UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2460

Fidelity Union Street Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | August 31 |

| |

Date of reporting period: | February 28, 2010 |

Item 1. Reports to Stockholders

Fidelity®

Arizona Municipal

Income Fund

and

Fidelity

Arizona Municipal

Money Market Fund

Semiannual Report

February 28, 2010

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | <Click Here> | The Chairman's message to shareholders. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Fidelity Arizona Municipal Income Fund |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Fidelity Arizona Municipal Money Market Fund |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months, and one year. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Board Approval of Investment Advisory Contracts and Management Fees | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Semiannual Report

(photo_of_Abigail_P_Johnson)

Dear Shareholder:

The turnaround in global capital markets that marked most of 2009 slowed in early 2010, as investors considered the risks to a sustained recovery, including increased political uncertainty, high unemployment, weak consumer spending and potential inflation on the horizon. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The chairman's signature appears here.)

Abigail P. Johnson

Semiannual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2009 to February 28, 2010).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semiannual Report

| Annualized

Expense Ratio | Beginning

Account Value

September 1, 2009 | Ending

Account Value

February 28, 2010 | Expenses Paid

During Period*

September 1, 2009

to February 28, 2010 |

Fidelity Arizona Municipal Income Fund | .56% | | | |

Actual | | $ 1,000.00 | $ 1,038.50 | $ 2.83 |

HypotheticalA | | $ 1,000.00 | $ 1,022.02 | $ 2.81 |

Fidelity Arizona Municipal Money Market Fund | .33% | | | |

Actual | | $ 1,000.00 | $ 1,000.05 | $ 1.64** |

HypotheticalA | | $ 1,000.00 | $ 1,023.16 | $ 1.66** |

A 5% return per year before expenses

* Expenses are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

** If certain fees were not voluntarily waived by FMR or its affiliates during the period, the annualized expense ratio for the Arizona Municipal Money Market Fund would have been .51% and the expenses paid in the actual and hypothetical examples above would have been $2.53 and $2.56, respectively.

Semiannual Report

Fidelity Arizona Municipal Income Fund

Investment Changes (Unaudited)

Top Five Sectors as of February 28, 2010 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

General Obligations | 22.2 | 21.8 |

Special Tax | 17.9 | 18.6 |

Water & Sewer | 17.8 | 17.5 |

Electric Utilities | 13.4 | 13.1 |

Education | 9.9 | 9.4 |

Weighted Average Maturity as of February 28, 2010 |

| | 6 months ago |

Years | 7.8 | 8.8 |

The weighted average maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding or redemption provision. |

Duration as of February 28, 2010 |

| | 6 months ago |

Years | 8.3 | 8.5 |

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. |

Quality Diversification (% of fund's net assets) |

As of February 28, 2010 | As of August 31, 2009 |

| AAA 3.1% | |  | AAA 3.0% | |

| AA,A 73.5% | |  | AA,A 74.9% | |

| BBB 16.7% | |  | BBB 17.7% | |

| BB and Below 0.8% | |  | BB and Below 0.9% | |

| Not Rated 1.2% | |  | Not Rated 1.3% | |

| Short-Term

Investments and

Net Other Assets 4.7% | |  | Short-Term

Investments and

Net Other Assets 2.2% | |

We have used ratings from Moody's® Investors Service, Inc. Where Moody's ratings are not available, we have used S&P® ratings. All ratings are as of the report date and do not reflect subsequent downgrades. |

Semiannual Report

Fidelity Arizona Municipal Income Fund

Investments February 28, 2010 (Unaudited)

Showing Percentage of Net Assets

Municipal Bonds - 96.5% |

| Principal Amount | | Value |

Arizona - 90.2% |

Arizona Board of Regents Arizona State Univ. Rev. (Polytechnic Campus Proj.) Series 2008 C: | | | | |

5.75% 7/1/22 | | $ 1,500,000 | | $ 1,748,970 |

5.75% 7/1/23 | | 250,000 | | 289,535 |

Arizona Board of Regents Ctfs. of Prtn.: | | | | |

(Arizona Biomedical Research Collaborative Bldg. Proj.) Series 2006, 5% 6/1/19 (AMBAC Insured) | | 1,140,000 | | 1,216,654 |

(Univ. of Arizona Projs.) Series 2006 A, 5% 6/1/18 (AMBAC Insured) | | 1,000,000 | | 1,078,200 |

Arizona Ctfs. of Prtn.: | | | | |

Series 2008 A, 5% 9/1/20 (FSA Insured) | | 1,640,000 | | 1,746,649 |

Series 2010 A, 5% 10/1/29 (FSA Insured) | | 5,000,000 | | 5,068,200 |

Arizona Game and Fish Dept. and Commission (AGF Administration Bldg. Proj.) Series 2006: | | | | |

5% 7/1/21 | | 1,280,000 | | 1,344,294 |

5% 7/1/32 | | 470,000 | | 470,724 |

Arizona Health Facilities Auth. Rev. (Banner Health Sys. Proj.): | | | | |

Series 2007 A, 5% 1/1/21 | | 1,000,000 | | 1,035,590 |

Series 2007 B, 0.9779% 1/1/37 (b) | | 1,000,000 | | 673,830 |

Series 2008 A, 5.25% 1/1/31 | | 1,000,000 | | 1,007,580 |

Series 2008 D, 6% 1/1/27 | | 1,000,000 | | 1,078,810 |

Arizona School Facilities Board Ctfs. of Prtn.: | | | | |

Series 2008, 5.75% 9/1/22 | | 1,000,000 | | 1,110,530 |

Series A2, 5% 9/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,062,060 |

Arizona School Facilities Board Rev. Series 2005, 5% 7/1/13 | | 1,225,000 | | 1,381,102 |

Arizona State Univ. Ctfs. of Prtn. (Research Infrastructure Proj.) Series 2004, 5.25% 9/1/24 | | 1,230,000 | | 1,275,252 |

Arizona State Univ. Nanotechnology LLC Lease Rev. Series 2009 A, 5% 3/1/34 (Assured Guaranty Corp. Insured) | | 1,000,000 | | 1,011,550 |

Arizona State Univ. Revs. Series 2005, 5% 7/1/26 (AMBAC Insured) | | 1,000,000 | | 1,007,370 |

Arizona Student Ln. Acquisition Auth. Student Ln. Rev. Series 1999 B1, 6.15% 5/1/29 (c) | | 500,000 | | 511,605 |

Arizona Trans. Board Hwy. Rev.: | | | | |

Series 2006, 5% 7/1/22 | | 400,000 | | 438,768 |

Series 2008 A, 5% 7/1/33 | | 2,000,000 | | 2,097,020 |

Arizona Wtr. Infrastructure Fin. Auth. Rev.: | | | | |

(Wtr. Quality Proj.) Series 2006 A, 5% 10/1/23 | | 500,000 | | 551,745 |

Series 2008 A, 5% 10/1/23 | | 2,000,000 | | 2,253,740 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Arizona - continued |

Arizona Wtr. Infrastructure Fin. Auth. Rev.: - continued | | | | |

Series 2009 A, 5% 10/1/29 | | $ 1,000,000 | | $ 1,089,690 |

Avondale Muni. Dev. Corp. Excise Tax Rev. 5% 7/1/28 | | 500,000 | | 524,965 |

Cottonwood Wtr. Sys. Rev.: | | | | |

5% 7/1/26 (XL Cap. Assurance, Inc. Insured) | | 1,405,000 | | 1,319,745 |

5% 7/1/30 (XL Cap. Assurance, Inc. Insured) | | 1,125,000 | | 1,002,263 |

5% 7/1/35 (XL Cap. Assurance, Inc. Insured) | | 1,300,000 | | 1,090,258 |

Downtown Phoenix Hotel Corp. Rev. Series A, 5.25% 7/1/23 (FGIC Insured) | | 1,750,000 | | 1,587,250 |

Dysart Unified School District #89 Gen. Oblig. (School Impt. Proj.) Series 2007 A, 5% 7/1/26 (FGIC Insured) (FSA Insured) | | 1,325,000 | | 1,394,602 |

Gilbert Wtr. Resources Muni. Property Corp. Wastewtr. Sys. & Util. Rev. Series 2004, 4.9% 4/1/19 | | 1,025,000 | | 1,025,103 |

Glendale Indl. Dev. Auth. (Midwestern Univ. Proj.)

Series 2007, 5.25% 5/15/19 | | 1,000,000 | | 1,057,470 |

Glendale Indl. Dev. Auth. Hosp. Rev. (John C. Lincoln Health Network Proj.): | | | | |

Series 2005 B, 5.25% 12/1/19 | | 1,040,000 | | 1,039,126 |

Series 2005, 5% 12/1/35 | | 1,000,000 | | 886,330 |

Series 2007, 5% 12/1/27 | | 1,000,000 | | 924,510 |

Glendale Western Loop 101 Pub. Facilities Corp.

Series 2008 A: | | | | |

6.25% 7/1/38 | | 3,000,000 | | 3,167,370 |

7% 7/1/33 | | 1,000,000 | | 1,086,920 |

Goodyear McDowell Road Commercial Corridor Impt. District 5.25% 1/1/17 (AMBAC Insured) | | 1,580,000 | | 1,710,634 |

Goodyear Pub. Impt. Corp. Facilities Rev. Series 2008, 6% 7/1/31 | | 1,000,000 | | 1,078,650 |

Marana Muni. Property Corp. Facilities Rev. Series A, 5.25% 7/1/22 | | 1,620,000 | | 1,786,261 |

Maricopa County Indl. Dev. Auth. Health Facilities Rev.: | | | | |

(Catholic Healthcare West Proj.): | | | | |

Series 1998 A, 5% 7/1/16 | | 545,000 | | 546,826 |

Series 2007 A, 5% 7/1/16 | | 1,000,000 | | 1,059,380 |

Series 2009 A, 6% 7/1/39 | | 1,000,000 | | 1,052,410 |

Series A, 5.25% 7/1/32 | | 1,000,000 | | 996,020 |

(Mayo Clinic Proj.) 5% 11/15/36 | | 1,000,000 | | 1,009,480 |

Maricopa County Indl. Dev. Auth. Hosp. Facilities Rev. (Mayo Clinic Hosp. Proj.) 5.25% 11/15/37 | | 1,000,000 | | 1,001,370 |

Maricopa County Unified School District #60 Higley (School Impt. Proj.) Series B, 5% 7/1/19 (FGIC Insured) | | 1,000,000 | | 1,079,390 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Arizona - continued |

