UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02383

AB BOND FUND, INC.

(Exact name of registrant as specified in charter)

66 Hudson Boulevard East

New York, New York 10005

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

66 Hudson Boulevard East

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Please scan QR code for

Fund Information

AB Tax-Aware Fixed Income Opportunities Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Tax-Aware Fixed Income Opportunities Portfolio (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ATTYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $86 | 0.81% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes of the Fund outperformed the Bloomberg Municipal Bond Index (the “benchmark”), before sales charges. Security selection in special tax and multi-family housing contributed, relative to the benchmark, while selection within industrial development and public higher education detracted. Overweights to senior living and public primary/secondary education contributed, while an overweight to the 10-year part of the detracted.

During the 12-month period, the Fund used derivatives in the form of interest rate swaps for hedging purposes, which added to absolute returns. Credit default swaps were used for investment purposes. Inflation swaps were utilized for hedging purposes. MMD Rate Locks were utilized for investment purposes, which added to returns.

Top contributors to performance:

Top detractors from performance:

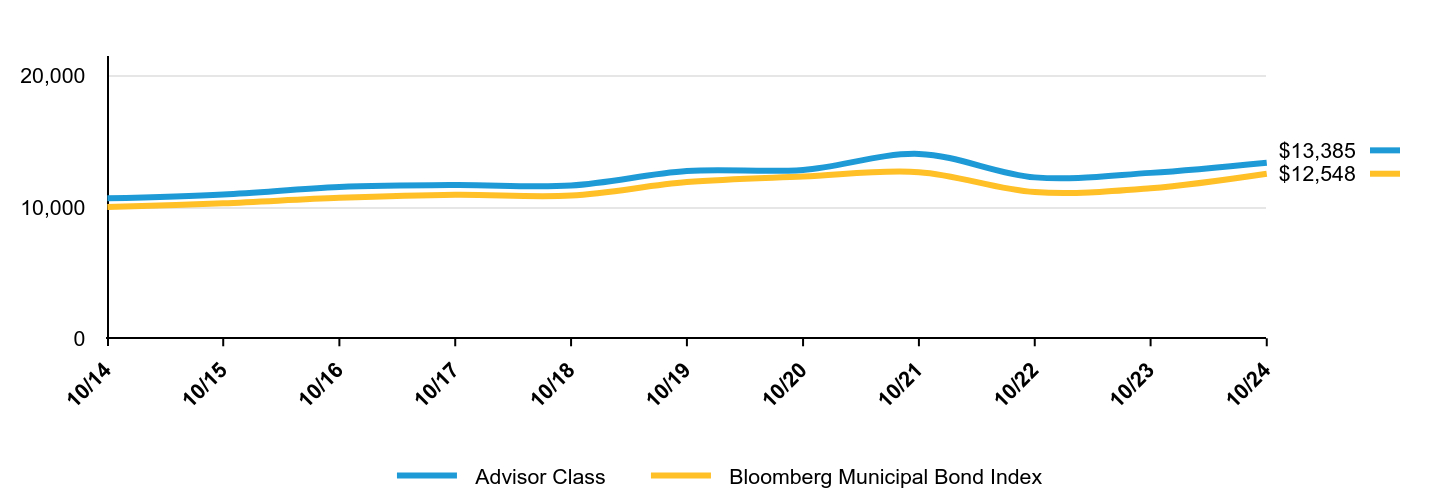

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Advisor Class | Bloomberg Municipal Bond Index |

|---|

| 10/14 | $10,667 | $10,000 |

| 10/15 | $10,963 | $10,287 |

| 10/16 | $11,528 | $10,704 |

| 10/17 | $11,682 | $10,939 |

| 10/18 | $11,648 | $10,883 |

| 10/19 | $12,745 | $11,908 |

| 10/20 | $12,833 | $12,336 |

| 10/21 | $14,052 | $12,661 |

| 10/22 | $12,266 | $11,144 |

| 10/23 | $12,608 | $11,439 |

| 10/24 | $13,385 | $12,548 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Advisor Class | 13.42% | 2.33% | 2.96% |

| Bloomberg Municipal Bond Index | 9.70% | 1.05% | 2.30% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/ATTYX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $647,799,147 |

| # of Portfolio Holdings | 710 |

| Portfolio Turnover Rate | 31% |

| Total Advisory Fees Paid | $2,017,590 |

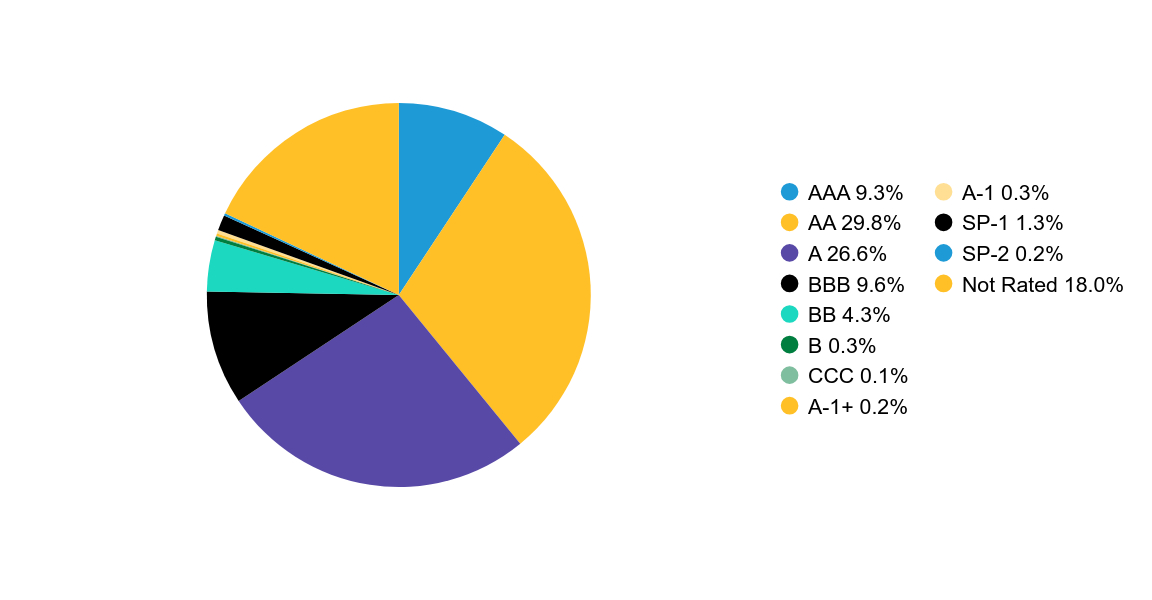

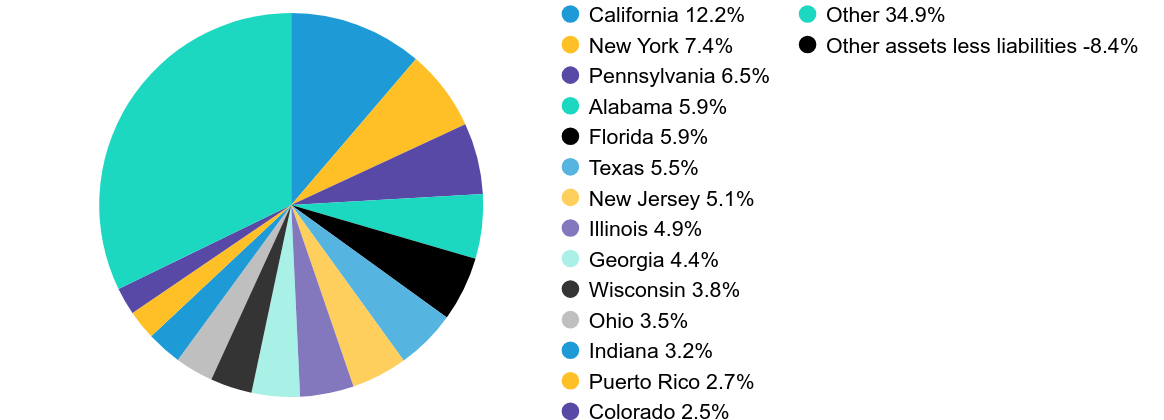

Graphical Representation of Holdings

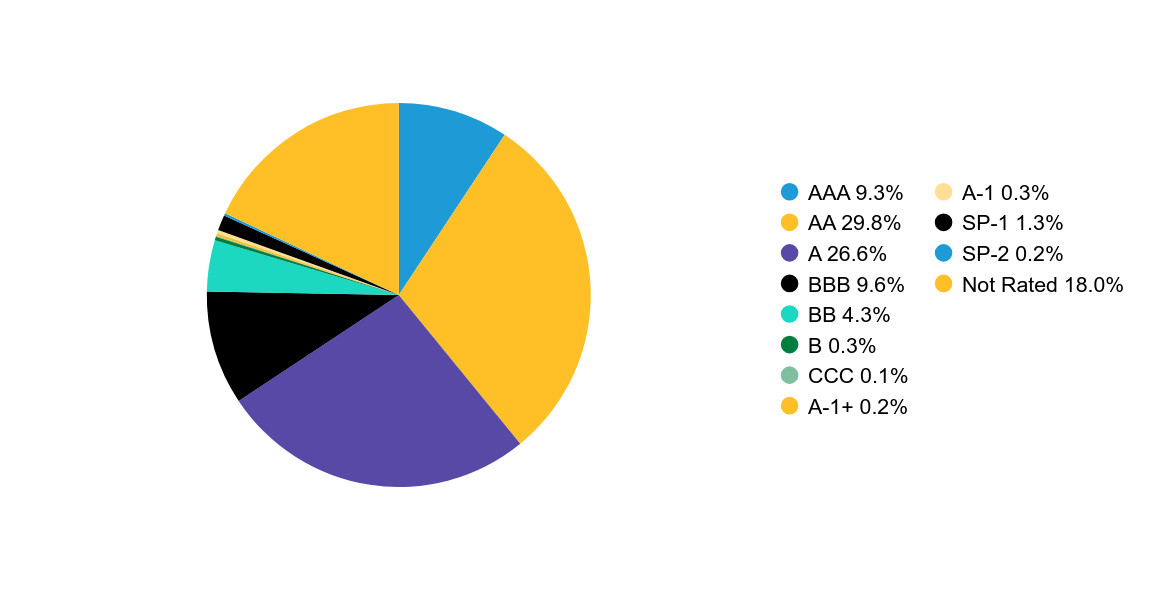

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 9.3% |

| AA | 29.8% |

| A | 26.6% |

| BBB | 9.6% |

| BB | 4.3% |

| B | 0.3% |

| CCC | 0.1% |

| A-1+ | 0.2% |

| A-1 | 0.3% |

| SP-1 | 1.3% |

| SP-2 | 0.2% |

| Not Rated | 18.0% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P.(the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

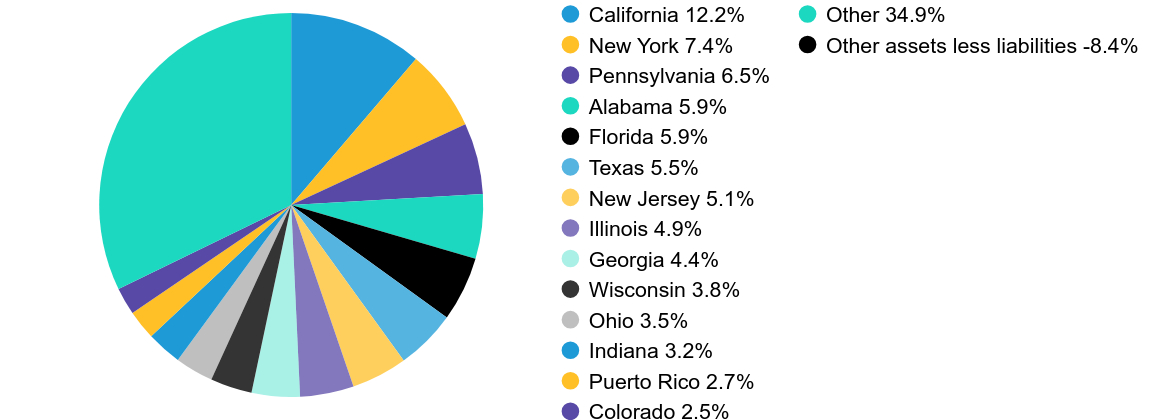

| Value | Value |

|---|

| California | 12.2% |

| New York | 7.4% |

| Pennsylvania | 6.5% |

| Alabama | 5.9% |

| Florida | 5.9% |

| Texas | 5.5% |

| New Jersey | 5.1% |

| Illinois | 4.9% |

| Georgia | 4.4% |

| Wisconsin | 3.8% |

| Ohio | 3.5% |

| Indiana | 3.2% |

| Puerto Rico | 2.7% |

| Colorado | 2.5% |

| Other | 34.9% |

| Other assets less liabilities | -8.4% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ATTYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ATTYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Tax-Aware Fixed Income Opportunities Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Tax-Aware Fixed Income Opportunities Portfolio (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ATTAX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $113 | 1.06% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes of the Fund outperformed the Bloomberg Municipal Bond Index (the “benchmark”), before sales charges. Security selection in special tax and multi-family housing contributed, relative to the benchmark, while selection within industrial development and public higher education detracted. Overweights to senior living and public primary/secondary education contributed, while an overweight to the 10-year part of the detracted.

During the 12-month period, the Fund used derivatives in the form of interest rate swaps for hedging purposes, which added to absolute returns. Credit default swaps were used for investment purposes. Inflation swaps were utilized for hedging purposes. MMD Rate Locks were utilized for investment purposes, which added to returns.

Top contributors to performance:

Top detractors from performance:

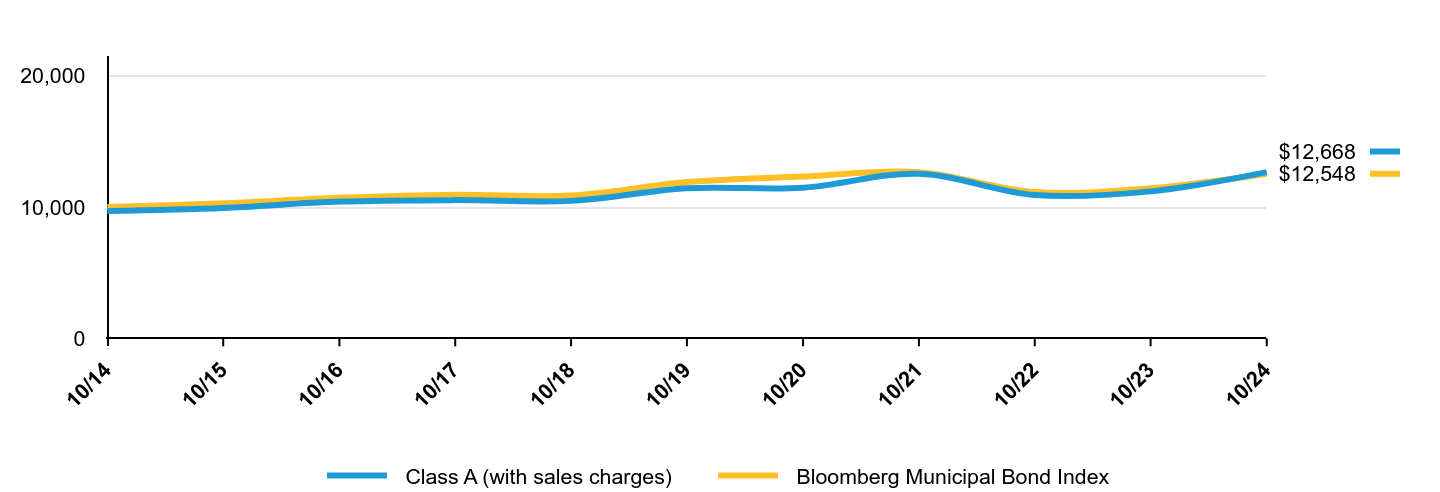

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class A (with sales charges) | Bloomberg Municipal Bond Index |

|---|

| 10/14 | $9,696 | $10,000 |

| 10/15 | $9,935 | $10,287 |

| 10/16 | $10,418 | $10,704 |

| 10/17 | $10,532 | $10,939 |

| 10/18 | $10,474 | $10,883 |

| 10/19 | $11,432 | $11,908 |

| 10/20 | $11,475 | $12,336 |

| 10/21 | $12,543 | $12,661 |

| 10/22 | $10,921 | $11,144 |

| 10/23 | $11,198 | $11,439 |

| 10/24 | $12,668 | $12,548 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charges) | 13.13% | 2.07% | 2.71% |

| Class A (with sales charges) | 9.76% | 1.46% | 2.39% |

| Bloomberg Municipal Bond Index | 9.70% | 1.05% | 2.30% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/ATTAX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $647,799,147 |

| # of Portfolio Holdings | 710 |

| Portfolio Turnover Rate | 31% |

| Total Advisory Fees Paid | $2,017,590 |

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 9.3% |

| AA | 29.8% |

| A | 26.6% |

| BBB | 9.6% |

| BB | 4.3% |

| B | 0.3% |

| CCC | 0.1% |

| A-1+ | 0.2% |

| A-1 | 0.3% |

| SP-1 | 1.3% |

| SP-2 | 0.2% |

| Not Rated | 18.0% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P.(the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| Value | Value |

|---|

| California | 12.2% |

| New York | 7.4% |

| Pennsylvania | 6.5% |

| Alabama | 5.9% |

| Florida | 5.9% |

| Texas | 5.5% |

| New Jersey | 5.1% |

| Illinois | 4.9% |

| Georgia | 4.4% |

| Wisconsin | 3.8% |

| Ohio | 3.5% |

| Indiana | 3.2% |

| Puerto Rico | 2.7% |

| Colorado | 2.5% |

| Other | 34.9% |

| Other assets less liabilities | -8.4% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ATTAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ATTAX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Tax-Aware Fixed Income Opportunities Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Tax-Aware Fixed Income Opportunities Portfolio (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ATCCX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $192 | 1.81% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes of the Fund outperformed the Bloomberg Municipal Bond Index (the “benchmark”), before sales charges. Security selection in special tax and multi-family housing contributed, relative to the benchmark, while selection within industrial development and public higher education detracted. Overweights to senior living and public primary/secondary education contributed, while an overweight to the 10-year part of the detracted.

During the 12-month period, the Fund used derivatives in the form of interest rate swaps for hedging purposes, which added to absolute returns. Credit default swaps were used for investment purposes. Inflation swaps were utilized for hedging purposes. MMD Rate Locks were utilized for investment purposes, which added to returns.

Top contributors to performance:

Top detractors from performance:

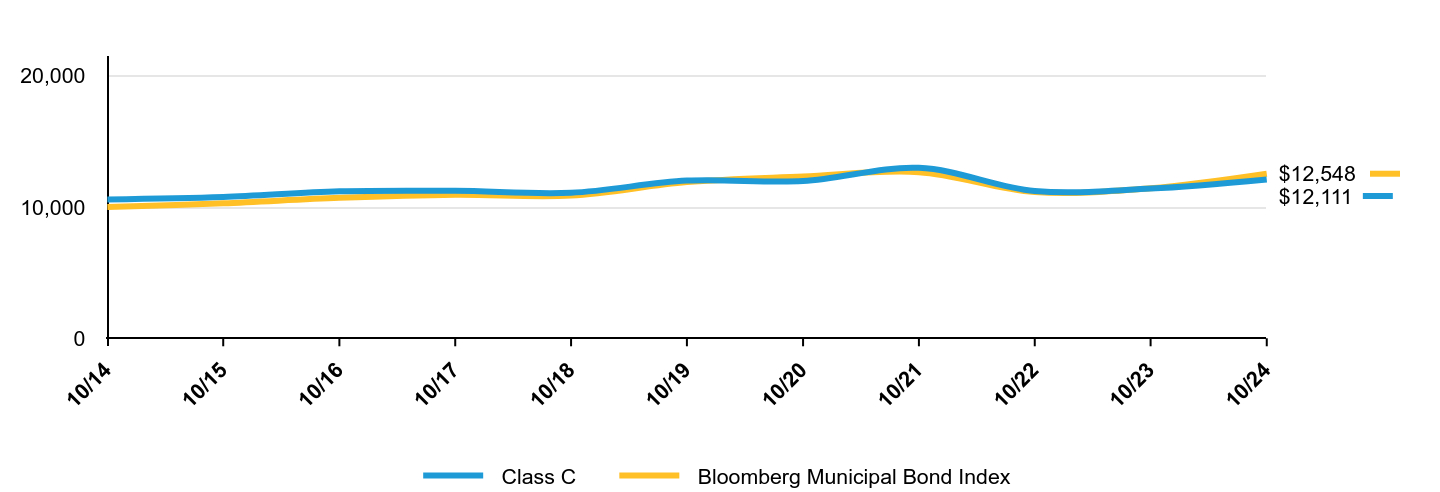

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class C | Bloomberg Municipal Bond Index |

|---|

| 10/14 | $10,585 | $10,000 |

| 10/15 | $10,770 | $10,287 |

| 10/16 | $11,202 | $10,704 |

| 10/17 | $11,239 | $10,939 |

| 10/18 | $11,094 | $10,883 |

| 10/19 | $12,019 | $11,908 |

| 10/20 | $11,981 | $12,336 |

| 10/21 | $12,990 | $12,661 |

| 10/22 | $11,225 | $11,144 |

| 10/23 | $11,412 | $11,439 |

| 10/24 | $12,111 | $12,548 |

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class C (without sales charges) | 12.29% | 1.31% | 1.93% |

| Class C (with sales charges) | 11.41% | 1.31% | 1.93% |

| Bloomberg Municipal Bond Index | 9.70% | 1.05% | 2.30% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/ATCCX-A for the most recent performance information.

| FUND STATISTICS | Fund Stats |

|---|

| Net Assets | $647,799,147 |

| # of Portfolio Holdings | 710 |

| Portfolio Turnover Rate | 31% |

| Total Advisory Fees Paid | $2,017,590 |

Graphical Representation of Holdings

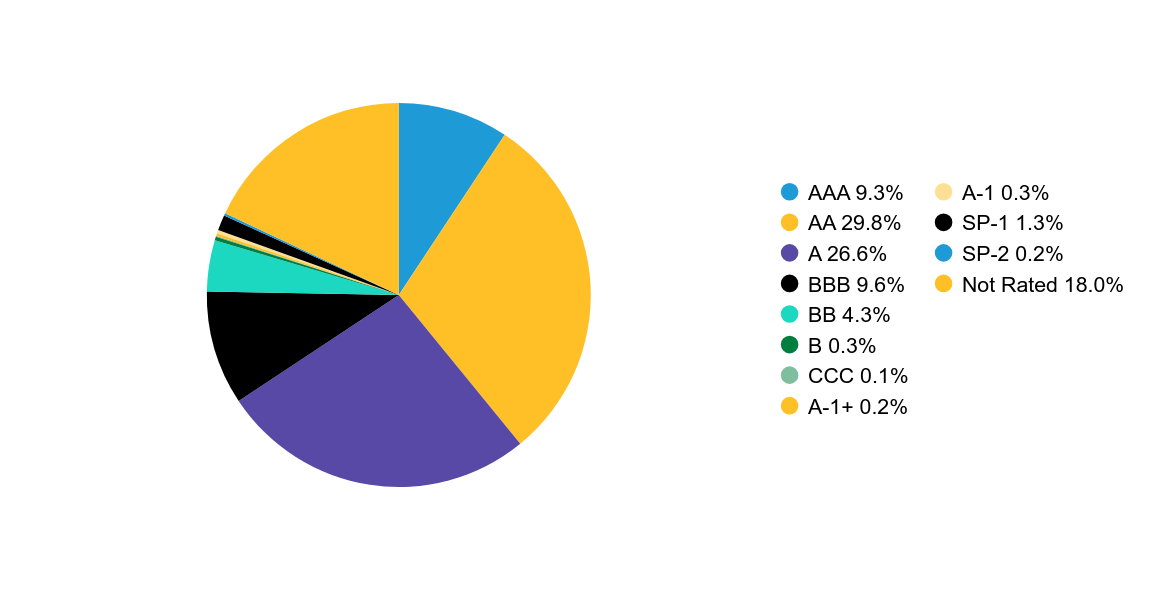

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 9.3% |

| AA | 29.8% |

| A | 26.6% |

| BBB | 9.6% |

| BB | 4.3% |

| B | 0.3% |

| CCC | 0.1% |

| A-1+ | 0.2% |

| A-1 | 0.3% |

| SP-1 | 1.3% |

| SP-2 | 0.2% |

| Not Rated | 18.0% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P.(the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| Value | Value |

|---|

| California | 12.2% |

| New York | 7.4% |

| Pennsylvania | 6.5% |

| Alabama | 5.9% |

| Florida | 5.9% |

| Texas | 5.5% |

| New Jersey | 5.1% |

| Illinois | 4.9% |

| Georgia | 4.4% |

| Wisconsin | 3.8% |

| Ohio | 3.5% |

| Indiana | 3.2% |

| Puerto Rico | 2.7% |

| Colorado | 2.5% |

| Other | 34.9% |

| Other assets less liabilities | -8.4% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ATCCX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ATCCX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

ITEM 2. CODE OF ETHICS.

(a) The registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer and principal accounting officer. A copy of the registrant’s code of ethics is filed herewith as Exhibit 19(a)(1).

(b) During the period covered by this report, no material amendments were made to the provisions of the code of ethics adopted in 2(a) above.

(c) During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics adopted in 2(a) above were granted.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The registrant’s Board of Directors has determined that independent directors Garry L. Moody, Marshall C. Turner, Jr., Jorge A. Bermudez and Carol C. McMullen qualify as audit committee financial experts.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) - (c) The following table sets forth the aggregate fees billed* by the independent registered public accounting firm Ernst & Young LLP, for the Fund’s last two fiscal years, for professional services rendered for: (i) the audit of the Fund’s annual financial statements included in the Fund’s annual report to stockholders; (ii) assurance and related services that are reasonably related to the performance of the audit of the Fund’s financial statements and are not reported under (i), which include advice and education related to accounting and auditing issues, quarterly press release review (for those Funds that issue quarterly press releases), and preferred stock maintenance testing (for those Funds that issue preferred stock); and (iii) tax compliance, tax advice and tax return preparation.

| | | | | | | | | | | | | | | | |

| | | | | | Audit Fees | | | Audit-Related

Fees | | | Tax Fees | |

AB Tax Aware Fixed Income Portfolio | | | 2023 | | | $ | 37,863 | | | $ | — | | | $ | 23,823 | |

| | | 2024 | | | $ | 45,000 | | | $ | — | | | $ | 23,724 | |

(d) Not applicable.

(e) (1) Beginning with audit and non-audit service contracts entered into on or after May 6, 2003, the Fund’s Audit Committee policies and procedures require the pre-approval of all audit and non-audit services provided to the Fund by the Fund’s independent registered public accounting firm. The Fund’s Audit Committee policies and procedures also require pre-approval of all audit and non-audit services provided to the Adviser and Service Affiliates to the extent that these services are directly related to the operations or financial reporting of the Fund.

(e) (2) No percentage of services addressed by (b) and (c) of this Item 4 were approved pursuant to the waiver provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. No amounts are reported for Item 4 (d).

(f) Not applicable.

(g) The following table sets forth the aggregate non-audit services provided to the Fund, the Fund’s Adviser and entities that control, are controlled by or under common control with the Adviser that provide ongoing services to the Fund: (“Service Affiliates”):

| | | | | | | | | | | | |

| | | | | | All Fees for

Non-Audit Services

Provided to the

Portfolio, the Adviser

and Service

Affiliates | | | Total Amount of

Foregoing Column Pre-

approved by the Audit

Committee

(Portion Comprised of

Audit Related Fees)

(Portion Comprised of

Tax Fees) | |

AB Tax Aware Fixed Income Portfolio | | | 2023 | | | $ | 1,784,853 | | | $ | 23,823 | |

| | | | | | | | | | $ | — | |

| | | | | | | | | | $ | (23,823 | ) |

| | | 2024 | | | $ | 2,048,030 | | | $ | 23,724 | |

| | | | | | | | | | $ | — | |

| | | | | | | | | | $ | (23,724 | ) |

(h) The Audit Committee of the Fund has considered whether the provision of any non-audit services not pre-approved by the Audit Committee provided by the Fund’s independent registered public accounting firm to the Adviser and Service Affiliates is compatible with maintaining the auditor’s independence.

(i) Not applicable.

(j) Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable to the registrant.

ITEM 6. INVESTMENTS.

Please see Schedule of Investments contained in the Report to Shareholders included under Item 7 of this Form N-CSR.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

OCT 10.31.24

ANNUAL FINANCIAL STATEMENTS AND ADDITIONAL INFORMATION

AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

PORTFOLIO OF INVESTMENTS

October 31, 2024

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

MUNICIPAL OBLIGATIONS – 105.1% | | | | | | | | |

Long-Term Municipal Bonds – 104.2% | | | | | | | | |

Alabama – 5.9% | | | | | | | | |

Black Belt Energy Gas District

(Apollo Global Management, Inc.)

Series 2024-A

5.25%, 05/01/2055 | | $ | 2,000 | | | $ | 2,166,697 | |

Black Belt Energy Gas District

(Goldman Sachs Group, Inc. (The))

Series 2022-F

5.50%, 11/01/2053 | | | 2,000 | | | | 2,125,261 | |

Series 2023-A

5.25%, 01/01/2054 | | | 2,000 | | | | 2,152,688 | |

Series 2023-D

5.428% (SOFR + 1.85%), 06/01/2049(a)(b)(c) | | | 10,000 | | | | 10,280,411 | |

Black Belt Energy Gas District

(Nomura Holdings, Inc.)

Series 2022-A

4.00%, 12/01/2052 | | | 1,000 | | | | 996,690 | |

Black Belt Energy Gas District

(Pacific Mutual Holding Co.)

Series 2024-C

5.00%, 05/01/2055 | | | 1,000 | | | | 1,067,497 | |

County of Jefferson AL Sewer Revenue

Series 2024

5.50%, 10/01/2053 | | | 1,000 | | | | 1,082,513 | |

Homewood Educational Building Authority

(CHF – Horizons II LLC)

Series 2024

5.50%, 10/01/2049 | | | 250 | | | | 264,334 | |

5.50%, 10/01/2054 | | | 250 | | | | 262,590 | |

Mobile County Industrial Development Authority

(ArcelorMittal SA)

Series 2024

5.00%, 06/01/2054 | | | 1,000 | | | | 1,020,893 | |

Southeast Alabama Gas Supply District (The)

(Pacific Mutual Holding Co.)

Series 2024-A

5.00%, 08/01/2054 | | | 2,000 | | | | 2,140,965 | |

Southeast Energy Authority A Cooperative District

(Morgan Stanley)

Series 2022-A

5.50%, 01/01/2053 | | | 1,000 | | | | 1,077,455 | |

5.656% (SOFR + 2.42%), 01/01/2053(c) | | | 2,000 | | | | 2,104,363 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 1 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Southeast Energy Authority A Cooperative District

(Royal Bank of Canada)

Series 2023-B

5.00%, 01/01/2054 | | $ | 10,000 | | | $ | 10,610,587 | |

Southeast Energy Authority A Cooperative District

(Sumitomo Mitsui Financial Group, Inc.)

Series 2023-A

5.25%, 01/01/2054 | | | 1,000 | | | | 1,058,310 | |

| | | | | | | | |

| | | | | | | 38,411,254 | |

| | | | | | | | |

Alaska – 1.0% | |

Alaska Housing Finance Corp.

(Pre-refunded – Others)

Series 2023

4.39%, 07/01/2026(b) | | | 2,000 | | | | 2,007,008 | |

Municipality of Anchorage AK Solid Waste Services Revenue

Series 2022-A

5.25%, 11/01/2062 | | | 4,000 | | | | 4,223,608 | |

| | | | | | | | |

| | | | | | | 6,230,616 | |

| | | | | | | | |

American Samoa – 0.0% | |

American Samoa Economic Development Authority

(Territory of American Samoa)

Series 2018

7.125%, 09/01/2038(b) | | | 135 | | | | 144,742 | |

| | | | | | | | |

|

Arizona – 2.3% | |

Arizona Industrial Development Authority

(AZIDA 2019-2)

Series 2019-2, Class A

3.625%, 05/20/2033 | | | 186 | | | | 176,739 | |

Arizona Industrial Development Authority

(Heritage Academy Laveen & Gateway Obligated Group)

Series 2021

5.00%, 07/01/2051(b) | | | 1,000 | | | | 922,538 | |

Arizona Industrial Development Authority

(KIPP NYC Public Charter Schools)

Series 2021-B

4.00%, 07/01/2061 | | | 1,000 | | | | 853,788 | |

Arizona Industrial Development Authority

(Legacy Cares, Inc.)

Series 2020

7.75%, 07/01/2050(d)(e)(f) | | | 1,000 | | | | 40,000 | |

| | |

| |

2 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Arizona Industrial Development Authority

(Pinecrest Academy of Nevada)

Series 2020-A

4.00%, 07/15/2050(b) | | $ | 100 | | | $ | 84,146 | |

Chandler Industrial Development Authority

(Intel Corp.)

Series 2022

5.00%, 09/01/2042 | | | 2,000 | | | | 2,047,866 | |

Series 2024

4.00%, 06/01/2049 | | | 2,000 | | | | 2,000,445 | |

City of Glendale AZ

(City of Glendale AZ COP)

Series 2021

2.222%, 07/01/2030 | | | 1,000 | | | | 883,804 | |

City of Tempe AZ

(City of Tempe AZ COP)

Series 2021

2.521%, 07/01/2036 | | | 1,000 | | | | 774,998 | |

Industrial Development Authority of the City of Phoenix Arizona (The)

(GreatHearts Arizona Obligated Group)

Series 2014

5.00%, 07/01/2044 | | | 100 | | | | 99,999 | |

Industrial Development Authority of the County of Pima (The)

(La Posada at Park Centre, Inc. Obligated Group)

Series 2022

6.75%, 11/15/2042(b) | | | 250 | | | | 274,068 | |

7.00%, 11/15/2057(b) | | | 250 | | | | 272,135 | |

Maricopa County Industrial Development Authority

(Commercial Metals Co.)

Series 2022

4.00%, 10/15/2047(b) | | | 600 | | | | 532,241 | |

Maricopa County Industrial Development Authority

(HonorHealth Obligated Group)

Series 2024-D

5.00%, 12/01/2042 | | | 1,000 | | | | 1,089,727 | |

Salt Verde Financial Corp.

(Citigroup, Inc.)

Series 2007

5.00%, 12/01/2032 | | | 2,000 | | | | 2,149,919 | |

Sierra Vista Industrial Development Authority

Series 2024

5.00%, 06/15/2044(b) | | | 1,000 | | | | 1,005,778 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 3 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Yuma Industrial Development Authority

AGC Series 2024

5.25%, 08/01/2043 | | $ | 1,250 | | | $ | 1,386,204 | |

| | | | | | | | |

| | | | | | | 14,594,395 | |

| | | | | | | | |

Arkansas – 0.3% | |

Arkansas Development Finance Authority

(Hybar LLC)

Series 2024

7.375%, 07/01/2048(b) | | | 1,300 | | | | 1,448,481 | |

Arkansas Development Finance Authority

(United States Steel Corp.)

Series 2022

5.45%, 09/01/2052 | | | 200 | | | | 207,372 | |

| | | | | | | | |

| | | | | | | 1,655,853 | |

| | | | | | | | |

California – 12.1% | |

Alameda Corridor Transportation Authority

Series 2022-A

0.00%, 10/01/2049(g) | | | 1,000 | | | | 573,620 | |

AGM Series 2024

Zero Coupon, 10/01/2053 | | | 1,000 | | | | 243,812 | |

Align Affordable Housing Bond Fund LP

(Park Landing LP)

Series 2022-2

5.66%, 08/01/2052 | | | 500 | | | | 499,092 | |

Align Affordable Housing Bond Fund LP

(SHI – Lake Worth LLC)

Series 2021

3.25%, 12/01/2051(b) | | | 1,000 | | | | 901,250 | |

ARC70 II TRUST

Series 2021

4.00%, 12/01/2059 | | | 300 | | | | 262,914 | |

Series 2023

4.84%, 04/01/2065(f)(h) | | | 1,905 | | | | 1,785,275 | |

Burbank-Glendale-Pasadena Airport Authority Brick Campaign

AGM Series 2024-B

4.50%, 07/01/2054 | | | 2,000 | | | | 1,970,195 | |

California Community Choice Financing Authority

Series 2024

5.00%, 02/01/2055(i) | | | 1,000 | | | | 1,069,378 | |

5.00%, 08/01/2055 | | | 2,000 | | | | 2,142,996 | |

California Community Choice Financing Authority

(American International Group, Inc.)

Series 2023-D

5.50%, 05/01/2054 | | | 2,000 | | | | 2,137,759 | |

| | |

| |

4 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

California Community Choice Financing Authority

(Deutsche Bank AG)

Series 2023

5.25%, 01/01/2054 | | $ | 4,445 | | | $ | 4,772,434 | |

California Community Choice Financing Authority

(Goldman Sachs Group, Inc. (The))

Series 2023

5.00%, 12/01/2053 | | | 1,000 | | | | 1,059,250 | |

California Community Choice Financing Authority

(Morgan Stanley)

Series 2023

4.866% (SOFR + 1.63%), 07/01/2053(c) | | | 2,000 | | | | 1,998,796 | |

5.00%, 07/01/2053(a)(b) | | | 10,000 | | | | 10,573,229 | |

California Community Housing Agency

(California Community Housing Agency Aster Apartments)

Series 2021-A

4.00%, 02/01/2056(b) | | | 1,000 | | | | 880,572 | |

California Community Housing Agency

(California Community Housing Agency Brio Apartments & Next on Lex Apartments)

Series 2021

4.00%, 02/01/2056(b) | | | 250 | | | | 212,731 | |

California Community Housing Agency

(California Community Housing Agency Fountains at Emerald Park)

Series 2021

3.00%, 08/01/2056(b) | | | 1,000 | | | | 736,428 | |

4.00%, 08/01/2046(b) | | | 495 | | | | 424,259 | |

California Community Housing Agency

(California Community Housing Agency Summit at Sausalito Apartments)

Series 2021

3.00%, 02/01/2057(b) | | | 1,000 | | | | 710,794 | |

California Community Housing Agency

(California Community Housing Agency Twin Creek Apartments)

Series 2022

Zero Coupon, 08/01/2065(b) | | | 2,500 | | | | 102,666 | |

5.50%, 02/01/2040(b) | | | 1,000 | | | | 904,584 | |

California Housing Finance Agency

Series 2019-2, Class A

4.00%, 03/20/2033 | | | 147 | | | | 148,355 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 5 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Series 2021-2, Class A

3.75%, 03/25/2035 | | $ | 959 | | | $ | 943,636 | |

Series 2021-2, Class X

0.82%, 03/25/2035(j) | | | 959 | | | | 42,161 | |

Series 2021-3, Class A

3.25%, 08/20/2036 | | | 239 | | | | 221,499 | |

Series 2021-3, Class X

0.77%, 08/20/2036(j) | | | 954 | | | | 46,393 | |

California Infrastructure & Economic Development Bank

(WFCS Holdings II LLC)

Series 2021

Zero Coupon, 01/01/2061(b) | | | 990 | | | | 77,529 | |

California Municipal Finance Authority

(CHF-Riverside II LLC)

Series 2019

5.00%, 05/15/2040 | | | 250 | | | | 260,901 | |

California Municipal Finance Authority

(Samuel Merritt University)

Series 2022

5.25%, 06/01/2053 | | | 1,000 | | | | 1,076,085 | |

California Pollution Control Financing Authority

(Poseidon Resources Channelside LP)

Series 2012

5.00%, 11/21/2045(b) | | | 250 | | | | 250,008 | |

Series 2023

5.00%, 07/01/2035(b) | | | 1,250 | | | | 1,357,473 | |

California Pollution Control Financing Authority

(San Diego County Water Authority Desalination Project Pipeline)

Series 2019

5.00%, 11/21/2045(b) | | | 1,000 | | | | 1,022,617 | |

California School Finance Authority

(Classical Academy Obligated Group)

Series 2022

5.00%, 10/01/2052(b) | | | 1,000 | | | | 1,001,887 | |

California Statewide Communities Development Authority

(Enloe Medical Center Obligated Group)

AGM Series 2022-A

5.375%, 08/15/2057 | | | 1,000 | | | | 1,073,108 | |

City of Los Angeles CA

Series 2024

5.00%, 06/26/2025 | | | 2,000 | | | | 2,024,849 | |

City of Los Angeles Department of Airports

Series 2020-C

5.00%, 05/15/2039 | | | 1,000 | | | | 1,046,136 | |

| | |

| |

6 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Series 2022

5.25%, 05/15/2047 | | $ | 2,000 | | | $ | 2,123,927 | |

CMFA Special Finance Agency

(CMFA Special Finance Agency Enclave)

Series 2022-A

4.00%, 08/01/2058(b) | | | 400 | | | | 318,965 | |

CMFA Special Finance Agency

(CMFA Special Finance Agency Latitude33)

Series 2021-A

3.00%, 12/01/2056(b) | | | 500 | | | | 353,167 | |

CMFA Special Finance Agency

(CMFA Special Finance Agency Solana at Grand)

Series 2021-A

4.00%, 08/01/2056(b) | | | 1,000 | | | | 888,998 | |

CMFA Special Finance Agency VIII Elan Huntington Beach

Series 2021

3.00%, 08/01/2056(b) | | | 1,000 | | | | 707,621 | |

County of Los Angeles CA

Series 2024

5.00%, 06/30/2025 | | | 2,000 | | | | 2,025,013 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority 777 Place-Pomona)

Series 2021

3.25%, 05/01/2057(b) | | | 500 | | | | 348,213 | |

4.00%, 05/01/2057(b) | | | 350 | | | | 250,647 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority 1818 Platinum Triangle-Anaheim)

Series 2021

3.25%, 04/01/2057(b) | | | 500 | | | | 365,125 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority Acacia on Santa Rosa Creek)

Series 2021

4.00%, 10/01/2056(b) | | | 1,000 | | | | 878,256 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority Altana Apartments)

Series 2021

4.00%, 10/01/2056(b) | | | 200 | | | | 162,699 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority Millennium South Bay-Hawthorne)

Series 2021

3.25%, 07/01/2056(b) | | | 1,000 | | | | 701,862 | |

4.00%, 07/01/2058(b) | | | 200 | | | | 140,805 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 7 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority

Oceanaire Apartments)

Series 2021

4.00%, 09/01/2056(b) | | $ | 500 | | | $ | 387,231 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority Park Crossing Apartments)

Series 2021

3.25%, 12/01/2058(b) | | | 800 | | | | 566,527 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority Pasadena Portfolio)

Series 2021

3.00%, 12/01/2056(b) | | | 1,000 | | | | 695,008 | |

4.00%, 12/01/2056(b) | | | 400 | | | | 300,627 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority The Crescent)

Series 2022

4.30%, 07/01/2059(b) | | | 500 | | | | 432,036 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority Union South Bay)

Series 2021-A2

4.00%, 07/01/2056(b) | | | 1,000 | | | | 816,591 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority Vineyard Gardens Apartments)

Series 2021

3.25%, 10/01/2058(b) | | | 1,000 | | | | 705,113 | |

CSCDA Community Improvement Authority

(CSCDA Community Improvement Authority Waterscape Apartments)

Series 2021-A

3.00%, 09/01/2056(b) | | | 1,000 | | | | 709,845 | |

Golden State Tobacco Securitization Corp.

Series 2021

3.85%, 06/01/2050 | | | 745 | | | | 684,414 | |

Series 2021-B

Zero Coupon, 06/01/2066 | | | 17,335 | | | | 1,875,791 | |

Los Angeles Unified School District/CA

Series 2024-A

5.00%, 07/01/2031 | | | 3,000 | | | | 3,449,237 | |

Northern California Energy Authority

(Pacific Mutual Holding Co.)

Series 2024

5.00%, 12/01/2054 | | | 2,000 | | | | 2,120,733 | |

| | |

| |

8 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

River Islands Public Financing Authority

(River Islands Public Financing Authority Community Facilities District No. 2003-1)

Series 2022

5.75%, 09/01/2052 | | $ | 1,000 | | | $ | 1,030,133 | |

San Francisco Intl Airport

Series 2019-A

5.00%, 05/01/2044 | | | 1,000 | | | | 1,028,786 | |

Series 2023-E

5.50%, 05/01/2040 | | | 1,315 | | | | 1,468,216 | |

Series 2024

5.00%, 05/01/2039 | | | 3,400 | | | | 3,649,547 | |

Southern California Public Power Authority

(American International Group, Inc.)

Series 2024-A

5.00%, 04/01/2055 | | | 1,400 | | | | 1,488,018 | |

State of California

Series 2024

4.00%, 08/01/2049 | | | 1,000 | | | | 1,003,058 | |

Tobacco Securitization Authority of Northern California

(Sacramento County Tobacco Securitization Corp.)

Series 2021

Zero Coupon, 06/01/2060 | | | 1,000 | | | | 162,624 | |

Tobacco Securitization Authority of Southern California

(San Diego County Tobacco Asset Securitization Corp.)

Series 2006

Zero Coupon, 06/01/2046 | | | 1,000 | | | | 226,976 | |

Yucaipa Valley Water District Financing Authority

(Yucaipa Valley Water District Water & Sewer Revenue)

Series 2024-A

5.00%, 06/01/2026 | | | 2,000 | | | | 2,054,255 | |

| | | | | | | | |

| | | | | | | 78,674,735 | |

| | | | | | | | |

Colorado – 2.5% | |

Aurora Highlands Community Authority Board

Series 2021-A

5.75%, 12/01/2051 | | | 500 | | | | 473,011 | |

Centerra Metropolitan District No. 1

Series 2022

6.50%, 12/01/2053 | | | 500 | | | | 514,329 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 9 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

City & County of Denver CO Airport System Revenue

(Denver Intl Airport)

Series 2018-A

5.00%, 12/01/2029 | | $ | 1,000 | | | $ | 1,053,611 | |

City & County of Denver CO Airport System Revenue

(United Airlines, Inc.)

Series 2017

5.00%, 10/01/2032 | | | 615 | | | | 615,096 | |

Colorado Educational & Cultural Facilities Authority

(James Irwin Educational Foundation Obligated Group)

Series 2022

5.00%, 09/01/2062 | | | 1,000 | | | | 996,973 | |

Colorado Educational & Cultural Facilities Authority

(Lighthouse Building Corp.)

Series 2021

4.00%, 10/01/2061 | | | 1,000 | | | | 781,238 | |

Colorado Health Facilities Authority

(Aberdeen Ridge, Inc. Obligated Group)

Series 2021-A

5.00%, 05/15/2049 | | | 100 | | | | 68,055 | |

Colorado Health Facilities Authority

(Christian Living Neighborhoods Obligated Group)

Series 2021

4.00%, 01/01/2042 | | | 1,000 | | | | 905,038 | |

Colorado Health Facilities Authority

(Frasier Meadows Manor, Inc. Obligated Group)

Series 2023-2

4.00%, 05/15/2041 | | | 100 | | | | 92,894 | |

Colorado Health Facilities Authority

(Intermountain Healthcare Obligated Group)

Series 2024-A

5.00%, 05/15/2054 | | | 2,000 | | | | 2,104,716 | |

Colorado State Education Loan Program

Series 2024-A

5.00%, 06/30/2025 | | | 4,000 | | | | 4,046,682 | |

Douglas County Housing Partnership

(Bridgewater Castle Rock ALF LLC)

Series 2021

5.375%, 01/01/2041(d)(e)(f) | | | 250 | | | | 187,500 | |

| | |

| |

10 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

E-470 Public Highway Authority

Series 2024-B

3.979% (SOFR + 0.75%), 09/01/2039(c) | | $ | 2,000 | | | $ | 1,999,629 | |

Johnstown Plaza Metropolitan District

Series 2022

4.25%, 12/01/2046 | | | 550 | | | | 492,933 | |

Platte River Metropolitan District

Series 2023-A

6.50%, 08/01/2053(b) | | | 210 | | | | 217,006 | |

St. Vrain Lakes Metropolitan District No. 4

Series 2024-A

0.00%, 09/20/2054(b)(g) | | | 1,000 | | | | 717,767 | |

Sterling Ranch Community Authority Board

(Sterling Ranch Metropolitan District No. 3)

Series 2022

6.50%, 12/01/2042 | | | 500 | | | | 531,595 | |

Vauxmont Metropolitan District

AGM Series 2019

5.00%, 12/15/2028 | | | 380 | | | | 392,078 | |

AGM Series 2020

5.00%, 12/01/2050 | | | 100 | | | | 103,340 | |

| | | | | | | | |

| | | | | | | 16,293,491 | |

| | | | | | | | |

Connecticut – 0.5% | |

City of New Haven CT

Series 2018-A

5.50%, 08/01/2038 | | | 615 | | | | 645,524 | |

Connecticut State Health & Educational Facilities Authority

(Yale University)

Series 2023-A

2.80%, 07/01/2048 | | | 2,200 | | | | 2,185,948 | |

Town of Hamden CT

(Whitney Center, Inc. Obligated Group)

Series 2022-A

7.00%, 01/01/2053 | | | 100 | | | | 108,739 | |

| | | | | | | | |

| | | | | | | 2,940,211 | |

| | | | | | | | |

District of Columbia – 1.6% | |

District of Columbia Income Tax Revenue

Series 2024-A

5.00%, 10/01/2037 | | | 3,500 | | | | 3,991,082 | |

District of Columbia Tobacco Settlement Financing Corp.

Series 2006

Zero Coupon, 06/15/2055 | | | 2,500 | | | | 254,508 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 11 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Metropolitan Washington Airports Authority Dulles Toll Road Revenue

Series 2009

Zero Coupon, 10/01/2037 | | $ | 10,000 | | | $ | 5,867,333 | |

| | | | | | | | |

| | | | | | | 10,112,923 | |

| | | | | | | | |

Florida – 5.8% | |

Bexley Community Development District

Series 2016

4.875%, 05/01/2047 | | | 100 | | | | 96,627 | |

Capital Projects Finance Authority/FL

Series 2024

5.00%, 06/15/2034(b) | | | 535 | | | | 546,862 | |

Capital Trust Agency, Inc.

(Educational Growth Fund LLC)

Series 2021

Zero Coupon, 07/01/2061(b) | | | 2,000 | | | | 139,784 | |

5.00%, 07/01/2056(b) | | | 1,090 | | | | 1,059,381 | |

City of Palmetto FL

(Renaissance Arts and Education, Inc.)

Series 2022

5.375%, 06/01/2057 | | | 1,000 | | | | 1,021,566 | |

City of Tampa FL

(State of Florida Cigarette Tax Revenue)

Series 2020-A

Zero Coupon, 09/01/2053 | | | 1,000 | | | | 245,549 | |

County of Lake FL

(Waterman Communities, Inc.)

Series 2020

5.75%, 08/15/2055 | | | 200 | | | | 200,380 | |

County of Lee FL Airport Revenue

Series 2024

5.25%, 10/01/2054 | | | 1,000 | | | | 1,060,895 | |

County of Miami-Dade FL

(County of Miami-Dade FL Non-Ad Valorem)

Series 2015-A

5.00%, 06/01/2028 | | | 780 | | | | 787,457 | |

County of Miami-Dade FL Aviation Revenue

Series 2015-A

5.00%, 10/01/2031 | | | 265 | | | | 267,450 | |

Series 2024-A

5.00%, 10/01/2034 | | | 5,400 | | | | 5,822,874 | |

County of Osceola FL Transportation Revenue

Series 2020-A

Zero Coupon, 10/01/2036 | | | 230 | | | | 136,154 | |

| | |

| |

12 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

County of Palm Beach FL

(Provident Group – LU Properties LLC)

Series 2024

6.00%, 06/01/2044 | | $ | 1,000 | | | $ | 1,009,365 | |

6.125%, 06/01/2054 | | | 1,000 | | | | 1,005,331 | |

County of Palm Beach FL

(Provident Group – LU Properties II LLC)

Series 2024

8.50%, 06/01/2033 | | | 100 | | | | 100,578 | |

County of Palm Beach FL

(Provident Group-PBAU Properties LLC)

Series 2019

5.00%, 04/01/2051(b) | | | 1,000 | | | | 946,697 | |

County of Palm Beach FL Airport System Revenue

Series 2024-B

5.25%, 10/01/2043(i) | | | 1,000 | | | | 1,084,549 | |

5.25%, 10/01/2044(i) | | | 1,100 | | | | 1,189,165 | |

County of Pasco FL

(H Lee Moffitt Cancer Center & Research Institute Obligated Group)

Series 2023

5.00%, 07/01/2030(b) | | | 3,000 | | | | 3,257,817 | |

Florida Development Finance Corp.

Series 2024

4.375%, 10/01/2054(b) | | | 1,000 | | | | 999,890 | |

Florida Development Finance Corp.

(Assistance Unlimited, Inc.)

Series 2022

6.00%, 08/15/2057(b) | | | 350 | | | | 350,825 | |

Florida Development Finance Corp.

(Brightline Trains Florida LLC)

AGM Series 2024

5.25%, 07/01/2047 | | | 2,500 | | | | 2,623,626 | |

Florida Development Finance Corp.

(Cornerstone Charter Academy, Inc. Obligated Group)

Series 2022

5.00%, 10/01/2042(b) | | | 1,000 | | | | 1,003,406 | |

Florida Development Finance Corp.

(Drs Kiran & Pallavi Patel 2017 Foundation for Global Understanding, Inc.)

Series 2021

4.00%, 07/01/2051(b) | | | 100 | | | | 86,013 | |

Florida Development Finance Corp.

(Seaside School Consortium, Inc.)

Series 2022

5.75%, 06/15/2047 | | | 1,000 | | | | 1,045,166 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 13 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Hillsborough County Aviation Authority

Series 2024

5.50%, 10/01/2054 | | $ | 1,000 | | | $ | 1,091,614 | |

Hillsborough County Industrial Development Authority

(BayCare Obligated Group)

Series 2024-C

4.125%, 11/15/2051 | | | 2,000 | | | | 1,926,648 | |

Jacksonville Transportation Authority

Series 2025

5.00%, 08/01/2027(i) | | | 1,000 | | | | 1,040,609 | |

Lee County Industrial Development Authority/FL

(Cypress Cove at Healthpark Florida Obligated Group)

Series 2022

5.25%, 10/01/2052 | | | 500 | | | | 463,534 | |

Miami-Dade County Educational Facilities Authority

Series 2025-B

5.25%, 04/01/2040(i) | | | 1,000 | | | | 1,112,390 | |

Miami-Dade County Industrial Development Authority

(AcadeMir Charter School Middle & Preparatory Academy Obligated Group)

Series 2022

5.50%, 07/01/2061(b) | | | 1,000 | | | | 1,013,016 | |

North Broward Hospital District

Series 2017-B

5.00%, 01/01/2037 | | | 100 | | | | 102,996 | |

Orange County Health Facilities Authority

(Presbyterian Retirement Communities, Inc. Obligated Group)

Series 2023

4.00%, 08/01/2042 | | | 1,000 | | | | 941,719 | |

Palm Beach County Educational Facilities Authority

(Palm Beach Atlantic University Obligated Group)

Series 2021

4.00%, 10/01/2041 | | | 1,000 | | | | 904,107 | |

Palm Beach County Health Facilities Authority

(Federation CCRC Operations Corp. Obligated Group)

Series 2022

4.25%, 06/01/2056 | | | 200 | | | | 170,428 | |

| | |

| |

14 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Palm Beach County Health Facilities Authority

(Green Cay Life Plan Village, Inc.)

Series 2022

11.50%, 07/01/2027(b) | | $ | 100 | | | $ | 126,874 | |

Pinellas County Industrial Development Authority

Series 2019

5.00%, 07/01/2039 | | | 1,000 | | | | 1,010,289 | |

School District of Broward County/FL

Series 2024

4.00%, 01/29/2025 | | | 1,000 | | | | 1,001,358 | |

Village Community Development District No. 13

(Village Community Development District No. 13 Phase I Series 2019 Special Assmnts)

Series 2019

3.55%, 05/01/2039 | | | 600 | | | | 554,847 | |

Village Community Development District No. 15

(Village Community Development District No. 15 Series 2023 Phase I Special Asmnts)

Series 2023

5.25%, 05/01/2054(b) | | | 100 | | | | 103,234 | |

| | | | | | | | |

| | | | | | | 37,651,070 | |

| | | | | | | | |

Georgia – 4.4% | |

Atlanta Development Authority (The)

(City of Atlanta GA Westside Tax Allocation District Gulch Area)

Series 2024

0.00%, 12/15/2048(b)(g) | | | 1,000 | | | | 835,074 | |

Series 2024-A

5.50%, 04/01/2039(b) | | | 1,000 | | | | 1,013,587 | |

Augusta Development Authority

(WellStar Health System Obligated Group)

Series 2018

5.00%, 07/01/2025 | | | 145 | | | | 146,281 | |

5.00%, 07/01/2031 | | | 1,065 | | | | 1,123,948 | |

DeKalb County Housing Authority

(HADC Avenues LLC)

Series 2023

6.17%, 06/01/2053(b) | | | 1,010 | | | | 974,121 | |

7.00%, 06/01/2041(b) | | | 235 | | | | 222,593 | |

Fayette County Development Authority

(United States Soccer Federation, Inc.)

Series 2024

5.25%, 10/01/2054 | | | 1,000 | | | | 1,063,556 | |

Main Street Natural Gas, Inc.

Series 2024-D

5.00%, 04/01/2054 | | | 1,000 | | | | 1,073,654 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 15 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Main Street Natural Gas, Inc.

(Citigroup, Inc.)

Series 2019-C

4.00%, 03/01/2050 | | $ | 3,215 | | | $ | 3,240,552 | |

Series 2023-A

5.00%, 06/01/2053 | | | 3,000 | | | | 3,187,302 | |

Main Street Natural Gas, Inc.

(Pre-refunded – Others)

Series 2019-B

4.00%, 08/01/2049 | | | 2,000 | | | | 2,000,732 | |

Main Street Natural Gas, Inc.

(Royal Bank of Canada)

Series 2023

4.929% (SOFR + 1.70%), 12/01/2053(c) | | | 2,000 | | | | 2,058,016 | |

Series 2023-B

5.00%, 07/01/2053 | | | 1,000 | | | | 1,059,824 | |

Municipal Electric Authority of Georgia

Series 2019

5.00%, 01/01/2038 | | | 100 | | | | 104,008 | |

5.00%, 01/01/2049 | | | 2,000 | | | | 2,040,794 | |

Series 2022

5.50%, 07/01/2063 | | | 1,500 | | | | 1,595,270 | |

AGM Series 2023

5.00%, 07/01/2064 | | | 1,000 | | | | 1,040,742 | |

Private Colleges & Universities Authority

(Emory University)

Series 2023

5.00%, 09/01/2033(b) | | | 5,000 | | | | 5,596,987 | |

| | | | | | | | |

| | | | | | | 28,377,041 | |

| | | | | | | | |

Guam – 0.3% | |

Antonio B Won Pat International Airport Authority

Series 2024-A

5.00%, 10/01/2029 | | | 1,300 | | | | 1,360,701 | |

Guam Power Authority

Series 2022-A

5.00%, 10/01/2043 | | | 500 | | | | 526,087 | |

Territory of Guam

Series 2019

5.00%, 11/15/2031 | | | 155 | | | | 157,417 | |

Territory of Guam

(Guam Section 30 Income Tax)

Series 2016-A

5.00%, 12/01/2046 | | | 200 | | | | 200,212 | |

| | | | | | | | |

| | | | | | | 2,244,417 | |

| | | | | | | | |

| | |

| |

16 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Hawaii – 0.4% | |

City & County Honolulu HI Wastewater System Revenue

Series 2025

5.00%, 07/01/2035(i) | | $ | 2,000 | | | $ | 2,279,092 | |

| | | | | | | | |

|

Idaho – 0.2% | |

Idaho Health Facilities Authority

(North Canyon Medical Center, Inc.)

Series 2023

7.125%, 11/01/2057 | | | 1,000 | | | | 1,087,015 | |

| | | | | | | | |

|

Illinois – 4.9% | |

Chicago Board of Education

Series 2012-A

5.00%, 12/01/2042 | | | 240 | | | | 235,521 | |

Series 2012-B

5.00%, 12/01/2033 | | | 1,000 | | | | 1,000,375 | |

Series 2019-A

5.00%, 12/01/2029 | | | 100 | | | | 104,296 | |

5.00%, 12/01/2030 | | | 100 | | | | 103,590 | |

Series 2019-B

5.00%, 12/01/2033 | | | 100 | | | | 102,651 | |

Series 2021-A

5.00%, 12/01/2033 | | | 1,000 | | | | 1,034,053 | |

Chicago O’Hare International Airport

Series 2024-A

5.50%, 01/01/2059 | | | 3,000 | | | | 3,224,947 | |

Series 2024-C

5.25%, 01/01/2042 | | | 2,000 | | | | 2,181,632 | |

Series 2024-E

5.00%, 01/01/2029 | | | 1,000 | | | | 1,055,697 | |

Chicago O’Hare International Airport

(Pre-refunded – US Treasuries)

Series 2015

5.00%, 01/01/2027 | | | 2,000 | | | | 2,003,688 | |

Series 2015-C

5.00%, 01/01/2034 | | | 335 | | | | 335,618 | |

County of Cook IL

Series 2021-B

4.00%, 11/15/2025 | | | 1,000 | | | | 1,007,043 | |

Illinois Finance Authority

(DePaul College Prep)

Series 2023

5.625%, 08/01/2053(b) | | | 1,000 | | | | 1,065,789 | |

Illinois Finance Authority

(Illinois Institute of Technology)

Series 2019

4.00%, 09/01/2035 | | | 100 | | | | 89,765 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 17 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Illinois Finance Authority

(Lake Forest College)

Series 2022-A

5.50%, 10/01/2047 | | $ | 1,000 | | | $ | 1,033,748 | |

Illinois Finance Authority

(Park Place of Elmhurst Obligated Group)

Series 2021

5.125%, 05/15/2060 | | | 76 | | | | 41,012 | |

Illinois Finance Authority

(Silver Cross Hospital Obligated Group)

Series 2015-C

5.00%, 08/15/2035 | | | 250 | | | | 251,852 | |

Illinois Housing Development Authority

(Drexel Court & Lake Park East)

Series 2022

7.17%, 11/01/2038 | | | 100 | | | | 103,686 | |

Series 2024

5.67%, 11/01/2038(f) | | | 955 | | | | 952,782 | |

Illinois State Toll Highway Authority

Series 2009

6.184%, 01/01/2034 | | | 1,000 | | | | 1,058,855 | |

Series 2019-A

5.00%, 01/01/2026 | | | 1,500 | | | | 1,533,208 | |

Metropolitan Pier & Exposition Authority

Series 2015-B

5.00%, 12/15/2045 | | | 600 | | | | 603,439 | |

Series 2017

0.00%, 12/15/2042(g) | | | 1,000 | | | | 726,189 | |

Metropolitan Pier & Exposition Authority

(Metropolitan Pier & Exposition Authority Lease)

Series 2020

5.00%, 06/15/2042 | | | 640 | | | | 668,361 | |

State of Illinois

Series 2010

7.35%, 07/01/2035 | | | 196 | | | | 213,191 | |

Series 2017-D

5.00%, 11/01/2026 | | | 930 | | | | 961,262 | |

Series 2018-A

5.00%, 10/01/2027 | | | 1,000 | | | | 1,050,013 | |

Series 2022-A

5.50%, 03/01/2047 | | | 1,000 | | | | 1,078,950 | |

Series 2022-C

5.50%, 10/01/2045 | | | 1,000 | | | | 1,087,155 | |

Series 2024

5.00%, 02/01/2026 | | | 1,000 | | | | 1,019,301 | |

5.00%, 02/01/2031 | | | 1,345 | | | | 1,461,815 | |

| | |

| |

18 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Series 2024-B

4.25%, 05/01/2046 | | $ | 1,000 | | | $ | 961,094 | |

5.00%, 05/01/2038 | | | 1,000 | | | | 1,091,349 | |

5.25%, 05/01/2043 | | | 1,000 | | | | 1,086,526 | |

State of Illinois Sales Tax Revenue

Series 2021

5.00%, 06/15/2025 | | | 1,000 | | | | 1,009,891 | |

| | | | | | | | |

| | | | | | | 31,538,344 | |

| | | | | | | | |

Indiana – 3.2% | |

City of Valparaiso IN

(Green Oaks of Valparaiso LLC)

Series 2021

5.375%, 12/01/2041(b) | | | 150 | | | | 122,816 | |

City of Whiting IN

(BP PLC)

Series 2023

4.40%, 11/01/2045 | | | 1,000 | | | | 1,029,527 | |

Indiana Finance Authority

Series 2024

5.00%, 07/01/2054 | | | 1,000 | | | | 1,015,333 | |

Indiana Finance Authority

(Brightmark Plastics Renewal Indiana LLC)

Series 2019

7.00%, 03/01/2039(f) | | | 1,070 | | | | 501,593 | |

Indiana Finance Authority

(CWA Authority, Inc.)

Series 2024

5.00%, 10/01/2045 | | | 1,000 | | | | 1,084,696 | |

Indiana Finance Authority

(Good Samaritan Hospital Obligated Group)

Series 2022

5.00%, 04/01/2029 | | | 100 | | | | 104,824 | |

Indiana Finance Authority

(Greencroft Goshen Obligated Group)

Series 2021

4.00%, 11/15/2043 | | | 1,000 | | | | 894,071 | |

Series 2023-2

4.00%, 11/15/2037 | | | 100 | | | | 96,053 | |

Indiana Finance Authority

(Marquette Manor)

Series 2015-A

5.00%, 03/01/2030 | | | 190 | | | | 190,438 | |

Indiana Finance Authority

(Ohio Valley Electric Corp.)

Series 2021-B

2.50%, 11/01/2030 | | | 165 | | | | 151,127 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 19 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Indiana Finance Authority

(Parkview Health System Obligated Group)

Series 2024-B

4.084% (SOFR + 0.71%), 11/01/2046(c)(f) | | $ | 9,825 | | | $ | 9,811,443 | |

Indiana Finance Authority

(University of Evansville)

Series 2022

5.25%, 09/01/2057 | | | 1,000 | | | | 1,001,991 | |

Indiana Housing & Community Development Authority

(Vita of Marion LLC)

Series 2021-A

5.25%, 04/01/2041(b) | | | 1,000 | | | | 839,329 | |

Indianapolis Local Public Improvement Bond Bank

(Pan Am Plaza Hotel)

Series 2023

5.75%, 03/01/2043 | | | 330 | | | | 358,950 | |

6.00%, 03/01/2053 | | | 250 | | | | 271,602 | |

Series 2023-F

7.75%, 03/01/2067 | | | 250 | | | | 282,874 | |

BAM Series 2023

5.25%, 03/01/2067 | | | 3,000 | | | | 3,173,697 | |

| | | | | | | | |

| | | | | | | 20,930,364 | |

| | | | | | | | |

Iowa – 1.0% | |

Iowa Finance Authority

Series 2022-E

4.181% (SOFR + 0.80%), 01/01/2052(c) | | | 5,000 | | | | 5,001,459 | |

Iowa Finance Authority

(Wesley Retirement Services, Inc. Obligated Group)

Series 2021

4.00%, 12/01/2031 | | | 100 | | | | 95,051 | |

4.00%, 12/01/2041 | | | 170 | | | | 144,011 | |

4.00%, 12/01/2046 | | | 115 | | | | 92,730 | |

4.00%, 12/01/2051 | | | 205 | | | | 160,044 | |

PEFA, Inc.

(Goldman Sachs Group, Inc. (The))

Series 2019

5.00%, 09/01/2049 | | | 1,000 | | | | 1,022,977 | |

| | | | | | | | |

| | | | | | | 6,516,272 | |

| | | | | | | | |

Kansas – 0.2% | |

City of Colby KS

(Citizens Medical Center, Inc.)

Series 2024

5.50%, 07/01/2026 | | | 1,000 | | | | 1,002,985 | |

| | |

| |

20 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

City of Overland Park KS Sales Tax Revenue

Series 2022

6.00%, 11/15/2034(b) | | $ | 100 | | | $ | 102,236 | |

6.50%, 11/15/2042(b) | | | 300 | | | | 306,240 | |

| | | | | | | | |

| | | | | | | 1,411,461 | |

| | | | | | | | |

Kentucky – 0.9% | |

City of Ashland KY

(Royal Blue Health LLC Obligated Group)

Series 2019

4.00%, 02/01/2034 | | | 385 | | | | 373,770 | |

City of Henderson KY

(Pratt Paper KY LLC)

Series 2022

3.70%, 01/01/2032(b) | | | 280 | | | | 274,208 | |

Kenton County Airport Board

Series 2024-A

5.25%, 01/01/2049 | | | 2,000 | | | | 2,125,091 | |

Kentucky Economic Development Finance Authority

(Baptist Healthcare System Obligated Group)

Series 2017-B

5.00%, 08/15/2037 | | | 175 | | | | 180,646 | |

Kentucky Economic Development Finance Authority

(Carmel Manor, Inc.)

Series 2022

4.50%, 10/01/2027 | | | 1,000 | | | | 1,000,116 | |

Kentucky Economic Development Finance Authority

(CommonSpirit Health)

Series 2019-A

4.00%, 08/01/2039 | | | 160 | | | | 156,536 | |

Kentucky Economic Development Finance Authority

(Masonic Homes of Kentucky, Inc. Obligated Group)

Series 2012

5.375%, 11/15/2042 | | | 65 | | | | 54,923 | |

Kentucky Economic Development Finance Authority

(Owensboro Health, Inc. Obligated Group)

Series 2017-A

5.00%, 06/01/2037 | | | 425 | | | | 431,660 | |

Kentucky Housing Corp.

(Churchill Park LLLP)

Series 2022-A

4.65%, 05/01/2025(b) | | | 130 | | | | 130,071 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 21 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

5.75%, 11/01/2040(b) | | $ | 600 | | | $ | 615,115 | |

Series 2022-B

6.75%, 11/01/2040(b) | | | 100 | | | | 102,415 | |

Louisville/Jefferson County Metropolitan Government

(Norton Healthcare Obligated Group)

Series 2016

5.00%, 10/01/2033 | | | 225 | | | | 229,030 | |

| | | | | | | | |

| | | | | | | 5,673,581 | |

| | | | | | | | |

Louisiana – 1.8% | |

City of New Orleans LA Water System Revenue

(Pre-refunded – US Govt Agencies)

Series 2014

5.00%, 12/01/2034 | | | 100 | | | | 100,117 | |

Louisiana Local Government Environmental Facilities & Community Development Auth

(Louisiana Utilities Restoration Corp. ELL System Restoration Revenue)

Series 2023

5.048%, 12/01/2034 | | | 1,000 | | | | 1,010,385 | |

Louisiana Local Government Environmental Facilities & Community Development Auth

(Woman’s Hospital Foundation)

Series 2017

5.00%, 10/01/2036 | | | 675 | | | | 695,054 | |

Louisiana Public Facilities Authority

(Calcasieu Bridge Partners LLC)

Series 2024

5.00%, 09/01/2066 | | | 1,000 | | | | 1,020,183 | |

5.75%, 09/01/2064 | | | 2,000 | | | | 2,163,699 | |

Louisiana Public Facilities Authority

(ElementUS Minerals LLC)

Series 2023

5.00%, 10/01/2043(b) | | | 2,000 | | | | 2,015,489 | |

Louisiana Public Facilities Authority

(Geo Prep Mid-City of Greater Baton Rouge)

Series 2022

6.125%, 06/01/2052(b) | | | 1,025 | | | | 1,059,355 | |

Louisiana Public Facilities Authority

(Louisiana Pellets, Inc.)

Series 2014-A

7.50%, 07/01/2023(d)(k) | | | 250 | | | | 3 | |

Louisiana Public Facilities Authority

(Louisiana State University & Agricultural & Mechanical College Auxiliary Revenue)

Series 2019

5.00%, 07/01/2059 | | | 1,335 | | | | 1,349,302 | |

| | |

| |

22 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

New Orleans Aviation Board

Series 2017-B

5.00%, 01/01/2043 | | $ | 215 | | | $ | 216,087 | |

Series 2024

5.00%, 01/01/2035(i) | | | 1,000 | | | | 1,063,480 | |

State of Louisiana Gasoline & Fuels Tax Revenue

Series 2022-A

3.874% (SOFR + 0.50%), 05/01/2043(c) | | | 980 | | | | 976,192 | |

| | | | | | | | |

| | | | | | | 11,669,346 | |

| | | | | | | | |

Maine – 0.0% | |

Finance Authority of Maine

(Casella Waste Systems, Inc.)

Series 2017

5.25%, 01/01/2025(b) | | | 100 | | | | 100,205 | |

| | | | | | | | |

|

Maryland – 1.3% | |

Maryland Economic Development Corp.

(Air Cargo Obligated Group)

Series 2019

4.00%, 07/01/2044 | | | 600 | | | | 545,849 | |

Maryland Economic Development Corp.

(Maryland Economic Development Corp. Morgan View & Thurgood Marshall Student Hsg)

Series 2022

6.00%, 07/01/2058 | | | 1,000 | | | | 1,100,430 | |

Maryland Economic Development Corp.

(Purple Line Transit Partners LLC)

Series 2022

5.25%, 06/30/2052 | | | 1,000 | | | | 1,040,095 | |

Maryland Health & Higher Educational Facilities Authority

(Adventist Healthcare Obligated Group)

Series 2021

5.00%, 01/01/2036 | | | 500 | | | | 520,290 | |

Maryland Stadium Authority

Series 2024

5.00%, 06/01/2038 | | | 2,000 | | | | 2,247,995 | |

Maryland Stadium Authority

(Baltimore City Public School Construction Financing Fund)

Series 2020

5.00%, 05/01/2050 | | | 1,500 | | | | 1,661,940 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 23 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

State of Maryland Department of Transportation

Series 2017

5.00%, 05/01/2026 | | $ | 1,315 | | | $ | 1,327,123 | |

| | | | | | | | |

| | | | | | | 8,443,722 | |

| | | | | | | | |

Massachusetts – 2.5% | |

City of Quincy MA

Series 2024

5.00%, 07/25/2025 | | | 2,000 | | | | 2,029,040 | |

Commonwealth of Massachusetts

Series 2024-B

5.00%, 05/01/2054 | | | 10,000 | | | | 10,733,849 | |

Commonwealth of Massachusetts Transportation Fund Revenue

Series 2023-B

5.00%, 06/01/2051 | | | 2,000 | | | | 2,140,150 | |

Massachusetts Bay Transportation Authority Sales Tax Revenue

Series 2024-A

5.25%, 07/01/2052 | | | 1,000 | | | | 1,100,699 | |

| | | | | | | | |

| | | | | | | 16,003,738 | |

| | | | | | | | |

Michigan – 1.6% | |

City of Detroit MI

Series 2014-B

4.00%, 04/01/2044(g) | | | 245 | | | | 193,347 | |

Series 2018

5.00%, 04/01/2038 | | | 75 | | | | 77,255 | |

Series 2021-A

5.00%, 04/01/2046 | | | 2,000 | | | | 2,067,267 | |

Series 2021-B

3.644%, 04/01/2034 | | | 200 | | | | 173,657 | |

City of Detroit MI Sewage Disposal System Revenue

(Great Lakes Water Authority Sewage Disposal System Revenue)

AGM Series 2006-D

3.853% (CME Term SOFR 3 Month + 0.60%), 07/01/2032(c) | | | 1,000 | | | | 979,005 | |

Great Lakes Water Authority Water Supply System Revenue

Series 2016-C

5.00%, 07/01/2025 | | | 1,000 | | | | 1,011,747 | |

Michigan Finance Authority

Series 2024-A

5.00%, 08/20/2025 | | | 1,250 | | | | 1,265,825 | |

| | |

| |

24 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Michigan Finance Authority

(Corewell Health Obligated Group)

Series 2016

5.00%, 11/01/2044 | | $ | 1,000 | | | $ | 1,005,517 | |

Michigan Finance Authority

(Michigan Finance Authority Tobacco Settlement Revenue)

Series 2020-A

3.267%, 06/01/2039 | | | 1,000 | | | | 933,667 | |

Michigan Finance Authority

(Trinity Health Corp.)

Series 2015

5.00%, 12/01/2024 | | | 1,000 | | | | 1,001,128 | |

Michigan Strategic Fund

(Michigan Strategic Fund – I 75 Improvement Project)

AGM Series 2018

4.125%, 06/30/2035 | | | 1,610 | | | | 1,594,057 | |

Michigan Tobacco Settlement Finance Authority

(Tobacco Settlement Financing Corp./MI)

Series 2008-C

Zero Coupon, 06/01/2058 | | | 7,750 | | | | 230,870 | |

| | | | | | | | |

| | | | | | | 10,533,342 | |

| | | | | | | | |

Minnesota – 1.3% | |

City of Bloomington MN

Series 2024-A

6.18%, 07/01/2041(b) | | | 1,000 | | | | 1,002,573 | |

City of Brooklyn Park MN

(Brooklyn Park AH I LLLP)

Series 2023

6.205%, 01/01/2042(b)(g) | | | 1,000 | | | | 1,038,646 | |

City of Brooklyn Park MN

(Brooklyn Park AH II LLLP)

Series 2024

6.26%, 07/01/2041(b) | | | 1,000 | | | | 1,006,895 | |

City of Columbus MN

(Adalyn Avenue LLLP)

Series 2023

5.98%, 12/01/2041(b) | | | 1,000 | | | | 1,023,638 | |

City of St. Cloud MN

(CentraCare Health System Obligated Group)

Series 2024

5.00%, 05/01/2042 | | | 1,000 | | | | 1,088,442 | |

| | |

| |

| abfunds.com | | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | 25 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Dakota County Community Development Agency

(Rosemont AH I LLLP)

Series 2023

5.30%, 07/01/2028(b) | | $ | 215 | | | $ | 214,835 | |

5.66%, 07/01/2041(b) | | | 585 | | | | 584,136 | |

Duluth Economic Development Authority

(Benedictine Health System Obligated Group)

Series 2021

4.00%, 07/01/2036 | | | 100 | | | | 91,055 | |

4.00%, 07/01/2041 | | | 100 | | | | 84,647 | |

Housing & Redevelopment Authority of The City of St. Paul Minnesota

(Minnesota Math & Science Academy)

Series 2021

4.00%, 06/01/2051(f) | | | 100 | | | | 71,512 | |

4.00%, 06/01/2056(f) | | | 100 | | | | 69,108 | |

Minneapolis-St. Paul Metropolitan Airports Commission

Series 2024

5.00%, 01/01/2041 | | | 1,000 | | | | 1,049,382 | |

Minnesota Municipal Gas Agency

(Royal Bank of Canada)

Series 2022-A

4.00%, 12/01/2052 | | | 1,000 | | | | 1,009,742 | |

| | | | | | | | |

| | | | | | | 8,334,611 | |

| | | | | | | | |

Mississippi – 0.3% | |

Mississippi Business Finance Corp.

(Alden Group Renewable Energy Mississippi LLC)

Series 2022

8.00%, 12/01/2029(f) | | | 500 | | | | 508,116 | |

Mississippi Development Bank

(Magnolia Regional Health Center)

Series 2021

4.00%, 10/01/2035(b) | | | 1,800 | | | | 1,597,939 | |

| | | | | | | | |

| | | | | | | 2,106,055 | |

| | | | | | | | |

Missouri – 0.2% | |

County of Jackson MO

Series 2014

5.00%, 12/01/2024 | | | 1,010 | | | | 1,010,994 | |

Kansas City Industrial Development Authority

(Platte Purchase Project)

Series 2019

5.00%, 07/01/2040(b) | | | 165 | | | | 150,881 | |

| | |

| |

26 | AB TAX-AWARE FIXED INCOME OPPORTUNITIES PORTFOLIO | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Lee’s Summit Industrial Development Authority

(John Knox Village Obligated Group)

Series 2021-A

5.00%, 08/15/2056 | | $ | 300 | | | $ | 277,183 | |

Taney County Industrial Development Authority

(Taney County Industrial Development Authority Lease)