UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03329

Variable Insurance Products Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | June 30, 2020 |

Item 1.

Reports to Stockholders

Fidelity® Variable Insurance Products:

High Income Portfolio

Semi-Annual Report

June 30, 2020

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, and if your insurance carrier elects to participate, you may not be receiving paper copies of the Fund’s shareholder reports from the insurance company that offers your variable insurance product unless you specifically request paper copies from your financial professional or the administrator of your variable insurance product. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically, by contacting your financial professional or the administrator of your variable insurance product. If you own a Fidelity-administered variable insurance product, please visit fidelity.com/mailpreferences to make your election or call 1-800-343-3548.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial professional or the administrator of your variable insurance product. If you own a Fidelity-administered variable insurance product, please visit fidelity.com/mailpreferences to make your election or call 1-800-343-3548. Your election to receive reports in paper will apply to all funds available under your variable insurance product.

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity® Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2020 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

Top Five Holdings as of June 30, 2020

| (by issuer, excluding cash equivalents) | % of fund's net assets |

| Tenet Healthcare Corp. | 3.0 |

| CCO Holdings LLC/CCO Holdings Capital Corp. | 2.6 |

| TransDigm, Inc. | 2.5 |

| JBS U.S.A. LLC/JBS U.S.A. Finance, Inc. | 2.1 |

| C&W Senior Financing Designated Activity Co. | 2.0 |

| | 12.2 |

Top Five Market Sectors as of June 30, 2020

| | % of fund's net assets |

| Telecommunications | 14.5 |

| Energy | 12.6 |

| Healthcare | 8.7 |

| Technology | 7.3 |

| Cable/Satellite TV | 6.3 |

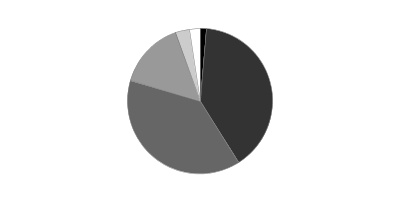

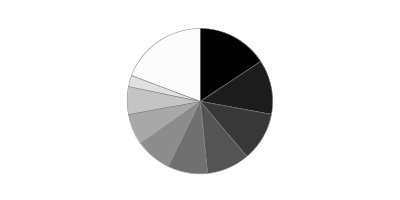

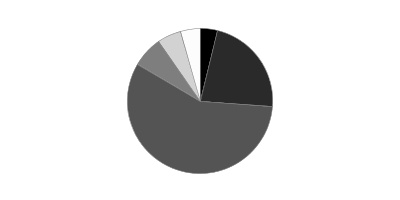

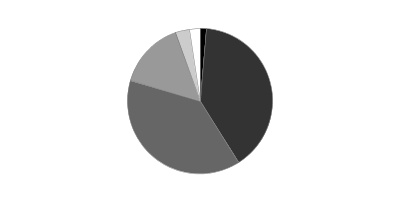

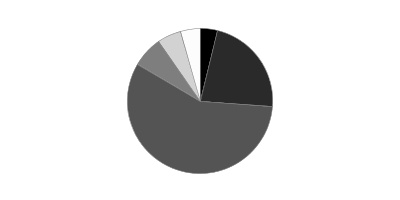

Quality Diversification (% of fund's net assets)

| As of June 30, 2020 |

| | BBB | 1.4% |

| | BB | 39.6% |

| | B | 38.5% |

| | CCC,CC,C | 15.1% |

| | Not Rated | 3.0% |

| | Short-Term Investments and Net Other Assets | 2.4% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

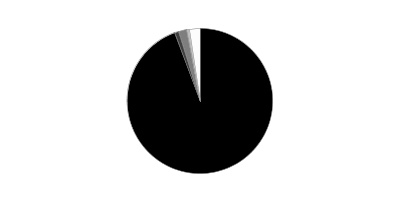

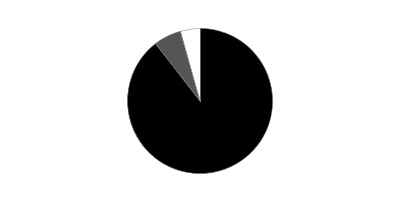

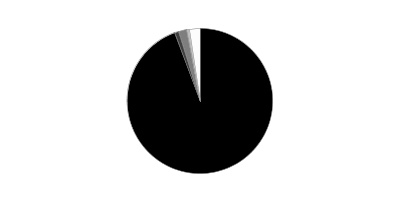

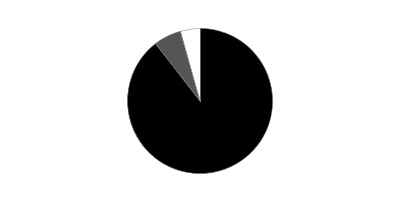

Asset Allocation (% of fund's net assets)

| As of June 30, 2020* |

| | Nonconvertible Bonds | 94.4% |

| | Convertible Bonds, Preferred Stocks | 0.9% |

| | Bank Loan Obligations | 1.7% |

| | Other Investments | 0.6% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 2.4% |

* Foreign investments - 22.4%

Schedule of Investments June 30, 2020 (Unaudited)