McAllister Academic Village LLC Rev. (Arizona State Univ. Hassayampa Academic Village Proj.) Series 2008, 5% 7/1/38 | | $ 1,000,000 | | $ 979,160 |

Mesa Util. Sys. Rev.: | | | | |

5% 7/1/20 (FGIC Insured) | | 1,000,000 | | 1,116,160 |

5% 7/1/24 (FGIC Insured) | | 3,000,000 | | 3,310,800 |

Navajo County Poll. Cont. Corp. Rev. (Arizona Pub. Svc. Co. Cholla Proj.) Series 2009 A, 5%, tender 6/1/12 (b) | | 2,000,000 | | 2,059,300 |

North Campus Facilities LLC (Northern Arizona Univ. Sys. Rev. Proj.) 5% 6/1/31 (AMBAC Insured) | | 1,225,000 | | 1,232,742 |

Northern Arizona Univ. Revs. 5% 6/1/21 (AMBAC Insured) | | 1,085,000 | | 1,169,565 |

Phoenix Civic Impt. Board Arpt. Rev.: | | | | |

Series A, 5% 7/1/33 | | 1,000,000 | | 1,010,110 |

Series B, 5.25% 7/1/27 (Nat'l. Pub. Fin. Guarantee Corp. Insured) (c) | | 1,100,000 | | 1,109,735 |

Phoenix Civic Impt. Corp. District Rev. (Plaza Expansion Proj.) Series 2005 B, 0% 7/1/38 (a) | | 2,000,000 | | 1,715,100 |

Phoenix Civic Impt. Corp. Excise Tax Rev.: | | | | |

(Civic Plaza Expansion Proj.) Series 2005 A: | | | | |

5% 7/1/18 (FGIC Insured) | | 550,000 | | 594,198 |

5% 7/1/30 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,014,870 |

Series 2007 A, 5% 7/1/22 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,250,000 | | 1,346,750 |

Phoenix Civic Impt. Corp. Transit Excise Tax Rev. (Lt. Rail Proj.) Series 2004, 5% 7/1/20 | | 1,000,000 | | 1,091,600 |

Phoenix Civic Impt. Corp. Wastewtr. Sys. Rev.: | | | | |

Series 2004: | | | | |

5% 7/1/24 | | 1,750,000 | | 1,840,843 |

5% 7/1/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 770,000 | | 795,025 |

Series 2007, 5% 7/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,100,240 |

Phoenix Civic Impt. Corp. Wtr. Sys. Rev.: | | | | |

Series 2001, 5.5% 7/1/24 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,187,660 |

Series 2002, 5.5% 7/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,500,000 | | 1,590,945 |

Series 2005: | | | | |

4.75% 7/1/27 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 155,000 | | 159,470 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Arizona - continued |

Phoenix Civic Impt. Corp. Wtr. Sys. Rev.: - continued | | | | |

Series 2005: | | | | |

5% 7/1/20 | | $ 5,000,000 | | $ 5,401,800 |

5% 7/1/29 | | 1,750,000 | | 1,814,418 |

Series 2009 A, 5% 7/1/39 | | 2,000,000 | | 2,052,360 |

Phoenix Gen. Oblig. Series 2002 B, 5.375% 7/1/20 | | 1,060,000 | | 1,135,673 |

Phoenix Street & Hwy. User Rev. Series 1992, 6.25% 7/1/11 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 20,000 | | 20,003 |

Pima County Ctfs. of Prtn. (Justice Bldg. Proj.): | | | | |

Series 2007 A, 5% 7/1/19 (AMBAC Insured) | | 735,000 | | 787,031 |

Series A, 5% 7/1/21 (AMBAC Insured) | | 935,000 | | 988,351 |

Pima County Unified School District #1 Tucson (Proj. of 2004): | | | | |

Series 2007 C, 5% 7/1/23 (FGIC Insured) | | 1,000,000 | | 1,077,400 |

Series 2008 D, 5% 7/1/25 (FSA Insured) | | 1,000,000 | | 1,070,910 |

Pinal County Indl. Dev. Auth. Correctional Facilities Contract Rev. (Florence West Prison Proj.): | | | | |

Series 2006 A, 5.25% 10/1/12 (ACA Finl. Guaranty Corp. Insured) | | 1,000,000 | | 1,027,330 |

Series 2007 A, 5.25% 10/1/13 (ACA Finl. Guaranty Corp. Insured) | | 1,335,000 | | 1,373,915 |

Pinal County Unified School District #1 Florence (2006 School Impt. Proj.) Series 2007 A: | | | | |

5% 7/1/19 (FGIC Insured) | | 1,000,000 | | 1,079,390 |

5% 7/1/20 (FGIC Insured) | | 1,000,000 | | 1,072,110 |

Pinal County Unified School District #44 J.O. Combs (2006 School Impt. Proj.) Series B, 5% 7/1/21 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 860,000 | | 922,015 |

Queen Creek Excise Tax & State Shared Rev. 5% 8/1/22 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,125,000 | | 1,193,535 |

Salt River Proj. Agricultural Impt. & Pwr. District Elec. Sys. Rev.: | | | | |

Series 2002 B: | | | | |

5% 1/1/20 | | 1,500,000 | | 1,614,915 |

5% 1/1/21 | | 290,000 | | 312,217 |

5% 1/1/31 | | 1,995,000 | | 2,048,805 |

Series 2005 A, 5% 1/1/35 | | 3,000,000 | | 3,094,590 |

Series 2006 A, 5% 1/1/37 | | 5,690,000 | | 5,854,609 |

Series 2008 A: | | | | |

5% 1/1/24 | | 1,075,000 | | 1,185,295 |

5% 1/1/38 | | 5,400,000 | | 5,597,802 |

Salt Verde Finl. Corp. Sr. Gas Rev. Series 2007, 5.5% 12/1/29 | | 3,000,000 | | 2,891,310 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Arizona - continued |

Scottsdale Indl. Dev. Auth. Hosp. Rev. (Scottsdale Healthcare Proj.) Series 2008 A, 5% 9/1/23 | | $ 355,000 | | $ 338,698 |

Scottsdale Muni. Property Corp. Excise Tax Rev. (Wtr. and Swr. Impt. Proj.) Series 2008 A, 5% 7/1/28 | | 1,050,000 | | 1,113,756 |

Sedona Excise Tax Rev.: | | | | |

Series 2004, 5% 7/1/15 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 2,120,000 | | 2,285,212 |

Series 2005, 5% 7/1/19 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,052,900 |

Tempe Gen. Oblig. Series 2006, 5% 7/1/20 | | 3,200,000 | | 3,572,096 |

Tempe Transit Excise Tax Rev. Series 2008, 4.75% 7/1/38 | | 160,000 | | 163,637 |

Tucson Ctfs. of Prtn. Series 2007, 5% 7/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,083,390 |

Tucson Gen. Oblig. Series 2005: | | | | |

5% 7/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 3,250,000 | | 3,682,315 |

5% 7/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 3,295,000 | | 3,649,641 |

Tucson Street & Hwy. User Rev. Series 1994 B, 7.5% 7/1/11 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,015,000 | | 1,099,945 |

Tucson Wtr. Rev. Series 2001 A, 5% 7/1/11 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,255,000 | | 1,298,436 |

Univ. Med. Ctr. Corp. Hosp. Rev.: | | | | |

Series 2004: | | | | |

5.25% 7/1/11 | | 210,000 | | 216,680 |

5.25% 7/1/15 | | 1,000,000 | | 1,042,300 |

Series 2005, 5% 7/1/16 | | 1,735,000 | | 1,769,492 |

Univ. of Arizona Univ. Revs.: | | | | |

(Univ. of Arizona Projs.): | | | | |

Series 2003 B, 5% 6/1/31 (AMBAC Insured) | | 300,000 | | 302,388 |

Series 2005 A, 5% 6/1/24 (AMBAC Insured) | | 1,040,000 | | 1,076,754 |

Series 2005 C, 5% 6/1/14 (AMBAC Insured) | | 360,000 | | 403,729 |

Series 2008 A, 5% 6/1/22 | | 1,315,000 | | 1,451,168 |

Series 2009 A, 5% 6/1/39 | | 1,000,000 | | 1,025,990 |

Yavapai County Indl. Dev. Auth. Solid Waste Disp. Rev. (Waste Mgmt., Inc. Proj.) Series 2002, 4%, tender 6/1/10 (b)(c) | | 1,000,000 | | 1,004,370 |

| | 153,648,755 |

Guam - 0.3% |

Guam Ed. Fing. Foundation Ctfs. of Prtn. Series A, 5% 10/1/12 | | 500,000 | | 522,340 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Puerto Rico - 5.0% |

Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. Rev.: | | | | |

Series 1998, 5.75% 7/1/22 (CIFG North America Insured) | | $ 700,000 | | $ 706,251 |

Series 2003, 5.75% 7/1/19 (FGIC Insured) | | 700,000 | | 713,279 |

Puerto Rico Commonwealth Infrastructure Fing. Auth. Series 2006 B, 5% 7/1/17 | | 1,000,000 | | 1,027,760 |

Puerto Rico Commonwealth Pub. Impt. Gen. Oblig.: | | | | |

Series 2002 A, 5.5% 7/1/18 | | 700,000 | | 737,681 |

Series 2003 A, 5.25% 7/1/14 | | 275,000 | | 290,422 |

Series 2007 A, 5.5% 7/1/21 (FGIC Insured) | | 1,000,000 | | 1,038,380 |

Puerto Rico Govt. Dev. Bank: | | | | |

Series 2006 B, 5% 12/1/12 | | 1,000,000 | | 1,055,240 |

Series 2006 C, 5.25% 1/1/15 (c) | | 500,000 | | 522,030 |

Puerto Rico Pub. Bldg. Auth. Rev.: | | | | |

Series G, 5.25% 7/1/13 | | 315,000 | | 328,926 |

Series M2, 5.75%, tender 7/1/17 (b) | | 200,000 | | 209,218 |

Puerto Rico Sales Tax Fing. Corp. Sales Tax Rev.: | | | | |

Series 2007 A, 0% 8/1/41 | | 3,200,000 | | 467,264 |

Series 2009 A, 6% 8/1/42 | | 1,300,000 | | 1,358,838 |

| | 8,455,289 |

Virgin Islands - 1.0% |

Virgin Islands Pub. Fin. Auth. Series 2009 B, 5% 10/1/25 | | 300,000 | | 301,575 |

