UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00242

Natixis Funds Trust II

(Exact name of Registrant as specified in charter)

888 Boylston Street, Suite 800 Boston, Massachusetts 02199-8197

(Address of principal executive offices) (Zip code)

Natalie Wagner, Esq.

Natixis Distribution, LLC

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: November 30

Date of reporting period: November 30, 2022

Item 1. Reports to Stockholders.

| (a) | The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows: |

Annual Report

November 30, 2022

Loomis Sayles Global Growth Fund

Loomis Sayles Senior Floating Rate and Fixed Income Fund

Vaughan Nelson Select Fund

TABLE OF CONTENTS

LOOMIS SAYLES GLOBAL GROWTH FUND

| | |

| |

| Manager: | | Symbols: |

| |

| Aziz V. Hamzaogullari, CFA® | | Class A LSAGX |

| |

| Loomis, Sayles & Company, L.P. | | Class C LSCGX |

| |

| | Class N LSNGX |

| |

| | Class Y LSGGX |

Investment Goal

The Fund’s investment goal is long-term growth of capital.

Market Conditions

Global equities experienced a meaningful decline and elevated volatility in the past 12 months. Persistently high inflation prompted the US Federal Reserve (Fed) to end its quantitative easing program and raise the federal funds rate by a total of 375 basis points. Other central banks across the globe took similar actions. Furthermore, the high uncertainty surrounding the terminal fed funds rate led to heightened market volatility. Tightening monetary policy, in turn, fueled concerns that the world economy might enter a recession in 2023. While corporate earnings held up relatively well through these challenging conditions, expectations that profits could decline in the year ahead contributed to a compression of valuations.

Geopolitical factors may have also played a key role in equities’ negative return. Russia’s invasion of Ukraine may have weighed on sentiment, as did the supply chain disruptions, higher energy prices, and the slowdown in Europe’s growth that followed in its wake. China was an additional source of concern, as the government’s heightened regulatory focus and zero-Covid policy hindered the country’s economy and acted as a headwind for global growth.

These factors contributed to broad-based weakness across the world equity markets, with outsized losses for Europe, the emerging markets, and mega-cap technology-related companies in the US. Higher-growth stocks were also negatively impacted. On the other hand, energy stocks delivered strong gains behind the rally in crude oil prices.

Performance Results

For the 12 months ended November 30, 2022, Class Y shares of the Loomis Sayles Global Growth Fund returned -20.95% at net asset value. The Fund underperformed its benchmark, the MSCI All Country World Index (Net), which returned -11.62%.

Explanation of Fund Performance

We are an active manager with a long-term, private equity approach to investing. Through our proprietary bottom-up research framework, we look to invest in those few high-quality businesses with sustainable competitive advantages and profitable growth when they trade at a significant discount to intrinsic value. Given the rare confluence of quality, growth, and valuation, we may study dozens of companies but may only invest in a select few businesses each year. We believe identifying those few businesses with such characteristics is an art, not a science. As a result of this rigorous approach, ours is a selective, high-conviction portfolio of typically 30-45 names.

The Fund’s positions in Meta Platforms, Amazon, and Alphabet detracted the most from performance. Stock selection in the communication services, information technology, consumer discretionary, and industrials sectors, as well as our allocations in the communication services, energy, consumer discretionary, financials, and information technology sectors, detracted from relative performance.

Meta Platforms operates online social networking platforms that allow people to connect, share, and interact with friends and communities. With over 3.6 billion monthly users and 200 million businesses worldwide using its family of apps – Facebook, Messenger, WhatsApp, and Instagram – the scale and reach of Meta’s network is unrivaled. A Fund holding since inception, Meta reported financial results during the period that were generally mixed with respect to consensus expectations. The company faced headwinds arising from privacy restrictions by Apple, the continuing negative impact of macro factors such as supply chain disruptions on advertising spending, and a transition to a new product format – short-form video – where monetization is currently lower. Management previously addressed the changes by Apple, which it believes decreased the accuracy of Facebook’s ad targeting, increased the difficulty of measuring outcomes, and contributed to underreporting of successful conversions such as sales and app installs by approximately 15% in the third quarter of 2021. The company has already been investing in a number of solutions, including commerce tools to help businesses reach more customers and privacy-enhancing technologies, and believes it has closed a substantial portion of the measurement gap. The company expects to further reduce the amount of underreporting in 2022 but expects the changes will remain a headwind. Apple’s changes impact not just Meta, but the broader mobile advertising ecosystem. As a function of its competitive advantages, we believe Meta remains well positioned relative to its peers, and there are no changes to our

1 |

assessment of the company’s quality or secular growth opportunities. Another near-term headwind is the company’s capital investments in and transition to a new product format – the short-form video. During our ownership of Meta, Facebook has gone through several product transitions including from desktop to mobile platforms, from newsfeed to stories, and now to short-form videos. Each such transition first requires capital expenditures followed by a gradual revenue ramp-up, creating pressures on topline, margins, and earnings. Over time, the required investment decreases and revenues increase. Of note, the Instagram “Reels” product, launched in August 2020, is now Meta’s fastest growing content format and largest contributor to engagement. The company previously reported that Reels was consuming more than 20% of users’ time spent on Instagram, and video, including FB Reels, accounted for 50% of time spent on Facebook. In the most recent quarter, the company reported a further 30% increase in time people spent on Reels across Facebook and Instagram. We believe this is a necessary cycle for maintaining sustainable competitive advantages and long-term growth. Finally, the company continues to invest significantly in its early-stage Reality Labs segment, which includes augmented and virtual reality products that the company views as building its long-term vision for the metaverse. While the company has incurred year-to-date operating expenses of $10.9 billion in the Reality Labs segment, the investment represented only one-third of the operating profit generated by the company’s highly profitable core business. Mark Zuckerberg has always managed the company with a long-term focus and strong strategic vision. Over the past ten years, Meta has spent over $90 billion on research and development and $80 billion on capital expenditures – a level of investment which few firms can match, and which creates high barriers to entry for competitors. And while the successful development of a metaverse is not an explicit part of our investment thesis for Meta, given the potential size of the opportunity, which we estimate could impact over $1 trillion of spending over the long term, and Meta’s positioning with billions of users and hundreds of millions of businesses, we believe Meta’s current balanced approach to its forward-looking investments makes sense. On the basis of its core business alone, we believe the company is substantially undervalued, even accounting for elevated levels of investment. Despite the near-term pressure on financial results, Meta continues to have significant advantages arising from its network of almost 3 billion daily users of its family of apps, 200 million businesses that use its platforms and tools every month, and 10 million advertisers who have consistently paid more per user for access to its rare network. We expect that corporations will continue to allocate an increasing proportion of their advertising spending online, and Meta remains one of very few platforms where advertisers can reach consumers at such scale in such a targeted and effective fashion. We believe Meta’s brands, network, and targeting advantage position the company to take increasing share of the industry’s profit pool and grow its market share from 6% currently to approximately 10% of the total global advertising market over our investment time horizon. We also believe that the expectations embedded in Meta’s current share price show a lack of appreciation for the company’s growth opportunities and the sustainability of its business model. We believe the consensus expectations and current market price reflect assumptions for free cash flow growth that are well below our long-term expectations of high-teens cash flow growth. As a result, we believe the shares trade at a significant discount to our estimate of intrinsic value, creating a compelling reward-to-risk opportunity. We took advantage of near-term market weakness to add to our position on multiple occasions over the past year.

