UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2460

Fidelity Union Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | August 31 |

| |

Date of reporting period: | August 31, 2013 |

Item 1. Reports to Stockholders

Fidelity®

Arizona Municipal

Income Fund

and

Fidelity

Arizona Municipal

Money Market Fund

Annual Report

August 31, 2013

(Fidelity Cover Art)

Contents

Performance | (Click Here) | How the fund has done over time. |

Management's Discussion of Fund Performance | (Click Here) | The Portfolio Manager's review of fund performance and strategy. |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Fidelity® Arizona Municipal Income Fund |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Fidelity Arizona Municipal Money Market Fund |

Investment Changes/

Performance | (Click Here) | A summary of major shifts in the fund's investments over the past six months, and one year. |

Investments | (Click Here) | A complete list of the fund's investments. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

Trustees and Officers | (Click Here) | |

Distributions | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2013 FMR LLC. All rights reserved.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Fidelity® Arizona Municipal Income Fund

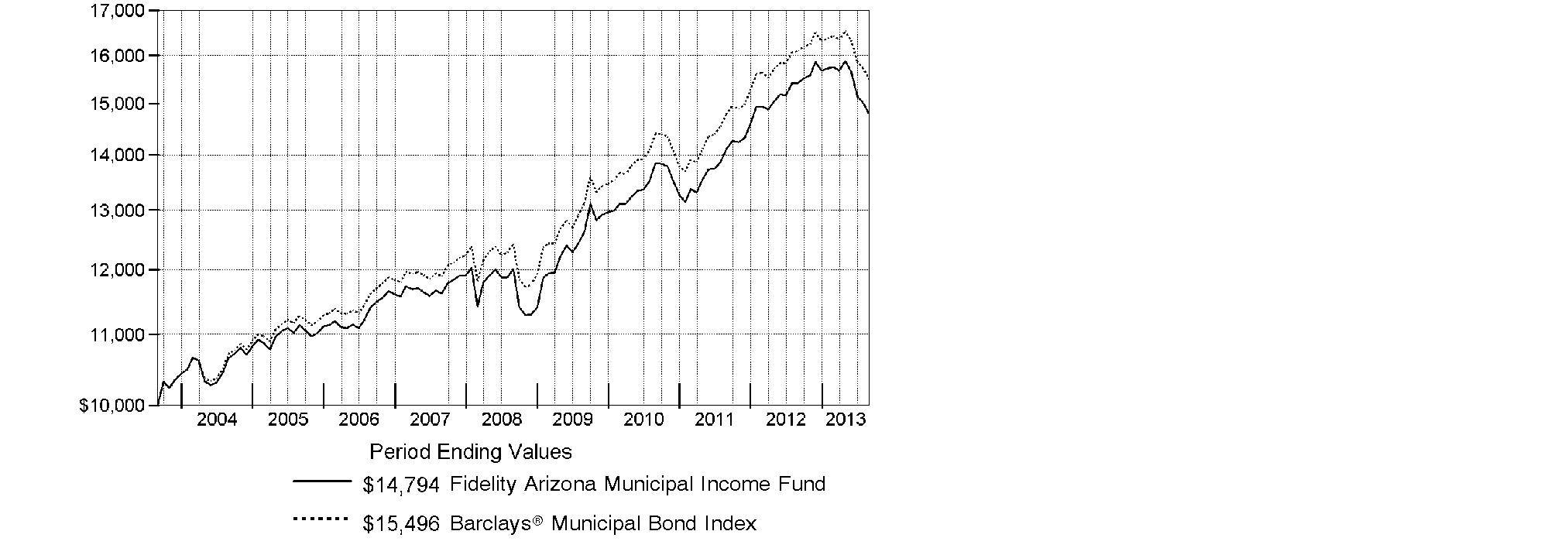

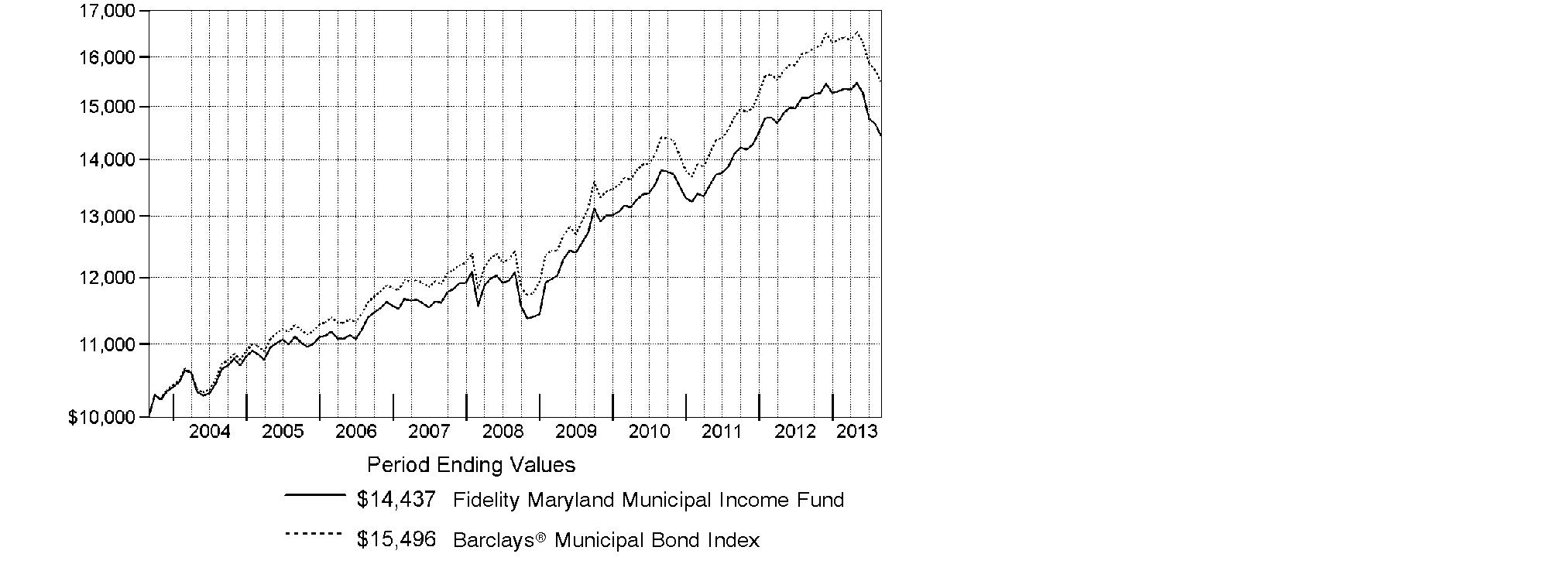

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended August 31, 2013 | Past 1

year | Past 5

years | Past 10

years |

Fidelity Arizona Municipal Income Fund | -4.03% | 4.27% | 3.99% |

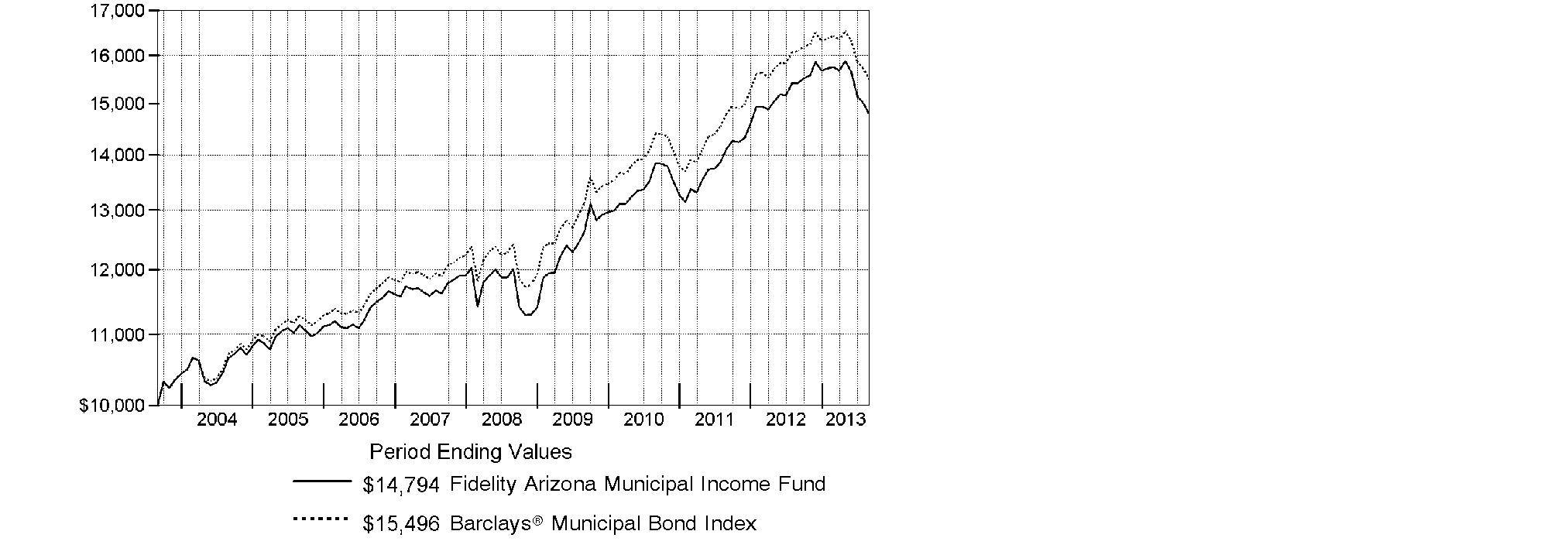

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Arizona Municipal Income Fund on August 31, 2003. The chart shows how the value of your investment would have changed, and also shows how the Barclays® Municipal Bond Index performed over the same period.