Showing Percentage of Net Assets

| Corporate Bonds - 95.3% | | | |

| | | Principal Amount | Value |

| Convertible Bonds - 0.9% | | | |

| Broadcasting - 0.9% | | | |

| DISH Network Corp.: | | | |

| 2.375% 3/15/24 | | $7,126,000 | $6,376,676 |

| 3.375% 8/15/26 | | 1,580,000 | 1,451,411 |

| | | | 7,828,087 |

| Nonconvertible Bonds - 94.4% | | | |

| Aerospace - 4.4% | | | |

| BBA U.S. Holdings, Inc. 5.375% 5/1/26 (a) | | 5,085,000 | 5,088,560 |

| Bombardier, Inc.: | | | |

| 6.125% 1/15/23 (a) | | 5,425,000 | 3,731,315 |

| 7.875% 4/15/27 (a) | | 1,220,000 | 799,100 |

| BWX Technologies, Inc.: | | | |

| 4.125% 6/30/28 (a) | | 1,785,000 | 1,780,538 |

| 5.375% 7/15/26 (a) | | 2,935,000 | 3,024,165 |

| Moog, Inc. 4.25% 12/15/27 (a) | | 2,140,000 | 2,085,858 |

| TransDigm UK Holdings PLC 6.875% 5/15/26 | | 975,000 | 906,750 |

| TransDigm, Inc.: | | | |

| 5.5% 11/15/27 | | 9,785,000 | 8,541,718 |

| 6.25% 3/15/26 (a) | | 7,860,000 | 7,855,088 |

| 6.5% 5/15/25 | | 425,000 | 397,413 |

| 7.5% 3/15/27 | | 850,000 | 816,918 |

| 8% 12/15/25 (a) | | 4,020,000 | 4,224,980 |

| | | | 39,252,403 |

| Air Transportation - 0.7% | | | |

| Aercap Global Aviation Trust 6.5% 6/15/45 (a)(b) | | 3,755,000 | 2,816,250 |

| XPO Logistics, Inc. 6.25% 5/1/25 (a) | | 3,000,000 | 3,142,500 |

| | | | 5,958,750 |

| Automotive & Auto Parts - 0.7% | | | |

| Ford Motor Credit Co. LLC: | | | |

| 3.219% 1/9/22 | | 1,070,000 | 1,040,800 |

| 3.339% 3/28/22 | | 815,000 | 788,268 |

| 4.687% 6/9/25 | | 1,600,000 | 1,562,480 |

| 5.113% 5/3/29 | | 1,905,000 | 1,858,099 |

| 5.125% 6/16/25 | | 1,185,000 | 1,187,702 |

| | | | 6,437,349 |

| Banks & Thrifts - 1.3% | | | |

| Ally Financial, Inc.: | | | |

| 5.75% 11/20/25 | | 8,640,000 | 9,230,249 |

| 8% 11/1/31 | | 1,415,000 | 1,825,393 |

| | | | 11,055,642 |

| Broadcasting - 1.2% | | | |

| Netflix, Inc.: | | | |

| 4.875% 4/15/28 | | 1,385,000 | 1,480,939 |

| 5.375% 11/15/29 (a) | | 525,000 | 576,629 |

| 5.875% 11/15/28 | | 1,785,000 | 2,032,669 |

| 6.375% 5/15/29 | | 560,000 | 649,600 |

| Sirius XM Radio, Inc.: | | | |

| 4.125% 7/1/30 (a) | | 575,000 | 567,215 |

| 5% 8/1/27 (a) | | 3,455,000 | 3,544,208 |

| 5.375% 4/15/25 (a) | | 1,495,000 | 1,535,365 |

| | | | 10,386,625 |

| Building Materials - 0.4% | | | |

| Advanced Drain Systems, Inc. 5% 9/30/27 (a) | | 3,680,000 | 3,707,600 |

| Cable/Satellite TV - 6.1% | | | |

| CCO Holdings LLC/CCO Holdings Capital Corp.: | | | |

| 4% 3/1/23 (a) | | 2,975,000 | 2,982,438 |

| 4.5% 8/15/30 (a) | | 1,750,000 | 1,785,875 |

| 5% 2/1/28 (a) | | 8,430,000 | 8,703,975 |

| 5.125% 5/1/27 (a) | | 5,530,000 | 5,721,338 |

| 5.5% 5/1/26 (a) | | 4,285,000 | 4,440,331 |

| CSC Holdings LLC: | | | |

| 4.125% 12/1/30 (a) | | 1,895,000 | 1,878,532 |

| 5.5% 5/15/26 (a) | | 7,580,000 | 7,779,885 |

| 7.75% 7/15/25 (a) | | 2,825,000 | 2,938,283 |

| DISH DBS Corp.: | | | |

| 5.875% 11/15/24 | | 3,685,000 | 3,666,575 |

| 7.75% 7/1/26 | | 2,070,000 | 2,194,428 |

| Dolya Holdco 18 DAC 5% 7/15/28 (a) | | 2,285,000 | 2,255,752 |

| Virgin Media Secured Finance PLC 5.5% 8/15/26 (a) | | 3,170,000 | 3,242,720 |

| Ziggo Bond Co. BV: | | | |

| 5.125% 2/28/30 (a) | | 185,000 | 183,557 |

| 6% 1/15/27 (a) | | 3,095,000 | 3,141,425 |

| Ziggo BV 5.5% 1/15/27 (a) | | 2,607,000 | 2,639,744 |

| | | | 53,554,858 |

| Capital Goods - 1.0% | | | |

| AECOM: | | | |

| 5.125% 3/15/27 | | 4,750,000 | 5,106,250 |

| 5.875% 10/15/24 | | 3,735,000 | 4,033,800 |

| | | | 9,140,050 |

| Chemicals - 2.0% | | | |

| Axalta Coating Systems/Dutch Holding BV 4.75% 6/15/27 (a) | | 2,155,000 | 2,166,206 |

| CF Industries Holdings, Inc. 5.15% 3/15/34 | | 170,000 | 181,783 |

| Element Solutions, Inc. 5.875% 12/1/25 (a) | | 6,140,000 | 6,199,481 |

| Olin Corp. 5.125% 9/15/27 | | 2,270,000 | 2,122,450 |

| The Chemours Co. LLC 5.375% 5/15/27 | | 3,185,000 | 2,878,253 |

| Valvoline, Inc.: | | | |

| 4.25% 2/15/30 (a) | | 660,000 | 650,100 |

| 4.375% 8/15/25 | | 2,355,000 | 2,366,775 |

| W. R. Grace & Co.-Conn. 4.875% 6/15/27 (a) | | 1,140,000 | 1,154,854 |

| | | | 17,719,902 |

| Consumer Products - 0.4% | | | |

| Prestige Brands, Inc. 6.375% 3/1/24 (a) | | 945,000 | 973,350 |

| Wolverine World Wide, Inc. 6.375% 5/15/25 (a) | | 2,335,000 | 2,445,913 |

| | | | 3,419,263 |

| Containers - 1.7% | | | |

| Ardagh Packaging Finance PLC/Ardagh MP Holdings U.S.A., Inc. 6% 2/15/25 (a) | | 1,213,000 | 1,243,834 |

| Berry Global, Inc. 4.875% 7/15/26 (a) | | 2,055,000 | 2,085,825 |

| OI European Group BV 4% 3/15/23 (a) | | 850,000 | 837,191 |

| Owens-Brockway Glass Container, Inc. 5.375% 1/15/25 (a) | | 2,115,000 | 2,136,150 |

| Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer (Luxembourg) SA 5.125% 7/15/23 (a) | | 1,790,000 | 1,811,068 |

| Silgan Holdings, Inc. 4.75% 3/15/25 | | 2,680,000 | 2,714,063 |

| Trivium Packaging Finance BV: | | | |

| 5.5% 8/15/26 (a) | | 3,555,000 | 3,586,106 |

| 8.5% 8/15/27 (a) | | 600,000 | 641,250 |

| | | | 15,055,487 |

| Diversified Financial Services - 2.8% | | | |

| FLY Leasing Ltd.: | | | |

| 5.25% 10/15/24 | | 1,837,000 | 1,487,970 |

| 6.375% 10/15/21 | | 1,290,000 | 1,173,900 |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | | | |

| 4.75% 9/15/24 | | 3,085,000 | 2,915,325 |

| 5.25% 5/15/27 | | 130,000 | 125,450 |

| 6.25% 5/15/26 | | 4,405,000 | 4,411,079 |

| Navient Corp. 7.25% 1/25/22 | | 1,925,000 | 1,929,813 |

| Radiate Holdco LLC/Radiate Financial Service Ltd.: | | | |

| 6.625% 2/15/25 (a) | | 4,115,000 | 4,095,289 |

| 6.875% 2/15/23 (a) | | 1,050,000 | 1,063,125 |

| Springleaf Finance Corp.: | | | |

| 6.875% 3/15/25 | | 2,180,000 | 2,236,544 |

| 7.125% 3/15/26 | | 1,300,000 | 1,345,487 |

| Ypso Finance BIS SA 6% 2/15/28 (a) | | 4,250,000 | 4,013,615 |

| | | | 24,797,597 |

| Diversified Media - 0.9% | | | |

| Nielsen Co. SARL (Luxembourg) 5% 2/1/25 (a) | | 5,420,000 | 5,325,150 |

| Nielsen Finance LLC/Nielsen Finance Co. 5% 4/15/22 (a) | | 2,250,000 | 2,243,700 |

| | | | 7,568,850 |

| Energy - 12.2% | | | |

| Cheniere Energy Partners LP: | | | |

| 5.25% 10/1/25 | | 6,250,000 | 6,229,375 |

| 5.625% 10/1/26 | | 3,190,000 | 3,158,706 |

| Chesapeake Energy Corp.: | | | |

| 7% 10/1/24 | | 875,000 | 21,875 |

| 8% 1/15/25 | | 4,350,000 | 97,875 |

| 8% 6/15/27 | | 4,176,000 | 93,960 |

| Citgo Petroleum Corp. 6.25% 8/15/22 (a) | | 3,500,000 | 3,478,195 |

| Comstock Resources, Inc.: | | | |

| 9.75% 8/15/26 | | 1,140,000 | 1,066,333 |

| 9.75% 8/15/26 | | 615,000 | 574,256 |

| Consolidated Energy Finance SA 3 month U.S. LIBOR + 3.750% 4.0634% 6/15/22 (a)(b)(c) | | 4,035,000 | 3,591,741 |

| Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp.: | | | |

| 5.75% 4/1/25 | | 4,545,000 | 3,925,835 |

| 6.25% 4/1/23 | | 2,710,000 | 2,411,900 |

| CVR Energy, Inc.: | | | |

| 5.25% 2/15/25 (a) | | 3,265,000 | 3,003,800 |

| 5.75% 2/15/28 (a) | | 390,000 | 341,250 |

| DCP Midstream Operating LP 5.375% 7/15/25 | | 3,420,000 | 3,394,350 |

| Denbury Resources, Inc.: | | | |

| 7.75% 2/15/24 (a) | | 3,170,000 | 1,204,600 |

| 9% 5/15/21 (a) | | 3,350,000 | 1,298,125 |

| 9.25% 3/31/22 (a) | | 4,400,000 | 1,760,000 |

| EG Global Finance PLC: | | | |

| 6.75% 2/7/25 (a) | | 2,170,000 | 2,118,463 |

| 8.5% 10/30/25 (a) | | 3,690,000 | 3,782,250 |

| Endeavor Energy Resources LP/EER Finance, Inc.: | | | |

| 5.5% 1/30/26 (a) | | 165,000 | 157,988 |

| 5.75% 1/30/28 (a) | | 1,635,000 | 1,569,600 |

| 6.625% 7/15/25 (a) | | 395,000 | 398,089 |

| EQM Midstream Partners LP 6.5% 7/1/27 (a) | | 1,135,000 | 1,162,615 |

| Hess Midstream Partners LP: | | | |

| 5.125% 6/15/28 (a) | | 2,465,000 | 2,372,365 |

| 5.625% 2/15/26 (a) | | 5,785,000 | 5,724,200 |

| Hilcorp Energy I LP/Hilcorp Finance Co. 5% 12/1/24 (a) | | 2,250,000 | 1,935,000 |

| Holly Energy Partners LP/Holly Energy Finance Corp. 5% 2/1/28 (a) | | 2,885,000 | 2,747,963 |

| Jonah Energy LLC 7.25% 10/15/25 (a) | | 3,695,000 | 452,638 |

| MEG Energy Corp. 7.125% 2/1/27 (a) | | 1,090,000 | 906,063 |

| Occidental Petroleum Corp.: | | | |

| 2.9% 8/15/24 | | 835,000 | 713,925 |

| 3.4% 4/15/26 | | 1,140,000 | 931,950 |

| 3.5% 8/15/29 | | 1,070,000 | 785,701 |

| 4.2% 3/15/48 | | 865,000 | 585,778 |

| 4.3% 8/15/39 | | 590,000 | 406,929 |

| 4.4% 4/15/46 | | 850,000 | 592,620 |

| 4.4% 8/15/49 | | 455,000 | 316,321 |

| 5.55% 3/15/26 | | 2,880,000 | 2,628,605 |

| 6.2% 3/15/40 | | 575,000 | 481,563 |

| 6.45% 9/15/36 | | 3,050,000 | 2,610,526 |

| 7.5% 5/1/31 | | 3,730,000 | 3,467,818 |

| 7.875% 9/15/31 | | 375,000 | 355,080 |

| 8.875% 7/15/30 (d) | | 1,270,000 | 1,268,413 |

| PBF Holding Co. LLC/PBF Finance Corp. 9.25% 5/15/25 (a) | | 2,405,000 | 2,567,338 |

| PBF Logistics LP/PBF Logistics Finance, Inc. 6.875% 5/15/23 | | 4,315,000 | 4,155,690 |

| Sanchez Energy Corp. 7.25% 2/15/23 (a)(e) | | 5,722,000 | 57,220 |

| Sunoco LP/Sunoco Finance Corp.: | | | |

| 4.875% 1/15/23 | | 1,595,000 | 1,571,075 |

| 5.5% 2/15/26 | | 1,580,000 | 1,532,600 |

| 5.875% 3/15/28 | | 500,000 | 496,330 |

| 6% 4/15/27 | | 65,000 | 64,350 |

| Targa Resources Partners LP/Targa Resources Partners Finance Corp.: | | | |

| 5.125% 2/1/25 | | 5,120,000 | 4,928,000 |

| 5.375% 2/1/27 | | 665,000 | 641,725 |

| 6.75% 3/15/24 | | 3,035,000 | 3,027,413 |

| TerraForm Power Operating LLC: | | | |

| 4.25% 1/31/23 (a) | | 935,000 | 939,675 |

| 5% 1/31/28 (a) | | 1,030,000 | 1,076,350 |

| U.S.A. Compression Partners LP: | | | |

| 6.875% 4/1/26 | | 8,000 | 7,730 |

| 6.875% 9/1/27 | | 775,000 | 736,095 |

| Viper Energy Partners LP 5.375% 11/1/27 (a) | | 3,965,000 | 3,889,348 |

| Weatherford International Ltd. 11% 12/1/24 (a) | | 1,753,000 | 1,222,718 |

| Western Gas Partners LP: | | | |

| 3.1% 2/1/25 | | 1,750,000 | 1,655,885 |

| 3.95% 6/1/25 | | 430,000 | 402,790 |

| 4% 7/1/22 | | 450,000 | 448,560 |

| 4.05% 2/1/30 | | 2,965,000 | 2,853,635 |

| 4.65% 7/1/26 | | 660,000 | 632,148 |

| 5.25% 2/1/50 | | 310,000 | 268,618 |

| 5.3% 3/1/48 | | 880,000 | 713,900 |

| | | | 108,013,832 |

| Entertainment/Film - 0.5% | | | |

| Altice Finco SA 7.625% 2/15/25 (a) | | 4,190,000 | 4,357,642 |

| Environmental - 0.4% | | | |

| LBC Tank Terminals Holding Netherlands BV 6.875% 5/15/23 (a) | | 3,630,000 | 3,663,650 |

| Food & Drug Retail - 0.3% | | | |

| Performance Food Group, Inc. 6.875% 5/1/25 (a) | | 2,480,000 | 2,560,600 |

| Food/Beverage/Tobacco - 4.0% | | | |

| ESAL GmbH 6.25% 2/5/23 (a) | | 1,060,000 | 1,052,050 |

| JBS U.S.A. LLC/JBS U.S.A. Finance, Inc.: | | | |

| 5.75% 6/15/25 (a) | | 7,925,000 | 8,024,063 |

| 5.875% 7/15/24 (a) | | 9,570,000 | 9,701,588 |

| 6.75% 2/15/28 (a) | | 940,000 | 992,884 |

| JBS U.S.A. Lux SA / JBS Food Co.: | | | |

| 5.5% 1/15/30 (a) | | 2,735,000 | 2,803,375 |

| 6.5% 4/15/29 (a) | | 5,495,000 | 5,831,569 |

| Post Holdings, Inc.: | | | |

| 4.625% 4/15/30 (a) | | 360,000 | 353,268 |

| 5% 8/15/26 (a) | | 2,300,000 | 2,308,625 |

| 5.625% 1/15/28 (a) | | 1,050,000 | 1,086,750 |

| 5.75% 3/1/27 (a) | | 1,635,000 | 1,692,225 |

| U.S. Foods, Inc. 6.25% 4/15/25 (a) | | 1,645,000 | 1,673,788 |

| | | | 35,520,185 |

| Gaming - 5.7% | | | |

| Boyd Gaming Corp.: | | | |

| 4.75% 12/1/27 (a) | | 1,090,000 | 935,416 |

| 6% 8/15/26 | | 930,000 | 864,900 |

| 6.375% 4/1/26 | | 2,460,000 | 2,337,000 |

| Caesars Resort Collection LLC 5.25% 10/15/25 (a) | | 6,330,000 | 5,507,100 |

| Eldorado Resorts, Inc.: | | | |

| 6% 4/1/25 | | 1,395,000 | 1,452,251 |

| 6% 9/15/26 | | 485,000 | 523,955 |

| 6.25% 7/1/25 (a)(d) | | 3,365,000 | 3,338,753 |

| 8.125% 7/1/27 (a)(d) | | 1,645,000 | 1,599,763 |

| GLP Capital LP/GLP Financing II, Inc. 5.25% 6/1/25 | | 2,645,000 | 2,876,199 |

| Golden Entertainment, Inc. 7.625% 4/15/26 (a) | | 2,935,000 | 2,700,200 |

| MCE Finance Ltd. 4.875% 6/6/25 (a) | | 2,075,000 | 2,085,464 |

| MGM Growth Properties Operating Partnership LP: | | | |

| 4.5% 9/1/26 | | 5,695,000 | 5,655,648 |

| 4.5% 1/15/28 | | 2,895,000 | 2,819,093 |

| 4.625% 6/15/25 (a) | | 560,000 | 548,845 |

| 5.75% 2/1/27 | | 870,000 | 891,750 |

| Scientific Games Corp. 5% 10/15/25 (a) | | 1,800,000 | 1,661,868 |

| Stars Group Holdings BV 7% 7/15/26 (a) | | 2,315,000 | 2,440,288 |

| Station Casinos LLC 5% 10/1/25 (a) | | 2,975,000 | 2,618,000 |

| Twin River Worldwide Holdings, Inc. 6.75% 6/1/27 (a) | | 1,645,000 | 1,562,750 |

| Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp. 5.25% 5/15/27 (a) | | 2,495,000 | 2,156,928 |

| Wynn Macau Ltd.: | | | |

| 4.875% 10/1/24 (a) | | 2,560,000 | 2,508,800 |

| 5.5% 10/1/27 (a) | | 2,950,000 | 2,903,906 |

| | | | 49,988,877 |

| Healthcare - 8.7% | | | |

| BCPE Cycle Merger Sub II, Inc. 10.625% 7/15/27 (a) | | 580,000 | 597,400 |

| Catalent Pharma Solutions 4.875% 1/15/26 (a) | | 400,000 | 406,080 |

| Centene Corp.: | | | |

| 4.25% 12/15/27 | | 980,000 | 1,011,272 |

| 4.625% 12/15/29 | | 5,100,000 | 5,399,727 |

| 5.375% 8/15/26 (a) | | 3,945,000 | 4,103,628 |

| Charles River Laboratories International, Inc.: | | | |

| 4.25% 5/1/28 (a) | | 290,000 | 289,852 |

| 5.5% 4/1/26 (a) | | 1,325,000 | 1,378,000 |

| Community Health Systems, Inc.: | | | |

| 6.25% 3/31/23 | | 3,570,000 | 3,362,797 |

| 8% 3/15/26 (a) | | 2,480,000 | 2,344,096 |

| CTR Partnership LP/CareTrust Capital Corp. 5.25% 6/1/25 | | 3,145,000 | 3,176,450 |

| DaVita HealthCare Partners, Inc. 4.625% 6/1/30 (a) | | 3,060,000 | 3,043,170 |

| HCA Holdings, Inc. 5.875% 2/15/26 | | 170,000 | 186,575 |

| Hologic, Inc.: | | | |

| 4.375% 10/15/25 (a) | | 2,070,000 | 2,090,265 |

| 4.625% 2/1/28 (a) | | 395,000 | 409,813 |

| IMS Health, Inc. 5% 5/15/27 (a) | | 2,745,000 | 2,807,970 |

| MPH Acquisition Holdings LLC 7.125% 6/1/24 (a) | | 1,845,000 | 1,715,850 |

| MPT Operating Partnership LP/MPT Finance Corp.: | | | |

| 5.25% 8/1/26 | | 1,515,000 | 1,571,813 |

| 5.5% 5/1/24 | | 2,870,000 | 2,913,050 |

| 6.375% 3/1/24 | | 1,275,000 | 1,313,250 |

| Service Corp. International 5.125% 6/1/29 | | 1,420,000 | 1,527,920 |

| Teleflex, Inc.: | | | |

| 4.25% 6/1/28 (a) | | 535,000 | 548,375 |

| 4.875% 6/1/26 | | 2,115,000 | 2,182,469 |

| Tenet Healthcare Corp.: | | | |

| 4.625% 6/15/28 (a) | | 680,000 | 666,182 |

| 4.875% 1/1/26 (a) | | 1,550,000 | 1,518,163 |

| 5.125% 5/1/25 | | 1,030,000 | 994,166 |

| 6.25% 2/1/27 (a) | | 2,720,000 | 2,699,600 |

| 6.75% 6/15/23 | | 4,805,000 | 4,768,963 |

| 7% 8/1/25 | | 7,260,000 | 7,115,453 |

| 7.5% 4/1/25 (a) | | 2,335,000 | 2,480,938 |

| 8.125% 4/1/22 | | 6,055,000 | 6,357,750 |

| Valeant Pharmaceuticals International, Inc.: | | | |

| 5.875% 5/15/23 (a) | | 39,000 | 38,903 |

| 7% 3/15/24 (a) | | 4,500,000 | 4,668,750 |

| 9.25% 4/1/26 (a) | | 2,500,000 | 2,712,250 |

| Vizient, Inc. 6.25% 5/15/27 (a) | | 240,000 | 251,400 |

| | | | 76,652,340 |

| Homebuilders/Real Estate - 1.7% | | | |

| Alliant Holdings Intermediate LLC 6.75% 10/15/27 (a) | | 7,272,000 | 7,247,421 |

| Howard Hughes Corp. 5.375% 3/15/25 (a) | | 3,200,000 | 2,977,920 |

| Starwood Property Trust, Inc. 4.75% 3/15/25 | | 1,015,000 | 923,650 |

| VICI Properties, Inc.: | | | |

| 3.5% 2/15/25 (a) | | 1,265,000 | 1,189,100 |

| 4.625% 12/1/29 (a) | | 2,410,000 | 2,349,750 |

| | | | 14,687,841 |

| Hotels - 0.3% | | | |

| Wyndham Hotels & Resorts, Inc. 5.375% 4/15/26 (a) | | 2,525,000 | 2,430,313 |

| Insurance - 1.5% | | | |

| AmWINS Group, Inc. 7.75% 7/1/26 (a) | | 5,465,000 | 5,738,250 |

| HUB International Ltd. 7% 5/1/26 (a) | | 2,155,000 | 2,155,000 |

| USI, Inc. 6.875% 5/1/25 (a) | | 5,270,000 | 5,316,113 |

| | | | 13,209,363 |

| Leisure - 0.3% | | | |

| Mattel, Inc.: | | | |

| 5.875% 12/15/27 (a) | | 85,000 | 88,188 |

| 6.75% 12/31/25 (a) | | 2,610,000 | 2,707,875 |

| | | | 2,796,063 |

| Metals/Mining - 1.7% | | | |

| First Quantum Minerals Ltd.: | | | |

| 7.25% 5/15/22 (a) | | 1,775,000 | 1,704,444 |

| 7.25% 4/1/23 (a) | | 4,195,000 | 4,006,225 |

| FMG Resources (August 2006) Pty Ltd. 4.5% 9/15/27 (a) | | 40,000 | 40,015 |

| Freeport-McMoRan, Inc. 3.875% 3/15/23 | | 2,770,000 | 2,773,601 |

| Kaiser Aluminum Corp.: | | | |

| 4.625% 3/1/28 (a) | | 2,500,000 | 2,390,800 |

| 6.5% 5/1/25 (a) | | 970,000 | 1,006,375 |

| Nufarm Australia Ltd. 5.75% 4/30/26 (a) | | 3,603,000 | 3,476,895 |

| | | | 15,398,355 |

| Paper - 0.4% | | | |

| Flex Acquisition Co., Inc.: | | | |

| 6.875% 1/15/25 (a) | | 1,600,000 | 1,544,000 |

| 7.875% 7/15/26 (a) | | 1,720,000 | 1,668,400 |

| | | | 3,212,400 |

| Restaurants - 1.0% | | | |

| 1011778 BC Unlimited Liability Co./New Red Finance, Inc.: | | | |

| 5% 10/15/25 (a) | | 2,190,000 | 2,179,050 |

| 5.75% 4/15/25 (a) | | 755,000 | 792,750 |

| Golden Nugget, Inc. 6.75% 10/15/24 (a) | | 4,845,000 | 3,482,344 |

| Yum! Brands, Inc. 7.75% 4/1/25 (a) | | 2,250,000 | 2,427,188 |

| | | | 8,881,332 |

| Services - 4.7% | | | |

| Aramark Services, Inc.: | | | |

| 4.75% 6/1/26 | | 1,955,000 | 1,881,688 |

| 5% 2/1/28 (a) | | 4,330,000 | 4,113,500 |

| 6.375% 5/1/25 (a) | | 4,365,000 | 4,507,430 |

| ASGN, Inc. 4.625% 5/15/28 (a) | | 1,020,000 | 996,152 |

| Brand Energy & Infrastructure Services, Inc. 8.5% 7/15/25 (a) | | 3,910,000 | 3,519,000 |

