UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00242

(Exact name of Registrant as specified in charter)

|

| 399 Boylston Street, Boston, Massachusetts 02116 |

(Address of principal executive offices) (Zip code)

|

Coleen Downs Dinneen, Esq. NGAM Distribution, L.P. 399 Boylston Street Boston, Massachusetts 02116 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: November 30

Date of reporting period: May 31, 2012

Item 1. Reports to Stockholders.

The Registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

SEMIANNUAL REPORT

May 31, 2012

ASG Growth Markets Fund

Gateway International Fund

Loomis Sayles Capital Income Fund

Loomis Sayles Senior Floating Rate and Fixed Income Fund

TABLE OF CONTENTS

Management Discussion and Investment Results page 1

Portfolio of Investments page 15

Financial Statements page 31

ASG GROWTH MARKETS FUND

Management Discussion

Managers:

Andrew W. Lo

Jeremiah H. Chafkin

Alexander D. Healy

AlphaSimplex Group, LLC

Robert S. Rickard

Reich & Tang Asset Management, LLC

Khalid (Kal) Ghayur

Stephen C. Platt

Westpeak Global Advisors, LLC

Objective:

The fund seeks to provide total return consistent with broad-based emerging market equity indexes while exposing investors to less risk than one or more such index.

Strategy:

Primarily invests in a portfolio of equity securities of companies located in emerging markets and derivative instruments that has risk and return characteristics similar to those of broad-based emerging market equity indexes.

Fund Inception:

October 21, 2011

Symbols:

| | |

| Class A | | AGMAX |

| Class C | | AGMCX |

| Class Y | | AGMYX |

What You Should Know:

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

Market Conditions

The period began full of optimism for a better year in financial markets despite turbulence from the European debt crisis. Investor hopes were buoyed by the European Central Bank’s additional allocation of short-term loans to meet demand from eurozone banks. Further monetary easing from developed and emerging market central banks added to the belief that emerging markets could avoid a material slowdown in growth. This optimism, in conjunction with hopes that increased liquidity would alleviate financing pressures in Europe, helped equities stage an impressive rally during the first quarter of 2012, with emerging markets slightly outperforming developed markets.

Hopes faded, however, as the second quarter advanced. Political uncertainty in Europe raised concerns about the ability of the eurozone to deal with financing issues and whether it is feasible for all member states to remain within the union. A Greek exit from the euro became a possibility, and the risk of contagion from Spain and Italy became a more imminent threat. Weaker-than-expected economic activity also fueled negative investor sentiment and demand rose for safe-haven currencies, such as the U.S. dollar and the Japanese yen, which further weakened emerging market returns.

Performance Results

For the six months ended May 31, 2012, Class A shares of ASG Growth Markets Fund returned -8.35% at net asset value. The fund underperformed its benchmark, the MSCI Emerging Markets Index (Net), which returned -1.14% over the same period.

Explanation of Fund Performance

The fund’s strategy is to manage a core portfolio of emerging market equities, together with an overlay of futures and forwards that is designed to manage and contain the risks of emerging markets. The core equity portfolio, which represents about two-thirds of the fund’s assets, seeks to track the MSCI Emerging Markets Index (Net) with modest tilts toward low valuation and high price-momentum stocks.

During the period, the core equity portfolio performed generally in line with its benchmark. The difference in performance between the fund and its benchmark occurred mostly in January as a result of efforts to hedge exposure to emerging markets in response to the substantial losses and elevated risk exhibited in the latter half of 2011.

Because equity and currency risk were identified as significant factors explaining emerging market performance in 2011, the portfolio’s risk-management overlay held short positions in equity futures and currency forwards as a hedge to offset emerging market risks entering 2012. Over the course of the first quarter, the degree of hedging in the risk-management overlay was reduced as markets recovered and volatility declined. Despite this reduction in hedging positions, the offsetting overlay exposures resulted in muted gains during the first quarter, relative to the fund’s benchmark. Larger hedge positions were reinstated as emerging markets declined in the period from March through May and, while the fund experienced negative returns over the period, it declined less than the benchmark.

As a result of these offsetting overlay exposures, the annualized volatility (as measured by standard deviation) of the ASG Growth Markets Fund during the period from December 1, 2011 through May 31, 2012 was 10.6%, as compared to the annualized volatility of 16.0% experienced by the benchmark over the same period.

Outlook

The outlook for global markets has turned negative as fears of global slowdown and political uncertainty remain high. Markets will be looking towards Europe for a more comprehensive solution to the debt crises. The impending presidential election in the United States will likely keep Washington from actively addressing current unemployment levels or the budget deficit, reducing chances of faster economic recovery. Investors are expected to focus on the slowing of growth in emerging markets – with China’s economy being a major focus – and whether increased stimulus spending, quantitative easing or decreased reserve requirements are able to stave off further recessionary pressures in the sector. If not, it is possible that capital flight from emerging markets will continue, putting downward pressure on asset prices.

1 |

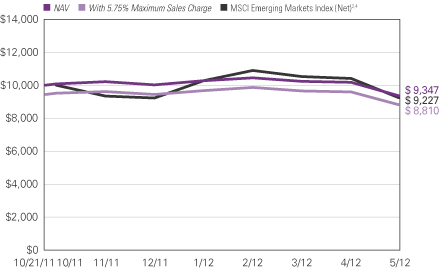

ASG GROWTH MARKETS FUND

Investment Results through May 31, 2012

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of $10,000 Investment in Class A Shares5

October 21, 2011 (inception) through May 31, 2012

Total Returns — May 31, 20125

| | | | | | | | |

| | | |

| | | 6 Months | | | Since

Inception | |

| | | |

| Class A (Inception 10/21/11) | | | | | | | | |

| NAV | | | -8.35 | % | | | -6.52 | % |

| With 5.75% Maximum Sales Charge | | | -13.60 | | | | -11.89 | |

| | | |

| Class C (Inception 10/21/11) | | | | | | | | |

| NAV | | | -8.71 | | | | -6.88 | |

| With CDSC1 | | | -9.61 | | | | -7.80 | |

| | | |

| Class Y (Inception 10/21/11) | | | | | | | | |

| NAV | | | -8.32 | | | | -6.39 | |

| | | |

| Comparative Performance | | | | | | | | |

| MSCI Emerging Markets Index (Net)2 | | | -1.14 | | | | -0.14 | |

| Morningstar Diversified Emerging Markets Fund Avg.3 | | | -3.10 | | | | -1.57 | |

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| | | | |

| Fund Composition | | % of Net

Assets as of

5/31/12 | |

| Common Stocks | | | 61.7 | |

| Preferred Stocks | | | 1.1 | |

| Forward Foreign Currency Contracts | | | 0.5 | |

| Futures Contracts | | | 0.9 | |

| Short-Term Investments and Other | | | 35.8 | |

Expense Ratios

as stated in the most recent prospectus

| | | | | | | | |

Share

Class | | Gross Expense

Ratio6 | | | Net Expense

Ratio7 | |

| A | | | 2.28 | % | | | 1.71 | % |

| C | | | 3.03 | | | | 2.46 | |

| Y | | | 2.03 | | | | 1.46 | |

NOTES TO CHARTS

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | MSCI Emerging Markets Index (Net) is an unmanaged index that is designed to measure the equity market performance of emerging markets. |

| 3 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 4 | The since-inception comparative performance figures shown are calculated from 10/31/11. |

| 5 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 6 | Before fee waivers and/or expense reimbursements. |

| 7 | After fee waivers and/or expense reimbursements. Waivers/reimbursements are contractual and are set to expire on 3/31/13. Contracts are reevaluated on an annual basis. |

| 2

GATEWAY INTERNATIONAL FUND

Management Discussion

Managers:

Michael T. Buckius, CFA

Kenneth H. Toft, CFA

Gateway Investment Advisers, LLC

Objective:

Over the long term, the fund seeks to capture the majority of the returns associated with international developed market equity investments, while exposing investors to less risk than such investments generally.

Strategy:

Under normal circumstances, invests in a broadly diversified portfolio of common stocks of non-U.S. companies, while also selling index call options and buying index put options.

