0000003794alliancebernstein:AllianceBernsteinIndexBloomberg1Minus10YearTIPSIndex18588AdditionalIndexMember2016-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02383

AB BOND FUND, INC.

(Exact name of registrant as specified in charter)

66 Hudson Boulevard East

New York, New York 10005

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

66 Hudson Boulevard East

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Please scan QR code for

Fund Information

AB All Market Real Return Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB All Market Real Return Portfolio (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AMTYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $101 | 0.93% |

How did the Fund perform last year? What affected the Fund’s performance?

Entering 2024, investors focused on the pace at which inflation would normalize. Despite a slow start in reducing inflationary concerns, economic growth across major economies was more resilient and broad-based than expected. This led to increased optimism about the economic outlook and strong equity performance. Real Estate, a notable rate-sensitive asset class, tends to outperform in falling rate environments and underperform in rising rate environments. For the AB All Market Real Return Portfolio, our strategic allocation to Real Estate was a significant contributor, especially in the third quarter following the US Federal Reserve's first rate cut in September. Similarly, the Portfolio's exposure to inflation-sensitive equities contributed, driven by the broad-based equity market rally in 2024. However, our modest tactical underweights to Real Estate and commodity producers detracted from relative performance. The AB All Market Real Return Portfolio allocates to various inflation-sensitive asset classes, including real estate, commodity producers, commodity futures, FX, inflation-sensitive equities and future natural resource equities. From a security selection standpoint, the Portfolio benefited from positive selection within Real Estate but was hurt by negative selection within future natural resource equities.

Top contributors to performance:

Top detractors from performance:

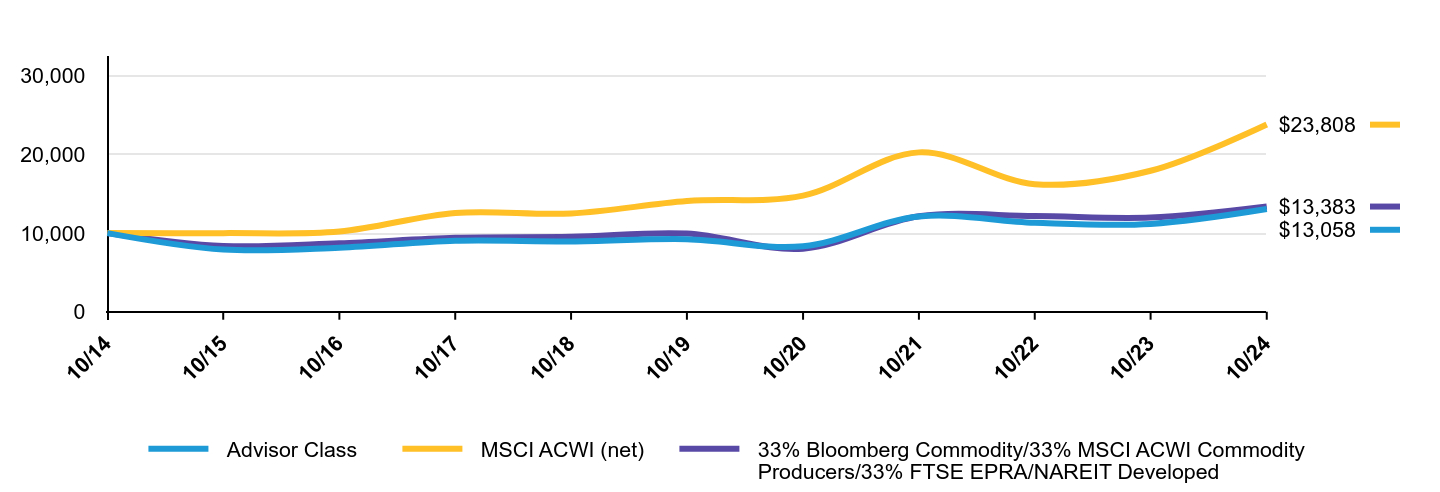

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Advisor Class | MSCI ACWI (net) | 33% Bloomberg Commodity/33% MSCI ACWI Commodity Producers/33% FTSE EPRA/NAREIT Developed |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $7,905 | $9,997 | $8,367 |

| 10/16 | $8,142 | $10,201 | $8,700 |

| 10/17 | $9,027 | $12,568 | $9,410 |

| 10/18 | $8,941 | $12,503 | $9,526 |

| 10/19 | $9,222 | $14,078 | $9,940 |

| 10/20 | $8,319 | $14,766 | $8,023 |

| 10/21 | $12,115 | $20,270 | $12,134 |

| 10/22 | $11,310 | $16,225 | $12,169 |

| 10/23 | $11,169 | $17,929 | $11,980 |

| 10/24 | $13,058 | $23,808 | $13,383 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Advisor Class | 16.91% | 7.20% | 2.70% |

| MSCI ACWI (net) | 32.79% | 11.08% | 9.06% |

| 33% Bloomberg Commodity/33% MSCI ACWI Commodity Producers/33% FTSE EPRA/NAREIT Developed | 11.71% | 6.13% | 2.96% |

The addition of the MSCI ACWI (net) broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AMTYX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $695,947,263 |

| # of Portfolio Holdings | 370 |

| Portfolio Turnover Rate | 90% |

| Total Advisory Fees Paid | $5,292,478 |

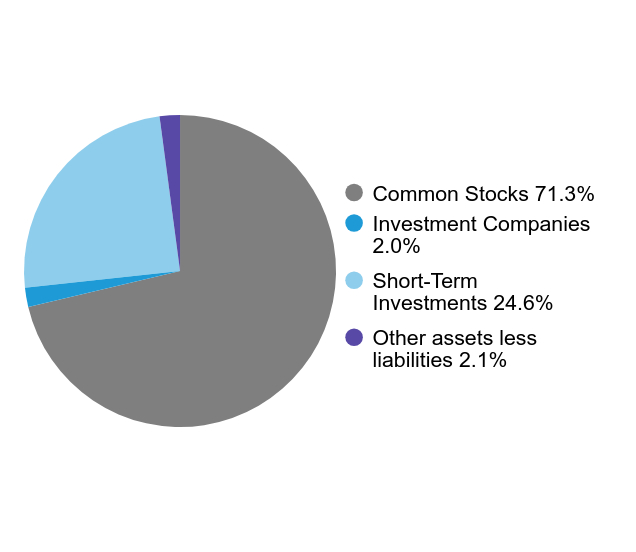

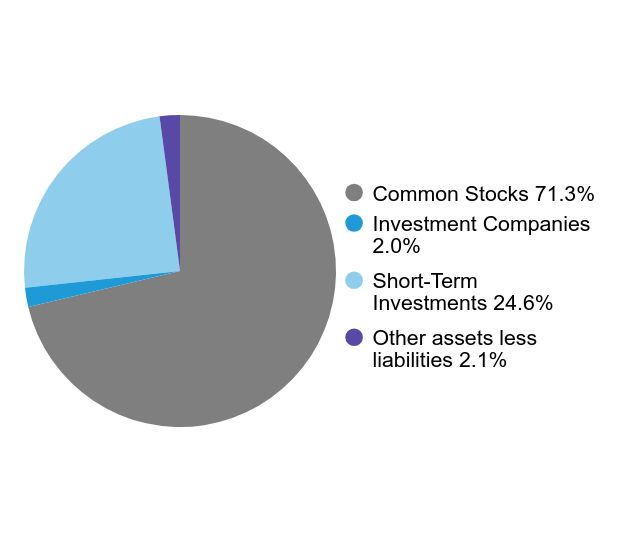

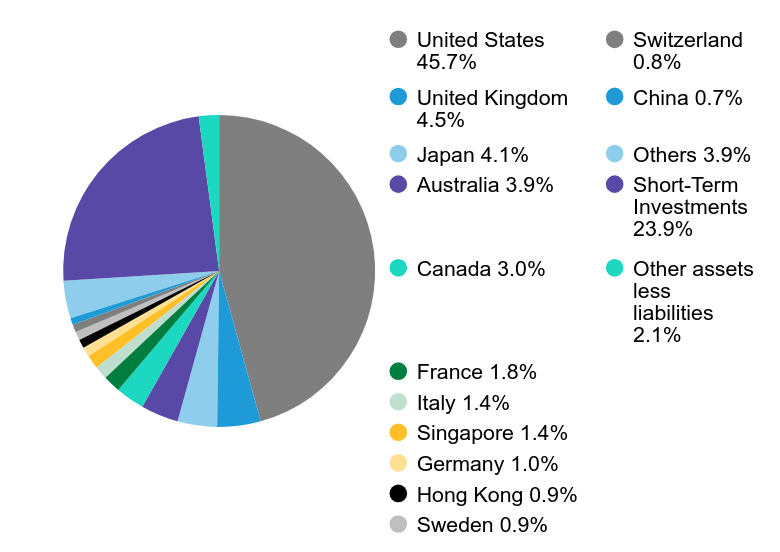

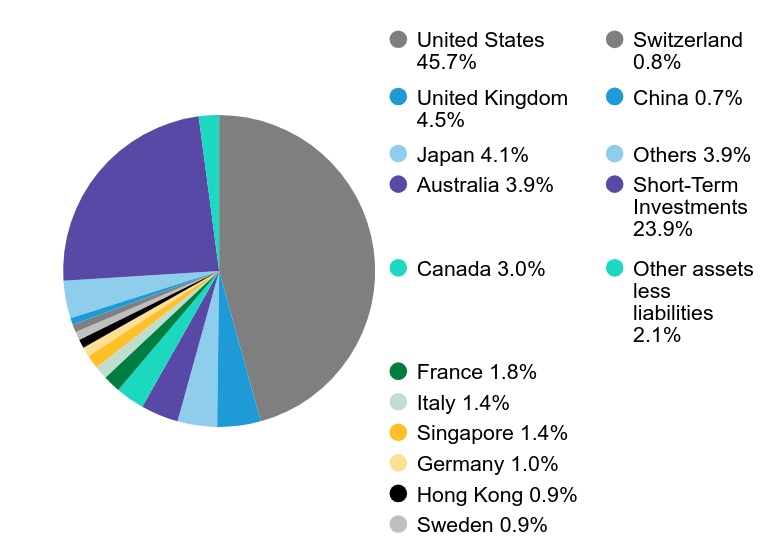

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Prologis, Inc. | $14,957,886 | 2.2% |

| Equinix, Inc. | $14,456,634 | 2.1% |

| Shell PLC | $10,399,486 | 1.5% |

| Exxon Mobil Corp. | $10,320,783 | 1.5% |

| Welltower, Inc. | $9,897,494 | 1.4% |

| Digital Realty Trust, Inc. | $9,305,388 | 1.3% |

| Simon Property Group, Inc. | $8,562,884 | 1.2% |

| Ventas, Inc. | $8,272,042 | 1.2% |

| Public Storage | $7,844,790 | 1.1% |

| VICI Properties, Inc. | $7,511,113 | 1.1% |

| Total | $101,528,500 | 14.6% |

| Asset Type | Value |

|---|

| Real Estate Stocks | 35.0% |

| Commodity Related Derivatives. | 32.0% |

| Inflation Sensitive Stocks | 17.0% |

| Commodity Related Stocks | 16.0% |

| |

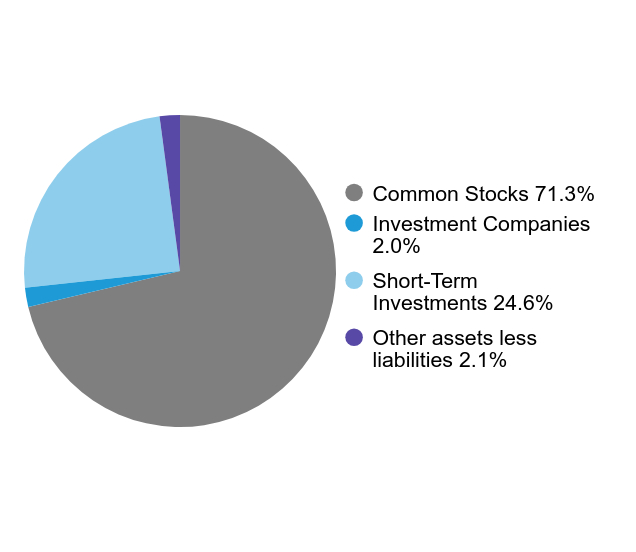

|---|

| Common Stocks | 71.3% |

| Investment Companies | 2.0% |

| Short-Term Investments | 24.6% |

| Other assets less liabilities | 2.1% |

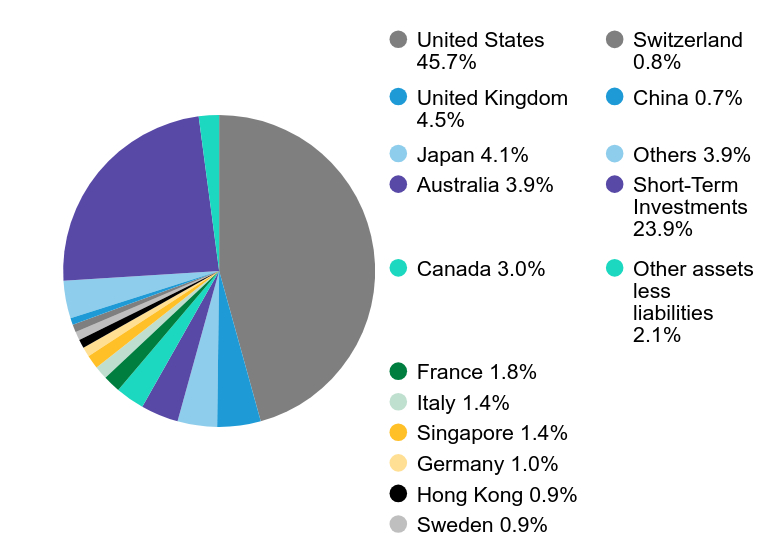

| Value | Value |

|---|

| United States | 45.7% |

| United Kingdom | 4.5% |

| Japan | 4.1% |

| Australia | 3.9% |

| Canada | 3.0% |

| France | 1.8% |

| Italy | 1.4% |

| Singapore | 1.4% |

| Germany | 1.0% |

| Hong Kong | 0.9% |

| Sweden | 0.9% |

| Switzerland | 0.8% |

| China | 0.7% |

| Others | 3.9% |

| Short-Term Investments | 23.9% |

| Other assets less liabilities | 2.1% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/AMTYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AMTYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB All Market Real Return Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB All Market Real Return Portfolio (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AMTOX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class 1 | $117 | 1.08% |

How did the Fund perform last year? What affected the Fund’s performance?

Entering 2024, investors focused on the pace at which inflation would normalize. Despite a slow start in reducing inflationary concerns, economic growth across major economies was more resilient and broad-based than expected. This led to increased optimism about the economic outlook and strong equity performance. Real Estate, a notable rate-sensitive asset class, tends to outperform in falling rate environments and underperform in rising rate environments. For the AB All Market Real Return Portfolio, our strategic allocation to Real Estate was a significant contributor, especially in the third quarter following the US Federal Reserve's first rate cut in September. Similarly, the Portfolio's exposure to inflation-sensitive equities contributed, driven by the broad-based equity market rally in 2024. However, our modest tactical underweights to Real Estate and commodity producers detracted from relative performance. The AB All Market Real Return Portfolio allocates to various inflation-sensitive asset classes, including real estate, commodity producers, commodity futures, FX, inflation-sensitive equities and future natural resource equities. From a security selection standpoint, the Portfolio benefited from positive selection within Real Estate but was hurt by negative selection within future natural resource equities.

Top contributors to performance:

Top detractors from performance:

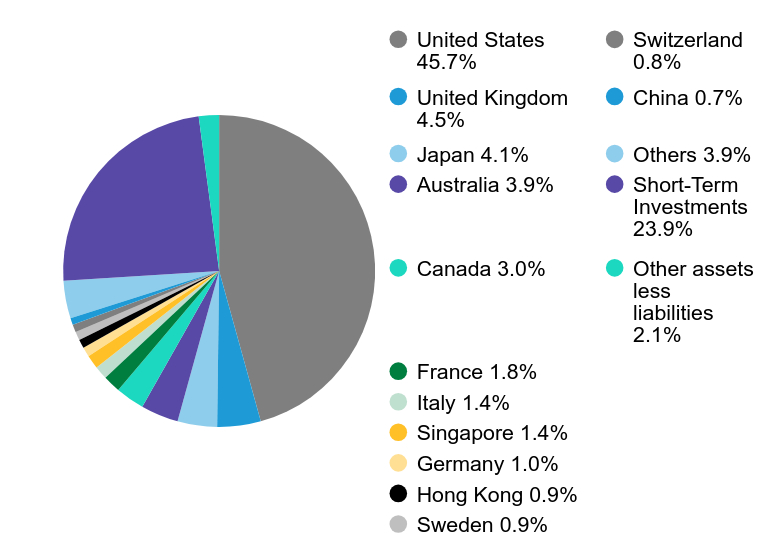

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class 1 | MSCI ACWI (net) | 33% Bloomberg Commodity/33% MSCI ACWI Commodity Producers/33% FTSE EPRA/NAREIT Developed |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $7,888 | $9,997 | $8,367 |

| 10/16 | $8,121 | $10,201 | $8,700 |

| 10/17 | $8,988 | $12,568 | $9,410 |

| 10/18 | $8,906 | $12,503 | $9,526 |

| 10/19 | $9,186 | $14,078 | $9,940 |

| 10/20 | $8,272 | $14,766 | $8,023 |

| 10/21 | $12,047 | $20,270 | $12,134 |

| 10/22 | $11,223 | $16,225 | $12,169 |

| 10/23 | $11,071 | $17,929 | $11,980 |

| 10/24 | $12,909 | $23,808 | $13,383 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class 1 | 16.61% | 7.04% | 2.59% |

| MSCI ACWI (net) | 32.79% | 11.08% | 9.06% |

| 33% Bloomberg Commodity/33% MSCI ACWI Commodity Producers/33% FTSE EPRA/NAREIT Developed | 11.71% | 6.13% | 2.96% |

The addition of the MSCI ACWI (net) broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AMTOX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $695,947,263 |

| # of Portfolio Holdings | 370 |

| Portfolio Turnover Rate | 90% |

| Total Advisory Fees Paid | $5,292,478 |

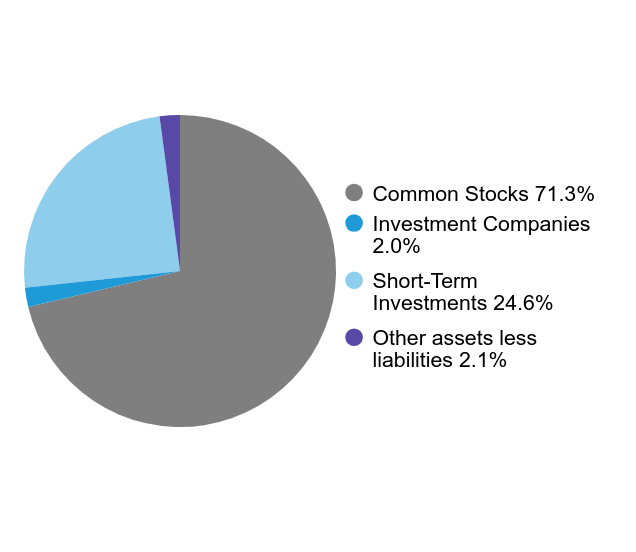

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Prologis, Inc. | $14,957,886 | 2.2% |

| Equinix, Inc. | $14,456,634 | 2.1% |

| Shell PLC | $10,399,486 | 1.5% |

| Exxon Mobil Corp. | $10,320,783 | 1.5% |

| Welltower, Inc. | $9,897,494 | 1.4% |

| Digital Realty Trust, Inc. | $9,305,388 | 1.3% |

| Simon Property Group, Inc. | $8,562,884 | 1.2% |

| Ventas, Inc. | $8,272,042 | 1.2% |

| Public Storage | $7,844,790 | 1.1% |

| VICI Properties, Inc. | $7,511,113 | 1.1% |

| Total | $101,528,500 | 14.6% |

| Asset Type | Value |

|---|

| Real Estate Stocks | 35.0% |

| Commodity Related Derivatives. | 32.0% |

| Inflation Sensitive Stocks | 17.0% |

| Commodity Related Stocks | 16.0% |

| |

|---|

| Common Stocks | 71.3% |

| Investment Companies | 2.0% |

| Short-Term Investments | 24.6% |

| Other assets less liabilities | 2.1% |

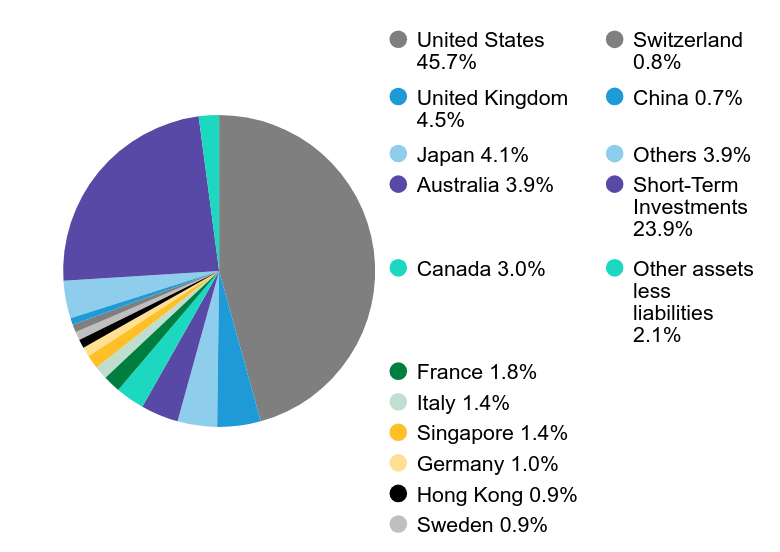

| Value | Value |

|---|

| United States | 45.7% |

| United Kingdom | 4.5% |

| Japan | 4.1% |

| Australia | 3.9% |

| Canada | 3.0% |

| France | 1.8% |

| Italy | 1.4% |

| Singapore | 1.4% |

| Germany | 1.0% |

| Hong Kong | 0.9% |

| Sweden | 0.9% |

| Switzerland | 0.8% |

| China | 0.7% |

| Others | 3.9% |

| Short-Term Investments | 23.9% |

| Other assets less liabilities | 2.1% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/AMTOX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AMTOX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB All Market Real Return Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB All Market Real Return Portfolio (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/AMTAX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $127 | 1.17% |

How did the Fund perform last year? What affected the Fund’s performance?

