UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00558

THE HARTFORD MUTUAL FUNDS II, INC.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

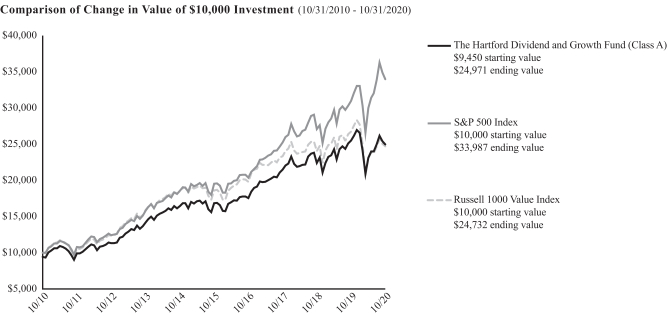

Hartford FUNDS OUR BENCHMARK IS THE INVESTOR®. Hartford Domestic Equity Funds Annual Report October 31, 2020 The Hartford Capital Appreciation Fund Hartford Core Equity Fund The Hartford Dividend and Growth Fund The Hartford Equity Income Fund The Hartford Growth Opportunities Fund The Hartford Healthcare Fund The Hartford MidCap Fund The Hartford MidCap Value Fund Hartford Quality Value Fund The Hartford Small Cap Growth Fund Hartford Small Cap Value Fund The Hartford Small Company Fund Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website (hartfordfunds.com). You will be notified by mail each time a report is posted and provided with a website link to access the report. You may at any time elect to receive paper copies of all shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, by calling 1-888-843-7824. Your election to receive reports in paper will apply to all Hartford Funds held in your account if you invest through your financial intermediary or directly with a Fund. If you previously elected to receive shareholder reports and other communications electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically anytime by contacting your financial intermediary.

A MESSAGE FROM THE PRESIDENT

Dear Shareholders:

Thank you for investing in Hartford Mutual Funds. The following is the Funds’ Annual Report covering the period from November 1, 2019 through October 31, 2020.

Market Review

During the 12 months ended October 31, 2020, U.S. stocks, as measured by the S&P 500 Index,1 gained 9.71% – an impressive number, to be sure, but one that doesn’t

begin to capture the drama of a pandemic-driven roller-coaster ride that has plunged the world into economic depths not seen since the Great Recession.

The period began with record-low unemployment, positive stock performances, and an optimistic global growth outlook. In late 2019, for example, months of trade tensions between the U.S. and China appeared to be eased by an initial agreement on tariff and trade reforms. The so-called “Phase One” deal, coupled with progress on resolving issues surrounding the U.K.’s withdrawal from the EU and a new United States-Mexico-Canada Agreement signed in January, 2020, brought calm to markets and seemed to set the stage for a strong 2020.

Instead, the novel coronavirus (COVID-19) pandemic erupted in late January and helped trigger a global recession. As world leaders grappled with the “new normal” of social distancing measures, business closures, and other mitigation efforts, many investors headed for the exits in March, 2020, bringing the longest bull market in U.S. economic history to an abrupt end. By mid-April, the U.S. unemployment rate had surged to 14.7%.

Late April 2020 brought a surprising recovery in U.S. markets, largely in response to an unprecedented economic rescue effort from central banks, including the U.S. Federal Reserve (Fed), which reduced interest rates to near zero and pledged trillions in U.S. securities purchases.

On the fiscal side, the U.S. government unveiled a series of aggressive policy initiatives, including passage of the $2 trillion CARES Act in late March, 2020. The combined fiscal and monetary support provided a lifeline to many businesses large and small, helping to reduce the nation’s unemployment rate in September, 2020, to 7.9% – still alarmingly high compared with the record-low 3.5% in February.

By the period’s end, the U.S. had reached another grim milestone of more than 230,000 coronavirus deaths. As fall cases surged, a new round of lockdowns and restrictions on economic activity, particularly in Europe, were widely adopted; however, Congress deadlocked over providing further economic stimulus. A late-period market selloff triggered by worsening virus numbers reminded investors of the potential for further economic uncertainty ahead. In addition, a contentious U.S. presidential campaign divided the nation.

As we continue to endure spikes in COVID-19 cases while awaiting the regulatory approvals and distribution of a safe and effective vaccine, uncertainty remains. In these unprecedented times, it’s more important than ever to maintain a strong relationship with your financial professional.

Thank you again for investing in Hartford Mutual Funds. For the most up-to-date information on our funds, please take advantage of all the resources available at hartfordfunds.com.

James Davey

President

Hartford Funds

| 1 | S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. |

| | The index is unmanaged and not available for direct investment. Past performance does not guarantee future results. |

Hartford Domestic Equity Funds

Table of Contents

The views expressed in each Fund’s Manager Discussion contained in the Fund Overview section are views of that Fund’s portfolio manager(s) through the end of the period and are subject to change based on market and other conditions, and we disclaim any responsibility to update the views contained herein. These views may contain statements that are “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable. Holdings and characteristics are subject to change. Fund performance reflected in each Fund’s Manager Discussion reflects the returns of such Fund’s Class A shares, before sales charges. Returns for such Fund’s other classes differ only to the extent that the classes do not have the same expenses.

|

| The Hartford Capital Appreciation Fund |

Fund Overview

October 31, 2020 (Unaudited)

| | |

Inception 07/22/1996 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

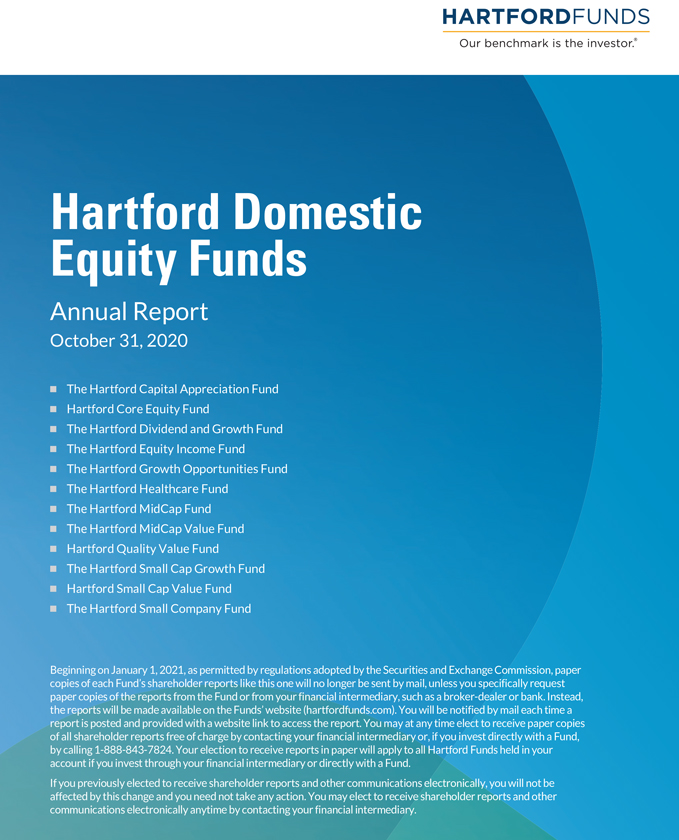

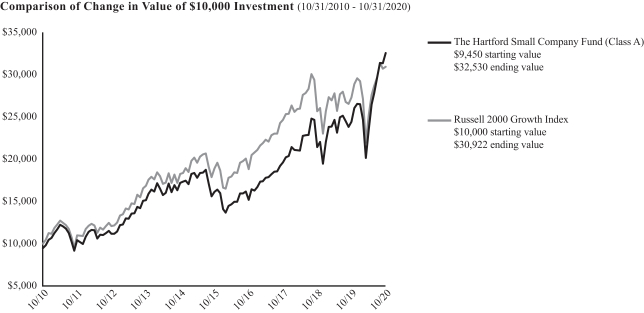

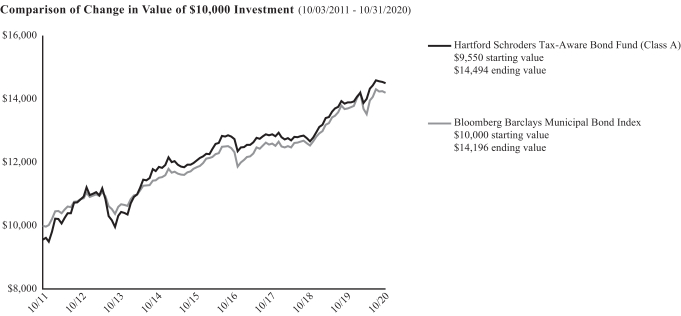

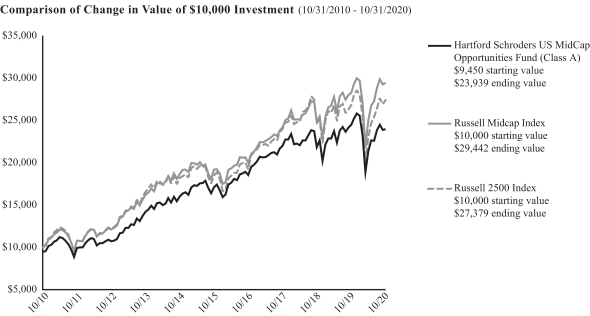

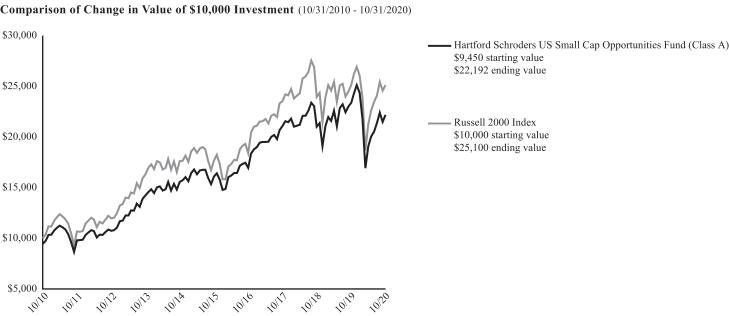

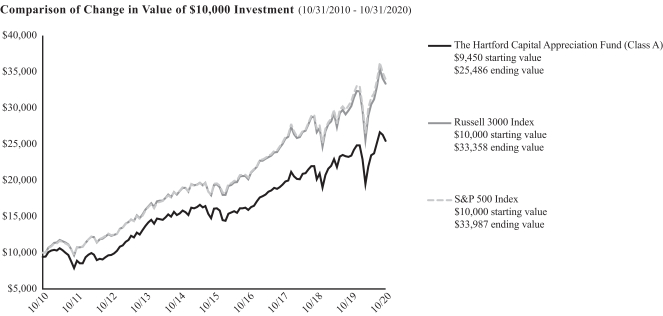

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/2020

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A1 | | | 8.62% | | | | 9.63% | | | | 10.43% | |

Class A2 | | | 2.65% | | | | 8.40% | | | | 9.81% | |

Class C1 | | | 7.78% | | | | 8.83% | | | | 9.63% | |

Class C3 | | | 6.78% | | | | 8.83% | | | | 9.63% | |

Class I1 | | | 8.94% | | | | 9.95% | | | | 10.76% | |

Class R31 | | | 8.25% | | | | 9.27% | | | | 10.09% | |

Class R41 | | | 8.59% | | | | 9.61% | | | | 10.43% | |

Class R51 | | | 8.93% | | | | 9.94% | | | | 10.76% | |

Class R61 | | | 9.03% | | | | 10.05% | | | | 10.86% | |

Class Y1 | | | 8.97% | | | | 10.02% | | | | 10.86% | |

Class F1 | | | 9.00% | | | | 10.02% | | | | 10.79% | |

Russell 3000 Index | | | 10.15% | | | | 11.48% | | | | 12.80% | |

S&P 500 Index | | | 9.71% | | | | 11.71% | | | | 13.01% | |

| 2 | Reflects maximum sales charge of 5.50% |

| 3 | Reflects a contingent deferred sales charge of 1.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/2020, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/2014. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 02/28/2017. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| | | | | | | | |

| Operating Expenses* | | Gross | | | Net | |

Class A | | | 1.08% | | | | 1.08% | |

Class C | | | 1.84% | | | | 1.84% | |

Class I | | | 0.80% | | | | 0.80% | |

Class R3 | | | 1.43% | | | | 1.43% | |

Class R4 | | | 1.12% | | | | 1.12% | |

Class R5 | | | 0.81% | | | | 0.81% | |

Class R6 | | | 0.71% | | | | 0.71% | |

Class Y | | | 0.82% | | | | 0.77% | |

Class F | | | 0.71% | | | | 0.71% | |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 02/28/2021 unless the Fund’s Board of Directors approves an earlier termination. Expenses shown include acquired fund fees and expenses. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 10/31/2020. |

|

| The Hartford Capital Appreciation Fund |

Fund Overview – (continued)

October 31, 2020 (Unaudited)

Portfolio Managers

Gregg R. Thomas, CFA

Senior Managing Director and Director, Investment Strategy

Wellington Management Company LLP

Thomas S. Simon, CFA, FRM

Senior Managing Director and Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Capital Appreciation Fund returned 8.62%, before sales charges, for the twelve-month period ended October 31, 2020, underperforming the Fund’s benchmarks, the Russell 3000 Index, which returned 10.15% for the same period, and the S&P 500 Index, which returned 9.71% for the same period. For the same period, the Class A shares of the Fund, before sales charges, outperformed the 5.35% average return of the Lipper Multi-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2020. Waning recession fears, improved trade sentiment, and accommodative U.S. Federal Reserve (Fed) policy benefited U.S. markets toward the end of 2019. In the first quarter of 2020, U.S. equities fell sharply after achieving record highs in February 2020, as the coronavirus spread rapidly throughout the country, causing unprecedented market disruptions and financial damage, and heightening fears of a severe economic downturn. Volatility surged to extreme levels, and the S&P 500 Index suffered its fastest-ever decline into a bear market. The unprecedented scale of the fiscal and monetary stimulus implemented by Congress and the Fed in response to the pandemic was the most influential driver of the market’s rebound in the second quarter of 2020. Momentum continued into the third quarter of 2020 with substantial monetary support from the Fed, a broadening U.S. economic recovery, better-than-expected corporate earnings, and promising trials for coronavirus vaccines. However, the path to a sustainable economic recovery was clouded by concerns about a resurgence in coronavirus infections in many parts of the country, an undetermined timeline for vaccines, high unemployment, elevated debt burdens, and uncertainty about additional fiscal stimulus.

Returns varied by market cap during the period, as large-cap equities, as measured by the S&P 500 Index, outperformed both mid- and small-cap equities, as measured by the S&P MidCap 400 Index and Russell 2000 Index, respectively.

Six of the eleven sectors in the Russell 3000 Index posted positive returns during the period. Strong performers included the Information Technology (+34.8%), Consumer Discretionary (+30.8%), and Communication Services (+16.2%) sectors. The Energy (-46.1%), Real Estate (-15.8%), and Financials (-15.2%) sectors fell the most during the period.

During the period, the Fund underperformed the Russell 3000 Index primarily due to weak stock selection within the Consumer Discretionary, Consumer Staples, and Financials sectors. Conversely, stronger selection within the Communication Services, Healthcare, and Information Technology sectors contributed positively to relative returns during the period. Sector allocation, a result of bottom-up stock selection, was positive during the period primarily due to the Fund’s underweight exposure to the Energy and Financials sectors in addition to an overweight to the Consumer Discretionary sector. An underweight to the Information Technology sector, as well as an overweight to the Industrials sector, relative to the Russell 3000 Index, detracted from performance.

Underweight exposures relative to the Russell 3000 Index to Apple (Information Technology), Microsoft (Information Technology), and Tesla (Consumer Discretionary) were the top detractors from Fund performance during the period. Apple designs, manufactures, and sells personal computers, tablets, wearables, and a variety of related services. Shares of Apple moved higher during the period. The company also announced that it would be participating in a 4-for-1 stock split during the period. As of the end of the period, we continued to hold the stock within the Fund but remained underweight relative to the Russell 3000 Index. Microsoft engages in the development and support of software, services, devices, and solutions. The company emerged from the coronavirus pandemic as a strong performer with stay-at-home and remote-work related businesses (Teams, Gaming, virtual desktop) gaining traction and performing well. The company’s stock continued to move higher during the period before giving back some gains after it was announced that the company’s bid for video-sharing site TikTok was not accepted. As of the end of the period, we remained underweight the stock within the Fund relative to the Russell 3000 Index. Tesla engages in the design, development, manufacture, and sale of fully electric vehicles, energy generation and storage systems. Shares of the company moved higher during the period as the company reported its fourth consecutive quarter of profitability, which many viewed as the last hurdle towards Tesla’s inclusion into the S&P 500 Index given its market cap. The stock did not make it into the S&P 500 Index, and shares dipped on the news. Towards the end of the period, the company held its Battery Day where it provided guidance in line with expectations, highlighted by expectations for a drop in battery costs, as well as plans for a $25,000 car within the next three years. We initiated a small position in the stock during the period, which we subsequently sold later in the period as we sought to capitalize on strength while pursuing other opportunities that we believe provide better risk and return profiles.

Aramark (Consumer Discretionary), Expedia (Consumer Discretionary), and Diamondback Energy (Energy) were among the largest detractors from performance on an absolute basis over the period.

|

| The Hartford Capital Appreciation Fund |

Fund Overview – (continued)

October 31, 2020 (Unaudited)

Top contributors to performance relative to the Russell 3000 Index included not holding benchmark constituent ExxonMobil (Energy) as well as the Fund’s positions in DraftKings (Consumer Discretionary) and Peloton Interactive (Consumer Discretionary). ExxonMobil engages in the exploration, development, and distribution of oil, gas, and petroleum products. Energy-related companies were adversely affected by failed negotiations between Saudi Arabia and Russia regarding production cuts amid a strong decrease in demand as coronavirus-related shelter-in-place orders limited travel globally. The Energy sector broadly was the worst-performing sector within the Russell 3000 Index during the period. Not owning the stock contributed positively to relative performance and as of the end of the period, we continued to not hold it. DraftKings is a digital sports entertainment and gaming company. The company took an unconventional route to the public markets by combining with a special purpose acquisition company (SPAC), typically referred to as a blank-check company, thus enabling the company to trade publicly without going through the initial public offering (IPO) process in April. Following its listing, the stock price has risen as sports betting revenue continued to rise following the resumption of live games across major sports leagues. Shares of the company gave up some gains late in the period after the company announced a secondary offering of shares. As of the end of the period, we continued to hold shares of DraftKings within the Fund. Peloton Interactive is an at-home fitness platform for live and on-demand indoor cycling. The company reported strong quarterly results at the beginning of 2020 with subscribers and revenues reported above expectations, but earnings guidance was revised slightly lower. As the coronavirus pandemic forced lockdown measures that included gyms and fitness studios, the company saw a large uptick in demand for its at-home offerings with subscriber growth and member engagement both trending upward. This led to consecutive quarters of outperformance relative to analyst expectations, driving the stock price higher during the period. As of the end of the period, the Fund remained overweight in the stock.

Amazon.com (Consumer Discretionary), Apple (Information Technology), and NVIDIA (Information Technology) contributed positively to performance on an absolute basis over the period.

The Fund’s investment process includes the use of factor-based strategies, which involve targeting certain company characteristics, or factors, that we believe impact returns across asset classes. Factor impact on the Fund was positive. The Fund’s slight underweight exposure to dividend paying equities and overweight exposure to names with higher liquidity contributed positively to performance, while the Fund’s slight underweight exposure to high momentum equities detracted from performance.

During the period, the Fund, at times, used equity index futures to equitize cash or efficiently manage risks. During the period, the use of equity index futures contributed slightly to performance.

What is the outlook as of the end of the period?

Macroeconomic uncertainty remains at the forefront as U.S. equity markets continue their rebound amid optimism from accommodative policy and strong earnings from index leaders, while a second wave of coronavirus infections unfolds in some states. Persistent market uncertainties – such as the outcome of the U.S. presidential election and the unknown efficacy and timeline for a coronavirus vaccine – cause us to believe that the range of potential economic outcomes is wide and

that current investor exuberance may not be long-lasting. Against this backdrop, we remain vigilant in balancing factor exposures in the Fund to seek to reduce the impact of factor volatility and help ensure that security selection drives results.

Looking across the factor landscape, we continue to monitor the risks facing equity factors amid ongoing market volatility. In 2020, trend-following factors (e.g., growth and momentum) have extended their outperformance over most other areas of the market. However, we believe valuations are stretched, and the primary risk we are monitoring is a momentum reversal, which we believe would be damaging to equities that are levered to the ongoing market rebound. For example, we have seen the outperformance of megacap technology companies dominate markets. While this streak seems set to continue, a momentum reversal could be a technical risk for these names, while any shift in the regulatory landscape could present a more fundamental risk. As of the end of the period, we maintained the Fund’s exposure to companies characterized by mean-reversion factors (e.g., value and contrarian), as we expect them to provide capital appreciation during economic recovery and in the event of a cyclical rally. That said, we are monitoring the risks these factors are exposed to, in particular the risk of insolvency in the event of a drawn-out economic slowdown. In our view, stocks that screen well for risk-aversion factors (e.g., low volatility and quality) tend to have protective characteristics such as stable profit margins and sustainable cash flows. Therefore, we see these exposures as a potential source of safety in the event of a traditional move to assets perceived to be less risky, but we are aware that they may lag the market during a strong rally. Finally, we believe that the market has not fully priced in the heightened risk that some companies become insolvent due to a prolonged economic slowdown while other companies that are able to pivot and adapt are likely to come out on top. We expect this to lead to a dispersion in equity results.

At the end of the period, the Fund’s largest overweights were to the Consumer Discretionary and Consumer Staples sectors, while the Fund’s largest underweights were to the Information Technology and Communication Services sectors, relative to the Russell 3000 Index.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. The Fund’s strategy for allocating assets among portfolio management teams may not work as intended. • Mid-cap securities can have greater risks and volatility than large-cap securities. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. These risks are generally greater for investments in emerging markets. • The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

|

| The Hartford Capital Appreciation Fund |

Fund Overview – (continued)

October 31, 2020 (Unaudited)

Composition by Sector(1)

as of 10/31/2020

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 6.8 | % |

Consumer Discretionary | | | 17.9 | |

Consumer Staples | | | 10.9 | |

Energy | | | 0.2 | |

Financials | | | 7.9 | |

Health Care | | | 16.2 | |

Industrials | | | 12.2 | |

Information Technology | | | 19.0 | |

Materials | | | 3.1 | |

Real Estate | | | 3.8 | |

Utilities | | | 0.4 | |

| | | | |

Total | | | 98.4 | % |

| | | | |

Short-Term Investments | | | 1.4 | |

Other Assets & Liabilities | | | 0.2 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Core Equity Fund |

Fund Overview

October 31, 2020 (Unaudited)

| | |

Inception 04/30/1998 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

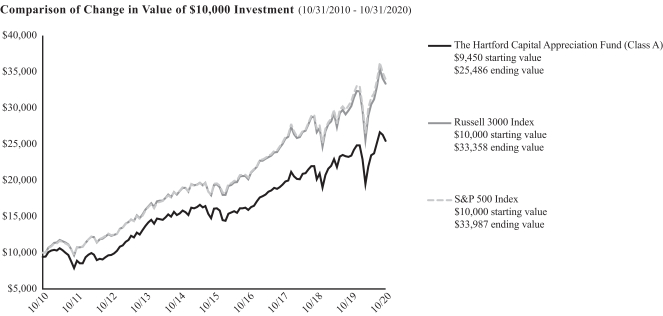

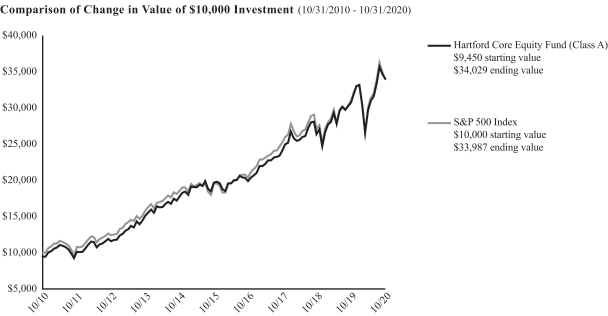

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/2020

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A1 | | | 10.58% | | | | 11.57% | | | | 13.67% | |

Class A2 | | | 4.50% | | | | 10.31% | | | | 13.03% | |

Class C1 | | | 9.74% | | | | 10.74% | | | | 12.84% | |

Class C3 | | | 8.74% | | | | 10.74% | | | | 12.84% | |

Class I1 | | | 10.87% | | | | 11.86% | | | | 13.84% | |

Class R31 | | | 10.17% | | | | 11.19% | | | | 13.36% | |

Class R41 | | | 10.58% | | | | 11.56% | | | | 13.73% | |

Class R51 | | | 10.85% | | | | 11.87% | | | | 14.05% | |

Class R61 | | | 10.96% | | | | 11.96% | | | | 14.12% | |

Class Y1 | | | 10.89% | | | | 11.92% | | | | 14.10% | |

Class F1 | | | 10.97% | | | | 11.94% | | | | 13.88% | |

S&P 500 Index | | | 9.71% | | | | 11.71% | | | | 13.01% | |

| 2 | Reflects maximum sales charge of 5.50% |

| 3 | Reflects a contingent deferred sales charge of 1.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/2020, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class I shares commenced operations on 03/31/2015. Performance prior to that date is that of the Fund’s Class A shares (excluding sales charges). Class R6 shares commenced operations on 03/31/2015 and performance prior to that date is that of the Fund’s Class Y

shares. Class F shares commenced operations on 02/28/2017. Performance for Class F shares prior to 02/28/2017 reflects the performance of Class I shares from 03/31/2015 through 02/27/2017 and Class A shares (excluding sales charges) prior to 03/31/2015.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| | | | | | | | |

| Operating Expenses* | | Gross | | | Net | |

Class A | | | 0.74% | | | | 0.74% | |

Class C | | | 1.48% | | | | 1.48% | |

Class I | | | 0.47% | | | | 0.47% | |

Class R3 | | | 1.11% | | | | 1.11% | |

Class R4 | | | 0.78% | | | | 0.78% | |

Class R5 | | | 0.49% | | | | 0.49% | |

Class R6 | | | 0.39% | | | | 0.39% | |

Class Y | | | 0.49% | | | | 0.46% | |

Class F | | | 0.39% | | | | 0.39% | |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 02/28/2021 unless the Fund’s Board of Directors approves an earlier termination. Expenses shown include acquired fund fees and expenses. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 10/31/2020. |

|

| Hartford Core Equity Fund |

Fund Overview – (continued)

October 31, 2020 (Unaudited)

Portfolio Managers

Mammen Chally, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Douglas W. McLane, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

David A. Siegle, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of the Hartford Core Equity Fund returned 10.58%, before sales charges, for the twelve-month period ended October 31, 2020, outperforming the Fund’s benchmark, the S&P 500 Index, which returned 9.71% for the same period. For the same period, the Class A shares of the Fund, before sales charges, also outperformed the 8.39% average return of the Lipper Large-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2020. Waning recession fears, improved trade sentiment, and accommodative U.S. Federal Reserve (Fed) policy benefited U.S. markets toward the end of 2019. In the first quarter of 2020, U.S. equities fell sharply after achieving record highs in February 2020, as the coronavirus spread rapidly throughout the country, causing unprecedented market disruptions and financial damage, and heightening fears of a severe economic downturn. The U.S. had approximately 188,000 confirmed cases of the coronavirus at the end of March 2020, surpassing all other countries. Volatility surged to extreme levels, and the S&P 500 Index suffered its fastest-ever decline into a bear market. The unprecedented scale of the fiscal and monetary stimulus implemented by Congress and the Fed in response to the pandemic was the most influential driver of the market’s rebound in the second quarter of 2020. Momentum continued into the third quarter of 2020 with substantial monetary support from the Fed, a broadening U.S. economic recovery, better-than-expected corporate earnings, and promising trials for coronavirus vaccines. However, the path to a sustainable economic recovery was clouded by concerns about a resurgence in coronavirus infections in many areas of the country, an undetermined timeline for vaccines, high unemployment, elevated debt burdens, and uncertainty about additional fiscal stimulus.

Returns varied by market cap during the period, as large-cap equities, as measured by the S&P 500 Index, outperformed small-cap and mid-cap equities, as measured by the Russell 2000 Index and S&P MidCap 400 Index, respectively.

Seven out of eleven sectors in the S&P 500 Index rose during the period, with the Information Technology (+34%) and Consumer Discretionary

(+25%) sectors performing the best. The Energy (-46%) and Financials (-15%) sectors were the worst performers during the period.

Overall, the Fund’s outperformance versus the S&P 500 Index during the period was driven by strong security selection, primarily within the Consumer Staples, Healthcare, and Industrials sectors. This was partially offset by weaker stock selection within the Information Technology, Consumer Discretionary, and Financials sectors, which detracted from performance. Sector allocation, a result of the bottom-up stock selection process, also contributed positively to relative performance, primarily driven by the Fund’s underweight to the Energy sector and overweight allocation to the Healthcare sector. This was partially offset by the Fund’s underweight to Information Technology, which detracted from performance.

The top contributors to relative performance over the period were not owning benchmark constituents ExxonMobil (Energy) and Wells Fargo (Financials), as well as an overweight position in FedEx (Industrials). Shares of ExxonMobil fell over the period following weak results and low oil prices as a result of the coronavirus. Exxon missed second-quarter 2020 earnings expectations after reporting a loss north of $1 billion, revenue of $32.6 billion that was $6 billion less than consensus, and a 10% quarter-over-quarter cut in production as the coronavirus pandemic pressured demand for the company’s products. Not owning the stock was a contributor to relative performance over the period due to its poor performance. Shares of Wells Fargo declined over the period after reporting consecutive disappointing quarterly results. In July 2020, the company announced it set aside a record $9.5 billion for credit losses. Executives warned they would earmark more for soured loans as the coronavirus pandemic continued to rage throughout the U.S. and weigh on companies and workers. Falling yields have also negatively affected the bank. Not owning the stock was also a contributor to relative performance over the period due to poor performance. Shares of delivery services company, FedEx, rose over the period after the company announced two consecutive fiscal quarters of strong earnings as online shopping soared among customers avoiding stores. The company also announced that shipping rates would increase for FedEx Express, FedEx Ground, and FedEx Freights in January 2021. During the period, we initiated a position in the company for the Fund. Top absolute contributors included Apple (Information Technology) and Amazon.com (Consumer Discretionary).

The top detractors from the Fund’s relative performance over the period included not owning benchmark constituent, Nvidia (Information

|

| Hartford Core Equity Fund |

Fund Overview – (continued)

October 31, 2020 (Unaudited)

Technology), an overweight position in Boston Properties (Real Estate), and an underweight position in Apple (Information Technology). U.S. chip maker Nvidia reported consecutive better-than-expected quarterly fiscal earnings. Overall revenue rose 50% on an annualized basis in the second quarter of 2020. Nvidia also announced its plan to purchase Arm from Softbank for $40 billion. Not owning the stock during the period was a detractor from the Fund’s performance due to the stock’s strong performance. Shares of Apple rose during the period after it reported consecutive strong quarterly results. Demand across all the company’s products has exceeded expectations during the period. The company benefited from a strong launch of the iPhone SE and economic stimulus measures. Apple executed a 4-for-1 stock split at the end of August. As of the end of the period, the Fund remains underweight given Apple’s size in the benchmark. Shares of Boston Properties declined over the period. Due to the stay-at-home policies during the period, physical occupancy within the company’s properties has been low. The Fund’s absolute detractors for the period included Boston Properties (Real Estate) and Raytheon (Industrials).

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

In the next few months, we will know a lot more about whether we will have a vaccine and treatment options to reduce the hospitalization and mortality rate for COVID-19. While we can see additional flare-ups, our base case assumption is that we can return to a new normal towards the end of 2021.

Outside of the U.S., there are still parts of the world where the incidence of cases has not stabilized, and in some areas, it does appear that the peak for the pandemic may still be many weeks or even months away. Unfortunately, a lot of uncertainty remains. We are spending more time understanding the possible permanent or semi-permanent changes to behavior, both from a consumer and corporate perspective, and what that might mean for some of the Fund’s holdings. However, it seems too early to come to firm conclusions.

We continue to stay focused on the long term as eventually we will put this health crisis behind us. While we did make some changes within the Fund, we continue to be incremental and mindful of the impact of volatility.

At the end of the period, the Fund’s largest overweight sectors relative to the S&P 500 Index were to the Consumer Staples and Industrials sectors, while the Fund’s largest underweights were to the Consumer Discretionary and Energy sectors, relative to the S&P 500 Index.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.

Composition by Sector(1)

as of 10/31/2020

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 10.3 | % |

Consumer Discretionary | | | 10.1 | |

Consumer Staples | | | 9.8 | |

Energy | | | 0.7 | |

Financials | | | 9.6 | |

Health Care | | | 14.3 | |

Industrials | | | 8.8 | |

Information Technology | | | 26.4 | |

Materials | | | 2.0 | |

Real Estate | | | 1.8 | |

Utilities | | | 3.2 | |

| | | | |

Total | | | 97.0 | % |

| | | | |

Short-Term Investments | | | 1.8 | |

Other Assets & Liabilities | | | 1.2 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| The Hartford Dividend and Growth Fund |

Fund Overview

October 31, 2020 (Unaudited)

| | |

Inception 07/22/1996 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

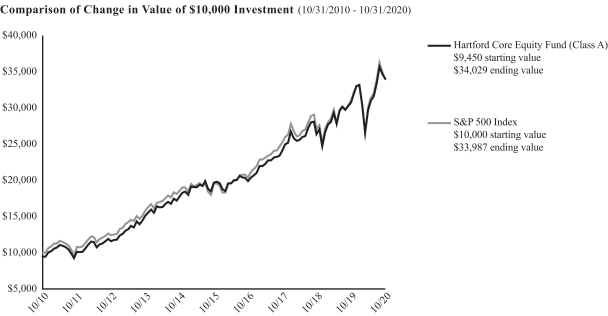

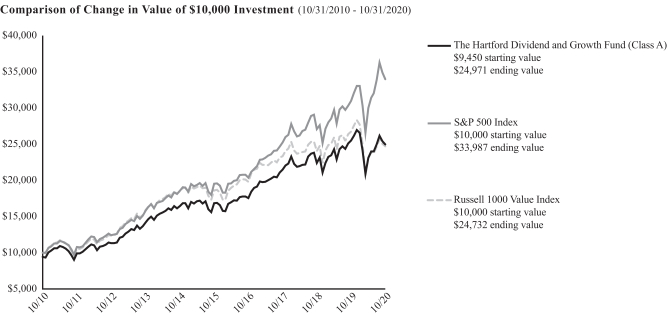

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/2020

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A1 | | | -2.20% | | | | 8.15% | | | | 10.20% | |

Class A2 | | | -7.58% | | | | 6.94% | | | | 9.58% | |

Class C1 | | | -3.01% | | | | 7.33% | | | | 9.38% | |

Class C3 | | | -3.95% | | | | 7.33% | | | | 9.38% | |

Class I1 | | | -1.97% | | | | 8.42% | | | | 10.47% | |

Class R31 | | | -2.54% | | | | 7.78% | | | | 9.85% | |

Class R41 | | | -2.26% | | | | 8.11% | | | | 10.19% | |

Class R51 | | | -1.97% | | | | 8.44% | | | | 10.52% | |

Class R61 | | | -1.87% | | | | 8.53% | | | | 10.62% | |

Class Y1 | | | -1.91% | | | | 8.51% | | | | 10.61% | |

Class F1 | | | -1.89% | | | | 8.49% | | | | 10.51% | |

S&P 500 Index | | | 9.71% | | | | 11.71% | | | | 13.01% | |

Russell 1000 Value Index | | | -7.57% | | | | 5.82% | | | | 9.48% | |

| 2 | Reflects maximum sales charge of 5.50% |

| 3 | Reflects a contingent deferred sales charge of 1.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/2020, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/2014. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 02/28/2017. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| | | | | | | | |

| Operating Expenses* | | Gross | | | Net | |

Class A | | | 1.01% | | | | 1.01% | |

Class C | | | 1.78% | | | | 1.78% | |

Class I | | | 0.75% | | | | 0.75% | |

Class R3 | | | 1.37% | | | | 1.37% | |

Class R4 | | | 1.05% | | | | 1.05% | |

Class R5 | | | 0.75% | | | | 0.75% | |

Class R6 | | | 0.66% | | | | 0.66% | |

Class Y | | | 0.75% | | | | 0.69% | |

Class F | | | 0.65% | | | | 0.65% | |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 02/28/2021 unless the Fund’s Board of Directors approves an earlier termination. Expenses shown include acquired fund fees and expenses. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 10/31/2020. |

|

| The Hartford Dividend and Growth Fund |

Fund Overview – (continued)

October 31, 2020 (Unaudited)

Portfolio Managers

Matthew G. Baker

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Nataliya Kofman

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Dividend and Growth Fund returned -2.20%, before sales charges, for the twelve-month period ended October 31, 2020, underperforming one of the Fund’s benchmarks, the S&P 500 Index, which returned 9.71% for the same period, and outperforming the Fund’s other benchmark, the Russell 1000 Value Index, which returned -7.57% for the same period. For the same period, the Class A shares of the Fund, before sales charges, outperformed the -5.44% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2020. Waning recession fears, improved trade sentiment, and accommodative U.S. Federal Reserve (Fed) policy benefited U.S. markets toward the end of 2019. In the first quarter of 2020, U.S. equities fell sharply after achieving record highs in February 2020, as the coronavirus spread rapidly throughout the country, causing unprecedented market disruptions and financial damage, and heightening fears of a severe economic downturn. The U.S. had approximately 188,000 confirmed cases of the coronavirus at the end of March 2020, surpassing all other countries. Volatility surged to extreme levels, and the S&P 500 Index suffered its fastest-ever decline into a bear market. The unprecedented scale of the fiscal and monetary stimulus implemented by Congress and the Fed in response to the pandemic was the most influential driver of the market’s rebound in the second quarter of 2020. Momentum continued into the third quarter of 2020 with substantial monetary support from the Fed, a broadening U.S. economic recovery, better-than-expected corporate earnings, and promising trials for coronavirus vaccines. However, the path to a sustainable economic recovery was clouded by concerns about a resurgence in coronavirus infections in many areas of the country, an undetermined timeline for vaccines, high unemployment, elevated debt burdens, and uncertainty about additional fiscal stimulus.

Returns varied by market cap during the period, as large-cap equities, measured by the S&P 500 Index, outperformed mid- and small-cap equities, as measured by the S&P MidCap 400 Index and Russell 2000 Index, respectively.

Seven out of eleven sectors in the S&P 500 Index rose during the period, with the Information Technology (+34%), Consumer Discretionary (+25%), and Communication Services (+16%) sectors performing the best. The Energy (-46%), Financials (-15%), and Real Estate (-10%) sectors were the worst performers during the period.

Security selection detracted from the Fund’s returns relative to the S&P 500 Index over the period. Stock selection effects were weakest within the Information Technology, Consumer Discretionary, and Communication Services sectors. This was partially offset by stronger selection within the Energy sector, which contributed positively to performance relative to the S&P 500 Index. Sector allocation, a result of the bottom-up stock selection process, detracted from the Fund’s performance relative to the S&P 500 Index over the period. An overweight to the Energy and Financials sectors, as well as an underweight to the Information Technology sector, detracted the most from returns relative to the S&P 500 Index.

The Fund’s top detractors from the Fund’s performance relative to the S&P 500 Index as well as absolute performance included not owning Amazon (Consumer Discretionary), an underweight to Apple (Information Technology), and an overweight to Bank of America (Financials). Not holding S&P 500 Index constituent Amazon (Consumer Discretionary), was a top relative detractor from performance during the period as shares of the company rose during the period. An underweight to Apple (Information Technology) was the other significant relative detractor from performance during the period as shares of Apple rose during the period. During the period, we maintained the Fund’s underweight in the company. Shares of Bank of America fell as coronavirus worries sent Treasury yields lower. Thirty-year U.S. Treasury notes fell to record low yields, and 10-year U.S. Treasury notes fell to levels not seen since 2016, narrowing the spread on the bank’s longer-term assets funded with shorter-term liabilities.

The Fund’s top contributors to performance relative to the S&P 500 Index during the period were ExxonMobil (Energy) and Eli Lilly (Healthcare), both of which were eliminated during the period, and not owning Wells Fargo (Financials). ExxonMobil (Energy) was a top contributor to relative performance during the period, as we exited the position prior to the energy market collapse in March 2020. Eli Lilly (Healthcare) was the other top contributor to relative performance over the period. Shares of Eli Lilly rose after the company reported strong results and news that it was entering into an agreement to develop an experimental therapy to combat coronavirus. We reduced the Fund’s position on the stock’s strong performance late spring and eliminated the position in early June. We benefited from not owning the shares in the Fund later in the period as the company has lagged the strong market rally. Shares of Wells Fargo fell over the period after the chief financial officer predicted higher loan-loss provisions in addition to a sharp drop in interest income for the year.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

|

| The Hartford Dividend and Growth Fund |

Fund Overview – (continued)

October 31, 2020 (Unaudited)

What is the outlook as of the end of the period?

Although the market continued to climb higher in the third quarter of 2020, we are wrestling with many unknowns in the short term. While large amounts of liquidity have been pumped into the market to try and safeguard consumer spending, we are still facing high rates of unemployment and each day are reminded of the increasing number of coronavirus cases. During these turbulent times, we believe it is best to try to avoid balance sheet risk while seeking to identify mispriced opportunities that can potentially create enormous value on the other side of the pandemic.

In the face of great uncertainty, we remain focused on seeking to invest in companies at reasonable valuations, with attractive long-term free cash flow generation, solid balance sheets, and resilient fundamentals.

At the end of the period, the Fund had its largest overweights in the Financials and Healthcare sectors, and the largest underweights in the Information Technology and Consumer Discretionary sectors, relative to the S&P 500 Index.

We continue to apply our valuation discipline within the Fund to seek to maintain a portfolio of resilient businesses that are reasonably valued and have favorable industry and competitive dynamics.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments.

Composition by Sector(1)

as of 10/31/2020

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 9.2 | % |

Consumer Discretionary | | | 6.7 | |

Consumer Staples | | | 6.0 | |

Energy | | | 3.7 | |

Financials | | | 17.2 | |

Health Care | | | 15.5 | |

Industrials | | | 9.4 | |

Information Technology | | | 18.7 | |

Materials | | | 4.0 | |

Real Estate | | | 2.5 | |

Utilities | | | 4.0 | |

| | | | |

Total | | | 96.9 | % |

| | | | |

Short-Term Investments | | | 1.9 | |

Other Assets & Liabilities | | | 1.2 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| The Hartford Equity Income Fund |

Fund Overview

October 31, 2020 (Unaudited)

| | |

Inception 08/28/2003 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

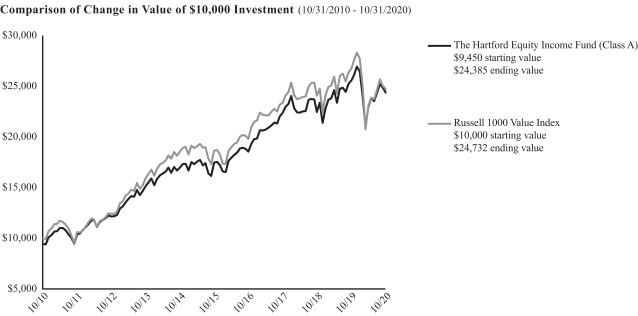

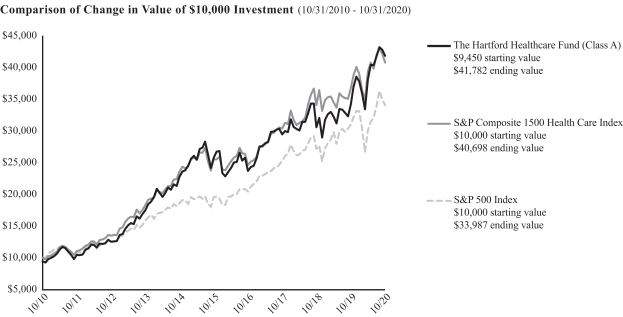

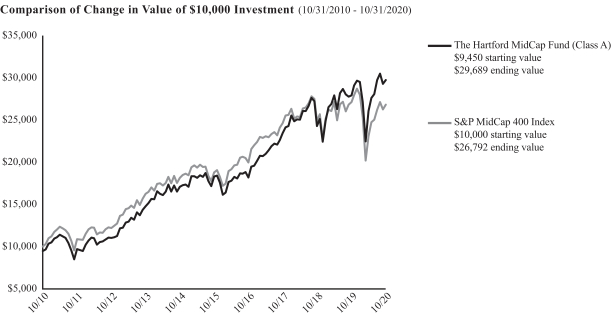

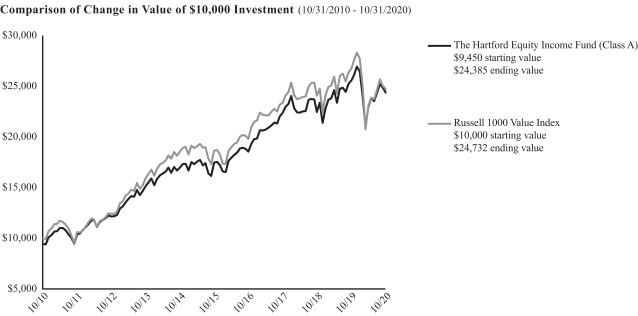

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/2020

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A1 | | | -4.68% | | | | 6.89% | | | | 9.94% | |

Class A2 | | | -9.92% | | | | 5.69% | | | | 9.32% | |

Class C1 | | | -5.38% | | | | 6.11% | | | | 9.14% | |

Class C3 | | | -6.26% | | | | 6.11% | | | | 9.14% | |

Class I1 | | | -4.44% | | | | 7.16% | | | | 10.24% | |

Class R31 | | | -4.97% | | | | 6.52% | | | | 9.57% | |

Class R41 | | | -4.72% | | | | 6.84% | | | | 9.90% | |

Class R51 | | | -4.46% | | | | 7.15% | | | | 10.23% | |

Class R61 | | | -4.34% | | | | 7.27% | | | | 10.35% | |

Class Y1 | | | -4.40% | | | | 7.23% | | | | 10.33% | |

Class F1 | | | -4.31% | | | | 7.24% | | | | 10.28% | |

Russell 1000 Value Index | | | -7.57% | | | | 5.82% | | | | 9.48% | |

| 2 | Reflects maximum sales charge of 5.50% |

| 3 | Reflects a contingent deferred sales charge of 1.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/2020, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/2014. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 02/28/2017. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| | | | | | | | |

| Operating Expenses* | | Gross | | | Net | |

Class A | | | 1.00% | | | | 1.00% | |

Class C | | | 1.76% | | | | 1.76% | |

Class I | | | 0.76% | | | | 0.76% | |

Class R3 | | | 1.36% | | | | 1.36% | |

Class R4 | | | 1.07% | | | | 1.07% | |

Class R5 | | | 0.76% | | | | 0.76% | |

Class R6 | | | 0.66% | | | | 0.66% | |

Class Y | | | 0.77% | | | | 0.72% | |

Class F | | | 0.66% | | | | 0.66% | |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 02/28/2021 unless the Fund’s Board of Directors approves an earlier termination. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 10/31/2020. |

|

| The Hartford Equity Income Fund |

Fund Overview – (continued)

October 31, 2020 (Unaudited)

Portfolio Managers

W. Michael Reckmeyer, III, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Adam H. Illfelder, CFA

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew C. Hand, CFA

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Equity Income Fund returned -4.68%, before sales charges, for the twelve-month period ended October 31, 2020, outperforming the Fund’s benchmark, the Russell 1000 Value Index, which returned -7.57% for the same period. For the same period, the Class A shares of the Fund, before sales charges, also outperformed the -5.44% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to that of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2020. Waning recession fears, improved trade sentiment, and accommodative U.S. Federal Reserve (Fed) policy benefited U.S. markets toward the end of 2019. In the first quarter of 2020, U.S. equities fell sharply as the coronavirus spread rapidly throughout the country, causing unprecedented market disruptions and financial damage, and heightening fears of a severe economic downturn. The U.S. had approximately 188,000 confirmed cases of the coronavirus at the end of March 2020, surpassing all other countries. Volatility surged to extreme levels, and the S&P 500 Index suffered its fastest-ever decline into a bear market. The unprecedented scale of the fiscal and monetary stimulus implemented by Congress and the Fed in response to the pandemic was the most influential driver of the market’s rebound in the second quarter of 2020. Momentum continued into the third quarter of 2020 with substantial monetary support from the Fed, a broadening U.S. economic recovery, better-than-expected corporate earnings, and promising trials for coronavirus vaccines. However, the path to a sustainable economic recovery was clouded by concerns about a resurgence in coronavirus infections in many areas of the country, an undetermined timeline for vaccines, high unemployment, elevated debt burdens, and uncertainty about additional fiscal stimulus.

During the period, four out of eleven sectors within the Russell 1000 Value Index posted positive absolute returns, with the Healthcare (+11%), Materials (+9%), and Consumer Staples (+4%) sectors performing the best. Conversely, the Energy (-46%), Real Estate (-22%), and Financials (-18%) sectors lagged over the period.

The Fund’s outperformance relative to the Russell 1000 Value Index was driven by security selection, primarily within the Financials, Real Estate,

and Industrials sectors. This more than offset less favorable selection within the Healthcare, Utilities, and Consumer Staples sectors. Sector allocation, a result of our bottom-up stock selection process, also contributed positively to relative performance due to the Fund’s overweight to the Healthcare sector and underweights to the Real Estate and Financials sectors. This was partially offset by the Fund’s underweight position in the Materials sector.

Top contributors to relative returns included not owning benchmark constituent Wells Fargo (Financials) as well as the Fund’s positions in UnitedHealth Group (Healthcare) and Deere (Industrials). Shares of Well Fargo dropped after the company reported a loss in the second quarter of 2020 driven by large loan loss provisions which more than doubled first-quarter 2020 levels. After falling in the first quarter of 2020 amid the broader market selloff, shares of UnitedHealth Group rebounded on strong second-quarter earnings, with earnings per share (EPS) up 100% year-over-year, beating the consensus expectations by a significant amount. Performance was driven by lower utilization and a significant decline in the medical loss ratio. Shares of Deere rose over the period after the company announced strong third-quarter 2020 results, which exceeded expectations. The agricultural machinery giant increased its sales outlook for the year as demand remained resilient despite the uncertainty related to coronavirus. The company also announced the completion of the acquisition of Unimil, a leading Brazilian company in the aftermarket service parts business.

Top detractors from relative results included Suncor Energy (Energy) and Phillips 66 (Energy), along with not owning benchmark constituent Danaher (Healthcare). Suncor Energy is a Canadian company primarily focused on developing petroleum resource basins. The company’s stock price slid as the company cut its dividend and lowered guidance for full-year production as a result of mandatory curtailments. At the start of September 2020, Suncor lowered guidance again after a fire broke out at their Fort McMurray facility, resulting in the acceleration of proposed maintenance. Shares of Phillips 66 traded lower as earnings fell in the second quarter of 2020, primarily due to a decline in results in the refining segment as margins and volume shrank. The stock continued to trend downward through the rest of the period. Shares of Danaher, a provider of medical equipment, climbed early in 2020 on the announcement of a deal to acquire General Electric’s biopharma unit, putting Danaher at the forefront of biotech equipment makers. Strong earnings and the announced split-off of dental business Envista further benefited the stock.

|

| The Hartford Equity Income Fund |

Fund Overview – (continued)

October 31, 2020 (Unaudited)

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

It is our belief that high-quality businesses with sustainable dividend policies are in an advantageous position to strengthen as they emerge from a downturn – taking market share, or, in some cases, making opportunistic acquisitions at attractive valuations. This is embodied in a quote we often reference: “The strong get stronger in crisis situations.”

To this end, amid the heightened market volatility, we have been exercising patience and, where possible, seeking to swap into higher quality companies at similar valuations. While we believe that the near-term threat of dividend cuts and suspensions has abated relative to earlier in the year, we remain vigilant, seeking to avoid potential dividend cutters and the companies that would be most directly impacted in a prolonged shutdown. In some instances, we have closely monitored the possibility of companies suspending a dividend temporarily as a measure to improve solvency. While this seems prudent in many cases, we prefer to avoid this contingency where possible, and favor companies with strong balance sheets that we believe can endure through the cycle.

At the end of the period, the Healthcare, Consumer Staples, and Industrials sectors represented the Fund’s largest overweights relative to the Russell 1000 Value Index, while the Communication Services, Consumer Discretionary, and Materials sectors were the Fund’s largest underweights.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. • Different investment styles may go in and out favor, which may cause the Fund to underperform the broader stock market. • The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

Composition by Sector(1)

as of 10/31/2020

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Communication Services | | | 5.4 | % |

Consumer Discretionary | | | 5.0 | |

Consumer Staples | | | 10.7 | |

Energy | | | 3.3 | |

Financials | | | 18.2 | |

Health Care | | | 17.0 | |

Industrials | | | 15.0 | |

Information Technology | | | 10.7 | |

Materials | | | 2.8 | |

Real Estate | | | 2.7 | |

Utilities | | | 7.6 | |

| | | | |

Total | | | 98.4 | % |

| | | | |

Short-Term Investments | | | 0.7 | |

Other Assets & Liabilities | | | 0.9 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| The Hartford Growth Opportunities Fund |

Fund Overview

October 31, 2020 (Unaudited)

| | |

Inception 03/31/1963 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks capital appreciation. |

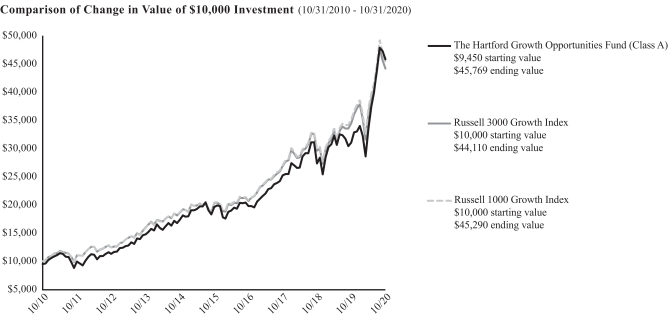

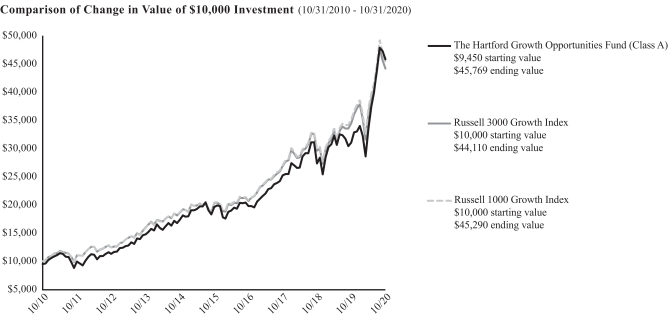

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 10/31/2020

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A1 | | | 47.77% | | | | 18.53% | | | | 17.09% | |

Class A2 | | | 39.64% | | | | 17.20% | | | | 16.43% | |

Class C1 | | | 46.72% | | | | 17.65% | | | | 16.24% | |

Class C3 | | | 45.72% | | | | 17.65% | | | | 16.24% | |

Class I1 | | | 48.19% | | | | 18.83% | | | | 17.38% | |

Class R31 | | | 47.28% | | | | 18.13% | | | | 16.73% | |

Class R41 | | | 47.74% | | | | 18.49% | | | | 17.08% | |

Class R51 | | | 48.15% | | | | 18.84% | | | | 17.43% | |

Class R61 | | | 48.26% | | | | 18.97% | | | | 17.54% | |

Class Y1 | | | 48.18% | | | | 18.93% | | | | 17.53% | |

Class F1 | | | 48.32% | | | | 18.92% | | | | 17.43% | |

Russell 3000 Growth Index | | | 28.20% | | | | 16.84% | | | | 16.00% | |

Russell 1000 Growth Index | | | 29.22% | | | | 17.32% | | | | 16.31% | |

| 2 | Reflects maximum sales charge of 5.50% |

| 3 | Reflects a contingent deferred sales charge of 1.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on 10/31/2020, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class R6 shares commenced operations on 11/07/2014. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 02/28/2017. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect historical or current expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| | | | | | | | |

| Operating Expenses* | | Gross | | | Net | |

Class A | | | 1.13% | | | | 1.13% | |

Class C | | | 1.88% | | | | 1.88% | |

Class I | | | 0.86% | | | | 0.86% | |

Class R3 | | | 1.48% | | | | 1.48% | |

Class R4 | | | 1.17% | | | | 1.17% | |

Class R5 | | | 0.87% | | | | 0.87% | |

Class R6 | | | 0.76% | | | | 0.76% | |

Class Y | | | 0.86% | | | | 0.80% | |

Class F | | | 0.76% | | | | 0.76% | |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 02/28/2021 unless the Fund’s Board of Directors approves an earlier termination. Expenses shown include acquired fund fees and expenses. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 10/31/2020. |

|

| The Hartford Growth Opportunities Fund |

Fund Overview – (continued)

October 31, 2020 (Unaudited)

Portfolio Managers

Stephen Mortimer

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Mario E. Abularach, CFA, CMT

Senior Managing Director and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Growth Opportunities Fund returned 47.77%, before sales charges, for the twelve-month period ended October 31, 2020, outperforming the Fund’s benchmarks, the Russell 3000 Growth Index, which returned 28.20% for the same period and the Russell 1000 Growth Index, which returned 29.22% for the same period. For the same period, the Class A shares of the Fund, before sales charges, outperformed the 27.08% average return of the Lipper Multi-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2020. Mid-cap growth equities outperformed the broader market during this period. In the first quarter of 2020, U.S. equities fell sharply as the coronavirus spread rapidly throughout the country, causing unprecedented market disruptions and financial damage, and heightening fears of a severe economic downturn. Many states adopted extraordinary measures to fight the contagion, while companies shuttered stores and production, withdrew earnings guidance, and drew down credit lines at a record pace as borrowing costs soared. Volatility surged to extreme levels, and the S&P 500 Index suffered its fastest-ever decline into a bear market. The unprecedented scale of fiscal and monetary stimulus implemented by Congress and the U.S. Federal Reserve (Fed) in response to the pandemic drove the market’s rebound in the second quarter of 2020. Momentum carried into the third quarter of 2020, bolstered by substantial monetary support from the Fed, a broadening U.S. economic recovery and promising trials for coronavirus vaccines. However, the path to sustainable economic recovery was clouded by concerns about a resurgence in coronavirus infections around the country, an undetermined timeline for vaccines, high unemployment, elevated debt burdens, and uncertainty about additional fiscal stimulus.

Eight out of eleven sectors in the Russell 3000 Growth Index rose during the period, with the Consumer Discretionary (+43%), Information Technology (+42%), and Communication Services (+32%) sectors performing the best. Conversely, the Energy (-32%) and Utilities (-10%) sectors lagged on a relative basis during the period.

Security selection contributed positively to the Fund’s performance relative to the Russell 3000 Growth Index during the period, with strong selection in the Information Technology, Healthcare and Industrials sectors, which was partially offset by weaker selection within the Financials and Consumer Discretionary sectors. Sector allocation, a

result of our bottom-up stock selection process, also contributed positively to performance relative to the Russell 3000 Growth Index during the period, due to an overweight to the Consumer Discretionary sector and lack of exposure to the Real Estate sector. This was partially offset by the negative impact of an underweight to the Information Technology sector, which detracted from performance.

Top contributors to performance relative to the Russell 3000 Growth Index during the period included Peloton (Consumer Discretionary), Square (Information Technology), and Advanced Micro Devices (Information Technology). Shares of Peloton, an exercise equipment and media company, rose over the period as the company has continued to see strong earnings reports throughout the coronavirus pandemic. Gym closures and continued fears of coronavirus have led to increased confidence in the theme of people being more open to working out at home as consumers look for alternatives to gyms. We increased the Fund’s position during the period. Shares of Square, a mobile payments provider, rose during the period. The company has seen strong earnings through the coronavirus pandemic. Its peer-to-peer Cash App helped drive Square’s performance, benefiting from its users depositing government stimulus checks. Unemployment checks and tax refunds have provided an additional boost for the app as well. Shares of Advanced Micro Devices, a semiconductor company, rose over the period after the Trump administration announced a phase one trade deal with China, removing a big obstacle for the company. The company also cited better-than-expected personal computer (PC) sales in the second half of the year, along with continued data-center growth and an increase in gaming console sales. The company has further benefited from Intel’s delay of its 7nm processors. Amazon (Consumer Discretionary) and Apple (information technology) were among the top absolute contributors during the period.

Top relative detractors from performance relative to the Russell 3000 Growth Index during the period included Pinterest (Communication Services), Microsoft (Information Technology), and Galapagos (Healthcare). Pinterest saw strong user growth in late 2019; however, the majority of new users came from international countries where users generate less revenue than those in the U.S. We eliminated the position within the Fund during the period. The Fund’s lack of exposure to Microsoft detracted from performance. Shares of Microsoft rose over the period on continued strong earnings reports and strengthened core offerings, such as the Azure cloud-computing business and Teams collaboration software which benefited from the work-from-home orders. Shares of Galapagos declined after the U.S. Food and Drug Administration (FDA) issued a complete response letter for filgotinib, a treatment for moderate to severe rheumatoid arthritis being developed in partnership with Gilead Sciences. A complete response letter is issued when the FDA has completed its review of a drug and has decided that it

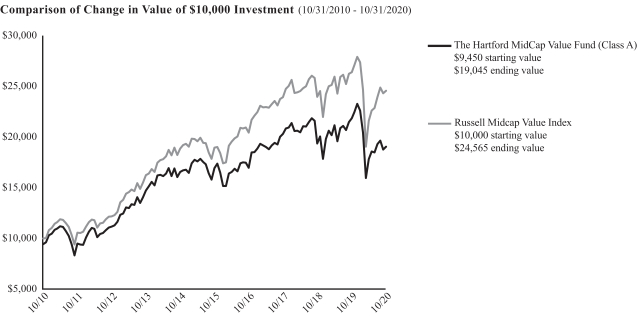

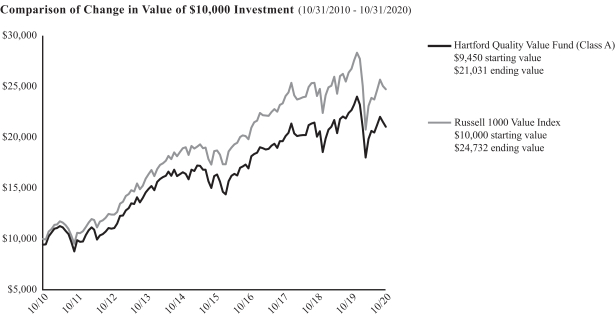

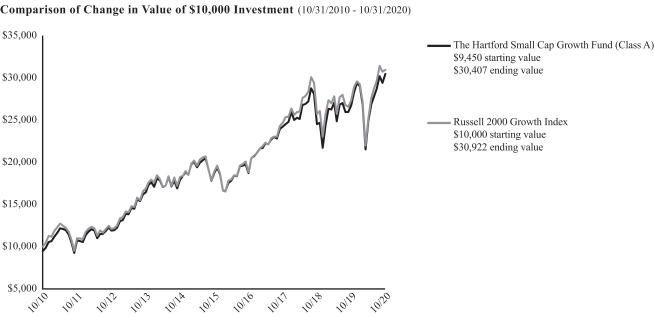

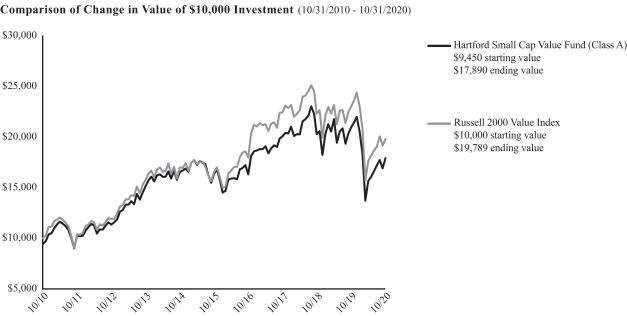

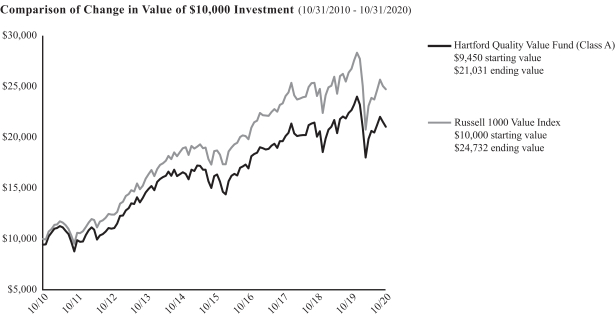

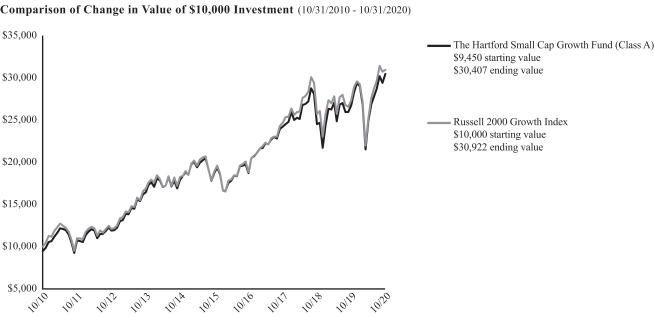

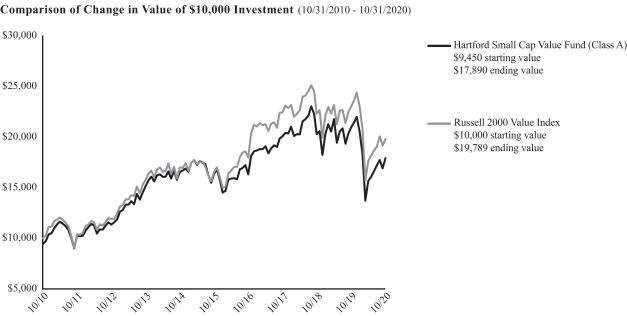

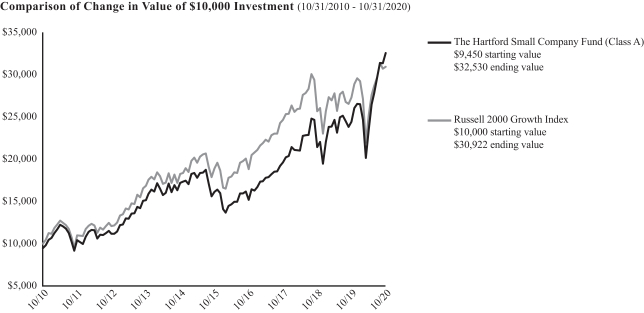

|