property Holdings Co. Ltd. | | 716,000 | 1,090,454 |

| Longfor Properties Co. Ltd. (c) | | 1,011,000 | 4,195,804 |

| Meitu, Inc. (a)(c) | | 1,093,500 | 242,006 |

| Meituan Dianping Class B (a) | | 541,490 | 6,458,970 |

| Melco Crown Entertainment Ltd. sponsored ADR | | 117,185 | 2,524,165 |

| MGM China Holdings Ltd. | | 527,200 | 834,812 |

| Momo, Inc. ADR | | 85,204 | 2,856,038 |

| NetEase, Inc. ADR | | 38,710 | 11,065,641 |

| New Oriental Education & Technology Group, Inc. sponsored ADR (a) | | 76,439 | 9,330,144 |

| Nexteer Auto Group Ltd. | | 339,000 | 315,955 |

| NIO, Inc. sponsored ADR (a)(b) | | 308,188 | 446,873 |

| Noah Holdings Ltd. sponsored ADR (a) | | 25,177 | 762,611 |

| Pinduoduo, Inc. ADR (a) | | 104,737 | 4,281,649 |

| Sands China Ltd. | | 1,314,800 | 6,476,205 |

| Semiconductor Manufacturing International Corp. (a) | | 1,770,000 | 2,248,340 |

| Shenzhou International Group Holdings Ltd. | | 412,900 | 5,705,722 |

| Shimao Property Holdings Ltd. | | 669,500 | 2,242,882 |

| Shui On Land Ltd. | | 1,205,500 | 242,598 |

| SINA Corp. (a) | | 38,039 | 1,506,344 |

| Sino Biopharmaceutical Ltd. | | 3,747,000 | 5,578,884 |

| SOHO China Ltd. | | 1,535,000 | 523,806 |

| Sunac China Holdings Ltd. | | 1,321,000 | 5,991,776 |

| Sunny Optical Technology Group Co. Ltd. | | 400,500 | 6,437,591 |

| TAL Education Group ADR (a) | | 212,538 | 9,098,752 |

| Tencent Holdings Ltd. | | 3,117,000 | 126,434,614 |

| Tencent Music Entertainment Group ADR (a) | | 48,329 | 668,873 |

| Tingyi (Cayman Islands) Holding Corp. | | 1,122,000 | 1,492,592 |

| Towngas China Co. Ltd. | | 409,922 | 315,999 |

| Uni-President China Holdings Ltd. | | 776,000 | 801,555 |

| Vipshop Holdings Ltd. ADR (a) | | 248,046 | 2,862,451 |

| Want Want China Holdings Ltd. | | 2,951,000 | 2,485,951 |

| Weibo Corp. sponsored ADR (a)(b) | | 28,517 | 1,402,751 |

| WH Group Ltd. (c) | | 5,109,500 | 5,393,299 |

| Wharf Real Estate Investment Co. Ltd. | | 654,000 | 3,846,648 |

| Wuxi Biologics (Cayman), Inc. (a)(c) | | 312,000 | 3,666,457 |

| Wynn Macau Ltd. | | 914,000 | 1,983,454 |

| Xiaomi Corp. Class B (a)(c) | | 4,337,000 | 4,913,807 |

| Xinyi Solar Holdings Ltd. | | 1,906,488 | 1,077,235 |

| Yihai International Holding Ltd. | | 259,000 | 1,761,392 |

| Yuzhou Properties Co. | | 515,958 | 217,952 |

| YY, Inc. ADR (a) | | 29,696 | 1,687,921 |

| Zhen Ding Technology Holding Ltd. | | 302,230 | 1,436,925 |

| Zhongsheng Group Holdings Ltd. Class H | | 293,000 | 971,359 |

| ZTO Express (Cayman), Inc. sponsored ADR | | 186,839 | 4,110,458 |

|

| TOTAL CAYMAN ISLANDS | | | 553,510,592 |

|

| Chile - 0.2% | | | |

| Aguas Andinas SA | | 1,317,262 | 603,923 |

| Banco de Chile | | 27,055,611 | 3,484,103 |

| Banco de Credito e Inversiones | | 26,766 | 1,490,248 |

| Banco Santander Chile | | 33,573,312 | 2,082,940 |

| Cencosud SA | | 714,322 | 969,960 |

| Colbun SA (a) | | 3,574,461 | 616,710 |

| Compania Cervecerias Unidas SA | | 101,407 | 1,011,868 |

| Compania de Petroleos de Chile SA (COPEC) | | 216,854 | 1,939,024 |

| CorpBanca SA | | 72,283,408 | 438,613 |

| Empresa Nacional de Telecomunicaciones SA (ENTEL) (a) | | 68,353 | 534,676 |

| Empresas CMPC SA | | 659,267 | 1,502,375 |

| Enel Chile SA | | 15,498,586 | 1,274,621 |

| Enersis SA | | 22,148,143 | 4,136,351 |

| LATAM Airlines Group SA | | 176,462 | 1,951,171 |

| S.A.C.I. Falabella | | 391,718 | 1,993,980 |

|

| TOTAL CHILE | | | 24,030,563 |

|

| China - 2.8% | | | |

| Agricultural Bank of China Ltd.: | | | |

| (A Shares) | | 1,137,100 | 587,589 |

| (H Shares) | | 16,906,000 | 6,956,882 |

| Aier Eye Hospital Group Co. Ltd. (A Shares) | | 63,340 | 355,517 |

| Air China Ltd. (H Shares) | | 1,052,000 | 928,814 |

| Aisino Co. Ltd. (A Shares) | | 26,200 | 76,568 |

| Aluminum Corp. of China Ltd.: | | | |

| (A shares) (a) | | 463,800 | 223,033 |

| (H Shares) (a) | | 2,160,000 | 639,936 |

| Angang Steel Co. Ltd. (H Shares) | | 1,449,800 | 484,993 |

| Anhui Conch Cement Co. Ltd.: | | | |

| (A Shares) | | 82,800 | 495,610 |

| (H Shares) | | 701,500 | 4,192,677 |

| Anxin Trust Co. Ltd. (A Shares) (a) | | 43,200 | 25,729 |

| AVIC Aircraft Co. Ltd. (A Shares) | | 84,600 | 180,135 |

| AVIC Aviation Engine Corp. PLC (A Shares) | | 19,952 | 59,866 |

| AVIC Capital Co. Ltd. (A Shares) | | 68,400 | 44,351 |

| AviChina Industry & Technology Co. Ltd. (H Shares) | | 1,358,000 | 641,454 |

| Baic Motor Corp. Ltd. (H Shares) (c) | | 937,000 | 581,228 |

| Bank Communications Co. Ltd.: | | | |

| (H Shares) | | 5,806,200 | 3,965,331 |

| Class A | | 245,000 | 195,136 |

| Bank of Beijing Co. Ltd. (A Shares) | | 179,600 | 141,208 |

| Bank of Chengdu Co. Ltd. Class A | | 202,100 | 241,758 |

| Bank of China Ltd.: | | | |

| (A Shares) | | 150,000 | 78,787 |

| (H Shares) | | 44,426,024 | 18,116,274 |

| Bank of Guiyang Co. Ltd. (A Shares) | | 181,760 | 235,780 |

| Bank of Hangzhou Co. Ltd. (A Shares) | | 181,331 | 231,647 |

| Bank of Jiangsu Co. Ltd. (A Shares) | | 104,400 | 104,811 |

| Bank of Nanjing Co. Ltd. (A Shares) | | 44,100 | 54,018 |

| Bank of Ningbo Co. Ltd. (A Shares) | | 177,700 | 681,163 |

| Bank of Shanghai Co. Ltd. (A Shares) | | 181,900 | 240,853 |

| Baoshan Iron & Steel Co. Ltd. (A Shares) | | 137,800 | 113,419 |

| BBMG Corp. (H Shares) | | 1,247,000 | 356,882 |

| Beijing Capital International Airport Co. Ltd. (H Shares) | | 970,000 | 918,708 |

