UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3221

Fidelity Charles Street Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | September 30 |

| |

Date of reporting period: | September 30, 2007 |

Item 1. Reports to Stockholders

Fidelity Asset Manager® 20%

Annual Report

September 30, 2007

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | <Click Here> | Ned Johnson's message to shareholders. |

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion | <Click Here> | The manager's review of fund performance, strategy and outlook |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of the fund's investments. |

Investment Summary | <Click Here> | A summary of the fund's holdings. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

Proxy Voting Results | <Click Here> | |

Board Approval of Investment Advisory Contracts and Management Fees | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com (search for "proxy voting guidelines") or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Many stock and bond markets around the world have been unsettled of late; however, volatility can often lead to opportunity for patient investors. Financial markets are always unpredictable, but there are a number of time-tested principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third investment principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces unconstructive "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended September 30, 2007 | Past 1

year | Past 5

years | Past 10

years |

Asset Manager 20% | 7.26% | 8.55% | 6.15% |

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Asset Manager 20%, a class of the fund, on September 30, 1997. The chart shows how the value of your investment would have changed, and also shows how the Lehman Brothers® U.S. Aggregate Index performed over the same period.

Annual Report

Management's Discussion of Fund Performance

Comments from Richard Habermann, Portfolio Manager of Fidelity Asset Manager® 20% during the period covered by this report

The U.S. stock, investment-grade and high-yield bond markets were volatile during the year ending September 30, 2007, but each finished with positive returns. Stocks began the period with a four-month winning streak amid an environment of falling energy prices, upbeat economic data and solid corporate earnings. They tumbled in February, however, stung by the slowing housing market, a looming subprime mortgage loan crisis and a short-lived freefall in the Asian markets. Stocks rallied strongly from March through May, but see-sawed in the final four months of the period as crude oil prices spiked, the housing slump grew more pronounced and subprime mortgage prices fell sharply. The Federal Reserve Board sparked a late-period rally by implementing cuts to key lending rates. For the year overall, the Standard & Poor's 500SM Index advanced 16.44%, the Lehman Brothers® U.S. Aggregate Index returned 5.14% and the Merrill Lynch® U.S. High Yield Master II Constrained Index was up 7.79%.

Asset Manager 20% was up 7.26% during the year, versus 7.53% for the Fidelity Asset Manager 20% Composite Index. The fund lagged the index despite favorable asset allocation and a strong showing from our equities, as disappointing results from our investment-grade bond holdings were simply too much to overcome. Regarding asset allocation, we got a meaningful boost from favoring high-yield securities relative to investment-grade debt. Excellent security selection propelled nine out of the 10 underlying equity sector central funds past their respective components of the Dow Jones Wilshire 5000 Composite IndexSM, with consumer staples, telecom services and information technology leading the way. Consumer discretionary was the lone detractor, lagging that sector of the index due to suboptimal industry positioning. Having some exposure to foreign stocks in the central funds proved fruitful, as overseas markets soundly beat their U.S. counterparts, supported by currency fluctuations. The fund's collective bond holdings trailed the Lehman Brothers index due to weak results from the investment-grade central fund, which had exposure to the sell-off in subprime mortgage securities. A high single-digit return from the high-income central fund helped offset some of the drag from investment grade, while the strategic cash portion of the fund - including the money market central fund - topped its benchmark.

Note to shareholders: Derek Young will become Co-Manager of the fund on October 1, 2007.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

The Fund invests in Fidelity Central Funds, which are open-end investment companies with similar investment objectives to those of the Fund, available only to other mutual funds and accounts managed by Fidelity Management & Research Company, (FMR) and its affiliates. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying Fidelity Central Funds, the Fund also indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds. These expenses are not included in the Fund's annualized expense ratio used to calculate either the actual or hypothetical expense estimates presented in the table but are summarized in a footnote to the table.

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2007 to September 30, 2007).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Annual Report

Investments - continued

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

Account Value

April 1, 2007 | Ending

Account Value

September 30, 2007 | Expenses Paid

During Period*

April 1, 2007 to

September 30, 2007 |

Class A | | | |

Actual | $ 1,000.00 | $ 1,029.50 | $ 4.48 |

HypotheticalA | $ 1,000.00 | $ 1,020.66 | $ 4.46 |

Class T | | | |

Actual | $ 1,000.00 | $ 1,027.90 | $ 5.69 |

Hypothetical A | $ 1,000.00 | $ 1,019.45 | $ 5.67 |

Class B | | | |

Actual | $ 1,000.00 | $ 1,025.00 | $ 8.48 |

Hypothetical A | $ 1,000.00 | $ 1,016.70 | $ 8.44 |

Class C | | | |

Actual | $ 1,000.00 | $ 1,024.70 | $ 8.37 |

Hypothetical A | $ 1,000.00 | $ 1,016.80 | $ 8.34 |

Asset Manager 20% | | | |

Actual | $ 1,000.00 | $ 1,030.70 | $ 2.90 |

Hypothetical A | $ 1,000.00 | $ 1,022.21 | $ 2.89 |

Institutional Class | | | |

Actual | $ 1,000.00 | $ 1,029.80 | $ 3.05 |

Hypothetical A | $ 1,000.00 | $ 1,022.06 | $ 3.04 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Central Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

| Annualized

Expense Ratio |

Class A | .88% |

Class T | 1.12% |

Class B | 1.67% |

Class C | 1.65% |

Asset Manager 20% | .57% |

Institutional Class | .60% |

In addition to the expenses noted above, the Fund also indirectly bears its proportionate shares of the expenses of the underlying Fidelity Central Funds. Annualized expenses of the underlying Fidelity Central Funds as of the most recent fiscal half-year ranged from less than .01% to .01%.

Annual Report

Investment Changes

The information in the following tables is based on the combined investments of the fund and its pro-rata share of the investments of Fidelity's Equity and Fixed-Income Central Funds.

