UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00242

Natixis Funds Trust II

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

Natixis Distributors, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: December 31

Date of reporting period: June 30, 2011

Item 1. Reports to Stockholders.

The Registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

SEMIANNUAL REPORT

June 30, 2011

ASG Diversifying Strategies Fund

ASG Global Alternatives Fund

ASG Managed Futures Strategy Fund

Loomis Sayles Absolute Strategies Fund

Loomis Sayles Multi-Asset Real Return Fund

TABLE OF CONTENTS

Management Discussion and Investment Results page 1

Consolidated Portfolio of Investments page 33

Consolidated Financial Statements page 71

ASG DIVERSIFYING STRATEGIES FUND

Management Discussion

Managers:

Andrew W. Lo

Jeremiah H. Chafkin

Philippe P. Lüdi

AlphaSimplex Group, LLC

(Adviser)

Robert S. Rickard

Reich & Tang Asset Management, LLC

(Subadviser)

Objective:

Pursues an absolute return strategy that seeks to provide capital appreciation while maintaining a low or negative correlation over time with the returns of major equity indices.

Strategy:

Seeks to generate positive absolute returns over time rather than track the performance of any particular index by using multiple quantitative investment models and strategies.

Inception Date:

August 3, 2009

Symbols:

| | |

| Class A | | DSFAX |

| Class C | | DSFCX |

| Class Y | | DSFYX |

Market Conditions

Financial markets began the year on a high note as investors anticipated a year of strong growth. As expectations rose, stock and commodity prices surged upward while the U.S. dollar weakened against key global currencies. At the same time, anxiety about inflation increased in many emerging market countries. These concerns forced some central banks to begin tightening monetary policy, which, in turn, may have contributed to the underperformance of emerging stock markets.

As the first half of 2011 progressed, market participants became less optimistic about global growth. The most visible factors contributing to this shift were the disasters in Japan, rising interest rates, sluggish first quarter U.S. growth and the continued European sovereign debt crisis. Stock and commodity prices fell, while bond markets rallied strongly and bond yields fell. Some relief finally came to stock markets at the end of the first half as the Greek parliament passed new reforms in exchange for additional aid.

Performance Results

For the six months ended June 30, 2011, Class A shares of ASG Diversifying Strategies Fund returned -2.76% at net asset value. The fund lagged its benchmark, the 3-month London Interbank Offered Rate (LIBOR), which returned 0.16%. The fund follows an absolute return strategy and does not seek to track any index. Therefore, we believe its most appropriate benchmark is the 3-month LIBOR.

Explanation of Fund Performance

The fund seeks to achieve absolute returns using a proprietary, statistical process, while maintaining a low or negative correlation over time with major equity indexes. The fund typically uses derivative instruments such as futures and forward contracts on global stock indexes, fixed-income securities, currencies, interest rates, and commodities to gain liquid, broad market exposures. The fund aims to achieve its correlation objective by selling futures on global stock indexes when the trailing 12-month equity correlation of fund

1 |

holdings would otherwise be too high. When the fund takes on a “long” exposure to a market, it profits as prices rise; when it takes on a “short” exposure, it profits as prices fall. As market events unfold, these various market exposures result in a profit or loss for the fund.

During the first half of the year, fixed income, currencies and commodities all contributed positively to performance. However, this was not enough to offset losses in equities during the first half of the year. The equity correlation control objective of the fund caused it to be periodically net short equities during the beginning of the year, when equity markets generally rose. As concerns about a global slowdown in growth intensified during the second quarter, the fund gave up most of its gains in commodities. The fund’s losses in equities continued through the second quarter as these same concerns led to a reversal in equities. The equity correlation control objective of the fund caused us to reduce its equity exposure through much of the second quarter. However, this was not sufficient to eliminate the fund’s losses in equities. Short-term interest rates remained low, so gains from the fund’s money market positions were small.

The biggest positive contributors during the first six months of 2011 were Japanese 10-year government bonds, gold, and the Swiss franc. Conversely, the biggest detractors from performance were the German, Japanese, and U.S. stock indexes. As is usually the case, the fund carried large exposures (as measured by the notional or contract values of futures contracts) to short-term interest rates such as the Eurodollar and LIBOR, in order to gain the diversification advantage provided by these low volatility assets.

The fund’s realized annualized volatility during the first half of 2011 was 8.8%, consistent with its risk objectives and well within its targeted range.

In order to help investors achieve diversification benefits in their overall portfolios, ASG Diversifying Strategies Fund seeks a low trailing 12-month correlation with global equity markets. The correlation of daily

returns was 28% with the S&P 500 Index during the

What You Should Know:

Investments in the Fund are subject to a number of risks. Please see the “Principal Risks” section of the Fund’s prospectus. The purchase of Fund shares should be seen as a long-term investment.

| 2

first half of the year, and 17% for the trailing 12-months ended June 30, 2011, which was in line with our objective.

Outlook

At the beginning of the second half of 2011, concerns about monetary, fiscal and political shifts dominate our outlook. Anxieties about slowing global growth and chronic worries about developed-country indebtedness remain fundamentally unresolved. At the end of the second quarter, the U.S. Federal Reserve Board concluded its stimulatory bond purchase (or quantitative easing) program, known as QE2, leaving investors uncertain about how U.S. Treasury bond prices will fare without government support and whether the U.S. will adopt a credible plan to contain its debt and deficit. Investors are also looking to see whether China tames its inflation without sacrificing growth and whether Greece will finally resolve its long-running debt crisis. The evolving opinion on the likely outcomes of these issues will influence markets and the pace of economic recovery in the coming months.

3 |

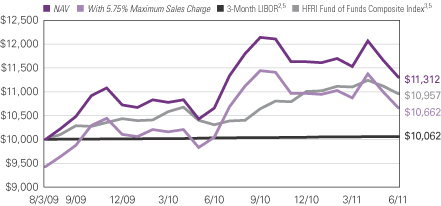

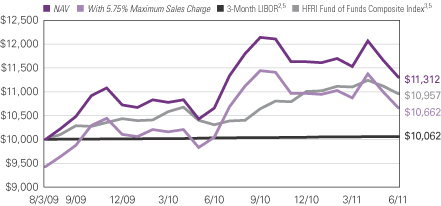

ASG DIVERSIFYING STRATEGIES FUND

Investment Results through June 30, 2011

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

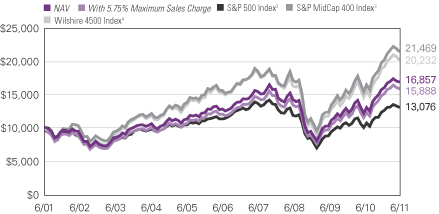

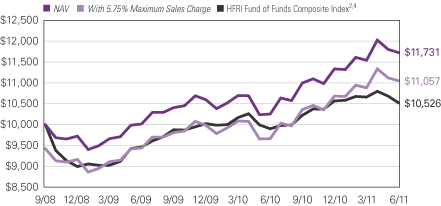

Growth of $10,000 Investment in Class A Shares6

August 3, 2009 (inception) through June 30, 2011

Average Annual Total Returns — June 30, 20116

| | | | | | | | | | | | |

| | | | |

| | | 6 Months | | | 1 Year | | | Since Inception5 | |

| | | | |

| Class A (Inception 8/3/09) | | | | | | | | | | | | |

| NAV | | | -2.76 | % | | | 6.12 | % | | | 6.68 | % |

| With 5.75% Maximum Sales Charge | | | -8.37 | | | | 0.07 | | | | 3.42 | |

| | | | |

| Class C (Inception 8/3/09) | | | | | | | | | | | | |

| NAV | | | -3.08 | | | | 5.33 | | | | 5.85 | |

| With CDSC1 | | | -4.05 | | | | 4.33 | | | | 5.85 | |

| | | | |

| Class Y (Inception 8/3/09) | | | | | | | | | | | | |

| NAV | | | -2.66 | | | | 6.29 | | | | 6.84 | |

| | | | |

| Comparative Performance | | | | | | | | | | | | |

| 3-Month LIBOR2 | | | 0.16 | | | | 0.39 | | | | 0.36 | |

| HFRI Fund of Funds Composite Index3 | | | -0.45 | | | | 6.52 | | | | 5.01 | |

| Morningstar Multialternative Fund Avg.4 | | | 0.98 | | | | 9.42 | | | | 6.17 | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ga.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

See Notes To Charts on page 5.

| 4

PORTFOLIO FACTS

| | | | |

| Fund Composition | | % of Net

Assets as of

6/30/11 | |

Certificates of Deposit | | | 69.1 | |

Financial Company Commercial Paper | | | 17.2 | |

Forward Foreign Currency Contracts | | | (0.5 | ) |

Futures Contracts | | | (0.4 | ) |

Other Assets less Liabilities | | | 14.6 | |

Expense Ratios

as stated in the most recent prospectus

| | | | | | | | |

| Share Class | | Gross Expense Ratio7 | | | Net Expense Ratio8 | |

| A | | | 1.99 | % | | | 1.74 | % |

C | | | 2.66 | | | | 2.49 | |

| Y | | | 1.83 | | | | 1.49 | |

NOTES TO CHARTS

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | 3-Month LIBOR, or the London Interbank Offered Rate, represents the average rate a leading bank, for a given currency (in this case U.S. dollars), can obtain unsecured funding, and is representative of short-term interest rates. |

| 3 | HFRI Fund of Funds Composite Index is an unmanaged, equally-weighted hedge fund index including over 800 domestic and offshore funds of funds. Funds included within the index have either at least $50 million in assets under management or have been actively trading for at least twelve (12) months. Performance information is submitted by the funds of funds to the index provider, which does not audit the information submitted. The index is rebalanced monthly. Performance data is net of all fees charged by the hedge funds. Index returns are calculated three times each month and are subject to periodic recalculation by Hedge Fund Research, Inc. The funds do not expect to update the index returns provided if subsequent recalculations cause such returns to change. In addition, because of these recalculations, the HFRI Index returns reported by the funds may differ from the index returns for the same period published by others. |

| 4 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 5 | The since-inception comparative performance figures shown are calculated from 8/1/09. |

| 6 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 7 | Before fee waivers and/or expense reimbursements. |

| 8 | After fee waivers and/or expense reimbursements. Waivers/reimbursements are contractual and are set to expire on 4/30/12. Contracts are reevaluated on an annual basis. |

5 |

ASG GLOBAL ALTERNATIVES FUND

Management Discussion

Managers:

Andrew W. Lo

Jeremiah H. Chafkin

Peter A. Lee

AlphaSimplex Group, LLC

(Adviser)

Robert S. Rickard

Reich & Tang Asset Management, LLC

(Subadviser)

Objective:

Seeks capital appreciation consistent with the return and risk characteristics of a diversified portfolio of hedge funds.

Strategy:

Seeks to achieve long and short exposure to global equity, bond, currency, and commodity markets through a wide range of derivative instruments and direct investments.

Inception Date:

September 30, 2008

Symbols:

| | |

| Class A | | GAFAX |

| Class C | | GAFCX |

| Class Y | | GAFYX |

Market Conditions

Financial markets began the year on a high note as investors anticipated a year of strong growth. As expectations rose, stock and commodity prices surged upward while the U.S. dollar weakened against key global currencies. At the same time, anxiety about inflation increased in many emerging market countries. These concerns forced some central banks to begin tightening monetary policy, which, in turn, may have contributed to the underperformance of emerging stock markets.

As the first half of 2011 progressed, market participants became less optimistic about global growth. The most visible factors contributing to this shift were the disasters in Japan, rising interest rates, sluggish first quarter U.S. growth and the continued European sovereign debt crisis. Stock and commodity prices fell, while bond markets rallied strongly and bond yields fell. Some relief finally came to stock markets at the end of the first half as the Greek parliament passed new reforms in exchange for additional aid.

As measured by the HFRI Fund of Funds index, the strongest returns posted by hedge funds during this period occurred during April, and their weakest returns occurred during May and June.

Performance Results

For the six months ended June 30, 2011, Class A Shares of ASG Global Alternatives Fund returned 3.49% at net asset value. The fund follows an absolute return strategy and does not seek to track an index. However, its returns may often be similar to those of the HFRI Fund of Funds Composite Index, which returned -0.45% for the same period. It is important to note that there are important differences between the fund and the benchmark, which is non-investable.

Explanation of Fund Performance

As always, the fund’s strategy is to take on the exposures that best reflect the liquid, broad market exposures of the hedge fund industry as estimated by a proprietary, statistical process. When the fund takes on a “long” exposure to a market, it profits as prices rise;

| 6

What You Should Know:

Investments in the Fund are subject to a number of risks. Please see the “Principal Risks” section of the Fund’s prospectus. The purchase of Fund shares should be seen as a long-term investment.

when it takes on a “short” exposure, it profits as prices fall. In taking on these exposures, the fund typically uses derivative instruments, such as futures and forward contracts on global stock indices, fixed-income securities, currencies, interest rates and commodities. As market events unfold, these various market exposures result in a profit or loss for the fund.

The fund’s largest gains during the first half came from exposure to foreign currencies, stocks and precious metals. The strongest individual contributors to performance were long exposure to U.S. stocks, gold, the Swiss franc, German stocks and the Australian dollar. The fund also held short positions in aluminum and natural gas. Overall, the fund’s short positions made a small positive contribution to returns. Short-term interest rates remained low, so gains from the fund’s money market positions were small.

During this period we made adjustments to the portfolio. In particular we bought stocks and Eurodollar contracts, while we sold bonds and base metals. The fund’s volatility was 7.6%, which is in line with our risk management expectations.

Outlook

At the beginning of the second half of 2011, concerns about monetary, fiscal and political shifts dominate our outlook. Anxieties about slowing global growth and chronic worries about developed-country indebtedness remain fundamentally unresolved. At the end of the second quarter, the U.S. Federal Reserve Board concluded its stimulatory bond purchase (or quantitative easing) program, known as QE2, leaving investors uncertain about how U.S. Treasury bond prices will fare without government support and whether the U.S. will adopt a credible plan to contain its debt and deficit. Investors are also looking to see whether China tames its inflation without sacrificing growth and whether Greece will finally resolve its long-running debt crisis. The evolving opinion on the likely outcomes of these issues will influence markets and the pace of economic recovery in the coming months.