| Beijing Shiji Information Technology Co. Ltd. (A Shares) | | 27,200 | 140,409 |

| Beijing Tongrentang Co. Ltd. (A Shares) | | 35,900 | 140,117 |

| BOE Technology Group Co. Ltd. (A Shares) | | 989,700 | 500,997 |

| BYD Co. Ltd.: | | | |

| (A Shares) | | 22,300 | 135,565 |

| (H Shares) (b) | | 446,000 | 2,091,971 |

| Caitong Securities Co. Ltd. | | 64,700 | 91,307 |

| CGN Power Co. Ltd. (H Shares) (c) | | 5,799,000 | 1,506,128 |

| Changjiang Securities Co. Ltd. (A Shares) | | 55,200 | 53,314 |

| Chaozhou Three-Circle Group Co. (A Shares) | | 51,500 | 137,129 |

| China Cinda Asset Management Co. Ltd. (H Shares) | | 5,049,000 | 1,047,400 |

| China CITIC Bank Corp. Ltd. (H Shares) | | 5,009,293 | 2,903,691 |

| China Coal Energy Co. Ltd. (H Shares) | | 741,000 | 295,497 |

| China Communications Construction Co. Ltd.: | | | |

| (A Shares) | | 293,200 | 391,647 |

| (H Shares) | | 2,264,000 | 1,723,453 |

| China Communications Services Corp. Ltd. (H Shares) | | 1,312,000 | 810,197 |

| China Construction Bank Corp. (H Shares) | | 52,896,649 | 42,384,525 |

| China Eastern Airlines Corp. Ltd.: | | | |

| (A Shares) (a) | | 209,900 | 154,273 |

| (H Shares) (a) | | 822,000 | 409,967 |

| China Everbright Bank Co. Ltd.: | | | |

| (A Shares) | | 718,700 | 442,723 |

| (H Shares) | | 1,981,000 | 911,592 |

| China Film Co. Ltd. (A Shares) | | 50,000 | 94,467 |

| China Fortune Land Development Co. Ltd. (A Shares) | | 98,100 | 397,731 |

| China Galaxy Securities Co. Ltd. (H Shares) | | 1,844,500 | 940,487 |

| China Gezhouba Group Co. Ltd. (A Shares) | | 76,500 | 62,249 |

| China Grand Automotive Services Co. Ltd. (A Shares) | | 167,800 | 85,966 |

| China Huarong Asset Management Co. Ltd. (c) | | 5,659,000 | 835,465 |

| China International Capital Corp. Ltd. (H Shares) (c) | | 670,800 | 1,223,168 |

| China International Travel Service Corp. Ltd. (A Shares) | | 52,800 | 677,056 |

| China Life Insurance Co. Ltd. (H Shares) | | 4,221,000 | 10,855,110 |

| China Longyuan Power Grid Corp. Ltd. (H Shares) | | 1,687,000 | 911,376 |

| China Merchants Bank Co. Ltd.: | | | |

| (A Shares) | | 287,800 | 1,449,555 |

| (H Shares) | | 2,378,691 | 11,344,527 |

| China Merchants Securities Co. Ltd. (A Shares) | | 189,000 | 440,906 |

| China Merchants Shekou Industrial Zone Holdings Co. Ltd. (A Shares) | | 243,400 | 646,459 |

| China Minsheng Banking Corp. Ltd.: | | | |

| (A Shares) | | 1,507,800 | 1,316,140 |

| (H Shares) | | 3,237,332 | 2,264,419 |

| China Molybdenum Co. Ltd.: | | | |

| (H Shares) (b) | | 2,238,000 | 705,275 |

| Class A | | 384,300 | 185,348 |

| China National Building Materials Co. Ltd. (H Shares) | | 2,044,000 | 1,722,732 |

| China National Chemical Engineering Co. Ltd. (A Shares) | | 121,200 | 102,866 |

| China National Nuclear Power Co. Ltd. (A Shares) | | 207,800 | 149,191 |

| China Northern Rare Earth Group High-Tech Co. Ltd. | | 116,700 | 166,599 |

| China Oilfield Services Ltd. (H Shares) | | 934,000 | 1,300,386 |

| China Pacific Insurance (Group) Co. Ltd. (H Shares) | | 1,691,800 | 6,138,339 |

| China Petroleum & Chemical Corp.: | | | |

| (A Shares) | | 425,000 | 295,596 |

| (H Shares) | | 14,541,800 | 8,271,015 |

| China Railway Construction Corp. Ltd.: | | | |

| (A Shares) | | 389,400 | 518,754 |

| (H Shares) | | 944,000 | 1,032,535 |

| China Railway Group Ltd.: | | | |

| (A Shares) | | 127,200 | 104,041 |

| (H Shares) | | 2,838,000 | 1,710,505 |

| China Railway Signal & Communications Corp. (H Shares) (c) | | 813,000 | 485,348 |

| China Reinsurance Group Corp. (H Shares) | | 3,499,000 | 570,835 |

| China Resources Sanjiu Medical & Pharmaceutical Co. Ltd. (A Shares) | | 35,200 | 147,205 |

| China Shenhua Energy Co. Ltd.: | | | |

| (A Shares) | | 31,000 | 81,118 |

| (H Shares) | | 1,994,500 | 4,050,711 |

| China Shipbuilding Industry Co. (A Shares) | | 334,700 | 251,606 |

| China Shipbuilding Industry Group Power Co. Ltd. (a) | | 13,400 | 39,852 |

| China Shipping Development Co. Ltd. (H Shares) | | 398,000 | 171,212 |

| China Southern Airlines Ltd. (H Shares) | | 1,300,000 | 800,072 |

| China State Construction Engineering Corp. Ltd. (A Shares) | | 1,386,640 | 1,032,008 |

| China Telecom Corp. Ltd. (H Shares) | | 7,600,000 | 3,233,106 |

| China Tower Corp. Ltd. (H Shares) (c) | | 23,360,000 | 5,141,370 |

| China United Network Communications Ltd. (A Shares) | | 760,700 | 662,243 |

| China Vanke Co. Ltd.: | | | |

| (A Shares) | | 184,000 | 692,316 |

| (H Shares) | | 919,100 | 3,351,543 |

| China Yangtze Power Co. Ltd. (A Shares) | | 497,400 | 1,261,259 |

| Chongqing Rural Commercial Bank Co. Ltd. (H Shares) | | 1,249,000 | 666,650 |

| Chongqing Zhifei Biological Products Co. Ltd. (A Shares) | | 31,800 | 219,231 |

| CITIC Securities Co. Ltd.: | | | |

| (A Shares) | | 20,500 | 63,082 |

| (H Shares) | | 1,668,500 | 3,061,224 |

| Contemporary Amperex Technology Co. Ltd. | | 12,100 | 118,026 |

| COSCO Shipping Development Co. Ltd. (H Shares) | | 481,000 | 53,886 |

| COSCO SHIPPING Holdings Co. Ltd.: | | | |

| (A Shares) (a) | | 38,300 | 25,045 |

| (H Shares) (a) | | 1,731,000 | 647,597 |

| CRRC Corp. Ltd.: | | | |

| (A Shares) | | 249,600 | 255,032 |

| (H Shares) | | 3,207,800 | 2,145,489 |

| Daqin Railway Co. Ltd. (A Shares) | | 474,700 | 514,188 |

| Datang International Power Generation Co. Ltd. (H Shares) | | 1,010,000 | 199,219 |

