UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03287

New Alternatives Fund

(Exact name of registrant as specified in charter)

150 Broadhollow Road, Suite PH2

Melville, New York 11747

(Address of principal executive offices) (Zip code)

David J. Schoenwald, President

New Alternatives Fund

150 Broadhollow Road, Suite PH2

Melville, New York 11747

(Name and address of agent for service)

Registrant’s telephone number, including area code: 631-423-7373

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | | | |

| | New Alternatives Fund A SOCIALLY RESPONSIBLE MUTUAL FUND EMPHASIZING ALTERNATIVE ENERGY AND THE ENVIRONMENT | | . |

ANNUAL

FINANCIAL REPORT

INVESTOR SHARES: NAEFX

CLASS A SHARES: NALFX

DECEMBER 31, 2020

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website (https://www.newalternativesfund.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary or, if you invest directly with the Fund, by logging into your account at www.newalternativesfund.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-441-6580 to inform the Fund that you wish to continue receiving paper copies of your shareholder reports.

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution unless preceded or accompanied by a prospectus for the Fund.

| | | | | | | | |

| THE FUND | | 150 Broadhollow Road | | Melville, New York 11747 | | (800) 423-8383 | | (631) 423-7373 |

| BNY Mellon Investment Servicing (US) Inc. | | PO Box 9794 | | Providence, RI 02940 | | (800) 441-6580 | | (610) 382-7819 |

| Overnight Address | | 4400 Computer Drive | | Westborough, MA 01581 | | | | |

| Foreside Funds Distributors LLC | | 400 Berwyn Park, | | Berwyn, PA 19312 | | | | |

| | 899 Cassatt Road | | | | | | |

Recycled Paper

NEW ALTERNATIVES FUND

SHAREHOLDER LETTER

(UNAUDITED)

Dear Shareholders,

Coming off a solid performance in 2019, 2020 certainly got off to a shaky start, as the Covid-19 pandemic started its deadly march around the world. As the quarantine period set in across the U.S. and the economy came to a near standstill, stock markets everywhere and New Alternatives Fund along with them, experienced precipitous drops from mid-February through the end of March. As we all began coping with this new reality and economic activity regained some reduced momentum, investment activity picked up. Interestingly, renewable energy development was a leader in recovery, perhaps driven by an increasing awareness of environmental concerns raised by the coronavirus.

After making a small recovery during the 2nd quarter of 2020, the Fund surged through the second half of the year to record some of its strongest gains since the Fund’s founding in 1982. After recording a respectable total return of 36.98 percent and 36.68 percent for its A Shares and Investor Shares respectively in 2019, the Fund registered a total return of 61.76 percent for its A Shares and 61.35 percent for its Investor Shares at December 31, 2020.

Many investment analysts thought the ravages of the international coronavirus pandemic, the increasingly erratic actions of the Trump administration and the turmoil leading up to and following the presidential election would have a negative effect on stock markets and company performance. However, renewable energy investment, and so called ESG (environmental, social, governance) investments appeared to have gained strength over the course of the year.

Despite the previous administration’s hostile position on renewable energy and environmental concerns, the Congress continued to pass legislation that supported wind, solar and other renewable development. Much of this support was included in stimulus legislation passed by the “lame duck” session in December 2020. Among the key provisions were the extension of production tax credits (PTC) for both onshore and offshore wind projects, extended investment tax credits (ITC) for solar construction, including residential, commercial and utility-scale; further credits for fuel cell development, electric vehicle (EV) charging infrastructure, and new research and development funding for variety of technologies. It is possible that all these policies, and additional support, will become law if Congress can pass the Growing Renewable Energy and Efficiency Now (GREEN, get it!) Act of 2021.

One of the first actions that President Biden took upon assuming office was to restore many of the environmental rules and clean energy policies that President Trump had abandoned in his four year tenure. There is a general sentiment that the current administration’s support for better environmental regulation and renewable energy expansion will give “green” investments a further boost heading into 2021 and beyond. The picture remains uncertain as conservative forces in the Senate and House seem likely to continue their obstruction to moving the U.S. away from fossil fuel dependency.

Renewable energy development and environmentally focused development seemed to reach a “tipping point” over the past 2 years. While it would be unlikely that we would experience the same kind of robust growth in 2021, we continue to believe that the Fund is well positioned for long term growth

1

NEW ALTERNATIVES FUND

SHAREHOLDER LETTER

(UNAUDITED)

and the companies in our portfolio will be among the primary drivers of carbon free energy development. A November 2020 report published by Bloomberg News declared that four of our core holdings — Enel SpA (Italy), Iberdrola SA (Spain), Next Era Energy Partners and Orsted A/S (Denmark) — are among the new “energy giants” as we enter an era of energy development away from fossil fuels toward renewable sources.

Fund Performance: The Net Asset Value (“NAV”) of New Alternatives Fund’s Class A Shares was $62.92 on December 31, 2019 and closed at $97.00 on December 31, 2020. The Fund’s Investor Shares ended with a NAV of $62.74 on December 31, 2019, and closed at $96.52 on December 31, 2020. The Fund’s net assets increased from $234,461,630 on December 31, 2019 to $427,826,710 on December 31, 2020. This increase of $193,365,080 was due to appreciation of the Fund’s holdings and a net increase in the number of Fund shares sold.

Approximately 27.3 percent of the Fund’s investments at December 31, 2020 were in U.S. based companies, including 4.7 percent held in cash (and cash equivalents) in U.S. banks and credit unions. European companies comprised approximately 45.6 percent of the Fund’s holdings, with 28.0 percent of that amount priced in Euros. The remaining countries and regions represented in the Fund’s portfolio included: Canada/Bermuda: 21.4 percent; Asia/Oceana (Japan, China, New Zealand, Australia): 5.7 percent. More details on this are contained on the chart on page 15.

The Fund’s largest sector, at 66 percent of holdings — Renewable Energy Power Producers and Developers — continued to be the primary contributor to our performance from January 1 to December 31, 2020. These companies, which include the “Yield Cos” * and utilities, gained between 1.69 and 136.5 percent with a few exceptions. The largest share price increases among this group of companies were: EDP Renovaveis SA (Spain/Portugal), up 136.5 percent; Orsted A/S (Denmark), up 97.3 percent; Boralex, Inc. (Canada), up 97.2 percent; Northland Power, Inc. (Canada), up 71.3 percent; Innergex Renewable Energy, Inc. (Canada), up 66.3 percent; and Clearway Energy, Inc., Class C, up 60.1 percent.

Other strong performers for the year included BYD Company, Ltd. (China), manufacturer of electric buses and cars and battery technology, which rose a remarkable 432.2 percent. In recent years, BYD has been overshadowed by the buzz generated by Tesla. But BYD has an established track record as a major global manufacturer of electric buses for urban transit systems. In addition, BYD’s HAN EV sedan is emerging as a solid competitor to Tesla’s cars at substantially lower prices. BYD also has its origins as a battery company and continues to be a strong player in battery development and energy storage technology in support of renewable energy projects. It’s solid, long term earnings and performance may be some of the reasons that Warren Buffet’s Berkshire Hathaway took a 25 percent stake in the company several years ago.

*Yield Cos are companies formed to own operating power assets which sell most of their electric production to major utilities under long term power purchase agreements. They are expected to pay most of their earnings in dividends to shareholders They are similar in structure to Real Estate Investment Trusts (REITs).

2

NEW ALTERNATIVES FUND

SHAREHOLDER LETTER

(UNAUDITED)

There were only two companies in the Fund whose share price went down in 2020. Avangrid, Inc., which operates as a regulated utility servicing the northeast United States and is a major developer of wind power projects across the U.S., including several pioneering offshore sites, saw its share price decline by 11.2 percent. Veolia Environnement SA (France), a water utility and international waste water treatment company, lost 8.6 percent of its share value. Avangrid continues to post solid earnings and pay a regular dividend but its share price may be depressed by the difficulties it has encountered in recent years with permitting and supply pipeline disruptions on both its offshore wind developments and its expansion projects for energy distribution (i.e., transmission lines). Veolia has been bogged down recently in its attempt to take over its chief European rival in water treatment, distribution and recycling, Suez SA. Despite lagging in 2020, Veolia has shown stronger performance so far in 2021.