| CDK Global, Inc.: | | | |

| 4.875% 6/1/27 | | 1,105,000 | 1,134,271 |

| 5.25% 5/15/29 (a) | | 465,000 | 482,865 |

| 5.875% 6/15/26 | | 1,940,000 | 2,014,923 |

| CoreCivic, Inc.: | | | |

| 4.625% 5/1/23 | | 495,000 | 475,200 |

| 5% 10/15/22 | | 1,430,000 | 1,401,400 |

| Frontdoor, Inc. 6.75% 8/15/26 (a) | | 1,570,000 | 1,668,125 |

| GEMS MENASA Cayman Ltd. 7.125% 7/31/26 (a) | | 5,245,000 | 4,977,833 |

| Laureate Education, Inc. 8.25% 5/1/25 (a) | | 3,875,000 | 4,020,313 |

| Sotheby's 7.375% 10/15/27 (a) | | 2,930,000 | 2,768,850 |

| Tempo Acquisition LLC: | | | |

| 5.75% 6/1/25 (a) | | 1,345,000 | 1,378,625 |

| 6.75% 6/1/25 (a) | | 3,210,000 | 3,250,125 |

| The GEO Group, Inc.: | | | |

| 5.875% 10/15/24 | | 710,000 | 557,847 |

| 6% 4/15/26 | | 2,600,000 | 1,995,500 |

| | | | 41,143,647 |

| Steel - 0.4% | | | |

| Allegheny Technologies, Inc. 5.875% 12/1/27 | | 3,820,000 | 3,533,500 |

| Super Retail - 0.2% | | | |

| The William Carter Co. 5.625% 3/15/27 (a) | | 1,575,000 | 1,622,250 |

| Technology - 7.2% | | | |

| Ascend Learning LLC: | | | |

| 6.875% 8/1/25 (a) | | 335,000 | 337,471 |

| 6.875% 8/1/25 (a) | | 2,470,000 | 2,482,350 |

| Banff Merger Sub, Inc. 9.75% 9/1/26 (a) | | 6,615,000 | 6,656,344 |

| Boxer Parent Co., Inc. 7.125% 10/2/25 (a) | | 800,000 | 840,240 |

| Camelot Finance SA 4.5% 11/1/26 (a) | | 2,410,000 | 2,410,000 |

| Ensemble S Merger Sub, Inc. 9% 9/30/23 (a) | | 4,000,000 | 4,040,000 |

| Entegris, Inc. 4.375% 4/15/28 (a) | | 1,820,000 | 1,851,850 |

| Fair Isaac Corp. 5.25% 5/15/26 (a) | | 4,065,000 | 4,430,850 |

| Financial & Risk U.S. Holdings, Inc. 8.25% 11/15/26 (a) | | 1,160,000 | 1,256,245 |

| Gartner, Inc.: | | | |

| 4.5% 7/1/28 (a) | | 1,470,000 | 1,487,199 |

| 5.125% 4/1/25 (a) | | 795,000 | 814,120 |

| Match Group, Inc. 4.125% 8/1/30 (a) | | 685,000 | 670,656 |

| Northwest Fiber LLC/Northwest Fiber Finance Sub, Inc. 10.75% 6/1/28 (a) | | 2,025,000 | 2,106,000 |

| Nortonlifelock, Inc. 5% 4/15/25 (a) | | 4,765,000 | 4,836,475 |

| Nuance Communications, Inc. 5.625% 12/15/26 | | 3,135,000 | 3,260,400 |

| Qorvo, Inc.: | | | |

| 4.375% 10/15/29 (a) | | 1,500,000 | 1,536,120 |

| 5.5% 7/15/26 | | 3,385,000 | 3,520,400 |

| Rackspace Hosting, Inc. 8.625% 11/15/24 (a) | | 8,790,000 | 8,948,220 |

| Sensata Technologies BV 5% 10/1/25 (a) | | 1,960,000 | 2,086,812 |

| SS&C Technologies, Inc. 5.5% 9/30/27 (a) | | 2,415,000 | 2,459,412 |

| TTM Technologies, Inc. 5.625% 10/1/25 (a) | | 7,895,000 | 7,830,893 |

| | | | 63,862,057 |

| Telecommunications - 13.9% | | | |

| Altice Financing SA: | | | |

| 5% 1/15/28 (a) | | 940,000 | 933,758 |

| 7.5% 5/15/26 (a) | | 8,260,000 | 8,652,350 |

| C&W Senior Financing Designated Activity Co.: | | | |

| 6.875% 9/15/27 (a) | | 11,260,000 | 11,175,528 |

| 7.5% 10/15/26 (a) | | 5,750,000 | 5,879,375 |

| Century Telephone Enterprises, Inc. 6.875% 1/15/28 | | 162,000 | 172,319 |

| CenturyLink, Inc.: | | | |

| 5.125% 12/15/26 (a) | | 4,810,000 | 4,797,975 |

| 5.625% 4/1/25 | | 1,725,000 | 1,783,650 |

| Front Range BidCo, Inc.: | | | |

| 4% 3/1/27 (a) | | 1,600,000 | 1,518,496 |

| 6.125% 3/1/28 (a) | | 1,810,000 | 1,760,225 |

| Frontier Communications Corp. 8% 4/1/27 (a) | | 10,120,000 | 10,271,800 |

| Intelsat Jackson Holdings SA: | | | |

| 8% 2/15/24 (a) | | 5,305,000 | 5,380,225 |

| 8.5% 10/15/24 (a)(e) | | 3,560,000 | 2,140,450 |

| Level 3 Financing, Inc.: | | | |

| 4.25% 7/1/28 (a) | | 2,320,000 | 2,316,938 |

| 5.25% 3/15/26 | | 2,620,000 | 2,699,517 |

| Millicom International Cellular SA: | | | |

| 6% 3/15/25 (a) | | 1,345,000 | 1,385,350 |

| 6.625% 10/15/26 (a) | | 6,780,000 | 7,198,538 |

| Neptune Finco Corp.: | | | |

| 6.625% 10/15/25 (a) | | 6,315,000 | 6,559,706 |

| 10.875% 10/15/25 (a) | | 205,000 | 220,375 |

| Sable International Finance Ltd. 5.75% 9/7/27 (a) | | 515,000 | 525,300 |

| SFR Group SA: | | | |

| 7.375% 5/1/26 (a) | | 5,850,000 | 6,100,380 |

| 8.125% 2/1/27 (a) | | 6,580,000 | 7,196,875 |

| Sprint Capital Corp. 6.875% 11/15/28 | | 3,165,000 | 3,857,186 |

| Sprint Communications, Inc. 6% 11/15/22 | | 2,145,000 | 2,262,396 |

| Sprint Corp.: | | | |

| 7.125% 6/15/24 | | 2,450,000 | 2,766,393 |

| 7.875% 9/15/23 | | 9,660,000 | 10,879,575 |

| T-Mobile U.S.A., Inc.: | | | |

| 3.75% 4/15/27 (a) | | 2,340,000 | 2,596,230 |

| 3.875% 4/15/30 (a) | | 2,340,000 | 2,608,094 |

| 4.5% 2/1/26 | | 1,245,000 | 1,259,890 |

| 6.375% 3/1/25 | | 25,000 | 25,688 |

| Telecom Italia Capital SA: | | | |

| 6% 9/30/34 | | 1,005,000 | 1,092,435 |

| 6.375% 11/15/33 | | 565,000 | 637,038 |

| Telecom Italia SpA 5.303% 5/30/24 (a) | | 2,950,000 | 3,071,747 |

| Telenet Finance Luxembourg Notes SARL 5.5% 3/1/28 (a) | | 3,000,000 | 3,127,500 |