| DHC Software Co. Ltd. (A Shares) | | 157,400 | 159,343 |

| Dong E-E-Jiao Co. Ltd. (A Shares) | | 22,300 | 111,744 |

| Dongfeng Motor Group Co. Ltd. (H Shares) | | 1,650,000 | 1,655,137 |

| Dongxing Securities Co. Ltd. (A Shares) | | 85,900 | 132,565 |

| East Money Information Co. Ltd. (A Shares) | | 115,900 | 245,018 |

| Everbright Securities Co. Ltd. (A Shares) | | 30,600 | 49,742 |

| Fangda Carbon New Material Co. Ltd. (A Shares) | | 52,448 | 79,587 |

| Financial Street Holdings Co. Ltd. (A Shares) | | 177,500 | 197,984 |

| Focus Media Information Technology Co. Ltd. (A Shares) | | 475,840 | 404,792 |

| Foshan Haitian Flavouring & Food Co. Ltd. (A Shares) | | 39,200 | 621,697 |

| Founder Securities Co. Ltd. (A Shares) | | 60,100 | 57,375 |

| Foxconn Industrial Internet Co. Ltd. (A Shares) | | 74,000 | 161,207 |

| Fuyao Glass Industries Group Co. Ltd. (H Shares) (c) | | 358,800 | 1,013,825 |

| GD Power Development Co. Ltd. (A Shares) | | 493,000 | 163,016 |

| Gemdale Corp. (A Shares) | | 43,500 | 73,464 |

| GF Securities Co. Ltd.: | | | |

| (A Shares) (a) | | 70,600 | 137,375 |

| (H Shares) | | 971,000 | 1,011,274 |

| Giant Network Group Co. Ltd. (A Shares) | | 45,400 | 114,756 |

| GoerTek, Inc. (A Shares) | | 90,300 | 237,964 |

| Great Wall Motor Co. Ltd. (H Shares) (b) | | 1,866,500 | 1,512,334 |

| Gree Electric Appliances, Inc. of Zhuhai (A Shares) | | 68,900 | 574,449 |

| Greenland Holdings Corp. Ltd. (A Shares) | | 66,500 | 64,347 |

| Guanghui Energy Co. Ltd. (A Shares) | | 376,500 | 175,820 |

| Guangzhou Automobile Group Co. Ltd. | | 12,200 | 19,898 |

| Guangzhou Automobile Group Co. Ltd. (H Shares) | | 1,821,526 | 1,819,223 |

| Guangzhou Baiyunshan Pharmaceutical Holdings Co. Ltd. (A Shares) | | 24,900 | 119,332 |

| Guangzhou Haige Communications Group (A Shares) | | 113,500 | 154,766 |

| Guangzhou R&F Properties Co. Ltd. (H Shares) | | 554,000 | 858,398 |

| Guosen Securities Co. Ltd. (A Shares) | | 72,000 | 124,916 |

| Guotai Junan Securities Co. Ltd.: | | | |

| (A Shares) | | 173,100 | 418,951 |

| (H Shares) (c) | | 443,600 | 677,865 |

| Guoyuan Securities Co. Ltd. (A Shares) | | 98,900 | 118,542 |

| Haier Smart Home Co. Ltd. (A Shares) | | 90,500 | 205,549 |

| Haitong Securities Co. Ltd.: | | | |

| (A Shares) | | 18,300 | 36,608 |

| (H Shares) | | 1,900,800 | 1,940,543 |

| Hanergy Mobile Energy Holding (d) | | 1,902,000 | 2 |

| Hangzhou Hikvision Digital Technology Co. Ltd. (A Shares) | | 180,200 | 825,411 |

| Hangzhou Robam Appliances Co. Ltd. (A Shares) | | 30,000 | 134,107 |

| Hangzhou Tigermed Consulting Co. Ltd. (A Shares) | | 21,600 | 209,442 |

| Heilan Home Co. Ltd. (A Shares) | | 93,500 | 101,963 |

| Henan Shuanghui Investment & Development Co. Ltd. (A Shares) | | 13,600 | 57,528 |

| Hengli Petrochemical Co. Ltd. (A Shares) | | 48,160 | 110,131 |

| Hengtong Optic-electric Co. Ltd. (A Shares) | | 32,000 | 66,734 |

| Hithink RoyalFlush Information Network Co. Ltd. (A Shares) | | 8,300 | 114,344 |

| Huaan Securities Co. Ltd. (A Shares) | | 14,400 | 12,873 |

| Huadian Power International Corp. Ltd. (H Shares) | | 602,000 | 225,575 |

| Huadong Medicine Co. Ltd. (A Shares) | | 8,560 | 31,685 |

| Huaneng Power International, Inc. (H Shares) | | 2,114,000 | 1,004,098 |

| Huaneng Renewables Corp. Ltd. (H Shares) | | 2,430,000 | 927,715 |

| Huatai Securities Co. Ltd.: | | | |

| (A Shares) | | 217,500 | 538,175 |

| (H Shares) (c) | | 765,000 | 1,137,109 |

| HUAXI Securities Co. Ltd. | | 8,100 | 10,950 |

| Huaxia Bank Co. Ltd. (A Shares) | | 294,600 | 313,201 |

| Huayu Automotive Systems Co. Ltd. (A Shares) | | 14,400 | 51,319 |

| Hubei Biocause Pharmaceutical Co. Ltd. (A Shares) | | 191,400 | 185,108 |

| Hundsun Technologies, Inc. (A Shares) | | 17,600 | 190,265 |

| iFlytek Co. Ltd. (A Shares) | | 13,400 | 62,946 |

| Industrial & Commercial Bank of China Ltd. (H Shares) | | 37,068,008 | 26,555,274 |

| Industrial Bank Co. Ltd. (A Shares) | | 472,900 | 1,256,218 |

| Industrial Securities Co. Ltd. (A Shares) | | 58,300 | 52,766 |

| Inner Mongoli Yili Industries Co. Ltd. (A Shares) | | 162,000 | 666,760 |

| Inner Mongolia Baotou Steel Union Co. Ltd. (A Shares) | | 200,900 | 39,064 |

| Inner Mongolia Yitai Coal Co. Ltd. (B Shares) | | 2,498,988 | 2,179,707 |

| Jiangsu Expressway Co. Ltd. (H Shares) | | 634,000 | 842,300 |

| Jiangsu Hengrui Medicine Co. Ltd. (A Shares) | | 81,360 | 1,049,030 |

| Jiangsu Yanghe Brewery JSC Ltd. (A Shares) | | 40,900 | 584,177 |

| Jiangxi Copper Co. Ltd. (H Shares) | | 779,000 | 911,998 |

| Jinke Properties Group Co. Ltd. (A Shares) | | 152,000 | 149,525 |

| Jointown Pharmaceutical Group (A Shares) | | 62,100 | 113,919 |

| Kangmei Pharmaceutical Co. Ltd. (A Shares) | | 42,400 | 22,418 |

| Kweichow Moutai Co. Ltd. (A Shares) | | 25,100 | 4,200,977 |

| Legend Holdings Corp.: | | | |

| (H Shares) (c) | | 136,700 | 300,494 |

| rights (a)(d) | | 9,446 | 1,567 |

| Lepu Medical Technology Beijing Co. Ltd. (A Shares) | | 31,600 | 135,375 |

| Liaoning Chengda Co. Ltd. (A Shares) (a) | | 64,100 | 127,585 |

| LONGi Green Energy Technology Co. Ltd. | | 81,630 | 264,278 |

| Luxshare Precision Industry Co. Ltd. (A Shares) | | 144,515 | 651,305 |

| Luzhou Laojiao Co. Ltd. (A Shares) | | 35,100 | 434,044 |

| Maanshan Iron & Steel Co. Ltd.: | | | |

| (A Shares) | | 672,600 | 253,828 |

| (H Shares) | | 660,000 | 249,628 |

| Mango Excellent Media Co. Ltd. (A Shares) | | 41,900 | 160,544 |

| Meinian Onehealth Healthcare Holdings Co. Ltd. (A Shares) | | 17,364 | 36,745 |