Top Five Bond Issuers as of September 30, 2007 |

(with maturities greater than one year) | % of fund's

net assets | % of fund's net assets

6 months ago |

Fannie Mae | 13.5 | 11.7 |

U.S. Treasury Obligations | 6.2 | 6.6 |

Freddie Mac | 5.0 | 3.6 |

Credit Suisse First Boston Mortgage Securities Corp. | 0.9 | 0.9 |

Ginnie Mae | 0.8 | 1.0 |

| 26.4 | |

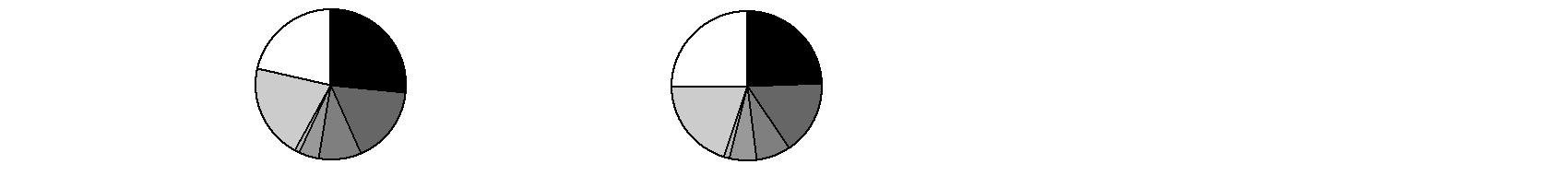

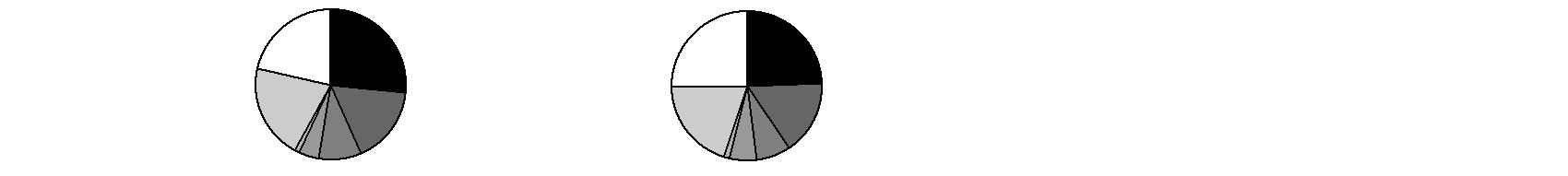

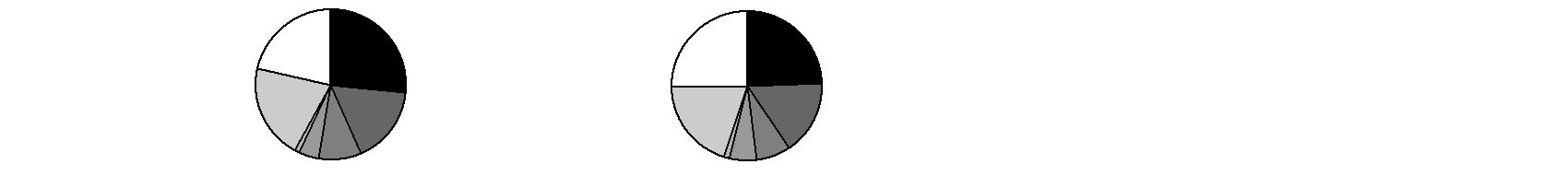

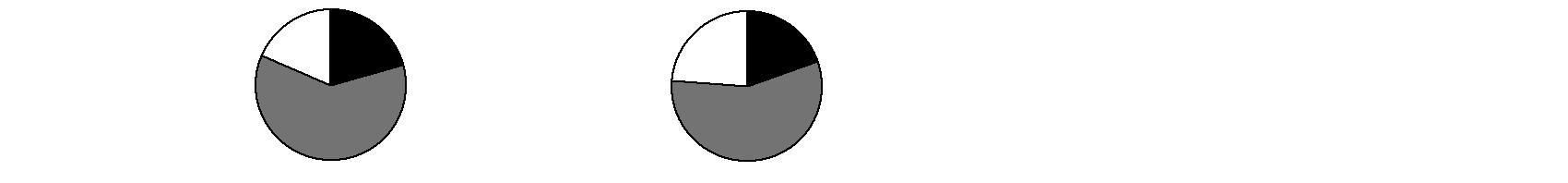

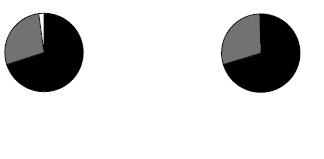

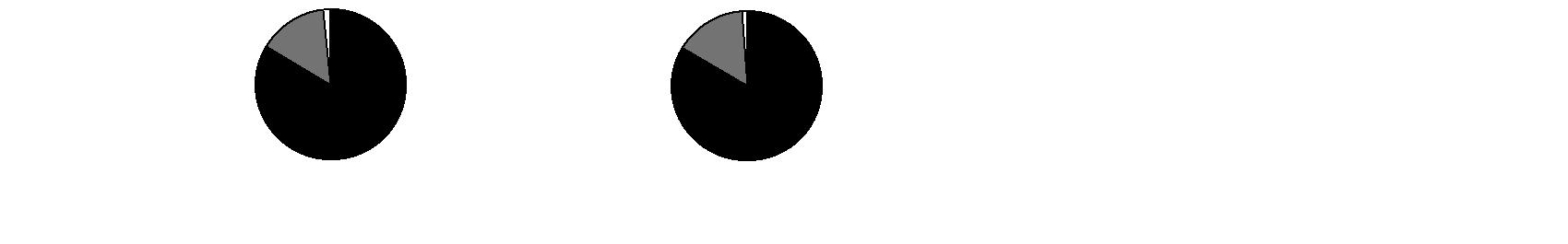

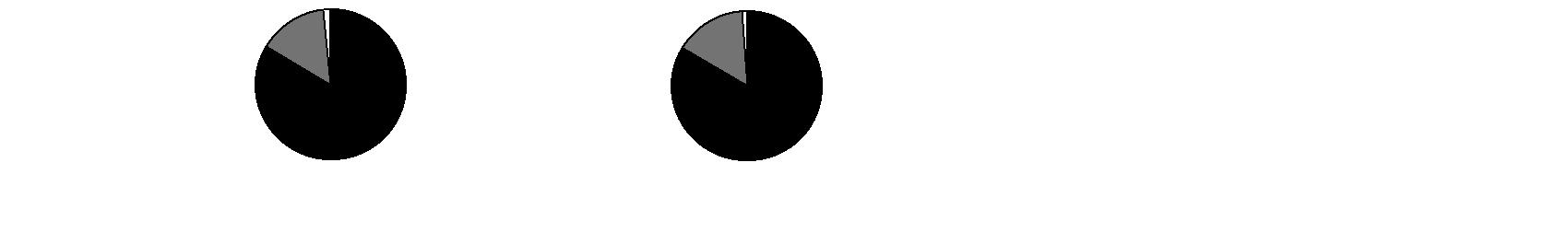

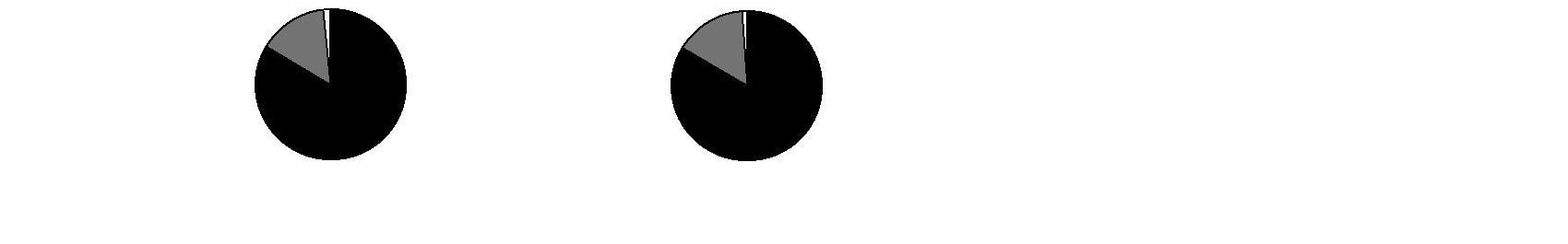

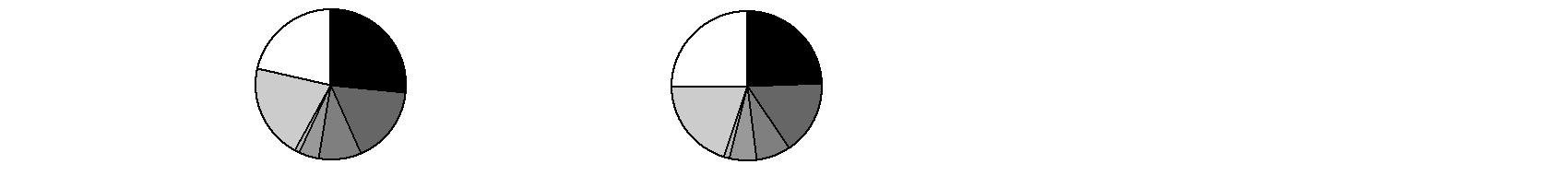

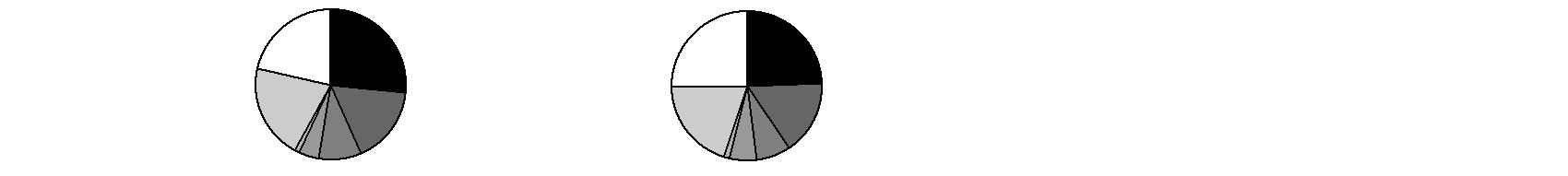

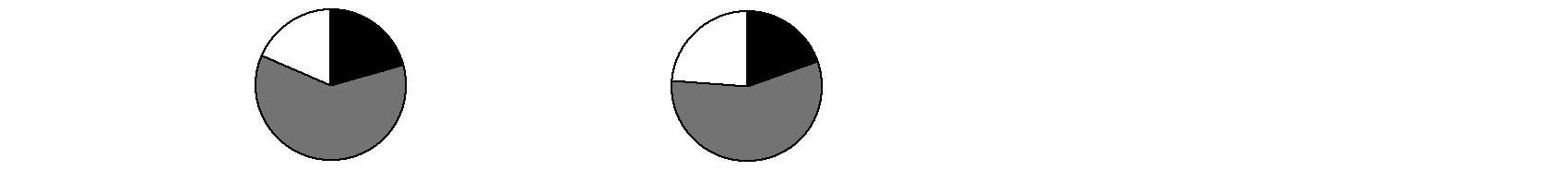

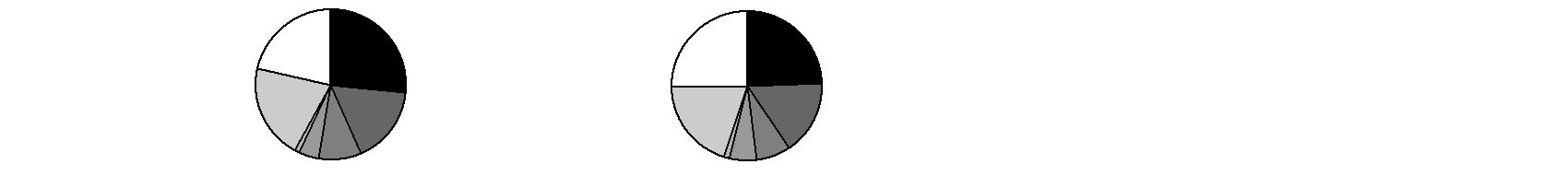

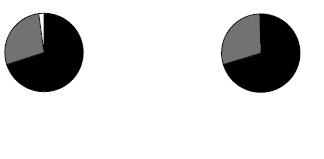

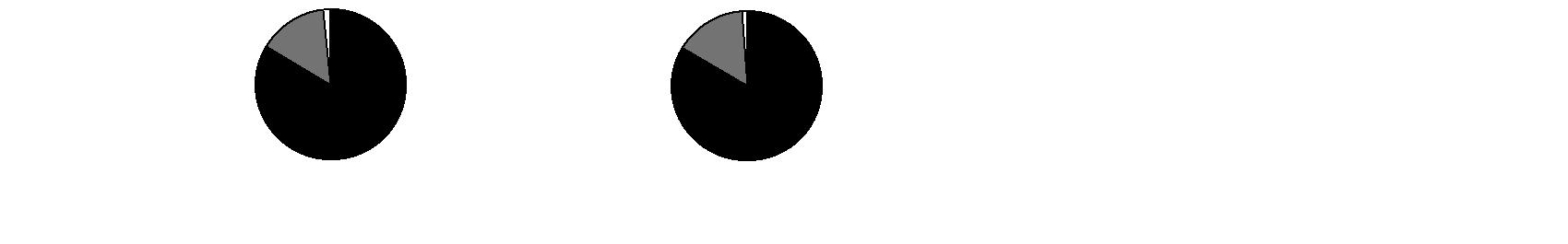

