UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number:811-00558

THE HARTFORD MUTUAL FUNDS II, INC.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610)386-4068

Date of fiscal year end: October 31

Date of reporting period: October 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Dear Fellow Shareholders:

Thank you for investing in Hartford Funds. The following is the Funds’ Annual Report covering the fiscal period from November 1, 2018 to October 31, 2019.

Market Review

During the 12 months ended October 31, 2019, U.S. stocks, as measured by the S&P 500 Index,1 gained 14.33% despite volatility throughout the period.

Political uncertainty has been a core driver of this increased market volatility. Escalating trade tensions between the U.S. and China, continued debate over how

the UK will handle its departure from the European Union, and the September announcement of an impeachment inquiry against President Trump all contributed to choppy market conditions.

However, July 1, 2019 marked a significant milestone: the U.S. entered the longest period of economic expansion on record, according to The National Bureau of Economic Research. Strong consumer spending in the U.S. has continued to buoy the domestic economy, helped by an unemployment rate that stayed at or below 4% throughout the 12 month period ended October 31, 2019.

Nevertheless, signs of a slowing global economy prompted central banks around the world to shift to more accommodating monetary policy. The U.S. Federal Reserve cut interest rates three times in 2019 to bring down the federal funds rate target down to a range of 1.50 – 1.75% as of October 31, 2019, while the European Central Bank, which already had established negative interest rates, further cut its rate to -0.50% as of September 18, 2019.

Politics, both at home and abroad, are likely to continue to play a key role in market movements this year. For this reason, we encourage you to maintain a strong relationship with your financial advisor, who can help guide you through shifting markets confidently. He or she can help you proactively build a portfolio that takes market uncertainty into account, along with your unique investment goals and risk tolerances. Your financial advisor can help you find a fit within our family of funds as you work toward those goals.

Thank you again for investing in Hartford Funds. For the most up-to-date information on our funds, please take advantage of all the resources available at hartfordfunds.com.

James Davey

President

Hartford Funds

| 1 | S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. |

The index is unmanaged and not available for direct investment. Past performance is not indicative of future results. |

Hartford Domestic Equity Funds

| 2 | ||||

| 38 | ||||

| 39 | ||||

Financial Statements: | ||||

Schedules of Investments: | ||||

| 42 | ||||

| 47 | ||||

| 50 | ||||

| 53 | ||||

| 55 | ||||

| 58 | ||||

| 61 | ||||

| 64 | ||||

| 66 | ||||

| 68 | ||||

| 71 | ||||

| 73 | ||||

| 76 | ||||

| 77 | ||||

| 81 | ||||

| 83 | ||||

| 87 | ||||

| 100 | ||||

| Report of Independent Registered Public Accounting Firm | 127 | |||

| Directors and Officers (Unaudited) | 128 | |||

How to Obtain a Copy of each Fund’s Proxy Voting Policies and Voting Records (Unaudited) | 132 | |||

| 132 | ||||

| Approval of Investment Management and Investment Sub-Advisory Agreements (Unaudited) | 133 | |||

The views expressed in each Fund’s Manager Discussion contained in the Fund Overview section are views of that Fund’ssub-adviser and portfolio management team through the end of the period and are subject to change based on market and other conditions. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable. Holdings and characteristics are subject to change. Fund performance reflected in each Fund’s Manager Discussion reflects the returns of such Fund’s Class A shares, before sales charges. Returns for such Fund’s other classes differ only to the extent that the classes do not have the same expenses.

| The Hartford Capital Appreciation Fund |

October 31, 2019 (Unaudited)

Inception 7/22/1996 Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks growth of capital. |

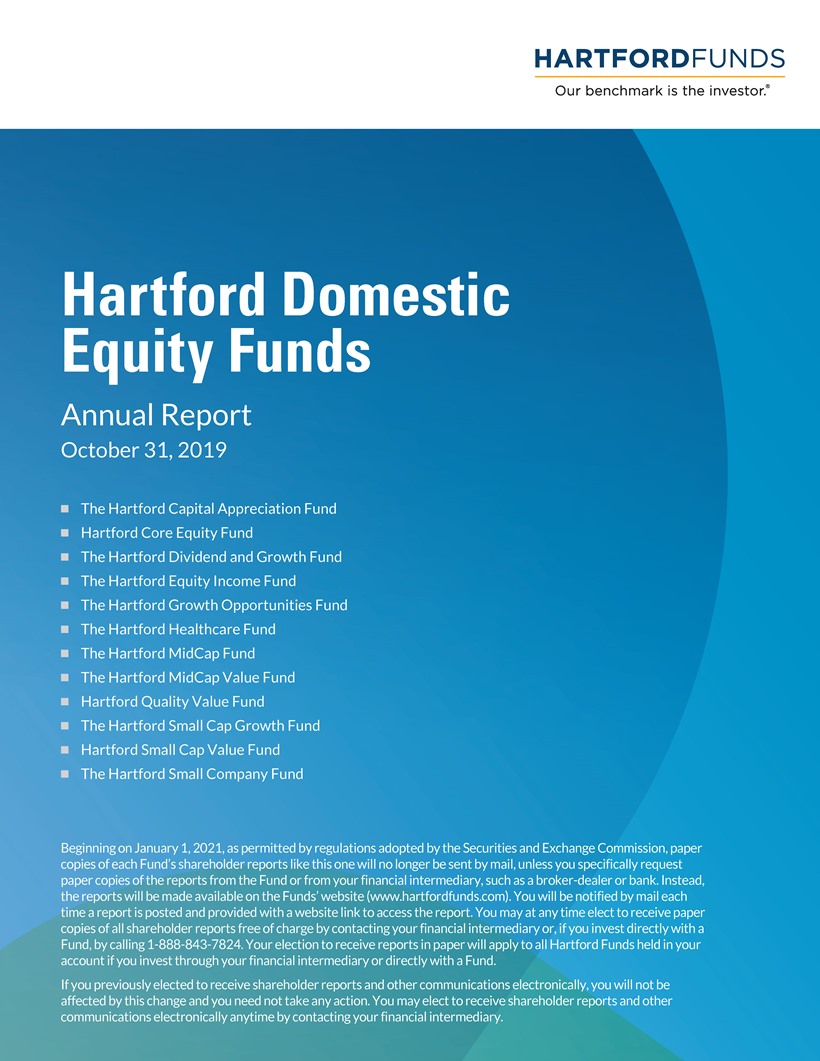

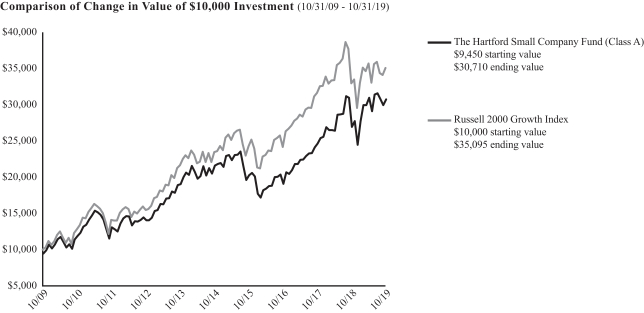

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/19

| 1 Year | 5 Years | 10 Years | ||||||||||

Class A1 | 16.32% | 8.72% | 11.12% | |||||||||

Class A2 | 9.86% | 7.50% | 10.50% | |||||||||

Class C1 | 15.45% | 7.94% | 10.33% | |||||||||

Class C2 | 14.49% | 7.94% | 10.33% | |||||||||

Class I1 | 16.66% | 9.04% | 11.45% | |||||||||

Class R31 | 15.91% | 8.37% | 10.79% | |||||||||

Class R41 | 16.27% | 8.71% | 11.13% | |||||||||

Class R51 | 16.64% | 9.03% | 11.46% | |||||||||

Class R61 | 16.74% | 9.13% | 11.57% | |||||||||

Class Y1 | 16.71% | 9.12% | 11.57% | |||||||||

Class F1 | 16.75% | 9.10% | 11.48% | |||||||||

Russell 3000 Index | 13.49% | 10.31% | 13.62% | |||||||||

S&P 500 Index | 14.33% | 10.78% | 13.70% | |||||||||

| 1 | Without sales charge |

| 2 | With sales charge |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/19, which may exclude

investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/14. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 2/28/17. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| Operating Expenses* | Gross | Net | ||||||