Fund Inception:

March 30, 2012

Symbols:

| | |

| Class A | | GAIAX |

| Class C | | GAICX |

| Class Y | | GAIYX |

What You Should Know:

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

Market Conditions

International markets struggled in April and May of 2012 with deteriorating economic conditions in Europe. The inclusion or exclusion of Greece from the eurozone was a fiercely debated topic in European capitals, and a series of elections across the continent revealed a populace weary of austerity. Economic data continued to show the eurozone economies slowing, and rates on sovereign debt of countries such as Spain, Portugal, Ireland and Italy climbed to levels largely seen as unsustainable over the long term.

Concerns regarding the stability of the European financial system spilled over into the Asian equity markets as well. These concerns were compounded by the perception that Asian policymakers, especially in China, were slow to act to avoid stoking domestic inflation. Australian stocks were weak due to concerns regarding a possible hard-landing in China, which imports raw materials from Australia.

As European and Asian markets struggled into May and investors fled for a safe haven, the U.S. dollar strengthened. This further weakened returns of Asian and European stocks held by U.S. investors.

Performance Results

From the inception of the fund on March 30, 2012 through May 31, 2012, Class A shares of Gateway International Fund returned -8.10% at net asset value. In a difficult environment for international stock markets, the fund held up better than its benchmark, the MSCI EAFE Index (net in U.S. dollars), which returned -13.21% over the same time period.

Explanation of Fund Performance

Hedging to help mitigate losses in periods of significant market declines over short periods of time is a fundamental component of the fund’s strategy, and the hedging strategies of the fund achieved that objective over this time period.

The combination of selling a portfolio of index call options on international indexes and purchasing protective index put options generated cash flow and reduced risk. For the period, the hedging portion of the fund generated returns of approximately 5.7%. While not enough to offset the entire loss in the equity portfolio, the hedging process was able to meaningfully reduce losses in a difficult market and allowed the fund to outperform its benchmark.

The final component of the fund’s return is the performance of the local currencies of each of the markets in which the fund invests. Over this period, currency values (except the Japanese yen) fell relative to the U.S. dollar. The fund does not hedge foreign currency exposure, so a stronger U.S. dollar translated into a loss of approximately 3.2% for the fund.

Outlook

After a difficult period, Europe appears to be willing to take dramatic steps to hold the eurozone together and stabilize its financial system. Eurozone markets have responded positively, which should help equity performance going forward. However, the results of a significant election in Greece and unfolding problems in the Spanish banking system could derail this process.

In Asia, investors continue to weigh the state of the Chinese economy and the response of the Chinese government to the slowdown. China has ramifications not only in the region but also on worldwide commodity prices. Japan has been wrestling with a strengthening currency, which is impairing its export-led economy and has impeded its already lackluster growth. The Bank of Japan has been actively working to weaken the yen and kick start domestic growth.

Against this backdrop of significant uncertainty, we believe that equity market volatility is likely to stay elevated. Higher volatility should translate into higher levels of cash flow from the fund’s hedging activities. The result should be an opportunity for attractive returns if markets improve or hold steady at current levels and attractive levels of risk management should markets continue to struggle.

3 |

GATEWAY INTERNATIONAL FUND

Investment Results through May 31, 2012

The table comparing the fund’s performance to an index provides a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Total Returns — May 31, 20124

| | | | |

| | |

| | | Since

Inception | |

| | |

| Class A (Inception 3/30/2012) | | | | |

| NAV | | | -8.10 | % |

| With 5.75% Maximum Sales Charge | | | -13.38 | |

| | |

| Class C (Inception 3/30/2012) | | | | |

| NAV | | | -8.10 | |

| With CDSC1 | | | -9.02 | |

| | |

| Class Y (Inception 3/30/2012) | | | | |

| NAV | | | -8.00 | |

| | |

| Comparative Performance | | | | |

| MSCI EAFE Index (Net)2 | | | -13.21 | |

| Morningstar Long/Short Equity3 | | | -4.13 | |

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| | | | |

| Fund Composition | | % of Net Assets as of 5/31/12 | |

| Common Stocks | | | 92.8 | |

| Purchased Options | | | 1.0 | |

| Written Options | | | (1.5 | ) |

| Short-Term Investments and Other | | | 7.7 | |

| |

| Ten Largest Holdings | | % of Net Assets as of 5/31/12 | |

| Royal Dutch Shell PLC, A Shares | | | 2.2 | |

| Nestle S.A., (Registered) | | | 2.1 | |

| Total S.A. | | | 2.1 | |

| Sanofi | | | 1.9 | |

| Fast Retailing Co. Ltd. | | | 1.9 | |

| HSBC Holdings PLC | | | 1.7 | |

| Siemens AG, (Registered) | | | 1.6 | |

| Novartis AG, (Registered) | | | 1.6 | |

| Vodafone Group PLC | | | 1.5 | |

| FANUC Corp. | | | 1.5 | |

| |

| Five Largest Countries | | % of Net Assets as of 5/31/12 | |

| Japan | | | 21.9 | |

| United Kingdom | | | 19.5 | |

| Germany | | | 10.4 | |

| France | | | 10.0 | |

| Australia | | | 8.3 | |

Portfolio holdings and asset allocations will vary.

Expense Ratios

as stated in the most recent prospectus

| | | | | | | | |

Share

Class | | Gross Expense

Ratio5 | | | Net Expense

Ratio6 | |

| A | | | 1.98 | % | | | 1.35 | % |

| C | | | 2.73 | | | | 2.10 | |

| Y | | | 1.73 | | | | 1.10 | |

NOTES TO CHARTS

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | MSCI EAFE Index (Net) (Europe, Australasia, Far East) is an unmanaged index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. |

| 3 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 5 | Before fee waivers and/or expense reimbursements. |

| 6 | After fee waivers and/or expense reimbursements. Waivers/reimbursements are contractual and are set to expire on 3/31/13. Contracts are reevaluated on an annual basis. |

| 4

LOOMIS SAYLES CAPITAL INCOME FUND

Management Discussion

Managers:

Arthur Barry, CFA

Daniel J. Fuss, CFA

Kathleen C. Gaffney, CFA

Warren N. Koontz, CFA

Loomis, Sayles & Company, L.P.

Objective:

The fund seeks high total return through a combination of current income and capital appreciation.

Strategy:

Under normal market conditions, will invest at least 70% of its assets in equity securities that may include common stocks, preferred stocks and convertible securities, including, among others, warrants, convertible debt securities and convertible preferred stock.

Fund Inception:

March 30, 2012

Symbols:

| | |

| Class A | | LSCAX |

| Class C | | LSCCX |

| Class Y | | LSCYX |

What You Should Know:

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

Market Conditions

Overall, market instability characterized the period from the fund’s inception on March 30, 2012, through May 31, 2012. The deteriorating sovereign debt situation in Europe, specifically Greece’s potential exit from the euro, and the corresponding fear of contagion spurred volatility and put downward pressure on the markets. In addition, U.S. macroeconomic indicators softened during the two-month period, casting a pall on forecasts concerning the domestic recovery and dampening investor optimism. Furthermore, China, the world’s second-largest economy, also showed signs of slowing, further diminishing prospects for global growth.

Performance Results

For the period from the fund’s inception on March 30, 2012 through May 31, 2012, Class A shares of Loomis Sayles Capital Income Fund returned -5.40% at net asset value. In a difficult period for stocks around the world, the fund held up better than its primary benchmark, the S&P 500 Index, and its secondary benchmark, the Russell 1000 Value Index, which returned -6.60% and -6.82% respectively. The fund also outperformed the -6.53% average return of the Morningstar Aggressive Allocation category.

Explanation of Fund Performance

The fund generally tends to overweight more defensive, slower growing stock market sectors. During the period, the fund’s strong security selection in the consumer discretionary sector aided performance. An overweight position in telecommunications was also helpful to results. The fund’s allocation in foreign-domiciled stocks generally detracted from the results of our stock-selection effort, as these stocks were among the worst-performers during the period.

An equity position in clothing retailer American Eagle was the among the strongest absolute performers for the period. The company generated better-than-expected revenue growth, margin expansion and inventory control under the leadership of its new CEO. Additionally, positions in telecommunication providers AT&T and Verizon Communications posted strong absolute performance, driven by increases in their wireless service revenues. During the period, Apple was added to the fund after a selloff and experienced subsequent price appreciation from strong market growth in China and the anticipation of an upcoming dividend.

Financial services giant JP Morgan was the most significant detractor from performance. Shares tumbled due to the estimated $2 billion in trading losses the company disclosed in May. We found this to be a good buying opportunity as the error, while a black mark for CEO James Dimon, could easily be absorbed by the strength of the company’s balance sheet. A position in Martin Marietta, a provider of construction materials, underperformed due to a hostile takeover attempt and economic woes. Furthermore, a position in insurance company MetLife detracted from performance. The company was not permitted to deploy its excess capital because it did not pass the latest Federal Reserve Board “stress test” for the top 20 bank holding companies.

Within the fund’s fixed-income allocation, a long duration position (price sensitivity to interest rate changes) aided performance as interest rates fell throughout the two-month period. Selected consumer non-cyclical names within the portfolio generated strong returns. Positions in high yield financials and utilities also contributed modestly to return.

By contrast, investment-grade credit struggled during the period, weighed down by market events and a marked evaporation of liquidity. Investment-grade industrial and financials names were the largest detractors. During the period, the fund did not hold U.S. Treasuries, which hampered performance because investors sought high-quality assets, particularly late in the period.

Outlook

We expect volatility to remain elevated due to geopolitical risks, energy market uncertainty and the European sovereign debt crisis. In this environment, we expect macroeconomic factors to continue to influence the markets because of investors’ erratic responses toward risk and economic news. We expect to continue to select stocks that sell at what we believe are significant discounts to their intrinsic value, mindful of the risks incurred. Within the fund’s fixed-income positions, we are opportunistically adding to peripheral European corporates and maintaining a long duration stance.

5 |

LOOMIS SAYLES CAPITAL INCOME FUND

Investment Results through May 31, 2012

The table comparing the fund’s performance to an index provides a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Total Returns — May 31, 20125

| | | | |

| | |

| | | Since Inception | |

| | |

| Class A (Inception 3/30/2012) | | | | |

| NAV | | | -5.40 | % |

| With 5.75% Maximum Sales Charge | | | -10.84 | |

| | |

| Class C (Inception 3/30/2012) | | | | |

| NAV | | | -5.60 | |

| With CDSC1 | | | -6.54 | |

| | |

| Class Y (Inception 3/30/2012) | | | | |

| NAV | | | -5.40 | |

| | |

| Comparative Performance | | | | |

| S&P 500® Index2 | | | -6.60 | |

| Russell 1000® Value Index3 | | | -6.82 | |

| Morningstar Aggressive Allocation4 | | | -6.53 | |

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| | | | |

| Fund Composition | | % of Net Assets as of 5/31/12 | |

| Common Stocks | | | 78.0 | |

| Bonds and Notes | | | 18.0 | |

| Preferred Stocks | | | 0.6 | |

| Short-Term Investments and Other | | | 3.4 | |

| |

| Ten Largest Holdings | | % of Net Assets as of 5/31/12 | |

| ExxonMobil Corp. | | | 2.3 | |

| Norfolk Southern Corp. | | | 2.2 | |

| EDP Finance BV, 6.000%, 02/02/2018 | | | 2.2 | |

| Sara Lee Corp. | | | 2.2 | |

| Pfizer, Inc. | | | 2.0 | |

| Merck & Co., Inc. | | | 2.0 | |

| Coca-Cola Enterprises, Inc. | | | 2.0 | |

Telecom Italia Capital S.A., 6.000%, 09/30/2034 | | | 1.9 | |

New Albertson's, Inc., 8.000%, 05/01/2031 | | | 1.9 | |

| National Fuel Gas Co. | | | 1.9 | |

| |

| Five Largest Industries | | % of Net Assets as of 5/31/12 | |

| Pharmaceuticals | | | 8.7 | |

| Oil, Gas & Consumable Fuels | | | 6.1 | |

| Banking | | | 4.2 | |

Diversified Telecommunication Services | | | 3.8 | |

| Beverages | | | 3.7 | |

Portfolio holdings and asset allocations will vary.

Expense Ratios

as stated in the most recent prospectus

| | | | | | | | |

Share

Class | | Gross Expense

Ratio6 | | | Net Expense

Ratio7 | |

| A | | | 1.32 | % | | | 1.20 | % |

| C | | | 2.07 | | | | 1.95 | |

| Y | | | 1.07 | | | | 0.95 | |

NOTES TO CHARTS:

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

| 3 | Russell 1000® Value Index is an unmanaged index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. |

| 4 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 5 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 6 | Before fee waivers and/or expense reimbursements. |

| 7 | After fee waivers and/or expense reimbursements. Waivers/reimbursements are contractual and are set to expire on 3/31/13. Contracts are reevaluated on an annual basis. |

| 6

LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND

Management Discussion

Managers:

Kevin J. Perry

John R. Bell

Loomis, Sayles & Company, L.P.

Objective:

The fund seeks to provide a high level of current income.

Strategy:

Primarily invests in a combination of adjustable floating rate loans and other floating rate debt instruments issued by U.S. and non-U.S. corporations or other business entities and fixed income securities, including derivatives that reference the returns of these instruments.

Fund Inception:

Class A & Class C:

September 30, 2011

Class Y:

September 16, 2011*

Fund Registration:

September 30, 2011*

Symbols:

| | |

| Class A | | LSFAX |

| Class C | | LSFCX |

| Class Y | | LSFYX |

What You Should Know:

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| * | 9/16/11 represents commencement of operations for Class Y shares for accounting and financial reporting purposes only. 9/30/11 represents the date Class Y shares were first registered for public sale under the Securities Act of 1933. |

Market Conditions

Healthy technical conditions and upbeat investor sentiment generally supported favorable capital market performance during the six-month period. In particular, perceived progress on the European Union’s sovereign debt crisis helped generate positive returns for the first five months of the period.

As the 2011 calendar year ended, macroeconomic factors overshadowed technical factors. Investors became more optimistic in January and February, and lower-rated bank loans generally performed well. In March and April, investor sentiment continued to be upbeat, which helped stabilize the bank loan sector. In fact, market performance was nearly identical in February, March and April. However, in May, fears over euro zone instability and slowing growth in China combined with softening technical conditions to cause the first negative monthly return in six months. Overall, strong liquidity and demand supported an increase in supply from bank-loan-issuing corporations, who used the funds to support mergers and acquisitions (M&A) activity.

Performance Results

For the six months ended May 31, 2012, Class A shares of Loomis Sayles Senior Floating Rate and Fixed Income Fund returned 6.82% at net asset value. The fund outperformed its benchmark, the S&P/LSTA Leveraged Loans Index, which returned 4.35% for the period. The fund outperformed the 4.54% average return of funds in its peer group, the Morningstar Bank Loan category.

Explanation of Fund Performance

The fund does not expect to make frequent tactical moves as part of its general investment strategy. Instead, the fund focuses on credit selection and generating a high level of current income over a full credit cycle while reserving its tactical flexibility to manage exposures appropriately based on significant shifts in our macroeconomic view.

On balance, the market tone was positive during the period, which helped support the fund’s returns. In this type of market environment, we are inclined to target issues offering higher income through our portfolio construction process and were successful in doing so during the period. Exposure to the primary issuance market also helped the fund’s price return versus the benchmark. No fund holdings defaulted during the six-month period.

The fund ended the period with 84% of the portfolio invested in bank loans, 9% invested in bonds and 7% held in cash. To minimize their interest rate sensitivity compared with more typical high-yield bonds, our bond selections have been focused on short-maturities (five years and shorter) with yields that we believe will add to loan performance. Loans remained attractive relative to bonds, as evidenced by the fund’s relatively small allocation to bonds during the period, an allocation decision that was positive for credit risk. We maintained a Standard & Poor’s average quality rating of B within the portfolio throughout the period. Furthermore, we did not change the fund’s risk positioning other than to increase its cash weight in May.

Outlook

Positive macroeconomic factors and the lack of major negative market shocks created a positive environment for loan performance during the six-month period. We believe that market participants generally expect the current trends to continue in the near term. While M&A activity seems to be picking up, the pipeline of new loan issues remains modest. Consensus opinions for CLO issuance and mutual fund inflows continue to suggest modest demand improvement.

Rating agencies and market consensus agree that the U.S. non-investment grade default rate will remain lower than the long-term average over the next 12 months. Combined with an expected improvement in market demand, low default rates imply a positive environment for credit investments over that period. However, European weakness, U.S. fiscal policy and potentially slowing growth in China are among the factors that have the potential to drive investors periodically to perceived safe-haven investments.

7 |

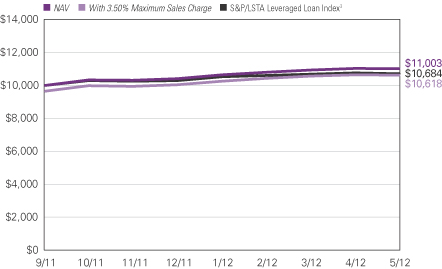

LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND

Investment Results through May 31, 2012

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of $10,000 Investment in Class A Shares5

September 30, 2011 (inception) through May 31, 2012

Total Returns — May 31, 20125

| | | | | | | | |

| | | |

| | | 6 Months | | | Since

Inception | |

| | | |

| Class A (Inception 9/30/11) | | | | | | | | |

| NAV | | | 6.82 | % | | | 10.03 | % |

| With 3.50% Maximum Sales Charge | | | 3.12 | | | | 6.14 | |

| | | |

| Class C (Inception 9/30/11) | | | | | | | | |

| NAV | | | 6.46 | | | | 9.51 | |

| With CDSC2 | | | 5.46 | | | | 8.51 | |

| | | |

| Class Y (Inception 9/30/11)1 | | | | | | | | |

| NAV | | | 6.92 | | | | 10.17 | |

| | | |

| Comparative Performance | | | | | | | | |

| S&P / LSTA Leveraged Loan® Index3 | | | 4.35 | | | | 6.84 | |

| Morningstar Bank Loan Fund Avg.4 | | | 4.54 | | | | 7.12 | |

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| | | | |

| Fund Composition | | % of Net

Assets as of

5/31/12 | |

| Senior Loans | | | 83.9 | |

| Bonds and Notes | | | 9.3 | |

| Short-Term Investments and Other | | | 6.8 | |

| | | | |

| Credit Quality | | % of Net

Assets as of

5/31/12* | |

| BBB | | | 0.9 | |

| BB | | | 23.7 | |

| B | | | 53.9 | |

| CCC & Lower | | | 12.6 | |

| Not Rated | | | 2.1 | |

| Short-term and other | | | 6.8 | |

| * | Credit quality at 5/31/12 reflects ratings assigned to individual holdings of the fund by Standard & Poor's (S&P); ratings are subject to change. The fund's shares are not rated by any rating agency and no credit rating for fund shares is implied. |

| | | | |

| Effective Maturity | | % of Net

Assets as of 5/31/12 | |

| 1 year or less | | | 7.6 | |

| 1-5 years | | | 36.7 | |

| 5-10 years | | | 55.1 | |

| 10+ years | | | 0.6 | |

| Average Effective Maturity | | | 5.1 years | |

Portfolio characteristics will vary.

Expense Ratios

as stated in the most recent prospectus

| | | | | | | | |

| Share Class | | Gross Expense Ratio6 | | | Net Expense Ratio7 | |

| A | | | 1.65 | % | | | 1.32 | % |

| C | | | 2.40 | | | | 2.07 | |

| Y | | | 1.40 | | | | 1.07 | |

NOTES TO CHARTS:

| 1 | 9/30/11 represents the date Class Y shares were first registered for public sale under the Securities Act of 1933. 9/16/11 represents commencement of operations for Class Y shares for accounting and financial reporting purposes only. |

| 2 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 3 | S&P/LSTA Leveraged Loan® Index reflects the market-weighted performance of institutional leveraged loans based upon real-time market weightings, spreads and interest payments. |

| 4 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 5 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 6 | Before fee waivers and/or expense reimbursements. |

| 7 | After fee waivers and/or expense reimbursements. Waivers/reimbursements are contractual and are set to expire on 3/31/13. Contracts are reevaluated on an annual basis. |

| 8

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

Before investing, consider a fund’s investment objectives, risks, charges and expenses. Visit ngam.natixis.com or call 800-225-5478 for a prospectus and/or a summary prospectus, both of which contain this and other information. Read it carefully.

PROXY VOTING INFORMATION

A description of the funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the funds’ website at ngam.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how the funds voted proxies relating to portfolio securities during the 12-month period ended June 30, 2012 will be available from the funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The funds’ Forms N-Q will be available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

9 |

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the funds’ prospectus. The examples below are intended to help you understand the ongoing costs of investing in the funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of fund shares shows the actual account values and actual fund expenses you would have paid on a $1,000 investment in the fund from December 1, 2011 through May 31, 2012 for ASG Growth Markets Fund and Loomis Sayles Senior Floating Rate and Fixed Income Fund and from March 30, 2012 through May 31, 2012 for Gateway International Fund and Loomis Sayles Capital Income Fund. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number

in the Expenses Paid During Period column as shown below for your class.

The second line in the table for each class of fund shares provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | | | | | | | |

| ASG GROWTH MARKETS FUND | | BEGINNING ACCOUNT VALUE

12/1/2011 | | | ENDING ACCOUNT VALUE

5/31/2012 | | | EXPENSES PAID DURING PERIOD*

12/1/2011 – 5/31/2012 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $916.50 | | | | $8.29 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.35 | | | | $8.72 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $912.90 | | | | $11.81 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,012.65 | | | | $12.43 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $916.80 | | | | $7.09 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,017.60 | | | | $7.47 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement), including expenses of the Subsidiary (see Note 1 of Notes to Financial Statements) and interest expense: 1.73%, 2.47% and 1.48% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

| 10

UNDERSTANDING FUND EXPENSES

| | | | | | | | | | | | |

| GATEWAY INTERNATIONAL FUND | | BEGINNING ACCOUNT VALUE

12/1/20111 | | | ENDING ACCOUNT VALUE

5/31/2012 | | | EXPENSES PAID DURING PERIOD

12/1/20111 – 5/31/2012 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $919.00 | | | | $2.19 | 1 |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.25 | | | | $6.81 | * |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $919.00 | | | | $3.41 | 1 |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.50 | | | | $10.58 | * |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $920.00 | | | | $1.79 | 1 |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.50 | | | | $5.55 | * |

| * | Hypothetical expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.35%, 2.10% and 1.10% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year (183), divided by 366 (to reflect the half-year period). |

| 1 | Fund commenced operations on March 30, 2012. Actual expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.35%, 2.10% and 1.10% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal period (62), divided by 366 (to reflect the partial period). |

| | | | | | | | | | | | |

| LOOMIS SAYLES CAPITAL INCOME FUND | | BEGINNING ACCOUNT VALUE

12/1/20111 | | | ENDING ACCOUNT VALUE

5/31/2012 | | | EXPENSES PAID DURING PERIOD

12/1/20111 – 5/31/2012 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $946.00 | | | | $1.98 | 1 |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.00 | | | | $6.06 | * |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $944.00 | | | | $3.21 | 1 |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.25 | | | | $9.82 | * |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $946.00 | | | | $1.57 | 1 |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.25 | | | | $4.80 | * |

| * | Hypothetical expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.20%, 1.95% and 0.95% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year (183), divided by 366 (to reflect the half-year period). |

| 1 | Fund commenced operations on March 30, 2012. Actual expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.20%, 1.95% and 0.95% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal period (62), divided by 366 (to reflect the partial period). |

11 |

UNDERSTANDING FUND EXPENSES

| | | | | | | | | | | | |

LOOMIS SAYLES SENIOR FLOATING RATE

AND FIXED INCOME FUND | | BEGINNING ACCOUNT VALUE

12/1/2011 | | | ENDING ACCOUNT VALUE

5/31/2012 | | | EXPENSES PAID DURING PERIOD*

12/1/2011 – 5/31/2012 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,068.20 | | | | $5.69 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.50 | | | | $5.55 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,064.60 | | | | $9.55 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.75 | | | | $9.32 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,069.20 | | | | $4.40 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.75 | | | | $4.29 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.10%, 1.85% and 0.85% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

| 12

BOARD APPROVAL OF THE INITIAL ADVISORY AGREEMENTS FOR GATEWAY INTERNATIONAL FUND AND LOOMIS SAYLES CAPITAL INCOME FUND

The Investment Company Act of 1940, as amended (the “1940 Act”), requires that both the full Board of Trustees of the Trusts and a majority of the Trustees who are not “interested persons” (as defined in the 1940 Act) of the Trusts (the “Independent Trustees”), voting separately, initially approve for a two-year term any new investment advisory agreements for a registered investment company, including newly formed funds such as the Gateway International Fund and the Loomis Sayles Capital Income Fund (each a “Fund” and collectively, the “Funds”). The Trustees, including the Independent Trustees, unanimously approved the proposed investment advisory agreements (together, the “Agreements”) for the Funds at an in-person meeting held on March 9, 2012.

In connection with this review, Fund management and other representatives of the Gateway International Fund’s adviser, Gateway Investment Advisers, LLC (“Gateway”), and the Loomis Sayles Capital Income Fund’s adviser, Loomis, Sayles & Company, L.P. (“Loomis Sayles”) (collectively, the “Advisers”), distributed to the Trustees materials including, among other items, (i) information on the proposed advisory fees and other expenses to be charged to the Funds, including information comparing the Funds’ expenses to those of peer groups of funds and information on fees charged to other accounts advised or sub-advised by the Advisers and the proposed expense cap, (ii) the Funds’ investment objectives and strategies, (iii) the size, education and experience of the Advisers’ respective investment staff and the investment strategies proposed to be used in managing the Funds, (iv) proposed arrangements for the distribution of the Funds’ shares, (v) the procedures proposed to be employed to determine the value of the Funds’ assets, (vi) each Fund’s investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vii) information about the Advisers’ performance, and (viii) the general economic outlook with particular emphasis on the mutual fund industry. The Trustees also considered the fact that they oversee other funds advised or sub-advised by the Advisers as well as information about the Advisers they had received in connection with their oversight of those other funds. Because the Funds are newly formed and had not commenced operations at the time of the Trustees’ review, certain information, including data relating to Fund performance, was not available, and therefore could not be distributed to the Trustees. Throughout the process, the Trustees were afforded the opportunity to ask questions of, and request additional materials from, the Advisers.

In considering whether to initially approve the Agreements, the Board of Trustees, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving weight to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included, but were not limited to, the factors listed below:

The nature, extent and quality of the services to be provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services to be provided by the Advisers and their respective affiliates to the Funds, and the resources to be dedicated to the Funds by the Advisers and their respective affiliates. The Trustees considered their experience with other funds advised or sub-advised by the Advisers, as well as any affiliations between the Advisers and Natixis Global Asset Management, L.P. (“Natixis US”). In this regard, the Trustees considered not only the advisory services proposed to be provided by the Advisers to the Funds, but also the monitoring and administrative services proposed to be provided by NGAM Advisors, L.P. (“NGAM Advisors”) and its affiliates to the Funds.

The Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that the scope of the services to be provided to the Funds under the Agreements seemed consistent with the Funds’ operational requirements, and that the Advisers had the capabilities, resources and personnel necessary to provide the advisory services that would be required by the Funds. The Trustees determined that the nature, extent and quality of services proposed to be provided under the Agreements supported approval of the Agreements.

Investment performance of the Funds and the Advisers. Because the Funds had not yet commenced operations, performance information for the Funds was not considered; however, the Board considered the performance of other funds and accounts managed by the Advisers, and also reviewed simulated performance of accounts managed in accordance with each Fund’s proposed strategies. Based on this and other information, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that the Advisers’ performance records and/or other relevant factors supported approval of the Agreements.

The costs of the services to be provided by the Advisers and their affiliates from their respective relationships with the Funds. Although the Funds had not yet commenced operations at the time of the Trustees’ review of the Agreements, the Trustees reviewed information comparing the proposed advisory fees and estimated total expenses of the Funds’ share classes with the fees and expenses of comparable share classes of comparable funds identified by the Advisers, and, in the case of Gateway, with the fees and expenses of other funds and institutional accounts managed by Gateway, as well as information about differences in such fees and the reasons for any such differences.

13 |

BOARD APPROVAL OF THE INITIAL ADVISORY AGREEMENTS FOR GATEWAY INTERNATIONAL FUND AND LOOMIS SAYLES CAPITAL INCOME FUND

In evaluating the fees charged to such comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage mutual fund assets. In evaluating the Funds’ proposed advisory fees, the Trustees also took into account the demands, complexity and quality of the investment management of the Funds and the need for the Advisers to offer competitive compensation. The Trustees also noted that each of the Funds would have an expense cap in place. In addition, the Trustees considered information regarding the administrative and distribution fees to be paid by the Funds to the Advisers’ affiliates.

Because the Funds had not yet commenced operations, historical profitability information with respect to the Funds was not considered. However, the Trustees noted the information provided in court cases in which adviser compensation or profitability were issues, the estimated expense levels of each of the Funds, and that each of the Funds would be subject to an expense cap.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that the advisory fees proposed to be charged to the Funds were fair and reasonable, and supported the approval of the Agreements.

Economies of scale. The Trustees considered the extent to which the Advisers may realize economies of scale or other efficiencies in managing the Funds, and whether those economies could be shared with the Funds through breakpoints in the advisory fees or other means, such as expense waivers or caps. The Trustees noted that each Fund is subject to an expense cap. After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that the extent to which economies of scale might be shared with the Funds supported the approval of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following: the compliance-related resources the Advisers and their respective affiliates would provide to the Funds and the potential so-called “fallout benefits” to the Advisers, such as the engagement of affiliates of the Advisers to provide distribution and administrative services to the Funds, and the benefits of research made available to the Advisers by reason of brokerage commissions (if any) generated by the Funds’ securities transactions. The Trustees also considered the fact that NGAM Advisors’ parent company would benefit from the retention of affiliated advisers. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest.

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that the Agreements should be approved.

| 14

Consolidated Portfolio of Investments – as of May 31, 2012 (Unaudited)

ASG Growth Markets Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | | | | | | | |

| | Common Stocks — 61.7% of Net Assets | | | | |

| | | | Brazil — 9.1% | | | | |

| | 11,300 | | | Banco Bradesco S.A., Sponsored Preference ADR(b) | | $ | 165,432 | |

| | 3,100 | | | Banco do Brasil S.A., Sponsored ADR | | | 30,690 | |

| | 3,600 | | | Banco Santander Brasil S.A., ADR | | | 28,620 | |

| | 6,700 | | | BM&FBovespa S.A. | | | 31,725 | |

| | 2,600 | | | BR Malls Participacoes S.A. | | | 28,619 | |

| | 1,500 | | | Braskem S.A., Sponsored ADR | | | 16,800 | |

| | 4,535 | | | BRF - Brasil Foods S.A., ADR | | | 70,610 | |

| | 4,400 | | | CCR S.A. | | | 34,251 | |

| | 1,400 | | | CETIP S.A. - Mercados Organizados | | | 20,200 | |

| | 500 | | | Cia Brasileira de Distribuicao Grupo Pao de Acucar, Preference ADR | | | 19,160 | |

| | 4,300 | | | Cia de Bebidas das Americas, Preference ADR(b) | | | 164,905 | |

| | 600 | | | Cia de Saneamento Basico do Estado de Sao Paulo, ADR | | | 41,838 | |

| | 4,125 | | | Cia Energetica de Minas Gerais, Sponsored Preference ADR | | | 71,074 | |

| | 1,300 | | | Cia Hering | | | 27,007 | |

| | 1,000 | | | Cia Paranaense de Energia, Sponsored Preference ADR | | | 20,320 | |

| | 1,440 | | | Cielo S.A., Sponsored ADR | | | 38,736 | |

| | 1,200 | | | Cosan S.A. Industria e Comercio | | | 17,826 | |

| | 700 | | | CPFL Energia S.A., ADR | | | 17,010 | |

| | 2,600 | | | EcoRodovias Infraestrutura e Logistica S.A. | | | 20,807 | |

| | 2,400 | | | EDP - Energias do Brasil S.A. | | | 15,351 | |

| | 895 | | | Embraer S.A., ADR | | | 25,239 | |

| | 2,500 | | | Fibria Celulose S.A., Sponsored ADR(c) | | | 16,300 | |

| | 4,100 | | | Gerdau S.A., Sponsored Preference ADR | | | 32,595 | |

| | 3,400 | | | Hypermarcas S.A.(c) | | | 18,594 | |

| | 12,900 | | | Itau Unibanco Holding S.A., Preference ADR(b) | | | 186,663 | |

| | 4,900 | | | JBS, S.A.(c) | | | 13,241 | |

| | 1,200 | | | Localiza Rent a Car S.A. | | | 19,040 | |

| | 700 | | | Lojas Renner S.A. | | | 20,182 | |

| | 600 | | | Multiplan Empreendimentos Imobiliarios S.A. | | | 14,250 | |

| | 2,700 | | | Odontoprev S.A. | | | 14,458 | |

| | 2,593 | | | Oi S.A. | | | 12,215 | |

| | 1,700 | | | Oi S.A., ADR | | | 20,468 | |

| | 7,423 | | | Petroleo Brasileiro S.A., ADR(b) | | | 145,194 | |

| | 11,000 | | | Petroleo Brasileiro S.A., Sponsored Preference ADR(b) | | | 207,900 | |

| | 2,500 | | | Raia Drogasil, S.A. | | | 23,118 | |

| | 2,100 | | | Redecard S.A. | | | 32,278 | |

| | 3,200 | | | Rossi Residencial S.A. | | | 8,377 | |

| | 2,700 | | | Souza Cruz S.A. | | | 36,145 | |

| | 1,700 | | | Sul America S.A. | | | 11,826 | |

| | 1,000 | | | TAM S.A., Preference ADR(c) | | | 21,740 | |

| | 1,800 | | | Telefonica Brasil S.A., Preference ADR | | | 42,516 | |

| | 2,100 | | | Tim Participacoes S.A., ADR | | | 51,345 | |

| | 700 | | | Totvs S.A. | | | 12,668 | |

| | 1,100 | | | Tractebel Energia S.A. | | | 18,244 | |

| | 3,000 | | | Ultrapar Participacoes S.A., Sponsored ADR | | | 61,260 | |

| | 6,738 | | | Vale S.A., Sponsored ADR(b) | | | 123,373 | |

| | 10,821 | | | Vale S.A., Sponsored Preference ADR(b) | | | 196,077 | |

| | | | | | | | |

| | | | | | | 2,266,287 | |

| | | | | | | | |

| | | | Chile — 0.9% | | | | |

| | 319 | | | Banco de Chile, ADR | | | 26,251 | |

| | 500 | | | Banco Santander Chile, ADR | | | 37,220 | |

| | 600 | | | Cia Cervecerias Unidas S.A., ADR | | | 38,982 | |

| | 1,400 | | | Corpbanca S.A., ADR | | | 25,998 | |

| | 900 | | | Empresa Nacional de Electricidad S.A., Sponsored ADR | | | 42,624 | |

| | 2,000 | | | Enersis S.A., Sponsored ADR | | | 34,400 | |

| | | | | | | | |

| | | | Chile — continued | | | | |

| | 500 | | | Sociedad Quimica y Minera de Chile S.A., Sponsored ADR | | $ | 25,985 | |

| | | | | | | | |

| | | | | | | 231,460 | |

| | | | | | | | |

| | | | China — 14.6% | | | | |

| | 22,000 | | | Agile Property Holdings Ltd. | | | 25,328 | |

| | 84,000 | | | Agricultural Bank of China Ltd., Class H | | | 33,934 | |

| | 22,000 | | | Air China Ltd., Class H(c) | | | 13,535 | |

| | 6,000 | | | Alibaba.com Ltd.(c) | | | 10,369 | |

| | 26,000 | | | Angang Steel Co. Ltd., Class H(c) | | | 14,787 | |

| | 4,500 | | | Anhui Conch Cement Co. Ltd., Class H(c) | | | 13,764 | |

| | 363,000 | | | Bank of China Ltd., Class H(b) | | | 138,460 | |

| | 37,000 | | | Bank of Communications Co. Ltd., Class H | | | 23,912 | |

| | 58,000 | | | Beijing Capital International Airport Co. Ltd., Class H | | | 36,324 | |

| | 5,500 | | | Beijing Enterprises Holdings Ltd. | | | 31,502 | |

| | 16,000 | | | Belle International Holdings Ltd. | | | 25,532 | |

| | 32,000 | | | Bosideng International Holdings Ltd. | | | 7,239 | |

| | 24,000 | | | Brilliance China Automotive Holdings Ltd.(c) | | | 23,595 | |

| | 24,000 | | | China BlueChemical Ltd., Class H(c) | | | 16,734 | |

| | 46,000 | | | China Citic Bank Corp. Ltd., Class H | | | 23,763 | |

| | 9,000 | | | China Coal Energy Co. Ltd., Class H | | | 8,324 | |

| | 39,000 | | | China Communications Construction Co. Ltd., Class H(c) | | | 36,520 | |

| | 26,000 | | | China Communications Services Corp. Ltd., Class H(c) | | | 12,941 | |

| | 339,000 | | | China Construction Bank Corp., Class H(b) | | | 235,821 | |

| | 40,000 | | | China Gas Holdings Ltd. | | | 19,560 | |

| | 2,700 | | | China Life Insurance Co. Ltd., ADR | | | 95,094 | |

| | 10,000 | | | China Mengniu Dairy Co. Ltd. | | | 27,492 | |

| | 13,000 | | | China Merchants Bank Co. Ltd., Class H(c) | | | 25,096 | |

| | 44,000 | | | China Minsheng Banking Corp. Ltd., Class H | | | 41,787 | |

| | 35,500 | | | China Mobile Ltd.(b) | | | 360,082 | |

| | 24,000 | | | China Overseas Land & Investment Ltd. | | | 50,193 | |

| | 1,299 | | | China Petroleum & Chemical Corp., ADR(b) | | | 115,949 | |

| | 10,000 | | | China Resources Enterprise Ltd. | | | 31,618 | |

| | 12,000 | | | China Resources Gas Group Ltd. | | | 22,816 | |

| | 10,000 | | | China Resources Land Ltd. | | | 18,765 | |

| | 10,000 | | | China Resources Power Holdings Co. Ltd. | | | 18,162 | |

| | 21,000 | | | China Shenhua Energy Co. Ltd., Class H | | | 73,709 | |

| | 95,000 | | | China Shipping Container Lines Co. Ltd., Class H(c) | | | 23,738 | |

| | 10,000 | | | China State Construction International Holdings Ltd. | | | 9,257 | |

| | 1,400 | | | China Telecom Corp. Ltd., ADR | | | 63,910 | |

| | 32,000 | | | China Unicom Hong Kong Ltd. | | | 43,450 | |

| | 10,400 | | | China Vanke Co. Ltd., Class B(c) | | | 13,596 | |

| | 22,000 | | | China ZhengTong Auto Services Holdings Ltd.(c) | | | 13,837 | |

| | 49,600 | | | China Zhongwang Holdings Ltd.(c) | | | 19,334 | |

| | 30,000 | | | Chongqing Rural Commercial Bank, Class H | | | 12,736 | |

| | 1,151 | | | CNOOC Ltd., Sponsored ADR(b) | | | 206,432 | |

| | 88,125 | | | Country Garden Holdings Co. Ltd.(c) | | | 32,788 | |

| | 14,000 | | | Daphne International Holdings Ltd. | | | 15,116 | |

| | 40,000 | | | Datang International Power Generation Co. Ltd., Class H(c) | | | 13,838 | |

| | 26,000 | | | Dongfeng Motor Group Co. Ltd., Class H(c) | | | 43,752 | |

| | 32,000 | | | Dongyue Group | | | 20,813 | |

| | 6,000 | | | ENN Energy Holdings Ltd.(c) | | | 23,000 | |

| | 68,000 | | | Evergrande Real Estate Group Ltd.(c) | | | 37,216 | |

| | 84,000 | | | Franshion Properties China Ltd. | | | 24,294 | |

| | 25,000 | | | Geely Automobile Holdings Ltd. | | | 9,042 | |

| | 7,000 | | | Golden Eagle Retail Group Ltd. | | | 15,256 | |

| | 112,000 | | | GOME Electrical Appliances Holding Ltd. | | | 17,568 | |

| | 11,000 | | | Great Wall Motor Co. Ltd., Class H | | | 22,478 | |

| | 54,000 | | | Guangdong Investment Ltd. | | | 35,359 | |

| | 25,200 | | | Guangzhou R&F Properties Co. Ltd., Class H | | | 33,276 | |

| | 17,000 | | | Haier Electronics Group Co. Ltd.(c) | | | 19,971 | |

| | 3,500 | | | Hengan International Group Co. Ltd. | | | 33,384 | |

See accompanying notes to financial statements.

15 |

Consolidated Portfolio of Investments – as of May 31, 2012 (Unaudited)

ASG Growth Markets Fund – (continued)

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | | | | | | | |

| | | | China — continued | | | | |

| | 951 | | | Huaneng Power International, Inc., Sponosored ADR(c) | | $ | 23,832 | |

| | 332,000 | | | Industrial & Commercial Bank of China Ltd., Class H(b) | | | 202,578 | |

| | 7,000 | | | Inner Mongolia Yitai Coal Co., Class B | | | 35,637 | |

| | 6,000 | | | Jiangxi Copper Co. Ltd., Class H | | | 12,604 | |

| | 5,000 | | | Kingboard Chemical Holdings Ltd. | | | 10,733 | |

| | 14,000 | | | Kunlun Energy Co. Ltd. | | | 23,929 | |

| | 3,800 | | | Lenovo Group Ltd., ADR | | | 64,258 | |

| | 10,500 | | | Longfor Properties Co. Ltd. | | | 16,231 | |

| | 1,416 | | | PetroChina Co. Ltd., ADR(b) | | | 178,515 | |

| | 14,000 | | | PICC Property & Casualty Co. Ltd., Class H | | | 15,466 | |

| | 3,000 | | | Ping An Insurance (Group) Co. of China Ltd., Class H | | | 21,977 | |

| | 53,000 | | | Poly Hong Kong Investments Ltd.(c) | | | 25,742 | |

| | 366,000 | | | Renhe Commercial Holdings Co. Ltd. | | | 17,839 | |

| | 28,000 | | | Shanghai Electric Group Co. Ltd., Class H | | | 12,689 | |

| | 8,800 | | | Shanghai Pharmaceuticals Holding Co. Ltd., Class H(c) | | | 10,600 | |

| | 25,500 | | | Shimao Property Holdings Ltd. | | | 33,920 | |

| | 30,000 | | | Shougang Fushan Resources Group Ltd. | | | 9,781 | |

| | 66,500 | | | Shui On Land Ltd. | | | 25,918 | |

| | 34,500 | | | Sino-Ocean Land Holdings Ltd. | | | 14,044 | |

| | 86,000 | | | Sinofert Holdings Ltd. | | | 14,813 | |

| | 412 | | | Sinopec Shanghai Petrochemical Co. Ltd., Sponsored ADR | | | 11,800 | |

| | 46,000 | | | Skyworth Digital Holdings Ltd. | | | 20,609 | |

| | 47,000 | | | Soho China Ltd. | | | 31,934 | |

| | 5,200 | | | Tencent Holdings Ltd. | | | 142,647 | |

| | 12,000 | | | Tingyi Cayman Islands Holding Corp. | | | 28,452 | |

| | 4,000 | | | Tsingtao Brewery Co. Ltd., Class H(c) | | | 25,101 | |

| | 33,000 | | | Want Want China Holdings Ltd. | | | 37,681 | |

| | 5,000 | | | Weichai Power Co. Ltd., Class H(c) | | | 22,026 | |

| | 7,000 | | | Wumart Stores, Inc., Class H(c) | | | 15,436 | |

| | 1,715 | | | Yanzhou Coal Mining Co. Ltd., Sponsored ADR(c) | | | 28,572 | |

| | 17,000 | | | Yingde Gases(c) | | | 15,856 | |

| | 108,000 | | | Yuexiu Property Co. Ltd. | | | 25,921 | |

| | 5,500 | | | Zhongsheng Group Holdings Ltd. | | | 8,826 | |

| | | | | | | | |

| | | | | | | 3,622,115 | |

| | | | | | | | |

| | | | Colombia — 0.7% | | | | |

| | 800 | | | BanColombia S.A., Sponsored Preference ADR | | | 47,368 | |

| | 1,895 | | | Ecopetrol S.A., Sponsored ADR | | | 112,866 | |

| | | | | | | | |

| | | | | | | 160,234 | |

| | | | | | | | |

| | | | Egypt — 0.2% | | | | |

| | 5,246 | | | Commercial International Bank Egypt S.A.E., GDR | | | 20,984 | |

| | 474 | | | Orascom Construction Industries, GDR | | | 19,287 | |

| | 8,074 | | | Orascom Telecom Holding S.A.E., GDR(c) | | | 20,080 | |

| | | | | | | | |

| | | | | | | 60,351 | |

| | | | | | | | |

| | | | India — 1.3% | | | | |

| | 1,591 | | | Axis Bank Ltd., GDR | | | 27,577 | |

| | 3,058 | | | HDFC Bank Ltd., ADR(c) | | | 85,502 | |

| | 1,410 | | | ICICI Bank Ltd., Sponsored ADR | | | 39,692 | |

| | 2,108 | | | Infosys Ltd., Sponsored ADR(b) | | | 88,747 | |

| | 1,347 | | | Mahindra & Mahindra Ltd., Sponsored GDR | | | 15,257 | |

| | 396 | | | State Bank of India, Sponsored GDR | | | 28,819 | |

| | 2,160 | | | Tata Motors Ltd., Sponsored ADR | | | 44,906 | |

| | | | | | | | |

| | | | | | | 330,500 | |

| | | | | | | | |

| | | | Indonesia — 2.4% | | | | |

| | 125,500 | | | Aneka Tambang Persero Tbk PT | | | 15,320 | |

| | 12,500 | | | Astra International Tbk PT | | | 85,248 | |

| | 58,000 | | | Bank Central Asia Tbk PT | | | 43,142 | |

| | 31,000 | | | Bank Danamon Indonesia Tbk PT | | | 17,465 | |

| | | | | | | | |

| | | | Indonesia — continued | | | | |

| | 68,000 | | | Bank Mandiri Persero Tbk PT | | $ | 49,696 | |

| | 58,000 | | | Bank Negara Indonesia Persero Tbk PT | | | 22,747 | |

| | 107,000 | | | Bank Rakyat Indonesia Persero Tbk PT | | | 64,020 | |

| | 118,500 | | | Charoen Pokphand Indonesia Tbk PT | | | 32,962 | |

| | 4,000 | | | Gudang Garam Tbk PT | | | 22,945 | |

| | 12,000 | | | Indocement Tunggal Prakarsa Tbk PT | | | 22,659 | |

| | 55,000 | | | Indofood Sukses Makmur Tbk PT | | | 27,568 | |

| | 41,500 | | | Indosat Tbk PT | | | 17,154 | |

| | 33,000 | | | Kalbe Farma Tbk PT | | | 13,567 | |

| | 56,000 | | | Perusahaan Gas Negara Persero Tbk PT | | | 21,970 | |

| | 16,500 | | | Semen Gresik Persero Tbk PT | | | 19,129 | |

| | 1,691 | | | Telekomunikasi Indonesia Persero Tbk PT, Sponsored ADR | | | 55,059 | |

| | 13,000 | | | Unilever Indonesia Tbk PT | | | 28,397 | |

| | 13,000 | | | United Tractors Tbk PT | | | 31,799 | |

| | | | | | | | |

| | | | | | | 590,847 | |

| | | | | | | | |

| | | | Korea — 10.9% | | | | |

| | 14 | | | Amorepacific Corp. | | | 12,859 | |

| | 675 | | | Celltrion, Inc. | | | 19,176 | |

| | 183 | | | Cheil Industries, Inc. | | | 15,062 | |

| | 93 | | | CJ CheilJedang Corp. | | | 26,477 | |

| | 196 | | | CJ Corp. | | | 13,436 | |

| | 438 | | | Daelim Industrial Co. Ltd. | | | 36,894 | |

| | 470 | | | Dongbu Insurance Co. Ltd. | | | 18,790 | |

| | 75 | | | E-Mart Co. Ltd. | | | 16,774 | |

| | 252 | | | GS Holdings | | | 11,805 | |

| | 760 | | | Hana Financial Group, Inc. | | | 23,925 | |

| | 1,060 | | | Hanwha Chem Corp. | | | 18,490 | |

| | 810 | | | Hanwha Corp. | | | 19,284 | |

| | 100 | | | Honam Petrochemical Corp. | | | 21,109 | |

| | 308 | | | Hyosung Corp. | | | 13,751 | |

| | 148 | | | Hyundai Department Store Co. Ltd. | | | 18,162 | |

| | 267 | | | Hyundai Engineering & Construction Co. Ltd. | | | 15,012 | |

| | 114 | | | Hyundai Glovis Co. Ltd. | | | 20,123 | |

| | 116 | | | Hyundai Heavy Industries Co. Ltd. | | | 26,177 | |

| | 1,000 | | | Hyundai Hysco Co. Ltd. | | | 31,303 | |

| | 680 | | | Hyundai Marine & Fire Insurance Co. Ltd. | | | 16,922 | |

| | 378 | | | Hyundai Mobis | | | 88,534 | |

| | 957 | | | Hyundai Motor Co.(b) | | | 197,486 | |

| | 1,436 | | | Hyundai Motor Co., GDR | | | 42,561 | |

| | 2,670 | | | Hyundai Securities Co. | | | 18,397 | |

| | 226 | | | Hyundai Wia Corp. | | | 33,340 | |

| | 1,970 | | | Industrial Bank of Korea | | | 19,999 | |

| | 640 | | | Kangwon Land, Inc. | | | 13,666 | |

| | 1,502 | | | KB Financial Group, Inc., ADR | | | 46,832 | |

| | 1,650 | | | Kia Motors Corp. | | | 111,961 | |

| | 1,600 | | | Korea Electric Power Corp., Sponsored ADR(c) | | | 15,040 | |

| | 3,610 | | | Korea Exchange Bank | | | 25,113 | |

| | 380 | | | Korea Gas Corp. | | | 13,300 | |

| | 370 | | | Korea Investment Holdings Co. Ltd. | | | 12,556 | |

| | 3,370 | | | Korea Life Insurance Co. Ltd.(c) | | | 17,394 | |

| | 84 | | | Korea Zinc Co. Ltd. | | | 25,253 | |

| | 475 | | | Korean Air Lines Co. Ltd.(c) | | | 18,154 | |

| | 1,370 | | | KP Chemical Corp. | | | 16,776 | |

| | 645 | | | KT&G Corp. | | | 42,954 | |

| | 170 | | | Kumho Petro Chemical Co. Ltd. | | | 16,868 | |

| | 190 | | | LG Chem Ltd. | | | 46,710 | |

| | 200 | | | LG Corp. | | | 9,297 | |

| | 1,995 | | | LG Display Co. Ltd., ADR(c) | | | 17,536 | |

| | 333 | | | LG Electronics, Inc. | | | 18,619 | |

| | 71 | | | LG Household & Health Care Ltd. | | | 35,121 | |

| | 3,960 | | | LG Uplus Corp. | | | 18,194 | |

See accompanying notes to financial statements.

| 16

Consolidated Portfolio of Investments – as of May 31, 2012 (Unaudited)

ASG Growth Markets Fund – (continued)

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | | | | | | | |

| | | | Korea — continued | | | | |

| | 18 | | | Lotte Confectionery Co. Ltd. | | $ | 23,692 | |

| | 81 | | | Lotte Shopping Co. Ltd. | | | 21,641 | |

| | 150 | | | Mando Corp. | | | 20,423 | |

| | 105 | | | NCSoft Corp. | | | 21,324 | |

| | 198 | | | NHN Corp. | | | 40,665 | |

| | 39 | | | Orion Corp. | | | 31,785 | |

| | 1,200 | | | POSCO, ADR | | | 90,876 | |

| | 294 | | | S1 Corp. | | | 14,070 | |

| | 625 | | | Samsung C&T Corp. | | | 35,941 | |

| | 580 | | | Samsung Card Co. | | | 16,304 | |

| | 229 | | | Samsung Electro-Mechanics Co. Ltd. | | | 19,758 | |

| | 1,291 | | | Samsung Electronics Co. Ltd., GDR(b) | | | 663,246 | |

| | 213 | | | Samsung Electronics Co. Ltd., Preference GDR | | | 64,533 | |

| | 122 | | | Samsung Engineering Co. Ltd. | | | 19,399 | |

| | 109 | | | Samsung Fire & Marine Insurance Co. Ltd. | | | 19,434 | |

| | 1,230 | | | Samsung Heavy Industries Co. Ltd. | | | 37,986 | |

| | 328 | | | Samsung Life Insurance Co. Ltd. | | | 27,107 | |

| | 1,500 | | | Shinhan Financial Group Co. Ltd., ADR | | | 96,630 | |

| | 203 | | | SK C&C Co. Ltd. | | | 16,120 | |

| | 127 | | | SK Holdings Co. Ltd. | | | 13,162 | |

| | 1,930 | | | SK Hynix, Inc.(c) | | | 37,715 | |

| | 2,940 | | | SK Networks Co. Ltd. | | | 20,997 | |

| | 1,900 | | | SK Telecom Co. Ltd., ADR | | | 21,166 | |

| | 430 | | | Woongjin Coway Co. Ltd. | | | 12,858 | |

| | 1,400 | | | Woori Finance Holdings Co. Ltd. | | | 13,025 | |

| | | | | | | | |

| | | | | | | 2,717,049 | |

| | | | | | | | |

| | | | Malaysia — 3.1% | | | | |

| | 22,100 | | | AirAsia Bhd | | | 24,457 | |

| | 16,600 | | | Alliance Financial Group Bhd | | | 21,388 | |

| | 9,500 | | | AMMB Holdings Bhd | | | 18,572 | |

| | 21,700 | | | Axiata Group Bhd | | | 36,702 | |

| | 57,200 | | | Berjaya Corp. Bhd | | | 14,499 | |

| | 800 | | | British American Tobacco Malaysia Bhd | | | 13,707 | |

| | 16,500 | | | CIMB Group Holdings Bhd | | | 38,972 | |

| | 29,000 | | | DiGi.Com Bhd | | | 36,505 | |

| | 8,300 | | | Genting Bhd | | | 26,106 | |

| | 23,200 | | | Genting Malaysia Bhd | | | 26,926 | |

| | 4,500 | | | Genting Plantations Bhd | | | 13,201 | |

| | 6,600 | | | Hong Leong Bank Bhd | | | 25,552 | |

| | 9,700 | | | Hong Leong Financial Group Bhd | | | 36,645 | |

| | 12,400 | | | IJM Corp. Bhd | | | 20,227 | |

| | 3,100 | | | Kuala Lumpur Kepong Bhd | | | 21,805 | |

| | 19,200 | | | Malayan Banking Bhd | | | 52,896 | |

| | 11,000 | | | Maxis Bhd | | | 21,441 | |

| | 25,500 | | | MMC Corp. Bhd | | | 21,629 | |

| | 9,800 | | | Parkson Holdings Bhd | | | 14,664 | |

| | 5,300 | | | Petronas Dagangan Bhd | | | 34,524 | |

| | 5,700 | | | Petronas Gas Bhd | | | 30,880 | |

| | 3,100 | | | Public Bank Bhd | | | 13,466 | |

| | 8,100 | | | RHB Capital Bhd | | | 18,935 | |

| | 14,900 | | | Sime Darby Bhd | | | 45,428 | |

| | 18,800 | | | Telekom Malaysia Bhd | | | 31,875 | |