Online retailer Amazon offers millions of products – sold by Amazon or by third parties – with the value proposition to consumers of selection, price, and convenience. Amazon’s enterprise IT business, Amazon Web Services (AWS), offers a suite of secure, on-demand cloud-computing services, with a value proposition to clients of speed, agility, and savings. In both of its core markets, we believe Amazon possesses strong and sustainable competitive advantages that would be difficult for competitors to replicate. A Fund holding since inception, Amazon reported fundamentally solid operating results that were generally above management’s guidance during the period. However, Amazon is facing short-term cost inflation that has contributed to over $10 billion of incremental expense over the past few quarters. While a portion of the additional expense is outside of Amazon’s direct control, including higher shipping, fuel, and labor costs, approximately two-thirds stems from Amazon’s strategic decision to invest in labor to make up for Covid-related employee absences, as well as investments undertaken to ensure that its fulfillment and transportation network remain unconstrained during the pandemic. And while expense pressures are expected to persist for the foreseeable future, Amazon expects them to decline over the coming quarters. Over time, we expect that Amazon will take steps to mitigate external cost inflation, and that it will realize greater productivity and fixed cost leverage from its investments in labor, fulfillment, and distribution. Despite a deceleration of revenue growth in its online retail business from the pandemic-enhanced prior year, we continue to believe Amazon is well positioned for durable long-term growth. Further, the company has added over 50 million Prime members over the past two years and is seeing strong growth in other businesses including AWS and advertising. Earlier this year, the company announced it was increasing the price of Prime membership for the first time since 2018, which we believe reflects its pricing power and ability to offset cost inflation. These near-term challenges do not impact our long-term view of Amazon’s quality, growth, or the attractiveness of its reward-to-risk proposition. We believe Amazon is one of the best-positioned companies in e-commerce and enterprise IT – in each case addressing large, underpenetrated markets experiencing secular growth that is still in its early stages. We believe the current share price shows a lack of appreciation for Amazon’s significant long-term growth opportunities and the sustainability of its business model. As a result, we believe the company is selling at a significant discount to our estimate of intrinsic value and offers a compelling reward-to-risk opportunity.

Alphabet is a holding company that owns a collection of businesses – the largest and most important of which by far is Google. Google is the global leader in online search and advertising, and also offers online cloud solutions to businesses and consumers

| 2

LOOMIS SAYLES GLOBAL GROWTH FUND

globally. We believe Alphabet’s competitive advantages include its scale, brand strength, the power of its network and business ecosystem, and innovative culture that is reinforced by its massive investments in research and development (R&D). A Fund holding since inception, Alphabet reported financial results during the period that were fundamentally solid and generally in line with consensus expectations for revenues and operating profits. After a strong first-half recovery in advertising spending, which had been depressed due to Covid-19 in the prior-year period, still solid growth in advertising revenue decelerated over the past six months due to challenging prior-year comparisons. The company also observed a slowdown from some advertisers in its YouTube and network advertising businesses. For comparison, YouTube growth of -2% in the most recent quarter came on top of 43% growth in the prior-year period. Despite some cyclical softening in advertising, YouTube continues to benefit from strong demand from brand advertisers due to its reach and engagement with over 2 billion monthly users who recently spent over 1 billion hours daily on the platform. As with other platforms, the company is transitioning to short-form videos, where monetization is currently lower. However, the company reported that YouTube Shorts were being watched each month by over 1.5 billion signed-in users, and that they were receiving over 30 billion daily views. Google Cloud revenue represented almost 10% of total revenue, and ended the period with a $28 billion run rate, up almost 40% year over year. We believe Google’s key revenue drivers of mobile search, YouTube, programmatic advertising, and an emerging cloud business that is Google’s fastest growing business, each continue to benefit from secular drivers including increased mobility, video advertising, better use of advertising technology to drive performance, and increased penetration of public cloud services. Google’s attractive financial model generates strong free cash flow and earns high returns on invested capital, enabling it to reinvest significantly in its business. Over the past fifteen years, Google has invested almost $190 billion in R&D and made over $160 billion of capital expenditures, an amount very few companies could replicate, and which creates high barriers to entry for competitors. We believe the global secular shift from traditional advertising to online advertising is the biggest long-term growth driver for Google. Online advertising accounts for approximately $450 billion, or around 25% of the $1.7 trillion annual spending on global advertising and marketing. Over our investment horizon, we believe this penetration will increase to over 40%. We believe investors underestimate Alphabet’s growth opportunities and the intrinsic value of the business given its unique and difficult-to-replicate attributes and business model. As a result, we believe the company’s shares trade at a significant discount to our estimate of intrinsic value and offer a compelling reward-to-risk opportunity.

The Fund’s positions in Vertex Pharmaceuticals, Alnylam Pharmaceuticals, and Novartis contributed the most to performance. Stock selection in the healthcare, consumer staples, energy, and financials sectors, along with our allocation in the healthcare sector, contributed positively to relative performance.

Vertex Pharmaceuticals is the leader in creating therapies for patients suffering from cystic fibrosis (CF), with four currently approved treatments, and the company is building out its capabilities to address related diseases that lever its core expertise in biology and medicinal chemistry. A Fund holding since the second quarter of 2021, Vertex reported financial results during the period that reflected the continued penetration of Trikafta, its latest and most efficacious CF therapy. In the US, the company continues to reach younger patients with newer generation therapies, while also penetrating a broader scope of international markets, both through new patients that did not previously have a therapy available and patients switching from older generations of therapies to the new standard of care. Vertex has now reached reimbursement agreements with 30 countries since Trikafta’s approval in late 2019. Outside of CF, the company has significant clinical efforts targeting type-1 diabetes, non-opioid pain relief, and kidney disease, and expects to start regulatory filings for its Exa-Cel therapy for blood disorders (formerly known as CTX001), co-developed with CRISPR Therapeutics, by year-end 2022. We believe Vertex’s strong and sustainable competitive advantages include its unparalleled understanding of CF, for which it is recognized as setting the standard of care, its partnerships with the CF Foundation and other entities that enhance its solutions capabilities, and its broader understanding of biology and serial approach to drug development. We believe expectations embedded in Vertex’s share price underestimate the defensibility of its dominant CF franchise, the life-changing benefit of its therapies for its growing base of 40,000 patients, and the strength of its science and innovation ability that is contributing to a growing pipeline of potentially transformative therapies outside of CF. We trimmed the position during the period following strong price performance but continue to believe the shares embed expectations for revenue and free cash flow that are below our long-term expectations. As a result, we believe the shares are trading at a discount to our estimate of intrinsic value and offer an attractive reward-to-risk opportunity.