Virgin Islands Pub. Fin. Auth. Refinery Facilities Rev. Series 2007, 4.7% 7/1/22 (c) | | 500,000 | | 447,925 |

Virgin Islands Wtr. & Pwr. Auth. Elec. Sys. Rev. Series 2007 A, 5% 7/1/27 | | 1,000,000 | | 968,390 |

| | 1,717,890 |

TOTAL INVESTMENT PORTFOLIO - 96.5% (Cost $162,768,534) | | 164,344,274 |

NET OTHER ASSETS - 3.5% | | 5,966,919 |

NET ASSETS - 100% | $ 170,311,193 |

Legend |

(a) Security initially issued in zero coupon form which converts to coupon form at a specified rate and date. The rate shown is the rate at period end. |

(b) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

(c) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

Other Information |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

The distribution of municipal securities by revenue source, as a percentage of total net assets, is as follows: |

General Obligations | 22.2% |

Special Tax | 17.9% |

Water & Sewer | 17.8% |

Electric Utilities | 13.4% |

Education | 9.9% |

Health Care | 9.0% |

Others* (individually less than 5%) | 9.8% |

| 100.0% |

*Includes net other assets |

Income Tax Information |

At August 31, 2009, the fund had a capital loss carryforward of approximately $397,926 all of which will expire on August 31, 2017. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Arizona Municipal Income Fund

Statement of Assets and Liabilities

| February 28, 2010 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value -

See accompanying schedule: Unaffiliated issuers (cost $162,768,534) | | $ 164,344,274 |

Cash | | 4,928,801 |

Receivable for fund shares sold | | 78,089 |

Interest receivable | | 1,553,890 |

Other receivables | | 553 |

Total assets | | 170,905,607 |

| | |

Liabilities | | |

Payable for fund shares redeemed | $ 314,349 | |

Distributions payable | 202,635 | |

Accrued management fee | 77,430 | |

Total liabilities | | 594,414 |

| | |

Net Assets | | $ 170,311,193 |

Net Assets consist of: | | |

Paid in capital | | $ 169,165,870 |

Undistributed net investment income | | 29,030 |

Accumulated undistributed net realized gain (loss) on investments | | (459,447) |

Net unrealized appreciation (depreciation) on investments | | 1,575,740 |

Net Assets, for 15,016,510 shares outstanding | | $ 170,311,193 |

Net Asset Value, offering price and redemption price per share ($170,311,193 ÷ 15,016,510 shares) | | $ 11.34 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Operations

Six months ended February 28, 2010 (Unaudited) |

| | |

Investment Income | | |

Interest | | $ 3,460,235 |

| | |

Expenses | | |

Management fee | $ 452,562 | |

Independent trustees' compensation | 288 | |

Miscellaneous | 317 | |

Total expenses before reductions | 453,167 | |

Expense reductions | (1,437) | 451,730 |

Net investment income | | 3,008,505 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 77,311 |

Change in net unrealized appreciation (depreciation) on investment securities | | 3,031,716 |

Net gain (loss) | | 3,109,027 |

Net increase (decrease) in net assets resulting from operations | | $ 6,117,532 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Arizona Municipal Income Fund

Financial Statements - continued

Statement of Changes in Net Assets

| Six months ended

February 28, 2010

(Unaudited) | Year ended

August 31,

2009 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income | $ 3,008,505 | $ 5,302,836 |

Net realized gain (loss) | 77,311 | (538,126) |

Change in net unrealized appreciation (depreciation) | 3,031,716 | 1,113,163 |

Net increase (decrease) in net assets resulting

from operations | 6,117,532 | 5,877,873 |

Distributions to shareholders from net investment income | (3,005,737) | (5,294,897) |

Distributions to shareholders from net realized gain | - | (409,050) |

Total distributions | (3,005,737) | (5,703,947) |

Share transactions

Proceeds from sales of shares | 36,807,433 | 65,045,430 |

Reinvestment of distributions | 1,781,910 | 3,572,863 |

Cost of shares redeemed | (26,448,488) | (57,178,441) |

Net increase (decrease) in net assets resulting from share transactions | 12,140,855 | 11,439,852 |

Redemption fees | 5,941 | 7,310 |

Total increase (decrease) in net assets | 15,258,591 | 11,621,088 |

| | |

Net Assets | | |

Beginning of period | 155,052,602 | 143,431,514 |

End of period (including undistributed net investment income of $29,030 and undistributed net investment income of $26,262, respectively) | $ 170,311,193 | $ 155,052,602 |

Other Information Shares | | |

Sold | 3,258,172 | 6,083,801 |

Issued in reinvestment of distributions | 157,474 | 336,051 |

Redeemed | (2,340,461) | (5,472,354) |

Net increase (decrease) | 1,075,185 | 947,498 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

| Six months ended February 28, 2010 | Years ended August 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 11.12 | $ 11.04 | $ 11.13 | $ 11.39 | $ 11.59 | $ 11.56 |

Income from Investment Operations | | | | | | |

Net investment income D | .207 | .425 | .419 | .418 | .417 | .417 |

Net realized and unrealized gain (loss) | .220 | .112 | (.054) | (.205) | (.149) | .087 |

Total from investment operations | .427 | .537 | .365 | .213 | .268 | .504 |

Distributions from net investment income | (.207) | (.425) | (.418) | (.418) | (.417) | (.419) |

Distributions from net realized gain | - | (.033) | (.037) | (.055) | (.051) | (.055) |

Total distributions | (.207) | (.458) | (.455) | (.473) | (.468) | (.474) |

Redemption fees added to paid in capital D | - F | .001 | - F | - F | - F | - F |

Net asset value, end of period | $ 11.34 | $ 11.12 | $ 11.04 | $ 11.13 | $ 11.39 | $ 11.59 |

Total Return B, C | 3.85% | 5.15% | 3.33% | 1.87% | 2.41% | 4.46% |

Ratios to Average Net Assets E | | | | | |

Expenses before reductions | .56% A | .55% | .55% | .55% | .55% | .55% |

Expenses net of fee waivers, if any | .56% A | .55% | .55% | .55% | .55% | .55% |

Expenses net of all reductions | .55% A | .55% | .52% | .48% | .50% | .50% |

Net investment income | 3.69% A | 3.97% | 3.76% | 3.70% | 3.69% | 3.62% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 170,311 | $ 155,053 | $ 143,432 | $ 129,125 | $ 107,024 | $ 100,695 |

Portfolio turnover rate | 6% A | 19% | 22% | 15% | 22% | 13% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

F Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Arizona Municipal Money Market Fund

Investment Changes (Unaudited)

Maturity Diversification |

Days | % of fund's investments 2/28/10 | % of fund's investments 8/31/09 | % of fund's investments 2/28/09 |

0 - 30 | 90.5 | 89.8 | 90.6 |

31 - 90 | 0.0 | 0.8 | 0.0 |

91 - 180 | 8.9 | 2.4 | 6.6 |

181 - 397 | 0.6 | 7.0 | 2.8 |

Weighted Average Maturity |

| 2/28/10 | 8/31/09 | 2/28/09 |

Fidelity Arizona Municipal Money Market Fund | 18 Days | 30 Days | 21 Days |

All Tax Free Money Market Funds Average* | 27 Days | 32 Days | 26 Days |

Asset Allocation (% of fund's net assets) |

As of February 28, 2010 | As of August 31, 2009 |

| Variable Rate

Demand Notes

(VRDNs) 88.1% | |  | Variable Rate

Demand Notes

(VRDNs) 81.7% | |

| Commercial Paper (including CP Mode) 1.1% | |  | Commercial Paper (including CP Mode) 3.9% | |

| Fidelity Municipal

Cash Central Fund 1.1% | |  | Fidelity Municipal

Cash Central Fund 2.0% | |

| Other Investments 9.5% | |  | Other Investments 11.3% | |

| Net Other Assets 0.2% | |  | Net Other Assets 1.1% | |

* Source: iMoneyNet, Inc.

Semiannual Report

Fidelity Arizona Municipal Money Market Fund

Investments February 28, 2010 (Unaudited)

Showing Percentage of Net Assets

Municipal Securities - 99.8% |

| Principal Amount | | Value |

Arizona - 94.7% |

Arizona Board of Regents Arizona State Univ. Rev. Bonds (Tempe Campus Projs.) Series 2009 A, 4% 7/1/10 | $ 2,185,000 | | $ 2,210,551 |

Arizona Health Facilities Auth. Rev.: | | | |

Bonds (Banner Health Proj.) Series 2008 D, 5% 1/1/11 | 2,000,000 | | 2,074,961 |

(Banner Health Sys. Proj.): | | | |

Series 2008 B, 0.18%, LOC Bank of Nova Scotia New York Branch, VRDN (a) | 13,600,000 | | 13,600,000 |

Series 2008 C, 0.17%, LOC Bank of Nova Scotia New York Branch, VRDN (a) | 5,410,000 | | 5,410,000 |

Series 2008 E, 0.23%, LOC Landesbank Baden-Wuert, VRDN (a) | 17,600,000 | | 17,600,000 |

(Catholic Healthcare West Proj.): | | | |

Series 2005 B, 0.17%, LOC JPMorgan Chase Bank, VRDN (a) | 5,130,000 | | 5,130,000 |

Series 2008 A, 0.17%, LOC JPMorgan Chase Bank, VRDN (a) | 3,600,000 | | 3,600,000 |

Series 2009 F, 0.17%, LOC Citibank NA, VRDN (a) | 11,300,000 | | 11,300,000 |

(Southwest Behavioral Health Svcs., Inc. Proj.) Series 2004, 0.21%, LOC JPMorgan Chase Bank, VRDN (a) | 2,960,000 | | 2,960,000 |

Arizona Hsg. Fin. Auth. Multi-family Hsg. Rev. (Santa Carolina Apts. Proj.) Series 2005, 0.27%, LOC Fannie Mae, VRDN (a)(c) | 3,645,000 | | 3,645,000 |

Arizona State Trans. Board Bonds Series 2003 A, 5% 7/1/10 | 3,500,000 | | 3,552,998 |

Arizona Trans. Board Excise Tax Rev. Bonds (Maricopa County Reg'l. Area Road Proj.) Series 2009, 3% 7/1/10 | 2,000,000 | | 2,017,191 |

Arizona Trans. Board Hwy. Rev. Participating VRDN Series PT 4605, 0.2% (Liquidity Facility Deutsche Postbank AG) (a)(d) | 4,000,000 | | 4,000,000 |

