As filed with the Securities and Exchange Commission on November 5, 2009

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00582

NEUBERGER BERMAN EQUITY FUNDS

(Exact Name of the Registrant as Specified in Charter)

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

(Address of Principal Executive Offices – Zip Code)

Registrant's telephone number, including area code: (212) 476-8800

Robert Conti

Chief Executive Officer and President

Neuberger Berman Equity Funds

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

Arthur Delibert, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006-1600

(Names and Addresses of agents for service)

Date of fiscal year end: August 31, 2009

Date of reporting period: August 31, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

Neuberger Berman

Equity Funds

Investor Class Shares

Trust Class Shares

Advisor Class Shares

Institutional Class Shares

Class A Shares

Class C Shares

Class R3 Shares

Climate Change Fund

Emerging Markets Equity Fund

Equity Income Fund

Focus Fund

Genesis Fund

Guardian Fund

International Fund

International Institutional Fund

International Large Cap Fund

Large Cap Disciplined Growth Fund

Mid Cap Growth Fund

Partners Fund

Real Estate Fund

Regency Fund

Select Equities Fund

Small and Mid Cap Growth Fund

Small Cap Growth Fund

Socially Responsive Fund

Annual Report

August 31, 2009

Contents

THE FUNDS

| President's Letter | | | 1 | | |

|

| PORTFOLIO COMMENTARY | |

|

| Climate Change Fund | | | 2 | | |

|

| Emerging Markets Equity Fund | | | 6 | | |

|

| Equity Income Fund | | | 10 | | |

|

| Focus Fund | | | 14 | | |

|

| Genesis Fund | | | 17 | | |

|

| Guardian Fund | | | 20 | | |

|

| International Fund | | | 24 | | |

|

| International Institutional Fund | | | 27 | | |

|

| International Large Cap Fund | | | 30 | | |

|

| Large Cap Disciplined Growth Fund | | | 34 | | |

|

| Mid Cap Growth Fund | | | 38 | | |

|

| Partners Fund | | | 42 | | |

|

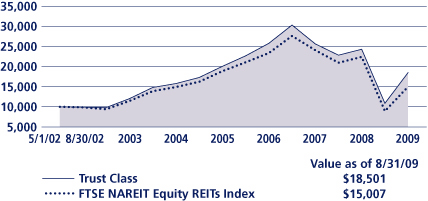

| Real Estate Fund | | | 45 | | |

|

| Regency Fund | | | 48 | | |

|

| Select Equities Fund | | | 51 | | |

|

| Small and Mid Cap Growth Fund | | | 55 | | |

|

| Small Cap Growth Fund | | | 58 | | |

|

| Socially Responsive Fund | | | 62 | | |

|

| FUND EXPENSE INFORMATION | | | 70 | | |

|

| SCHEDULE OF INVESTMENTS/TOP TEN EQUITY HOLDINGS | |

|

| Climate Change Fund | | | 73 | | |

|

| Emerging Markets Equity Fund | | | 75 | | |

|

| Equity Income Fund | | | 78 | | |

|

| Focus Fund | | | 80 | | |

|

| Genesis Fund | | | 81 | | |

|

| Guardian Fund | | | 83 | | |

|

| International Fund | | | 84 | | |

|

| International Institutional Fund | | | 87 | | |

| International Large Cap Fund | | | 90 | | |

|

| Large Cap Disciplined Growth Fund | | | 93 | | |

|

| Mid Cap Growth Fund | | | 95 | | |

|

| Partners Fund | | | 97 | | |

|

| Real Estate Fund | | | 99 | | |

|

| Regency Fund | | | 100 | | |

|

| Select Equities Fund | | | 102 | | |

|

| Small and Mid Cap Growth Fund | | | 103 | | |

|

| Small Cap Growth Fund | | | 105 | | |

|

| Socially Responsive Fund | | | 107 | | |

|

| FINANCIAL STATEMENTS | | | 117 | | |

|

| FINANCIAL HIGHLIGHTS (ALL CLASSES) PER SHARE DATA | |

|

| Climate Change Fund | | | 173 | | |

|

| Emerging Markets Equity Fund | | | 173 | | |

|

| Equity Income Fund | | | 173 | | |

|

| Focus Fund | | | 175 | | |

|

| Genesis Fund | | | 175 | | |

|

| Guardian Fund | | | 177 | | |

|

| International Fund | | | 179 | | |

|

| International Institutional Fund | | | 181 | | |

|

| International Large Cap Fund | | | 181 | | |

|

| Large Cap Disciplined Growth Fund | | | 183 | | |

|

| Mid Cap Growth Fund | | | 183 | | |

|

| Partners Fund | | | 185 | | |

|

| Real Estate Fund | | | 187 | | |

|

| Regency Fund | | | 187 | | |

|

| Select Equities Fund | | | 189 | | |

|

| Small and Mid Cap Growth Fund | | | 189 | | |

|

| Small Cap Growth Fund | | | 189 | | |

|

| Socially Responsive Fund | | | 191 | | |

|

| Reports of Independent Registered Public Accounting Firms | | | 199 | | |

|

| Directory | | | 202 | | |

|

| Trustees and Officers | | | 203 | | |

|

| Proxy Voting Policies and Procedures | | | 213 | | |

|

| Quarterly Portfolio Schedule | | | 213 | | |

|

| Notice to Shareholders | | | 214 | | |

|

| Report of Votes of Shareholders | | | 215 | | |

|

"Neuberger Berman" and the Neuberger Berman logo are service marks of Neuberger Berman LLC. "Neuberger Berman Management LLC" and the individual fund names in this shareholder report are either service marks or registered service marks of Neuberger Berman Management LLC, formerly Neuberger Berman Management Inc. ©2009 Neuberger Berman Management LLC. All rights reserved.

President's Letter

Dear Fellow Shareholder,

The fiscal year ended August 31, 2009 was one of remarkable extremes, involving a series of unprecedented events affecting the financial markets and global economy as well as drastic shifts in the performance patterns of the capital markets. During the period, the S&P 500 Index closed down by roughly 18%, which included both the worst six-month market decline and the strongest six-month rally for the index since the early 1930s.

The equity market was under pressure even before the start of the reporting period, as the damaged housing market, rising unemployment, constrained consumer spending and difficult credit conditions helped undermine the economy and investor confidence. With September 2008's financial crisis, however, the situation became markedly worse. Credit markets virtually froze, stocks dropped precipitously across the globe, and investors became increasingly concerned not just about recession, but the possibility of a 1930s-style depression.

In the midst of these problems, governments worldwide took unprecedented measures to shore up liquidity and stimulate their economies, providing massive bailouts to individual financial institutions and seeking ways to support balance sheets and reduce the impact of toxic debt on the credit markets. Despite these efforts, economic news continued to be dismal for months. However, by March, signs of marginal improvement in housing and the banking sector, as well as moderating declines in other areas triggered new optimism that worst-case economic scenarios could be avoided, and led to a sharp rebound in stocks that continued, with some breaks, through the end of the reporting period.

Looking forward, we believe there continue to be risks. Although the economy appears to be improving, its long-term strength is in question: domestic consumers face many challenges including high unemployment and a relatively conservative credit environment, and corporations may become less eager to spend once depleted inventory levels are restored. Still, governments worldwide remain very serious about economic stimulus, and prospects for consumers in the emerging markets are currently considerably brighter than for their U.S. counterparts, potentially providing some support for well positioned globally oriented companies.

