As filed with the Securities and Exchange Commission on November 5, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00582

NEUBERGER BERMAN EQUITY FUNDS

(Exact Name of the Registrant as Specified in Charter)

c/o Neuberger Berman Management LLC

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

(Address of Principal Executive Offices – Zip Code)

Registrant's telephone number, including area code: (212) 476-8800

Robert Conti

Chief Executive Officer and President

c/o Neuberger Berman Management LLC

Neuberger Berman Equity Funds

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

Arthur C. Delibert, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006-1600

(Names and Addresses of agents for service)

Date of fiscal year end: August 31, 2010

Date of reporting period: August 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

| | | | | Neuberger Berman Equity Funds |

| | | | | | |

| | | | | Investor Class Shares Trust Class Shares Advisor Class Shares Institutional Class Shares | Class A Shares Class C Shares Class R3 Shares |

| | | | | | |

| | | | | Climate Change Fund Emerging Markets Equity Fund Equity Income Fund Focus Fund Genesis Fund Guardian Fund International Fund International Institutional Fund International Large Cap Fund Intrinsic Value Fund | Large Cap Disciplined Growth Fund Mid Cap Growth Fund Multi-Cap Opportunities Fund Partners Fund Real Estate Fund Regency Fund Select Equities Fund Small Cap Growth Fund Socially Responsive Fund |

| | | | | | |

| | | | | | |

| | | | | |

| | | | | | |

| | | | | | |

| | | | | Annual Report | |

| | | | | August 31, 2010 | |

| | | | | THE FUNDS | |

| | | | | President's Letter | 1 |

| | | | | | |

| | | | | PORTFOLIO COMMENTARY (UNAUDITED) | |

| | | | | | |

| | | | | Climate Change Fund | 2 |

| | | | | | |

| | | | | Emerging Markets Equity Fund | 6 |

| | | | | | |

| | | | | Equity Income Fund | 10 |

| | | | | | |

| | | | | Focus Fund | 14 |

| | | | | | |

| | | | | Genesis Fund | 18 |

| | | | | | |

| | | | | Guardian Fund | 22 |

| | | | | | |

| | | | | International Fund | 26 |

| | | | | | |

| | | | | International Institutional Fund | 29 |

| | | | | | |

| | | | | International Large Cap Fund | 32 |

| | | | | | |

| | | | | Intrinsic Value Fund | 36 |

| | | | | | |

| | | | | Large Cap Disciplined Growth Fund | 40 |

| | | | | | |

| | | | | Mid Cap Growth Fund | 44 |

| | | | | | |

| | | | | Multi-Cap Opportunities Fund | 48 |

| | | | | | |

| | | | | Partners Fund | 52 |

| | | | | | |

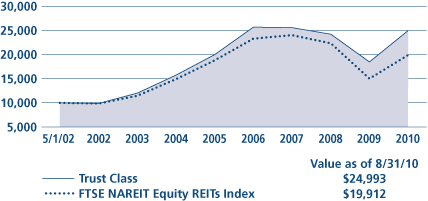

| | | | | Real Estate Fund | 56 |

| | | | | | |

| | | | | Regency Fund | 60 |

| | | | | | |

| | | | | Select Equities Fund | 64 |

| | | | | | |

| | | | | Small Cap Growth Fund | 68 |

| | | | | | |

| | | | | Socially Responsive Fund | 72 |

| | | | | | |

| | | | | FUND EXPENSE INFORMATION | 81 |

| | | | | | |

| | | | | SCHEDULE OF INVESTMENTS/TOP TEN EQUITY HOLDINGS | |

| | | | | | |

| | | | | Climate Change Fund | 85 |

| | | | | | |

| | | | | Emerging Markets Equity Fund | 87 |

| | | | | | |

| | | | | Equity Income Fund | 90 |

| | | | | | |

| | | | | Focus Fund | 92 |

| | | | | | |

| | | | | Genesis Fund | 93 |

| | | | | | |

| | | | | Guardian Fund | 95 |

| | | | | | |

| | | | | International Fund | 96 |

| | | | | International Institutional Fund | 99 |

| | | | | | |

| | | | | International Large Cap Fund | 102 |

| | | | | | |

| | | | | Intrinsic Value Fund | 105 |

| | | | | | |

| | | | | Large Cap Disciplined Growth Fund | 107 |

| | | | | | |

| | | | | Mid Cap Growth Fund | 109 |

| | | | | | |

| | | | | Multi-Cap Opportunities Fund | 111 |

| | | | | | |

| | | | | Partners Fund | 112 |

| | | | | | |

| | | | | Real Estate Fund | 114 |

| | | | | | |

| | | | | Regency Fund | 115 |

| | | | | | |

| | | | | Select Equities Fund | 117 |

| | | | | | |

| | | | | Small Cap Growth Fund | 118 |

| | | | | | |

| | | | | Socially Responsive Fund | 120 |

| | | | | | |

| | | | | FINANCIAL STATEMENTS | 131 |

| | | | | | |

| | | | | FINANCIAL HIGHLIGHTS (ALL CLASSES) PER SHARE DATA | |

| | | | | | |

| | | | | Climate Change Fund | 185 |

| | | | | | |

| | | | | Emerging Markets Equity Fund | 185 |

| | | | | | |

| | | | | Equity Income Fund | 187 |

| | | | | | |

| | | | | Focus Fund | 187 |

| | | | | | |

| | | | | Genesis Fund | 189 |

| | | | | | |

| | | | | Guardian Fund | 191 |

| | | | | | |

| | | | | International Fund | 193 |

| | | | | | |

| | | | | International Institutional Fund | 193 |

| | | | | | |

| | | | | International Large Cap Fund | 195 |

| | | | | | |

| | | | | Intrinsic Value Fund | 195 |

| | | | | | |

| | | | | Large Cap Disciplined Growth Fund | 197 |

| | | | | | |

| | | | | Mid Cap Growth Fund | 199 |

| | | | | | |

| | | | | Multi-Cap Opportunities Fund | 201 |

| | | | | | |

| | | | | Partners Fund | 201 |

| | | | | | |

| | | | | Real Estate Fund | 203 |

| | | | | | |

| | | | | Regency Fund | 205 |

| | | | | | |

| | | | | Select Equities Fund | 207 |

| | | | | | |

| | | | | Small Cap Growth Fund | 207 |

| | | | | | |

| | | | | Socially Responsive Fund | 211 |

| | | | | Reports of Independent Registered Public Accounting Firms | 218 |

| | | | | | |

| | | | | Directory | 220 |

| | | | | | |

| | | | | Trustees and Officers | 221 |

| | | | | | |

| | | | | Proxy Voting Policies and Procedures | 231 |

| | | | | | |

| | | | | Quarterly Portfolio Schedule | 231 |

| | | | | | |

| | | | | Notice to Shareholders | 232 |

| | | | | | |

The "Neuberger Berman" name and logo are registered service marks of Neuberger Berman Group LLC. "Neuberger Berman Management LLC" and the individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Management LLC. ©2010 Neuberger Berman Management LLC. All rights reserved.

President's Letter

Dear Fellow Shareholder,

The fiscal year ended August 31, 2010 was a time marked by significant volatility, as unsteady markets adjusted in real time to changing economic news. Over the course of the period, the U.S. stock market moved from a low-quality, speculative rally coming out of the financial crisis to a market more focused on concerns about slower-than-anticipated economic growth.