| | | | 122,853,302 |

| Utilities - 5.7% | | | |

| Clearway Energy Operating LLC: | | | |

| 4.75% 3/15/28 (a) | | 585,000 | 596,665 |

| 5.75% 10/15/25 | | 1,720,000 | 1,786,048 |

| DCP Midstream Operating LP: | | | |

| 5.125% 5/15/29 | | 3,300,000 | 3,151,500 |

| 5.625% 7/15/27 | | 2,305,000 | 2,322,288 |

| Global Partners LP/GLP Finance Corp.: | | | |

| 7% 6/15/23 | | 2,750,000 | 2,643,438 |

| 7% 8/1/27 | | 2,200,000 | 2,035,000 |

| InterGen NV 7% 6/30/23 (a) | | 6,695,000 | 6,427,200 |

| NextEra Energy Partners LP 4.5% 9/15/27 (a) | | 565,000 | 590,611 |

| NRG Energy, Inc.: | | | |

| 5.25% 6/15/29 (a) | | 2,105,000 | 2,215,070 |

| 5.75% 1/15/28 | | 1,190,000 | 1,255,450 |

| 6.625% 1/15/27 | | 900,000 | 940,500 |

| NRG Yield Operating LLC 5% 9/15/26 | | 2,150,000 | 2,176,875 |

| NSG Holdings II LLC/NSG Holdings, Inc. 7.75% 12/15/25 (a) | | 8,480,837 | 8,565,646 |

| PG&E Corp. 5.25% 7/1/30 | | 1,845,000 | 1,854,225 |

| Talen Energy Supply LLC 10.5% 1/15/26 (a) | | 1,110,000 | 876,900 |

| Vistra Operations Co. LLC: | | | |

| 5% 7/31/27 (a) | | 3,790,000 | 3,853,483 |

| 5.5% 9/1/26 (a) | | 7,084,000 | 7,247,924 |

| 5.625% 2/15/27 (a) | | 2,175,000 | 2,233,682 |

| | | | 50,772,505 |

|

| TOTAL NONCONVERTIBLE BONDS | | | 833,214,430 |

|

| TOTAL CORPORATE BONDS | | | |

| (Cost $868,532,284) | | | 841,042,517 |

| | | Shares | Value |

|

| Common Stocks - 0.0% | | | |

| Automotive & Auto Parts - 0.0% | | | |

| Motors Liquidation Co. GUC Trust (f) | | 3 | 5 |

| Energy - 0.0% | | | |

| Weatherford International PLC (f) | | 12,948 | 25,508 |

| Telecommunications - 0.0% | | | |

| CUI Acquisition Corp. Class E (f)(g) | | 1 | 35,011 |

| TOTAL COMMON STOCKS | | | |

| (Cost $1,473,972) | | | 60,524 |

| | | Principal Amount | Value |

|

| Bank Loan Obligations - 1.7% | | | |

| Cable/Satellite TV - 0.2% | | | |

| WideOpenWest Finance LLC Tranche B, term loan 3 month U.S. LIBOR + 3.250% 4.25% 8/19/23 (b)(c)(h) | | 1,302,842 | 1,238,247 |

| Energy - 0.1% | | | |

| California Resources Corp. Tranche 1LN, term loan 3 month U.S. LIBOR + 10.375% 11.375% 12/31/21 (b)(c)(h) | | 3,060,000 | 137,700 |

| Gavilan Resources LLC Tranche 2LN, term loan 3 month U.S. LIBOR + 6.000% 0% 3/1/24 (c)(e)(h) | | 4,810,000 | 12,025 |

| Sanchez Energy Corp.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 8.000% 0% 12/31/49 (c)(e)(g)(h) | | 1,525,908 | 534,068 |

| term loan 0% 12/31/49 (e)(g)(h) | | 658,000 | 230,300 |

|

| TOTAL ENERGY | | | 914,093 |

|

| Gaming - 0.3% | | | |

| Golden Entertainment, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.75% 10/20/24 (b)(c)(h) | | 2,977,025 | 2,681,793 |

| Services - 0.4% | | | |

| Almonde, Inc.: | | | |

| Tranche 2LN, term loan 3 month U.S. LIBOR + 7.250% 8.25% 6/13/25 (b)(c)(h) | | 130,000 | 111,944 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.5% 6/13/24 (b)(c)(h) | | 549,510 | 479,074 |

| Brand Energy & Infrastructure Services, Inc. Tranche B, term loan 3 month U.S. LIBOR + 4.250% 5.4519% 6/21/24 (b)(c)(h) | | 3,264,050 | 2,978,446 |

|

| TOTAL SERVICES | | | 3,569,464 |

|

| Technology - 0.1% | | | |

| Ultimate Software Group, Inc. 1LN, term loan 3 month U.S. LIBOR + 4.000% 5/3/26 (c)(h)(i) | | 1,245,000 | 1,228,080 |

| Telecommunications - 0.6% | | | |

| Intelsat Jackson Holdings SA: | | | |

| Tranche B, term loan 3 month U.S. LIBOR + 3.750% 8% 11/27/23 (b)(c)(h) | | 3,125,000 | 3,103,531 |

| Tranche B-4, term loan 3 month U.S. LIBOR + 4.500% 8.75% 1/2/24 (b)(c)(h) | | 280,000 | 279,300 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 5.500% 5.05% 7/13/21 (b)(c)(h)(j) | | 2,116,460 | 2,144,249 |

|

| TOTAL TELECOMMUNICATIONS | | | 5,527,080 |

|

| TOTAL BANK LOAN OBLIGATIONS | | | |

| (Cost $21,273,137) | | | 15,158,757 |

|

| Preferred Securities - 0.6% | | | |

| Banks & Thrifts - 0.3% | | | |

| Bank of America Corp. 5.2% (b)(k) | | 1,400,000 | 1,355,668 |

| Wells Fargo & Co. 5.9% (b)(k) | | 1,820,000 | 1,806,300 |

|

| TOTAL BANKS & THRIFTS | | | 3,161,968 |

|

| Energy - 0.3% | | | |

| MPLX LP 6.875% (b)(k) | | 2,630,000 | 2,408,761 |

| TOTAL PREFERRED SECURITIES | | | |

| (Cost $5,908,421) | | | 5,570,729 |

| | | Shares | Value |

|

| Money Market Funds - 4.0% | | | |

| Fidelity Cash Central Fund 0.12% (l) | | | |

| (Cost $35,259,731) | | 35,253,007 | 35,260,057 |

| TOTAL INVESTMENT IN SECURITIES - 101.6% | | | |

| (Cost $932,447,545) | | | 897,092,584 |

| NET OTHER ASSETS (LIABILITIES) - (1.6)% | | | (14,485,453) |

| NET ASSETS - 100% | | | $882,607,131 |

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $571,373,007 or 64.7% of net assets.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(d) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(e) Non-income producing - Security is in default.

(f) Non-income producing

(g) Level 3 security

(h) Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty.

(i) The coupon rate will be determined upon settlement of the loan after period end.

(j) Position or a portion of the position represents an unfunded loan commitment. At period end, the total principal amount and market value of unfunded commitments totaled $1,036,612 and $1,050,222, respectively.

(k) Security is perpetual in nature with no stated maturity date.

