Fidelity® Investments Money Market Funds Treasury Only Portfolio

Treasury Portfolio

Government Portfolio

Money Market Portfolio

Prime Money Market Portfolio

Prime Reserves Portfolio

Tax-Exempt Portfolio

Semi-Annual Report September 30, 2017 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-297-2952 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Treasury Only Portfolio

Investment Summary/Performance (Unaudited)

Effective Maturity Diversification

| Days | % of fund's investments 9/30/17 | % of fund's investments 3/31/17 | % of fund's investments 9/30/16 |

| 1 - 7 | 22.6 | 14.4 | 16.8 |

| 8 - 30 | 4.5 | 30.2 | 16.1 |

| 31 - 60 | 30.2 | 24.6 | 23.8 |

| 61 - 90 | 34.7 | 19.0 | 30.6 |

| 91 - 180 | 8.0 | 10.2 | 11.7 |

| > 180 | 0.0 | 1.6 | 1.0 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940.

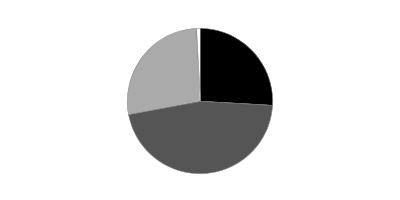

Asset Allocation (% of fund's net assets)

| As of September 30, 2017 |

| | U.S. Treasury Debt | 100.0% |

| As of March 31, 2017 |

| | U.S. Treasury Debt | 100.1% |

| | Net Other Assets (Liabilities)* | (0.1)% |

* Net Other Assets (Liabilities) are not included in the pie chart

Current And Historical 7-Day Yields

| | 9/30/17 | 6/30/17 | 3/31/17 | 12/31/16 | 9/30/16 |

| Class I | 0.89% | 0.78% | 0.47% | 0.31% | 0.17% |

| Class II | 0.74% | 0.63% | 0.32% | 0.16% | 0.02% |

| Class III | 0.64% | 0.53% | 0.22% | 0.06% | 0.01% |

| Class IV | 0.39% | 0.28% | 0.01% | 0.01% | 0.01% |

| Select Class | 0.84% | 0.73% | 0.42% | 0.26% | 0.12% |

| Institutional Class | 0.93% | 0.82% | 0.51% | 0.35% | 0.21% |

Yield refers to the income paid by the Fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending September 30, 2017, the most recent period shown in the table, would have been 0.86% for Class I, 0.70% for Class II, 0.60% for Class III, 0.35% for Class IV, 0.81% for Select Class and 0.89% for Institutional Class.

Percentages shown as 0.0% may reflect amounts less than 0.05%.

Treasury Only Portfolio

Investments September 30, 2017 (Unaudited)

Showing Percentage of Net Assets

| U.S. Treasury Debt - 100.0% | | | | |

| | | Yield(a) | Principal Amount (000s) | Value (000s) |

| U.S. Treasury Obligations - 100.0% | | | | |

| U.S. Treasury Bills | | | | |

| 10/5/17 to 2/15/18 | | 0.96 to 1.14 % | $9,703,929 | $9,686,386 |

| U.S. Treasury Notes | | | | |

| 10/31/17 to 7/31/19 | | 0.74 to 1.32 (b) | 3,520,041 | 3,521,534 |

| TOTAL U.S. TREASURY DEBT | | | | |

| (Cost $13,207,920) | | | | 13,207,920 |

| TOTAL INVESTMENT IN SECURITIES - 100.0% | | | | |

| (Cost $13,207,920) | | | | 13,207,920 |

| NET OTHER ASSETS (LIABILITIES) - 0.0% | | | | 5,067 |

| NET ASSETS - 100% | | | | $13,212,987 |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets.

Legend

(a) Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

Investment Valuation

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

Treasury Only Portfolio

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | | September 30, 2017 (Unaudited) |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $13,207,920) | | $13,207,920 |

| Cash | | 1 |

| Receivable for fund shares sold | | 11,188 |

| Interest receivable | | 9,102 |

| Prepaid expenses | | 32 |

| Receivable from investment adviser for expense reductions | | 401 |

| Total assets | | 13,228,644 |

| Liabilities | | |

| Payable for fund shares redeemed | $9,218 | |

| Distributions payable | 3,943 | |

| Accrued management fee | 1,555 | |

| Distribution and service plan fees payable | 248 | |

| Other affiliated payables | 622 | |

| Other payables and accrued expenses | 71 | |

| Total liabilities | | 15,657 |

| Net Assets | | $13,212,987 |

| Net Assets consist of: | | |

| Paid in capital | | $13,213,013 |

| Distributions in excess of net investment income | | (4) |

| Accumulated undistributed net realized gain (loss) on investments | | (22) |

| Net Assets | | $13,212,987 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($6,980,558 ÷ 6,979,422 shares) | | $1.00 |

| Class II: | | |

| Net Asset Value, offering price and redemption price per share ($215,974 ÷ 215,990 shares) | | $1.00 |

| Class III: | | |

| Net Asset Value, offering price and redemption price per share ($896,925 ÷ 896,663 shares) | | $1.00 |

| Class IV: | | |

| Net Asset Value, offering price and redemption price per share ($35,548 ÷ 35,542 shares) | | $1.00 |

| Select Class: | | |

| Net Asset Value, offering price and redemption price per share ($153,744 ÷ 153,744 shares) | | $1.00 |

| Institutional Class: | | |

| Net Asset Value, offering price and redemption price per share ($4,930,238 ÷ 4,930,047 shares) | | $1.00 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Six months ended September 30, 2017 (Unaudited) |

| Investment Income | | |

| Interest | | $59,703 |

| Expenses | | |

| Management fee | $9,188 | |

| Transfer agent fees | 3,241 | |

| Distribution and service plan fees | 1,477 | |

| Accounting fees and expenses | 474 | |

| Custodian fees and expenses | 75 | |

| Independent trustees' fees and expenses | 24 | |

| Registration fees | 79 | |

| Audit | 22 | |

| Legal | 11 | |

| Miscellaneous | 39 | |

| Total expenses before reductions | 14,630 | |

| Expense reductions | (2,245) | 12,385 |

| Net investment income (loss) | | 47,318 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | | (19) |

| Total net realized gain (loss) | | (19) |

| Net increase in net assets resulting from operations | | $47,299 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Six months ended September 30, 2017 (Unaudited) | Year ended March 31, 2017 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $47,318 | $31,360 |

| Net realized gain (loss) | (19) | 93 |

| Net increase in net assets resulting from operations | 47,299 | 31,453 |

| Distributions to shareholders from net investment income | (47,508) | (31,217) |

| Share transactions - net increase (decrease) | (524,650) | 114,871 |

| Total increase (decrease) in net assets | (524,859) | 115,107 |

| Net Assets | | |

| Beginning of period | 13,737,846 | 13,622,739 |

| End of period | $13,212,987 | $13,737,846 |

| Other Information | | |

| Undistributed net investment income end of period | $– | $186 |

| Distributions in excess of net investment income end of period | $(4) | $– |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Treasury Only Portfolio Class I

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | | | |

| | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | .004 | .002 | –A | –A | –A | –A |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | .004 | .002 | –A | –A | –A | –A |

| Distributions from net investment income | (.004) | (.002) | –A | –A | –A | –A |

| Total distributions | (.004) | (.002) | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | .37% | .23% | .04% | .01% | .01% | .01% |

| Ratios to Average Net AssetsD | | | | | | |

| Expenses before reductions | .21%E | .21% | .21% | .21% | .21% | .21% |

| Expenses net of fee waivers, if any | .18%E | .18% | .11% | .05% | .06% | .10% |

| Expenses net of all reductions | .18%E | .18% | .11% | .05% | .06% | .10% |

| Net investment income (loss) | .73%E | .24% | .05% | - %F | .01% | .01% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $6,981 | $7,638 | $10,035 | $9,402 | $9,795 | $9,431 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Annualized

F Amount represents less than .005%.