Major headlines about Chinese efforts to contain growth and possible contagion from European sovereign debt issues joined slowing economic data from the U.S. in cooling sentiment. Regionally, performance was led by the emerging markets, where economic growth rates were higher and fears related to developed markets' issues were less severe. U.S. stocks generally closed in mildly positive territory, but international developed markets, working through debt concerns and the austerity measures necessary to counteract them, declined.

Despite fears reported in the headlines, economic data over the period were mixed. Just as the market may have overreacted on the upside during the rally, we think the later selloff may have been overstated as well. Also, we believe the possibility of a double-dip recession, a topic that resurfaced this summer, remains unlikely. While the temporary increase from the inventory replacement cycle was shorter-lived and less steep than generally expected, more current data are somewhat more optimistic. In July, business inventories saw the largest increase in two years, a positive for U.S. GDP growth. August's capacity utilization number also increased, although it remains below the longer-term average. Retail sales, an indicator of consumer spending, declined in August, but that too remains well above levels a year ago.

While the U.S. government's $814 billion stimulus package, which helped the economy in the short term, is ending, inflation and interest rates remain low, and corporate America appears to be healthy. Between sharp cost-cutting measures during the downturn and conservative spending coming out of it, company balance sheets are showing abundant cash—which can be deployed to increase shareholder value, toward future growth, or for mergers and acquisitions, which have already begun to accelerate.

Consumer spending is the counterpoint. Private wage and salary disbursements increased by $25.7 billion in July, but serious pressure on consumers continues. At 9.6%, the unemployment rate is still far too high. The savings rate increased during the second quarter, credit remains somewhat constrained, and the housing sector is weak. While the total number of jobs increased over the fiscal year, more hiring is clearly needed.

GDP growth was revised down to 1.7% for the second quarter and, all told, we expect below-trend economic growth for at least the near term. Without strong economic growth, we expect investors will begin to focus more on fundamentals. In such an environment, we believe the market should offer a premium for companies that are truly exceptional, and that can execute under a variety of economic conditions.

That would be a quintessential stock-picker's scenario—where the variation in performance between individual securities is meaningful, and where investors are rewarded for thoughtful, detailed fundamental analysis—and that speaks to our strengths. Moving forward, we think the quality of our investment teams, our thorough and independent research, and our investment disciplines will be advantages.

Thank you for your continued confidence in Neuberger Berman. We look forward to continuing to serve your investment needs.

Sincerely,

Robert Conti

President and CEO

Neuberger Berman Mutual Funds

Climate Change Fund Commentary

For the fiscal year ended August 31, 2010, Neuberger Berman Climate Change Fund posted a slightly negative return, underperforming its benchmark, the MSCI World Index. The Fund outperformed the more comparable HSBC Global Climate Change Index and many of its peers for the period.

To some degree, performance of the MSCI World Index was driven by defensive areas this period, such as Telecommunications and Consumer Staples—sectors that are less relevant to the portfolio's investment theme. Defensive stocks led within markets that were extremely volatile, shaken by global macroeconomic concerns. While we acknowledge the difficulties of the past year's uncertain macro environment, key defensive decisions helped us temper volatility and outperform our peers and what we consider the more appropriate indexes.

We remain constructive from a thematic perspective. We continue to believe the Fund is advantageously positioned as a long-term, global portfolio that invests in a diverse universe of companies poised to benefit from efforts to address the impacts of climate change worldwide. We continue to allocate assets across three main themes—Cleaner Energy including wind, solar, nuclear and natural gas; Energy Efficiency including smart grid technology, energy efficient buildings and transportation; and Climate Adaptation including water services, carbon trading and agriculture.

Given the market backdrop over the past year, we were very balanced in our management approach, aware that some of our investment areas entailed higher volatility. A significant part of the portfolio is allocated to renewable energy and other higher-beta, growth-oriented areas. While some of these holdings posted lackluster performance, we had prudently bar-belled our exposure with more defensive holdings. Broad diversification remained a strategic priority for the Fund as we focused on key areas such as nuclear power, natural gas, water and smart grid. Defensive investments this period included a healthy weighting to Utilities and other dividend-paying companies. In power and utility companies, we continued to see attractive dividends, solid earnings visibility and exposure to clean energy growth opportunities. Both ou r diversification and the inclusion of Utilities tempered portfolio volatility and helped us outperform many "pure play" alternative and clean energy investment vehicles during the period.

While we manage a global portfolio, another defensive decision involved maintaining a significant allocation—approximately 65-70% of assets—to the U.S. market. As we witnessed economic deterioration in Europe and parts of Asia, an overweight to the U.S., which we believed was showing signs of recovery, seemed prudent. The case for an overweight U.S. allocation extends beyond macroeconomic considerations as well. We continue to believe the U.S. has much more room to advance in climate change efforts than regions such as Europe. We believe as more stringent environmental regulations begin to take hold in the U.S., and companies become more aggressive in their pursuit of cleaner energy, it will open up a great deal of opportunity for many American companies to benefit, and some foreign companies as well. Additi onally, from our perspective, the valuations of the U.S. stocks that we participate in do not reflect the long-term potential in many of these areas.

From a climate-policy perspective, movement over the period was disappointing, from the Copenhagen Global Climate Change Conference to the lack of progress from the U.S. Senate on a comprehensive energy bill. Policy uncertainty has created a short-term cloud and overhang over many companies levered to cleaner energy and climate change in particular.

Even so, with a much more active Environmental Protection Agency under the Obama administration, regulations have been and, we believe, will continue to be drafted that should benefit our portfolio holdings longer-term regardless of the lack of national energy legislation. These regulations are what we believe will be the first wave of the administration's strategy to economically burden more carbon intensive forms of energy. Although political uncertainty exists, we believe the new regulations pave the way for a bright future for cleaner energy, the largest component of the portfolio. We, therefore, believe the environmental policy direction is certainly very favorable for the companies in this Fund.

Looking forward, we believe regulatory forces driving the desire for an increasingly diversified, clean and secure energy mix could provide a myriad of investment opportunities across the Fund's Cleaner Energy, Energy Efficiency and Climate Adaptation segments—most of which still have billions of dollars in "stimulus tailwind" and could benefit from favorable incentives and rising demand for years to come.

Sincerely,

Ronald B. Silvestri

Portfolio Manager

Climate change-related companies may be particularly susceptible to such factors as environmental protection regulatory actions, changes in government standards and subsidy levels, changes in taxation, and other domestic and international, political, regulatory and economic developments. Such companies may also be significantly affected by the level or pace of technological change in industries focusing on energy, pollution and environmental control. Because society's focus on climate change issues is relatively new, there could be significant changes of emphasis and direction, and rapid technological change, rendering even new approaches and products obsolete. The risks associated with these investments are set forth in the prospectus and statement of additional information.

Investing in foreign securities involves greater risks than investing in securities of U.S. issuers, including currency fluctuations, changes in local economic and political conditions, and the need to operate in less regulated financial markets.

To the extent that the Fund emphasizes small-, mid- or large-cap stocks, it takes on the associated risks. At times, large-cap stocks may lag other types of stocks in performance, which could cause a fund holding those stocks to perform worse than certain other funds. Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile.

The composition, industries and holdings of the Fund are subject to change. Climate Change Fund is invested in a wide array of stocks and no single holding makes up a significant portion of the Fund's total assets.