(l) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $185,421 |

| Total | $185,421 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $35,011 | $-- | $-- | $35,011 |

| Energy | 25,508 | 25,508 | -- | -- |

| Financials | 5 | 5 | -- | -- |

| Corporate Bonds | 841,042,517 | -- | 841,042,517 | -- |

| Bank Loan Obligations | 15,158,757 | -- | 14,394,389 | 764,368 |

| Preferred Securities | 5,570,729 | -- | 5,570,729 | -- |

| Money Market Funds | 35,260,057 | 35,260,057 | -- | -- |

| Total Investments in Securities: | $897,092,584 | $35,285,570 | $861,007,635 | $799,379 |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 77.6% |

| Luxembourg | 6.4% |

| Multi-National | 3.5% |

| Netherlands | 2.9% |

| Ireland | 2.3% |

| Canada | 2.0% |

| France | 1.5% |

| Cayman Islands | 1.5% |

| United Kingdom | 1.1% |

| Others (Individually Less Than 1%) | 1.2% |

| | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | June 30, 2020 (Unaudited) |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $897,187,814) | $861,832,527 | |

| Fidelity Central Funds (cost $35,259,731) | 35,260,057 | |

| Total Investment in Securities (cost $932,447,545) | | $897,092,584 |

| Receivable for investments sold | | 2,831,806 |

| Receivable for fund shares sold | | 1,086,841 |

| Interest receivable | | 13,834,429 |

| Distributions receivable from Fidelity Central Funds | | 3,841 |

| Other receivables | | 494 |

| Total assets | | 914,849,995 |

| Liabilities | | |

| Payable to custodian bank | $156,891 | |

| Payable for investments purchased | | |

| Regular delivery | 10,815,391 | |

| Delayed delivery | 6,280,000 | |

| Payable for fund shares redeemed | 14,375,627 | |

| Accrued management fee | 420,321 | |

| Distribution and service plan fees payable | 36,623 | |

| Other affiliated payables | 91,203 | |

| Other payables and accrued expenses | 66,808 | |

| Total liabilities | | 32,242,864 |

| Net Assets | | $882,607,131 |

| Net Assets consist of: | | |

| Paid in capital | | $989,494,012 |

| Total accumulated earnings (loss) | | (106,886,881) |

| Net Assets | | $882,607,131 |

| Net Asset Value and Maximum Offering Price | | |

| Initial Class: | | |

| Net Asset Value, offering price and redemption price per share ($292,762,847 ÷ 57,902,323 shares) | | $5.06 |

| Service Class: | | |

| Net Asset Value, offering price and redemption price per share ($52,219,708 ÷ 10,414,287 shares) | | $5.01 |

| Service Class 2: | | |

| Net Asset Value, offering price and redemption price per share ($145,903,286 ÷ 30,054,344 shares) | | $4.85 |

| Investor Class: | | |

| Net Asset Value, offering price and redemption price per share ($391,721,290 ÷ 77,928,246 shares) | | $5.03 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended June 30, 2020 (Unaudited) |

| Investment Income | | |

| Dividends | | $523,975 |

| Interest | | 27,991,285 |

| Income from Fidelity Central Funds | | 185,421 |

| Total income | | 28,700,681 |

| Expenses | | |

| Management fee | $2,540,348 | |

| Transfer agent fees | 383,785 | |

| Distribution and service plan fees | 218,562 | |

| Accounting fees and expenses | 167,194 | |

| Custodian fees and expenses | 7,875 | |

| Independent trustees' fees and expenses | 2,977 | |

| Audit | 42,056 | |

| Legal | 1,405 | |

| Miscellaneous | 67,646 | |

| Total expenses before reductions | 3,431,848 | |

| Expense reductions | (8,255) | |

| Total expenses after reductions | | 3,423,593 |

| Net investment income (loss) | | 25,277,088 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (28,423,165) | |

| Fidelity Central Funds | 3,324 | |

| Total net realized gain (loss) | | (28,419,841) |

| Change in net unrealized appreciation (depreciation) on investment securities | | (59,432,795) |

| Net gain (loss) | | (87,852,636) |

| Net increase (decrease) in net assets resulting from operations | | $(62,575,548) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended June 30, 2020 (Unaudited) | Year ended December 31, 2019 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $25,277,088 | $52,166,800 |

| Net realized gain (loss) | (28,419,841) | (12,326,337) |

| Change in net unrealized appreciation (depreciation) | (59,432,795) | 94,044,788 |

| Net increase (decrease) in net assets resulting from operations | (62,575,548) | 133,885,251 |

| Distributions to shareholders | (7,663,601) | (51,787,940) |

| Share transactions - net increase (decrease) | (91,057,883) | 73,598,351 |

| Total increase (decrease) in net assets | (161,297,032) | 155,695,662 |

| Net Assets | | |

| Beginning of period | 1,043,904,163 | 888,208,501 |

| End of period | $882,607,131 | $1,043,904,163 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

VIP High Income Portfolio Initial Class

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $5.43 | $4.97 | $5.46 | $5.38 | $4.95 | $5.52 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .141 | .286 | .288 | .290 | .320 | .333 |

| Net realized and unrealized gain (loss) | (.470) | .457 | (.473) | .091 | .402 | (.531) |

| Total from investment operations | (.329) | .743 | (.185) | .381 | .722 | (.198) |

| Distributions from net investment income | (.041) | (.283) | (.305) | (.301) | (.292) | (.364) |

| Tax return of capital | – | – | – | – | – | (.008) |

| Total distributions | (.041) | (.283) | (.305) | (.301) | (.292) | (.372) |

| Redemption fees added to paid in capitalA | – | – | – | – | – | –B |

| Net asset value, end of period | $5.06 | $5.43 | $4.97 | $5.46 | $5.38 | $4.95 |

| Total ReturnC,D,E | (6.11)% | 15.11% | (3.46)% | 7.13% | 14.61% | (3.63)% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | .68%H,I | .67% | .67% | .67% | .68% | .68% |

| Expenses net of fee waivers, if any | .68%H,I | .67% | .67% | .67% | .68% | .68% |

| Expenses net of all reductions | .68%H,I | .67% | .67% | .67% | .68% | .68% |

| Net investment income (loss) | 5.64%H,I | 5.31% | 5.33% | 5.22% | 6.05% | 5.94% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $292,763 | $327,442 | $299,239 | $355,469 | $457,620 | $437,798 |

| Portfolio turnover rateJ | 73%H | 30% | 69% | 70% | 73% | 69% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Proxy expenses are not annualized.

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

VIP High Income Portfolio Service Class

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $5.38 | $4.93 | $5.42 | $5.34 | $4.92 | $5.49 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .138 | .279 | .280 | .283 | .311 | .324 |

| Net realized and unrealized gain (loss) | (.468) | .449 | (.471) | .092 | .395 | (.528) |

| Total from investment operations | (.330) | .728 | (.191) | .375 | .706 | (.204) |

| Distributions from net investment income | (.040) | (.278) | (.299) | (.295) | (.286) | (.358) |

| Tax return of capital | – | – | – | – | – | (.008) |

| Total distributions | (.040) | (.278) | (.299) | (.295) | (.286) | (.366) |

| Redemption fees added to paid in capitalA | – | – | – | – | – | –B |

| Net asset value, end of period | $5.01 | $5.38 | $4.93 | $5.42 | $5.34 | $4.92 |

| Total ReturnC,D,E | (6.18)% | 14.92% | (3.60)% | 7.07% | 14.37% | (3.76)% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | .78%H,I | .77% | .77% | .77% | .78% | .78% |

| Expenses net of fee waivers, if any | .78%H,I | .77% | .77% | .77% | .78% | .78% |

| Expenses net of all reductions | .78%H,I | .77% | .77% | .77% | .78% | .77% |

| Net investment income (loss) | 5.54%H,I | 5.21% | 5.23% | 5.12% | 5.95% | 5.84% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $52,220 | $66,123 | $58,231 | $68,104 | $84,945 | $73,313 |

| Portfolio turnover rateJ | 73%H | 30% | 69% | 70% | 73% | 69% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Proxy expenses are not annualized.