Annual Report

Market Recap: Signs of an improving economy, speculation that the Federal Reserve would soon taper its stimulus program and the challenges of some high-profile issuers caused municipal bond yields to rise and prices to decline over the latter part of the 12-month period ending August 31, 2013. For the year, the Barclays® Municipal Bond Index returned -3.70%, underperforming the taxable investment-grade debt market, which returned -2.47%, as measured by the Barclays® U.S. Aggregate Bond Index. The muni market was relatively steady from September 2012 through April 2013, as interest rates remained range-bound, state tax revenues continued to recover and investors poured money into the asset class. But munis came under intense pressure in May, when U.S. bonds of all types sold off as the Fed indicated it might curtail its massive purchases of government bonds sooner than expected. The difficulties of a few issuers - Puerto Rico, Detroit and Illinois - also continued to weigh heavily on the muni market. In mid-July, Detroit became the largest U.S. city to file for bankruptcy protection. In late August, Puerto Rico debt declined further in the wake of uninspiring economic data and a high-profile Barron's article highlighting the significant challenges faced by the commonwealth and other issuers on the island. At period end, munis were selling at some of their most compelling values relative to Treasuries since 2011.

Comments from Kevin Ramundo, Portfolio Manager of Fidelity® Arizona Municipal Income Fund: For the year, the fund returned -4.03%, while the Barclays Arizona 4+ Year Enhanced Municipal Bond Index returned -3.38%. I kept the fund's duration in line with its benchmark, evaluated bonds based on both their yield and potential for price appreciation, kept the fund diversified in terms of sectors and issuers, and continued to draw from Fidelity's research and trading resources to find bonds that offered what I believe represented good value. A trio of factors was behind the fund's underperformance of the Barclays index: the fund's out-of index investments in Puerto Rico bonds, which came under heavy selling pressure in the final weeks of the period; its barbell yield-curve positioning, with its overweight in long-maturity bonds underperforming; and its underweighting in housing bonds, which generally outpaced the Arizona muni market. Contributing to the fund's performance versus the index was the fund's underweighting in prepaid gas bonds, which investors sold during the market decline; and its outsized stake in higher-coupon callable bonds, which behaved defensively as interest rates climbed and outperformed lower-coupon callable bonds in the sector.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (March 1, 2013 to August 31, 2013).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report

Shareholder Expense Example - continued

| Annualized Expense RatioB | Beginning

Account Value

March 1, 2013 | Ending

Account Value

August 31, 2013 | Expenses Paid

During Period*

March 1, 2013 to August 31, 2013 |

Fidelity Arizona Municipal Income Fund | .55% | | | |

Actual | | $ 1,000.00 | $ 939.20 | $ 2.69 |

HypotheticalA | | $ 1,000.00 | $ 1,022.43 | $ 2.80 |

Fidelity Arizona Municipal Money Market Fund | .14% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .71 |

HypotheticalA | | $ 1,000.00 | $ 1,024.50 | $ .71 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Annual Report

Fidelity Arizona Municipal Income Fund

Investment Changes (Unaudited)

Top Five Sectors as of August 31, 2013 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Health Care | 17.7 | 14.6 |

General Obligations | 17.6 | 17.5 |

Electric Utilities | 15.4 | 16.5 |

Education | 15.3 | 13.8 |

Special Tax | 14.5 | 13.9 |

Weighted Average Maturity as of August 31, 2013 |

| | 6 months ago |

Years | 8.1 | 6.4 |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and market changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Duration as of August 31, 2013 |

| | 6 months ago |

Years | 8.2 | 7.1 |

Duration is a measure of a security's price sensitivity to changes in interest rates. Duration differs from maturity in that it considers a security's interest payments in addition to the amount of time until the security reaches maturity, and also takes into account certain maturity shortening features (e.g., demand features, interest rate resets, and call options) when applicable. Securities with longer durations generally tend to be more sensitive to interest rate changes than securities with shorter durations. A fund with a longer average duration generally can be expected to be more sensitive to interest rate changes than a fund with a shorter average duration. |

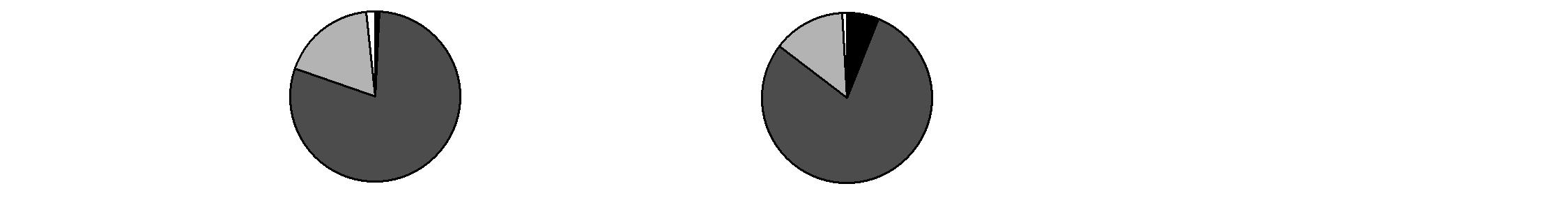

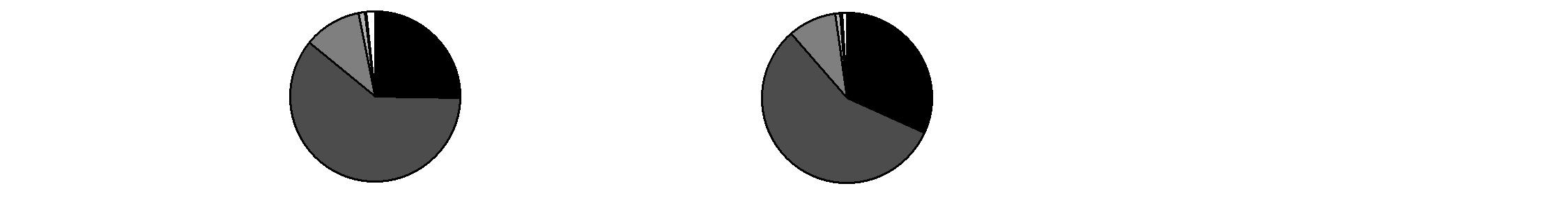

Quality Diversification (% of fund's net assets) |

As of August 31, 2013 | As of February 28, 2013 |

| AAA 0.8% | |  | AAA 6.1% | |

| AA,A 79.6% | |  | AA,A 79.3% | |

| BBB 18.0% | |  | BBB 13.8% | |

| Short-Term

Investments and

Net Other Assets 1.6% | |  | Short-Term

Investments and

Net Other Assets 0.8% | |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

Annual Report

Fidelity Arizona Municipal Income Fund

Investments August 31, 2013

Showing Percentage of Net Assets

Municipal Bonds - 98.4% |

| Principal Amount | | Value |

Arizona - 96.7% |

Arizona Board of Regents Arizona State Univ. Rev.: | | | | |

(Polytechnic Campus Proj.) Series 2008 C: | | | | |

5.75% 7/1/22 | | $ 1,500,000 | | $ 1,678,845 |

5.75% 7/1/23 | | 250,000 | | 277,675 |

Series 2012 A: | | | | |

5% 7/1/21 | | 1,070,000 | | 1,231,859 |

5% 7/1/26 | | 1,000,000 | | 1,075,210 |

Arizona Board of Regents Ctfs. of Prtn.: | | | | |

(Arizona Biomedical Research Collaborative Bldg. Proj.) Series 2006, 5% 6/1/19 (AMBAC Insured) | | 1,140,000 | | 1,221,521 |

(Univ. of Arizona Projs.): | | | | |

Series 2006 A, 5% 6/1/18 (AMBAC Insured) | | 1,000,000 | | 1,080,100 |

Series 2012 C, 5% 6/1/26 | | 3,035,000 | | 3,170,209 |

Arizona Ctfs. of Partnership: | | | | |

Series 2008 A, 5% 9/1/20 (FSA Insured) | | 1,640,000 | | 1,771,774 |

Series 2010 A, 5% 10/1/29 (FSA Insured) | | 5,000,000 | | 5,099,450 |

Series 2013 A, 5% 10/1/25 | | 1,870,000 | | 1,965,987 |

Arizona Game and Fish Dept. and Commission (AGF Administration Bldg. Proj.) Series 2006: | | | | |

5% 7/1/21 | | 1,280,000 | | 1,317,555 |

5% 7/1/32 | | 470,000 | | 451,139 |

Arizona Health Facilities Auth. Hosp. Sys. Rev.: | | | | |

(Phoenix Children's Hosp. Proj.) Series 2012 A, 5% 2/1/42 | | 1,000,000 | | 893,020 |