Portfolio Holdings and Challenges: As usual, the composition of the Fund’s portfolio did not change a great deal in 2020. The most notable movement of companies came as the result of the continuing consolidation and acquisitions in certain areas. Early in the year, we sold our small position of Japanese solar cell, semiconductor and electronics manufacturer Kyocera Corporation after several years of sluggish performance. We replaced this holding with shares of Canadian Solar, Inc., a joint Canadian/Chinese solar cell and module manufacturer that continues to be among the world’s leading producers of photovoltaic solar components. After experiencing a substantial drop in share price during the broader market retreat at the beginning of the Covid-19 quarantine period in March, 2020, Canadian Solar’s share rebounded to finish the year with a strong growth of 131.8 percent at December 31, 2020.

The only other changes in the Fund’s holdings in 2020 were the result of mergers, acquisitions and reorganizations. In February, Ingersoll-Rand PLC, an Ireland-based industrial conglomerate and manufacturer of energy management systems for buildings and transportation, spun off its energy management division into a new company called Trane Technologies. We took the offered share conversion and now hold Trane in the Fund, replacing the Ingersoll-Rand position. As of year end 2020, Trane had returned 43.4 percent. Pattern Energy, Inc., one of our Yield Cos, was taken private when the company was bought out by the Canadian Pension Plan Investment Board. Lastly, Brookfield Renewable Energy Partners LP completed its purchase of TerraForm Power, Inc. early in the third quarter of 2020. This new company operating under the Brookfield umbrella as Brookfield Renewable Corporation, Inc., has replaced TerraForm in the Fund’s portfolio. The acquisition was structured such that the Fund received shares of the new entity, Brookfield Renewable Corporation and additional shares of Brookfield Energy Partners LP.

The Fund continued to add to some holdings and reduced others in response to current market conditions, to balance the portfolio and when we felt a company’s prospects changed. Among those, we increased our shares of: Enel SpA (Italy); Iberdrola SA (Spain); Infratil, Ltd. and TrustPower, Ltd. (New Zealand); Signify NV (Netherlands),Veolia Environnement SA (France), Sims, Ltd. (Australia),TransAlta Renewables, Inc. (Canada), Avangrid, Inc., Eversource Energy, NextEra Energy Partners LP., and Terna Rete Elettrica Nazionale SPA (Italy).

3

NEW ALTERNATIVES FUND

SHAREHOLDER LETTER

(UNAUDITED)

We also made smaller additional purchases of Northland Power, Inc. (Canada), BYD Company, Ltd. (China), Johnson Controls International PLC (Ireland), Acciona SA (Spain), and Hannon Armstrong Sustainable Infrastructure Capital, Inc. The Fund also continue to reduce our holdings of Clearway Energy, Inc.’s C shares and increase our holdings of Clearway’s A shares. There is a slight difference in voting rights attached to each share class, but Clearway’s A shares pay, on average, a slightly higher dividend so we have chosen over time to emphasize the dividend return on our investment.

During this same period from January 1 to December 31, 2020, we reduced our share holdings in: Panasonic Corporation (Japan); Boralex, Inc., Class A (Canada); Clearway Energy, Inc., Class C; EDP Renovaveis SA (Portugal/Spain); Innergex Renewable Energy, Inc. (Canada); Siemens Gamesa Renewable Energy SA (Spain); Koninklijke Philips NV (Netherlands); and Vestas Wind Systems A/S (Denmark).

As of December 31, 2020, New Alternatives Fund held positions in 36 companies and had certificates of deposit with 2 credit unions supporting community development. You can read descriptions of all the investments in the Fund’s portfolio on our web site at: https://www.newalternativesfund.com/the-fund/our-holdings-2-3-2/.

Cash Holdings: At year end, approximately 4.9 percent of the Fund’s net assets were held in cash.

Income from Dividends and Interest: The per share dividend for Class A Shares went down from $0.26 in 2019 to $0.07 in 2020. There was no dividend payment for Investor Shares in 2020. The downward trend in our ordinary dividend in recent years is due to continuing recharacterization of payments from a number of the Fund’s investment, primarily the Yield Cos, as returns of capital. This situation has also continued to increase the capital gain payment as noted below. Return of capital is a payment, or return received from an investment that is not considered a taxable event and is not taxed as income.

Realized and Unrealized Capital Gain/Loss: The Fund paid a net realized of $4.71 per share for both Class A Shares and Investor Shares in 2020. This was an increase from the $3.23 per share net realized capital gain paid in 2019. During the year ending December 31, 2020, the Fund had net realized and unrealized gains of $153,081,297.

This year’s increase in total net assets was due to the appreciation of most of the Fund’s holdings, a gain of $19,920,336 from realized gains from investments and foreign currency and a net increase of $59,468,301 for share subscriptions in the year ending December 31, 2020.

Expenses: The Fund’s cost of operations increased in 2020 mostly due to costs associated with the growth of the Fund’s assets. The number of shareholder accounts increased as well. The amounts paid to the investment advisor, Accrued Equities, Inc., the Bank of New York Mellon (the Fund’s custodian) and BNY Mellon Investment Servicing (U.S.), Inc. (the Fund’s accounting agent, transfer agent and administrator) are largely based on net assets. The Fund’s net assets increased during 2020, ending approximately 82.5 percent higher for the entire year. BNY Mellon, in its role as transfer agent, bases

4

NEW ALTERNATIVES FUND

SHAREHOLDER LETTER

(UNAUDITED)

its fees on the number of shareholder accounts established during the year. This figure increased by approximately 19.2 percent. Total Fund Expenses increased by $516,569, or approximately 23.1 percent. The total number of shares increased from 3,726,541 on December 31, 2019 to 4,411,910 on December 31, 2020, approximately 18.4 percent. As result of the overall increase in the Fund’s net assets in both share classes, the expense ratio for the Class A Shares decreased from 1.08 percent in 2019 to 0.96 percent in 2020. The expense ratio for the Investor Shares includes an additional 12b-1 fee of 0.25 percent for an expense ratio of 1.21 percent for 2020, down from 1.33 percent in 2019.

The Fund Web Site/On-Line Capabilities: We continue to build the Fund’s on-line functions and web site features. All relevant Fund documents are posted on our web site which can be accessed at: www.newalternativesfund.com.

We encourage all shareholders to create an on-line account log-on, which is available through a link on our web site. When you access the web site, go to the “Open An Account” link on the selection bar and follow the instructions to create your account access. You can use this link to open an account, purchase or redeem shares, check the current balance of your account, sign up for e-delivery of reports and documents, and perform account maintenance such as address changes.

SPECIAL NOTE: On the cover page of this annual report is an important notice concerning a change in the Fund’s policy on the printing and distribution of our annual and semi-annual reports. Effective after this 2020 Annual Report, shareholders will no longer automatically receive a printed copy of future annual and semi-annual reports by mail unless you specifically request copies from the Fund or from your financial intermediary if your account is held by a brokerage firm or bank. You can make this request in writing to New Alternatives Fund, 150 Broadhollow Rd., Suite PH2, Melville, NY 11747; by email to: info@newalternativesfund.com; or by calling our shareholder services center at: 800-441-6580 to request a paper copy of our reports. Otherwise, you will be able to read and download future reports through a link on the Fund web site.

Shareholder Comments: We continue to receive, use and welcome advice and comments from shareholders. You can contact us by e-mail at: info@newalternativesfund.com, regular “snail mail” (Support the Postal Service!) or give us a call at 800-423-8383 or 631-423-7373.

David Schoenwald

Murray Rosenblith

February 18, 2021

The Principal Underwriter is Foreside Funds Distributors LLC and the Co-Distributor is Accrued Equities, Inc.

Investment Objective: The Fund’s investment objective is long-term capital appreciation, with income as a secondary objective. We seek to achieve its investment objective by investing in equity securities. The equity securities in which the Fund invests consist primarily of common stocks. Other equity

5

NEW ALTERNATIVES FUND

SHAREHOLDER LETTER

(UNAUDITED)

securities in which the Fund may invest include Yield Cos, American Depositary Receipts (“ADRs”), real estate investment trusts (“REITs”) and publicly traded master limited partnerships (“MLPs”). The Fund makes investments in a wide range of industries and in companies of all sizes. The Fund invests in equity securities of both U.S. and foreign companies, and has no limitation on the percentage of assets invested in the U.S. or abroad. Under normal market conditions, at least 25 percent of the Fund’s total assets will be invested in equity securities of companies in the alternative energy industry.

“Alternative Energy” or “Renewable Energy” means the production, conservation, storage, and transmission of energy to reduce pollution and harm to the environment, particularly when compared to conventional coal, oil or nuclear energy.

Risk Disclosure: All investments are subject to inherent risks. An investment in the Fund is no exception. Accordingly, you may lose money by investing in the Fund. This disclosure of risks is not complete. Go to our web site at: www.newalternativesfund.com, call 800-423-8383 or write to the Fund to obtain a prospectus that contains a more complete description of risks associated with investment in the Fund and other information about the Fund.

6

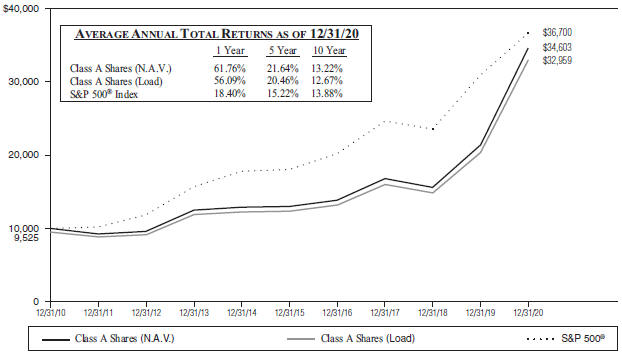

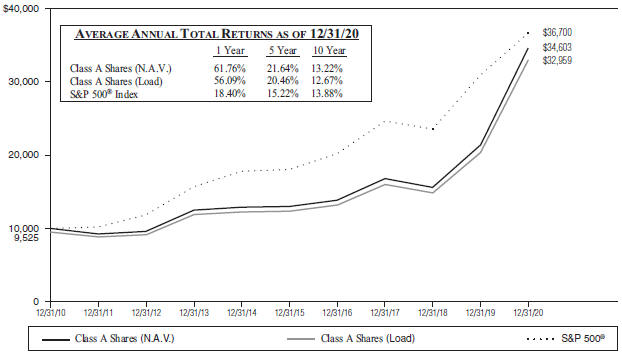

New Alternatives Fund Class A Shares Growth of $10,000 vs. The S&P 500® Index

(Unaudited)

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. The “Load” performance quoted reflects a deduction for Class A Shares’ maximum front-end sales charge of 3.50%. Prior to May 1, 2017, the Class A Shares’ maximum front end sales charge was 4.75%. Returns include the reinvestment of dividends and distributions. Performance data current to the most recent month-end may be obtained by calling 800-423-8383. The graph and table do not reflect the deduction of taxes that a Shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s total annual operating expenses, as stated in its current prospectus dated April 30, 2020 are 1.08%*** for the Class A Shares.

*** Per prospectus. The expense ratio presented above may vary from the expense ratio presented in other sections of this report which is based on expenses incurred during the year covered by this report.

7

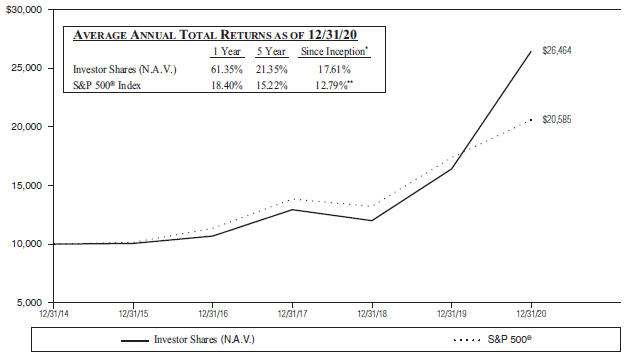

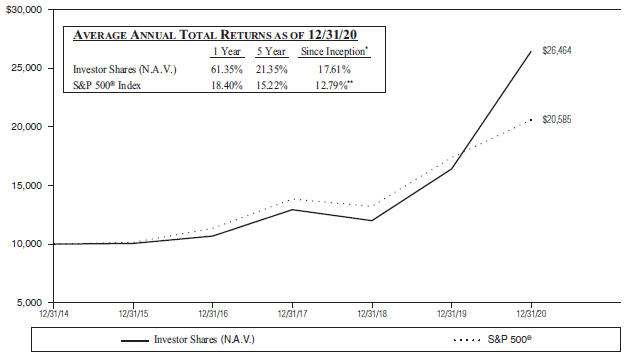

New Alternatives Fund Investor Shares Growth of $10,000 vs. The S&P 500® Index

(Unaudited)

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. A 2.00% redemption fee applies to Investor Shares redeemed within 60 days of purchase. This redemption fee is not reflected in the returns shown above. Returns include the reinvestment of dividends and distributions. Performance data current to the most recent month-end may be obtained by calling 800-423-8383. The graph and table do not reflect the deduction of taxes that a Shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s total annual operating expenses, as stated in its current prospectus dated April 30, 2020 are 1.33%*** for the Investor Shares.

The S&P 500® Index is an unmanaged stock market index and does not reflect any asset-based charges for investment management or transaction expenses. You cannot invest directly in this index. Current and future portfolio holdings are subject to change and risk.

* The inception date for Investor Shares of New Alternatives Fund was December 31, 2014.

**The performance presented is from the inception date of the Investor Shares of the Fund only and is not from the inception date of the Fund’s broad-based securities market index.

*** Per prospectus. The expense ratio presented above may vary from the expense ratio presented in other sections of this report which is based on expenses incurred during the year covered by this report.

8

NEW ALTERNATIVES FUND

FUND EXPENSE EXAMPLE

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs such as the sales charge and redemption fees; and (2) ongoing costs, including management fees, distribution (i.e., Rule 12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period shown (July 1, 2020) and held for the entire six months ended December 31, 2020.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Six Months Ended December 31, 2020” to estimate the expenses you paid on your account during this period.

Note: The Fund’s Transfer Agent, BNY Mellon Investment Servicing (US) Inc., charges an annual IRA maintenance fee of $20 for IRA accounts. That fee is not reflected in the accompanying table.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as the sales charge, redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher.

9

NEW ALTERNATIVES FUND

FUND EXPENSE EXAMPLE

(Unaudited)

| | | | | | | | | | | | |

| |

| | | Beginning

Account Value

July 1, 2020 | | | Ending

Account Value

December 31, 2020 | | | Expenses Paid During

Six Months Ended

December 31, 2020 | |

| |

Class A Shares * | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,557.70 | | | | $6.04 | |

Hypothetical | | | | | | | | | | | | |

(assumes 5% return before expenses) | | | $1,000.00 | | | | $1,020.41 | | | | $4.77 | |

Investor Shares ** | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,555.80 | | | | $7.58 | |

Hypothetical | | | | | | | | | | | | |

(assumes 5% return before expenses) | | | $1,000.00 | | | | $1,019.20 | | | | $5.99 | |

| * | Expenses are equal to the annualized expense ratio of the Fund’s Class A Shares for the six-month period of 0.94%, multiplied by the average account value over the period, multiplied by the number of days (184) in the most recent fiscal half year, then divided by the days in the year (366) to reflect the half year period. The Class A Shares’ ending account value on the first line in the table is based on its actual total return of 55.77% for the six-month period of July 1, 2020 to December 31, 2020. |

| ** | Expenses are equal to the annualized expense ratio of the Fund’s Investor Shares for the six-month period of 1.18%, multiplied by the average account value over the period, multiplied by the number of days (184) in the most recent fiscal half year, then divided by the days in the year (366) to reflect the half year period. The Investor Shares’ ending account value on the third line in the table is based on its actual total return of 55.58% for the six-month period of July 1, 2020 to December 31, 2020. |

10

NEW ALTERNATIVES FUND

SCHEDULE OF INVESTMENTS

December 31, 2020

(Unaudited)

| | | | | | | | |

Sector Diversification | | % of Net

Assets | | Value | |

Common Stocks | | | | | | | | |

Alternate Energy: | | | | | | | | |

Renewable Energy Power Producers & Developers | | | 66.0 | % | | $ | 282,191,128 | |

