- FLIR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Teledyne FLIR (FLIR) DEF 14ADefinitive proxy

Filed: 10 Mar 17, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to§240.14a-12 |

FLIR SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

27700 SW Parkway Avenue

Wilsonville, Oregon 97070

(503) 498 -3547

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 21, 2017

To the Shareholders of FLIR Systems, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of FLIR Systems, Inc. (the “Company”) will be held on Friday, April 21, 2017, at 9:00 a.m., local time at the principal executive offices of FLIR Systems, Inc. at 27700 SW Parkway Avenue, Wilsonville, Oregon 97070 for the following purposes:

| 1. | Election of Directors. To elect the ten director nominees identified in the attached Proxy Statement, each for aone-year term expiring in 2018 and to hold office until his or her successor is elected and qualified; |

| 2. | Approval of the Executive Bonus Plan. To approve the adoption of the Amended and Restated 2012 Executive Bonus Plan for the Company’s executive officers; |

| 3. | Ratification of Appointment of the Independent Registered Public Accounting Firm. To ratify the appointment by the Audit Committee of the Company’s Board of Directors of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2017; |

| 4. | Advisory Vote on Executive Compensation. To hold an advisory vote on executive compensation; |

| 5. | Advisory Vote on Frequency of Advisory Vote on Executive Compensation. To hold an advisory vote on the frequency with which an advisory vote on executive compensation should be held; and |

| 6. | Other Business. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The Board of Directors of the Company has fixed the close of business on February 24, 2017 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof.

On or about March 10, 2017, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our annual meeting and our annual report to shareholders. This Notice provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of proxy materials by mail. This Proxy Statement and our 2016 annual report can be accessed directly at the following Internet address: www.flir.com/investor.

Earl R. Lewis

Chairman of the Board of Directors

Wilsonville, Oregon

March 10, 2017

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 21, 2017

The Notice of Annual Meeting, Proxy Statement and Annual Report on Form10-K are available at www.flir.com/ investor and www.proxyvote.com.

IT IS IMPORTANT THAT PROXIES BE COMPLETED AND SUBMITTED PROMPTLY. THEREFORE, WHETHER OR NOT YOU PLAN TO BE PRESENT IN PERSON AT THE ANNUAL MEETING, PLEASE SUBMIT YOUR VOTE BY PROXY VIA THE INTERNET, BY TELEPHONE OR BY MAIL IN THE ENCLOSED POSTAGE-PAID ENVELOPE IN ACCORDANCE WITH THE ACCOMPANYING INSTRUCTIONS.

FLIR SYSTEMS, INC.

27700 SW Parkway Avenue

Wilsonville, Oregon 97070

(503)498-3547

PROXY STATEMENT

for the

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 21, 2017

INTRODUCTION

General

This Proxy Statement is being furnished to the shareholders of FLIR Systems, Inc., an Oregon corporation (“FLIR,” the “Company,” “we,” “us,” or “our”), as part of the solicitation of proxies by the Company’s Board of Directors (the “Board of Directors” or the “Board”) from holders of the outstanding shares of FLIR common stock, par value $0.01 per share (the “Common Stock”), for use at the Company’s Annual Meeting of Shareholders to be held on April 21, 2017, at 9:00 a.m., local time at the principal executive offices of FLIR Systems, Inc. at 27700 SW Parkway Avenue, Wilsonville, OR 97070, and at any adjournment or postponement thereof (the “Annual Meeting”). At the Annual Meeting, shareholders will be asked to elect ten members to the Board of Directors, approve the adoption of the Amended and Restated 2012 Executive Bonus Plan (the “Bonus Plan”), ratify the appointment by the Audit Committee of the Board of Directors of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017, hold an advisory vote on executive compensation, hold an advisory vote on the frequency with which an advisory vote on executive compensation should be held and transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. This Proxy Statement, together with the enclosed proxy card, is first being made available to shareholders of FLIR on or about March 10, 2017.

Solicitation, Voting and Revocability of Proxies

The Board of Directors has fixed the close of business on February 24, 2017 as the record date for the determination of the shareholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of Common Stock at the close of business on such date will be entitled to vote at the Annual Meeting, with each such share entitling its owner to one vote on all matters properly presented at the Annual Meeting. On the record date, there were 136,370,293 shares of Common Stock then outstanding. The presence, in person or by proxy, of a majority of the total number of outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting.

If you are a shareholder of record, you can vote (i) by attending the Annual Meeting and voting in person, (ii) by signing, dating and mailing in your proxy card, or (iii) by following the instructions on your proxy card for voting by telephone or on the Internet. If you hold your shares through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy. If you hold your shares through a broker, bank or other nominee and would like to vote in person at the Annual Meeting, you must first obtain a proxy issued in your name from the institution that holds your shares.

If the form of proxy is properly executed and returned in time to be voted at the Annual Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon.Executed but unmarked

1

proxies will be voted FOR the election of the ten nominees to the Board of Directors, FOR the approval of the Bonus Plan, FOR the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2017, FOR the approval of the advisory resolution relating to the Company’s executive compensation, and FOR the approval of the advisory vote on executive compensation every year.The Board of Directors does not know of any matters other than those described in the Notice of Annual Meeting that are to come before the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in the proxy will vote the shares represented by such proxy upon such matters as determined by a majority of the Board of Directors.

A shareholder may revoke a proxy at any time prior to its exercise by filing a written notice of revocation with, or by delivering a duly executed proxy bearing a later date to, the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070, or by attending the Annual Meeting and voting in person (although the mere presence of a shareholder at the Annual Meeting will not automatically revoke such shareholder’s previous proxy). A shareholder who attends the Annual Meeting need not revoke a previously executed proxy and vote in person unless such shareholder wishes to do so. All valid, unrevoked proxies will be voted at the Annual Meeting.

2

PROPOSAL 1: ELECTION OF DIRECTORS

The Company’s Board of Directors has ten members and all director nominees will stand for election to aone-year term. Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy FOR the election as directors of the persons named below as nominees. The Board of Directors believes that the nominees will stand for election and will serve if elected as directors. However, if any of the persons nominated by the Board of Directors fails to stand for election or is unable to accept election, the number of directors constituting the Board of Directors may be reduced prior to the Annual Meeting or the proxies may be voted for the election of such other person as the Board of Directors may recommend.

Information as to Nominees and Continuing Directors

The following table sets forth the names of the Board of Directors’ nominees for election as a director and those directors who will continue to serve after the Annual Meeting. Also set forth in this section is certain other information with respect to each such person’s age (as of the date of the Annual Meeting), principal occupation and business experience during at least the past five years, the periods during which he or she has served as a director of FLIR, and any position(s) currently held with FLIR.