Alnylam Pharmaceuticals is a leader in gene therapies based on its pioneering small-interfering RNA (siRNA) approach to disease treatment. Founded in 2002, Alnylam was one of the first companies to develop and commercialize therapies based on RNA interference (RNAi), a breakthrough discovery in understanding how genes are naturally regulated within cells, which was recognized with the 2006 Nobel Prize in Medicine. We believe Alnylam’s strong and sustainable competitive advantages include its deep, cumulative and compounding knowledge in the science of RNAi therapeutics, in particular its creation and advancement of unique siRNA-based therapies, and the multiple partnerships it has entered on the basis of its technology which provide both external funding and established commercialization avenues. Today, the company’s technology is the basis for five approved therapies, six therapies currently in clinical trials, and a robust pipeline of potential treatments that we expect to enter clinical trials in the coming years, with a focus on genetic diseases, cardiometabolic diseases, infectious diseases, and central nervous system and ocular diseases. A

3 |

Fund holding since the second quarter of 2021, shares jumped almost 50% in August following news that Onpattro, the company’s approved therapy for hATTR amyloidosis, met its primary endpoint in the much larger indication of ATTR with cardiomyopathy, which is estimated to have a patient population approximately ten times as large. The results substantially increase the likelihood that the therapy will receive approval in the new indication, where it would be the first RNAi-based therapy. We believe the uniqueness of Alnylam’s pioneering scientific expertise and technology is evident from both its existing products, which provide meaningful value to previously underserved patient populations, and the numerous partnerships in which world-class global pharmaceutical companies and specialty competitors alike have sought to access its proprietary technology. With its approved therapies and substantial pipeline of significant late-stage clinical programs, we believe the company has now reached the point at which its existing therapies will continue to contribute positively and its subsequent innovations will shift its financial profile from that of an early-stage biotech company to a profitable business with normalized margins, and one able to internally fund its ongoing growth needs. Over our long-term investment horizon, we believe the company can generate substantial revenue growth while turning profitable and generating substantial cumulative free cash flow. We believe Alnylam’s market price continues to substantially undervalue the potential contribution from the company’s clinical-stage assets – which we believe is unsupported by the company’s established track record for producing genetically validated therapeutics. Further, while embedded expectations reflect some success for its currently marketed products, we believe the market is focused on short-term profitability while ignoring the platform the company has built, which we believe will serve as the basis for ongoing innovation over our long-term investment horizon and beyond. As a result, we believe the company is selling at a substantial discount to our estimate of its intrinsic value and offers a compelling reward-to-risk opportunity.

Novartis is a diversified global healthcare company with market leadership in branded and generic pharmaceuticals. The company’s Innovative Medicines division accounts for about 80% of total revenue and 85% of core operating income, while the Sandoz generics and biosimilars division accounts for about 20% of revenue and approximately 15% of core operating income. We believe Novartis’ strong and sustainable competitive advantages include its brand, culture of innovation, product breadth, clinical trials expertise, powerful global manufacturing and distribution network, and the benefits of scale. Decades of investment in innovative R&D and the accumulation of intellectual property has resulted in a broad suite of mature, successful products, as well as newer, differentiated, rapidly growing products, and a large, well-balanced clinical pipeline of approximately 75 new molecular entities and approximately 150 projects in total, which we believe will lay the foundation of growth for the next 10 years. A Fund holding since inception, Novartis reported financial results that were fundamentally solid and generally in line with consensus expectations during the period. We believe the company executed well during the period, which included strong performance in its “growth” portfolio that now accounts for over 50% of sales. The company also continued to streamline its organization to focus on innovation. During the period, this included combining its oncology and non-oncology units into a single focused unit, announcing a spin-off of its Sandoz unit, expected in late 2023, and announcing that the company would use the proceeds from the sale of its ownership interest in Roche to buy back up to $15 billion of Novartis shares. Novartis remains a differentiated business that we believe will benefit from accelerating growth, continued solid execution, a structurally improving business, and a strong management team that is making sound strategic decisions to enable greater focus on the company’s long-term competitive advantages of brand, scale, technology, and innovation. We believe the company is focused on and executing in the right areas of growth to create long-term shareholder value, and the current stock price embeds future growth expectations that are well below our forecasts. As a result, we believe the shares are selling at a discount to our estimate of intrinsic value and offer a compelling reward-to-risk opportunity. We trimmed our position during the period, but Novartis remained our top holding as of November 30.

All aspects of our quality-growth-valuation investment thesis must be present simultaneously for us to make an investment. Often our research is completed well in advance of the opportunity to invest. We are patient investors and maintain coverage of high-quality businesses in order to take advantage of meaningful price dislocations if and when they occur. During the period we initiated new positions in Block, Doximity, Netflix, Shopify, and Tesla. We added to our existing holdings in Ambev, Boeing, CRISPR, Fanuc, Meta, and Under Armour. We trimmed our existing positions in Alibaba, Deere, Nestle, Novartis, Oracle, Reckitt Benckiser, Roche, Unilever, and Vertex Pharmaceuticals. We sold our positions in Colgate Palmolive, Core Laboratories, and Schlumberger.

Outlook

Our investment process is characterized by bottom-up fundamental research and a long-term investment time horizon. The nature of the process leads to a lower-turnover portfolio in which sector positioning is the result of stock selection. The Fund ended the year with overweight positions in the communication services, consumer discretionary, healthcare, information technology, and industrials sectors and underweight positions in the financials and consumer staples sectors. We did not own positions in the energy, materials, utilities or real estate sectors.

| 4

LOOMIS SAYLES GLOBAL GROWTH FUND

Top Ten Holdings as of November 30, 2022

| | | | | | | | |

| | | |

| | | | Security Name | | % of

Net Assets | |

| | 1 | | | Novartis AG | | | 5.18 | % |

| | 2 | | | Alphabet, Inc. | | | 5.01 | |

| | 3 | | | MercadoLibre, Inc. | | | 4.85 | |

| | 4 | | | Amazon.com, Inc. | | | 4.68 | |

| | 5 | | | Boeing Co. (The) | | | 4.36 | |

| | 6 | | | Visa, Inc. | | | 4.29 | |

| | 7 | | | Microsoft Corp. | | | 3.75 | |

| | 8 | | | Adyen NV | | | 3.70 | |

| | 9 | | | Oracle Corp. | | | 3.63 | |

| | 10 | | | Meta Platforms, Inc. | | | 3.58 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments, are presented on an individual security basis and do not represent holdings of the issuer.

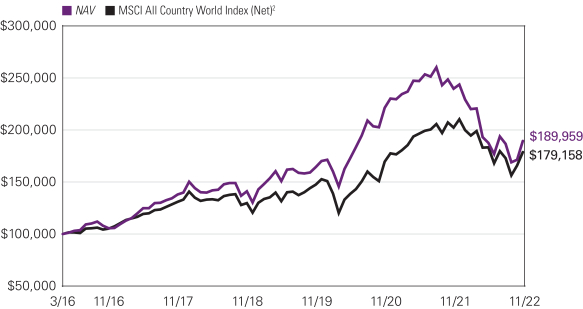

Hypothetical Growth of $100,000 Investment in Class Y Shares

March 31, 2016 (inception) through November 30, 20223

5 |

Average Annual Total Returns — November 30, 20223

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Expense Ratios4 | |

| | | 1 Year | | | 5 Years | | | Life of Class | | | Gross | | | Net | |

| | | | | | | |

| Class Y (Inception 3/31/16) | | | | | | | | | | | Class Y/A/C | | | | Class N | | | | | | | | | |

| NAV | | | -20.95 | % | | | 6.57 | % | | | 10.10 | % | | | — | % | | | 1.04 | % | | | 0.95 | % |

| | | | | | | |

| Class A (Inception 3/31/16) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | -21.08 | | | | 6.31 | | | | 9.83 | | | | — | | | | 1.29 | | | | 1.20 | |

| With 5.75% Maximum Sales Charge | | | -25.60 | | | | 5.06 | | | | 8.85 | | | | — | | | | | | | | | |

| | | | | | | |

| Class C (Inception 3/31/16) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | -21.71 | | | | 5.51 | | | | 8.99 | | | | — | | | | 2.04 | | | | 1.95 | |

| With CDSC1 | | | -22.44 | | | | 5.51 | | | | 8.99 | | | | — | | | | | | | | | |

| | | | | | | |

| Class N (Inception 3/31/17) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | -20.87 | | | | 6.61 | | | | — | | | | 9.24 | | | | 0.98 | | | | 0.90 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| MSCI All Country World Index (Net)2 | | | -11.62 | | | | 6.41 | | | | 9.11 | | | | 8.10 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | MSCI All Country World Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 3/31/23. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 6

LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND

| | |

| |

| Managers: | | Symbols: |

| |

| John R. Bell | | Class A LSFAX |

| |

| Michael L. Klawitter,CFA® | | Class C LSFCX |

| |

| Heather M. Young,CFA® | | Class N LSFNX |

| |

| Loomis, Sayles & Company, L.P. | | Class Y LSFYX |

Investment Goal

The Fund seeks to provide a high level of current income.