See accompanying notes which are an integral part of the financial statements.

Treasury Only Portfolio Class II

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | | | |

| | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | .003 | .001 | –A | –A | –A | –A |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | .003 | .001 | –A | –A | –A | –A |

| Distributions from net investment income | (.003) | (.001) | –A | –A | –A | –A |

| Total distributions | (.003) | (.001) | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | .29% | .09% | .01% | .01% | .01% | .01% |

| Ratios to Average Net AssetsD | | | | | | |

| Expenses before reductions | .36%E | .36% | .36% | .36% | .36% | .36% |

| Expenses net of fee waivers, if any | .33%E | .33% | .13% | .05% | .06% | .10% |

| Expenses net of all reductions | .33%E | .33% | .13% | .05% | .06% | .10% |

| Net investment income (loss) | .58%E | .09% | .03% | - %F | .01% | .01% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $216 | $159 | $307 | $310 | $359 | $354 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Annualized

F Amount represents less than .005%.

See accompanying notes which are an integral part of the financial statements.

Treasury Only Portfolio Class III

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | | | |

| | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | .002 | –A | –A | –A | –A | –A |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | .002 | –A | –A | –A | –A | –A |

| Distributions from net investment income | (.002) | –A | –A | –A | –A | –A |

| Total distributions | (.002) | –A | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | .24% | .04% | .01% | .01% | .01% | .01% |

| Ratios to Average Net AssetsD | | | | | | |

| Expenses before reductions | .46%E | .46% | .46% | .46% | .46% | .46% |

| Expenses net of fee waivers, if any | .43%E | .38% | .15% | .05% | .06% | .10% |

| Expenses net of all reductions | .43%E | .38% | .15% | .05% | .06% | .10% |

| Net investment income (loss) | .48%E | .04% | .01% | - %F | .01% | .01% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $897 | $921 | $831 | $635 | $487 | $408 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Annualized

F Amount represents less than .005%.

See accompanying notes which are an integral part of the financial statements.

Treasury Only Portfolio Class IV

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | | | |

| | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | .001 | –A | –A | –A | –A | –A |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | .001 | –A | –A | –A | –A | –A |

| Distributions from net investment income | (.001) | –A | –A | –A | –A | –A |

| Total distributions | (.001) | –A | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | .12% | .01% | .01% | .01% | .01% | .01% |

| Ratios to Average Net AssetsD | | | | | | |

| Expenses before reductions | .71%E | .72% | .71% | .71% | .71% | .71% |

| Expenses net of fee waivers, if any | .68%E | .37% | .14% | .04% | .06% | .10% |

| Expenses net of all reductions | .68%E | .37% | .14% | .04% | .06% | .10% |

| Net investment income (loss) | .23%E | .05% | .02% | .01% | .01% | .01% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $36 | $32 | $338 | $114 | $18 | $22 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Annualized

See accompanying notes which are an integral part of the financial statements.

Treasury Only Portfolio Select Class

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | | | |

| | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | .003 | .002 | –A | –A | –A | –A |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | .003 | .002 | –A | –A | –A | –A |

| Distributions from net investment income | (.003) | (.002) | –A | –A | –A | –A |

| Total distributions | (.003) | (.002) | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | .34% | .18% | .03% | .01% | .01% | .01% |

| Ratios to Average Net AssetsD | | | | | | |

| Expenses before reductions | .26%E | .26% | .27% | .26% | .26% | .26% |

| Expenses net of fee waivers, if any | .23%E | .23% | .12% | .05% | .06% | .10% |

| Expenses net of all reductions | .23%E | .23% | .12% | .05% | .06% | .10% |

| Net investment income (loss) | .68%E | .19% | .04% | - %F | .01% | .01% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $154 | $94 | $180 | $194 | $215 | $210 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Annualized

F Amount represents less than .005%.

See accompanying notes which are an integral part of the financial statements.

Treasury Only Portfolio Institutional Class

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | |

| | 2017 | 2017 | 2016 | 2015 A |

| Selected Per–Share Data | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | |

| Net investment income (loss) | .004 | .003 | .001 | –B |

| Net realized and unrealized gain (loss)B | – | – | – | – |

| Total from investment operations | .004 | .003 | .001 | –B |

| Distributions from net investment income | (.004) | (.003) | (.001) | –B |

| Total distributions | (.004) | (.003) | (.001) | –B |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnC,D | .39% | .27% | .05% | .01% |

| Ratios to Average Net AssetsE | | | | |

| Expenses before reductions | .18%F | .18% | .18% | .19%F |

| Expenses net of fee waivers, if any | .14%F | .14% | .12% | .04%F |

| Expenses net of all reductions | .14%F | .14% | .12% | .04%F |

| Net investment income (loss) | .77%F | .28% | .04% | - %F,G |

| Supplemental Data | | | | |

| Net assets, end of period (in millions) | $4,930 | $4,894 | $1,932 | $126 |

A For the period May 14, 2014 (commencement of sale of shares) to March 31, 2015.

B Amount represents less than $.0005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Annualized

G Amount represents less than .005%.

See accompanying notes which are an integral part of the financial statements.

Treasury Portfolio

Investment Summary/Performance (Unaudited)

Effective Maturity Diversification

| Days | % of fund's investments 9/30/17 | % of fund's investments 3/31/17 | % of fund's investments 9/30/16 |

| 1 - 7 | 55.0 | 52.3 | 50.5 |

| 8 - 30 | 0.2 | 16.1 | 7.5 |

| 31 - 60 | 13.4 | 7.4 | 12.6 |

| 61 - 90 | 19.6 | 7.5 | 12.7 |

| 91 - 180 | 11.8 | 12.9 | 12.9 |

| > 180 | 0.0 | 3.8 | 3.8 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940.

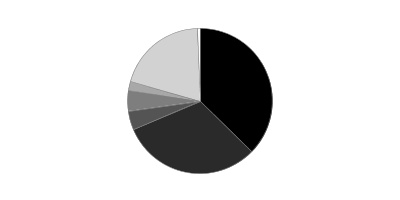

Asset Allocation (% of fund's net assets)

| As of September 30, 2017 |

| | U.S. Treasury Debt | 51.1% |

| | Repurchase Agreements | 46.7% |

| | Net Other Assets (Liabilities) | 2.2% |

| As of March 31, 2017 |

| | U.S. Treasury Debt | 60.5% |

| | Repurchase Agreements | 39.0% |

| | Net Other Assets (Liabilities) | 0.5% |

Current And Historical 7-Day Yields

| | 9/30/17 | 6/30/17 | 3/31/17 | 12/31/16 | 9/30/16 |

| Class I | 0.91% | 0.83% | 0.55% | 0.35% | 0.20% |

| Class II | 0.76% | 0.68% | 0.40% | 0.20% | 0.05% |

| Class III | 0.66% | 0.58% | 0.30% | 0.10% | 0.01% |

| Class IV | 0.41% | 0.33% | 0.05% | 0.01% | 0.01% |

| Select Class | 0.86% | 0.78% | 0.50% | 0.30% | 0.15% |

| Institutional Class | 0.95% | 0.87% | 0.59% | 0.39% | 0.24% |

Yield refers to the income paid by the Fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending September 30, 2017, the most recent period shown in the table, would have been 0.87% for Class I, 0.71% for Class II, 0.61% for Class III, 0.36% for Class IV, 0.82% for Select Class and 0.90% for Institutional Class.

Percentages shown as 0.0% may reflect amounts less than 0.05%.

Treasury Portfolio

Investments September 30, 2017 (Unaudited)

Showing Percentage of Net Assets

| U.S. Treasury Debt - 51.1% | | | | |

| | | Yield(a) | Principal Amount (000s) | Value (000s) |

| U.S. Treasury Obligations - 51.1% | | | | |

| U.S. Treasury Bills | | | | |

| 11/2/17 to 3/8/18 | | 1.02 to 1.15 % | $6,025,400 | $6,010,548 |

| U.S. Treasury Notes | | | | |

| 10/31/17 to 7/31/19 | | 0.74 to 1.32 (b) | 6,899,441 | 6,901,485 |

| TOTAL U.S. TREASURY DEBT | | | | |

| (Cost $12,912,033) | | | | 12,912,033 |

| U.S. Treasury Repurchase Agreement - 46.7% | | | |

| | | Maturity Amount (000s) | Value (000s) |

| In a joint trading account at 1.05% dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations) # | | $1,102,032 | $1,101,936 |

| With: | | | |

| Barclays Capital, Inc. at 1.06%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $32,642,977, 0.63% - 3.75%, 9/30/17 - 2/15/26) | | 32,003 | 32,000 |

| BMO Capital Markets Corp. at: | | | |

| 1.06%, dated 9/27/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $32,058,389, 2.00%, 2/15/22) | | 31,072 | 31,000 |

| 1.07%, dated 8/29/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $15,408,279, 2.50%, 8/15/23) | | 15,042 | 15,000 |

| BMO Harris Bank NA at: | | | |

| 1.06%, dated: | | | |

| 7/7/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $26,972,770, 1.00%, 5/15/18) | | 26,070 | 26,000 |

| 7/13/17 due 10/5/17 (Collateralized by U.S. Treasury Obligations valued at $27,625,584, 0.75% - 3.38%, 10/31/17 - 8/15/47) | | 27,067 | 27,000 |

| 7/25/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $29,910,821, 2.75%, 11/15/23) | | 29,066 | 29,000 |

| 8/3/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $28,983,625, 1.38%, 6/30/18) | | 28,073 | 28,000 |

| 8/9/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $47,126,931, 0.88% - 3.63%, 1/31/18 - 8/15/47) | | 46,126 | 46,000 |

| 8/10/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $31,811,875, 1.38% - 3.63%, 1/31/18 - 8/15/47) | | 31,082 | 31,000 |

| 8/17/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $32,866,081, 3.63%, 2/15/20) | | 32,084 | 32,000 |

| 1.07%, dated: | | | |

| 7/25/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $30,038,752, 2.00% - 3.13%, 11/15/26 - 2/15/43) | | 29,073 | 29,000 |

| 7/26/17 due 10/6/17: | | | |

| (Collateralized by U.S. Treasury Obligations valued at $29,744,271, 2.00%, 2/15/22) | | 29,073 | 29,000 |

| (Collateralized by U.S. Treasury Obligations valued at $14,341,317, 0.75% - 3.63%, 12/31/17 - 8/15/47) | | 14,037 | 14,000 |

| 7/27/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $14,432,234, 0.75% - 3.63%, 10/31/17 - 2/15/47) | | 14,038 | 14,000 |

| 7/28/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $29,886,108, 2.50%, 5/15/24) | | 29,076 | 29,000 |

| 9/1/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $16,366,004, 2.00% - 2.25%, 12/31/23 - 8/15/25) | | 16,049 | 16,000 |

| 9/14/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $20,609,326, 2.00%, 2/15/22) | | 20,054 | 20,000 |

| 1.08%, dated 8/4/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $17,379,952, 0.00% - 3.63%, 11/16/17 - 8/15/47) | | 17,053 | 17,000 |

| BNP Paribas, S.A. at: | | | |

| 1.08%, dated: | | | |

| 7/18/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $28,625,207, 0.00% - 6.25%, 10/12/17 - 8/15/45) | | 28,076 | 28,000 |

| 8/7/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $57,215,995, 0.00% - 7.88%, 10/12/17 - 8/15/40) | | 56,153 | 56,000 |

| 8/8/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $63,344,370, 0.00% - 3.88%, 10/12/17 - 11/15/45) | | 62,169 | 62,000 |

| 8/11/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $126,708,639, 0.00% - 6.25%, 10/12/17 - 2/15/45) | | 124,339 | 124,000 |

| 1.09%, dated: | | | |

| 8/25/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $64,408,498, 0.00% - 4.75%, 10/12/17 - 8/15/44) | | 63,179 | 63,000 |

| 8/30/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $73,513,380, 0.00% - 2.38%, 10/12/17 - 8/15/24) | | 72,201 | 72,000 |

| 8/31/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $66,863,521, 1.24% - 4.75%, 8/31/18 - 11/15/46) | | 65,181 | 65,000 |

| 9/5/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $50,502,338, 2.00% - 4.63%, 2/15/23 - 11/15/43) | | 49,135 | 49,000 |

| 9/7/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $65,833,031, 2.00% - 2.88%, 11/15/26 - 8/15/45) | | 64,176 | 64,000 |

| 9/11/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $132,908,977, 1.50% - 6.25%, 8/31/18 - 11/15/43) | | 129,355 | 129,000 |

| 9/13/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $137,779,223, 0.00% - 2.75%, 10/12/17 - 11/15/23) | | 135,376 | 135,000 |

| 9/15/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $134,709,362, 0.00% - 7.63%, 10/12/17 - 2/15/45) | | 132,364 | 132,000 |

| 1.1%, dated: | | | |

| 7/18/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $28,627,106, 0.00% - 8.75%, 10/12/17 - 5/15/46) | | 28,096 | 28,000 |

| 8/14/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $191,025,596, 0.00% - 9.13%, 11/2/17 - 11/15/44) | | 187,686 | 187,000 |

| 8/15/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $64,460,208, 0.00% - 3.88%, 10/12/17 - 8/15/44) | | 63,231 | 63,000 |

| 9/20/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $101,017,665, 0.00% - 7.50%, 10/12/17 - 11/15/46) | | 99,269 | 99,000 |

| 9/21/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $74,789,882, 1.13% - 8.75%, 10/31/18 - 2/15/46) | | 73,203 | 73,000 |

| 1.11%, dated: | | | |

| 8/28/17 due 11/28/17 (Collateralized by U.S. Treasury Obligations valued at $31,958,465, 1.50% - 3.75%, 8/31/18 - 2/15/46) | | 31,088 | 31,000 |

| 8/30/17 due 11/30/17 (Collateralized by U.S. Treasury Obligations valued at $265,775,159, 0.00% - 4.38%, 10/12/17 - 11/15/46) | | 259,735 | 259,000 |

| 1.12%, dated: | | | |

| 6/27/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $28,646,692, 0.00% - 8.75%, 11/30/17 - 11/15/44) | | 28,105 | 28,000 |

| 7/24/17 due 11/9/17 (Collateralized by U.S. Treasury Obligations valued at $29,645,027, 0.00% - 6.88%, 10/12/17 - 8/15/44) | | 29,097 | 29,000 |

| 7/25/17 due 11/9/17 (Collateralized by U.S. Treasury Obligations valued at $29,643,513, 0.00% - 3.88%, 10/12/17 - 8/15/46) | | 29,097 | 29,000 |

| 1.13%, dated 6/29/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $26,649,516, 0.00% - 6.13%, 10/12/17 - 2/15/46) | | 26,098 | 26,000 |

| 1.14%, dated 7/6/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $55,590,831, 0.00% - 6.88%, 10/12/17 - 2/15/47) | | 54,205 | 54,000 |

| Credit AG at 1.05%, dated 9/29/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $32,642,949, 2.00%, 9/30/20) | | 32,007 | 32,000 |

| Deutsche Bank AG at 1.06%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $98,959,324, 1.13% - 5.50%, 2/28/19 - 5/15/44) | | 97,009 | 97,000 |