| Metallurgical Corp. China Ltd.: | | | |

| (A Shares) | | 296,500 | 115,334 |

| (H Shares) | | 1,171,000 | 247,900 |

| Midea Group Co. Ltd. (A Shares) | | 93,100 | 733,239 |

| Muyuan Foodstuff Co. Ltd. (A Shares) | | 35,800 | 500,193 |

| NARI Technology Co. Ltd. (A Shares) | | 78,700 | 245,102 |

| New China Life Insurance Co. Ltd. | | 64,400 | 435,399 |

| New China Life Insurance Co. Ltd. (H Shares) | | 480,900 | 1,866,458 |

| Offshore Oil Enginering Co. Ltd. (A Shares) | | 155,000 | 132,633 |

| Oppein Home Group, Inc. (A Shares) | | 6,900 | 108,110 |

| Orient Securities Co. Ltd. (A Shares) | | 31,300 | 44,401 |

| People's Insurance Co. of China Group (H Shares) | | 4,235,000 | 1,783,669 |

| PetroChina Co. Ltd. (H Shares) | | 12,006,000 | 5,854,865 |

| PICC Property & Casualty Co. Ltd. (H Shares) | | 3,742,001 | 4,735,574 |

| Ping An Bank Co. Ltd. (A Shares) | | 438,300 | 1,011,407 |

| Ping An Insurance Group Co. of China Ltd.: | | | |

| (A Shares) | | 231,900 | 2,895,147 |

| (H Shares) | | 3,093,000 | 35,698,759 |

| Poly Developments & Holdings (A Shares) | | 353,500 | 722,544 |

| Postal Savings Bank of China Co. Ltd. (H Shares) (c) | | 4,495,000 | 2,882,028 |

| Power Construction Corp. of China Ltd. (A Shares) | | 60,646 | 38,402 |

| Qihoo 360 Technology Co. Ltd. (A Shares) | | 35,200 | 112,837 |

| Risesun Real Estate Development Co. Ltd. (A Shares) | | 132,600 | 163,675 |

| Rongsheng Petrochemical Co. Ltd. (A Shares) | | 48,000 | 75,068 |

| SAIC Motor Corp. Ltd. (A Shares) | | 229,100 | 764,088 |

| Sanan Optoelectronics Co. Ltd. (A Shares) | | 15,300 | 32,985 |

| Sany Heavy Industry Co. Ltd. (A Shares) | | 209,900 | 401,112 |

| SDIC Capital Co. Ltd. | | 60,600 | 105,390 |

| SDIC Power Holdings Co. Ltd. (A Shares) | | 52,900 | 62,619 |

| Seazen Holdings Co. Ltd. (A Shares) | | 27,200 | 122,795 |

| Shaanxi Coal Industry Co. Ltd. (A Shares) | | 60,200 | 71,580 |

| Shandong Buchang Pharmaceuticals Co. Ltd. (A Shares) | | 37,470 | 108,899 |

| Shandong Gold Mining Co. Ltd. (A Shares) | | 50,280 | 228,406 |

| Shandong Weigao Medical Polymer Co. Ltd. (H Shares) | | 1,040,000 | 1,193,963 |

| Shanghai 2345 Network Holding Group Co. Ltd. (A Shares) | | 214,240 | 99,047 |

| Shanghai Construction Group Co. Ltd. (A Shares) | | 192,600 | 93,257 |

| Shanghai Electric Group Co. Ltd.: | | | |

| (A Shares) | | 293,800 | 203,456 |

| (H Shares) | | 902,000 | 275,901 |

| Shanghai Fosun Pharmaceutical (Group) Co. Ltd.: | | | |

| (A Shares) | | 37,600 | 135,821 |

| (H Shares) | | 311,500 | 879,166 |

| Shanghai International Airport Co. Ltd. (A Shares) | | 7,072 | 76,547 |

| Shanghai International Port Group Co. Ltd. (A Shares) | | 54,600 | 44,983 |

| Shanghai Lujiazui Finance Trust Ltd. (B Shares) | | 1,609,936 | 1,773,188 |

| Shanghai Pharmaceuticals Holding Co. Ltd. (H Shares) | | 496,300 | 896,774 |

| Shanghai Pudong Development Bank Co. Ltd. (A Shares) | | 702,500 | 1,246,979 |

| Shanghai Tunnel Engineering Co. Ltd. | | 150,800 | 124,605 |

| Shanghaioriental Pearl Media Co. Ltd. | | 189,390 | 241,971 |

| Shanxi Lu'an Environmental Energy Development Co. Ltd. (A Shares) | | 187,000 | 186,018 |

| Shanxi Securities Co. Ltd. (A Shares) | | 99,200 | 109,636 |

| Shanxi Xinghuacun Fen Wine Factory Co. Ltd. (A Shares) | | 14,400 | 181,728 |

| Shanxi Xishan Coal & Electricity Power Co. Ltd. (A Shares) | | 255,000 | 205,147 |

| Shenergy Co. Ltd. (A Shares) | | 85,171 | 70,007 |

| Shenwan Hongyuan Group Co. Ltd. (A Shares) | | 364,100 | 247,486 |

| Shenzhen Inovance Technology Co. Ltd. (A Shares) | | 36,200 | 128,074 |

| Shenzhen Kangtai Biological Products Co. Ltd. | | 14,800 | 181,838 |

| Shenzhen Mindray Bio-Medical Electronics Co. Ltd. (A Shares) | | 7,500 | 189,371 |