Series 2012 A, 5% 2/1/23 | | 1,285,000 | | 1,339,548 |

Arizona Health Facilities Auth. Rev.: | | | | |

(Banner Health Sys. Proj.): | | | | |

Series 2007 A, 5% 1/1/21 | | 1,000,000 | | 1,072,580 |

Series 2007 B, 1.84% 1/1/37 (b) | | 1,000,000 | | 756,960 |

Series 2008 A, 5.25% 1/1/31 | | 1,000,000 | | 1,018,090 |

Series 2008 D: | | | | |

5.375% 1/1/32 | | 1,000,000 | | 1,024,880 |

6% 1/1/27 | | 1,000,000 | | 1,087,700 |

Series 2011 B1, 5.25% 3/1/39 | | 1,000,000 | | 978,000 |

Series 2012 A, 5% 1/1/43 | | 3,500,000 | | 3,304,630 |

Arizona School Facilities Board Ctfs. of Prtn.: | | | | |

Series 2005 A2, 5% 9/1/16 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,665,000 | | 1,790,008 |

Series 2008, 5.75% 9/1/22 | | 1,000,000 | | 1,106,030 |

Series A2, 5% 9/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,064,870 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Arizona - continued |

Arizona State Lottery Rev. Series 2010 A, 5% 7/1/21 (FSA Insured) | | $ 1,000,000 | | $ 1,096,250 |

Arizona Trans. Board Hwy. Rev.: | | | | |

Series 2008 A, 5% 7/1/33 | | 1,000,000 | | 1,041,180 |

Series 2011 A, 5.25% 7/1/26 | | 1,250,000 | | 1,386,763 |

Avondale Muni. Dev. Corp. Excise Tax Rev. 5% 7/1/28 | | 500,000 | | 517,270 |

Cottonwood Wtr. Sys. Rev.: | | | | |

5% 7/1/26 (XL Cap. Assurance, Inc. Insured) | | 1,405,000 | | 1,413,346 |

5% 7/1/30 (XL Cap. Assurance, Inc. Insured) | | 1,125,000 | | 1,096,200 |

5% 7/1/35 (XL Cap. Assurance, Inc. Insured) | | 1,300,000 | | 1,215,188 |

Glendale Indl. Dev. Auth. (Midwestern Univ. Proj.) Series 2007, 5.25% 5/15/19 | | 1,000,000 | | 1,111,950 |

Glendale Indl. Dev. Auth. Hosp. Rev. (John C. Lincoln Health Network Proj.): | | | | |

Series 2005 B, 5.25% 12/1/19 | | 1,040,000 | | 1,079,260 |

Series 2005, 5% 12/1/35 | | 1,000,000 | | 963,530 |

Series 2007: | | | | |

5% 12/1/27 | | 1,000,000 | | 1,001,810 |

5% 12/1/32 | | 1,000,000 | | 969,870 |

Goodyear McDowell Road Commercial Corridor Impt. District 5.25% 1/1/17 (AMBAC Insured) | | 1,580,000 | | 1,721,852 |

Goodyear Pub. Impt. Corp. Facilities Rev. Series 2008, 6% 7/1/31 | | 1,000,000 | | 1,068,320 |

Marana Muni. Property Corp. Facilities Rev. Series A, 5.25% 7/1/22 | | 1,620,000 | | 1,796,256 |

Maricopa County Indl. Dev. Auth. Health Facilities Rev.: | | | | |

(Catholic Healthcare West Proj.): | | | | |

Series 2007 A: | | | | |

5% 7/1/16 | | 1,000,000 | | 1,093,430 |

5.25% 7/1/32 | | 1,000,000 | | 1,000,610 |

Series 2009 A, 6% 7/1/39 | | 1,000,000 | | 1,069,670 |

(Mayo Clinic Proj.) 5% 11/15/36 | | 1,000,000 | | 994,490 |

Maricopa County Poll. Cont. Rev. (Southern California Edison Co. Proj.) Series 2000 A, 5% 6/1/35 | | 6,000,000 | | 6,006,354 |

McAllister Academic Village LLC Rev. (Arizona State Univ. Hassayampa Academic Village Proj.) Series 2008, 5% 7/1/38 | | 1,000,000 | | 1,017,490 |

Mesa Hwy. Proj. Advancement Series 2011 A: | | | | |

5% 7/1/17 | | 500,000 | | 534,890 |

5% 7/1/21 | | 1,000,000 | | 1,060,800 |

Mesa Util. Sys. Rev.: | | | | |

Series 2006, 5% 7/1/24 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,114,070 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Arizona - continued |

Mesa Util. Sys. Rev.: - continued | | | | |

Series 2011, 5% 7/1/35 | | $ 1,015,000 | | $ 1,037,340 |

Northern Ariz Univ. Ctfs. of Prtn. (Univ. Proj.) Series 2013, 5% 9/1/24 | | 1,000,000 | | 1,069,420 |

Northern Arizona Univ. Revs.: | | | | |

Series 2012: | | | | |

5% 6/1/36 | | 860,000 | | 849,577 |

5% 6/1/41 | | 1,250,000 | | 1,224,188 |

Series 2013, 5% 8/1/27 | | 1,000,000 | | 1,037,140 |

5% 6/1/21 (AMBAC Insured) | | 1,085,000 | | 1,161,558 |

Phoenix Civic Impt. Board Arpt. Rev.: | | | | |

Series 2008 A, 5% 7/1/33 | | 1,000,000 | | 1,010,170 |

Series 2013, 5% 7/1/26 (c) | | 1,100,000 | | 1,157,486 |

Phoenix Civic Impt. Corp. District Rev. (Plaza Expansion Proj.) Series 2005 B, 5.5% 7/1/38 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 2,000,000 | | 2,057,500 |

Phoenix Civic Impt. Corp. Excise Tax Rev.: | | | | |

(Civic Plaza Expansion Proj.) Series 2005 A: | | | | |

5% 7/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 550,000 | | 582,621 |

5% 7/1/30 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,031,030 |

Series 2007 A, 5% 7/1/22 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,250,000 | | 1,343,338 |

Phoenix Civic Impt. Corp. Wastewtr. Sys. Rev.: | | | | |

Series 2004, 5% 7/1/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 770,000 | | 789,235 |

Series 2007, 5% 7/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,095,150 |

Phoenix Civic Impt. Corp. Wtr. Sys. Rev.: | | | | |

Series 2001, 5.5% 7/1/24 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,187,770 |

Series 2005, 5% 7/1/29 | | 1,750,000 | | 1,825,163 |

Series 2011, 5% 7/1/23 | | 1,050,000 | | 1,183,697 |

Phoenix-Mesa Gateway Arpt. Auth. (Mesa Proj.) Series 2012: | | | | |

5% 7/1/24 (c) | | 380,000 | | 389,511 |

5% 7/1/27 (c) | | 400,000 | | 397,604 |

Pima County Ctfs. of Prtn.: | | | | |

(Justice Bldg. Proj.) Series 2007 A: | | | | |

5% 7/1/19 (AMBAC Insured) | | 650,000 | | 697,808 |

5% 7/1/21 (AMBAC Insured) | | 910,000 | | 948,466 |

Series 2013 A, 5% 12/1/22 | | 1,000,000 | | 1,107,490 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Arizona - continued |

Pima County Gen. Oblig. Series 2011, 5% 7/1/21 | | $ 1,000,000 | | $ 1,131,040 |

Pima County Swr. Sys. Rev.: | | | | |

Series 2011 B: | | | | |

5% 7/1/22 | | 1,635,000 | | 1,823,973 |

5% 7/1/25 | | 1,000,000 | | 1,076,990 |

Series 2012 A: | | | | |

5% 7/1/25 | | 1,600,000 | | 1,730,224 |

5% 7/1/26 | | 1,000,000 | | 1,068,300 |

Pima County Unified School District #1 Tucson (Proj. of 2004): | | | | |

Series 2007 C, 5% 7/1/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,075,420 |

Series 2008 D, 5% 7/1/25 (FSA Insured) | | 1,000,000 | | 1,077,020 |

Pinal County Indl. Dev. Auth. Correctional Facilities Contract Rev. (Florence West Prison Proj.) Series 2007 A, 5.25% 10/1/13 (ACA Finl. Guaranty Corp. Insured) | | 1,335,000 | | 1,337,697 |

Pinal County Unified School District #44 J.O. Combs (2006 School Impt. Proj.) Series B, 5% 7/1/21 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 860,000 | | 915,556 |

Queen Creek Excise Tax & State Shared Rev. 5% 8/1/22 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,125,000 | | 1,202,603 |

Salt River Proj. Agricultural Impt. & Pwr. District Elec. Sys. Rev.: | | | | |

Series 2005 A, 5% 1/1/35 | | 2,000,000 | | 2,046,060 |

Series 2006 A, 5% 1/1/37 | | 5,690,000 | | 5,799,476 |

Series 2008 A: | | | | |

5% 1/1/24 | | 1,075,000 | | 1,160,140 |

5% 1/1/33 | | 1,000,000 | | 1,033,260 |

5% 1/1/38 | | 3,400,000 | | 3,460,554 |

Series 2009 A, 5% 1/1/26 | | 1,950,000 | | 2,087,885 |

Salt Verde Finl. Corp. Sr. Gas Rev. Series 2007: | | | | |

5% 12/1/37 | | 1,000,000 | | 913,450 |

5.5% 12/1/29 | | 3,000,000 | | 3,031,890 |

Scottsdale Gen. Oblig. Series 2012, 5% 7/1/22 | | 1,010,000 | | 1,168,055 |

Scottsdale Indl. Dev. Auth. Hosp. Rev. (Scottsdale Healthcare Proj.): | | | | |

Series 2006 C, 5% 9/1/35 (FSA Insured) | | 415,000 | | 406,327 |

Series 2008 A, 5% 9/1/23 | | 355,000 | | 364,287 |

Scottsdale Muni. Property Corp. Excise Tax Rev. (Wtr. and Swr. Impt. Proj.) Series 2008 A, 5% 7/1/28 | | 1,050,000 | | 1,121,684 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Arizona - continued |