Even with recent gains, the past fiscal year has been enormously painful for investors. For portfolio managers who focus on fundamentals, this period has carried some unique challenges, as a largely indiscriminate equity sell-off has been followed by a period in which many low-quality stocks, which had declined precipitously, enjoyed some of the market's best returns on the upside. Still, for practitioners of long-term investing, one benefit of the steep correction was to depress the stock prices of many good companies—allowing such investors viable entry points in what they believe could be exceptional opportunities.

As always, the portfolio managers at Neuberger Berman are approaching this environment thoughtfully and with great precision. Although they do not profess to be market prognosticators, they remain highly attentive to current macroeconomic trends, as well as the development of new regulation in this era of heightened government activism. Most importantly, they remain true to their investment disciplines, looking at individual company fundamentals as well as key measures of quality, value and risk to create portfolios that they believe will serve their shareholders well over the long term. This expertise and focus on individual stock selection, I believe, will be highly valuable in the current market and economic environment.

Thank you for your continued confidence in Neuberger Berman. We look forward to serving your investment needs in the year to come.

Sincerely,

Robert Conti

President and CEO

Neuberger Berman Mutual Funds

1

Climate Change Fund Commentary

For the fiscal year ended August 31, 2009, Neuberger Berman Climate Change Fund trailed its benchmark, the MSCI World Index, as both the Fund and the index declined as a result of an unprecedented equity market environment. While the Fund was outdistanced by the more comparable HSBC Global Climate Change Index during the period, the Fund outperformed many "pure play" alternative and clean energy investment vehicles. Although extreme market volatility created a challenging environment at times during the 12-month reporting period, we are greatly encouraged by the Fund's strong performance in calendar year 2009 and are more energized than ever about the Fund's investment approach, especially given the many positive climate-change related government, industry and company-specific policies and initiatives that are developing on an ongoing basis.

Government policy momentum has been extraordinary this calendar year, with the Obama Administration and Congress introducing numerous climate-related initiatives. The American Reinvestment and Recovery Act, passed in February, provides for more than $100 billion in spending on low-carbon growth initiatives. Recently, federal agencies have begun deploying these funds in myriad ways—for example, through clean energy cash grants and loan guarantees, advanced battery/electric vehicle grants, renewable energy manufacturing tax credits, smart grid grants and cleaner transportation programs (such as "cash-for-clunkers" and natural gas vehicle incentives). On a global basis, governments are targeting "green" stimulus initiatives in the hope, not only to improve energy security and environmental benefits, but also to drive job creation; we estimate that hundreds of billions of dollars have been directed worldwide to address these issues so far. We believe that an upcoming global climate change summit in Copenhagen could stimulate even more interest in climate change issues—and by extension support opportunities in climate change-related investing.

The Climate Change Fund invests within three broad market segments—Cleaner Energy, Energy Efficiency and Climate Adaptation—carving out investment sub-themes within these areas. During the fiscal year, a number of factors supported Fund results, including relatively defensive holdings (e.g., natural gas utilities, water metering companies) with strong management teams and stocks within our alternative energy and energy storage sub-themes (within our Cleaner Energy and Energy Efficiency categories). We believe the energy storage/battery industry is poised to enter a significant expansion phase driven by higher energy costs, technological breakthroughs and domestic and international policy support; for example, the global lithium ion battery market for automotive applications alone is expected to grow exponentially over the coming decade. In alternative energy, the geothermal industry appears promising to us. Not only is it a clean, dependable and cost-effective energy solution, but it appears to have strong regulatory support (in the form of renewable electricity standards) and a seemingly abundant, although largely untapped, source of supply.

Several factors impeded Fund performance during the fiscal year, including lingering questions about commodity prices and economy-wide concerns over the availability of capital. For instance, even with continued progress toward grid parity, our solar sub-theme underperformed as the fragile credit market and softening demand gave rise to oversupply, pricing pressures, and short-term profitability concerns. The wind industry also succumbed to the weak credit market as marginal wind farms struggled to access project finance and some utilities pared back capital expenditures, which triggered concerns about turbine overcapacity. Importantly, these sectors have rebounded strongly in calendar year 2009 and we continue to believe that the long-term investment appeal of both wind and solar remains intact, with the two industries likely, in our view, to be among the top beneficiaries of government stimulus in 2010.

Although economic and credit-related fears appear to be tapering off, we believe that the Fund's diversification—by segment, geography, market capitalization and sector—remains a key advantage. The Fund continues to be overweighted in U.S. securities—largely due to policy catalysts and signs of economic stabilization—but our international exposure has continued to rise in recent months. At the close of the fiscal year, our allocation among the three investment components was as follows: 40% Cleaner Energy, 34% Energy Efficiency and 22% Climate Adaptation. Our holdings currently span market capitalizations and represent eight of 10 industrial sectors, with our largest overweights in smart grid, water service, natural gas and wind power. Cash levels are currently low as we continue to find what we consider exceptional opportunities with attractive long-term reward/risk profiles.

2

In closing, we believe that climate change-related companies could benefit from the economic recovery, especially given the potential impact of climate-related stimulus next year and ongoing political support for policy initiatives. In our view, the Fund is well positioned to capitalize on these potential short-term developments and the ongoing, long-term evolution of the world to a new "carbon constrained" reality.

Sincerely,

Ronald B. Silvestri

Portfolio Manager

Climate change-related companies may be particularly susceptible to such factors as environmental protection regulatory actions, changes in government standards and subsidy levels, changes in taxation, and other domestic and international, political, regulatory and economic developments. Such companies may also be significantly affected by the level or pace of technological change in industries focusing on energy, pollution and environmental control. Because society's focus on climate change issues is relatively new, there could be significant changes of emphasis and direction, and rapid technological change, rendering even new approaches and products obsolete. The risks associated with these investments are set forth in the prospectus and statement of additional information.

Investing in foreign securities involves greater risks than investing in securities of U.S. issuers, including currency fluctuations, changes in local economic and political conditions, and the need to operate in less regulated financial markets.

To the extent that the Fund emphasizes small-, mid- or large-cap stocks, it takes on the associated risks. At times, large-cap stocks may lag other types of stocks in performance, which could cause a fund holding those stocks to perform worse than certain other funds. Small- or mid-cap stocks may fluctuate more widely in price than the market as a whole; underperform other types of stocks or be difficult to sell when the economy is not robust or during market downturns; be more affected than other types of stocks by the underperformance of a sector emphasized by the Fund. In addition, smaller companies in which the Fund may invest are often more volatile and less liquid than the stocks of larger companies; and these companies: may have a shorter history of operations than larger companies; may not have as great an ability to raise additional capital; and may have a less diversified product line, making them more susceptible to market pressure.

The composition, industries and holdings of the Fund are subject to change. Climate Change Fund is invested in a wide array of stocks and no single holding makes up a significant portion of the Fund's total assets.

3

Climate Change Fund

TICKER SYMBOLS

| Institutional Class | | NBCLX | |

| Class A | | NBCAX | |

| Class C | | NBCCX | |

SECTOR ALLOCATION

| (% of Equity Market Value) | |

| Consumer Discretionary | | | 4.1 | % | |

| Consumer Staples | | | 0.5 | | |

| Energy | | | 9.1 | | |

| Financials | | | 2.2 | | |

| Industrials | | | 37.7 | | |

| Information Technology | | | 10.2 | | |

| Materials | | | 6.8 | | |

| Utilities | | | 28.5 | | |

| Other | | | 0.9 | | |

| Total | | | 100.0 | % | |

AVERAGE ANNUAL TOTAL RETURN1,3,10

| | | Inception

Date | | 1 Year | | Life of

Fund | |

| At NAV | |

| Institutional Class | | 05/01/2008 | | | (26.55 | %) | | | (27.05 | %) | |

| Class A | | 05/01/2008 | | | (26.77 | %) | | | (27.22 | %) | |

| Class C | | 05/01/2008 | | | (27.22 | %) | | | (27.73 | %) | |

| With Sales Charge | |

| Class A | | | | | (30.95 | %) | | | (30.37 | %) | |

| Class C | | | | | (27.92 | %) | | | (27.73 | %) | |

| Index | |

| MSCI World Index2,19 | | | | | (16.64 | %) | | | (19.29 | %) | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2012 for Institutional Class, Class A and Class C shares. The net expense ratios were 1.03%, 1.28% and 2.03% for Institutional Class, Class A and C shares, respectively. As stated in the Fund's most recent prospectus, the total annual fund operating expense ratios for fiscal year 2008 were 25.07%, 16.86% and 28.63% for Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements).

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charge (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1% which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

4

Climate Change Fund

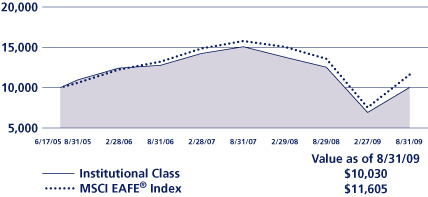

COMPARISON OF A $10,000 INVESTMENT

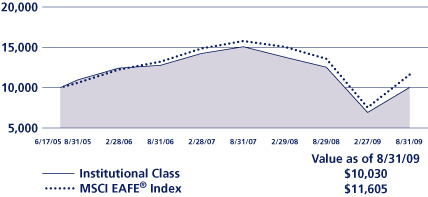

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Average Annual Total Return chart on previous page). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

5

Emerging Markets Equity Fund Commentary

We are pleased to report that, for the period from its October 8, 2008 inception through fiscal year-end on August 31, 2009, Neuberger Berman Emerging Markets Equity Fund posted a strong positive return and outperformed its benchmark, the MSCI Emerging Markets (MSCI EM) Index.

The emerging markets, as measured by the MSCI EM Index, bottomed in October. They were extremely volatile from that point until early March, when the U.S. and developed international markets began to see improvement on the back of government stimulus plans and early indications of economic improvement. From March through the end of this reporting period, the index was up substantially, with numerous underlying countries posting high double-digit or low triple-digit returns.

During the October-August reporting period, all sectors of the index were positive, with Materials stocks performing best, up over 70%. The weakest index sector was Telecommunications, but even that closed up by 26%. China, Brazil and India contributed strongly to the index on a country basis, while Eastern European nations were relatively weak.

Beginning as it did in the midst of a tremendous worldwide equity market correction, the portfolio was well positioned from the start to employ some of the key tenets of its strategy—seeking opportunities from mispricings, and identifying quality companies selling at a discount to their underlying values.

Within the portfolio, stock selection in the Information Technology sector was excellent, and made a significant contribution to our outperformance. Wasion, a Chinese power meter firm, was a top performer for the period. Having completed an extensive build-out in generating capacity, China is now focusing spending on its electricity grid, benefiting companies like Wasion. ZTE, a Chinese telecom equipment manufacturer, was another positive contributor, on news that the company is gaining market share overseas and is likely to be a major beneficiary of increased mobile capital expenditures in China.

Stock selection in Energy also contributed to results. The Brazilian oil and gas firm Petrobras saw shares rise as prospects in Brazil's offshore oil segment improved. Addax Petroleum, a Canadian energy company with assets in West Africa and Kurdistan, was another strong performer. Addax was purchased by Chinese energy company Sinopec at a premium.

An overweight in Consumer Staples, along with solid stock selection, was also additive. Hengan International, a Chinese disposable paper hygiene products company, performed very well, although Central European Distribution, the largest producer and distributor of vodka in Poland and Russia, was among our weakest holdings, declining on concerns about Eastern European exposure and euro- and dollar-denominated debt.

Materials holdings were the largest detriment on a relative basis. Being underweight in the benchmark's top-performing sector, along with several individual disappointments, hurt relative results. Uralkali, a CIS-based potash producer, declined steeply. Potash prices had risen significantly in the first half of 2008, and fertilizer stocks throughout the world rallied. However, in what appeared to be punishment for charging market prices, the Russian government levied a large fine on the firm, damaging its prospects. Evraz was another disappointment. The Russian steel maker had become highly leveraged after several acquisitions, so when credit conditions became largely frozen early in the reporting period, the stock fell to near-bankruptcy levels. We purchased the stock well into its correction, but the severity of the economic downturn took a further toll on the share price. We recovered part of our losses before selling, but Evraz was still one of our poorest performers. Cash holdings within the portfolio, while not significant, were another slight negative in a sharply rallying market.

Looking ahead, we remain fairly cautious on the global economy. However, we expect better growth from the emerging markets than from developed nations. While there are rather large disparities among developing countries, the economic fundamentals of many emerging markets appear, in our opinion, to be strong, and, in many cases, more attractive than their developed counterparts. We think countries like China, India and Indonesia, with low public and private debt-to-GDP levels, banking systems with lower loan-to-deposit ratios, and strong potential from domestic

6

demand growth driven by large populations, offer attractive opportunities. Conversely, the indebted, export-driven economies of Taiwan, Korea and Eastern Europe are, in our opinion, less appealing.

In terms of individual stocks, the portfolio remains overweight in smaller domestic-market driven names, which we believe will continue to show secular growth despite global economic weakness. Sector overweights include Consumer Staples, Health Care, Information Technology and Industrials, and underweights include Energy and Financials.

In the face of a market that has rallied sharply since the Fund's inception, we continue to seek companies with strong fundamentals and attractive valuations across markets, using bottom-up stock selection to identify the opportunities we believe are best positioned for the longer term.

Sincerely,

Conrad Saldanha

Portfolio Manager

The risks involved in seeking capital appreciation from investments primarily in companies based outside the United States are set forth in the prospectus and statement of additional information.

Investing in foreign securities involves greater risks than investing in securities of U.S. issuers, including currency fluctuations, changes in local economic and political conditions, and the need to operate in less regulated financial markets. These risks are typically heightened for investments in emerging markets.

Investing in the stocks of even the largest companies involves all the risks of stock market investing, including the risk that they may lose value due to overall market or economic conditions.

The composition, industries and holdings of the Fund are subject to change. In an attempt to reduce overall volatility, Emerging Markets Equity Fund diversifies the portfolio holdings over a wide array of countries and individual stocks.

7

Emerging Markets Equity Fund

TICKER SYMBOLS

| Institutional Class | | NEMIX | |

| Class A | | NEMAX | |

| Class C | | NEMCX | |

SECTOR ALLOCATION

| (% of Equity Market Value) | |

| Consumer Discretionary | | | 5.6 | % | |

| Consumer Staples | | | 7.4 | | |

| Energy | | | 12.6 | | |

| Financials | | | 19.7 | | |

| Health Care | | | 3.7 | | |

| Industrials | | | 13.5 | | |

| Information Technology | | | 16.0 | | |

| Materials | | | 11.6 | | |

| Telecommunication Services | | | 8.9 | | |

| Utilities | | | 1.0 | | |

| Total | | | 100.0 | % | |

CUMULATIVE TOTAL RETURN1,3,10

| | | Inception

Date | | Cumulative Total

Return Ended 8/31/09

Life of Fund | |

| At NAV | |

| Institutional Class | | 10/08/2008 | | | 44.66 | % | |

| Class A | | 10/08/2008 | | | 44.38 | % | |

| Class C | | 10/08/2008 | | | 43.42 | % | |

| With Sales Charge | |

| Class A | | | | | 36.08 | % | |

| Class C | | | | | 42.42 | % | |

| Index | |

| MSCI Emerging Markets Index2,19 | | | | | 30.66 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2012 for Institutional Class, Class A and Class C shares. The net expense ratios were 1.25%, 1.50% and 2.25% for Institutional Class, Class A and Class C shares, respectively. As stated in the Fund's most recent prospectus, the total annual fund operating expense ratios for fiscal year 2008 were 2.09%, 2.45% and 3.20% for Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements).

Total Returns shown with a sales charge reflect the deduction of current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

8

Emerging Markets Equity Fund

COMPARISON OF A $10,000 INVESTMENT

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Cumulative Total Return chart on previous page). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

9

Equity Income Fund Commentary

We are pleased to report that for the fiscal year ended August 31, 2009, Neuberger Berman Equity Income Fund outperformed its benchmark, the S&P 500 Index. In light of the investment environment, however, returns for both the Fund and the index were negative.

The past 12 months encompassed some of the most difficult economic and market conditions in memory. The S&P 500 closed down over 18% for the fiscal year, but that figure belies the quarter-by-quarter turbulence beneath it. Beginning with the Lehman bankruptcy and economic crisis that ensued, we saw enormous upheaval in financial markets. By March 2009, the market had bottomed. A bank bailout proposal and other mildly positive news supported equities in a rally that continued through August. For the full fiscal year, however, every sector of the S&P 500 closed down.

Equity Income Fund has defensive features that seek to provide value in difficult environments. The sectors we emphasize—Real Estate Investment Trusts (REITs), Utilities, Convertible Bonds and higher yielding stocks—contribute to a portfolio designed for high income and capital appreciation potential, with less volatility than the market. This strategy, along with an opportunistic cash position and successful option writing strategies, led to our outperformance for the fiscal year.

Heading into this period, we had taken profits in Energy holdings, resulting in a significant cash position. With concerns about the slowdown already underway and the potential for damage to come, we kept approximately 20% of assets in cash and cash equivalents, which helped limit the impact of ongoing upheaval. We also purchased floating rate notes, which are cash equivalents whose income advantage helped us meet yield goals.

At an average of 14%, the portfolio's Utilities holdings were at a significant overweight versus the index. This sector has defensive characteristics and attractive, often growing dividends. Although Utilities underperformed the broader index, our stock selection enhanced relative performance.

In REITs, approximately 15% of assets, we sought companies with ample cash, attractive dividends and the potential to grow their businesses and withstand economic setbacks. We generally avoided traditional commercial and industrial REITs, finding what we consider compelling opportunities elsewhere. Digital Realty, a digital storage REIT, was a top performer. The aptly named Health Care REIT, as well as GZI, a Chinese REIT, and American Campus Communities, an off-campus housing firm, were beneficial to results. Timber REIT holdings also helped relative returns. Among traditional REITs, Weingarten Realty Investors and Equity Residential disappointed.

In Convertible Bonds, the portfolio's weighting was as high as 30% recently, up from around 18% last year. From September through November, the sector came under pressure as hedge funds began deleveraging quickly, dumping securities inventory at what we consider an exceptional discount to par. In December, we sifted through the carnage and built exposure as price declines drove yields to 10-15%. Even after the market improved, we believe the yield-to-maturity and yield-to-puts of our portfolio holdings remain impressive relative to the five-year U.S. Treasury. By August, we sold certain convertible bonds after dramatic appreciation and redeployed proceeds into other bonds with, in our opinion, attractive yields, strong balance sheets and good cash flows. The portfolio's allocation was approximately 22% by the period's close.

The Fund also benefited from option writing throughout the year. We sold call options as stocks in the portfolio approached our target sell prices, allowing us the potential to enhance the income from stocks as they neared our exit prices. When possible, we also sold puts on companies we wished to own at a particular price. This also served to increase income.

The most negative impact on the portfolio this period came from an overweight in Energy, where many holdings underperformed as oil prices declined from approximately $140 per barrel to $40 within seven months. We also owned energy-related Canadian Income Trusts. Holdings such as Hugoton Royalty Trust, Canadian Oil Sands Trust and Cathedral Energy suffered doubly as the Canadian dollar weakened toward year-end.

10

The Fund was significantly underweighted in Consumer Discretionary and Staples stocks versus the S&P 500, on concerns about high unemployment, declining home prices, limited access to credit, and a slowdown in U.S. consumer spending. Although REITs fall under the category of Financials, the portfolio was underweighted in traditional bank stocks versus the index. This hurt relative performance during the rally, but benefited the portfolio for the full year. For a brief time, the Fund owned JPMorgan Chase and Bank of America but sold these positions when we became uncertain about earnings as government intervention continued.

Going forward, our approach is optimistic but relatively cautious. We believe the Fund is well positioned to take advantage of improvements in the broader market, while limiting exposure to volatility and providing a competitive yield. The portfolio's cash position is down. In Energy, we expect benefits as oil prices rise on diminished production and increasing demand. The portfolio is overweighted in Materials, with holdings including Freeport-McMoRan Copper & Gold and Royal Gold serving as a hedge against a potentially weaker U.S. dollar. We expect to continue to find opportunity in Convertibles and select non-traditional REITs. Finally, the Fund remains underweighted in companies dependent on the U.S. consumer, instead looking to overweight those we believe have great assets, sustainable business models and an ability to continuously grow in a capital-constrained world.

Sincerely,

Richard S. Levine, Tony Gleason and Sandy Pomeroy

Portfolio Co-Managers

The risks involved in seeking capital appreciation from investments in a wide array of stocks are set forth in the prospectus and statement of additional information.

Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile.

Investing in the stocks of even the largest companies involves all the risks of stock market investing, including the risk that they may lose value due to overall market or economic conditions.

The composition, industries and holdings of the Fund are subject to change. Equity Income Fund is invested in a wide array of stocks and no single holding makes up a significant portion of the Fund's total assets.

11

Equity Income Fund

TICKER SYMBOLS

| Institutional Class | | NBHIX | |

| Class A | | NBHAX | |

| Class C | | NBHCX | |

SECTOR ALLOCATION

| (% of Equity Market Value) | |

| Consumer Discretionary | | | 2.0 | % | |

| Consumer Staples | | | 6.8 | | |

| Energy | | | 14.5 | | |

| Financials | | | 22.5 | | |

| Health Care | | | 1.7 | | |

| Industrials | | | 2.1 | | |

| Information Technology | | | 1.8 | | |

| Materials | | | 3.7 | | |

| Telecommunication Services | | | 1.7 | | |

| Utilities | | | 14.1 | | |

| Other | | | 29.1 | | |

| Total | | | 100.0 | % | |

AVERAGE ANNUAL TOTAL RETURN1,3

| | | Inception

Date | | 1 Year | | Life of

Fund | |

| At NAV | |

| Institutional Class | | 06/09/2008 | | | (15.54 | %) | | | (0.94 | %) | |

| Class A17 | | 06/09/2008 | | | (16.01 | %) | | | (1.13 | %) | |

| Class C17 | | 06/09/2008 | | | (16.60 | %) | | | (1.44 | %) | |

| With Sales Charge | |

| Class A17 | | | | | (20.81 | %) | | | (3.18 | %) | |

| Class C17 | | | | | (17.42 | %) | | | (1.44 | %) | |

| Index | |

| S&P 500 Index2,19 | | | | | (18.25 | %) | | | (7.76 | %) | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

During the period from November 2, 2006 through June 9, 2008, the Fund's Trust Class had only one investor, which could have impacted Fund performance. The inception date for the Fund's Institutional Class, Class A and Class C shares was June 9, 2008. Performance shown for the Institutional Class, Class A and Class C shares prior to that date is that of the Trust Class, which had an inception date of November 2, 2006 and converted into Institutional Class shares and ceased operations on June 9, 2008.

Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2012 for Institutional Class, Class A and Class C shares. The net expense ratios were 0.85%, 1.23% and 1.98% for Institutional Class, Class A and Class C shares, respectively. As stated in the Fund's most recent prospectus, the total annual fund operating expense ratios for fiscal year 2008 were 3.41%, 5.73% and 7.00% for Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements).

Total Returns shown with a sales charge reflect the deduction of current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

12

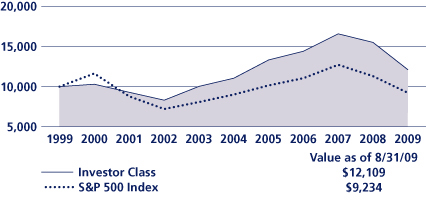

Equity Income Fund

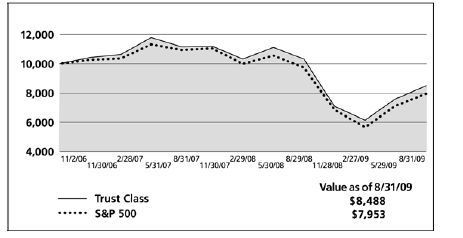

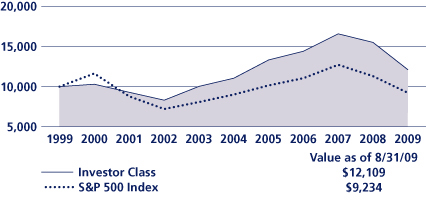

COMPARISON OF A $10,000 INVESTMENT (WITH SALES CHARGE)

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Class A shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Average Annual Total Return chart on previous page). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

13

Focus Fund Commentary

The fiscal year ended August 31, 2009 was a period of unprecedented market volatility as fallout from the credit crisis triggered a substantial decline, which was followed by a rally as governments responded worldwide. Although Neuberger Berman Focus Fund was able to regain a substantial amount of lost ground and roughly match the performance of its S&P 500 benchmark in the second half of the fiscal year, it recorded a loss and trailed the index for the full period.

Health Care investments had the most negative effect on performance relative to the benchmark. Two disappointing holdings in this sector were joint replacement manufacturer Zimmer Holdings and biotechnology company Genzyme. In the case of Zimmer, management's failure to quickly and effectively address issues regarding payments to doctors resulted in a loss of business momentum in a highly competitive market. We eliminated the position, but not before sustaining a substantial loss. Genzyme shares fell when one of its major plants failed an FDA inspection and then encountered manufacturing issues at the plant, causing an extended shut-down. We expect the plant to be fully functional by late November, which we consider a big first step in Genzyme's potential road to recovery.

Financials sector investments also underperformed, with Bank of America and Citigroup detracting from results. Citigroup had been a long-standing portfolio holding. We held onto the position throughout much of the credit crisis with the belief that the company would be able to weather the turmoil and ultimately emerge as a stronger entity. However, as the economy grew increasingly dire in the fourth quarter of calendar year 2008 and the stock market experienced a precipitous decline, in our view it became a real possibility that Citigroup might not survive. So, we gradually sold the position and took steep losses, albeit at much higher price levels than where Citigroup bottomed a few months later. We purchased Bank of America after the stock dropped 30% off its recent high because we felt that the risk/reward looked compelling. Yet when the federal government stepped in a few months later to inject capital into the company, we believed the risk to common shareholders became too severe. We therefore exited the position, again at a sharp loss, but several weeks before the stock reached its bottom. The Fund maintains exposure to the higher quality, better capitalized Financials that have and, we believe, should continue to benefit as the market stabilizes.

Consumer Discretionary sector investments posted a solid gain versus a loss for the corresponding S&P 500 sector component. Helped by particularly strong sales in its Olive Garden division, casual dining company Darden Restaurants enjoyed a gain for the period (although we then sold the position at an overall loss). Off-price retailer TJX was one of the few retailers to record sales growth over the last 12 months. The company's ability to access better brands (a result of the weak sales for full-price retailers) helped boost sales.

Although our Energy sector investments recorded a substantial loss, they outperformed the benchmark sector component by a sizable margin. Our focus on exploration and production companies with the lowest finding and development costs, which make them less leveraged to energy prices, helped limit the damage in this, the S&P 500's second worst performing sector. Range Resources, was the Fund's best Energy sector performer.

Reluctantly putting on our economic forecasting hat, we remain cautiously optimistic. We think the doomsday "Great Depression II" scenario is now highly unlikely. However, we question whether the V-shaped recovery equities investors appear to be anticipating will materialize. The economy has come a long way in the last six months, but this may be more a function of the replenishment of severely depleted inventories and government programs temporarily stimulating consumer spending than an indication of more normalized demand-driven growth.

Over the last six months, we believe investor confidence in a strong economic recovery and appetite for risk have increased significantly as evidenced by the superior performance of economically sensitive sectors such as Financials, Industrials, Materials and Energy and big moves in what we consider lower quality, more speculative issues. If economic growth fails to meet what may be optimistic expectations, we believe that today's market leaders are probably vulnerable. We think that focusing on undervalued companies that can sustain respectable cash flow and earnings growth even in a less vibrant economy could be a relatively satisfactory approach in the year ahead.

14

Sincerely,

David Levine

Portfolio Manager

Because the Fund is concentrated in a small number of stocks, it will be substantially overweighted or underweighted in certain economic sectors at any given time. Therefore its performance is likely to be disproportionately affected by the factors influencing those sectors and may suffer if certain economic sectors it emphasizes do not perform as expected. The risks associated with these investments are set forth in the prospectus and statement of additional information.

Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile. Large-cap stocks are subject to all the risks of stock market investing, including the risk that they may lose value.

The composition, industries and holdings of the Fund are subject to change.

15

Focus Fund

TICKER SYMBOLS

| Investor Class | | NBSSX | |

| Trust Class | | NBFCX | |

| Advisor Class | | NBFAX | |

SECTOR ALLOCATION

| (% of Equity Market Value) | |

| Consumer Discretionary | | | 8.7 | % | |

| Consumer Staples | | | 12.6 | | |

| Energy | | | 14.4 | | |

| Financials | | | 12.7 | | |

| Health Care | | | 16.6 | | |

| Industrials | | | 11.1 | | |

| Information Technology | | | 20.5 | | |

| Utilities | | | 3.4 | | |

| Total | | | 100.0 | % | |

AVERAGE ANNUAL TOTAL RETURN1,3,9

| | | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

| Investor Class | | 10/19/1955 | | | (21.06 | %) | | | 0.27 | % | | | 2.02 | % | | | 10.21 | % | |

| Trust Class | | 08/30/1993 | | | (21.21 | %) | | | 0.06 | % | | | 1.82 | % | | | 10.22 | % | |

| Advisor Class | | 09/03/1996 | | | (21.45 | %) | | | (0.17 | %) | | | 1.58 | % | | | 10.17 | % | |

| S&P 500 Index2,19 | | | | | (18.25 | %) | | | 0.49 | % | | | (0.79 | %) | | | 9.61 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual fund operating expense ratios for fiscal year 2008 were 0.90%, 1.12% and 1.35% for Investor Class, Trust Class and Advisor Class shares, respectively.

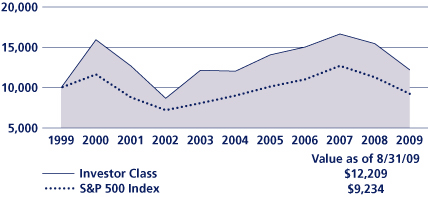

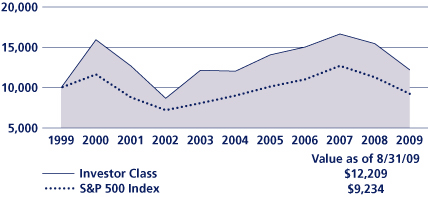

COMPARISON OF A $10,000 INVESTMENT

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Average Annual Total Return chart above). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

16

Genesis Fund Commentary

U.S. stocks mounted a sustained rally following the early March market bottom. However, this advance failed to compensate for the sharp sell-off during the first half of the fiscal year ended August 31, 2009. For the full 12-month period, all 10 Russell 2000® Index sectors declined, with four finishing down 20% or more. Neuberger Berman Genesis Fund recorded strongly positive returns in the second half of the period but finished in negative territory, lagging its Russell 2000 benchmark.

The disappointing relative returns of Health Care and Consumer Discretionary sector investments were largely responsible for the Fund's underperformance versus the benchmark. We made some mistakes, most notably ArthroCare and K-V Pharmaceutical Company, both of which suffered company-specific problems and were eliminated from the portfolio. Contract research companies Pharmaceutical Product Development and ICON PLC also performed poorly as large pharmaceuticals responded to potential changes in the health care system by reducing research and development spending. We believe this is a temporary phenomenon and that once "big pharma" increases R&D spending, these two well-positioned companies will rebound. Radio rating services company Arbitron and casket and headstone manufacturer Matthews International were the poorest performing Consumer Discretionary investments. Arbitron's struggles are tied to the pressures facing its primary customers—radio operators which have been experiencing a severe advertising slump. We have meaningfully reduced our position in Arbitron. As for Matthews, this is a classic "Steady Eddie" company with strong competitive positions in stable end markets. Due largely to the severe recession and a decline in the nation's death rate for 2009, Matthews is on track to have modestly down earnings for the year—a disappointing performance for investors who had become accustomed to consistently increasing earnings during the past several years. As a result, the stock was not able to keep pace with the overall Consumer Discretionary segment during the fiscal year.

Although the portfolio was overweighted in Energy—the Russell 2000's worst performing sector—and our holdings declined sharply, they outpaced sector counterparts and made a positive contribution to relative performance. Our bias toward exploration and production companies such as Southwestern Energy and Concho Resources, which have solid balance sheets and have been steadily increasing production and reserves on an economic basis, was the primary reason our holdings outperformed the corresponding benchmark component by a wide margin. Financials holdings also outperformed. The portfolio was significantly underweighted in Financials and our avoidance of the most credit-sensitive financial businesses helped us escape much of the damage in this hard-hit sector.

Over the last six months we have witnessed a sea change in investor sentiment. Investors have gone from asking, "How bad will it get?" to "How good is it going to be?" We believe that investor confidence in a strong global economic recovery is reflected in their renewed appetite for risk. To wit, from the Russell 2000 bottom on March 9, 2009 through August 31, 2009, lower quality, more speculative stocks—as measured by return on equity, price/projected earnings, market capitalization range and stock price (stocks trading under $5 per share)—have outperformed by a wide margin. Historically, Genesis has lagged its benchmark during such periods due to our focus on owning high quality businesses.

Moreover, we are not so confident that the current economic rebound is sustainable. We believe that recent improvement in the U.S. economy is primarily the result of rebuilding inventories that were decimated when the "economic sky was falling." In addition, government programs may have temporarily reinvigorated consumer spending. Once inventories are brought in line with still relatively weak domestic demand and government incentives for consumer spending are reduced or eliminated, we believe the economy may lose momentum.

Our long-held approach of seeking a diversified portfolio of high quality, financially strong companies selling at average to below-average prices remains intact. We have overlaid this approach with several macroeconomic themes. Consequently, we continue to underweight sectors such as Consumer Discretionary and Financials (specifically, credit-sensitive businesses such as banking, consumer credit companies and real estate investment trusts) that are highly dependent on the still overleveraged American consumer. Also, we continue to overweight sectors such as Energy, select Materials and agriculture-related Industrials, which we believe should continue to benefit from increasing emerging market demand. We also remain committed to less economically sensitive businesses, such as "Steady Eddies" and Health Care. We believe

17

these strategies could lead to superior relative performance if our reservations regarding the durability of a vibrant economic recovery prove justified. If economic growth exceeds our expectations, we believe the portfolio's overweights in Energy, Materials and select Industrials should help Genesis participate in any extended stock-market advance.

Sincerely,

Judith M. Vale and Robert D'Alelio

Portfolio Co-Managers

The risks involved in seeking capital appreciation from investments primarily in companies with small market capitalization are set forth in the prospectus and statement of additional information.

Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile.

The composition, industries and holdings of the Fund are subject to change. Genesis Fund is invested in a wide array of stocks and no single holding makes up a significant portion of the Fund's total assets.

18

Genesis Fund

TICKER SYMBOLS

| Investor Class | | NBGNX | |

| Trust Class | | NBGEX | |

| Advisor Class | | NBGAX | |

| Institutional Class | | NBGIX | |

SECTOR ALLOCATION

| (% of Equity Market Value) | |

| Consumer Discretionary | | | 4.9 | % | |

| Consumer Staples | | | 8.1 | | |

| Energy | | | 14.6 | | |

| Financials | | | 10.3 | | |

| Health Care | | | 18.7 | | |

| Industrials | | | 25.0 | | |

| Information Technology | | | 10.5 | | |

| Materials | | | 6.7 | | |

| Utilities | | | 1.2 | | |

| Total | | | 100.0 | % | |

AVERAGE ANNUAL TOTAL RETURN1,3

| | | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

| Investor Class | | 09/27/1988 | | | (25.72 | %) | | | 5.52 | % | | | 10.48 | % | | | 11.84 | % | |

| Trust Class | | 08/26/1993 | | | (25.73 | %) | | | 5.48 | % | | | 10.44 | % | | | 11.84 | % | |

| Advisor Class | | 04/02/1997 | | | (25.95 | %) | | | 5.20 | % | | | 10.15 | % | | | 11.65 | % | |

| Institutional Class7 | | 07/01/1999 | | | (25.55 | %) | | | 5.74 | % | | | 10.74 | % | | | 11.97 | % | |

| Russell 2000® Index2,19 | | | | | (21.29 | %) | | | 2.21 | % | | | 4.30 | % | | | 8.29 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual fund operating expense ratios for fiscal year 2008 were 1.04%, 1.11%, 1.37% and 0.86% for Investor Class, Trust Class, Advisor Class and Institutional Class shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2019 for Institutional Class shares.

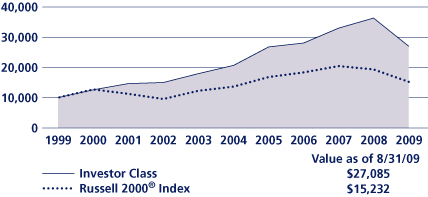

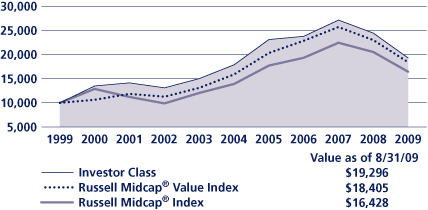

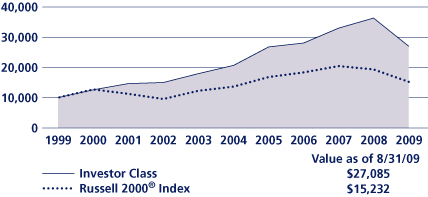

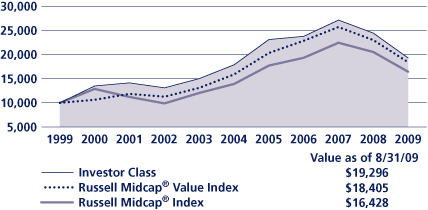

COMPARISON OF A $10,000 INVESTMENT

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Average Annual Total Return chart above). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

19

Guardian Fund Commentary

For the fiscal year ended August 31, 2009, Neuberger Berman Guardian Fund underperformed its benchmark, the S&P 500 Index. Within an overwhelmingly down market, performance for both the Fund and the index was negative.

In September 2008, the macroeconomic environment appeared dire, and markets sold off indiscriminately. Credit was constrained, business and consumer spending collapsed, and capacity utilization plummeted as businesses aggressively liquidated inventory. By early calendar year 2009, evidence suggested to us that this unprecedented global inventory destocking was ending, shifting toward a replenishment cycle.

Subsequent to the March equity market low, we have seen a significant rebound in global industrial production as businesses position to restock inventory. Over this period, the global economy has also benefited from various stimulus packages, reopened credit markets, low interest rates, and generally healthy corporate balance sheets. Together these factors added to optimism, and the markets rallied strongly. While the economy is clearly enjoying a vigorous near-term bounce, we believe consumers need to deleverage, and that the government's serious fiscal problems must also be addressed to remove long-term headwinds for economic growth. We are also concerned about pockets of excess industrial capacity in light of lower demand, and are cautious about growth rates and fundamentals when the inventory boost ends.

As long-term investors, we made few changes to the types of companies we own, except for selective repositioning for the "post-Lehman bankruptcy" environment. Turnover remains relatively low, and our adjustments have been thoughtful, careful and aligned with our longer-term strategy. We continue focusing on businesses whose growth, we believe, is less dependent on a vibrant global economy. In our opinion, most holdings either have recession-resistant businesses, or some strategic advantage that should allow them to gain market share to offset cyclical pressure presented by a weak economy.

We used last year's volatility to add to and introduce such names at attractive valuations. For example, while the newspaper business is weak, we own Washington Post Company for its high-growth Kaplan education business—Kaplan is enjoying extraordinary growth as American workers return to school to add credentials and improve their employment prospects.

Intuit, a top performer, is another example. Intuit provides individual and business productivity software and services including TurboTax, Quicken and QuickBooks. Through marketing initiatives, Intuit has grown its business and acquired new small- and medium-sized business customers during a period of economic weakness. For instance, the company has introduced a free version of the QuickBooks general ledger accounting system. This version demonstrates the software's value proposition—low cost and compelling benefits—and from there, Intuit can offer a full suite of paid services, such as payroll and payment systems, and web hosting.

We are currently limiting exposure to credit-sensitive Financials, as credit losses are rising, and the business models and earnings potential of the post-2008 world are still unclear. Within the Consumer Discretionary sector, we are avoiding retailers, expecting that consumer spending will be more measured. Finally, we are avoiding deep cyclicals; these include many Materials-related businesses and Industrial sector companies that depend on high capacity utilization rates for growth. All of these areas have enjoyed strong rallies off of the March lows.

Within a wildly divergent market—down following the Lehman bankruptcy then sharply higher—individual stock performance over this reporting period had more to do with the timing of specific purchases and sales. For instance, our top performer was IntercontinentalExchange, whose volume growth, we believe, should continue with increased regulation of securities markets. We added Praxair, a resilient, well-run business, during the valuation opportunity in 2008. Yahoo is in a turnaround, with a solid balance sheet, no debt, a low price-to-cash flow ratio and strong positioning for an ad-spending recovery, and Markel is one of the largest participants in the fragmented specialty insurance sector. We bought it at a meaningful discount, and believe it is positioned to grow. All of these holdings were new to the portfolio and were initially purchased prior to the rally from the March lows.

Among poor performers, we continue to own cable and component distributor Anixter. While disappointing for the August reporting period, it has been a strong performer in calendar year 2009. We eliminated Weingarten Realty Investors

20

and American Express last fall on concerns about credit markets. We sold Liberty Global but held Comcast, a resilient business that has enjoyed improved share price performance recently. We also sold Petroleo Brasiliero and added to our position in BG Group. While Petroleo Brasiliero needed additional leverage to finance growth, BG Group has an immaculate balance sheet, and has been an opportunistic buyer of energy properties.

True to our successful long-term strategy, we continue to manage the portfolio with a three- to five-year view, looking for businesses with advantaged growth. After performing better than the index during much of calendar year 2009, we lost ground in August as investors favored the "cyclical bounce" stocks we consider risky. We are encouraged by the prospects for our companies and think the portfolio is well positioned for growth within the more challenging environment we foresee. As always, we look forward to continuing to serve your investment needs.

Sincerely,

Arthur Moretti

Portfolio Manager

The risks involved in seeking capital appreciation from investments primarily in mid- to large-cap stocks are set forth in the prospectus and statement of additional information.

Mid-capitalization stocks are more vulnerable to financial risks and other risks than larger stocks. They are generally less liquid than larger stocks, so their market prices tend to be more volatile. Large-cap stocks are subject to all the risks of stock market investing, including the risk that they may lose value.

The composition, industries and holdings of the Fund are subject to change. Guardian Fund is invested in a wide array of stocks and no single holding makes up a significant portion of the Fund's total assets.

21

Guardian Fund

TICKER SYMBOLS

| Investor Class | | NGUAX | |

| Trust Class | | NBGTX | |

| Advisor Class | | NBGUX | |

| Institutional Class | | NGDLX | |

| Class A | | NGDAX | |

| Class C | | NGDCX | |

| Class R3 | | NGDRX | |

SECTOR ALLOCATION

| (% of Equity Market Value) | |

| Consumer Discretionary | | | 16.6 | % | |

| Energy | | | 12.9 | | |

| Financials | | | 14.1 | | |

| Health Care | | | 7.8 | | |

| Industrials | | | 18.8 | | |

| Information Technology | | | 23.9 | | |

| Materials | | | 3.2 | | |

| Utilities | | | 2.7 | | |

| Total | | | 100.0 | % | |

AVERAGE ANNUAL TOTAL RETURN1,3,8,15

| | | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

| At NAV | |

| Investor Class | | 06/01/1950 | | | (22.65 | %) | | | 1.74 | % | | | 1.28 | % | | | 10.81 | % | |

| Trust Class | | 08/03/1993 | | | (22.74 | %) | | | 1.59 | % | | | 1.15 | % | | | 10.78 | % | |

| Advisor Class | | 09/03/1996 | | | (23.05 | %) | | | 1.13 | % | | | 0.74 | % | | | 10.67 | % | |

| Institutional Class22 | | 05/27/2009 | | | (22.58 | %) | | | 1.76 | % | | | 1.29 | % | | | 10.81 | % | |

| Class A21 | | 05/27/2009 | | | (22.61 | %) | | | 1.75 | % | | | 1.29 | % | | | 10.81 | % | |

| Class C21 | | 05/27/2009 | | | (22.83 | %) | | | 1.70 | % | | | 1.26 | % | | | 10.80 | % | |

| Class R321 | | 05/27/2009 | | | (22.68 | %) | | | 1.74 | % | | | 1.28 | % | | | 10.80 | % | |

| With Sales Charge | |

| Class A21 | | | | | (27.06 | %) | | | 0.56 | % | | | 0.69 | % | | | 10.70 | % | |

| Class C21 | | | | | (23.50 | %) | | | 1.70 | % | | | 1.26 | % | | | 10.80 | % | |

| Index | |

| S&P 500 Index2,19 | | | | | (18.25 | %) | | | 0.49 | % | | | (0.79 | %) | | | 10.75 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2019 for Advisor Class shares, through August 31, 2012 for Institutional Class shares and through August 31, 2013 for Class A, Class C and Class R3 shares. The net expense ratios were 1.51%, 0.76%, 1.11%, 1.86% and 1.36% for Advisor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively. As stated in the Fund's most recent prospectus, the total annual fund operating expense ratios for fiscal year 2008 were 0.90%, 1.07%, 3.44%, 0.78%, 1.21%, 1.96% and 1.41% for Investor Class, Trust Class, Advisor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively (prior to any fee waivers or expense reimbursements).

Total Returns shown with a sales charge reflect the deduction of current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

22

Guardian Fund

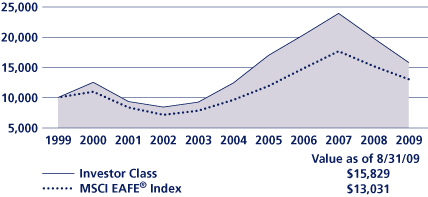

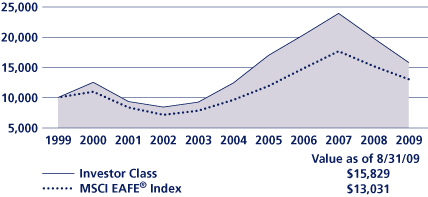

COMPARISON OF A $10,000 INVESTMENT

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Average Annual Total Return chart on previous page). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

23

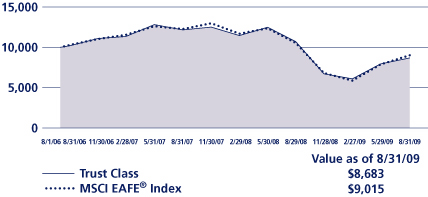

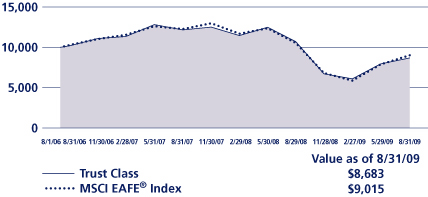

International Fund Commentary

For the fiscal year ended August 31, 2009, Neuberger Berman International Fund underperformed its benchmark, the MSCI EAFE® Index. While both the Fund and the index posted double-digit positive returns in calendar year 2009, returns for the full period were negative.

This was a tremendously difficult time for world's economies and equity markets, with steep declines in the EAFE Index from the beginning of the reporting period through early March 2009. Although markets rallied subsequently, the extremely bearish environment that endured through much of the period overwhelmed more recent improvements. For the full fiscal year, all sectors within the EAFE were down, with Consumer Staples performing best on a relative basis, and Materials declining most. Every country in the index declined except Spain, which was up less than 1%.

Because this report covers two distinctly different market environments—one in which defensive positioning was beneficial, and one in which cyclical companies outperformed—overall themes are not readily apparent. Taking the period as a whole, the market sectors that fared best included Consumer Staples, Telecommunications, Health Care and Consumer Discretionary. Materials, Information Technology, Financials, Utilities, Industrials and Energy were relatively weak. Throughout the period, our holdings reflected our commitment to our QuaRP (quality at a reasonable price) philosophy.

During the fiscal year, the Fund benefited on a relative basis from a lack of exposure to the weak Utilities sector, which, although usually defensive, underperformed. Given that we are QuaRP investors, Utilities companies rarely meet our requirements, tending to be lower growth, highly capital intensive, and highly regulated businesses. Stock selection within Telecommunications was also additive, and stock selection was beneficial within Materials as well. Initiated at a favorable time, our position in French chemical company Arkema was among the portfolio's top performers. However, Wacker Chemie, a German chemical company, lagged and was eliminated from the portfolio. While its solar business remains strong, Wacker's more cyclical chemical business has recently hampered company results. Finally, in a decidedly negative market, the Fund's somewhat higher-than-average level of cash and cash equivalents was another benefit.

In terms of detractors, the performance of some of the portfolio's Industrial holdings was disappointing. Vallourec, a French maker of seamless steel tubing and connectors used in deepwater drilling for natural gas, was our poorest performer. The stock was hurt by a soft U.S. gas market, and was sold. Health Care was another area of weakness. Within Energy, Addax Petroleum, a Canadian company with assets in West Africa and Kurdistan, was the Fund's top contributor. The company was taken over by Chinese energy company Sinopec during the period and was sold. Cameco, a Canadian uranium company, was also among our strongest performers. As governments worldwide look for ways to increase energy production with a lower carbon footprint, Cameco has benefited. However, Fund holdings underperformed the benchmark sector component, with disappointments including Paladin, a smaller-cap, lower-production Australian uranium company which has been eliminated from the portfolio. Canadian Natural Resources, a higher cost oil producer that was disproportionately impacted as commodity prices declined, also underperformed. We sold the stock early in the period. In Information Technology, an overweight and stock selection worked against us. While Canadian data specialist MacDonald Dettwiler was one of our best holdings, British electronics firm Laird PLC was one of the weakest and was sold. Our slight underweight and stock selection in Consumer Discretionary stocks were a headwind in this environment.

Within the troubled Financials sector, portfolio holdings had mixed results. On the positive side, Deutsche Boerse, operator of the Frankfurt stock exchange and an electronic and derivatives exchange, saw earnings exceed expectations, and performed very well. We believe the company should benefit further as new regulations move over-the-counter financial instruments to exchanges. Norwegian commercial bank DnB NOR returned to favor, as investors appeared to have considered its risks and opportunities more rationally. However, Swiss Re, an insurer of primary insurance companies, was sold from the portfolio after experiencing losses greater than we had anticipated. Piraeus, a Greek bank, declined on economic concerns and was eliminated from the portfolio. And French insurance company, Euler Hermes, was another significant disappointment that was sold. Overall, Fund holdings underperformed the benchmark in the sector.

24

Looking ahead, we continue to be fairly cautious on the global economy, expecting a protracted and muted recovery. While remaining somewhat defensive, we are adding cyclical names on a stock-by-stock basis where we find valuations compelling after lowered assumptions for revenue growth and margin expansion. In these markets, we continue to remain focused on our QuaRP discipline, seeking high quality, financially strong companies with good organic growth opportunities—an approach that we believe can deliver superior returns over the long run.

Sincerely,

Benjamin Segal

Portfolio Manager

The Fund is currently closed to new investors.

The risks involved in seeking capital appreciation from investments primarily in companies based outside the United States are set forth in the prospectus and statement of additional information.

Investing in foreign securities involves greater risks than investing in securities of U.S. issuers, including currency fluctuations, changes in local economic and political conditions, and the need to operate in less regulated financial markets. These risks are typically heightened for investments in emerging markets.