| Shenzhen Overseas Chinese Town Co. Ltd. (A Shares) | | 45,700 | 45,659 |

| Shenzhen Salubris Pharmaceuticals Co. Ltd. (A Shares) | | 35,400 | 94,054 |

| Shenzhen Zhongjin Lingnan Nonfemet Co. Ltd. (A Shares) | | 163,000 | 92,959 |

| Shijiazhuang Baosh Electric Co. Ltd. (A Shares) | | 146,100 | 98,794 |

| Sichuan Chuantou Energy Co. Ltd. (A Shares) | | 64,800 | 88,839 |

| Sichuan Kelun Pharmaceutical Co. Ltd. (A Shares) | | 33,300 | 112,870 |

| Sichuan New Hope Agribusiness Co. Ltd. (A Shares) | | 62,400 | 195,353 |

| Sinolink Securities Co. Ltd. (A Shares) | | 103,500 | 124,925 |

| Sinopec Engineering Group Co. Ltd. (H Shares) | | 792,000 | 452,435 |

| Sinopec Shanghai Petrochemical Co. Ltd.: | | | |

| (A Shares) | | 366,600 | 206,073 |

| (H Shares) | | 966,000 | 266,799 |

| Sinopharm Group Co. Ltd. (H Shares) | | 604,800 | 2,165,940 |

| Sinotrans Ltd. (H Shares) | | 836,000 | 245,805 |

| Songcheng Performance Development Co. Ltd. (A Shares) | | 39,200 | 164,695 |

| Soochow Securities Co. Ltd. (A Shares) | | 69,500 | 89,610 |

| Spring Airlines Co. Ltd. (A Shares) | | 27,500 | 168,635 |

| Suning.com Co. Ltd. (A Shares) | | 351,900 | 526,842 |

| Suzhou Gold Mantis Consolidated Co. Ltd. | | 81,600 | 92,600 |

| Tasly Pharmaceutical Group Co. Ltd. (A Shares) | | 40,000 | 83,020 |

| TBEA Co. Ltd. (A Shares) | | 39,900 | 36,357 |

| TCL Corp. (A Shares) | | 339,900 | 158,783 |

| Tong Ren Tang Technologies Co. Ltd. (H Shares) | | 219,000 | 218,037 |

| Tonghua Dongbao Pharmaceutical Co. Ltd. (A Shares) | | 57,100 | 129,508 |

| Tongling Nonferrous Metals Group Co. Ltd. (A Shares) | | 808,900 | 249,161 |

| Tongwei Co. Ltd. (A Shares) | | 67,200 | 121,067 |

| TravelSky Technology Ltd. (H Shares) | | 460,000 | 1,048,550 |

| Tsingtao Brewery Co. Ltd.: | | | |

| (A Shares) | | 22,000 | 146,616 |

| (H Shares) | | 226,000 | 1,309,674 |

| Walvax Biotechnology Co. Ltd. (A Shares) | | 42,800 | 183,210 |

| Wanhua Chemical Group Co. Ltd. (A Shares) | | 91,400 | 591,108 |

| Weichai Power Co. Ltd.: | | | |

| (A Shares) | | 182,100 | 298,570 |

| (H Shares) | | 983,800 | 1,548,521 |

| Weifu High-Technology Group Co. Ltd. (A Shares) | | 6,000 | 14,288 |

| Wens Foodstuffs Group Co. Ltd. (A Shares) | | 106,200 | 606,644 |

| Western Securities Co. Ltd. (A Shares) | | 95,500 | 119,899 |

| Wuliangye Yibin Co. Ltd. (A Shares) | | 79,500 | 1,487,200 |

| WuXi AppTec Co. Ltd. | | 43,300 | 578,002 |

| WuXi AppTec Co. Ltd. (H Shares) (c) | | 63,080 | 760,538 |

| XCMG Construction Machinery Co. Ltd. (A Shares) | | 223,300 | 143,164 |

| Xiamen C&D, Inc. (A Shares) | | 136,200 | 164,092 |

| Xinjiang Goldwind Science & Technology Co. Ltd.: | | | |

| (A Shares) | | 9,500 | 16,939 |

| (H Shares) | | 411,764 | 491,073 |

| Yanzhou Coal Mining Co. Ltd. (H Shares) | | 996,000 | 1,010,515 |

| Yonghui Superstores Co. Ltd. (A Shares) | | 329,600 | 390,191 |

| Yonyou Network Technology Co. Ltd. (A Shares) | | 45,400 | 190,256 |

| Yunnan Baiyao Group Co. Ltd. (A Shares) | | 41,200 | 506,296 |

| Zhangzhou Pientzehuang Pharmaceutical Co. Ltd. (A Shares) | | 9,500 | 146,278 |

| Zhaojin Mining Industry Co. Ltd. (H Shares) | | 540,500 | 604,483 |

| Zhejiang China Commodities City Group Co. Ltd. (A Shares) | | 205,600 | 113,836 |

| Zhejiang Chint Electric Co. Ltd. (A Shares) | | 17,600 | 56,981 |

| Zhejiang Dahua Technology Co. Ltd. (A Shares) | | 25,500 | 58,246 |

| Zhejiang Expressway Co. Ltd. (H Shares) | | 800,000 | 655,095 |

| Zhejiang Longsheng Group Co. Ltd. (A Shares) | | 74,200 | 145,644 |

| Zhejiang Semir Garment Co. Ltd. (A Shares) | | 66,500 | 104,997 |

| Zhengzhou Yutong Bus Co. Ltd. (A Shares) | | 14,600 | 29,623 |

| ZhongAn Online P & C Insurance Co. Ltd. (H Shares) (a)(b)(c) | | 163,100 | 542,937 |

| Zhuzhou CRRC Times Electric Co. Ltd. (H Shares) | | 267,700 | 993,319 |

| Zijin Mining Group Co. Ltd. (H Shares) | | 3,609,000 | 1,250,121 |

| Zoomlion Heavy Industry Science and Technology Co. Ltd. (A Shares) | | 189,900 | 157,639 |