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

VIP High Income Portfolio Service Class 2

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $5.22 | $4.79 | $5.27 | $5.20 | $4.80 | $5.36 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .130 | .262 | .264 | .267 | .296 | .309 |

| Net realized and unrealized gain (loss) | (.461) | .438 | (.451) | .090 | .383 | (.514) |

| Total from investment operations | (.331) | .700 | (.187) | .357 | .679 | (.205) |

| Distributions from net investment income | (.039) | (.270) | (.293) | (.287) | (.279) | (.347) |

| Tax return of capital | – | – | – | – | – | (.008) |

| Total distributions | (.039) | (.270) | (.293) | (.287) | (.279) | (.355) |

| Redemption fees added to paid in capitalA | – | – | – | – | – | –B |

| Net asset value, end of period | $4.85 | $5.22 | $4.79 | $5.27 | $5.20 | $4.80 |

| Total ReturnC,D,E | (6.39)% | 14.77% | (3.63)% | 6.91% | 14.17% | (3.87)% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | .93%H,I | .92% | .92% | .92% | .93% | .93% |

| Expenses net of fee waivers, if any | .93%H,I | .92% | .92% | .92% | .93% | .93% |

| Expenses net of all reductions | .93%H,I | .92% | .92% | .92% | .93% | .93% |

| Net investment income (loss) | 5.38%H,I | 5.06% | 5.08% | 4.97% | 5.80% | 5.68% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $145,903 | $187,747 | $139,564 | $166,993 | $189,179 | $160,639 |

| Portfolio turnover rateJ | 73%H | 30% | 69% | 70% | 73% | 69% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Proxy expenses are not annualized.

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

VIP High Income Portfolio Investor Class

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $5.39 | $4.94 | $5.43 | $5.36 | $4.93 | $5.50 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .140 | .283 | .284 | .287 | .317 | .329 |

| Net realized and unrealized gain (loss) | (.459) | .448 | (.470) | .083 | .403 | (.529) |

| Total from investment operations | (.319) | .731 | (.186) | .370 | .720 | (.200) |

| Distributions from net investment income | (.041) | (.281) | (.304) | (.300) | (.290) | (.362) |

| Tax return of capital | – | – | – | – | – | (.008) |

| Total distributions | (.041) | (.281) | (.304) | (.300) | (.290) | (.370) |

| Redemption fees added to paid in capitalA | – | – | – | – | – | –B |

| Net asset value, end of period | $5.03 | $5.39 | $4.94 | $5.43 | $5.36 | $4.93 |

| Total ReturnC,D,E | (5.97)% | 14.94% | (3.50)% | 6.95% | 14.64% | (3.68)% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | .71%H,I | .70% | .71% | .71% | .71% | .71% |

| Expenses net of fee waivers, if any | .71%H,I | .70% | .71% | .71% | .71% | .71% |

| Expenses net of all reductions | .71%H,I | .70% | .71% | .71% | .71% | .71% |

| Net investment income (loss) | 5.60%H,I | 5.28% | 5.30% | 5.18% | 6.02% | 5.90% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $391,721 | $462,593 | $391,173 | $456,983 | $469,732 | $398,719 |

| Portfolio turnover rateJ | 73%H | 30% | 69% | 70% | 73% | 69% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Proxy expenses are not annualized.

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended June 30, 2020

1. Organization.

VIP High Income Portfolio (the Fund) is a fund of Variable Insurance Products Fund (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares, Service Class shares, Service Class 2 shares and Investor Class shares. All classes have equal rights and voting privileges, except for matters affecting a single class.

Effective January 1, 2020:

Investment advisers Fidelity Investments Money Management, Inc., FMR Co., Inc., and Fidelity SelectCo, LLC, merged with and into Fidelity Management & Research Company. In connection with the merger transactions, the resulting, merged investment adviser was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to "Fidelity Management & Research Company LLC".

Broker-dealer Fidelity Distributors Corporation merged with and into Fidelity Investments Institutional Services Company, Inc. ("FIISC"). FIISC was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to "Fidelity Distributors Company LLC".

Fidelity Investments Institutional Operations Company, Inc. converted from a Massachusetts corporation to a Massachusetts LLC, and changed its name to "Fidelity Investments Institutional Operations Company LLC".

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds, bank loan obligations and preferred securities are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of June 30, 2020 is included at the end of the Fund's Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to market discount, capital loss carryforwards, partnerships and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $21,766,085 |

| Gross unrealized depreciation | (54,146,364) |

| Net unrealized appreciation (depreciation) | $(32,380,279) |

| Tax cost | $929,472,863 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of prior fiscal period end and is subject to adjustment.

| No expiration | |

| Short-term | $(26,139,758) |

| Long-term | (45,323,130) |

| Total capital loss carryforward | $(71,462,888) |

Delayed Delivery Transactions and When-Issued Securities. During the period, the Fund transacted in securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The securities purchased on a delayed delivery or when-issued basis are identified as such in the Fund's Schedule of Investments. The Fund may receive compensation for interest forgone in the purchase of a delayed delivery or when-issued security. With respect to purchase commitments, the Fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract's terms, or if the issuer does not issue the securities due to political, economic, or other factors.

Restricted Securities (including Private Placements). The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

Loans and Other Direct Debt Instruments. The Fund invests in direct debt instruments which are interests in amounts owed to lenders by corporate or other borrowers. These instruments may be in the form of loans, trade claims or other receivables and may include standby financing commitments such as revolving credit facilities that obligate the Fund to supply additional cash to the borrower on demand. Loans may be acquired through assignment or participation. The Fund also invests in unfunded loan commitments, which are contractual obligations for future funding. Information regarding unfunded commitments is included at the end of the Fund's Schedule of Investments.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, are noted in the table below.

| | Purchases ($) | Sales ($) |

| VIP High Income Portfolio | 317,977,167 | 332,647,987 |

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .45% of the Fund's average net assets and an annualized group fee rate that averaged .10% during the period. The group fee rate is based upon the monthly average net assets of a group of registered investment companies with which the investment adviser has management contracts. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annualized management fee rate was .55% of the Fund's average net assets.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate 12b-1 Plans for each Service Class of shares. Each Service Class pays Fidelity Distributors Company LLC (FDC), an affiliate of the investment adviser, a service fee. For the period, the service fee is based on an annual rate of .10% of Service Class' average net assets and .25% of Service Class 2's average net assets.

For the period, total fees, all of which were re-allowed to insurance companies for the distribution of shares and providing shareholder support services, were as follows:

| Service Class | $27,932 |

| Service Class 2 | 190,630 |

| | $218,562 |

Transfer Agent Fees. Fidelity Investments Institutional Operations Company LLC (FIIOC), an affiliate of the investment adviser, is the Fund's transfer, dividend disbursing, and shareholder servicing agent. FIIOC receives an asset-based fee with respect to each class. Each class pays a fee for transfer agent services, typesetting and printing and mailing of shareholder reports, excluding mailing of proxy statements. For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets(a) |

| Initial Class | $101,568 | .07 |

| Service Class | 18,994 | .07 |

| Service Class 2 | 51,851 | .07 |

| Investor Class | 211,372 | .10 |

| | $383,785 | |

(a) Annualized

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. For the period, the fees were equivalent to the following annualized rates:

| | % of Average Net Assets |

| VIP High Income Portfolio | .04 |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro-rata portion of the line of credit, which are reflected in Miscellaneous expenses on the Statement of Operations, and are as follows:

| | Amount |

| VIP High Income Portfolio | $1,230 |

During the period, there were no borrowings on this line of credit.

7. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $988 for the period. In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, custodian credits reduced the Fund's expenses by $6,236.

In addition, during the period the investment adviser or an affiliate reimbursed and/or waived a portion of fund-level operating expenses in the amount of $1,031.

8. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended