- FLIR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Teledyne FLIR (FLIR) DEF 14ADefinitive proxy

Filed: 8 Mar 19, 5:15pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to§240.14a-12 |

FLIR SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

The World’sSixth Sense™

27700 SW Parkway Avenue Wilsonville, Oregon 97070 (503) 498-3547 |

NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

Date and Time: |

Friday, April 19, 2019 |

Place: |

FLIR Systems, Inc. | |||

9:00 a.m. | 27700 SW Parkway Avenue | |||||

Pacific Time

| Wilsonville, Oregon 97070

|

Dear Fellow Shareholder,

It is my pleasure to invite you to attend the Annual Meeting of Shareholders of FLIR Systems, Inc. The following items are on the agenda:

| 1. | Election of Directors. We will vote to elect the eleven director nominees identified in the attached proxy statement, each for aone-year term expiring in 2020. |

| 2. | KPMG Ratification. We will vote to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019. |

| 3. | Advisory Vote on Executive Compensation. We will hold an advisory vote on executive compensation. |

| 4. | Approve the 2019 Employee Stock Purchase Plan. We will vote to approve the 2019 Employee Stock Purchase Plan (ESPP). |

| 5. | Other Business. We will transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The record date is February 22, 2019. Holders of 135,476,898 FLIR shares at the close of business on this date are entitled to notice of and to vote at the Annual Meeting.

We expect to mail to our shareholders a notice that proxy materials are available online on or about March 8, 2019. These materials will contain instructions on how to access the proxy statement for our annual meeting and our annual report to shareholders. The notice also will provide instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of proxy materials by mail. This proxy statement and our 2018 annual report on Form 10-K can be accessed directly at www.flir.com/about/investor-relations.

Earl R. Lewis

Chairman of the Board of Directors

Wilsonville, Oregon

March 8, 2019

|

| |||

Your vote is important! Please vote. The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K are available at www.flir.com/about/investor-relations and www.proxyvote.com.

IT IS IMPORTANT THAT PROXIES BE COMPLETED AND SUBMITTED PROMPTLY. THEREFORE, WHETHER OR NOT YOU PLAN TO BE PRESENT IN PERSON AT THE ANNUAL MEETING, PLEASE SUBMIT YOUR VOTE BY PROXY VIA THE INTERNET, BY TELEPHONE OR BY MAIL IN THE ENCLOSED POSTAGE-PAID ENVELOPE IN ACCORDANCE WITH THE ACCOMPANYING INSTRUCTIONS.

| ||||

| PROXY STATEMENT SUMMARY | i | |||

| CORPORATE GOVERNANCE AND RELATED MATTERS | 1 | |||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 9 | ||||

| MANAGEMENT | 10 | |||

| 10 | ||||

| LETTER FROM COMPENSATION COMMITTEE | 12 | |||

| COMPENSATION DISCUSSION AND ANALYSIS | 15 | |||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| COMPENSATION COMMITTEE REPORT | 32 | |||

| COMPENSATION OF NAMED EXECUTIVE OFFICERS | 33 | |||

| 33 | ||||

| 34 | ||||

| PROXY STATEMENT SUMMARY | | |

This summary sets forth certain performance highlights and provides an overview of the more detailed information contained later in this report. It sets forth the proposals to be voted on. You should read the entire proxy statement before casting your vote. In this proxy statement, the terms “FLIR,” “we,” and “our” and the “Company” refer to FLIR Systems, Inc.

Highlights of FLIR’s Performance

Business highlights for 2018 include the following:

The FLIR

|

2018 marked the first full year under our new chief executive officer, Jim Cannon, and executive management team and our realignment into three business units: Government and Defense, Industrial and Commercial. In addition, we began implementation of “The FLIR Method,” an operating methodology based on LEAN principles in a learning environment of continuous operational improvement to increase operational efficiencies, provide a foundation for profitability and consistent earnings growth and exceed shareholder expectations. We believe that some of the operational improvements during 2018 are the result of implementation of the FLIR method.

| |||

Revenue |

During 2018, Revenue was $1.78 Billion, compared to $1.80 Billion for 2017, a decrease of 1.4% compared to prior year, which included $140 million of revenue from the small and medium-sized (SMB) security products business which was divested in February 2018.

| |||

Operating

|

Operating margin is defined as the Company’s operating income divided by revenue for the same period. During 2018, we achieved GAAP operating margin of 17.9% compared to 16.1% in 2017 based on generally accepted accounting principles (“GAAP”).

| |||

Earnings Per |

2018 GAAP earnings per diluted share were $2.01 compared to $0.77 in 2017. GAAP net earnings in 2018 were negatively impacted by pre-tax charges of $23.3 million associated with export compliance matters including a penalty accrued in connection with a consent agreement, a pre-tax charge of $13.7 million for the loss on sale of business, and other items, partially offset by discrete tax benefits including the release of a $33.1 million previously recorded unrecognized tax position. GAAP net earnings in 2017 were negatively impacted by discrete tax charges of $94.4 million related to the U.S. Tax Cuts and Jobs Act, as well as a $23.6 million pre-tax loss on assets held for sale.

|

| 2019 PROXY STATEMENT | FLIR | i |

| CORPORATE GOVERNANCE AND RELATED MATTERS | | |

CORPORATE GOVERNANCE AND RELATED MATTERS

Shareholders and other parties interested in communicating directly with the Chairman, any Committee Chair, or with thenon-employee directors as a group may do so by contacting the Chairman of the Board, c/o Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070. Concerns relating to accounting, internal controls or auditing matters are promptly brought to the attention of the Audit Committee and handled in accordance with procedures established by the Audit Committee.

Shareholder engagement is an important element of our overall corporate governance. Our chief executive officer,

chief financial officer and other members of our management team regularly engage in dialogue with our shareholders. During 2018 and the first quarter of 2019, Company management and members of the Compensation Committee actively solicited input from the Company’s top 65 institutional shareholders regarding the Company’s executive compensation program, including the Company’s 2018 non-binding vote on executive compensation (commonly referred to as the “say-on-pay vote”), corporate governance matters and other topics of interest to the shareholder. Telephone calls and meetings were scheduled with every institutional shareholder who agreed to speak with the Company directly.

What We Heard From Shareholders

|

What FLIR Did

| |||

• Guaranteed annual incentive payments, despite their being limited to threshold and coinciding with hiring decisions, should not be provided. | • Entered into an amended employment agreement with Mr. Cannon that eliminated the guaranteed annual incentive payment for 2018 that had been provided in Mr. Cannon’s new hire employment agreement. Mr. Cannon’s 2018 annual incentive plan payment was based on achievement of the performance metrics under the 2018 AIP. See “2018 Target Cash Incentives & Actual Payments Received” on page 25.

• Actual Company performance during 2017 resulted in an annual incentive payout for Mr. Cannon that was in excess of the 2017 guaranteed amount | |||

• Disliked prior practice of providing payout for partial term performance (“banking”) feature in performance-based RSU design with a preference for complete, multi-year performance cycles. | • Established full three-year performance cycles, eliminating banking. | |||

• Growth should be a focus in incentive plan goals. | • Established target performance goals for the 2018 AIP and the performance-based RSUs that were designed to provide target payout only if we achieve significant growth and improvement over prior year performance. | |||

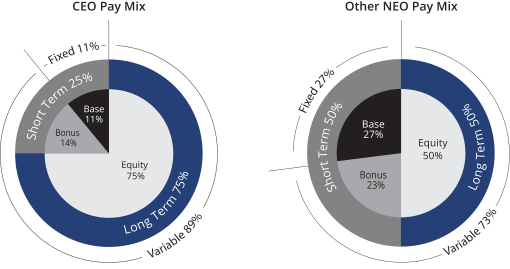

• Majority of pay should be variable and at least half of the annual LTI awards should be delivered in performance-based RSUs. | • In 2018, 89% of the annual target total direct compensation for our CEO was variable (i.e., at-risk) and 73% of the annual target total direct compensation, on average, for our other NEOs was variable.

• Performance-based RSUs comprised 50% of the 2018 long-term incentive grants to our NEOs. For our CEO, inclusive of his Leadership Performance Award, performance-based RSUs comprised 67% of his 2018 long-term incentive grants. | |||

• Additional input on desired incentive plan metrics and other executive compensation program features. | • The Compensation Committee reviews and evaluates our executive compensation program on an annual basis and we take all shareholder feedback and input into account when developing and approving the Company’s executive compensation program.

| |||

During 2018, the Company’s Board of Directors held six meetings and acted by unanimous written consent one time. In 2018, each director attended more than 75% of the total board and committee meetings. Pursuant to FLIR’s Corporate Governance Principles, each director is expected to commit

the time necessary to prepare for and attend all board and committee meetings, as well as the Annual Meeting of Shareholders. All members of the Board attended the 2018 Annual Meeting of Shareholders and all members of the Board are expected to attend the 2019 Annual Meeting of Shareholders.

| 2019 PROXY STATEMENT | FLIR | 1 |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

Board of Directors Independence

FLIR’s Corporate Governance Principles provide that the Board of Directors must be comprised of a majority of independent directors. The Board of Directors reviews annually the relationship that each director has with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and determines the independence of each director. The Board has determined that each of the directors of the Company is “independent” as defined by applicable NASDAQ rules, except for Mr. Lewis, who retired as President and Chief Executive Officer of the Company in May 2013, and Mr. Cannon, the Company’s current Chief Executive Officer. The Board of Directors took into account all relevant facts and circumstances in making this determination.

The Board of Directors has standing Audit, Compensation and Corporate Governance Committees. In 2016 the Board of Directors established an Ethics and Compliance Committee to provide enhanced focus specifically on ethics and compliance matters involving the Company and to highlight the Board’s commitment to Company compliance efforts. Each committee operates pursuant to a written charter, which is reviewed annually. The charter of each committee may be viewed online at www.flir.com/about/investor-relations. The performance of each committee is reviewed annually. Each committee may obtain advice and assistance from internal or external legal, accounting and other advisors. The members of the Audit, Compensation, Corporate Governance and Ethics and Compliance Committees have all been determined to be “independent” as defined by applicable NASDAQ rules. The current members of each committee are identified in the following table.

Name

| Audit

| Corporate

| Compensation

| Ethics and

| ||||||||||||||||

James J. Cannon

| ||||||||||||||||||||

John D. Carter

|

Chair

| |||||||||||||||||||

William W. Crouch

|

|

|

|

|

|

|

| |||||||||||||

Catherine A. Halligan

|

|

|

Chair1

|

| ||||||||||||||||

Earl R. Lewis

| ||||||||||||||||||||

Angus L. Macdonald

|

Chair2

|

|

|

| ||||||||||||||||

Michael T. Smith

|

|

|

|

| ||||||||||||||||

Cathy A. Stauffer

|

|

|

| |||||||||||||||||

Robert S. Tyrer

|

| |||||||||||||||||||

John W. Wood, Jr.

|

| |||||||||||||||||||

Steven E. Wynne

|

|

|

|

Chair

|

| |||||||||||||||

| 1 | Ms. Halligan became Chair of the Compensation Committee succeeding Mr. Macdonald beginning with the Compensation Committee’s July 2018 meeting. |

| 2 | Mr. Macdonald became Chair of the Audit Committee succeeding Mr. Smith beginning with the Audit Committee’s July 2018 meeting. Prior to becoming Chair of the Audit Committee, Mr. Macdonald was Chair of the Compensation Committee. |

| 3 | Mr. Tyrer became a member of the Audit Committee beginning with the Audit Committee’s October 2018 meeting. |

The Audit Committee is responsible for, among other things: overseeing the integrity of the Company’s financial statements and financial reporting process; the independent registered public accounting firm’s qualifications, appointment and independence; the performance of the internal audit function; the review of all third-party transactions involving, directly or indirectly, the Company and any of its directors or officers; and the adequacy of the Company’s accounting and internal control systems. During fiscal year 2018, the Audit Committee held five meetings.

The Compensation Committee is responsible for, among other things: all matters relating to the compensation of the Company’s executives, including salaries, bonuses, fringe benefits, incentive compensation, equity-based

compensation, retirement benefits, severance pay and benefits, and compensation and benefits in the event of a change of control of the Company, oversee and evaluate the performance of the Company’s CEO, oversee the administration of the Company’s talent management process, and executive talent management and succession. The Compensation Committee also administers the Company’s equity compensation plans. See also the “Compensation Discussion and Analysis” section of this Proxy Statement for additional details on the governance of the Compensation Committee and a description of the Company’s processes and procedures for determining executive compensation. During 2018, the Compensation Committee held eight meetings.

| 2 | FLIR | 2019 PROXY STATEMENT |

| CORPORATE GOVERNANCE AND RELATED MATTERS | | |

The Corporate Governance Committee is responsible for, among other things: recommending to the Board operating policies to ensure an appropriate level of corporate governance; overseeing the Board’s annual self- evaluation; identifying qualified candidates to serve on the Board; determining the qualification of Board members; evaluating the size and composition of the Board and its committees; reviewing the Company’s Corporate Governance Principles; in conjunction with the Compensation Committee, reviewing the compensation policies fornon-employee directors; providing oversight assistance of management activities relating to the integrity and security of the Company’s information technology systems, including with the full Board review and oversight of the Company’s cybersecurity initiatives; and recommending nominees to stand for election at each annual meeting of shareholders. The Corporate Governance Committee seeks candidates to serve on the Board who are persons of integrity, with significant accomplishments and recognized business experience, but does not have any specific minimum qualifications or criteria for director nominees. As required by its charter, the Corporate Governance Committee considers diversity of backgrounds, experiences, expertise, skill sets and viewpoints when considering nominees for director. We actively seek director candidates who bring diversity of age, gender, nationality, race, ethnicity, and sexual orientation. During each board meeting, the Corporate Governance Committee reviews candidates for directorship assembled in the previous quarter. During 2018, the Corporate Governance Committee held four meetings.

The Ethics and Compliance Committee was established in 2016 to provide enhanced focus specifically on ethics and compliance matters involving the Company and to highlight the Board’s commitment to Company compliance efforts and is responsible for, among other things: at the direction of the Board, to make recommendations regarding the Company’s corporate compliance and ethics posture, programs, policies and procedures to facilitate the operation of the Company in a compliant and ethical manner; as may be requested by the Board from time to time, to develop and recommend to the Corporate Governance Committee or Board for approval, revisions to the Company’s corporate governance principles with respect to the Company’s ethics and compliance; as requested by the Board, review and make recommendations regarding the content of the Company’s Code of Ethical Business Conduct and Code of Ethics for Senior Financial Officers; and as requested by the Board, review and make recommendations to the Board or Corporate Governance Committee with respect to policies and programs to facilitate compliance with the Company’s Code of Ethical Business Conduct, Corporate Governance Principles, and Corporate policies and procedures addressing the ethical and compliance operations of the Company, as adopted and amended from time to time by the Board. The members of the Ethics and Compliance Committee were instrumental in reviewing and remediating the Company’s compliance efforts and facilitating the Company’s Consent Agreement with the United States Department of State. During 2018, the Ethics and Compliance Committee held five meetings.