| ZTE Corp.: | | | |

| (A Shares) (a) | | 32,800 | 155,202 |

| (H Shares) (a) | | 531,536 | 1,482,930 |

|

| TOTAL CHINA | | | 342,727,486 |

|

| Colombia - 0.1% | | | |

| Bancolombia SA | | 114,465 | 1,391,867 |

| Cementos Argos SA | | 284,403 | 642,010 |

| Ecopetrol SA | | 2,704,762 | 2,432,685 |

| Grupo de Inversiones Suramerica SA | | 101,638 | 1,028,408 |

| Interconexion Electrica SA ESP | | 226,143 | 1,304,671 |

| Inversiones Argos SA | | 124,907 | 676,272 |

|

| TOTAL COLOMBIA | | | 7,475,913 |

|

| Czech Republic - 0.0% | | | |

| Ceske Energeticke Zavody A/S | | 82,835 | 1,889,603 |

| Komercni Banka A/S | | 40,084 | 1,354,932 |

| MONETA Money Bank A/S (c) | | 292,857 | 973,287 |

|

| TOTAL CZECH REPUBLIC | | | 4,217,822 |

|

| Denmark - 1.1% | | | |

| A.P. Moller - Maersk A/S: | | | |

| Series A | | 1,803 | 2,163,988 |

| Series B | | 3,789 | 4,833,258 |

| Carlsberg A/S Series B | | 58,913 | 8,287,994 |

| Christian Hansen Holding A/S | | 56,447 | 4,333,760 |

| Coloplast A/S Series B | | 64,778 | 7,805,697 |

| Danske Bank A/S | | 348,039 | 4,965,900 |

| DSV A/S | | 120,597 | 11,701,805 |

| Genmab A/S (a) | | 36,532 | 7,982,049 |

| H Lundbeck A/S | | 41,734 | 1,423,571 |

| ISS Holdings A/S | | 89,716 | 2,347,766 |

| Novo Nordisk A/S Series B | | 966,689 | 53,156,982 |

| Novozymes A/S Series B | | 113,894 | 5,362,478 |

| ORSTED A/S (c) | | 103,601 | 9,087,590 |

| Pandora A/S | | 55,690 | 2,738,444 |

| Tryg A/S | | 71,267 | 1,990,514 |

| Vestas Wind Systems A/S | | 103,723 | 8,450,086 |

| William Demant Holding A/S (a) | | 56,425 | 1,489,213 |

|

| TOTAL DENMARK | | | 138,121,095 |

|

| Egypt - 0.0% | | | |

| Commercial International Bank SAE | | 573,150 | 2,876,403 |

| Commercial International Bank SAE sponsored GDR | | 151,516 | 748,489 |

| Eastern Tobacco Co. | | 527,846 | 523,594 |

| Elsewedy Electric Co. | | 287,746 | 239,788 |

|

| TOTAL EGYPT | | | 4,388,274 |

|

| Finland - 0.7% | | | |

| Elisa Corp. (A Shares) | | 76,713 | 4,189,776 |

| Fortum Corp. | | 244,264 | 5,963,441 |

| Kone OYJ (B Shares) | | 185,835 | 11,822,212 |

| Metso Corp. | | 54,431 | 2,056,750 |

| Neste Oyj | | 231,296 | 8,347,729 |

| Nokia Corp. | | 3,131,907 | 11,497,274 |

| Nokian Tyres PLC | | 66,653 | 1,903,055 |

| Nordea Bank ABP (Stockholm Stock Exchange) | | 1,767,995 | 12,940,552 |

| Orion Oyj (B Shares) | | 55,233 | 2,448,038 |

| Sampo Oyj (A Shares) | | 245,362 | 10,054,898 |

| Stora Enso Oyj (R Shares) | | 319,885 | 4,147,425 |

| UPM-Kymmene Corp. | | 294,106 | 9,558,399 |

| Wartsila Corp. | | 250,341 | 2,641,841 |

|

| TOTAL FINLAND | | | 87,571,390 |

|

| France - 6.6% | | | |

| Accor SA | | 103,365 | 4,440,701 |

| Aeroports de Paris | | 15,768 | 2,996,663 |

| Air Liquide SA | | 215,741 | 28,657,358 |

| Alstom SA | | 103,392 | 4,468,383 |

| Amundi SA (c) | | 33,584 | 2,397,199 |

| Arkema SA | | 35,938 | 3,673,083 |

| Atos Origin SA | | 53,633 | 4,162,279 |

| AXA SA | | 1,050,128 | 27,798,182 |

| BIC SA | | 12,363 | 858,331 |

| bioMerieux SA | | 20,246 | 1,656,270 |

| BNP Paribas SA | | 610,543 | 31,906,707 |

| Bollore SA (a) | | 2,237 | 9,531 |

| Bollore SA | | 471,915 | 2,042,148 |

| Bouygues SA | | 119,831 | 5,078,606 |

| Bureau Veritas SA | | 159,706 | 4,077,169 |

| Capgemini SA | | 87,350 | 9,834,696 |

| Carrefour SA | | 324,728 | 5,524,890 |

| Casino Guichard Perrachon SA (b) | | 29,668 | 1,600,501 |

| CNP Assurances | | 86,249 | 1,710,321 |

| Compagnie de St. Gobain | | 269,363 | 10,956,338 |

| Covivio | | 26,704 | 3,022,972 |

| Credit Agricole SA | | 620,174 | 8,092,248 |

| Danone SA | | 336,877 | 27,907,330 |

| Dassault Aviation SA | | 1,272 | 1,766,234 |

| Dassault Systemes SA | | 72,274 | 10,966,609 |

| Edenred SA | | 130,277 | 6,858,063 |

| EDF SA (a) | | 23,260 | 240,014 |

| EDF SA | | 301,129 | 3,107,277 |

| Eiffage SA | | 42,470 | 4,562,369 |

| ENGIE | | 994,141 | 16,625,938 |

| Essilor International SA | | 154,432 | 23,562,160 |

| Eurazeo SA | | 20,696 | 1,442,641 |

| Eutelsat Communications | | 90,472 | 1,715,358 |

| Faurecia SA | | 39,174 | 1,825,400 |

| Gecina SA | | 24,227 | 4,155,733 |

| Groupe Eurotunnel SA | | 242,895 | 4,066,221 |

| Hermes International SCA | | 17,003 | 12,231,423 |

| ICADE | | 15,486 | 1,516,441 |

| Iliad SA | | 12,984 | 1,343,842 |

| Imerys SA | | 18,997 | 733,506 |

| Ingenico SA | | 33,024 | 3,526,264 |

| Ipsen SA | | 21,812 | 2,323,221 |

| JCDecaux SA | | 38,772 | 1,059,439 |

| Kering SA | | 41,294 | 23,497,362 |

| Klepierre SA | | 111,849 | 4,165,242 |

| L'Oreal SA | | 113,518 | 33,145,615 |

| L'Oreal SA (a) | | 23,733 | 6,929,693 |

| Legrand SA | | 144,561 | 11,282,797 |

| LVMH Moet Hennessy Louis Vuitton SE | | 151,222 | 64,580,267 |

| Michelin CGDE Series B | | 93,782 | 11,418,642 |

| Natixis SA | | 487,785 | 2,236,493 |

| Orange SA | | 1,081,847 | 17,411,796 |

| Pernod Ricard SA | | 116,387 | 21,482,963 |

| Peugeot Citroen SA | | 324,028 | 8,203,517 |

| Publicis Groupe SA | | 114,122 | 4,911,647 |

| Remy Cointreau SA (b) | | 13,450 | 1,798,594 |

| Renault SA | | 106,401 | 5,430,295 |

| Safran SA | | 178,453 | 28,232,211 |

| Sanofi SA | | 614,837 | 56,680,074 |

| Sartorius Stedim Biotech | | 14,158 | 2,119,074 |

| Schneider Electric SA | | 298,675 | 27,758,993 |

| SCOR SE | | 93,800 | 3,952,360 |

| SEB SA | | 11,694 | 1,775,060 |

| Societe Generale Series A | | 420,584 | 11,960,957 |

| Sodexo SA (a) | | 8,142 | 895,364 |

| Sodexo SA | | 39,617 | 4,356,625 |

| SR Teleperformance SA | | 32,412 | 7,345,498 |

| Suez Environnement SA | | 198,891 | 3,099,978 |

| Thales SA | | 57,102 | 5,581,429 |

| Total SA | | 1,300,406 | 68,750,184 |

| Ubisoft Entertainment SA (a) | | 45,951 | 2,713,130 |

| Valeo SA | | 129,511 | 4,815,750 |

| Veolia Environnement SA | | 298,852 | 7,856,108 |

| VINCI SA | | 278,039 | 31,195,748 |

| Vivendi SA | | 501,245 | 13,953,602 |

| Wendel SA | | 15,194 | 2,152,125 |

| Worldline SA (a)(c) | | 44,925 | 2,728,209 |

|

| TOTAL FRANCE | | | 800,917,461 |

|

| Germany - 5.2% | | | |

| adidas AG | | 98,339 | 30,364,212 |

| Allianz SE | | 230,218 | 56,224,464 |

| Axel Springer SE (a) | | 27,082 | 1,887,785 |

| BASF AG | | 501,590 | 38,130,490 |

| Bayer AG | | 509,969 | 39,561,456 |

| Bayerische Motoren Werke AG (BMW) | | 178,673 | 13,692,116 |

| Beiersdorf AG | | 54,099 | 6,404,732 |

| Brenntag AG | | 89,500 | 4,491,871 |

| Carl Zeiss Meditec AG | | 21,664 | 2,361,822 |

| Commerzbank AG | | 548,502 | 3,280,785 |

| Continental AG | | 61,180 | 8,194,501 |

| Covestro AG (c) | | 95,612 | 4,590,683 |

| Daimler AG (Germany) | | 497,942 | 29,106,141 |

| Delivery Hero AG (a)(c) | | 63,117 | 2,958,676 |

| Deutsche Bank AG | | 1,093,745 | 7,921,731 |

| Deutsche Borse AG | | 103,863 | 16,084,193 |

| Deutsche Lufthansa AG | | 121,603 | 2,108,272 |

| Deutsche Post AG | | 548,002 | 19,405,176 |

| Deutsche Telekom AG | | 1,804,490 | 31,751,049 |

| Deutsche Wohnen AG (Bearer) | | 195,229 | 7,342,156 |

| Drillisch AG (b) | | 26,900 | 719,438 |

| E.ON AG | | 1,213,990 | 12,242,453 |

| Evonik Industries AG | | 109,382 | 2,885,152 |

| Fraport AG Frankfurt Airport Services Worldwide | | 25,358 | 2,119,436 |

| Fresenius Medical Care AG & Co. KGaA | | 90,437 | 6,527,712 |

| Fresenius Medical Care AG & Co. KGaA sponsored ADR | | 52,053 | 1,877,552 |

| Fresenius SE & Co. KGaA | | 224,804 | 11,815,364 |

| GEA Group AG | | 86,235 | 2,636,236 |

| Hannover Reuck SE | | 32,807 | 5,810,436 |

| HeidelbergCement Finance AG | | 79,677 | 5,920,104 |

| Henkel AG & Co. KGaA | | 54,966 | 5,293,564 |

| Hochtief AG | | 12,856 | 1,603,022 |

| Hugo Boss AG | | 38,464 | 1,618,146 |

| Infineon Technologies AG | | 690,109 | 13,366,566 |

| KION Group AG | | 34,049 | 2,262,542 |

| Knorr-Bremse AG | | 26,165 | 2,640,663 |

| Lanxess AG | | 49,506 | 3,218,979 |

| Merck KGaA | | 69,599 | 8,297,980 |

| Metro Wholesale & Food Specialist AG | | 92,956 | 1,513,638 |

| MTU Aero Engines Holdings AG | | 28,747 | 7,675,530 |

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen | | 78,359 | 21,761,054 |

