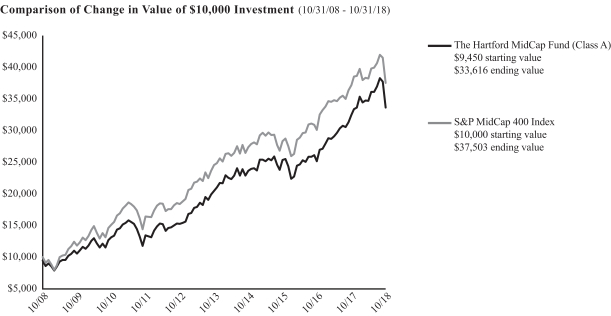

UNITED STATES

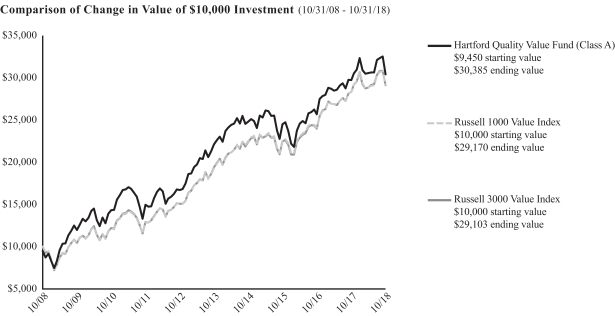

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-00558

THE HARTFORD MUTUAL FUNDS II, INC.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

A MESSAGE FROM THE PRESIDENT

Dear Shareholders:

Thank you for investing in Hartford Funds. The following is the Funds’ Annual Report, covering the period from November 1, 2017 through October 31, 2018.

Market Review

Despite a volatile year, during the 12 months ended October 31, 2018, U.S. stocks, as measured by the S&P 500 Index,1 saw positive returns. During this period, the S&P

500 Index had a 7.35% return.

As of the end of September 2018, there were more than 35 days in 2018 when the S&P 500 Index closed 1% higher or lower than the previous day, which is more than triple the number of 1% swings experienced in all of 2017. Rising interest rates, inflation anxiety, and concerns surrounding U.S. tariffs and trade policies have all contributed to the return of market volatility.

Throughout 2018, the U.S. Federal Reserve (Fed) continued its cycle of interest-rate increases. At the end of October 2018, short-term rates ranged from 2% to 2.25%. At the time of this writing, expectations were for a continued gradual increase through the end of this calendar year and into next. Central banks overseas are also beginning to unwind their accommodative policies by raising interest rates, which may impact global markets.

Going forward, politics both at home and abroad are likely to continue playing a key role in driving market movements. For example, protectionist U.S. trade policies have sparked concern and uncertainty among some investors.

We encourage you to maintain a strong relationship with your financial advisor, who can help guide you through shifting markets confidently. He or she can help you proactively build a portfolio that takes market uncertainty into account, along with your unique investment goals and risk tolerances. Your financial advisor can help you find a fit within our family of funds as you work toward those goals.

Thank you again for investing in Hartford Funds. For the most up-to-date information on our funds, please take advantage of all the resources available at hartfordfunds.com.

James Davey

President

Hartford Funds

| 1 | S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. The index is unmanaged and not available for direct investment. Past performance is not indicative of future results. |

Hartford Domestic Equity Funds

Table of Contents

| * | Effective November 1, 2018, the fund’s name changed to the Hartford Small Cap Value Fund |

The views expressed in each Fund’s Manager Discussion contained in the Fund Overview section are views of that Fund’s sub-adviser and portfolio management team through the end of the period and are subject to change based on market and other conditions. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable.

|

| The Hartford Capital Appreciation Fund |

Fund Overview

October 31, 2018 (Unaudited)

| | |

Inception 7/22/1996 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

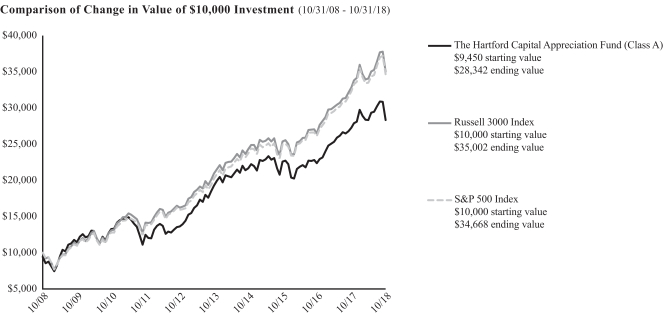

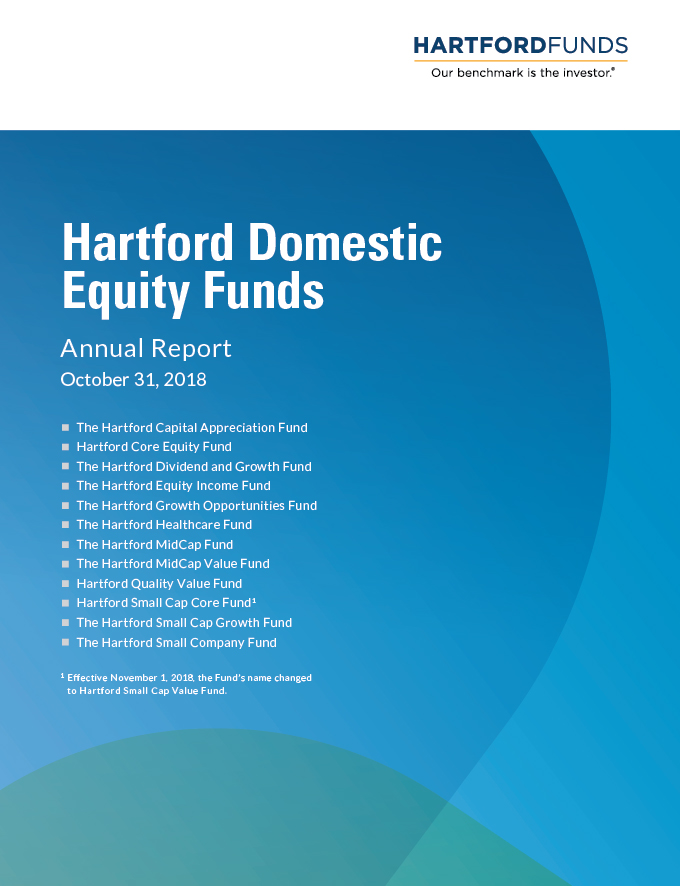

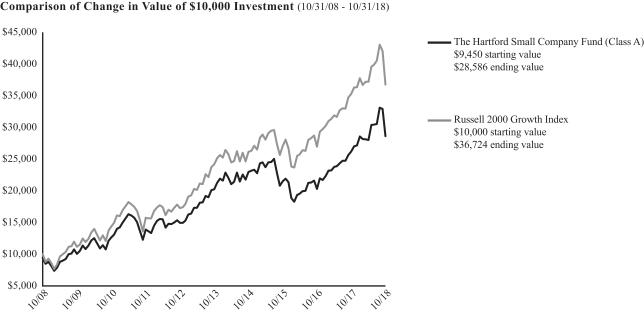

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A1 | | | 3.92% | | | | 8.01% | | | | 11.61% | |

Class A2 | | | -1.80% | | | | 6.79% | | | | 10.98% | |

Class C1 | | | 3.15% | | | | 7.24% | | | | 10.82% | |

Class C2 | | | 2.28% | | | | 7.24% | | | | 10.82% | |

Class I1 | | | 4.19% | | | | 8.33% | | | | 11.94% | |

Class R31 | | | 3.57% | | | | 7.67% | | | | 11.29% | |

Class R41 | | | 3.87% | | | | 8.00% | | | | 11.63% | |

Class R51 | | | 4.18% | | | | 8.32% | | | | 11.97% | |

Class R61 | | | 4.29% | | | | 8.41% | | | | 12.07% | |

Class Y1 | | | 4.28% | | | | 8.42% | | | | 12.07% | |

Class F1 | | | 4.28% | | | | 8.37% | | | | 11.96% | |

Russell 3000 Index | | | 6.60% | | | | 10.81% | | | | 13.35% | |

S&P 500 Index | | | 7.35% | | | | 11.34% | | | | 13.24% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/18, which may exclude

investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/14. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 2/28/17. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

Russell 3000 Index (reflects no deduction for fees, expenses or taxes) measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

S&P 500 Index (reflects no deduction for fees, expenses or taxes) is a float-adjusted market capitalization-weighted price index composed of 500 widely held common stocks.