Market Conditions

Despite rising interest rates throughout 2022, the loan market was hampered by strong risk-off sentiment during the latter half of the period. Lower-rated loans generally underperformed higher-rated loans, defaults were minimal, and prices were pressured by technical factors. At the end of the period, loan prices generally hovered in the low 90s, indicative of the recession concerns prevailing in the market.

New loan issuance was muted throughout the period, though the total value of loans outstanding continued to grow, ending November at a near-record high of $1.42 trillion. Collateralized loan obligation (CLO) formation remained fairly strong despite higher debt costs, as issuers were able to take advantage of lower loan prices to drive returns. Loan mutual fund flows were positive early in 2022 but switched to outflows as investors sought relative safety in other asset classes.

Performance Results

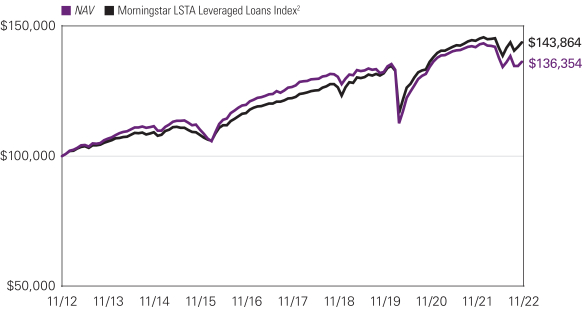

For the 12 months ended November 30, 2022, Class Y shares of the Loomis Sayles Senior Floating Rate and Fixed Income Fund returned -4.04% at net asset value. The Fund underperformed its benchmark, the Morningstar LSTA Leveraged Loan Index, which returned -0.41%.

Explanation of Fund Performance

The Fund underperformed its benchmark for the full period, primarily due to the risk positioning of bank loan holdings given the risk-off tone that persisted during much of the period.

The most significant detractor from performance versus the benchmark was the Fund’s overweight in B-rated loans, followed by its underweighting of higher-quality loans relative to the benchmark. The Fund’s higher-than-average cash balance, maintained for liquidity purposes, contributed slightly to relative performance. Small allocations to high yield bonds and US Treasuries detracted modestly from performance. However, the portfolio experienced no defaults, and its interest income saw strong growth as interest rates increased during the period.

We target a yield advantage for the Fund versus the benchmark in most market conditions. A yield advantage can be enhanced through primary market new issue discounts and by swapping into loans or bonds with more appealing risk/return characteristics as those opportunities arise. Maintaining an appropriate liquidity policy is a primary objective. The Fund is currently positioned with about 81% bank loans, 7% bonds, and 4% Treasury notes and bills, and 8% held in cash on a trade-date basis.

We examine the relative attractiveness of the high yield corporate bond market in relation to bank loans based on potential risk-adjusted return. We judge potential return on high yield bonds in comparison to loans when assessing whether the additional volatility in the bond market is appropriately compensated versus the Fund’s benchmark. Currently, we view that tradeoff as poorly compensated in much of the bond market. We initiated a small position in Treasury bills to enhance yield beyond the short-term rates offered by the Fund’s custodian, which enables us to boost Fund liquidity while earning a return.

Outlook

The environment for loan credit quality remains relatively stable despite the impact of inflation and market uncertainty. Demand for loans has been declining as investors seek relative safety or discounts in other asset classes. We agree with the market’s expectation that default rates are poised to remain low due to both company-specific circumstances (ample liquidity, few loan maturities, successful cost-savings programs, and revenue retention) and capital structures that can withstand current macroeconomic headwinds.

Inflationary cost pressures have, thus far, been well-absorbed by most of the companies to which we lend. We expect these companies will successfully handle increased borrowing costs associated with interest rate increases. We believe that most borrowers have hedged at least some of their rate risk.

7 |

Our macro base case shows odds of a downturn increasing, although we are waiting for profits to decline before making an official call on recession. We think inflation is in the process of reaching a peak. We expect the Federal Reserve to increase rates by 50 basis points at the December meeting, with future interest rate changes dependent on the patterns of jobless claims and employment. Our goal remains to construct a portfolio that can withstand many pressures without suffering significant credit losses.

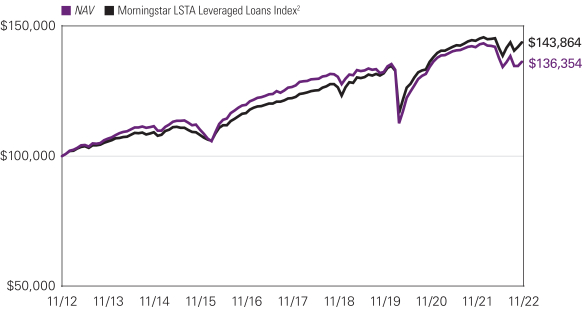

Hypothetical Growth of $100,000 Investment in Class Y Shares

November 30, 2012 through November 30, 20223

Average Annual Total Returns — November 30, 20223

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Expense Ratios4 | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Life of Class | | | Gross | | | Net | |

| | | | | | | |

Class Y | | | | | | | | | | | | | | | Class N | | | | | | | | | |

NAV | | | -4.04 | % | | | 1.48 | % | | | 3.15 | % | | | — | % | | | 1.00 | % | | | 0.81 | % |

| | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | |

NAV | | | -4.28 | | | | 1.23 | | | | 2.89 | | | | — | | | | 1.25 | | | | 1.06 | |

With 3.50% Maximum Sales Charge | | | -7.59 | | | | 0.50 | | | | 2.53 | | | | — | | | | | | | | | |

| | | | | | | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | |

NAV | | | -5.04 | | | | 0.46 | | | | 2.28 | | | | — | | | | 2.00 | | | | 1.81 | |

With CDSC1 | | | -5.94 | | | | 0.46 | | | | 2.28 | | | | — | | | | | | | | | |

| | | | | | | |

Class N (Inception 3/31/17) | | | | | | | | | | | | | | | | | | | | | | | | |

NAV | | | -4.00 | | | | 1.51 | | | | — | | | | 1.91 | | | | 1.04 | | | | 0.76 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Morningstar LSTA Leveraged Loan Index2 | | | -0.41 | | | | 3.30 | | | | 3.70 | | | | 3.36 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase, and includes automatic conversion to Class A shares after eight years. |

| 2 | Morningstar LSTA Leveraged Loan Index covers loan facilities and reflects the market-value-weighted performance of U.S. dollar-denominated institutional leveraged loans. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 3/31/23. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 8

VAUGHAN NELSON SELECT FUND

| | |

| |

| Managers: | | Symbols: |

| |

| Chris D. Wallis, CFA®, CPA | | Class A VNSAX |

| |

| Scott J. Weber, CFA® | | Class C VNSCX |

| |

| Vaughan Nelson Investment Management, L.P. | | Class N VNSNX |

| |

| | Class Y VNSYX |

Investment Goal

The Fund seeks long-term capital appreciation.

Market Conditions

During the fiscal year ended November 30, 2022, equity market performance was initially defined by Russia’s invasion of Ukraine and NATO’s sharp response. These events further supported inflationary pressures and weighed on future economic growth.

The US Federal Reserve (Fed) raised the fed funds rate, kicking off the first Fed hiking cycle since 2018. The high inflation environment proved stickier than expected. With inflation elevated, the cost of capital rising, liquidity conditions deteriorating, and earnings estimates set for negative revisions, heightened equity market volatility led to further downside.

As we moved through the summer months, risk assets continued to be pressured by accelerating inflationary pressures, decelerating economic growth, and tightening financial conditions. Inflationary pressures in the US moved from goods to services and housing, in the form of owners’ equivalent rent. The yield curve flattened with the M2 (a measure of the money supply including cash, checking deposits, and other types of deposits readily convertible to cash) money supply decelerating. The rapid slowdown in economic growth and tightening financial conditions are creating a recessionary environment in the US, Europe, and most export-led economies.

Through the final months of the fiscal year, the exceptional US dollar strength drove markets as the Fed dramatically tightened financial conditions by increasing interest rates and aggressively shrinking its balance sheet. The strong US dollar accelerated the exportation of US inflation to the rest of the world, forcing nearly all global central banks to follow the Fed in raising interest rates. Tighter financial conditions forced global equity and fixed income markets to reduce investment positions and leverage, driving nearly all asset classes lower. To date, equity markets have repriced valuation multiples in line with the higher cost of capital but have not yet priced a potential earnings recession.

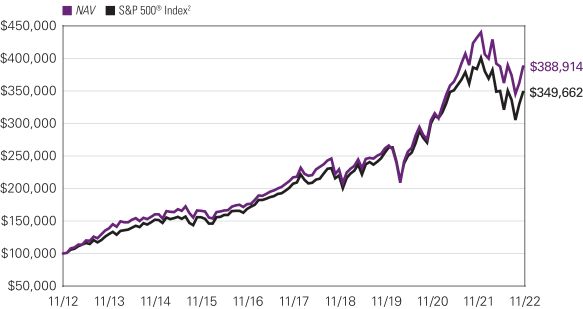

Performance Results

For the 12 months ended November 30, 2022, Class Y shares of the Vaughan Nelson Select Fund returned -10.31% at net asset value. The Fund underperformed its benchmark, the S&P 500® Index, which returned -9.21%.

Explanation of Fund Performance

The Fund underperformed on a relative basis during the period.

The largest detractor was industrials, driven by security selection. Saia, Inc. drove the underperformance due largely to concerns around the macro cycle. We expect their investments building out their national network for the LTL (less-than-truckload) market to improve margins in the company over time.

Selection within consumer staples detracted, with the largest underperformance led by McCormick & Company, Incorporated, who struggled with inflationary costs and supply chain pressures. The supply chain issues should prove to be temporary, and pricing actions by the company will recoup margin over time as inflation slows down.

Healthcare was a slightly negative relative sector for the Fund, and Masimo Corporation was the largest detractor from performance due to management’s misallocation of capital and high valuation.

An underweight to energy, the top performing sector, detracted from relative performance.

Information technology was the top relative performing sector for the Fund due to a strong year from Jack Henry & Associates, Inc., where the company benefited from its stable, growing, defensive business and a relatively strong end market.

In financials the Fund experienced positive attribution, with Berkshire Hathaway Inc. Class B leading the way as they benefited from a volatile macro environment where they could deploy capital as valuations dislocate.

An underweight to the challenged consumer discretionary and communication services sectors helped on a relative basis.

9 |

Both an underweight to and security selection within real estate aided relative performance. Prologis, Inc. was the top performer due to strong pricing growth and strategic capital allocation. Low vacancy rates and higher inflation should lead to high lease marks-to-market over time, and the company is adding ancillary services to enhance the value of their offering.

Finally, overweights to materials and utilities, outperforming sectors, helped throughout the fiscal year.

Outlook

Over the short to medium term, markets will continue to be heavily influenced by the ongoing energy and capital shortages dominating realpolitik. Given the nature of the challenges, there are no short-term solutions, but only tradeoffs driven by the political calendar and responses to crises as they flare up. As these twin crises confront a developing global recession with all major central banks continuing to tighten financial conditions, equity investors’ underlying premise must be that countries do not choose bankruptcy via austerity. We have witnessed pivots by the Bank of England, the European Union Bank, the Bank of Japan, and the Bank of Korea supporting this premise as they have reimplemented forms of liquidity support. Given that the current level of US interest rates would result in the bankruptcy of the US Treasury over the medium term, it will not surprise us to see the Fed also pivot as they are forced to deal with the reality of ensuring the US Treasury’s solvency.

Top Ten Holdings as of November 30, 2022

| | | | | | | | |

| | | |

| | | | Security Name | | % of

Net Assets | |

| | 1 | | | NextEra Energy, Inc. | | | 5.44 | % |

| | 2 | | | Dollar General Corp. | | | 5.16 | |

| | 3 | | | Sherwin-Williams Co. (The) | | | 5.14 | |

| | 4 | | | Wheaton Precious Metals Corp. | | | 5.04 | |

| | 5 | | | Intercontinental Exchange, Inc. | | | 4.76 | |

| | 6 | | | Microsoft Corp. | | | 4.74 | |

| | 7 | | | Danaher Corp. | | | 4.74 | |

| | 8 | | | Motorola Solutions, Inc. | | | 4.36 | |

| | 9 | | | Clorox Co. (The) | | | 4.34 | |

| | 10 | | | McCormick & Co., Inc. | | | 4.21 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments, are presented on an individual security basis and do not represent holdings of the issuer.

| 10

VAUGHAN NELSON SELECT FUND

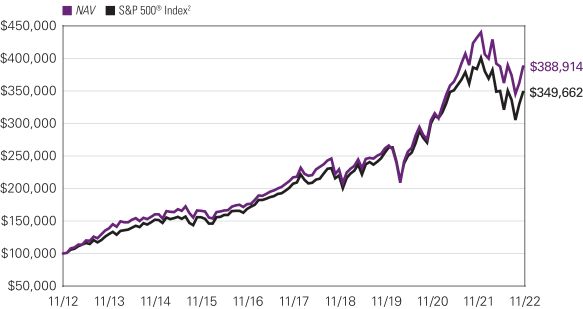

Hypothetical Growth of $100,000 Investment in Class Y Shares

November 30, 2012 through November 30, 20223

Average Annual Total Returns — November 30, 20223

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | Expense Ratios4 | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Life of Class | | | Gross | | | Net | |

| | | | | | | |

| Class Y | | | | | | | | | | | | | | | Class N | | | | | | | | | |

| NAV | | | -10.31 | % | | | 12.32 | % | | | 14.54 | % | | | — | % | | | 0.86 | % | | | 0.85 | % |

| | | | | | | |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | -10.50 | | | | 12.05 | | | | 14.25 | | | | — | | | | 1.11 | | | | 1.10 | |

| With 5.75% Maximum Sales Charge | | | -15.64 | | | | 10.74 | | | | 13.58 | | | | — | | | | | | | | | |

| | | | | | | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | -11.16 | | | | 11.21 | | | | 13.57 | | | | — | | | | 1.86 | | | | 1.85 | |

| With CDSC1 | | | -11.79 | | | | 11.21 | | | | 13.57 | | | | — | | | | | | | | | |

| | | | | | | |

| Class N (Inception 3/31/17) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | -10.29 | | | | 12.34 | | | | — | | | | 13.58 | | | | 49.24 | | | | 0.80 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| S&P 500® Index2 | | | -9.21 | | | | 10.98 | | | | 13.34 | | | | 12.08 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large cap segment of the U.S. equities market. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 3/31/23. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

