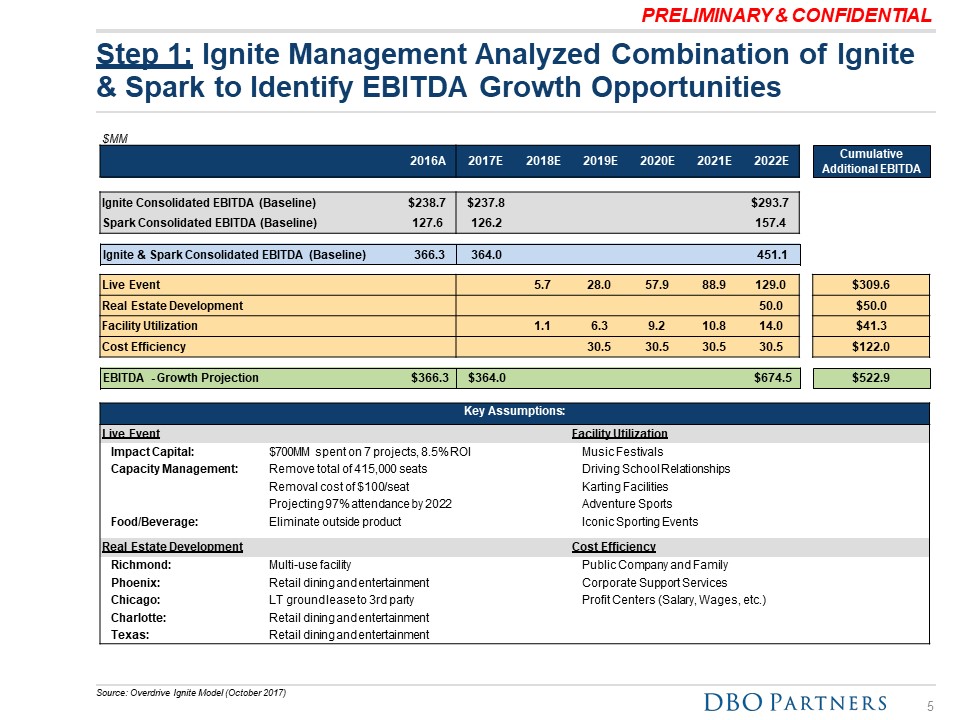

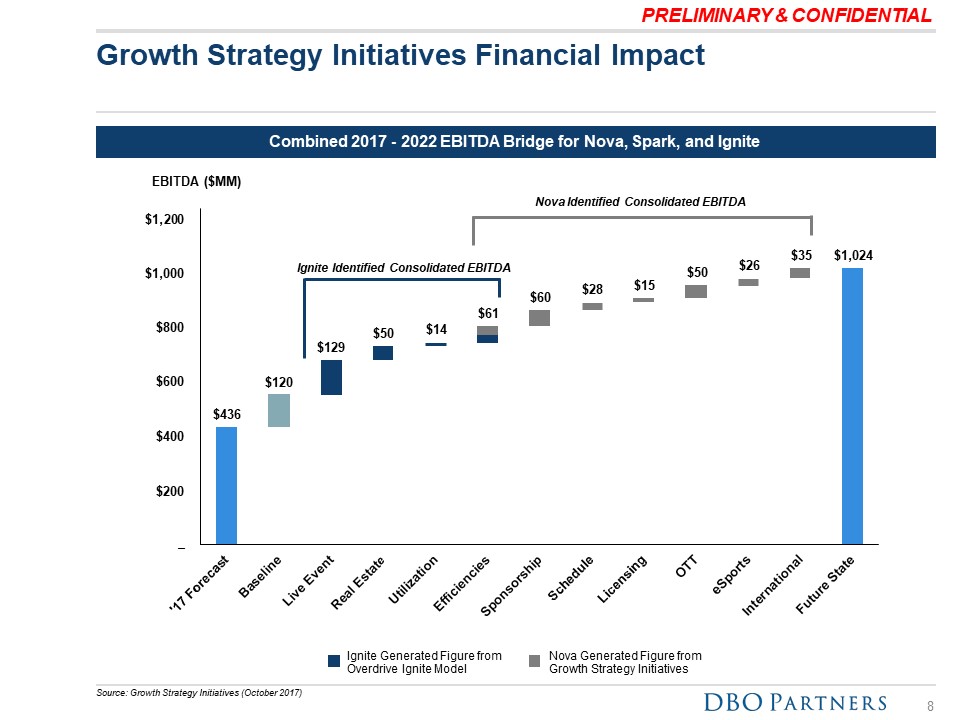

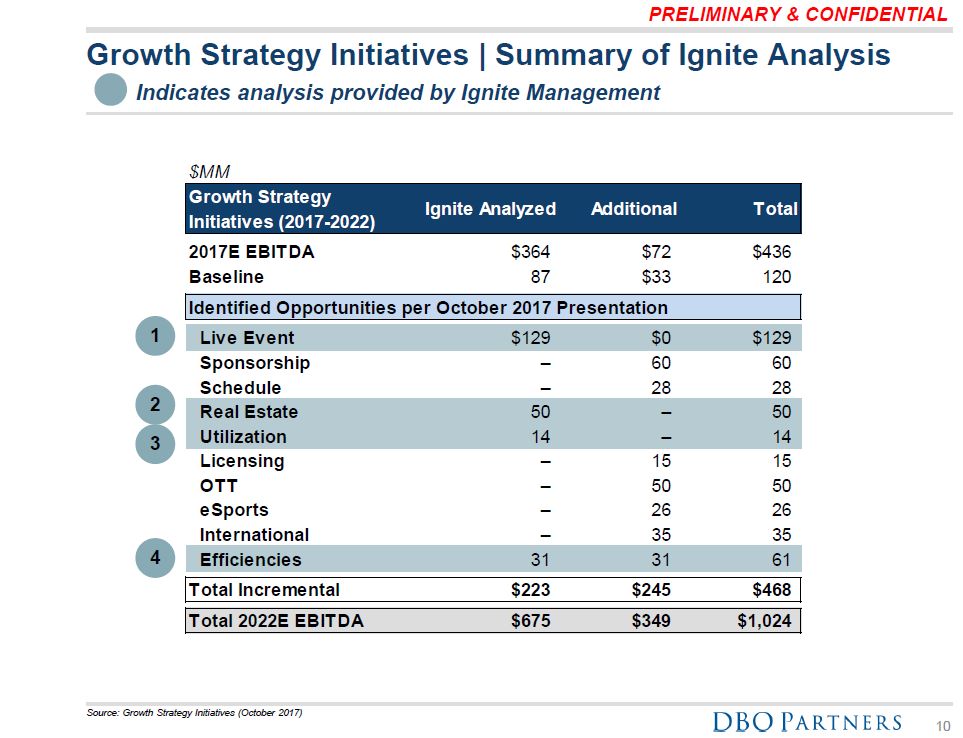

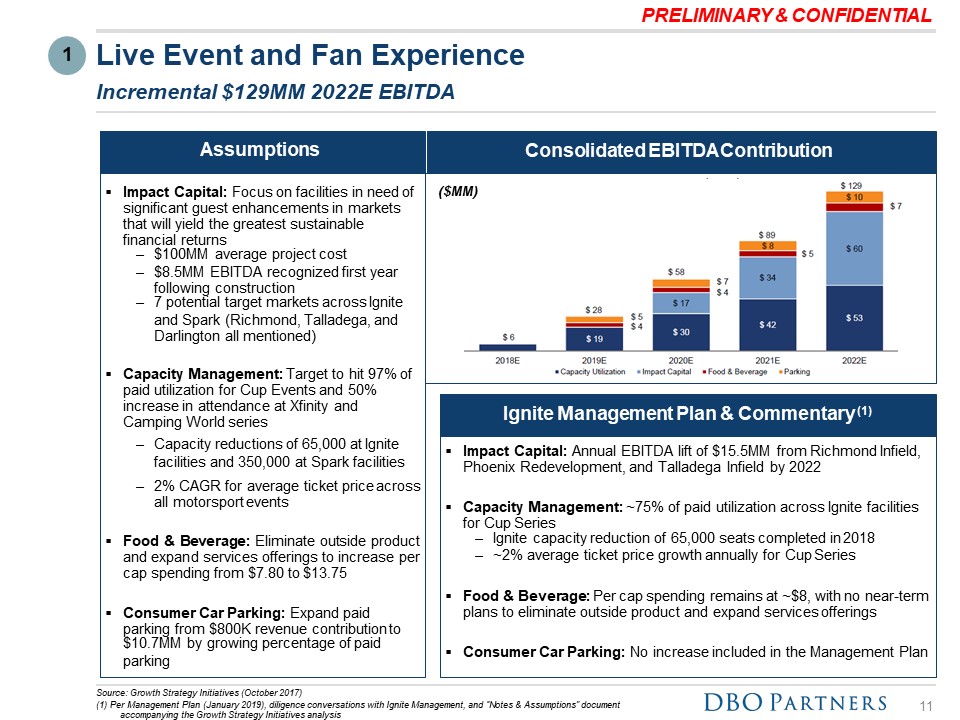

PRELIMINARY & CONFIDENTIAL Source: Growth Strategy Initiatives (October 2017)(1) Per Management Plan (January 2019), diligence conversations with Ignite Management, and “Notes & Assumptions” document accompanying the Growth Strategy Initiatives analysis Impact Capital: Focus on facilities in need of significant guest enhancements in markets that will yield the greatest sustainable financial returns$100MM average project cost$8.5MM EBITDA recognized first year following construction7 potential target markets across Igniteand Spark (Richmond, Talladega, and Darlington all mentioned) Capacity Management: Target to hit 97% of paid utilization for Cup Events and 50% increase in attendance at Xfinity and Camping World seriesCapacity reductions of 65,000 at Ignitefacilities and 350,000 at Spark facilities2% CAGR for average ticket price across all motorsport events Food & Beverage: Eliminate outside product and expand services offerings to increase per cap spending from $7.80 to $13.75 Consumer Car Parking: Expand paid parking from $800K revenue contribution to$10.7MM by growing percentage of paidparking 11 Ignite Management Plan & Commentary (1) Impact Capital: Annual EBITDA lift of $15.5MM from Richmond Infield, Phoenix Redevelopment, and Talladega Infield by 2022Capacity Management: ~75% of paid utilization across Ignite facilities for Cup SeriesIgnite capacity reduction of 65,000 seats completed in 2018~2% average ticket price growth annually for Cup SeriesFood & Beverage: Per cap spending remains at ~$8, with no near-term plans to eliminate outside product and expand services offeringsConsumer Car Parking: No increase included in the Management Plan 1 Live Event and Fan ExperienceIncremental $129MM 2022E EBITDA Assumptions Consolidated EBITDA Contribution ($MM)