Class A | 1.07% | 1.07% | ||||||

Class C | 1.82% | 1.82% | ||||||

Class I | 0.79% | 0.79% | ||||||

Class R3 | 1.43% | 1.43% | ||||||

Class R4 | 1.11% | 1.11% | ||||||

Class R5 | 0.81% | 0.81% | ||||||

Class R6 | 0.71% | 0.71% | ||||||

Class Y | 0.80% | 0.75% | ||||||

Class F | 0.71% | 0.71% | ||||||

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 2/29/20 unless the Fund’s Board of Directors approves an earlier termination. Expenses shown include acquired fund fees and expenses. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended 10/31/19. |

| 2 |

|

| The Hartford Capital Appreciation Fund |

Fund Overview – (continued)

October 31, 2019 (Unaudited)

Portfolio Managers

Gregg R. Thomas, CFA

Senior Managing Director and Director, Investment Strategy

Wellington Management Company LLP

Tom S. Simon, CFA, FRM

Senior Managing Director and Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Capital Appreciation Fund returned 16.32%, before sales charge, for the twelve-month period ended October 31, 2019, outperforming the Fund’s benchmarks, the Russell 3000 Index and the S&P 500 Index, which returned 13.49% and 14.33%, respectively, for the same period. For the same period, Class A shares of the Fund also outperformed the 11.56% average return of the LipperMulti-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ended October 31, 2019. Towards the end of 2018, volatility was elevated as markets contended with a confluence of slowing growth, tighter liquidity and monetary policy, trade uncertainty, swelling fiscal deficits, and political turmoil. The Federal Reserve (Fed) raised its benchmark interest rate by 0.25% in December 2018. During the first quarter of 2019, U.S. equities rallied to their largest quarterly gain since 2009, lifted by an accommodative shift in Fed policy and guidance, optimism for a U.S.-China trade deal, relatively strong fourth-quarter 2018 earnings, and corporate buybacks. The Fed left its benchmark interest rate unchanged during the first quarter, signaling a more patient approach toward future policy-rate adjustments in response to slowing economic growth and muted inflation. By June 2019, unresolved U.S. trade frictions with China, Mexico, Japan, and the European Union (EU) unsettled markets and raised concerns about the potential risks to U.S. economic growth from increasing cost pressures, supply chain disruptions, and waning business confidence and investment plans. In the third quarter of 2019, U.S. equities rose, with the U.S. economy remaining resilient despite elevated geopolitical uncertainties and slowing global growth. U.S.-China trade relations were particularly volatile in the absence of meaningful compromises on key structural issues. Expectations for a protracted trade war and the potential for a longer-term decoupling of the world’s two largest economies eroded consumer and business confidence and curtailed capital spending. The Fed lowered its benchmark interest rate in July and September 2019 by a combined 0.50% in effort to sustain economic expansion and mitigate the risks of slowing growth and trade frictions. In October, the Fed lowered interest rates for a third time in 2019 by 0.25% and signaled its intention to pause further changes in policy. The U.S. and China made progress towards finalizing sections of a “phase one” trade agreement.

Returns varied by market cap during the period, aslarge-cap stocks, as measured by the S&P 500 Index, outperformed bothmid- andsmall-cap stocks, as measured by the S&P MidCap 400 Index and Russell 2000 Index, respectively.

Ten out of eleven sectors in the Russell 3000 Index posted positive returns during the period. Strong performers included the Real Estate (+25.1%), Utilities (+23.1%), and Information Technology (+22.6%) sectors; the Energy sector(-14.8%) was the sole detractor.

The Fund outperformed the Russell 3000 Index primarily due to strong stock selection within the Healthcare, Consumer Discretionary, and Information Technology sectors. Conversely, weak selection within the Industrials, Communication Services, and the Energy sectors detracted from returns relative to the Russell 3000 Index during the period. Sector allocation, a result ofbottom-up stock selection, was positive during the period primarily due to the Fund’s underweight to the Energy sector. An underweight to the Information Technology sector, as well as an overweight to the Healthcare sector, detracted from performance relative to the Russell 3000 Index.

Top contributors to performance relative to the Russell 3000 Index included Shopify (Information Technology), Insulet (Healthcare), and Chipotle Mexican Grill (Consumer Discretionary). Shopify is a cloud-based commerce platform designed for small- andmedium-sized businesses. The stock price moved significantly higher during the period as the company has consistently outperformed consensus estimates for revenue and gross profits on a quarterly basis. More recently, Shopify’s stock price has moved lower as the market reacted negatively to an announced acquisition and lower-than-expected earnings per share (EPS). We sold the Fund’s position in the stock during the period. Insulet is a medical device company focused on the development of insulin infusion systems for individuals with insulin-dependent diabetes. The stock price moved higher following two consecutive quarters of results coming in above consensus estimates. Management of Insulet also raised guidance for the coming year ending December 2019, as management expects increased adoption rates for its Omnipod product. As of the end of the period, we continued to hold this position in the Fund. Chipotle Mexican Grill is a fast-casual, fresh Mexican food restaurant. The company’s share price marched higher over the period on the back of consistent quarterly results that were in line with or in excess of market expectations. We sold the Fund’s position in this company. American Tower (Real Estate), Chipotle, and Shopify contributed positively to performance on an absolute basis over the period.

We Co. (Industrials), Microsoft (Information Technology), and Uber Technologies (Industrials) were among the top detractors from performance relative to the Russell 3000 Index over the period. The Fund’s position in We Co., a U.S.-based provider of shared workspaces and services, was the top detractor from relative performance during the period. The fair valuation of private placement We Co. declined during the period as the result of various well-publicized negative events that ultimately led to a failed initial public offering (IPO) and the departure of

| 3 |

|

| The Hartford Capital Appreciation Fund |

Fund Overview – (continued)

October 31, 2019 (Unaudited)

the Chief Executive Officer (CEO) and founder. As of the end of the period, we continued to hold this position in the Fund. The Fund’s underweight exposure to Microsoft relative to the Russell 3000 Index was another top detractor from performance. Growth in Azure, Microsoft’s commercial cloud offering, helped propel the stock price higher and helped overcome some of the weakness within Microsoft’s gaming unit. The Fund remained underweight relative to the Russell 3000 Index’s exposure and we trimmed the Fund’s position during the period. Uber Technologies, a technology platform for the mobility of people and things, also detracted from performance relative to the Russell 3000 Index during the period. The company, which is best known for its ride hailing service, delivered mixed results during its first quarterly earnings call as a public company. During the period, the company struggled to show that it could turn a profit and navigate regulatory hurdles such as the classification of drivers as employees. As of the end of the period, we continued to hold this position in the Fund. We Co., Altria Group (Consumer Staples), and Uber Technologies were among the largest detractors from performance on an absolute basis over the period.

Strategies included in the Fund are chosen based on extensive analysis of qualitative and quantitative factors. Risk factors managed within the overall portfolio include but are not limited to: growth, value, momentum, contrarian, high volatility, low volatility, quality and leverage. During the period, factor impact on the Fund was positive. Exposure to value and momentum factors contributed positively to performance, while the Fund’s exposure to higher volatility equities and dividend yield detracted from performance during the period.

International exposure (country and currency) contributed positively to results, particularly driven by exposure to North America (United States and Canada), Europe (Netherlands), and emerging markets (China).

The Fund, at times, used derivative instruments such as currency forwards to hedge currency risk and/or equity index futures to hedge market risk. During the period, the use of these derivatives did not have a significant impact on performance.

What is the outlook as of the end of the period?

Macro challenges continue to weigh on markets; however, we believe that opportunities to generate alpha still exist. In particular, we believe that unresolved trade tensions, slowing global growth, and growing policy uncertainty have dampened investor risk appetite and impacted corporate fundamentals for companies and industries most exposed to these risks. Further, we believe that a multi-strategy factor-based approach to capital allocation can help manage risk amidst uncertainty and reduce excess drawdown in the event of market shocks.

As we look across the factor landscape, we maintain conviction in our diversified factor exposures. We are closely monitoring the Fund’s exposure to trend-following factors (e.g., growth and momentum) as they are exhibiting higher beta, which may also represent more downside risk. Similarly, we have beenre-evaluating the Fund’s more defensive exposures in order to determine whether they will continue to be defensive if market conditions change. Risk-averse factors, such as low volatility, have outperformed recently and appear overvalued on some metrics. However, our research indicates that low volatility (in particular) has historically provided downside protection even in instances where it appeared overvalued. In contrast, value-oriented and

contrarian approaches continue to look attractive on most valuation frameworks. While a catalyst for any value recovery continues to be uncertain, we have maintained the Fund’s exposure as it may help the Fund participate in any potential cyclical rally if the aforementioned macro tensions subside.

At the end of the period, the Fund’s largest overweights were to the Consumer Discretionary and Healthcare sectors, while the Fund’s largest underweights were to Information Technology and Energy sectors, relative to the Russell 3000 Index.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.The Fund’s strategy for allocating assets among portfolio management teams may not work as intended.•Mid-cap securities can have greater risks and volatility thanlarge-cap securities.• Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. These risks are generally greater for investments in emerging markets.• The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

Composition by Sector(1)

as of October 31, 2019

| Sector | Percentage of Net Assets | |||

Equity Securities |

| |||

Communication Services | 8.2 | % | ||

Consumer Discretionary | 14.4 | |||

Consumer Staples | 7.4 | |||

Energy | 1.4 | |||

Financials | 11.6 | |||

Health Care | 16.3 | |||

Industrials | 10.3 | |||

Information Technology | 15.9 | |||

Materials | 3.9 | |||

Real Estate | 4.9 | |||

Utilities | 3.5 | |||

|

| |||

Total | 97.8 | % | ||

|

| |||

Short-Term Investments | 2.5 | |||

Other Assets & Liabilities | (0.3 | ) | ||

|

| |||

Total | 100.0 | % | ||

|

| |||

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

| 4 |

|

| Hartford Core Equity Fund |

Fund Overview

October 31, 2019 (Unaudited)

Inception 4/30/1998 Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks growth of capital. |

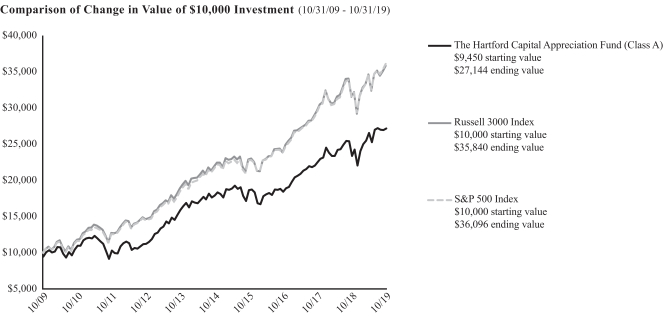

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/19

| 1 Year | 5 Years | 10 Years | ||||||||||

Class A1 | 16.60% | 11.60% | 14.21% | |||||||||

Class A2 | 10.19% | 10.35% | 13.57% | |||||||||

Class C1 | 15.71% | 10.79% | 13.39% | |||||||||

Class C2 | 14.71% | 10.79% | 13.39% | |||||||||

Class I1 | 16.91% | 11.87% | 14.35% | |||||||||

Class R31 | 16.18% | 11.25% | 13.93% | |||||||||

Class R41 | 16.59% | 11.60% | 14.28% | |||||||||

Class R51 | 16.90% | 11.92% | 14.62% | |||||||||

Class R61 | 17.01% | 12.00% | 14.69% | |||||||||

Class Y1 | 16.94% | 11.98% | 14.68% | |||||||||

Class F1 | 17.00% | 11.93% | 14.38% | |||||||||

S&P 500 Index | 14.33% | 10.78% | 13.70% | |||||||||

| 1 | Without sales charge |

| 2 | With sales charge |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/19, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class I shares commenced operations on 3/31/15. Performance prior to that date is that of the Fund’s Class A shares (excluding sales charges). Class R6 shares commenced operations on 3/31/15 and performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 2/28/17. Performance for Class F shares prior to 2/28/17 reflects the performance of Class I shares from 3/31/15 through 2/27/17 and Class A shares (excluding sales charges) prior to 3/31/15.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| Operating Expenses* | Gross | Net | ||||||

Class A | 0.75% | 0.75% | ||||||

Class C | 1.49% | 1.49% | ||||||

Class I | 0.47% | 0.47% | ||||||

Class R3 | 1.10% | 1.10% | ||||||

Class R4 | 0.79% | 0.79% | ||||||

Class R5 | 0.49% | 0.49% | ||||||

Class R6 | 0.39% | 0.39% | ||||||

Class Y | 0.48% | 0.45% | ||||||

Class F | 0.39% | 0.39% | ||||||

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 2/29/20 unless the Fund’s Board of Directors approves an earlier termination. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended 10/31/19. |

| 5 |

|

| Hartford Core Equity Fund |

Fund Overview – (continued)

October 31, 2019 (Unaudited)