11 |

ADDITIONAL INFORMATION

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Fund is actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis Affiliates”) and does not sponsor, endorse or participate in the provision of any Natixis Affiliates services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information, disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Natixis Funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on Natixis Funds’ website at im.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how Natixis Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available from Natixis Funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The Natixis Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www.sec.gov. First and third quarter schedules of portfolio holdings are also available at im.natixis.com/funddocuments. A hard copy may be requested from the Fund at no charge by calling 800-225-5478.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

| 12

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of Fund shares shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from June 1, 2022 through November 30, 2022. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table for each class of Fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each Fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | | | | | | | |

| LOOMIS SAYLES GLOBAL GROWTH FUND | | BEGINNING

ACCOUNT VALUE

6/1/2022 | | | ENDING

ACCOUNT VALUE

11/30/2022 | | | EXPENSES PAID

DURING PERIOD*

6/1/2022 – 11/30/2022 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,008.60 | | | | $6.04 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.05 | | | | $6.07 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,004.50 | | | | $9.80 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.29 | | | | $9.85 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,009.20 | | | | $4.53 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.56 | | | | $4.56 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,009.20 | | | | $4.78 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.31 | | | | $4.81 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.20%, 1.95%, 0.90% and 0.95% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

13 |

| | | | | | | | | | | | |

| LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND | | BEGINNING

ACCOUNT VALUE

6/1/2022 | | | ENDING

ACCOUNT VALUE

11/30/2022 | | | EXPENSES PAID

DURING PERIOD*

6/1/2022 – 11/30/2022 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $986.80 | | | | $5.23 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.80 | | | | $5.32 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $983.00 | | | | $8.95 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.04 | | | | $9.10 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $988.30 | | | | $3.74 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.31 | | | | $3.80 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $988.10 | | | | $3.99 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.06 | | | | $4.05 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.05%, 1.80%, 0.75% and 0.80% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| | | | | | | | | | | | |

| VAUGHAN NELSON SELECT FUND | | BEGINNING

ACCOUNT VALUE

6/1/2022 | | | ENDING

ACCOUNT VALUE

11/30/2022 | | | EXPENSES PAID

DURING PERIOD*

6/1/2022 – 11/30/2022 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $998.30 | | | | $5.56 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.50 | | | | $5.62 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $994.90 | | | | $9.30 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.74 | | | | $9.40 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $999.40 | | | | $4.01 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.06 | | | | $4.05 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $999.40 | | | | $4.31 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.76 | | | | $4.36 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.11%, 1.86%, 0.80% and 0.86% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| 14

Portfolio of Investments – as of November 30, 2022

Loomis Sayles Global Growth Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | Common Stocks — 100.0% of Net Assets | |

| | | | Brazil — 8.1% | |

| | 1,002,597 | | | Ambev S.A., ADR | | $ | 3,057,921 | |

| | 4,929 | | | MercadoLibre, Inc.(a) | | | 4,588,825 | |

| | | | | | | | |

| | | | | | | 7,646,746 | |

| | | | | | | | |

| | | | Canada — 2.5% | |

| | 58,050 | | | Shopify, Inc., Class A(a) | | | 2,373,084 | |

| | | | | | | | |

| | | | China — 12.7% | |

| | 16,020 | | | Alibaba Group Holding Ltd., Sponsored ADR(a)(b) | | | 1,402,711 | |

| | 15,534 | | | Baidu, Inc., Sponsored ADR(a)(b) | | | 1,686,992 | |

| | 178,432 | | | Budweiser Brewing Co. APAC Ltd., 144A | | | 517,610 | |

| | 10,493 | | | NXP Semiconductors NV | | | 1,845,089 | |

| | 72,600 | | | Tencent Holdings Ltd.(b) | | | 2,745,463 | |

| | 65,259 | | | Trip.com Group Ltd., ADR(a)(b) | | | 2,085,025 | |

| | 31,624 | | | Yum China Holdings, Inc. | | | 1,743,115 | |

| | | | | | | | |

| | | | | | | 12,026,005 | |

| | | | | | | | |

| | | | Denmark — 2.2% | |

| | 16,969 | | | Novo Nordisk A/S, Class B | | | 2,128,558 | |

| | | | | | | | |

| | | | France — 1.0% | |

| | 9,448 | | | Sodexo S.A. | | | 904,868 | |

| | | | | | | | |

| | | | Japan — 2.5% | |

| | 15,800 | | | FANUC Corp. | | | 2,375,703 | |

| | | | | | | | |

| | | | Netherlands — 3.7% | |

| | 2,220 | | | Adyen NV, 144A(a) | | | 3,497,208 | |

| | | | | | | | |

| | | | Switzerland — 7.3% | |

| | 36,003 | | | CRISPR Therapeutics AG(a) | | | 1,972,604 | |

| | 55,056 | | | Novartis AG, (Registered) | | | 4,897,481 | |

| | | | | | | | |

| | | | | | | 6,870,085 | |

| | | | | | | | |

| | | | United Kingdom — 4.2% | |

| | 73,068 | | | Experian PLC | | | 2,585,237 | |

| | 7,136 | | | Reckitt Benckiser Group PLC | | | 512,104 | |

| | 17,572 | | | Unilever PLC | | | 881,239 | |

| | | | | | | | |

| | | | | | | 3,978,580 | |

| | | | | | | | |

| | | | United States — 55.8% | |

| | 14,378 | | | Alnylam Pharmaceuticals, Inc.(a) | | | 3,171,643 | |

| | 46,976 | | | Alphabet, Inc., Class A(a) | | | 4,744,106 | |

| | 45,869 | | | Amazon.com, Inc.(a) | | | 4,428,193 | |

| | 5,094 | | | Autodesk, Inc.(a) | | | 1,028,733 | |

| | 16,148 | | | Block, Inc.(a) | | | 1,094,350 | |

| | 23,077 | | | Boeing Co. (The)(a) | | | 4,128,014 | |

| | 2,194 | | | Deere & Co. | | | 967,554 | |

| | 39,300 | | | Doximity, Inc., Class A(a) | | | 1,335,807 | |

| | 7,384 | | | Expeditors International of Washington, Inc. | | | 856,987 | |

| | 28,664 | | | Meta Platforms, Inc., Class A(a) | | | 3,385,219 | |

| | 13,924 | | | Microsoft Corp. | | | 3,552,570 | |

| | 11,360 | | | Nestle S.A., (Registered) | | | 1,352,107 | |

| | 9,316 | | | Netflix, Inc.(a) | | | 2,846,318 | |

| | 41,372 | | | Oracle Corp. | | | 3,435,117 | |

| | 12,572 | | | QUALCOMM, Inc. | | | 1,590,232 | |

| | 7,026 | | | Roche Holding AG | | | 2,294,859 | |

| | 11,771 | | | Salesforce, Inc.(a) | | | 1,886,303 | |

| | 15,733 | | | SEI Investments Co. | | | 979,851 | |

| | 10,336 | | | Tesla, Inc.(a) | | | 2,012,419 | |

| | 88,566 | | | Under Armour, Inc., Class A(a) | | | 885,660 | |

| | 6,102 | | | Vertex Pharmaceuticals, Inc.(a) | | | 1,930,673 | |

| | 18,687 | | | Visa, Inc., Class A | | | 4,055,079 | |

| | 6,227 | | | Yum! Brands, Inc. | | | 801,166 | |

| | | | | | | | |

| | | | | | | 52,762,960 | |

| | | | | | | | |

| | | | Total Common Stocks

(Identified Cost $103,405,647) | | | 94,563,797 | |

| | | | | | | | |

| | Short-Term Investments — 0.6% | |

| $ | 581,057 | | | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 11/30/2022 at 1.500% to be repurchased at $581,082 on 12/01/2022 collateralized by $556,200 U.S. Treasury Bond, 7.625% due 2/15/2025 valued at $592,722 including accrued interest (Note 2 of Notes to Financial Statements)

(Identified Cost $581,057) | | $ | 581,057 | |

| | | | | | | | |

| | | | | | | | |

| | | | Total Investments — 100.6%

(Identified Cost $103,986,704) | | | 95,144,854 | |

| | | | Other assets less liabilities — (0.6)% | | | (525,055 | ) |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 94,619,799 | |

| | | | | | | | |

| | | | | | | | |

| | (†) | | | See Note 2 of Notes to Financial Statements. | |

| | (a) | | | Non-income producing security. | |

| | (b) | | | Security invests in variable interest entities based in China. See Note 8 of Notes to Financial Statements. | |

| | | | | |

| | 144A | | | All or a portion of these securities are exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2022, the value of Rule 144A holdings amounted to $4,014,818 or 4.2% of net assets. | |

| | ADR | | | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs may be significantly influenced by trading on exchanges not located in the United States. | |

Industry Summary at November 30, 2022

| | | | |

Interactive Media & Services | | | 13.3 | % |

IT Services | | | 11.7 | |

Internet & Direct Marketing Retail | | | 11.1 | |

Software | | | 10.5 | |

Pharmaceuticals | | | 9.8 | |

Biotechnology | | | 7.5 | |

Hotels, Restaurants & Leisure | | | 5.9 | |

Aerospace & Defense | | | 4.4 | |

Beverages | | | 3.7 | |

Semiconductors & Semiconductor Equipment | | | 3.7 | |

Machinery | | | 3.5 | |

Entertainment | | | 3.0 | |

Professional Services | | | 2.7 | |

Automobiles | | | 2.1 | |

Other Investments, less than 2% each | | | 7.1 | |

Short-Term Investments | | | 0.6 | |

| | | | |

Total Investments | | | 100.6 | |

Other assets less liabilities | | | (0.6 | ) |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

Currency Exposure Summary at November 30, 2022

| | | | |

United States Dollar | | | 74.6 | % |

Swiss Franc | | | 9.0 | |

Euro | | | 5.6 | |

Hong Kong Dollar | | | 3.4 | |

British Pound | | | 3.3 | |

Japanese Yen | | | 2.5 | |

Danish Krone | | | 2.2 | |

| | | | |

Total Investments | | | 100.6 | |

Other assets less liabilities | | | (0.6 | ) |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

See accompanying notes to financial statements.

15 |

Portfolio of Investments – as of November 30, 2022

Loomis Sayles Senior Floating Rate and Fixed Income Fund

| | | | | | | | |

Principal Amount | | | Description | | Value (†) | |

| | Senior Loans — 81.3% of Net Assets | |

| | | | Aerospace & Defense — 0.1% | |

| $ | 617,000 | | | Spirit Aerosystems, Inc., 2022 Term Loan, 1/15/2027(a) | | $ | 608,775 | |

| | | | | | | | |

| | | | Airlines — 2.5% | |

| | 9,595,000 | | | American Airlines, Inc., 2021 Term Loan, 3-month LIBOR + 4.750%, 8.993%, 4/20/2028(b)(c) | | | 9,528,219 | |

| | 4,791,499 | | | LifeMiles Ltd., 2021 Term Loan B, 3-month LIBOR + 5.250%, 9.985%, 8/30/2026(c)(d) | | | 4,318,338 | |

| | 2,375,000 | | | Mileage Plus Holdings LLC, 2020 Term Loan B, 3-month LIBOR + 5.250%, 8.777%, 6/21/2027(c)(d) | | | 2,440,312 | |

| | 3,065,667 | | | SkyMiles IP Ltd., 2020 SkyMiles Term Loan B, 3-month LIBOR + 3.750%, 7.993%, 10/20/2027(c)(d) | | | 3,106,287 | |

| | 6,067,150 | | | United Airlines, Inc., 2021 Term Loan B, 3-month LIBOR + 3.750%, 8.108%, 4/21/2028(b)(c) | | | 5,982,635 | |

| | | | | | | | |

| | | | | | | 25,375,791 | |

| | | | | | | | |

| | | | Automotive — 1.8% | |

| | 4,000,000 | | | First Brands Group LLC, 2021 2nd Lien Term Loan, 3-month LIBOR + 8.500%, 11.871%, 3/30/2028(c)(d) | | | 3,580,000 | |

| | 5,552,093 | | | First Brands Group LLC, 2021 Term Loan, 3-month SOFR + 5.00%, 8.369%, 3/30/2027(c)(d) | | | 5,348,498 | |

| | 5,419,960 | | | IXS Holdings, Inc., 2020 Term Loan B, 3-month LIBOR + 4.250%, 7.816%, 3/05/2027(b)(c) | | | 4,268,218 | |

| | 7,386,403 | | | Wheel Pros LLC, 2021 Term Loan, 3-month LIBOR + 4.500%, 8.825%, 5/11/2028(b)(c) | | | 4,871,702 | |

| | | | | | | | |

| | | | | | | 18,068,418 | |

| | | | | | | | |

| | | | Banking — 0.5% | |

| | 5,492,400 | | | Novae LLC, 1st Lien Term Loan, 6-month LIBOR + 5.000%, 9.696%, 12/22/2028(b)(c) | | | 4,943,160 | |

| | | | | | | | |

| | | | Brokerage — 4.4% | |

| | 2,000,000 | | | AqGen Ascensus, Inc., 2021 2nd Lien Term Loan, 8/02/2029(a) | | | 1,735,000 | |

| | 1,589,449 | | | AqGen Ascensus, Inc., 2021 2nd Lien Term Loan, 3-month LIBOR + 6.500%, 10.250%, 8/02/2029(c)(e) | | | 1,378,847 | |

| | 4,482,325 | | | Astra Acquisition Corp., 2021 1st Lien Term Loan, 1-month LIBOR + 5.250%, 9.321%, 10/25/2028(c)(e) | | | 4,049,018 | |

| | 3,574,750 | | | DRW Holdings LLC, 2021 Term Loan, 1-month LIBOR + 3.750%, 7.821%, 3/01/2028(c)(f) | | | 3,479,805 | |

| | 8,852,045 | | | Edelman Financial Center LLC, 2018 2nd Lien Term Loan, 1-month LIBOR + 6.750%, 10.821%, 7/20/2026(c)(f) | | | 7,961,352 | |

| | 5,635,558 | | | Eisner Advisory Group LLC, Term Loan, 1-month SOFR + 5.25%, 9.451%, 7/28/2028(b)(c) | | | 5,297,425 | |

| | 4,733,682 | | | HighTower Holdings LLC, 2021 Term Loan B, 3-month LIBOR + 4.000%, 8.278%, 4/21/2028(b)(c) | | | 4,414,159 | |