| Deutsche Bank Securities, Inc. at 1.06%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $52,024,643, 0.00% - 2.63%, 11/15/17 - 12/31/22) | | 51,005 | 51,000 |

| Federal Reserve Bank of New York at 1%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $6,051,504,336, 8.75%, 8/15/20) | | 6,051,504 | 6,051,000 |

| Goldman Sachs & Co. at 1.06%, dated 9/29/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $32,656,631, 0.00% - 2.75%, 11/9/17 - 8/15/42) | | 32,007 | 32,000 |

| ING Financial Markets LLC at 1.03%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $51,328,361, 1.63%, 5/31/23) | | 49,004 | 49,000 |

| Lloyds Bank PLC at 1.16%, dated: | | | |

| 8/16/17 due 11/16/17 (Collateralized by U.S. Treasury Obligations valued at $25,608,448, 1.38%, 6/30/18) | | 25,074 | 25,000 |

| 8/24/17 due 11/22/17 (Collateralized by U.S. Treasury Obligations valued at $30,795,334, 2.13% - 6.13%, 12/31/21 - 11/15/27) | | 30,087 | 30,000 |

| 8/31/17 due 11/29/17 (Collateralized by U.S. Treasury Obligations valued at $33,696,975, 1.50%, 8/31/18) | | 33,096 | 33,000 |

| 9/12/17 due 12/14/17 (Collateralized by U.S. Treasury Obligations valued at $66,640,288, 2.25% - 6.13%, 11/15/23 - 11/15/27) | | 65,195 | 65,000 |

| 9/14/17 due 12/15/17 (Collateralized by U.S. Treasury Obligations valued at $68,729,365, 2.13% - 6.13%, 12/31/21 - 11/15/27) | | 67,199 | 67,000 |

| Mitsubishi UFJ Securities (U.S.A.), Inc. at: | | | |

| 1.04%, dated 9/28/17 due 10/5/17 (Collateralized by U.S. Treasury Obligations valued at $31,623,667, 1.50% - 7.13%, 4/15/20 - 11/15/46) | | 31,006 | 31,000 |

| 1.05%, dated 9/18/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $16,375,758, 0.00% - 3.00%, 9/13/18 - 5/15/45) | | 16,014 | 16,000 |

| MUFG Securities EMEA PLC at: | | | |

| 1.07%, dated: | | | |

| 9/15/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $103,912,150, 2.63%, 11/15/20) | | 101,093 | 101,000 |

| 9/22/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $49,219,515, 2.13% - 2.63%, 11/15/20 - 5/15/25) | | 48,026 | 48,000 |

| 10/2/17 due 10/6/17(c) | | 13,005 | 13,000 |

| 1.09%, dated: | | | |

| 9/7/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $16,484,512, 2.00% - 2.63%, 11/15/20 - 11/15/25) | | 16,019 | 16,000 |

| 9/12/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $32,747,672, 2.00% - 2.63%, 8/15/20 - 11/15/25) | | 32,034 | 32,000 |

| 1.1%, dated: | | | |

| 8/28/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $12,366,059, 1.50%, 3/31/23) | | 12,034 | 12,000 |

| 8/29/17 due 10/6/17: | | | |

| (Collateralized by U.S. Treasury Obligations valued at $16,653,677, 2.13% - 3.00%, 5/15/25 - 11/15/45) | | 16,021 | 16,000 |

| (Collateralized by U.S. Treasury Obligations valued at $6,243,913, 2.88%, 11/15/46) | | 6,008 | 6,000 |

| (Collateralized by U.S. Treasury Obligations valued at $1,033,211, 1.75%, 3/31/22) | | 1,001 | 1,000 |

| 9/25/17 due 10/13/17 (Collateralized by U.S. Treasury Obligations valued at $16,336,381, 1.63%, 5/15/26) | | 16,009 | 16,000 |

| 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $10,240,527, 1.50%, 8/15/26) | | 10,001 | 10,000 |

| 1.11%, dated: | | | |

| 9/6/17 due: | | | |

| 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $7,286,822, 3.00%, 5/15/45) | | 7,006 | 7,000 |

| 10/20/17 (Collateralized by U.S. Treasury Obligations valued at $7,246,029, 1.25% - 2.25%, 3/31/19 - 11/15/25) | | 7,009 | 7,000 |

| 9/7/17 due 10/17/17 (Collateralized by U.S. Treasury Obligations valued at $16,392,120, 2.63%, 8/15/20 - 11/15/20) | | 16,020 | 16,000 |

| Natixis SA at 1.04%, dated 9/28/17 due 10/5/17 (Collateralized by U.S. Treasury Obligations valued at $63,312,820, 1.00% - 4.75%, 5/15/18 - 2/15/41) | | 62,013 | 62,000 |

| Nomura Securities International, Inc. at 1.06%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $366,224,085, 0.00% - 9.13%, 2/8/18 - 8/15/46) | | 357,032 | 357,000 |

| Norinchukin Bank at: | | | |

| 1.16%, dated: | | | |

| 8/14/17 due 11/6/17 (Collateralized by U.S. Treasury Obligations valued at $16,346,705, 2.13%, 8/31/20) | | 16,043 | 16,000 |

| 8/21/17 due 11/9/17 (Collateralized by U.S. Treasury Obligations valued at $15,319,634, 2.13%, 8/31/20) | | 15,039 | 15,000 |

| 8/23/17 due 11/15/17 (Collateralized by U.S. Treasury Obligations valued at $15,319,634, 2.13%, 8/31/20) | | 15,041 | 15,000 |

| 8/30/17 due 11/22/17 (Collateralized by U.S. Treasury Obligations valued at $33,695,059, 2.13%, 8/31/20) | | 33,089 | 33,000 |

| 8/31/17 due 11/21/17 (Collateralized by U.S. Treasury Obligations valued at $178,671,530, 3.63%, 8/15/19) | | 175,462 | 175,000 |

| 9/25/17 due 12/1/17 (Collateralized by U.S. Treasury Obligations valued at $16,326,367, 2.13%, 8/31/20) | | 16,035 | 16,000 |

| 1.17%, dated 7/26/17 due 10/26/17 (Collateralized by U.S. Treasury Obligations valued at $14,312,900, 2.13%, 8/31/20) | | 14,042 | 14,000 |

| 1.2%, dated 6/29/17 due 10/3/17 (Collateralized by U.S. Treasury Obligations valued at $13,301,082, 2.13%, 8/31/20) | | 13,042 | 13,000 |

| Prudential Insurance Co. of America at 1.08%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $156,029,413, 1.00% - 8.75%, 8/15/18 - 2/15/36) | | 152,003 | 151,989 |

| RBC Capital Markets Corp. at 1.08%, dated 8/3/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $7,192,470, 0.75% - 5.38%, 11/30/17 - 2/15/47) | | 7,019 | 7,000 |

| RBC Dominion Securities at: | | | |

| 1.04%, dated: | | | |

| 9/12/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $18,370,652, 1.38%, 1/31/21) | | 18,015 | 18,000 |

| 9/13/17 due 10/6/17: | | | |

| (Collateralized by U.S. Treasury Obligations valued at $34,699,049, 2.13%, 5/15/25) | | 34,028 | 34,000 |

| (Collateralized by U.S. Treasury Obligations valued at $34,699,049, 2.13%, 5/15/25) | | 34,029 | 34,000 |

| (Collateralized by U.S. Treasury Obligations valued at $34,699,049, 2.13%, 5/15/25) | | 34,023 | 34,000 |

| 1.05%, dated 9/13/17 due 10/6/17: | | | |

| (Collateralized by U.S. Treasury Obligations valued at $34,699,250, 2.13%, 5/15/25) | | 34,033 | 34,000 |

| (Collateralized by U.S. Treasury Obligations valued at $34,699,250, 2.13%, 5/15/25) | | 34,034 | 34,000 |