Climate Change Fund

| TICKER SYMBOLS |

| Institutional Class | | NBCLX |

| Class A | | NBCAX |

| Class C | | NBCCX |

| SECTOR ALLOCATION |

| (% of Total Investments) |

| Consumer Discretionary | | | 1.8 | % |

| Consumer Staples | | | 0.5 | |

| Energy | | | 10.6 | |

| Financials | | | 0.4 | |

| Industrials | | | 28.3 | |

| Information Technology | | | 13.5 | |

| Materials | | | 1.5 | |

| Utilities | | | 40.4 | |

| Short-Term | | | 3.0 | |

| Total | | | 100.0 | % |

| PERFORMANCE HIGHLIGHTS1,3,10 |

| | | | | Average Annual Total Return Ended 08/31/2010 | |

| | | Inception Date | | 1 Year | | Life of Fund | |

| At NAV | |

| Institutional Class | | 05/01/2008 | | | –0.17 | % | | –16.57 | % | |

| Class A | | 05/01/2008 | | | –0.22 | % | | –16.70 | % | |

| Class C | | 05/01/2008 | | | –0.97 | % | | –17.30 | % | |

| With Sales Charge | |

| Class A | | | | | –5.92 | % | | –18.78 | % | |

| Class C | | | | | –1.96 | % | | –17.30 | % | |

| Index | |

MSCI World Index2,19 | | | | | 2.07 | % | | –10.76 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 9.87%, 9.94% and 10.96% for Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and reimbursements were 1.00%, 1.25% and 2.00% for Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2013 for Institutional Class, Class A and Class C shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charge (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1% which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

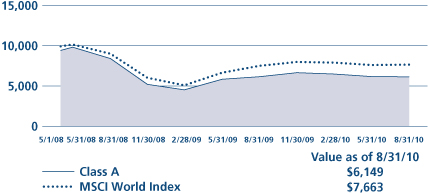

Climate Change Fund

COMPARISON OF A $10,000 INVESTMENT (WITH SALES CHARGE) |

|

| |

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Class A shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Performance Highlights chart on previous page). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Emerging Markets Equity Fund Commentary

We are pleased to report that, for the fiscal year ended August 31, 2010, Neuberger Berman Emerging Markets Equity Fund Institutional Class generated a positive return and roughly matched its benchmark, the MSCI Emerging Markets (EM) Index. (See page 8 for performance of other share classes.)

While emerging markets turned in double-digit positive results for the fiscal year, the period was volatile. The markets dramatically outperformed from September through the end of calendar-year 2009, rising more than 18% versus 6% for developed overseas markets (represented by the MSCI EAFE® Index). Emerging markets weakened early in calendar-year 2010, as investors reacted to concerns about the Chinese government's plans to constrain growth. In the calendar second quarter, they declined but less than either the EAFE or S&P 500. With emerging markets economies in relatively better shape than their developed counterparts, the emerging markets were somewhat insulated from the sovereign debt issues in Europe and weakening economic data from the U.S. that worried investors. Emerging markets advanced again in July but were down slightly in August.

Within the MSCI EM Index, Consumer Staples was the best performing sector, followed by Consumer Discretionary and Materials. While every sector in the index posted gains, Telecommunications and Energy were weakest. Geographically, stronger markets included Colombia, Chile and Thailand. The Czech Republic, Morocco and Hungary were negative. Within the Fund, the Financials, Energy and Health Care sectors were the largest contributors to outperformance, primarily because of strong stock selection. Consumer Staples, Information Technology and our small cash and cash equivalents position detracted. Geographically, Brazil, Thailand and China were additive on a relative basis, while investments in Israel, Chile and South Africa detracted from Fund results.

In terms of individual holdings, Brazilian iron ore company Vale was our top contributor this period. As Vale outperformed, our relatively large position was a benefit. Thailand's auto lender Thanachart was another top contributor. Both Thanachart and Top Glove, the Malaysian rubber glove manufacturer, turned in outstanding results for the year. Thanachart benefited from a recent acquisition, while Top Glove expanded as latex costs declined and sales of medical gloves increased. Banco Do Estado do Rio Grande do Sul, a leading Brazilian bank, outperformed as well. The bank's loan growth remained strong and asset quality remained solid.

Disappointments included Inspur, a Chinese enterprise resource planning software vendor. Inspur declined on weaker-than-expected second quarter results. We believe that Inspur's fundamentals remain strong, and have added to the position on weakness. Taewoong, a leading Korean engineering forged-component supplier, focused on the wind energy and ship-building industries, also detracted, on weak order flow and the strengthening Korean currency. Unitech, a residential real estate developer in India, declined on concerns about inflation and its potential effect on real estate demand. Ausnutria, a Chinese baby formula and infant nutrition company, was sold from the portfolio as competition from multinational players intensified.

Looking ahead, in our view, the secular growth opportunity in emerging markets continues to be in the domestic sectors—which will also have less earnings volatility in an uncertain global backdrop. From a sector perspective, we think the consumer sectors are already pricing in much of the upside. In our view, the Health Care sector offers good consumer type exposure, with high returns and good cash flow generation at reasonable multiples. The other domestic sector where we are positive is Industrials, due to large infrastructure bottlenecks. This is a recurring theme across a great number of countries, including Brazil and the Philippines. Across the board, the Fund is currently underweighted versus the benchmark in Financials, Utilities, Telecommunications and Energy and overweighted in Health Care and Informatio n Technology.

On the country front, we believe there is growth and value in countries including Thailand, Turkey and the Philippines, and believe India and Brazil still have interesting mid-cap opportunities. We believe Brazil could start to perform once the approximately $72 billion deal from Petrobras and the October presidential elections—where the expected outcome should signal the continuation of favorable trends—get out of the way. In Korea and Taiwan, which continue to be export-driven

markets (especially for technology products), we are more cautious, looking for select opportunities. We think China is a contrarian market where we see select opportunities in the domestic space. There has been considerable policy noise locally in China to address the rapidly rising property prices and wage increases. The mounting U.S. pressure on the Chinese to revalue its currency, the renminbi, could lead to increased tensions over trade and, in our view, is a genuine risk.

While emerging markets equities outperformed their U.S. and developed international peers this year, we continue to see the markets overall as reasonably valued, especially considering their 5-6% incremental growth versus developed markets. We believe that our strict bottom-up fundamental analysis within a macro perspective will help us continue to capture the opportunity these markets represent.

Sincerely,

Conrad Saldanha

Portfolio Manager

The risks involved in seeking capital appreciation from investments primarily in companies based outside the United States are set forth in the prospectus and statement of additional information.

Investing in foreign securities involves greater risks than investing in securities of U.S. issuers, including currency fluctuations, changes in local economic and political conditions, and the need to operate in less regulated financial markets. These risks are typically heightened for investments in emerging markets.

To the extent that the Fund emphasizes small-, mid- or large-cap stocks, it takes on the associated risks. At times, large-cap stocks may lag other types of stocks in performance, which could cause a fund holding those stocks to perform worse than certain other funds. Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile.

The composition, industries and holdings of the Fund are subject to change. In an attempt to reduce overall volatility, Emerging Markets Equity Fund diversifies the portfolio holdings over a wide array of countries and individual stocks.

Emerging Markets Equity Fund

| TICKER SYMBOLS |

| Institutional Class | | NEMIX | |

| Class A | | NEMAX | |

| Class C | | NEMCX | |

| Class R3 | | NEMRX | |

| SECTOR ALLOCATION |

| (% of Total Investments) | |

| Consumer Discretionary | | | 8.6 | % | |

| Consumer Staples | | | 5.8 | | |

| Energy | | | 11.9 | | |

| Financials | | | 18.4 | | |

| Health Care | | | 7.3 | | |

| Industrials | | | 9.1 | | |

| Information Technology | | | 16.5 | | |

| Materials | | | 12.7 | | |

| Telecommunication Services | | | 5.7 | | |

| Utilities | | | 0.7 | | |

| Short-Term | | | 3.3 | | |

| Total | | | 100.0 | % | |

| PERFORMANCE HIGHLIGHTS1,3,10 |

| | | | | Average Annual Total Return Ended 08/31/2010 | |

| | | Inception Date | | 1 Year | | Life of Fund | |

| At NAV | |

| Institutional Class | | 10/08/2008 | | | 18.76 | % | | | 32.98 | % | |

| Class A | | 10/08/2008 | | | 18.58 | % | | | 32.73 | % | |

| Class C | | 10/08/2008 | | | 17.62 | % | | | 31.71 | % | |

Class R313 | | 06/21/2010 | | | 18.64 | % | | | 32.90 | % | |

| With Sales Charge | |

| Class A | | | | | 11.72 | % | | | 28.66 | % | |

| Class C | | | | | 16.62 | % | | | 31.71 | % | |

| Index | |

MSCI Emerging Markets Index2,19 | | | | | 18.34 | % | | | 25.80 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 14.80%, 19.00%, 17.58% and 3.05% for Institutional Class, Class A, Class C and Class R3 shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and reimbursements were 1.30%, 1.56%, 2.30% and 1.93% for Institutional Class, Class A, Class C and Class R3 shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2013 for Institutional Class, Class A, Class C and Class R3 shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

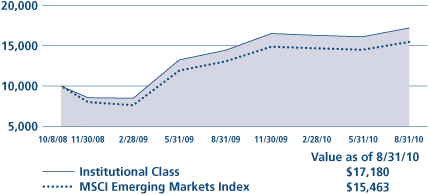

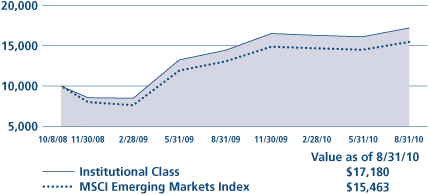

Emerging Markets Equity Fund

COMPARISON OF A $10,000 INVESTMENT |

|

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Performance Highlights chart on previous page). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distribu tions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Equity Income Fund Commentary

We are pleased to report that for the fiscal year ended August 31, 2010, Neuberger Berman Equity Income Fund generated a strongly positive return and significantly outperformed its benchmark, the S&P 500 Index.

By the second half of calendar-year 2009 it seemed apparent that the U.S. was pulling out of the recession that had followed the financial crisis. Stocks had already begun discounting that move, starting their advance in March 2009, and the positive trend in both the markets and the economy continued through the remainder of the year.

In the beginning of calendar-year 2010, however, investors paused, and in our opinion questioned, whether stocks had climbed too far too fast, expanding beyond what appeared warranted by economic data considering the many uncertainties that remained. When early 2010 economic data continued to appear positive, investors found renewed optimism and drove the markets higher until the end of April. In May, the European sovereign debt crisis deepened, damaging investor confidence fairly significantly. From that point through the Fund's fiscal year-end, the market maintained a very volatile, wide trading range.

Taking the fiscal year as a whole, the first half was characterized by investor enthusiasm, while the second half was marked by concern, loss of confidence, and risk aversion. Given the Equity Income investment philosophy and process, we were able to use the volatility we saw to our advantage. We used our strict investment discipline to reposition the portfolio, selling strong performers in up markets, and buying attractive stocks at discounted prices when the market was weaker.

Within the portfolio, certain sectors performed particularly well, contributing significantly to our outperformance for the period. The largest single benefit came from our Energy holdings. We continue to believe that oil is in a structural bull market, and that, as the global economy recovers, demand for oil and oil products will continue to drive prices higher. Within the sector, Penn West, Cathedral Energy, CNOOC, Enbridge and Arc Energy Trust were among the top contributors.

The second key area for us this period was real estate investment trusts (REITs), always a significant part of our strategy. Our exposure to REITs, and in particular to unconventional REITs and international names, was highly beneficial, with standout investments within the sector including AvalonBay, Ascendas (a Singapore REIT) and Digital Realty Trust.

Our avoidance of certain equity sectors also contributed to the Fund's outperformance this period. For example, our underweight, versus the benchmark, to the relatively weak Health Care sector was beneficial relative to the S&P 500. Information Technology holdings were also positive, as strong stock selection, in terms of both sub-sector and the specific companies within them, provided contributions to returns. Materials was a similar story this period, with the portfolio exposed to the right sectors and companies, and in particular, owning the gold royalty companies. As with REITs, with concern about the U.S. consumer, we have been seeking companies with international exposure across our equity position.

After lagging during the first half of the fiscal period, Utilities, another important portion of our strategy, began to show some improvement in the second half. Taking the period as a whole, they too contributed to our outperformance. There were individual disappointments including Exelon and NextEra, but their negative effect was more than compensated for by strong performers within the sector.

Finally, a combination of our option writing and exposure to convertible securities was additive. One highlight within this group was a convertible preferred issued by Vale, a Brazilian mining company, which contributed strongly to the Fund's performance.

Looking ahead, we think the near-term market outlook remains choppy, as many of the issues that impacted the second half of this fiscal period are still with us—important among them, uncertainty about sovereign debt and uncertainty surrounding the U.S. economy's ability to grow in a meaningful way.

We expect to see global economic growth, but at slower than typical levels. As a result, while we remain cautious, we also believe that stocks are quite reasonably priced in the current market. We continue to find what we consider some phenomenal companies with great balance sheets, that appear to us well positioned to grow their earnings and their free cash flow, which in our view should eventually enable them to raise their dividends as well.

We view the current environment, complicated though it may be, as something of a sweet spot for the Equity Income strategy. We think the companies we own will continue to generate good profit growth, that will manifest itself in good dividend growth going forward. At the same time, we remain confident that our strategy's yield and other defensive characteristics may help insulate the portfolio should the outlook temporarily weaken.

Sincerely,

Richard S. Levine, Tony Gleason and Sandy Pomeroy

Portfolio Co-Managers

The risks involved in seeking capital appreciation from investments in a wide array of stocks are set forth in the prospectus and statement of additional information.

To the extent that the Fund emphasizes small-, mid- or large-cap stocks, it takes on the associated risks. At times, large-cap stocks may lag other types of stocks in performance, which could cause a fund holding those stocks to perform worse than certain other funds. Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile.

The composition, industries and holdings of the Fund are subject to change. Equity Income Fund is invested in a wide array of stocks and no single holding makes up a significant portion of the Fund's total assets.

Equity Income Fund

| TICKER SYMBOLS |

| Institutional Class | | NBHIX |

| Class A | | NBHAX |

| Class C | | NBHCX |

| Class R3 | | NBHRX |

| SECTOR ALLOCATION |

| (% of Total Investments) |

| Consumer Discretionary | | | 1.4 | % |

| Consumer Staples | | | 4.5 | |

| Energy | | | 14.1 | |

| Financials | | | 15.9 | |

| Health Care | | | 4.3 | |

| Industrials | | | 3.8 | |

| Information Technology | | | 2.7 | |

| Materials | | | 2.9 | |

| Telecommunication Services | | | 5.1 | |

| Utilities | | | 15.0 | |

| Other | | | 23.5 | |

| Short-Term | | | 6.8 | |

| Total | | | 100.0 | % |

| PERFORMANCE HIGHLIGHTS1,3 |

| | | | | Average Annual Total Return Ended 08/31/2010 |

| | | Inception Date | | 1 Year | | Life of Fund |

| At NAV | |

| Institutional Class | | 06/09/2008 | | | 18.81 | % | | 3.87 | % |

Class A17 | | 06/09/2008 | | | 18.36 | % | | 3.62 | % |

Class C17 | | 06/09/2008 | | | 17.59 | % | | 3.21 | % |

Class R317 | | 06/21/2010 | | | 18.62 | % | | 3.83 | % |

| With Sales Charge | |

Class A17 | | | | | 11.58 | % | | 2.03 | % |

Class C17 | | | | | 16.59 | % | | 3.21 | % |

| Index | |

S&P 500 Index2,19 | | | | | 4.91 | % | | –4.61 | % |

The performance data for each class includes the performance of the Fund's oldest share class, Trust Class, from November 2, 2006 through June 9, 2008. The performance data of Class R3 also includes the performance of Institutional Class from June 9, 2008 through June 21, 2010. See footnote 17 for information about the effects of the different fees paid by each class.

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 1.36%, 2.35%, 2.84% and 1.56% for Institutional Class, Class A, Class C and Class R3 shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and reimbursements were 0.84%, 1.20%, 1.95% and 1.45% for Institutional Class, Class A, Class C and Class R3 shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2013 for Institutional Class, Class A, Class C and Class R3 shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

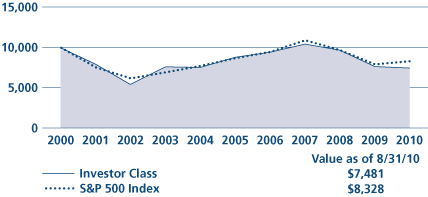

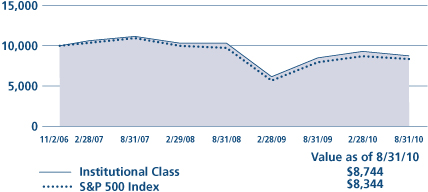

Equity Income Fund

| COMPARISON OF A $10,000 INVESTMENT17 |

|

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Performance Highlights chart on previous page). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distribu tions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Focus Fund Commentary

During the volatile fiscal year ended August 31, 2010, Neuberger Berman Focus Fund posted a marginally negative return, underperforming its benchmark, the S&P 500 Index. While this is disappointing to us, we believe the Fund represents a portfolio of shares in businesses that have strong competitive positions in their industries and which are trading at distinct discounts to what we consider the underlying value of their assets and operations.

Within the index, the best-performing sectors included Consumer Discretionary, Industrials and Telecommunications. Financials, Information Technology and Health Care underperformed. We had entered the reporting period somewhat defensively positioned, seeking opportunities in Health Care and Information Technology. This defensive positioning was a key reason for the Fund's underperformance.

The Fund was invested in what we consider quality names during the period. For a variety of reasons, the share prices of large-capitalization, high-quality companies have generally underperformed in recent years. One source of this underperformance is that investors have been reducing exposure to U.S. common stocks. As money has moved into bonds and foreign stocks, these flows have hurt the prices of the Fund's holdings. We think this has created an interesting value opportunity. The U.S. stock market is trading at roughly the same level now as it was back in 1998. Over the past 12-plus years, our economy has expanded and U.S. companies have increased their exposure to developing markets. These companies have grown revenues and profits and increased the value of their businesses. While the timing is unclear, and the U.S . still faces challenges, we believe these dynamics have created a very interesting valuation opportunity in many high-quality stocks. We think patient investors will be rewarded for holding these high-quality businesses at today's reasonable valuations.

The top positive contributor to performance for the fiscal year was Rockwell Automation. This industrial company benefited from an improving economy over the course of the reporting period. We have since sold the position as it reached what we considered full valuation. Another positive contributor was XTO Energy, which was taken over by ExxonMobil during the period. The Fund also benefited from holding Brinker International, the owner of Chili's and other restaurants. Their management really focused the company during the fiscal year, managed it for cash flow, started a share repurchase program and increased the dividend significantly.

The single largest detractor from performance for the fiscal year was Range Resources, a natural gas producer. In our view, the company is a best-in-class operator within a best-in-class geography, owning assets in the core of the Marcellus shale region. The stock declined on investors' concerns about the long-term outlook for gas at the intersection of low gas prices and what appears to be undisciplined drilling activity. We think drilling activity will decline in the coming months as obligations expire, that prices ultimately will rise, and that the net asset value of Range Resources, which far exceeds its current share price, will be realized. Other areas of underperformance came from Information Technology, where we owned Hewlett-Packard and Yahoo!. Within Health Care, our ownership of Gilead Sciences hurt relative performance.

Looking ahead, we expect continued volatility, but within mildly positive markets. The recovery seems to have stalled somewhat, but we see healthy corporate balance sheets with significant cash, as well as stock buybacks, increased dividends, and increasing merger and acquisition activity, all of which, in our opinion, should be positive for the markets. After a dramatic cutback in capital expenditures, we have started to see a small pickup in capital spending, which is a good sign for the economy and markets. Furthermore, as the new Basel III banking rules get ironed out, some of the uncertainty that these widely anticipated proposals have created will be eliminated.

We think valuations are positive for stocks on a longer-term basis, and that as volatility continues, it will create buying opportunities along the way. As always, we think about decisions from an overall portfolio perspective. We remain highly attuned to the interaction among holdings in an attempt to minimize risk and enhance the prospects for healthy returns.

In our opinion, the Fund is positioned to take advantage of a return to U.S. high quality equities which, given the valuations currently present in the market, seems very likely.

Sincerely,

Gregory Francfort and David Levine

Portfolio Co-Managers

Because the Fund is concentrated in a small number of stocks, it will be substantially overweighted or underweighted in certain economic sectors at any given time. Therefore its performance is likely to be disproportionately affected by the factors influencing those sectors and may suffer if certain economic sectors it emphasizes do not perform as expected. The risks associated with these investments are set forth in the prospectus and statement of additional information.

Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile. Large-cap stocks are subject to all the risks of stock market investing, including the risk that they may lose value.

The composition, industries and holdings of the Fund are subject to change.

Focus Fund

| TICKER SYMBOLS |

| Investor Class | | NBSSX |

| Trust Class | | NBFCX |

| Advisor Class | | NBFAX |

| Institutional Class | | NFALX |

| Class A | | NFAAX |

| Class C | | NFACX |

| SECTOR ALLOCATION |

| (% of Total Investments) | |

| Consumer Discretionary | | | 12.1 | % |

| Consumer Staples | | | 6.2 | |

| Energy | | | 11.9 | |

| Financials | | | 16.0 | |

| Health Care | | | 18.0 | |

| Industrials | | | 10.9 | |

| Information Technology | | | 19.2 | |

| Materials | | | 2.2 | |

| Utilities | | | 1.5 | |

| Short-Term | | | 2.0 | |

| Total | | | 100.0 | % |

| PERFORMANCE HIGHLIGHTS1,3,9 |

| | | | | Average Annual Total Return Ended 08/31/2010 |

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund |

| At NAV | |

| Investor Class | | 10/19/1955 | | | –2.39 | % | | | –3.25 | % | | | –2.86 | % | | | 9.96 | % |

Trust Class5 | | 08/30/1993 | | | –2.61 | % | | | –3.46 | % | | | –3.06 | % | | | 9.97 | % |

Advisor Class5 | | 09/03/1996 | | | –2.83 | % | | | –3.67 | % | | | –3.28 | % | | | 9.92 | % |

Institutional Class22 | | 06/21/2010 | | | –2.33 | % | | | –3.24 | % | | | –2.85 | % | | | 9.96 | % |

Class A25 | | 06/21/2010 | | | –2.38 | % | | | –3.25 | % | | | –2.86 | % | | | 9.96 | % |

Class C25 | | 06/21/2010 | | | –2.57 | % | | | –3.29 | % | | | –2.88 | % | | | 9.96 | % |

| With Sales Charge | |

Class A25 | | | | | –8.00 | % | | | –4.39 | % | | | –3.43 | % | | | 9.84 | % |

Class C25 | | | | | –3.53 | % | | | –3.29 | % | | | –2.88 | % | | | 9.96 | % |

| Index | |

S&P 500 Index2,19 | | | | | 4.91 | % | | | –0.91 | % | | | –1.81 | % | | | 9.52 | % |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 1.01%, 1.26% and 1.54%, 0.80%, 1.16% and 1.91% for Investor Class, Trust Class, Advisor Class, Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and reimbursements were 1.52%, 0.77%, 1.13% and 1.88% for Advisor Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2020 for Advisor Class shares and through August 31, 2013 for Institutional Class, Class A and Class C shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

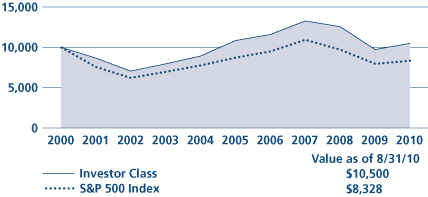

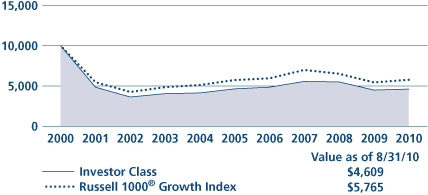

Focus Fund

| COMPARISON OF A $10,000 INVESTMENT |

|

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Performance Highlights chart on previous page). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributi ons or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Genesis Fund Commentary

We witnessed oscillation in investor risk preference during the fiscal year ended August 31, 2010. From September 2009 until the mid-April market high, investors' confidence in the economic recovery translated into a willingness to take on risk in the form of more speculative and economically sensitive stocks. However, as weak economic data called into question the strength and sustainability of the recovery, investors hit the "risk-off" button and rotated into bonds and higher quality companies in less economically sensitive sectors.

Not surprisingly considering our affection for high quality, consistently-profitable companies and our aversion to risk, Neuberger Berman Genesis Fund lagged its Russell 2000® Index benchmark while investors were taking more risk and outperformed when their appetite for risk diminished. We are pleased to report that, for the full 12-month period, the Fund generated a positive return and outperformed its benchmark.

Investments in the Materials sector had the most positive impact on performance relative to the benchmark, with salt and specialty-fertilizer company Compass Minerals and dispenser and closure producer AptarGroup making major contributions. Industrial sector holdings also excelled, led by strong gains from coal mining equipment manufacturers Bucyrus International and Joy Global. Superior relative performance in the Energy sector was driven by solid gains from hydraulic fracturing proppant leader CARBO Ceramics, metallurgical coal producer Alpha Natural Resources, and domestic oil and gas exploration company Concho Resources. We believe most of the aforementioned companies still have attractive upside potential. However, we have pared back our positions in Bucyrus International, Joy Global and Alpha Natural Resources bec ause we believe that Chinese demand for coal may soften as the Chinese government takes actions to cool its economy.

Collectively, our Consumer Discretionary sector investments detracted from relative performance. Two of the biggest disappointments were for-profit education companies Strayer Education and Capella Education. In general, for-profit education companies came under pressure due to new Department of Education (DOE) regulations that threaten to reduce the availability of student loans for for-profit schools. The DOE has set two new criteria, at least one of which must be satisfied for a school to retain full eligibility. While Strayer and Capella have thus far failed to meet one of the criteria, both assert that they should easily satisfy the second. If they make good on this assertion, we believe both stocks can rebound.

Information Technology sector holdings also underperformed. ManTech International, which produces security systems for the Departments of Defense, Homeland Security and State, and foreign government agencies, we believe is really a defense company. We suspect that the stock came under pressure largely due to investor concern over potential cuts in U.S. government defense spending. We believe the stock is currently very cheap and offers an attractive risk/reward profile.

Health Care sector holdings lagged, with veterinary hospital, clinic and lab company VCA Antech among the Fund's poorest performers. VCA earnings were pressured by reduced consumer spending on pet care. However, we think earnings will recover as pet owners resume spending needed to take care of their pets.

The dramatic slowdown in Gross Domestic Product (GDP) growth in the second quarter of 2010 did not surprise us. We had anticipated that, once severely depleted inventories were replenished and government stimulus programs wound down, economic growth would moderate significantly. Now, in our view, the business community and equity investors are beginning to discount uncertainty regarding the near and intermediate term outlook for the economy. Is inflation or deflation the biggest threat? What is the ultimate economic impact of major regulatory overhauls of the health care and financial industries? What is the outlook for taxes? Currently, no one (including us) has answers to these questions. In addition, due to deficit concerns, we believe more financial stimulus from the federal government appears politically unpalatabl e. Most importantly, in our opinion, the American consumer is still overleveraged. Until consumers get their personal balance sheets in better shape, we expect consumer spending and therefore end-demand will remain soft and economic growth will remain uninspiring. We think this is not an encouraging scenario for the broad stock market.

One encouraging note is that stocks are quite cheap relative to fixed income alternatives. At some point, even if the economy remains sluggish, investors may tire of extremely low bond yields and move back into equities. One thing we believe could be quite constructive for the stock market would be for cash-rich corporate America to increase equity dividends, thereby enhancing the attractiveness of stocks relative to bonds.

How are we responding to the aforementioned economic and market uncertainty? By doing the same thing we have always done—searching for high-quality, financially strong small companies capable of consistently growing earnings over the economic cycle. Over the long term, we believe this will continue to be productive.

Sincerely,

Judith M. Vale and Robert D'Alelio

Portfolio Co-Managers

The risks involved in seeking capital appreciation from investments primarily in companies with small market capitalization are set forth in the prospectus and statement of additional information.

Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile.

The composition, industries and holdings of the Fund are subject to change. Genesis Fund is invested in a wide array of stocks and no single holding makes up a significant portion of the Fund's total assets.

Genesis Fund

| TICKER SYMBOLS |

| Investor Class | | NBGNX |

| Trust Class | | NBGEX |

| Advisor Class | | NBGAX |

| Institutional Class | | NBGIX |

| SECTOR ALLOCATION |

| (% of Total Investments) | |

| Consumer Discretionary | | | 5.3 | % |

| Consumer Staples | | | 8.3 | |

| Energy | | | 12.8 | |

| Financials | | | 9.2 | |

| Health Care | | | 18.4 | |

| Industrials | | | 18.8 | |

| Information Technology | | | 10.0 | |

| Materials | | | 9.3 | |

| Utilities | | | 2.9 | |

| Short-Term | | | 5.0 | |

| Total | | | 100.0 | % |

| PERFORMANCE HIGHLIGHTS1,3 |

| | | | | Average Annual Total Return Ended 08/31/2010 |

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund |

| Investor Class | | 09/27/1988 | | | 8.41 | % | | | 1.81 | % | | | 8.85 | % | | | 11.68 | % |

Trust Class5 | | 08/26/1993 | | | 8.34 | % | | | 1.76 | % | | | 8.81 | % | | | 11.68 | % |

Advisor Class5 | | 04/02/1997 | | | 8.11 | % | | | 1.50 | % | | | 8.53 | % | | | 11.49 | % |

Institutional Class7 | | 07/01/1999 | | | 8.68 | % | | | 2.03 | % | | | 9.09 | % | | | 11.81 | % |

Russell 2000® Index2,19 | | | | | 6.60 | % | | | –0.69 | % | | | 2.48 | % | | | 8.21 | % |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 1.10%, 1.14%, 1.40% and 0.89% for Investor Class, Trust Class, Advisor Class and Institutional Class shares, respectively (prior to any fee waivers or expense reimbursement for Institutional Class shares). The expense ratio net of waivers and reimbursements was 0.87% for Institutional Class shares. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2020 for Institutional Class and Advisor Class shares and through August 31, 2013 for Trust Class shares.

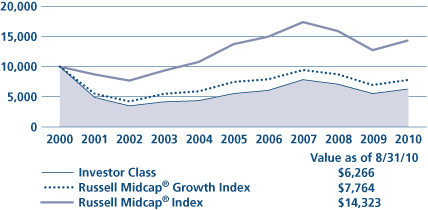

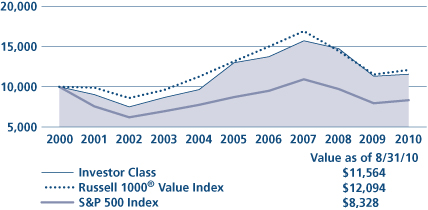

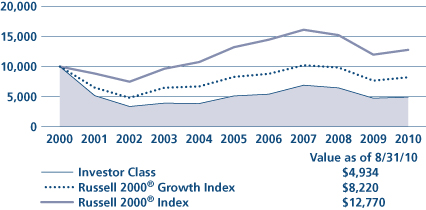

Genesis Fund

| COMPARISON OF A $10,000 INVESTMENT |

|

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Performance Highlights chart on previous page). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Guardian Fund Commentary

We are pleased to report that, for the fiscal year ended August 31, 2010, Neuberger Berman Guardian Fund generated a positive return and outperformed its benchmark, the S&P 500 Index.

We saw a sharp shift in market sentiment over this fiscal year. For the first two-thirds of the period, the economy was expanding at an above-trend rate—coming off the bottom of the recession, with an inventory cycle underway, and, through April 2010, with active discussion about how the Federal Reserve might begin to exit its quantitative easing program. Against that backdrop, equities performed very well, led by shares of businesses that would be the greatest beneficiaries of a cyclical recovery, including Consumer Discretionary, Industrials, credit-sensitive Financials and Materials.

In late April and early May, as worries about sovereign debt issues in Europe increased, credit markets grew nervous and many equity investors sold their shares. This was the lead-in to the seasonally soft summer months, and throughout the summer, economic statistics—industrial production, employment, spending—weakened. Against this backdrop, some of the sectors that had outperformed came under the most pressure.

Within the Fund, our focus for several years has been on identifying businesses positioned to perform in a slower growth environment on the strength of their products and value to customers. Earlier this period, the shares of many traditional growth sectors performed poorly as investors favored cyclical exposure. As multiples between growth and value converged, we were able to buy high-quality growth companies at what we believe were very attractive prices. That is where we have been adding holdings—in strong businesses, with good secular growth, whose stocks have underperformed. We now have a meaningful Consumer Staples allocation, a different mix in Health Care, and a number of one-off names across the portfolio that share these characteristics.

Examples include Coca-Cola, W.W. Grainger, the industrial distributor, and MasterCard, the debit/credit card payment processing firm. These businesses proved defensive during the downturn, but also demonstrated that they can maintain and protect earnings in an inflationary environment. We believe, given the current environment, that such extremes are not off the table.

For the fiscal year, despite the fact that we were largely underexposed to the best performing sectors early on, we were able to deliver very good relative returns by executing our strategy. The largest contributors to our outperformance this period included three long-term core holdings: Intuit, Altera and Millipore.

We bought Intuit years ago, believing that the business could grow in a tough environment, and in our opinion they have done a remarkable job—through 2008, 2009 and today at a double-digit pace. Altera also outperformed. While it's late in the semiconductor cycle, the secular outlook for Altera, based on what we consider superior technology, has become more apparent. Biosciences firm Millipore was put into play by a hostile acquisition bid from a competitor, and then acquired by a white knight at a premium. During the first quarter of calendar-year 2010, we began to see increased merger and acquisition activity. We expect to see more going forward given the growing strength of corporate balance sheets.

Disappointments included Charles Schwab, a core long-term holding whose business is growing, and that stands to benefit when interest rates eventually rise. The stock underperformed as European debt and U.S. recovery concerns pushed out the likely timeline for rate increases and the related upside earnings potential. We continue to own Schwab, encouraged by management's execution of its business.

Covidien, a Health Care name we added over the winter on the opportunity to buy good secular growth at an attractive value, performed well through early spring. The stock weakened over concerns about slowing utilization of medical services, likely triggered by the coming expiration of extended COBRA benefits. We remain positive about the stock and sector, and continue to own both Covidien and C.R. Bard.

Washington Post, which we owned for its Kaplan education business, was frustrating. While we got the fundamentals right—Kaplan met our expectations for dramatic and contra-cyclical growth—the regulatory environment changed dramatically. As proposed regulations threatened Kaplan's business model, we eliminated our position.

From our perspective, investor expectations seem to have overshot early in the fiscal year, as inventory rebuilding drove GDP growth at a rate that we think is likely to prove greater than the long-term trend. As the fiscal year progressed, credit market volatility in Europe and fears of a double-dip recession appear to have caused sentiment to overshoot on the downside. While we expect there will be challenges ahead, we think odds are that the economy will remain on course for a slow recovery.

In an uncertain world, we remain confident that the high quality businesses represented in the Guardian Fund are financially strong, and positioned to deliver reasonable growth over a wide range of economic outcomes.

As always, we look forward to continuing to serve your investment needs.

Sincerely,

Arthur Moretti

Portfolio Manager

The risks involved in seeking capital appreciation from investments primarily in mid- to large-cap stocks are set forth in the prospectus and statement of additional information.

Mid-capitalization stocks are more vulnerable to financial risks and other risks than larger stocks. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile. Large-cap stocks are subject to all the risks of stock market investing, including the risk that they may lose value due to overall market or economic conditions.

The composition, industries and holdings of the Fund are subject to change. Guardian Fund is invested in a wide array of stocks and no single holding makes up a significant portion of the Fund's total assets.