Nominees: | Age | Director Since | Position Held with FLIR | |||||||

John D. Carter | 71 | 2003 | Director | |||||||

William W. Crouch | 75 | 2005 | Director | |||||||

Catherine A. Halligan | 54 | 2014 | Director | |||||||

Earl R. Lewis | 73 | 1999 | Chairman of the Board of Directors | |||||||

Angus L. Macdonald | 62 | 2001 | Director | |||||||

Michael T. Smith | 73 | 2002 | Director | |||||||

Cathy A. Stauffer | 57 | 2014 | Director | |||||||

Andrew C. Teich | 56 | 2013 | Director and Chief Executive Officer | |||||||

John W. Wood, Jr. | 73 | 2009 | Director | |||||||

Steven E. Wynne | 65 | 1999 | Director | |||||||

Nominees

JOHN D. CARTER. Mr. Carter has served as a director of the Company since August 2003. From 2002 to 2005, Mr. Carter was a principal in the consulting firm of Imeson & Carter, which specialized in transportation and international business transactions. Mr. Carter served as President and Chief Executive Officer of Schnitzer Steel Industries Inc., a metals recycling company, from May 2005 to November 2008. Since December 1, 2008, Mr. Carter has served as Chairman of the Board of Directors of Schnitzer Steel Industries, Inc. From 1982 to 2002, Mr. Carter served in a variety of senior management capacities at Bechtel Group, Inc. including Executive Vice President and Director, as well as President of Bechtel Enterprises, Inc., a wholly owned subsidiary. Mr. Carter is a member of the Board of Directors and Chairman of the Audit Committee of Northwest Natural Gas Company. He is also on the Board of the Oregon chapter of the Nature Conservancy. He is the principal owner and manager of Birch Creek Associates LLC, which is engaged in agricultural and commercial land ownership, including vineyard ownership, and Dusky Goose LLC, which is in the wine production and sales business. He received his BA in History from Stanford University and his JD from Harvard Law School. In addition to his legal experience gained while practicing law, Mr. Carter brings many years of senior executive management experience, most recently as president and chief executive officer of a multi-billion dollar public company. This combination of legal and management experience enables Mr. Carter to provide guidance to the Company in the areas of legal risk oversight, enterprise risk management, corporate governance, financial management and corporate strategic planning.

3

GENERAL WILLIAM W. CROUCH (UNITED STATES ARMY—RETIRED). General Crouch has served as a director of the Company since May 2005. General Crouch retired from the United States Army in 1999 following a36-year career during which he served in numerous roles including Commanding General—Eighth Army and Chief of Staff, United Nations Command and United States Forces Korea; Commander in Chief, United States Army, Europe; Commanding General, NATO Implementation (later Stabilization) Force, Bosnia/Herzegovina; and the United States Army’s 27th Vice Chief of Staff. Until 2010, he served as one of five generals who oversaw the Army’s Battle Command Training Program. In October 2000, General Crouch was namedco-chair of the USS COLE Commission, which was formed to examine the terrorist attack on the USS COLE. He has served as a Distinguished Senior Fellow with the Center for Civil Military Operations at the United States Naval Post Graduate School, and serves on the Board of the Keck Institute for International and Strategic Studies at Claremont McKenna College. He received a B.A. in Civil Government from Claremont McKenna College, and a M.A. in History from Texas Christian University. He holds an Advanced Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization. General Crouch’s career as an Army officer and continuing interest in the United States military afford the Company significant insight into the Company’s important military customers in terms of strategic and tactical doctrines and how the Company’s products should be developed and adapted to facilitate the implementation of these doctrines. General Crouch also possesses an understanding of the political and military realities in certain global regions in which the Company’s products are employed. In addition, General Crouch’s experience in senior leadership roles in large Army commands enables him to offer guidance on the leadership of complex organizations such as the Company.

CATHERINE A. HALLIGAN. Ms. Halligan has served as a director of the Company since March 2014. She has served as Advisor to Narvar, a provider of supply chain and post purchase optimization SaaS technology, since 2013. Previously, Ms. Halligan was an Advisor to PowerReviews Inc., a leading social commerce network, from January to March 2012 and Senior Vice President Sales and Marketing from July 2010 to January 2012. Prior to joining PowerReviews Inc., Ms. Halligan held several executive level positions with prominent retailers. From 2005 to 2010, Ms. Halligan served in various executive positions with Walmart, a retailer, including as Vice President Market Development, Global eCommerce from 2009 to 2010 and as Chief Marketing Officer of Walmart.com from 2007 to 2009 along with other executive roles from 2005 to 2009. From 2000 to 2005, Ms. Halligan was an associate partner at Prophet, a management consulting firm. From 1996 to 1999, Ms. Halligan held retail management positions with Williams Sonoma Inc., including Vice President and General Manager, Internet and Vice President, Marketing. Ms. Halligan also has previous executive marketing retail experience with Blue Nile, Inc. and the Gymboree Corporation. Ms. Halligan began her career as a Marketing and Planning Analyst for Lands’ End from 1987 to 1991. Since January 2012, Ms. Halligan has served as an independent director at Ulta Beauty, where she chairs the Compensation Committee and is a member of the Nominating and Governance Committee, and previously served for two years on the Audit Committee. Ms. Halligan received her B.S. in Finance from Northern Illinois University. With over 20 years of experience in marketing, digital and e commerce within the retail industry, Ms. Halligan provides significant expertise with respect to strategic marketing issues, Internet technology and omnichannel business capabilities.

EARL R. LEWIS. Mr. Lewis served as Chairman, President and Chief Executive Officer of the Company from November 2000 until his retirement in May 2013 as President and Chief Executive Officer. He continues to serve as Chairman of the Board. Mr. Lewis was initially elected to the Board in June 1999 in connection with the acquisition of Spectra Physics AB (which at the time owned approximately 35% of the Company) by Thermo Instrument Systems, Inc. Prior to joining FLIR, Mr. Lewis served in various capacities at Thermo Instrument Systems, Inc., with his last role as President and Chief Executive Officer. Mr. Lewis is a member of the Board of Directors of Harvard BioScience and NxStage Medical, Inc. Mr. Lewis is a Trustee of Clarkson University and New Hampton School. Mr. Lewis holds a B.S. from Clarkson College of Technology and has attended post-graduate programs at the University of Buffalo, Northeastern University and Harvard University. Mr. Lewis holds a Masters Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization. Mr. Lewis’ leadership of the Company in the past decade affords him a deep understanding of the Company’s technology and operations, as well as the markets in

4

which the Company operates. Mr. Lewis’ prior service in executive management positions and his past and present service on other boards of directors, including public company boards, enable him to provide insight and guidance in an array of areas including global operations and strategic planning, enterprise risk management, and corporate governance. Mr. Lewis has played, and continues to play, an active role in the Company’s financial management and corporate development, including merger and acquisition activity.

ANGUS L. MACDONALD. Mr. Macdonald has served as a director of the Company since April 2001. In 2000, Mr. Macdonald founded and is currently President of Venture Technology Merchants, LLC, an advisory and merchant banking firm to growth companies regarding capital formation, corporate development and strategy. From 1996 to 2000, Mr. Macdonald was Senior Vice President and headed Special Situations in the health care equities research group at Lehman Brothers, Inc. Prior to joining Lehman Brothers, Mr. Macdonald was a senior securities analyst at Fahnestock, Inc. (now Oppenheimer). He holds a B.A. from the University of Pennsylvania and an MBA from Cranfield University, UK. Through his more than 20 years of experience in investment and merchant banking, Mr. Macdonald has developed extensive expertise in corporate development strategies for technology enterprises such as the Company as well as in financial structuring and strategy. Mr. Macdonald’s years of experience in the financial services sector benchmarking and comparing best practices operationally as well as from an executive management and compensation perspective, provide the Company with insight into the value creation impacts of various financial and operational strategies. These skills enable him to successfully serve as a member of the Company’s Audit and Compensation Committees and to provide insight to the Company in the development of its financial management, capital deployment, employee compensation and executive retention strategies.

MICHAEL T. SMITH. Mr. Smith has served as a director of the Company since July 2002. From 1997 until his retirement in May 2001, Mr. Smith was Chairman of the Board and Chief Executive Officer of Hughes Electronics Corporation. From 1985 until 1997, he served in a variety of capacities for Hughes, including Vice Chairman of Hughes Electronics, Chairman of Hughes Missile Systems and Chairman of Hughes Aircraft Company. Prior to joining Hughes in 1985, Mr. Smith spent nearly 20 years with General Motors in a variety of financial management positions. Mr. Smith is also a director of Teledyne Technologies Incorporated, WABCO Holdings Inc., and Zero Gravity Solutions. He was previously a director of Ingram Micro. Mr. Smith holds a B.A. from Providence College and an MBA from Babson College. He also served as an officer in the United States Army. Throughout his career, Mr. Smith has had extensive financial and general management experience, including service as the chief executive officer of a large public company. These skills and experiences qualify him to serve as the Company’s Audit Committee financial expert and also provides the Company with expertise in corporate governance, enterprise risk management and strategic planning as well as in the areas of global operations and corporate strategic development.