Wind Turbines | | | 8.2 | | | | 34,901,218 | |

Energy Storage | | | 0.5 | | | | 2,342,000 | |

Solar Photovoltaic | | | 0.3 | | | | 1,281,000 | |

Energy Conservation | | | 6.0 | | | | 25,569,197 | |

Sustainable Energy Financial Services | | | 5.5 | | | | 23,786,250 | |

Water Systems & Utilities | | | 4.4 | | | | 18,913,700 | |

Energy Management | | | 2.4 | | | | 10,119,016 | |

Transportation | | | 1.7 | | | | 7,184,498 | |

Recycling & Waste Management | | | 0.2 | | | | 1,035,000 | |

Warrants | | | 0.0 | | | | — | |

Certificates of Deposit | | | 0.1 | | | | 300,000 | |

Other Assets in Excess of Liabilities | | | 4.7 | | | | 20,203,703 | |

| | | | | | | | |

Net Assets | | | 100.0 | % | | $ | 427,826,710 | |

| | | | | | | | |

Top Ten Portfolio Issuers

December 31, 2020

(Unaudited)

| | | | |

Name | | % of Net

Assets |

Brookfield Renewable Corp., Class A (Canada) | | | 6.1 | % |

Hannon Armstrong Sustainable Infrastructure Capital, Inc., REIT | | | 5.5 | |

EDP Renovaveis SA (Spain/Portugal) | | | 5.2 | |

Orsted A/S (Denmark) | | | 5.0 | |

NextEra Energy Partners LP | | | 4.7 | |

Enel SpA (Italy) | | | 4.5 | |

Iberdrola SA (Spain) | | | 4.4 | |

Vestas Wind Systems A/S (Denmark) | | | 4.1 | |

TransAlta Renewables, Inc. (Canada) | | | 4.1 | |

Siemens Gamesa Renewable Energy SA (Spain) | | | 4.0 | |

| | | | |

Total Top Ten | | | 47.6 | % |

| | | | |

| | | | |

Portfolio holdings are subject to change, risk and may not represent current compositions of the portfolio.

11

NEW ALTERNATIVES FUND

SCHEDULE OF INVESTMENTS

December 31, 2020

| | | | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS – 95.2% | | | | | | | | |

Alternate Energy — 75.0%* | | | | | | | | |

Energy Storage — 0.5% | | | | | | | | |

Panasonic Corp. (Japan) SP ADR | | | 200,000 | | | $ | 2,342,000 | |

| | | | | | | | |

| | | | | | | 2,342,000 | |

| | | | | | | | |

| | |

Renewable Energy Power Producers & Developers — 66.0% | | | | | | | | |

Acciona SA (Spain) | | | 100,000 | | | | 14,256,656 | |

Atlantica Sustainable Infrastructure PLC (Great Britain)** | | | 400,000 | | | | 15,192,000 | |

Avangrid, Inc. | | | 325,000 | | | | 14,771,250 | |

Boralex, Inc., Class A (Canada) | | | 75,000 | | | | 2,784,035 | |

Brookfield Renewable Corp., Class A (Canada) | | | 450,000 | | | | 26,221,500 | |

Brookfield Renewable Partners LP (Bermuda/Canada)*** | | | 375,000 | | | | 16,181,250 | |

Clearway Energy, Inc., Class A | | | 475,000 | | | | 14,036,250 | |

Clearway Energy, Inc., Class C | | | 75,000 | | | | 2,394,750 | |

EDP Renovaveis SA (Spain/Portugal) | | | 800,000 | | | | 22,282,896 | |

Enel SpA (Italy) | | | 1,900,000 | | | | 19,209,713 | |

Eversource Energy | | | 175,000 | | | | 15,139,250 | |

Iberdrola SA (Spain) | | | 1,325,340 | | | | 18,943,489 | |

Infratil Ltd. (New Zealand) | | | 2,000,000 | | | | 10,504,700 | |

Innergex Renewable Energy, Inc. (Canada) | | | 750,000 | | | | 16,125,000 | |

NextEra Energy Partners LP**,*** | | | 300,000 | | | | 20,115,000 | |

Northland Power, Inc. (Canada) | | | 325,000 | | | | 11,664,250 | |

Orsted A/S (Denmark) | | | 105,000 | | | | 21,431,209 | |

TransAlta Renewables, Inc. (Canada) | | | 1,025,000 | | | | 17,527,500 | |

Trustpower Ltd. (New Zealand) | | | 600,000 | | | | 3,410,430 | |

| | | | | | | | |

| | | | | | | 282,191,128 | |

| | | | | | | | |

| | |

Solar Photovoltaic — 0.3% | | | | | | | | |

Canadian Solar, Inc. (Canada)**** | | | 25,000 | | | | 1,281,000 | |

| | | | | | | | |

| | | | | | | 1,281,000 | |

| | | | | | | | |

| | |

Wind Turbines — 8.2% | | | | | | | | |

Siemens Gamesa Renewable Energy SA (Spain) | | | 425,000 | | | | 17,180,369 | |

Vestas Wind Systems A/S (Denmark) | | | 75,000 | | | | 17,720,849 | |

| | | | | | | | |

| | | | | | | 34,901,218 | |

| | | | | | | | |

Total Alternate Energy | | | | | | | 320,715,346 | |

| | | | | | | | |

| | |

Energy Conservation — 6.0% | | | | | | | | |

Johnson Controls International PLC (Ireland) | | | 50,000 | | | | 2,329,500 | |

Koninklijke Philips NV (Netherlands)**** | | | 102,028 | | | | 5,526,857 | |

Owens Corning, Inc. | | | 25,000 | | | | 1,894,000 | |

Signify NV (Netherlands)**** | | | 375,000 | | | | 15,818,840 | |

| | | | | | | | |

| | | | | | | 25,569,197 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

12

NEW ALTERNATIVES FUND

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2020

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Sustainable Energy Financial Services — 5.5% | | | | | | | | |

Hannon Armstrong Sustainable Infrastructure Capital, Inc., REIT | | | 375,000 | | | $ | 23,786,250 | |

| | | | | | | | |

| | | | | | | 23,786,250 | |

| | | | | | | | |

| | |

Water Systems & Utilities — 4.4% | | | | | | | | |

American Water Works Co., Inc. | | | 25,000 | | | | 3,836,750 | |

Veolia Environnement SA (France) ADR | | | 600,000 | | | | 14,568,000 | |

Xylem, Inc. | | | 5,000 | | | | 508,950 | |

| | | | | | | | |

| | | | | | | 18,913,700 | |

| | | | | | | | |

| | |

Energy Management — 2.4% | | | | | | | | |

Terna Rete Elettrica Nazionale SPA (Italy) | | | 850,000 | | | | 6,490,016 | |

Trane Technologies PLC (Ireland) | | | 25,000 | | | | 3,629,000 | |

| | | | | | | | |

| | | | | | | 10,119,016 | |

| | | | | | | | |

| | |

Transportation — 1.7% | | | | | | | | |

BYD Co. Ltd. (China) SP ADR | | | 125,000 | | | | 6,596,250 | |

Shimano, Inc. (Japan) SP ADR | | | 25,000 | | | | 588,248 | |

| | | | | | | | |

| | | | | | | 7,184,498 | |

| | | | | | | | |

| | |

Recycling & Waste Management — 0.2% | | | | | | | | |

Sims Ltd. (Australia) SP ADR | | | 100,000 | | | | 1,035,000 | |

| | | | | | | | |

| | | | | | | 1,035,000 | |

| | | | | | | | |

| | |

Total Common Stocks (Cost $225,999,265) | | | | | | | 407,323,007 | |

| | | | | | | | |

WARRANTS – 0.0% | | | | | | | | |

Alternate Energy — 0.0% | | | | | | | | |

Abengoa SA, Class B Exp. 2025 (Spain)^**** | | | 500,000 | | | | — | |

| | | | | | | | |

Total Warrants (Cost $4,204) | | | | | | | — | |

| | | | | | | | |

| | | Par | | | | |

| | |

CERTIFICATES OF DEPOSIT – 0.1% | | | | | | | | |

Socially Concerned Banks — 0.1% | | | | | | | | |

Alternatives Federal Credit Union 0.80% due 03/13/21 | | $ | 200,000 | | | | 200,000 | |

Self Help Credit Union 0.40% due 12/30/21 | | | 100,000 | | | | 100,000 | |

| | | | | | | | |

Total Certificates of Deposit (Cost $300,000) | | | | | | | 300,000 | |

| | | | | | | | |

| | |

Investments in Securities (Cost $226,303,469) — 95.3% | | | | | | | 407,623,007 | |

Other Assets in Excess of Liabilities — 4.7% | | | | | | | 20,203,703 | |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 427,826,710 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

13

NEW ALTERNATIVES FUND

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2020

| ** | These entities are commonly known as “Yieldco’s”. Yieldco’s are companies formed to own operating power assets which sell most of their electric production to major utilities under long term power purchase agreements. They are expected to pay most of their earnings in dividends to shareholders. They are similar in structure to Real Estate Investment Trusts (REITs). |

| ^ | An investment with a value of $0 or 0.0% of the Fund’s net assets was valued by the Fund’s investment advisor. |

| *** | Master Limited Partnership |

| **** | Non-income producing security. |

| ADR | -American Depositary Receipts |

| PLC | -Public Limited Company |

| REIT | -Real Estate Investment Trust |

| SP ADR | -Sponsored American Depositary Receipts |

The accompanying notes are an integral part of these financial statements.

14

NEW ALTERNATIVES FUND

SCHEDULE OF INVESTMENTS (Concluded)

December 31, 2020

Country Portfolio Issuers

(Unaudited)

| | | | |

Country | | % of Net

Assets | |

United States | | | 22.6 | % |

Canada | | | 21.4 | |

Spain | | | 17.0 | |

Denmark | | | 9.2 | |

Italy | | | 6.0 | |

Netherlands | | | 5.0 | |

Great Britain | | | 3.6 | |

France | | | 3.4 | |

New Zealand | | | 3.3 | |

China | | | 1.5 | |

Ireland | | | 1.4 | |

Japan | | | 0.7 | |

Australia | | | 0.2 | |

Other Assets/Liabilities | | | 4.7 | |

| | | | |

| | | 100.0 | % |

| | | | |

The accompanying notes are an integral part of these financial statements.

15

NEW ALTERNATIVES FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2020

| | | | |

| ASSETS | | | |

Investment securities at fair value (cost: $226,303,469) (Notes 2A and 7) | | $ | 407,623,007 | |

Cash | | | 20,903,331 | |

Foreign currency at value (cost: $4,607) | | | 4,632 | |

Receivables: | | | | |

Capital shares subscribed | | | 2,156,528 | |

Dividends | | | 384,921 | |

Tax reclaims | | | 431,640 | |

Prepaid insurance and registration | | | 49,223 | |

| | | | |

Total Assets | | | 431,553,282 | |

| | | | |

| LIABILITIES | | | |

| | | | |

Payables: | | | | |

Distributions . | | | 2,307,390 | |

Capital shares reacquired | | | 1,071,639 | |

Management fees | | | 179,715 | |

Transfer agent fees | | | 55,424 | |

Custodian fees | | | 36,167 | |

Professional fees | | | 23,200 | |

Postage and printing fees | | | 16,384 | |

12b-1 fees | | | 4,503 | |

Accrued expenses and other liabilities | | | 32,150 | |

| | | | |

Total Liabilities | | | 3,726,572 | |

| | | | |

Net Assets | | $ | 427,826,710 | |

| | | | |

| ANALYSIS OF NET ASSETS | | | | |

Net capital paid in shares of capital shares | | $ | 248,374,101 | |

Total distributable earnings | | | 179,452,609 | |

| | | | |

Net Assets | | $ | 427,826,710 | |

| | | | |

Class A Shares: | | | | |

Net Assets | | $ | 404,594,309 | |

Net asset value and redemption price per share ($404,594,309/4,171,206) shares of outstanding beneficial interest, unlimited authorization, no par value | | $ | 97.00 | |

| | | | |

Maximum offering price per share (100/96.50 of $97.00) | | $ | 100.52 | |

| | | | |

Investor Shares: | | | | |

Net Assets | | $ | 23,232,401 | |

Net asset value, offering and redemption* price per share ($23,232,401/240,704) shares of outstanding beneficial interest, unlimited authorization, no par value | | $ | 96.52 | |

| | | | |

| * | Redemption fee may apply (Note 1) |

The accompanying notes are an integral part of these financial statements.

16

NEW ALTERNATIVES FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2020

| | | | |

Investment Income: | | | | |

Dividends (net of $647,701 foreign taxes withheld) | | $ | 3,738,259 | |

| | | | |

Total Investment Income | | | 3,738,259 | |

| | | | |

Expenses: | | | | |

Management fee (Note 4) | | | 1,538,775 | |

Transfer agent fees | | | 410,272 | |

Administration and accounting fees | | | 255,865 | |

Legal fees | | | 140,215 | |

Custodian fees | | | 111,330 | |

Registration fees | | | 62,752 | |

Compliance service fees | | | 55,200 | |

Postage and printing fees | | | 48,097 | |

Trustees fees (Note 5) | | | 39,000 | |

Audit fees | | | 22,700 | |

12b-1 fees (Investor Shares) (Note 4) | | | 26,760 | |

Insurance fees | | | 15,550 | |

Other expenses | | | 23,108 | |

| | | | |

Total Expenses | | | 2,749,624 | |

| | | | |

Net Investment Income | | | 988,635 | |

| | | | |

| |

Net Realized and Unrealized Gain/(Loss) from Investments and Foreign Currency Related Transactions: | | | | |

| |

Realized Gain from Investments and Foreign Currency Related Transactions (Notes 2B & 6): | | | | |

Net realized gain from investments | | | 19,911,021 | |

Net realized gain from foreign currency transactions | | | 9,315 | |

| | | | |

Net Realized Gain | | | 19,920,336 | |

| | | | |

| |

Net Change in Unrealized Appreciation/(Depreciation) on Investments and Foreign Currency Related Translations: | | | | |

Net change in unrealized appreciation/(depreciation) on investments | | | 133,137,027 | |

Net change in unrealized appreciation/(depreciation) on foreign currency translations | | | 23,934 | |

| | | | |

Net change in unrealized appreciation/(depreciation) | | | 133,160,961 | |

| | | | |

Net Realized and Unrealized Gain on Investments and Foreign Currency Related Translations | | | 153,081,297 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 154,069,932 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

17

NEW ALTERNATIVES FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | For the

Year Ended

December 31, 2020 | | For the

Year Ended

December 31, 2019 |

Investment Activities: | | | | | | | | | | |

Net investment income | | | $ | 988,635 | | | | $ | 308,905 | |

Net realized gain from investments and foreign currency transactions | | | | 19,920,336 | | | | | 11,693,077 | |

Net change in unrealized appreciation/(depreciation) on investments and foreign currency translations | | | | 133,160,961 | | | | | 51,833,321 | |

| | | | | | | | | | |

Net increase in net assets resulting from operations | | | | 154,069,932 | | | | | 63,835,303 | |

| | | | | | | | | | |

| | |

Distributions to Shareholders from distributable earnings: | | | | | | | | | | |

Class A Shares | | | | (19,091,032 | ) | | | | (12,098,715 | ) |

Investor Shares | | | | (1,082,121 | ) | | | | (311,228 | ) |

| | | | | | | | | | |

Total distributions to shareholders from distributable earnings | | | | (20,173,153 | ) | | | | (12,409,943 | ) |

| | | | | | | | | | |

| | |

Capital Share Transactions: | | | | | | | | | | |

Net increase in net assets from capital share transactions (Note 3) | | | | 59,468,301 | | | | | 8,666,394 | |

| | | | | | | | | | |

| | |

Total Increase in Net Assets | | | | 193,365,080 | | | | | 60,091,754 | |

| | |

Net Assets: | | | | | | | | | | |

Beginning of the year | | | | 234,461,630 | | | | | 174,369,876 | |

| | | | | | | | | | |

End of the year | | | $ | 427,826,710 | | | | $ | 234,461,630 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

18

NEW ALTERNATIVES FUND

FINANCIAL HIGHLIGHTS

STATEMENT OF PER SHARE INCOME AND CAPITAL CHANGES

For a share outstanding throughout each year

| | | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | For the Years Ended December 31, | | | | |

| |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

Net asset value at the beginning of year | | $ | 62.92 | | | $ | 48.48 | | | $ | 55.54 | | | $ | 47.78 | | | $ | 46.46 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment income* | | | 0.26 | | | | 0.09 | | | | 0.09 | | | | 0.90 | | | | 0.54 | |

Net realized and unrealized gain/(loss) on investments and foreign currency related transactions | | | 38.60 | | | | 17.84 | | | | (3.94) | | | | 9.18 | | | | 2.55 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 38.86 | | | | 17.93 | | | | (3.85) | | | | 10.08 | | | | 3.09 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Distributions | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.07) | | | | (0.26) | | | | (0.33) | | | | (1.03) | | | | (0.67) | |

From net realized gains | | | (4.71) | | | | (3.23) | | | | (2.88) | | | | (1.29) | | | | (1.10) | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (4.78) | | | | (3.49) | | | | (3.21) | | | | (2.32) | | | | (1.77) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value at end of year | | $ | 97.00 | | | $ | 62.92 | | | $ | 48.48 | | | $ | 55.54 | | | $ | 47.78 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total return | | | | | | | | | | | | | | | | | | | | |

(Sales load not reflected) | | | 61.76% | | | | 36.98% | | | | (6.93)% | | | | 21.08% | | | | 6.66% | |

Net assets, end of the year | | | | | | | | | | | | | | | | | | | | |

(in thousands) | | $ | 404,594 | | | $ | 228,348 | | | $ | 170,699 | | | $ | 209,804 | | | $ | 179,974 | |

Ratio of expenses to average net assets | | | 0.96% | | | | 1.08% | | | | 1.12% | | | | 1.07% | | | | 1.12% | |

Ratio of net investment income/(loss) to average net assets | | | 0.36% | | | | 0.16% | | | | 0.17% | | | | 1.64% | | | | 1.12% | |

Portfolio turnover | | | 20.34% | | | | 18.78% | | | | 17.77% | | | | 11.31% | | | | 30.44% | |

Number of shares outstanding at end of the year | | | 4,171,206 | | | | 3,629,088 | | | | 3,520,688 | | | | 3,777,599 | | | | 3,766,734 | |

| * | The selected per share data was calculated using the average shares outstanding method for the year. |

The accompanying notes are an integral part of these financial statements.

19

NEW ALTERNATIVES FUND

FINANCIAL HIGHLIGHTS

STATEMENT OF PER SHARE INCOME AND CAPITAL CHANGES

For a share outstanding throughout each year

| | | | | | | | | | | | | | | | | | | | |

| Investor Shares | | For the Years Ended December 31, | |

| |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

Net asset value at the beginning of year | | $ | 62.74 | | | $ | 48.36 | | | $ | 55.41 | | | $ | 47.71 | | | $ | 46.39 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment Operations | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)* | | | 0.08 | | | | (0.05) | | | | (0.04) | | | | 0.76 | | | | 0.42 | |

Net realized and unrealized gain/(loss) on investments and foreign currency related transactions | | | 38.41 | | | | 17.79 | | | | (3.92) | | | | 9.15 | | | | 2.56 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 38.49 | | | | 17.74 | | | | (3.96) | | | | 9.91 | | | | 2.98 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Distributions | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.13) | | | | (0.21) | | | | (0.92) | | | | (0.56) | |

From net realized gains | | | (4.71) | | | | (3.23) | | | | (2.88) | | | | (1.29) | | | | (1.10) | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (4.71) | | | | (3.36) | | | | (3.09) | | | | (2.21) | | | | (1.66) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value at end of year | | $ | 96.52 | | | $ | 62.74 | | | $ | 48.36 | | | $ | 55.41 | | | $ | 47.71 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total return | | | 61.35% | | | | 36.68% | | | | (7.15)% | | | | 20.76% | | | | 6.42% | |

Net assets, end of the year | | | | | | | | | | | | | | | | | | | | |

(in thousands) | | $ | 23,232 | | | $ | 6,114 | | | $ | 3,671 | | | $ | 3,275 | | | $ | 1,848 | |

Ratio of expenses to average net assets | | | 1.21% | | | | 1.33% | | | | 1.37% | | | | 1.32% | | | | 1.37% | |

Ratio of net investment income (loss) to average net assets | | | 0.11% | | | | (0.09)% | | | | (0.08)% | | | | 1.39% | | | | 0.87% | |

Portfolio turnover | | | 20.34% | | | | 18.78% | | | | 17.77% | | | | 11.31% | | | | 30.44% | |

Number of shares outstanding at end of the year | | | 240,704 | | | | 97,453 | | | | 75,901 | | | | 59,105 | | | | 38,727 | |

| * | The selected per share data was calculated using the average shares outstanding method for the year. |

The accompanying notes are an integral part of these financial statements.

20

NEW ALTERNATIVES FUND

NOTES TO FINANCIAL STATEMENTS

For the Year Ended December 31, 2020

1) ORGANIZATION – New Alternatives Fund (the “Trust”) was organized as a Delaware statutory trust on June 12, 2014. The Trust currently offers one series of shares, also known as “New Alternatives Fund” (the “Fund”).The Fund is the successor to New Alternatives Fund, Inc. (the “Predecessor Company”), a New York corporation that commenced operations in 1982. The Fund is a diversified, open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). On November 14, 2014, the Predecessor Company was reorganized into the Fund. The Fund was organized for the purpose of continuing the investment operations and performance history of the Predecessor Company and prior to the reorganization had no substantial assets or prior history of investment operations. The Fund currently offers two classes of shares: Class A Shares and Investor Shares. Class A Shares represent a continuance of the original class of shares offered by the Predecessor Company. Class A Shares are sold subject to a front-end sales charge. Class A Shares of the Fund do not have any distribution (i.e., Rule 12b-1) charges, service charges or redemption fees. Investor Shares are not subject to a sales charge but are subject to a 2.00% redemption fee imposed on any Investor Shares redeemed within sixty (60) days of their initial purchase. Any redemption fee imposed is retained by the Fund and is meant to deter short-term trading in Investor Shares and to offset any transaction and other costs associated with short-term trading. For the year ended December 31, 2020, no redemption fees were imposed on the redemption of Investor Shares. Investor Shares are also subject to 12b-1 fees. The investment objective of the Fund is long-term capital appreciation, with income as a secondary objective. The Fund seeks to achieve its investment objective by investing in equity securities. The equity securities in which the Fund invests consist primarily of common stocks. Other equity securities in which the Fund may invest include “Yieldco’s”, American Depositary Receipts (“ADRs”), real estate investment trusts (“REITs”) and publicly-traded master limited partnerships (“MLPs”). The Fund makes investments in a wide range of industries and in companies of all sizes. The Fund invests in equity securities of both U.S. and foreign companies, and has no limitation on the percentage of assets invested in the U.S. or abroad. Under normal market conditions, at least 25% of the Fund’s total assets will be invested in equity securities of companies in the alternative energy industry. “Alternative Energy” or “Renewable Energy” means the production, conservation, storage and transmission of energy to reduce pollution and harm to the environment, particularly when compared to conventional coal, oil or nuclear energy.

2) ACCOUNTING POLICIES – The Fund is an investment company that follows the accounting and reporting guidance of Accounting Standards Codification Topic 946 applicable to Investment Companies. The following is a summary of significant accounting policies followed by the Fund.

A. PORTFOLIO VALUATION – The Fund’s net asset value (“NAV”) is calculated once daily at the close of regular trading hours on the New York Stock Exchange (“NYSE”) (generally 4:00 p.m. Eastern time) on each day the NYSE is open. Securities held by the Fund are valued based on the official closing price or the last reported sale price on national securities exchanges where they are primarily traded or on the National Association of Securities Dealers Automatic

21

NEW ALTERNATIVES FUND

NOTES TO FINANCIAL STATEMENTS

For the Year Ended December 31, 2020

Quotation System (“NASDAQ”) market system as of the close of business on the day the securities are being valued. That is normally 4:00 p.m. Eastern time. If there were no sales on that day or the securities are traded on other over-the-counter markets, the mean of the last bid and asked prices prior to the market close is used. Short-term debt securities having a remaining maturity of 60 days or less are amortized based on their cost. Certificates of Deposit are valued at amortized cost, provided such amount approximates market value and are categorized in Level 2.

Non-U.S. equity securities are valued based on their most recent closing market prices on their primary market and are translated from the local currency into U.S. dollars using current exchange rates on the day of valuation. The Fund may hold securities that are primarily listed on foreign exchanges that trade on weekends or other days when the Fund does not price its shares. As such, the Fund’s NAV may change on days when shareholders will not be able to purchase or redeem Fund shares.

If the market price of a security held by the Fund is unavailable at the time the Fund prices its shares at 4:00 p.m. Eastern time, the Fund will use the “fair value” of such security as determined in good faith by Accrued Equities, Inc., the Fund’s investment advisor, under methods established by and under the general supervision of the Trust’s Board of Trustees. The Fund may use fair value pricing if the value of a security it holds has been materially affected by events occurring before the Fund’s pricing time but after the close of the primary markets or exchange on which the security is traded. This most commonly occurs with foreign securities, but may occur in other cases as well. Certain foreign securities are fair valued by utilizing an external pricing service in the event of any significant market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. The Fund does not invest in unlisted securities.

The inputs and valuations techniques used to measure fair value of the Fund’s net assets are summarized into three levels as described in the hierarchy below:

| | | | | | | | |

| | ● | | Level 1 | | - | | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | | | |

| | ● | | Level 2 | | - | | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

22

NEW ALTERNATIVES FUND

NOTES TO FINANCIAL STATEMENTS

For the Year Ended December 31, 2020

| | | | | | | | |

| | ● | | Level 3 | | - | | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used, as of December 31, 2020, in valuing the

Fund’s assets carried at fair value:

| | | | | | | | | | | | | | | | |

| | | Total

Value at

12/31/2020 | | | Level 1 –

Quoted

Price | | | Level 2 –

Significant

Observable

Inputs | | | Level 3 –

Significant

Unobservable

Inputs | |

Common Stocks | | | | | | | | | | | | | | | | |

Alternate Energy | | $ | 320,715,346 | | | $ | 320,715,346 | | | $ | — | | | $ | — | |

Energy Conservation | | | 25,569,197 | | | | 25,569,197 | | | | — | | | | — | |

Sustainable Energy Financial | | | | | | | | | | | | | | | | |

Services | | | 23,786,250 | | | | 23,786,250 | | | | — | | | | — | |

Water Systems & Utilities | | | 18,913,700 | | | | 18,913,700 | | | | — | | | | — | |

Energy Management | | | 10,119,016 | | | | 10,119,016 | | | | — | | | | — | |

Transportation | | | 7,184,498 | | | | 7,184,498 | | | | — | | | | — | |

Recycling & Waste | | | | | | | | | | | | | | | | |

Management | | | 1,035,000 | | | | 1,035,000 | | | | — | | | | — | |

Warrants | | | 0 | | | | — | | | | 0 | | | | — | |

Certificates of Deposit | | | 300,000 | | | | — | | | | 300,000 | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | 407,623,007 | | | $ | 407,323,007 | | | $ | 300,000 | | | $ | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

At the end of each calendar quarter, management evaluates the classification of Level 1, 2 and 3 assets and liabilities. Various factors are considered, such as changes in liquidity from the prior reporting period; whether or not a broker is willing to execute at the quoted price; the depth and consistency of prices from third party pricing services; and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates the classification of Level 1 and Level 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges.

The Fund utilizes an external pricing service to fair value certain foreign securities in the event of any significant market movements between the time the Fund valued certain foreign securities and the earlier closing of foreign markets. Such fair valuations are categorized as Level 2 in the hierarchy. Significant market movements were not deemed to have occurred at December 31, 2020, and therefore, the Fund did not utilize the external pricing service

23

NEW ALTERNATIVES FUND

NOTES TO FINANCIAL STATEMENTS

For the Year Ended December 31, 2020

model adjustments. Transfers in and out between Levels are based on values at the end of the period. The Fund did not hold any Level 3 categorized securities during the year ended December 31, 2020.

B. FOREIGN CURRENCY TRANSLATION – Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. If foreign currency translations are not available, the foreign exchange rate(s) will be valued at fair market value using procedures approved by the Trust’s Board of Trustees.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid.

C. SECURITY TRANSACTIONS AND RELATED INVESTMENT INCOME – Security transactions are accounted for on the trade date (date order to buy or sell is executed). The cost of investments sold is determined by use of specific lots for both financial reporting and income tax purposes in determining realized gains and losses on investments.

D. INVESTMENT INCOME AND EXPENSE RECOGNITION – Dividend income is recorded as of the ex-dividend date. Non-cash dividends included in dividend income are recorded at the fair value of the security received. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after the Fund determines the existence of a dividend declaration after exercising reasonable diligence. Interest income, including amortization/accretion of premium and discount, is accrued daily. Return of capital distributions are recorded as a reduction of cost of the related investments. Expenses are accrued on a daily basis. Fund level expenses common to all classes are allocated to each class based upon relative daily net assets of each class.

E. DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS – Dividends from net investment income and distributions from net realized capital gains, if any, will be declared

24

NEW ALTERNATIVES FUND

NOTES TO FINANCIAL STATEMENTS

For the Year Ended December 31, 2020

and paid at least annually to shareholders and recorded on ex-date. Income dividends and capital gain distributions are determined in accordance with U.S. federal income tax regulations which may differ from accounting principles generally accepted in the United States of America.

F. U.S. TAX STATUS – No provision is made for U.S. income taxes as it is the Fund’s intention to qualify for and elect the tax treatment applicable to regulated investment companies under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to its shareholders which will be sufficient to relieve it from U.S. income and excise taxes.

G. USE OF ESTIMATES IN THE PREPARATION OF FINANCIAL STATEMENTS – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

H. OTHER – In the normal course of business, the Fund may enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on claims that may be made against the Fund in the future, and therefore, cannot be estimated; however, based on experience, the risk of material loss for such claims is considered remote.

I.ALLOCATION – Investment income earned, realized capital gains and losses, and unrealized appreciation and depreciation for the Fund are allocated daily to each class of shares based upon its proportionate share of total net assets of the Fund. Class-specific expenses are charged directly to the class incurring the expense. Common expenses, which are not attributable to a specific class, are allocated daily to each class of shares based upon its proportionate share of total net assets of the Fund.

J. CASH – Cash represents amounts held on deposit with the Fund’s custodian bank. Balances at times may exceed federally insured limits.

25

NEW ALTERNATIVES FUND

NOTES TO FINANCIAL STATEMENTS

For the Year Ended December 31, 2020

3) SHARES OF BENEFICIAL INTEREST – There are unlimited, no par value shares of beneficial interest authorized. On December 31, 2020, the Fund’s total shares outstanding were 4,411,910. Aggregate paid-in capital including reinvestment of dividends was $248,374,101. Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | | | |

| | | For the Year Ended | | | For the Year Ended | |

| | | December 31, 2020 | | | December 31, 2019 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Class A Shares | | | | | | | | | | | | | | | | |

Shares of beneficial interest sold | | | 983,674 | | | $ | 71,993,179 | | | | 224,511 | | | $ | 13,069,157 | |

Reinvestment of distributions | | | 173,948 | | | | 16,872,102 | | | | 168,472 | | | | 10,599,373 | |

Redemptions | | | (615,504 | ) | | | (40,807,869 | ) | | | (284,583 | ) | | | (16,281,570 | ) |

| | | | | | | | | | | | | | | | |

Net Increase | | | 542,118 | | | $ | 48,057,412 | | | | 108,400 | | | $ | 7,386,960 | |

| | | | | | | | | | | | | | | | |

| | |

| | | For the Year Ended | | | For the Year Ended | |

| | | December 31, 2020 | | | December 31, 2019 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Investor Shares | | | | | | | | | | | | | | | | |

Shares of beneficial interest sold | | | 146,897 | | | $ | 11,502,944 | | | | 21,325 | | | $ | 1,249,503 | |

Reinvestment of distributions | | | 10,295 | | | | 993,669 | | | | 4,654 | | | | 299,740 | |

Redemptions | | | (13,941 | ) | | | (1,085,724 | ) | | | (4,427 | ) | | | (269,809 | ) |

| | | | | | | | | | | | | | | | |

Net Increase | | | 143,251 | | | $ | 11,410,889 | | | | 21,552 | | | $ | 1,279,434 | |

| | | | | | | | | | | | | | | | |

4) MANAGEMENT FEE AND OTHER TRANSACTIONS WITH AFFILIATES – Accrued Equities, Inc. (“Accrued Equities” or the “Advisor”), an SEC registered investment advisor and broker-dealer, serves as investment advisor to the Fund pursuant to an Investment Advisory Agreement, and as an underwriter (but not a principal underwriter) of the Fund’s shares pursuant to a Sub-Distribution Agreement. For it’s investment advisory services, the Fund pays Accrued Equities an annual management fee of 1.00% of the first $25 million of average daily net assets; 0.50% of the next $475 million of average daily net assets; and 0.40% of average daily net assets more than $500 million. The Fund incurred management fees of $1,538,775 for the year ended December 31, 2020.