Portfolio Managers

Mammen Chally, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

David A. Siegle, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Douglas W. McLane, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of the Hartford Core Equity Fund returned 16.60%, before sales charge, for the twelve-month period ended October 31, 2019, outperforming the Fund’s benchmark, the S&P 500 Index, which returned 14.33% for the same period. For the same period, Class A shares of the Fund also outperformed the 13.41% average return of the LipperLarge-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ended October 31, 2019. Towards the end of 2018, volatility was elevated as markets contended with a confluence of slowing growth, tighter liquidity and monetary policy, trade uncertainty, swelling fiscal deficits, and political turmoil. The Federal Reserve (Fed) raised its benchmark interest rate by 0.25% in December 2018. During the first quarter of 2019, U.S. equities rallied to their largest quarterly gain since 2009, lifted by a cautious shift in Fed policy and guidance, optimism for a U.S.-China trade deal, relatively strong fourth-quarter 2018 earnings, and corporate buybacks. The Fed left its benchmark interest rate unchanged during the first quarter, signaling a more patient approach toward future policy-rate adjustments in response to slowing economic growth and muted inflation. By June 2019, unresolved U.S. trade frictions with China, Mexico, Japan, and the European Union (EU) unsettled markets and raised concerns about the potential risks to U.S. economic growth from increasing cost pressures, supply chain disruptions, and waning business confidence and investment plans. In the third quarter of 2019, U.S. equities rose, with the U.S. economy remaining resilient despite elevated geopolitical uncertainties and slowing global growth. U.S.-China trade relations were particularly volatile in the absence of meaningful compromises on key structural issues. Expectations for a protracted trade war and the potential for a longer-term decoupling of the world’s two largest economies eroded consumer and business confidence and curtailed capital spending. The Fed lowered its benchmark interest rate in July and September 2019 by a combined 0.50% in effort to sustain economic expansion and mitigate the risks of slowing growth and trade frictions. In October, the Fed lowered interest rates for a third time in 2019 by 0.25% and signaled its intention to pause further changes in policy. The U.S. and China made progress towards finalizing sections of a “phase one” trade agreement.

Returns varied by market cap during the period, aslarge-cap stocks, as measured by the S&P 500 Index, outperformedsmall-cap andmid-cap stocks, as measured by the Russell 2000 Index and S&P MidCap 400 Index, respectively.

Ten out of eleven sectors in the S&P 500 Index rose during the period, with the Real Estate (+27%), Utilities (+24%), Information Technology (+23%), and Consumer Discretionary (+16%) sectors performing the best. The Energy sector(-11%) lagged the broader S&P 500 Index during the period.

Overall, outperformance versus the S&P 500 Index was driven by strong security selection, primarily within the Consumer Staples, Healthcare, and Industrials sectors. This was partially offset by weaker stock selection within the Energy and Consumer Discretionary sectors, which detracted from relative performance. Sector allocation, a result of thebottom-up stock selection process, also contributed positively to relative performance primarily driven by the Fund’s underweight to the Energy sector and overweight allocation to the Utilities sector. This was partially offset by the Fund’s overweight to the Healthcare sector, which detracted from relative performance.

The top contributors to performance relative to the S&P 500 Index were Teradyne (Information Technology), NextEra Energy (Utilities), and not owning Exxon Mobil (Energy), a constituent in the S&P 500 Index. Teradyne is a U.S.-based developer and supplier of automatic test equipment. Shares of the company’s stock rose during the period after reporting strong earnings. NextEra Energy is a U.S.-based company involved in the generation, transmission, distribution, and sale of electric energy in the U.S. and Canada. The company’s stock price outperformed during the period after reporting strong earnings in the last three periods. Shares of U.S.-based global integrated oil and gas company, Exxon Mobil, declined during the period. Despite reporting strong second quarter 2019 results, shares continued to sell off as fears over an escalating trade war between the U.S. and China weighed on investor sentiment. Top absolute contributors included Microsoft (Information Technology) and Procter & Gamble (Consumer Staples).

The top detractors from performance relative to the S&P 500 Index included EOG Resources (Energy), Continental Resources (Energy), and NetApp (Information Technology). EOG Resources is a U.S.-based oil and gas production company. Shares of the company’s stock declined during the period due to prolonged weakness in crude oil pricing, which impacted their upstream energy projects. Shares of Continental

| 6 |

|

| Hartford Core Equity Fund |

Fund Overview – (continued)

October 31, 2019 (Unaudited)

Resources, another U.S.-based oil and gas production company, also fell during the period as a result of negative earnings estimate revisions. The company was also impacted by weaker crude oil and natural gas prices, which more than offset a rise in production. As of the end of the period, we maintained the Fund’s position. Shares of NetApp, aU.S.-based software systems and services provider for the management and storage of customer data, declined during the period. The company announced that sales would be well below expectations in the current year due to broad slowdown in technology hardware spending. We eliminated the Fund’s position in the stock as the industry dynamics have clearly become more competitive. Top absolute detractors for the period included EOG Resources (Energy) and Continental Resources (Energy).

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

Since the middle of 2018, there has been a change to the near-term market outlook, driven by the change in the U.S. bond market yield curve. The10-year Treasury yield is near the lows it experienced in 2016. After nine rate increases in 0.25% increments from late 2015 to late 2018, the Fed has now cut interest rates three times. Through all of this, the U.S. dollar has continued to strengthen against the major currencies and China has allowed its currency to weaken. In the U.S., we are now seeing some weakening of exports and capital investment. However, we believe that indicators such as credit, jobless claims, housing activity, and consumer confidence do not signify a recession at this point. Moreover, our conversations with companies indicate that, in general, competition for labor is among the bigger constraints for growth rather than a decrease in demand.

Against this backdrop, we now have the possibility that the House of Representatives will start impeachment proceedings against President Trump. As investors, we are concerned about potential ramifications on items scheduled on the legislative calendar, such as the necessary ratification of USMCA (United States-Mexico-Canada Agreement, which is the proposed replacement for the North American Free Trade Agreement). We believe the pressure on profits and the need to pass on costs will become critical if we have a combination of tariffs and the lack of a ratified USMCA.

Over the next few quarters, we believe that there will be more to analyze given that we are approaching an election year. It is clear there are several policy proposals that could have an impact on stocks the Fund holds, and while we are working to understand the implications, we believe it is too early to act one way or another.

At the end of the period, the Fund’s largest overweight sectors relative to the S&P 500 Index were to Consumer Staples and Healthcare sectors, while the Fund’s largest underweights were to the Energy and Communication Services sectors.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.

Composition by Sector(1)

as of October 31, 2019

| Sector | Percentage of Net Assets | |||

Equity Securities |

| |||

Communication Services | 7.6 | % | ||

Consumer Discretionary | 9.4 | |||

Consumer Staples | 10.3 | |||

Energy | 1.3 | |||

Financials | 13.0 | |||

Health Care | 15.3 | |||

Industrials | 10.0 | |||

Information Technology | 19.5 | |||

Materials | 1.8 | |||

Real Estate | 2.1 | |||

Utilities | 4.8 | |||

|

| |||

Total | 95.1 | % | ||

|

| |||

Short-Term Investments | 5.0 | |||

Other Assets & Liabilities | (0.1 | ) | ||

|

| |||

Total | 100.0 | % | ||

|

| |||

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

| 7 |

|

| The Hartford Dividend and Growth Fund |

Fund Overview

October 31, 2019 (Unaudited)