CATHY A. STAUFFER. Ms. Stauffer has served as a director of the Company since March 2014. From September 2005 to 2016 Ms. Stauffer owned and operated her own consulting Company, Cathy Stauffer Consulting, specializing in consumer technology products and assisting clients in identifying and understanding key opportunities and market trends, and developing strategies and tactics for successful market implementation and consumer adoption. In 2010, Ms. Stauffer also served as the Executive Vice President of Market Development for Premier Retail Networks /IZ-ON Media, a Technicolor owned digital media company. From 2004 to 2005, Ms. Stauffer served as Senior Vice President Marketing and Chief Marketing Officer for Gateway Computers, a global personal computer original equipment manufacturer and consumer electronics direct marketer. From 1977 to 1993 and from 1997 to 2004, Ms. Stauffer served in multiple capacities, including as President and in other executive roles, for The Good Guys, Inc., a consumer electronics specialty retailer. Ms. Stauffer also currently serves as the Chairman of Beverages & More, Inc., a leading specialty retailer of alcoholic beverages and related products, and Wilton Brands LLC, a privately owned leading supplier of craft, sewing, knitting, hobby and home decorating materials. Ms. Stauffer’s over three decades of experience in the branding, marketing, communications and market insights in the consumer electronics industry affords the Board valuable insight into the strategic marketing of consumer electronics, a continually increasing focus of the Company. In addition, Ms. Stauffer is a National Associate of Corporate Directors (“NACD”) Board Leadership Fellow, the highest standard of credentialing for directors and governance professionals.

5

ANDREW C. TEICH. Mr. Teich has been President and Chief Executive Officer of the Company since May 2013. He was elected to the Company’s Board of Directors in July 2013. Previously, Mr. Teich was President of the Company’s Commercial Systems Division from January 2010 to May 2013. From April 2006 to January 2010, he served as President of the Company’s Commercial Vision Systems Division. From 2000 to 2006, he served as the Senior Vice President of Sales and Marketing and then asCo-President of the Imaging Division at FLIR. Mr. Teich joined FLIR as Senior Vice President, Marketing, as a result of FLIR’s acquisition of Inframetrics in March 1999. While at Inframetrics, Mr. Teich served as Vice President of Sales and Marketing from 1996 to 1999. From 1984 to 1996, Mr. Teich served in various capacities within the sales organization at Inframetrics. He holds a B.S. in Marketing from Arizona State University and is an alumnus of the Harvard Business School Advanced Management Program. Mr. Teich has been a Director of Sensata Technologies Inc. since May 2013. Mr. Teich’s over30-year career in the thermal imaging industry, including the last 18 years with the Company, has enabled him to develop a comprehensive understanding of the Company’s technologies, operations and markets. Combined with prior executive service in roles of increasing responsibility, Mr. Teich’s skill set affords the Company expertise in technology innovation, strategic planning, global operations, and sales and marketing. Mr. Teich has announced his resignation as the Company’s President and Chief Executive Officer pending the appointment of his successor.

JOHN W. WOOD, JR. Mr. Wood has served as a director of the Company since May 2009. Mr. Wood served as Chief Executive Officer of Analogic Corporation, a leading designer and manufacturer of medical imaging and security systems, from 2003 to 2006. Prior to joining Analogic, Mr. Wood held senior executive positions over a22-year career at Thermo Electron Corporation. He served as President of Peek Ltd., a division of Thermo Electron Corporation, and as a Senior Vice President of the parent company. He previously served as President and Chief Executive Officer of Thermedics, a subsidiary of Thermo Electron Corporation. Mr. Wood is a director of ESCO Corporation and American Superconductor Corporation. Mr. Wood earned a Bachelor’s degree in Electrical Engineering from Louisiana Tech University and a Master’s degree in Electrical Engineering from Massachusetts Institute of Technology. Mr. Wood holds an Executive Masters Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization. Through his academic training and his extensive executive experience with companies in relevant industries, Mr. Wood possesses the knowledge and expertise to understand and offer guidance regarding the Company’s technologies and markets. In addition, as the former chief executive officer of a public company, Mr. Wood is qualified to provide leadership in the areas of corporate governance, operations and enterprise risk management.

STEVEN E. WYNNE. Mr. Wynne has served as a director of the Company since November 1999. Since July 2012, Mr. Wynne has served as an Executive Vice President of Health Services Group, Inc., a diversified insurance and pharmacy company, where he previously served as Senior Vice President, from February 2010 to January 2011. From January 2011 through July 2012, he served as ExecutiveVice-President ofJELD-WEN, Inc., an international manufacturer of doors and windows. From March 2004 through March 2007, Mr. Wynne was President and Chief Executive Officer of SBI International, Ltd., parent company of sports apparel and footwear company Fila. From August 2001 through March 2002, and from April 2003 through February 2004, Mr. Wynne was a partner in the Portland, Oregon law firm of Ater Wynne LLP. Mr. Wynne served as acting Senior Vice President and General Counsel of the Company from April 2002 through March 2003. Mr. Wynne was formerly Chairman and Chief Executive Officer of eteamz.com, an online community serving amateur athletics, from June 2000 until its sale to Active.com in January 2001. From February 1995 to March 2000, Mr. Wynne served as President and Chief Executive Officer of adidas America, Inc. Prior to that time, he was a partner in the law firm of Ater Wynne LLP. Mr. Wynne received an undergraduate degree and a J.D. from Willamette University. Mr. Wynne also serves on the boards of directors ofJELD-WEN Holding, Inc., Pendleton Woolen Mills, Cityfyd and Lone Rock Resources. Mr. Wynne has been associated with the Company in a variety of capacities since 1983, including prior service as its outside counsel. By virtue of this extensive relationship, Mr. Wynne has developed a high degree of familiarity with the Company’s operations, risks and opportunities. In addition, Mr. Wynne’s legal training and senior executive leadership experience with other companies qualify him to provide insight and guidance as a member of the Company’s Audit Committee, as well as in the areas of corporate governance, strategic planning and enterprise risk management.

6

Recommendation of the Board of Directors

The Board of Directors unanimously recommends that shareholders vote FOR the election of each of its nominees for director.If a quorum is present, a director nominee will be elected if the number of votes castFORthe nominee exceeds the number of votes castAGAINSTsuch nominee. Abstentions and brokernon-votes are counted for purposes of determining whether a quorum exists at the Annual Meeting, but will have no effect on the election of directors.

CORPORATE GOVERNANCE AND RELATED MATTERS

Communications with Directors

Shareholders and other parties interested in communicating directly with the Chairman or with thenon-employee directors as a group may do so by writing to the Chairman of the Board, c/o Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070. Concerns relating to accounting, internal controls or auditing matters are promptly brought to the attention of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

Meetings

During 2016, the Company’s Board of Directors held eight meetings and acted by unanimous written consent one time. Each incumbent director attended more than 75% of the aggregate of the total number of meetings held by the Board of Directors and the total number of meetings held by all committees of the Board on which he or she served, during the period in which he or she served as a director or a committee member, as applicable, in 2016. Under the Company’s Corporate Governance Principles, each director is expected to commit the time necessary to prepare for and attend all Board meetings and meetings of committees of the Board on which he or she serves, as well as the Company’s Annual Meeting of Shareholders. All members of the Company’s Board of Directors attended the 2016 Annual Meeting of Shareholders.