Casa Grande Indl. Dev. Auth. Indl. Dev. Rev. (Price Companies, Inc. Proj.) Series A, 0.5%, LOC Bank of America NA, VRDN (a)(c) | 1,930,000 | | 1,930,000 |

Coconino County Poll. Cont. Corp. Rev. (Arizona Pub. Svc. Co. Navajo Proj.): | | | |

Series 1994 A, 0.17%, LOC KBC Bank NV, VRDN (a)(c) | 32,590,000 | | 32,590,000 |

Series 2009 B, 0.17%, LOC JPMorgan Chase Bank, VRDN (a)(c) | 4,610,000 | | 4,610,000 |

Glendale Indl. Dev. Auth. (Midwestern Univ. Proj.) Series 2008, 0.2%, LOC Bank of America NA, VRDN (a) | 6,800,000 | | 6,800,000 |

Maricopa County Indl. Dev. Auth. Multi-family Hsg. Rev.: | | | |

(Glenn Oaks Apts. Proj.) Series 2001, 0.27%, LOC Fannie Mae, VRDN (a)(c) | 3,299,675 | | 3,299,675 |

(Ranchwood Apts. Proj.) Series 2001 A, 0.25%, LOC Fannie Mae, VRDN (a)(c) | 5,000,000 | | 5,000,000 |

(San Angelin Apts. Proj.) Series 2004, 0.23%, LOC Fannie Mae, VRDN (a)(c) | 3,100,000 | | 3,100,000 |

Municipal Securities - continued |

| Principal Amount | | Value |

Arizona - continued |

Maricopa County Indl. Dev. Auth. Multi-family Hsg. Rev.: - continued | | | |

(San Lucas Apts. Proj.) Series 2003, 0.24%, LOC Fannie Mae, VRDN (a)(c) | $ 1,700,000 | | $ 1,700,000 |

(San Martin Apts. Proj.) Series A1, 0.24%, LOC Fannie Mae, VRDN (a)(c) | 7,000,000 | | 7,000,000 |

(San Miguel Apts. Proj.) Series 2003, 0.23%, LOC Fannie Mae, VRDN (a)(c) | 1,300,000 | | 1,300,000 |

(San Remo Apts. Proj.) Series 2002, 0.24%, LOC Fannie Mae, VRDN (a)(c) | 10,800,000 | | 10,800,000 |

(Village at Sun Valley Apts. Proj.) Series 2008, 0.35%, LOC Freddie Mac, VRDN (a)(c) | 3,500,000 | | 3,500,000 |

(Village Square Apts. Proj.) Series 2004, 0.27%, LOC Fannie Mae, VRDN (a)(c) | 1,000,000 | | 1,000,000 |

Maricopa County Indl. Dev. Auth. Rev. (Clayton Homes, Inc. Proj.) Series 1998, 0.5%, LOC U.S. Bank NA, Minnesota, VRDN (a)(c) | 1,000,000 | | 1,000,000 |

Phoenix Civic Impt. Board Arpt. Rev. Bonds Series D, 5% 7/1/10 (c) | 2,780,000 | | 2,817,889 |

Phoenix Civic Impt. Corp. Series 2009, 0.27% 3/10/10, LOC Bank of America NA, CP | 3,800,000 | | 3,800,000 |

Phoenix Civic Impt. Corp. Wtr. Sys. Rev.: | | | |

Bonds Series 2005, 5% 7/1/10 | 4,000,000 | | 4,060,663 |

Participating VRDN Series Putters 3458, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 6,000,000 | | 6,000,000 |

Phoenix Gen. Oblig. Participating VRDN Series BBT 2012, 0.19% (Liquidity Facility Branch Banking & Trust Co.) (a)(d) | 7,280,000 | | 7,280,000 |

Phoenix Indl. Dev. Auth. Cultural Facilities Rev. (Phoenix Art Museum Proj.) Series 2006, 0.28%, LOC Wells Fargo Bank NA, VRDN (a) | 200,000 | | 200,000 |

Phoenix Indl. Dev. Auth. Multi-family Hsg. Rev.: | | | |

(Del Mar Terrance Apts. Proj.) Series 1999 A, 0.22%, LOC Freddie Mac, VRDN (a) | 3,900,000 | | 3,900,000 |

(Paradise Lakes Apt. Proj.) Series 2007 B, 0.19%, LOC Wachovia Bank NA, VRDN (a)(c) | 18,800,000 | | 18,800,000 |

(Westward Ho Apts. Proj.) Series 2003 A, 0.27%, LOC Bank of America NA, VRDN (a)(c) | 1,400,000 | | 1,400,000 |

Phoenix Indl. Dev. Auth. Rev.: | | | |

(Desert Botanical Garden Proj.) Series 2000, 0.21%, LOC JPMorgan Chase Bank, VRDN (a) | 1,800,000 | | 1,800,000 |

(Independent Newspaper, Inc. Proj.) Series 2000, 0.4%, LOC Wachovia Bank NA, VRDN (a)(c) | 885,000 | | 885,000 |

(Phoenix Expansion Proj.) Series 2002, 0.81%, LOC JPMorgan Chase Bank, VRDN (a)(c) | 2,105,000 | | 2,105,000 |

Municipal Securities - continued |

| Principal Amount | | Value |

Arizona - continued |

Phoenix Indl. Dev. Auth. Rev.: - continued | | | |

(Plastican Proj.) Series 1997, 0.5%, LOC Bank of America NA, VRDN (a)(c) | $ 1,835,000 | | $ 1,835,000 |

(Swift Aviation Svcs., Inc. Proj.) Series 2002, 0.23%, LOC U.S. Bank NA, Minnesota, VRDN (a)(c) | 6,410,000 | | 6,410,000 |

Pima County Ctfs. of Prtn. Bonds Series 2009, 3% 6/1/10 | 4,000,000 | | 4,017,470 |

Pima County Gen. Oblig. Bonds: | | | |

Series 2009 A, 2% 7/1/10 | 3,700,000 | | 3,718,569 |

Series 2009, 4% 7/1/10 | 4,000,000 | | 4,046,792 |

Pima County Indl. Dev. Auth. Indl. Rev. (Tucson Elec. Pwr. Co. Proj.) Series 1982 A, 0.2%, LOC Wells Fargo Bank NA, VRDN (a) | 3,000,000 | | 3,000,000 |

Pima County Indl. Dev. Auth. Multi-family Hsg. Rev. (River Point Proj.) Series 2001, 0.25%, LOC Fannie Mae, VRDN (a)(c) | 6,000,000 | | 6,000,000 |

Salt River Proj. Agricultural Impt. & Pwr. District Elec. Sys. Rev. Participating VRDN: | | | |

Series EGL 06 14 Class A, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 3,400,000 | | 3,400,000 |

Series MS 3078, 0.22% (Liquidity Facility Morgan Stanley) (a)(d) | 3,900,000 | | 3,900,000 |

Series ROC II R 11712, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 3,635,000 | | 3,635,000 |

Series WF 09 40C, 0.18% (Liquidity Facility Wells Fargo & Co.) (a)(d) | 3,900,000 | | 3,900,000 |

Scottsdale Gen. Oblig. Participating VRDN Series BBT 08 20, 0.19% (Liquidity Facility Branch Banking & Trust Co.) (a)(d) | 11,195,000 | | 11,195,000 |

Scottsdale Indl. Dev. Auth. Rev. Series 2001 A, 0.21%, LOC JPMorgan Chase Bank, VRDN (a) | 8,026,000 | | 8,026,000 |

Show Low Indl. Dev. Auth. Solid Waste Disp. Rev. (Snowflake White Mountain Pwr. LLC Proj.) Series 2006, 0.29%, LOC JPMorgan Chase Bank, VRDN (a)(c) | 4,000,000 | | 4,000,000 |

Tempe Indl. Dev. Auth. Rev. (ASUF Brickyard Proj.) Series 2004 A, 0.2%, LOC Bank of America NA, VRDN (a) | 7,600,000 | | 7,600,000 |

Tempe Transit Excise Tax Rev. Series 2006, 0.2% (Liquidity Facility Royal Bank of Canada), VRDN (a) | 25,475,000 | | 25,475,000 |

Tucson Gen. Oblig. Bonds Series 2002, 5% 7/1/10 | 2,385,000 | | 2,421,315 |

Univ. of Arizona Univ. Revs. Bonds: | | | |

Series 1992 A, 6% 6/1/10 | 1,000,000 | | 1,013,833 |

Series 2008 B, 4% 6/1/10 | 1,675,000 | | 1,689,898 |

Yavapai County Indl. Dev. Auth.: | | | |

(Northern Arizona Healthcare Sys. Proj.) Series 2008 B, 0.17%, LOC Banco Bilbao Vizcaya Argentaria SA, VRDN (a) | 3,900,000 | | 3,900,000 |

Municipal Securities - continued |

| Principal Amount | | Value |

Arizona - continued |

Yavapai County Indl. Dev. Auth.: - continued | | | |

(Yavapai Reg'l. Med. Ctr. Proj.) Series 2008A, 0.2%, LOC UBS AG, VRDN (a) | $ 1,500,000 | | $ 1,500,000 |

Yavapai County Indl. Dev. Auth. Solid Waste Disp. Rev. (Allied Waste North America, Inc. Proj.) Series 2008 A, 0.23%, LOC Bank of America NA, VRDN (a)(c) | 10,000,000 | | 10,000,000 |

| | 334,462,805 |

California - 0.3% |

California Hsg. Fin. Agcy. Rev. (Home Mtg. Prog.) Series 2005 A, 0.18% (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (a)(c) | 1,000,000 | | 1,000,000 |

Kentucky - 0.1% |

Carroll County Envir. Facilities Rev. (Kentucky Utils. Co. Proj.) Series 2006 B, 0.29%, LOC Commerzbank AG, VRDN (a)(c) | 400,000 | | 400,000 |

Ohio - 0.4% |

Dayton Montgomery County Port Auth. Spl. Arpt. Facilities Rev. (Wilmington Air Park, Inc. Proj.) Series 2007 B, 4% (Deutsche Post AG Guaranteed), VRDN (a)(c) | 1,400,000 | | 1,400,000 |

Pennsylvania - 0.7% |

Chester County Health & Ed. Auth. Rev. (Jenner's Pond Proj.) Series 2006, 0.38%, LOC Citizens Bank of Pennsylvania, VRDN (a) | 1,585,000 | | 1,585,000 |