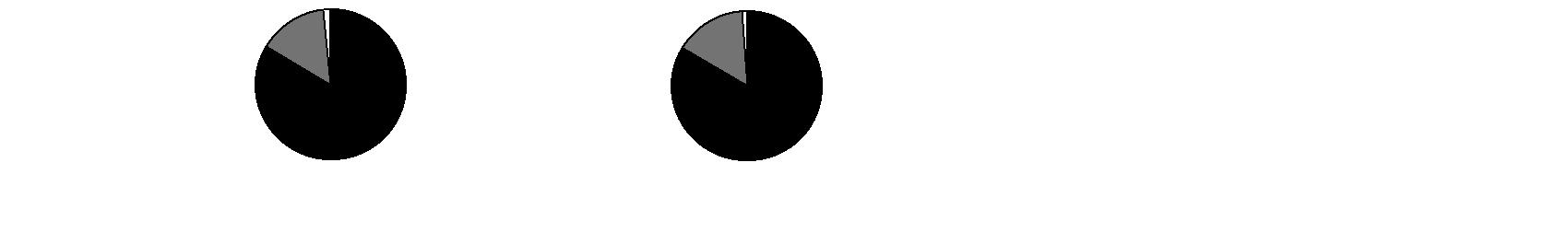

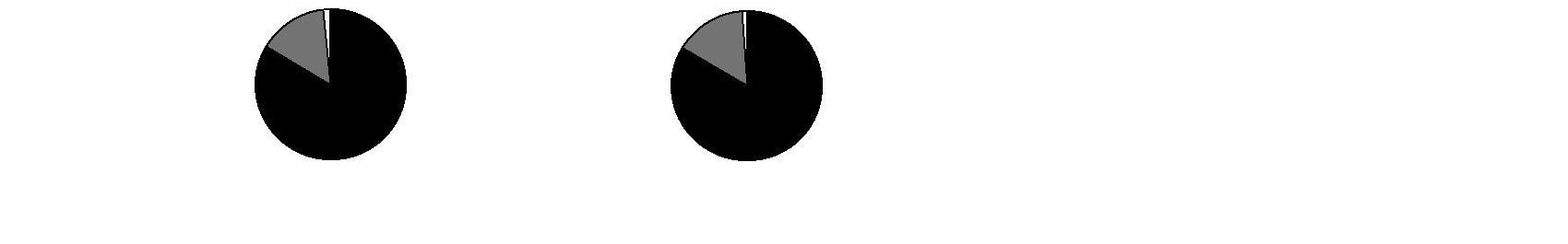

Quality Diversification (% of fund's net assets) |

As of September 30, 2007 | As of March 31, 2007 |

| U.S.Government and U.S.Government

Agency Obligations 26.8% | |  | U.S.Government and U.S.Government

Agency Obligations 24.5% | |

| AAA,AA,A 16.7% | |  | AAA,AA,A 16.1% | |

| BBB 9.3% | |  | BBB 7.4% | |

| BB and Below 4.4% | |  | BB and Below 6.0% | |

| Not Rated 0.8% | |  | Not Rated 1.1% | |

| Equities 20.5% | |  | Equities 19.6% | |

| Short-Term

Investments and

Net Other Assets 21.5% | |  | Short-Term

Investments and

Net Other Assets 25.3% | |

We have used ratings from Moody's® Investors Services, Inc. Where Moody's ratings are not available, we have used S&P® ratings. All ratings are as of the report date an do not reflect subsequent downgrades. Percentages are adjusted for the effect of futures contracts, if applicable. |