The Fund pays no remuneration to two of its trustees, David J. Schoenwald and Murray D. Rosenblith, who are also officers or employees of Accrued Equities.

Foreside Funds Distributors LLC (the “Distributor”) serves as the principal underwriter of the Fund pursuant to a Distribution Agreement for the limited purpose of acting as statutory underwriter to

26

NEW ALTERNATIVES FUND

NOTES TO FINANCIAL STATEMENTS

For the Year Ended December 31, 2020

facilitate the distribution of shares of the Fund. The Distributor has entered into a Sub-Distribution Agreement with Accrued Equities. Effective May 1, 2017, the Fund charges a maximum front-end sales charge of 3.50% on most new sales of the Fund’s Class A Shares. Of this amount, the Distributor and Accrued Equities receive the net underwriter commission and pay out the remaining sales commission to other brokers who actually sell new Class A Shares. Their share of the sales commission may vary. The aggregate underwriter commissions on all sales of Class A Shares of the Fund during the year ended December 31, 2020 was $54,961 and the amounts received by the Distributor and Accrued Equities were $18,320 and $36,641, respectively. The Distributor and Accrued Equities are also entitled to receive sales commissions for the sale of Class A Shares. For the year ended December 31, 2020, the Distributor and Accrued Equities received $9,712 and $23,094 in sales commissions, respectively, for the sale of Class A Shares of the Fund. Underwriter commissions and sales commissions received by the Distributor are set aside by the Distributor and used solely for distribution-related expenses.

Investor Shares of the Fund are not subject to a sales charge. The Fund has adopted a distribution plan (the “Rule 12b-1 Plan”) for its Investor Shares in accordance with the requirements of Rule 12b-1 under the 1940 Act. The Rule 12b-1 Plan provides that the Fund may pay a fee to Accrued Equities, the Distributor, or certain broker-dealers, investment advisers, banks or other financial institutions at an annual rate of up to 0.25% of the average daily net assets of the Fund’s Investor Shares to finance certain activities primarily intended to sell such Investor Shares. For the year ended December 31, 2020, 12b-1 Fees of $26,760 were accrued by the Investor Shares of the Fund.

The Board of Trustees has authorized the Class A Shares of the Fund to pay sub-transfer agent fees to financial intermediaries, including securities dealers, that provide shareholder account-related services to their customers who own Class A Shares of the Fund, or to reimburse Accrued Equities for such expenses it reimbursed on behalf of the Class A Shares. The sub-transfer agent services provided must be necessary and may not duplicate services already provided by a Fund service provider. The sub-transfer agent services may not be for distribution-related services. The fees paid by the Class A Shares may not exceed the fees that would have been incurred by customers of the financial intermediaries if they maintained their customer account directly with the Fund.

5) TRUSTEES’ FEES – For the year ended December 31, 2020, the Fund paid trustees’ fees of $39,000 to its Trustees who are not “interested persons” of the Trust, as that term is defined in the 1940 Act (the “Independent Trustees”).

For the year ended December 31, 2020, each Independent Trustee received an annual fee of $9,000 for their services as an Independent Trustee of the Trust. As Vice-Chairperson of the Trust’s Board of Trustees, Sharon Reier received an additional annual fee of $1,000. Each member of the Audit Committee received an additional $500 annual fee and Susan Hickey, Chairperson of theAudit Committee, received an additional annual fee of $500. The Independent Trustees are also entitled to receive reimbursement of “coach” travel expenses to attend Board Meetings. The Trustees and Officers of the Trust who are

27

NEW ALTERNATIVES FUND

NOTES TO FINANCIAL STATEMENTS

For the Year Ended December 31, 2020

officers and employees of the Advisor do not receive compensation from the Fund for their services and are paid for their services by the Advisor. The Fund’s Chief Compliance Officer is not an officer or employee of the Advisor and is compensated directly by the Fund for his services.

6) PURCHASES AND SALES OF SECURITIES – For the year ended December 31, 2020, the aggregate cost of securities purchased totaled $93,105,819. Net realized gains (losses) were computed on a specific lot basis. The proceeds received on sales of securities for the year ended December 31, 2020 was $54,883,884.

7) FEDERAL INCOME TAX INFORMATION – At December 31, 2020, the federal tax basis cost and aggregate gross unrealized appreciation and depreciation of securities held by the Fund were as follows:

| | | | | | | | |

Cost of investments for tax purposes | | | | | | $ | 228,155,418 | |

| | | | | | | | |

Unrealized appreciation for tax purposes | | | | | | $ | 181,899,128 | |

Unrealized depreciation for tax purposes | | | | | | | (2,431,539 | ) |

| | | | | | | | |

Net unrealized appreciation on investments and foreign currency translation | | | | | | $ | 179,467,589 | |

| | | | | | | | |

The tax character of distributions paid during 2020 and 2019 was as follows: | | | | | | | | |

Distributions paid from: | | | 2020 | | | | 2019 | |

Ordinary Income | | $ | 890,822 | | | $ | 1,102,925 | |

Long-Term Capital Gains | | | 19,282,331 | | | | 11,307,018 | |

| | | | | | | | |

| | $ | 20,173,153 | | | $ | 12,409,943 | |

| | | | | | | | |

For federal income tax purposes, distributions from net investment income and short-term capital gains are treated as ordinary income dividends.

As of December 31, 2020, the components of distributable earnings (deficit) on a tax basis were as follows:

| | | | |

Distributions in Excess of Net Investment Income | | $ | (14,980 | ) |

Net Unrealized Appreciation on | | | | |

Investments and Foreign Currency Translations* | | | 179,467,589 | |

| | | | |

| | $ | 179,452,609 | |

| | | | |

* The primary difference between distributable earnings on a book and tax basis is due to wash sale losses, investments in partnerships and other book tax cost differences.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (current and prior three tax years), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal

28

NEW ALTERNATIVES FUND

NOTES TO FINANCIAL STATEMENTS

For the Year Ended December 31, 2020

excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

8) RISKS Foreign Securities – Investing in foreign securities (including depositary receipts traded on U.S. exchanges but representing shares of foreign companies) involves more risks than investing in U.S. securities. Risks of investing in foreign companies include currency exchange rates between foreign currencies and the U.S. dollar. The political, economic and social structures of some foreign countries may be less stable and more volatile than those in the U.S. Brokerage commissions and other fees may be higher for foreign securities. Foreign companies may not be subject to the same disclosure, accounting, auditing and financial reporting standards as U.S. companies. These risks can increase the potential for losses in the Fund and affect its share price.

Concentration – Under normal market conditions, at least 25% of the Fund’s total asset will be invested in equity securities of companies in the Alternative Energy industry. A downturn in this group of industries would have a larger impact on the Fund than on a fund that does not concentrate its investments. As of December 31, 2020, the Fund had 75% of its net assets invested in Alternative Energy companies.

COVID-19 – Market disruptions associated with the COVID-19 pandemic have had a global impact, and uncertainty exists as to its long-term implications. The COVID-19 pandemic could adversely affect the value and liquidity of the Fund’s investments, impair the Fund’s ability to satisfy redemption requests, and negatively impact the Fund’s performance. In addition, the outbreak of COVID-19, and measures taken to mitigate its effects, could result in disruptions to the services provided to the Fund by its service providers. Fund management is continuing to monitor this development and evaluate its impact on the Fund.

9) SUBSEQUENT EVENTS – Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued and has determined that there were no subsequent events requiring disclosure.

29

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

New Alternatives Fund

Opinion on the Financial Statements