These gains belie the fact that this reporting period contained two very different markets. As the period began, the markets, which had been threatened by the possibility of a double-dip recession through summer 2010, rallied. The Federal Reserve's second quantitative easing effort ("QE2") was a tremendous stimulus that, along with unexpectedly strong corporate earnings, returned the market to its feet. Economically sensitive areas led as risk appetites increased, and the S&P 500 advanced by over 27% through February 2011.

Market volatility began to increase in March in the wake of the disaster in Japan and worsening global economic news. The U.S. economy grew only 0.8% through the first half of 2011, bringing investor sentiment full circle to recessionary fears. In addition, the ending of QE2, alarming headlines from the European debt crisis, engineered slowdowns in China and India, and a once unthinkable downgrade of U.S. government debt aggravated fears. Risk aversion increased, with investors pulling over $30 billion from equity mutual funds in July alone. In August, the CBOE Volatility (VIX) Index spiked to 48, a level not seen since March 2009, and consumer confidence hit a two-year low.

While the period closed in uncertain territory, our portfolio managers generally remain guardedly optimistic, expecting continued slow growth ahead rather than recession. In August, total industrial production was 3.4% above its level a year ago. Inventory restocking, M&A activity, and slow, steady increases in capital expenditures could also support growth for the remainder of the year. In addition, corporate balance sheets remain healthy, and in many cases, flush with cash; and earnings continue to show resilience.

With headlines continuing to influence investor sentiment and behavior, however, ongoing concerns bear watching. Paramount among these is what course of action the U.S. government and EU leaders will take in addressing their serious deficit situations. The Fed has suggested that policymakers will consider further steps to help stimulate the U.S. economy and has initiated an effort to reduce longer term interest rates dubbed "Operation Twist." However, with interest rates extremely low, and after two rounds of quantitative easing, it is uncertain what more the Fed can do. At the time of this writing, EU leaders continue working toward a solution to address Greece's potential default.

Regarding the U.S., our hope is that the deeply divided government will move past partisanship to reach lasting solutions to fiscal challenges. Meanwhile, we are closely watching economic indicators such as industrial and service business data, and consumer spending.

We have seen three sharp market declines during the last three years. During each, correlations among equities rose and stocks declined indiscriminately. As the market recovered from the first two downturns, fundamentals-driven active managers were able to add value, as the stocks of companies best positioned for the ensuing economic backdrop outperformed. Although it's too early to know this time, we think our strengths as hands-on active managers are on our side. We continue to believe that managers employing tested strategies and in-depth research to build differentiated, advantaged portfolios will outperform over the long term.

Along these lines, we are pleased to have introduced two new mutual funds—Neuberger Berman Global Equity Fund and Neuberger Berman Global Thematic Opportunities Fund, which you can learn more about in this report. Along with our other relatively new fund, Neuberger Berman Global Allocation Fund, they reinforce our commitment to providing shareholders with global investment opportunities, through experienced management teams and disciplined investment approaches.

Thank you for your confidence in Neuberger Berman. We look forward to continuing to serve your investment needs.

Neuberger Berman Emerging Markets Equity Fund Institutional Class generated a 3.44% total return for the fiscal year ended August 31, 2011, and underperformed its benchmark, the MSCI Emerging Markets (EM) Index, which provided a 9.40% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

From late summer through calendar year-end 2010, emerging markets continued their strong run, benefiting from expectations for improving global growth and ongoing local demographic and economic strength. Several factors converged, as the fiscal year progressed, however, that pulled back performance. As economic growth in developed markets came into question, with serious debt and political headwinds in both the U.S. and eurozone, markets weighted toward exports (global sectors) came under pressure. Additionally, concerns over inflation prompted investor outflows, particularly from local, smaller cap sectors. Central banks in several high growth economies, including China and India, began raising interest rates in an effort to control inflation and manage growth. Food inflation is a particular concern across emerging markets as it can make up almost half of the consumer price index (CPI) in certain countries.

Taking the fiscal year as a whole, emerging markets turned in high single-digit returns, underperforming both international developed markets and the S&P 500 Index. Although markets generally slowed down somewhat after their strong run, results remained positive for all sectors except Utilities. Consumer Discretionary and Staples stocks showed significant strength for the period, followed by Telecommunication Services. In addition to Utilities, Financials and Industrials stocks were areas of weakness.

By country, Thailand, Indonesia and Mexico were among the strongest markets, while Egypt, Turkey and India were the weakest. With the exception of a relatively robust Russian market, the powerful BRIC economies—Brazil, Russia, India and China—underperformed significantly this period.

Relative to the benchmark, the portfolio benefited most from underweights in the two weakest sectors, Utilities and Financials, and from our overweight in Consumer Discretionary holdings. Stock selection within Consumer Staples was also additive to performance. An overweight to the relatively weak Industrials and Health Care sectors and an underweight in Energy, relative to the benchmark, were detrimental to peformance.

Among individual holdings, Korean auto parts manufacturer Hyundai Mobis was the Fund's top contributor to performance. Hyundai/Kia Motors benefited from a loss of production from Japanese automakers. Longer term, we believe the company will benefit as Japanese automakers diversify their supplier base. Indonesia's PT Global Mediacom, an integrated pay TV and broadcasting company, benefited from favorable analyst reports highlighting the company's value. International Container Terminal, a Philippines based terminal port operator, performed well on strong fundamentals and new terminal concession wins.

Disappointments included Indian cable TV company DEN Networks. In our view, DEN is positioned to benefit from the migration to digital cable, but regulatory hurdles delayed the shutdown of the analog spectrum. Boer Power, a Chinese industrial company, underperformed as competition eroded the profitability of their Electronic Distribution Systems business. Xingda International, a leading Chinese wire manufacturer, detracted as margins dropped in both its auto and solar businesses. We believe these businesses' margins will recover over time. Supply disruptions impacted Melfas, a capacitive touch-sensor chip company. The possibility that Samsung, their biggest customer, may be developing their own chips raises significant risks for the company, and we sold the stock late in the reporting period.

We continue to see secular growth opportunities in the domestic sectors of the emerging markets. Fundamentals have remained solid and have been supported by a rising middle class, urbanization and governments with healthy balance sheets. While we acknowledge structural inflation will likely remain elevated, on average, wages have been rising faster than inflation, which combined with high savings rates bodes well for consumption over the long term.

From a sector perspective, Health Care continues to be our largest overweight, offering good consumer exposure, with a record of high returns and good cash flow generation at reasonable valuations. We are also constructive on domestically

driven Industrials, due to their potential role in resolving large infrastructure bottlenecks, capacity constraints and rising labor input costs—a recurring theme across many countries, including Brazil, India, China and the Philippines. We are underweighted in Financials compared to the benchmark, where we find valuations expensive. We are also slightly overweighted in Consumer Staples.

At the country level, we see growth and value in Thailand (where we think the decisive parliamentary victory of the Puea Thai party bodes well for stability), Turkey and the Philippines. We believe India offers interesting mid-cap opportunities, as does Brazil on a selective basis. We are more cautious on component-oriented export markets such as Korea and Taiwan, but are finding select opportunities. We also continue to see opportunities in the domestic sectors in China, although considerable government policy noise (to address rapidly rising property prices and wage increases) has put downward pressure on the market. While we see potential for a property bubble in China's largest cities, we continue to think that risks on a national level are largely overstated. We also believe that local government debt is manageable considering the significant reserves of the national government.We feel the biggest risk will likely be in Chinese financials, where we are underweight compared to the benchmark.