Top Five Stocks as of September 30, 2007 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Exxon Mobil Corp. | 0.3 | 0.2 |

Procter & Gamble Co. | 0.3 | 0.3 |

Google, Inc. Class A (sub. vtg.) | 0.3 | 0.2 |

Cisco Systems, Inc. | 0.3 | 0.2 |

General Electric Co. | 0.3 | 0.4 |

| 1.5 | |

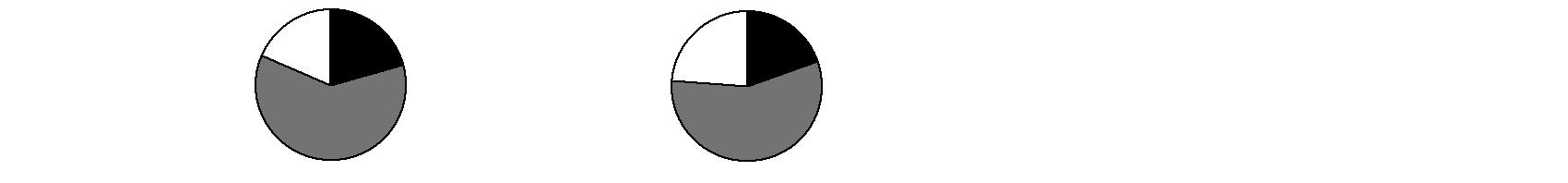

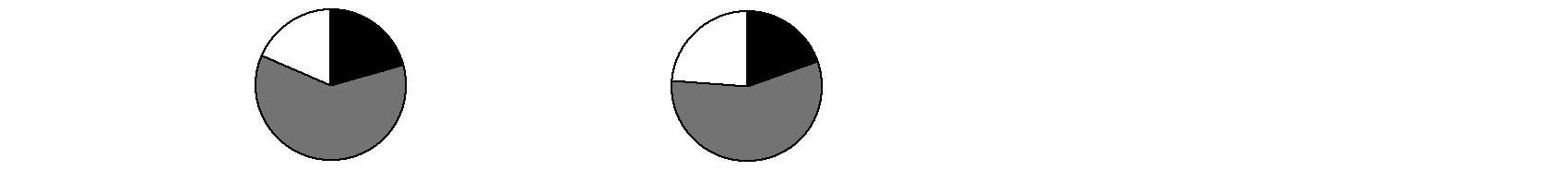

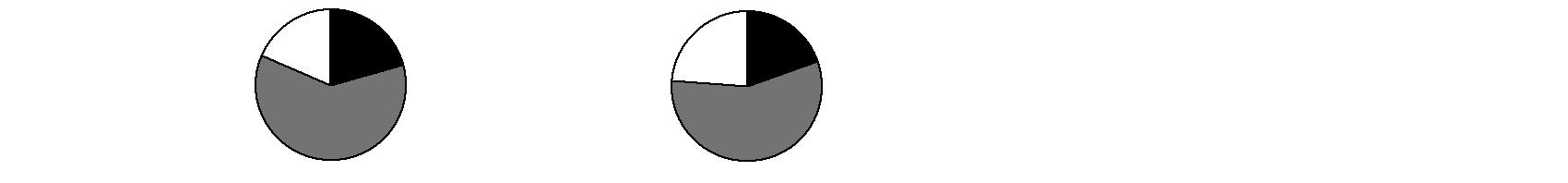

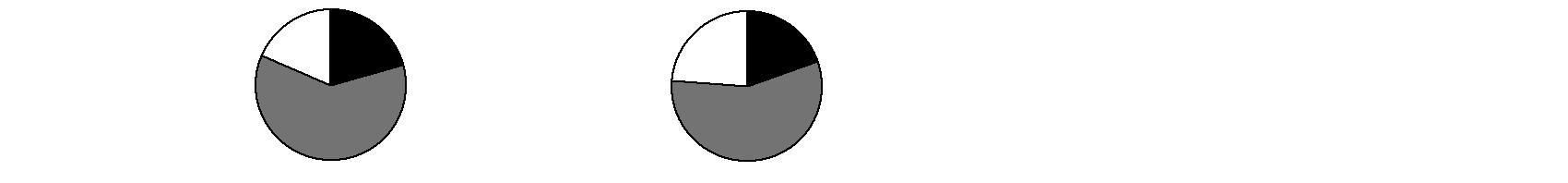

Asset Allocation (% of fund's net assets) |

As of September 30, 2007 | As of March 31, 2007 |

| Stock class and

Equity Futures 20.6% | |  | Stock class and

Equity Futures 19.5% | |

| Bond class 60.7% | |  | Bond class 56.6% | |

| Short-term class 18.7% | |  | Short-term class 23.9% | |

Asset allocations in the pie charts reflect the categorization of assets as defined in the fund's prospectus in effect as of the time periods indicated above. Percentages are adjusted for the effect of futures contracts and swap contracts, if applicable. |

Annual Report

Investment Summary

The information in the following table is based on the direct investments of the Fund.

Fund Holdings as of September 30, 2007 |

| % of fund's

net assets |

Equity Holdings | |

Equity Sector Central Funds | |

Fidelity Financials Central Fund | 3.6 |

Fidelity Information Technology Central Fund | 3.1 |

Fidelity Health Care Central Fund | 2.2 |

Fidelity Industrials Central Fund | 2.2 |

Fidelity Energy Central Fund | 2.0 |

Fidelity Consumer Discretionary Central Fund | 1.9 |

Fidelity Consumer Staples Central Fund | 1.6 |

Fidelity Materials Central Fund | 0.7 |

Fidelity Telecom Services Central Fund | 0.7 |

Fidelity Utilities Central Fund | 0.7 |

Total Equity Sector Central Funds | 18.7 |

Fixed-Income Central Funds | |

Investment Grade Fixed-Income Funds | 47.1 |

High Yield Fixed-Income Funds | 4.0 |

Total Fixed-Income Central Funds | 51.1 |

Money Market Central Funds | 25.4 |

Other Short-Term Investments and Net Other Assets | 4.8 |

Total | 100.0 |

At period end, foreign investments including the Fund's pro-rata share of the underlying Central Funds was 7.7% of net assets.

A holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable.

Annual Report

Investments September 30, 2007

Showing Percentage of Net Assets

Equity Sector Central Funds - 18.7% |

| Shares | | Value (000s) |

Fidelity Consumer Discretionary Central Fund (c) | 400,444 | | $ 48,742 |

Fidelity Consumer Staples Central Fund (c) | 316,343 | | 39,907 |

Fidelity Energy Central Fund (c) | 359,823 | | 50,544 |

Fidelity Financials Central Fund (c) | 817,890 | | 90,663 |

Fidelity Health Care Central Fund (c) | 456,942 | | 54,673 |

Fidelity Industrials Central Fund (c) | 413,880 | | 55,944 |

Fidelity Information Technology Central Fund (c) | 522,529 | | 78,426 |

Fidelity Materials Central Fund (c) | 119,420 | | 17,546 |

Fidelity Telecom Services Central Fund (c) | 111,124 | | 16,929 |

Fidelity Utilities Central Fund (c) | 138,056 | | 17,006 |

TOTAL EQUITY SECTOR CENTRAL FUNDS (Cost $370,268) | 470,380 |

Fixed-Income Central Funds - 51.1% |

| | | |

Investment Grade Fixed-Income Funds - 47.1% | | | |

Fidelity Tactical Income Central Fund (c) | 12,262,861 | | 1,187,781 |

High Yield Fixed-Income Funds - 4.0% | | | |

Fidelity Floating Rate Central Fund (c) | 628,271 | | 61,332 |

Fidelity High Income Central Fund 1 (c) | 402,214 | | 39,618 |

TOTAL HIGH YIELD FIXED-INCOME FUNDS | | 100,950 |

TOTAL FIXED-INCOME CENTRAL FUNDS (Cost $1,300,045) | 1,288,731 |

Money Market Central Funds - 25.4% |

| | | |

Fidelity Cash Central Fund, 5.12% (a) | 504,173,587 | | 504,174 |

Fidelity Money Market Central Fund, 5.54% (a) | 135,550,134 | | 135,550 |

TOTAL MONEY MARKET CENTRAL FUNDS (Cost $639,724) | 639,724 |

U.S. Treasury Obligations - 0.1% |

| Principal Amount (000s) | | |

U.S. Treasury Bills, yield at date of purchase 3.95% to 4.17% 12/6/07 (b)