Sedona Excise Tax Rev.: | | | | |

Series 2004, 5% 7/1/15 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | $ 2,120,000 | | $ 2,198,270 |

Series 2005, 5% 7/1/19 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,040,770 |

Tempe Excise Tax Rev. Series 2012, 5% 7/1/25 | | 1,090,000 | | 1,190,629 |

Tempe Transit Excise Tax Rev. Series 2008, 4.75% 7/1/38 | | 60,000 | | 60,278 |

Tucson Ctfs. of Prtn.: | | | | |

Series 2006 A, 5% 7/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 3,050,000 | | 3,305,895 |

Series 2007, 5% 7/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | | 1,093,230 |

Tucson Wtr. Rev. Series 2013 A: | | | | |

5% 7/1/24 | | 1,250,000 | | 1,384,913 |

5% 7/1/25 | | 1,150,000 | | 1,256,272 |

Univ. Med. Ctr. Corp. Hosp. Rev.: | | | | |

Series 2005, 5% 7/1/16 | | 860,000 | | 911,256 |

Series 2011, 6% 7/1/39 | | 2,235,000 | | 2,336,827 |

5.625% 7/1/36 | | 1,000,000 | | 965,660 |

Univ. of Arizona Univ. Revs.: | | | | |

(Univ. of Arizona Projs.) Series 2005 A, 5% 6/1/24 (AMBAC Insured) | | 1,040,000 | | 1,081,590 |

Series 2008 A, 5% 6/1/22 | | 1,315,000 | | 1,441,279 |

Series 2009 A, 5% 6/1/39 | | 1,000,000 | | 1,011,860 |

Series 2012 A: | | | | |

5% 6/1/25 | | 1,000,000 | | 1,095,480 |

5% 6/1/37 | | 2,000,000 | | 2,032,420 |

Yavapai County Indl. Dev. Auth.: | | | | |

(Northern Healthcare Sys. Proj.) Series 2011, 5% 10/1/20 | | 1,000,000 | | 1,136,120 |

Series 2012 A, 5.25% 8/1/33 | | 2,000,000 | | 1,907,300 |

| | 150,813,691 |

Guam - 0.6% |

Guam Int'l. Arpt. Auth. Rev. Series 2013 C: | | | | |

5% 10/1/18 (a)(c) | | 300,000 | | 313,359 |

6.375% 10/1/43 (a)(c) | | 200,000 | | 196,704 |

Guam Pwr. Auth. Rev. Series 2012 A, 5% 10/1/21 (FSA Insured) | | 400,000 | | 452,372 |

| | 962,435 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Puerto Rico - 0.9% |

Puerto Rico Govt. Dev. Bank Series 2006 C, 5.25% 1/1/15 (c) | | $ 500,000 | | $ 507,360 |

Puerto Rico Sales Tax Fing. Corp. Sales Tax Rev.: | | | | |

Series 2007 A, 0% 8/1/44 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 920,000 | | 98,550 |

Series 2009 A, 6% 8/1/42 | | 600,000 | | 533,850 |

Series 2011 C: | | | | |

0% 8/1/39 | | 1,200,000 | | 185,424 |

0% 8/1/41 | | 500,000 | | 66,710 |

| | 1,391,894 |

Virgin Islands - 0.2% |

Virgin Islands Pub. Fin. Auth. Series 2009 B, 5% 10/1/25 | | 300,000 | | 309,330 |

TOTAL INVESTMENT PORTFOLIO - 98.4% (Cost $154,802,721) | 153,477,350 |

NET OTHER ASSETS (LIABILITIES) - 1.6% | | 2,571,682 |

NET ASSETS - 100% | $ 156,049,032 |

Legend |

(a) Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

(c) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

Other Information |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

The distribution of municipal securities by revenue source, as a percentage of total net assets, is as follows (Unaudited): |

Health Care | 17.7% |

General Obligations | 17.6% |

Electric Utilities | 15.4% |

Education | 15.3% |

Special Tax | 14.5% |

Water & Sewer | 11.8% |

Others* (Individually Less Than 5%) | 7.7% |

| 100.0% |

* Includes net other assets |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Arizona Municipal Income Fund

Statement of Assets and Liabilities

| August 31, 2013 |

| | |

Assets | | |

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $154,802,721) | | $ 153,477,350 |

Cash | | 1,139,580 |

Receivable for investments sold | | 123,117 |

Receivable for fund shares sold | | 549,120 |

Interest receivable | | 1,628,683 |

Other receivables | | 258 |

Total assets | | 156,918,108 |

| | |

Liabilities | | |

Payable for investments purchased on a delayed delivery basis | $ 510,819 | |

Payable for fund shares redeemed | 101,304 | |

Distributions payable | 184,144 | |

Accrued management fee | 72,809 | |

Total liabilities | | 869,076 |

| | |

Net Assets | | $ 156,049,032 |

Net Assets consist of: | | |

Paid in capital | | $ 157,334,205 |

Undistributed net investment income | | 37,002 |

Accumulated undistributed net realized gain (loss) on investments | | 3,196 |

Net unrealized appreciation (depreciation) on investments | | (1,325,371) |

Net Assets, for 13,799,549 shares outstanding | | $ 156,049,032 |

Net Asset Value, offering price and redemption price per share ($156,049,032 ÷ 13,799,549 shares) | | $ 11.31 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Arizona Municipal Income Fund

Financial Statements - continued

Statement of Operations

| Year ended August 31, 2013 |

| | |

Investment Income | | |

Interest | | $ 6,884,620 |

| | |

Expenses | | |

Management fee | $ 1,020,544 | |

Independent trustees' compensation | 712 | |

Miscellaneous | 447 | |

Total expenses before reductions | 1,021,703 | |

Expense reductions | (2,609) | 1,019,094 |

Net investment income (loss) | | 5,865,526 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 414,386 |

Change in net unrealized appreciation (depreciation) on investment securities | | (13,510,768) |

Net gain (loss) | | (13,096,382) |

Net increase (decrease) in net assets resulting from operations | | $ (7,230,856) |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| Year ended

August 31,

2013 | Year ended

August 31,

2012 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 5,865,526 | $ 5,907,732 |

Net realized gain (loss) | 414,386 | 691,454 |

Change in net unrealized appreciation (depreciation) | (13,510,768) | 8,464,250 |

Net increase (decrease) in net assets resulting

from operations | (7,230,856) | 15,063,436 |

Distributions to shareholders from net investment income | (5,864,083) | (5,887,837) |

Distributions to shareholders from net realized gain | (382,125) | (27,968) |

Total distributions | (6,246,208) | (5,915,805) |

Share transactions

Proceeds from sales of shares | 56,665,182 | 41,095,218 |

Reinvestment of distributions | 3,619,802 | 3,359,514 |

Cost of shares redeemed | (74,669,582) | (30,074,016) |

Net increase (decrease) in net assets resulting from share transactions | (14,384,598) | 14,380,716 |

Redemption fees | 3,595 | 1,089 |

Total increase (decrease) in net assets | (27,858,067) | 23,529,436 |

| | |

Net Assets | | |

Beginning of period | 183,907,099 | 160,377,663 |

End of period (including undistributed net investment income of $37,002 and undistributed net investment income of $25,344, respectively) | $ 156,049,032 | $ 183,907,099 |

Other Information Shares | | |

Sold | 4,727,263 | 3,444,168 |

Issued in reinvestment of distributions | 300,213 | 281,600 |

Redeemed | (6,309,658) | (2,528,170) |

Net increase (decrease) | (1,282,182) | 1,197,598 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

Years ended August 31, | 2013 | 2012 | 2011 | 2010 | 2009 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 12.19 | $ 11.55 | $ 11.76 | $ 11.12 | $ 11.04 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .382 | .413 | .420 | .416 | .425 |

Net realized and unrealized gain (loss) | (.855) | .641 | (.210) | .639 | .112 |

Total from investment operations | (.473) | 1.054 | .210 | 1.055 | .537 |

Distributions from net investment income | (.382) | (.412) | (.420) | (.416) | (.425) |

Distributions from net realized gain | (.025) | (.002) | - | - | (.033) |

Total distributions | (.407) | (.414) | (.420) | (.416) | (.458) |

Redemption fees added to paid in capital B | - D | - D | - D | .001 | .001 |

Net asset value, end of period | $ 11.31 | $ 12.19 | $ 11.55 | $ 11.76 | $ 11.12 |

Total Return A | (4.03)% | 9.26% | 1.92% | 9.69% | 5.15% |

Ratios to Average Net Assets C | | | | | |

Expenses before reductions | .55% | .55% | .55% | .55% | .55% |

Expenses net of fee waivers, if any | .55% | .55% | .55% | .55% | .55% |

Expenses net of all reductions | .55% | .55% | .55% | .55% | .55% |

Net investment income (loss) | 3.16% | 3.47% | 3.71% | 3.66% | 3.97% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 156,049 | $ 183,907 | $ 160,378 | $ 184,201 | $ 155,053 |