We believe that our bottom-up fundamental analysis within a macro perspective will help us continue to capture the longer-term opportunity these markets hold.

The risks involved in seeking capital appreciation from investments primarily in companies based outside the United States are set forth in the prospectus and statement of additional information.

Investing in foreign securities involves greater risks than investing in securities of U.S. issuers, including currency fluctuations, changes in local economic and political conditions, and the need to operate in less regulated financial markets. These risks are typically heightened for investments in emerging markets.

To the extent that the Fund emphasizes small-, mid- or large-cap stocks, it takes on the associated risks. At times, large-cap stocks may lag other types of stocks in performance, which could cause a fund holding those stocks to perform worse than certain other funds. Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile.

The composition, industries and holdings of the Fund are subject to change.

Emerging Markets Equity Fund (Unaudited)

| Institutional Class | | NEMIX | |

| Class A | | NEMAX | |

| Class C | | NEMCX | |

| Class R3 | | NEMRX | |

| (as a % of Total Investments) | |

| Consumer Discretionary | | | 12.7 | % | |

| Consumer Staples | | | 7.5 | | |

| Energy | | | 9.4 | | |

| Financials | | | 14.5 | | |

| Health Care | | | 5.6 | | |

| Industrials | | | 10.0 | | |

| Information Technology | | | 11.6 | | |

| Materials | | | 14.2 | | |

| Telecommunication Services | | | 7.2 | | |

| Utilities | | | 1.6 | | |

| Short-Term Investments | | | 5.7 | | |

| Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS2,9,12 |

| | | | | Average Annual Total Return Ended 08/31/2011 | |

| | | Inception Date | | 1 Year | | Life of Fund | |

| At NAV | |

| Institutional Class | | 10/08/2008 | | | 3.44 | % | | | 21.94 | % | |

| Class A | | 10/08/2008 | | | 3.16 | % | | | 21.68 | % | |

| Class C | | 10/08/2008 | | | 2.41 | % | | | 20.76 | % | |

Class R312 | | 06/21/2010 | | | 2.73 | % | | | 21.61 | % | |

| With Sales Charge | |

| Class A | | | | | –2.77 | % | | | 19.22 | % | |

| Class C | | | | | 1.41 | % | | | 20.76 | % | |

| Index | |

MSCI Emerging Markets Index1,18 | | | | | 9.40 | % | | | 19.88 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2010 were 6.65%, 6.72%, 7.06% and 2.76% for Institutional Class, Class A, Class C and Class R3 shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The expense ratios net of waivers and/or reimbursements were 1.27%, 1.52%, 2.27% and 1.92% for Institutional Class, Class A, Class C and Class R3 shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2014 for Institutional Class, Class A, Class C and Class R3 shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

Emerging Markets Equity Fund (Unaudited)

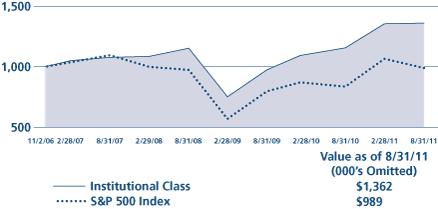

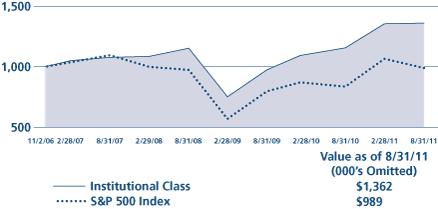

| COMPARISON OF A $1,000,000 INVESTMENT |

(000's Omitted)

|

| |

| This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. The results shown in the graph do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Equity Income Fund Commentary (Unaudited)

Neuberger Berman Equity Income Fund Institutional Class generated a 17.70% total return for the fiscal year ended August 31, 2011. As is typical during a strong rally in the equity market, the portfolio underperformed its benchmark, the S&P 500 Index, which generated an 18.50% return. (Performance for all share classes is provided in the table immediately following this letter.) Because of the portfolio's defensive positioning, however, it made headway relative to the index during the final quarter of the fiscal year, when the rally abated and volatility intensified.

The market's strength for much of the fiscal year was largely based on relatively strong economic expectations. Going into calendar year 2011, the consensus among analysts had been for U.S. GDP growth to be in the range of 3%-4%. In the final months of the reporting period, however, fears of a double-dip recession were reignited by renewed concern over the serious debt issues facing Greece and Europe in general, and what broader effects might be felt.

Against this shifting backdrop, the Fund performed well for a number of reasons. Real Estate Investment Trusts (REITs) were among the top performing asset classes for much of this period relative to the S&P 500 Index, even though they pulled back sharply during July and August. Representing approximately 20% of the portfolio's assets, our position in REITs—namely those focused on specialty and international areas—benefited performance. American Campus Communities, a student housing specialist, was among the top contributors, while RLJ Lodging and Suntec were detractors. We did not own RLJ the entire fiscal year, so the portfolio saw less of the benefit from the sector's positive run. We consider the company undervalued, and expect that its niche—longer-term lodging for consultant type clientele—may be a benefit given that the trend toward hiring consultants instead of full-time employees tends to be increasing. Suntec, a Singapore-based office and retail REIT, underperformed as investors questioned the sustainability of the strong growth in the Asian markets.

The portfolio also benefited from investments with exposure to emerging markets consumers, a theme within the portfolio for over two years now. In this category, names including Philip Morris International and Unilever benefited as wages in some emerging markets continued to increase, leading to a higher quality of living standards, particularly in Asia. Both were among top contributors this period.

Precious metals commodity-related stocks—gold in particular—also outperformed relative to the benchmark. Royal Gold was our strongest contributor this fiscal year, and Franco-Nevada also performed well. Gold prices increased as investors sought a safe haven against a weaker U.S. dollar, fears about U.S. debt, and market volatility. Both names also offer a modest dividend yield. Within the convertibles portion of the portfolio, NovaGold appreciated significantly as well, and we sold it for a gain.

Despite the fact that oil and gas prices declined somewhat during the fiscal year, several of our diversified Canadian oil sands holdings, including Crescent Point, Cenovus, and Arc Resources, performed extremely well. CNOOC, the Chinese oil and gas conglomerate, was also beneficial to results. That position was sold for a gain and we replaced it with PetroChina, which we believed had more significant upside potential. Despite the recent price movement, we remain positive on oil. From our point of view, prices over $75 per barrel are still quite profitable for our portfolio holdings, even the higher-cost producers.

The portfolio's Utilities investments, at just over 16% of assets, added value over the fiscal year as well. The sector appeared relatively attractive in recent months as investors sought yield in a volatile market. We witnessed several of our Utilities holdings raise their dividends this period. Among our holdings, CenterPoint Energy was a standout performer, with both a dividend increase and a big win in a Texas rate case, enabling the company to begin to recoup costs.

Our convertible bond holdings were a relative detriment this period. While absolute performance was positive, they lagged the market, as they tend to do during equity rallies. Still, they are an excellent source of income and generally help dampen volatility within the portfolio, in our view. Our focus continues to be on bonds with maturity or put dates of less than seven years.

Within convertibles and elsewhere, commodities including coal, timber and uranium fell somewhat out of favor as emerging markets economies began raising interest rates to help contain inflation. This, along with the slowdown in developed markets, took a toll on holdings including James River and Paladin, both convertible bonds, and Potlatch, one of our timber REITs.

While we thought earlier analyst estimates of 3% to 4% GDP growth were overly optimistic, we also believe fears of a double-dip recession are overblown and anticipate the U.S. will muddle through with a growth rate near 1% through 2012, barring unforeseen issues in Europe. In the current environment, however, we think fear has overtaken greed, and the markets have been weak and extremely volatile as investors may react nervously to headlines and analyze each economic data release for meaning and direction.

We consider the portfolio to be well positioned against the volatility that we expect will continue. With its defensive characteristics and yield component, the portfolio typically outperforms when markets are difficult. Additionally, with the strength in our companies' balance sheets and the benefit of rising dividends, we think the Fund may be a good alternative to the bond market for investors seeking income.

Sincerely,

Richard S. Levine, Tony Gleason and Sandy Pomeroy

Portfolio Co-Managers

The risks involved in seeking capital appreciation from investments in a wide array of stocks are set forth in the prospectus and statement of additional information.

To the extent that the Fund emphasizes small-, mid- or large-cap stocks, it takes on the associated risks. At times, large-cap stocks may lag other types of stocks in performance, which could cause a fund holding those stocks to perform worse than certain other funds. Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile.

Investing in foreign securities involves greater risks than investing in securities of U.S. issuers, including currency fluctuations, changes in local economic and political conditions, and the need to operate in less regulated financial markets. These risks are typically heightened for investments in emerging markets.

The composition, industries and holdings of the Fund are subject to change.

Equity Income Fund (Unaudited)

| Institutional Class | | NBHIX | |

| Class A | | NBHAX | |

| Class C | | NBHCX | |

| Class R3 | | NBHRX | |

| (as a % of Total Investments) | |

| Consumer Discretionary | | | 2.1 | % | |

| Consumer Staples | | | 7.6 | | |

| Energy | | | 12.0 | | |

| Financials | | | 23.4 | | |

| Health Care | | | 3.8 | | |

| Industrials | | | 7.5 | | |

| Information Technology | | | 1.2 | | |

| Materials | | | 5.3 | | |

| Telecommunication Services | | | 5.2 | | |

| Utilities | | | 16.1 | | |

| Other | | | 10.6 | | |

| Short-Term Investments | | | 5.2 | | |

| Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS2,9 |

| | | | | Average Annual Total Return Ended 08/31/2011 | |

| | | Inception Date | | 1 Year | | Life of Fund | |

| At NAV | |

Institutional Class16 | | 06/09/2008 | | | 17.70 | % | | | 6.60 | % | |

Class A16 | | 06/09/2008 | | | 17.27 | % | | | 6.31 | % | |

Class C16 | | 06/09/2008 | | | 16.31 | % | | | 5.79 | % | |

Class R316 | | 06/21/2010 | | | 16.92 | % | | | 6.42 | % | |

| With Sales Charge | |

Class A16 | | | | | | | 10.52 | % | | | 5.01 | % | |

Class C16 | | | | | | | 15.31 | % | | | 5.79 | % | |

| Index | |

S&P 500 Index1,18 | | | | | | | 18.50 | % | | | –0.23 | % | |

The performance data for each class includes the performance of the Fund's oldest share class, Trust Class, from November 2, 2006 through June 9, 2008. The performance data for Class R3 also includes the performance of the Fund's Institutional Class from June 9, 2008 through June 21, 2010. See footnote 16 for information about the effects of the different fees paid by each class.

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2010 were 1.02%, 1.37%, 2.13% and 1.44% for Institutional Class, Class A, Class C and Class R3 shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The expense ratios net of waivers and/or reimbursements were 0.81%, 1.17%, 1.92% and 1.42% for Institutional Class, Class A, Class C and Class R3 shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2014 for Institutional Class, Class A, Class C and Class R3 shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

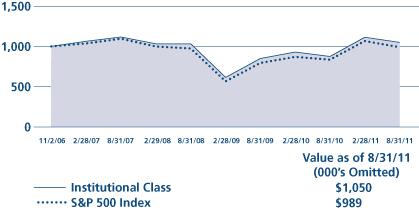

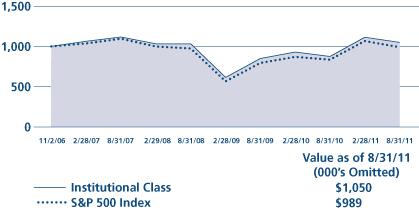

Equity Income Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT16 |

(000's Omitted)

|

| |

| This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. The results shown in the graph do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Focus Fund Commentary (Unaudited)

Neuberger Berman Focus Fund Investor Class generated a 17.61% total return for the fiscal year ended August 31, 2011 and trailed its benchmark, the S&P 500 Index, which provided an 18.50% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

The fiscal year was an extremely volatile time for the markets. From a strong start in the fall of 2010 through the first calendar quarter of 2011, investors appeared optimistic that the economic recovery was progressing well, and that the GDP growth rate would accelerate as the year progressed. In late spring, the markets experienced a setback as investors struggled with the potential impact of a second round of serious sovereign debt issues in Europe, signs of slowing growth combined with contentious debt ceiling negotiations in the U.S., and the possibility of decelerating growth in emerging markets. Equities declined in response and volatility rose for the remainder of the fiscal period.

Although the Fund held its ground fairly well during the decline, market conditions were something of a headwind. Nonetheless, because the Fund is a concentrated portfolio of our analysts' best ideas, we believe our shareholders will benefit if headline risk declines and investors once again evaluate opportunities in a way that more clearly plays to the strengths of bottom-up active managers—on business prospects, valuations and fundamentals.

For the fiscal year as a whole, cyclical sectors led the market as investor optimism reigned for roughly two-thirds of the reporting period. All sectors in the S&P 500 Index except for Financials were positive for the fiscal year, with the best returns coming from the Energy and Consumer Discretionary sectors. The more defensive Telecommunication Services and Utilities sectors underperformed the index slightly over the period.

Within the portfolio, Information Technology holdings detracted the most from performance relative to the benchmark, although Energy holdings also underperformed. Within Information Technology, Apple was a top contributor, but poor performance from Hewlett-Packard and NXP Semiconductors counteracted any positive effect. Hewlett-Packard had been performing well under the direction of CEO Mark Hurd, who was ousted in August 2010. As new management took the helm, we continued to believe there was value in the company, but as earnings weakened and the company's new strategic direction became less clear, we sold our position, finding what we consider better opportunities elsewhere.

NXP is a supplier of high performance and standard semiconductor devices with a dominant market share in the vast majority of its product segments. One of the key growth drivers for NXP is an emerging technology that enables payments to be made via smart phones. Because this is a new technology, however, integration into mobile phones has been choppy and concerns about the ramp-up of this product, combined with overall economic weakness, have been weighing heavily on the stock. We see a great deal of value in its shares at current levels, however, and expect sales to pick up when the economy improves and even more so if the company's differentiated payment technology takes root and becomes widespread within the mobile phone industry.

On the positive side, our Consumer Discretionary holdings outperformed relative to the benchmark, on both strong stock selection and overweight positions. Brinker International, the operator of Chili's Restaurants, Discovery Communications, and Comcast performed well. We sold Brinker during the period, but continue to have meaningful positions in both Discovery and Comcast.

Discovery Communications is, in our view, a very well run pure-play cable network with a strong international presence. The company owns a number of cable TV channels including Discovery Channel, TLC and Animal Planet. We continue to see value in the stock and expect further upside as the company benefits from increased adoption of paid television internationally and makes strides in improving its network ratings and monetization domestically.

Comcast closed the NBC Universal deal this period, which should be self-funding from a cash flow perspective going forward. The rest of the business also continues to perform well, generating significant free cash flow which the company is redeploying to shareholders via dividends and buybacks.

Beyond our Consumer Discretionary holdings, strong stock selection led to outperformance in the Consumer Staples, Financials and Health Care sectors as well. Although we underperformed the index, we were able to add value in seven of 10 sectors.

As we enter the remainder of the year, equities appear attractive to us, although we expect the market may continue to be extremely volatile as long as macroeconomic news continues to drive investor behavior. We believe our valuation discipline allows us to use volatility to our advantage, however, as we work to purchase sound companies with strong growth prospects at depressed levels.

While we choose each holding based on its individual fundamentals, we are also mindful of how the Fund comes together as a whole. We therefore pay close attention to how holdings correlate with each other in order to create a portfolio of stocks with what we consider an optimal risk/reward balance. At this time, we believe we have a well-diversified portfolio with both cyclical and counter-cyclical exposure and believe that our rigorous bottom-up stock selection process should work in favor of our shareholders over time.

Sincerely,

Tim Creedon and David Levine

Portfolio Co-Managers

Because the Fund is concentrated in a small number of stocks, it may be substantially overweighted or underweighted in certain economic sectors at any given time. Therefore its performance is likely to be disproportionately affected by the factors influencing those sectors and may suffer if certain economic sectors it emphasizes do not perform as expected. The risks associated with these investments are set forth in the prospectus and statement of additional information.

Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile. Large-cap stocks are subject to all the risks of stock market investing, including the risk that they may lose value.

The composition, industries and holdings of the Fund are subject to change.

Focus Fund (Unaudited)

| Investor Class | | NBSSX | |

| Trust Class | | NBFCX | |

| Advisor Class | | NBFAX | |

| Institutional Class | | NFALX | |

| Class A | | NFAAX | |

| Class C | | NFACX | |

| (as a % of Total Investments) | |

| Consumer Discretionary | | | 17.2 | % | |

| Consumer Staples | | | 7.8 | | |

| Energy | | | 12.1 | | |

| Financials | | | 14.0 | | |

| Health Care | | | 12.1 | | |

| Industrials | | | 9.8 | | |

| Information Technology | | | 16.1 | | |

| Materials | | | 4.5 | | |

| Utilities | | | 3.8 | | |

| Short-Term Investments | | | 2.6 | | |

| Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS2,8 |

| | | | | Average Annual Total Return Ended 08/31/2011 | |

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| At NAV | |

| Investor Class | | 10/19/1955 | | | 17.61 | % | | | –1.40 | % | | | 1.01 | % | | | 10.09 | % | |

Trust Class4 | | 08/30/1993 | | | 17.39 | % | | | –1.61 | % | | | 0.81 | % | | | 10.10 | % | |

Advisor Class4 | | 09/03/1996 | | | 17.20 | % | | | –1.83 | % | | | 0.60 | % | | | 10.05 | % | |

Institutional Class21 | | 06/21/2010 | | | 17.85 | % | | | –1.35 | % | | | 1.03 | % | | | 10.10 | % | |

Class A24 | | 06/21/2010 | | | 17.43 | % | | | –1.43 | % | | | 0.99 | % | | | 10.09 | % | |

Class C24 | | 06/21/2010 | | | 16.62 | % | | | –1.61 | % | | | 0.90 | % | | | 10.07 | % | |

| With Sales Charge | |

Class A24 | | | | | | | 10.64 | % | | | –2.59 | % | | | 0.40 | % | | | 9.98 | % | |

Class C24 | | | | | | | 15.62 | % | | | –1.61 | % | | | 0.90 | % | | | 10.07 | % | |

| Index | |

S&P 500 Index1,18 | | | | | | | 18.50 | % | | | 0.78 | % | | | 2.70 | % | | | 9.67 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2010 were 0.98%, 1.19%, 1.43%, 0.80%, 1.16% and 1.91% for Investor Class, Trust Class, Advisor Class, Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The expense ratios net of waivers and/or reimbursements were 0.75%, 1.11% and 1.86% for Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2021 for Advisor Class shares and August 31, 2014 for Institutional Class, Class A and Class C shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

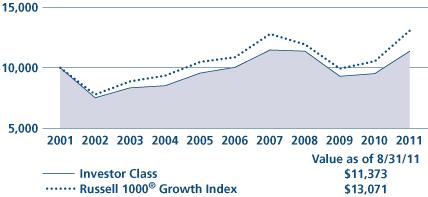

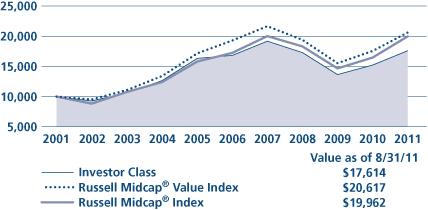

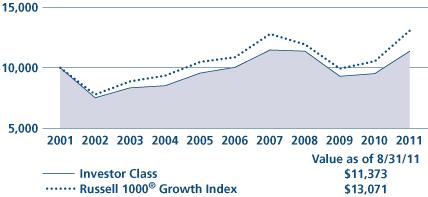

Focus Fund (Unaudited)

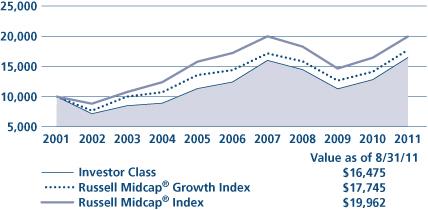

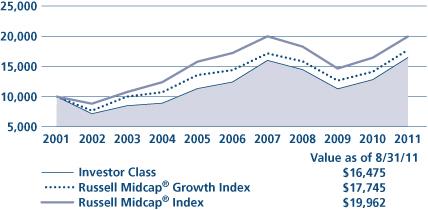

| COMPARISON OF A $10,000 INVESTMENT |

|

| |

| This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. The results shown in the graph do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Genesis Fund Commentary (Unaudited)

Neuberger Berman Genesis Fund Investor Class posted a 29.65% total return for the fiscal year ended August 31, 2011, outperforming its benchmark, the Russell 2000® Index, which provided a 22.19% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

There was a dramatic shift in terms of the stock market's performance during the fiscal year. Over the first eight months of the reporting period, the market rose sharply and more volatile/high beta stocks (whose performance is closely tied to overall market results) typically outperformed higher quality/less speculative issues (companies with higher than average profitability, less financial leverage and which are less cyclical). However, we saw a nearly complete reversal of this trend during the last four months of the period, as investor risk appetite was largely replaced with risk aversion. Against this backdrop, higher quality companies generally performed better than their higher beta counterparts.

This changing environment demonstrated what we feel has been a key attribute for the Fund. While the Fund lagged its benchmark during the market's sharp ascent, it outperformed its benchmark when the market faltered. This is consistent with what we've seen in the past, and it resulted in the Fund's strong absolute and relative performance during the fiscal year.

Stock selection was the main driver of the Fund's outperformance. Sector positioning was also beneficial, albeit to a lesser extent. The Fund's holdings and longtime overweight in the Energy sector added significant value during the period. In particular, CARBO Ceramics, Cabot Oil & Gas and Oceaneering International posted very strong results. These three companies, as well as other Energy companies held within the portfolio, benefited from rising oil prices and/or increased drilling activity.

Other notable standouts were Consumer Staples company Church & Dwight and Health Care firm Dionex. Church & Dwight markets a diverse array of household and personal care items, including its Arm & Hammer brand products. The company's stock rose sharply as its earnings surpassed expectations and it continued to generate strong free cash flow. Dionex manufactures liquid chromatography systems that are used to analyze the composition and quality of substances for biopharmaceutical, environmental and industrial customers. During the reporting period, Dionex agreed to be acquired by Thermo Fisher Scientific at a significant premium and we sold the position.

The two largest detractors from performance were for-profit education companies Capella Education and Strayer Education. These Consumer Discretionary stocks saw their stock prices fall sharply given ongoing concerns that enrollment rates would decline and that expenses would rise. While we feel these are the best-in-class companies within the for-profit education industry, we pared our exposures given the uncertainties about future revenue growth, and eliminated the Capella position after the reporting period.

Several holdings within the Financial sector, including Greenhill & Co. and Westamerica Bancorp, were also detrimental to Fund performance. Greenhill & Co.'s stock fell as its earnings declined given the tepid merger and acquisition environment. We pared the position during the period and sold out entirely in September 2011. Westamerica faltered along with the overall banking industry during the reporting period. However, we remain positive on Westamerica given its strong capital position and its historically solid track record. We also feel that the company could be a beneficiary of anticipated consolidation in the banking industry as weaker competitors get absorbed by best-in-class operators like Westamerica.

In our last report to shareholders, we stated our belief that "a number of factors could result in below average gross domestic product (GDP) growth in the coming years." Recent developments have been consistent with our view, as economic growth has moderated in recent months. Another issue that could impact the markets and investor sentiment is the escalating European debt crisis and its potential impact on the U.S. financial system. We feel the portfolio is well-positioned given the uncertainties that exist today. We continue to manage a diversified portfolio of what we consider high quality companies with proven track records of generating strong results in various economic and market environments. The portfolio is also balanced—including relatively defensive companies that we believe could hold up relatively well should the market continue

to falter, as well as certain cyclical companies, such as those in the energy and agriculture industries, that could benefit should global growth strengthen more than is currently anticipated.

Sincerely,

Judith M. Vale and Robert D'Alelio

Portfolio Co-Managers

The risks involved in seeking capital appreciation from investments primarily in companies with small market capitalization are set forth in the prospectus and statement of additional information.

Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile.

The composition, industries and holdings of the Fund are subject to change.

Genesis Fund (Unaudited)

| Investor Class | | NBGNX | |

| Trust Class | | NBGEX | |

| Advisor Class | | NBGAX | |

| Institutional Class | | NBGIX | |

| (as a % of Total Investments) | |

| Consumer Discretionary | | | 6.4 | % | |

| Consumer Staples | | | 7.1 | | |

| Energy | | | 15.4 | | |

| Financials | | | 7.7 | | |

| Health Care | | | 12.7 | | |

| Industrials | | | 18.5 | | |

| Information Technology | | | 10.9 | | |

| Materials | | | 11.9 | | |

| Utilities | | | 3.2 | | |

| Short-Term Investments | | | 6.2 | | |

| Total | | | 100.0 | % | |

| | | | | Average Annual Total Return Ended 08/31/2011 | |

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| Investor Class | | 09/27/1988 | | | 29.65 | % | | | 6.21 | % | | | 10.01 | % | | | 12.41 | % | |

Trust Class4 | | 08/26/1993 | | | 29.56 | % | | | 6.17 | % | | | 9.97 | % | | | 12.40 | % | |

Advisor Class4 | | 04/02/1997 | | | 29.23 | % | | | 5.90 | % | | | 9.69 | % | | | 12.21 | % | |

Institutional Class6 | | 07/01/1999 | | | 29.87 | % | | | 6.45 | % | | | 10.25 | % | | | 12.55 | % | |

Russell 2000® Index1,18 | | | | | | | 22.19 | % | | | 1.53 | % | | | 5.85 | % | | | 8.79 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2010 were 1.06%, 1.12%, 1.38% and 0.87% for Investor Class, Trust Class, Advisor Class and Institutional Class shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The expense ratio net of waivers and reimbursements was 0.85% for Institutional Class shares. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2021 for Institutional Class and Advisor Class shares and through August 31, 2014 for Trust Class shares.

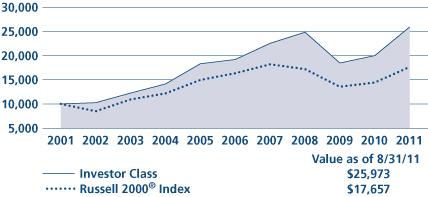

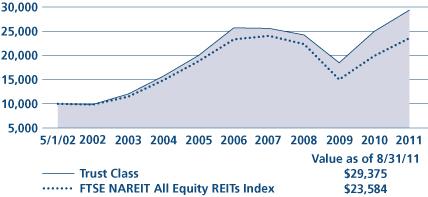

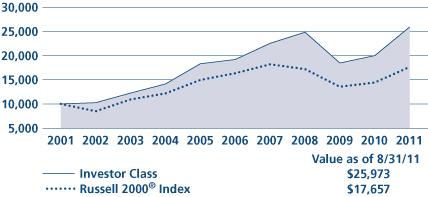

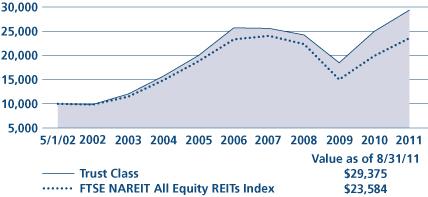

| COMPARISON OF A $10,000 INVESTMENT |

|

| |

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart above). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. The results shown in the table and the graph do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Global Equity Fund Commentary (Unaudited)

During the two-month period from its inception on June 30, 2011 through August 31, 2011, Neuberger Berman Global Equity Fund Institutional Class posted a –9.00% return, underperforming its benchmark, the MSCI World Index, which provided a –7.47% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

In this, our first annual report letter, we would like to take the opportunity to explain our approach to portfolio management. The Global Equity Fund follows an investment discipline, Quality at a Reasonable Price (QuaRP), designed by our team, which includes a four-step process that applies initial screening, fundamental and strategic analysis, and financial analysis to help identify investment opportunities that others may miss. With the flexibility to invest across styles and market capitalization ranges, as well as outside the benchmark, we believe our approach enables us to build a differentiated portfolio with the potential to benefit our shareholders.

Looking more closely at our process, we first perform an initial screening of securities to ensure they have "quality" characteristics such as historically high return on invested capital and earnings per share, as well as low debt ratios.

Companies that pass the initial screening undergo intensive hands-on strategic analysis for a thorough understanding of both the companies and their business environments. We assess each company's strategy, management team quality, and commitment to driving shareholder value. As part of this assessment, we generally meet with company management, as well as numerous industry competitors, suppliers and customers.

Finally, using a proprietary discounted cash flow model and valuation criteria including price to cash flow and price to earnings metrics, we are able to identify the explicit price levels at which we would become a buyer—or seller—of a particular stock. In the end, we are able to build a diversified portfolio of between approximately 60 to 100 names that we believe will outperform the market over the long term.

During this abbreviated reporting period, representing tremendously negative investor sentiment and high market volatility, every sector of the MSCI World Index reported negative results. Worst hit were Financials, Industrials and Consumer Discretionary stocks. Performance of Consumer Staples, Utilities, and Information Technology stocks was relatively better. By country, Greece, Italy and Germany were the worst performing markets during a period in which all markets in the index, except New Zealand, lost value.

Within the portfolio, stock selection in the Materials, Telecommunication Services and Consumer Discretionary sectors was beneficial to performance on a relative basis, while Information Technology, Financials and Consumer Staples holdings disappointed. In terms of performance by country, holdings in Canada had the most positive effect on portfolio performance this period, followed by Germany. A zero allocation to Italy was also beneficial relative to the index. Our weaker markets this period included Korea, the U.S., and Japan.

Three of our top contributors to performance were New Gold, Silver Wheaton and Goldcorp—Canadian precious metals companies that benefited from strong operations and upward commodity price movement, especially as investors sought safe heavens from the equity market. Four U.S.-based companies—Apple, Cabot Oil & Gas, Waste Connections and McDonald's—were also top contributors.

Disappointments during the two-month period included Lincoln National, a U.S.-based financial services company. Lincoln is quite sensitive to movement in the capital markets, and has been adversely affected by prospects for continued low interest rates, poor equity returns, and higher hedging costs. Other underperformers included Alcatel-Lucent, Credit Suisse, Hyundai Mobis, Nippon Electric Glass, and Deutsche Boerse. Lincoln National, Credit Suisse and Nippon Electric Glass have been sold, but, generally speaking, we continue to believe in our longer-term value assessments of the companies we continue to own.

The current negative market sentiment has been driven by the European policy makers' delayed response to the EU sovereign debt crisis and signs of a potential U.S. economic slowdown. This has focused investor concerns on large

structural issues that developed markets' governments are struggling to address effectively. We believe that, sooner or later, fiscal deficits will be reduced—either via higher taxes or via lower spending—which we believe will act as a drag to economic growth in the U.S., Europe and Japan in particular. At the same time, emerging markets are currently experiencing higher levels of inflation, which could result in higher interest rates and/or slower economic growth. As a consequence, the portfolio remains underweighted relative to the benchmark in Japan, where public debt is high, and also in the weaker European economies which we believe will suffer the most fiscal retrenchment.

However, we believe that, following improvements to their balance sheets since the financial crisis of 2008, many companies with no apparent exposure exposed to these risks are in good shape. Operating profit margins are high, and since spending on fixed assets and working capital has been restrained, cash flow is strong. As a result, valuation levels appear compelling to us. Although risks remain, we have identified a few themes that we anticipate will drive stock selection in the portfolio going forward: 1) an end to increases in the costs of raw materials, which could help Materials and Consumer Staples companies; 2) growing demand in emerging markets as the middle class grows, which could benefit global multinational Consumer Staples and Consumer Discretionary firms; and 3) consumers and companies spending more on maintenance and ongoing expenses rather than new purchases, which may benefit Consumer Discretionary sub-sectors like Cable TV, or corporate software IT firms.

With the discipline of our QuaRP strategy and the benefit of insight into these secular themes, we believe we can deliver value for our shareholders over the longer term.

Sincerely,

Benjamin Segal and Saurin Shah

Portfolio Co-Managers

The risks involved in seeking capital appreciation from investments primarily in issuers who are based or who operate outside the United States are set forth in the prospectus and statement of additional information.

Investing in foreign securities involves greater risks than investing in securities of U.S. issuers, including currency fluctuations, changes in local economic and political conditions, and the need to operate in less regulated financial markets. These risks are typically heightened for investments in emerging markets.

Investing in the stocks of even the largest companies involves all the risks of stock market investing, including the risk that they may lose value due to overall market or economic conditions.

The composition, industries and holdings of the Fund are subject to change.

Global Equity Fund (Unaudited)

| Institutional Class | | NGQIX | |

| Class A | | NGQAX | |

| Class C | | NVACX | |

| (as a % of Total Investments) | |

| Consumer Discretionary | | | 10.5 | % | |

| Consumer Staples | | | 8.0 | | |

| Energy | | | 11.1 | | |

| Financials | | | 10.6 | | |

| Health Care | | | 11.2 | | |

| Industrials | | | 11.9 | | |

| Information Technology | | | 13.7 | | |

| Materials | | | 14.8 | | |

| Telecommunication Services | | | 6.1 | | |

| Short-Term Investments | | | 2.1 | | |

| Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS2,9 |

| | | Inception Date | | Cumulative Total Return Ended 08/31/2011 Life of Fund | |

| At NAV | |

| Institutional Class | | 06/30/2011 | | | –9.00 | % | |

| Class A | | 06/30/2011 | | | –9.10 | % | |

| Class C | | 06/30/2011 | | | –9.20 | % | |

| With Sales Charge | |

| Class A | | | | | | | –14.33 | % | |

| Class C | | | | | | | –10.11 | % | |

| Index | |

MSCI World Index1,18 | | | | | | | –7.47 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the estimated total annual operating expense ratios for fiscal year 2011 were 1.42%, 1.78% and 2.53% for Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The estimated expense ratios net of waivers and/or reimbursements were 1.15%, 1.51% and 2.26% for Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2014 for Institutional Class, Class A and Class C shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

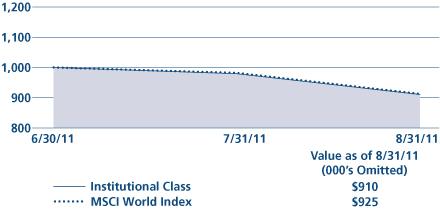

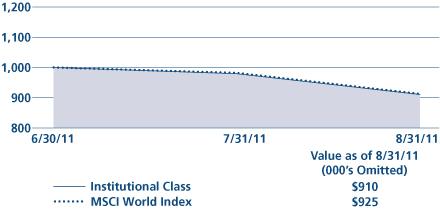

Global Equity Fund (Unaudited)

| COMPARISON OF A $1,000,000 INVESTMENT |

(000's Omitted)

|

| |

| This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. The results shown in the graph do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Global Thematic Opportunities Fund Commentary (Unaudited)

During the period from its inception on June 30, 2011 through August 31, 2011, Neuberger Berman Global Thematic Opportunities Fund Institutional Class provided a –5.60% return, outperforming its benchmark, the MSCI All Country World Index (ACWI), which delivered a –7.56% return during the period. (Performance for all share classes is provided in the table immediately following this letter.)

Coming off of a nine-month rally during the full fiscal year, global equity markets stumbled in summer 2011 as fears of a double-dip recession were reignited. A weakened economic outlook for the U.S. was combined with heightened concerns over the serious debt issues facing Greece and Europe and their broader potential consequences. Interest rate increases in China, India and other several emerging markets nations aimed at controlling inflation implied that rapid growth in those markets could come to an abrupt end as well. As headwinds to the global economy appeared to increase, we saw investors grow more conservative, moving down the risk spectrum, out of emerging markets, and from equities to bonds.

The Fund is designed to invest along longer-term themes in which we expect above-average growth driven by structural changes in the global economy. This period, themes included being "long what China is short," the strong emerging markets consumer, being on the right side of inflation worldwide, and demand for ever-increasing agricultural yields, among others. Our managers travel extensively, going to where the investments are for a deep, hands-on understanding of the companies, economies, and industries in which we invest. Compared with the MSCI ACWI Index, we are currently underweighted in the U.S., Europe and Japan, and overweighted in emerging markets and Canada, based on our view of where the best opportunities exist.

During the abbreviated reporting period, even though investors generally shied away from emerging markets equities, a number of our top contributors came from our emerging markets consumer theme. Companies like Ace Hardware Indonesia, which serves as a combination of a Bed, Bath and Beyond and Home Depot for Indonesian consumers, and Philip Morris International saw consistent demand. Las Vegas Sands, whose operations in Macao and Singapore are quite profitable, was another top contributor, as were two auto-related names. Hong Kong's Dah Chong Hong Holdings has benefited from stellar auto sales in China. The company is the exclusive distributor of Bentleys and also has a large contract with Isuzu. India's Mahindra & Mahindra, a distributor of sport utility vehicles and tractors, was also strong, benefiting from demand stemming from generally poor road conditions.

As part of our inflation theme, we have a higher tilt toward gold than the index. Stocks closely tied to gold and other precious metals commodities holdings were a big positive for the portfolio this period, as investors sought a safe haven against a weaker dollar, fears about U.S. debt, and market volatility. Agnico-Eagle Mines and Goldcorp benefited as gold prices increased, and Silver Wheaton was also a top contributor.

Stocks within our agriculture theme underperformed over the past two months. For example, China's First Tractor was our largest detractor this period. However, we remain bullish about the sector for the longer term and are willing to be patient. As wages and quality of life improve in the emerging markets, and particularly in China, the increased demand for dietary proteins is driving a greater need for grain for feed.

All America Latina Logistica also disappointed as risk-averse investors avoided emerging markets. We continue to like this Brazilian infrastructure company, viewing it as part of the solution to helping increase Brazil's ability to export goods to Asia and other regions.

The Energy sector contained several detractors for the period. Energy names are part of our "long what China is short" theme. Coal holdings including Indonesia's PT Adaro Energy and Alpha Natural Resources, a U.S. holding, disappointed as emerging markets governments increased interest rates to manage growth and relieve inflationary pressures. Investors worried that this activity could cool the growing recent demand for products such as coal. We remain bullish for the long term on both thermal and metallurgical coal and anticipate using any temporary price declines as a buying opportunity.

One other disappointment this period was the asset manager Invesco, part of our "money in motion" theme. Investors moved money from equities to bonds during this period's market volatility, which are lower margin products for Invesco.

Longer term, however, we anticipate that investors who want to keep up with inflation to re-enter the equity market, particularly in high dividend areas, out of frustration for the current low yields of bonds.

Looking ahead, we believe that U.S. economic growth will be relatively slow in the coming months, but that we will see much more attractive economic growth in other parts of the world. Our goal is to find companies, either U.S.-based or foreign, that we believe are best positioned to take advantage of that global growth. We plan to apply a rigorous investment discipline as we seek investment candidates with what we would view as great growth stories, trading at reasonable valuations. We believe we can to identify "under the radar" local companies, multinationals, and strong niche players positioned to benefit from structural global themes that will serve our shareholders well over time.

Sincerely,

Anthony Gleason, Sandy Pomeroy, William Hunter and Richard Levine

Portfolio Co-Managers

The risks involved in seeking capital appreciation from investments primarily in issuers who are based or who operate outside the United States are set forth in the prospectus and statement of additional information.

Investing in foreign securities involves greater risks than investing in securities of U.S. issuers, including currency fluctuations, changes in local economic and political conditions, and the need to operate in less regulated financial markets. These risks are typically heightened for investments in emerging markets.

To the extent that the Fund emphasizes small-, mid- or large-cap stocks, it takes on the associated risks. At times, large-cap stocks may lag other types of stocks in performance, which could cause a fund holding those stocks to perform worse than certain other funds. Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile.

The composition, industries and holdings of the Fund are subject to change.

Global Thematic Opportunities Fund (Unaudited)

| Institutional Class | | NGHIX | |

| Class A | | NGHAX | |

| Class C | | NGHCX | |

| (as a % of Total Investments) | |

| Consumer Discretionary | | | 13.3 | % | |

| Consumer Staples | | | 8.2 | | |

| Energy | | | 17.3 | | |

| Financials | | | 8.3 | | |

| Health Care | | | 1.8 | | |

| Industrials | | | 15.6 | | |

| Information Technology | | | 4.1 | | |

| Materials | | | 12.4 | | |

| Telecommunication Services | | | 1.7 | | |

| Utilities | | | 3.4 | | |

| Short-Term Investments | | | 13.9 | | |

| Total | | | 100.0 | % | |

| | | Inception Date | | Cumulative Total Return Ended 08/31/2011 Life of Fund | |

| At NAV | |

| Institutional Class | | 06/30/2011 | | | –5.60 | % | |

| Class A | | 06/30/2011 | | | –5.60 | % | |

| Class C | | 06/30/2011 | | | –5.80 | % | |

| With Sales Charge | |

| Class A | | | | | | | –11.03 | % | |

| Class C | | | | | | | –6.74 | % | |

| Index | |

MSCI All Country World Index1,18 | | | | | | | –7.56 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the estimated total annual operating expense ratios for fiscal year 2011 were 1.56%, 1.92% and 2.67% for Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The estimated expense ratios net of waivers and/or reimbursements were 1.25%, 1.61% and 2.36% for Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2014 for Institutional Class, Class A and Class C shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

Global Thematic Opportunities Fund (Unaudited)

| COMPARISON OF A $1,000,000 INVESTMENT |

(000's Omitted)

|

| |

| This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. The results shown in the graph do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Guardian Fund Commentary (Unaudited)

Neuberger Berman Guardian Fund Investor Class generated a 21.35% total return for the fiscal year ended August 31, 2011, outperforming its benchmark, the S&P 500 Index, which provided an 18.50% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

The fiscal year started on the heels of a difficult spring and summer, when fears of a double-dip recession ran high. As economic data improved, the stock market enjoyed a strong three-quarter run. As we moved into summer 2011, however, the same set of fears seen last spring were replayed. With a second version of the Greek debt crisis, followed by a contentious U.S. debt ceiling debate, investors went from being encouraged by what seemed a healthy economy to experiencing worries over a potential recession.

Near the beginning of the fiscal year, we began adding to some of our favorite portfolio holdings, increasing weightings at what we believe were excellent valuations. The stock market rallied strongly, and, through the first half of fiscal year 2011, many of the names we had purchased at depressed levels last summer contributed positively to performance. Our performance is typically advantaged during slow-growth environments, as our quality focus identifies businesses that, in our opinion, can grow by gaining share in challenging economic times. For the first three quarters of this reporting period, high-quality businesses outperformed, and their stocks were revalued accordingly. As a result, the Fund enjoyed a performance advantage over the market index.

Ironically, the environment at the end the reporting period is similar to a year ago. Investor anxiety is high and many high-quality businesses are again priced for recession. Following the early summer's Greek debt negotiations, investors sold indiscriminately, and our holdings declined with the market regardless of the advantages we believe they offer. Although the Fund lost some of its "lead," it closed the fiscal year ahead of the benchmark.

In our opinion, when the market does not discriminate, this creates opportunity. We have now seen the good thrown out with the bad three times in three years. During the first two periods of weakness, we actively bought businesses that, in our opinion had previously been too richly valued as stocks. This time, we felt very well positioned already, and yet we also were able to buy two names that had been on our prospect list for years.

Google's disappointing earnings, driven by a decision to invest toward future growth, allowed us to introduce a position in the stock, and a merger deal that Wall Street did not like created an opening for us in Ecolab. Ecolab, which provides sanitizing and pest control products as well as food service equipment and food safety services to various industries, has, in our view, the predictability, strong free cash flow, and great secular growth opportunities associated with consumer staples companies, with the added advantage of controlling distribution.

Within the portfolio, several of our top contributors, including Altera, Schlumberger, and BG Group, performed well in the first three quarters of the period, but gave up some ground more recently. MasterCard was a benefit to the portfolio throughout. We bought MasterCard during last summer's weakness and amid concerns about prospective rules on debit processing fees. A year later, we believe the business remains very strong under a new CEO, and the stock performed well through the downturn. W.W. Grainger is another stock that held up well. Grainger reports sales numbers on a monthly basis, and as fears of recession have increased, stable, frequent revenue reports are helpful.

On the negative side, Hospira, a leading specialty injectable drug company, was our weakest performer. We view Hospira as part of the solution to controlling health care costs and consider it an attractive business for the longer term. The stock declined this period as the company's response to FDA-cited manufacturing issues has been slow and costly. The insurer Progressive was another disappointment. A defensive business, the stock was largely overlooked during the rally, even though it is managed well, growing, and taking market share. We like the company, and think its innovative new usage-based auto insurance product called Snapshot could prove to be disruptive to its competition. We bought SAIC for its fast-growing cyber security business, but as the balance of its government contract business faces a headwind on concerns about the budget, we sold the position before the end of the period.

There has been fear that market volatility and negative sentiment will spill into the economy, weakening spending. So far that hasn't happened. High frequency statistics—like credit card processing volumes, same store sales, and industrial distributors' revenues—remain relatively positive. However, statistics with more long-term significance reflect more uncertainty. In August, business and consumer sentiment and intentions surveys fell dramatically, and hints of companies delaying business decisions are evident in reduced goods orders for fall and holiday delivery, lower transportation utilization rates, and softening in electronic components orders.

Our view is that, as long as Europe doesn't deteriorate into a full crisis situation, the factors that could cause a recession are not present. While the debt problem creates uncertainty and is likely to lead to continued slow growth, we anticipate high-quality companies like those in the Fund to continue to be advantaged, and, barring a broader problem out of Europe, we are optimistic for the intermediate to long term.

Sincerely,

Arthur Moretti

Portfolio Manager

The risks involved in seeking capital appreciation from investments primarily in mid- to large-cap stocks are set forth in the prospectus and statement of additional information.

Mid-capitalization stocks are more vulnerable to financial risks and other risks than larger stocks. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile. Large-cap stocks are subject to all the risks of stock market investing, including the risk that they may lose value due to overall market or economic conditions.

The composition, industries and holdings of the Fund are subject to change.

Guardian Fund (Unaudited)

| Investor Class | | NGUAX | |

| Trust Class | | NBGTX | |

| Advisor Class | | NBGUX | |

| Institutional Class | | NGDLX | |

| Class A | | NGDAX | |

| Class C | | NGDCX | |

| Class R3 | | NGDRX | |

| (as a % of Total Investments) | |

| Consumer Discretionary | | | 9.0 | % | |

| Consumer Staples | | | 8.9 | | |

| Energy | | | 14.9 | | |

| Financials | | | 11.4 | | |

| Health Care | | | 13.7 | | |

| Industrials | | | 14.1 | | |

| Information Technology | | | 21.4 | | |

| Materials | | | 5.5 | | |

| Short-Term Investments | | | 1.1 | | |

| Total | | | 100.0 | % | |

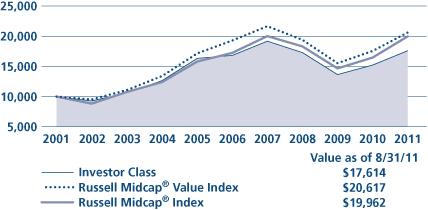

PERFORMANCE HIGHLIGHTS2,7,14 |

| | | | | Average Annual Total Return Ended 08/31/2011 | |

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| At NAV | |

| Investor Class | | 06/01/1950 | | | 21.35 | % | | | 1.89 | % | | | 3.93 | % | | | 10.92 | % | |

Trust Class4 | | 08/03/1993 | | | 21.08 | % | | | 1.71 | % | | | 3.77 | % | | | 10.89 | % | |

Advisor Class4 | | 09/03/1996 | | | 20.59 | % | | | 1.30 | % | | | 3.37 | % | | | 10.77 | % | |

Institutional Class21 | | 05/27/2009 | | | 21.51 | % | | | 1.98 | % | | | 3.98 | % | | | 10.93 | % | |

Class A20 | | 05/27/2009 | | | 21.06 | % | | | 1.80 | % | | | 3.89 | % | | | 10.92 | % | |

Class C20 | | 05/27/2009 | | | 20.11 | % | | | 1.46 | % | | | 3.71 | % | | | 10.89 | % | |

Class R320 | | 05/27/2009 | | | 20.79 | % | | | 1.69 | % | | | 3.83 | % | | | 10.91 | % | |

| With Sales Charge | |

Class A20 | | | | | | | 14.11 | % | | | 0.60 | % | | | 3.27 | % | | | 10.81 | % | |

Class C20 | | | | | | | 19.11 | % | | | 1.46 | % | | | 3.71 | % | | | 10.89 | % | |

| Index | |

S&P 500 Index1,18 | | | | | | | 18.50 | % | | | 0.78 | % | | | 2.70 | % | | | 10.77 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.