| Puma AG | | 44,590 | 3,354,371 |

| RWE AG | | 300,580 | 9,162,024 |

| SAP SE | | 536,211 | 71,048,753 |

| Siemens AG | | 418,812 | 48,330,935 |

| Siemens Healthineers AG (c) | | 80,040 | 3,400,688 |

| Symrise AG | | 71,748 | 6,904,173 |

| Telefonica Deutschland Holding AG | | 480,741 | 1,525,405 |

| Thyssenkrupp AG (b) | | 222,530 | 3,175,562 |

| TUI AG | | 74,849 | 977,123 |

| TUI AG (GB) | | 174,451 | 2,282,349 |

| Uniper SE | | 108,947 | 3,394,950 |

| United Internet AG | | 65,744 | 1,980,489 |

| Volkswagen AG | | 15,912 | 3,015,156 |

| Vonovia SE | | 276,733 | 14,725,229 |

| Wirecard AG (b) | | 64,800 | 8,206,422 |

| Zalando SE (a)(c) | | 75,925 | 3,289,785 |

|

| TOTAL GERMANY | | | 632,441,292 |

|

| Greece - 0.1% | | | |

| Alpha Bank AE (a) | | 792,301 | 1,688,661 |

| EFG Eurobank Ergasias SA (a) | | 1,471,606 | 1,490,284 |

| Ff Group (a)(d) | | 7,962 | 10,656 |

| Greek Organization of Football Prognostics SA | | 113,644 | 1,235,785 |

| Hellenic Telecommunications Organization SA | | 141,268 | 2,142,764 |

| Jumbo SA | | 54,785 | 1,069,280 |

| Motor Oil (HELLAS) Corinth Refineries SA | | 33,893 | 836,911 |

| National Bank of Greece SA (a) | | 290,345 | 984,418 |

|

| TOTAL GREECE | | | 9,458,759 |

|

| Hong Kong - 2.5% | | | |

| AIA Group Ltd. | | 6,586,000 | 65,584,869 |

| Bank of East Asia Ltd. | | 655,178 | 1,578,259 |

| Beijing Enterprises Holdings Ltd. | | 292,000 | 1,374,852 |

| BOC Hong Kong (Holdings) Ltd. | | 2,024,000 | 6,953,709 |

| BYD Electronic International Co. Ltd. | | 373,500 | 641,365 |

| China Agri-Industries Holdings Ltd. | | 541,000 | 178,236 |

| China Everbright International Ltd. | | 2,068,629 | 1,563,482 |

| China Everbright Ltd. | | 590,000 | 874,147 |

| China Jinmao Holdings Group Ltd. | | 3,058,000 | 2,033,022 |

| China Merchants Holdings International Co. Ltd. | | 793,250 | 1,240,271 |

| China Mobile Ltd. | | 3,370,500 | 27,391,044 |

| China Overseas Land and Investment Ltd. | | 2,108,000 | 6,651,779 |

| China Power International Development Ltd. | | 1,507,000 | 314,714 |

| China Resources Beer Holdings Co. Ltd. | | 810,989 | 4,157,962 |

| China Resources Pharmaceutical Group Ltd. (c) | | 844,000 | 779,441 |

| China Resources Power Holdings Co. Ltd. | | 1,255,780 | 1,578,182 |

| China Taiping Insurance Group Ltd. | | 860,465 | 1,934,413 |

| China Unicom Ltd. | | 3,548,000 | 3,493,003 |

| CITIC Pacific Ltd. | | 3,493,000 | 4,594,988 |

| CLP Holdings Ltd. | | 877,500 | 9,113,209 |

| CNOOC Ltd. | | 9,837,000 | 14,639,922 |

| CSPC Pharmaceutical Group Ltd. | | 2,544,000 | 6,515,492 |

| Far East Horizon Ltd. | | 1,021,000 | 966,625 |

| Fosun International Ltd. | | 1,724,500 | 2,254,918 |

| Galaxy Entertainment Group Ltd. | | 1,194,000 | 8,221,454 |

| Guangdong Investment Ltd. | | 1,616,000 | 3,497,506 |

| Hang Lung Properties Ltd. | | 1,135,000 | 2,494,961 |

| Hang Seng Bank Ltd. | | 414,800 | 8,654,845 |

| Henderson Land Development Co. Ltd. | | 742,296 | 3,707,459 |

| Hong Kong & China Gas Co. Ltd. | | 5,576,794 | 10,824,011 |

| Hong Kong Exchanges and Clearing Ltd. | | 655,673 | 20,426,861 |

| Hua Hong Semiconductor Ltd. (c) | | 272,000 | 546,951 |

| Hysan Development Co. Ltd. | | 314,434 | 1,239,262 |

| Lenovo Group Ltd. | | 4,180,000 | 2,914,058 |

| Link (REIT) | | 1,164,730 | 12,685,543 |

| MMG Ltd. (a) | | 1,436,000 | 298,949 |

| MTR Corp. Ltd. | | 823,413 | 4,721,273 |

| New World Development Co. Ltd. | | 3,280,497 | 4,692,543 |

| PCCW Ltd. | | 2,442,627 | 1,450,713 |

| Power Assets Holdings Ltd. | | 752,500 | 5,369,945 |

| Shanghai Industrial Holdings Ltd. | | 359,000 | 668,269 |

| Shenzhen Investment Ltd. | | 1,118,000 | 440,039 |

| Sino Land Ltd. | | 1,618,225 | 2,419,032 |

| Sino-Ocean Group Holding Ltd. | | 1,091,413 | 401,260 |

| Sinotruk Hong Kong Ltd. | | 383,000 | 578,739 |

| SJM Holdings Ltd. | | 1,016,000 | 1,085,333 |

| Sun Art Retail Group Ltd. | | 1,415,417 | 1,444,281 |

| Sun Hung Kai Properties Ltd. | | 869,083 | 13,169,492 |

| Swire Pacific Ltd. (A Shares) | | 283,500 | 2,702,403 |

| Swire Properties Ltd. | | 582,000 | 1,830,419 |

| Techtronic Industries Co. Ltd. | | 739,000 | 5,775,296 |

| Vitasoy International Holdings Ltd. | | 424,000 | 1,724,115 |

| Wharf Holdings Ltd. | | 594,000 | 1,347,937 |

| Wheelock and Co. Ltd. | | 434,000 | 2,684,118 |

| Winteam Pharmaceutical Group Ltd. | | 1,272,000 | 567,981 |

| Yuexiu Property Co. Ltd. | | 3,716,000 | 818,495 |

|

| TOTAL HONG KONG | | | 295,811,447 |

|

| Hungary - 0.1% | | | |

| MOL Hungarian Oil and Gas PLC Series A (For. Reg.) | | 197,619 | 1,953,337 |

| OTP Bank PLC | | 119,026 | 5,482,503 |

| Richter Gedeon PLC | | 68,735 | 1,273,878 |

|

| TOTAL HUNGARY | | | 8,709,718 |

|

| India - 2.3% | | | |

| Adani Ports & Special Economic Zone Ltd. (a) | | 321,257 | 1,788,887 |

| Ambuja Cements Ltd. | | 338,604 | 964,153 |

| Ashok Leyland Ltd. | | 623,290 | 673,184 |

| Asian Paints Ltd. | | 154,697 | 3,940,471 |

| Aurobindo Pharma Ltd. | | 138,575 | 913,624 |

| Avenue Supermarts Ltd. (a)(c) | | 69,568 | 1,951,994 |

| Axis Bank Ltd. | | 1,133,922 | 11,740,258 |

| Bajaj Auto Ltd. | | 42,883 | 1,960,013 |

| Bajaj Finance Ltd. | | 93,317 | 5,287,991 |

| Bajaj Finserv Ltd. | | 19,770 | 2,264,212 |

| Bandhan Bank Ltd. (c) | | 194,203 | 1,672,219 |

| Bharat Forge Ltd. | | 119,302 | 761,629 |

| Bharat Petroleum Corp. Ltd. | | 360,753 | 2,669,816 |

| Bharti Airtel Ltd. | | 1,131,816 | 5,960,473 |

| Bharti Infratel Ltd. | | 180,435 | 481,883 |

| Bosch Ltd. | | 4,166 | 897,188 |

| Britannia Industries Ltd. | | 34,512 | 1,586,539 |

| Cipla Ltd. (a) | | 185,048 | 1,216,518 |

| Coal India Ltd. | | 710,540 | 2,074,207 |

| Container Corp. of India Ltd. | | 113,134 | 936,777 |

| Dabur India Ltd. | | 310,965 | 2,021,658 |

| Divi's Laboratories Ltd. | | 37,556 | 927,892 |

| Dr. Reddy's Laboratories Ltd. | | 66,452 | 2,607,135 |

| Eicher Motors Ltd. | | 7,749 | 2,455,037 |

| GAIL India Ltd. (a) | | 821,484 | 1,587,653 |

| Glenmark Pharmaceuticals Ltd. | | 75,827 | 336,729 |

| Godrej Consumer Products Ltd. | | 209,623 | 2,186,619 |

| Grasim Industries Ltd. | | 177,668 | 1,923,476 |

| Havells India Ltd. | | 123,073 | 1,198,265 |

| HCL Technologies Ltd. | | 291,055 | 4,769,023 |

| HDFC Standard Life Insurance Co. Ltd. (c) | | 260,082 | 2,291,969 |

| Hero Motocorp Ltd. | | 57,648 | 2,193,779 |

| Hindalco Industries Ltd. | | 615,866 | 1,626,854 |

| Hindustan Petroleum Corp. Ltd. | | 344,801 | 1,575,064 |

| Hindustan Unilever Ltd. | | 354,773 | 10,866,019 |

| Housing Development Finance Corp. Ltd. | | 897,565 | 26,918,333 |

| ICICI Bank Ltd. | | 1,298,730 | 8,466,726 |

| ICICI Lombard General Insurance Co. Ltd. (c) | | 78,816 | 1,485,077 |

| Indiabulls Housing Finance Ltd. | | 130,065 | 377,151 |

| Indian Oil Corp. Ltd. | | 952,958 | 1,966,948 |

| Infosys Ltd. | | 1,725,953 | 16,584,550 |

| Infosys Ltd. sponsored ADR | | 168,080 | 1,611,887 |

| InterGlobe Aviation Ltd. (a)(c) | | 46,939 | 961,253 |

| ITC Ltd. | | 1,882,192 | 6,825,903 |

| JSW Steel Ltd. | | 453,219 | 1,453,192 |

| Larsen & Toubro Ltd. | | 262,439 | 5,441,167 |

| LIC Housing Finance Ltd. | | 163,721 | 950,271 |

| Lupin Ltd. (a) | | 109,562 | 1,149,897 |

| Mahindra & Mahindra Financial Services Ltd. | | 171,208 | 849,645 |

| Mahindra & Mahindra Ltd. | | 391,766 | 3,343,466 |

| Marico Ltd. | | 282,377 | 1,455,277 |

| Maruti Suzuki India Ltd. | | 57,643 | 6,137,358 |

| Motherson Sumi Systems Ltd. (a) | | 515,578 | 892,205 |

| Nestle India Ltd. | | 11,720 | 2,464,787 |

| NTPC Ltd. | | 1,345,424 | 2,318,445 |

| Oil & Natural Gas Corp. Ltd. | | 1,410,596 | 2,813,330 |

| Page Industries Ltd. | | 2,832 | 1,026,010 |

| Petronet LNG Ltd. | | 281,164 | 1,133,731 |

| Pidilite Industries Ltd. (a) | | 73,931 | 1,458,814 |

| Piramal Enterprises Ltd. | | 44,902 | 1,063,493 |

| Power Grid Corp. of India Ltd. | | 1,032,497 | 2,885,198 |

| Rec Ltd. | | 441,253 | 867,426 |

| Reliance Industries Ltd. | | 1,555,885 | 32,045,666 |

| Shree Cement Ltd. | | 4,472 | 1,252,737 |

| Shriram Transport Finance Co. Ltd. | | 99,793 | 1,598,476 |

| State Bank of India (a) | | 1,026,500 | 4,511,168 |

| Sun Pharmaceutical Industries Ltd. | | 491,351 | 2,999,358 |

| Tata Consultancy Services Ltd. | | 492,418 | 15,682,531 |

| Tata Motors Ltd. (a) | | 946,287 | 2,338,218 |

| Tata Power Co. Ltd. | | 437,343 | 365,031 |

| Tata Steel Ltd. | | 195,150 | 1,044,150 |

| Tech Mahindra Ltd. | | 237,736 | 2,473,686 |

| Titan Co. Ltd. | | 172,648 | 3,236,759 |

| Ultratech Cemco Ltd. | | 49,273 | 2,875,366 |

| United Spirits Ltd. (a) | | 143,462 | 1,261,120 |

| UPL Ltd. (a) | | 276,810 | 2,324,365 |

| Vedanta Ltd. | | 971,088 | 2,025,322 |

| Vodafone Idea Ltd. (a) | | 2,754,316 | 150,943 |

| Wipro Ltd. | | 605,222 | 2,214,708 |

| Yes Bank Ltd. | | 880,550 | 871,382 |

| Zee Entertainment Enterprises Ltd. (a) | | 368,944 | 1,349,144 |

|

| TOTAL INDIA | | | 271,830,878 |

|

| Indonesia - 0.5% | | | |

| PT Adaro Energy Tbk | | 7,671,700 | 715,259 |

| PT Astra International Tbk | | 11,290,900 | 5,584,488 |

| PT Bank Central Asia Tbk | | 5,522,600 | 12,361,388 |

| PT Bank Mandiri (Persero) Tbk | | 10,388,800 | 5,193,043 |

| PT Bank Negara Indonesia (Persero) Tbk | | 4,142,189 | 2,261,150 |

| PT Bank Rakyat Indonesia Tbk | | 31,123,700 | 9,325,758 |

| PT Bank Tabungan Negara Tbk | | 1,445,700 | 191,342 |

| PT Barito Pacific Tbk | | 14,965,000 | 1,012,774 |

| PT Bumi Serpong Damai Tbk (a) | | 2,319,700 | 233,591 |

| PT Charoen Pokphand Indonesia Tbk | | 3,766,200 | 1,689,062 |

| PT Gudang Garam Tbk | | 230,800 | 921,751 |

| PT Hanjaya Mandala Sampoerna Tbk | | 4,794,900 | 727,014 |

| PT Indah Kiat Pulp & Paper Tbk | | 1,401,400 | 725,444 |

| PT Indocement Tunggal Prakarsa Tbk | | 948,900 | 1,351,869 |

| PT Indofood CBP Sukses Makmur Tbk | | 1,234,900 | 1,022,408 |

| PT Indofood Sukses Makmur Tbk | | 2,110,300 | 1,156,452 |

| PT Jasa Marga Tbk | | 705,953 | 273,930 |

| PT Kalbe Farma Tbk | | 11,316,400 | 1,285,075 |

| PT Pabrik Kertas Tjiwi Kimia Tbk | | 481,200 | 362,221 |

| PT Pakuwon Jati Tbk | | 5,852,200 | 260,441 |

| PT Perusahaan Gas Negara Tbk Series B | | 5,992,400 | 899,274 |

| PT Semen Gresik (Persero) Tbk | | 1,634,800 | 1,474,403 |

| PT Surya Citra Media Tbk | | 1,664,100 | 144,571 |

| PT Tambang Batubara Bukit Asam Tbk | | 1,003,300 | 160,655 |

| PT Telekomunikasi Indonesia Tbk Series B | | 27,043,100 | 7,891,741 |

| PT Unilever Indonesia Tbk | | 789,000 | 2,456,699 |

| PT United Tractors Tbk | | 842,412 | 1,300,289 |

|

| TOTAL INDONESIA | | | 60,982,092 |

|

| Ireland - 0.4% | | | |