Shareholder Nominations and Proxy Access

The Corporate Governance Committee will review recommendations from shareholders of individuals for consideration as candidates for election to the Board of Directors. Any such recommendation should be submitted in writing to the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070. Our Bylaws set forth procedures that must be followed by shareholders seeking to nominate directors. Our Fourth Restated Bylaws include proxy access, which permits eligible shareholders to nominate candidates for election to the Board. Our Bylaws allow a shareholder or a group of no more than 20 shareholders that has maintained continuous ownership of 3% or more of the Company’s Common Stock for at least three years to include in the Company’s proxy materials nominees for election as director for an annual meeting of shareholders. With our current board consisting of eleven members, eligible shareholders may nominate a number of director nominees not to exceed two of the directors then in office. To nominate a director, the shareholder must provide the information required by our Bylaws. In addition, the shareholder must give timely notice to our Corporate Secretary in accordance with our Bylaws, which, in general, require that the notice be received by our Corporate Secretary within the period described under “Dates for Submission of Shareholder Proposals for 2020 Annual Meeting of Shareholders” section of this Proxy Statement. Each notice given by a shareholder with respect to nominations for the election of directors must comply with the requirements of Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and our Bylaws.

FLIR maintains a Governance page on its website that provides specific information about its corporate governance initiatives, including FLIR’s Corporate Governance Principles, Code of Ethical Business Conduct, Code of Ethics for Senior Financial Officers and charters for the committees of the Board of Directors. The Governance page can be found on our website at www.flir.com/about/investor-relations. To the extent mandated by legal requirements, we intend to disclose on our website any amendments or waivers to our Corporate Governance Principles, Code of Ethical Business Conduct, and Code of Ethics for Senior Financial Officers.

On February 6, 2019, the Board of Directors, based on the recommendation of the Corporate Governance Committee, determined that it was in the best interest of the Company and its shareholders to remove the mandatory retirement age provision of our Corporate Governance Principles. In making this determination, the Board of Directors considered not only the valuable guidance and experience that each of the specific director nominees that would have otherwise been impacted by this policy provides the Board, but also the fact that an arbitrary limitation on the age of a potential director limits the Board of Directors’ ability to consider the widest

| 2019 PROXY STATEMENT | FLIR | 3 |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

variety of potential director nominees, especially given that age does not necessarily diminish a person’s ability to bring a history of significant accomplishments and leadership, and valuable experience, skills and characteristics to the Board. In making this change the Board also reconfirmed its commitment to complete diversity of its Board.

FLIR’s policies and practices reflect corporate governance initiatives that are compliant with the listing requirements of NASDAQ and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, as amended (“SOX”) and the Dodd-Frank Wall Street Reform and Consumer Protection Act, as amended (the “Dodd-Frank Act”), including:

| • | The Board of Directors has adopted clear corporate governance policies; |

| • | A majority of the Board members are independent of FLIR and its management based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by NASDAQ; |

| • | All members of the Board’s Audit, Compensation, Corporate Governance, and Ethics and Compliance Committees are independent based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by NASDAQ, SOX, and the Dodd-Frank Act; |

| • | The independent members of the Board of Directors meet regularly without the presence of management; |

| • | FLIR has a Code of Ethical Business Conduct; |

| • | The charter of each Board committee clearly establishes its role and responsibilities; |

| • | FLIR has a Chief Compliance Officer and an Internet-based hotline monitored by EthicsPoint® that is available to all employees, and FLIR’s Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal controls or auditing matters; and |

| • | FLIR has adopted a Code of Ethics for Senior Financial Officers that applies to its Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer/Corporate Controller, Vice President of Global Tax and Planning, Corporate Treasurer, Vice President of Global Finance Operations, Business Unit Controllers and Site Controllers. |

You may obtain copies of the documents posted on FLIR’s Governance page on its website by writing to the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070.

Board Leadership Structure and Role in Risk Oversight

The Company has a separate Chairman of the Board and Chief Executive Officer structure. In addition, the Chairman of

the Company’s Corporate Governance Committee serves as Presiding Director for the executive sessions of the independent directors. The Board has determined that this structure is appropriate for the Company at this time as it most fully maximizes our Chairman’s extensive knowledge of the Company’s business and industry. The Board acknowledges that no single leadership model is right for all companies, however, so the Board periodically reviews its leadership structure.

The Board is actively involved in oversight of risks inherent in the operation of the Company’s business including, without limitation, those risks described in the Company’s reports filed from time to time with the Securities and Exchange Commission (“SEC”). It is management’s responsibility to manage risk and bring to the Board’s attention the material risks to the Company. The Board has oversight responsibility for the processes established to report and monitor systems for material risks applicable to the Company. The Board manages this responsibility at the Board level with assistance from its four committees, as appropriate. The Board has delegated to the Audit Committee certain tasks related to the Company’s risk management process. The Audit Committee (i) serves as an independent and objective body to monitor the Company’s financial reporting process and internal control systems and (ii) assists the Board in oversight of the Company’s compliance with legal and regulatory requirements. The Board has delegated to the Compensation Committee responsibility for oversight of management’s compensation risk assessment, including the annual determination of whether or not the Company’s compensation policies and practices are reasonably likely to have a material adverse effect on the Company. The Corporate Governance Committee oversees the Company’s risks in the areas of corporate governance and is primarily responsible for the integrity and security of the Company’s information technology systems, including the review and oversight of the Company’s cybersecurity initiatives, Board and committee performance and membership and compensation and director nomination/succession. The Ethics and Compliance Committee at the direction of the Board of Directors provides enhanced oversight and makes recommendations concerning the Company’s compliance and ethics posture. These committees report the results of their review processes to the full Board during regularly scheduled Board meetings or more frequently, if warranted. In addition to review and discussion of reports prepared by the committees of the Board, the Board periodically discusses risk oversight in specific areas as they arise, including as part of its corporate strategy review.

Company management annually conducts an assessment of our compensation policies and practices, including our executive compensation programs, to evaluate the potential risks associated with these policies and practices. Management has reviewed and discussed the findings of the assessment with the Compensation Committee concluding that our compensation programs are designed with an

| 4 | FLIR | 2019 PROXY STATEMENT |

| CORPORATE GOVERNANCE AND RELATED MATTERS | | |

appropriate balance of risk and reward and do not encourage excessive or unnecessary risk-taking behavior. As a result, we do not believe that risks relating to our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on the Company.

In conducting this review, management considered the following attributes of our programs:

| • | Mix of base salary, annual incentive opportunities, and long-term equity compensation; |

| • | Balance between annual and longer-term performance opportunities; |

| • | Alignment of annual and long-term incentives to ensure that the awards encourage consistent behaviors and achievable performance results over the long term; |

| • | Use of equity awards (performance-based and time-based) that vest over time and in some cases attach additional holding periods after vesting; |

| • | Generally providing senior executives with long-term equity-based compensation on an annual basis. We believe that accumulating equity over a period of time encourages executives to take actions that promote the long-term sustainability of our business; |

| • | Stock ownership guidelines that are reasonable and designed to align the interests of our executive officers with those of our shareholders. This discourages executive officers from focusing on short-term results without regard for longer-term consequences; and |

| • | Compensation decisions include subjective considerations, which limit the influence of strictly formulaic factors on excessive risk taking. |

In addition, our Compensation Committee considered compensation risk implications during its deliberations on the design of our 2019 executive compensation programs with the goal of appropriately balancing short-term incentives and long-term performance.

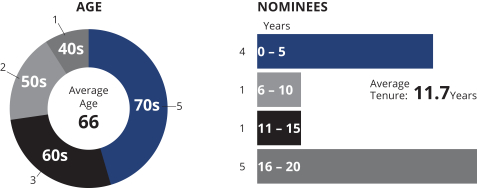

In recommending the director nominees for the Board of Directors, the Corporate Governance Committee and Board of Directors considered the backgrounds, experiences, expertise, skill sets and viewpoints of each of the director nominees and the overall composition of the Board. Certain characteristics of our director nominees are highlighted below:

The Board of Directors nominates the following individuals to serve on the Board.

Nominees:

| Age

| Director Since

| Position Held with FLIR

| |||||||||

James J. Cannon

|

|

48

|

|

|

2017

|

|

Director and Chief Executive Officer

| |||||

John D. Carter

|

|

73

|

|

|

2003

|

|

Director

| |||||

William W. Crouch

|

|

77

|

|

|

2005

|

|

Director

| |||||

Catherine A. Halligan

|

|

56

|

|

|

2014

|

|

Director

| |||||

Earl R. Lewis

|

|

75

|

|

|

1999

|

|

Chairman of the Board of Directors

| |||||

Angus L. Macdonald

|

|

64

|

|

|

2001

|

|

Director

| |||||

Michael T. Smith

|

|

75

|

|

|

2002

|

|

Director

| |||||

Cathy A. Stauffer

|

|

59

|

|

|

2014

|

|

Director

| |||||

Robert S. Tyrer

|

|

61

|

|

|

2017

|

|

Director

| |||||

John W. Wood, Jr.

|

|

75

|

|

|

2009

|

|

Director

| |||||

Steven E. Wynne

|

|

67

|

|

|

1999

|

|

Director

| |||||

| 2019 PROXY STATEMENT | FLIR | 5 |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

Nominees

James J Cannon

Age: 48 Director Since: 2017 Position Held: President, CEO and Director

| Mr. Cannon has served as a director of the Company since June 2017. Previously, Mr. Cannon was an employee of Stanley Black & Decker, Inc. since 2001, most recently as President, Stanley Security, North America & Emerging Markets, since October 2014. Previously, Mr. Cannon was President of Stanley Oil & Gas from August 2012 to October 2014, President of Stanley Industrial & Automotive Repair, Europe and Latin America, from July 2011 to August 2012, and President of Stanley Industrial and Automotive Repair, North America from February 2009 to July 2011. Prior to that, from 1989 to 1999, Mr. Cannon served in the United States Army in various locations around the World as an infantryman and armor officer, including Operations Desert Shield and Desert Storm in Iraq, where he was awarded a Combat Infantryman’s Badge. Mr. Cannon is a graduate of the University of Tennessee, Chattanooga, with a B.S. in Business Administration/Marketing. Mr. Cannon is a member of the Board of Directors of Lydall, Inc. Mr. Cannon’s experience in the United States Army, prior executive experience and his position as Chief Executive Officer provide the knowledge and expertise to understand and offer guidance regarding the Company’s business operations, technologies and markets. | |||

John D. Carter

Age: 73 Director Since: 2003 Position Held: Director

| Mr. Carter has served as a director of the Company since August 2003. From 2002 to 2005, Mr. Carter was a principal in the consulting firm of Imeson & Carter, which specialized in transportation and international business transactions. Mr. Carter served as President and Chief Executive Officer of Schnitzer Steel Industries Inc., a metals recycling company, from May 2005 to November 2008. Since December 1, 2008, Mr. Carter has served as Chairman of the Board of Directors of Schnitzer Steel Industries, Inc. From 1982 to 2002, Mr. Carter served in a variety of senior management capacities at Bechtel Group, Inc. Mr. Carter is a member of the Board of Directors and Chairman of the Audit Committee of Northwest Natural Holdings. He received his BA in History from Stanford University and his JD from Harvard Law School. In addition to his legal experience gained while practicing law, Mr. Carter brings many years of senior executive management experience, most recently as president and chief executive officer of a multi-billion dollar public company. This combination of legal and management experience enables Mr. Carter to provide guidance to the Company in the areas of legal risk oversight, enterprise risk management, corporate governance, financial management and corporate strategic planning. | |||

General William W. Crouch (United States Army—Retired)

Age: 77 Director Since: 2005 Position Held: Director | General Crouch has served as a director of the Company since May 2005. General Crouch retired from the United States Army in 1999 following a36-year career during which he served in numerous roles including Commanding General—Eighth Army and Chief of Staff, United Nations Command and United States Forces Korea; Commander in Chief, United States Army, Europe; Commanding General, NATO Implementation (later Stabilization) Force, Bosnia/Herzegovina; and the United States Army’s 27th Vice Chief of Staff. Until 2010, he served as one of five generals who oversaw the Army’s Battle Command Training Program. In October 2000, General Crouch was namedco-chair of the USS COLE Commission, which was formed to examine the terrorist attack on the USS COLE. He has served as a Distinguished Senior Fellow with the Center for Civil Military Operations at the United States Naval Postgraduate School, and serves on the Board of the Keck Institute for International and Strategic Studies at Claremont McKenna College. He received a B.A. in Civil Government from Claremont McKenna College, and a M.A. in History from Texas Christian University. He holds a Masters Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization. General Crouch’s career as an Army officer and continuing interest in the United States military afford the Company significant insight into the Company’s important military customers in terms of strategic and tactical doctrines and how the Company’s products should be developed and adapted to facilitate the implementation of these doctrines. General Crouch also possesses an understanding of the political and military realities in certain global regions in which the Company’s products are employed. In addition, General Crouch’s experience in senior leadership roles in large Army commands enables him to offer guidance on the leadership of complex organizations such as the Company.

| |||

Catherine A. Halligan

Age: 56 Director Since: 2014 Position Held: Director | Ms. Halligan has served as a director of the Company since March 2014. Ms. Halligan has served as Advisor to Narvar, a provider of supply chain and post purchase optimization SaaS technology, since 2013. Previously, Ms. Halligan was an Advisor to PowerReviews Inc., a leading social commerce network, from January to March 2012 and Senior Vice President Sales and Marketing from July 2010 to January 2012. Prior to joining PowerReviews Inc., Ms. Halligan held several executive level positions with prominent retailers. From 2005 to 2010, Ms. Halligan served in various executive positions with Walmart, a retailer, including as Vice President Market Development, Global eCommerce from 2009 to 2010 and as Chief Marketing Officer of Walmart.com from 2007 to 2009 along with other executive roles from 2005 to 2009. From 2000 to 2005, Ms. Halligan was an associate partner at Prophet, a management consulting firm. From 1996 to 1999, Ms. Halligan held retail management positions with Williams Sonoma Inc., including Vice President and General Manager, Internet and Vice President, Marketing. Ms. Halligan also has previous executive marketing retail experience with Blue Nile, Inc. and the Gymboree Corporation. Ms. Halligan began her career as a Marketing and Planning Analyst for Lands’ End from 1987 to 1991. Since January 2012, Ms. Halligan has served as an independent director at Ulta Beauty, where she chairs the Compensation Committee and is a member of the Nominating and Governance Committee, and previously served for two years on the Audit Committee. Ms. Halligan is also on the board of Ferguson plc, a FTSE 100 company, and is a member of the Audit, Nomination and Remuneration Committees. With over 20 years of experience in marketing, digital ande-commerce within the retail industry, Ms. Halligan provides significant expertise with respect to strategic marketing issues, Internet technology and omnichannel business capabilities. | |||

| 6 | FLIR | 2019 PROXY STATEMENT |

| CORPORATE GOVERNANCE AND RELATED MATTERS | | |

Earl R. Lewis

Age: 75 Director Since: 1999 Position Held: Chairman of the Board of Directors | Mr. Lewis served as Chairman, President and Chief Executive Officer of the Company from November 2000 until his retirement in May 2013 as President and Chief Executive Officer. He continues to serve as Chairman of the Board. Mr. Lewis was initially elected to the Board in June 1999 in connection with the acquisition of Spectra Physics AB (which at the time owned approximately 35% of the Company) by Thermo Instrument Systems, Inc. Prior to joining FLIR, Mr. Lewis served in various capacities at Thermo Instrument Systems, Inc., with his last role as President and Chief Executive Officer. Mr. Lewis is a member of the Board of Directors of NxStage Medical, Inc. Mr. Lewis is a Trustee of Clarkson University and New Hampton School. Mr. Lewis holds a B.S. from Clarkson College of Technology and has attended post-graduate programs at the University of Buffalo, Northeastern University and Harvard University. Mr. Lewis holds a Masters Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization. Mr. Lewis’ leadership of the Company in the past decade affords him a deep understanding of the Company’s technology and operations, as well as the markets in which the Company operates. Mr. Lewis’ prior service in executive management positions and his past and present service on other boards of directors, including public company boards, enable him to provide insight and guidance in an array of areas including global operations and strategic planning, enterprise risk management, and corporate governance. Mr. Lewis has played, and continues to play, an active role in the Company’s financial management and corporate development, including merger and acquisition activity.