Board of Directors Independence

The Company’s Corporate Governance Principles provide that the Board of Directors must be comprised of a majority of independent directors. The Board of Directors reviews annually the relationship that each director has with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and determines the independence of each director. The Board has determined that each of the directors of the Company is “independent” as defined by applicable NASDAQ Stock Market (“NASDAQ”) rules, except for Mr. Lewis, who retired as the Company’s President and Chief Executive Officer in May 2013, and Mr. Teich, the Company’s current President and Chief Executive Officer. The Board of Directors took into account all relevant facts and circumstances in making this determination.

7

Board of Directors Committees

The Board of Directors has standing Audit, Compensation and Corporate Governance Committees. During 2016 the Board of Directors established an Ethics and Compliance Committee to focus specifically on ethics and compliance matters involving the Company and to highlight the Board’s commitment to Company compliance efforts. Each committee operates pursuant to a written charter, which is reviewed annually. The charter of each committee may be viewed online at www.flir.com/investor. The performance of each committee is reviewed annually. Each committee may obtain advice and assistance from internal or external legal, accounting and other advisors. The members of the Audit, Compensation, Corporate Governance and Ethics and Compliance Committees have all been determined to be “independent” as defined by applicable NASDAQ rules. The members of each committee are identified in the following table.

Name | Audit | Corporate Governance | Compensation | Ethics and Compliance | ||||

John D. Carter | Chair | |||||||

William W. Crouch | X | X | X | |||||

Catherine A. Halligan | X | |||||||

Earl R. Lewis | ||||||||

Angus L. Macdonald | X | Chair | ||||||

Michael T. Smith | Chair | X | ||||||

Cathy A. Stauffer | X | |||||||

Andrew C. Teich | ||||||||

John W. Wood, Jr. | X | |||||||

Steven E. Wynne | X | X | Chair |

The Audit Committee is responsible for, among other things: overseeing the integrity of the Company’s financial statements and financial reporting process; the independent registered public accounting firm’s qualifications, appointment and independence; the performance of the internal audit function; the review of all third-party transactions involving, directly or indirectly, the Company and any of its directors or officers; and the adequacy of the Company’s accounting and internal control systems. During fiscal year 2016, the Audit Committee held five meetings.

The Compensation Committee is responsible for, among other things: all matters relating to the compensation of the Company’s executives, including salaries, bonuses, fringe benefits, incentive compensation, equity-based compensation, retirement benefits, severance pay and benefits, and compensation and benefits in the event of a change of control of the Company, and executive talent management and succession. The Compensation Committee also administers the Company’s equity compensation plans. During fiscal year 2016, the Compensation Committee held seven meetings and acted by unanimous written consent one time. See also the “Compensation Discussion and Analysis” section of this Proxy Statement for additional details on the governance of the Compensation Committee and a description of the Company’s processes and procedures for determining executive compensation.

The Corporate Governance Committee is responsible for, among other things: recommending to the Board operating policies that conform to appropriate levels of corporate governance practice; overseeing the Board’s annual self-evaluation; identifying qualified candidates to serve on the Board; determining the qualification of Board members; evaluating the size and composition of the Board and its committees; reviewing the Company’s Corporate Governance Principles; reviewing the compensation policies fornon-employee directors; providing oversight assistance of management activities relating to the integrity and security of the Company’s information technology systems; and recommending nominees to stand for election at each annual meeting of shareholders. The Corporate Governance Committee seeks candidates to serve on the Board who are persons of integrity, with significant accomplishments and recognized business experience, but does not have any specific minimum qualifications or criteria for director nominees. As required by its charter, the Corporate Governance Committee considers diversity of backgrounds and viewpoints when considering nominees for director but has not

8

established a formal policy regarding diversity in identifying director nominees. During fiscal year 2016, the Corporate Governance Committee held four meetings.

The Ethics and Compliance Committee was established in 2016 to focus specifically on ethics and compliance matters involving the Company and to highlight the Board’s commitment to Company compliance efforts and is responsible for, among other things: at the direction of the Board, to make recommendations regarding the Company’s corporate compliance and ethics posture, programs, policies and procedures to facilitate the operation of the Company in a compliant and ethical manner; as may be requested by the Board from time to time, to develop and recommend to the Corporate Governance Committee or Board for approval, revisions to the Company’s corporate governance principles with respect to the Company’s ethics and compliance; as requested by the Board, review and make recommendations regarding the content of the Company’s Code of Ethical Business Conduct and Code of Ethics for Senior Financial Officers; and as requested by the Board, review and make recommendations to the Board or Corporate Governance Committee with respect to policies and programs to facilitate compliance with the Company’s Code of Ethical Business Conduct, Corporate Governance Principles, and Corporate policies and procedures addressing the ethical and compliance operations of the Company, as adopted and amended from time to time by the Board.

Shareholder Nominations and Proxy Access

The Corporate Governance Committee will review recommendations by shareholders of individuals for consideration as candidates for election to the Board of Directors. Any such recommendations should be submitted in writing to the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070. Historically, the Company has not had a formal policy concerning shareholder recommendations to the Corporate Governance Committee (or its predecessors) because the informal consideration process in place to date has been adequate given that the Company has never received any director recommendations from shareholders. The absence of such a policy does not mean, however, that a recommendation would not have been considered had one been received. The Corporate Governance Committee will consider director candidates recommended by shareholders on the same basis it considers director candidates identified by the Committee.

In October 2016, the Board adopted the Fourth Restated Bylaws of the Company (the “Bylaws”). Our Bylaws set forth procedures that must be followed by shareholders seeking to nominate directors. Our Fourth Restated Bylaws include proxy access, which permits eligible shareholders to nominate candidates for election to the Board. Our Bylaws allow a shareholder or a group of no more than 20 shareholders that has maintained continuous ownership of 3% or more of the Company’s Common Stock for at least three years to include nominees for election as director in the Company’s proxy materials for an annual meeting of shareholders. With our current board consisting of ten members, eligible shareholders may nominate a number of director nominees not to exceed two of the directors then in office. To nominate a director, the shareholder must provide the information required by our Bylaws. In addition, the shareholder must give timely notice to our Corporate Secretary in accordance with our Bylaws, which, in general, require that the notice be received by our Corporate Secretary within the time period described above under “Dates for Submission of Shareholder Proposals for 2018 Annual Meeting of Shareholders” section of this Proxy Statement. Each notice given by a shareholder with respect to nominations for the election of directors must comply with the requirements of Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Bylaws.

9

Corporate Governance

FLIR maintains a Governance page on its website that provides specific information about its corporate governance initiatives, including FLIR’s Corporate Governance Principles, Code of Ethical Business Conduct for FLIR Operations Inside the United States, Code of Ethics for Senior Financial Officers and charters for the committees of the Board of Directors. The Governance page can be found on our website at www.flir.com/investor. To the extent mandated by legal requirements, we intend to disclose on our website any amendments to our Corporate Governance Principles, Code of Ethical Business Conduct for FLIR Operations Inside the United States and Code of Ethics for Senior Financial Officers, or any waivers of its requirements. On October 19, 2016, the Board granted an exception to General William Crouch from the mandatory retirement age imposed on our directors in our Corporate Governance Principles, who will have attained the age of 75 on the date of the 2017 Annual meeting of shareholders. The Board waived this requirement due to General Couch’s understanding of political and military realities in certain global regimes in which the Company’s products are employed and his experience in senior leadership roles in large Army commands that enables him to offer guidance on the leadership of complex organizations such as the Company, which the Board believes make him an indispensable member of the Board at this point in time.