Entering 2024, investors focused on the pace at which inflation would normalize. Despite a slow start in reducing inflationary concerns, economic growth across major economies was more resilient and broad-based than expected. This led to increased optimism about the economic outlook and strong equity performance. Real Estate, a notable rate-sensitive asset class, tends to outperform in falling rate environments and underperform in rising rate environments. For the AB All Market Real Return Portfolio, our strategic allocation to Real Estate was a significant contributor, especially in the third quarter following the US Federal Reserve's first rate cut in September. Similarly, the Portfolio's exposure to inflation-sensitive equities contributed, driven by the broad-based equity market rally in 2024. However, our modest tactical underweights to Real Estate and commodity producers detracted from relative performance. The AB All Market Real Return Portfolio allocates to various inflation-sensitive asset classes, including real estate, commodity producers, commodity futures, FX, inflation-sensitive equities and future natural resource equities. From a security selection standpoint, the Portfolio benefited from positive selection within Real Estate but was hurt by negative selection within future natural resource equities.

Top contributors to performance:

Top detractors from performance:

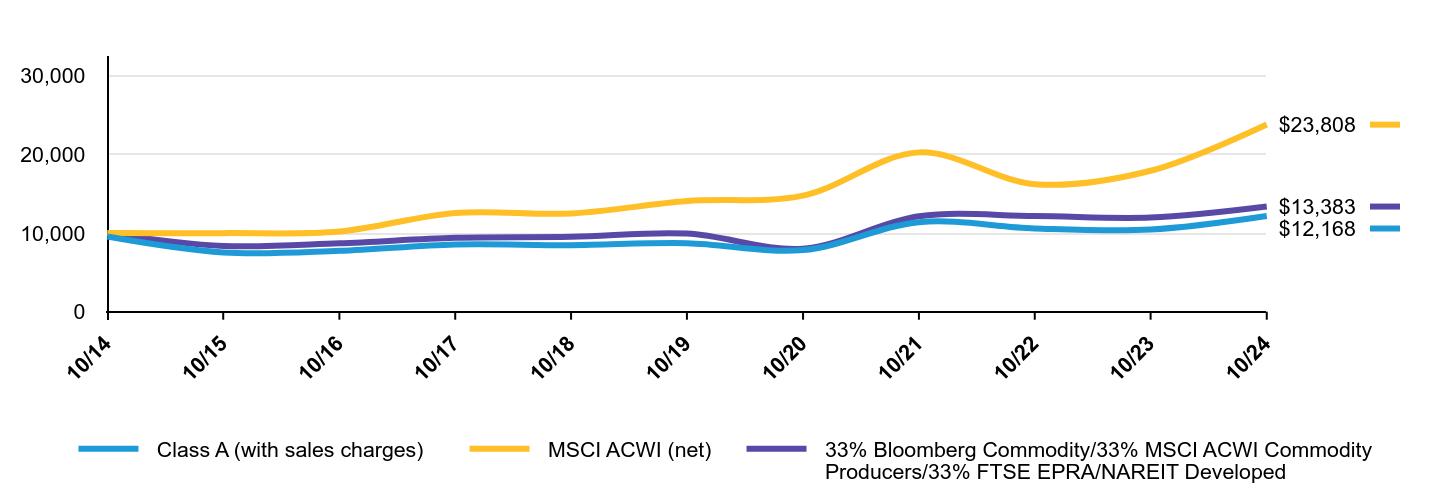

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class A (with sales charges) | MSCI ACWI (net) | 33% Bloomberg Commodity/33% MSCI ACWI Commodity Producers/33% FTSE EPRA/NAREIT Developed |

|---|

| 10/14 | $9,572 | $10,000 | $10,000 |

| 10/15 | $7,547 | $9,997 | $8,367 |

| 10/16 | $7,754 | $10,201 | $8,700 |

| 10/17 | $8,565 | $12,568 | $9,410 |

| 10/18 | $8,470 | $12,503 | $9,526 |

| 10/19 | $8,722 | $14,078 | $9,940 |

| 10/20 | $7,841 | $14,766 | $8,023 |

| 10/21 | $11,392 | $20,270 | $12,134 |

| 10/22 | $10,594 | $16,225 | $12,169 |

| 10/23 | $10,449 | $17,929 | $11,980 |

| 10/24 | $12,168 | $23,808 | $13,383 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charges) | 16.46% | 6.89% | 2.43% |

| Class A (with sales charges) | 11.51% | 5.97% | 1.98% |

| MSCI ACWI (net) | 32.79% | 11.08% | 9.06% |

| 33% Bloomberg Commodity/33% MSCI ACWI Commodity Producers/33% FTSE EPRA/NAREIT Developed | 11.71% | 6.13% | 2.96% |

The addition of the MSCI ACWI (net) broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/AMTAX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $695,947,263 |

| # of Portfolio Holdings | 370 |

| Portfolio Turnover Rate | 90% |

| Total Advisory Fees Paid | $5,292,478 |

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Prologis, Inc. | $14,957,886 | 2.2% |

| Equinix, Inc. | $14,456,634 | 2.1% |

| Shell PLC | $10,399,486 | 1.5% |

| Exxon Mobil Corp. | $10,320,783 | 1.5% |

| Welltower, Inc. | $9,897,494 | 1.4% |

| Digital Realty Trust, Inc. | $9,305,388 | 1.3% |

| Simon Property Group, Inc. | $8,562,884 | 1.2% |

| Ventas, Inc. | $8,272,042 | 1.2% |

| Public Storage | $7,844,790 | 1.1% |

| VICI Properties, Inc. | $7,511,113 | 1.1% |

| Total | $101,528,500 | 14.6% |

| Asset Type | Value |

|---|

| Real Estate Stocks | 35.0% |

| Commodity Related Derivatives. | 32.0% |

| Inflation Sensitive Stocks | 17.0% |

| Commodity Related Stocks | 16.0% |

| |

|---|

| Common Stocks | 71.3% |

| Investment Companies | 2.0% |

| Short-Term Investments | 24.6% |

| Other assets less liabilities | 2.1% |

| Value | Value |

|---|

| United States | 45.7% |

| United Kingdom | 4.5% |

| Japan | 4.1% |

| Australia | 3.9% |

| Canada | 3.0% |

| France | 1.8% |

| Italy | 1.4% |

| Singapore | 1.4% |

| Germany | 1.0% |

| Hong Kong | 0.9% |

| Sweden | 0.9% |

| Switzerland | 0.8% |

| China | 0.7% |

| Others | 3.9% |

| Short-Term Investments | 23.9% |

| Other assets less liabilities | 2.1% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/AMTAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/AMTAX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB All Market Real Return Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB All Market Real Return Portfolio (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/ACMTX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $210 | 1.95% |

How did the Fund perform last year? What affected the Fund’s performance?

Entering 2024, investors focused on the pace at which inflation would normalize. Despite a slow start in reducing inflationary concerns, economic growth across major economies was more resilient and broad-based than expected. This led to increased optimism about the economic outlook and strong equity performance. Real Estate, a notable rate-sensitive asset class, tends to outperform in falling rate environments and underperform in rising rate environments. For the AB All Market Real Return Portfolio, our strategic allocation to Real Estate was a significant contributor, especially in the third quarter following the US Federal Reserve's first rate cut in September. Similarly, the Portfolio's exposure to inflation-sensitive equities contributed, driven by the broad-based equity market rally in 2024. However, our modest tactical underweights to Real Estate and commodity producers detracted from relative performance. The AB All Market Real Return Portfolio allocates to various inflation-sensitive asset classes, including real estate, commodity producers, commodity futures, FX, inflation-sensitive equities and future natural resource equities. From a security selection standpoint, the Portfolio benefited from positive selection within Real Estate but was hurt by negative selection within future natural resource equities.

Top contributors to performance:

Top detractors from performance:

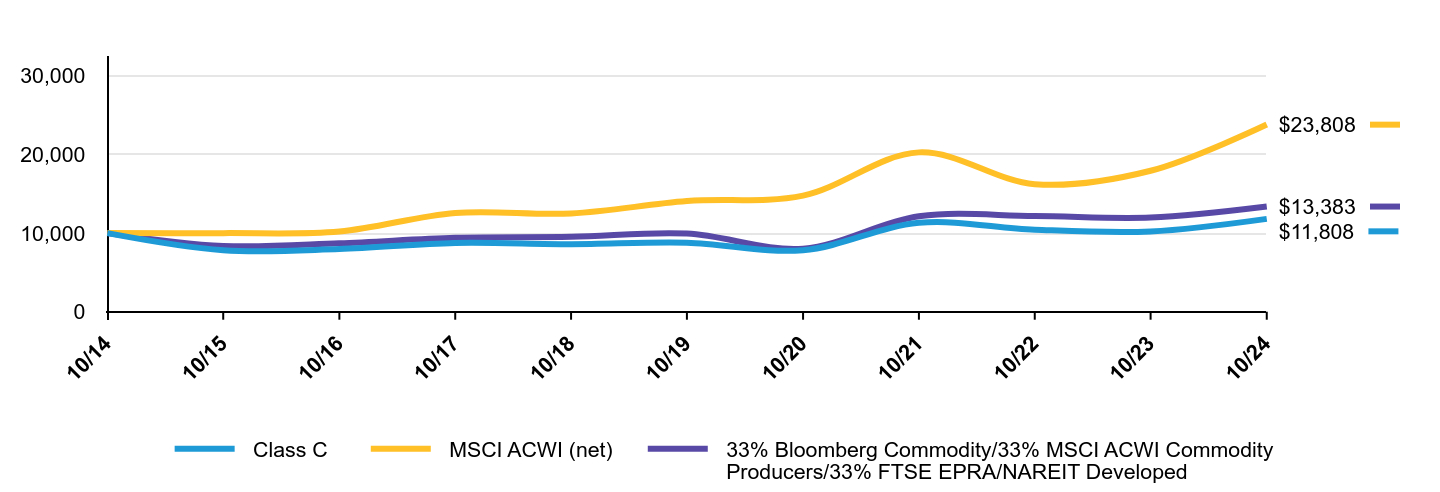

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class C | MSCI ACWI (net) | 33% Bloomberg Commodity/33% MSCI ACWI Commodity Producers/33% FTSE EPRA/NAREIT Developed |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $7,825 | $9,997 | $8,367 |

| 10/16 | $7,977 | $10,201 | $8,700 |

| 10/17 | $8,754 | $12,568 | $9,410 |

| 10/18 | $8,595 | $12,503 | $9,526 |

| 10/19 | $8,781 | $14,078 | $9,940 |

| 10/20 | $7,829 | $14,766 | $8,023 |

| 10/21 | $11,306 | $20,270 | $12,134 |

| 10/22 | $10,434 | $16,225 | $12,169 |

| 10/23 | $10,209 | $17,929 | $11,980 |

| 10/24 | $11,808 | $23,808 | $13,383 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class C (without sales charges) | 15.66% | 6.10% | 1.68% |

| Class C (with sales charges) | 14.66% | 6.10% | 1.68% |

| MSCI ACWI (net) | 32.79% | 11.08% | 9.06% |

| 33% Bloomberg Commodity/33% MSCI ACWI Commodity Producers/33% FTSE EPRA/NAREIT Developed | 11.71% | 6.13% | 2.96% |

The addition of the MSCI ACWI (net) broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/ACMTX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $695,947,263 |

| # of Portfolio Holdings | 370 |

| Portfolio Turnover Rate | 90% |

| Total Advisory Fees Paid | $5,292,478 |

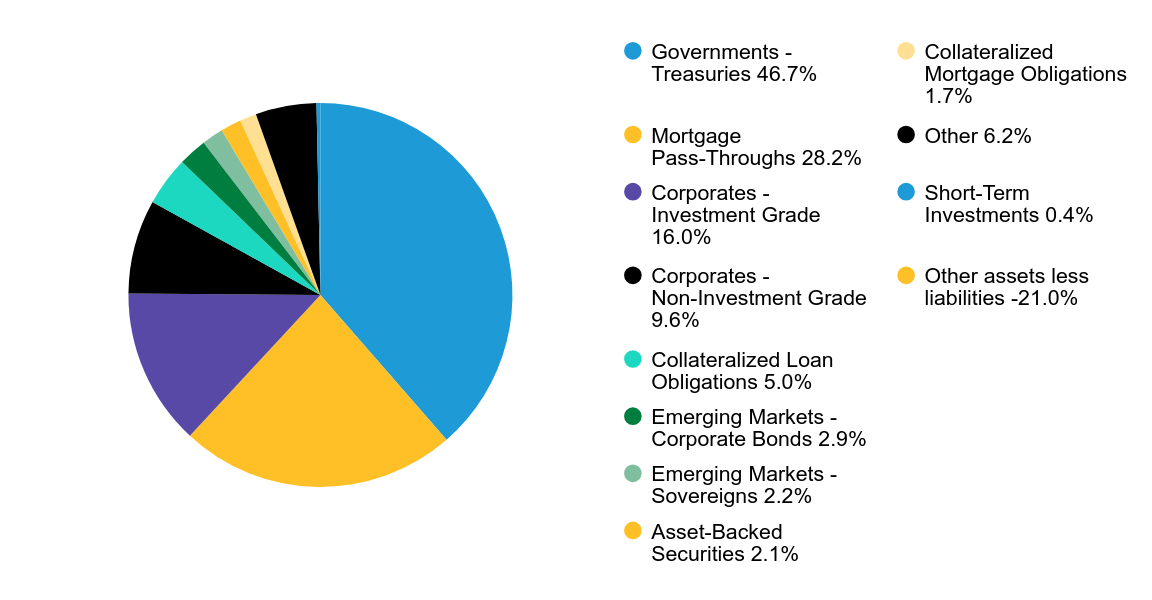

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Prologis, Inc. | $14,957,886 | 2.2% |

| Equinix, Inc. | $14,456,634 | 2.1% |

| Shell PLC | $10,399,486 | 1.5% |

| Exxon Mobil Corp. | $10,320,783 | 1.5% |

| Welltower, Inc. | $9,897,494 | 1.4% |

| Digital Realty Trust, Inc. | $9,305,388 | 1.3% |

| Simon Property Group, Inc. | $8,562,884 | 1.2% |

| Ventas, Inc. | $8,272,042 | 1.2% |

| Public Storage | $7,844,790 | 1.1% |

| VICI Properties, Inc. | $7,511,113 | 1.1% |

| Total | $101,528,500 | 14.6% |

| Asset Type | Value |

|---|

| Real Estate Stocks | 35.0% |

| Commodity Related Derivatives. | 32.0% |

| Inflation Sensitive Stocks | 17.0% |

| Commodity Related Stocks | 16.0% |

| |

|---|

| Common Stocks | 71.3% |

| Investment Companies | 2.0% |

| Short-Term Investments | 24.6% |

| Other assets less liabilities | 2.1% |

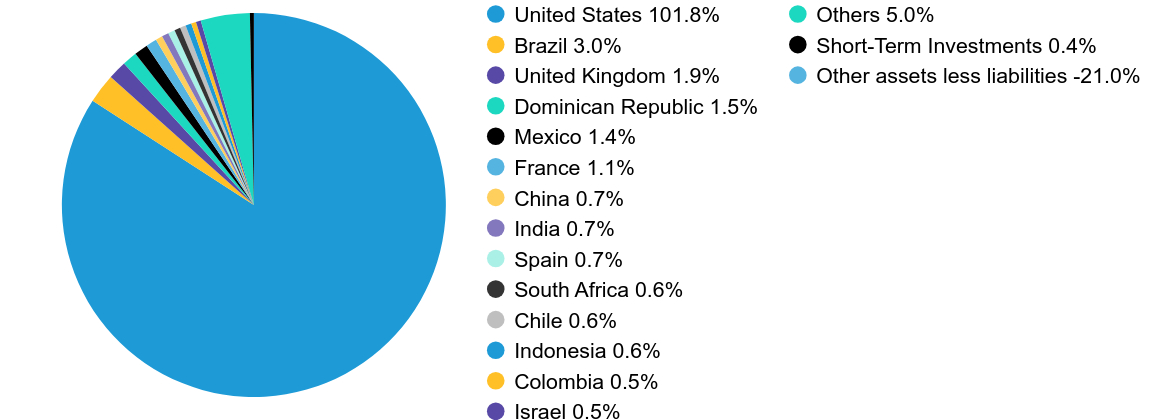

| Value | Value |

|---|

| United States | 45.7% |

| United Kingdom | 4.5% |

| Japan | 4.1% |

| Australia | 3.9% |

| Canada | 3.0% |

| France | 1.8% |

| Italy | 1.4% |

| Singapore | 1.4% |

| Germany | 1.0% |

| Hong Kong | 0.9% |

| Sweden | 0.9% |

| Switzerland | 0.8% |

| China | 0.7% |

| Others | 3.9% |

| Short-Term Investments | 23.9% |

| Other assets less liabilities | 2.1% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/ACMTX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/ACMTX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB All Market Real Return Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB All Market Real Return Portfolio (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/AMTZX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class Z | $91 | 0.84% |

How did the Fund perform last year? What affected the Fund’s performance?

Entering 2024, investors focused on the pace at which inflation would normalize. Despite a slow start in reducing inflationary concerns, economic growth across major economies was more resilient and broad-based than expected. This led to increased optimism about the economic outlook and strong equity performance. Real Estate, a notable rate-sensitive asset class, tends to outperform in falling rate environments and underperform in rising rate environments. For the AB All Market Real Return Portfolio, our strategic allocation to Real Estate was a significant contributor, especially in the third quarter following the US Federal Reserve's first rate cut in September. Similarly, the Portfolio's exposure to inflation-sensitive equities contributed, driven by the broad-based equity market rally in 2024. However, our modest tactical underweights to Real Estate and commodity producers detracted from relative performance. The AB All Market Real Return Portfolio allocates to various inflation-sensitive asset classes, including real estate, commodity producers, commodity futures, FX, inflation-sensitive equities and future natural resource equities. From a security selection standpoint, the Portfolio benefited from positive selection within Real Estate but was hurt by negative selection within future natural resource equities.