Portfolio turnover rate | 20% | 12% | 10% | 10% | 19% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

D Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Arizona Municipal Money Market Fund

Investment Changes/Performance (Unaudited)

Effective Maturity Diversification |

Days | % of fund's investments 8/31/13 | % of fund's investments 2/28/13 | % of fund's investments 8/31/12 |

1 - 7 | 76.7 | 71.6 | 87.2 |

8 - 30 | 8.6 | 1.1 | 0.2 |

31 - 60 | 2.9 | 9.9 | 2.6 |

61 - 90 | 0.2 | 0.0 | 0.0 |

91 - 180 | 5.1 | 13.2 | 5.0 |

> 180 | 6.5 | 4.2 | 5.0 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

Weighted Average Maturity |

| 8/31/13 | 2/28/13 | 8/31/12 |

Fidelity Arizona Municipal Money Market Fund | 33 Days | 36 Days | 27 Days |

All Tax-Free Money Market Fund Average* | 42 Days | 31 Days | 39 Days |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and market changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Weighted Average Life |

| 8/31/13 | 2/28/13 | 8/31/12 |

Fidelity Arizona Municipal Money Market Fund | 33 Days | 36 Days | 27 Days |

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security. |

* Source: iMoneyNet, Inc.

Annual Report

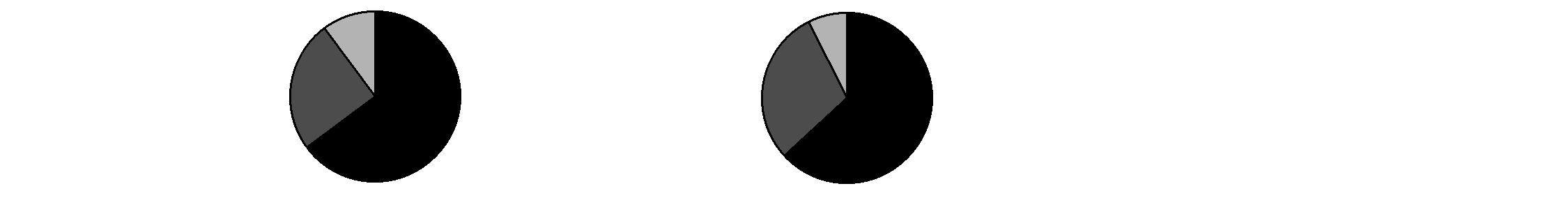

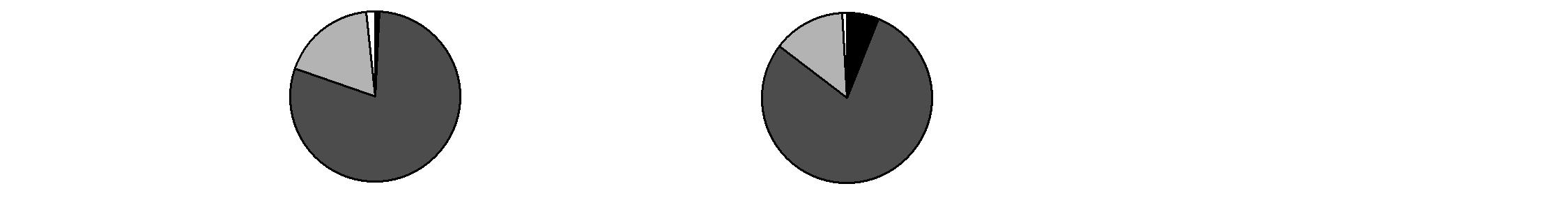

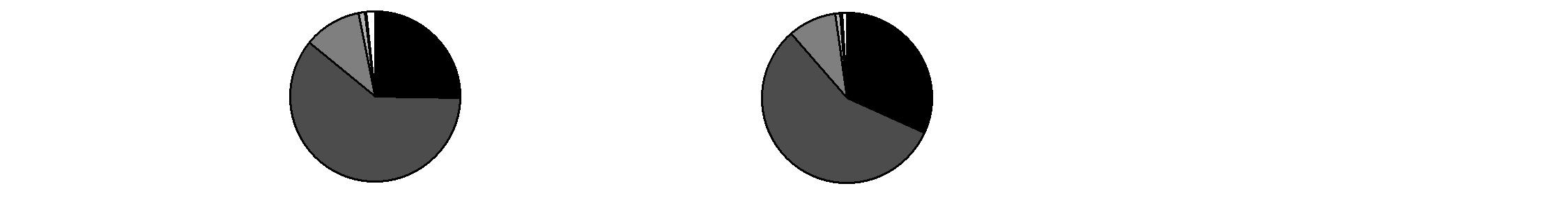

Asset Allocation (% of fund's net assets) |

As of August 31, 2013 | As of February 28, 2013 |

| Variable Rate

Demand Notes

(VRDNs) 66.1% | |  | Variable Rate

Demand Notes

(VRDNs) 63.4% | |

| Other Municipal

Debt 25.4% | |  | Other Municipal

Debt 29.5% | |

| Investment

Companies 10.5% | |  | Investment

Companies 7.5% | |

| Net Other Assets (Liabilities) † (2.0)% | |  | Net Other Assets (Liabilities) † (0.4)% | |

† Net Other Assets (Liabilities) are not included in the pie chart.

Current and Historical Seven-Day Yields

| 8/31/13 | 5/31/13 | 2/28/13 | 11/30/12 | 8/31/12 |

Fidelity Arizona Municipal Money Market Fund | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

Yield refers to the income paid by the fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending August 31, 2013, the most recent period shown in the table, would have been -0.38%.

Annual Report

Fidelity Arizona Municipal Money Market Fund

Investments August 31, 2013

Showing Percentage of Net Assets

Variable Rate Demand Note - 66.1% |

| Principal Amount | | Value |

Alabama - 0.1% |

Decatur Indl. Dev. Board Exempt Facilities Rev. (Nucor Steel Decatur LLC Proj.) Series 2003 A, 0.39% 9/6/13, VRDN (a)(d) | $ 200,000 | | $ 200,000 |

Arizona - 64.2% |

Arizona Board of Regents Arizona State Univ. Rev.: | | | |

Participating VRDN Series Putters 4147, 0.07% 9/6/13 (Liquidity Facility JPMorgan Chase Bank) (a)(e) | 3,665,000 | | 3,665,000 |

Series 2008 A, 0.06% 9/6/13, LOC JPMorgan Chase Bank, VRDN (a) | 9,100,000 | | 9,100,000 |

Arizona Health Facilities Auth. Rev.: | | | |

(Banner Health Sys. Proj.): | | | |

Series 2008 E, 0.06% 9/6/13, LOC Bank of America NA, VRDN (a) | 2,300,000 | | 2,300,000 |

Series 2008 G, 0.07% 9/6/13, LOC U.S. Bank NA, Cincinnati, VRDN (a) | 26,100,000 | | 26,100,000 |

(Catholic Healthcare West Proj.): | | | |

Series 2005 B, 0.08% 9/6/13, LOC JPMorgan Chase Bank, VRDN (a) | 11,710,000 | | 11,710,000 |

Series 2008 B, 0.07% 9/6/13, LOC PNC Bank NA, VRDN (a) | 10,000,000 | | 10,000,000 |

Series 2009 F, 0.05% 9/6/13, LOC Mizuho Corporate Bank Ltd., VRDN (a) | 15,200,000 | | 15,200,000 |

(Royal Oaks Life Care Cmnty. Proj.) Series 2002, 0.08% 9/6/13, LOC Bank of America NA, VRDN (a) | 3,500,000 | | 3,500,000 |

Arizona Health Facilities Auth. Sr. Living Rev. (Royal Oaks Life Care Cmnty. Proj.) Series 2008, 0.08% 9/6/13, LOC Bank of America NA, VRDN (a) | 3,700,000 | | 3,700,000 |

Arizona Hsg. Fin. Auth. Multi-family Hsg. Rev. (Santa Carolina Apts. Proj.) Series 2005, 0.1% 9/6/13, LOC Fannie Mae, VRDN (a)(d) | 3,645,000 | | 3,645,000 |

Arizona Trans. Board Hwy. Rev. Participating VRDN Series WF 11 138C, 0.06% 9/6/13 (Liquidity Facility Wells Fargo Bank NA) (a)(e) | 10,455,000 | | 10,455,000 |

Casa Grande Indl. Dev. Auth. Indl. Dev. Rev. (Price Companies, Inc. Proj.) Series A, 0.26% 9/6/13, LOC Bank of America NA, VRDN (a)(d) | 1,230,000 | | 1,230,000 |

Coconino County Poll. Cont. Corp. Rev.: | | | |

(Arizona Pub. Svc. Co. Navajo Proj.) Series 2009 B, 0.08% 9/3/13, LOC JPMorgan Chase Bank, VRDN (a)(d) | 11,700,000 | | 11,700,000 |

(Tucson Elec. Pwr. Co. Navajo Proj.) Series 2010 A, 0.11% 9/6/13, LOC JPMorgan Chase Bank, VRDN (a)(d) | 3,500,000 | | 3,500,000 |