| |||

Angus L. Macdonald

Age: 64 Director Since: 2001 Position Held: Director | Mr. Macdonald has served as a director of the Company since April 2001. In 2000, Mr. Macdonald founded and is currently President of Venture Technology Merchants, LLC, an advisory and merchant banking firm to growth companies regarding capital formation, corporate development and strategy. From 1996 to 2000, Mr. Macdonald was Senior Vice President and headed Special Situations in the health care equities research group at Lehman Brothers, Inc. Prior to joining Lehman Brothers, Mr. Macdonald was a senior securities analyst at Fahnestock, Inc. (now Oppenheimer). He holds a B.A. from the University of Pennsylvania and an MBA from Cranfield University, U.K., and has attended post graduate courses at Harvard Business School including specific programs on Compensation Committee and also Audit Committee best practices. Mr. Macdonald holds an Advanced Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization. Through his more than 30 years of experience in investment and merchant banking, Mr. Macdonald has developed extensive expertise in corporate development strategies for technology enterprises such as the Company as well as in financial structuring and strategy. Mr. Macdonald’s years of experience in the financial services sector benchmarking and comparing best practices operationally as well as from an executive management and compensation perspective, provide the Company with insight into the value creation impacts of various financial and operational strategies. These skills enable him to successfully serve as a member of the Company’s Audit and Compensation Committees and to provide insight to the Company in the development of its financial management, capital deployment, employee compensation and executive retention strategies.

| |||

Michael T. Smith

Age: 75 Director Since: 2002 Position Held: Director | Mr. Smith has served as a director of the Company since July 2002. From 1997 until his retirement in May 2001, Mr. Smith was Chairman of the Board and Chief Executive Officer of Hughes Electronics Corporation. From 1985 until 1997, he served in a variety of capacities for Hughes, including Vice Chairman of Hughes Electronics, Chairman of Hughes Missile Systems and Chairman of Hughes Aircraft Company. Prior to joining Hughes in 1985, Mr. Smith spent nearly 20 years with General Motors in a variety of financial management positions. Mr. Smith is also a director of Teledyne Technologies Incorporated, WABCO Holdings Inc., and Zero Gravity Solutions. He was previously a director of Ingram Micro. Mr. Smith holds a B.A. from Providence College and an MBA from Babson College. He also served as an officer in the United States Army. Throughout his career, Mr. Smith has had extensive financial and general management experience, including service as the chief executive officer of a large public company. These skills and experiences qualify him to serve as the Company’s Audit Committee financial expert and also provide the Company with expertise in corporate governance, enterprise risk management and strategic planning as well as in the areas of global operations and corporate strategic development.

| |||

| 2019 PROXY STATEMENT | FLIR | 7 |

| CORPORATE GOVERNANCE AND RELATED MATTERS | |

Cathy A. Stauffer

Age: 59 Director Since: 2014 Position Held: Director | Ms. Stauffer has served as a director of the Company since March 2014. From September 2005 to 2016 Ms. Stauffer owned and operated her own consulting company, Cathy Stauffer Consulting, providing strategic advice to CEOs and public and private companies primarily focused on new technology and changing consumer and commercial markets. In 2010, Ms. Stauffer also served as the Executive Vice President of Market Development for Premier Retail Networks, a Technicolor owned digital media company. From 2004 to 2005, Ms. Stauffer served as Senior Vice President Marketing and Chief Marketing Officer for Gateway Computers, a global personal computer and consumer electronics company. Beginning in 1977, Ms. Stauffer served in multiple capacities, including as President and EVP of Merchandising and Marketing for The Good Guys, Inc., a consumer electronics specialty retailer where she was closely involved in every new consumer technology launch from the compact disc player to the smart phone. Ms. Stauffer also currently serves as the Chairman of Beverages & More, Inc., a leading specialty retailer of alcoholic beverages and related products. In addition, Ms. Stauffer is a NACD Board Leadership Fellow and has earned the CERT Certificate in Cybersecurity Oversight awarded by the Software Engineering Institute of Carnegie Mellon University. Ms. Stauffer’s over three decades of broad and deep operating experience across a variety of industries and disciplines, brings technology innovation, marketing, communications and strategic partnership expertise that affords the Board valuable insight related to consumer and commercial technology business, new market development, marketing and customer experience.

| |||

Robert S. Tyrer

Age: 61 Director Since: 2017 Position Held: Director | Mr. Tyrer has served as a director of the Company since October 2017. Mr. Tyrer is currently theco- president of The Cohen Group, a business advisory firm providing strategic advice and assistance in business development, regulatory affairs, deal sourcing, and capital raising activities, a position he has held since 2001. Previously, he served as the Chief of Staff to the United States Secretary of Defense William Cohen from 1997-2001, where he provided strategic advice on all aspects of national security and acted as the primary liaison between the Department of Defense and Congress, the White House, other Federal agencies and private industry. Prior to entering the Pentagon, Mr. Tyrer served 21 years on Capitol Hill in a variety of congressional staff roles, including Chief of Staff to then-Senator William Cohen of Maine from 1989-1996 and campaign manager for U.S. Senator Susan Collins in her successful 1996 U.S. Senate campaign. Mr. Tyrer is a graduate of the University of Maine and a member of the Advisory Board of the University of Maine’s School of Policy and International Affairs. He is a Senior Adviser at the Center for Strategic and International Studies in Washington, DC. He served as a member of the board of directors of EDO Corporation, a military and commercial products and professional services company, for four years until the company was purchased by ITT Corporation in 2007. Mr. Tyrer also served on the Board of Directors of Clean Air Power, a publicly-traded company based in the United Kingdom, from 2014 until it was acquired in 2015. He is also a member of the Advisory Board of the Public Diplomacy Collaborative at the John F. Kennedy School of Government at Harvard University. Mr. Tyrer’s experience in government, politics, business and consulting makes him uniquely qualified to offer guidance regarding the Company’s business operations, technologies and markets, particularly as it relates to government procurement and defense.

| |||

John W. Wood, Jr.

Age: 75 Director Since: 2009 Position Held: Director | Mr. Wood has served as a director of the Company since May 2009. Mr. Wood served as Chief Executive Officer of Analogic Corporation, a leading designer and manufacturer of medical imaging and security systems, from 2003 to 2006. Prior to joining Analogic, Mr. Wood held senior executive positions over a22-year career at Thermo Electron Corporation. He served as President of Peek Ltd., a division of Thermo Electron Corporation, and as a Senior Vice President of the parent company. He previously served as President and Chief Executive Officer of Thermedics, a subsidiary of Thermo Electron Corporation. Mr. Wood is a director of American Superconductor Corporation. Mr. Wood earned a Bachelor’s degree in Electrical Engineering from Louisiana Tech University and a Master’s degree in Electrical Engineering from Massachusetts Institute of Technology. Mr. Wood holds a Masters Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization. Through his academic training and his extensive executive experience with companies in relevant industries, Mr. Wood possesses the knowledge and expertise to understand and offer guidance regarding the Company’s technologies and markets. In addition, as the former chief executive officer of a public company, Mr. Wood is qualified to provide leadership in the areas of corporate governance, operations and enterprise risk management.

| |||

| 8 | FLIR | 2019 PROXY STATEMENT |

| CORPORATE GOVERNANCE AND RELATED MATTERS | | |

Steven E. Wynne

Age: 67 Director Since: 1999 Position Held: Director | Mr. Wynne has served as a director of the Company since November 1999. Since July 2012, Mr. Wynne has served as an Executive Vice President of Health Services Group, Inc., a diversified insurance and pharmacy company, where he previously served as Senior Vice President, from February 2010 to January 2011. From January 2011 through July 2012, he served as Executive Vice- President ofJELD-WEN, Inc., an international manufacturer of doors and windows. From March 2004 through March 2007, Mr. Wynne was President and Chief Executive Officer of SBI International, Ltd., parent company of sports apparel and footwear company Fila. From August 2001 through March 2002, and from April 2003 through February 2004, Mr. Wynne was a partner in the Portland, Oregon law firm of Ater Wynne LLP. Mr. Wynne served as acting Senior Vice President and General Counsel of the Company from April 2002 through March 2003. Mr. Wynne was formerly Chairman and Chief Executive Officer of eteamz.com, an online community serving amateur athletics, from June 2000 until its sale to Active.com in January 2001. From February 1995 to March 2000, Mr. Wynne served as President and Chief Executive Officer of adidas America, Inc. Prior to that time, he was a partner in the law firm of Ater Wynne LLP. Mr. Wynne received an undergraduate degree and a J.D. from Willamette University. Mr. Wynne also serves on the boards of directors ofJELD-WEN Holding, Inc., Pendleton Woolen Mills, Lone Rock Resources and Northwest Natural Gas Company (a subsidiary of Northwest Holdings). Mr. Wynne has been associated with the Company in a variety of capacities since 1983, including prior service as its outside counsel. By virtue of this extensive relationship, Mr. Wynne has developed a high degree of familiarity with the Company’s operations, risks and opportunities. In addition, Mr. Wynne’s legal training and senior executive leadership experience with other companies qualify him to provide insight and guidance as a member of the Company’s Audit Committee, as well as in the areas of corporate governance, strategic planning and enterprise risk management. | |||

Recommendation of the Board of Directors

The Board of Directors unanimously recommends that shareholders voteFOR the election of each of its nominees for director. If a quorum is present, a director nominee will be elected if the number of votes cast FOR the nominee exceeds the number of votes cast AGAINST such nominee. Abstentions and brokernon-votes are counted for purposes of determining whether a quorum exists at the Annual Meeting, but will have no effect on the election of directors. See “Corporate Governance and Related Matters—Nominees” for information about the qualifications of the nominees.

| 2019 PROXY STATEMENT | FLIR | 9 |

| MANAGEMENT | |

The executive officers of the Company for 2018 are as follows:

Nominees:

| Age

| Position

| ||

James J. Cannon

|

48

|

Chief Executive Officer

| ||

Carol P. Lowe

|

53

|

Executive Vice President and Chief Financial Officer

| ||

Todd M. DuChene

|

55

|

Senior Vice President, General Counsel, Secretary, and Chief Ethics and Compliance Officer

| ||

Jeffrey D. Frank

|

62

|

Senior Vice President, Global Product Strategy

| ||

Anthony D. Buffum

|

37

|

Senior Vice President, Chief Human Resources Officer

|

Information concerning the principal occupations and business experience during at least the past five years of Mr. Cannon is set forth under “Corporate Governance and Related Matters—Nominees.” Information concerning the principal occupations and business experience during at least the past five years of the executive officers of the Company who are not also directors of the Company is set forth below.

Carol P. Lowe

Age: 53 Position Held: Executive Vice President and Chief Financial Officer

| Ms. Lowe has been Executive Vice President and Chief Financial Officer since November 2017. Previously, Ms. Lowe served as Senior Vice President and Chief Financial Officer at Sealed Air Corporation (NYSE: SEE). Ms. Lowe also worked for Carlisle Companies Inc. for over ten years in numerous executive leadership positions, including President of two business units and Chief Financial Officer. Ms. Lowe also served as a board member of Cytec Industries, Inc. from 2007 to 2015, and currently serves on the board of EMCOR Group, Inc., where she is a member of the Audit Committee. She received her Bachelor of Science degree in accounting from the University of North Carolina Charlotte and an MBA from the Fuqua School of Business at Duke University. | |||

Todd M. DuChene

Age: 55 Position Held: Senior Vice President, General Counsel, Secretary and Chief Ethics and Compliance Officer

| Mr. DuChene joined FLIR in September 2014 as its Senior Vice President, General Counsel and Secretary. Prior to joining FLIR, Mr. DuChene served as Executive Vice President, General Counsel and Secretary of Nuance Communications, Inc., a leading provider of speech recognition and related technology to enterprise, healthcare and mobile and consumer customers, where he was responsible for the legal, intellectual property, corporate governance and regulatory activities of the company, from October 2011 to September 2014. Previously, Mr. DuChene served as Senior Vice President, General Counsel and Secretary of National Semiconductor Corporation from January 2008 to October 2011, prior to its acquisition by Texas Instruments Inc. In addition, Mr. DuChene has served as General Counsel to each of Solectron Corporation, Fisher Scientific International Inc. (now ThermoFisher Scientific), and OfficeMax, Inc. Mr. DuChene began his legal career as a corporate lawyer with BakerHostetler in Cleveland, Ohio in 1988. Mr. DuChene is a graduate of The College of Wooster, Wooster, Ohio and the University of Michigan Law School. | |||

| 10 | FLIR | 2019 PROXY STATEMENT |

| MANAGEMENT | | |

Jeffrey D. Frank

Age: 62 Position Held: Senior Vice President, Global Product Strategy

| Prior to his promotion to Senior Vice President, Global Product Strategy in January 2014, Mr. Frank had served as the Company’s Vice President, Global Product Strategy since May 2013. Mr. Frank previously served as Vice President of Product Strategy for the Company’s Commercial Systems Division from December 2004 to May 2013. Prior to joining FLIR, Mr. Frank was a founder and served as Vice President of Business Development for Indigo Systems, Inc. commencing with that company’s inception in 1997. Mr. Frank joined FLIR upon Indigo’s acquisition by FLIR in 2004. Previously, Mr. Frank was Vice President of Business Development for Raytheon Corporation from 1994 to 1997, and for Amber Engineering from 1987 to 1994 prior to Amber’s acquisition by Raytheon Corporation. | |||

Anthony D. Buffum

Age: 37 Position Held: Senior Vice President, Chief Human Resources Officer

| Mr. Buffum has been Senior Vice President and Chief Human Resources (HR) Officer since October 2018. Previously, Mr. Buffum served as Vice President of Human Resources for Stanley Security (Global), a division of Stanley Black & Decker, from January 2018 to October 2018; Vice President Human Resources Stanley Security, North America, from January 2015 to December 2017; Vice President, Human Resources, Industrial & Automotive Repair (Global), a division of Stanley Black & Decker from October 2012 to December 2014 and prior to that as Vice President Human Resources, Industrial and Automotive Repair, North America, Asia and Europe Markets from June 2012 to October 2012. Mr. Buffum started his career at General Electric in 2003 as part of its Human Resources Leadership Program and earned his Bachelor of Science degree in Industrial and Labor Relations from Cornell University. | |||

| 2019 PROXY STATEMENT | FLIR | 11 |

| LETTER TO SHAREHOLDERS | |

Thank you for your investment in FLIR Systems, Inc. We are committed to pay practices designed to maximize principles of good governance and to strengthen the alignment between Company management and Company stakeholders, particularly our shareholders. Our program design and actual payments made to our management seek to provide competitive compensation for superior performance with the majority of executive compensation “at risk” and contingent on achievement ofpre-established metrics over a long-term period.

In order to demonstrate our commitment to shareholders, at our 2017 annual meeting of shareholders, we adopted an annual “say-on-pay” vote from our previously shareholder approved every three-year vote. At our 2018 annual meeting, our“say-on-pay” vote achieved a majority vote of our shareholders but did not achieve the level of support consistent with our prior “say-on-pay” votes.

As a result, immediately prior to the 2018 vote and during the fall/winter of 2018 and the first quarter of 2019 we engaged in an extensive shareholder outreach program to elicit shareholder feedback on Company performance, governance, and pay practices, and to highlight to shareholders the significant changes we made in our compensation program for 2018 and the continuing enhancements planned for 2019. During this outreach, we contacted our top 65 institutional shareholders, representing approximately 72% of our outstanding shares as of December 31, 2018. We held telephonic meetings with every shareholder who responded positively to our outreach efforts.

As a result of our shareholder outreach during 2018, our 2018 compensation program design featured the following shareholder identified improvements:

Annual Incentive Plan

| • | Replaced 2017 metrics of Adjusted EPS, Revenue, and Adjusted Operating Cash Flow goals with 2018 metrics of Organic Revenue Growth (50%), Adjusted Operating Margin (30%), and Working Capital Turnover (20%). We note that these same metrics have been established for 2019; and |

| • | The metrics established for 2018 (and for 2019) at target are: |

| • | Increase in Organic Revenue Growth (as defined in our Compensation Discussion and Analysis beginning on page 26). |

| • | Increase in Adjusted Operating Margin (as defined in our Compensation Discussion and Analysis beginning on page 26). |

| • | Increase in Working Capital Turnover (as defined in our Compensation Discussion and Analysis beginning on page 26). |

with threshold, target and maximum metrics set at levels that require our management team to achieve significant operational improvement over prior year performance to achieve target payouts.

Long-Term Incentive Plan (2018 and 2019)

| • | Eliminated the use of Stock Options for executive and senior officers; |

| • | 50% of the long-term incentive award opportunity isat-risk through the use of performance-based restricted stock units (PRSUs) with three-year cliff vesting and 50% is time-based RSUs vesting ratably over a three-year period; |

| • | Replaced the 2017 PRSU performance metrics of Operating Income and Revenue with Adjusted EBITDA using a three-year CAGR (50%) and Organic Revenue using a three-year CAGR (50%). Target levels of achievement for these new metrics over a three-year period are tied to challenging cumulative annual growth rates and operational efficiencies not achieved by the Company in its recent history; and |

| • | Established full three-year performance cycles, without partial vesting or any annual interim performance assessment. |

In addition to the above, on April 24, 2018, as a result of the Board of Director’s assessment of Mr. Cannon’s accomplishments, Company performance and the strategic plan he developed and has been executing on since his hire (in June 2017), the Company entered into an amended employment agreement with Mr. Cannon to secure his commitment to the Company over the long-term. The intent of this amended employment agreement was to further incent Mr. Cannon in the execution of the Company’s strategic plan to enhance shareholder value and to ensure long-term executive leadership stability as we continue to progress on our strategic plan. See “Employment Agreements” on page 30.

| 12 | FLIR | 2019 PROXY STATEMENT |

| MANAGEMENT | | |

Key details of Mr. Cannon’s amended employment agreement are:

| • | Elimination of a partial guaranteed bonus payment for 2018 that was included in Mr. Cannon’s new hire employment agreement (originally included to compensate Mr. Cannon for loss of bonus due to hismid-year start date). Our intent to provide a guaranteed partial bonus had been an expressed concern of certain of our shareholders during the shareholder outreach. We note that actual Company performance to plan during 2017 (of which Mr. Cannon played a significant role) resulted in a bonus payment for Mr. Cannon in excess of the 2017 guaranteed amount, eliminating the impact of or need for the guaranteed payment. Additional details are provided under “Employment Agreements” on page 30. |

| • | A leadership performance-based RSU award to create even greater alignment between Mr. Cannon and long-term value creation and extend the typical vesting period to enhance the retentiveness of the award. These performance-based RSUs have the same three-year CAGR Organic Revenue and adjusted EBITDA metrics as Mr. Cannon’s other 2018 equity performance-based awards but are subject to the additional requirement that Mr. Cannon remain as CEO through the fourth anniversary of the grant (for 50% of any earned shares) and through the fifth anniversary of the grant (for the remaining 50% of earned shares, if any) to vest. |

Shareholders provided their views on a number of items. Below we have summarized specific feedback we received and the actions we took in response:

What We Heard From Shareholders

|

What FLIR Did

| |||

• Guaranteed annual incentive payments, despite their being limited to threshold and coinciding with hiring decisions, should not be provided. | • Entered into an amended employment agreement with Mr. Cannon that eliminated the guaranteed annual incentive payment for 2018 that had been provided in Mr. Cannon’s new hire employment agreement. Mr. Cannon’s 2018 annual incentive plan payment was based on achievement of the performance metrics under the 2018 AIP. See “2018 Target Cash Incentives & Actual Payments Received” on page 25.

• Actual Company performance during 2017 resulted in an annual incentive payout for Mr. Cannon that was in excess of the 2017 guaranteed amount | |||

• Disliked prior practice of providing payout for partial term performance (“banking”) feature in performance-based RSU design with a preference for complete, multi-year performance cycles. | • Established full three-year performance cycles, eliminating banking. | |||

• Growth should be a focus in incentive plan goals. | • Established target performance goals for the 2018 AIP and the performance-based RSUs that were designed to provide targeted payout only if we achieve significant growth and improvement over prior year performance. | |||

• Majority of pay should be variable and at least half of the annual LTI awards should be delivered in performance-based RSUs. | • In 2018, 89% of the annual target total direct compensation for our CEO was variable (i.e., at-risk) and 73% of the annual target total direct compensation, on average, for our other NEOs was variable.

• Performance-based RSUs comprised 50% of the 2018 long-term incentive grants to our NEOs. For our CEO, inclusive of his Leadership Performance Award, performance-based RSUs comprised 67% of his 2018 long-term incentive grants. | |||

• Additional input on desired incentive plan metrics and other executive compensation program features. | • The Compensation Committee reviews and evaluates our executive compensation program on an annual basis and we take all shareholder feedback and input into account when developing and approving the Company’s executive compensation program.

| |||

We believe these compensation design enhancements have corresponded to significant improvement in the Company’s performance and business operations.

“Proposal 3: Advisory Vote on Executive Compensation” or “say-on-pay” begins on page 50 of this proxy statement. The Board of Directors unanimously recommends that shareholders voteFOR this proposal. Please review the information contained elsewhere in this proxy statement under “Compensation Discussion and Analysis” beginning on page 15 and under “Proposal 3: Advisory Vote on Executive Compensation” on page 50. We are confident that our programs are designed to motivate our executives and pay for performance that is aligned with shareholder interests.

| 2019 PROXY STATEMENT | FLIR | 13 |

| MANAGEMENT | |

In closing, we would like to thank our shareholders for their investment in FLIR and their engagement with us during the past year. Your insight and candor were most appreciated. We value the support and input of our shareholders, your investment in FLIR, and we look forward to continuing to have an open dialogue.

Sincerely,

Catherine A. Halligan, Chair of the Compensation Committee

General William W. Crouch

Angus L. Macdonald

Cathy A. Stauffer

Michael T. Smith

| 14 | FLIR | 2019 PROXY STATEMENT |

| COMPENSATION DISCUSSION AND ANALYSIS | | |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the principles and material elements of our executive compensation program, how we applied those principles in determining the material elements of the compensation for our Named Executive Officers (“NEOs”) for 2018 and how we use our executive compensation program to drive performance.

Our executive compensation program is designed to align the interests of our executive officers with those of our shareholders by providing market-competitive compensation opportunities to our executives upon the achievement of a variety of short-term and long-term objectives. The Compensation Committee reviews at least annually all elements of executive officer compensation and makes changes as needed to remain competitive, fair, reasonable and consistent with our goals of pay for performance and alignment with shareholder interests. We believe that our actions in 2018 and in prior years effectively link pay to performance.

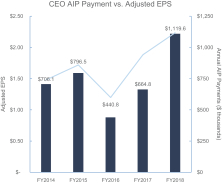

2018 was the first full year following our transition to Jim Cannon as Chief Executive Officer, the realignment of the Company’s operating structure from six segments to three operating business units, and implementation of The FLIR Method (“TFM”). In 2018, we achieved growth in our 2018 Annual Incentive Plan (“2018 AIP”) targets of organic revenue, adjusted operating margin and working capital turns, and enhanced profitability.

Our 2018 executive compensation program reflected our objectives of establishment of a foundation for building consistent long-term revenue and earnings growth, operational efficiency and improved capital management.

Our Business and Strategy

We are a world leader in sensor systems that enhance perception and awareness. Our advanced sensors and integrated sensor systems enable the creation, gathering, and analysis of critical data and images for use in a wide variety of applications in commercial, industrial, and government markets worldwide.

Our operational task is to consistently exceed shareholder commitments with integrity. And our purpose as an entity is to save lives and livelihoods. We will operate with these in mind all the time and will drive our strategies with the intention to succeed in the eyes of our customers, employees, and shareholders.

Our core values are: Be Ready, Be Bold, Be Brave, and Be Ambitious. First is Be Ready, which speaks to prioritizing speed and agility in reacting to an ever- changing technology landscape. Second is Be Bold, by pioneering and innovating to continue pushing the boundaries of what is possible in both our technology as well as our daily operations. Third is Be Brave in our actions to exhibit the utmost integrity and ethics in our daily decision-making—not usually, but always. And Fourth is Be Ambitious with a will to win, a tenacity to find the best ways to accomplish our tasks, and collaborate with the utmost respect for our teammates and our customers.

These core values serve as the standards by which our people operate and behave at FLIR, aligning culture with our business strategy. We expect our teams to feel accountable for upholding these values each and every day, and by doing so, we expect to see tangible results in our business performance.

During 2018 we also continued a business transformation through the initiative that we call The FLIR Method (“TFM”). This is a long-term investment that we expect to better enable organic growth, increase our profitability, and generate excess cash to utilize in ways that enhance shareholder returns. TFM initiatives have been launched throughout the organization with a focus on enhancing our productivity, refining our product pricing strategy, standardizing our core business terminology to better share best practices globally, implement expanded talent development programs, boost our acquisition and integration processes, and continue to develop world-class products that exceed our customers’ expectations.

2018 Business Highlights

During 2018, Revenue was $1.78 Billion, compared to $1.80 Billion for 2017, a decrease of 1.4% compared to prior year, which included $140 million of revenue from the security products businesses which were divested in February 2018. Excluding the revenue from the divested security businesses, organic revenue growth was 6% in 2018. Organic Revenue (defined as Revenue excluding the impact of acquisitions, divestitures and foreign currency translation changes) was a

| 2019 PROXY STATEMENT | FLIR | 15 |

| COMPENSATION DISCUSSION AND ANALYSIS | |

metric accounting for 50% of the 2018 AIP. The 6% organic revenue growth achieved 109% of the target Organic Revenue metric for our 2018 AIP.

During 2018, we achieved GAAP operating margin of 17.9% compared to 16.1% in 2017. Operating Margin is defined as the Company’s earnings from operations divided by revenue for the same period. Adjusted Operating Margin for purposes of the Company’s annual incentive plan is defined as Adjusted non-GAAP earnings from operations divided by Organic Revenue. Adjusted non-GAAP earnings from operations is defined as non-GAAP earnings from operations (defined as GAAP earnings from operations excluding amortization of acquired intangible assets, purchase accounting adjustments, restructuring charges, acquisition related expenses, loss on sale of business, executive transition costs, export compliance matters and other) divided by Organic Revenue. During 2018, we achieved Adjusted Operating Margin of 23.12% compared to Adjusted Operating Margin in 2017 of 21.90%, an increase in Adjusted Operating Margin of 122 basis points year over year. Adjusted Operating Margin was a metric accounting for 30% of 2018 annual incentive plan. The 122 basis point increase in Adjusted Operating Margin achieved 169% of the target Operating Margin metric for our 2018 AIP.

2018 Working Capital Turnover was 2.82x compared to 2.60x for 2017, an increase in Working Capital Turnover of 0.22x year over year. Increase in Working Capital Turnover was a metric accounting for 20% of our 2018 AIP. The increase in

Working Capital Turnover achieved 72% of the target Working Capital Turnover metric for our 2018 annual incentive plan. Working Capital Turnover is calculated as revenue divided by the trailing five-quarter average of the Company’s net working capital balances comprised of accounts receivable, inventories, demonstration assets, and accounts payable, excluding the impact of current year acquisitions and dispositions.

2018 GAAP net earnings per diluted share was $2.01 compared to $0.77 in 2017. GAAP net earnings in 2018 were negatively impacted by pre-tax charges of $23.3 million associated with export compliance matters including a penalty accrued in connection with a consent agreement, a pre-tax charge of $13.7 million for the loss on the sale of business, and other items, partially offset by discrete tax benefits including the release of a $33.1 million previously recorded unrecognized tax position. GAAP net earnings in 2017 were negatively impacted by discrete tax charges of $94.4 million related to the U.S. Tax Cuts and Jobs Act, as well as a $23.6 million pre-tax loss on assets held for sale.

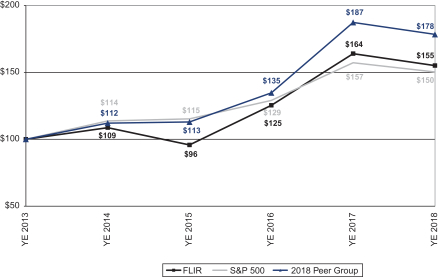

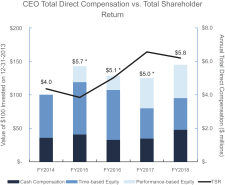

Stock Price Performance

Over the three- and five-year periods ending December 31, 2018, we outperformed the Standard & Poor’s 500 Index (the “S&P 500”) and underperformed our 2018 Peer Group (see below) in relative total shareholder return (“TSR”), as reflected in the following graph. At December 31, 2018, the closing price of our Common Stock was $43.54.

Total Shareholder Return—5 Year

| 16 | FLIR | 2019 PROXY STATEMENT |

| COMPENSATION DISCUSSION AND ANALYSIS | | |

2018 Executive Compensation Highlights

In response to shareholder communication concerning executive compensation during our shareholder outreach and as part of our regular review of compensation program design to enhance business performance and align executive compensation with shareholder expectations, the Compensation Committee approved a number of significant changes to our executive compensation programs for 2018. These changes were responsive to shareholders and more closely aligned executive compensation with organizational changes, business strategy and implementation of TFM and included the following:

What We Changed |

| Why We Changed |

| |||||

| Established performance goals for growth in Organic Revenue, Adjusted Operating Margin, and Working Capital Turnover. These measures replaced those used in our 2017 program: Adjusted EPS, Revenue and Operating Cash Flow. | To focus executives on improving returns from robust R&D spending; to continue to augment pricing discipline and cost controls; and to improve cash flow by improving working capital turnover. | ||||||

| Established a three-year performance measurement period and eliminated the “banking” feature from our old design. Replaced Operating Income and Revenue with Adjusted EBITDA CAGR and Organic Revenue CAGR as the performance goals. | Shareholder requests for three-year measurement periods; established a comprehensive performance metric commonly used for market comparison; and to capture and measure long-term value creation, while creating more direct alignment between management and shareholders over the multi-year period.

| ||||||

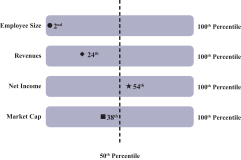

| Provided modest increases (approximately 3%) for most executives and, as described in more detail below, provided a larger increase to our CEO. | To maintain market-competitiveness consistent with our 50th percentile target market positioning. | ||||||

During 2018, the Compensation Committee made several key decisions:

| • | Base Salary—Increased annual base salaries of our NEOs to maintain market-competitiveness. Salary increases for our NEOs were approximately 3%, and higher in the case of our CEO in recognition of his accomplishments and our 50th percentile target market positioning. |