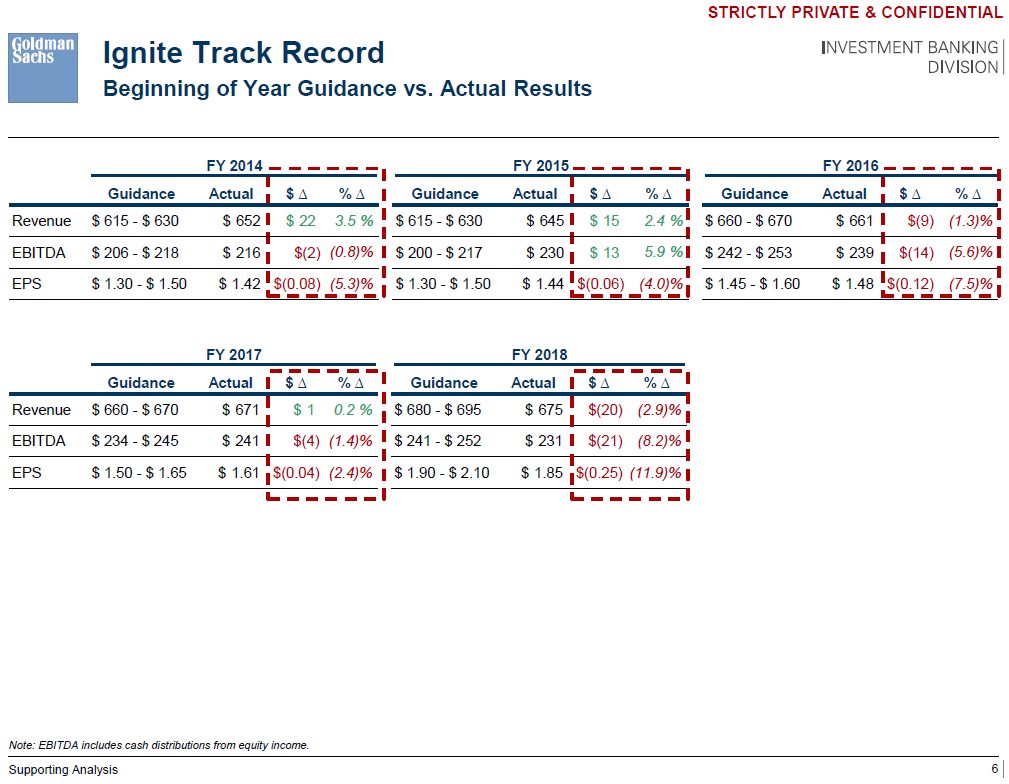

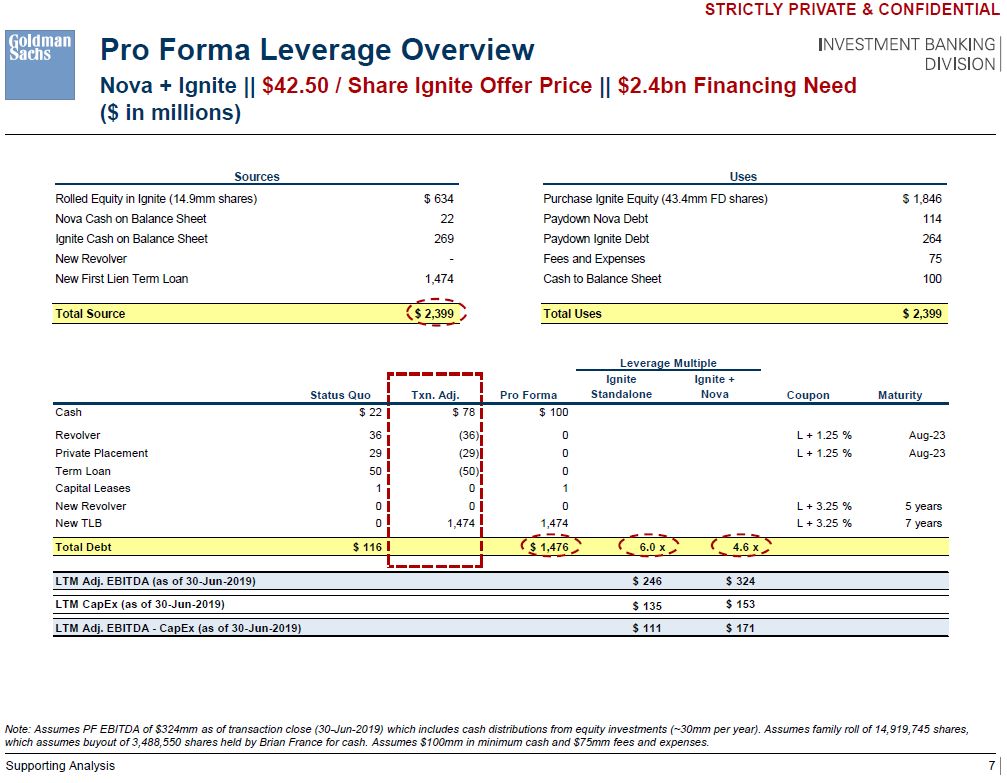

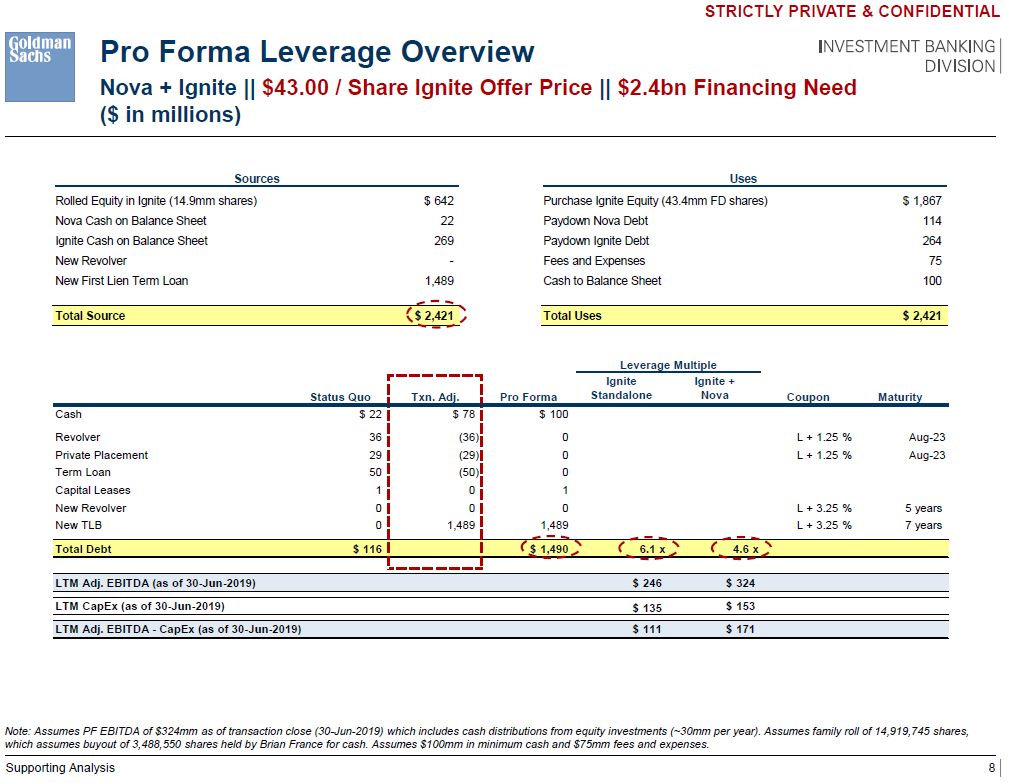

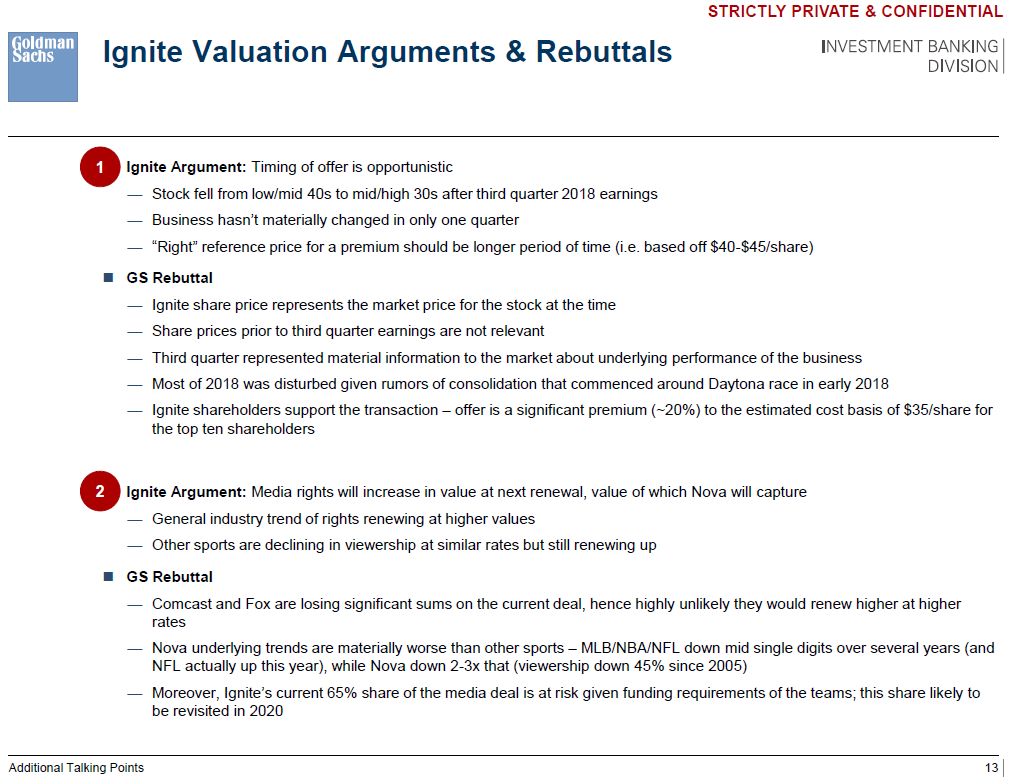

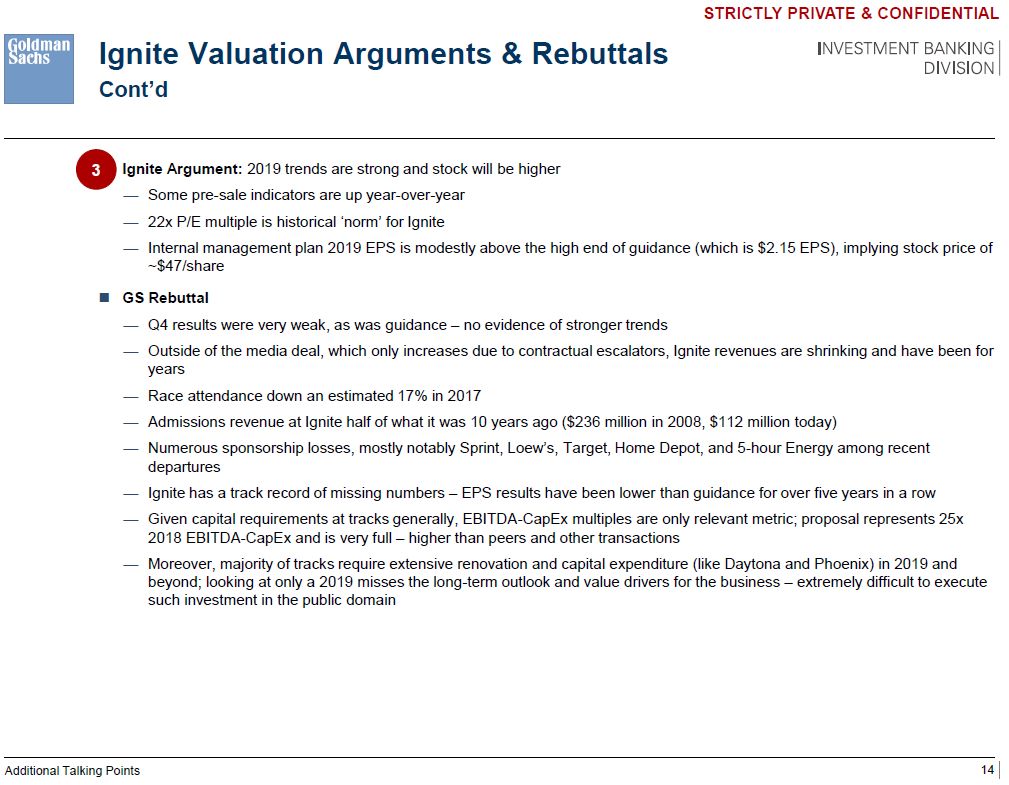

STRICTLY PRIVATE & CONFIDENTIAL 2 Response to IgniteKey Talking Points Family pleased that Committee agrees the acquisition of Ignite is critical to the future of the sport and wants to reach terms that are agreeable to all partiesHowever, given operating trends (attendance, ratings/viewership, sponsorship, etc), Family also views this as a turnaround situation with all the attendant risksAll of risks are being assumed by the Family given they are rolling all of their equity into the combination, which represents the bulk of their net worth while public shareholders get cashed out with value certainty at a high priceCommittee ask of $54/share doesn’t reflect the risks of executing the turnaround and risk of the significant debt burden given the financing requirements of the transactionMoreover, Family highlights key near-term and long-term risks to the Ignite standalone planThere is downside risk to Ignite’s 2019 estimates; Ignite has missed the top end of its EPS guidance for over five years straight. The actual results were below top of guidance for EPS, which serves as a proxy for the internal management plan.Media rights could actually renew at a lower amount in 2024, particularly given viewership trends, and teams may demand a larger share of the media rights as early as 2020 – either of which would have significant negative value implications for IgniteGrowth / turnaround plan that Special Committee previously reviewed was really a Camaro plan and is not executable without their support. For example, industry efforts to develop growth initiatives have struggled, as evidenced by Formula One’s OTT strategy (technical bugs, delayed launch until a month after the season already started)