Top contributors to performance:

Top detractors from performance:

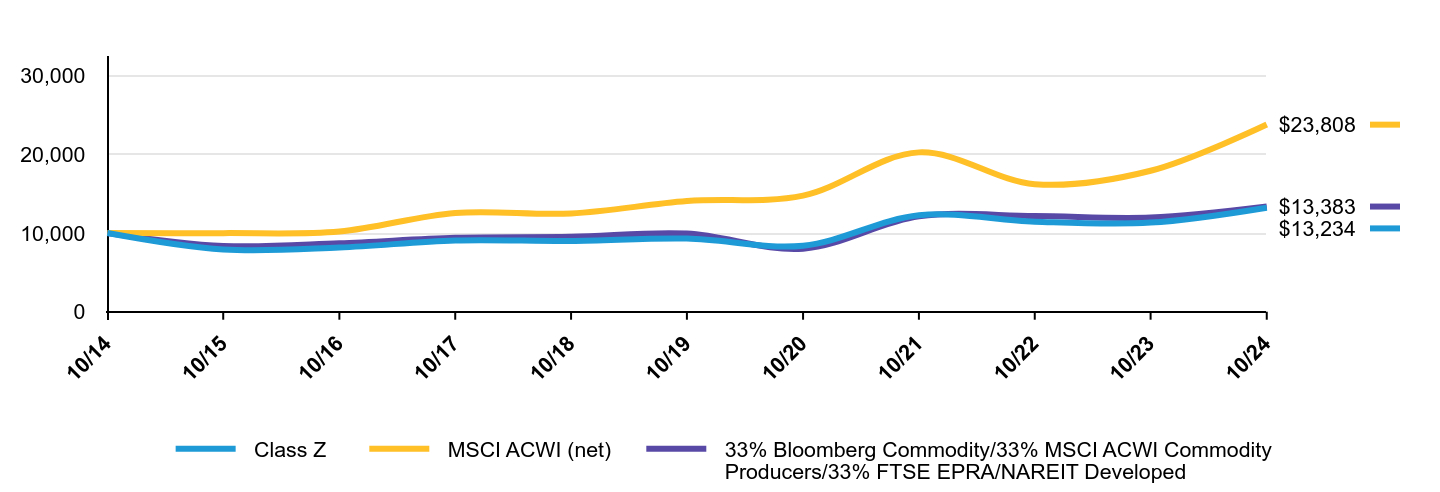

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class Z | MSCI ACWI (net) | 33% Bloomberg Commodity/33% MSCI ACWI Commodity Producers/33% FTSE EPRA/NAREIT Developed |

|---|

| 10/14 | $10,019 | $10,000 | $10,000 |

| 10/15 | $7,921 | $9,997 | $8,367 |

| 10/16 | $8,166 | $10,201 | $8,700 |

| 10/17 | $9,063 | $12,568 | $9,410 |

| 10/18 | $9,001 | $12,503 | $9,526 |

| 10/19 | $9,305 | $14,078 | $9,940 |

| 10/20 | $8,398 | $14,766 | $8,023 |

| 10/21 | $12,274 | $20,270 | $12,134 |

| 10/22 | $11,460 | $16,225 | $12,169 |

| 10/23 | $11,336 | $17,929 | $11,980 |

| 10/24 | $13,234 | $23,808 | $13,383 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class Z | 16.96% | 7.34% | 2.84% |

| MSCI ACWI (net) | 32.79% | 11.08% | 9.06% |

| 33% Bloomberg Commodity/33% MSCI ACWI Commodity Producers/33% FTSE EPRA/NAREIT Developed | 11.71% | 6.13% | 2.96% |

The addition of the MSCI ACWI (net) broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/AMTZX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $695,947,263 |

| # of Portfolio Holdings | 370 |

| Portfolio Turnover Rate | 90% |

| Total Advisory Fees Paid | $5,292,478 |

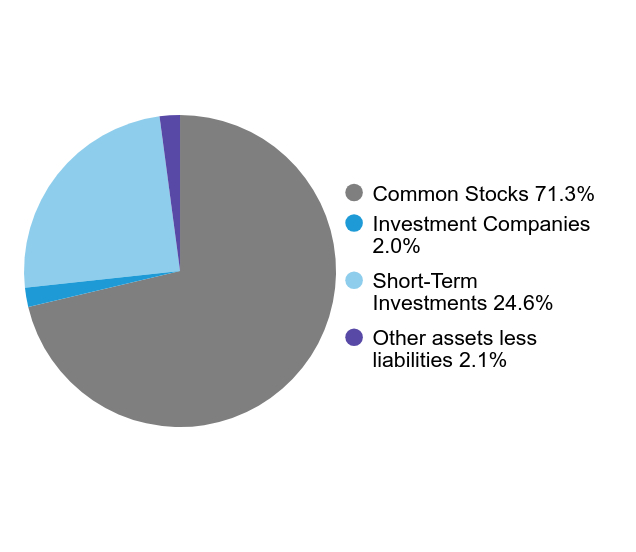

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Prologis, Inc. | $14,957,886 | 2.2% |

| Equinix, Inc. | $14,456,634 | 2.1% |

| Shell PLC | $10,399,486 | 1.5% |

| Exxon Mobil Corp. | $10,320,783 | 1.5% |

| Welltower, Inc. | $9,897,494 | 1.4% |

| Digital Realty Trust, Inc. | $9,305,388 | 1.3% |

| Simon Property Group, Inc. | $8,562,884 | 1.2% |

| Ventas, Inc. | $8,272,042 | 1.2% |

| Public Storage | $7,844,790 | 1.1% |

| VICI Properties, Inc. | $7,511,113 | 1.1% |

| Total | $101,528,500 | 14.6% |

| Asset Type | Value |

|---|

| Real Estate Stocks | 35.0% |

| Commodity Related Derivatives. | 32.0% |

| Inflation Sensitive Stocks | 17.0% |

| Commodity Related Stocks | 16.0% |

| |

|---|

| Common Stocks | 71.3% |

| Investment Companies | 2.0% |

| Short-Term Investments | 24.6% |

| Other assets less liabilities | 2.1% |

| Value | Value |

|---|

| United States | 45.7% |

| United Kingdom | 4.5% |

| Japan | 4.1% |

| Australia | 3.9% |

| Canada | 3.0% |

| France | 1.8% |

| Italy | 1.4% |

| Singapore | 1.4% |

| Germany | 1.0% |

| Hong Kong | 0.9% |

| Sweden | 0.9% |

| Switzerland | 0.8% |

| China | 0.7% |

| Others | 3.9% |

| Short-Term Investments | 23.9% |

| Other assets less liabilities | 2.1% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/AMTZX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/AMTZX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Bond Inflation Strategy

Annual Shareholder Report

This annual shareholder report contains important information about the AB Bond Inflation Strategy (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ABNYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $62 | 0.59% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes except Class C outperformed the Bloomberg US 1-10 Year Treasury Inflation-Protected Securities ("TIPS") Index (the “benchmark”), before sales charges. Sector allocation was the largest contributor relative to the benchmark, from allocation to investment-grade corporate bonds, asset-backed securities, agency risk-sharing transactions and high-yield corporate bonds. Overall positioning in US TIPS contributed, as positioning in six-month TIPS added more than losses from positioning in two- and five-year TIPS. Yield-curve positioning detracted from performance, as positioning on the six-month and 10-year parts of the yield-curve outweighed gains from the five-year part of the curve. Currency decisions did not affect results.

During the 12-month period, the Fund used currency forwards to hedge currency risk and actively manage currency positions. Treasury futures and interest rate swaps were utilized to manage duration, country exposure and yield-curve positioning. Consumer Price Index swaps were used to hedge inflation and for investment purposes. Credit default swaps were utilized in the corporate and commercial mortgage-backed securities sectors for hedging and investment purposes.

Top contributors to performance:

Top detractors from performance::

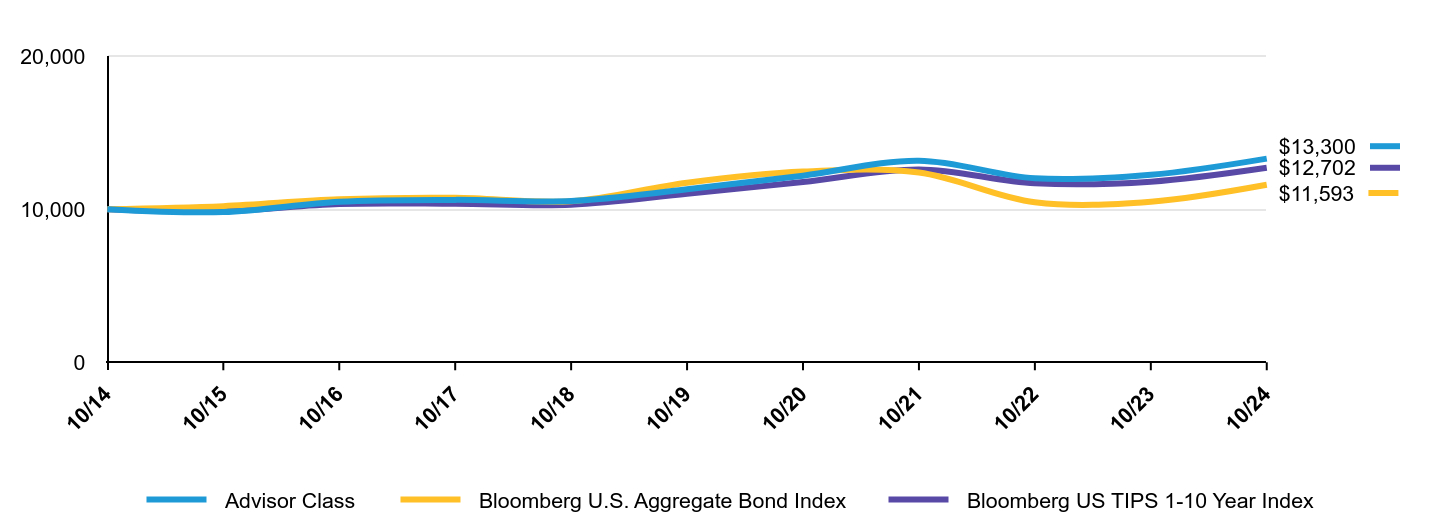

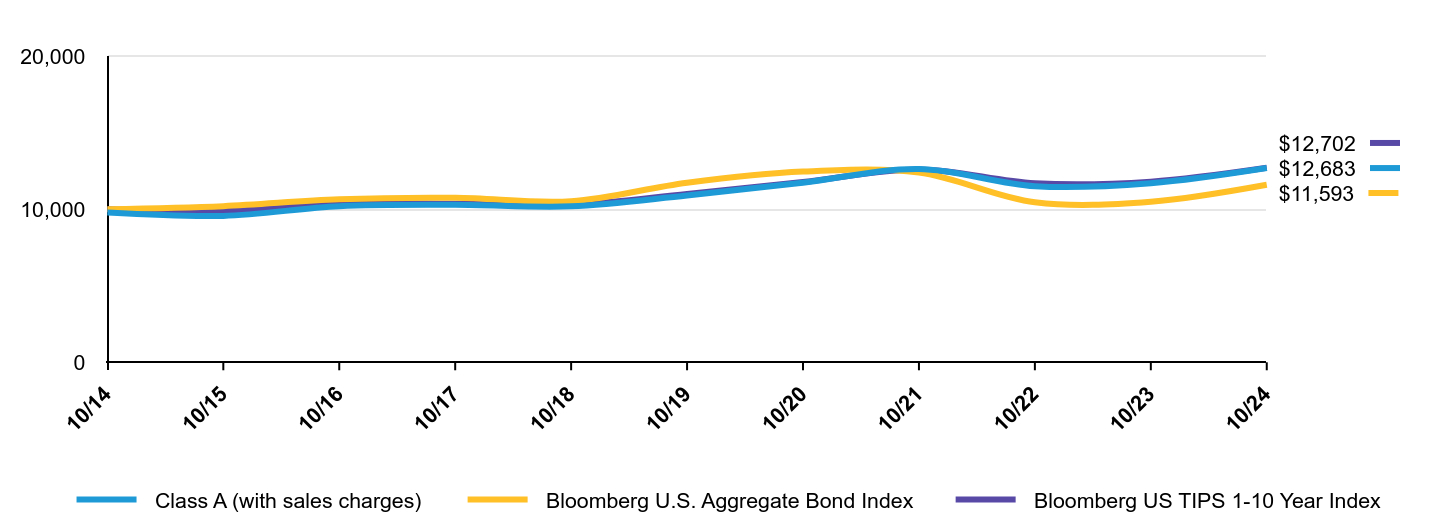

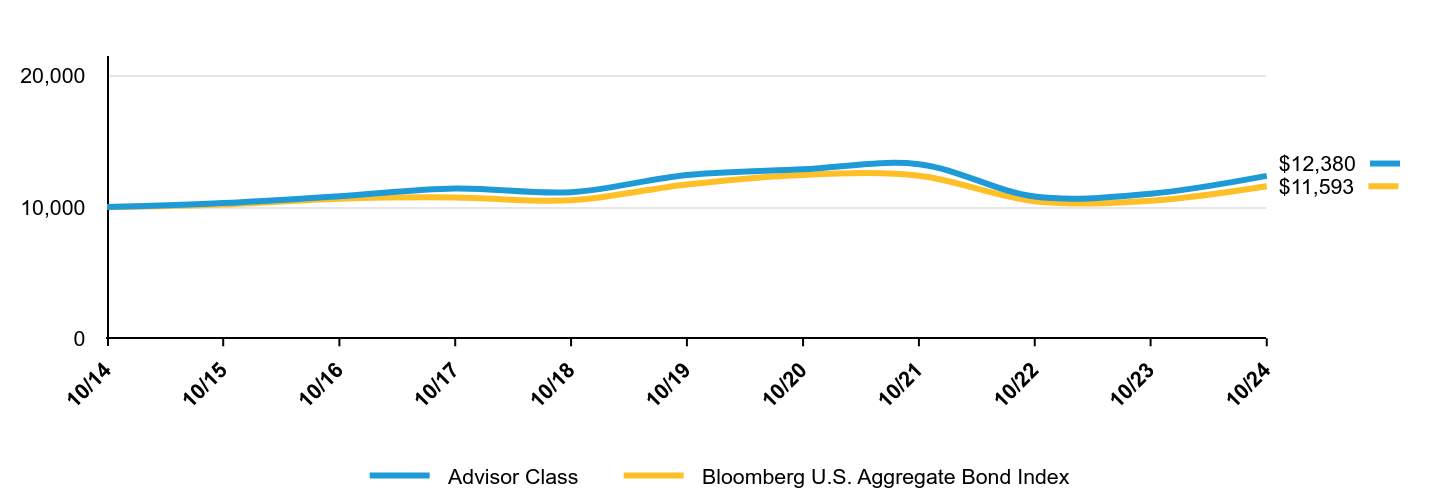

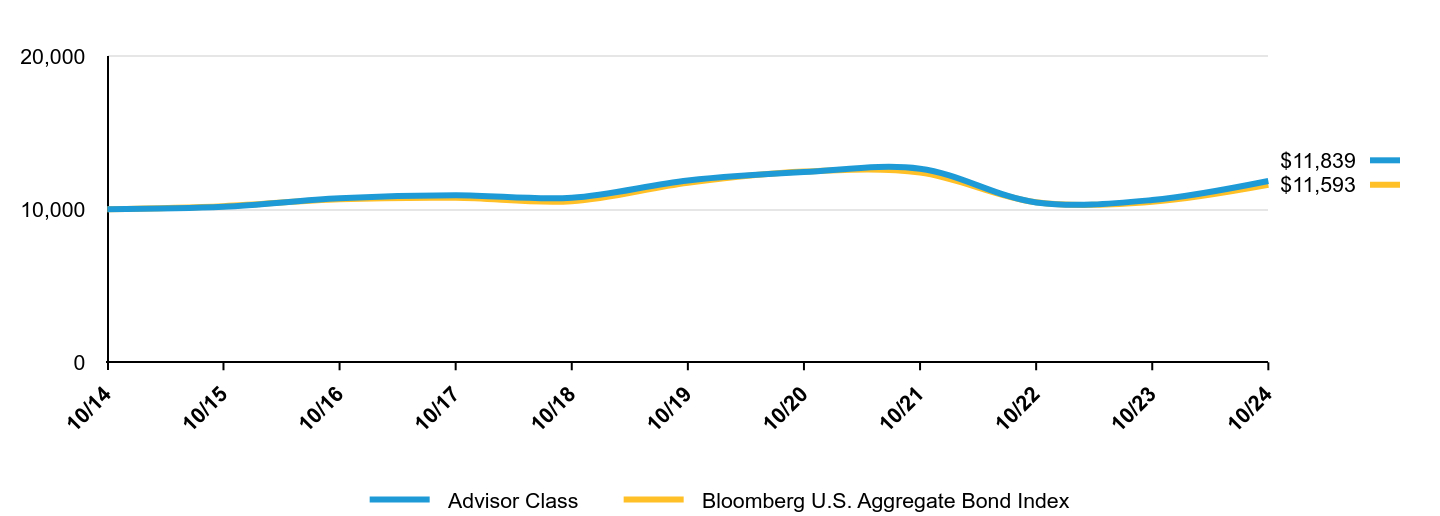

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Advisor Class | Bloomberg U.S. Aggregate Bond Index | Bloomberg US TIPS 1-10 Year Index |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,810 | $10,196 | $9,876 |

| 10/16 | $10,484 | $10,641 | $10,337 |

| 10/17 | $10,605 | $10,737 | $10,352 |

| 10/18 | $10,533 | $10,517 | $10,289 |

| 10/19 | $11,292 | $11,727 | $10,996 |

| 10/20 | $12,187 | $12,453 | $11,766 |

| 10/21 | $13,160 | $12,393 | $12,595 |

| 10/22 | $12,012 | $10,450 | $11,690 |

| 10/23 | $12,244 | $10,487 | $11,794 |

| 10/24 | $13,300 | $11,593 | $12,702 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Advisor Class | 8.63% | 3.33% | 2.89% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Bloomberg US TIPS 1-10 Year Index | 7.70% | 2.93% | 2.42% |

The addition of the Bloomberg U.S. Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/ABNYX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $646,673,170 |

| # of Portfolio Holdings | 284 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $2,068,717 |