You cannot invest directly in an index.

Performance information may reflect historical waivers/reimbursements without which performance would have been lower.

| | | | | | | | |

| Operating Expenses* | | Gross | | | Net | |

Class A | | | 1.10% | | | | 1.10% | |

Class C | | | 1.83% | | | | 1.83% | |

Class I | | | 0.81% | | | | 0.81% | |

Class R3 | | | 1.43% | | | | 1.43% | |

Class R4 | | | 1.12% | | | | 1.12% | |

Class R5 | | | 0.82% | | | | 0.82% | |

Class R6 | | | 0.72% | | | | 0.72% | |

Class Y | | | 0.72% | | | | 0.72% | |

Class F | | | 0.72% | | | | 0.72% | |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross and Net expenses are the same. Expenses shown include acquired fund fees and expenses. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended 10/31/18. |

|

| The Hartford Capital Appreciation Fund |

Fund Overview – (continued)

October 31, 2018 (Unaudited)

Portfolio Managers

Kent M. Stahl, CFA*

Senior Managing Director and Chief Investment Strategist

Wellington Management Company LLP

Gregg R. Thomas, CFA

Senior Managing Director and Director, Investment Strategy

Wellington Management Company LLP

* Mr. Stahl announced his plan to retire and withdraw from the partnership of Wellington Management Group LLP, the ultimate holding company of Wellington Management Company LLP, as of December 31, 2018. Accordingly, he will no longer serve as a portfolio manager to the Fund as of December 31, 2018.

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Capital Appreciation Fund returned 3.92%, before sales charge, for the twelve-month period ended October 31, 2018, underperforming the Fund’s benchmarks, the Russell 3000 Index and the S&P 500 Index, which returned 6.60% and 7.35%, respectively, for the same period. For the same period, Class A shares of the Fund outperformed the 3.71% average return of the Lipper Multi-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve month period ending October 31, 2018. The Federal Reserve (Fed) raised its benchmark interest rate by 0.25% four times during the twelve-month period ending October 31, 2018, in line with expectations. Despite continued White House turmoil and heightened U.S. tensions with Russia and North Korea, strong employment data and corporate earnings helped propel the market to a series of new highs during the first half of the period. In December 2017, tax reform was a key area of focus, culminating with a $1.5 trillion tax reform bill signed into law by Donald Trump. Entering 2018, bullish sentiment was exceptionally strong, as better-than-expected corporate profits helped drive U.S. equities higher. Signs of inflation entered the market in February and led to heightened levels of volatility. By the summer of 2018, talk of tariffs and trade wars had progressed to implementation, raising concerns in an otherwise strong economy. Nonetheless, positive sentiment persisted for much of the summer, fueled by robust earnings growth, fiscal stimulus, the announcement of a preliminary trade deal between the U.S. and Mexico, and expectations for stronger U.S. economic growth relative to other regions of the world. This all changed in the final month of the period, as U.S. equities saw their worst performance in recent years in October 2018. Concerns surrounding slowing global growth, rich valuations, and volatile U.S.-China trade relations weighed heavily on sentiment into the end of the period.

Returns varied by market-cap during the period, as large-cap equities, as measured by the S&P 500 Index, outperformed both mid- and small-cap equities, as measured by the S&P MidCap 400 Index and Russell 2000 Index respectively.

Nine of eleven sectors in the Russell 3000 Index posted positive returns during the period. Strong performers included the Consumer Discretionary (+12.8%), Information Technology (+12.4%), and

Healthcare (+11.5%) sectors, while the Materials (-10.5%) and Industrials (-1.5%) sectors detracted most.

The Fund underperformed the Russell 3000 Index primarily due to weak stock selection within the Information Technology, Financials, and Healthcare sectors. Conversely, stock selection within the Industrials, Materials, and Real Estate sectors contributed positively to returns relative to the Russell 3000 Index during the period. Sector allocation, a result of bottom-up stock selection, was slightly positive during the period. The Fund’s underweight to Consumer Staples and Utilities sectors, as well as an overweight to the Information Technology sectors, contributed to returns relative to the Russell 3000 Index. This was slightly offset by the Fund’s overweight to Materials and Industrials sectors, which detracted from performance.

Top detractors from performance relative to the Russell 3000 Index included Amazon (Consumer Discretionary), Apple (Information Technology), and Microsoft (Information Technology). Underweight exposure to U.S.-based global e-commerce retailer Amazon detracted from relative performance. The stock price rose after the company posted strong earnings during the period as investors continued to be bullish on the prospects of continued strong growth. While we have added to the position over the period, we remained underweight relative to the Russell 3000 Index. The Fund’s underweight position in Apple, a U.S.-based designer and manufacturer of mobile devices and digital content distribution markets, was another top relative detractor during the period. Sales during the period, driven by the iPhone, continued to come in higher than anticipated, helping boost the stock price higher. We continued to be underweight Apple given its high valuation. Underweight exposure to Microsoft, a U.S.-based developer of software products and services, detracted from results. The stock price rose during the period as the company released strong quarterly and fiscal 2018 financial results driven by robust performance across all business segments (productivity and business processes, intelligent cloud, and personal computing). We continue to hold an underweight position due to high valuation in our view. TERASO (Healthcare), Rethink Robotics (Information Technology), and Las Vegas Sands (Consumer Discretionary) detracted most from performance on an absolute basis over the period.

Trade Desk (Information Technology), Under Armour (Consumer Discretionary), and Nike (Consumer Discretionary) were the top absolute and relative contributors to performance over the period. Share prices of Trade Desk, a U.S.-based firm that developed a global technology platform for buyers of advertising, rose during the period as strong quarterly earnings far exceeded analyst expectations, driven by multiple

|

| The Hartford Capital Appreciation Fund |

Fund Overview – (continued)

October 31, 2018 (Unaudited)

growth drivers in the U.S. and internationally. The company also raised its 2018 revenue guidance. After a strong run, we eliminated the position and moved the capital to more compelling opportunities in our view. Shares of Under Armour, a U.S.-based manufacturer and retailer of performance apparel, rose over the period driven by strength in the apparel category and international growth. We continued to own the name as we believe the market underappreciates the company’s ability to improve returns on capital driven by a reacceleration of growth. Nike, a U.S.-based provider of athletic footwear, apparel, and accessories, was also a key relative contributor. The company’s share price surged after the company reported strong quarterly results during the period as new innovation platforms are all working, sales are accelerating across all regions and channels (including the U.S.), gross margins are beating expectations, and inventory issues are in the rearview mirror. Management’s strategic focus on doubling the growth of innovation, speed, and direct relationships (“triple double”) is well under way. We continued to hold an overweight position in the stock.

Strategies included in the Fund are chosen based on extensive analysis of qualitative and quantitative factors. Risk factors managed within the overall portfolio include but are not limited to: growth, value, momentum, contrarian, high volatility, low volatility, quality and leverage. Over the period, factor impact on the Fund was positive. Exposure to momentum and higher liquidity equities contributed positively to performance, while the Fund’s exposure to higher volatility equities and dividend yield detracted.