(Cost $2,283) | | $ 2,300 | | 2,284 |

Cash Equivalents - 4.6% |

| Maturity Amount (000s) | | Value (000s) |

Investments in repurchase agreements in a joint trading account at 3.95%, dated 9/28/07 due 10/1/07 (Collateralized by U.S. Government Obligations) #

(Cost $116,536) | $ 116,574 | | $ 116,536 |

TOTAL INVESTMENT PORTFOLIO - 99.9% (Cost $2,428,856) | | 2,517,655 |

NET OTHER ASSETS - 0.1% | | 2,137 |

NET ASSETS - 100% | $ 2,519,792 |

Futures Contracts |

| Expiration Date | | Underlying Face Amount at Value (000s) | | Unrealized Appreciation/

(Depreciation) (000s) |

Purchased |

Equity Index Contracts |

137 S&P 500 Index Contracts | Dec. 2007 | | $ 52,680 | | $ 1,374 |

The face value of futures purchased as a percentage of net assets - 2.1% |

Legend |

(a) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. |

(b) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At the period end, the value of securities pledged amounted to $2,284,000. |

(c) Affiliated fund that is available only to investment companies and accounts managed by Fidelity Investments. A complete schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-Q and is available upon request or at the SEC's web site at www.sec.gov. A holdings listing for the Fund, which presents direct holdings as well as the pro rata share of securities and other investments held indirectly through its investment in underlying non-money market fidelity Central Funds, is available at Fidelity.com and/or advisor.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements, which are not covered by the fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's web site or upon request. |

# Additional Information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value (Amounts in thousands) |

$116,536,000 due 10/01/07 at 3.95% |

ABN AMRO Bank N.V., New York Branch | $ 33,960 |

Banc of America Securities LLC | 33,960 |

Barclays Capital, Inc. | 24,111 |

Deutsche Bank Securities, Inc. | 19,357 |

Morgan Stanley & Co., Inc. | 292 |

UBS Securities LLC | 4,856 |

| $ 116,536 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Cash Central Fund | $ 24,806 |

Fidelity Consumer Discretionary Central Fund | 729 |

Fidelity Consumer Staples Central Fund | 784 |

Fidelity Energy Central Fund | 456 |

Fidelity Financials Central Fund | 2,103 |

Fidelity Floating Rate Central Fund | 4,778 |

Fidelity Health Care Central Fund | 679 |

Fidelity High Income Central Fund 1 | 5,771 |

Fidelity Industrials Central Fund | 758 |

Fidelity Information Technology Central Fund | 234 |

Fidelity Materials Central Fund | 305 |

Fidelity Money Market Central Fund | 7,332 |

Fidelity Tactical Income Central Fund | 55,083 |

Fidelity Telecom Services Central Fund | 318 |

Fidelity Utilities Central Fund | 424 |

Total | $ 104,560 |

Affiliated Central Funds - continued |

Additional information regarding the Fund's fiscal year to date purchases and sales, including the ownership percentage, of the non Money Market Central Funds is as follows: |

Fund

(Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Value,

end of

period | % ownership, end of

period |

Fidelity Consumer Discretionary Central Fund | $ 47,952 | $ - | $ 2,332 | $ 48,742 | 6.8% |

Fidelity Consumer Staples Central Fund | 34,712 | 157 | 1,879 | 39,907 | 6.8% |

Fidelity Energy Central Fund | 37,554 | - | 3,203 | 50,544 | 6.8% |

Fidelity Financials Central Fund | 93,331 | - | 5,423 | 90,663 | 6.8% |

Fidelity Floating Rate Central Fund | 63,028 | - | - | 61,332 | 2.6% |

Fidelity Health Care Central Fund | 52,438 | - | 4,142 | 54,673 | 6.8% |

Fidelity High Income Central Fund 1 | 104,532 | - | 66,971 | 39,618 | 13.3% |

Fidelity Industrials Central Fund | 45,811 | 305 | 2,096 | 55,944 | 6.8% |

Fidelity Information Technology Central Fund | 64,215 | 856 | 4,590 | 78,426 | 6.8% |

Fidelity Materials Central Fund | 12,878 | 45 | 597 | 17,546 | 6.8% |

Fidelity Tactical Income Central Fund | 944,066 | 261,028 | - | 1,187,781 | 21.6% |

Fidelity Telecom Services Central Fund | 13,285 | 358 | 915 | 16,929 | 6.8% |

Fidelity Utilities Central Fund | 15,266 | - | 1,348 | 17,006 | 6.8% |

Total | $ 1,529,068 | $ 262,749 | $ 93,496 | $ 1,759,111 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | September 30, 2007 |

Assets | | |

Investment in securities, at value (including repurchase agreements of $116,536) - See accompanying schedule: Unaffiliated issuers (cost $118,819) | $ 118,820 | |

Fidelity Central Funds (cost $2,310,037) | 2,398,835 | |

Total Investments (cost $2,428,856) | | $ 2,517,655 |

Receivable for fund shares sold | | 3,150 |

Distributions receivable from Fidelity Central Funds | | 8,907 |

Prepaid expenses | | 2 |

Other receivables | | 2 |

Total assets | | 2,529,716 |

| | |

Liabilities | | |

Payable for investments purchased | $ 5,489 | |

Payable for fund shares redeemed | 2,947 | |

Accrued management fee | 865 | |

Distribution fees payable | 4 | |

Payable for daily variation on futures contracts | 223 | |

Other affiliated payables | 283 | |

Other payables and accrued expenses | 113 | |

Total liabilities | | 9,924 |

| | |

Net Assets | | $ 2,519,792 |

Net Assets consist of: | | |

Paid in capital | | $ 2,419,264 |

Undistributed net investment income | | 12,670 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (2,315) |

Net unrealized appreciation (depreciation) on investments | | 90,173 |

Net Assets | | $ 2,519,792 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Assets and Liabilities - continued

Amounts in thousands (except per-share amounts) | September 30, 2007 |

Calculation of Maximum Offering Price

Class A:

Net Asset Value and redemption price per share

($3,421.67 ÷ 265.348 shares) | | $ 12.90 |

| | |

Maximum offering price per share (100/94.25 of $12.90) | | $ 13.69 |

Class T:

Net Asset Value and redemption price per share ($3,953.77 ÷ 307.064 shares) | | $ 12.88 |

| | |

Maximum offering price per share (100/96.50 of $12.88) | | $ 13.35 |

Class B:

Net Asset Value and offering price per share

($991.14 ÷ 77.029 shares) A | | $ 12.87 |

| | |

Class C:

Net Asset Value and offering price per share

($1,696.77 ÷ 131.949 shares) A | | $ 12.86 |

| | |

Asset Manager 20%:

Net Asset Value, offering price and redemption price per share ($2,509,480.95 ÷ 194,428.507 shares) | | $ 12.91 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($247.91 ÷ 19.213 shares) | | $ 12.90 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

Amounts in thousands | Year ended September 30, 2007 |

Investment Income | | |

Interest | | $ 5,243 |

Income from Fidelity Central Funds | | 104,560 |

Total income | | 109,803 |

| | |

Expenses | | |

Management fee | $ 9,714 | |

Transfer agent fees | 2,507 | |

Distribution fees | 20 | |

Accounting fees and expenses | 752 | |

Independent trustees' compensation | 8 | |

Registration fees | 187 | |

Audit | 75 | |

Legal | 21 | |

Miscellaneous | 80 | |

Total expenses before reductions | 13,364 | |

Expense reductions | (177) | 13,187 |

Net investment income (loss) | | 96,616 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 553 | |

Fidelity Central Funds | 7,881 | |

Futures contracts | 1,544 | |

Total net realized gain (loss) | | 9,978 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 52,910 | |

Futures contracts | 1,185 | |

Total change in net unrealized appreciation (depreciation) | | 54,095 |

Net gain (loss) | | 64,073 |

Net increase (decrease) in net assets resulting from operations | | $ 160,689 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

Amounts in thousands | Year ended

September 30, 2007 | Year ended

September 30, 2006 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 96,616 | $ 69,932 |

Net realized gain (loss) | 9,978 | 103,946 |

Change in net unrealized appreciation (depreciation) | 54,095 | (47,468) |

Net increase (decrease) in net assets resulting

from operations | 160,689 | 126,410 |

Distributions to shareholders from net investment income | (97,255) | (64,555) |

Distributions to shareholders from net realized gain | (97,648) | (38,711) |

Total distributions | (194,903) | (103,266) |

Share transactions - net increase (decrease) | 423,256 | 383,568 |

Total increase (decrease) in net assets | 389,042 | 406,712 |

| | |

Net Assets | | |

Beginning of period | 2,130,750 | 1,724,038 |

End of period (including undistributed net investment income of $12,670 and $13,186, respectively) | $ 2,519,792 | $ 2,130,750 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class A

Year ended September 30, | 2007G |

Selected Per-Share Data | |

Net asset value, beginning of period | $ 13.13 |

Income from Investment Operations | |

Net investment income (loss)E | .48 |

Net realized and unrealized gain (loss) | .40 |

Total from investment operations | .88 |

Distributions from net investment income | (.52) |

Distributions from net realized gain | (.59) |

Total distributions | (1.11) |

Net asset value, end of period | $ 12.90 |

Total ReturnB,C,D | 7.03% |

Ratios to Average Net AssetsH | |

Expenses before reductions | .87%A |

Expenses net of fee waivers, if any | .87%A |

Expenses net of all reductions | .87%A |

Net investment income (loss) | 3.84%A |

Supplemental Data | |

Net assets, end of period (in millions) | $ 3 |

Portfolio turnover rateF | 6% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period October 2, 2006 (commencement of sale of shares) to September 30, 2007.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses ranged from less than .01% to .01%.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class T

Year ended September 30, | 2007G |

Selected Per-Share Data | |

Net asset value, beginning of period | $ 13.13 |

Income from Investment Operations | |

Net investment income (loss)E | .45 |

Net realized and unrealized gain (loss) | .40 |

Total from investment operations | .85 |

Distributions from net investment income | (.51) |

Distributions from net realized gain | (.59) |

Total distributions | (1.10) |

Net asset value, end of period | $ 12.88 |

Total Return B,C,D | 6.75% |

Ratios to Average Net Assets H | |

Expenses before reductions | 1.11%A |

Expenses net of fee waivers, if any | 1.11%A |

Expenses net of all reductions | 1.11%A |

Net investment income (loss) | 3.60%A |

Supplemental Data | |

Net assets, end of period (in millions) | $ 4 |

Portfolio turnover rateF | 6% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period October 2, 2006 (commencement of sale of shares) to September 30, 2007.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses ranged from less than .01% to .01%.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class B

Year ended September 30, | 2007G |

Selected Per-Share Data | |

Net asset value, beginning of period | $ 13.13 |

Income from Investment Operations | |

Net investment income (loss)E | .39 |

Net realized and unrealized gain (loss) | .38 |

Total from investment operations | .77 |

Distributions from net investment income | (.44) |

Distributions from net realized gain | (.59) |

Total distributions | (1.03) |

Net asset value, end of period | $ 12.87 |

Total ReturnB,C,D | 6.13% |

Ratios to Average Net AssetsH | |

Expenses before reductions | 1.65% A |

Expenses net of fee waivers, if any | 1.65% A |

Expenses net of all reductions | 1.65% A |

Net investment income (loss) | 3.06%A |

Supplemental Data | |

Net assets, end of period (in millions) | $ 1 |

Portfolio turnover rateF | 6% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period October 2, 2006 (commencement of sale of shares) to September 30, 2007.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses ranged from less than .01% to .01%.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class C

Year ended September 30, | 2007 G |

Selected Per-Share Data | |

Net asset value, beginning of period | $ 13.13 |

Income from Investment Operations | |

Net investment income (loss)E | .39 |

Net realized and unrealized gain (loss) | .38 |

Total from investment operations | .77 |

Distributions from net investment income | (.45) |

Distributions from net realized gain | (.59) |

Total distributions | (1.04) |

Net asset value, end of period | $ 12.86 |

Total ReturnB,C,D | 6.15% |

Ratios to Average Net AssetsH | |

Expenses before reductions | 1.64%A |

Expenses net of fee waivers, if any | 1.64%A |

Expenses net of all reductions | 1.64%A |

Net investment income (loss) | 3.07%A |

Supplemental Data | |

Net assets, end of period (in millions) | $ 2 |

Portfolio turnover rateF | 6% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period October 2, 2006 (commencement of sale of shares) to September 30, 2007.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses ranged from less than .01% to .01%.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Asset Manager 20%

Years ended September 30, | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 13.14 | $ 13.00 | $ 12.25 | $ 11.80 | $ 10.61 |

Income from Investment Operations | | | | | |

Net investment income (loss)B | .53 | .46 | .33 | .23 | .30 |

Net realized and unrealized gain (loss) | .38 | .39 | .74 | .45 | 1.19 |

Total from investment operations | .91 | .85 | 1.07 | .68 | 1.49 |

Distributions from net investment income | (.55) | (.43) | (.32) | (.23) | (.30) |

Distributions from net realized gain | (.59) | (.28) | - | - | - |

Total distributions | (1.14) | (.71) | (.32) | (.23) | (.30) |

Net asset value, end of period | $ 12.91 | $ 13.14 | $ 13.00 | $ 12.25 | $ 11.80 |

Total ReturnA | 7.26% | 6.77% | 8.85% | 5.80% | 14.26% |

Ratios to Average Net AssetsD | | | | | |

Expenses before reductions | .57% | .58% | .60% | .63% | .64% |

Expenses net of fee waivers, if any | .57% | .58% | .60% | .63% | .64% |

Expenses net of all reductions | .57% | .57% | .58% | .61% | .61% |

Net investment income (loss) | 4.15% | 3.58% | 2.64% | 1.86% | 2.69% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 2,509 | $ 2,131 | $ 1,724 | $ 1,395 | $ 971 |

Portfolio turnover rateC | 6% | 81%E | 81%E | 232% | 276% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Calculated based on average shares outstanding during the period.

C Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses ranged from less than .01% to .01%.

E Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Institutional Class

Year ended September 30, | 2007F |

Selected Per-Share Data | |

Net asset value, beginning of period | $ 13.13 |

Income from Investment Operations | |

Net investment income (loss)D | .53 |

Net realized and unrealized gain (loss) | .38 |

Total from investment operations | .91 |

Distributions from net investment income | (.55) |

Distributions from net realized gain | (.59) |

Total distributions | (1.14) |

Net asset value, end of period | $ 12.90 |

Total ReturnB,C | 7.24% |

Ratios to Average Net AssetsG | |

Expenses before reductions | .59%A |

Expenses net of fee waivers, if any | .59%A |

Expenses net of all reductions | .59%A |

Net investment income (loss) | 4.13%A |

Supplemental Data | |

Net assets, end of period (000 omitted) | $ 248 |

Portfolio turnover rateE | 6% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F For the period October 2, 2006 (commencement of sale of shares) to September 30, 2007.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses ranged from less than .01% to .01%.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended September 30, 2007

1. Organization.

Fidelity Asset Manager 20% (the Fund) is a fund of Fidelity Charles Street Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class B, Class C, Asset Manager 20% and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. The Fund commenced sale of Class A, Class T, Class B, Class C, and Institutional Class shares and the existing class was designated Asset Manager 20% on October 2, 2006. In order to disclose class level financial information dollar amounts presented in the notes are unrounded. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions also differ by class.

2. Investments in Fidelity Central Funds.

The Fund may invest in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on their investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the Fund. These strategies are consistent with the investment objectives of the Fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the Fund. The following summarizes the Fund's investment in each Fidelity Central Fund.

Annual Report

Notes to Financial Statements - continued

2. Investments in Fidelity Central Funds - continued

Fidelity Central Fund | Investment

Manager | Investment

Objective | Investment

Practices | Expense

Ratio* |

Fidelity Equity Sector Central Funds | Fidelity Management & Research Company, Inc. (FMRC) | Each fund seeks capital appreciation by investing primarily in common stocks, with a concentration in a particular industry. | Foreign Securities Repurchase Agreements Restricted Securities | Less than .01% to .01% |

Fidelity Floating Rate Central Fund | FMRC | Seeks a high level of income by normally investing in floating rate loans and other floating rate securities. | Loans & Direct Debt Instruments Repurchase Agreements Restricted Securities | Less than .01% |

Fidelity High Income Central Fund 1 | FMRC | Seeks a high level of income and may also seek capital appreciation by investing primarily in debt securities, preferred stocks, and convertible securities, with an emphasis on lower-quality debt securities. | Loans & Direct Debt Instruments Repurchase Agreements Restricted Securities | Less than .01% |

Fidelity Tactical Income Central Fund | Fidelity Investments Money Management, Inc. (FIMM) FIMM | Seeks a high level of income by normally investing in investment-grade debt securities. | Delayed Delivery & When Issued Securities Mortgage Dollar Rolls Repurchase Agreements Restricted Securities Swap Agreements | Less than .01% |

Fidelity Money Market Central Funds | FIMM | Seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .01% to .01% |

* Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual

shareholder report.

Annual Report

2. Investments in Fidelity Central Funds - continued

The Central Funds may invest a portion of their assets in securities of issuers that hold mortgage securities including subprime mortgage securities. The value of these securities is sensitive to changes in economic conditions, including delinquencies and/or defaults, and may be adversely affected by shifts in the market's perception of the issuers and changes in interest rates.

A holdings listing for the Fund, which presents direct holdings as well as the pro rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable. A complete list of holdings for each Fidelity Central Fund is available upon request or at the SEC's web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the Fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. For example, when developments occur between the close of a market and the close of the NYSE that may materially affect the value of some or all of the securities, or when trading in a security is halted, those securities may be fair valued. Factors used in the determination of fair value may include monitoring news to identify

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Security Valuation - continued

significant market or security specific events such as changes in the value of U.S. securities markets, reviewing developments in foreign markets, evaluating the performance of ADRs, futures contracts and exchange-traded funds and monitoring current market trading activity, interest rates, credit quality and default rates for debt instruments. Because the Fund's utilization of fair value pricing depends on market activity, the frequency with which fair value pricing is used cannot be predicted and may be utilized to a significant extent. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities.

Foreign Currency. The Fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV for processing shareholder transactions includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each Fund in the trust. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known. Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of

Annual Report

3. Significant Accounting Policies - continued

Expenses - continued

the Fidelity Central Funds. Although not included in the Fund's expenses, the Fund indirectly bears its proportionate share of the Fidelity Central Funds' expenses through the impact of these expenses on each Fidelity Central Fund's net asset value. Based on their most recent shareholder report date, expenses of the Fidelity Central Funds ranged from less than .01% to .01%.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, the Fund will claim a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to futures transactions, partnerships (including allocations from Fidelity Central Funds), deferred trustees compensation and foreign currency transactions.

The tax-basis components of distributable earnings and the federal tax cost as of period end were as follows:

Unrealized appreciation | $ 63,045,194 |

Unrealized depreciation | (19,227,341) |

Net unrealized appreciation (depreciation) | 43,817,853 |

Undistributed ordinary income | 44,083,874 |

Undistributed long-term capital gain | 12,628,190 |

Cost for federal income tax purposes | $ 2,473,837,554 |

The tax character of distributions paid was as follows:

| September 30, 2007 | September 30, 2006 |

Ordinary Income | $ 136,976,584 | $ 82,527,943 |

Long-term Capital Gains | 57,926,972 | 20,737,807 |

Total | $ 194,903,556 | $ 103,265,750 |

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

New Accounting Pronouncements. In July 2006, Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement 109 (FIN 48), was issued and is effective on the last business day of the semiannual reporting period for fiscal years beginning after December 15, 2006. FIN 48 sets forth a threshold for financial statement recognition, measurement and disclosure of a tax position taken or expected to be taken on a tax return. Management has concluded that the adoption of FIN 48 will not result in a material impact on the Fund's net assets, results of operations and financial statement disclosures.

In addition, in September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

4. Operating Policies.

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the Fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Futures Contracts. The Fund may use futures contracts to manage its exposure to the stock market. Buying futures tends to increase a fund's exposure to the underlying instrument, while selling futures tends to decrease a fund's exposure to the underlying instrument or hedge other fund investments. Upon entering into a futures contract, a fund is required to deposit with a clearing broker, no later than the following business day, an amount ("initial margin") equal to a certain percentage of the face value of the contract. The initial margin may be in the form of cash or securities and is transferred to a segregated account on settlement date. Subsequent payments ("variation margin") are made or received by a fund depending on the daily fluctuations in the value of the futures contract and are accounted for as unrealized gains or losses. Realized gains (losses) are

Annual Report

4. Operating Policies - continued

Futures Contracts - continued

recorded upon the expiration or closing of the futures contract. Securities deposited to meet margin requirements are identified in the Schedule of Investments. Futures contracts involve, to varying degrees, risk of loss in excess of any futures variation margin reflected in the Statement of Assets and Liabilities. The underlying face amount at value of any open futures contracts at period end is shown in the Schedule of Investments under the caption "Futures Contracts." This amount reflects each contract's exposure to the underlying instrument at period end. Losses may arise from changes in the value of the underlying instruments or if the counterparties do not perform under the contract's terms. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded.

5. Purchases and Sales of Investments.

Purchases and sales of securities (including the Equity and Fixed-Income Central Funds), other than short-term securities, aggregated $262,748,552 and $94,048,722, respectively.

6. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and a group fee rate that averaged ..12% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annual management fee rate was .42% of the Fund's average net assets.

FMR pays a portion of the management fees received from the Fund to the Fidelity Central Funds' investment advisers, who are also affiliates, for managing the assets of the Fidelity Central Funds.

Distribution and Service Plan. In accordance with Rule 12b -1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares, except for the Asset Manager 20% and Institutional Class. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of FMR, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services.

