UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-00537

Franklin Custodian Funds

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: 9/30

Date of reporting period: 9/30/15

Item 1. Reports to Stockholders.

| |

| Contents | |

| Annual Report | |

| Economic and Market Overview | 3 |

| Franklin DynaTech Fund | 4 |

| Franklin Growth Fund | 14 |

| Franklin Income Fund | 24 |

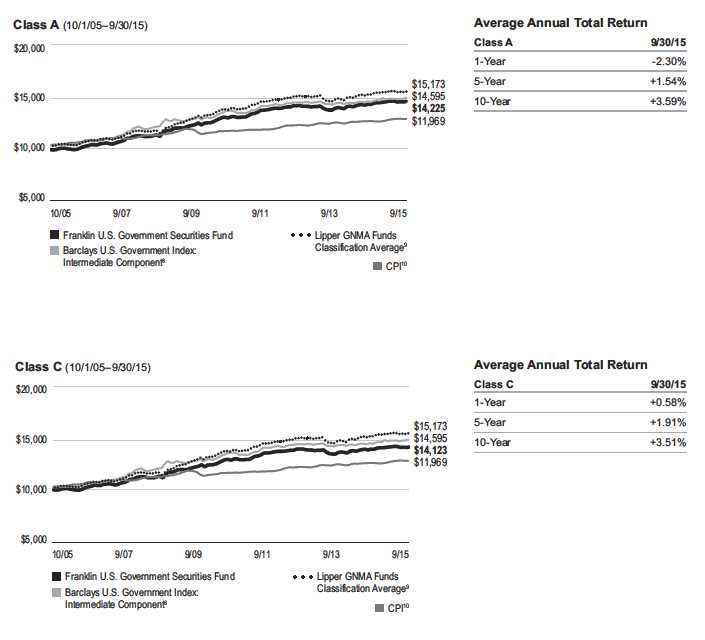

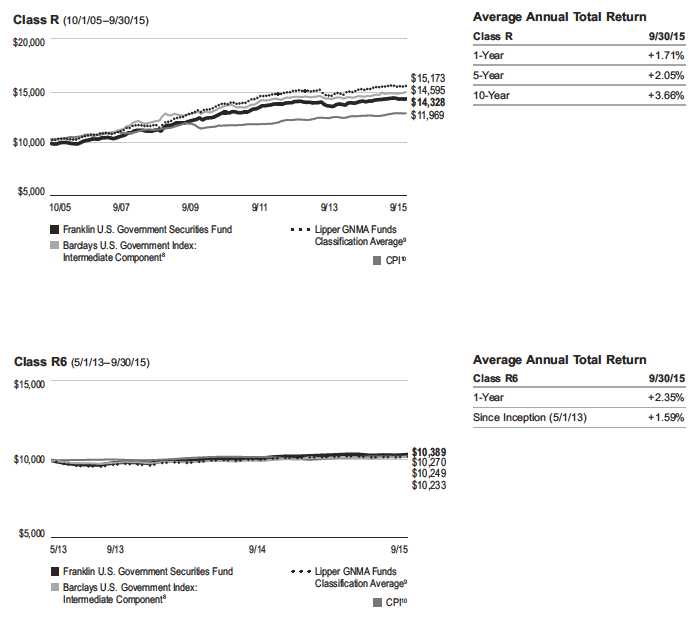

| Franklin U.S. Government Securities Fund | 35 |

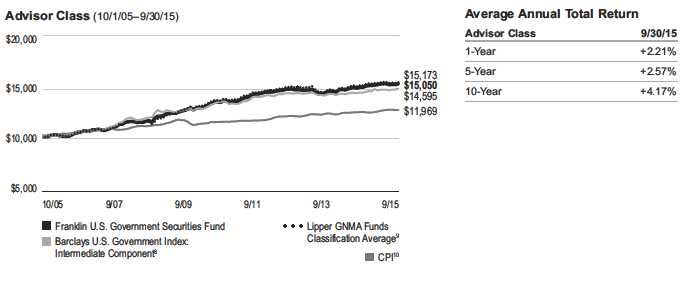

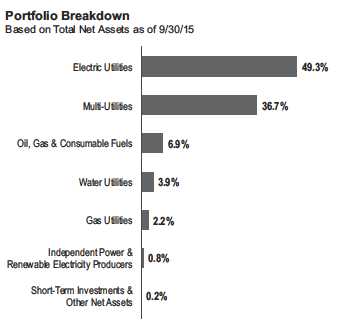

| Franklin Utilities Fund | 44 |

| Financial Highlights and Statements of Investments | 53 |

| Financial Statements | 109 |

| Notes to Financial Statements | 118 |

| Report of Independent Registered | |

| Public Accounting Firm | 137 |

| Tax Information | 138 |

| Board Members and Officers | 139 |

| Shareholder Information | 144 |

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

|

2 Annual Report

franklintempleton.com

Annual Report

Economic and Market Overview

U.S. economic growth was mixed during the 12 months under review. Growth expanded in 2014’s fourth quarter, slowed in 2015’s first quarter and rebounded in 2015’s second quarter. Additionally, estimates indicated tepid third-quarter growth despite healthy consumer spending as businesses cut back on inventories, exports declined and governments reduced their spending. Manufacturing and service activities expanded during the 12-month period, contributing to new jobs, and the unemployment rate declined from 5.9% in September 2014 to 5.1% at period-end.1 Housing market data were generally encouraging as home sales and prices rose amid declining mortgage rates. Retail sales generally rose for the 12-month period as strong employment gains led to broad-based improvement, especially for auto and auto components sales. Inflation, as measured by the Consumer Price Index, remained subdued for the period and declined toward period-end mainly due to a sharp drop in energy prices.

The Federal Reserve (Fed) ended its bond buying program in October 2014 and kept its target interest rate at 0%–0.25% while considering when an increase might be appropriate. Although global financial markets anticipated an increase, in September the Fed kept interest rates unchanged and said it would continue to monitor developments domestically and abroad. The Fed also raised its forecast for 2015 U.S. economic growth and lowered its unemployment projections.

Investor confidence grew during the period as corporate profits remained healthy, the Fed kept its target interest rate low, economic data in Europe improved, China introduced more stimulus measures and Greece reached an agreement with its international creditors. However, the U.S. stock market endured some sell-offs when many investors reacted to geopolitical tensions in certain regions, Greece’s debt negotiations and ongoing uncertainty over the Fed’s timing for raising interest rates. Less robust growth in China as well as devaluation of the renminbi also affected equity markets. U.S. stocks retreated overall for the 12 months under review as the Standard & Poor’s 500 Index and the Dow Jones Industrial Average declined from all-time highs reached in May.

The foregoing information reflects our analysis and opinions as of September 30, 2015. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

franklintempleton.com

Annual Report

3

Franklin DynaTech Fund

This annual report for Franklin DynaTech Fund covers the fiscal year ended September 30, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation by investing primarily in equity securities of companies that emphasize innovation and new technologies, and that benefit from new industry conditions in the dynamically changing global economy.

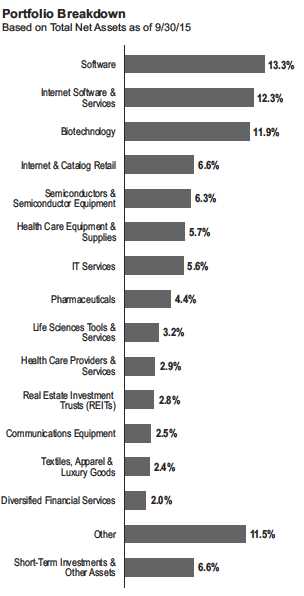

Performance Overview

The Fund’s Class A shares delivered a +3.40% cumulative total return for the 12 months under review. In comparison, the Russell 1000® Growth Index, which measures performance of the largest companies in the Russell 3000® Index with higher price-to-book ratios and higher forecasted growth values, generated a total return of +3.17%.1 Also for comparison, the broad U.S. stock market as measured by the Standard & Poor’s 500 Index (S&P 500®), had a -0.61% total return, and domestic and international-based stocks as measured by the NASDAQ Composite Index® posted a +4.00% total return.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

The Fund’s health care holdings contributed notably to absolute performance during the reporting period.2 Shares of medical device maker DexCom rose given growing use of its continuous glucose monitors and market interest about approval by the U.S. Food and Drug Administration (FDA) of related product enhancements expected to help the company capture a greater share of this expanding market. Biopharmaceutical firm Incyte Therapeutic’s stock performed well amid enthusiasm for its immuno-oncology agent epacadostat that has shown encouraging test results as a treatment for melanoma. Positive test data for the company’s arthritis drug baricitinib and FDA approval of Jakafi for treatment of polycythemia vera also fueled investor optimism. Shares of UnitedHealth Group, a health care provider, rose resulting from stable medical cost trends and solid underwriting for its managed care business, increased customer use of its health services platform products in an expanding market, and its acquisition of pharmacy benefit manager Catamaran.

The Fund’s information technology (IT) positions also substantially supported results.3 Palo Alto Networks, a provider of next generation network and PC security solutions, benefited in fiscal year 2015 from growing sales of its strong product portfolio and from a variety of high profile cyberattacks that helped to expand the market. Shares of Visa, a global payments technology firm, rose in response to news the company might purchase Visa Europe, as well as from solid cross-border traffic and increased currency translation that supported stronger-than-expected revenue. MasterCard, another global payments firm, experienced success in the domestic commercial credit business, taking market share from American

1. Source: Morningstar.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell

Investment Group.

2. The health care sector comprises biotechnology, health care equipment and supplies, health care providers and services, health care technology, life sciences tools and

services, and pharmaceuticals in the SOI.

3. The IT sector comprises communications equipment; electronic equipment, instruments and components; Internet software and services; IT services; semiconductors and

semiconductor equipment; software; and technology hardware, storage and peripherals in the SOI.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 58.

4 Annual Report franklintempleton.com

FRANKLIN DYNATECH FUND

Express and Visa. The company reported strong long-term revenue guidance based on solid underlying fundamentals.

The Fund’s consumer discretionary and materials sector holdings also aided performance.4 In consumer discretionary, online retail shopping service provider Amazon.com reported strong, sustained revenue growth in core domestic retail, including Amazon Prime customers, and better-than-expected profits for its new Amazon Web Services cloud computing business. Additionally, the company improved its fixed and variable costs through lower shipping expenses, better utilization of fulfillment centers and growing use of third-party sellers. NIKE is exposed to the best secular growth area in the apparel industry and is a leader in the growing athletic category. It has a proven category strategy driven by innovation and marketing that has worked tremendously in the U.S. and is now being replicated across the globe. In other sectors, shares of Cytec Industries,5 a specialty materials and chemicals company, performed well due to an announced acquisition by Belgium-based Solvay at a premium to Cytec’s share price.

In contrast, the Fund’s energy sector holdings weighed on absolute performance.6 The decline in crude oil and natural gas prices was driven by supply growth exceeding slowing demand growth, which resulted in reduced capital spending and lower forecasted volume growth for energy and production companies. In this environment, Anadarko Petroleum increased production to consistently exceed guidance and sold assets to generate cash reserves for the company’s long-term health. The sell-off in oilfield services stocks was broad-based as investors became more fearful of protracted lower oil prices and spending levels. Diversified oilfield service companies FMC Technologies5 and Schlumberger outperformed smaller companies in their industry, although companies with greater offshore exposure like FMC Technologies lost value as investors believed that offshore spending would remain depressed for several years. However, we believe offshore spending is likely to be more resilient than most expect. FMC Technologies and Schlumberger are leaders in their primary markets and should be well positioned if spending recovers, in our view.

Some of the Fund’s positions in the industrials sector also hindered performance.7 Flowserve’s stock declined based on concerns about oil and gas markets, as energy market activity

affected a significant portion of the company’s total sales and the stock itself was correlated with oil prices.5 The company’s second-quarter earnings met analyst expectations, but sales and orders declined more than anticipated.

In other sectors, shares of Gilead Sciences were flat following a doubling of stock value in the prior year. The company lowered the price of Harvoni, one of its hepatitis C medicines, to

4. The consumer discretionary sector comprises Internet and catalog retail; media; and textiles, apparel and luxury goods in the SOI. The materials sector holdings were

sold by period-end.

5. Sold by period-end.

6. The energy sector comprises energy equipment and services; and oil, gas and consumable fuels in the SOI.

7. The industrials sector comprises aerospace and defense, air freight and logistics, commercial services and supplies, and electrical equipment in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

|

franklintempleton.com Annual Report 5

| | |

| FRANKLIN DYNATECH FUND | | |

| |

| |

| |

| |

| Top 10 Holdings | | |

| 9/30/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| |

| Google Inc., A & C | 4.3 | % |

| Internet Software & Services | | |

| Amazon.com Inc. | 3.8 | % |

| Internet & Catalog Retail | | |

| Facebook Inc., A | 3.3 | % |

| Internet Software & Services | | |

| MasterCard Inc., A | 2.8 | % |

| IT Services | | |

| Celgene Corp. | 2.6 | % |

| Biotechnology | | |

| Visa Inc., A | 2.6 | % |

| IT Services | | |

| Allergan PLC | 2.5 | % |

| Pharmaceuticals | | |

| Gilead Sciences Inc. | 2.2 | % |

| Biotechnology | | |

| Palo Alto Networks Inc. | 2.2 | % |

| Communications Equipment | | |

| Salesforce.com Inc. | 1.8 | % |

| Software | | |

protect its market share after Abbvie launched a competing drug in December, and sales of Harvoni declined after peaking in March. After earning profits in fiscal year 2014, online user-generated review database provider Yelp reported operating losses based largely on slowing user growth, U.S. market saturation and competition from rivals.5 Chinese Internet search provider Baidu also earned growing profits in 2014, but earnings decreased in 2015 as it sought to expand new markets such as food delivery and group purchases for dining and movie tickets. Social media provider Twitter experienced net losses despite growing revenue as it recognized the need to increase its audience.5

As managers of Franklin DynaTech Fund, at period-end we remained encouraged by the relative abundance of companies that we believe have strong long-term growth prospects trading at what we perceive to be attractive valuations. We believe it is these innovative, thought-leading companies that may promote economic advancement over the longer term.

Thank you for your continued participation in Franklin DynaTech Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of September 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

|

6 Annual Report

franklintempleton.com

FRANKLIN DYNATECH FUND

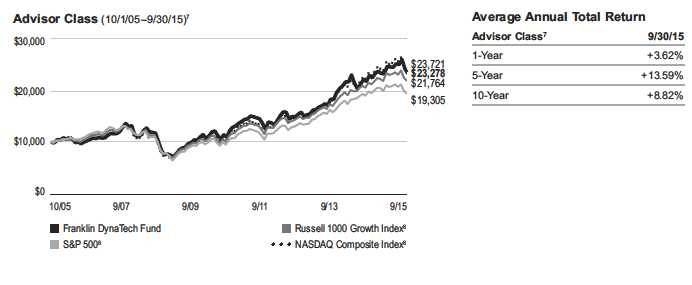

Performance Summary as of September 30, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 9/30/15 | | 9/30/14 | | Change |

| A (FKDNX) | $ | 46.04 | $ | 46.08 | -$ | 0.04 |

| C (FDYNX) | $ | 40.00 | $ | 40.53 | -$ | 0.53 |

| R (FDNRX) | $ | 45.16 | $ | 45.35 | -$ | 0.19 |

| R6 (FDTRX) | $ | 47.15 | $ | 46.97 | +$ | 0.18 |

| Advisor (FDYZX) | $ | 46.96 | $ | 46.87 | +$ | 0.09 |

| |

| |

| Distributions1 (10/1/14–9/30/15) | | | | | | |

| | | Long-Term | | | | |

| Share Class | | Capital Gain | | | | |

| A | $ | 1.6140 | | | | |

| C | $ | 1.6140 | | | | |

| R | $ | 1.6140 | | | | |

| R6 | $ | 1.6140 | | | | |

| Advisor | $ | 1.6140 | | | | |

franklintempleton.com

Annual Report

|

7

FRANKLIN DYNATECH FUND

PERFORMANCE SUMMARY

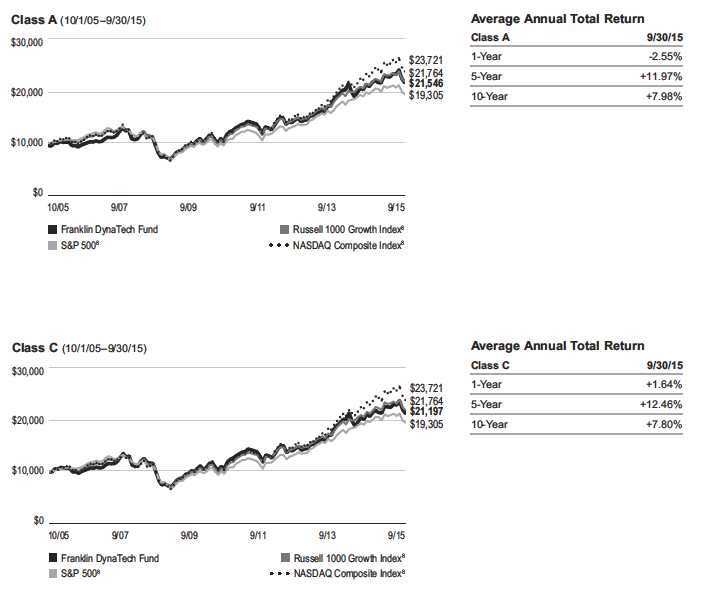

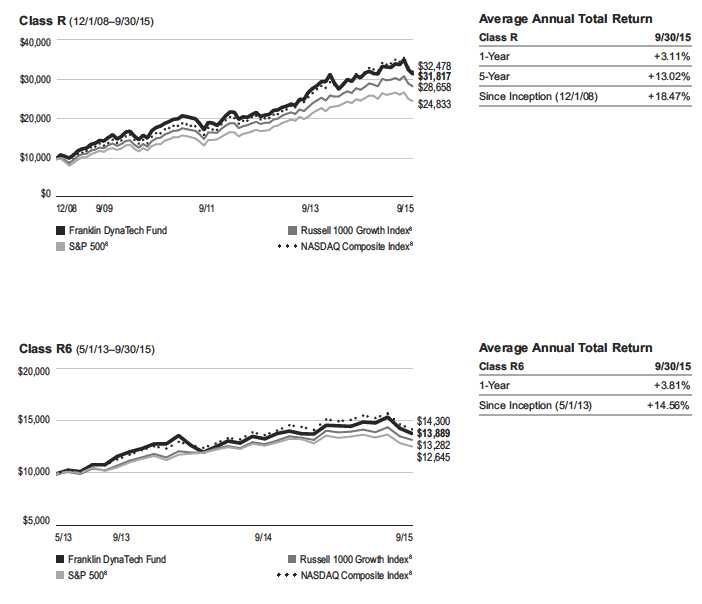

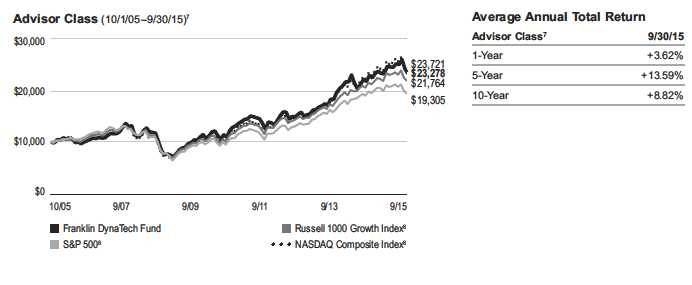

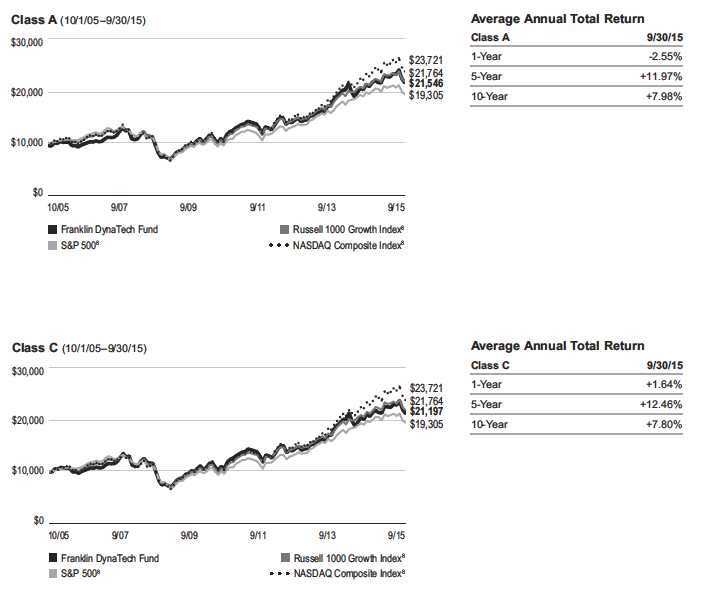

Performance as of 9/30/152

Cumulative total return excludes sales charges. Average annual total return and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | |

| | Cumulative | | Average Annual | | | Value of | Total Annual | |

| Share Class | Total Return3 | | Total Return4 | | $ | 10,000 Investment5 | Operating Expenses6 | |

| A | | | | | | | 0.89 | % |

| 1-Year | +3.40 | % | -2.55 | % | $ | 9,745 | | |

| 5-Year | +86.78 | % | +11.97 | % | $ | 17,602 | | |

| 10-Year | +128.57 | % | +7.98 | % | $ | 21,546 | | |

| C | | | | | | | 1.64 | % |

| 1-Year | +2.63 | % | +1.64 | % | $ | 10,164 | | |

| 5-Year | +79.85 | % | +12.46 | % | $ | 17,985 | | |

| 10-Year | +111.97 | % | +7.80 | % | $ | 21,197 | | |

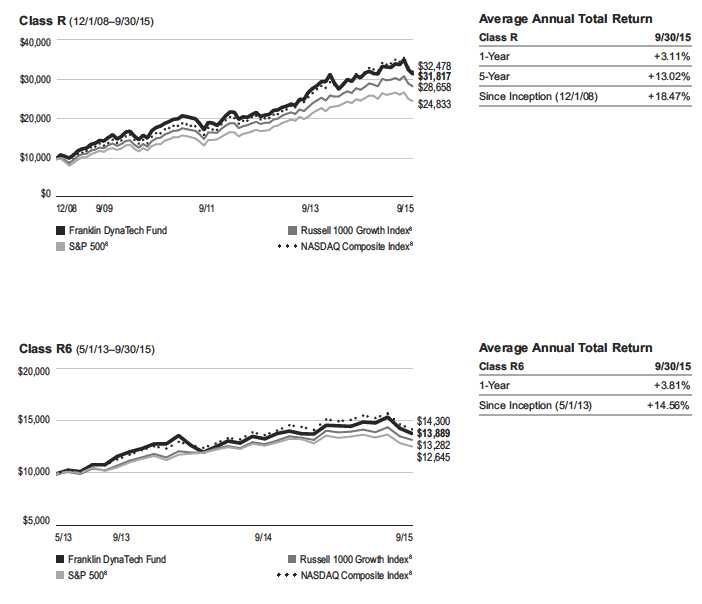

| R | | | | | | | 1.14 | % |

| 1-Year | +3.11 | % | +3.11 | % | $ | 10,311 | | |

| 5-Year | +84.40 | % | +13.02 | % | $ | 18,440 | | |

| Since Inception (12/1/08) | +218.17 | % | +18.47 | % | $ | 31,817 | | |

| R6 | | | | | | | 0.49 | % |

| 1-Year | +3.81 | % | +3.81 | % | $ | 10,381 | | |

| Since Inception (5/1/13) | +38.89 | % | +14.56 | % | $ | 13,889 | | |

| Advisor7 | | | | | | | 0.64 | % |

| 1-Year | +3.62 | % | +3.62 | % | $ | 10,362 | | |

| 5-Year | +89.06 | % | +13.59 | % | $ | 18,906 | | |

| 10-Year | +132.78 | % | +8.82 | % | $ | 23,278 | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

|

8 Annual Report

franklintempleton.com

FRANKLIN DYNATECH FUND

PERFORMANCE SUMMARY

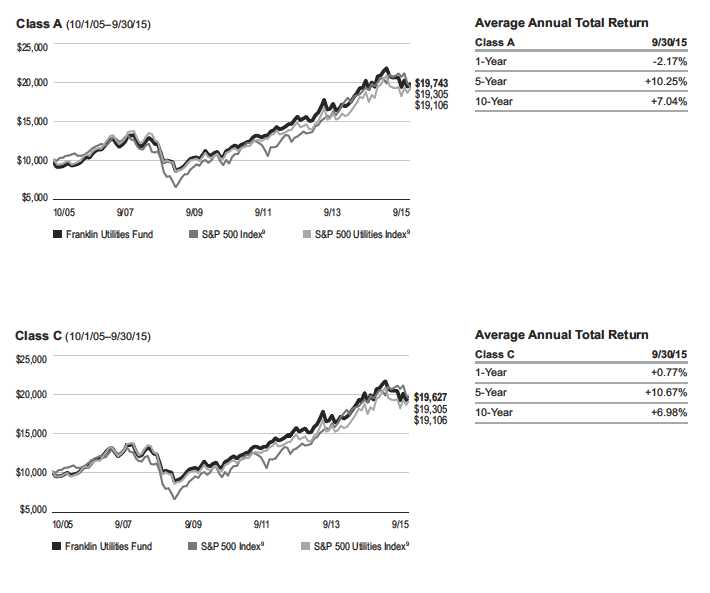

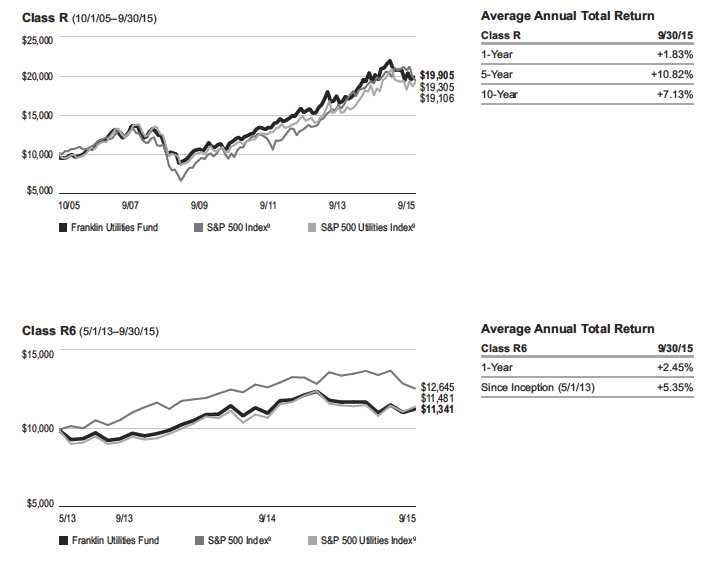

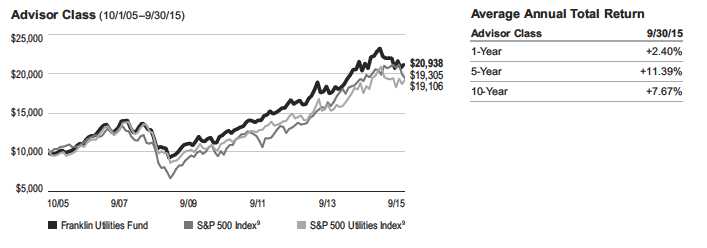

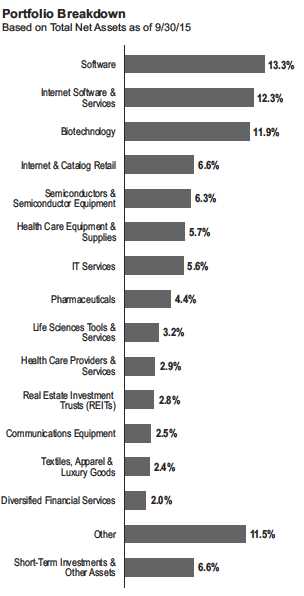

Total Return Index Comparison for a Hypothetical $10,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

franklintempleton.com

Annual Report

|

9

FRANKLIN DYNATECH FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

|

10 Annual Report

franklintempleton.com

FRANKLIN DYNATECH FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

All investments involve risks, including possible loss of principal. The Fund’s investments in fast-growing industries, including the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. The Fund may also invest in small capitalization companies, which can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis capital gain.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses

to become higher than the figures shown.

7. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the

following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s

maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 5/15/08, actual Advisor Class performance is used reflecting

all charges and fees applicable to that class. Since 5/15/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were

+81.15% and +8.39%.

8. Source: Morningstar. The Russell 1000 Growth Index is market capitalization weighted and measures performance of those Russell 1000 Index companies with higher

price-to-book ratios and higher forecasted growth values. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market

performance. The NASDAQ Composite Index is a broad-based, market capitalization-weighted index designed to measure all NASDAQ domestic and international-based

common type stocks listed on The NASDAQ Stock Market.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

|

11

FRANKLIN DYNATECH FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

1. Divide your account value by $1,000.

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

2. Multiply the result by the number under the heading “Expenses Paid During Period.”

If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50.

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

|

12 Annual Report

franklintempleton.com

FRANKLIN DYNATECH FUND

YOUR FUND’S EXPENSES

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 4/1/15 | | Value 9/30/15 | | Period* 4/1/15–9/30/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 946.50 | $ | 4.39 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.56 | $ | 4.56 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 943.00 | $ | 8.04 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.80 | $ | 8.34 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 945.40 | $ | 5.61 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.30 | $ | 5.82 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 948.50 | $ | 2.34 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.66 | $ | 2.43 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 947.50 | $ | 3.17 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.81 | $ | 3.29 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.90%;

C: 1.65%; R: 1.15%; R6: 0.48%; and Advisor: 0.65%), multiplied by the average account value over the period, multiplied by 183/365 to

reflect the one-half year period.

franklintempleton.com

Annual Report

|

13

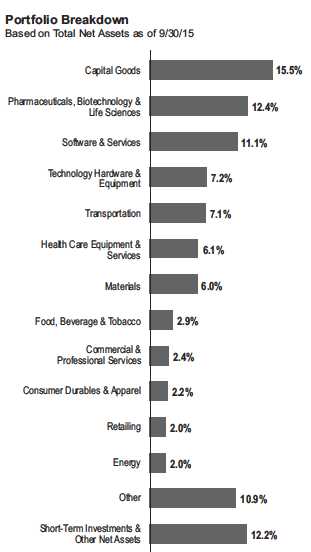

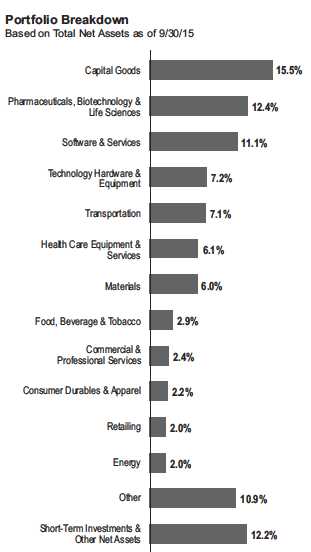

Franklin Growth Fund

We are pleased to bring you Franklin Growth Fund’s annual report for the fiscal year ended September 30, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation by investing substantially in equity securities of companies that are leaders in their industries.

Performance Overview

The Fund’s Class A shares delivered a +2.94% cumulative total return for the 12 months under review. In comparison, the Standard & Poor’s 500 Index (S&P 500), which is a broad measure of U.S. stock performance, had a -0.61% total return.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 17.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

Franklin Growth Fund owned shares of 155 companies at period-end. We continue to invest in a broad array of companies of all sizes and in varied industries.

1. Source: Morningstar.

The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 67.

|

14 Annual Report

franklintempleton.com

FRANKLIN GROWTH FUND

During the period under review, most investment sectors contributed to absolute performance, particularly industrials, health care and consumer discretionary.2 In industrials, air service provider Alaska Air Group reported record margin and profits largely due to competitor Delta Air Line’s slowing capacity growth in Seattle and falling fuel prices. Shares of fluid filtration products supplier Pall Corporation rose as Danaher announced a definitive agreement to acquire the company. Defense contractor Northrup Grumman has consistently met or exceeded consensus estimates for revenues and profitability, returned large amounts of capital to shareholders through dividends and share repurchases, and raised its guidance in its first quarter and second quarter earnings calls. In health care, beauty drug maker Allergan gained from its acquisition by Actavis, and injection drug and infusion technology provider Hospira benefited from being acquired by Pfizer. In consumer discretionary, online retail shopping service provider Amazon.com reported strong, sustained revenue growth in core domestic retail, including Amazon Prime customers, and better-than-expected profits for its new Amazon web services cloud computing business. Additionally, the company improved its fixed and variable costs through lower shipping expenses, better utilization of fulfillment centers and growing use of third-party sellers.

Energy companies, including many with solid fundamentals, were generally hurt by declining energy prices and geopolitical unrest. Thus, the Fund’s modest energy sector allocation hindered absolute performance. Anadarko Petroleum reduced capital spending and lowered its 2015 volume growth forecast as crude oil and natural gas prices fell. The sell-off in oilfield services stocks also negatively affected energy technology provider FMC Technologies and oil and gas industry products and services firm Halliburton.

| | |

| Top 10 Holdings | | |

| 9/30/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| |

| Apple Inc. | 4.0 | % |

| Technology Hardware & Equipment | | |

| Alaska Air Group Inc. | 2.3 | % |

| Transportation | | |

| Google Inc., A & C | 1.8 | % |

| Software & Services | | |

| Northrop Grumman Corp. | 1.6 | % |

| Capital Goods | | |

| Amazon.com Inc. | 1.6 | % |

| Retailing | | |

| The Walt Disney Co. | 1.5 | % |

| Media | | |

| Cytec Industries Inc. | 1.3 | % |

| Materials | | |

| Biogen Inc. | 1.3 | % |

| Pharmaceuticals, Biotechnology & Life Sciences | | |

| The Boeing Co. | 1.3 | % |

| Capital Goods | | |

| Amgen Inc. | 1.2 | % |

| Pharmaceuticals, Biotechnology & Life Sciences | | |

In other sectors, Trimble Navigation, a positioning, wireless and software technology provider, suffered as its end markets — oil exploration, agriculture, China and South America —deteriorated simultaneously. U.S. dollar strength also weakened sales and had a negative exchange rate effect. A large drop in copper prices hurt copper and gold mining firm Freeport-McMoRan (sold by period-end), which had to sell its Candelaria copper mine and raise funds through equity sales to maintain its financial strength. IT software and services provider International Business Machines’ legacy services, software and hardware businesses struggled as enterprises accelerated their investment in emerging cloud computing and Software as a Service solutions.

2. The industrials sector comprises capital goods, commercial and professional services, and transportation in the SOI. The health care sector comprises health care

equipment and services; and pharmaceuticals, biotechnology and life sciences in the SOI. The consumer discretionary sector comprises automobiles and components,

consumer durables and apparel, consumer services, media and retailing in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

|

franklintempleton.com Annual Report 15

FRANKLIN GROWTH FUND

Thank you for your continued participation in Franklin Growth Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of September 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

|

16 Annual Report

franklintempleton.com

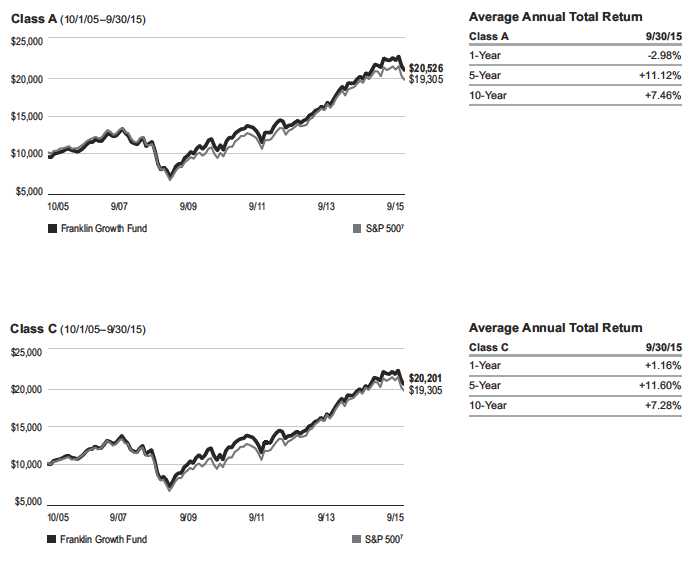

FRANKLIN GROWTH FUND

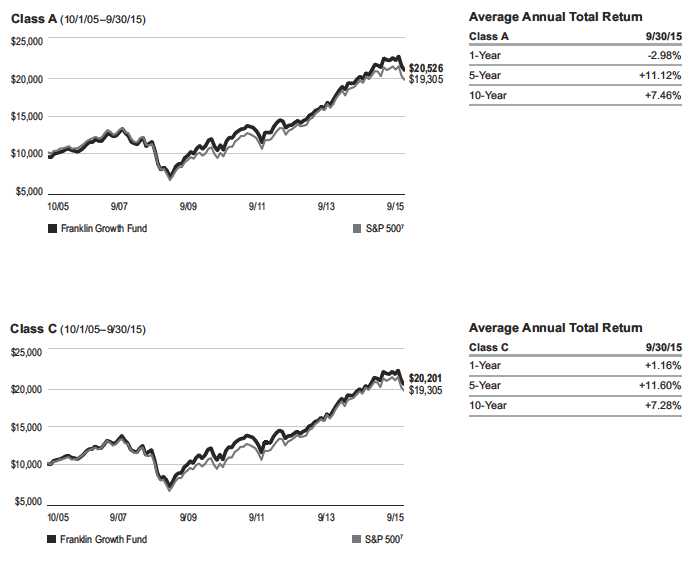

Performance Summary as of September 30, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | |

| Net Asset Value | | | | | |

| Share Class (Symbol) | | 9/30/15 | | 9/30/14 | Change |

| A (FKGRX) | $ | 72.40 | $ | 70.51 | +$1.89 |

| C (FRGSX) | $ | 67.17 | $ | 65.75 | +$1.42 |

| R (FGSRX) | $ | 71.93 | $ | 70.05 | +$1.88 |

| R6 (FIFRX) | $ | 72.69 | $ | 70.76 | +$1.93 |

| Advisor (FCGAX) | $ | 72.67 | $ | 70.75 | +$1.92 |

| | |

| Distributions1 (10/1/14–9/30/15) | | |

| | | Dividend |

| Share Class | | Income |

| A | $ | 0.1859 |

| R6 | $ | 0.4667 |

| Advisor | $ | 0.3521 |

franklintempleton.com

Annual Report

|

17

FRANKLIN GROWTH FUND

PERFORMANCE SUMMARY

Performance as of 9/30/152

Cumulative total return excludes sales charges. Average annual total return and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | |

| | Cumulative | | Average Annual | | | Value of | Total Annual | |

| Share Class | Total Return3 | | Total Return4 | | $ | 10,000 Investment5 | Operating Expenses6 | |

| A | | | | | | | 0.90 | % |

| 1-Year | +2.94 | % | -2.98 | % | $ | 9,702 | | |

| 5-Year | +79.72 | % | +11.12 | % | $ | 16,938 | | |

| 10-Year | +117.76 | % | +7.46 | % | $ | 20,526 | | |

| C | | | | | | | 1.65 | % |

| 1-Year | +2.16 | % | +1.16 | % | $ | 10,116 | | |

| 5-Year | +73.09 | % | +11.60 | % | $ | 17,309 | | |

| 10-Year | +102.01 | % | +7.28 | % | $ | 20,201 | | |

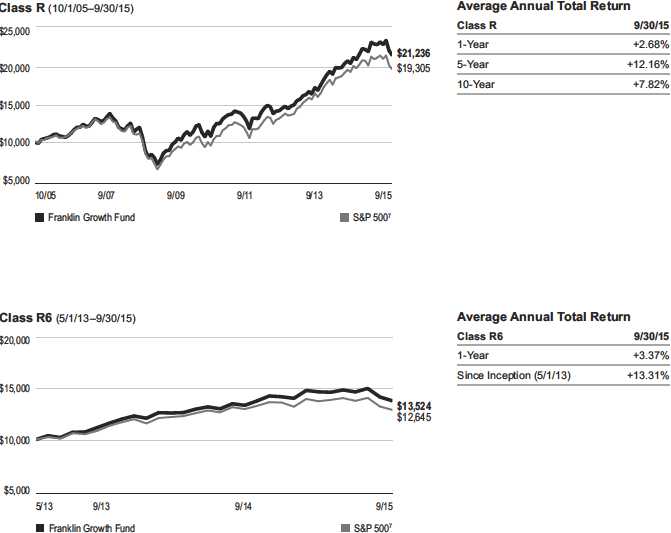

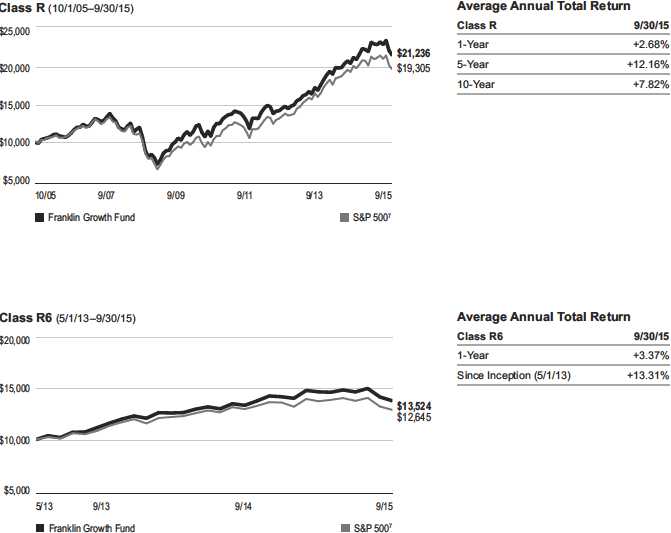

| R | | | | | | | 1.15 | % |

| 1-Year | +2.68 | % | +2.68 | % | $ | 10,268 | | |

| 5-Year | +77.48 | % | +12.16 | % | $ | 17,748 | | |

| 10-Year | +112.36 | % | +7.82 | % | $ | 21,236 | | |

| R6 | | | | | | | 0.47 | % |

| 1-Year | +3.37 | % | +3.37 | % | $ | 10,337 | | |

| Since Inception (5/1/13) | +35.24 | % | +13.31 | % | $ | 13,524 | | |

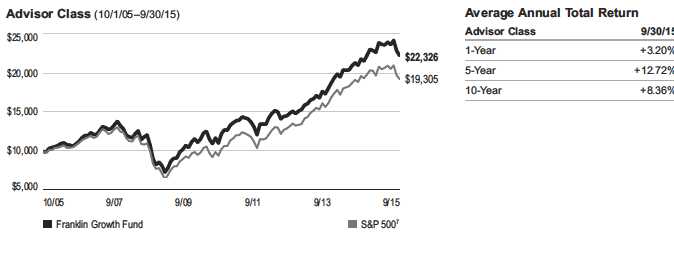

| Advisor | | | | | | | 0.65 | % |

| 1-Year | +3.20 | % | +3.20 | % | $ | 10,320 | | |

| 5-Year | +81.99 | % | +12.72 | % | $ | 18,199 | | |

| 10-Year | +123.26 | % | +8.36 | % | $ | 22,326 | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

|

18 Annual Report

franklintempleton.com

FRANKLIN GROWTH FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

franklintempleton.com

Annual Report

|

19

FRANKLIN GROWTH FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

|

20 Annual Report

franklintempleton.com

FRANKLIN GROWTH FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

All investments involve risks, including possible loss of principal. Historically, the Fund has focused on larger companies. The Fund may also invest in small, relatively new and/or unseasoned companies, which involves additional risks, as the prices of these securities can be volatile, particularly over the short term. The Fund may focus on particular sectors of the market from time to time, which can carry greater risks of adverse developments in such sectors. In addition, the Fund may invest up to 40% of its net assets in stocks of foreign companies, which involve special risks, including currency fluctuations and economic as well as political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

7. Source: Morningstar. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

|

21

FRANKLIN GROWTH FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

1. Divide your account value by $1,000.

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

2. Multiply the result by the number under the heading “Expenses Paid During Period.”

If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50.

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

|

22 Annual Report

franklintempleton.com

FRANKLIN GROWTH FUND

YOUR FUND’S EXPENSES

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 4/1/15 | | Value 9/30/15 | | Period* 4/1/15–9/30/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 938.30 | $ | 4.23 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.71 | $ | 4.41 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 934.70 | $ | 7.86 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.95 | $ | 8.19 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 937.10 | $ | 5.44 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.45 | $ | 5.67 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 940.20 | $ | 2.19 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.81 | $ | 2.28 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 939.50 | $ | 3.01 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.96 | $ | 3.14 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.87%;

C: 1.62%; R: 1.12%; R6: 0.45% and Advisor: 0.62%), multiplied by the average account value over the period, multiplied by 183/365

to reflect the one-half year period.

franklintempleton.com

Annual Report

|

23

Franklin Income Fund

This annual report for Franklin Income Fund covers the fiscal year ended September 30, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks to maximize income while maintaining prospects for capital appreciation by investing, under normal market conditions, in a diversified portfolio of debt and equity securities.

Performance Overview

The Fund’s Class A shares had a -10.93% cumulative total return for the 12 months under review. In comparison, the Fund’s equity benchmark, the Standard & Poor’s 500 Index (S&P 500), which is a broad measure of U.S. stock performance, had a -0.61% total return.1 The Fund’s fixed income benchmark, the Barclays U.S. Aggregate Bond Index, which tracks the U.S. investment-grade, taxable bond market, posted a +2.94% total return.1 The Fund’s peers, as measured by the Lipper Mixed-Asset Target Allocation Moderate Funds Classification Average, which consists of funds chosen by Lipper that, by practice, maintain a mix of 40% to 60% equity securities, with the remainder in bonds and cash, returned -3.06%.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 28.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

By generally performing independent analysis of debt, convertible and equity securities, we search for undervalued or out-of-favor securities we believe offer opportunities for income today and significant growth tomorrow. We consider such factors as a company’s experience and managerial strength; its cash flow potential and profitability; its competitive positioning and

| | | | | |

| Dividend Distributions* | | | |

| 10/1/14–9/30/15 | | | | |

| | | Dividend per Share (cents) | |

| | | | | | Advisor |

| Month | Class A | Class C | Class R | Class R6 | Class |

| October | 1.00 | 0.89 | 0.93 | 1.05 | 1.03 |

| November | 1.00 | 0.89 | 0.93 | 1.05 | 1.03 |

| December | 1.00 | 0.89 | 0.93 | 1.04 | 1.03 |

| January | 1.00 | 0.89 | 0.93 | 1.04 | 1.03 |

| February | 1.00 | 0.89 | 0.93 | 1.04 | 1.03 |

| March | 1.00 | 0.91 | 0.94 | 1.04 | 1.03 |

| April | 1.00 | 0.91 | 0.94 | 1.04 | 1.03 |

| May | 1.00 | 0.91 | 0.94 | 1.04 | 1.03 |

| June | 1.00 | 0.89 | 0.93 | 1.05 | 1.03 |

| July | 1.00 | 0.89 | 0.93 | 1.05 | 1.03 |

| August | 1.00 | 0.89 | 0.93 | 1.05 | 1.03 |

| September | 1.00 | 0.90 | 0.93 | 1.04 | 1.02 |

| Total | 12.00 | 10.75 | 11.19 | 12.53 | 12.35 |

*The distribution amount is the sum of the dividend payments to shareholders for

the period shown and includes only estimated tax-basis net investment income.

All Fund distributions will vary depending upon current market conditions, and

past distributions are not indicative of future trends.

advantages; its responsiveness to changes in interest rates and business conditions; debt maturity schedules and borrowing requirements; a company’s changing financial condition and market recognition of the change; and a security’s relative value based on such factors as anticipated cash flow, interest or dividend coverage, asset coverage and earnings.

Manager’s Discussion

During the 12 months under review, we continued to strategically shift the Fund’s asset mix in seeking to manage risks, and our equity holdings increased while our fixed income holdings declined. The Fund’s equity weighting rose from 60.6% to 65.5% of total net assets and its fixed income weighting fell from 38.2% to 32.5%. Our cash position rose from 1.2% to 2.0% of total net assets.

1. Source: Morningstar.

2. Source: Lipper, a Thomson Reuters Company. For the 12-month period ended 9/30/15, this category consisted of 574 funds. Lipper calculations do not include sales

charges or expense subsidization by a fund’s manager. The Fund’s performance relative to the average may have differed if these and other factors had been considered.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 77.

|

24 Annual Report franklintempleton.com

FRANKLIN INCOME FUND

| | |

| Portfolio Breakdown | | |

| 9/30/15 | | |

| | % of Total | |

| | Net Assets | |

| Equity* | 65.5 | % |

| Utilities | 11.0 | % |

| Energy | 10.2 | % |

| Materials | 8.4 | % |

| Industrials | 8.4 | % |

| Health Care | 7.5 | % |

| Financials | 5.5 | % |

| Information Technology | 5.3 | % |

| Consumer Discretionary | 4.5 | % |

| Telecommunication Services | 2.5 | % |

| Consumer Staples | 2.2 | % |

| Fixed Income** | 32.5 | % |

| Energy | 6.5 | % |

| Consumer Discretionary | 5.9 | % |

| Financials | 4.8 | % |

| Telecommunication Services | 3.1 | % |

| Information Technology | 3.0 | % |

| Materials | 2.8 | % |

| Other | 6.4 | % |

| Short-Term Investments & Other Net Assets | 2.0 | % |

*Includes convertible bonds.

**Includes senior floating rate interests.

The Fund’s equity holdings underperformed the S&P 500 during the period, largely because of weak performance in the Fund’s energy and materials sector positions. During the period, crude oil prices declined precipitously by about one half, influenced by OPEC’s drive for greater market share along with uncertain demand in late 2014 and early 2015 as global economies slowed. This environment took a severe toll on the share prices of large, international, integrated oil companies including Royal Dutch Shell, Chevron, BP, Total and Exxon Mobil, which were among the Fund’s leading energy sector decliners. Our positions in upstream-focused oil and gas producers including Canadian Oil Sands, Anadarko Petroleum and Chesapeake Energy also lost value as crude oil and natural gas prices fell. Additionally, with reduced revenues and cash flows expected in a lower commodity price environment, capital expenditure budgets for upstream activities declined, dimming the outlook for oilfield services and equipment companies including Schlumberger and Halliburton. On a more positive note, the industry’s supply and demand balance began to improve somewhat as low prices stimulated consumption and as reduced investment weighed on the forward supply outlook.

A majority of holdings in the materials sector detracted from Fund performance, with Freeport-McMoRan, BHP Billiton and Rio Tinto among the largest decliners. These well-positioned operators with relatively stronger balance sheets than those of their peers have lowered their cost structures, but their recent results reflected dramatically lower commodity prices and lighter volumes. Results of two of our larger global chemical companies, E.I. du Pont de Nemours and Co. and The Dow Chemical Co., also negatively affected performance. Du Pont’s results have been disappointing and the company recently lowered annual guidance following declining demand, unfavorable currency exchange rates and a lack of progress reducing costs. Dow Chemical was hurt by currency exchange rates and lower energy prices that suppressed ethylene profitability.

In the financials sector, our positions overall hurt performance as small gains in banks, namely Citigroup3 and Wells Fargo & Co., were more than offset by losses in Royal Bank of Canada and insurance company MetLife. Hindering MetLife was uncertainty about interest rate rises as well as its exposure to slowing Asian economies. Although we continue to be optimistic about Royal Bank of Canada, the Canadian dollar’s declining value and fears of slower Canadian economic growth amid energy market volatility pressured the bank’s results over the past year.

The utilities sector produced a major positive contribution with strong results from PG&E, Xcel Energy and The Southern Co., although Exelon, one of our larger utility holdings, notably detracted. The market generally viewed utilities less favorably earlier in the year as the prospect for interest rate increases was high, but utility stocks rebounded somewhat as the Fed elected not to raise rates in September. Although the potential for future rate hikes may likely continue to dampen investor sentiment toward utility sector stocks, we feel our focus on individual utility companies with meaningful earnings-per-share growth potential somewhat mitigated this interest rate sensitivity. Within the Fund’s utilities sector, we sought investments we viewed as having growth potential with

3. Sold by period-end.

|

franklintempleton.com Annual Report 25

FRANKLIN INCOME FUND

liquefied natural gas export projects, capital investment and rate-base growth aimed at enhancing our nation’s electricity transmission and natural gas pipeline infrastructure, certain states where the regulatory environment has been welcoming to needed capital investments, and renewable energy projects. At period-end, the Fund’s overall weighting in utilities remained toward the low end of its historical range.

The Fund’s industrials sector holdings also contributed positively to performance, particularly investments in aerospace and defense. Lockheed Martin and Raytheon are examples of companies that fit well with our overall investment framework as we believe they operate strong businesses with underappre-ciated growth and improving margins and cash flows. Given new product development and healthy government defense spending levels, we believe the opportunity for defense contractors should be attractive for the next several years. Although the Fund’s industrials sector exposure benefited overall results, logistics facilitator CEVA Holdings and a new position in multi-industry conglomerate United Technologies hindered sector performance. Our weighting in industrials grew as the year progressed due to strong performance and the addition of several new investments made later in the Fund’s fiscal year as fears of slower global economic activity created opportunities we considered compelling.

In the consumer discretionary sector, strong results for one of the Fund’s larger holdings, retailer Target, aided Fund performance. Investors reacted favorably to Target’s new management team, which had increased in-store traffic, refocused merchandise and exited its troubled Canadian segment.

In health care, pharmaceutical giants Eli Lilly and Pfizer continued to benefit from new drug development prospects, and their results aided Fund performance, while Merck and Sanofi had disappointing results and detracted from performance.

Within fixed income, despite a slight reduction in U.S. Treasury yields, high yield corporate bonds had negative returns as yield spreads over Treasuries widened during the period. This widening was most pronounced in the energy and materials sectors, but growing investor concerns about corporate credit quality in general was evident across most sectors. Despite the negative impact on returns during the reporting period, in our view, the spread widening created opportunities for us to selectively increase our exposure to certain high yield bond issuers at attractive valuations.

| | |

| Top Five Equity Holdings | | |

| 9/30/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| |

| Royal Dutch Shell PLC | 2.4 | % |

| Energy | | |

| General Electric Co. | 2.2 | % |

| Industrials | | |

| PG&E Corp. | 1.7 | % |

| Utilities | | |

| The Dow Chemical Co. | 1.5 | % |

| Materials | | |

| Chevron Corp. | 1.4 | % |

| Energy | | |

Energy was a primary detractor among fixed income sectors driven largely by declines in the securities of independent exploration and production companies. Notable laggards included Linn Energy, Energy XXI Gulf Coast, Halcon Resources, SandRidge Energy and Chesapeake Energy, all of which are North American producers of oil and gas. Commodity price declines raised investor concerns over these companies’ ability to manage cash flows and ultimately meet debt obligations as they become due. During the period we consolidated positions, eliminating several holdings that we believed remained challenged in favor of others that, in our view, appeared to have a clearer path to navigating the industry downturn and restructuring balance sheets through effective capital structure management. The debt securities of oilfield services and equipment companies, particularly offshore drilling contractors including Ocean Rig UDW,3 Hercules Offshore and Vantage Drilling (Offshore Group Investment),3 also lost value as upstream spending expectations fell and industry supply expanded.

Another major fixed income detractor during the period was the basic industry sector.4 Despite being a relatively small allocation within the Fund, our holdings in coal mining companies substantially weighed on performance due to a confluence of factors including falling prices, lower volumes and concerns regarding the continuing decline of coal as a fuel source. The coal industry’s cash flow generation was far below expectations and led to financial distress for many of the top producers. Our holdings in Peabody Energy, Walter Energy, Arch Coal and Alpha Natural Resources3 were notable detractors from this sector during the period. We significantly reduced our overall exposure to the coal industry, and at period-end the portfolio held small positions in Peabody Energy, Walter Energy and Arch Coal secured bonds.

4. Basic industry holdings are in materials in the fixed income section of the SOI.

|

26 Annual Report

franklintempleton.com

FRANKLIN INCOME FUND

| | |

| Top Five Fixed Income Holdings | | |

| and Senior Floating Rate Interests* | | |

| 9/30/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| iHeartCommunications Inc. | 1.9 | % |

| Consumer Discretionary | | |

| First Data Corp. | 1.9 | % |

| Information Technology | | |

| JPMorgan Chase & Co. | 1.9 | % |

| Financials | | |

| Citigroup Inc. | 1.2 | % |

| Financials | | |

| Dynegy Inc. | 0.8 | % |

| Utilities | | |

| |

| *Does not include convertible bonds. | | |

The communications sector also suppressed our fixed income returns during the period.5 Hurting our Sprint position were investor concerns regarding the company’s ability to maintain its share of new subscribers and manage its balance sheet during a period of slowing industry growth. We continue to monitor the progress of Sprint’s new management team as they work closely with Softbank to improve operations and position the company for future growth. iHeartCommunications also weighed on returns due to concerns over its currently high level of debt and the company’s ability to deleverage over time. iHeartCommunications continued to deliver solid operational results and took advantage of its large platform to gain market share from the competition.

Our fixed income holdings in the consumer non-cyclical sector delivered positive returns during the period.6 The hospital industry continued to benefit from broadening access to health care and the resulting growth in demand for its services. Our holdings in HCA, Tenet Healthcare and CHS/Community Health Systems produced solid returns, and the companies were well positioned to benefit from increased future demand, in our view.

The information technology sector also helped the Fund during the period with solid performance from some of our largest

holdings. First Data shares rose as the company continued to strengthen its balance sheet by raising new equity to retire debt and exploring an initial public offering to further reduce its debt load. Freescale Semiconductor also made gains as it continued to improve its cash flow and strengthen its balance sheet. Both companies greatly benefited from refinancing higher cost debt with new debt at much lower interest rates, which had a significant positive impact on cash flow.

Thank you for your continued participation in Franklin Income Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of September 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

5. Communications holdings are in consumer discretionary and telecommunication services in the fixed income section of the SOI.

6. Consumer non-cyclical holdings are in consumer discretionary, consumer staples, health care and information technology in the fixed income section of the SOI.

See www.franklintempletondatasources.com for additional data provider information.

|

franklintempleton.com Annual Report 27

FRANKLIN INCOME FUND

Performance Summary as of September 30, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 9/30/15 | | 9/30/14 | | Change |

| A (FKINX) | $ | 2.10 | $ | 2.48 | -$ | 0.38 |

| C (FCISX) | $ | 2.13 | $ | 2.50 | -$ | 0.37 |

| R (FISRX) | $ | 2.07 | $ | 2.44 | -$ | 0.37 |

| R6 (FNCFX) | $ | 2.09 | $ | 2.46 | -$ | 0.37 |

| Advisor (FRIAX) | $ | 2.09 | $ | 2.46 | -$ | 0.37 |

| |

| |

| Distributions1 (10/1/14–9/30/15) | | | | | | |

| Dividend |

| Share Class | | Income | | | | |

| A | $ | 0.1200 | | | | |

| C | $ | 0.1075 | | | | |

| R | $ | 0.1119 | | | | |

| R6 | $ | 0.1253 | | | | |

| Advisor | $ | 0.1235 | | | | |

|

28 Annual Report

franklintempleton.com

FRANKLIN INCOME FUND

PERFORMANCE SUMMARY

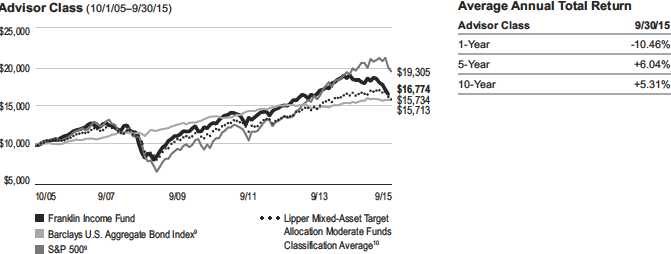

Performance as of 9/30/152

Cumulative total return excludes sales charges. Average annual total return and value of $10,000 investment include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | |

| | Cumulative | | Average Annual | | | Value of | Total Annual | |

| Share Class | Total Return3 | | Total Return4 | | $ | 10,000 Investment5 | Operating Expenses6 | |

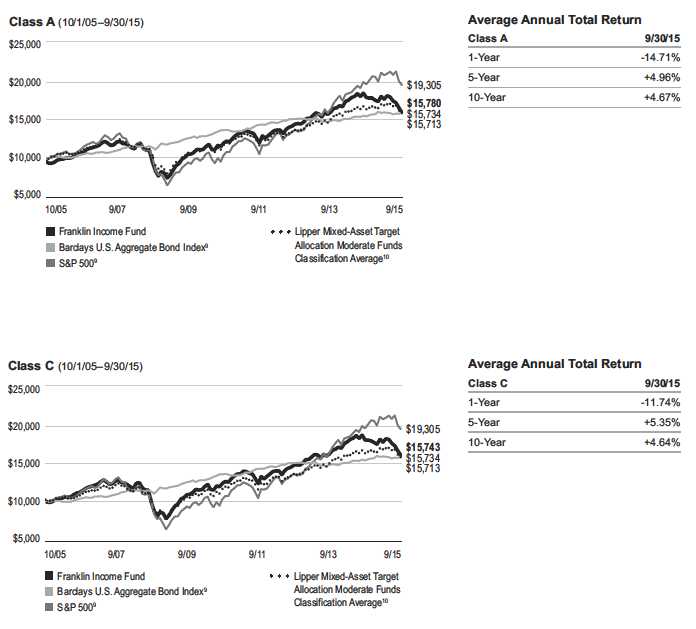

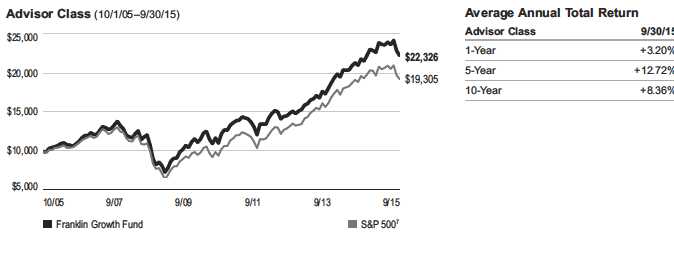

| A | | | | | | | 0.61 | % |

| 1-Year | -10.93 | % | -14.71 | % | $ | 8,529 | | |

| 5-Year | +32.83 | % | +4.96 | % | $ | 12,739 | | |

| 10-Year | +64.74 | % | +4.67 | % | $ | 15,780 | | |

| C | | | | | | | 1.11 | % |

| 1-Year | -10.89 | % | -11.74 | % | $ | 8,826 | | |

| 5-Year | +29.78 | % | +5.35 | % | $ | 12,978 | | |

| 10-Year | +57.43 | % | +4.64 | % | $ | 15,743 | | |

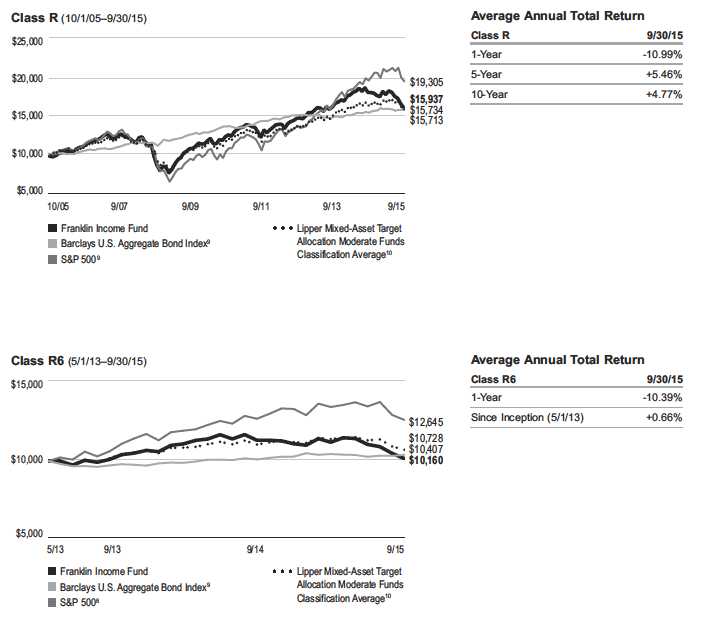

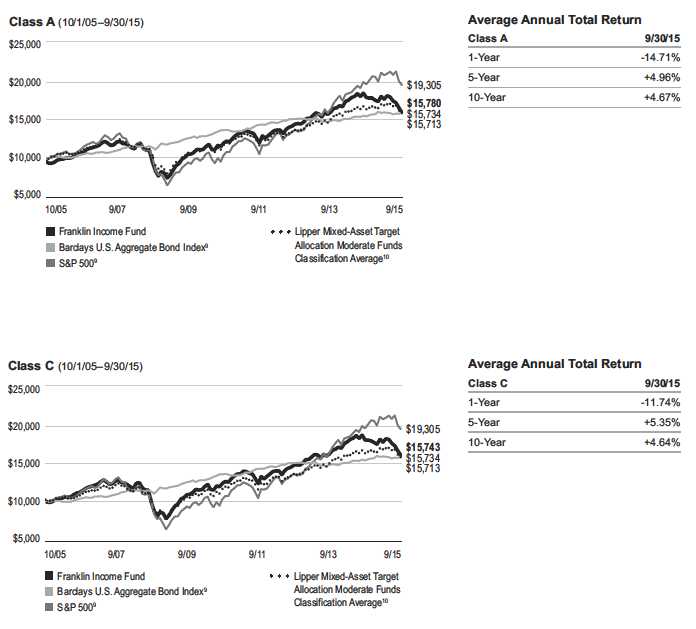

| R | | | | | | | 0.96 | % |

| 1-Year | -10.99 | % | -10.99 | % | $ | 8,901 | | |

| 5-Year | +30.44 | % | +5.46 | % | $ | 13,044 | | |

| 10-Year | +59.37 | % | +4.77 | % | $ | 15,937 | | |

| R6 | | | | | | | 0.38 | % |

| 1-Year | -10.39 | % | -10.39 | % | $ | 8,961 | | |

| Since Inception (5/1/13) | +1.60 | % | +0.66 | % | $ | 10,160 | | |

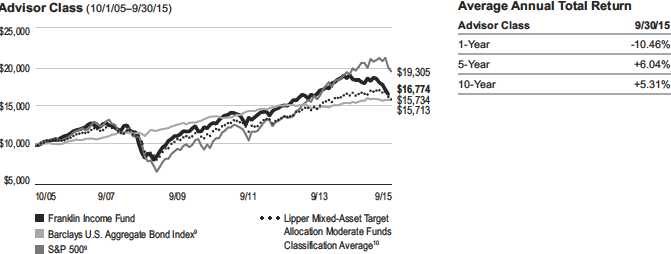

| Advisor | | | | | | | 0.46 | % |

| 1-Year | -10.46 | % | -10.46 | % | $ | 8,954 | | |

| 5-Year | +34.09 | % | +6.04 | % | $ | 13,409 | | |

| 10-Year | +67.74 | % | +5.31 | % | $ | 16,774 | | |

| | | | | | |

| | | | 30-Day Standardized Yield8 | |

| | Distribution | | | | | |

| Share Class | Rate7 | | (with waiver) | | (without waiver) | |

| A | 5.48 | % | 4.65 | % | 4.65 | % |

| C | 5.07 | % | 4.34 | % | 4.34 | % |

| R | 5.39 | % | 4.48 | % | 4.48 | % |

| R6 | 5.97 | % | 5.09 | % | 5.09 | % |

| Advisor | 5.86 | % | 4.99 | % | 4.99 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

franklintempleton.com

Annual Report

|

29

FRANKLIN INCOME FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

|

30 Annual Report

franklintempleton.com

FRANKLIN INCOME FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

franklintempleton.com

Annual Report

|

31

FRANKLIN INCOME FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund’s share price and yield will be affected by interest rate movements. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. The Fund’s portfolio includes a substantial portion of higher yielding, lower rated corporate bonds because of the relatively higher yields they offer. Floating-rate loans are lower rated, higher yielding instruments, which are subject to increased risk of default and can potentially result in loss of principal. These securities carry a greater degree of credit risk relative to investment-grade securities. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

7. Distribution rate is based on an annualization of the respective class’s September dividend and the maximum offering price (NAV for Classes C, R, R6 and Advisor) per

share on 9/30/15.

8. The 30-day standardized yield for the 30 days ended 9/30/15 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be

regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends

paid to shareholders) or the income reported in the Fund’s financial statements.

9. Source: Morningstar. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance. The Barclays U.S.

Aggregate Bond Index is a market capitalization-weighted index representing the U.S. investment-grade, fixed-rate, taxable bond market with index components for government

and corporate, mortgage pass-through and asset-backed securities. All issues included are SEC registered, taxable, dollar denominated and nonconvertible, must have at least

one year to final maturity and must be rated investment grade (Baa3/BBB-/BBB- or higher) using the middle rating of Moody’s, S&P and Fitch, respectively.

10. Source: Lipper, a Thomas Reuters Company. The Lipper Mixed-Asset Target Allocation Moderate Funds Classification Average is calculated by averaging the total

returns of all funds within the Lipper Mixed-Asset Target Allocation Moderate Funds classification in the Lipper Open-End underlying funds universe. Lipper Mixed-Asset

Target Allocation Moderate Funds are defined as funds that, by portfolio practice, maintain a mix of between 40%–60% equity securities, with the remainder invested in

bonds, cash and cash equivalents. For the 12-month period ended 9/30/15, there were 574 funds in this category. Lipper calculations do not include sales charges or

expense subsidization by a fund’s manager. The Fund’s performance relative to the average may have differed if these and other factors had been considered.

See www.franklintempletondatasources.com for additional data provider information.

|

32 Annual Report franklintempleton.com

FRANKLIN INCOME FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

1. Divide your account value by $1,000.

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

2. Multiply the result by the number under the heading “Expenses Paid During Period.”

If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50.

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

franklintempleton.com

Annual Report

|

33

| | | | | | |

| FRANKLIN INCOME FUND | | | | | | |

| YOUR FUND’S EXPENSES | | | | | | |

| |

| |

| |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 4/1/15 | | Value 9/30/15 | | Period* 4/1/15–9/30/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 901.60 | $ | 2.86 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.06 | $ | 3.04 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 904.30 | $ | 5.25 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.55 | $ | 5.57 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 902.70 | $ | 4.53 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.31 | $ | 4.81 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 906.10 | $ | 1.77 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,023.21 | $ | 1.88 |

| Advisor | | | | | | |

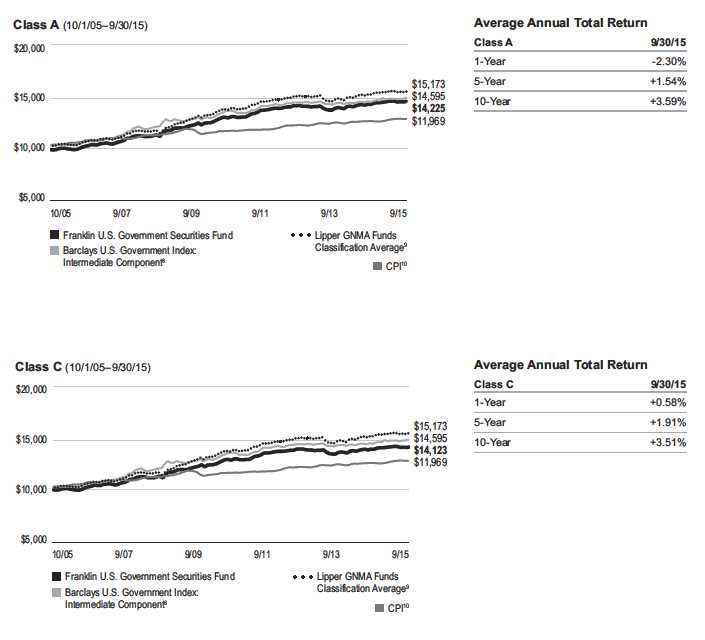

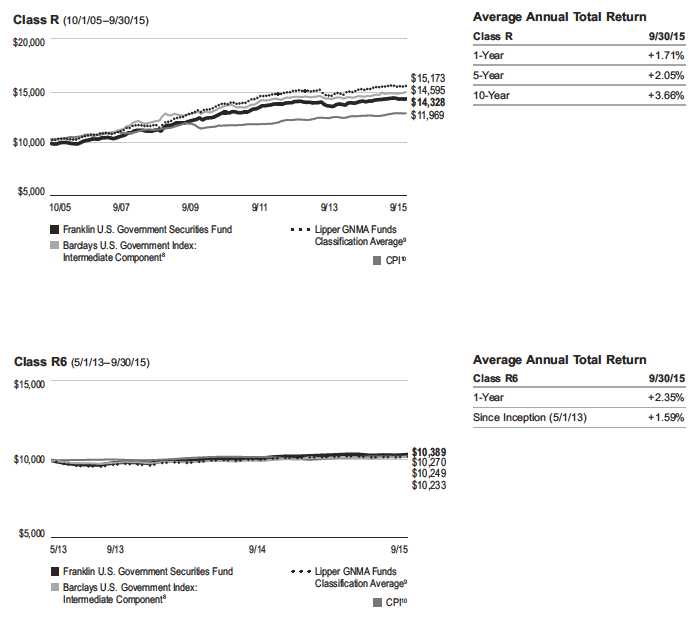

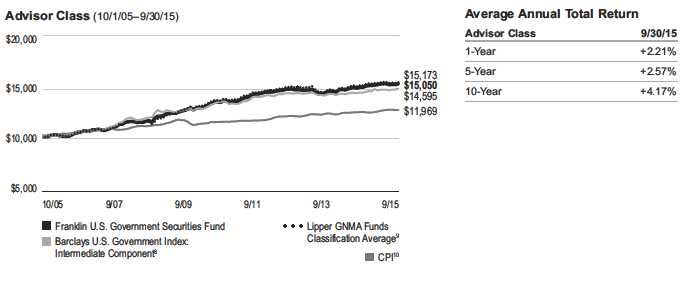

| Actual | $ | 1,000 | $ | 905.80 | $ | 2.15 |