FLIR’s policies and practices reflect corporate governance initiatives that are compliant with the listing requirements of NASDAQ and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, as amended (“SOX”) and the Dodd-Frank Wall Street Reform and Consumer Protection Act, as amended (the “Dodd-Frank Act”), including:

| • | The Board of Directors has adopted clear corporate governance policies; |

| • | A majority of the Board members is independent of FLIR and its management based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by NASDAQ; |

| • | All members of the Board’s Audit, Compensation, Corporate Governance and Ethics and Compliance Committees are independent based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by NASDAQ, SOX, and the Dodd-Frank Act; |

| • | The independent members of the Board of Directors meet regularly without the presence of management; |

| • | FLIR has a Code of Ethical Business Conduct for FLIR Operations Inside the United States and a Code of Ethical Business Conduct for FLIR Operations Outside the United States; |

| • | The charters of the Board committees clearly establish their respective roles and responsibilities; |

| • | FLIR has an ethics officer and an Internet-based hotline monitored by EthicsPoint® that is available to all employees, and FLIR’s Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal controls or auditing matters; and |

| • | FLIR has adopted a Code of Ethics for Senior Financial Officers that applies to its Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer/Corporate Controller, Vice President of Global Tax and Planning, Corporate Treasurer, Vice President of Global Finance Operations, Business Unit Controllers and Site Controllers. |

You may obtain copies of the documents posted on FLIR’s Governance page on its website by writing to the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070.

Board Leadership Structure and Role in Risk Oversight

The Company has a separate Chairman of the Board and Chief Executive Officer structure. In addition, the Chairman of the Company’s Corporate Governance Committee serves as Presiding Director for the executive sessions of the independent directors. The Board has determined that this structure is appropriate for the Company at this time as it most fully maximizes our Chairman’s and our CEO’s extensive knowledge of the

10

Company’s business and industry. The Board acknowledges that no single leadership model is right for all companies at all times, however, so the Board periodically reviews its leadership structure.

The Board is actively involved in oversight of risks inherent in the operation of the Company’s business including, without limitation, those risks described in the Company’s reports filed from time to time with the Securities and Exchange Commission (“SEC”). It is management’s responsibility to manage risk and bring to the Board’s attention the material risks to the Company. The Board has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company. The Board manages this responsibility at the Board level with assistance from its four committees, as appropriate. The Board has delegated to the Audit Committee certain tasks related to the Company’s risk management process. The Audit Committee (i) serves as an independent and objective body to monitor the Company’s financial reporting process and internal control systems and (ii) assists the Board in oversight of the Company’s compliance with legal and regulatory requirements. The Board has delegated to the Compensation Committee basic responsibility for oversight of management’s compensation risk assessment, including the annual determination of whether or not the Company’s compensation policies and practices are reasonably likely to have a material adverse effect on the Company. The Corporate Governance Committee oversees the Company’s risks in the areas of corporate governance and ethics and compliance, and is primarily responsible for Board and committee performance and director nomination/succession. The Ethics and Compliance Committee at the direction of the Board of Directors makes recommendations concerning the Company’s compliance and ethics posture. These committees report the results of their review processes to the full Board during regularly scheduled Board meetings or more frequently, if warranted. In addition to review and discussion of reports prepared by the committees of the Board, the Board periodically discusses risk oversight in specific areas as they arise, including as part of its corporate strategy review.

Compensation Risk

Company management annually conducts an assessment of our compensation policies and practices, including our executive compensation programs, to evaluate the potential risks associated with these policies and practices. Management has reviewed and discussed the findings of the assessment with the Compensation Committee concluding that our compensation programs are designed with an appropriate balance of risk and reward and do not encourage excessive or unnecessary risk-taking behavior. As a result, we do not believe that risks relating to our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on the Company.

In conducting this review, management considered the following attributes of our programs:

| • | Mix of base salary, annual incentive opportunities, and long-term equity compensation; |

| • | Balance between annual and longer-term performance opportunities; |

| • | Alignment of annual and long-term incentives to ensure that the awards encourage consistent behaviors and achievable performance results over the long term; |

| • | Use of equity awards that vest over time and in some cases additional holding periods after vesting; |

| • | Generally providing senior executives with long-term equity-based compensation on an annual basis. We believe that accumulating equity over a period of time encourages executives to take actions that promote the long-term sustainability of our business; |

| • | Stock ownership guidelines that are reasonable and designed to align the interests of our executive officers with those of our shareholders. This discourages executive officers from focusing on short-term results without regard for longer-term consequences; and |

| • | Compensation decisions include subjective considerations, which limit the influence of strictly formulaic factors on excessive risk taking. |

In addition, our Compensation Committee considered compensation risk implications during its deliberations on the design of our 2017 executive compensation programs with the goal of appropriately balancing short-term incentives and long-term performance.

11

MANAGEMENT

Executive Officers

The executive officers of the Company are as follows:

Name | Age | Position | ||||

Andrew C. Teich | 56 | President and Chief Executive Officer | ||||

Todd M. DuChene | 53 | Senior Vice President, General Counsel, Secretary and Chief Ethics and Compliance Officer | ||||

Jeffrey D. Frank | 60 | Senior Vice President, Global Product Strategy | ||||

Shane R. Harrison | 40 | Senior Vice President, Corporate Development and Strategy | ||||

Travis D. Merrill | 40 | Senior Vice President, Marketing and Chief Marketing Officer | ||||

Amit Singhi | 51 | Senior Vice President, Finance and Chief Financial Officer | ||||

Thomas A. Surran | 54 | Senior Vice President, Chief Operating Officer | ||||

Information concerning the principal occupations and business experience during at least the past five years of Mr. Teich is set forth under “Proposal 1: “Election of Directors - Information as to Nominees and Continuing Directors - Nominees.” Information concerning the principal occupations and business experience during at least the past five years of the executive officers of the Company who are not also directors of the Company is set forth below.

TODD M. DUCHENE. Mr. DuChene joined FLIR in September 2014 as its Senior Vice President, General Counsel and Secretary. Prior to joining FLIR, Mr. DuChene served as Executive Vice President, General Counsel and Secretary of Nuance Communications, Inc., a leading provider of speech recognition and related technology to enterprise, healthcare and mobile and consumer customers, where he was responsible for the legal, intellectual property, corporate governance and regulatory activities of the company, from October 2011 to September 2014. Previously, Mr. DuChene served as Senior Vice President, General Counsel and Secretary of National Semiconductor Corporation from January 2008 to October 2011, prior to its acquisition by Texas Instruments Inc. In addition, Mr. DuChene has served as General Counsel to each of Solectron Corporation, Fisher Scientific International Inc. (now ThermoFisher Scientific), and OfficeMax, Inc. Mr. DuChene began his legal career as a corporate lawyer with BakerHostetler in Cleveland, Ohio in 1988. Mr. DuChene is a graduate of The College of Wooster, Wooster, Ohio and the University of Michigan Law School.

JEFFREY D. FRANK. Prior to his promotion to Senior Vice President, Global Product Strategy in January 2014, Mr. Frank had served as the Company’s Vice President, Global Product Strategy since May 2013. Mr. Frank previously served as Vice President of Product Strategy for the Company’s Commercial Systems Division from December 2004 to May 2013. Prior to joining FLIR, Mr. Frank was a founder and served as Vice President of Business Development for Indigo Systems, Inc. commencing with that company’s inception in 1997. Mr. Frank joined FLIR upon Indigo’s acquisition by FLIR in 2004. Previously, Mr. Frank was Vice President of Business Development for Raytheon Corporation from 1994 to 1997, and for Amber Engineering from 1987 to 1994 prior to Amber’s acquisition by Raytheon Corporation.