International exposure (country and currency) detracted from results, particularly driven by exposure to Emerging Markets (China and South Korea) and Europe (Switzerland and France).

During the period, the Fund, at times, used derivative instruments, such as currency forwards to hedge currency risk and equity index futures to hedge market risk. During the period, the use of these derivatives did not have a significant impact on performance.

What is the outlook?

Mixed economic data from the U.S. suggests the potential for a later stage market cycle. While we continue to expect economic expansion, we also expect to see growth slow. Positive drivers of growth include elevated capital expenditure intentions, the highest consumer confidence levels since 2000, and increased income expectations. While these signal a near term increase in investment and consumption, other news points to a potential slowing of economic expansion. Specifically, the tight labor market combined with the continued uncertainty with regards to trade agreements between the U.S. and its trade partners may lead to increased inflation and slower growth. As such, we continue to expect to see higher interest rates and increased equity market volatility.

At the end of the period, the Fund’s largest overweights were to Consumer Discretionary and Industrials sectors, while the Fund’s largest underweights were to Information Technology and Communication Services sectors, relative to the Russell 3000 Index.

Important Risks

Investing involves risk, including the possible loss of principal. The Fund seeks to achieve its investment objective by allocating assets among different asset classes and/or portfolio management teams. There is no guarantee the Fund will achieve its stated objective. Security prices fluctuate in value depending on general market and economic conditions

and the prospects of individual companies. •Mid-cap securities can have greater risks and volatility than large-cap securities. •Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. These risks are generally greater for investments in emerging markets. •The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

Composition by Sector(1)

as of October 31, 2018

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 5.3 | % |

Consumer Discretionary | | | 15.3 | |

Consumer Staples | | | 7.6 | |

Energy | | | 3.0 | |

Financials | | | 12.3 | |

Health Care | | | 15.8 | |

Industrials | | | 12.3 | |

Information Technology | | | 17.3 | |

Materials | | | 3.7 | |

Real Estate | | | 4.4 | |

Utilities | | | 1.8 | |

| | | | |

Total | | | 98.8 | % |

| | | | |

Short-Term Investments | | | 1.9 | |

Other Assets & Liabilities | | | (0.7 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Core Equity Fund |

Fund Overview

October 31, 2018 (Unaudited)

| | |

Inception 4/30/1998 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

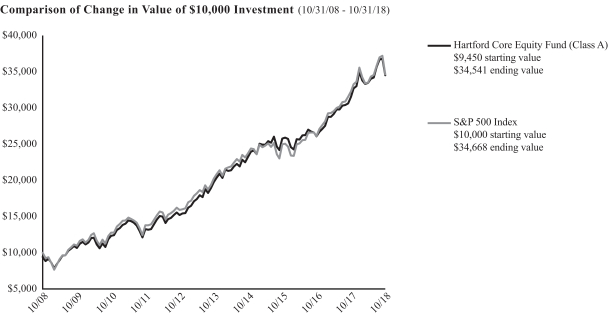

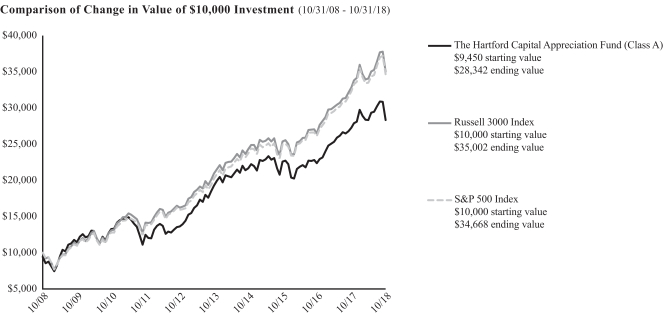

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A1 | | | 9.41% | | | | 11.78% | | | | 13.84% | |

Class A2 | | | 3.40% | | | | 10.53% | | | | 13.20% | |

Class C1 | | | 8.61% | | | | 10.99% | | | | 13.00% | |

Class C2 | | | 7.61% | | | | 10.99% | | | | 13.00% | |

Class I1 | | | 9.72% | | | | 12.00% | | | | 13.95% | |

Class R31 | | | 9.02% | | | | 11.46% | | | | 13.58% | |

Class R41 | | | 9.37% | | | | 11.82% | | | | 13.89% | |

Class R51 | | | 9.69% | | | | 12.13% | | | | 14.25% | |

Class R61 | | | 9.80% | | | | 12.20% | | | | 14.32% | |

Class Y1 | | | 9.77% | | | | 12.19% | | | | 14.31% | |

Class F1 | | | 9.80% | | | | 12.04% | | | | 13.97% | |

S&P 500 Index | | | 7.35% | | | | 11.34% | | | | 13.24% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/18, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class I shares commenced operations on 3/31/15. Performance prior to that date is that of the Fund’s Class A shares (excluding sales charges). Class R6 shares commenced operations on 3/31/15 and performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 2/28/17. Performance for Class F shares prior to 2/28/17 reflects the performance of Class I shares from 3/31/15 through 2/27/17 and Class A shares (excluding sales charges) prior to 3/31/15.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

S&P 500 Index (reflects no deduction for fees, expenses or taxes) is a float-adjusted market capitalization-weighted price index composed of 500 widely held common stocks.

You cannot invest directly in an index.

Performance information may reflect historical waivers/reimbursements without which performance would have been lower.

| | | | | | | | |

| Operating Expenses* | | Gross | | | Net | |

Class A | | | 0.77% | | | | 0.77% | |

Class C | | | 1.51% | | | | 1.51% | |

Class I | | | 0.51% | | | | 0.51% | |

Class R3 | | | 1.12% | | | | 1.12% | |

Class R4 | | | 0.81% | | | | 0.81% | |

Class R5 | | | 0.51% | | | | 0.51% | |

Class R6 | | | 0.41% | | | | 0.41% | |

Class Y | | | 0.42% | | | | 0.42% | |

Class F | | | 0.41% | | | | 0.41% | |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross and Net expenses are the same. Expenses shown include acquired fund fees and expenses. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended 10/31/18. |

|

| Hartford Core Equity Fund |

Fund Overview – (continued)

October 31, 2018 (Unaudited)

Portfolio Managers

Mammen Chally, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

David A. Siegle, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Douglas W. McLane, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of the Hartford Core Equity Fund returned 9.41%, before sales charge, for the twelve-month period ended October 31, 2018, outperforming the Fund’s benchmark, the S&P 500 Index, which returned 7.35% for the same period. For the same period, Class A shares of the Fund also outperformed the 5.93% average return of the Lipper Large-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, rose for the twelve-month period ending October 31, 2018. The U.S. Federal Reserve (Fed) raised its benchmark interest rate by 0.25% four times during the twelve-month period ending October 31, 2018, in line with expectations. Despite continued White House turmoil and heightened U.S. tensions with Russia and North Korea, strong employment data and corporate earnings helped propel the market to a series of new highs during the first half of the period. In December 2017, tax reform was a key area of focus, culminating with a $1.5 trillion tax reform bill signed into law by Donald Trump. Entering 2018, bullish sentiment was exceptionally strong; as better-than-expected corporate profits helped drive U.S. equities higher. Signs of inflation entered the market in February and led to heightened levels of volatility. By the summer of 2018, talk of tariffs and trade wars had progressed to implementation, raising concerns in an otherwise strong economy. Nonetheless, positive sentiment persisted for much of the summer, fueled by robust earnings growth, fiscal stimulus, the announcement of a preliminary trade deal between the U.S. and Mexico, and expectations for stronger U.S. economic growth relative to other regions of the world. This all changed in the final month of the period, as U.S. equities saw their worst performance in recent years in October. Concerns surrounding slowing global growth, rich valuations, and volatile U.S. and China trade relations weighed heavily on sentiment into the end of the period.