Montgomery County Indl. Dev. Auth. Rev. (Haverford School Proj.) Series 2008, 0.2%, LOC Citizens Bank of Pennsylvania, VRDN (a) | 1,000,000 | | 1,000,000 |

| | 2,585,000 |

Puerto Rico - 1.1% |

Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. Rev. Series 1998 A, 0.2%, LOC Bank of Nova Scotia New York Branch, VRDN (a) | 3,900,000 | | 3,900,000 |

Texas - 1.3% |

Brazos River Auth. Poll. Cont. Rev. (Texas Utils. Energy Co. Proj.) Series 2002 A, 0.22%, LOC Citibank NA, VRDN (a)(c) | 3,700,000 | | 3,700,000 |

Greater East Texas Higher Ed. Auth. Student Ln. Rev. Series 1995 B, 0.22%, LOC State Street Bank & Trust Co., Boston, VRDN (a)(c) | 1,000,000 | | 1,000,000 |

| | 4,700,000 |

Washington - 0.1% |

Port of Seattle Rev. Series 2005, 0.28%, LOC Fortis Banque SA, VRDN (a)(c) | 300,000 | | 300,000 |

Municipal Securities - continued |

| Shares | | Value |

Other - 1.1% |

Fidelity Municipal Cash Central Fund, 0.19% (b) | 3,881,000 | | $ 3,881,000 |

TOTAL INVESTMENT PORTFOLIO - 99.8% (Cost $352,628,805) | | 352,628,805 |

NET OTHER ASSETS - 0.2% | | 615,104 |

NET ASSETS - 100% | $ 353,243,909 |

Security Type Abbreviations |

CP - COMMERCIAL PAPER |

VRDN - VARIABLE RATE DEMAND NOTE |

Legend |

(a) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. |

(c) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

(d) Provides evidence of ownership in one or more underlying municipal bonds. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Municipal Cash Central Fund | $ 7,985 |

Other Information |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Arizona Municipal Money Market Fund

Statement of Assets and Liabilities

| February 28, 2010 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value -

See accompanying schedule: Unaffiliated issuers (cost $348,747,805) | $ 348,747,805 | |

Fidelity Central Funds (cost $3,881,000) | 3,881,000 | |

Total Investments (cost $352,628,805) | | $ 352,628,805 |

Cash | | 146,954 |

Receivable for investments sold | | 1,000,011 |

Receivable for fund shares sold | | 2,806,096 |

Interest receivable | | 312,215 |

Distributions receivable from Fidelity Central Funds | | 746 |

Other receivables | | 106 |

Total assets | | 356,894,933 |

| | |

Liabilities | | |

Payable for fund shares redeemed | 3,577,205 | |

Distributions payable | 18 | |

Accrued management fee | 73,801 | |

Total liabilities | | 3,651,024 |

| | |

Net Assets | | $ 353,243,909 |

Net Assets consist of: | | |

Paid in capital | | $ 353,212,064 |

Undistributed net investment income | | 1 |

Accumulated undistributed net realized gain (loss) on investments | | 31,844 |

Net Assets, for 353,051,871 shares outstanding | | $ 353,243,909 |

Net Asset Value, offering price and redemption price per share ($353,243,909 ÷ 353,051,871 shares) | | $ 1.00 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Arizona Municipal Money Market Fund

Financial Statements - continued

Statement of Operations

Six months ended February 28, 2010 (Unaudited) |

| | |

Investment Income | | |

Interest | | $ 610,112 |

Income from Fidelity Central Funds | | 7,985 |

Total income | | 618,097 |

| | |

Expenses | | |

Management fee | $ 919,570 | |

Independent trustees' compensation | 666 | |

Miscellaneous | 7,674 | |

Total expenses before reductions | 927,910 | |

Expense reductions | (328,060) | 599,850 |

Net investment income | | 18,247 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | (57) |

Net increase in net assets resulting from operations | | $ 18,190 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

| Six months ended

February 28, 2010

(Unaudited) | Year ended

August 31,

2009 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income | $ 18,247 | $ 2,560,639 |

Net realized gain (loss) | (57) | 17,595 |

Net increase in net assets resulting

from operations | 18,190 | 2,578,234 |

Distributions to shareholders from net investment income | (18,246) | (2,560,731) |

Share transactions at net asset value of $1.00 per share

Proceeds from sales of shares | 566,744,570 | 1,391,807,322 |

Reinvestment of distributions | 18,034 | 2,508,619 |

Cost of shares redeemed | (586,725,017) | (1,414,170,262) |

Net increase (decrease) in net assets and shares resulting from share transactions | (19,962,413) | (19,854,321) |

Total increase (decrease) in net assets | (19,962,469) | (19,836,818) |

| | |

Net Assets | | |

Beginning of period | 373,206,378 | 393,043,196 |

End of period (including undistributed net investment income of $1 and undistributed net investment income of $0, respectively) | $ 353,243,909 | $ 373,206,378 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

| Six months ended February 28, 2010 | Years ended August 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income | - G | .006 | .022 | .032 | .027 | .016 |

Distributions from net investment income | - G | (.006) | (.022) | (.032) | (.027) | (.016) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B, C | .00% E | .64% | 2.25% | 3.26% | 2.78% | 1.60% |

Ratios to Average Net Assets D, F | | | | | |

Expenses before reductions | .51% A | .54% | .50% | .50% | .50% | .50% |

Expenses net of fee waivers, if any | .33% A | .53% | .50% | .50% | .50% | .50% |

Expenses net of all reductions | .33% A | .52% | .41% | .38% | .37% | .43% |

Net investment income | .01% A | .64% | 2.20% | 3.22% | 2.77% | 1.63% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 353,244 | $ 373,206 | $ 393,043 | $ 340,848 | $ 267,738 | $ 217,819 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount represents less than .01%.

F Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

G Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended February 28, 2010 (Unaudited)

1. Organization.

Fidelity Arizona Municipal Income Fund (the Income Fund) is a fund of Fidelity Union Street Trust. Fidelity Arizona Municipal Money Market Fund (the Money Market Fund) is a fund of Fidelity Union Street Trust II. Each trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. Fidelity Union Street Trust and Fidelity Union Street Trust II (the trusts) are organized as a Massachusetts business trust and a Delaware statutory trust, respectively. The Income Fund is a non-diversified fund. Each Fund is authorized to issue an unlimited number of shares. Each Fund may be affected by economic and political developments in the state of Arizona.

2. Investments in Fidelity Central Funds.

The Funds may invest in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Funds' Schedules of Investments list each of the Fidelity Central Funds held as of period end, if any, as an investment of each Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Funds indirectly bear their proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Funds:

Security Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Income Fund uses independent pricing services approved by the Board of Trustees to value their investments. When current market prices or quotations are not readily available or reliable, valuations may be determined in good faith in accordance with procedures adopted by the Board of Trustees. Factors used in determining value may include significant market or security specific events, changes in

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

3. Significant Accounting Policies - continued

Security Valuation - continued

interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and may be utilized to a significant extent. The value used for net asset value (NAV) calculation under these procedures may differ from published prices for the same securities.

Each Fund categorizes the inputs to valuation techniques used to value their investments into a disclosure hierarchy consisting of three levels as shown below.

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the fund's own assumptions based on the best information available)

For the Income Fund, changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of February 28, 2010, for each Fund's investments is included at the end of each Fund's Schedule of Investments. Valuation techniques used to value each Fund's investments by major category are as follows.

For the Income Fund, debt securities, including restricted securities, are valued based on evaluated quotations received from independent pricing services or from dealers who make markets in such securities. For municipal securities, pricing services utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices and are generally categorized as Level 2 in the hierarchy. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value and are categorized as level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Investments in open-end mutual funds are valued at their closing net asset value each business day and are categorized as Level 1 in the hierarchy.

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities owned by the Money Market Fund are valued at amortized cost which approximates value and are categorized as Level 2 in the hierarchy.

Semiannual Report

3. Significant Accounting Policies - continued

Investment Transactions and Income. For financial reporting purposes, the Funds' investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day for the Income Fund and trades executed through the end of the current business day for the Money Market Fund. Gains and losses on securities sold are determined on the basis of identified cost. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Expenses. Most expenses of each trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each Fund in the trust. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

The Money Market Fund participated in the U.S. Treasury Department's Temporary Guarantee Program for Money Market Funds (the "Program") through September 18, 2009. The Money Market Fund paid the U.S. Treasury Department fees equal to 0.04% based on the number of shares outstanding as of September 19, 2008 to participate in the Program through September 18, 2009. The expense was borne by the Money Market Fund without regard to any expense limitation in effect for the Money Market Fund.

Income Tax Information and Distributions to Shareholders. Each year, each Fund intends to qualify as a regulated investment company by distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. A Fund's federal tax return is subject to examination by the Internal Revenue Service (IRS) for a period of three years.

Dividends are declared daily and paid monthly from net investment income. Distributions from realized gains, if any, are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to futures transactions, market discount, deferred trustees compensation, capital loss carryforwards and losses deferred due to excise tax regulations.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The Funds purchase municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that the IRS will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows for each Fund:

| Tax cost | Gross unrealized

appreciation | Gross unrealized

depreciation | Net unrealized

appreciation

(depreciation) |

Fidelity Arizona Municipal Income Fund | $ 162,738,605 | $ 3,955,269 | $ (2,349,600) | $ 1,605,669 |

Fidelity Arizona Municipal Money Market Fund | 352,628,805 | - | - | - |

Short-Term Trading (Redemption) Fees. Shares held in the Income Fund less than 30 days are subject to a redemption fee equal to .50% of the proceeds of the redeemed shares. All redemption fees, including any estimated redemption fees paid by FMR, are retained by the Fund and accounted for as an addition to paid in capital.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, for the Income Fund aggregated $14,833,153 and $4,878,815, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provides the Funds with investment management related services for which the Funds pay a monthly management fee. FMR pays all other expenses, except the compensation of the independent Trustees and certain exceptions such as interest expense, including commitment fees. The management fee paid to FMR by the Funds is reduced by an amount equal to the fees and expenses paid by the Funds to the independent Trustees. Each Fund's management fee is equal to the following annual rate of average net assets:

Fidelity Arizona Municipal Income Fund | .55% |

Fidelity Arizona Municipal Money Market Fund | .50% |

Semiannual Report

6. Committed Line of Credit.

The Income Fund participates with other funds managed by FMR in a $3.5 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro-rata portion of the line of credit, which is reflected in Miscellaneous Expense on the Statement of Operations, and is as follows:

Fidelity Arizona Municipal Income Fund | $ 317 |

During the period, there were no borrowings on this line of credit.

7. Expense Reductions.

FMR or its affiliates voluntarily agreed to waive certain fees during the period for the Money Market fund. The amount of the waiver is $327,760.

In addition, through arrangements with each applicable Fund's custodian, credits realized as a result of uninvested cash balances were used to reduce each applicable Fund's management fee. During the period, these credits reduced management fee by the following amounts:

Fidelity Arizona Municipal Income Fund | $ 1,437 |

Fidelity Arizona Municipal Money Market Fund | 300 |

8. Other.

The Funds' organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Funds. In the normal course of business, the Funds may also enter into contracts that provide general indemnifications. The Funds' maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Funds. The risk of material loss from such claims is considered remote.

The supply of municipal money market securities has fluctuated significantly due to market volatility. As a result, the Money Market Fund's cash position may be significant during the period.

Semiannual Report

Board Approval of Investment Advisory Contracts and Management Fees

Fidelity Arizona Municipal Income Fund / Fidelity Arizona Municipal Money Market Fund

Each year, the Board of Trustees, including the Independent Trustees (together, the Board), votes on the renewal of the management contract and sub-advisory agreements (together, the Advisory Contracts) for each fund. The Board, assisted by the advice of fund counsel and Independent Trustees' counsel, requests and considers a broad range of information throughout the year.

The Board meets regularly and considers at each of its meetings factors that are relevant to its annual consideration of the renewal of each fund's Advisory Contracts, including the services and support provided to each fund and its shareholders. The Board has established three standing committees, each composed of Independent Trustees with varying backgrounds, to which the Board has assigned specific subject matter responsibilities in order to enhance effective decision-making by the Board. The Operations Committee meets regularly throughout the year and, among other matters, considers matters specifically related to the annual consideration of the renewal of each fund's Advisory Contracts. The Board, acting directly and through its Committees, requests and receives information concerning the annual consideration of the renewal of each fund's Advisory Contracts. The Board also meets as needed to consider matters specifically related to the Board's annual consideration of the renewal of Advisory Contracts.

At its September 2009 meeting, the Board of Trustees, including the Independent Trustees, unanimously determined to renew each fund's Advisory Contracts. In reaching its determination, the Board considered all factors it believed relevant, including (i) the nature, extent, and quality of the services to be provided to each fund and its shareholders (including the investment performance of each fund); (ii) the competitiveness of each fund's management fee and total expenses; (iii) the total costs of the services to be provided by and the profits to be realized by Fidelity from its relationship with each fund; (iv) the extent to which economies of scale would be realized as each fund grows; and (v) whether fee levels reflect these economies of scale, if any, for the benefit of fund shareholders.

In considering whether to renew the Advisory Contracts for each fund, the Board ultimately reached a determination, with the assistance of fund counsel and Independent Trustees' counsel and through the exercise of its business judgment, that the renewal of the Advisory Contracts and the compensation to be received by Fidelity under the management contracts is consistent with Fidelity's fiduciary duty under applicable law. The Board's decision to renew the Advisory Contracts was not based on any single factor noted above, but rather was based on a comprehensive consideration of all the information provided to the Board at its meetings throughout the year. The Board, in reaching its determination to renew the Advisory Contracts, is aware that shareholders in each fund have a broad range of investment choices available to them, including a wide choice among mutual funds offered by competitors to Fidelity, and that each fund's shareholders, with the opportunity to review and weigh the disclosure provided by the fund in its prospectus and other public disclosures, have chosen to invest in that fund, managed by Fidelity.

Semiannual Report

Nature, Extent, and Quality of Services Provided. The Board considered staffing within the investment adviser, FMR, and the sub-advisers (together, the Investment Advisers), including the backgrounds of the funds' investment personnel and the funds' investment objectives and disciplines. The Independent Trustees also had discussions with senior management of Fidelity's investment operations and investment groups. The Board considered the structure of the portfolio manager compensation program and whether this structure provides appropriate incentives.

Resources Dedicated to Investment Management and Support Services. The Board reviewed the size, education, and experience of the Investment Advisers' investment staff, their use of technology, and the Investment Advisers' approach to recruiting, training, and retaining portfolio managers and other research, advisory, and management personnel. In response to the recent financial crisis, Fidelity took a number of actions intended to cut costs and improve efficiency without weakening the investment teams or resources. The Board specifically noted Fidelity's response to the 2008 credit market crisis. The Board noted that Fidelity's analysts have access to a variety of technological tools and market and securities data that enable them to perform both fundamental and quantitative analysis and to specialize in various disciplines. The Board considered Fidelity's extensive global research capabilities that enable the Investment Advisers to aggregate data from various sources in an effort to produce positive investment results. The Board also considered that Fidelity's portfolio managers and analysts have access to daily portfolio attribution that allows for monitoring of a fund's portfolio, as well as an electronic communication system that provides immediate real-time access to research concerning issuers and credit enhancers. In addition, the Board considered the trading resources that are an integral part of the fixed-income portfolio management investment process.

Shareholder and Administrative Services. The Board considered (i) the nature, extent, quality, and cost of advisory, administrative, distribution, and shareholder services performed by the Investment Advisers and their affiliates under the Advisory Contracts and under separate agreements covering transfer agency and pricing and bookkeeping services for each fund; (ii) the nature and extent of the Investment Advisers' supervision of third party service providers, principally custodians and subcustodians; and (iii) the resources devoted to, and the record of compliance with, each fund's compliance policies and procedures.

Semiannual Report

Board Approval of Investment Advisory Contracts and

Management Fees - continued

The Board noted that the growth of fund assets over time across the complex allows Fidelity to reinvest in the development of services designed to enhance the value or convenience of the Fidelity funds as investment vehicles. These services include 24-hour access to account information and market information through phone representatives and over the Internet, and investor education materials and asset allocation tools.

Investment in a Large Fund Family. The Board considered the benefits to shareholders of investing in a Fidelity fund, including the benefits of investing in a fund that is part of a large family of funds offering a variety of investment disciplines and providing a large variety of mutual fund investor services. The Board noted that Fidelity had taken a number of actions over the previous year that benefited particular funds, including (i) dedicating additional resources to investment research and to restructure and broaden the focus of the investment research teams; (ii) bolstering the senior management team that oversees asset management; (iii) contractually agreeing to reduce the management fee on Fidelity U.S. Bond Index Fund; and (iv) expanding Class A and Class T load waiver categories to increase rollover retention opportunities and create consistent policies across the classes.

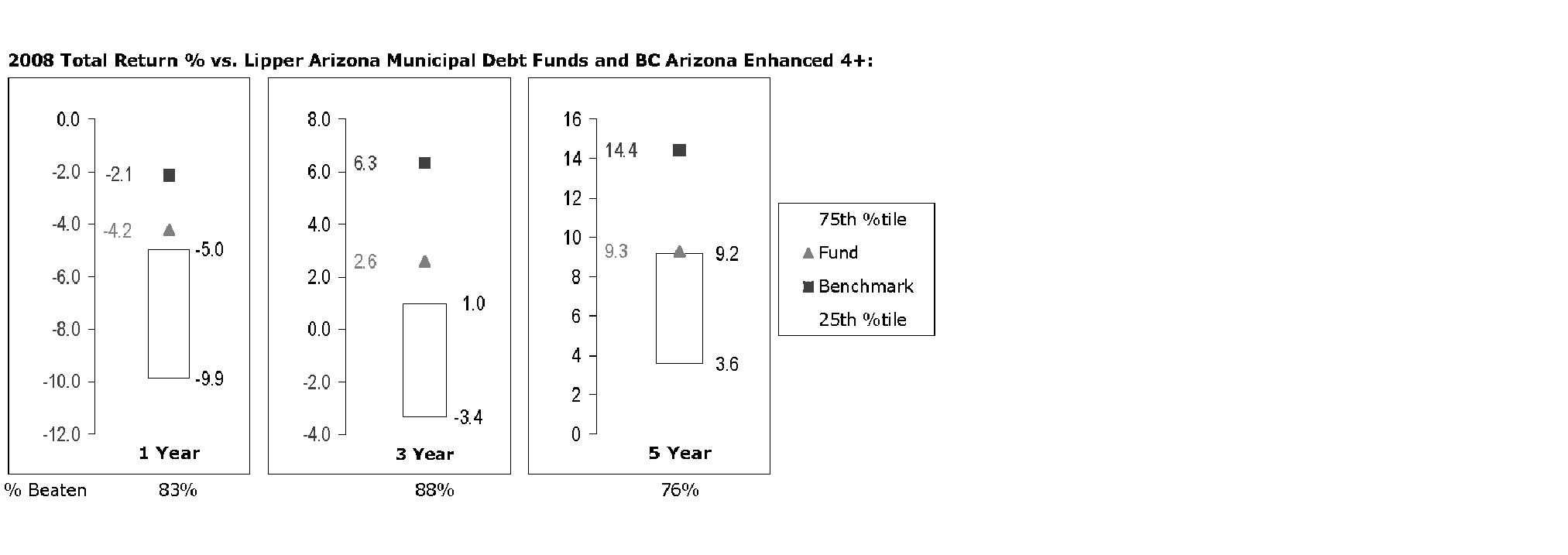

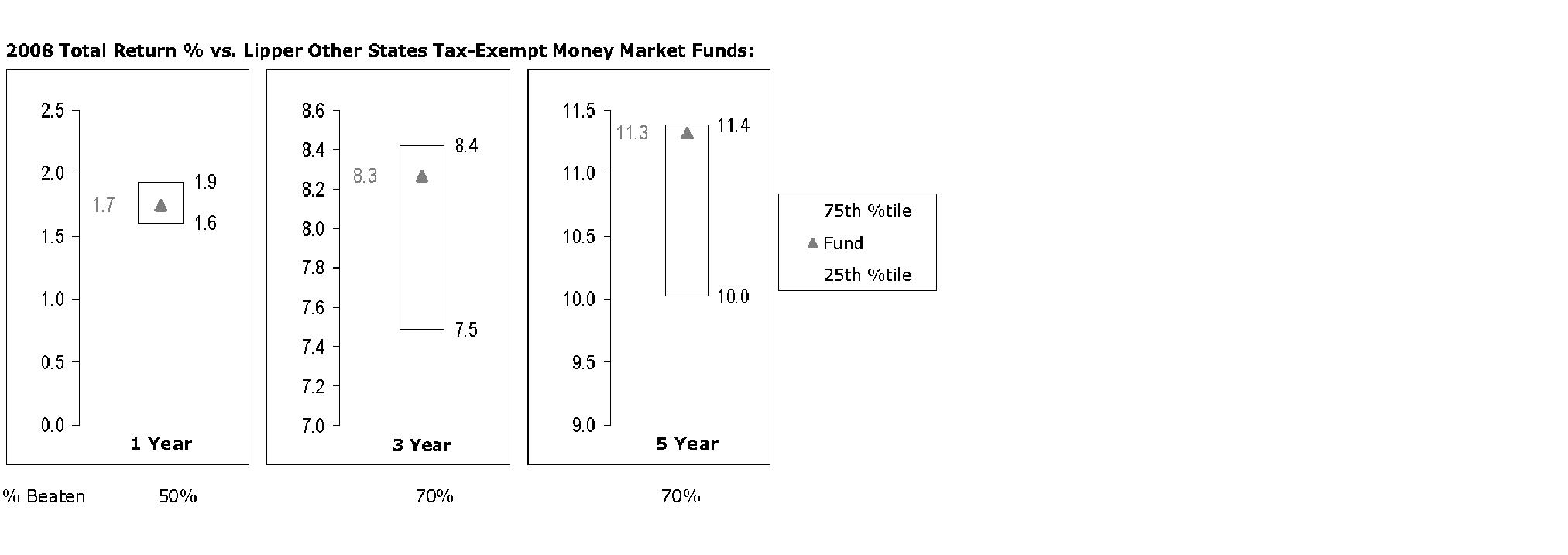

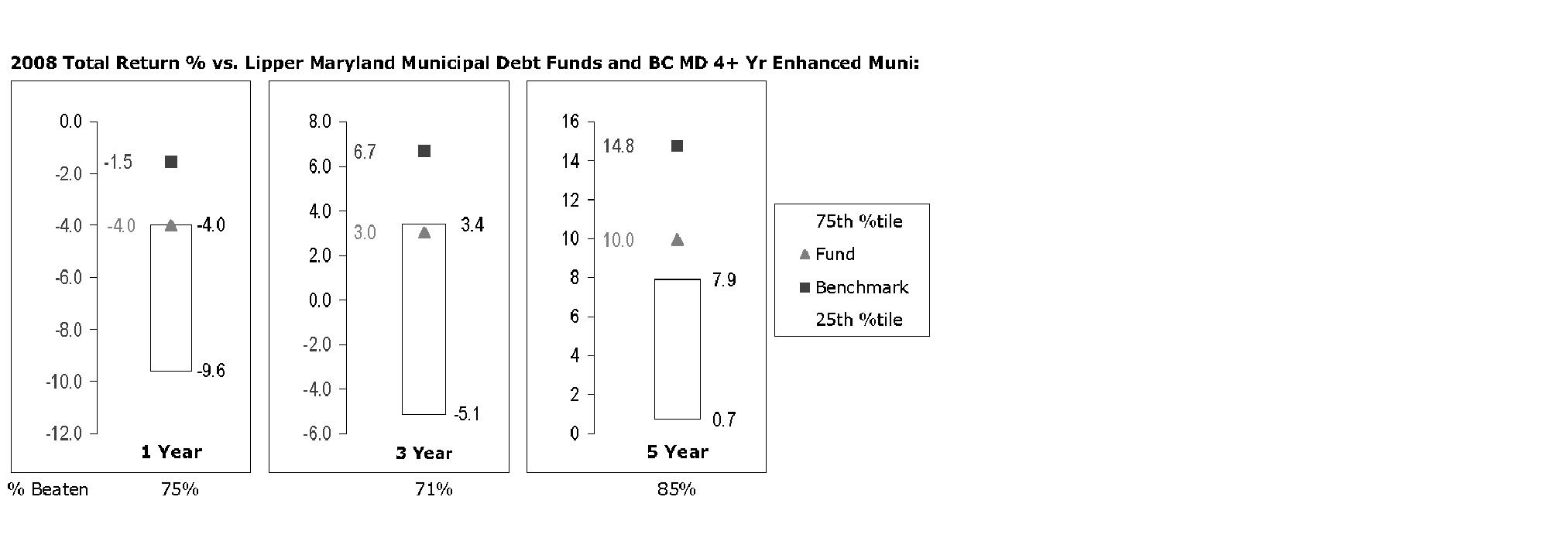

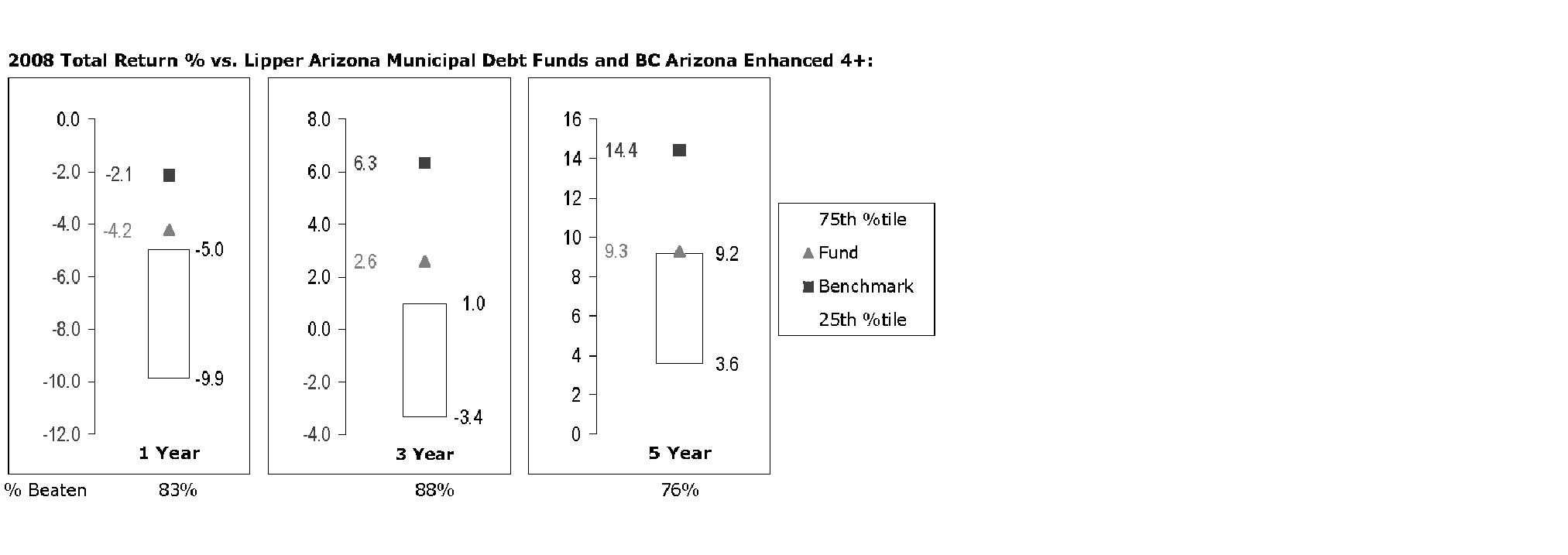

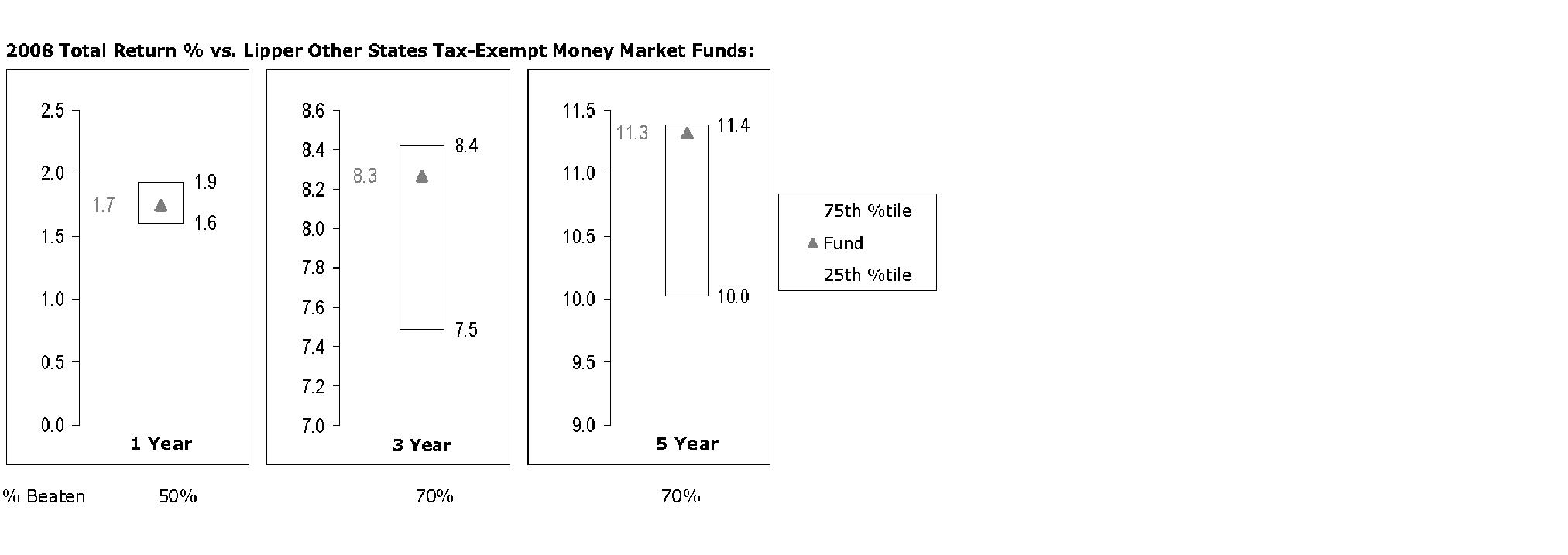

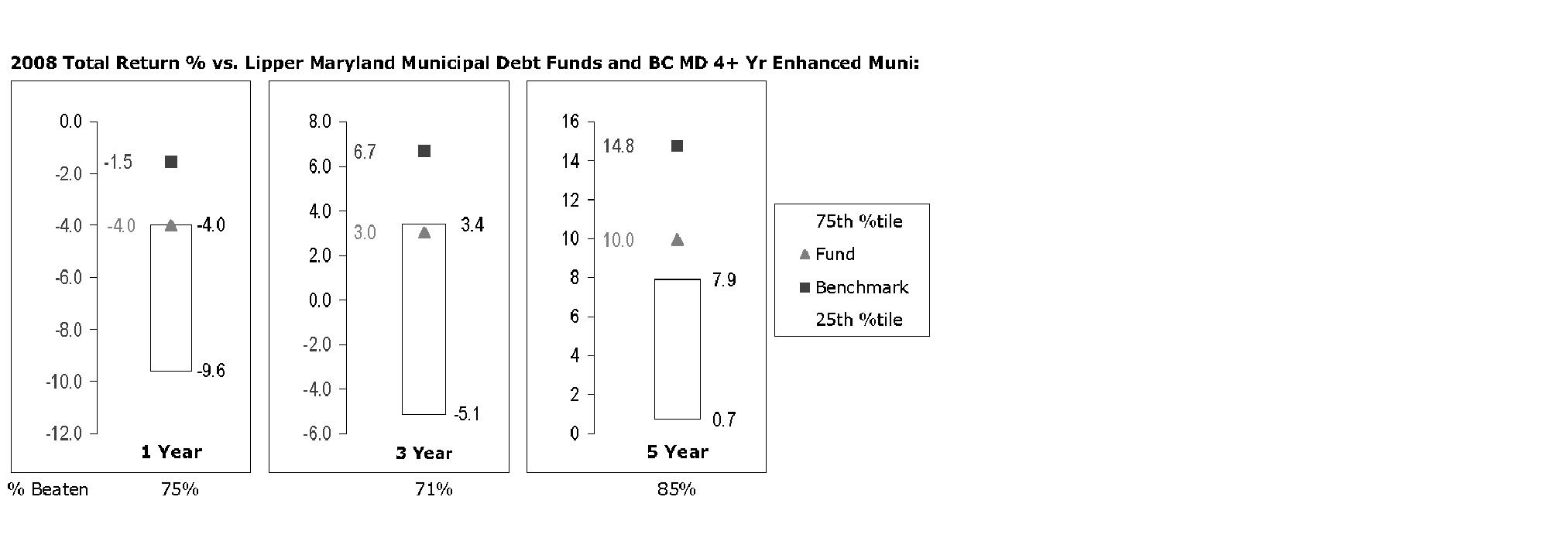

Investment Performance. The Board considered whether each fund has operated in accordance with its investment objective, as well as its record of compliance with its investment restrictions. It also reviewed each fund's absolute investment performance, as well as each fund's relative investment performance measured against (i) a broad-based securities market index (bond fund only, as money market funds are typically not compared against a market index), and (ii) a peer group of mutual funds over multiple periods. For each fund, the following charts considered by the Board show, over the one-, three-, and five-year periods ended December 31, 2008, the fund's cumulative total returns, the cumulative total returns of a broad-based securities market index ("benchmark") (bond fund only), and a range of cumulative total returns of a peer group of mutual funds identified by Lipper Inc. as having an investment objective similar to that of the fund. The box within each chart shows the 25th percentile return (bottom of box) and the 75th percentile return (top of box) of the peer group. Returns shown above the box are in the first quartile and returns shown below the box are in the fourth quartile. The percentage beaten number noted below each chart corresponds to the percentile box and represents the percentage of funds in the peer group whose performance was equal to or lower than that of the fund.

Semiannual Report

Fidelity Arizona Municipal Income Fund

The Board reviewed the fund's relative investment performance against its peer group and stated that the performance of the fund was in the first quartile for all the periods shown. The Board also stated that the investment performance of the fund was lower than its benchmark for all the periods shown. The Board also reviewed the fund's performance during 2009. The Board discussed with FMR actions that have been taken by FMR to improve the fund's below-benchmark performance.