Eclipse Fdg. Trust Various States Participating VRDN Series Solar 06 23, 0.06% 9/6/13 (Liquidity Facility U.S. Bank NA, Cincinnati) (a)(e) | 3,900,000 | | 3,900,000 |

Variable Rate Demand Note - continued |

| Principal Amount | | Value |

Arizona - continued |

Maricopa County Indl. Dev. Auth. Multi-family Hsg. Rev.: | | | |

(Glenn Oaks Apts. Proj.) Series 2001, 0.11% 9/6/13, LOC Fannie Mae, VRDN (a)(d) | $ 2,259,675 | | $ 2,259,675 |

(Ranchwood Apts. Proj.) Series 2001 A, 0.1% 9/6/13, LOC Fannie Mae, VRDN (a)(d) | 1,500,000 | | 1,500,000 |

(San Angelin Apts. Proj.) Series 2004, 0.06% 9/6/13, LOC Fannie Mae, VRDN (a)(d) | 1,300,000 | | 1,300,000 |

(San Martin Apts. Proj.) Series A1, 0.06% 9/6/13, LOC Fannie Mae, VRDN (a)(d) | 6,000,000 | | 6,000,000 |

(San Remo Apts. Proj.) Series 2002, 0.06% 9/6/13, LOC Fannie Mae, VRDN (a)(d) | 8,675,000 | | 8,675,000 |

(Village at Sun Valley Apts. Proj.) Series 2008, 0.09% 9/6/13, LOC Freddie Mac, VRDN (a)(d) | 9,240,000 | | 9,240,000 |

(Village Square Apts. Proj.) Series 2004, 0.08% 9/6/13, LOC Fannie Mae, VRDN (a)(d) | 1,000,000 | | 1,000,000 |

Maricopa County Indl. Dev. Auth. Rev.: | | | |

(Clayton Homes, Inc. Proj.) Series 1998, 0.11% 9/6/13, LOC U.S. Bank NA, Cincinnati, VRDN (a)(d) | 1,000,000 | | 1,000,000 |

(Valley of the Sun YMCA Proj.) Series 2008, 0.08% 9/6/13, LOC U.S. Bank NA, Cincinnati, VRDN (a) | 6,700,000 | | 6,700,000 |

Mesa Util. Sys. Rev. Participating VRDN Series ROC II R 11959X, 0.07% 9/6/13 (Liquidity Facility Citibank NA) (a)(e) | 7,250,000 | | 7,250,000 |

Northern Arizona Univ. Revs. Participating VRDN Series Solar 07 14, 0.06% 9/6/13 (Liquidity Facility U.S. Bank NA, Cincinnati) (a)(e) | 4,600,000 | | 4,600,000 |

Phoenix Civic Impt. Corp. Wtr. Sys. Rev. Participating VRDN: | | | |

Series Putters 3458, 0.07% 9/6/13 (Liquidity Facility JPMorgan Chase Bank) (a)(e) | 4,000,000 | | 4,000,000 |

Series ROC II R 12311, 0.06% 9/6/13 (Liquidity Facility Citibank NA) (a)(e) | 3,500,000 | | 3,500,000 |

Phoenix Gen. Oblig. Participating VRDN Series BBT 2012, 0.06% 9/6/13 (Liquidity Facility Branch Banking & Trust Co.) (a)(e) | 10,675,000 | | 10,675,000 |

Phoenix Indl. Dev. Auth. Multi-family Hsg. Rev.: | | | |

(Del Mar Terrace Apts. Proj.) Series 1999 A, 0.08% 9/6/13, LOC Freddie Mac, VRDN (a) | 2,300,000 | | 2,300,000 |

(Westward Ho Apts. Proj.) Series 2003 A, 0.13% 9/6/13, LOC Bank of America NA, VRDN (a)(d) | 4,085,000 | | 4,085,000 |

Phoenix Indl. Dev. Auth. Rev.: | | | |

(Desert Botanical Garden Proj.) Series 2000, 0.07% 9/6/13, LOC JPMorgan Chase Bank, VRDN (a) | 600,000 | | 600,000 |

(Independent Newspaper, Inc. Proj.) Series 2000, 0.26% 9/6/13, LOC Wells Fargo Bank NA, VRDN (a)(d) | 630,000 | | 630,000 |

Variable Rate Demand Note - continued |

| Principal Amount | | Value |

Arizona - continued |

Phoenix Indl. Dev. Auth. Rev.: - continued | | | |

(Phoenix Expansion Proj.) Series 2002, 0.32% 9/6/13, LOC JPMorgan Chase Bank, VRDN (a)(d) | $ 1,805,000 | | $ 1,805,000 |

Pima County Indl. Dev. Auth. Indl. Rev. (Tucson Elec. Pwr. Co. Proj.) Series 1982 A, 0.06% 9/6/13, LOC Wells Fargo Bank NA, VRDN (a) | 7,900,000 | | 7,900,000 |

Pima County Indl. Dev. Auth. Multi-family Hsg. Rev.: | | | |

(River Point Proj.) Series 2001, 0.1% 9/6/13, LOC Fannie Mae, VRDN (a)(d) | 5,845,000 | | 5,845,000 |

Series A, 0.1% 9/6/13, LOC Fannie Mae, VRDN (a)(d) | 3,200,000 | | 3,200,000 |

Pima County Indl. Dev. Auth. Rev. (Broadway Proper Congregate Proj.) Series 2000 A, 0.05% 9/6/13, LOC Fed. Home Ln. Bank, San Francisco, VRDN (a) | 3,460,000 | | 3,460,000 |

Salt River Proj. Agricultural Impt. & Pwr. District Elec. Sys. Rev. Participating VRDN: | | | |

Series EGL 06 14 Class A, 0.06% 9/6/13 (Liquidity Facility Citibank NA) (a)(e) | 1,300,000 | | 1,300,000 |

Series EGL 07 0012, 0.06% 9/6/13 (Liquidity Facility Citibank NA) (a)(e) | 1,000,000 | | 1,000,000 |

Series MS 3078, 0.06% 9/6/13 (Liquidity Facility Cr. Suisse) (a)(e) | 1,500,000 | | 1,500,000 |

Series MS 3179, 0.09% 9/6/13 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(e) | 3,020,000 | | 3,020,000 |

Series ROC II R 11980 X, 0.06% 9/6/13 (Liquidity Facility Citibank NA) (a)(e) | 2,800,000 | | 2,800,000 |

Series WF 09 40C, 0.06% 9/6/13 (Liquidity Facility Wells Fargo & Co.) (a)(e) | 3,300,000 | | 3,300,000 |

Scottsdale Gen. Oblig. Participating VRDN Series BBT 08 20, 0.06% 9/6/13 (Liquidity Facility Branch Banking & Trust Co.) (a)(e) | 11,030,000 | | 11,030,000 |

Tempe Indl. Dev. Auth. Rev. (ASUF Brickyard Proj.) Series 2004 A, 0.06% 9/6/13, LOC Bank of America NA, VRDN (a) | 11,450,000 | | 11,450,000 |

Yuma Indl. Dev. Auth. Hosp. Rev. (Yuma Reg'l. Med. Ctr. Proj.) Series 2008, 0.07% 9/6/13, LOC JPMorgan Chase Bank, VRDN (a) | 9,500,000 | | 9,500,000 |

| | 262,129,675 |

California - 0.2% |

California Health Facilities Fing. Auth. Rev. Participating VRDN Series MS 3267, 0.06% 9/6/13 (Liquidity Facility Cr. Suisse) (a)(e) | 1,000,000 | | 1,000,000 |

Delaware - 0.1% |

Delaware Econ. Dev. Auth. Rev. (Delmarva Pwr. & Lt. Co. Proj.) Series 1999 A, 0.23% 9/6/13, VRDN (a) | 400,000 | | 400,000 |

Variable Rate Demand Note - continued |

| Principal Amount | | Value |

Louisiana - 0.1% |

Saint James Parish Gen. Oblig. (Nucor Steel Louisiana LLC Proj.) Series 2010 B1, 0.34% 9/6/13, VRDN (a) | $ 360,000 | | $ 360,000 |

Nebraska - 0.1% |

Stanton County Indl. Dev. Rev. (Nucor Corp. Proj.) Series 1996, 0.39% 9/6/13, VRDN (a)(d) | 200,000 | | 200,000 |

Nevada - 0.0% |

Clark County Arpt. Rev. Series 2008 C3, 0.27% 9/6/13, LOC Landesbank Baden-Wurttemberg, VRDN (a)(d) | 100,000 | | 100,000 |

New Jersey - 0.3% |

Salem County Poll. Cont. Fin. Auth. Rev. (Pub. Svc. Elec. and Gas Co. Proj.): | | | |

Series 2003 B1, 0.26% 9/6/13, VRDN (a) | 900,000 | | 900,000 |

Series 2012 A, 0.28% 9/6/13, VRDN (a)(d) | 200,000 | | 200,000 |

| | 1,100,000 |

North Carolina - 0.1% |

Parson County Indl. Facilities and Poll. Cont. Fing. Auth. (CertainTeed Gypsum NC, Inc. Proj.) Series 2010, 0.09% 9/6/13, LOC Cr. Industriel et Commercial, VRDN (a) | 600,000 | | 600,000 |

Ohio - 0.2% |

Ohio Higher Edl. Facility Commission Rev. (Univ. Hosp. Health Sys. Proj.) Series 2008 B, 0.1% 9/6/13, LOC RBS Citizens NA, VRDN (a) | 1,000,000 | | 1,000,000 |

Puerto Rico - 0.2% |

Puerto Rico Commonwealth Pub. Impt. Gen. Oblig. Series 2003 C5-2, 0.06% 9/6/13, LOC Barclays Bank PLC, VRDN (a) | 100,000 | | 100,000 |

RIB Floater Trust Various States Letter of Cr. Enhanced Participating VRDN Series BC 13 18WE, 0.11% 9/6/13 (Liquidity Facility Barclays Bank PLC) (a)(e) | 800,000 | | 800,000 |

| | 900,000 |

Tennessee - 0.3% |

Montgomery County Pub. Bldg. Auth. Pooled Fing. Rev. (Tennessee County Ln. Pool Prog.) Series 2002, 0.12% 9/3/13, LOC Bank of America NA, VRDN (a) | 1,015,000 | | 1,015,000 |

Texas - 0.1% |

Gulf Coast Waste Disp. Auth. Solid Waste Disp. Rev. (Waste Mgmt., Inc. Proj.) Series A, 0.1% 9/6/13, LOC JPMorgan Chase Bank, VRDN (a)(d) | 200,000 | | 200,000 |

Variable Rate Demand Note - continued |

| Principal Amount | | Value |

Wyoming - 0.1% |

Lincoln County Envir. (PacifiCorp Proj.) Series 1995, 0.24% 9/6/13, VRDN (a)(d) | $ 250,000 | | $ 250,000 |

Sweetwater County Poll. Cont. Rev. (PacifiCorp Proj.) Series 1984, 0.23% 9/6/13, VRDN (a) | 100,000 | | 100,000 |

| | 350,000 |

TOTAL VARIABLE RATE DEMAND NOTE (Cost $269,554,675) |

269,554,675

|

Other Municipal Debt - 25.4% |

| | | |

Arizona - 24.5% |

Arizona Ctfs. of Partnership Bonds: | | | |

Series 2010 B, 2% 10/1/13 | 1,800,000 | | 1,802,298 |

Series 2013 A: | | | |

2% 10/1/13 | 3,760,000 | | 3,765,330 |

2% 10/1/13 | 755,000 | | 756,070 |

Arizona Health Facilities Auth. Rev. Bonds: | | | |

(Banner Health Sys. Proj.): | | | |

Series 2008 A, 5% 1/1/14 | 1,225,000 | | 1,244,169 |

Series 2008 D, 5% 1/1/14 | 3,000,000 | | 3,047,338 |

Series 2007 A, 5% 1/1/14 | 2,300,000 | | 2,335,226 |

Arizona School Facilities Board Ctfs. of Prtn. Bonds Series 2008, 5.5% 9/1/13 | 3,300,000 | | 3,300,000 |

Arizona State Univ. Ctfs. of Partnership Bonds (Research Infrastructure Proj.) Series 2004, 5% 9/1/13 | 2,000,000 | | 2,000,000 |

Arizona Trans. Board Hwy. Rev. Bonds Series 2011 A, 5% 7/1/14 | 1,600,000 | | 1,663,419 |

Chandler Gen. Oblig. Bonds Series GS 07 49TP, 0.19%, tender 12/12/13 (Liquidity Facility Wells Fargo & Co.) (a)(e)(f) | 1,295,000 | | 1,295,000 |

Mesa Gen. Oblig. Bonds Series 2002, 5.375% 7/1/14 | 1,090,000 | | 1,136,334 |

Phoenix Civic Impt. Corp. Series 2009, 0.13% 9/3/13, LOC Bank of America NA, CP | 1,610,000 | | 1,610,000 |

Series 2011 B1: | | | |

0.15% 9/16/13, LOC Barclays Bank PLC, CP | 13,000,000 | | 13,000,000 |

0.15% 9/16/13, LOC Barclays Bank PLC, CP | 4,000,000 | | 4,000,000 |

Phoenix Civic Impt. Corp. Transit Excise Tax Rev. Bonds (Lt. Rail Proj.) Series 2013, 2% 7/1/14 | 3,900,000 | | 3,957,802 |

Phoenix Civic Impt. Corp. Wastewtr. Sys. Rev.: | | | |

Series 2012 A, 0.15% 10/3/13, LOC Royal Bank of Canada, CP | 5,800,000 | | 5,800,000 |

Other Municipal Debt - continued |

| Principal Amount | | Value |

Arizona - continued |

Phoenix Civic Impt. Corp. Wastewtr. Sys. Rev.: - continued | | | |

Series 2012 B, 0.17% 12/3/13, LOC Wells Fargo Bank NA, CP | $ 3,800,000 | | $ 3,800,000 |

Phoenix Civic Impt. Corp. Wtr. Sys. Rev. Bonds Series 2005, 5% 7/1/14 | 1,990,000 | | 2,067,305 |

Phoenix Gen. Oblig. Bonds Series 2004, 4.5% 7/1/14 (Pre-Refunded to 7/1/14 @ 100) | 2,470,000 | | 2,558,298 |

Pima County Ctfs. of Prtn. Bonds Series 2013 B, 1.5% 12/1/13 | 2,330,000 | | 2,337,196 |

Pima County Reg'l. Trans. Auth. Excise Tax Rev. Bonds Series 2011, 4% 6/1/14 | 4,015,000 | | 4,127,402 |

Salt River Proj. Agricultural Impt. & Pwr. District Elec. Sys. Rev.: | | | |

Bonds: | | | |

Series 2009 A, 3% 1/1/14 | 1,070,000 | | 1,079,851 |

Series 2009 B, 3% 1/1/14 | 5,000,000 | | 5,046,027 |

Series 2011 A, 3% 12/1/13 | 1,105,000 | | 1,112,603 |

Series 2013 C, 0.09% 9/10/13, CP | 15,400,000 | | 15,400,000 |

Scottsdale Gen. Oblig. Bonds Series 2011, 3% 7/1/14 | 2,000,000 | | 2,045,917 |

Scottsdale Muni. Property Corp. Excise Tax Rev. Bonds Series 2005 D, 5% 7/1/14 | 2,500,000 | | 2,598,295 |

Tempe Gen. Oblig. Bonds Series 2013 B, 1% 7/1/14 | 2,285,000 | | 2,299,765 |

Tucson Street & Hwy. User Rev. Bonds Series 2013 A, 2% 7/1/14 | 4,525,000 | | 4,589,481 |

| | 99,775,126 |

Kentucky - 0.3% |

Jefferson County Poll. Cont. Rev. Bonds (Louisville Gas & Elec. Co. Proj.) Series 1993 A, 0.22% tender 9/17/13, CP mode | 700,000 | | 700,000 |

Trimble County Poll. Cont. Rev. Bonds (Louisville Gas & Elec. Co. Proj.) Series 1992 A, 0.32% tender 9/25/13, CP mode (d) | 600,000 | | 600,000 |

| | 1,300,000 |

Massachusetts - 0.3% |

Massachusetts Indl. Fin. Agcy. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.) Series 1992, 0.3% tender 9/9/13, CP mode | 1,300,000 | | 1,300,000 |

New Hampshire - 0.1% |

New Hampshire Bus. Fin. Auth. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.) Series 1990 A2: | | | |

0.32% tender 9/25/13, CP mode (d) | 300,000 | | 300,000 |

0.35% tender 9/9/13, CP mode (d) | 300,000 | | 300,000 |

| | 600,000 |

Other Municipal Debt - continued |

| Principal Amount | | Value |

Puerto Rico - 0.2% |

JPMorgan Chase Letter of Cr. Enhanced Tender Option Bonds Series Putters 4362, 0.21%, tender 11/15/13 (Liquidity Facility JPMorgan Chase Bank) (a)(d)(e)(f) | $ 800,000 | | $ 800,000 |

TOTAL OTHER MUNICIPAL DEBT (Cost $103,775,126) |

103,775,126

|

Investment Company - 10.5% |

| Shares | | |

Fidelity Municipal Cash Central Fund, 0.07% (b)(c) (Cost $42,963,000) | 42,963,000 | |

42,963,000

|

TOTAL INVESTMENT PORTFOLIO - 102.0% (Cost $416,292,801) | 416,292,801 |

NET OTHER ASSETS (LIABILITIES) - (2.0)% | (8,264,744) |

NET ASSETS - 100% | $ 408,028,057 |

Security Type Abbreviations |

CP | - | COMMERCIAL PAPER |

VRDN | - | VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly) |

Legend |

(a) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

(b) Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund. |

(c) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(d) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

(e) Provides evidence of ownership in one or more underlying municipal bonds. |

(f) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $2,095,000 or 0.5% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition Date | Cost |

Chandler Gen. Oblig. Bonds Series GS 07 49TP, 0.19%, tender 12/12/13 (Liquidity Facility Wells Fargo & Co.) | 12/6/12 - 7/22/13 | $ 1,295,000 |

JPMorgan Chase Letter of Cr. Enhanced Tender Option Bonds Series Putters 4362, 0.21%, tender 11/15/13(Liquidity Facility JPMorgan Chase Bank) | 7/18/13 | $ 800,000 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Municipal Cash Central Fund | $ 41,108 |

Other Information |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Arizona Municipal Money Market Fund