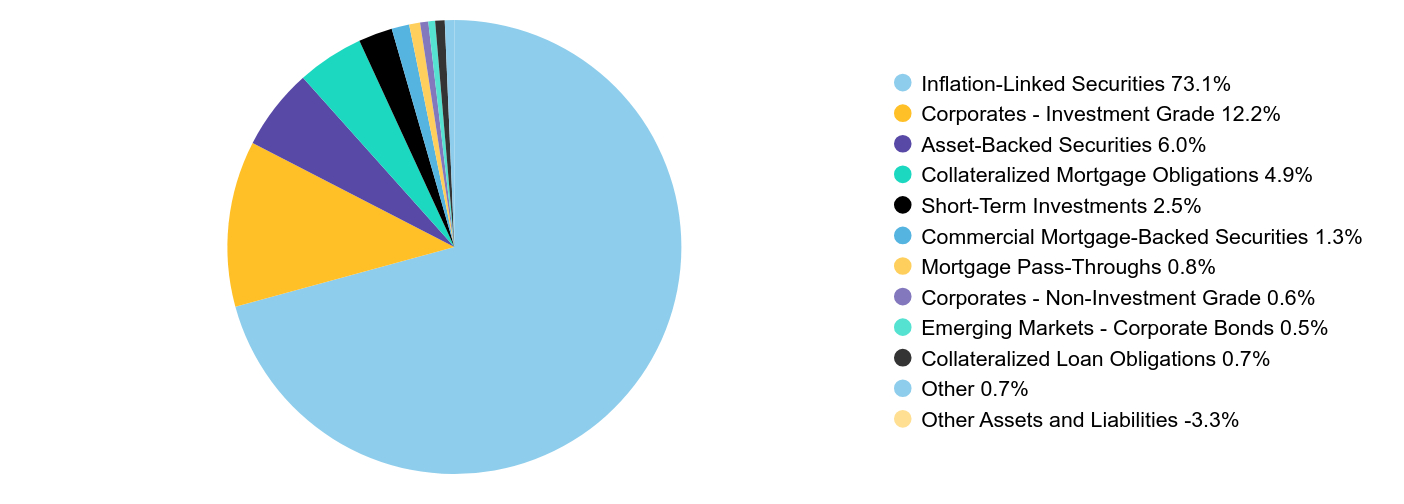

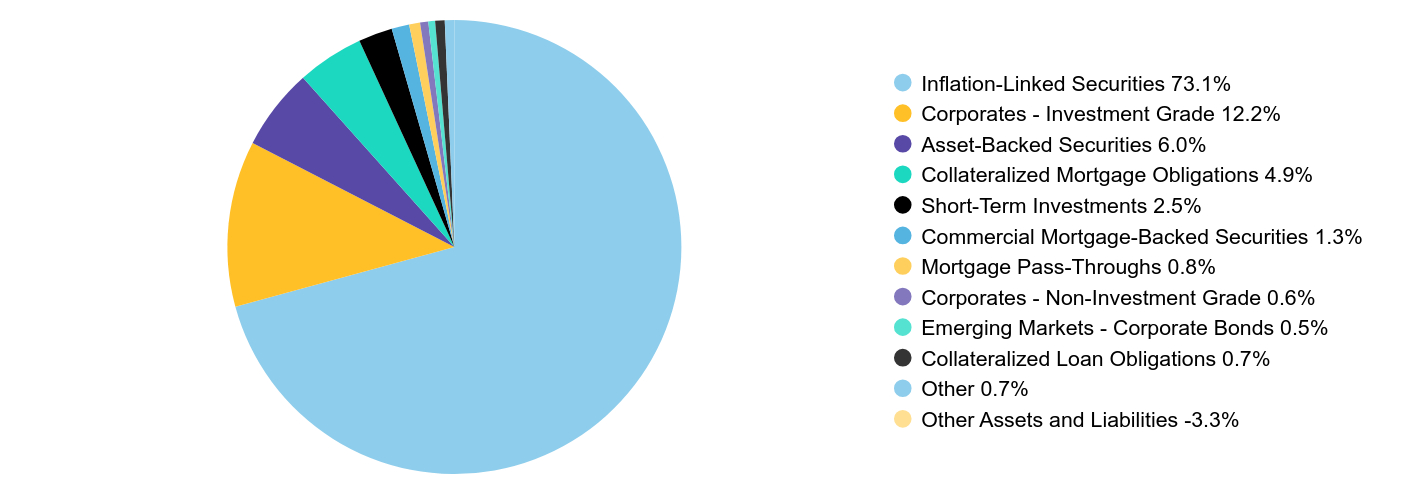

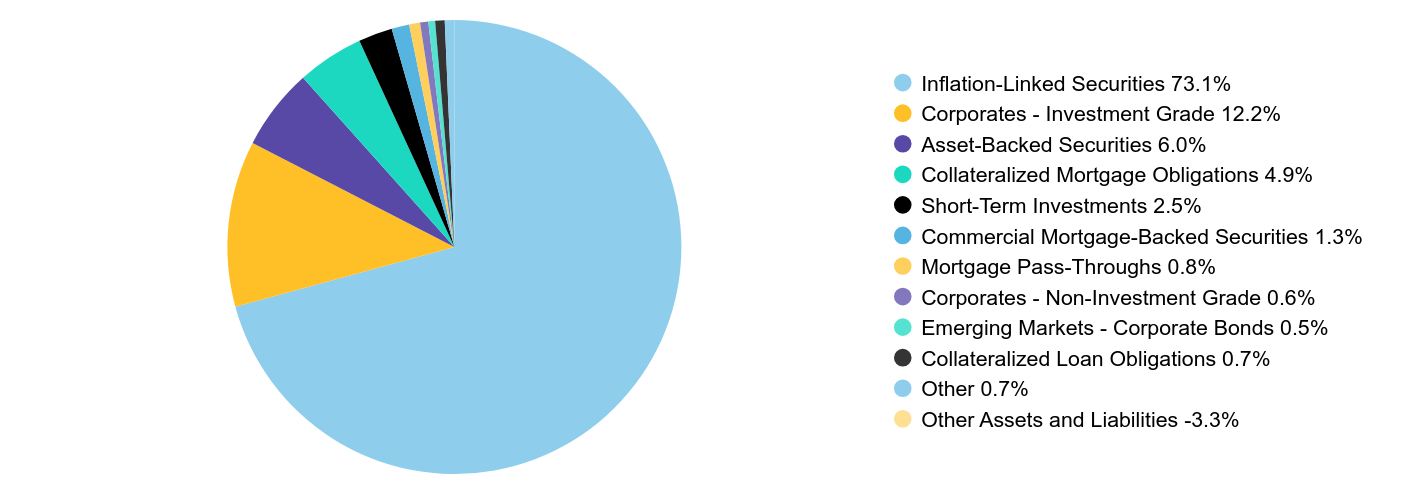

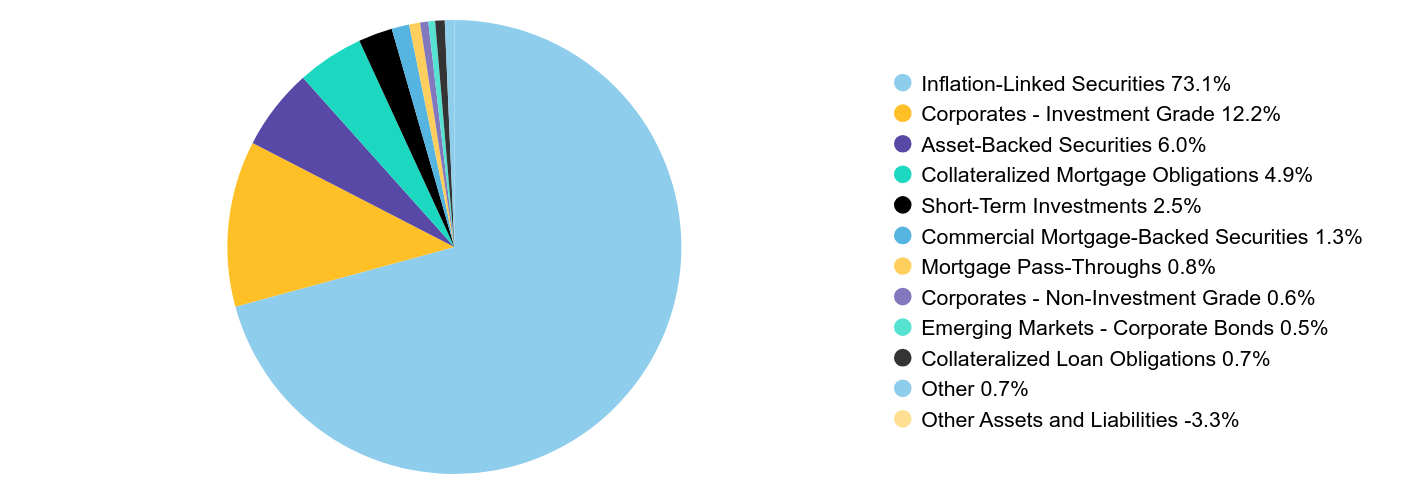

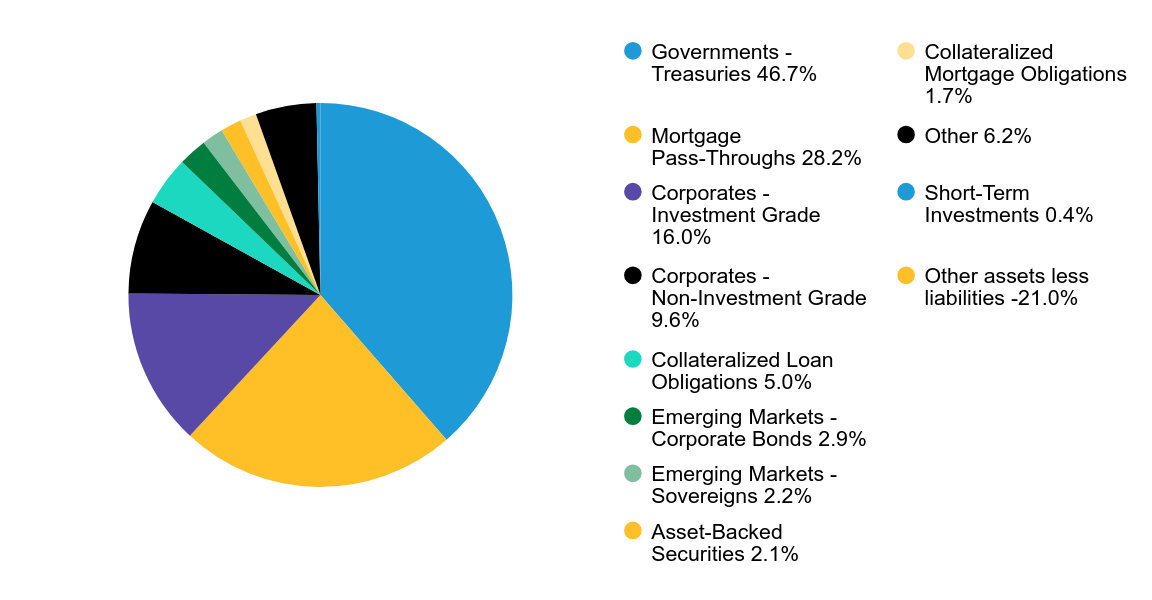

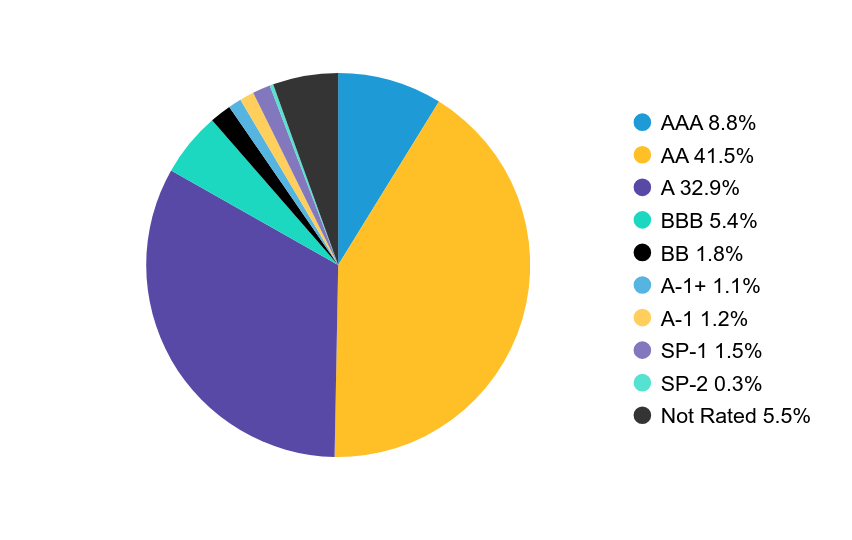

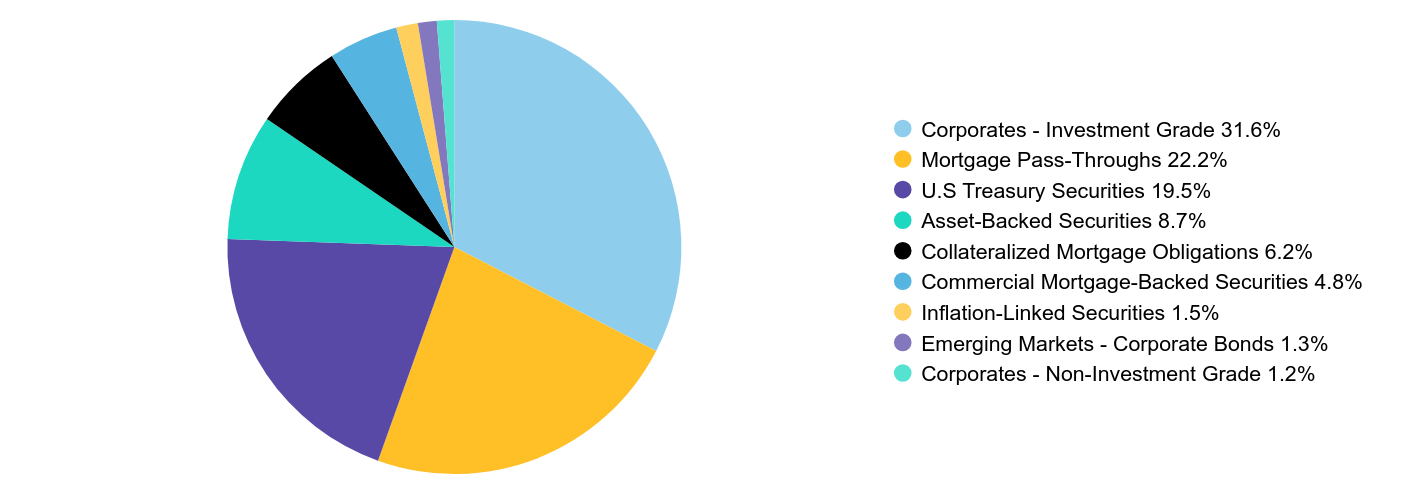

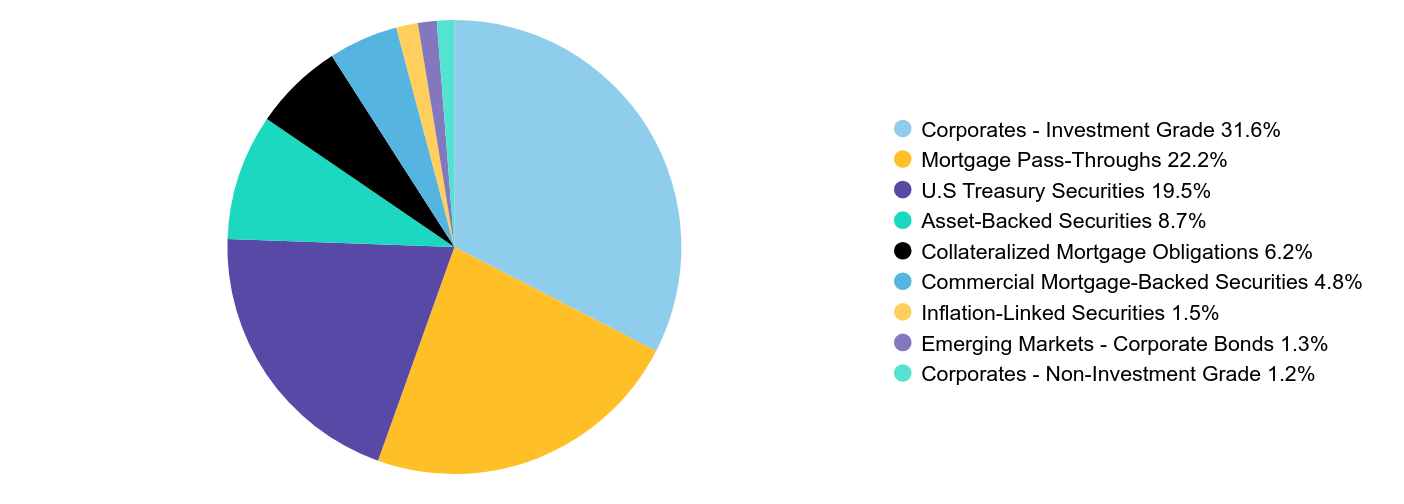

Graphical Representation of Holdings

Inflation Protection Breakdown

| U.S. Inflation - Protected Exposure | 73.1% |

| Non-Inflation Exposure | 26.9% |

| Total | 100.0% |

| Value | Value |

|---|

| Inflation-Linked Securities | 73.1% |

| Corporates - Investment Grade | 12.2% |

| Asset-Backed Securities | 6.0% |

| Collateralized Mortgage Obligations | 4.9% |

| Short-Term Investments | 2.5% |

| Commercial Mortgage-Backed Securities | 1.3% |

| Mortgage Pass-Throughs | 0.8% |

| Corporates - Non-Investment Grade | 0.6% |

| Emerging Markets - Corporate Bonds | 0.5% |

| Collateralized Loan Obligations | 0.7% |

| Other | 0.7% |

| Other Assets and Liabilities | -3.3% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ABNYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ABNYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Bond Inflation Strategy

Annual Shareholder Report

This annual shareholder report contains important information about the AB Bond Inflation Strategy (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ABNOX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class 1 | $72 | 0.69% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes except Class C outperformed the Bloomberg US 1-10 Year Treasury Inflation-Protected Securities ("TIPS") Index (the “benchmark”), before sales charges. Sector allocation was the largest contributor relative to the benchmark, from allocation to investment-grade corporate bonds, asset-backed securities, agency risk-sharing transactions and high-yield corporate bonds. Overall positioning in US TIPS contributed, as positioning in six-month TIPS added more than losses from positioning in two- and five-year TIPS. Yield-curve positioning detracted from performance, as positioning on the six-month and 10-year parts of the yield-curve outweighed gains from the five-year part of the curve. Currency decisions did not affect results.

During the 12-month period, the Fund used currency forwards to hedge currency risk and actively manage currency positions. Treasury futures and interest rate swaps were utilized to manage duration, country exposure and yield-curve positioning. Consumer Price Index swaps were used to hedge inflation and for investment purposes. Credit default swaps were utilized in the corporate and commercial mortgage-backed securities sectors for hedging and investment purposes.

Top contributors to performance:

Top detractors from performance::

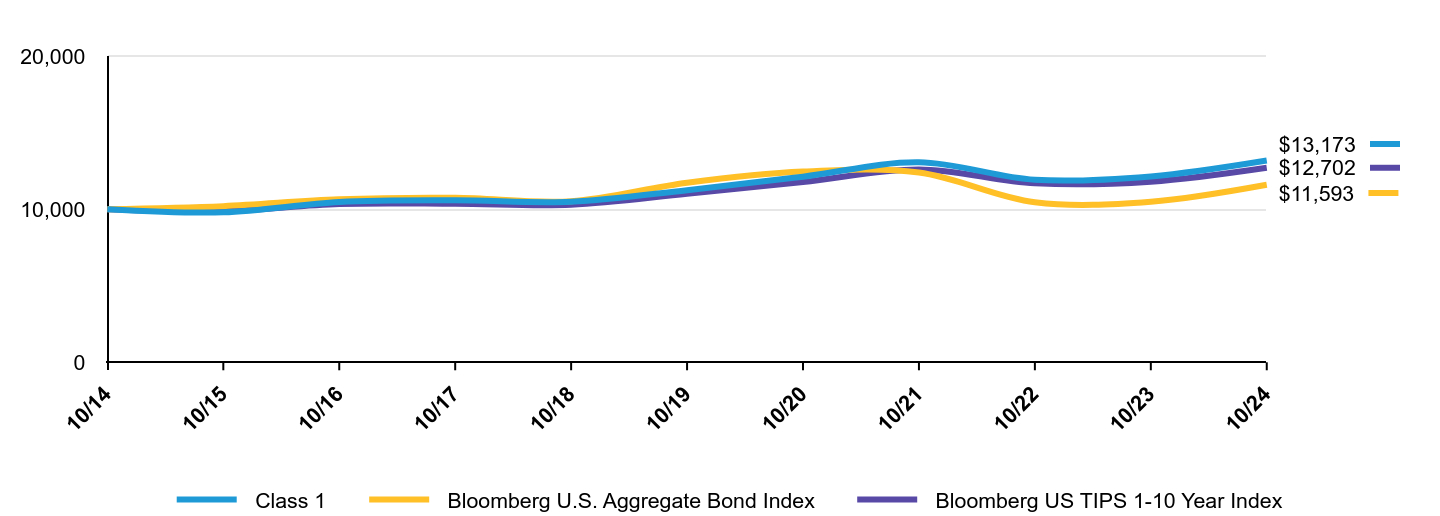

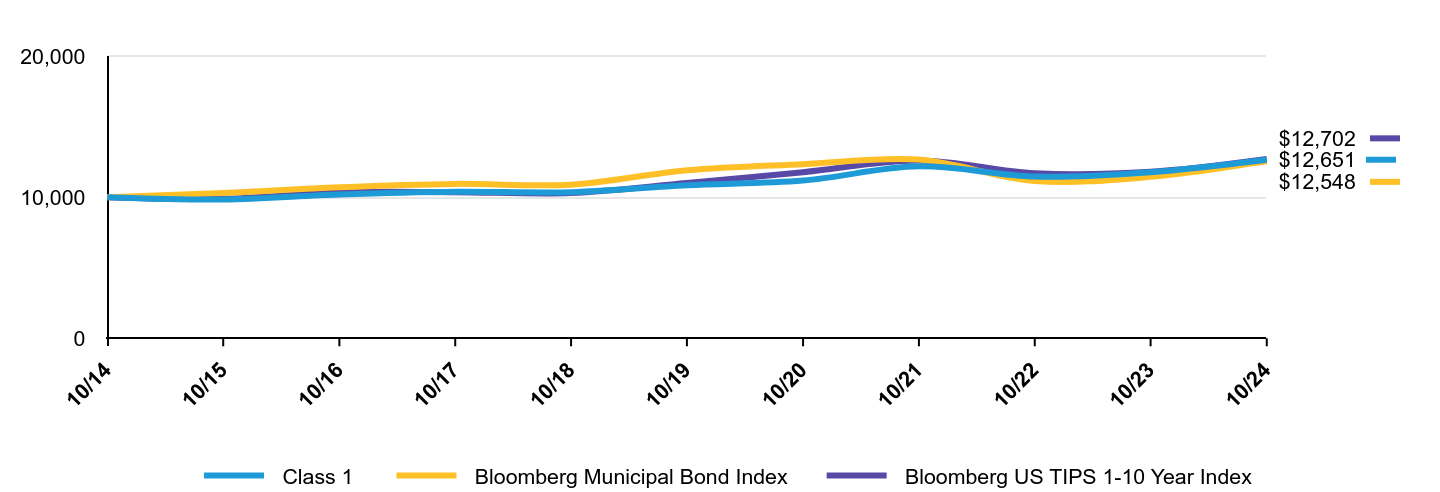

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class 1 | Bloomberg U.S. Aggregate Bond Index | Bloomberg US TIPS 1-10 Year Index |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,796 | $10,196 | $9,876 |

| 10/16 | $10,471 | $10,641 | $10,337 |

| 10/17 | $10,577 | $10,737 | $10,352 |

| 10/18 | $10,485 | $10,517 | $10,289 |

| 10/19 | $11,238 | $11,727 | $10,996 |

| 10/20 | $12,119 | $12,453 | $11,766 |

| 10/21 | $13,061 | $12,393 | $12,595 |

| 10/22 | $11,917 | $10,450 | $11,690 |

| 10/23 | $12,137 | $10,487 | $11,794 |

| 10/24 | $13,173 | $11,593 | $12,702 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class 1 | 8.53% | 3.23% | 2.79% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Bloomberg US TIPS 1-10 Year Index | 7.70% | 2.93% | 2.42% |

The addition of the Bloomberg U.S. Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/ABNOX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $646,673,170 |

| # of Portfolio Holdings | 284 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $2,068,717 |

Graphical Representation of Holdings

Inflation Protection Breakdown

| U.S. Inflation - Protected Exposure | 73.1% |

| Non-Inflation Exposure | 26.9% |

| Total | 100.0% |

| Value | Value |

|---|

| Inflation-Linked Securities | 73.1% |

| Corporates - Investment Grade | 12.2% |

| Asset-Backed Securities | 6.0% |

| Collateralized Mortgage Obligations | 4.9% |

| Short-Term Investments | 2.5% |

| Commercial Mortgage-Backed Securities | 1.3% |

| Mortgage Pass-Throughs | 0.8% |

| Corporates - Non-Investment Grade | 0.6% |

| Emerging Markets - Corporate Bonds | 0.5% |

| Collateralized Loan Obligations | 0.7% |

| Other | 0.7% |

| Other Assets and Liabilities | -3.3% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ABNOX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ABNOX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Bond Inflation Strategy

Annual Shareholder Report

This annual shareholder report contains important information about the AB Bond Inflation Strategy (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/ABNTX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class 2 | $62 | 0.59% |

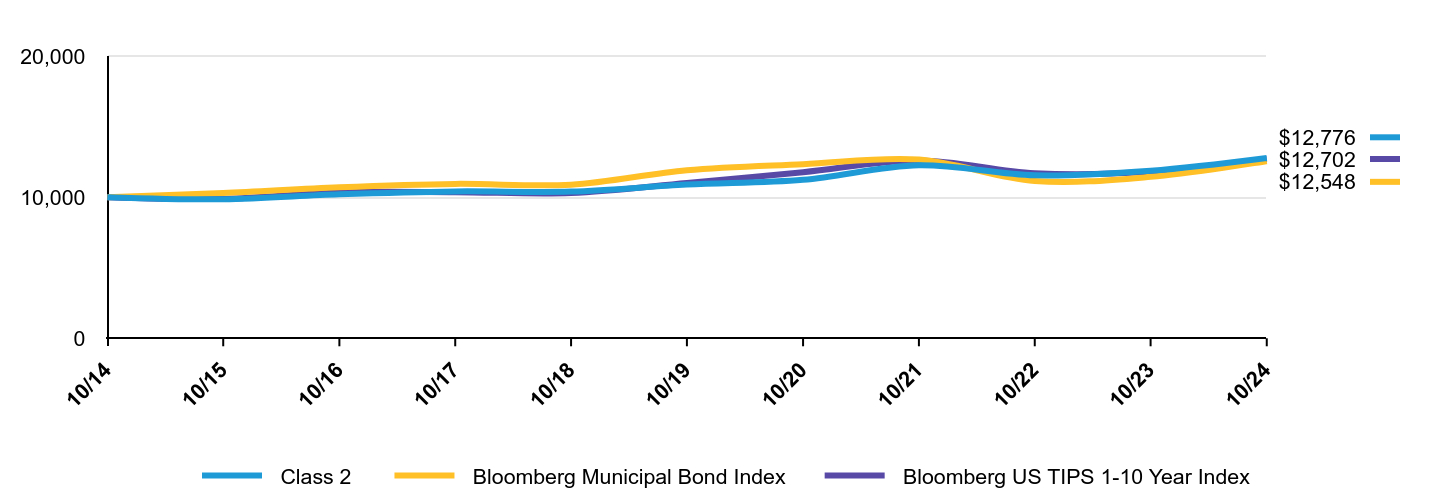

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes except Class C outperformed the Bloomberg US 1-10 Year Treasury Inflation-Protected Securities ("TIPS") Index (the “benchmark”), before sales charges. Sector allocation was the largest contributor relative to the benchmark, from allocation to investment-grade corporate bonds, asset-backed securities, agency risk-sharing transactions and high-yield corporate bonds. Overall positioning in US TIPS contributed, as positioning in six-month TIPS added more than losses from positioning in two- and five-year TIPS. Yield-curve positioning detracted from performance, as positioning on the six-month and 10-year parts of the yield-curve outweighed gains from the five-year part of the curve. Currency decisions did not affect results.

During the 12-month period, the Fund used currency forwards to hedge currency risk and actively manage currency positions. Treasury futures and interest rate swaps were utilized to manage duration, country exposure and yield-curve positioning. Consumer Price Index swaps were used to hedge inflation and for investment purposes. Credit default swaps were utilized in the corporate and commercial mortgage-backed securities sectors for hedging and investment purposes.

Top contributors to performance:

Top detractors from performance::

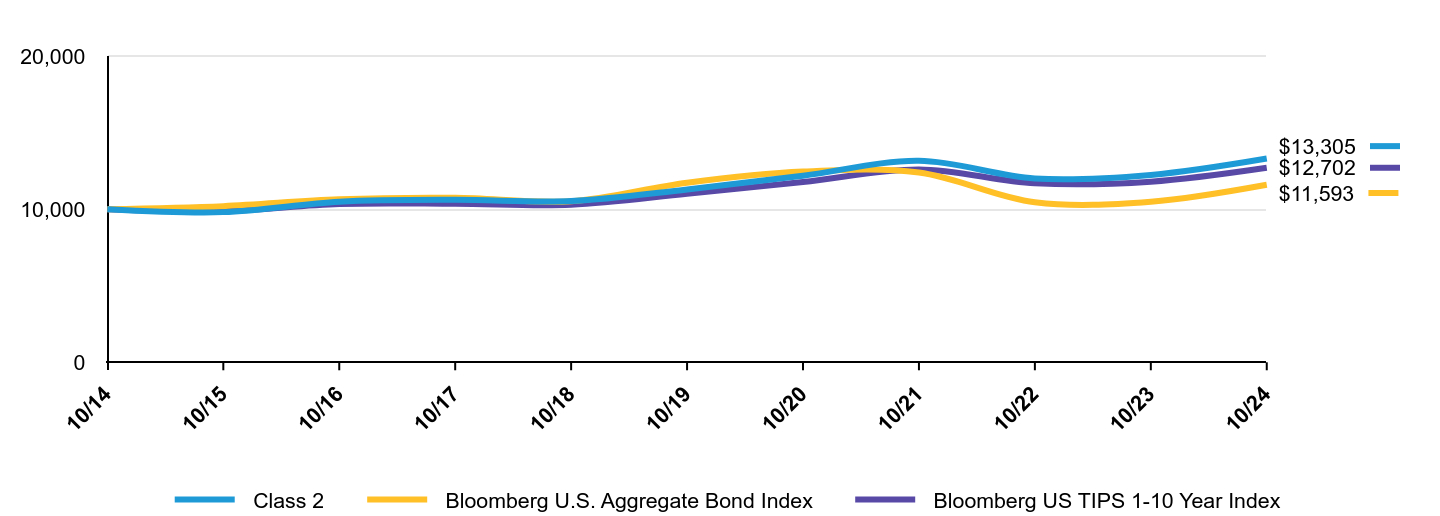

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class 2 | Bloomberg U.S. Aggregate Bond Index | Bloomberg US TIPS 1-10 Year Index |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,805 | $10,196 | $9,876 |

| 10/16 | $10,483 | $10,641 | $10,337 |

| 10/17 | $10,609 | $10,737 | $10,352 |

| 10/18 | $10,527 | $10,517 | $10,289 |

| 10/19 | $11,284 | $11,727 | $10,996 |

| 10/20 | $12,182 | $12,453 | $11,766 |

| 10/21 | $13,154 | $12,393 | $12,595 |

| 10/22 | $12,001 | $10,450 | $11,690 |

| 10/23 | $12,234 | $10,487 | $11,794 |

| 10/24 | $13,305 | $11,593 | $12,702 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class 2 | 8.75% | 3.35% | 2.90% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Bloomberg US TIPS 1-10 Year Index | 7.70% | 2.93% | 2.42% |

The addition of the Bloomberg U.S. Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/ABNTX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $646,673,170 |

| # of Portfolio Holdings | 284 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $2,068,717 |

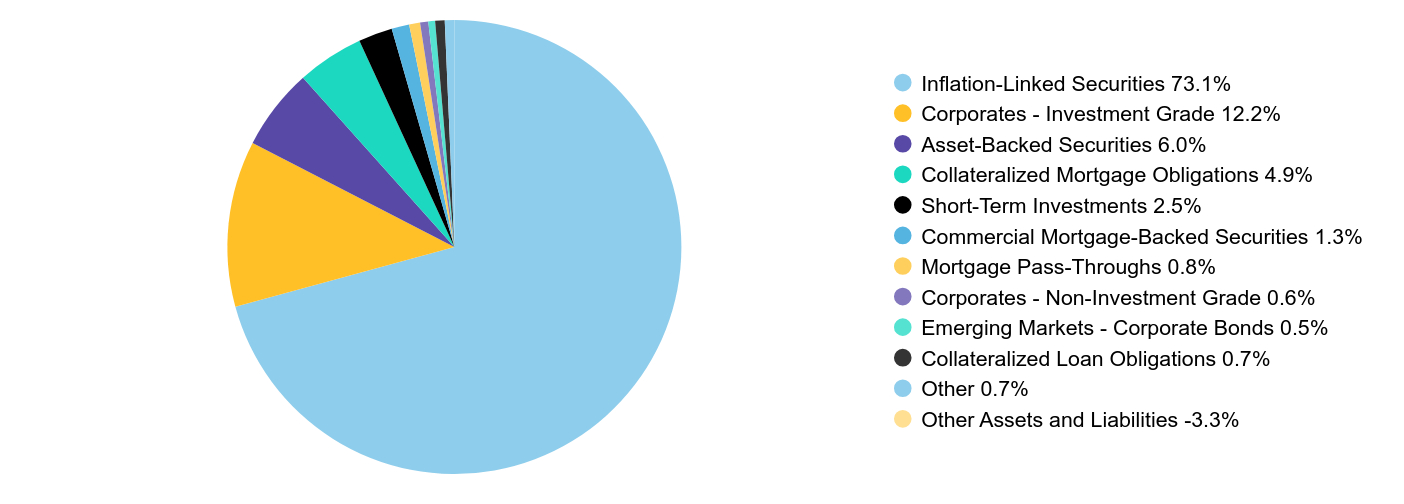

Graphical Representation of Holdings

Inflation Protection Breakdown

| U.S. Inflation - Protected Exposure | 73.1% |

| Non-Inflation Exposure | 26.9% |

| Total | 100.0% |

| Value | Value |

|---|

| Inflation-Linked Securities | 73.1% |

| Corporates - Investment Grade | 12.2% |

| Asset-Backed Securities | 6.0% |

| Collateralized Mortgage Obligations | 4.9% |

| Short-Term Investments | 2.5% |

| Commercial Mortgage-Backed Securities | 1.3% |

| Mortgage Pass-Throughs | 0.8% |

| Corporates - Non-Investment Grade | 0.6% |

| Emerging Markets - Corporate Bonds | 0.5% |

| Collateralized Loan Obligations | 0.7% |

| Other | 0.7% |

| Other Assets and Liabilities | -3.3% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/ABNTX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/ABNTX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Bond Inflation Strategy

Annual Shareholder Report

This annual shareholder report contains important information about the AB Bond Inflation Strategy (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/ABNAX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $88 | 0.84% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes except Class C outperformed the Bloomberg US 1-10 Year Treasury Inflation-Protected Securities ("TIPS") Index (the “benchmark”), before sales charges. Sector allocation was the largest contributor relative to the benchmark, from allocation to investment-grade corporate bonds, asset-backed securities, agency risk-sharing transactions and high-yield corporate bonds. Overall positioning in US TIPS contributed, as positioning in six-month TIPS added more than losses from positioning in two- and five-year TIPS. Yield-curve positioning detracted from performance, as positioning on the six-month and 10-year parts of the yield-curve outweighed gains from the five-year part of the curve. Currency decisions did not affect results.

During the 12-month period, the Fund used currency forwards to hedge currency risk and actively manage currency positions. Treasury futures and interest rate swaps were utilized to manage duration, country exposure and yield-curve positioning. Consumer Price Index swaps were used to hedge inflation and for investment purposes. Credit default swaps were utilized in the corporate and commercial mortgage-backed securities sectors for hedging and investment purposes.

Top contributors to performance:

Top detractors from performance::

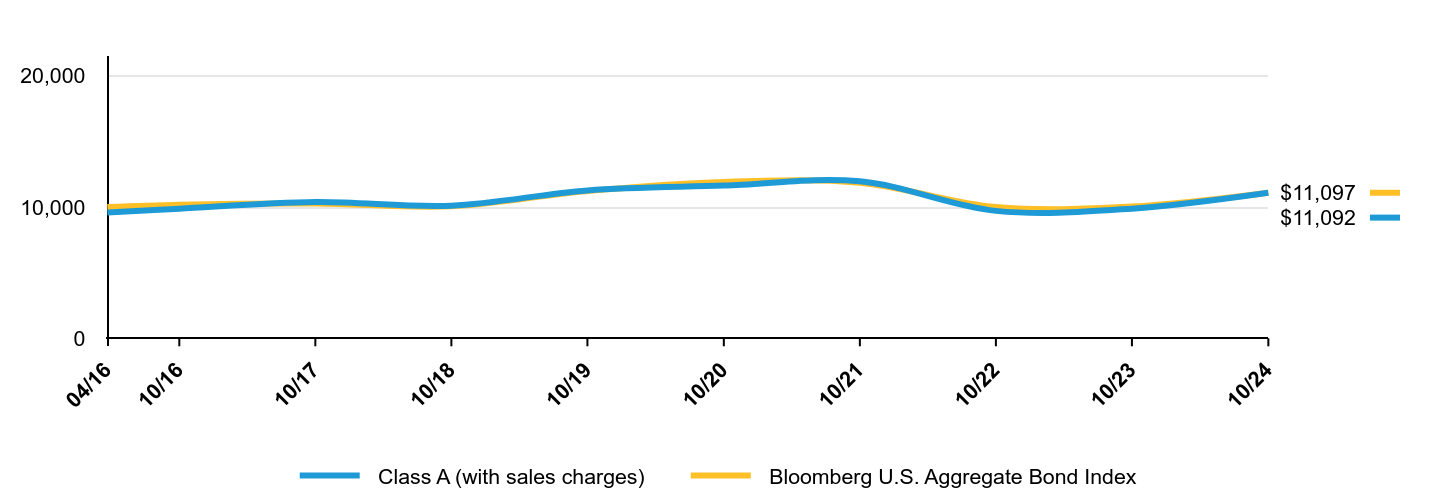

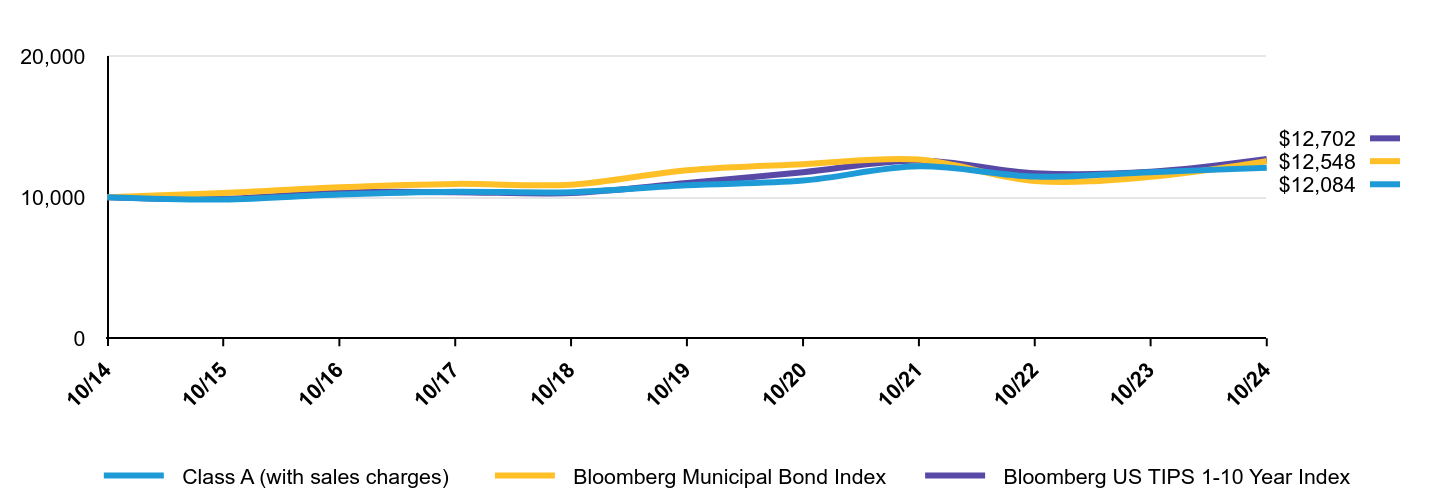

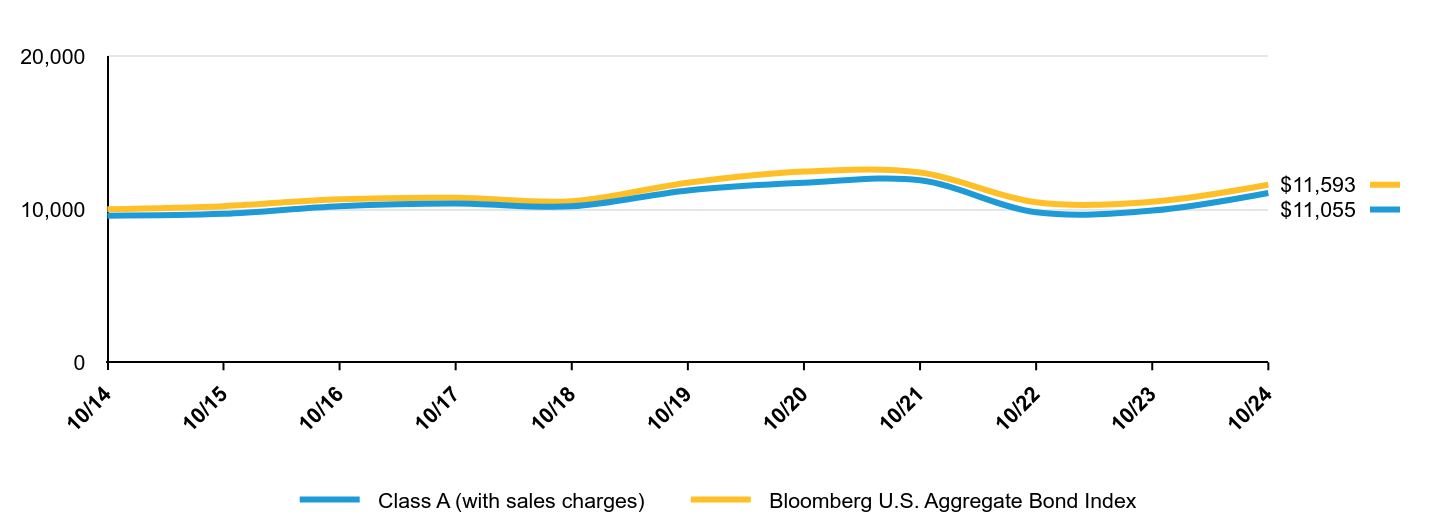

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class A (with sales charges) | Bloomberg U.S. Aggregate Bond Index | Bloomberg US TIPS 1-10 Year Index |

|---|

| 10/14 | $9,773 | $10,000 | $10,000 |

| 10/15 | $9,560 | $10,196 | $9,876 |

| 10/16 | $10,194 | $10,641 | $10,337 |

| 10/17 | $10,286 | $10,737 | $10,352 |

| 10/18 | $10,184 | $10,517 | $10,289 |

| 10/19 | $10,897 | $11,727 | $10,996 |

| 10/20 | $11,730 | $12,453 | $11,766 |

| 10/21 | $12,625 | $12,393 | $12,595 |

| 10/22 | $11,498 | $10,450 | $11,690 |

| 10/23 | $11,693 | $10,487 | $11,794 |

| 10/24 | $12,683 | $11,593 | $12,702 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charges) | 8.46% | 3.08% | 2.64% |

| Class A (with sales charges) | 6.03% | 2.62% | 2.41% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Bloomberg US TIPS 1-10 Year Index | 7.70% | 2.93% | 2.42% |

The addition of the Bloomberg U.S. Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/ABNAX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $646,673,170 |

| # of Portfolio Holdings | 284 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $2,068,717 |

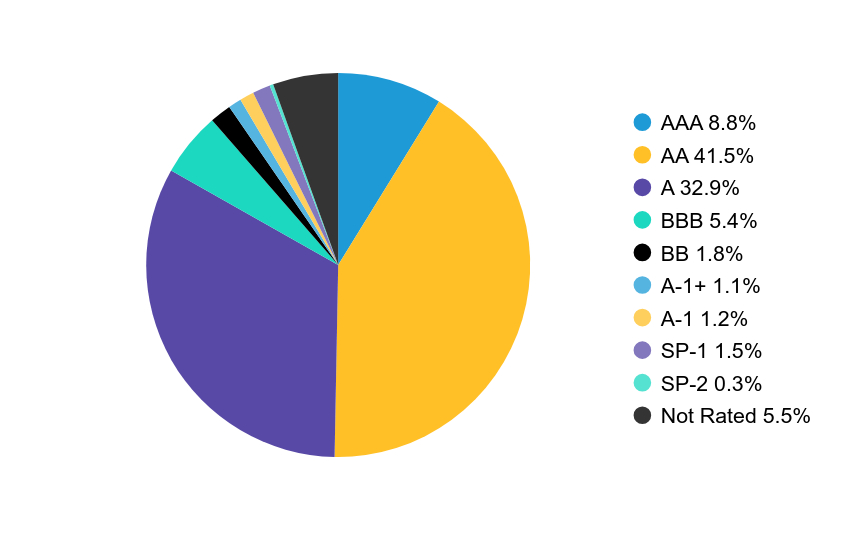

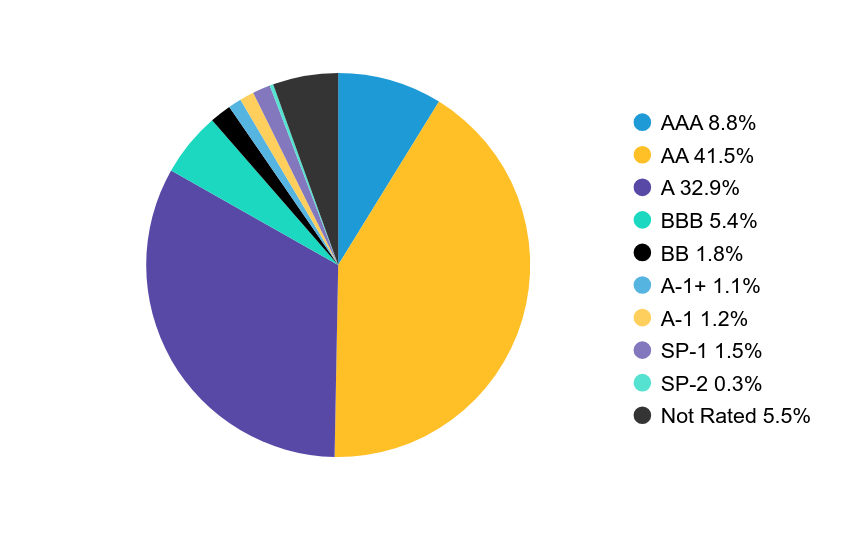

Graphical Representation of Holdings

Inflation Protection Breakdown

| U.S. Inflation - Protected Exposure | 73.1% |

| Non-Inflation Exposure | 26.9% |

| Total | 100.0% |

| Value | Value |

|---|

| Inflation-Linked Securities | 73.1% |

| Corporates - Investment Grade | 12.2% |

| Asset-Backed Securities | 6.0% |

| Collateralized Mortgage Obligations | 4.9% |

| Short-Term Investments | 2.5% |

| Commercial Mortgage-Backed Securities | 1.3% |

| Mortgage Pass-Throughs | 0.8% |

| Corporates - Non-Investment Grade | 0.6% |

| Emerging Markets - Corporate Bonds | 0.5% |

| Collateralized Loan Obligations | 0.7% |

| Other | 0.7% |

| Other Assets and Liabilities | -3.3% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/ABNAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/ABNAX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Bond Inflation Strategy

Annual Shareholder Report

This annual shareholder report contains important information about the AB Bond Inflation Strategy (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/ABNCX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $165 | 1.59% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes except Class C outperformed the Bloomberg US 1-10 Year Treasury Inflation-Protected Securities ("TIPS") Index (the “benchmark”), before sales charges. Sector allocation was the largest contributor relative to the benchmark, from allocation to investment-grade corporate bonds, asset-backed securities, agency risk-sharing transactions and high-yield corporate bonds. Overall positioning in US TIPS contributed, as positioning in six-month TIPS added more than losses from positioning in two- and five-year TIPS. Yield-curve positioning detracted from performance, as positioning on the six-month and 10-year parts of the yield-curve outweighed gains from the five-year part of the curve. Currency decisions did not affect results.

During the 12-month period, the Fund used currency forwards to hedge currency risk and actively manage currency positions. Treasury futures and interest rate swaps were utilized to manage duration, country exposure and yield-curve positioning. Consumer Price Index swaps were used to hedge inflation and for investment purposes. Credit default swaps were utilized in the corporate and commercial mortgage-backed securities sectors for hedging and investment purposes.

Top contributors to performance:

Top detractors from performance::

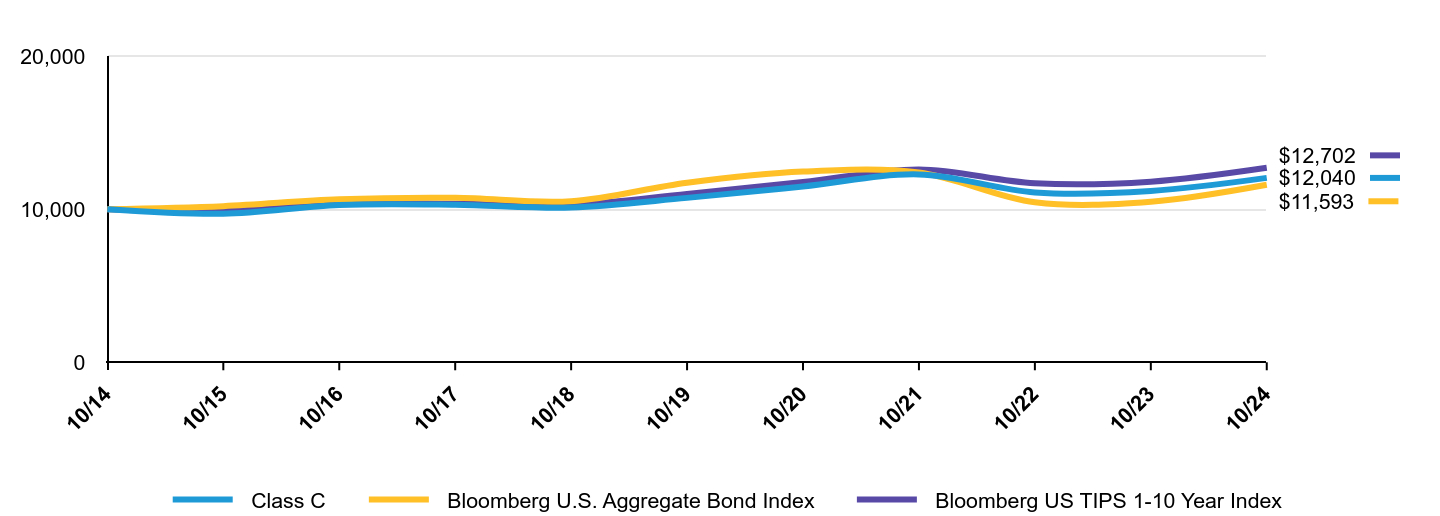

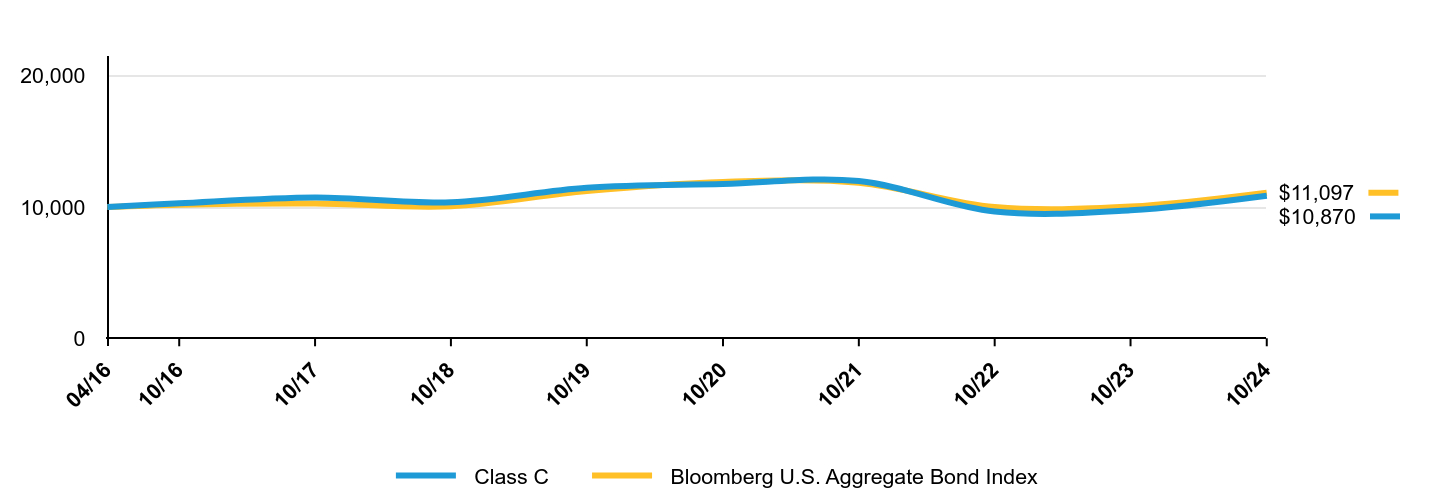

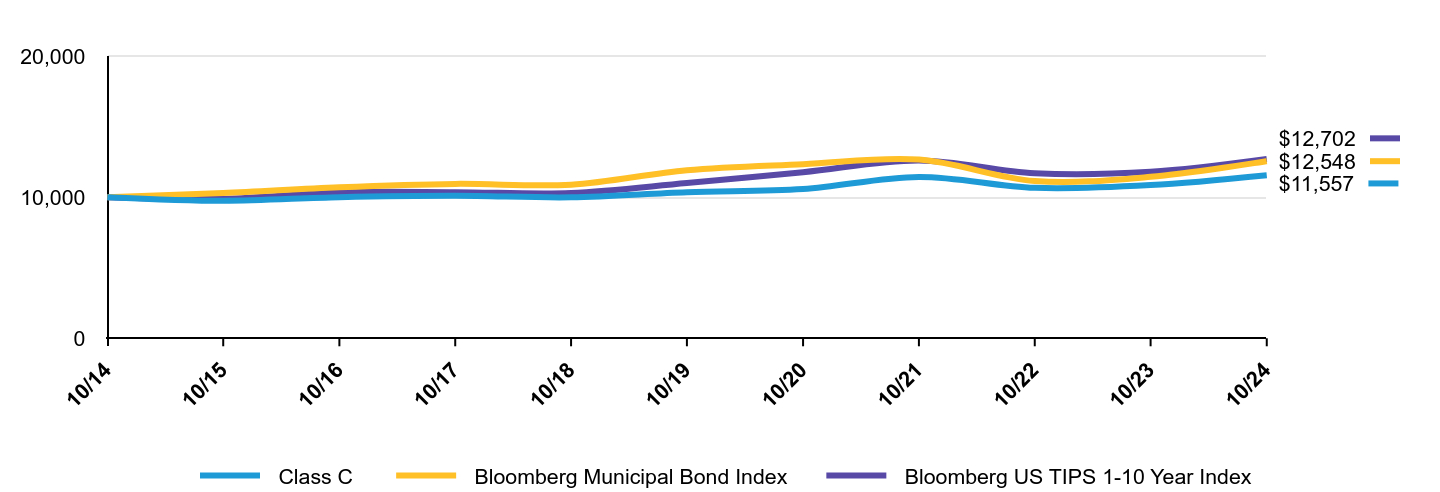

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class C | Bloomberg U.S. Aggregate Bond Index | Bloomberg US TIPS 1-10 Year Index |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,707 | $10,196 | $9,876 |

| 10/16 | $10,276 | $10,641 | $10,337 |

| 10/17 | $10,293 | $10,737 | $10,352 |

| 10/18 | $10,110 | $10,517 | $10,289 |

| 10/19 | $10,735 | $11,727 | $10,996 |

| 10/20 | $11,479 | $12,453 | $11,766 |

| 10/21 | $12,267 | $12,393 | $12,595 |

| 10/22 | $11,091 | $10,450 | $11,690 |

| 10/23 | $11,186 | $10,487 | $11,794 |

| 10/24 | $12,040 | $11,593 | $12,702 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class C (without sales charges) | 7.64% | 2.32% | 1.87% |

| Class C (with sales charges) | 6.64% | 2.32% | 1.87% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Bloomberg US TIPS 1-10 Year Index | 7.70% | 2.93% | 2.42% |

The addition of the Bloomberg U.S. Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/ABNCX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $646,673,170 |

| # of Portfolio Holdings | 284 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $2,068,717 |

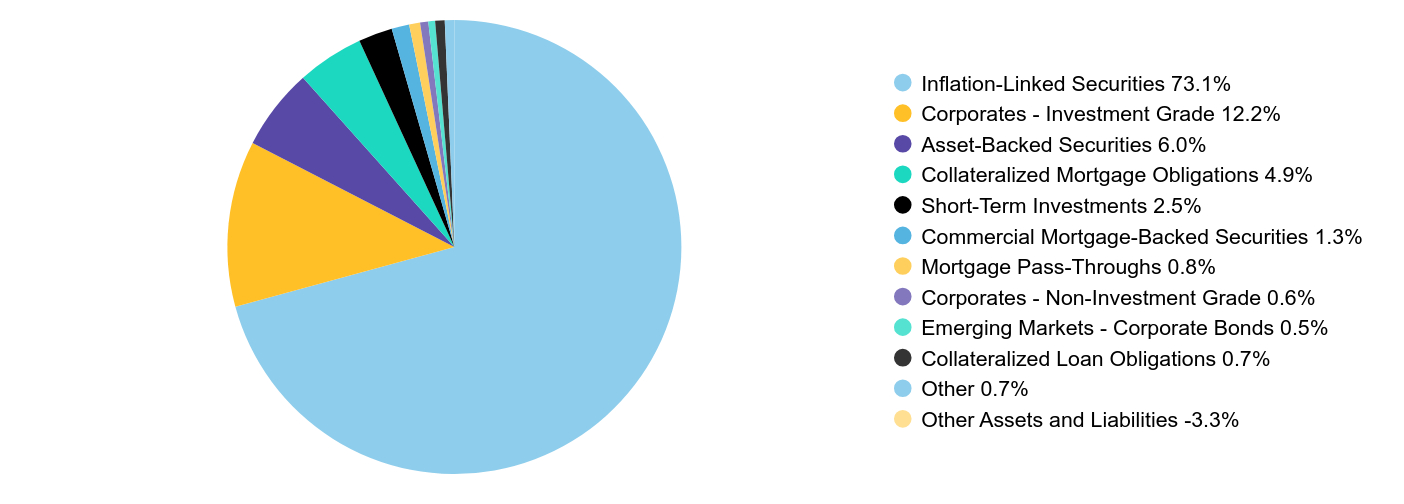

Graphical Representation of Holdings

Inflation Protection Breakdown

| U.S. Inflation - Protected Exposure | 73.1% |

| Non-Inflation Exposure | 26.9% |

| Total | 100.0% |

| Value | Value |

|---|

| Inflation-Linked Securities | 73.1% |

| Corporates - Investment Grade | 12.2% |

| Asset-Backed Securities | 6.0% |

| Collateralized Mortgage Obligations | 4.9% |

| Short-Term Investments | 2.5% |

| Commercial Mortgage-Backed Securities | 1.3% |

| Mortgage Pass-Throughs | 0.8% |

| Corporates - Non-Investment Grade | 0.6% |

| Emerging Markets - Corporate Bonds | 0.5% |

| Collateralized Loan Obligations | 0.7% |

| Other | 0.7% |

| Other Assets and Liabilities | -3.3% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/ABNCX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/ABNCX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Bond Inflation Strategy

Annual Shareholder Report

This annual shareholder report contains important information about the AB Bond Inflation Strategy (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/ANBIX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $62 | 0.59% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes except Class C outperformed the Bloomberg US 1-10 Year Treasury Inflation-Protected Securities ("TIPS") Index (the “benchmark”), before sales charges. Sector allocation was the largest contributor relative to the benchmark, from allocation to investment-grade corporate bonds, asset-backed securities, agency risk-sharing transactions and high-yield corporate bonds. Overall positioning in US TIPS contributed, as positioning in six-month TIPS added more than losses from positioning in two- and five-year TIPS. Yield-curve positioning detracted from performance, as positioning on the six-month and 10-year parts of the yield-curve outweighed gains from the five-year part of the curve. Currency decisions did not affect results.

During the 12-month period, the Fund used currency forwards to hedge currency risk and actively manage currency positions. Treasury futures and interest rate swaps were utilized to manage duration, country exposure and yield-curve positioning. Consumer Price Index swaps were used to hedge inflation and for investment purposes. Credit default swaps were utilized in the corporate and commercial mortgage-backed securities sectors for hedging and investment purposes.

Top contributors to performance:

Top detractors from performance::

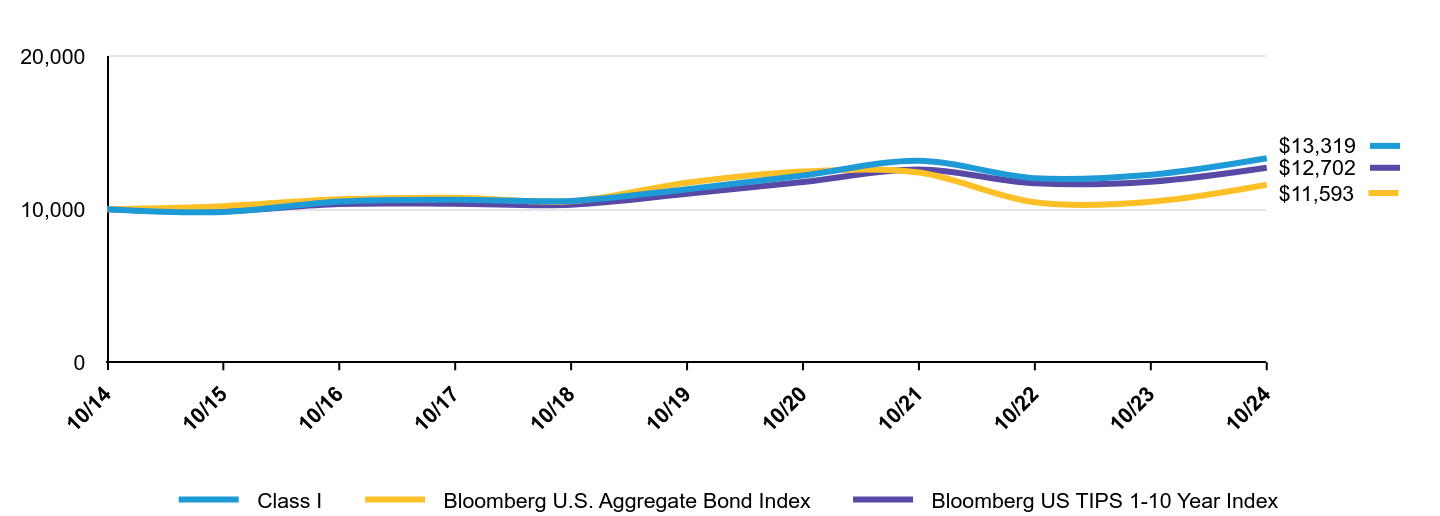

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class I | Bloomberg U.S. Aggregate Bond Index | Bloomberg US TIPS 1-10 Year Index |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,812 | $10,196 | $9,876 |

| 10/16 | $10,497 | $10,641 | $10,337 |

| 10/17 | $10,617 | $10,737 | $10,352 |

| 10/18 | $10,539 | $10,517 | $10,289 |

| 10/19 | $11,301 | $11,727 | $10,996 |

| 10/20 | $12,201 | $12,453 | $11,766 |

| 10/21 | $13,163 | $12,393 | $12,595 |

| 10/22 | $12,022 | $10,450 | $11,690 |

| 10/23 | $12,248 | $10,487 | $11,794 |

| 10/24 | $13,319 | $11,593 | $12,702 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 8.74% | 3.34% | 2.91% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Bloomberg US TIPS 1-10 Year Index | 7.70% | 2.93% | 2.42% |

The addition of the Bloomberg U.S. Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/ANBIX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $646,673,170 |

| # of Portfolio Holdings | 284 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $2,068,717 |

Graphical Representation of Holdings

Inflation Protection Breakdown

| U.S. Inflation - Protected Exposure | 73.1% |

| Non-Inflation Exposure | 26.9% |

| Total | 100.0% |

| Value | Value |

|---|

| Inflation-Linked Securities | 73.1% |

| Corporates - Investment Grade | 12.2% |

| Asset-Backed Securities | 6.0% |

| Collateralized Mortgage Obligations | 4.9% |

| Short-Term Investments | 2.5% |

| Commercial Mortgage-Backed Securities | 1.3% |

| Mortgage Pass-Throughs | 0.8% |

| Corporates - Non-Investment Grade | 0.6% |

| Emerging Markets - Corporate Bonds | 0.5% |

| Collateralized Loan Obligations | 0.7% |

| Other | 0.7% |

| Other Assets and Liabilities | -3.3% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/ANBIX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/ANBIX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Bond Inflation Strategy

Annual Shareholder Report

This annual shareholder report contains important information about the AB Bond Inflation Strategy (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/ABNZX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class Z | $62 | 0.59% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes except Class C outperformed the Bloomberg US 1-10 Year Treasury Inflation-Protected Securities ("TIPS") Index (the “benchmark”), before sales charges. Sector allocation was the largest contributor relative to the benchmark, from allocation to investment-grade corporate bonds, asset-backed securities, agency risk-sharing transactions and high-yield corporate bonds. Overall positioning in US TIPS contributed, as positioning in six-month TIPS added more than losses from positioning in two- and five-year TIPS. Yield-curve positioning detracted from performance, as positioning on the six-month and 10-year parts of the yield-curve outweighed gains from the five-year part of the curve. Currency decisions did not affect results.

During the 12-month period, the Fund used currency forwards to hedge currency risk and actively manage currency positions. Treasury futures and interest rate swaps were utilized to manage duration, country exposure and yield-curve positioning. Consumer Price Index swaps were used to hedge inflation and for investment purposes. Credit default swaps were utilized in the corporate and commercial mortgage-backed securities sectors for hedging and investment purposes.

Top contributors to performance:

Top detractors from performance::

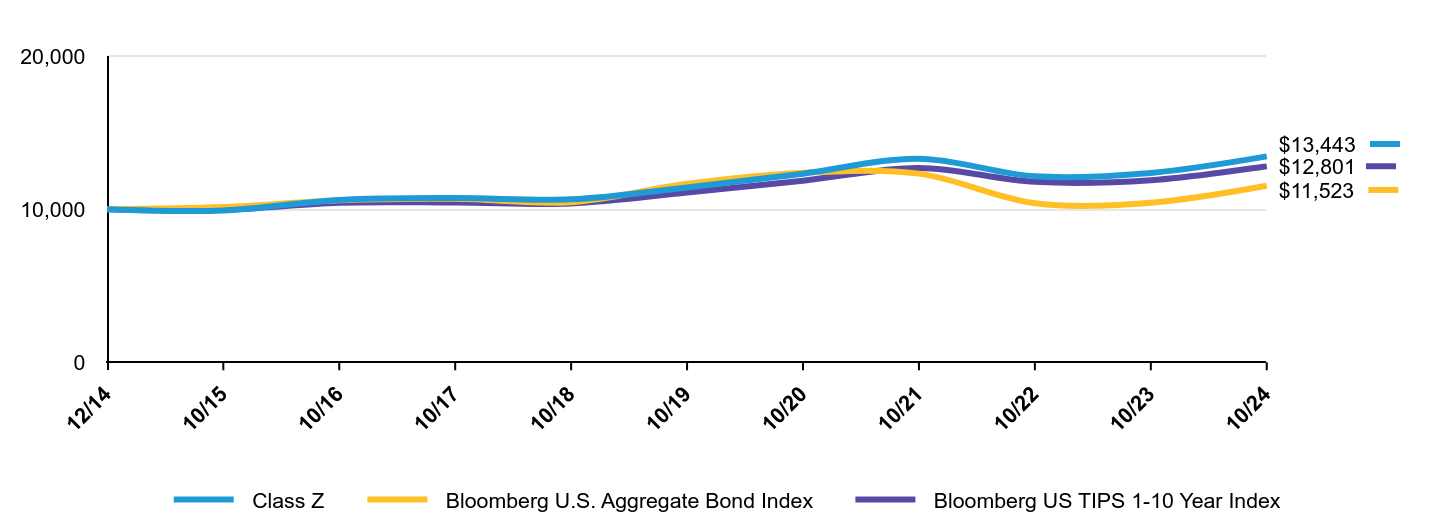

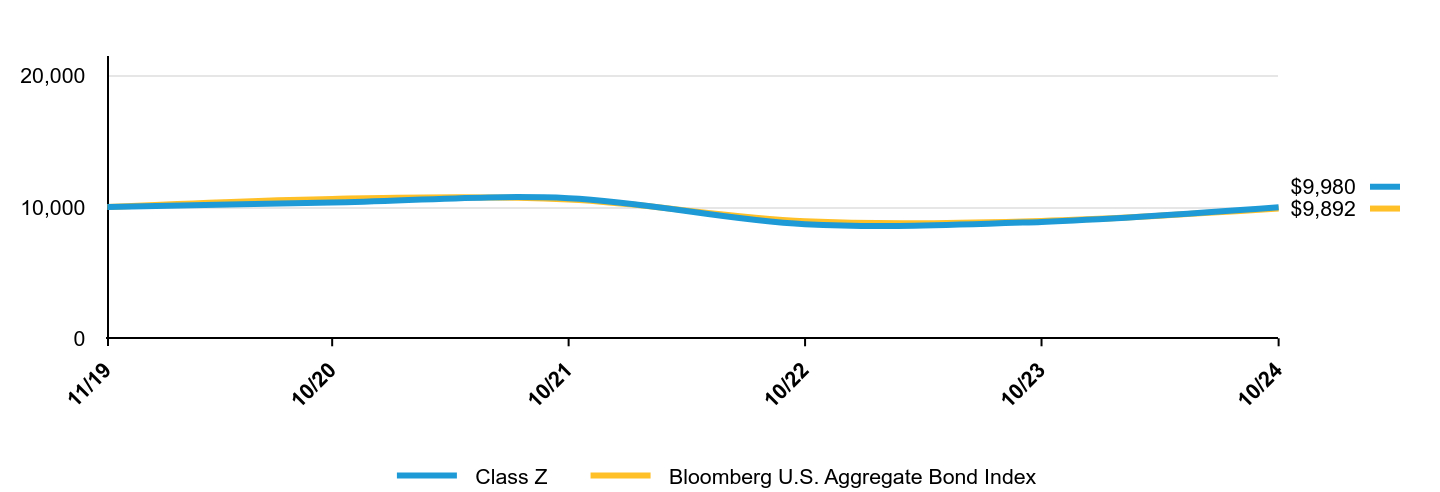

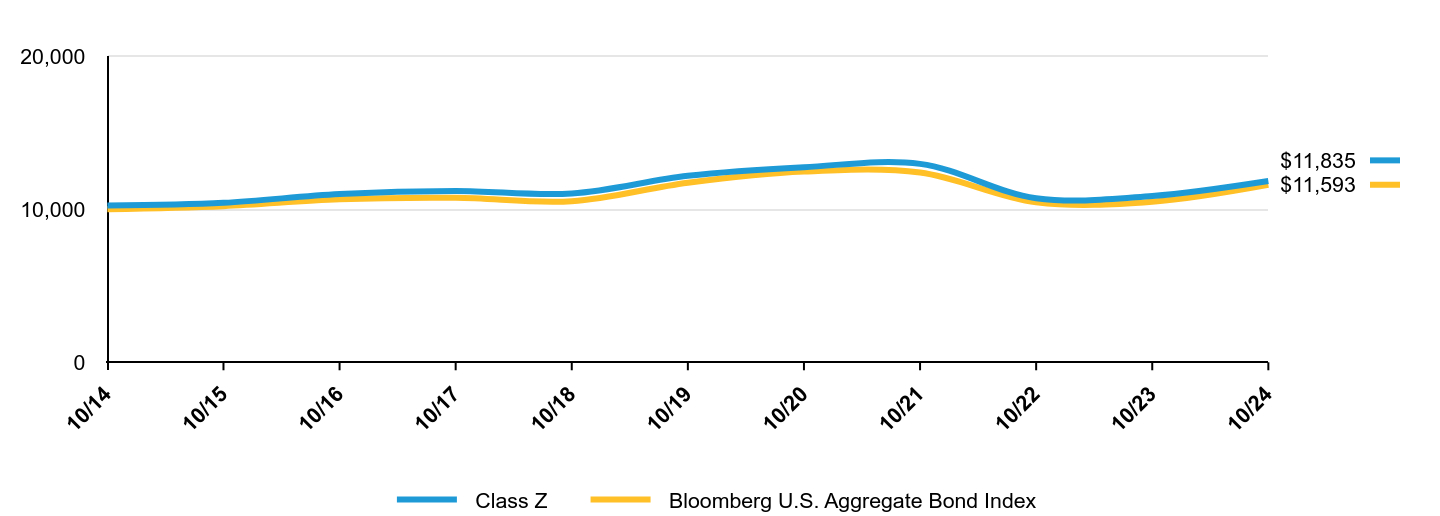

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class Z | Bloomberg U.S. Aggregate Bond Index | Bloomberg US TIPS 1-10 Year Index |

|---|

| 12/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,914 | $10,134 | $9,953 |

| 10/16 | $10,597 | $10,577 | $10,418 |

| 10/17 | $10,723 | $10,672 | $10,433 |

| 10/18 | $10,640 | $10,453 | $10,369 |

| 10/19 | $11,413 | $11,656 | $11,081 |

| 10/20 | $12,317 | $12,378 | $11,858 |

| 10/21 | $13,295 | $12,318 | $12,693 |

| 10/22 | $12,144 | $10,387 | $11,782 |

| 10/23 | $12,366 | $10,424 | $11,886 |

| 10/24 | $13,443 | $11,523 | $12,801 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Since Inception 12/11/14 |

|---|

| Class Z | 8.71% | 3.33% | 3.04% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.44% |

| Bloomberg US TIPS 1-10 Year Index | 7.70% | 2.93% | 2.53% |

The addition of the Bloomberg U.S. Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/ABNZX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $646,673,170 |

| # of Portfolio Holdings | 284 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $2,068,717 |

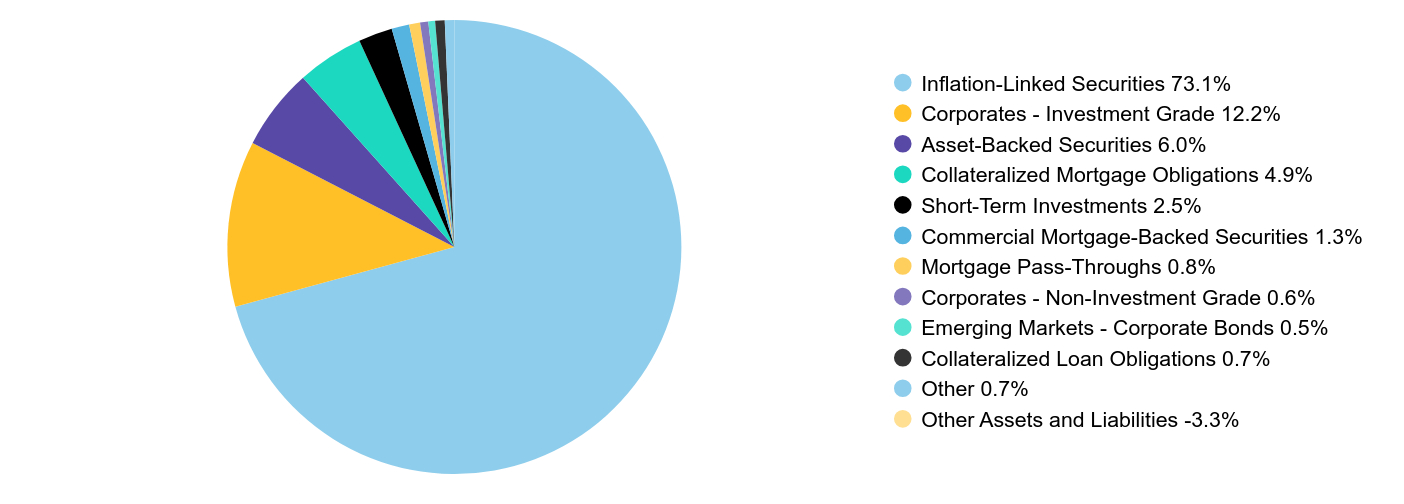

Graphical Representation of Holdings

Inflation Protection Breakdown

| U.S. Inflation - Protected Exposure | 73.1% |

| Non-Inflation Exposure | 26.9% |

| Total | 100.0% |

| Value | Value |

|---|

| Inflation-Linked Securities | 73.1% |

| Corporates - Investment Grade | 12.2% |

| Asset-Backed Securities | 6.0% |

| Collateralized Mortgage Obligations | 4.9% |

| Short-Term Investments | 2.5% |

| Commercial Mortgage-Backed Securities | 1.3% |

| Mortgage Pass-Throughs | 0.8% |

| Corporates - Non-Investment Grade | 0.6% |

| Emerging Markets - Corporate Bonds | 0.5% |

| Collateralized Loan Obligations | 0.7% |

| Other | 0.7% |

| Other Assets and Liabilities | -3.3% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/ABNZX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/ABNZX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

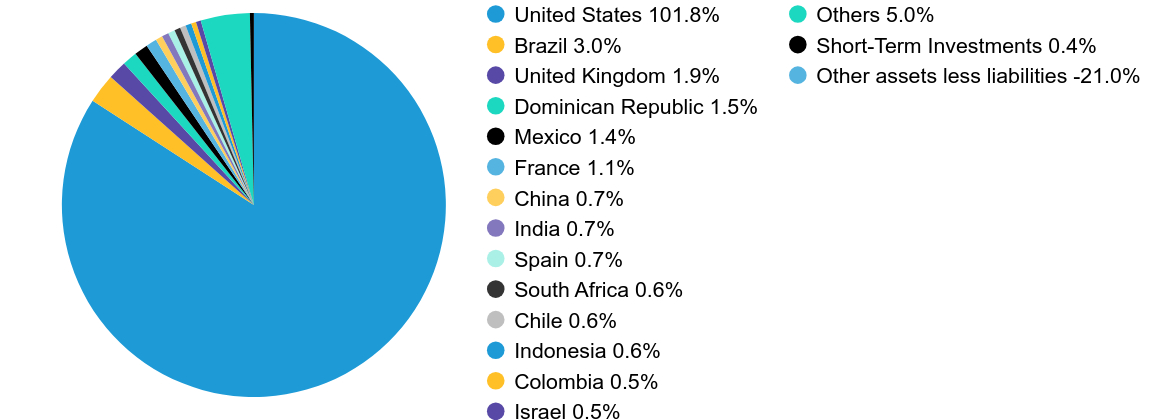

Annual Shareholder Report

This annual shareholder report contains important information about the AB Income Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ACGYX-A. You can also request this information by contacting us at (800) 227 4618.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $58 | 0.55% |

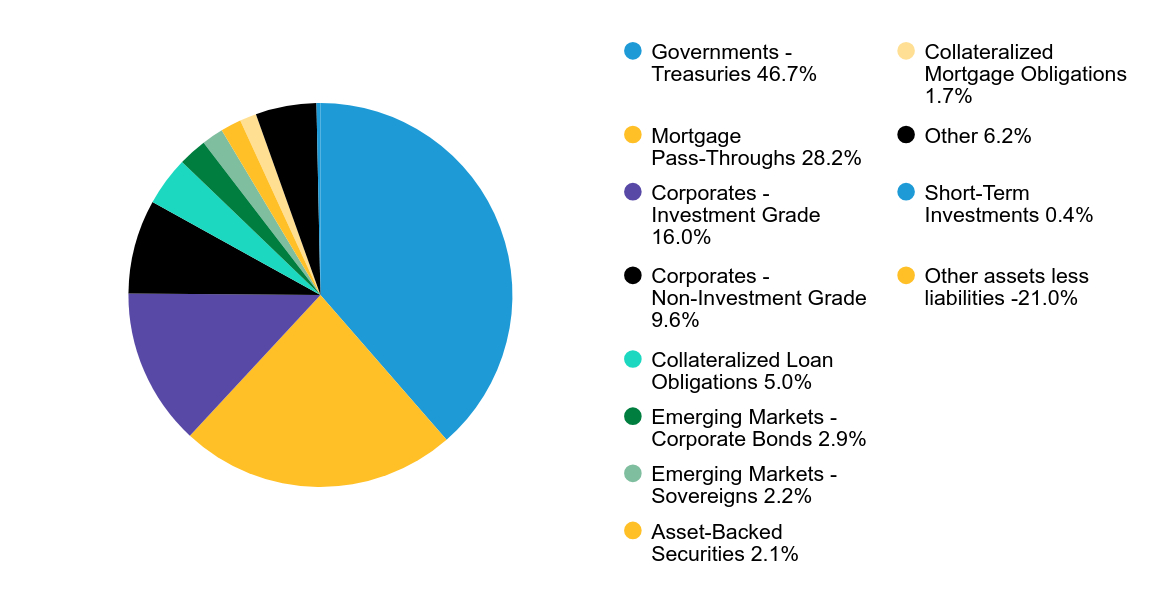

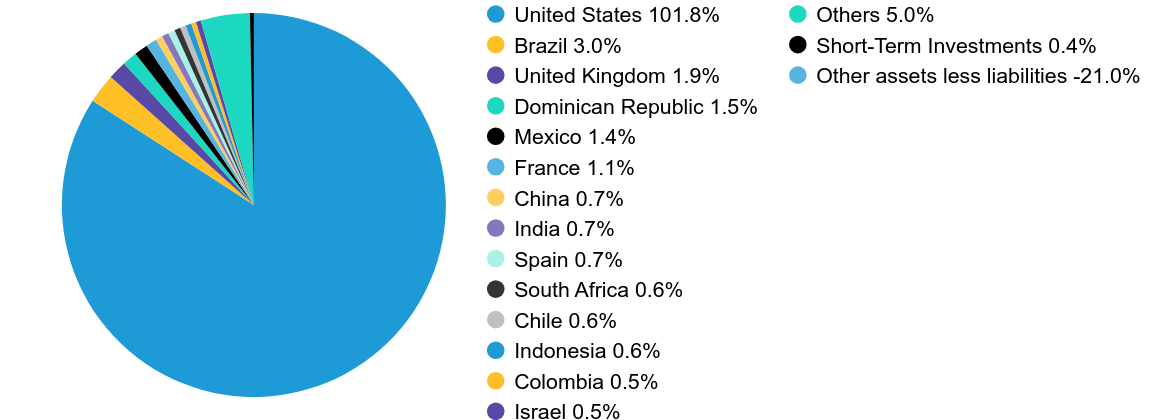

How did the Fund perform last year? What affected the Fund’s performance?

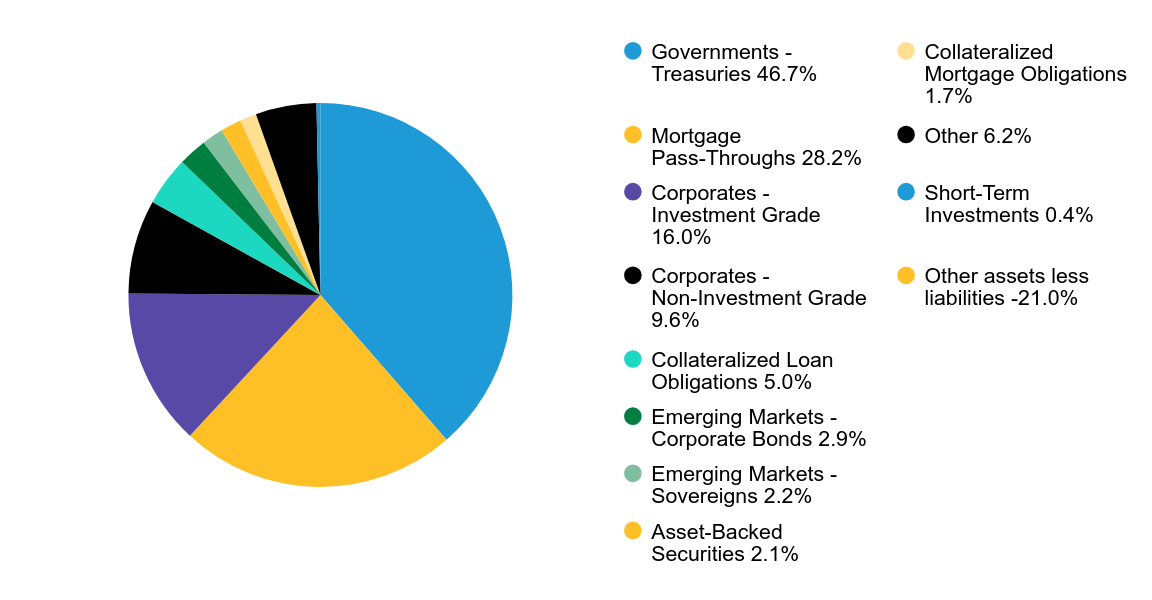

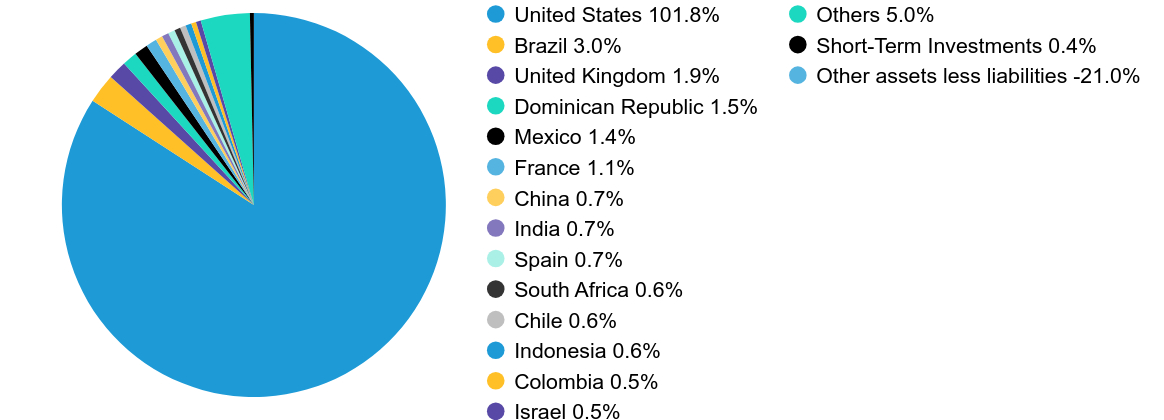

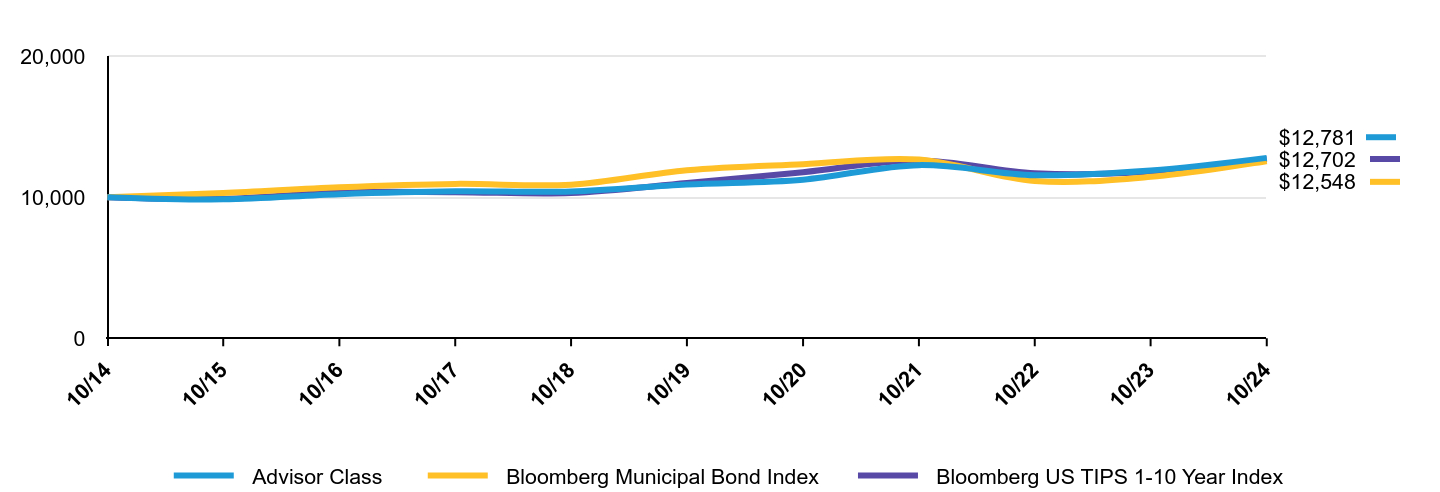

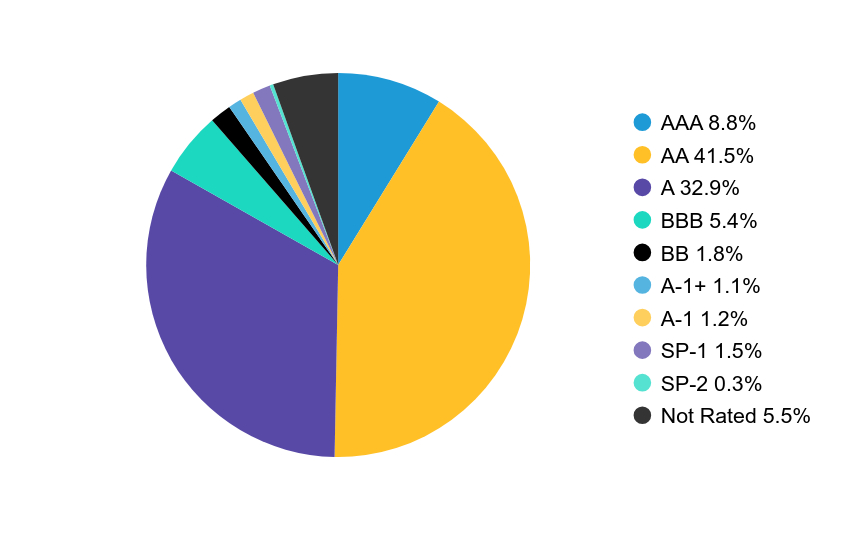

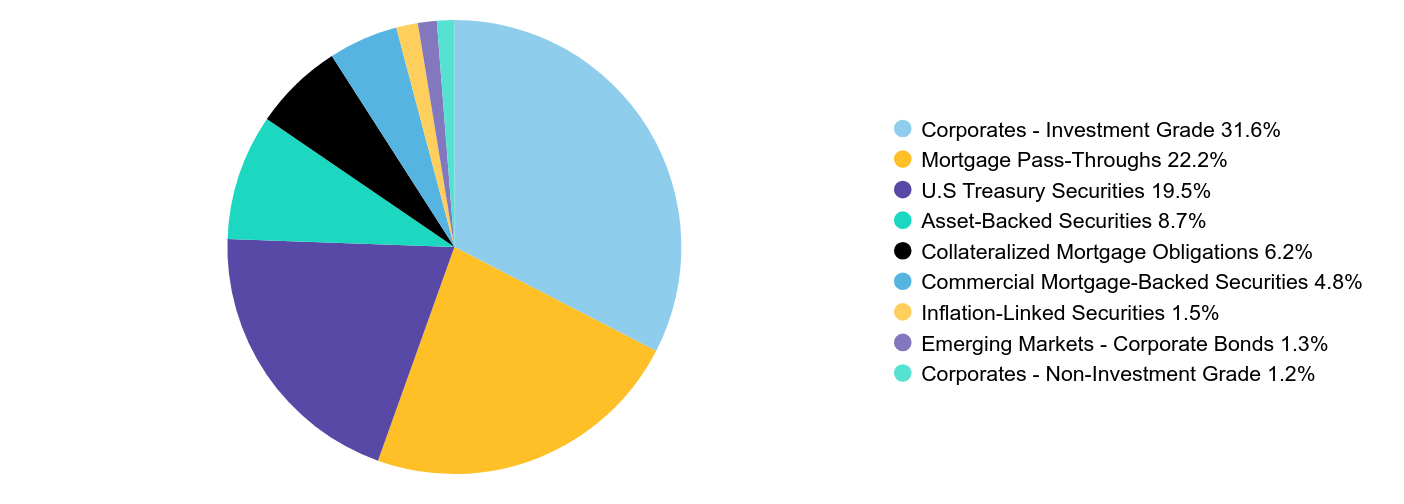

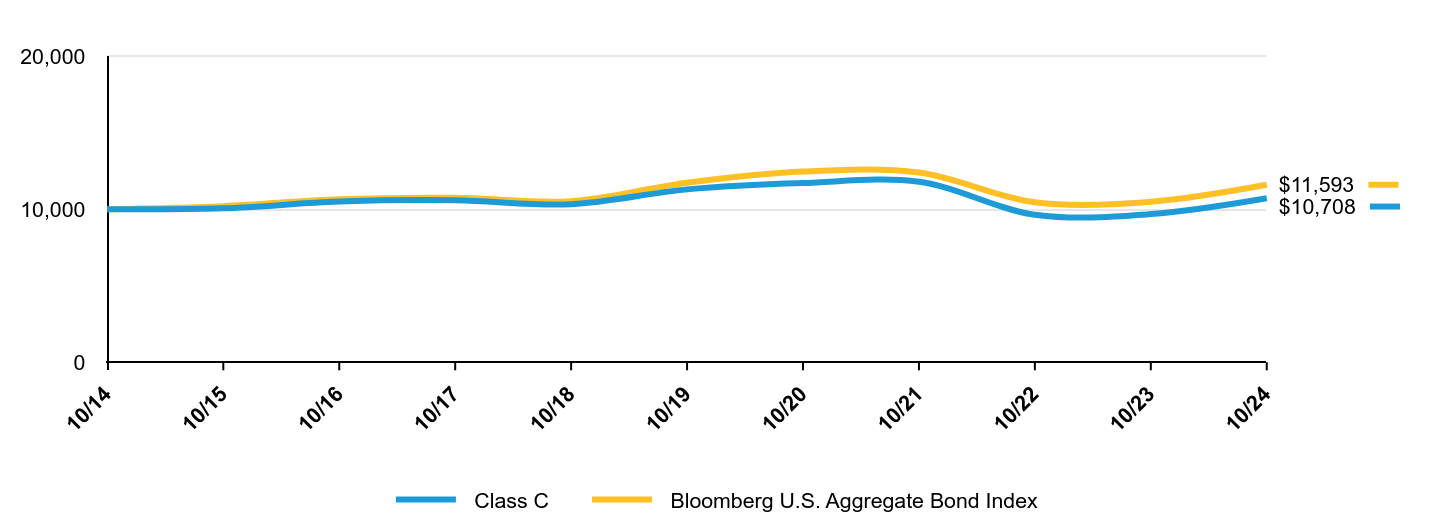

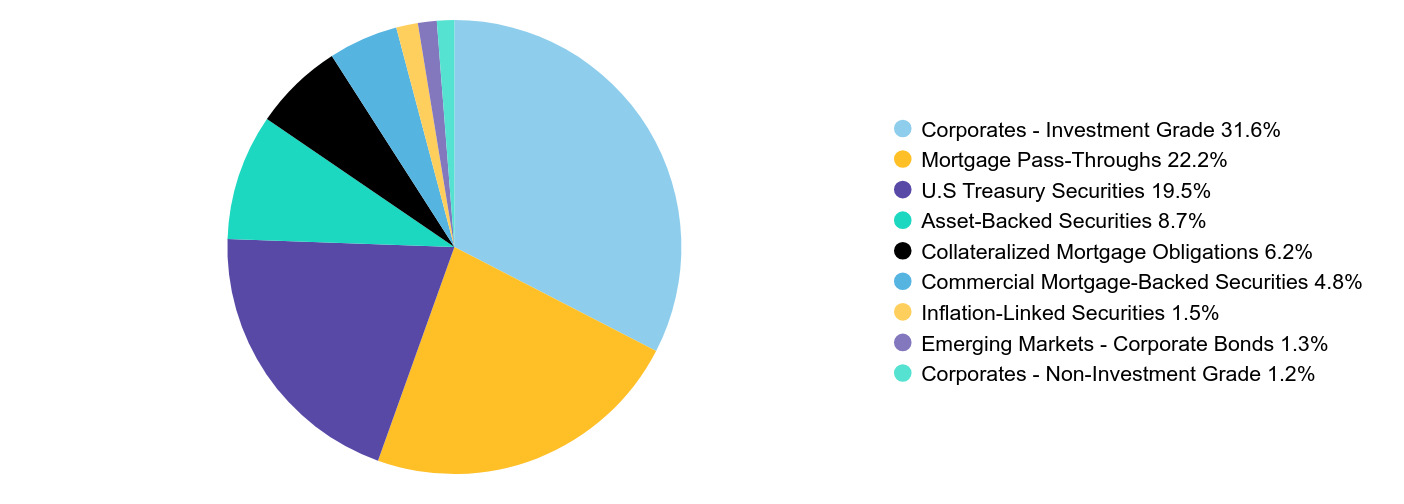

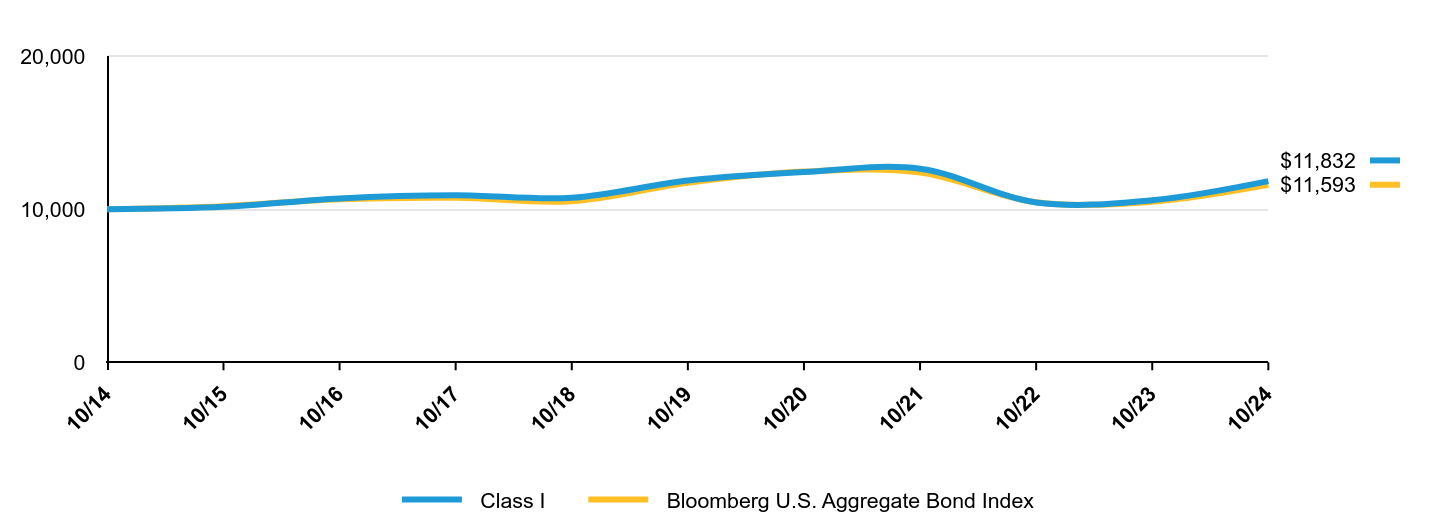

During the 12-month period, all share classes outperformed the Bloomberg U.S. Aggregate Bond Index (“the benchmark”), before sales charges. Over the period, sector allocation contributed the most to relative performance because of off-benchmark exposure to US high-yield and emerging-market corporate bonds, collateralized loan obligations and emerging-market sovereign bonds, which outweighed losses from an underweight to US investment-grade corporates and an overweight to US Treasuries. Security selection also contributed, as selections within US investment-grade corporates and quasi-sovereign bonds added more to performance than a loss from selection in US agency mortgage-backed securities. Yield-curve positioning contributed, from an overweight to the six-month part of the US Treasury curve that added more to performance than losses from an overweight to the two-year and an underweight to the 20-year parts of the curve. Country allocation and currency decisions did not have an impact on performance.

During the 12-month period, the Fund used derivatives in the form of interest rate futures to manage and hedge duration risk and/or take active yield-curve positioning. Currency forwards were used to hedge foreign currency exposure. Credit default swaps were also utilized to effectively obtain high-yield credit/sector exposure. Interest rate swaps were used to manage and hedge duration risk and/or take active yield-curve positioning. Consumer Price Index swaps were utilized to obtain exposure to inflation protection. Purchased options and written options were purchased as part of put spread for downside protection (hedging).

Top contributors to performance:

Top detractors from performance: