UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

| |

| ☒ | Preliminary Proxy Statement |

|

| |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| |

| ☐ | Definitive Proxy Statement |

|

| |

| ☐ | Definitive Additional Materials |

|

| |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

FLIR SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | |

| ☒ | | No fee required. |

| | | |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| | |

| ☐ | | Fee paid previously with preliminary materials. |

| | | |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing party: |

| | | (4) | | Date Filed: |

|

| | |

|

The World's Sixth SenseTM |

2020

Notice of Annual Meeting of Shareholders

and Proxy Statement

|

| | |

| | | |

| | | |

| | The World’s Sixth Sense™ 27700 SW Parkway Avenue Wilsonville, Oregon 97070 (503) 498-3547 | |

NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

|

| | | |

Date and Time: | [•], [•] [•], 2020 | Place: | FLIR Systems, Inc. |

| | [•] | | [•] |

| | [•] | | [•] |

Dear Fellow Shareholder,

It is my pleasure to invite you to attend the Annual Meeting of Shareholders of FLIR Systems, Inc. The following items are on the agenda:

| |

| 1. | Election of Directors. We will vote to elect the eleven director nominees identified in the attached proxy statement, each for a one-year term expiring in 2021. |

| |

| 2. | KPMG Ratification. We will vote to ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. |

| |

| 3. | Advisory Vote on Executive Compensation. We will hold an advisory vote on executive compensation. |

| |

| 4. | Approve the Reincorporation of FLIR from Oregon to Delaware. We will vote to approve the reincorporation of FLIR from Oregon to Delaware. |

| |

| 5. | Other Business. We will transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The record date is [•] [•], 2020. Holders of [•] FLIR shares at the close of business on the record date are entitled to notice of and to vote at the Annual Meeting.

Earl R. Lewis

Chairman of the Board of Directors

Wilsonville, Oregon

[•] [•], 2020

|

|

Your vote is important! Please vote. The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K are available at www.flir.com/about/investor-relations and www.proxyvote.com. IT IS IMPORTANT THAT PROXIES BE COMPLETED AND SUBMITTED PROMPTLY. THEREFORE, WHETHER OR NOT YOU PLAN TO BE PRESENT IN PERSON AT THE ANNUAL MEETING, PLEASE SUBMIT YOUR VOTE BY PROXY VIA THE INTERNET, BY TELEPHONE OR BY MAIL IN THE ENCLOSED POSTAGE-PAID ENVELOPE IN ACCORDANCE WITH THE ACCOMPANYING INSTRUCTIONS. |

PROXY STATEMENT SUMMARY

This summary sets forth certain performance highlights and provides an overview of the more detailed information contained later in this report. It sets forth the proposals to be voted on. You should read the entire proxy statement before casting your vote. In this proxy statement, the terms “FLIR,” “we,” “our” and the “Company” refer to FLIR Systems, Inc.

FLIR's 2019 Business Highlights

Throughout 2019 we made meaningful progress in our efforts to drive continuous measurable improvement within our business. During the year, we continued to evolve our strategic priorities, focusing on leadership in sensor solutions, unmanned and autonomous solutions, airborne Intelligence/Surveillance/Reconnaissance (“ISR”) and decision support, which are described in more detail below. This, combined with the success of our ongoing execution of The FLIR Method ("TFM"), drove strong financial results and significant operational improvements. As a result, in 2019 we achieved:

•Revenue of $1.9 billion, the highest in our history

•13% growth in total backlogs

•Operating margin of 14.5%

•Gross profit of $929.5 million

•Net earnings of $171.6 million, or $1.26 per diluted share

•Strong cash generation of $370.4 million

During the year, we achieved Organic Revenue growth and completed successful M&A activities highlighted by the acquisitions of Aeryon Labs and Endeavor Robotics. Aeryon Labs is a leading developer of high-performance unmanned aircraft systems for military, public safety and critical infrastructure markets. Endeavor Robotics is a leading developer of battle-tested tactical unmanned ground vehicles for the global military, public safety and critical infrastructure markets. Together, the additions of Aeryon and Endeavor significantly advance our strategy to be a leader in unmanned solutions and were instrumental in FLIR winning several key franchise programs in 2019.

We also faced challenges to our business in 2019. In particular, a number of end markets served by our Commercial Business Unit continued to face headwinds that negatively impacted FLIR’s consolidated Organic Revenue growth and profitability targets for the full year. Late in the year, we commenced activities designed to simplify and reshape our product portfolio and reduce the complexity of our business. These activities include discontinuation of certain non-core consumer centric product lines in our Outdoor and Tactical Systems business, and, in February 2020, we committed to a plan to sell our Raymarine non-thermal maritime electronics business, subject to certain conditions of the proposed transaction and customary regulatory approvals. The business is being actively marketed and we intend to complete the sale within 2020. In addition, we will restructure our business units by consolidating from three business units to two by integrating the remaining businesses within the Commercial business unit into the Industrial business unit beginning in the first quarter of 2020. We believe these actions to simplify and reshape our product portfolio will support our efforts to focus on higher growth opportunities across our enterprise, positioning FLIR for long-term, sustainable growth.

Our strong balance sheet and liquidity position enables FLIR to return value to stockholders. In 2019, we paid $92 million in dividends to shareholders and repurchased $125 million of our common stock. Importantly, our share repurchase activity in 2019 is a testament to the continued confidence we have in the strength and outlook of our business.

Sensor Leadership

Key to FLIR’s operating strategy is to maintain its global leadership position in advanced sensors and integrated sensor systems. FLIR sensors enable the gathering, measurement, and analysis of critical information through a wide variety of applications. FLIR currently offers the broadest range of thermal imaging solutions in the world. As the cost of thermal imaging technology has declined, FLIR’s opportunities to increase the adoption of thermal technology and create new markets for the technology have expanded. In order to better serve the customers in these markets, we have also augmented our thermal product offerings with complementary sensing technologies, such as visible imaging, radar, laser, sonar, chemical sensing, and environmental sensing technologies.

Unmanned and Autonomous Solutions

|

| | |

| | | |

| 2020 PROXY STATEMENT | FLIR | i |

Unmanned solutions are core to FLIR’s strategy because the purpose of an unmanned vehicle combined with FLIR sensors, allow users to see or detect what is out in the distance without putting the user in harm’s way. This helps Armed Forces and other professionals to safely accomplish their missions and provides end users with more information to perform their jobs. Our unmanned platform is growing significantly and includes a broad suite of solutions. FLIR is also pursuing numerous opportunities in advanced driver-assistance systems (“ADAS”) and longer-term, fully autonomous driving, where thermal sensing technologies are expected to play critical roles as these solutions evolve.

Airborne ISR

FLIR has significant opportunities with thermal imaging systems used in intelligence, surveillance and reconnaissance applications for the precise positioning of objects or people from substantial distances and for enhanced situational awareness, particularly at night or in conditions of reduced or obscured visibility. While these systems can be installed on fixed platforms or manned-mobile platforms, we are benefitting from recent franchise program wins and other significant opportunities in Airborne applications for both manned and unmanned platforms.

Decision Support

As FLIR continues to advance its mission to increase awareness and perception so professionals can make more informed decisions, we strive to provide better, value-added, actionable information to our customers. To this end, we have developed core competencies in software, automation, machine learning and artificial intelligence. We are doing this through R&D investments, talent development, acquisitions and minority investments to provide intelligent sensing solutions. As we continue to advance our state-of-the-art hardware solutions with additional layers of analytics, FLIR is well-positioned to capitalize on opportunities as a technology-driven decision support company.

The FLIR Method

We continued implementation of “The FLIR Method” or “TFM,” an operating methodology based on LEAN principles in a learning environment of continuous improvement to increase operational efficiencies, provide a foundation for profitability and consistent earnings growth and exceed shareholder expectations. We believe that many of the operational improvements made during 2019, including productivity grains, customer driven product innovation and enhancements to the compliance program, are the result of implementation of TFM.

Build-out of Compliance Function

In 2018, we entered into a Consent Agreement with the United States Department of State’s Directorate of Defense Trade Controls (“DDTC”). Under the terms of the agreement, we agreed to pay $30 million penalty, half of which was suspended, provided the funds are used for compliance program improvements. In 2019, we continued the implementation and build-out of a more robust compliance program. We expect these investments for trade compliance will exceed the minimum required by the consent agreement.

Going Forward in 2020

FLIR will continue to focus on simplifying and reshaping the Company’s product portfolio and organizational structure to support its efforts to focus on its key strategic priorities, improve operational efficiencies and position FLIR for long-term, sustainable growth.

|

| | |

| | | |

| ii | FLIR | 2020 PROXY STATEMENT |

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

The Board of Directors of FLIR (“Board of Directors” or “Board”, or individually, each a “Director”) is soliciting proxies to be voted at the 2020 Annual Meeting of Shareholders to be held on [•] [•], 2020 (the “Annual Meeting”), at [•] [•], at [•], or any postponement or adjournment of the Annual Meeting. We are making this Proxy Statement and other proxy materials available to each person who is registered as a holder of our shares in our official stock ownership records (such owners are referred to as “shareholders of record,” or “shareholder,” or “you,” or “your”) as of the close of business on [•] [•], 2020 (the “Record Date”) for the Annual Meeting beginning on [•], 2020. Our shareholders of record are invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement.

Purpose of the Meeting. Important matters outlined in the Notice of Annual Meeting of Shareholders will be considered at our Annual Meeting. We have provided these proxy materials to you in connection with the solicitation of proxies by our Board of Directors. This Proxy Statement describes matters on which you, as a shareholder, are entitled to vote and provides you with information so that you can make an informed decision.

Voting Your Shares. You may vote your shares via the Internet, by telephone, by mail or in person at the Annual Meeting. If you vote via the Internet, by telephone or in person at the Annual Meeting, you do not need to mail in a proxy card. If you choose to use the Internet or telephone to vote, you must do so by 11:59 p.m. Eastern Daylight Time on [•] [•], 2020, the day before our Annual Meeting takes place.

|

| | | | | | |

| INTERNET | | TELEPHONE OR CELL PHONE | | MAIL | | IN PERSON |

| | | | | | | |

Visit www.proxyvote.com. You will need the control number in your notice, proxy card or voting instruction form. | | Dial toll-free (1-800-690-6903) or the telephone number on your voting instruction form. You will need the control number in your notice, proxy card or voting instruction form. | | If you received a paper copy of your proxy materials, send your completed and signed proxy card or voting instruction form using the enclosed postage-paid envelope. | | By following the instructions below under “Attending the Meeting” and requesting a ballot when you arrive. |

Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares by completing and returning the proxy card or voting instruction form as promptly as possible, or by voting by telephone or via the Internet, prior to the Annual Meeting to ensure that your shares will be represented at the Annual Meeting if you are unable to attend. If your shares are held in “street name” with a broker or similar party, you have a right to direct that broker or similar party on how to vote the shares held in your account. You will need to contact your broker to determine whether you will be able to vote using one of these alternative methods.

Attending the Meeting. If you attend our Annual Meeting, we will require that you present a picture identification for security reasons. We reserve the right to exclude any person whose name does not appear on our official stock ownership records as of the Record Date. If you hold shares in “street name,” you must bring a letter from your broker, or a current brokerage statement, to indicate that the broker is holding shares for your benefit. We also reserve the right to request any person to leave the Annual Meeting who is disruptive, refuses to follow the rules established for such meeting or for any other reason.

OUR BOARD OF DIRECTORS RECOMMENDS:

| |

| • | That you vote FOR our nominees for Directors of the Company as described in Proposal 1; |

| |

| • | That you vote FOR the ratification of our Audit Committee’s selection of KPMG LLP to serve as our independent registered public accounting firm for fiscal year 2020 as described in Proposal 2; |

| |

| • | That you vote FOR, on an advisory basis, the approval of the Company’s executive compensation as described in Proposal 3; and |

| |

| • | That you vote FOR the approval of the Company’s reincorporation from Oregon to Delaware as described in Proposal 4. |

Shareholders Eligible to Vote at Our Annual Meeting. Shareholders as of the Record Date will be entitled to vote at our Annual Meeting. If your shares are registered directly in your name with our transfer agent, Computershare, you are a shareholder of record, and these proxy materials are being sent directly to you from the Company. As the shareholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting. If your shares are held in “street name,” meaning your

|

| | |

| | | |

| 2020 PROXY STATEMENT | FLIR | iii |

shares are held in a brokerage account or by a bank or other nominee, you are the beneficial owner of these shares and these proxy materials are being forwarded to you by your broker, bank or other nominee, who is considered the shareholder of record with respect to such shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote and you will receive instructions from your broker, bank or other nominee describing how to vote your shares; however, you may not vote these shares in person at the Annual Meeting unless you obtain a legal proxy from the shareholder of record (i.e., your broker, bank or other nominee) giving you the right to vote such shares.

As of [•] [•], 2020, there were [•] shares of common stock outstanding and owned by shareholders. Each share of common stock is entitled to one vote on each matter considered at our Annual Meeting.

Proxies. Our Board of Directors has appointed certain persons (“proxy holders”) to vote proxy shares in accordance with the instructions of our shareholders. If you authorize the proxy holders to vote your shares with respect to any matter to be acted upon, the shares will be voted in accordance with your instructions. If you are a shareholder of record and you authorize the proxy holders to vote your shares but do NOT specify how your shares should be voted on one or more matters, the proxy holders will vote your shares on those matters as our Board of Directors recommends. If any other matter properly comes before the Annual Meeting, the proxy holders will vote on that matter in their discretion.

If you are a beneficial owner of shares held in street name and do not provide your broker or nominee with instructions on how to vote your shares, a “broker non-vote” occurs. Under the rules of The NASDAQ Stock Market (the “Nasdaq Rules”), the organization that holds your shares (i.e., your broker or nominee) may generally vote on routine matters at its discretion but cannot vote on “non-routine” matters. Proposal 2 (ratification of selection of the independent registered public accountant) is a matter that we believe will be designated as “routine.” However, Proposal 1 (election of Directors), Proposal 3 (advisory approval of the Company’s executive compensation) and Proposal 4 (approval of the Company’s reincorporation from Oregon to Delaware) are matters that we believe will be considered “non-routine.” Accordingly, a broker or nominee cannot vote on Proposals 1, 3 and 4 without voting instructions. We strongly encourage you to provide voting instructions to your broker or nominee so that your vote will be counted on all matters.

Establishing a Quorum; Effect of Abstentions and Broker Non-Votes. In order for the Company to conduct the Annual Meeting, the holders of a majority of the common stock outstanding and entitled to vote as of the Record Date must be present in person or represented by proxy at the Annual Meeting. Abstentions and “broker non-votes” will be counted for purposes of establishing a quorum at the Annual Meeting.

Brokers who hold shares for the accounts of their clients may vote such shares either as directed by their clients or in their own discretion as discussed above under “Proxies.” Abstentions and broker non-votes are not included as votes cast and will not affect the outcome of any of the proposals.

Revocation of Proxies. You can change or revoke your proxy at any time prior to the voting at the Annual Meeting by the following methods:

| |

| • | If you voted via the Internet or by telephone, by submitting subsequent voting instructions via the Internet or by telephone before the closing of those voting facilities at 11:59 p.m., Eastern Daylight Time on [•] mailing your request to our Corporate Secretary at 1201 S Joyce St., Arlington, VA 22202, so that it is received not later than 4:00 p.m. Eastern Daylight Time, on [•] [•], 2020. |

| |

| • | By voting your shares by ballot in person at the Annual Meeting; |

| |

| • | If you have instructed a broker, bank or other nominee to vote your shares, by following the directions received from your broker, bank or other nominee to change those instructions; or |

| |

| • | Mailing your request to our Corporate Secretary at 1201 S Joyce St., Arlington, VA 22202, so that it is received not later than 4:00 p.m. Eastern Daylight Time, on [•] [•], 2020. |

Counting the Vote. [•] will act as the Inspector of Elections and will tabulate the votes.

Required Vote.

Election of Directors. In an uncontested election, each Director shall be elected by a majority of the votes cast at the Annual Meeting. This means that the number of votes cast “FOR” a Director’s election exceeds the number of votes cast “AGAINST” that Director’s election. A properly executed proxy marked “ABSTAIN” with respect to the election of one or more Directors or shares held by a broker for which voting instructions have not been given will not be voted with respect to the Director or Directors indicated, although it will be counted for purposes of determining whether a quorum is present. In a contested election (an election in which the number of candidates

|

| | |

| | | |

| iv | FLIR | 2020 PROXY STATEMENT |

exceeds the number of director positions to be filled), the Directors shall be elected by a plurality of the votes cast by the shares entitled to vote on the election of Directors.

Ratification of Selection of Independent Registered Public Accounting Firm. Pursuant to the Company’s Amended and Restated Bylaws (“Bylaws”), the ratification of the selection of KPMG LLP to serve as the Company’s independent public accountant for the fiscal year ending December 31, 2020 requires a majority of the votes cast at the Annual Meeting to be voted “FOR” the proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Advisory Vote Approving the Company’s Executive Compensation. We will consider this proposal to be approved, on an advisory basis, if a majority of the votes cast at the Annual Meeting are voted “FOR” the proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Approval of Reincorporation from Oregon to Delaware. Pursuant to Section 60.474 of the Oregon Business Corporation Act (the “OBCA”), the approval of the Company’s conversion from an Oregon corporation to a Delaware corporation requires a majority of all the votes entitled to be cast at the Annual Meeting to be voted “FOR” the proposal. Abstentions and broker non-votes will have the same effect as a vote “AGAINST” this proposal.

Other Matters. Approval of any other proposal to be voted upon at the Annual Meeting requires a majority of the votes cast at the Annual Meeting to be voted “FOR” the proposal.

Interests of Certain Persons in Matters to be Acted Upon.

No Director or executive officer of the Company who has served at any time since the beginning of fiscal 2019, and no nominee for election as a director of the Company, or any of their respective associates, has any substantial interest, direct or indirect, in any matter to be acted upon at the Annual Meeting other than (i) the interests held by such persons through their respective beneficial ownership of the shares of the Company’s common stock set forth below in the section entitled “Stock Owned by Management,” and (ii) Proposal 1: Election of Directors.

|

| | |

| | | |

| 2020 PROXY STATEMENT | FLIR | v |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS |

| |

CORPORATE GOVERNANCE AND RELATED MATTERS

Communications with Directors

Shareholders and other parties interested in communicating directly with the Chairman, any Committee Chair, or with the non-employee directors as a group may do so by contacting the Chairman of the Board, c/o Corporate Secretary, FLIR Systems, Inc., 1201 S Joyce St., Arlington, VA 22202. In general, any shareholder communication delivered to FLIR for forwarding to Board members will be forwarded in accordance with the shareholder’s instructions. Concerns relating to accounting, internal controls or auditing matters are promptly brought to the attention of the Audit Committee and handled in accordance with procedures established by the Audit Committee.

Shareholder Engagement

Shareholder engagement is an important element of our overall corporate governance. Our Chief Executive Officer, Chief Financial Officer and other members of our management team regularly engage in dialogue with our shareholders. During 2018 and the first quarter of 2019, Company management and members of the Compensation Committee actively solicited input from the Company’s top 65 institutional shareholders regarding the Company’s executive compensation program, corporate governance matters and other topics of interest to the shareholders. Telephone calls and meetings were scheduled with every institutional shareholder who agreed to speak with the Company directly.

Our shareholders indicated their support for our executive compensation program, as evidenced by our say-on-pay vote passing with 92% of the votes cast in favor at the 2019 Annual Meeting of Shareholders.

Meetings

During 2019, the Board of Directors held seven meetings. In 2019, each director attended more than 75% of the total board and committee meetings. Pursuant to FLIR’s Corporate Governance Principles, each director is expected to commit the time necessary to prepare for and attend all board and committee meetings, as well as the Annual Meeting of Shareholders. All members of the Board attended the 2019 Annual Meeting of Shareholders and all members of the Board are expected to attend the 2020 Annual Meeting of Shareholders.

Board of Directors Independence

FLIR’s Corporate Governance Principles provide that the Board of Directors must be comprised of a majority of independent directors. The Board of Directors reviews annually the relationship that each director has with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and determines the independence of each director. The Board took into account all relevant facts and circumstance and has determined that each of the directors of the Company is “independent” as defined by applicable NASDAQ rules, except for Mr. Lewis, who retired as President and Chief Executive Officer of the Company in May 2013, and Mr. Cannon, the Company’s current Chief Executive Officer.

Board of Directors Committees

The Board of Directors has standing Audit, Compensation and Corporate Governance Committees. Each standing committee operates pursuant to a written charter, which is reviewed annually. The charter of each committee may be viewed online at www.flir.com/about/investor-relations. The performance of each committee is reviewed annually. Each committee may obtain advice and assistance from internal or external legal, accounting and other advisors. The members of the Audit, Compensation and Corporate Governance Committees have all been determined to be “independent” as defined by applicable NASDAQ listing rules.

|

| | |

| | | |

| 1 | FLIR | 2020 PROXY STATEMENT |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

| |

The current members of each committee are identified in the following table. | |

1 | Mr. Wynne became Chair of the Corporate Governance Committee succeeding Mr. Carter beginning with the Corporate Governance Committee’s July 2019 meeting. |

The Audit Committee is responsible for, among other things: overseeing the integrity of the Company’s financial statements and financial reporting process and related systems of disclosure controls and internal quality-control procedures; assisting the Board in oversight of the Company's compliance with legal and regulatory requirements; the independent registered public accounting firm’s qualifications, appointment and independence; the performance of the internal audit function; the review of all related-party transactions involving, directly or indirectly, the Company and any of its directors or officers; and the adequacy of the Company’s accounting and internal control systems. During fiscal year 2019, the Audit Committee held six meetings.

The Compensation Committee is responsible for, among other things: all matters relating to the compensation of the Company’s executives, including salaries, bonuses, perquisites, incentive compensation, equity-based compensation, retirement benefits, severance pay and benefits, and compensation and benefits in the event of a change of control of the Company; oversight and evaluation of the performance of the Company’s CEO; oversight of the administration of the Company’s talent management process; and executive talent management and succession. The Compensation Committee also administers the Company’s equity compensation plans and oversees the preparation of executive compensation disclosures included in the Company’s annual proxy statement or annual report on Form 10-K. The Compensation Committee has the authority to delegate any of its responsibilities, along with the authority to take action in relation to such responsibilities, to one or more subcommittees or to a committee of the independent members of the Board as the Compensation Committee may deem appropriate in its sole discretion. See also the “Compensation Discussion and Analysis” section of this Proxy Statement for additional details on the governance of the Compensation Committee and a description of the Company’s processes and procedures for determining executive compensation. During 2019, the Compensation Committee held five meetings.

The Corporate Governance Committee is responsible for, among other things: recommending to the Board operating policies to ensure an appropriate level of corporate governance; identifying and reviewing nominations for qualified candidates to serve on the Board; determining the qualification of Board members; evaluating the size and composition of the Board and its committees; reviewing the Company’s Corporate Governance Principles; reviewing the Company’s Code of Ethical Business Conduct and the Code of Ethics for Senior Financial Officers; providing oversight of management activities and enterprise risks, including the integrity and security of the Company’s Information Technology systems, business information and third party data, including with the full Board review and oversight of the Company’s cybersecurity initiatives; and recommending nominees to stand for election at each annual meeting of shareholders. The Corporate Governance Committee seeks candidates to serve on the Board who are persons of integrity, with significant accomplishments and recognized business experience, but does not have any specific minimum qualifications or criteria for director nominees. As required by its charter, the Corporate Governance Committee considers diversity of backgrounds, experiences, expertise, skill sets and viewpoints when considering nominees for director. We actively seek director candidates who bring diversity of, including, but not limited to, work experiences, military service, age, gender, nationality, race, ethnicity and sexual orientation. During each board

|

| | |

| | | |

| 2020 PROXY STATEMENT | FLIR | 2 |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS |

| |

meeting, the Corporate Governance Committee reviews candidates for directorship assembled in the previous quarter. During 2019, the Corporate Governance Committee held four meetings.

The Ethics and Compliance Committee was an ad hoc special advisory committee whose responsibility was to review and make recommendations regarding the Company’s corporate compliance and ethics posture, programs, policies and procedures to facilitate the operation of the Company in a compliant and ethical manner. The Ethics and Compliance Committee was formed in June 2016 and dissolved in October 2019, with their responsibilities being absorbed by the Audit Committee and the Corporate Governance Committee. The Ethics and Compliance Committee held no meetings during fiscal year 2019.

The Transactions Committee is a special advisory committee formed in December 2019 to review strategic transactions and opportunities for the Company. During 2019, the Transactions Committee held four meetings.

Shareholder Nominations and Proxy Access

The Corporate Governance Committee will review recommendations from shareholders of individuals for consideration as candidates for election to the Board of Directors. Any such recommendation should be submitted in writing to the Corporate Secretary, FLIR Systems, Inc., 1201 S Joyce St., Arlington, VA 22202. Our Bylaws set forth procedures that must be followed by shareholders seeking to nominate directors. Our Bylaws include proxy access, which permits eligible shareholders to nominate candidates for election to the Board. This allows a shareholder or a group of no more than 20 shareholders that has maintained continuous ownership of 3% or more of the Company’s common stock for at least three years to include in the Company’s proxy materials nominees for election as director for an annual meeting of shareholders. With our current Board consisting of eleven members, eligible shareholders may nominate a number of director nominees not to exceed two of the directors then in office. To nominate a director, the shareholder must provide the information required by our Bylaws. In addition, the shareholder must give timely notice to our Corporate Secretary in accordance with our Bylaws, which, in general, require that the notice be received by our Corporate Secretary within the period described under “Dates for Submission of Shareholder Proposals for 2021 Annual Meeting of Shareholders” section of this Proxy Statement. Each notice given by a shareholder with respect to nominations for the election of directors must comply with the requirements of Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and our Bylaws. The Corporate Governance Committee evaluates candidates recommended by shareholders using the same criteria as for other candidates recommended by its members, other members of the Board, or other persons.

Corporate Governance

FLIR maintains a Governance page on its website that provides specific information about its corporate governance initiatives, including FLIR’s Corporate Governance Principles, Code of Ethical Business Conduct, Code of Ethics for Senior Financial Officers and charters for the committees of the Board of Directors. The Governance page can be found on our website at www.flir.com/about/investor-relations. To the extent mandated by legal requirements, we intend to disclose on our website any amendments or waivers to our Corporate Governance Principles, Code of Ethical Business Conduct, and Code of Ethics for Senior Financial Officers.

FLIR’s policies and practices reflect corporate governance initiatives that are compliant with the listing requirements of NASDAQ and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, as amended (“SOX”) and the Dodd-Frank Wall Street Reform and Consumer Protection Act, as amended (the “Dodd-Frank Act”), including:

| |

| • | The Board of Directors has adopted clear corporate governance policies; |

| |

| • | A majority of the Board members are independent of FLIR and its management based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by NASDAQ; |

| |

| • | All members of the Board’s Audit, Compensation and Corporate Governance Committees are independent based on the relevant independence requirements set forth in the NASDAQ listing rules as well as any additional or supplemental independence standards contained in the Company’s Corporate Governance Principles or established by SOX and the Dodd-Frank Act; |

| |

| • | The independent members of the Board of Directors meet regularly without the presence of management; |

| |

| • | FLIR has a Code of Ethical Business Conduct; |

| |

| • | The charter of each Board committee clearly establishes its role and responsibilities; |

|

| | |

| | | |

| 3 | FLIR | 2020 PROXY STATEMENT |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

| |

| |

| • | FLIR has a Chief Compliance Officer and an Internet-based hotline monitored by EthicsPoint® that is available to all employees, and FLIR’s Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal controls or auditing matters; and |

| |

| • | FLIR has adopted a Code of Ethics for Senior Financial Officers that applies to its Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer/Corporate Controller, Corporate Treasurer, Business Unit Controllers and Site Controllers. |

You may obtain copies of the documents posted on FLIR’s Governance page on its website by writing to the Corporate Secretary, FLIR Systems, Inc., 1201 S Joyce St., Arlington, VA 22202.

Corporate Social Responsibility

Every day, FLIR technology and solutions are making a difference in the world. We are the World’s Sixth Sense, working to revolutionize human perception and innovating technologies that help professionals make informed decisions that save lives and livelihoods. We are guided by our Task and our Purpose to exceed our commitments with integrity and bound by a sense of duty to each other, the customers we serve, and the communities in which we live.

Whether in the line of duty, in the wildlife parks of Kenya, or in the classroom, FLIR technology plays a vital role in producing a safer, more sustainable, and more equitable future.

Corporate Social Responsibility (CSR) is key to our culture, and we are committed to giving back to those who put our technological solutions to ever-expanding beneficial use. Additionally, FLIR employees volunteer their own time to support social issues that align with business priorities and give back to the community in which we work and live. The Company’s corporate citizenship initiatives and activities described below support our commitment to create long-term, sustainable value for our employees, customers, shareholders and communities.

COMPANY VALUES

FLIR is made up of innovative, engaged and yet diverse groups of people. What brings us all together are our Core Organizational Values: a few firmly held beliefs about how we do business, develop our people and set a new standard for the industry. Taken together, our values embody what it means to BE FLIR.

BE BOLD

We have a pioneering, courageous spirit to innovate for the future. We do not fear the unknown and will blaze new trails to save lives and livelihoods.

BE BRAVE

We do the right thing, even when it’s hard and no one is watching, to the benefit of our customers, employees, shareholders and communities. We pride ourselves on integrity.

BE READY

We are nimble and move decisively, at the speed of heat, to embrace better ways to pursue our mission. We do not shirk in the face of change.

BE AMBITIOUS

We are results-driven, passionate about winning, and strive to exceed customer expectations every day. We collaborate and always treat each other with respect as we pursue success. We never forget that a win for us is a win for the real-life heroes we serve.

COMPANY COMMITMENTS

The Company’s CSR strategy is built upon a foundation of community involvement in three areas: Planet, Purpose, and Potential. We believe that investing in our people, in our communities, and in operating our business sustainably will drive long-term value for the Company and our shareholders. These three pillars, as described below, provide the framework by which we manage our key initiatives.

|

| | |

| | | |

| 2020 PROXY STATEMENT | FLIR | 4 |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

| |

PLANET

Environmental Stewardship

FLIR technology aids environmental stewards and organizations across the globe, collaborating with scientific researchers and field experts to better understand and improve responsible use and protection of the natural environment through conservation, sustainable practices, ecological research, and citizen science. FLIR technology helps visualize the impact of greenhouse gases, the research, study, and preservation of fauna and flora, and a host of other environmental phenomena.

In 2016, the Company’s Swedish subsidiary conducted a review of how FLIR products may impact the environment and was able to identify a group of environmental aspects that played a greater role than the others, namely how FLIR products help reduce gas emissions and energy losses. FLIR customers can use the Company’s products to detect heat losses, energy leakage, and greenhouse leaks. For example, FLIR technology can be used to detect a fire at an early stage when large amounts of biological material is stored, and biological and chemical processes occur that cause heat to build up. FLIR Optical Gas Imaging cameras can detect, in real time, leaks of harmful gases that are hazardous to the environment such as methane, sulfur hexafluoride, carbon dioxide, carbon monoxide and refrigerants. FLIR technology is able to help customers reduce amounts of environmentally harmful gases that would otherwise be released into the atmosphere. The Company also announced the “FLIR Conservation Discount Program” in May 2019, as part of an initiative to bridge our innovative solutions with environmental efforts to make our world a better and safer place. Customers and organizations that are able to successfully demonstrate conservation work and technology needs receive discounts on select FLIR products. Since the launch of the Conservation Discount Program, various organizations have benefited from the discount and utilized FLIR technology in various conservation efforts, ranging from honeybee management methods and winter hive monitoring in Sacramento to drone aerial surveillance for anti-poaching/conservation of animals in the Malaysian Rainforest. FLIR will continue to utilize its technology and products to make tangible positive impacts on the environment and foster sustainability.

Partnership with World Wildlife Fund

As part of our environmental stewardship mission, FLIR has collaborated with World Wildlife Fund (WWF) since 2016, providing thermal imaging camera technology to rangers in Africa on their mission to fight poaching. Poachers usually work under the cover of darkness, but thermal imaging cameras give rangers the competitive advantage to see at night. More than 230 poachers have been arrested since the first FLIR camera was installed in April 2016. In January 2019, FLIR CEO James J. Cannon and WWF CEO Carter Roberts announced The Kifaru Rising Project. This multi-year collaboration will deploy FLIR thermal imaging technology across 10 parks and game reserves in Kenya to help improve wildlife ranger safety and achieve the goal of ending rhino poaching. The Kifaru Rising Project will significantly broaden the use of FLIR technology across Kenya and build on the experience and success achieved in the initial parks where FLIR cameras have already been effectively used for several years. The Kifaru Rising Project includes a pledge by FLIR of more than $3 million in technology, engineering assistance, and training with the goal of eliminating rhino poaching in Kenya by 2021.

PURPOSE

Veteran Support

For almost four decades, FLIR has provided militaries and first responders around the world with technology and solutions to help them accomplish their mission safely and effectively. Today, approximately 9% of the Company’s U.S. workforce is self-reported as veterans in a range of job roles, including engineering, operations, finance, business development, customer support, and executive management. To help veterans in their transition to the civilian workplace, we are committed to doubling the veteran employee population of our U.S. personnel to up to 18% by the end of 2022, with significant career opportunities within our Government and Defense Business Unit. Additionally, we announced the TradeForce program in October 2019 that assists U.S. veterans who want to start or expand a career in the skilled trades including electricians, HVAC professionals, plumbers and building inspectors. TradeForce offers recently separated U.S. Veterans free thermography training and a FLIR camera to help start their career and 38 veterans have since completed or registered to participate in the TradeForce program.

POTENTIAL

STEM Education

Today’s students are tomorrow’s explorers, discoverers, and innovators. At FLIR, we support the curiosity and interest of children in science, technology, and engineering to fuel future innovations. Through the FLIR Education Portal, educators have access to an assortment of free lesson plans, labs, and teaching videos to assist and encourage thermal-focused science, technology, engineering, and mathematics (STEM) related activities in the classroom. Our goal is to inspire educators and students to explore the unseen world of thermal imaging and make STEM subjects more interesting in schools and to our future leaders, our youth.

|

| | |

| | | |

| 5 | FLIR | 2020 PROXY STATEMENT |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

| |

Environmental, Social and Governance Responsibilities

While our primary mission is to build long-term value for our shareholders, our focus on environmental, social and governance responsibilities has been a core value of our Company. We believe that we can maximize shareholder value if we do business in a sustainable and socially responsible way. Highlights of our ESG initiatives include:

SUSTAINABLE MANUFACTURING

In everything we do, we aim to strengthen our business and the communities we serve so all can thrive long into the future. We recognize that the sustainability of our business is directly linked to the sustainability of our communities. Through initiatives like The FLIR Method (TFM) and LEAN method, we look to integrate sustainability into our everyday actions. An element of the TFM focuses on drastically improving product quality and eliminating waste and inefficiency in our production system through better manufacturing processes. We are focused on developing best practices and knowledge in order to better manage our use of resources in order to build and maintain a sustainable manufacturing process.

HEALTH AND WELLNESS OF OUR EMPLOYEES

FLIR employees are our most important assets and are critical to the Company’s success. FLIR values health and wellness of its employees and strongly believes that being more aware of one’s health risks and becoming more proactive is essential to improving and maintaining one’s health. FLIR invests in onsite fitness centers, provides a health club reimbursement through our fitness subsidy program and offers its employees various incentives and opportunities to participate in certain health-focused activities. In 2019, over a thousand employees and dependents received flu shots and 40% of eligible employees participated in the U.S. Employee Wellness Incentive Program and earned a total of $190,000 in incentives to offset their medical premiums in 2020. FLIR also provided its employees with various opportunities to participate in wellness events in 2019, such as the FLIR Wellness Amazing Race Step Challenge in the fourth quarter with approximately 900 participants taking over 300 million steps, and the FLIR Runs Wild 5K event in the second quarter in which over 1000 FLIR employees participated globally to raise more than $27,000 dollars for the WWF.

DIVERSITY

Our people set us apart and we celebrate diversity. FLIR is comprised of innovative, engaged, and diverse groups of people. What brings us all together are our Core Organizational Values: BE BRAVE - BE BOLD - BE READY - BE AMBITIOUS. These firmly held beliefs guide how we do business, develop our team and nurture a culture of diversity and inclusion. We celebrate and respect our differences, regardless of race, gender, age, religion, and identity. Taken together, our values embody what it means to BE FLIR. We believe diversity gives FLIR a competitive edge in the global marketplace, reflecting the different aspects of our customer, market and colleagues. Empowering an inclusive workplace enables us to better suit and serve the communities in which we live and operate. We are dedicated to a culture that values and respects differences in race, gender, age, religion and identity. Diversity is an integral part of the way we do business and our success as a global leader depends on it.

CORPORATE GOVERNANCE

For discussion of our corporate governance, please see page 3.

Board Leadership Structure and Role in Risk Oversight

The Company has a separate Chairman of the Board and Chief Executive Officer structure. In addition, the Chairman of the Company’s Corporate Governance Committee serves as Presiding Director for the executive sessions of the independent directors. The Board has determined that this structure is appropriate for the Company at this time as it most fully maximizes our Chairman’s extensive knowledge of the Company’s business and industry. The Board acknowledges that no single leadership model is right for all companies, however, so the Board periodically reviews its leadership structure.

The Board is actively involved in oversight of risks inherent in the operation of the Company’s business including, without limitation, those risks described in the Company’s reports filed from time to time with the Securities and Exchange Commission (“SEC”). It is management’s responsibility to manage risk and bring to the Board’s attention the material risks to the Company. The Board has oversight responsibility for the processes established to report and monitor systems for material risks applicable to the Company. The Board manages this responsibility at the Board level with assistance from its three standing committees as appropriate. The Board has delegated to the Audit Committee certain tasks related to the Company’s risk management process. The Audit Committee serves as an independent and objective body, overseeing the integrity of the Company’s financial statements and financial reporting process and related systems of disclosure controls and internal quality-control procedures, and assists the Board in oversight of the Company’s compliance with legal and regulatory requirements. The Board has delegated to the Compensation Committee responsibility for oversight of management’s

|

| | |

| | | |

| 2020 PROXY STATEMENT | FLIR | 6 |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

| |

compensation risk assessment, including the annual determination of whether or not the Company’s compensation policies and practices are reasonably likely to have a material adverse effect on the Company, as well as talent management and succession planning oversight. The Corporate Governance Committee oversees the Company’s risks in the areas of corporate governance and is primarily responsible for the integrity and security of the Company’s information technology systems, including the review and oversight of the Company’s cybersecurity initiatives, including assessments of the overall threat landscape and strategies and infrastructure investments to monitor and mitigate such threats, Board and committee performance and membership and director nomination/succession. These committees report the results of their review processes to the full Board during regularly scheduled Board meetings or more frequently, if warranted. In addition to review and discussion of reports prepared by the committees of the Board, the Board periodically discusses risk oversight in specific areas as they arise, including as part of its corporate strategy review.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is a present or former officer or employee of the Company. In addition, during fiscal year 2019, no executive officer of the Company had served on the compensation committee or any similar committee of any other entity or served as a director for any other entity whose executive officers served on the Company's Compensation Committee.

Compensation Risk

Company management annually conducts an assessment of our compensation policies and practices, including our executive compensation programs, to evaluate the potential risks associated with these policies and practices. Management has reviewed and discussed the findings of the independent assessment conducted by Pay Governance, the Committee's independent outside advisor, with the Compensation Committee concluding that our compensation programs are designed with an appropriate balance of risk and reward and do not encourage excessive or unnecessary risk-taking behavior. As a result, we do not believe that risks relating to our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on the Company.

In conducting this review, management considered the following attributes of our programs:

| |

| • | Mix of base salary, annual incentive opportunities, and long-term equity compensation; |

| |

| • | Balance between annual and longer-term performance opportunities; |

| |

| • | Alignment of annual and long-term incentives to ensure that the awards encourage consistent behaviors and achievable performance results over the long term; |

| |

| • | Use of equity awards (performance-based and time-based) that vest over time and in some cases attach additional holding periods after vesting; |

| |

| • | Generally providing senior executives with long-term equity-based compensation on an annual basis. We believe that accumulating equity over a period of time encourages executives to take actions that promote the long-term sustainability of our business; |

| |

| • | Stock ownership guidelines that are reasonable and designed to align the interests of our executive officers with those of our shareholders. This discourages executive officers from focusing on short-term results without regard for longer-term consequences; and |

| |

| • | Compensation decisions include subjective considerations, which limit the influence of strictly formulaic factors on excessive risk taking. |

In addition, our Compensation Committee considered compensation risk implications during its deliberations on the design of our 2020 executive compensation programs with the goal of appropriately balancing short-term incentives and long-term performance.

Director Nominees

The Corporate Governance Committee considers candidates for Director who are recommended by its members, by other Board members, by shareholders, and by management, as well as those identified by third-party search firms retained to assist in identifying and evaluating possible candidates. The Board does not have a specific diversity policy but fully appreciates the value of Board diversity.

In evaluating candidates for Board membership, the Board and the Corporate Governance Committee consider many factors based on the specific needs of the business and what is in the best interests of the Company’s shareholders. This includes diversity of professional experience, military service, age, gender, race, ethnicity, and cultural background. In February 2019, the Board and the Corporate Governance Committee amended the Company's Corporate Governance Principles to remove the mandatory retirement provision that stated that no director shall stand for re-election after attaining age 75, other than by Board exception on a case-by-case basis upon a

|

| | |

| | | |

| 7 | FLIR | 2020 PROXY STATEMENT |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

| |

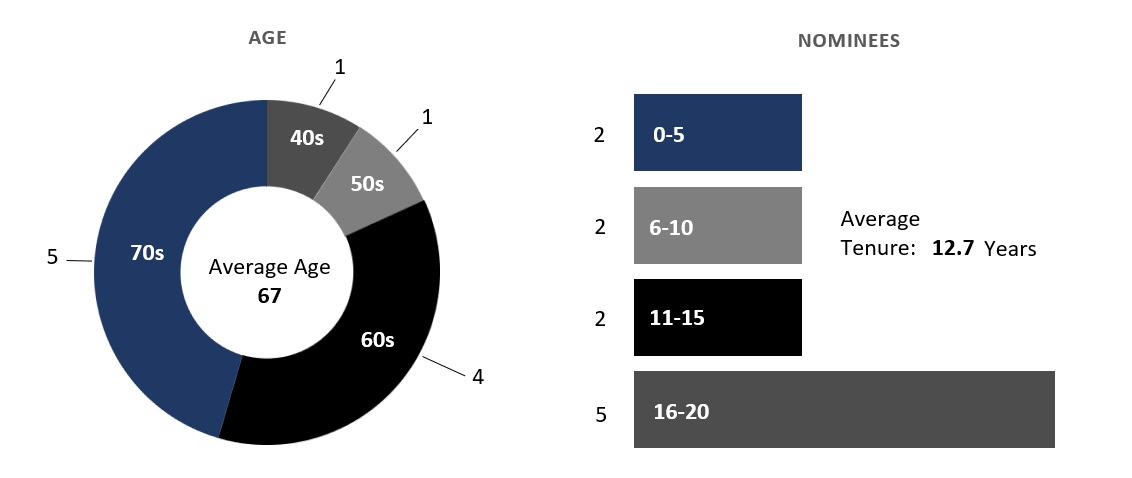

finding that doing so is in the best interest of the Company. The Board and the Corporate Governance Committee focus on how the experiences and skill sets of each Director nominee complement those of fellow Director nominees to create a balanced Board with diverse viewpoints and deep expertise. Certain characteristics of our director nominees are highlighted below:

| |

| ◦ | One self-identifying LGBTQ Director |

| |

| • | Veterans of U.S. Armed Forces |

| |

| ◦ | Three U.S. military veteran Directors |

| |

| ◦ | Five Directors meet the Securities and Exchange Commission’s (SEC) criteria as “audit committee financial experts” |

| |

| • | CEO Leadership Experience |

| |

| ◦ | Six Directors are current or former CEOs who add to the effectiveness of the Board through leadership experience in large, complex organizations and expertise in corporate governance, strategic planning and risk management |

The Board of Directors nominates the following individuals to serve on the Board. |

| | | |

| Nominees: | Age | Director Since | Position Held with FLIR |

| James J. Cannon | 49 | 2017 | Director and Chief Executive Officer |

| John D. Carter | 74 | 2003 | Director |

| William W. Crouch | 78 | 2005 | Director |

| Catherine A. Halligan | 56 | 2014 | Director |

| Earl R. Lewis | 76 | 1999 | Chairman of the Board of Directors |

| Angus L. Macdonald | 65 | 2001 | Director |

| Michael T. Smith | 76 | 2002 | Director |

| Cathy A. Stauffer | 60 | 2014 | Director |

| Robert S. Tyrer | 62 | 2017 | Director |

| John W. Wood, Jr. | 76 | 2009 | Director |

| Steven E. Wynne | 67 | 1999 | Director |

|

| | |

| | | |

| 2020 PROXY STATEMENT | FLIR | 8 |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS |

| |

|

| | |

| Nominees |

James J Cannon

Age: 49 Director Since: 2017 Position Held: President, CEO and Director | | Mr. Cannon has served as a director of the Company since June 2017. Previously, Mr. Cannon was an employee of Stanley Black & Decker, Inc. since 2001, most recently as President, Stanley Security, North America & Emerging Markets, since October 2014. Previously, Mr. Cannon was President of Stanley Oil & Gas from August 2012 to October 2014, President of Stanley Industrial & Automotive Repair, Europe and Latin America, from July 2011 to August 2012, and President of Stanley Industrial and Automotive Repair, North America from February 2009 to July 2011. Prior to that, from 1989 to 1999, Mr. Cannon served in the United States Army in various locations around the world as an infantryman and armor officer, including Operations Desert Shield and Desert Storm in Iraq, where he was awarded a Combat Infantryman’s Badge. Mr. Cannon is a graduate of the University of Tennessee, Chattanooga, with a B.S. in Business Administration/Marketing. Mr. Cannon is a member of the Board of Directors of Lydall, Inc.

Mr. Cannon’s experience in the United States Army, prior executive experience and his position as Chief Executive Officer provide the knowledge and expertise to understand and offer guidance regarding the Company’s business operations, technologies and markets.

|

John D. Carter

Age: 74 Director Since: 2003 Position Held: Director | | Mr. Carter has served as a director of the Company since August 2003. From 2002 to 2005, Mr. Carter was a principal in the consulting firm of Imeson & Carter, which specialized in transportation and international business transactions. Mr. Carter served as President and Chief Executive Officer of Schnitzer Steel Industries Inc., a metals recycling company, from May 2005 to November 2008. Since December 1, 2008, Mr. Carter has served as Chairman of the Board of Directors of Schnitzer Steel Industries, Inc. From 1982 to 2002, Mr. Carter served in a variety of senior management capacities at Bechtel Group, Inc., and President of Bechtel Enterprises, Inc. He served as director of Jeld-Wen, Inc. until 2018. Mr. Carter is a member of the Board of Directors and has served as Chairman of the Audit Committee of Northwest Natural Holdings. He was also on the Board of the Oregon chapter of the Nature Conservancy until 2019. He received his BA in History from Stanford University and his JD from Harvard Law School.

In addition to his legal experience gained while practicing law, Mr. Carter brings many years of senior executive management experience, most recently as president and chief executive officer of a multi-billion dollar public company. This combination of legal and management experience enables Mr. Carter to provide guidance to the Company in the areas of legal risk oversight, enterprise risk management, corporate governance, financial management and corporate strategic planning.

|

General William W. Crouch (United States Army—Retired)

Age: 78 Director Since: 2005 Position Held: Director | | General Crouch has served as a director of the Company since May 2005. General Crouch retired from the United States Army in 1999 following a 36-year career during which he served in numerous roles including Commanding General-Eighth Army and Chief of Staff, United Nations Command and United States Forces Korea; Commander in Chief, United States Army, Europe; Commanding General, NATO Implementation (later Stabilization) Force, Bosnia/Herzegovina; and the United States Army’s 27th Vice Chief of Staff. Until 2010, he served as one of five generals who oversaw the Army’s Battle Command Training Program. In October 2000, General Crouch was named co-chair of the USS COLE Commission, which was formed to examine the terrorist attack on the USS COLE. He has served as a Distinguished Senior Fellow with the Center for Civil Military Operations at the United States Naval Postgraduate School, and serves on the Board of the Keck Institute for International and Strategic Studies at Claremont McKenna College. He received a B.A. in Civil Government from Claremont McKenna College, and a M.A. in History from Texas Christian University. He holds a Masters Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization.

General Crouch’s career as an Army officer and continuing interest in the United States military afford the Company significant insight into the Company’s important military customers in terms of strategic and tactical doctrines and how the Company’s products should be developed and adapted to facilitate the implementation of these doctrines and how the Company's products should be developed and adapted to facilitate the implementation of these doctrines. General Crouch also possesses an understanding of the political and military realities in certain global regions in which the Company’s products are employed. In addition, General Crouch’s experience in senior leadership roles in large Army commands enables him to offer guidance on the leadership of complex organizations such as the Company.

|

|

| | |

| | | |

| 9 | FLIR | 2020 PROXY STATEMENT |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

| |

|

| | |

Catherine A. Halligan

Age: 56 Director Since: 2014 Position Held: Director | | Ms. Halligan has served as a director of the Company since March 2014. Ms. Halligan has served as Advisor to Narvar, a provider of supply chain and post purchase optimization SaaS technology, since 2013. Previously, Ms. Halligan was an Advisor to PowerReviews Inc., a leading social commerce network, from January to March 2012 and Senior Vice President Sales and Marketing from July 2010 to January 2012. Prior to joining PowerReviews Inc., Ms. Halligan held several executive level positions with prominent retailers. From 2005 to 2010, Ms. Halligan served in various executive positions with Walmart, a retailer, including as Vice President Market Development, Global eCommerce from 2009 to 2010 and as Chief Marketing Officer of Walmart.com from 2007 to 2009 along with other executive roles from 2005 to 2009. From 2000 to 2005, Ms. Halligan was an associate partner at Prophet, a management consulting firm. From 1996 to 1999, Ms. Halligan held retail management positions with Williams Sonoma Inc., including Vice President and General Manager, Internet and Vice President, Marketing. Ms. Halligan also has previous executive marketing retail experience with Blue Nile, Inc. and the Gymboree Corporation. Ms. Halligan began her career as a Marketing and Planning Analyst for Lands’ End from 1987 to 1991. Since January 2012, Ms. Halligan has served as an independent director at Ulta Beauty, where she chairs the Compensation Committee and is a member of the Nominating and Governance Committee, and previously served for two years on the Audit Committee. Ms. Halligan is also on the board of Ferguson plc, a FTSE 100 company, and is a member of the Audit, Nomination and Remuneration Committees.

With over 20 years of experience in marketing, digital and e-commerce within the retail industry, Ms. Halligan provides significant expertise with respect to strategic marketing issues, Internet technology and omnichannel business capabilities.

|

Earl R. Lewis

Age: 76 Director Since: 1999 Position Held: Chairman of the Board of Directors | | Mr. Lewis served as Chairman, President and Chief Executive Officer of the Company from November 2000 until his retirement in May 2013 as President and Chief Executive Officer. He continues to serve as Chairman of the Board. Mr. Lewis was initially elected to the Board in June 1999 in connection with the acquisition of Spectra Physics AB (which at the time owned approximately 35% of the Company) by Thermo Instrument Systems, Inc. Prior to joining FLIR, Mr. Lewis served in various capacities at Thermo Instrument Systems, Inc., with his last role as President and Chief Executive Officer. Mr. Lewis is a member of the Board of Directors of Harvard BioScience and NxStage Medical, Inc. Mr. Lewis is a Trustee of Clarkson University and New Hampton School. Mr. Lewis holds a B.S. from Clarkson College of Technology and has attended post-graduate programs at the University of Buffalo, Northeastern University and Harvard University. Mr. Lewis holds a Masters Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization.

Mr. Lewis’ leadership of the Company in the past decade affords him a deep understanding of the Company’s technology and operations, as well as the markets in which the Company operates. Mr. Lewis’ prior service in executive management positions and his past and present service on other boards of directors, including public company boards, enable him to provide insight and guidance in an array of areas including global operations and strategic planning, enterprise risk management, and corporate governance. Mr. Lewis has played, and continues to play, an active role in the Company’s financial management and corporate development, including merger and acquisition activity.

|

Angus L. Macdonald

Age: 65 Director Since: 2001 Position Held: Director | | Mr. Macdonald has served as a director of the Company since April 2001. In 2000, Mr. Macdonald founded and is currently President of Venture Technology Merchants, LLC, an advisory and merchant banking firm to growth companies regarding capital formation, corporate development and strategy. From 1996 to 2000, Mr. Macdonald was Senior Vice President and headed Special Situations in the health care equities research group at Lehman Brothers, Inc. Prior to joining Lehman Brothers, Mr. Macdonald was a senior securities analyst at Fahnestock, Inc. (now Oppenheimer). He holds a B.A. from the University of Pennsylvania and an MBA from Cranfield University, U.K., and has attended post graduate courses at Harvard Business School including specific programs on Compensation Committee and also Audit Committee best practices. Mr. Macdonald holds an Advanced Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization.

Through his more than 30 years of experience in investment and merchant banking, Mr. Macdonald has developed extensive expertise in corporate development strategies for technology enterprises such as the Company as well as in financial structuring and strategy. Mr. Macdonald’s years of experience in the financial services sector benchmarking and comparing best practices operationally as well as from an executive management and compensation perspective, provide the Company with insight into the value creation impacts of various financial and operational strategies. These skills enable him to successfully serve as a member of the Company’s Audit and Compensation Committees and to provide insight to the Company in the development of its financial management, capital deployment, employee compensation and executive retention strategies.

|

|

| | |

| | | |

| 2020 PROXY STATEMENT | FLIR | 10 |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS |

| |

|

| | |

Michael T. Smith

Age: 76 Director Since: 2002 Position Held: Director | | Mr. Smith has served as a director of the Company since July 2002. From 1997 until his retirement in May 2001, Mr. Smith was Chairman of the Board and Chief Executive Officer of Hughes Electronics Corporation. From 1985 until 1997, he served in a variety of capacities for Hughes, including Vice Chairman of Hughes Electronics, Chairman of Hughes Missile Systems and Chairman of Hughes Aircraft Company. Prior to joining Hughes in 1985, Mr. Smith spent nearly 20 years with General Motors in a variety of financial management positions. Mr. Smith is also a director of Teledyne Technologies Incorporated, WABCO Holdings Inc., and Zero Gravity Solutions. He was previously a director of Ingram Micro. Mr. Smith holds a B.A. from Providence College and an MBA from Babson College. He also served as an officer in the United States Army.