Statement of Assets and Liabilities

| August 31, 2013 |

| | |

Assets | | |

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $373,329,801) | $ 373,329,801 | |

Fidelity Central Funds (cost $42,963,000) | 42,963,000 | |

Total Investments (cost $416,292,801) | | $ 416,292,801 |

Cash | | 156,744 |

Receivable for fund shares sold | | 7,798,348 |

Interest receivable | | 493,184 |

Distributions receivable from Fidelity Central Funds | | 2,317 |

Other receivables | | 1,298 |

Total assets | | 424,744,692 |

| | |

Liabilities | | |

Payable for fund shares redeemed | $ 16,682,777 | |

Distributions payable | 182 | |

Accrued management fee | 33,668 | |

Other affiliated payables | 8 | |

Total liabilities | | 16,716,635 |

| | |

Net Assets | | $ 408,028,057 |

Net Assets consist of: | | |

Paid in capital | | $ 408,018,442 |

Accumulated undistributed net realized gain (loss) on investments | | 9,615 |

Net Assets, for 407,805,551 shares outstanding | | $ 408,028,057 |

Net Asset Value, offering price and redemption price per share ($408,028,057 ÷ 407,805,551 shares) | | $ 1.00 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended August 31, 2013 |

| | |

Investment Income | | |

Interest | | $ 620,537 |

Income from Fidelity Central Funds | | 41,108 |

Total income | | 661,645 |

| | |

Expenses | | |

Management fee | $ 1,987,125 | |

Independent trustees' compensation | 1,501 | |

Total expenses before reductions | 1,988,626 | |

Expense reductions | (1,366,747) | 621,879 |

Net investment income (loss) | | 39,766 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 34,577 |

Net increase in net assets resulting from operations | | $ 74,343 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Arizona Municipal Money Market Fund

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

August 31,

2013 | Year ended

August 31,

2012 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 39,766 | $ 37,553 |

Net realized gain (loss) | 34,577 | 15,267 |

Net increase in net assets resulting from operations | 74,343 | 52,820 |

Distributions to shareholders from net investment income | (39,744) | (37,465) |

Distributions to shareholders from net realized gain | (19,435) | - |

Total distributions | (59,179) | (37,465) |

Share transactions at net asset value of $1.00 per share

Proceeds from sales of shares | 1,139,250,963 | 1,036,385,786 |

Reinvestment of distributions | 56,967 | 36,751 |

Cost of shares redeemed | (1,120,287,777) | (1,030,133,140) |

Net increase (decrease) in net assets and shares resulting from share transactions | 19,020,153 | 6,289,397 |

Total increase (decrease) in net assets | 19,035,317 | 6,304,752 |

| | |

Net Assets | | |

Beginning of period | 388,992,740 | 382,687,988 |

End of period | $ 408,028,057 | $ 388,992,740 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

Years ended August 31, | 2013 | 2012 | 2011 | 2010 | 2009 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | |

Net investment income (loss) | - D | - D | - D | - D | .006 |

Net realized and unrealized gain (loss) D | - | - | - | - | - |

Total from investment operations | - D | - D | - D | - D | .006 |

Distributions from net investment income | - D | - D | - D | - D | (.006) |

Distributions from net realized gain | - D | - | - | - | - |

Total distributions | - D | - D | - D | - D | (.006) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return A | .02% | .01% | .01% | .01% | .64% |

Ratios to Average Net Assets B,C | | | | | |

Expenses before reductions | .50% | .50% | .50% | .50% | .54% |

Expenses net of fee waivers, if any | .16% | .19% | .26% | .33% | .53% |

Expenses net of all reductions | .16% | .19% | .26% | .33% | .52% |

Net investment income (loss) | .01% | .01% | .01% | .01% | .64% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 408,028 | $ 388,993 | $ 382,688 | $ 345,362 | $ 373,206 |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

C Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

D Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended August 31, 2013

1. Organization.

Fidelity Arizona Municipal Income Fund (the Income Fund) is a fund of Fidelity Union Street Trust. Fidelity Arizona Municipal Money Market Fund (the Money Market Fund) is a fund of Fidelity Union Street Trust II. Each Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. Fidelity Union Street Trust and Fidelity Union Street Trust II (the Trusts) are organized as a Massachusetts business trust and a Delaware statutory trust, respectively. The Income Fund is a non-diversified fund. Each Fund is authorized to issue an unlimited number of shares. Each Fund may be affected by economic and political developments in the state of Arizona.

2. Investments in Fidelity Central Funds.

The Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Funds' Schedules of Investments list each of the Fidelity Central Funds held as of period end, if any, as an investment of each Fund, but do not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, each Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Funds' Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Funds:

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. In accordance with valuation policies and procedures approved by the Board of Trustees (the Board), the Income Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the FMR Fair Value Committee (the Committee), in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Income Fund's valuation policies and procedures and is responsible for approving and reporting to the Board all fair value determinations.

Each Fund categorizes the inputs to valuation techniques used to value their investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value each Fund's investments by major category are as follows:

For the Income Fund, debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. For municipal securities, pricing vendors utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type as well as broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

For the Money Market Fund, as permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity. Securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

Annual Report

3. Significant Accounting Policies - continued

Investment Valuation - continued

For the Income Fund, changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy.

Investment Transactions and Income. For financial reporting purposes, the Funds' investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day for the Income Fund and trades executed through the end of the current business day for the Money Market Fund. Gains and losses on securities sold are determined on the basis of identified cost. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, each Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of August 31, 2013, each Fund did not have any unrecognized tax benefits in the financial statements; nor is each Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Each Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Funds claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to market discount and deferred trustees compensation.

The Funds purchase municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that the IRS will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows for each Fund:

| Tax cost | Gross unrealized appreciation | Gross unrealized depreciation | Net unrealized appreciation

(depreciation) on securities and other investments |

Fidelity Arizona Municipal Income Fund | $ 154,786,993 | $ 3,202,468 | $ (4,512,111) | $ (1,309,643) |

Fidelity Arizona Municipal Money Market Fund | 416,292,801 | - | - | - |

The tax-based components of distributable earnings as of period end were as follows for each Fund:

| Undistributed tax-exempt

income | Undistributed

ordinary

income | Undistributed long-term

capital gain | Net unrealized appreciation

(depreciation) |

Fidelity Arizona Municipal Income Fund | $ 21,276 | $ - | $ 3,197 | $ (1,309,643) |

Fidelity Arizona Municipal Money Market Fund | 204 | 6,849 | 2,565 | - |

Annual Report

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax character of distributions paid was as follows:

August 31, 2013 | | | | |

| Tax-Exempt

Income | Ordinary

Income | Long-term

Capital Gains | Total |

Fidelity Arizona Municipal Income Fund | $ 5,864,083 | $ - | $ 382,125 | $ 6,246,208 |

Fidelity Arizona Municipal Money Market Fund | 39,744 | 3,887 | 15,548 | 59,179 |

August 31, 2012 | | | | |

| Tax-Exempt

Income | Ordinary

Income | Long-term

Capital Gains | Total |

Fidelity Arizona Municipal Income Fund | $ 5,887,837 | $ 27,968 | $ - | $ 5,915,805 |

Fidelity Arizona Municipal Money Market Fund | 37,465 | - | - | 37,465 |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Income Fund less than 30 days may be subject to a redemption fee equal to .50% of the net asset value of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

Delayed Delivery Transactions and When-Issued Securities. During the period, the Funds transacted in securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The securities purchased on a delayed delivery or when-issued basis are identified as such in each applicable Fund's Schedule of Investments. The Funds may receive compensation for interest forgone in the purchase of a delayed delivery or when-issued security. With respect to purchase commitments, each applicable Fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract's terms, or if the issuer does not issue the securities due to political, economic, or other factors.

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Restricted Securities. The Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of each applicable Fund's Schedule of Investments.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, for the Income Fund aggregated $35,385,411 and $49,706,363, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provides the Funds with investment management related services for which the Funds pay a monthly management fee. FMR pays all other expenses, except the compensation of the independent Trustees and certain exceptions such as interest expense, including commitment fees. The management fee paid to FMR by the Funds is reduced by an amount equal to the fees and expenses paid by the Fund to the independent Trustees. Each Fund's management fee is equal to the following annual rate of average net assets:

Fidelity Arizona Municipal Income Fund | .55% |

Fidelity Arizona Municipal Money Market Fund | .50% |

6. Committed Line of Credit.

The Income Fund participates with other funds managed by FMR or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro-rata portion of the line of credit, which are reflected in Miscellaneous expenses on the Statement of Operations, and are as follows:

Fidelity Arizona Municipal Income Fund | $ 447 |

During the period, there were no borrowings on this line of credit.

Annual Report

7. Expense Reductions.

FMR or its affiliates voluntarily agreed to waive certain fees for the Money Market Fund in order to maintain a minimum annualized yield of .01%. Such arrangements may be discontinued by FMR at any time. For the period, the amount of the waiver was $1,362,525.

In addition, through arrangements with each applicable Fund's custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce each applicable Fund's expenses. All of the applicable expense reductions are noted in the table below:

| Custody

expense

reduction | Transfer Agent

expense

reduction |

Fidelity Arizona Municipal Income Fund | $ 1,785 | $ 824 |

Fidelity Arizona Municipal Money Market Fund | 2,084 | 2,138 |

8. Other.