SHANE R. HARRISON. Mr. Harrison has been Senior Vice President, Corporate Development and Strategy since April 2015. Previously, Mr. Harrison was FLIR’s Vice President of Corporate Development and Investor Relations from August 2010 to April 2015. Prior to joining FLIR, Mr. Harrison was a Vice President at Lehman Brothers in their Global Technology Investment Banking group from 2004 to 2008, where he managed business acquisition and capital markets transactions for a variety of technology companies. Previously, he was a Business Planning Analyst at Goodrich Aerospace and an Audit Senior with Deloitte & Touche. Mr. Harrison received his BS cum laude from the University of Oregon and his MBA from the UCLA Anderson School of Management.

TRAVIS D. MERRILL. Mr. Merrill joined FLIR in April 2014 as Senior Vice President, Marketing and Chief Marketing Officer. Prior to joining FLIR, Mr. Merrill served as Vice President of Marketing for Samsung

12

Electronics America, where he led the GALAXY Tab business from 2011 to 2014. Previously, he held Strategy and Marketing roles for Samsung in Korea and in the US from 2006 to 2011. From 1998 to 2004, Mr. Merrill held various Operations, Marketing, and International Development positions in the telecommunications industry at Covad and at US West (now CenturyLink). Mr. Merrill received a B.A. magna cum laude from Wabash College, an M.S. in Telecommunications from the University of Colorado Boulder, and an MBA from Harvard Business School.

AMIT SINGHI. Mr. Singhi joined FLIR in August 2015 as Senior Vice President, Finance, and Chief Financial Officer. Prior to joining FLIR, Mr. Singhi was an employee of Ford Motor Company from August 1994 to August 2015, most recently as Controller of Ford Motor Company’s Global Customer Service Division, Aftermarket Parts & Services since April 2015. Mr. Singhi was previously Chief Financial Officer of Ford South America from April 2012 to March 2015, Director, Americas Profit Analysis from January 2011 to March 2012, and Controller, Retail/Fleet Marketing & Global Lifecycle Analytics from January 2010 to December 2010. He holds an M.B.A. and an M.S. in Electrical Engineering Systems from the University of Michigan, and a Bachelors of Technology in Electrical Engineering from the Indian Institute of Technology.

THOMAS A. SURRAN. Mr. Surran has served as the Company’s Senior Vice President, Chief Operating Officer since January 2014. Mr. Surran previously served as President of the Company’s Commercial Systems Division from May 2013 to January 2014. Mr. Surran joined the Company for a second time in December 2009 as the Chief Financial Officer of the Commercial Systems Division. From May 2010 until May 2013, in addition to his Division Chief Financial Officer role, Mr. Surran also served as Vice President and General Manager of Raymarine, a FLIR company. Previously, Mr. Surran served in the role of General Manager of the Company’s Commercial Vision Systems (formerly Indigo) Operations in Goleta, CA from January 2004 to June 2007. Mr. Surran initially joined FLIR upon Indigo’s acquisition by FLIR in 2004. Prior to Indigo, he held positions with TDK Corporation, Headway Technologies, Inc., and Everex Systems, Inc. Mr. Surran received his B.S. from Xavier University and his MBA from the University of Chicago.

13

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis describes the principles and material elements of our executive compensation program, how we applied those principles in determining the material elements of the compensation for our Named Executive Officers (“NEOs”) for 2016 and how we use our executive compensation program to drive performance. We believe that our actions in 2016 and in prior years effectively link pay to performance.

Our NEOs for 2016 are:

| • | Andrew C. Teich, President and Chief Executive Officer (“CEO”) |

| • | Amit Singhi, Senior Vice President, Finance and Chief Financial Officer (“CFO”) |

| • | Thomas A. Surran, Senior Vice President, Chief Operating Officer |

| • | Todd M. DuChene, Senior Vice President, General Counsel, Secretary and Chief Ethics and Compliance Officer |

| • | Jeffrey D. Frank, Senior Vice President, Global Product Strategy |

Executive Summary

Our Business and Strategy

We are a world leader in sensor systems that enhance perception and awareness. Our advanced sensors and integrated sensor systems enable the creation, gathering, and analysis of critical data and images for use in a wide variety of applications in commercial, industrial, and government markets worldwide.

Our strategy is focused on enabling our customers to benefit from the valuable information produced by advanced sensing technologies and on delivering sustained superior financial performance and returns for our shareholders. Over the past ten years we have dramatically expanded the availability of thermal imaging technology in a wide range of applications through a business model that focuses on reducing costs through continuous innovation and vertical integration. This has resulted in a nearly 16 fold increase in annual unit volumes since 2006, and the establishment of thermal imaging solutions in numerous markets where it was previously unavailable due to cost or technology constraints.

2016 Business and Financial Highlights

In 2016, we increased consolidated revenue by 7% with five of our six segments showing revenue growth. Revenue in the Instruments segment declined compared to 2015 primarily due to softness in the building and predictive maintenance product lines during 2016. For 2016 we achieved 89% of our revenue growth target established for our annual incentive plan.

In addition, in 2016 we completed four acquisitions establishing a platform for future revenue and earnings growth. Transaction related expenses caused operating profitability to decline which impacted earnings per share, our most heavily weighted incentive plan metric for 2016. This attention to long-term Company performance negatively impacted overall achievement of 2016 executive incentive plan metrics and contributed to reducing our executives’ annual incentive compensation by over 50% as compared to their 2016 incentive targets.

Business highlights for 2016 include the following:

| • | Strategic Acquisitions—We acquired four businesses during the year. In June, we acquired Armasight, Inc., a leading developer of tactical sporting, hunting, and military optics products, and Innovative |

14

Security Designs, Inc., a provider of advanced networked security camera solutions. In November, we acquired Point Grey Research, Inc., makers of advanced visible imaging cameras and solutions that are used in machine vision applications, and Prox Dynamics AS, an innovative manufacturer of nano-class unmanned aerial systems (UAS) that are used for military and para-military intelligence and surveillance. |

| • | Operating cash flow—During 2016, we generated $312 million of cash flow from operations, an increase of 13% and representing 187% of net income. This growth was primarily due to changes in current balances. Cash flow was sufficient to continue to invest in our business and contributed to our ability to make four acquisitions, return $132 million in cash to our shareholders via share repurchases and dividend payments, while still finishing the year with ample cash resources for continued deployment. Operating cash flow was a metric in our annual incentive plan and we achieved 150% of our target for this metric in 2016. |

| • | Return of capital—We continued to return capital to shareholders both directly and indirectly. During 2016, we repurchased 2.1 million shares of our Common Stock at an average price of $30.99 per share, and paid Common Stock dividends of $66 million. During 2016, these initiatives improved our total shareholder return by 4%, and improved our return on equity by 1%. Since the inception of our share repurchase program in 2003, the program has returned nearly $1.3 billion of capital to our shareholders. |

| • | New products and innovation—We introduced a wide array of new products during 2016, many utilizing our revolutionary Lepton® thermal microcamera core. For example, we introduced the Scout TK, a handheld thermal monocular for outdoor enthusiasts that creates a new entry-level price point for consumers, theTG-130 handheld spot temperature tool for professionals and homeowners, and the TrafiOne intelligent traffic sensor. Through our business of selling our technology to original equipment manufacturers (OEMs), Lepton was incorporated into several interesting products during 2016, including the CAT S60 smartphone, the Scott Sight firefighter mask, and theSnap-on Diagnostic Thermal Imager for automotive maintenance and repair applications. We also introduced our new high-performance uncooled camera core, the Boson, which is our smallest, lightest, and least power-consuming, high-performance uncooled thermal camera for OEMs. Many of these products feature innovative software to enhance the user experience and increase the value proposition of the product, such as advanced image processing, resolution enhancement, video analytics algorithms, and advanced user interfaces. We believe that these products and technologies demonstrate our ongoing commitment to being a customer-focused technology leader, and are expected to have a positive impact on our future results. |

15

Stock Price Performance

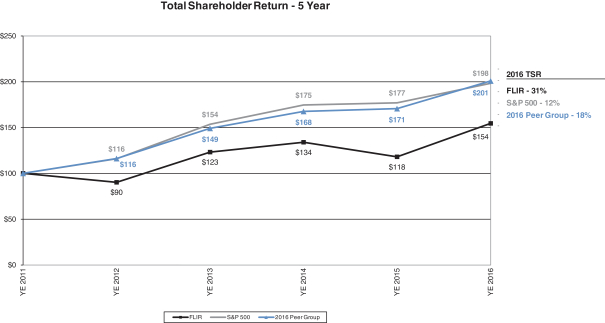

Over the three- and five-year periods ending December 31, 2016, we underperformed both the Standard & Poor’s 500 Index (the “S&P 500”) and our 2016 Peer Group (see below) in relative total shareholder return (“TSR”), as reflected in the following graph. During 2016, we outperformed both the S&P 500 as well as the Peer Group. At December 31, 2016, the closing price of our Common Stock was $36.19.

2016 Executive Compensation Highlights

Our executive compensation program is designed to align the interests of our executive officers with those of our shareholders by providing market-competitive compensation opportunities to our executives upon the achievement of a variety of short-term and long-term objectives. The Compensation Committee reviews at least annually all elements of compensation for our executive officers, including our NEOs, and makes changes as needed to remain competitive, fair, reasonable and consistent with our goals of pay for performance and alignment with shareholder interests.

During 2016, the Compensation Committee made several key decisions:

| • | Base Salary—Increased annual base salaries of our NEOs to maintain market-competitiveness. Salary increases for our NEOs ranged from a low of 1.7% to a high of 5.0%, with an average increase of 3.1%. |

| • | Annual Cash Incentive—Increased the annual cash incentive opportunity of our CEO from 105% to 110% of his base salary to remain market-competitive with target cash compensation at the 50th percentile of our 2016 Comparator Group. Designed our 2016 annual incentive plan (“AIP”) to focus exclusively on Company performance objectives, with a strong emphasis on earnings per share (“EPS”), as the criteria for payment of cash incentives to the NEOs. |

16

| • | Long-Term Equity Incentive—Granted a mix of time-based and performance-based equity awards to our NEOs, with the performance-based equity awards eligible for vesting based on our relative TSR and return on invested capital (“ROIC”), each over a three-year performance period, and with any shares vesting at the end of the three-year performance period subject to an additional1-year holding period. This incentive is designed to retain key executives over a longer-term period by providing time-based equity awards vesting over three years and, through the overlay of equity awards where vesting is based on achieving relative TSR greater than market and ROIC performance in excess of our 2016 Peer Group. These programs provide the opportunity for our key executives to earn additional compensation for over performance that is also beneficial to our shareholders. |

We continually review our executive compensation plans and practices based on such factors the Compensation Committee deems appropriate, which may include evolving market practices, executive officer retention, feedback from our shareholders, changes in our strategy or financial performance, or changes in accounting and tax rules. For 2017, our Compensation Committee solicited input from several of our key shareholders regarding the Company’s compensation program and has taken shareholder feedback into account in designing our 2017 compensation program for executive officers.

Pay for Performance Overview

Pay Mix

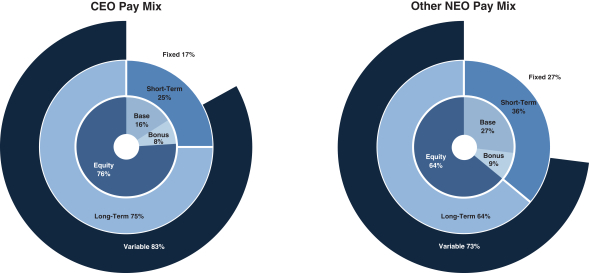

In 2016, we continued our strong commitment to a pay for performance methodology by aligning a significant portion of executive compensation with demonstrated performance. As shown by the charts below, fixed compensation for our CEO was only 17% of annual total direct compensation (27% on average for our other NEOs) with CEO at risk performance-based compensation (annual cash incentives and long-term equity incentives) making up the remaining 83% of annual total direct compensation (base salary, annual cash incentives, and long-term incentive equity incentives) (73% on average for our other NEOs).

| ||

17

Overall Alignment of Pay and Performance

Our executive compensation program is designed to limit the amount of fixed (not at risk) compensation and to pay out incentive (at risk) compensation only upon the achievement of superior financial results. Target annual total direct compensation (which includes both at risk and not at risk compensation) is established annually at or about the 50th percentile of our 2016 Comparator Group (see below). At risk incentive compensation is paid only if stringent objective financial metrics are met. As a result, because most of our annual total direct compensation is at risk and subject to stringent Company performance criteria, it is intended that our executive officers, including our NEOs, will earn compensation only at or about the 50th percentile of our 2016 Comparator Group if the Company achieves superior results. Failure to achieve targeted metrics significantly impacts the amount of performance-based compensation earned and is intended to result in total realized compensation for executive officers below the 50th percentile of our 2016 Comparator Group. We believe thispay-for-performance philosophy incentivizes our executive officers, including our NEOs, to meet our short-term and long-term objectives.

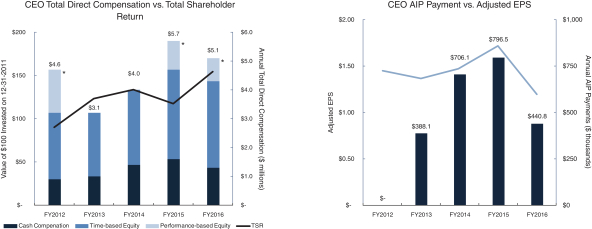

The charts below illustrate the alignment between key metrics (our TSR and adjusted EPS) on which our compensation decisions (annual total direct compensation and annual cash incentives paid to our CEO) were based for each of the last five fiscal years.

| * | Performance-based Equity Value reflects the grant date fair value of the Award when granted, not the resulting value to the executive: For FY2012 the performance-based Equity Award did not vest and no value was realized by the executive. |

| • | Annual total direct compensation consists of annual base salary, AIP payment and annual long-term incentive award (grant date fair value of annual equity awards, not cash actually received). Annual total direct compensation is based on the compensation of Mr. Earl Lewis for fiscal 2012 and the compensation of Mr. Teich for fiscal 2013, 2014, 2015 and 2016. Compensation shown above excludes amounts reported under the “Change in Pension Value” and the “All Other Compensation” columns in the Summary Compensation Table. |

| • | TSR line illustrates the total shareholder return on our common stock during the period from December 31, 2011 through December 31, 2016, assuming $100 was invested at the end of fiscal 2011 and assuming reinvestment of dividends. |

| • | Adjusted EPS line illustrates our reported EPS as adjusted by our Compensation Committee for fiscal 2012 through fiscal 2016 to exclude certainnon-operating adjustments. Our 2013 reported EPS of $1.22 was adjusted to exclude $27.5 million ofpre-tax restructuring expenses and $3.5 million ofpre-tax executive retirement expenses related to Mr. Lewis’ retirement as CEO. Our 2014 reported EPS of $1.39 was adjusted to exclude $17.0 million ofpre-tax restructuring expenses. |

18

Other Key Compensation Practices

We believe we engage in best practice executive compensation policies and programs:

What we do

| • | Independent Compensation Committee. The Compensation Committee is made up of all independent directors. |

| • | Independent Compensation Committee Advisor. The Compensation Committee engaged its own independent compensation consultant to assist with the design of the 2016 compensation program. |

| • | Annual Executive Compensation Review. The Compensation Committee conducts an annual review of compensation for our executive officers and a review of compensation-related risks. |

| • | CompensationAt-Risk. The executive compensation program is designed so that a significant portion of executive annual compensation is “at risk” to align the interests of our NEOs and our shareholders. For 2016 actual incentive plan achievement was only 48% of target based on the challenging goals set by our Compensation Committee. |

| • | Mixed Performance-Based Incentives and Incentive Caps. Our executive compensation program utilizes a mix of performance-based cash incentives (short-term) and time- and performance-based equity incentives (long-term) having different performance-based metrics. We also cap maximum annual performance-based cash incentives at 200% of the payout target and performance-based equity compensation at 200% of the payout target for the Performance Grant, as discussed below. |

| • | Multi-Year Vesting Requirements. The performance-based equity awards granted to the NEOs vest or are earned over a three-year period, consistent with current market practice and our retention objectives. |

| • | Clawback Policy: We adopted a clawback policy with respect to cash incentive awards that requires that such awards be repaid to the Company in the event of certain acts of misconduct or gross negligence. |

| • | Stock Ownership Guidelines. We maintain stock ownership guidelines for our directors and our executive officers. Within five years of joining the Company, directors and executive officers are required to hold shares of the Company’s common stock or in the money options equal to or greater than four times the director’s annual board retainer (greater than or equal to one times salary for executive officers, other than the CEO). The CEO is required to hold vested shares of the Company’s common stock equal to or greater than three times the CEO’s annual salary. For 2016, shares that vest pursuant to our performance-based equity awards generally are subject to an additional1-year holding requirement before the shares can be sold. |

What we don’t do

| • | Limited Perquisites. We provide minimal perquisites and other personal benefits to the NEOs. |

| • | No “Golden Parachute” Tax Reimbursements. We do not provide any tax reimbursement payments (including “gross-ups”) on any tax liability that the NEOs might owe as a result of the application of Sections 280G or 4999 of the Internal Revenue Code (the “Code”). |

| • | Hedging and Pledging Prohibited. Employees may not hedge or pledge Company securities as collateral. |

| • | No Repricing of Underwater Options. Our plan prohibits the repricing of stock options or other downward adjustment in the option price of previously granted stock options (other than to reflect corporate transactions such as mergers). |

| • | No Stock Options Granted with an Exercise Price Less Than Fair Market Value. All stock options are granted with an exercise price at the closing price on the date of grant. |

19

Corporate Governance and Decision-Making

General Philosophy

Our executive compensation program is designed to promote the following principal objectives:

| • | To attract and retain executive officers with the skills, experience and motivation to enable the Company to achieve its stated objectives; |

| • | To provide a mix of current, short-term and long-term compensation to achieve a balance between current income and long-term incentive opportunity and promote focus on both annual and multi-year business objectives; |

| • | To align total compensation with the performance results we seek for our shareholders, including, long-term growth in revenue and EPS; |

| • | To allow executive officers who demonstrate consistent performance over a multi-year period to earn above-average compensation when we achieve above-average long-term performance; |

| • | To be affordable and appropriate in light of our size, strategy and anticipated performance; and |

| • | To be straightforward and transparent in its design, so that shareholders and other interested parties can clearly understand all elements of our executive compensation programs, individually and in the aggregate. |

The Compensation Committee uses these principles to determine base salaries, annual cash incentives and long-term equity incentives. The Compensation Committee also considers our business objectives, the skills and experience of the executive, competitive practices and trends and corporate considerations, including the compensation level of an executive officer relative to our other executive officers and affordability of the compensation program. The Compensation Committee further considers the results of the annual advisory“say-on-pay” vote and shareholder feedback.

At our 2014 Annual Meeting, a strong majority (approximately 86% of the votes cast) of our shareholders approved the executive compensation program described in our 2014 proxy statement. The Compensation Committee considered this strong shareholder support in implementing the 2016 executive compensation program.

Fiscal 2016 Peer Group

The Compensation Committee, in consultation with management and from Aon Hewitt’s technology compensation consulting group, Radford (“Radford”), compares our executive compensation program with compensation paid by a peer group consisting of a broad range of high-technology companies whose businesses are similar to ours and with which we typically compete for executive talent.

For the composition of our 2016 peer group (the “2016 Peer Group”), we considered publicly-traded companies of similar size (based on revenues, employee size and market capitalization) and in the test and measurement and sensor systems industries. Each of the companies below met most, if not all, of these criteria. We also qualitatively evaluated each 2016 Peer Group member based on its business focus and corporate strategy and ultimately selected companies most similar to FLIR with regards to business focus and financial profile.

After reviewing our Peer Group in October 2015, the Compensation Committee did not make any changes to the Peer Group. The tables below set forth our 2016 Peer Group.

Fiscal 2016 Peer Group

AMETEK | KLA-Tencor | Perkin Elmer | Trimble Navigation | |||

Bio-Rad Laboratories | Lam Research | Rockwell Collins | Viavi Solutions (formerly JDSU) | |||

Curtiss Wright | MKS Instruments | Roper Technologies | Waters Corporation | |||

Esterline Technologies | Moog | Teledyne Technologies | Woodward | |||

FEI Company | OSI Systems | Teradyne |

20

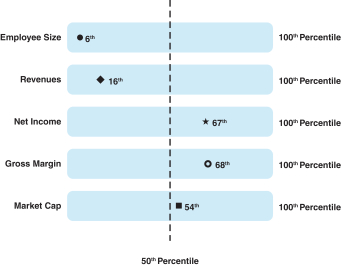

Based on data compiled by Radford in August 2015, we were in the lower quartile of the 2016 Peer Group based on employee size and trailing12-month revenues, above the 50th percentile of the 2016 Peer Group based on trailing12-month net income and gross margin, and approximately at the 50th percentile of the 2016 Peer Group median with respect to market capitalization. The chart below illustrates our positioning versus the 2016 Peer Group for these metrics.

Radford provided data for our 2016 Peer Group on base salary, annual cash incentive opportunities, long-term equity incentives, and annual total direct compensation. Radford supplemented the 2016 Peer Group data with data from the Radford Global Technology Survey. The survey data was blended equally with the 2016 Peer Group data, where possible, to create our comparison group (the “2016 Comparator Group”). The Compensation Committee, in consultation with management, used this data to assess the compensation levels paid by the 2016 Comparator Group and the levels paid at approximately the 50th percentile of the 2016 Comparator Group. The Compensation Committee retains the discretion to set any element of an executive officer’s compensation outside this targeted level based on such factors as it deems appropriate including, but not limited to, the experience and responsibilities of such executive officer, the expected future contribution of each executive officer, the overall mix of base salary and short-term and long-term incentives being offered to the executive, internal pay equity based on the impact on the business and performance, retention and such other individual and business factors that may be relevant to an executive officer.

Role of Compensation Committee

The Compensation Committee has a written charter approved by the Board that specifies the Compensation Committee’s duties and responsibilities, which is available on our website at: http://investors.flir.com/corporate-governance.cfm?CategoryID=2305. In accordance with its charter, the Compensation Committee is responsible for all compensation for our executive officers. In discharging this responsibility, the Compensation Committee annually:

| • | reviews and establishes our compensation strategy to ensure that our executive officers are rewarded appropriately for their contributions to our growth and profitability, |

| • | reviews and establishes performance goals and objectives with respect to the compensation of our CEO and other executive officers, and |

| • | evaluates the performance of the CEO, and reviews the CEO’s evaluation of our other executive officers and in conjunction with the Corporate Governance Committee of the Board reviews and establishes the compensation of the Board. |

21