Guardian Fund

| TICKER SYMBOLS |

| Investor Class | | NGUAX |

| Trust Class | | NBGTX |

| Advisor Class | | NBGUX |

| Institutional Class | | NGDLX |

| Class A | | NGDAX |

| Class C | | NGDCX |

| Class R3 | | NGDRX |

| SECTOR ALLOCATION |

| (% of Total Investments) | |

| Consumer Discretionary | | | 5.4 | % |

| Consumer Staples | | | 8.9 | |

| Energy | | | 13.6 | |

| Financials | | | 11.6 | |

| Health Care | | | 9.3 | |

| Industrials | | | 18.1 | |

| Information Technology | | | 26.6 | |

| Materials | | | 2.6 | |

| Short-Term | | | 3.9 | |

| Total | | | 100.0 | % |

| PERFORMANCE HIGHLIGHTS1,3,8,15 |

| | | | | Average Annual Total Return Ended 08/31/2010 |

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund |

| At NAV |

| Investor Class | | 06/01/1950 | | | 7.99 | % | | –0.63 | % | | | 0.49 | % | | | 10.76 | % |

Trust Class5 | | 08/03/1993 | | | 7.75 | % | | –0.79 | % | | | 0.34 | % | | | 10.72 | % |

Advisor Class5 | | 09/03/1996 | | | 7.38 | % | | –1.21 | % | | | –0.04 | % | | | 10.61 | % |

Institutional Class22 | | 05/27/2009 | | | 8.22 | % | | –0.57 | % | | | 0.52 | % | | | 10.76 | % |

Class A21 | | 05/27/2009 | | | 7.72 | % | | –0.67 | % | | | 0.47 | % | | | 10.75 | % |

Class C21 | | 05/27/2009 | | | 7.08 | % | | –0.85 | % | | | 0.38 | % | | | 10.74 | % |

Class R321 | | 05/27/2009 | | | 7.51 | % | | –0.72 | % | | | 0.44 | % | | | 10.75 | % |

| With Sales Charge |

Class A21 | | | | | 1.57 | % | | –1.84 | % | | | –0.12 | % | | | 10.65 | % |

Class C21 | | | | | 6.08 | % | | –0.85 | % | | | 0.38 | % | | | 10.74 | % |

| Index |

S&P 500 Index2,19 | | | | | 4.91 | % | | –0.91 | % | | | –1.81 | % | | | 10.65 | % |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, visit www.nb.com/performance.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 0.97%, 1.15%, 5.33%, 0.81%, 1.17%, 1.92% and 1.42% for Investor Class, Trust Class, Advisor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and reimbursements were 1.51%, 0.75%, 1.11%, 1.86% and 1.36% for Advisor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through August 31, 2020 for Advisor Class shares, through August 31, 2013 for Institutional Class, Class A, Class C and Class R3 shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

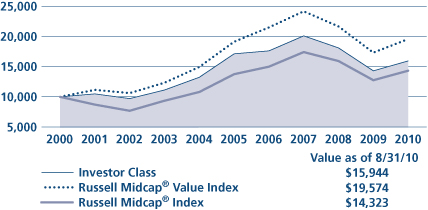

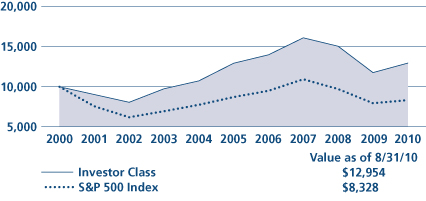

Guardian Fund

| COMPARISON OF A $10,000 INVESTMENT |

|

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures and any applicable sales charges (see Performance Highlights chart on previous page). The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indexes shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributi ons or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

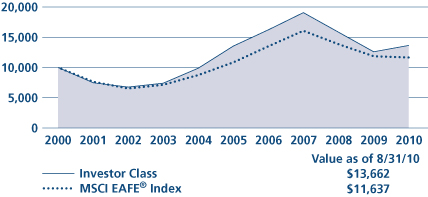

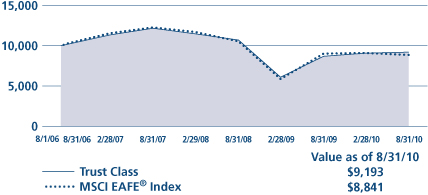

International Fund Commentary

We are pleased to report that, for the fiscal year ended August 31, 2010, Neuberger Berman International Fund posted a positive return and significantly outperformed its benchmark, the MSCI EAFE® Index.

The MSCI EAFE Index was down slightly for the 12-month reporting period. The rally that had taken place in calendar-year 2009 began to peter out at the end of the first quarter of calendar-year 2010, with the markets turning dramatically negative in the second quarter, as the index declined by nearly 14% when concerns about European sovereign debt worsened. While markets recovered somewhat by fiscal year-end, the volatility continued as investors appeared to remain undecided on the state of the global economic recovery.

The MSCI EAFE Index underperformed both the S&P 500 Index and the MSCI Emerging Markets Index this fiscal period. Within the EAFE index, Consumer Staples was the best performing sector, with Telecommunications and Industrials adding incrementally to performance. In contrast, Financials were quite negative, followed by Energy and Utilities. On a country basis, the U.K., Switzerland and Sweden contributed significantly to index performance, while Japan, France and Spain were most detrimental to performance.

The Fund's substantial outperformance relative to its benchmark was driven primarily by stock selection, although sector allocation was also positive. The Fund added value in eight of 10 sectors, with significant outperformance in Energy, Materials and Financials. Our two disappointments this period were Health Care and Consumer Staples. In terms of countries, Canada, the U.K. and Germany were most positive for the Fund, while Australia, Hong Kong and Greece were weakest.

Within Energy, top contributors included Cairn, a U.K.-based oil company, which rose on news that it had secured contracts to sell oil at better-than-expected prices, Pacific Rubiales, a Canadian-listed oil and natural gas producer with assets in South America, up due to production growth and continued exploration success in its Quifa field, and Ultrapar, an oil and gas distributor, which benefited from the strength of the Brazilian economic recovery. In Materials, Croda, a U.K.-based global specialty chemical company, outperformed, as did Eldorado Gold, releasing strong results and raising guidance provided regarding their earnings due to better-than-expected production. In Financials, we had some disappointments—including National Bank of Greece (sold in the fourth quarter of calendar-year 2009), as well as CNP Assurances, a French insurer, and Deutsche Boerse, a transaction-services provider for the securities industry, both of which we continue to hold. Overall, however, our holdings in the sector outperformed. In Health Care, where we underperformed, iSOFT, an Australia-based health care software company, Ipsen, a French specialty pharmaceuticals firm, and Nobel Biocare, a Swiss dental implants manufacturer, disappointed. We sold our position in Nobel.

Given the uncertain environment, the Fund remains somewhat defensively positioned. In Europe, the Fund has limited exposure to the economies we consider weakest, notably Greece. European holdings are concentrated in companies that operate globally, and are likely beneficiaries of a weaker euro (as German businesses have been). Relative to the benchmark, the Fund remains underweighted in Japan, where we struggle to identify high-quality companies, and Australia, where we find valuations unattractive. The Fund is overweighted in emerging markets, notably Brazil, where we think the upcoming presidential election is unlikely to affect pro-growth economic policies. We continue to be less concerned about China's tightening measures, believing the country will still generate strong GDP growth; and while wage hikes in China hav e made news this year, we believe they pose little threat to the profitability of the companies we hold (which include Chinese companies and developed market companies with operations there).