Returns varied by market-cap during the period, as large-cap equities, as measured by the S&P 500 Index outperformed small-cap and mid-cap equities, as measured by the Russell 2000 Index and S&P MidCap 400 Index respectively.

Nine out of eleven sectors in the S&P 500 Index rose during the period, with Consumer Discretionary (+15%), Information Technology (+13%), and Healthcare (+11%) performing the best. Materials (-9%) and Industrials (-1%) lagged on a relative basis during the period.

Overall, outperformance relative to the S&P 500 Index was driven by strong security selection, primarily within the Information Technology, Industrials, and Healthcare sectors. This was partially offset by weak stock selection within the Consumer Discretionary sector. Sector allocation, a result of the bottom up stock selection, contributed modestly to benchmark-relative performance primarily driven by the Fund’s overweight to the Healthcare sector and underweight allocation to the Energy sector. This was partially offset by the Fund’s overweight to the Utilities sector.

The top contributors to performance relative to the S&P 500 Index were NetApp (Information Technology), GoDaddy (Information Technology), and TJX Companies (Consumer Discretionary). NetApp provides storage and data management solutions; shares rose after the company raised its guidance for fiscal year 2019 amid a favorable backdrop for corporate information technology spending. GoDaddy, a web hosting company, outperformed during the period as cross-selling and improved product features drove sales growth. TJX, a global off-price apparel and home goods retailer, also contributed to positive relative returns. During the year, the shares outperformed after management reported strong consecutive quarterly earnings on the heels of strong same store sales and better-than-expected 2018 guidance. Top absolute contributors included NetApp (Information Technology) and Mastercard (Information Technology).

The top detractors from performance relative to the S&P 500 Index included Amazon (Consumer Discretionary), Apple (Information Technology), and Chubb (Financials). Shares of Amazon, a U.S.-based global e-commerce retailer rose during the period as the company continued to expand the categories of its offerings. Not owning Amazon over the period detracted from benchmark-relative returns. Apple continued its streak of outperformance after a strong earnings report from July that highlighted the growing nature of its annuity and services business. The Fund’s underweight to the outperforming stock detracted from relative performance. Shares of Chubb, a global insurance company, fell amid higher than expected catastrophe losses during the period. Top absolute detractors for the period included Micron (Information Technology) and Chubb (Financials).

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

|

| Hartford Core Equity Fund |

Fund Overview – (continued)

October 31, 2018 (Unaudited)

What is the outlook?

While the overall U.S. economy remains relatively healthy, most companies are beginning to see increasing labor and material costs. With unemployment levels low and trending lower, we still believe risks to U.S. inflation are to the upside. Many companies are facing the prospect of either absorbing these costs (therefore reducing marginal profitability) or passing the costs through and face the uncertain consumer demand that may come from raising prices. Trade continues to dominate the narrative right now. While the initial tariff rate may be offset by some efficiencies and very nominal price increases, the risks remain high given the automatic rise in tariffs next year. We are hopeful that a conversation with China will restart soon. We are becoming cautious about supply chain disruption and capital expenditure uncertainty given the trade talks and potential reciprocal measures that China may impose. We believe that the risk of a spike in oil prices is rising each day as Iran is being blocked out of international markets. Offsetting some of these risks is the employment situation and changes to the Childcare tax and current withholdings that could be a positive surprise for many Americans’ tax refund next cycle. Given all of the above and, considering the market moves so far relative to earnings, we believe that the risk for increased volatility remains high.

Overall, we believe the U.S. economy remains healthy, and we continue to monitor policy decisions and economic trends that may impact the Fund’s holdings. We remain consistent in adhering to our disciplined portfolio construction process that we believe allows us to assess risk, weight individual positions accordingly, and in the process build a portfolio that focuses largely on stock selection in seeking to outperform the S&P 500 Index.

At the end of the period, the Fund’s largest overweight sectors relative to the S&P 500 Index were to Healthcare and Utilities, while the Fund’s largest underweights were to Communication Services and Energy sectors.

Important Risks

Investing involves risk, including the possible loss of principal. There is no guarantee the Fund will achieve its stated objective. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.

Composition by Sector(1)

as of October 31, 2018

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 6.2 | % |

Consumer Discretionary | | | 9.8 | |

Consumer Staples | | | 8.7 | |

Energy | | | 2.4 | |

Financials | | | 14.0 | |

Health Care | | | 17.4 | |

Industrials | | | 10.6 | |

Information Technology | | | 18.8 | |

Materials | | | 2.1 | |

Real Estate | | | 1.0 | |

Utilities | | | 4.9 | |

| | | | |

Total | | | 95.9 | % |

| | | | |

Short-Term Investments | | | 3.7 | |

Other Assets & Liabilities | | | 0.4 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| The Hartford Dividend and Growth Fund |

Fund Overview

October 31, 2018 (Unaudited)

| | |

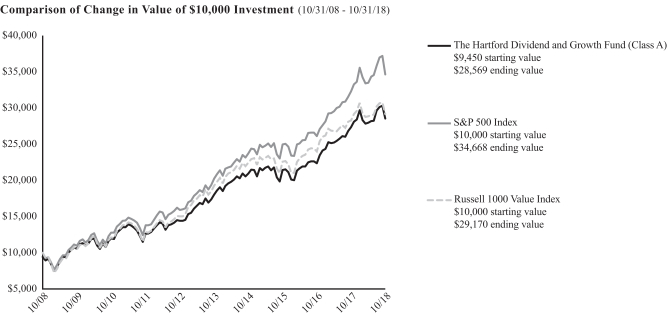

Inception 7/22/1996 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

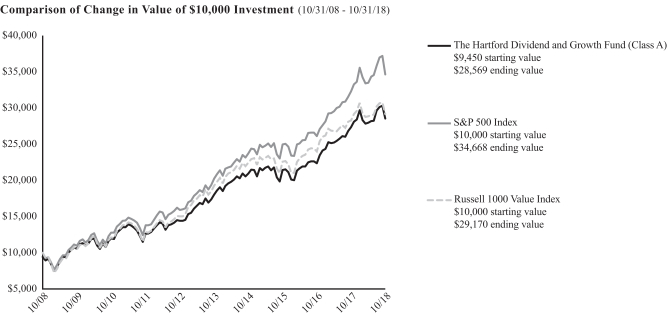

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A1 | | | 4.38% | | | | 9.59% | | | | 11.70% | |

Class A2 | | | -1.36% | | | | 8.36% | | | | 11.07% | |

Class C1 | | | 3.58% | | | | 8.77% | | | | 10.87% | |

Class C2 | | | 2.65% | | | | 8.77% | | | | 10.87% | |

Class I1 | | | 4.68% | | | | 9.84% | | | | 11.98% | |

Class R31 | | | 4.03% | | | | 9.23% | | | | 11.35% | |

Class R41 | | | 4.32% | | | | 9.56% | | | | 11.70% | |

Class R51 | | | 4.65% | | | | 9.89% | | | | 12.04% | |

Class R61 | | | 4.76% | | | | 9.98% | | | | 12.14% | |

Class Y1 | | | 4.72% | | | | 9.98% | | | | 12.14% | |

Class F1 | | | 4.77% | | | | 9.88% | | | | 12.00% | |

S&P 500 Index | | | 7.35% | | | | 11.34% | | | | 13.24% | |

Russell 1000 Value Index | | | 3.03% | | | | 8.61% | | | | 11.30% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/18, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/14. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 2/28/17. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

S&P 500 Index (reflects no deduction for fees, expenses or taxes) is a float-adjusted market capitalization-weighted price index composed of 500 widely held common stocks.

Russell 1000 Value Index (reflects no deduction for fees, expenses or taxes) measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index based on their market capitalization and current index membership.

You cannot invest directly in an index.

Performance information may reflect historical waivers/reimbursements without which performance would have been lower.

| | | | | | | | |

| Operating Expenses* | | Gross | | | Net | |

Class A | | | 1.01% | | | | 1.01% | |

Class C | | | 1.76% | | | | 1.76% | |

Class I | | | 0.78% | | | | 0.78% | |

Class R3 | | | 1.36% | | | | 1.36% | |

Class R4 | | | 1.05% | | | | 1.05% | |

Class R5 | | | 0.75% | | | | 0.75% | |

Class R6 | | | 0.65% | | | | 0.65% | |

Class Y | | | 0.66% | | | | 0.66% | |

Class F | | | 0.65% | | | | 0.65% | |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross and Net expenses are the same. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended 10/31/18. |

|

| The Hartford Dividend and Growth Fund |

Fund Overview – (continued)

October 31, 2018 (Unaudited)

Portfolio Managers

Edward P. Bousa, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew G. Baker

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Mark E. Vincent

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Dividend and Growth Fund returned 4.38%, before sales charge, for the twelve-month period ended October 31, 2018, underperforming the Fund’s benchmark, the S&P 500 Index, which returned 7.35% for the same period. Class A shares of the Fund outperformed the Russell 1000 Value Index, the Fund’s other benchmark, which returned 3.03% for the same period. For the same period, Class A shares of the Fund outperformed the 3.32% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2018. The U.S. Federal Reserve (Fed) raised its benchmark interest rate by 0.25% four times during the twelve-month period ending October 31, 2018, in line with expectations. Despite continued White House turmoil and heightened U.S. tensions with Russia and North Korea, strong employment data and corporate earnings helped propel the market to a series of new highs during the first half of the period. In December, tax reform was a key area of focus, culminating with a $1.5 trillion tax reform bill signed into law by Donald Trump. Entering 2018, bullish sentiment was exceptionally strong as better-than-expected corporate profits helped drive U.S. equities higher. Signs of inflation entered the market in February and led to heightened levels of volatility. By the summer of 2018, talk of tariffs and trade wars had progressed to implementation, raising concerns in an otherwise strong economy. Nonetheless, positive sentiment persisted for much of the summer, fueled by robust earnings growth, fiscal stimulus, the announcement of a preliminary trade deal between the U.S. and Mexico, and expectations for stronger U.S. economic growth relative to other regions of the world. This all changed in the final month of the period, as U.S. equities saw their worst performance in recent years in October 2018. Concerns surrounding slowing global growth, rich valuations, and volatile U.S.-China trade relations weighed heavily on investor confidence into the end of the period.

Returns varied by market-cap during the period, as large-cap equities, measured by the S&P 500 Index, outperformed mid and small-cap equities, measured by the S&P MidCap 400 Index and Russell 2000 Index, respectively.

Nine out of eleven sectors in the S&P 500 Index rose during the period, with Consumer Discretionary (+15%), Information Technology (+13%), and Healthcare (+11%) sectors leading the index higher. Materials (-9%) and Industrials (-1%) sectors lagged on a relative basis and were the only two sectors to post negative returns during the period.

Sector allocation, a result of the bottom up stock selection process, drove underperformance relative to the S&P 500 Index during the period. An underweight to the Consumer Discretionary sector and an overweight to Financials sector detracted most from performance relative to the S&P 500 Index. This was offset by an underweight to Industrials and Real Estate sectors, which contributed positively to performance relative to the S&P 500 Index. Stock selection also detracted from relative performance, particularly within the Financials, Consumer Discretionary, and Industrials sectors. This was partially offset by stronger selection within the Communication Services, Healthcare, and Energy sectors, which contributed positively to performance relative to the S&P 500 Index.

The Fund’s top detractors from performance relative to the S&P 500 Index included Amazon (Consumer Discretionary), Apple (Information Technology), and Chubb (Financials). Not owning Amazon, a constituent in the S&P 500 Index, a U.S.-based global e-commerce retailer, detracted from performance relative to the S&P 500 Index as the company reported strong organic growth and rising profit, along with increasing net sales year over year. The share price of Apple, U.S.-based designer and manufacturer of mobile devices and distributor of digital content, rose during the period as the company reported strong quarterly results which came in ahead of consensus expectations and were viewed as positive by investors. Although we held the name, the Fund’s underweight weighed on relative results. The stock price of Chubb, a U.S.-based provider of insurance products, fell as the company announced decreased earnings per share and premium growth that was below expectations. Additionally, insurance equities as a whole suffered due to rising interest rates and catastrophe losses. American International Group (Financials) and Bristol-Myers Squibb (Healthcare) were among the top absolute detractors during the period.

The Fund’s top contributors to performance relative to the S&P 500 Index during the period were Facebook (Communication Services), General Electric (Industrials), and Verizon (Communication Services). Not holding Facebook, constituent in the S&P 500 Index, a U.S.-based social media provider, contributed to performance relative to the S&P 500 Index as the company faced ongoing concerns over data privacy

|

| The Hartford Dividend and Growth Fund |

Fund Overview – (continued)

October 31, 2018 (Unaudited)

issues. Share prices of General Electric (GE), a U.S.-based multinational conglomerate operating in the technology infrastructure, capital finance, and consumer and industrial products industries, fell as the company reported earnings results that were weaker than consensus estimates primarily driven by another miss in their Power Segment. The Fund’s small position in GE was eliminated during the period. Verizon, a U.S.-based communications technology company, saw its share price rise as the company reported strong quarterly results with earnings per share beating street estimates and reduced its capital expenditure. Top absolute performers during the period included Microsoft (Information Technology) and Merck (Healthcare).

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook?

Looking ahead, we believe the market should continue to achieve new record highs, and valuations should continue to rise. In part, we believe these market conditions have been driven by lower tax rates and broad economic strength. While we might expect for companies that benefit most from tax rate cuts to lead, we have continued to see growth equities leading and think this could continue in the near term. Although we appreciate that disruption is a powerful force, we do expect for growth in technology equities to slow and for the growth of such equities to pause eventually.

As of the end of the period, the economy has picked up, and capacity utilization is high and we believe that this should benefit the Materials sector. Defense equities came under pressure and we believe this created a buying opportunity as the sector should benefit going forward with more clarity with respect to timing of payments from the U.S. government. We also believe that the Healthcare sector has done better as investors seem to appreciate that the outlook is better than feared. We find medical device companies are generally very expensive. Though we are somewhat challenged to find companies that fit our approach, we maintained a neutral weight to the Healthcare sector. We maintained an overweight to the Financials sector, particularly among banks and insurers where costs are being held flat or coming down. We are likely approaching the end of Fed rate increases and expect that bank equities are unlikely to benefit from net interest margin increases after mid-2019.

At the end of the period, the Fund’s largest sector overweights relative to the S&P 500 Index were to Financials, Energy, and Materials sectors, while the Fund’s largest underweights were to Information Technology, Consumer Discretionary, and Consumer Staples sectors.

We continue to rely on our process and philosophy as we construct the Fund.

Important Risks

Investing involves risk, including the possible loss of principal. There is no guarantee the Fund will achieve its stated objective. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. •For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. •Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments.

Composition by Sector(1)

as of October 31, 2018

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Communication Services | | | 8.8 | % |

Consumer Discretionary | | | 3.8 | |

Consumer Staples | | | 5.6 | |

Energy | | | 9.0 | |

Financials | | | 20.3 | |

Health Care | | | 15.1 | |

Industrials | | | 8.3 | |

Information Technology | | | 13.7 | |

Materials | | | 4.6 | |

Real Estate | | | 2.5 | |

Utilities | | | 4.9 | |

| | | | |

Total | | | 96.6 | % |

| | | | |

Short-Term Investments | | | 3.3 | |

Other Assets & Liabilities | | | 0.1 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| The Hartford Equity Income Fund |

Fund Overview

October 31, 2018 (Unaudited)

| | |

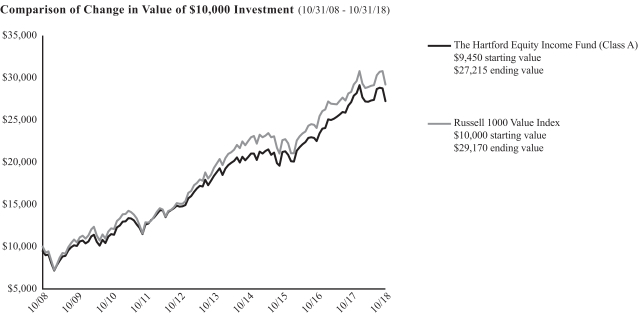

Inception 8/28/2003 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

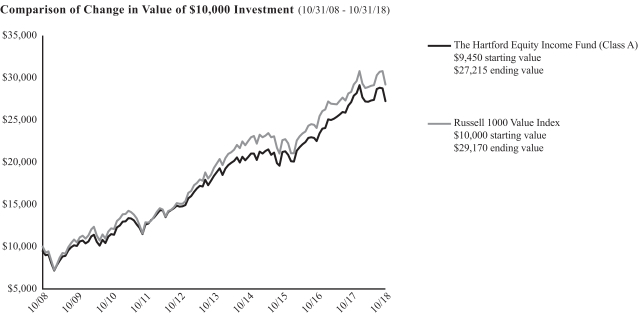

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A1 | | | 0.49% | | | | 8.22% | | | | 11.16% | |

Class A2 | | | -5.03% | | | | 7.01% | | | | 10.53% | |

Class C1 | | | -0.22% | | | | 7.44% | | | | 10.35% | |

Class C2 | | | -1.16% | | | | 7.44% | | | | 10.35% | |

Class I1 | | | 0.77% | | | | 8.51% | | | | 11.45% | |

Class R31 | | | 0.12% | | | | 7.84% | | | | 10.79% | |

Class R41 | | | 0.43% | | | | 8.17% | | | | 11.11% | |

Class R51 | | | 0.78% | | | | 8.50% | | | | 11.48% | |

Class R61 | | | 0.83% | | | | 8.60% | | | | 11.59% | |

Class Y1 | | | 0.79% | | | | 8.59% | | | | 11.58% | |

Class F1 | | | 0.85% | | | | 8.55% | | | | 11.47% | |

Russell 1000 Value Index | | | 3.03% | | | | 8.61% | | | | 11.30% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/18, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/14. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 2/28/17. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

Russell 1000 Value Index (reflects no deduction for fees, expenses or taxes) measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index based on their market capitalization and current index membership.

You cannot invest directly in an index.

Performance information may reflect historical waivers/reimbursements without which performance would have been lower.

| | | | | | | | |

| Operating Expenses* | | Gross | | | Net | |

Class A | | | 1.01% | | | | 1.01% | |

Class C | | | 1.75% | | | | 1.75% | |

Class I | | | 0.76% | | | | 0.76% | |

Class R3 | | | 1.37% | | | | 1.37% | |

Class R4 | | | 1.07% | | | | 1.07% | |

Class R5 | | | 0.77% | | | | 0.77% | |

Class R6 | | | 0.67% | | | | 0.67% | |

Class Y | | | 0.68% | | | | 0.68% | |

Class F | | | 0.66% | | | | 0.66% | |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross and Net expenses are the same. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended 10/31/18. |

|

| The Hartford Equity Income Fund |

Fund Overview – (continued)

October 31, 2018 (Unaudited)

Portfolio Managers

W. Michael Reckmeyer, III, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Karen H. Grimes, CFA*

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Ian R. Link, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

* Ms. Grimes has announced her plan to retire and withdraw from the partnership of Wellington Management Group LLP, the ultimate holding company of Wellington Management Company LLP, as of December 31, 2018. Accordingly, she will no longer serve as a portfolio manager to the Fund as of December 31, 2018.

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Equity Income Fund returned 0.49%, before sales charge for the twelve-month period ended October 31, 2018, underperforming the Fund’s benchmark, the Russell 1000 Value Index, which returned 3.03% for the same period. For the same period, Class A shares of the Fund also underperformed the 3.32% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2018. The U.S. Federal Reserve (Fed) raised its benchmark interest rate by 0.25% four times during the twelve-month period ending October 31, 2018, in line with expectations. Despite continued White House turmoil and heightened U.S. tensions with Russia and North Korea, strong employment data and corporate earnings helped propel the market to a series of new highs during the first half of the period. In December 2017, tax reform was a key area of focus, culminating with a $1.5 trillion tax reform bill signed into law by President Donald Trump. Entering 2018, bullish sentiment was exceptionally strong, as better-than-expected corporate profits helped drive U.S. equities higher. Signs of inflation entered the market in February and led to heightened levels of volatility. By the summer of 2018, talk of tariffs and trade wars had progressed to implementation, raising concerns in an otherwise strong economy. Nonetheless, positive sentiment persisted for much of the summer, fueled by robust earnings growth, fiscal stimulus, the announcement of a preliminary trade deal between the U.S. and Mexico, and expectations for stronger U.S. economic growth relative to other regions of the world. This all changed in the final month of the period, as U.S. equities saw their worst performance in recent years in October. Concerns surrounding slowing global growth, rich valuations, and volatile U.S.-China trade relations weighed heavily on sentiment into the end of the period.

During the period, eight out of eleven sectors within the Russell 1000 Value Index posted positive absolute returns with Healthcare (14%), Communication Services (9%), and Information Technology (9%) sectors performing the best. Materials (-10%), Industrials (-8%), and Financials (-1%) sectors lagged during the period.

Underperformance relative to the Russell 1000 Value Index was driven by security selection, primarily within the Financials, Energy, and Consumer Staples sectors. This more than offset stronger stock selection within Industrials, Information Technology, and Communication Services sectors, which detracted from performance. Sector allocation, a result of our bottom-up stock selection process, contributed to performance during the period primarily due to the Fund’s overweight in the Utilities sector and underweight in the Financials sector. This was partially offset by an overweight to the Industrials sector, which detracted.

Top detractors from performance relative to the Russell 1000 Value Index during the period included Invesco (Financials), MetLife (Financials), and British-American Tobacco (Consumer Staples). Invesco is a U.S.-based investment management company. The Fund’s position continued to underperform due to net outflows in the company’s active management business. We trimmed the Fund’s position in the stock. MetLife is a U.S.-based global financial company providing life and property and casualty (P&C) insurance, annuity and retail banking. The company’s stock price has declined during the period as a result of massive insurance losses due to rainstorms and flooding across the U.S. and Canada. British-American Tobacco is a UK-based tobacco company. The company’s stock declined during the period as a challenging regulatory environment weighed on tobacco equities in 2018, which we believe has caused the market to overreact. British American Tobacco continues to push into next generation products with its heat-not-burn product, increasing share in key markets globally. We continued to hold the Fund’s position. A top absolute detractor during the period was DowDuPont (Materials).

Top contributors to returns relative to the Russell 1000 Value Index included Eli Lilly (Healthcare), General Electric (Industrials), and Union Pacific (Industrials). Share prices of Eli Lilly, a global pharmaceutical company, rose during the period. The company recently reported better than expected quarterly results driven by their diabetes franchise, and was also supported by favorable market reactions to management’s plans to spin off their animal health business, Elanco, which raised $1.5B in the September IPO. General Electric, a U.S.-based globally diversified technology and financial services company, contributed to relative performance during the period after the Fund’s position was eliminated earlier in the period. The stock price lagged as a result of the company’s stagnant power business, sizeable writedowns in their long

|

| The Hartford Equity Income Fund |

Fund Overview – (continued)

October 31, 2018 (Unaudited)

term care insurance business, a dividend cut, and general concern over management effectiveness which resulted in a CEO transition in the span of one year. Union Pacific is a U.S.-based railroad holding company. The company’s stock price rose during the period due to strong rail volumes, an improving pricing outlook, and the potential for better margins through the adoption of Precision Scheduled Railroading principles. We trimmed the Fund’s position in the stock. A top absolute contributor during the period was Cisco Systems (Information Technology).

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook?

As of the end of the period, the U.S. economy remained strong, with continued job growth driving the unemployment rate below (4%). Retail sales were strong through the summer and consumer confidence remained near all-time highs. Tax cuts continued to boost consumer spending and corporate earnings growth, leading to strong business confidence and high levels of capital spending. Small Business Optimism, as measured by the National Federation of Independent Business, reached a record level of 108.8 in August. Inflation ticked up modestly to 2.4%, but remained near the Fed’s targeted level. Alongside strong economic growth, the Fed raised its real gross domestic product growth forecast to 3.1% for 2018, up from its prior forecast of 2.8% in June, and they raised short-term interest rates by 0.25% in September. Rate expectations now include four more increases by the end of 2019.

Outside of the U.S., macroeconomic data has been weaker due in part to the implementation of tariffs against Chinese goods and threats of tariffs against other countries. We are monitoring supply chain impacts in the Technology, Industrial, and Consumer sectors, which may result in increased inflationary pressure and manufacturing dislocations. We are also mindful of the overall impact these tariffs may have on global economic growth. China has added stimulus to their economy to offset headwinds from tariffs, but growth does appear to have slowed from a high level. Weakening demand from China has impacted European growth as well, with the Eurozone manufacturing Purchasing Managers’ Index declining for the third consecutive month to the lowest in two years.

Industrials, Consumer Staples, and Utilities sectors represented the Fund’s largest sector overweights relative to the Russell 1000 Value Index, while Consumer Discretionary, Real Estate, and Financials sectors were the Fund’s largest underweights at the end of the period.

Important Risks

Investing involves risk, including the possible loss of principal. There is no guarantee the Fund will achieve its stated objective. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. •For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. •Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. •Different investment styles may go in and out favor, which may cause the Fund to underperform the broader stock market. •The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

Composition by Sector(1)

as of October 31, 2018

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Communication Services | | | 6.3 | % |

Consumer Discretionary | | | 1.3 | |

Consumer Staples | | | 9.9 | |

Energy | | | 11.7 | |

Financials | | | 21.0 | |

Health Care | | | 17.0 | |

Industrials | | | 9.7 | |

Information Technology | | | 8.5 | |

Materials | | | 3.1 | |

Real Estate | | | 1.6 | |

Utilities | | | 8.0 | |

| | | | |

Total | | | 98.1 | % |

| | | | |

Short-Term Investments | | | 1.9 | |

Other Assets & Liabilities | | | 0.0 | * |

| | | | |

Total | | | 100.0 | % |

| | | | |

| * | Percentage rounds to zero. |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| The Hartford Growth Opportunities Fund |

Fund Overview

October 31, 2018 (Unaudited)

| | |

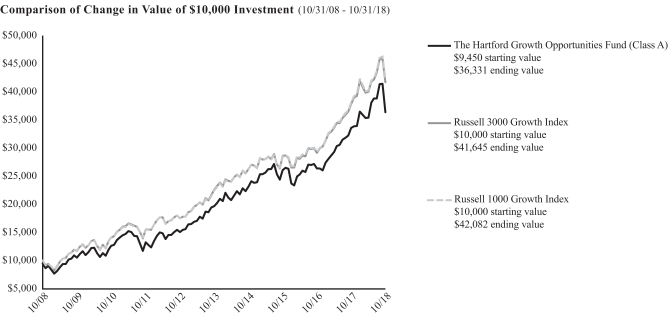

Inception 3/31/1963 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks capital appreciation. |

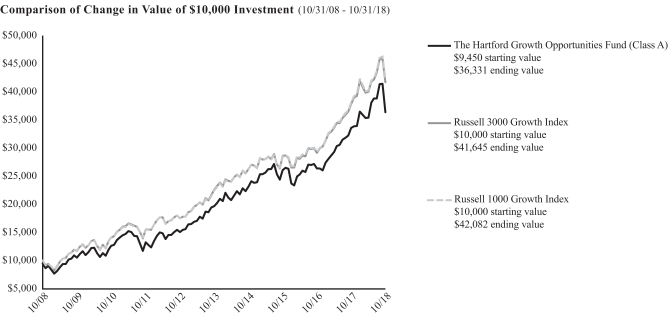

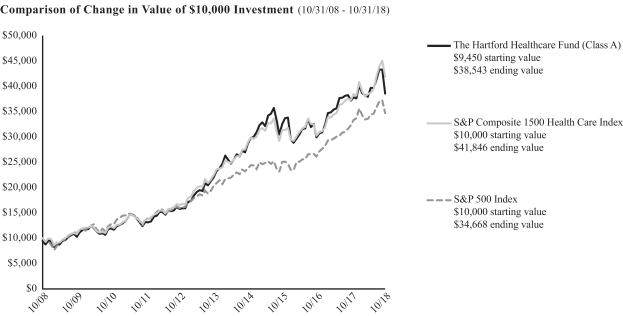

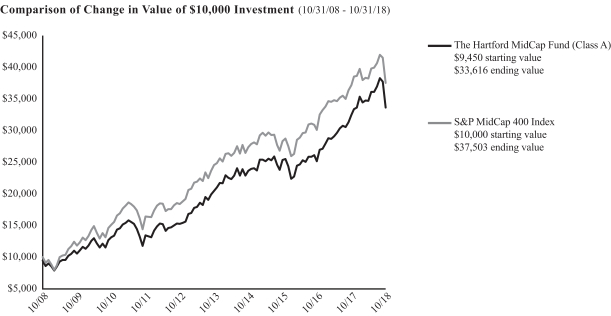

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A1 | | | 8.31% | | | | 13.08% | | | | 14.42% | |

Class A2 | | | 2.35% | | | | 11.80% | | | | 13.77% | |

Class C1 | | | 7.49% | | | | 12.26% | | | | 13.60% | |

Class C2 | | | 6.55% | | | | 12.26% | | | | 13.60% | |

Class I1 | | | 8.62% | | | | 13.35% | | | | 14.72% | |

Class R31 | | | 7.94% | | | | 12.71% | | | | 14.10% | |

Class R41 | | | 8.28% | | | | 13.05% | | | | 14.45% | |

Class R51 | | | 8.60% | | | | 13.39% | | | | 14.78% | |

Class R61 | | | 8.71% | | | | 13.49% | | | | 14.90% | |

Class Y1 | | | 8.68% | | | | 13.49% | | | | 14.90% | |

Class F1 | | | 8.71% | | | | 13.38% | | | | 14.74% | |

Russell 3000 Growth Index | | | 10.20% | | | | 13.06% | | | | 15.33% | |

Russell 1000 Growth Index | | | 10.71% | | | | 13.43% | | | | 15.45% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/18, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/14. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 2/28/17. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

Russell 3000 Growth Index (reflects no deduction for fees, expenses or taxes) measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

Russell 1000 Growth Index (reflects no deduction for fees, expenses or taxes) measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index based on their market capitalization and current index membership.

You cannot invest directly in an index.

Performance information may reflect historical waivers/reimbursements without which performance would have been lower.

| | | | | | | | |

| Operating Expenses* | | Gross | | | Net | |

Class A | | | 1.14% | | | | 1.14% | |

Class C | | | 1.87% | | | | 1.87% | |

Class I | | | 0.88% | | | | 0.88% | |

Class R3 | | | 1.47% | | | | 1.47% | |

Class R4 | | | 1.16% | | | | 1.16% | |

Class R5 | | | 0.87% | | | | 0.87% | |

Class R6 | | | 0.76% | | | | 0.76% | |

Class Y | | | 0.77% | | | | 0.77% | |

Class F | | | 0.76% | | | | 0.76% | |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross and Net expenses are the same. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended 10/31/18. |

|

| The Hartford Growth Opportunities Fund |

Fund Overview – (continued)

October 31, 2018 (Unaudited)

Portfolio Managers

Michael T. Carmen, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Mario E. Abularach, CFA, CMT

Senior Managing Director and Equity Research Analyst

Wellington Management Company LLP

Stephen Mortimer

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Growth Opportunities Fund returned 8.31%, before sales charge, for the twelve-month period ended October 31, 2018, underperforming the Fund’s benchmarks, the Russell 3000 Growth Index and the Russell 1000 Growth Index, which returned 10.20% and 10.71% respectively, for the same period. For the same period, the Class A shares of the Fund outperformed the 7.80% average return of the Lipper Multi-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ended October 31, 2018. The U.S. Federal Reserve (Fed) raised its benchmark interest rate by 0.25% four times during the twelve-month period ended October 31, 2018, in line with expectations. Despite continued White House turmoil and heightened U.S. tensions with Russia and North Korea, strong employment data and corporate earnings helped propel the market to a series of new highs during the first half of the period. In December 2017, tax reform was a key area of focus, culminating with a $1.5 trillion tax reform bill signed into law by Donald Trump. Entering 2018, bullish sentiment was exceptionally strong, as better-than-expected corporate profits helped drive U.S. equities higher. Signs of inflation entered the market in February and led to heightened levels of volatility. By the summer of 2018, talk of tariffs and trade wars had progressed to implementation, raising concerns in an otherwise strong economy.

Nonetheless, positive sentiment persisted for much of the summer, fueled by robust earnings growth, fiscal stimulus, the announcement of a preliminary trade deal between the U.S. and Mexico, and expectations for stronger U.S. economic growth relative to other regions of the world. This all changed in the final month of the period, as U.S. equities saw their worst performance in recent years in October 2018. Concerns surrounding slowing global growth, rich valuations, and volatile U.S. and China trade relations weighed heavily on sentiment into the end of the period.

Returns varied by market-cap during the period, as large-cap equities, measured by the S&P 500 Index, outperformed mid and small-cap equities, measured by the S&P MidCap 400 Index and Russell 2000 Index, respectively.

Nine out of eleven sectors in the Russell 3000 Growth Index rose during the period, with Consumer Discretionary (17%), Information Technology

(13%), and Consumer Staples (11%) performing the best. Materials (-11%) and Energy (-11%) lagged on a relative basis during the period.

Sector allocation, a result of our bottom-up stock selection process, detracted from performance relative to the Russell 3000 Growth Index during the period, due to an overweight to Consumer Discretionary and Energy sectors. This was partially offset by the positive impact of an underweight to the Consumer Staples sector, which contributed to performance relative to the Russell 3000 Growth Index. Security selection contributed to performance relative to the Russell 3000 Growth Index during the period, with strong selection in Health Care, Consumer Staples, and Industrials sectors, which was partially offset by weaker selection within Consumer Discretionary, Materials, and Real Estate sectors.

Top detractors from performance relative to the Russell 3000 Growth Index during the period included Apple (Information Technology), Floor & Décor (Consumer Discretionary), and Microsoft (Information Technology). Shares of Apple, a U.S.-based leader in mobile devices and digital content distribution markets, rose during the period as the company reported strong quarterly results which came in ahead of consensus expectations and were viewed as positive by investors. The company displayed significant topline growth due to increase in iPhone average selling prices (ASPs) and massive earnings per share growth due to tax reform and year over year reduction in shares outstanding. Not owning a position in Apple, a benchmark constituent, detracted from performance relative to the Russell 3000 Growth Index. Floor & Décor, a U.S.-based flooring and related accessory retailer, also detracted from performance during the period. The stock price fell after the company announced softer than expected quarterly sales growth including lower same-store-sales and guidance below consensus expectations. We initiated a position in Floor & Décor during the period and as of the end of the period, continued to believe in the long term growth prospects of the company, but trimmed the Fund’s position to fund more compelling opportunities in our view. Shares of Microsoft, a U.S.-based developer of software products and services, rose due to strong revenue growth mainly attributable to the commercial cloud and pull through of newer hybrid server products. Not owning a position in Microsoft, a benchmark constituent, detracted from performance relative to the Russell 3000 Growth Index. Advanced Micro Devices (Information Technology) and ADT (Industrials) were among the top absolute detractors during the period.

|

| The Hartford Growth Opportunities Fund |

Fund Overview – (continued)

October 31, 2018 (Unaudited)

Top contributors to performance relative to the Russell 3000 Growth Index during the period included Trade Desk (Information Technology), DexCom (Healthcare), and Wayfair (Consumer Discretionary). The stock price of Trade Desk, a U.S.-based technology company providing ad buyers a platform to manage and display social, mobile, and video advertising, rose after revenue and earnings came in significantly above consensus estimates. We trimmed the Fund’s position on strength. The share price of DexCom, a U.S.-based provider of continuous monitoring systems for diabetes patients, rose on strong earnings results and revenue growth which exceeded consensus estimates. The company is seeing robust demand for its G6 monitoring device, in addition to increased patient awareness. Share prices of Wayfair, a U.S.-based online home goods and furnishings provider, rose as the company announced strong revenue growth, along with consistent order and customer growth. ServiceNow (Information Technology) was among the top absolute contributors during the period.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook?

While we continue to remain optimistic on the outlook for continued economic growth in the U.S., we are becoming more cautious around macroeconomic uncertainties including the impacts of trade tensions between the U.S. and China.

We are still identifying a wide array of ideas in the Fund that differ from the Russell 3000 Growth Index, and while we generally believe valuations are not quite as attractive as they have been over the past year, we are finding a number of companies that we view as mispriced for continued economic growth. The recent market pullback has given us a chance to reevaluate the Fund’s positioning and add to our highest conviction names where we believe market sentiment has overwhelmed strong fundamentals. Information Technology continues to be the Fund’s largest absolute sector weight.

At the end of the period, the Fund’s largest overweight positions relative to the Russell 3000 Growth Index were to Healthcare, Consumer Discretionary, and Energy sectors, while the Fund’s largest underweights were to Industrials, Consumer Staples, and Information Technology sectors.

Important Risks

Investing involves risk, including the possible loss of principal. There is no guarantee the Fund will achieve its stated objective. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. •Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. •Mid-cap securities can have greater risks and volatility than large-cap securities. •The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur. •Different investment styles may go in and out favor, which may cause the Fund to underperform the broader stock market. •The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

Composition by Sector(1)

as of October 31, 2018

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Communication Services | | | 9.7 | % |

Consumer Discretionary | | | 17.4 | |

Consumer Staples | | | 3.8 | |

Energy | | | 2.2 | |

Financials | | | 4.7 | |

Health Care | | | 18.2 | |

Industrials | | | 9.4 | |

Information Technology | | | 32.1 | |

Materials | | | 1.0 | |

Real Estate | | | 1.0 | |

| | | | |

Total | | | 99.5 | % |

| | | | |

Short-Term Investments | | | 1.4 | |

Other Assets & Liabilities | | | (0.9 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|