Inception 7/22/1996 Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

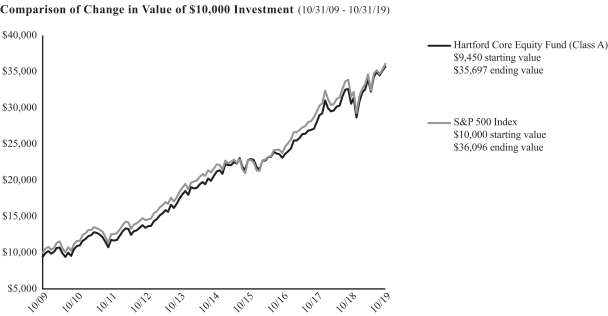

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/19

| 1 Year | 5 Years | 10 Years | ||||||||||

Class A1 | 13.75% | 9.17% | 11.85% | |||||||||

Class A2 | 7.49% | 7.94% | 11.22% | |||||||||

Class C1 | 12.92% | 8.35% | 11.03% | |||||||||

Class C2 | 11.92% | 8.35% | 11.03% | |||||||||

Class I1 | 14.08% | 9.43% | 12.13% | |||||||||

Class R31 | 13.33% | 8.79% | 11.50% | |||||||||

Class R41 | 13.71% | 9.12% | 11.85% | |||||||||

Class R51 | 14.05% | 9.46% | 12.19% | |||||||||

Class R61 | 14.16% | 9.54% | 12.28% | |||||||||

Class Y1 | 14.10% | 9.53% | 12.28% | |||||||||

Class F1 | 14.15% | 9.48% | 12.16% | |||||||||

S&P 500 Index | 14.33% | 10.78% | 13.70% | |||||||||

Russell 1000 Value Index | 11.21% | 7.61% | 11.96% | |||||||||

| 1 | Without sales charge |

| 2 | With sales charge |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/19, which may exclude

investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/14. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 2/28/17. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| Operating Expenses* | Gross | Net | ||||||

Class A | 1.00% | 1.00% | ||||||

Class C | 1.76% | 1.76% | ||||||

Class I | 0.73% | 0.73% | ||||||

Class R3 | 1.35% | 1.35% | ||||||

Class R4 | 1.05% | 1.05% | ||||||

Class R5 | 0.74% | 0.74% | ||||||

Class R6 | 0.65% | 0.65% | ||||||

Class Y | 0.74% | 0.69% | ||||||

Class F | 0.64% | 0.64% | ||||||

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 2/29/20 unless the Fund’s Board of Directors approves an earlier termination. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended 10/31/19. |

| 8 |

|

| The Hartford Dividend and Growth Fund |

Fund Overview – (continued)

October 31, 2019 (Unaudited)

Portfolio Managers

Edward P. Bousa, CFA*

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew G. Baker

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Nataliya Kofman

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Mark E. Vincent

Managing Director and Equity Research Analyst

Wellington Management Company LLP

* Mr. Bousa announced his plan to retire, and effective June 30, 2020, he will no longer serve as a portfolio manager for the Fund.

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Dividend and Growth Fund returned 13.75%, before sales charge, for the twelve-month period ended October 31, 2019, underperforming one of the Fund’s benchmarks, the S&P 500 Index, which returned 14.33% for the same period. For the same period, Class A shares of the Fund outperformed the Fund’s other benchmark, the Russell 1000 Value Index, which returned 11.21%. For the same period, Class A shares of the Fund outperformed the 10.99% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ended October 31, 2019. Towards the end of 2018, volatility was elevated as markets contended with a confluence of slowing growth, tighter liquidity and monetary policy, trade uncertainty, swelling fiscal deficits, and political turmoil. The Federal Reserve (Fed) raised its benchmark interest rate by 0.25% in December 2018. During the first quarter of 2019, U.S. equities rallied to their largest quarterly gain since 2009, lifted by an accommodative shift in Fed policy and guidance, optimism for a U.S.-China trade deal, relatively strong fourth-quarter 2018 earnings, and corporate buybacks. The Fed left its benchmark interest rate unchanged during the first quarter, signaling a more patient approach toward future policy-rate adjustments in response to slowing economic growth and muted inflation. By June 2019, unresolved U.S. trade frictions with China, Mexico, Japan, and the European Union (EU) unsettled markets and raised concerns about the potential risks to U.S. economic growth from increasing cost pressures, supply chain disruptions, and waning business confidence and investment plans. In the third quarter of 2019, U.S. equities rose, with the U.S. economy remaining resilient despite elevated geopolitical uncertainties and slowing global growth. U.S.-China trade relations were particularly volatile in the absence of meaningful compromises on key structural issues. Expectations for a protracted trade war and the potential for a longer-term decoupling of the world’s two largest economies eroded

consumer and business confidence and curtailed capital spending. The Fed lowered its benchmark interest rate in July and September 2019 by a combined 0.50% in effort to sustain economic expansion and mitigate the risks of slowing growth and trade frictions. In October, the Fed lowered interest rates for a third time in 2019 by 0.25% and signaled its intention to pause further changes in policy. The U.S. and China made progress towards finalizing sections of a “phase one” trade agreement.

Returns varied by market cap during the period, aslarge-cap stocks, measured by the S&P 500 Index, outperformedmid- andsmall-cap stocks, measured by the S&P MidCap 400 Index and Russell 2000 Index, respectively.

Ten out of eleven sectors in the S&P 500 Index rose during the period, with the Real Estate (+27%), Utilities (+24%), and Information Technology (+23%) sectors leading the index higher. The Energy sector(-11%) was the only sector to post negative returns during the period.

Security selection contributed positively to performance relative to the S&P 500 Index over the period. Stock selection effects were strongest within the Financials, Energy, Industrials, and Healthcare sectors. This was partially offset by weaker selection within the Real Estate, Utilities, and Information Technology sectors. Sector allocation, a result of thebottom-up stock selection process, detracted from relative performance over the period. An overweight to the Energy sector and an underweight to the Information Technology sector detracted the most from relative returns. This was slightly offset by an overweight to the Utilities sector, which contributed positively to performance relative to the S&P 500 Index.

The Fund’s top detractors from absolute performance as well as from performance relative to the S&P 500 Index included DXC Technology (Information Technology), HP (Information Technology), and EnCana (Energy). DXC Technology detracted from returns relative to the S&P 500 Index, and we eliminated the Fund’s position during the period. We underestimated the impact of the transition to the cloud and the speed at which DXC could transition from legacy to digital technology. As our investment thesis for this position was not materializing, we felt we had better opportunities elsewhere. The Fund’s position in HP detracted from

| 9 |

|

| The Hartford Dividend and Growth Fund |

Fund Overview – (continued)

October 31, 2019 (Unaudited)

returns relative to the S&P 500 Index over the period due to concerns that the printing segment is coming under pressure. HP has recently announced a restructuring program, and while we have trimmed some of the Fund’s position during the period due to the risk in the new printing model, we believe that this turnaround strategy makes sense and as of the end of the period, continued to believe in the longer-term prospects of the company. EnCana detracted from relative returns driven by lower oil prices due to growing concerns around a slowdown in the global macroeconomic environment.

The Fund’s top contributors to relative performance versus the S&P 500 Index during the period were KLA (Information Technology), NextEra Energy (Utilities), and not holding Johnson & Johnson (Healthcare), a constituent of the S&P 500 Index. KLA continued to outperform its semiconductor equipment peer group with strong fiscal fourth quarter 2019 earnings and guidance for September above consensus expectations. As of the end of the period, we continued to maintain the Fund’s position as we believe KLA has a sustainable competitive advantage that is not fully reflected in the current share price. NextEra Energy reported strong third quarter earnings and reaffirmed that it would deliver at the high end of expectations through 2022. Not holding Johnson & Johnson contributed positively to relative performance over the period as the company’s share price has been under pressure due to ongoing litigation risk surrounding its various products. Top absolute performers during the period included Microsoft (Information Technology) and Bank of America (Financials).

Derivatives were not used in a significant manner in the Fund during the period, and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

We remain cautious on equity markets in the near term as we are beginning to see early signs of pressures on earnings growth. Despite the recent easing of geopolitical tensions between the U.S. and China, we continue to believe that the ongoing trade negotiations between the two countries remain a key input to our outlook, and we expect continued heightened market volatility through the end of the year and into 2020. Should trade policy issues get resolved and interest rates remain at low levels, our outlook on the market would become more constructive.

In our view, the U.S. market is expensive by most measures. We believe traditional defensive areas are highly valued and do not provide the downside protection we seek. We have maintained the Fund’s overweight position in the Financials sector longer than we typically would at this point in the cycle, but we continue to believe that the valuations and the quality of the businesses are attractive in this sector. We have been selectively increasing the Fund’s exposure to the Healthcare sector as opportunities present themselves.

At the end of the period, the Fund’s largest sector overweights relative to the S&P 500 Index were to the Financials, Energy, and Healthcare sectors, while the Fund’s largest underweights were to the Information Technology, Consumer Discretionary, and Consumer Staples sectors.

We continue to rely on our process and philosophy as we construct the Fund.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.• For dividend-paying stocks, dividends are not guaranteed and may decrease without notice.•Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments.

Composition by Sector(1)

as of October 31, 2019

| Sector | Percentage of Net Assets | |||

Equity Securities |

| |||

Communication Services | 9.9 | % | ||

Consumer Discretionary | 5.2 | |||

Consumer Staples | 5.9 | |||

Energy | 7.1 | |||

Financials | 19.8 | |||

Health Care | 15.3 | |||

Industrials | 8.8 | |||

Information Technology | 13.4 | |||

Materials | 3.7 | |||

Real Estate | 2.8 | |||

Utilities | 4.3 | |||

|

| |||

Total | 96.2 | % | ||

|

| |||

Short-Term Investments | 3.7 | |||

Other Assets & Liabilities | 0.1 | |||

|

| |||

Total | 100.0 | % | ||

|

| |||

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

| 10 |

|

| The Hartford Equity Income Fund |

Fund Overview

October 31, 2019 (Unaudited)

Inception 8/28/2003 Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

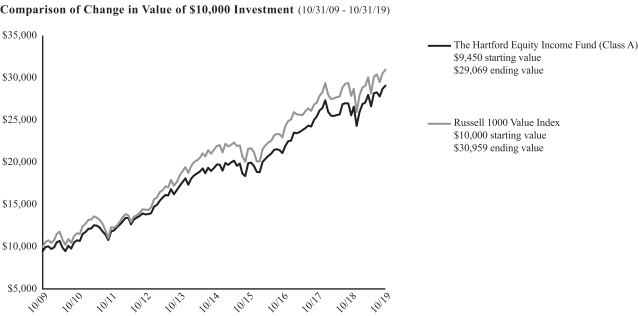

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/19

| 1 Year | 5 Years | 10 Years | ||||||||||

Class A1 | 13.88% | 8.55% | 11.89% | |||||||||

Class A2 | 7.62% | 7.33% | 11.26% | |||||||||

Class C1 | 13.00% | 7.75% | 11.07% | |||||||||

Class C2 | 12.00% | 7.75% | 11.07% | |||||||||

Class I1 | 14.17% | 8.82% | 12.17% | |||||||||

Class R31 | 13.48% | 8.16% | 11.51% | |||||||||

Class R41 | 13.85% | 8.50% | 11.85% | |||||||||

Class R51 | 14.14% | 8.82% | 12.20% | |||||||||

Class R61 | 14.29% | 8.92% | 12.30% | |||||||||

Class Y1 | 14.21% | 8.90% | 12.29% | |||||||||

Class F1 | 14.24% | 8.87% | 12.20% | |||||||||

Russell 1000 Value Index | 11.21% | 7.61% | 11.96% | |||||||||

| 1 | Without sales charge |

| 2 | With sales charge |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/19, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/14. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 2/28/17. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| Operating Expenses* | Gross | Net | ||||||

Class A | 1.00% | 1.00% | ||||||

Class C | 1.75% | 1.75% | ||||||

Class I | 0.75% | 0.75% | ||||||

Class R3 | 1.37% | 1.37% | ||||||

Class R4 | 1.06% | 1.06% | ||||||

Class R5 | 0.76% | 0.76% | ||||||

Class R6 | 0.66% | 0.66% | ||||||

Class Y | 0.77% | 0.71% | ||||||

Class F | 0.66% | 0.66% | ||||||

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 2/29/20 unless the Fund’s Board of Directors approves an earlier termination. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended 10/31/19. |

| 11 |

|

| The Hartford Equity Income Fund |

Fund Overview – (continued)

October 31, 2019 (Unaudited)

Portfolio Managers

W. Michael Reckmeyer, III, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Ian R. Link, CFA*

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Adam H. Illfelder, CFA

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew Hand, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

* Effective December 31, 2019, Ian R. Link, CFA will no longer serve as a portfolio manager for the Fund.

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Equity Income Fund returned 13.88%, before sales charge, for the twelve-month period ended October 31, 2019, outperforming the Fund’s benchmark, the Russell 1000 Value Index, which returned 11.21% for the same period. For the same period, Class A shares of the Fund also outperformed the 10.99% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to that of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ended October 31, 2019. Towards the end of 2018, volatility was elevated as markets contended with a confluence of slowing growth, tighter liquidity and monetary policy, trade uncertainty, swelling fiscal deficits, and political turmoil. The Federal Reserve (Fed) raised its benchmark interest rate by 0.25% in December 2018. During the first quarter of 2019, U.S. equities rallied to their largest quarterly gain since 2009, lifted by a cautious shift in Fed policy and guidance, optimism for a U.S.-China trade deal, relatively strong fourth-quarter 2018 earnings, and corporate buybacks. The Fed left its benchmark interest rate unchanged during the first quarter, signaling a more patient approach toward future policy-rate adjustments in response to slowing economic growth and muted inflation. By June 2019, unresolved U.S. trade frictions with China, Mexico, Japan, and the European Union (EU) unsettled markets and raised concerns about the potential risks to U.S. economic growth from increasing cost pressures, supply chain disruptions, and waning business confidence and investment plans. In the third quarter of 2019, U.S. equities rose, with the U.S. economy remaining resilient despite elevated geopolitical uncertainties and slowing global growth. U.S.-China trade relations were particularly volatile in the absence of meaningful compromises on key structural issues. Expectations for a protracted trade war and the potential for a longer-term decoupling of the world’s two largest economies eroded consumer and business confidence and curtailed capital spending. The Fed lowered its benchmark interest rate in July and September 2019 by a combined 0.50% in effort to sustain

economic expansion and mitigate the risks of slowing growth and trade frictions. In October, the Fed lowered interest rates for a third time in 2019 by 0.25% and signaled its intention to pause further changes in policy. The U.S. and China made progress towards finalizing sections of a “phase one” trade agreement.

During the period, ten out of eleven sectors within the Russell 1000 Value Index posted positive absolute returns with the Real Estate (+25%), Utilities (+23%), and Information Technology (+22%) sectors performing the best. The Energy(-12%) sector was the only sector that declined during the period.

Outperformance relative to the Russell 1000 Value Index was driven by security selection, primarily within the Energy, Financials, and Healthcare sectors. This more than offset less favorable selection within the Consumer Staples and Materials sectors. Sector allocation, a result of ourbottom-up stock selection process, detracted from relative performance due to the Fund’s underweight position in the Real Estate sector and overweight position in the Energy sector. This was partially offset by the Fund’s overweight positions in the Utilities and Industrials sectors.

Top contributors to performance relative to the Russell 1000 Value Index during the period included KLA (Information Technology), Analog Devices (Information Technology), and Crown Castle (Real Estate). KLA is a leading supplier of process control and yield management equipment for the semiconductor industry. Shares jumped during the third quarter of 2019, a result of strong quarterly results and guidance that was above expectations due to increased development spending by foundry and logic customers. Analog Devices is a U.S.-based company that designs, manufactures, and markets semiconductor equipment and technology. Shares rose during the period as the company posted earnings that beat estimates in each of the last four quarters. Crown Castle is a U.S.-based company, owning a nationwide portfolio of communications infrastructure. The company’s stock rose over the period due to strong earnings and tailwinds from expectations of increased business as customers build out 5G infrastructure.

| 12 |

|

| The Hartford Equity Income Fund |

Fund Overview – (continued)

October 31, 2019 (Unaudited)

Top detractors from results relative to the Russell 1000 Value Index included Suncor Energy (Energy) and not owning benchmark constituents Procter & Gamble (P&G) (Consumer Staples) or AT&T (Communication Services). Suncor Energy is a Canadian company primarily focused on developing petroleum resource basins. Shares have traded lower over the trailing twelve months, and the company reported third-quarter earnings that missed estimates. Integrated companies, like Suncor, were weighed down by the government’s mandatory oil production cuts which sharply reduced the price discount on Canadian versus U.S. oil. Shares of P&G moved higher as strong organic sales growth continued, driven by reinvestment, innovation, and organizational realignment. Growth was broad-based across all ten categories. Additionally, management guidance suggests continued gross margin expansion into fiscal year 2020. AT&T is a U.S.-based provider of telecommunication, media, and technology services. The company has positioned itself competitively in the media streaming space with its acquisition of HBO earlier this year. The stock rose over the period and performance was boosted by third-quarter earnings that beat estimates.

Derivatives were not used in a significant manner in the Fund during the period, and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

We believe we are in the latter stages of the business cycle. As such, we have positioned the portfolio more defensively as of the end of the period. We have been focusing on companies that appear attractively valued over a variety of potential economic scenarios. While we do not expect a recession in the near term, we are mindful of broader macro and political risks and want to be positioned defensively ahead of any potentially negative developments.

The Healthcare, Information Technology, and Industrials sectors represented the Fund’s largest sector overweights relative to the Russell 1000 Value Index, while the Real Estate, Consumer Discretionary, and Financials sectors were the Fund’s largest underweights at the end of the period.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.•For dividend-paying stocks, dividends are not guaranteed and may decrease without notice.•Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments.•Different investment styles may go in and out favor, which may cause the Fund to underperform the broader stock market.•The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

Composition by Sector(1)

as of October 31, 2019

| Sector | Percentage of Net Assets | |||

Equity Securities |

| |||

Communication Services | 6.0 | % | ||

Consumer Discretionary | 3.2 | |||

Consumer Staples | 9.6 | |||

Energy | 8.6 | |||

Financials | 20.5 | |||

Health Care | 16.8 | |||

Industrials | 11.4 | |||

Information Technology | 9.3 | |||

Materials | 2.5 | |||

Real Estate | 2.2 | |||

Utilities | 7.8 | |||

|

| |||

Total | 97.9 | % | ||

| �� | |||

Short-Term Investments | 2.1 | |||

Other Assets & Liabilities | 0.0 | * | ||

|

| |||

Total | 100.0 | % | ||

|

| |||

| * | Percentage rounds to zero. |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

| 13 |

|

| The Hartford Growth Opportunities Fund |

Fund Overview

October 31, 2019 (Unaudited)

Inception 3/31/1963 Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks capital appreciation. |

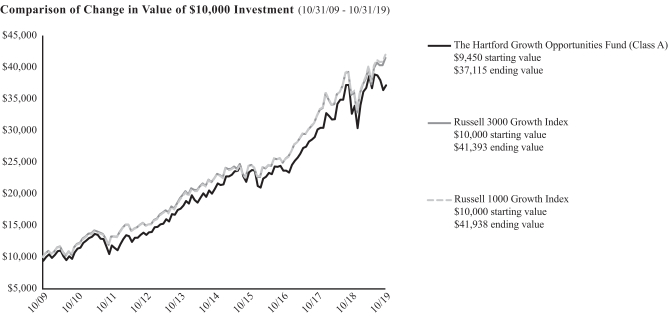

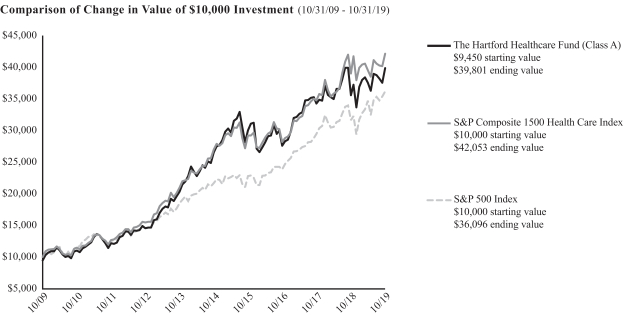

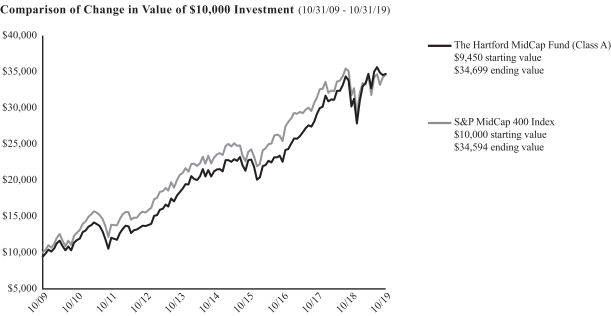

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/19

| 1 Year | 5 Years | 10 Years | ||||||||||

Class A1 | 13.64% | 12.29% | 14.65% | |||||||||

Class A2 | 7.33% | 11.02% | 14.01% | |||||||||

Class C1 | 12.79% | 11.46% | 13.83% | |||||||||

Class C2 | 12.04% | 11.46% | 13.83% | |||||||||

Class I1 | 13.94% | 12.56% | 14.96% | |||||||||

Class R31 | 13.25% | 11.92% | 14.32% | |||||||||

Class R41 | 13.57% | 12.25% | 14.67% | |||||||||

Class R51 | 13.92% | 12.58% | 15.01% | |||||||||

Class R61 | 14.03% | 12.69% | 15.12% | |||||||||

Class Y1 | 14.00% | 12.68% | 15.11% | |||||||||

Class F1 | 14.07% | 12.62% | 14.99% | |||||||||

Russell 3000 Growth Index | 16.34% | 13.05% | 15.26% | |||||||||

Russell 1000 Growth Index | 17.10% | 13.43% | 15.41% | |||||||||

| 1 | Without sales charge |

| 2 | With sales charge |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recentmonth-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/19, which may exclude

investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/14. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 2/28/17. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| Operating Expenses* | Gross | Net | ||||||

Class A | 1.11% | 1.11% | ||||||

Class C | 1.85% | 1.85% | ||||||

Class I | 0.83% | 0.83% | ||||||

Class R3 | 1.46% | 1.46% | ||||||

Class R4 | 1.15% | 1.15% | ||||||

Class R5 | 0.85% | 0.85% | ||||||

Class R6 | 0.74% | 0.74% | ||||||

Class Y | 0.82% | 0.79% | ||||||

Class F | 0.74% | 0.74% | ||||||

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 2/29/20 unless the Fund’s Board of Directors approves an earlier termination. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended 10/31/19. |

| 14 |

|

| The Hartford Growth Opportunities Fund |

Fund Overview – (continued)

October 31, 2019 (Unaudited)

Portfolio Managers

Michael T. Carmen, CFA*

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Stephen Mortimer

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Mario E. Abularach, CFA, CMT

Senior Managing Director and Equity Research Analyst

Wellington Management Company LLP

* Effective March 1, 2020, Michael T. Carmen, CFA will no longer serve as a portfolio manager for the Fund.

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Growth Opportunities Fund returned 13.64%, before sales charge, for the twelve-month period ended October 31, 2019, underperforming the Fund’s benchmarks, the Russell 3000 Growth Index and the Russell 1000 Growth Index, which returned 16.34% and 17.10%, respectively, for the same period. For the same period, the Class A shares of the Fund underperformed the 14.00% average return of the LipperMulti-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ended October 31, 2019. Towards the end of 2018, volatility was elevated as markets contended with a confluence of slowing growth, tighter liquidity and monetary policy, trade uncertainty, swelling fiscal deficits, and political turmoil. The Federal Reserve (Fed) raised its benchmark interest rate by 0.25% in December 2018. During the first quarter of 2019, U.S. equities rallied to their largest quarterly gain since 2009, lifted by an accommodative shift in Fed policy and guidance, optimism for a U.S.-China trade deal, relatively strong fourth-quarter 2018 earnings, and corporate buybacks. The Fed left its benchmark interest rate unchanged during the first quarter, signaling a more patient approach toward future policy-rate adjustments in response to slowing economic growth and muted inflation. By June 2019, unresolved U.S. trade frictions with China, Mexico, Japan, and the European Union (EU) unsettled markets and raised concerns about the potential risks to U.S. economic growth from increasing cost pressures, supply chain disruptions, and waning business confidence and investment plans. In the third quarter of 2019, U.S. equities rose, with the U.S. economy remaining resilient despite elevated geopolitical uncertainties and slowing global growth. U.S.-China trade relations were particularly volatile in the absence of meaningful compromises on key structural issues. Expectations for a protracted trade war and the potential for a longer-term decoupling of the world’s two largest economies eroded consumer and business confidence and curtailed capital spending. The Fed lowered its benchmark interest rate in July and September 2019 by a combined 0.50% in effort to sustain economic expansion and mitigate the risks of slowing growth and trade frictions. In October, the Fed lowered interest rates for a third time in 2019 by 0.25% and signaled its

intention to pause further changes in policy. The U.S. and China made progress towards finalizing sections of a “phase one” trade agreement.

Returns varied by market cap during the period, aslarge-cap stocks, measured by the S&P 500 Index, outperformedmid- andsmall-cap stocks, measured by the S&P MidCap 400 Index and Russell 2000 Index, respectively.

Ten out of eleven sectors in the Russell 3000 Growth Index rose during the period, with the Utilities (+34%), Real Estate (+27%), and Materials (+24%) sectors performing the best. The Energy(-22%) sector lagged on a relative basis during the period.

Sector allocation, a result of ourbottom-up stock selection process, detracted from performance relative to the Russell 3000 Growth Index during the period, due to an underweight to the Information Technology sector and an overweight to the Consumer Discretionary sector. This was partially offset by the positive impact of an overweight to the Communication Services sector, which contributed positively to performance relative to the Russell 3000 Growth Index. Security selection contributed positively to performance relative to the Russell 3000 Growth Index during the period, with strong selection in the Healthcare and Information Technology sectors. This positive performance was partially offset by weaker selection within the Communication Services and Industrials sectors, which detracted from performance relative to the Russell 3000 Growth Index.

Top detractors from performance relative to the Russell 3000 Growth Index during the period included Microsoft (Information Technology), We Co. (Industrials), and 2U (Information Technology). The Fund’s lack of exposure to Microsoft negatively affected performance the most. Microsoft delivered impressive results across the board, with acceleration in Office, double-digit growth in Server/Database, high single-digit growth in PC Windows, and operating margin improvement. We Co. is a U.S.-based provider of shared workspaces and services. During the period, the company pulled its initial public offering registration statement filing. Investor concerns over the Chief Executive Officer (CEO) and business model viability (among other things) caused valuations of We Co. to decline. Shares of 2U, a provider of cloud-based software for online education courses, traded down after management meaningfully lowered their full-year guidance and turned focus away fromtop-line growth towards profitability in their July earnings release. The company cited increasing competition in its graduate degree

| 15 |

|

| The Hartford Growth Opportunities Fund |

Fund Overview – (continued)

October 31, 2019 (Unaudited)

segment as a challenge totop-line growth. We Co. (Industrials) and 2U (Information Technology) were among the top absolute detractors during the period.

Top contributors to performance relative to the Russell 3000 Growth Index during the period included Shopify (Information Technology), Insulet (Healthcare), and Advanced Micro Devices (Information Technology). Shares of Shopify, a cloud-based commerce platform operator for small andmedium-sized businesses, rose after announcing a strong fourth quarter of 2018, beating consensus expectations across the board. Net ads, gross merchandise volume (GMV) growth, and merchant growth innon-core geographies all were strong. We eliminated the Fund’s position in Shopify after the stock exceeded our price target. Shares of Insulet, a medical device maker, rose after the company reported quarterly earnings that exceeded both management guidance and market expectations as all three revenue segments outperformed. Notably, adoption rates of the company’s Omnipod DASH system showed signs of growth. Shares of Advanced Micro Devices (AMD), a semiconductor company, rose due to an announced multi-year partnership with Samsung Electronics in ultralow-power, high-performance mobile graphics chips based on AMD Radeon technologies. Additionally, Microsoft unveiled several new Surface laptops using AMD CPU chips. Investors viewed these moves as a positive for AMD’s latest CPUs and its competitive positioning against Intel. We increased the Fund’s position during the period. Shopify (Information Technology) and Advanced Micro Devices (Information Technology) were among the top absolute contributors during the period.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

In our opinion, there is still much uncertainty surrounding geopolitics globally and the upcoming U.S. presidential election. During the escalating U.S. and China trade tensions, we have been avoiding U.S. companies with notable exposure to China and are focused on idiosyncratic opportunities that we believe are more insulated from geopolitical issues and macro uncertainty. The growth outlook has marginally come down over the past year as a result of trade tensions, but we think recession fears are just suspicions and not a certainty.

We aim to keep a steady hand for the time being until we see significant fundamental change, striving to not be overly reactive to negative market sentiment. Accordingly, we have not made any wholesale changes to the Fund as of the end of the period.

At the end of the period, the Fund’s largest overweights were to the Consumer Discretionary and Healthcare sectors. The Fund’s largest underweight was to the Information Technology sector.