Throughout his career, Mr. Smith has had extensive financial and general management experience, including service as the chief executive officer of a large public company. These skills and experiences qualify him to serve as the Company’s Audit Committee financial expert and also provide the Company with expertise in corporate governance, enterprise risk management and strategic planning as well as in the areas of global operations and corporate strategic development.

|

Cathy A. Stauffer

Age: 60 Director Since: 2014 Position Held: Director | | Ms. Stauffer has served as a director of the Company since March 2014. From September 2005 to 2016 Ms. Stauffer owned and operated her own consulting company, Cathy Stauffer Consulting, providing strategic advice to CEOs and public and private companies primarily focused on new technology and changing consumer and commercial markets. In 2010, Ms. Stauffer also served as the Executive Vice President for Premier Retail Networks, a Technicolor owned digital media company. From 2004 to 2005, Ms. Stauffer served as Senior Vice President Marketing and Chief Marketing Officer for Gateway Computers, a global personal computer and consumer electronics company. Beginning in 1977, Ms. Stauffer served in multiple capacities, including as President for The Good Guys, Inc., a consumer electronics specialty retailer where she was closely involved in every new consumer technology launch from the compact disc player to the smart phone. Ms. Stauffer also currently serves as the Chairman of Beverages & More, Inc., a leading specialty retailer of food, beverage and alcohol products; on the board of The SWIG Company, a national commercial real estate investment firm; and on the Senior Advisory Board of TowerBrook Capital Partners. Ms. Stauffer is a member of Consumer Technology Association's Board of Industry Leaders, and, is a NACD Board Leadership Fellow.

Ms. Stauffer brings to the Board 30+ years of executive leadership and operating experience in technology, innovation, marketing, communications and strategic partnerships, and valuable insight related to consumer and commercial technology markets, new product development, strategic marketing and board governance and oversight.

|

Robert S. Tyrer

Age: 62 Director Since: 2017 Position Held: Director | | Mr. Tyrer has served as a director of the Company since October 2017. Mr. Tyrer is currently the co- president of The Cohen Group, a business advisory firm providing strategic advice and assistance in business development, regulatory affairs, deal sourcing, and capital raising activities, a position he has held since 2001. Previously, he served as the Chief of Staff to the United States Secretary of Defense William Cohen from 1997-2001, where he provided strategic advice on all aspects of national security and acted as the primary liaison between the Department of Defense and Congress, the White House, other Federal agencies and private industry. Prior to entering the Pentagon, Mr. Tyrer served 21 years on Capitol Hill in a variety of congressional staff roles, including Chief of Staff to then-Senator William Cohen of Maine from 1989-1996 and campaign manager for U.S. Senator Susan Collins in her successful 1996 U.S. Senate campaign. Mr. Tyrer is a graduate of the University of Maine and a member of the Advisory Board of the University of Maine’s School of Policy and International Affairs. He is a Senior Adviser at the Center for Strategic and International Studies in Washington, DC. He served as a member of the board of directors of EDO Corporation, a military and commercial products and professional services company, for four years until the company was purchased by ITT Corporation in 2007. Mr. Tyrer also served on the Board of Directors of Clean Air Power, a publicly-traded company based in the United Kingdom, from 2014 until it was acquired in 2015. He is also a member of the Advisory Board of the Public Diplomacy Collaborative at the John F. Kennedy School of Government at Harvard University.

Mr. Tyrer’s experience in government, politics, business and consulting makes him uniquely qualified to offer guidance regarding the Company’s business operations, technologies and markets, particularly as it relates to government procurement and defense.

|

|

| | |

| | | |

| 11 | FLIR | 2020 PROXY STATEMENT |

|

| |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

| |

|

| | |

John W. Wood, Jr.

Age: 76 Director Since: 2009 Position Held: Director | | Mr. Wood has served as a director of the Company since May 2009. Mr. Wood served as Chief Executive Officer of Analogic Corporation, a leading designer and manufacturer of medical imaging and security systems, from 2003 to 2006. Prior to joining Analogic, Mr. Wood held senior executive positions over a 22-year career at Thermo Electron Corporation. He served as President of Peek Ltd., a division of Thermo Electron Corporation, and as a Senior Vice President of the parent company. He previously served as President and Chief Executive Officer of Thermedics, a subsidiary of Thermo Electron Corporation. Mr. Wood also served as a member of the board of directors of American Superconductor Corporation from 2006 to 2019. Mr. Wood earned a Bachelor’s degree in Electrical Engineering from Louisiana Tech University and a Master’s degree in Electrical Engineering from Massachusetts Institute of Technology. Mr. Wood holds a Masters Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization.

Through his academic training and his extensive executive experience with companies in relevant industries, Mr. Wood possesses the knowledge and expertise to understand and offer guidance regarding the Company’s technologies and markets. In addition, as the former chief executive officer of a public company, Mr. Wood is qualified to provide leadership in the areas of corporate governance, operations and enterprise risk management. |

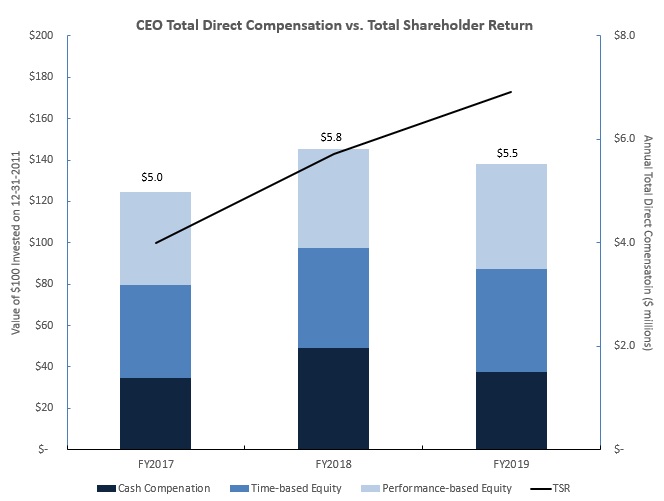

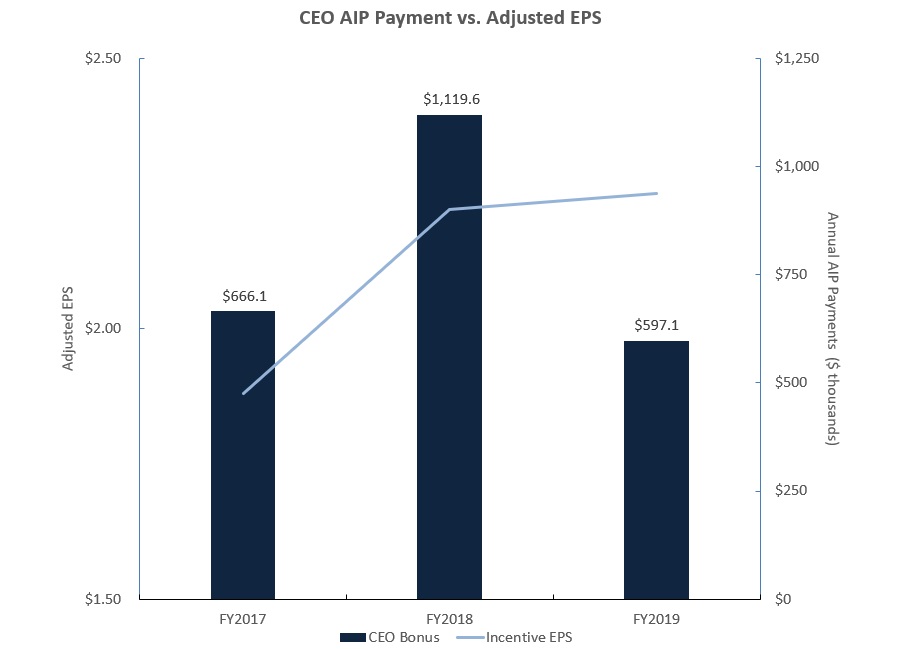

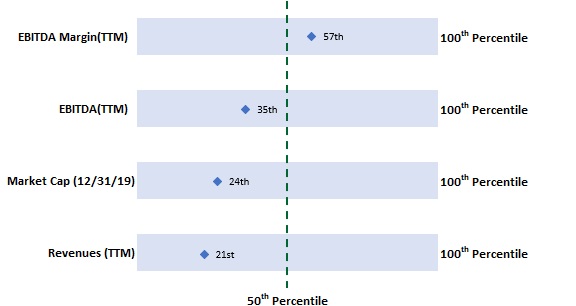

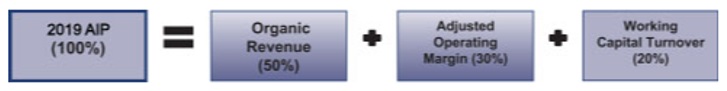

Steven E. Wynne