Annual Report

Notes to Financial Statements - continued

6. Fees and Other Transactions with Affiliates - continued

Distribution and Service Plan - continued

For the period, the Distribution and Service Fee rates and the total amounts paid to and retained by FDC were as follows:

| Distribution

Fee | Service

Fee | Paid to

FDC | Retained

by FDC |

Class A | -% | .25% | $ 2,825 | $ 727 |

Class T | .25% | .25% | 6,936 | 446 |

Class B | .75% | .25% | 4,140 | 3,359 |

Class C | .75% | .25% | 6,586 | 4,830 |

| | | $ 20,487 | $ 9,362 |

Sales Load. FDC receives a front-end sales charge of up to 5.75% for selling Class A shares, and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the Fund. FDC receives the proceeds of contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. These charges depend on the holding period. The deferred sales charges range from 5% to 1% for Class B, 1% for Class C, 1.00% to .50% for certain purchases of Class A shares and .25% for certain purchases of Class T shares.

For the period, sales charge amounts retained by FDC were as follows:

| Retained

by FDC |

Class A | $ 7,469 |

Class T | 2,267 |

Class B* | 477 |

Class C* | 4 |

| $ 10,217 |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the

sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund, except for Asset Manager 20%. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, is the transfer agent for Asset Manager 20% shares. FIIOC and FSC receive account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. FIIOC and FSC pay for typesetting, printing and mailing of shareholder reports, except proxy statements.

Annual Report

6. Fees and Other Transactions with Affiliates - continued

Transfer Agent Fees - continued

For the period, the total transfer agent fees paid by each class to FIIOC or FSC, were as follows:

| Amount | % of

Average

Net Assets |

Class A | $ 1,809 | .16* |

Class T | 2,089 | .15* |

Class B | 778 | .19* |

Class C | 1,211 | .18* |

Asset Manager 20% | 2,500,890 | .11 |

Institutional Class | 221 | .12* |

| $ 2,506,998 | |

* Annualized

Accounting Fees. FSC maintains the Fund's accounting records. The fee is based on the level of average net assets for the month.

7. Committed Line of Credit.

The Fund participates with other funds managed by FMR in a $4.2 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro rata portion of the line of credit, which amounted to $5,134 and is reflected in Miscellaneous Expense on the Statement of Operations. During the period, there were no borrowings on this line of credit.

8. Expense Reductions.

FMR voluntarily agreed to reimburse Asset Manager 20% operating expenses. During the period, this reimbursement reduced the class' expenses by $86,390.

Many of the brokers with whom FMR places trades on behalf of the Fund and the Equity Sector Central Funds provided services to the Fund in addition to trade execution. These services included payments of certain expenses on behalf of the Fund totaling $14,648 for the period. In addition, through arrangements with the Fund's custodian and each class' transfer agent, credits realized as a result of uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $1,444.

Annual Report

Notes to Financial Statements - continued

8. Expense Reductions - continued

During the period, credits reduced each class' transfer agent expense as noted in the table below.

| Transfer Agent

expense reduction |

Class C | $ 2 |

Asset Manager 20% | 67,941 |

| $ 67,943 |

9. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

The United States Securities and Exchange Commission ("SEC") is conducting an investigation of FMR (covering the years 2002 to 2004) arising from gifts, gratuities and business entertainment provided by certain brokers to certain individuals who were employed on FMR's domestic equity trading desk during that period. FMR is in discussions with the SEC staff regarding the possible resolution of the matter, but as of period-end no final resolution has been reached.

In December 2006, the Independent Trustees completed their own investigation of the matter with the assistance of independent counsel. The Independent Trustees and FMR agree that, despite the absence of proof that the Fidelity mutual funds experienced diminished execution quality as a result of the improper receipt of gifts and business entertainment, the conduct at issue was serious and is worthy of redress. Accordingly, the Independent Trustees have requested and FMR has agreed to pay $42 million to Fidelity mutual funds, plus interest to be determined at the time that payment is made. A method of allocating this payment among the funds has not yet been determined. The total payment to the Fund is not anticipated to have a material impact on the Fund's net assets. In addition, FMR reimbursed related legal expenses which are recorded in the accompanying Statement of Operations as an expense reduction.

Annual Report

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

Years ended September 30, | 2007 A | 2006 |

From net investment income | | |

Class A | $ 39,791 | $ - |

Class T | 49,051 | - |

Class B | 12,517 | - |

Class C | 20,780 | - |

Asset Manager 20% | 97,126,066 | 64,555,177 |

Institutional Class | 7,027 | - |

Total | $ 97,255,232 | $ 64,555,177 |

From net realized gain | | |

Class A | $ 5,081 | $ - |

Class T | 20,043 | - |

Class B | 9,970 | - |

Class C | 9,436 | - |

Asset Manager 20% | 97,599,264 | 38,710,573 |

Institutional Class | 4,530 | - |

Total | $ 97,648,324 | $ 38,710,573 |

A Distributions for Class A, Class T, Class B, Class C and Institutional Class are for the period October 2, 2006 (commencement of sale of shares)

to September 30, 2007.

Annual Report

Notes to Financial Statements - continued

11. Share Transactions.

Transactions for each class of shares were as follows:

| Shares | Dollars |

Years ended September 30, | 2007A | 2006 | 2007A | 2006 |

Class A | | | | |

Shares sold | 271,096 | - | $ 3,462,355 | $ - |

Reinvestment of distributions | 2,590 | - | 32,986 | - |

Shares redeemed | (8,338) | - | (106,244) | - |

Net increase (decrease) | 265,348 | - | $ 3,389,097 | $ - |

Class T | | | | |

Shares sold | 314,428 | - | $ 4,039,296 | $ - |

Reinvestment of distributions | 5,054 | - | 64,229 | - |

Shares redeemed | (12,418) | - | (158,426) | - |

Net increase (decrease) | 307,064 | - | $ 3,945,099 | $ - |

Class B | | | | |

Shares sold | 87,110 | - | $ 1,119,230 | $ - |

Reinvestment of distributions | 1,586 | - | 20,151 | - |

Shares redeemed | (11,667) | - | (148,544) | - |

Net increase (decrease) | 77,029 | - | $ 990,837 | $ - |

Class C | | | | |

Shares sold | 138,353 | - | $ 1,774,788 | $ - |

Reinvestment of distributions | 1,740 | - | 22,123 | - |

Shares redeemed | (8,144) | - | (103,462) | - |

Net increase (decrease) | 131,949 | - | $ 1,693,449 | $ - |

Asset Manager 20% | | | | |

Shares sold | 63,397,753 | 58,821,375 | $ 815,352,615 | $ 762,877,913 |

Reinvestment of distributions | 14,705,597 | 7,686,827 | 187,331,699 | 98,885,268 |

Shares redeemed | (45,831,913) | (36,921,374) | (589,696,416) | (478,193,593) |

Net increase (decrease) | 32,271,437 | 29,586,828 | $ 412,987,898 | $ 383,569,588 |

Institutional Class | | | | |

Shares sold | 18,496 | - | $ 238,374 | $ - |

Reinvestment of distributions | 717 | - | 9,130 | - |

Shares redeemed | - | - | - | - |

Net increase (decrease) | 19,213 | - | $ 247,504 | $ - |

A Share transactions for Class A, Class T, Class B, Class C and Institutional Class are for the period October 2, 2006 (commencement of sale of

shares) to September 30, 2007.

Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Charles Street Trust and Shareholders of Fidelity Asset Manager 20%:

We have audited the accompanying statement of assets and liabilities of Fidelity Asset Manager 20% (the Fund), a fund of Fidelity Charles Street Trust, including the schedule of investments as of September 30, 2007, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.