7 |

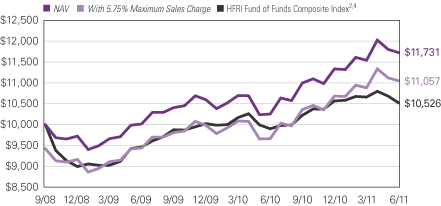

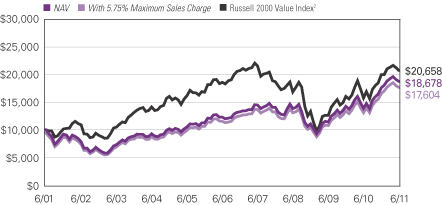

ASG GLOBAL ALTERNATIVES FUND

Investment Results through June 30, 2011

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

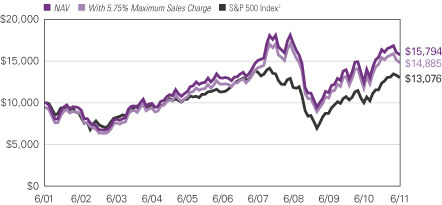

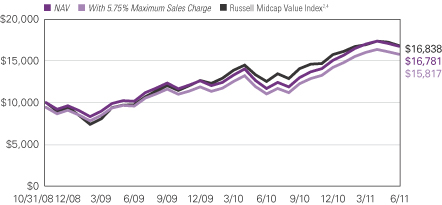

Growth of $10,000 Investment in Class A Shares5

September 30, 2008 (inception) through June 30, 2011

Average Annual Total Returns — June 30, 20115

| | | | | | | | | | | | |

| | | | |

| | | 6 Months | | | 1 Year | | | Since Inception4 | |

| | | | |

| Class A (Inception 9/30/08) | | | | | | | | | | | | |

| NAV | | | 3.49 | % | | | 14.42 | % | | | 5.98 | % |

| With 5.75% Maximum Sales Charge | | | -2.45 | | | | 7.88 | | | | 3.72 | |

| | | | |

| Class C (Inception 9/30/08) | | | | | | | | | | | | |

| NAV | | | 3.06 | | | | 13.53 | | | | 5.19 | |

| With CDSC1 | | | 2.06 | | | | 12.53 | | | | 5.19 | |

| | | | |

| Class Y (Inception 9/30/08) | | | | | | | | | | | | |

| NAV | | | 3.66 | | | | 14.67 | | | | 6.25 | |

| | | | |

| Comparative Performance | | | | | | | | | | | | |

| HFRI Fund of Funds Composite Index2 | | | -0.45 | | | | 6.52 | | | | 1.96 | |

| Morningstar Multialternative Fund Avg.3 | | | 0.98 | | | | 9.42 | | | | 2.72 | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ga.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

See Notes To Charts on page 9.

| 8

PORTFOLIO FACTS

| | | | |

| |

| Fund Composition | | % of Net

Assets as of

6/30/11 | |

Certificates of Deposit | | | 68.0 | |

Financial Company Commercial Paper | | | 23.1 | |

Forward Foreign Currency Contracts | | | (0.0 | ) |

Futures Contracts | | | 1.2 | |

Other Assets less Liabilities | | | 7.7 | |

Expense Ratios

as stated in the most recent prospectus

| | | | | | | | |

| Share Class | | Gross Expense Ratio6 | | | Net Expense Ratio7 | |

| A | | | 1.67 | % | | | 1.61 | % |

| C | | | 2.42 | | | | 2.36 | |

| Y | | | 1.42 | | | | 1.36 | |

NOTES TO CHARTS

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | HFRI Fund of Funds Composite Index is an unmanaged, equally-weighted hedge fund index including over 800 domestic and offshore funds of funds. Funds included within the index have either at least $50 million in assets under management or have been actively trading for at least twelve (12) months. Performance information is submitted by the funds of funds to the index provider, which does not audit the information submitted. The index is rebalanced monthly. Performance data is net of all fees charged by the hedge funds. Index returns are calculated three times each month and are subject to periodic recalculation by Hedge Fund Research, Inc. The funds do not expect to update the index returns provided if subsequent recalculations cause such returns to change. In addition, because of these recalculations, the HFRI Index returns reported by the funds may differ from the index returns for the same period published by others. |

| 3 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 4 | The since-inception comparative performance figures shown are calculated from 10/1/08. |

| 5 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 6 | Before fee waivers and/or expense reimbursements. |

| 7 | After fee waivers and/or expense reimbursements. Waivers/reimbursements are contractual and are set to expire on 4/30/12. Contracts are reevaluated on an annual basis. |

9 |

ASG MANAGED FUTURES STRATEGY FUND

Management Discussion

Managers:

Andrew W. Lo

Jeremiah H. Chafkin

AlphaSimplex Group, LLC

(Adviser)

Robert S. Rickard

Reich & Tang Asset Management, LLC

(Subadviser)

Objective:

Pursues an absolute return strategy that seeks to provide capital appreciation.

Strategy:

Seeks to generate positive absolute returns over time by using a variety of derivative instruments, including futures and forward contracts, to capture the exposures suggested by its absolute return strategy while also seeking to add value through volatility management.

Inception Date:

July 30, 2010

Symbols:

| | |

| Class A | | AMFAX |

| Class C | | ASFCX |

| Class Y | | ASFYX |

Market Conditions

Financial markets began the year on a high note as investors anticipated a year of strong growth. As expectations rose, stock and commodity prices surged upward, while the U.S. dollar weakened against key global currencies. At the same time, anxiety about inflation increased in many emerging market countries. These concerns forced some central banks to begin tightening monetary policy, which may have contributed to the underperformance of emerging stock markets.

As the first half of 2011 progressed, market participants became less optimistic about global growth due, in part, to disasters in Japan, rising interest rates, sluggish first quarter U.S. growth and the continued European sovereign debt crisis. Stock and commodity prices fell, while bond markets rallied strongly and bond yields fell. Some relief finally came to stock markets at the end of the first half of 2011 as the Greek parliament passed new reforms in exchange for additional aid.

Performance Results

For the six months ended June 30, 2011, Class A Shares of ASG Managed Futures Strategy Fund returned 0.19% at net asset value. The fund follows an absolute return strategy and does not seek to track an index. However, its returns may often be similar to those of the FTSE StableRisk Trend Composite Index, which returned 3.64% for the same period. It is important to note that there are important differences between the fund and the benchmark in terms of risk management. There were no significant changes to the fund strategy during this period.

Explanation of Fund Performance

The difference in performance between the fund and the benchmark was generally due to the fund’s risk management mechanism, which aims to scale total portfolio positions up or down in response to market volatility, correlation and the fund’s drawdown. In general, a lower volatility helps mitigate the impact of continued losses, but at the cost of muting potential gains. The fund reduced its exposures following the high

| 10

What You Should Know:

Investments in the Fund are subject to a number of risks. Please see the “Principal Risks” section of the Fund’s prospectus. The purchase of Fund shares should be seen as a long-term investment.

volatility around the Japanese earthquake and around the end of the second quarter in response to losses experienced by trend-following strategies.

The fund uses a set of proprietary quantitative models to identify trends in global stock, fixed-income, currency, and commodity markets. When the fund takes on a “long” exposure to a market, it profits as prices rise; when it takes on a “short” exposure, it profits as prices fall. In taking on these exposures, the fund typically uses derivative instruments such as futures and forward contracts. As market events unfold, these various market exposures result in a profit or loss for the fund.

During the first six months of 2011, all of our trend models profitably captured trends in foreign currencies and fixed income. However, unlike the second half of 2010, commodity returns from trend following were nearly flat, while returns from stock market trends were negative. This was largely a result of the risk control mechanism reducing the fund’s exposure to equity markets following the Japanese earthquake in expectation of continued high volatility. In this instance, this resulted in lower gains during the equity markets’ recovery. Similarly, towards the end of June, equity markets were experiencing increasing volatility and the fund had automatically reduced its total exposures due to its drawdown, again reducing the fund’s gains from the end-of-month rally.

Specific assets that contributed very positively during the first six months of 2011 included the Swiss franc, Swedish krona, the Eurodollar interest rate, Japanese 10-year government bonds and silver. Conversely, positions in the New Zealand dollar as well as Japanese and Swedish stock market futures contributed negatively. As is usually the case, the fund obtained large exposures (as measured by the notional or contract values of futures contracts) to short-term interest rates such as the Eurodollar and London Interbank Offered Rate (LIBOR), in order to gain the diversification advantage provided by these low volatility assets.

We continued to scale portfolio positions to keep total portfolio risk at or below its target. As market volatility

11 |

increases, positions are reduced; and as market volatility decreases, positions are increased. The fund’s realized annualized volatility has been consistent with the fund’s risk objectives in the first six months of 2011 at 11%. The correlation of daily returns was 63% with the S&P 500 Index and -31% with the J.P. Morgan Global Bond Index, demonstrating the possible diversification benefits of the fund. Given low interest rates, the fund’s money market position contributed only marginally to performance during the first half of 2011.

Outlook

At the beginning of the second half of 2011, concerns about monetary, fiscal and political shifts dominate our outlook. Anxieties about slowing global growth and chronic worries about developed-country indebtedness remain fundamentally unresolved. At the end of the second quarter, the U.S. Federal Reserve Board concluded its stimulatory bond purchase (or quantitative easing) program, known as QE2, leaving investors uncertain about how U.S. Treasury bond prices will fare without government support and whether the U.S. will adopt a credible plan to contain its debt and deficit. Investors are also looking to see whether China tames its inflation without sacrificing growth and whether Greece will finally resolve its long-running debt crisis. The evolving opinion on the likely outcomes of these issues will influence markets and the pace of economic recovery in the coming months.

| 12

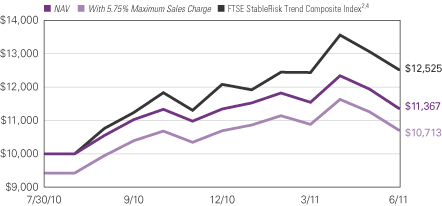

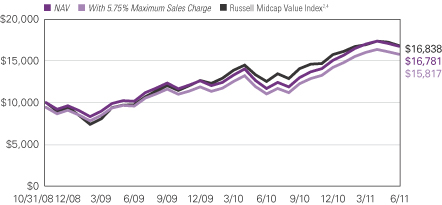

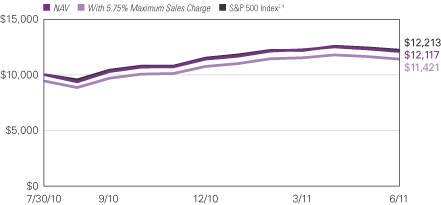

ASG MANAGED FUTURES STRATEGY FUND

Investment Results through June 30, 2011

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

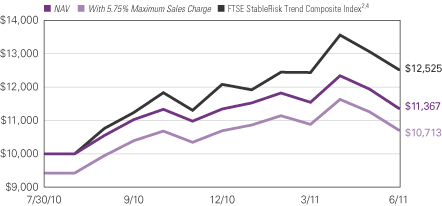

Growth of $10,000 Investment in Class A Shares5

July 30, 2010 (inception) through June 30, 2011

Total Returns — June 30, 20115

| | | | | | | | |

| | | |

| | | 6 Months | | | Since Inception4 | |

| | | |

| Class A (Inception 7/30/10) | | | | | | | | |

| NAV | | | 0.19 | % | | | 13.65 | % |

| With 5.75% Maximum Sales Charge | | | -5.60 | | | | 7.12 | |

| | | |

| Class C (Inception 7/30/10) | | | | | | | | |

| NAV | | | -0.19 | | | | 12.83 | |

| With CDSC1 | | | -1.19 | | | | 11.83 | |

| | | |

| Class Y (Inception 7/30/10) | | | | | | | | |

| NAV | | | 0.38 | | | | 13.82 | |

| | | |

| Comparative Performance | | | | | | | | |

| FTSE StableRisk Trend Composite Index2 | | | 3.64 | | | | 20.32 | |

| Morningstar Managed Futures Fund Avg.3 | | | -1.84 | | | | 8.57 | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ga.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

13 |

PORTFOLIO FACTS

| | | | |

| Fund Composition | | % of Net

Assets as of

6/30/11 | |

Certificates of Deposit | | | 66.1 | |

Financial Company Commercial Paper | | | 19.9 | |

Forward Foreign Currency Contracts | | | (1.0 | ) |

Futures Contracts | | | 0.3 | |

Other Assets less Liabilities | | | 14.7 | |

Expense Ratios

as stated in the most recent prospectus

| | | | | | | | |

| Share Class | | Gross Expense Ratio6 | | | Net Expense Ratio7 | |

| A | | | 1.88 | % | | | 1.72 | % |

| C | | | 2.63 | | | | 2.47 | |

| Y | | | 1.63 | | | | 1.47 | |

NOTES TO CHARTS

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | FTSE StableRisk Trend Composite Index is an unmanaged index based on a transparent trend-following strategy designed to provide long and/or short exposure to various asset classes at a targeted level of volatility. |

| 3 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 4 | The since-inception comparative performance figures shown are calculated from 8/1/10. |

| 5 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 6 | Before fee waivers and/or expense reimbursements. |

| 7 | After fee waivers and/or expense reimbursements. Waivers/reimbursements are contractual and are set to expire on 4/30/12. Contracts are reevaluated on an annual basis. |

| 14

LOOMIS SAYLES ABSOLUTE STRATEGIES FUND

Management Discussion

Managers:

Matthew J. Eagan, CFA

Kevin Kearns

Todd P. Vandam, CFA

Loomis, Sayles & Company, L.P.

Objective:

Seeks to provide an attractive absolute total return, complemented by prudent management designed to manage risks and protect investor capital.

Strategy:

Seeks to generate positive total returns by utilizing a flexible investment approach that allocates investments across a global range of investment opportunities related to credit, currencies and interest rates while employing risk management strategies to mitigate downside risk.

Inception Date:

December 15, 2010

Symbols:

| | |

| Class A | | LABAX |

| Class C | | LABCX |

| Class Y | | LASYX |

Market Conditions

The period started off on an optimistic note, driven by solid global growth projections and improving confidence. In this environment, investors favored higher-risk sectors and securities. Beginning late in the first quarter and extending through late June, a series of events caused market sentiment to shift. Specifically, a devastating earthquake in Japan, soaring oil prices stemming from political unrest in the Middle East and North Africa, projections for slower global growth, rising inflation and unemployment suppressed the financial markets. Concerns about debt-laden Greece, expectations for a political showdown over the U.S. debt ceiling and uncertainty about the financial markets’ response to the end of quantitative easing also contributed to the volatility. In this environment, investors staged a flight to safety, and higher-quality sectors and securities outperformed. Nevertheless, higher-risk securities performed the best for the six-month period, as high-yield and investment-grade corporate bonds outperformed Treasuries.

Performance Results

For the six months ended June 30, 2011, Class A shares of Loomis Sayles Absolute Strategies Fund returned 0.16% at net asset value. The fund performed in line with its benchmark, the 3-month London Interbank Offered Rate (LIBOR), which returned 0.16% for the period. The fund follows an absolute return strategy and is not managed to an index.

Explanation of Fund Performance

The fund’s high-yield and investment-grade corporate bonds posted strong returns during the first quarter of 2011, as investors continued to reach for yield in the low-interest-rate environment. We focused on higher-risk/higher-reward-potential cyclical issues that we believed would outperform during the next phase of the economic recovery. In addition, the fund’s securities denominated in the Russian ruble and Mexican peso were strong contributors to performance, as commodity-based currencies benefited from strong global demand.

Within the fund’s Treasury component, we maintained a flat to short duration (a measure of a fund’s sensitivity to interest rate changes) to mitigate interest-rate risk. This strategy detracted from performance during the

15 |

second quarter, when demand for high-quality securities pushed Treasury yields lower. (When rates decline, funds with longer durations experience greater price appreciation.) In addition, the fund’s commercial and residential mortgage-backed securities (CMBS and RMBS) faced strong technical headwinds that caused prices to decline, although fundamentals remained intact. Furthermore, convertible bonds lagged due to their market values moving in sync with falling equity markets late in the period.

During the period, we used a broad range of derivatives for hedging and investment purposes. Derivatives can be useful tools for expressing macroeconomic views, reducing overall market exposure and keeping fund volatility in check. When contemplating the use of derivatives, we consider the expected relative risks and returns of such investments and their related costs.

We used U.S. Treasury futures to hedge interest-rate risk by managing our exposure to the yield curve (a curve that shows the relationship between bond yields across the maturity spectrum) and by reducing duration. The curve strategy contributed positively to fund performance, while reducing duration detracted from performance. Additionally, we used credit default swaps (CDS) to manage global and industry-specific credit risks. On a net basis, the CDS detracted from fund performance, as we attempted to mitigate volatility. We also used forward foreign currency contracts to manage various currency exposures. During the period, our long position in the Australian dollar and our short position in the euro detracted from performance.

Outlook

Overall, we believe interest rates generally will trend upward with periodic volatility, as the struggling U.S. housing market and European sovereign-debt woes continue to worry investors.

We believe the market is in the expansion phase of the credit cycle and therefore remain optimistic toward credit-sensitive securities. Looking ahead, we believe individual security selection will become increasingly important. We remain optimistic about CMBS and RMBS, and continue to favor currencies from countries we believe can generate robust growth and do not have fiscal deficit concerns, including non-Japan Asia and countries with commodity-sensitive currencies.

What You Should Know:

Investments in the Fund are subject to a number of risks. Please see the “Principal Risks” section of the Fund’s prospectus. The purchase of Fund shares should be seen as a long-term investment.

| 16

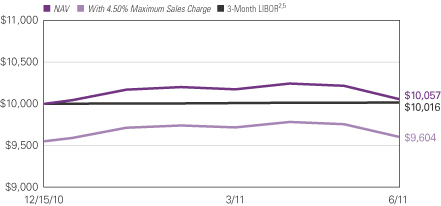

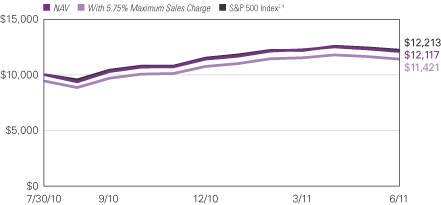

LOOMIS SAYLES ABSOLUTE STRATEGIES FUND

Investment Results through June 30, 2011

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

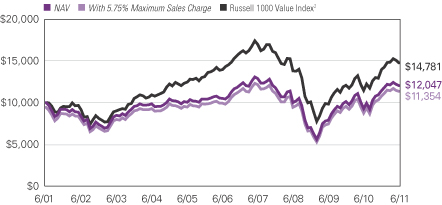

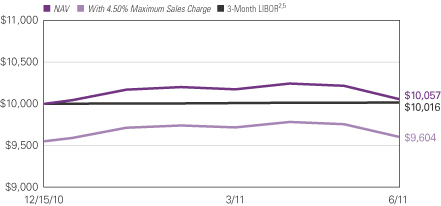

Growth of $10,000 Investment in Class A Shares6

December 15, 2010 (inception) through June 30, 2011

Total Returns — June 30, 20116

| | | | | | | | |

| | | |

| | | 6 Months | | | Since Inception5 | |

| | | |

| Class A (Inception 12/15/10) | | | | | | | | |

| NAV | | | 0.16 | % | | | 0.58 | % |

| With 4.50% Maximum Sales Charge | | | -4.32 | | | | -3.94 | |

| | | |

| Class C (Inception 12/15/10) | | | | | | | | |

| NAV | | | -0.28 | | | | 0.03 | |

| With CDSC1 | | | -1.26 | | | | -0.96 | |

| | | |

| Class Y (Inception 12/15/10) | | | | | | | | |

| NAV | | | 0.25 | | | | 0.66 | |

| | | |

| Comparative Performance | | | | | | | | |

| 3-Month LIBOR2 | | | 0.16 | | | | 0.16 | |

| 3-Month LIBOR + 300 basis points3 | | | 1.67 | | | | 1.67 | |

| Morningstar Multisector Bond Fund Avg.4 | | | 3.30 | | | | 3.30 | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ga.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

17 |

PORTFOLIO FACTS

| | | | |

| Fund Composition | | % of Net

Assets as of

6/30/11 | |

Bonds and Notes | | | 66.3 | |

Senior Loans | | | 9.4 | |

Preferred Stocks | | | 2.9 | |

Purchased Options | | | 0.0 | |

Credit Default Swap Agreements | | | 0.0 | |

Forward Foreign Currency Contracts | | | (0.1 | ) |

Futures Contracts | | | (0.1 | ) |

Short-Term Investments and Other | | | 21.6 | |

Expense Ratios

as stated in the most recent prospectus

| | | | | | | | |

| Share Class | | Gross Expense Ratio7 | | | Net Expense Ratio8 | |

| A | | | 1.28 | % | | | 1.28 | % |

| C | | | 2.03 | % | | | 2.03 | % |

| Y | | | 1.03 | % | | | 1.03 | % |

NOTES TO CHARTS

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | 3-Month LIBOR, or the London Interbank Offered Rate, represents the average rate a leading bank, for a given currency (in this case U.S. dollars), can obtain unsecured funding, and is representative of short-term interest rates. |

| 3 | 3-Month LIBOR +300 basis points is created by adding 3.00% to the annual percentage change of the 3-Month LIBOR. |

| 4 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 5 | The since-inception comparative performance figures shown are calculated from 1/1/11. |

| 6 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 7 | Before fee waivers and/or expense reimbursements. |

| 8 | After fee waivers and/or expense reimbursements. Waivers/reimbursements are contractual and are set to expire on 4/30/12. Contracts are reevaluated on an annual basis. |

| 18

LOOMIS SAYLES MULTI-ASSET REAL RETURN FUND

Management Discussion

Kevin Kearns

David Rolley, CFA

Laura Sarlo, CFA

Loomis, Sayles & Company, L.P.

Objective:

Seeks to maximize real returns consistent with prudent investment management.

Strategy:

Seeks to pursue its investment goal primarily through exposure to investments in fixed-income securities, equity securities, currencies and commodity-linked instruments.

Inception Date:

September 30, 2010

Symbols:

| | |

| Class A: | | MARAX |

| Class C: | | MARCX |

| Class Y: | | MARYX |

Market Conditions

Securities offering higher risk and higher reward potential rallied through the start of the year amid positive macroeconomic data and continued strength in corporate earnings. Late in the first quarter and throughout most of the second quarter, volatility returned to the markets. Higher oil prices, supply-chain disruptions stemming from Japan’s earthquake, global growth concerns and Greece’s sovereign-debt crisis caused investors to seek the relative safety of Treasury securities. Yields declined across the U.S. Treasury yield curve (a curve that shows the relationship between bond yields across the maturity spectrum), except at the long end, where the 30-year Treasury bond yield increased slightly. Securities within the five- to ten-year maturity range experienced the largest yield declines. Throughout the period, corporate balance sheets remained strong and earnings continued to beat analyst expectations. The new-issue market for investment-grade and high-yield securities remains on track for another year of strong supply.

Performance Results

For the six months ended June 30, 2011, Class A shares of the Loomis Sayles Multi-Asset Real Return Fund returned -2.12% at net asset value. The fund underperformed its benchmark, the Barclays Capital U.S. TIPS Index, which returned 5.81% for the period. The fund follows an absolute return strategy and is not managed to an index.

Explanation of Fund Performance

Allocations to high-yield and investment-grade corporate bonds contributed strongly to performance, until the flight to quality emerged. High-yield securities in the communications, energy and consumer non-cyclical sectors were among the top performers. In the investment-grade sector, the fund’s longer-duration (a measure of a fund’s sensitivity to interest rate changes) bonds offered yield advantages and benefited from the falling-rate environment. Selected issues in the banking, energy and communications industries made the largest contributions. Additionally, exposure

19 |

to countries experiencing classic inflationary pressures, including the commodity-rich nations of Mexico, Russia, Colombia and South Africa, proved beneficial, due to their notable currency appreciation.

Equity exposure detracted from performance as stocks sold off late in June. Securities in the banking, oil and manufacturing industries had the greatest negative impact on performance. In addition, certain foreign-currency trades weighed on results. The U.S. dollar remained under pressure, as loose monetary policy, fiscal concerns and diversification away from U.S. dollar-denominated assets weighed on the greenback. Furthermore, our efforts to manage duration dragged down performance. We expected Treasury yields to increase on mounting inflation concerns. Yet, Treasury yields generally declined due to the flight to quality, and our shorter-duration strategy lagged.

During the period, we used a broad range of derivatives for hedging and investment purposes. Derivatives can be useful tools for expressing macroeconomic views, reducing overall market exposure and keeping fund volatility in check. When contemplating the use of derivatives, we consider the expected relative risks and returns of such investments and their related costs. In particular, we used commodity futures to gain exposure to various commodities, including precious metals, which contributed to performance, and energy, which detracted from performance. We used U.S. Treasury futures to manage interest rate risk. During the period, we sold these futures to reduce duration, which detracted from performance. Credit default swaps (CDS) were used to remove overall global and industry credit-market exposure while allowing the fund to hold specific selections. The use of CDS did not materially affect performance. Various forward foreign currency contracts helped us manage the fund’s overall exposure to currencies. During the period, some of the positions had more impact than others. The fund’s overall long position in the Australian dollar and Singapore dollar detracted from performance.

What You Should Know:

Investments in the Fund are subject to a number of risks. Please see the “Principal Risks” section of the Fund’s prospectus. The purchase of Fund shares should be seen as a long-term investment.

| 20

Outlook

Looking ahead, we will continue to focus on identifying and categorizing economic regimes and maintaining a well-diversified portfolio. We remain concerned about inflation triggered by debt in developed countries and classic inflation in emerging markets. Inflationary pressures should continue to push emerging-market currencies higher. We expect certain commodities to outperform on strong global demand and the massive rebuilding effort in Japan.

21 |

LOOMIS SAYLES MULTI-ASSET REAL RETURN FUND

Investment Results through June 30, 2011

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

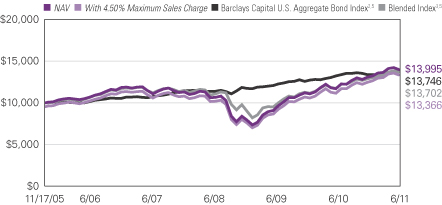

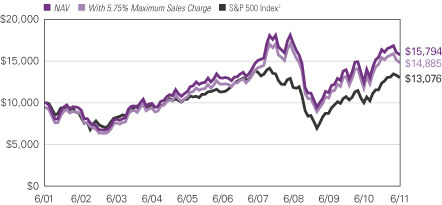

Growth of $10,000 Investment in Class A Shares6

September 30, 2010 (inception) through June 30, 2011

Total Returns — June 30, 20116

| | | | | | | | |

| | | |

| | | 6 Months | | | Since Inception5 | |

| | | |

| Class A (Inception 9/30/10) | | | | | | | | |

| NAV | | | -2.12 | % | | | -0.07 | % |

| With 4.50% Maximum Sales Charge | | | -6.54 | | | | -4.55 | |

| | | |

| Class C (Inception 9/30/10) | | | | | | | | |

| NAV | | | -2.42 | | | | -0.58 | |

| With CDSC1 | | | -3.39 | | | | -1.57 | |

| | | |

| Class Y (Inception 9/30/10) | | | | | | | | |

| NAV | | | -2.02 | | | | 0.06 | |

| | | |

| Comparative Performance | | | | | | | | |

| Barclays Capital U.S. TIPS Index2 | | | 5.81 | | | | 5.13 | |

| CPI + 300 basis points3 | | | 4.53 | | | | 5.67 | |

| Morningstar Conservative Allocation Fund Avg.4 | | | 3.83 | | | | 7.50 | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ga.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

See Notes To Charts on page 23.

| 22

| | | | |

| Fund Composition | | % of Net

Assets as of

6/30/11 | |

Bonds and Notes | | | 40.6 | |

Common Stocks | | | 12.7 | |

Exchange Traded Funds | | | 8.7 | |

Preferred Stocks | | | 1.5 | |

Senior Loans | | | 1.0 | |

Purchased Options | | | 1.0 | |

Written Options | | | (0.2 | ) |

Credit Default Swap Agreements | | | 0.1 | |

Forward Foreign Currency Contracts | | | (0.1 | ) |

Futures Contracts | | | (0.3 | ) |

Short-Term Investments and Other | | | 35.0 | |

Expense Ratios

as stated in the most recent prospectus

| | | | | | | | |

| Share Class | | Gross Expense Ratio7 | | | Net Expense Ratio8 | |

| A | | | 1.93 | % | | | 1.40 | % |

| C | | | 2.68 | | | | 2.15 | |

| Y | | | 1.68 | | | | 1.15 | |

NOTES TO CHARTS

| 1 | Performance for Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 2 | Barclays Capital U.S. Treasury Inflation Protected Securities (TIPS) Index is an unmanaged index that tracks inflation protected securities issued by the U.S. Treasury. |

| 3 | CPI +300 basis points is created by adding 3.00% to the annual percentage change in the Consumer Price Index (CPI). The Consumer Price Index is an unmanaged index that represents the rate of inflation of U.S. consumer prices as determined by the U.S. Bureau of Labor Statistics. |

| 4 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 5 | The since-inception comparative performance figures shown are calculated from 10/1/10. |

| 6 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 7 | Before fee waivers and/or expense reimbursements. |

| 8 | After fee waivers and/or expense reimbursements. Waivers/reimbursements are contractual and are set to expire on 4/30/12. Contracts are reevaluated on an annual basis. |

23 |

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

Before investing, consider each fund’s investment objectives, risks, charges and expenses. Visit ga.natixis.com or call 800-225-5478 for a prospectus and/or a summary prospectus, both of which contain this and other information. Read it carefully.

PROXY VOTING INFORMATION

A description of the funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the funds’ website at ga.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how the funds voted proxies during the 12-month period ended June 30, 2011 is available on the funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

| 24

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different types of costs: transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions, and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table for each class shows the actual account values and actual fund expenses you would have paid on a $1,000 investment in the fund from January 1, 2011 through June 30, 2011. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown for your Class.

The second line for the table of each class provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

25 |

| | | | | | | | | | | | |

| ASG DIVERSIFYING STRATEGIES FUND | | BEGINNING

ACCOUNT VALUE

1/1/2011 | | | ENDING

ACCOUNT VALUE

6/30/2011 | | | EXPENSES PAID

DURING PERIOD*

1/1/2011 – 6/30/2011 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $972.40 | | | | $8.41 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.27 | | | | $8.60 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $969.20 | | | | $12.11 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,012.50 | | | | $12.37 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $973.40 | | | | $7.24 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,017.46 | | | | $7.40 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement), including expenses of the Subsidiary (see Note 1 of Notes to Financial Statements) and interest expense: 1.72%, 2.48% and 1.48% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

| | | | | | | | | | | | |

| ASG GLOBAL ALTERNATIVES FUND | | BEGINNING

ACCOUNT VALUE

1/1/2011 | | | ENDING

ACCOUNT VALUE

6/30/2011 | | | EXPENSES PAID

DURING PERIOD*

1/1/2011 – 6/30/2011 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,034.90 | | | | $8.12 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.81 | | | | $8.05 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,030.60 | | | | $11.88 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,013.09 | | | | $11.78 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,036.60 | | | | $6.87 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.05 | | | | $6.80 | |

| * | Expenses are equal to the Fund’s annualized expense ratio, including expenses of the Subsidiary (see Note 1 of Notes to Financial Statements) and interest expense: 1.61%, 2.36% and 1.36% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

| 26

| | | | | | | | | | | | |

ASG MANAGED FUTURES

STRATEGY FUND | | BEGINNING

ACCOUNT VALUE

1/1/2011 | | | ENDING

ACCOUNT VALUE

6/30/2011 | | | EXPENSES PAID

DURING PERIOD*

1/1/2011 – 6/30/2011 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,001.90 | | | | $8.49 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.31 | | | | $8.55 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $998.10 | | | | $12.19 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,012.60 | | | | $12.28 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,003.80 | | | | $7.25 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,017.55 | | | | $7.30 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement), including expenses of the Subsidiary (see Note 1 of Notes to Financial Statements) and interest expense: 1.71%, 2.46% and 1.46% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

| | | | | | | | | | | | |

LOOMIS SAYLES ABSOLUTE

STRATEGIES FUND | | BEGINNING

ACCOUNT VALUE

1/1/2011 | | | ENDING

ACCOUNT VALUE

6/30/2011 | | | EXPENSES PAID

DURING PERIOD*

1/1/2011 – 6/30/2011 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,001.60 | | | | $6.15 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.65 | | | | $6.21 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $997.20 | | | | $9.80 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.98 | | | | $9.89 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,002.50 | | | | $4.92 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.89 | | | | $4.96 | |

| * | Expenses are equal to the Fund’s annualized expense ratio: 1.24%, 1.98% and 0.99% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

27 |

| | | | | | | | | | | | |

LOOMIS SAYLES MULTI-ASSET REAL

RETURN FUND | | BEGINNING

ACCOUNT VALUE

1/1/2011 | | | ENDING

ACCOUNT VALUE

6/30/2011 | | | EXPENSES PAID

DURING PERIOD*

1/1/2011 – 6/30/2011 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $978.80 | | | | $6.62 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.10 | | | | $6.76 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $975.80 | | | | $10.29 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.38 | | | | $10.49 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $979.80 | | | | $5.40 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.34 | | | | $5.51 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement), including expenses of the Subsidiary (see Note 1 of Notes to Financial Statements): 1.35%, 2.10% and 1.10% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

| 28

BOARD APPROVAL OF THE EXISTING ADVISORY AND SUB-ADVISORY AGREEMENTS FOR ASG GLOBAL ALTERNATIVES FUND AND ASG DIVERSIFYING STRATEGIES FUND

The Board of Trustees, including the Independent Trustees, considers matters bearing on each Fund’s advisory and sub-advisory agreements (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review and Governance Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additional one-year period. After the Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements.

In connection with these meetings, the Trustees receive materials that the Funds’ investment adviser and sub-adviser (collectively, the “Advisers”) believe to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Funds and the performance of peer groups and categories of funds and the Funds’ performance benchmarks, (ii) information on the Funds’ advisory and sub-advisory fees and other expenses, including information comparing the Funds’ expenses to the fees charged to institutional accounts with similar strategies managed by the Advisers and to those of peer groups of funds and information about any applicable expense caps and fee “breakpoints,” (iii) sales and redemption data in respect of the Funds, (iv) information about the profitability of the Agreements to the Advisers and (v) information obtained through the completion of a questionnaire by the Advisers (the Trustees are consulted as to the information requested through that questionnaire). The Board of Trustees, including the Independent Trustees, also consider other matters such as (i) each Adviser’s financial results and/or financial condition, (ii) the Funds’ investment objectives and strategies and the size, education and experience of the Advisers’ respective investment staffs and their use of technology, external research and trading cost measurement tools, (iii) arrangements in respect of the distribution of the Funds’ shares and the related costs, (iv) the procedures employed to determine the value of the Funds’ assets, (v) the allocation of the Funds’ brokerage, if any, including, if applicable, allocations to brokers affiliated with the Advisers and the use of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services, (vi) the resources devoted to, and the record of compliance with, the Funds’ investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vii) information about amounts invested by the Funds’ portfolio managers in the Funds or in similar accounts that they manage and (viii) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Advisers.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board of Trustees that provide detailed information about the Funds’ investment performance and the fees charged to the Funds

29 |

for advisory and other services. This information generally includes, among other things, an internal performance rating for the Funds based on agreed-upon criteria, graphs showing performance and fee differentials against the Funds’ categories of funds, performance ratings provided by a third-party, total return information for various periods, and third-party performance rankings for various periods comparing the Funds against their categories. The portfolio management team for the Funds or other representatives of the Advisers make periodic presentations to the Contract Review and Governance Committee and/or the full Board of Trustees, and if the Funds are identified as presenting possible performance concerns it may be subject to more frequent board presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about the Funds’ portfolios. The Trustees also receive periodic updates between meetings.

The Board of Trustees most recently approved the continuation of the Agreements at their meeting held in June 2011. The Agreements were continued for a one-year period. In considering whether to approve the continuation of the Agreements, the Board of Trustees, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included, but were not limited to, the factors listed below.

The nature, extent and quality of the services provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Advisers and their affiliates to the Funds and the resources dedicated to the Funds by the Advisers and their affiliates.

The Trustees considered not only the advisory services provided by the Advisers to the Funds, but also the administrative services provided by Natixis Asset Management Advisors, L.P. (“Natixis Advisors”) and its affiliates to the Funds.

The Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Funds and the Advisers. As noted above, the Trustees received information about the performance of the Funds over various time periods, including information which compared the performance of the Funds to the performance of a peer group and category of funds and the Funds’ performance benchmarks. In addition, the Trustees also reviewed data prepared by an independent third party which analyzed the performance of the Funds using a variety of performance metrics, including metrics which also measured the performance of the Funds on a risk adjusted basis. The Board noted that, given the recent commencement of operations of each Fund, the Funds have a limited operating history upon which to evaluate their performance.

| 30

With respect to the Funds, the Board concluded that the Funds’ performance or other relevant factors supported the renewal of the Agreements.

The Trustees also considered each Adviser’s performance and reputation generally, the performance as a fund family generally (as noted by certain financial publications), and the historical responsiveness of the Advisers to Trustee concerns about performance and the willingness of the Advisers to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Funds and the Advisers supported the renewal of the Agreements.

The costs of the services to be provided and profits to be realized by the Advisers and their affiliates from their respective relationships with the Funds. The Trustees considered the fees charged to the Funds for advisory and sub-advisory services as well as the total expense level of the Funds. This information included comparisons (provided both by management and also by an independent third party) of the Funds’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Advisers to comparable accounts (such as institutional separate accounts), as well as information about differences in such fees. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage and the greater regulatory costs associated with the management of mutual fund assets. In evaluating the Funds’ advisory and sub-advisory fees, the Trustees also took into account the demands, complexity and quality of the investment management of the Funds and the need for the Advisers to offer competitive compensation. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps for various funds in the fund family. The Trustees noted that management had instituted an expense cap for each Fund, and they considered the amounts waived or reimbursed under these caps. The Trustees noted that the ASG Diversifying Strategies Fund had an advisory fee that was above the median of a peer group of funds. The Trustees considered management’s justification for the higher fee and also noted that the advisory fee rate was only slightly above the peer group median.

The Trustees also considered the compensation directly or indirectly received by the Advisers and their affiliates from their relationships with the Funds. The Trustees reviewed information provided by management as to the profitability of the Advisers’ and their affiliates’ relationships with the Funds, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability, including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser profitability was an issue, the performance of the Funds, the expense levels of the Funds, and whether the Advisers had implemented breakpoints and/or expense caps.

31 |

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the advisory fees charged to the Funds were fair and reasonable, and that the costs of these services generally and the related profitability of the Advisers and their affiliates in respect of their relationships with the Funds supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Advisers and whether those economies are shared with the Funds through breakpoints in their investment advisory fees or other means, such as expense waivers or caps. The Trustees noted that each of the Funds was subject to an expense cap. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and a relative basis) and the profitability to the Advisers and their affiliates of their relationships with the Funds, as discussed above.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the extent to which economies of scale were shared with the Funds supported the renewal of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| | • | | The effect of recent market and economic turmoil on the performance, asset levels and expense ratios of the Funds. |

| | • | | Whether each Fund has operated in accordance with its investment objectives and the Funds’ records of compliance with its investment restrictions, and the compliance programs of the Funds and the Advisers. They also considered the compliance-related resources the Advisers and their affiliates were providing to the Funds. |

| | • | | The nature, quality, cost and extent of administrative and shareholder services performed by the Advisers and their affiliates, both under the Agreements and under separate agreements covering administrative services. |

| | • | | So-called “fallout benefits” to the Advisers, such as the engagement of affiliates of the Advisers to provide distribution, administrative and brokerage services to the Funds. The Trustees also considered the fact that Natixis Advisors’ parent company benefits from the retention of affiliated Advisers. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

| | • | | The Trustees’ review and discussion of the Funds’ advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that each of the existing Agreements should be continued through June 30, 2012.

| 32

Consolidated Portfolio of Investments – as of June 30, 2011 (Unaudited)

ASG Diversifying Strategies Fund

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | | | | | |

| | Certificates of Deposit — 69.1% of Net Assets | | | | |

| $ | 13,000,000 | | | National Bank of Canada, 0.030%, 7/01/2011 | | $ | 13,000,000 | |

| | 13,000,000 | | | Citibank, 0.070%, 7/01/2011 | | | 13,000,000 | |

| | 2,000,000 | | | Toronto Dominion Bank, 0.270%, 7/07/2011 | | | 2,000,054 | |

| | 4,500,000 | | | Standard Chartered Bank (NY), 0.270%, 7/11/2011 | | | 4,500,126 | |

| | 5,000,000 | | | Credit Industriel et Commercial (NY), 0.460%, 7/11/2011(b) | | | 5,000,430 | |

| | 7,000,000 | | | Banco Bilbao de Vizcaya Argentaria (NY), 0.510%, 7/11/2011 | | | 7,000,271 | |

| | 12,000,000 | | | UniCredit Bank AG (NY), 0.270%, 7/18/2011 | | | 12,000,060 | |

| | 5,000,000 | | | Lloyds TSB Bank PLC (NY), 0.230%, 7/19/2011 | | | 5,000,100 | |

| | 10,000,000 | | | Toronto Dominion Bank, 0.200%, 7/20/2011 | | | 10,000,211 | |

| | 13,000,000 | | | Bank of Montreal (IL), 0.120%, 7/25/2011 | | | 13,000,000 | |

| | 8,000,000 | | | KBC Bank NV (NY), 0.490%, 7/29/2011 | | | 8,002,000 | |

| | 5,000,000 | | | Barclays Bank PLC, 1.000%, 7/29/2011 | | | 5,003,295 | |

| | 12,000,000 | | | Societe Generale, 0.200%, 8/01/2011 | | | 11,999,676 | |

| | 4,500,000 | | | Lloyds TSB Bank PLC (NY), 0.470%, 8/01/2011 | | | 4,500,999 | |