| 1.07%, dated: | | | |

| 7/20/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $28,622,867, 1.38%, 1/31/21) | | 28,079 | 28,000 |

| 7/24/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $29,641,639, 2.13%, 5/15/25) | | 29,082 | 29,000 |

| 9/7/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $32,664,275, 2.13%, 5/15/25) | | 32,087 | 32,000 |

| 1.08%, dated 7/25/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $29,641,246, 1.38% - 2.13%, 1/31/21 - 5/15/25) | | 29,085 | 29,000 |

| RBS Securities, Inc. at 1.06%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $6,121,855, 1.13% - 2.75%, 1/31/19 - 2/15/24) | | 6,001 | 6,000 |

| Societe Generale at: | | | |

| 1.09%, dated: | | | |

| 7/5/17 due 10/5/17 (Collateralized by U.S. Treasury Obligations valued at $55,481,462, 0.00% - 4.50%, 10/12/17 - 11/15/44) | | 54,150 | 54,000 |

| 7/6/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $55,553,431, 1.25% - 3.63%, 10/31/18 - 5/15/46) | | 54,150 | 54,000 |

| 7/13/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $56,755,362, 0.00% - 8.75%, 10/12/17 - 5/15/46) | | 55,150 | 55,000 |

| 1.1%, dated 8/18/17 due 11/20/17 (Collateralized by U.S. Treasury Obligations valued at $55,164,666, 0.00% - 3.63%, 10/12/17 - 11/15/46) | | 54,155 | 54,000 |

| Sumitomo Mitsui Trust Bank Ltd. at 1.16%, dated: | | | |

| 8/23/17 due 10/4/17 (Collateralized by U.S. Treasury Obligations valued at $17,520,165, 2.50% - 4.25%, 11/15/17 - 5/15/24) | | 17,023 | 17,000 |

| 8/30/17 due 10/5/17 (Collateralized by U.S. Treasury Obligations valued at $7,208,454, 2.50% - 4.25%, 11/15/17 - 5/15/24) | | 7,008 | 7,000 |

| 9/6/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $7,201,262, 2.25% - 4.25%, 11/15/17 - 11/15/24) | | 7,009 | 7,000 |

| 9/13/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $7,161,280, 2.38% - 4.25%, 11/15/17 - 8/15/24) | | 7,009 | 7,000 |

| 10/4/17 due 10/6/17(c) | | 7,009 | 7,000 |

| TD Securities (U.S.A.) at 1.06%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $30,602,703, 2.13%, 2/29/24) | | 30,003 | 30,000 |

| TOTAL U.S. TREASURY REPURCHASE AGREEMENT | | | |

| (Cost $11,810,925) | | | 11,810,925 |

| TOTAL INVESTMENT IN SECURITIES - 97.8% | | | |

| (Cost $24,722,958) | | | 24,722,958 |

| NET OTHER ASSETS (LIABILITIES) - 2.2% | | | 567,005 |

| NET ASSETS - 100% | | | $25,289,963 |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets.

Legend

(a) Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Represents a forward settling transaction and therefore no collateral securities had been allocated as of period end. The agreement contemplated the delivery of U.S. Treasury Obligations as collateral on settlement date.

Investment Valuation

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Other Information

# Additional information on each counterparty to the repurchase agreement is as follows:

| Repurchase Agreement / Counterparty | Value (000s) |

| $1,101,936,000 due 10/02/17 at 1.05% | |

| Bank of Nova Scotia | $526,589 |

| HSBC Securities (USA), Inc. | 474,367 |

| Merrill Lynch, Pierce, Fenner & Smith, Inc. | 41,580 |

| RBC Dominion Securities, Inc. | 59,400 |

| | $1,101,936 |

See accompanying notes which are an integral part of the financial statements.

Treasury Portfolio

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | | September 30, 2017 (Unaudited) |

| Assets | | |

Investment in securities, at value (including repurchase agreements of $11,810,925) — See accompanying schedule:

Unaffiliated issuers (cost $24,722,958) | | $24,722,958 |

| Receivable for investments sold | | 577,746 |

| Receivable for fund shares sold | | 92 |

| Interest receivable | | 30,756 |

| Prepaid expenses | | 49 |

| Receivable from investment adviser for expense reductions | | 724 |

| Other receivables | | 209 |

| Total assets | | 25,332,534 |

| Liabilities | | |

| Payable for investments purchased | $27,021 | |

| Payable for fund shares redeemed | 1,272 | |

| Distributions payable | 9,066 | |

| Accrued management fee | 2,824 | |

| Distribution and service plan fees payable | 1,059 | |

| Other affiliated payables | 1,054 | |

| Other payables and accrued expenses | 275 | |

| Total liabilities | | 42,571 |

| Net Assets | | $25,289,963 |

| Net Assets consist of: | | |

| Paid in capital | | $25,289,977 |

| Undistributed net investment income | | 12 |

| Accumulated undistributed net realized gain (loss) on investments | | (26) |

| Net Assets | | $25,289,963 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($8,416,645 ÷ 8,413,652 shares) | | $1.00 |

| Class II: | | |

| Net Asset Value, offering price and redemption price per share ($1,393,951 ÷ 1,392,998 shares) | | $1.00 |

| Class III: | | |

| Net Asset Value, offering price and redemption price per share ($2,653,845 ÷ 2,653,576 shares) | | $1.00 |

| Class IV: | | |

| Net Asset Value, offering price and redemption price per share ($805,001 ÷ 804,763 shares) | | $1.00 |

| Select Class: | | |

| Net Asset Value, offering price and redemption price per share ($268,625 ÷ 268,566 shares) | | $1.00 |

| Institutional Class: | | |

| Net Asset Value, offering price and redemption price per share ($11,751,896 ÷ 11,751,670 shares) | | $1.00 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Six months ended September 30, 2017 (Unaudited) |

| Investment Income | | |

| Interest | | $98,680 |

| Expenses | | |

| Management fee | $14,473 | |

| Transfer agent fees | 5,033 | |

| Distribution and service plan fees | 5,875 | |

| Accounting fees and expenses | 628 | |

| Custodian fees and expenses | 67 | |

| Independent trustees' fees and expenses | 36 | |

| Registration fees | 130 | |

| Audit | 25 | |

| Legal | 16 | |

| Miscellaneous | 63 | |

| Total expenses before reductions | 26,346 | |

| Expense reductions | (3,372) | 22,974 |

| Net investment income (loss) | | 75,706 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | | (18) |

| Total net realized gain (loss) | | (18) |

| Net increase in net assets resulting from operations | | $75,688 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Six months ended September 30, 2017 (Unaudited) | Year ended March 31, 2017 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $75,706 | $46,904 |

| Net realized gain (loss) | (18) | 192 |

| Net increase in net assets resulting from operations | 75,688 | 47,096 |

| Distributions to shareholders from net investment income | (76,214) | (46,502) |

| Share transactions - net increase (decrease) | 6,341,681 | 1,492,662 |

| Total increase (decrease) in net assets | 6,341,155 | 1,493,256 |

| Net Assets | | |

| Beginning of period | 18,948,808 | 17,455,552 |

| End of period | $25,289,963 | $18,948,808 |

| Other Information | | |

| Undistributed net investment income end of period | $12 | $520 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Treasury Portfolio Class I

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | | | |

| | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | .004 | .003 | .001 | –A | –A | –A |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | .004 | .003 | .001 | –A | –A | –A |

| Distributions from net investment income | (.004) | (.003) | (.001) | –A | –A | –A |

| Total distributions | (.004) | (.003) | (.001) | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | .39% | .27% | .05% | .01% | .01% | .01% |

| Ratios to Average Net AssetsD | | | | | | |

| Expenses before reductions | .21%E | .21% | .21% | .21% | .21% | .21% |

| Expenses net of fee waivers, if any | .18%E | .18% | .13% | .07% | .08% | .16% |

| Expenses net of all reductions | .18%E | .18% | .13% | .07% | .08% | .16% |

| Net investment income (loss) | .77%E | .27% | .05% | .01% | .01% | .01% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $8,417 | $8,308 | $9,639 | $11,727 | $9,736 | $9,964 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Annualized

See accompanying notes which are an integral part of the financial statements.

Treasury Portfolio Class II

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | | | |

| | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | .003 | .001 | –A | –A | –A | –A |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | .003 | .001 | –A | –A | –A | –A |

| Distributions from net investment income | (.003) | (.001) | –A | –A | –A | –A |

| Total distributions | (.003) | (.001) | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | .31% | .12% | .01% | .01% | .01% | .01% |

| Ratios to Average Net AssetsD | | | | | | |

| Expenses before reductions | .36%E | .36% | .36% | .36% | .36% | .36% |

| Expenses net of fee waivers, if any | .33%E | .33% | .22% | .07% | .08% | .16% |

| Expenses net of all reductions | .33%E | .33% | .22% | .07% | .08% | .16% |

| Net investment income (loss) | .62%E | .12% | .01% | .01% | .01% | .01% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $1,394 | $363 | $557 | $70 | $133 | $127 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Annualized

See accompanying notes which are an integral part of the financial statements.

Treasury Portfolio Class III

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | | | |

| | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | .003 | .001 | –A | –A | –A | –A |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | .003 | .001 | –A | –A | –A | –A |

| Distributions from net investment income | (.003) | (.001) | –A | –A | –A | –A |

| Total distributions | (.003) | (.001) | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | .26% | .05% | .01% | .01% | .01% | .01% |

| Ratios to Average Net AssetsD | | | | | | |

| Expenses before reductions | .46%E | .46% | .46% | .46% | .46% | .46% |

| Expenses net of fee waivers, if any | .43%E | .39% | .17% | .07% | .08% | .16% |

| Expenses net of all reductions | .43%E | .39% | .17% | .07% | .08% | .16% |

| Net investment income (loss) | .52%E | .06% | .02% | .01% | .01% | .01% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $2,654 | $2,563 | $2,862 | $2,866 | $2,654 | $2,844 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Annualized

See accompanying notes which are an integral part of the financial statements.

Treasury Portfolio Class IV

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | | | |

| | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | .001 | –A | –A | –A | –A | –A |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | .001 | –A | –A | –A | –A | –A |

| Distributions from net investment income | (.001) | –A | –A | –A | –A | –A |

| Total distributions | (.001) | –A | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | .14% | .01% | .01% | .01% | .01% | .01% |

| Ratios to Average Net AssetsD | | | | | | |

| Expenses before reductions | .71%E | .71% | .71% | .71% | .71% | .71% |

| Expenses net of fee waivers, if any | .68%E | .43% | .18% | .07% | .08% | .16% |

| Expenses net of all reductions | .68%E | .43% | .18% | .07% | .08% | .16% |

| Net investment income (loss) | .27%E | .02% | .01% | .01% | .01% | .01% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $805 | $793 | $905 | $621 | $591 | $527 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Annualized

See accompanying notes which are an integral part of the financial statements.

Treasury Portfolio Select Class

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | | | |

| | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss) | .004 | .002 | –A | –A | –A | –A |

| Net realized and unrealized gain (loss)A | – | – | – | – | – | – |

| Total from investment operations | .004 | .002 | –A | –A | –A | –A |

| Distributions from net investment income | (.004) | (.002) | –A | –A | –A | –A |

| Total distributions | (.004) | (.002) | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB,C | .36% | .22% | .04% | .01% | .01% | .01% |

| Ratios to Average Net AssetsD | | | | | | |

| Expenses before reductions | .26%E | .26% | .26% | .26% | .26% | .26% |

| Expenses net of fee waivers, if any | .23%E | .23% | .15% | .07% | .08% | .16% |

| Expenses net of all reductions | .23%E | .23% | .15% | .07% | .08% | .16% |

| Net investment income (loss) | .72%E | .22% | .04% | .01% | .01% | .01% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $269 | $276 | $287 | $225 | $238 | $198 |

A Amount represents less than $.0005 per share.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Annualized

See accompanying notes which are an integral part of the financial statements.

Treasury Portfolio Institutional Class

| | Six months ended (Unaudited) September 30, | Years ended March 31, | | |

| | 2017 | 2017 | 2016 | 2015 A |

| Selected Per–Share Data | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | |

| Net investment income (loss) | .004 | .003 | .001 | –B |

| Net realized and unrealized gain (loss)B | – | – | – | – |

| Total from investment operations | .004 | .003 | .001 | –B |

| Distributions from net investment income | (.004) | (.003) | (.001) | –B |

| Total distributions | (.004) | (.003) | (.001) | –B |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnC,D | .41% | .31% | .07% | .01% |

| Ratios to Average Net AssetsE | | | | |

| Expenses before reductions | .18%F | .18% | .18% | .18%F |

| Expenses net of fee waivers, if any | .14%F | .14% | .13% | .07%F |

| Expenses net of all reductions | .14%F | .14% | .13% | .07%F |

| Net investment income (loss) | .81%F | .31% | .11% | - %F,G |

| Supplemental Data | | | | |

| Net assets, end of period (in millions) | $11,752 | $6,645 | $3,205 | $669 |

A For the period May 14, 2014 (commencement of sale of shares) to March 31, 2015.

B Amount represents less than $.0005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Annualized

G Amount represents less than .005%.

See accompanying notes which are an integral part of the financial statements.

Government Portfolio

Investment Summary/Performance (Unaudited)

Effective Maturity Diversification

| Days | % of fund's investments 9/30/17 | % of fund's investments 3/31/17 | % of fund's investments 9/30/16 |

| 1 - 7 | 39.8 | 30.6 | 35.5 |

| 8 - 30 | 24.2 | 24.5 | 12.7 |

| 31 - 60 | 12.7 | 15.8 | 19.3 |

| 61 - 90 | 16.3 | 18.1 | 16.8 |

| 91 - 180 | 7.0 | 8.6 | 13.8 |

| > 180 | 0.0 | 2.4 | 1.9 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940.

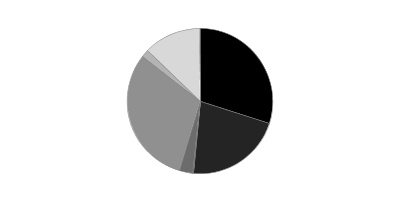

Asset Allocation (% of fund's net assets)

| As of September 30, 2017 |

| | U.S. Treasury Debt | 17.3% |

| | U.S. Government Agency Debt | 48.8% |

| | Repurchase Agreements | 34.1% |

| | Net Other Assets (Liabilities)* | (0.2)% |

* Net Other Assets (Liabilities) are not included in the pie chart

| As of March 31, 2017 |

| | U.S. Treasury Debt | 25.9% |

| | U.S. Government Agency Debt | 46.1% |

| | Repurchase Agreements | 27.3% |

| | Variable Rate Demand Notes (VRDNs) | 0.7% |

Current And Historical 7-Day Yields

| | 9/30/17 | 6/30/17 | 3/31/17 | 12/31/16 | 9/30/16 |

| Class I | 0.91% | 0.81% | 0.56% | 0.39% | 0.27% |

| Class II | 0.76% | 0.66% | 0.41% | 0.24% | 0.12% |

| Class III | 0.66% | 0.56% | 0.31% | 0.14% | 0.02% |

| Select Class | 0.86% | 0.76% | 0.51% | 0.34% | 0.22% |

| Institutional Class | 0.95% | 0.85% | 0.60% | 0.43% | 0.31% |

Yield refers to the income paid by the Fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending September 30, 2017, the most recent period shown in the table, would have been 0.88% for Class I, 0.73% for Class II, 0.63% for Class III, 0.83% for Select Class and 0.91% for Institutional Class.

Percentages shown as 0.0% may reflect amounts less than 0.05%.

Government Portfolio

Investments September 30, 2017 (Unaudited)

Showing Percentage of Net Assets

| U.S. Treasury Debt - 17.3% | | | | |

| | | Yield(a) | Principal Amount (000s) | Value (000s) |

| U.S. Treasury Obligations - 17.3% | | | | |

| U.S. Treasury Bills | | | | |

| 11/2/17 to 3/8/18 | | 1.02 to 1.15 % | $10,216,488 | $10,191,281 |

| U.S. Treasury Notes | | | | |

| 10/31/17 to 7/31/19 | | 0.74 to 1.19 (b) | 6,752,000 | 6,756,078 |

| TOTAL U.S. TREASURY DEBT | | | | |

| (Cost $16,947,359) | | | | 16,947,359 |

|

| U.S. Government Agency Debt - 48.8% | | | | |

| Federal Agencies - 48.8% | | | | |

| Fannie Mae | | | | |

| 10/5/17 to 1/11/18 | | 1.02 to 1.28 (b) | 3,243,915 | 3,239,948 |

| Federal Farm Credit Bank | | | | |

| 10/16/17 to 6/26/19 | | 1.01 to 1.29 (b) | 3,495,500 | 3,495,626 |

| Federal Home Loan Bank | | | | |

| 10/2/17 to 12/27/18 | | 0.91 to 1.31 (b) | 35,945,300 | 35,937,110 |

| Freddie Mac | | | | |

| 11/13/17 to 6/28/18 | | 0.97 to 1.30 (b) | 5,040,717 | 5,038,329 |

| TOTAL U.S. GOVERNMENT AGENCY DEBT | | | | |

| (Cost $47,711,013) | | | | 47,711,013 |

| U.S. Government Agency Repurchase Agreement - 15.8% | | | |

| | | Maturity Amount (000s) | Value (000s) |

| In a joint trading account at: | | | |

| 1.05% dated 9/29/17 due 10/2/17 (Collateralized by U.S. Government Obligations) # | | $1,305,702 | $1,305,588 |

| 1.07% dated 9/29/17 due 10/2/17 (Collateralized by U.S. Government Obligations) # | | 4,802,365 | 4,801,937 |

| With: | | | |

| BNP Paribas, S.A. at: | | | |

| 1.1%, dated: | | | |

| 8/22/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $77,150,767, 0.00% - 7.63%, 10/12/17 - 6/20/47) | | 75,206 | 75,000 |

| 8/25/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $77,255,543, 0.00% - 4.50%, 10/12/17 - 8/20/47) | | 75,215 | 75,000 |

| 1.11%, dated 8/31/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $306,708,368, 0.00% - 8.75%, 10/12/17 - 1/20/47) | | 299,848 | 299,000 |

| 1.12%, dated 8/15/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $311,376,280, 0.00% - 7.63%, 10/12/17 - 2/15/47) | | 303,027 | 301,900 |

| 1.13%, dated 6/27/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $75,178,364, 0.00% - 7.00%, 10/12/17 - 8/20/47) | | 73,275 | 73,000 |

| Citibank NA at: | | | |

| 1.02%, dated 9/26/17 due 10/3/17 (Collateralized by U.S. Treasury Obligations valued at $73,562,522, 0.38% - 10.00%, 11/30/17 - 7/1/47) | | 72,014 | 72,000 |

| 1.03%, dated 9/26/17 due 10/3/17 (Collateralized by U.S. Treasury Obligations valued at $443,129,418, 0.00% - 9.50%, 10/12/17 - 4/1/56) | | 433,087 | 433,000 |

| ING Financial Markets LLC at: | | | |

| 1.09%, dated: | | | |

| 8/2/17 due 10/30/17 (Collateralized by U.S. Government Obligations valued at $179,836,657, 4.00%, 11/20/45 - 5/20/47) | | 176,474 | 176,000 |

| 8/3/17 due 11/1/17 (Collateralized by U.S. Government Obligations valued at $150,199,559, 4.00%, 8/20/45) | | 147,401 | 147,000 |

| 8/4/17 due 11/2/17 (Collateralized by U.S. Government Obligations valued at $89,918,282, 2.13% - 6.75%, 4/24/26 - 3/15/31) | | 88,240 | 88,000 |

| 8/7/17 due 11/3/17 (Collateralized by U.S. Government Obligations valued at $168,570,370, 4.00%, 11/20/45 - 2/20/46) | | 165,440 | 165,000 |

| 8/14/17 due 11/3/17 (Collateralized by U.S. Government Obligations valued at $154,234,565, 4.00%, 8/20/45 - 2/20/46) | | 151,416 | 151,000 |

| 8/15/17 due 11/3/17 (Collateralized by U.S. Government Obligations valued at $92,950,480, 1.38% - 3.75%, 1/28/19 - 4/24/26) | | 91,251 | 91,000 |

| 1.1%, dated 9/28/17 due 11/2/17 (Collateralized by U.S. Government Obligations valued at $73,443,440, 0.88% - 2.38%, 10/26/17 - 5/15/27) | | 72,077 | 72,000 |

| Merrill Lynch, Pierce, Fenner & Smith at 1.06%, dated 8/11/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $458,681,219, 2.87% - 4.00%, 3/1/30 - 10/1/47) | | 449,806 | 449,000 |

| Mitsubishi UFJ Securities (U.S.A.), Inc. at: | | | |

| 1.07%, dated: | | | |

| 9/28/17 due 10/5/17 (Collateralized by U.S. Government Obligations valued at $146,897,462, 0.00% - 5.00%, 2/1/18 - 8/20/67) | | 144,030 | 144,000 |

| 9/29/17 due 10/2/17 (Collateralized by U.S. Government Obligations valued at $138,732,369, 2.33% - 4.90%, 8/1/19 - 10/1/47) | | 136,012 | 136,000 |

| 1.1%, dated: | | | |

| 9/5/17 due 11/6/17 (Collateralized by U.S. Government Obligations valued at $258,272,899, 2.00% - 5.75%, 1/1/19 - 6/20/67) | | 253,479 | 253,000 |

| 9/6/17 due 11/7/17 (Collateralized by U.S. Government Obligations valued at $212,328,550, 0.00% - 6.50%, 9/13/18 - 9/1/47) | | 208,394 | 208,000 |

| 9/7/17 due 11/8/17 (Collateralized by U.S. Government Obligations valued at $76,558,438, 2.17% - 5.37%, 11/1/21 - 9/1/47) | | 75,142 | 75,000 |

| 9/13/17 due 11/14/17 (Collateralized by U.S. Government Obligations valued at $199,015,473, 2.24% - 5.82%, 9/1/18 - 8/20/67) | | 195,369 | 195,000 |

| 9/21/17 due 11/20/17 (Collateralized by U.S. Government Obligations valued at $196,926,167, 2.70% - 4.50%, 6/1/24 - 6/1/47) | | 193,354 | 193,000 |

| 9/26/17 due 11/27/17 (Collateralized by U.S. Government Obligations valued at $162,209,733, 2.30% - 5.96%, 11/1/21 - 9/1/47) | | 159,301 | 159,000 |

| Natixis SA at 1.05%, dated 9/28/17 due 10/5/17 (Collateralized by U.S. Treasury Obligations valued at $148,198,740, 0.13% - 4.00%, 1/31/20 - 2/1/44) | | 144,029 | 144,000 |

| Nomura Securities International, Inc. at 1.08%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Government Obligations valued at $1,526,057,333, 2.00% - 10.50%, 11/1/17 - 12/20/60) | | 1,496,135 | 1,496,000 |

| RBC Capital Markets Corp. at: | | | |

| 1.09%, dated: | | | |

| 7/21/17 due 10/19/17 (Collateralized by U.S. Government Obligations valued at $147,204,646, 2.50% - 8.00%, 11/1/17 - 9/20/47) | | 144,392 | 144,000 |

| 8/10/17 due 11/8/17 (Collateralized by U.S. Government Obligations valued at $197,178,868, 1.48% - 4.50%, 11/1/26 - 9/20/47) | | 193,526 | 193,000 |

| 8/14/17 due 11/13/17 (Collateralized by U.S. Government Obligations valued at $108,280,975, 2.50% - 5.00%, 2/1/24 - 9/1/47) | | 106,292 | 106,000 |

| 1.1%, dated 7/6/17 due: | | | |

| 10/3/17 (Collateralized by U.S. Government Obligations valued at $80,802,158, 2.50% - 5.50%, 10/1/23 - 9/20/47) | | 79,215 | 79,000 |

| 10/4/17 (Collateralized by U.S. Government Obligations valued at $147,310,926, 1.13% - 8.00%, 12/1/17 - 9/20/47) | | 144,396 | 144,000 |

| RBC Dominion Securities at: | | | |

| 1.05%, dated 9/21/17 due 10/3/17 (Collateralized by U.S. Government Obligations valued at $151,008,433, 3.50%, 4/20/46) | | 148,052 | 148,000 |

| 1.07%, dated: | | | |

| 7/7/17 due 10/5/17 (Collateralized by U.S. Government Obligations valued at $146,237,170, 3.50%, 4/20/46) | | 143,383 | 143,000 |

| 7/10/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $147,246,711, 3.50%, 3/20/47) | | 144,394 | 144,000 |

| 7/11/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $70,553,624, 3.50%, 5/20/47) | | 69,189 | 69,000 |

| 7/19/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $146,185,147, 3.00% - 3.50%, 4/20/46 - 7/20/46) | | 143,395 | 143,000 |

| 1.08%, dated: | | | |

| 7/13/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $148,259,397, 3.50%, 4/20/46 - 3/20/47) | | 145,422 | 145,000 |

| 7/17/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $146,196,937, 3.50%, 4/20/46) | | 143,403 | 143,000 |

| 7/20/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $147,206,074, 3.50%, 4/20/46 - 3/20/47) | | 144,415 | 144,000 |

| 7/21/17 due 10/6/17: | | | |

| (Collateralized by U.S. Government Obligations valued at $147,201,668, 3.50%, 3/20/47) | | 144,415 | 144,000 |

| (Collateralized by U.S. Government Obligations valued at $147,201,667, 3.50%, 4/20/46) | | 144,419 | 144,000 |

| 1.09%, dated 7/24/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $148,213,467, 3.50%, 3/20/47) | | 145,430 | 145,000 |

| RBC Financial Group at: | | | |

| 1.07%, dated 8/14/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $78,185,607, 2.31% - 6.50%, 3/1/27 - 9/20/47) | | 76,142 | 76,000 |

| 1.09%, dated: | | | |

| 8/14/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $78,382,913, 3.00% - 6.50%, 8/1/26 - 9/20/47) | | 76,212 | 76,000 |

| 8/15/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $155,276,564, 1.50% - 4.50%, 1/1/27 - 7/1/47) | | 152,423 | 152,000 |

| 8/16/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $107,252,409, 3.13% - 5.00%, 1/1/26 - 8/20/47) | | 105,292 | 105,000 |

| 1.1%, dated 9/11/17 due 10/6/17 (Collateralized by U.S. Government Obligations valued at $152,077,521, 2.50% - 6.50%, 1/1/26 - 9/20/47) | | 149,414 | 149,000 |

| Societe Generale at: | | | |

| 1.07%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $301,659,986, 0.13% - 6.75%, 4/15/19 - 8/15/44) | | 293,026 | 293,000 |

| 1.08%, dated: | | | |

| 9/26/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $575,473,094, 0.13% - 1.75%, 3/31/19 - 1/31/23) | | 563,524 | 563,000 |

| 9/28/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $105,072,817, 0.63% - 1.00%, 2/28/18 - 1/15/24) | | 103,099 | 103,000 |

| TOTAL U.S. GOVERNMENT AGENCY REPURCHASE AGREEMENT | | | |

| (Cost $15,473,425) | | | 15,473,425 |

|

| U.S. Treasury Repurchase Agreement - 18.3% | | | |

| With: | | | |

| Barclays Capital, Inc. at 1.06%, dated 9/29/17 due 10/2/17 (Collateralized by U.S. Treasury Obligations valued at $130,571,625, 0.63% - 3.13%, 11/30/17 - 2/15/26) | | 128,011 | 128,000 |

| BMO Capital Markets Corp. at: | | | |

| 1.06%, dated 9/27/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $132,639,056, 3.63%, 2/15/20) | | 129,300 | 129,000 |

| 1.07%, dated 8/29/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $69,608,127, 1.50% - 3.88%, 5/15/18 - 11/15/26) | | 68,190 | 68,000 |

| BMO Harris Bank NA at: | | | |

| 1.06%, dated: | | | |

| 7/7/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $134,468,754, 1.00% - 2.50%, 5/15/18 - 2/29/24) | | 131,351 | 131,000 |

| 7/13/17 due 10/5/17 (Collateralized by U.S. Treasury Obligations valued at $134,192,057, 0.88% - 3.75%, 12/31/17 - 8/15/47) | | 131,324 | 131,000 |

| 7/25/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $136,353,001, 2.75%, 11/15/23) | | 132,299 | 132,000 |

| 8/3/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $137,869,400, 1.00% - 1.38%, 5/31/18 - 6/30/18) | | 134,351 | 134,000 |

| 8/9/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $207,721,773, 0.88% - 3.63%, 1/31/18 - 8/15/47) | | 203,556 | 203,000 |

| 8/10/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $138,588,593, 0.63% - 3.63%, 10/31/17 - 8/15/47) | | 135,358 | 135,000 |

| 8/17/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $139,701,580, 2.00% - 3.88%, 2/15/20 - 8/15/40) | | 135,354 | 135,000 |

| 1.07%, dated: | | | |

| 7/25/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $135,293,451, 2.13% - 3.88%, 5/15/18 - 12/31/23) | | 132,333 | 132,000 |

| 7/26/17 due 10/6/17: | | | |

| (Collateralized by U.S. Treasury Obligations valued at $137,016,024, 2.88%, 8/15/45 - 11/15/46) | | 132,333 | 132,000 |

| (Collateralized by U.S. Treasury Obligations valued at $67,629,438, 0.63% - 3.63%, 12/31/17 - 8/15/47) | | 66,177 | 66,000 |

| 7/27/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $67,503,387, 0.88% - 3.63%, 1/31/18 - 8/15/47) | | 66,179 | 66,000 |

| 7/28/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $137,301,059, 1.75%, 10/31/18) | | 133,348 | 133,000 |

| 9/1/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $69,194,286, 2.00% - 3.88%, 5/15/18 - 11/15/26) | | 67,203 | 67,000 |

| 9/14/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $81,920,806, 2.00%, 2/15/22) | | 80,216 | 80,000 |

| 1.08%, dated 8/4/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $82,176,632, 0.00% - 3.63%, 12/31/17 - 8/15/47) | | 80,247 | 80,000 |

| BNP Paribas, S.A. at: | | | |

| 1.08%, dated: | | | |

| 7/18/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $133,000,102, 0.00% - 8.75%, 10/12/17 - 8/15/44) | | 130,351 | 130,000 |

| 8/7/17 due 10/6/17 (Collateralized by U.S. Treasury Obligations valued at $271,910,389, 0.00% - 3.00%, 10/12/17 - 11/15/44) | | 266,726 | 266,000 |