Fidelity Arizona Municipal Money Market Fund

Semiannual Report

Board Approval of Investment Advisory Contracts and

Management Fees - continued

The Board reviewed the fund's relative investment performance against its peer group and stated that the performance of the fund was in the second quartile for all the periods shown. The Board noted that FMR does not consider that Lipper peer group to be a particularly meaningful comparison for the fund, however, because the peer group combines tax-exempt money market funds from several different states. The Board also reviewed the fund's performance during 2009.

Based on its review, and giving particular weight to the nature and quality of the resources dedicated by the Investment Advisers to maintain and improve relative performance and factoring in the unprecedented recent market events, the Board concluded that the nature, extent, and quality of the services provided to each fund will benefit each fund's shareholders, particularly in light of the Board's view that each fund's shareholders benefit from investing in a fund that is part of a large family of funds offering a variety of investment disciplines and services.

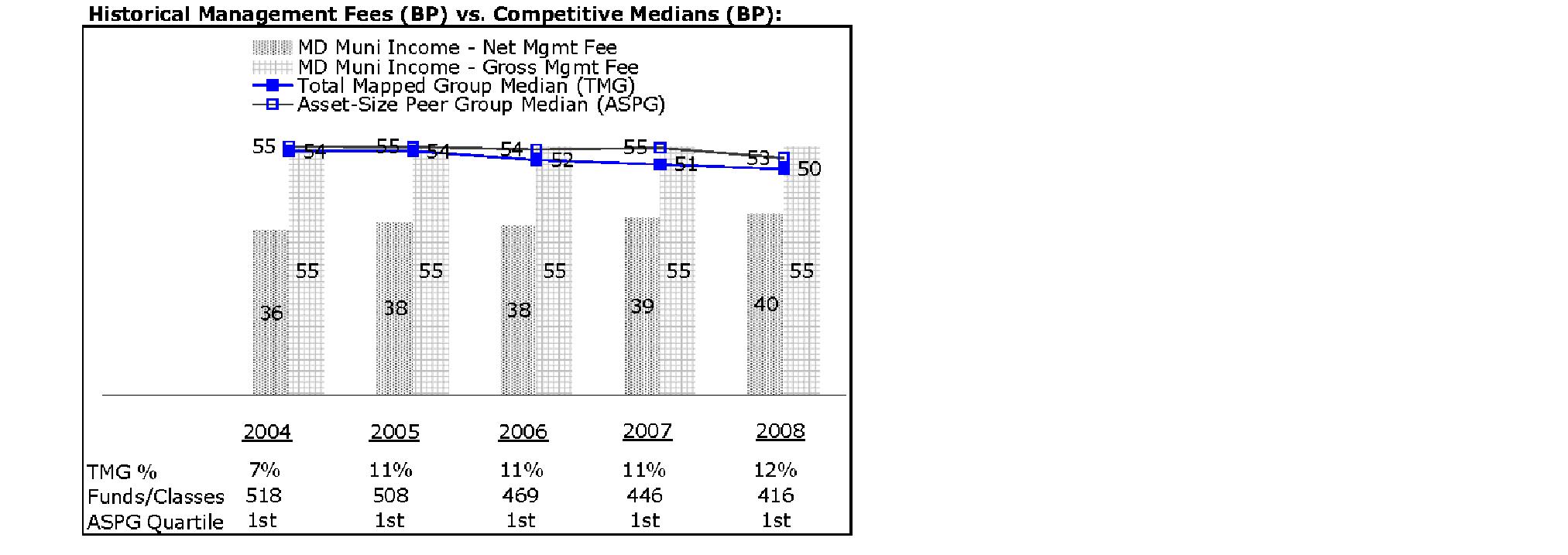

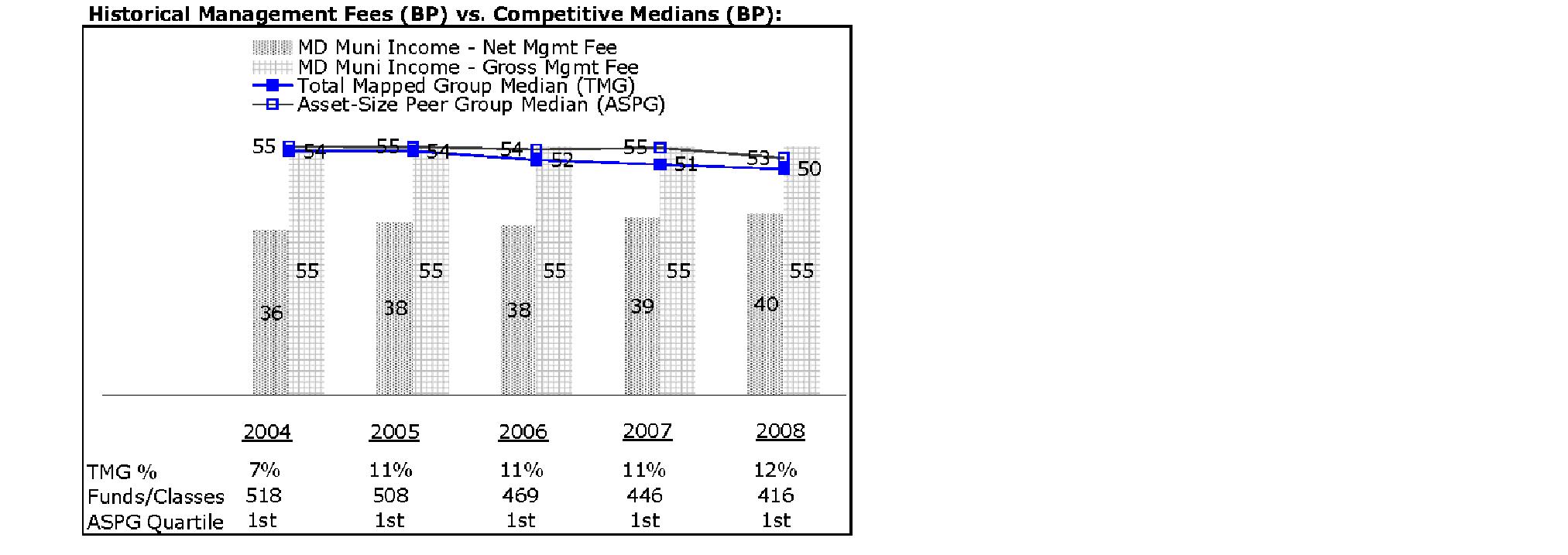

Competitiveness of Management Fee and Total Fund Expenses. The Board considered each fund's management fee and total expenses compared to "mapped groups" of competitive funds and classes. Fidelity creates "mapped groups" by combining similar Lipper investment objective categories that have comparable management fee characteristics. Combining Lipper investment objective categories aids the Board's management fee and total expense comparisons by broadening the competitive group used for comparison and by reducing the number of universes to which various Fidelity funds are compared.