| | 7,462,500 | | | LHS Borrower LLC, 2022 Term Loan B, 1-month SOFR + 4.750%, 8.937%, 2/16/2029(c)(e) | | | 6,016,641 | |

| | 5,050,808 | | | Resolute Investment Managers, Inc., 2020 Term Loan C, 3-month LIBOR + 4.250%, 7.924%, 4/30/2024(c)(d) | | | 4,204,797 | |

| | 7,153,468 | | | Teneo Holdings LLC, Term Loan, 1-month LIBOR + 5.250%, 9.437%, 7/11/2025(c)(d) | | | 6,838,286 | |

| | | | | | | | |

| | | | | | | 45,375,330 | |

| | | | | | | | |

| | | | Building Materials — 3.7% | |

| | 4,512,299 | | | ACProducts, Inc., 2021 Term Loan B, LIBOR + 4.25%, 7.325%, 5/17/2028(e)(g) | | | 3,266,589 | |

| | 5,300,000 | | | Chamberlain Group, Inc., Term Loan B, 11/03/2028(a) | | | 4,953,857 | |

| | | | Building Materials — continued | | | | |

| $ | 2,693,165 | | | Cornerstone Building Brands, Inc., 2021 Term Loan B, 1-month LIBOR + 3.250%, 7.123%, 4/12/2028(c)(e) | | $ | 2,388,918 | |

| | 2,500,000 | | | CP Atlas Buyer, Inc., 2021 Term Loan B, 11/23/2027(a) | | | 2,196,875 | |

| | 2,550,478 | | | CP Atlas Buyer, Inc., 2021 Term Loan B, 1-month LIBOR + 3.500%, 7.571%, 11/23/2027(c)(e) | | | 2,241,233 | |

| | 3,500,868 | | | Foley Products Co. LLC, 2021 Term Loan, 3-month SOFR + 4.750%, 8.453%, 12/29/2028(c)(e) | | | 3,319,278 | |

| | 3,331,594 | | | LBM Acquisition LLC, Term Loan B, 6-month LIBOR + 3.750%, 7.121%, 12/17/2027(b)(c) | | | 2,859,107 | |

| | 6,492,000 | | | Oscar AcquisitionCo. LLC, Term Loan B, 3-month SOFR + 4.500%, 8.153%, 4/29/2029(c)(e) | | | 5,972,640 | |

| | 4,206,022 | | | Park River Holdings, Inc., Term Loan, 3-month LIBOR + 3.250%, 6.993%, 12/28/2027(b)(c) | | | 3,643,467 | |

| | 4,464,296 | | | Specialty Building Products Holdings LLC, 2021 Term Loan B, 1-month LIBOR + 3.250%, 7.266%, 10/15/2028(c)(e) | | | 3,935,544 | |

| | 3,397,004 | | | U.S. Silica Co., 2018 Term Loan B, 1-month LIBOR + 4.000%, 8.125%, 5/01/2025(c)(d) | | | 3,344,622 | |

| | | | | | | | |

| | | | | | | 38,122,130 | |

| | | | | | | | |

| | | | Cable Satellite — 2.1% | |

| | 13,217,187 | | | DirecTV Financing LLC, Term Loan, 1-month LIBOR + 5.000%, 9.071%, 8/02/2027(b)(c) | | | 12,640,388 | |

| | 4,091,797 | | | Intelsat Jackson Holdings S.A., 2021 Exit Term Loan B, 6-month SOFR + 4.50%, 7.445%, 2/01/2029(c)(e) | | | 3,947,561 | |

| | 5,020,868 | | | ViaSat, Inc., Term Loan, 1-month SOFR + 4.50%, 8.701%, 3/02/2029(c)(e) | | | 4,866,075 | |

| | | | | | | | |

| | | | | | | 21,454,024 | |

| | | | | | | | |

| | | | Chemicals — 3.7% | |

| | 3,275,000 | | | Aruba Investments, Inc., 2020 2nd Lien Term Loan, 1-month LIBOR + 7.750%, 11.794%, 11/24/2028(b)(c) | | | 2,958,406 | |

| | 5,105,205 | | | Bakelite U.S. Holdco, Inc., 2022 Term Loan, 3-month SOFR + 4.00%, 7.669%, 5/29/2029(c)(e) | | | 4,747,841 | |

| | 1,928,520 | | | GEON Performance Solutions LLC, 2021 Term Loan, 1-month LIBOR + 4.500%, 8.174%, 8/18/2028(b)(c) | | | 1,863,432 | |

| | 6,644,686 | | | Groupe Solmax, Inc., Term Loan, 3-month LIBOR + 4.750%, 8.392%, 5/29/2028(b)(c) | | | 5,249,302 | |

| | 3,151,586 | | | Hyperion Materials & Technologies, Inc., 2021 Term Loan B, LIBOR + 4.50%, 9.062%, 8/30/2028(e)(g) | | | 3,029,462 | |

| | 3,611,000 | | | Ineos US Finance LLC, 2022 USD Term Loan B, 11/08/2027(a) | | | 3,559,110 | |

| | 1,913,125 | | | Lonza Group AG, USD Term Loan B, 3-month LIBOR + 4.000%, 7.674%, 7/03/2028(b)(c) | | | 1,752,422 | |

| | 6,184,920 | | | Luxembourg Investment Co. 428 S.a. r.l., Term Loan B, 3-month SOFR + 5.00%, 8.553%, 1/03/2029(c)(e) | | | 4,968,532 | |

| | 3,681,500 | | | Olympus Water U.S. Holding Corp., 2022 Incremental Term Loan, 3-month SOFR + 4.500%, 8.153%, 11/09/2028(c)(e) | | | 3,548,046 | |

| | 5,600,000 | | | PMHC II, Inc., 2022 Term Loan B, 3-month SOFR + 4.250%, 8.494%, 4/23/2029(c)(f) | | | 4,691,288 | |

| | 2,051,588 | | | SCIH Salt Holdings, Inc., 2021 Incremental Term Loan B, 3-month LIBOR + 4.000%, 8.415%, 3/16/2027(b)(c) | | | 1,970,817 | |

| | | | | | | | |

| | | | | | | 38,338,658 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 16

Portfolio of Investments – as of November 30, 2022

Loomis Sayles Senior Floating Rate and Fixed Income Fund – (continued)

| | | | | | | | |

Principal Amount | | | Description | | Value (†) | |

| | | | Construction Machinery — 0.3% | |

| $ | 3,899,268 | | | ASP Blade Holdings, Inc., Initial Term Loan, 3-month LIBOR + 4.000%, 7.674%, 10/13/2028(c)(e) | | $ | 3,197,400 | |

| | | | | | | | |

| | | | Consumer Cyclical Services — 4.5% | |

| | 4,591,000 | | | Galaxy U.S. Opco, Inc., Term Loan, 1-month SOFR + 4.75%, 8.837%, 4/29/2029(c)(e) | | | 4,183,549 | |

| | 743,000 | | | Go Daddy Operating Co. LLC, 2022 Term Loan B5, 1-month SOFR + 3.25%, 7.337%, 10/21/2029(c)(f) | | | 740,318 | |

| | 5,269,761 | | | Inmar Holdings, Inc., 2017 1st Lien Term Loan, 1-month LIBOR + 4.000%, 8.071%, 5/01/2024(c)(d) | | | 4,763,864 | |

| | 2,500,000 | | | Inmar Holdings, Inc., 2017 2nd Lien Term Loan, 1-month LIBOR + 8.000%, 12.071%, 5/01/2025(c)(d) | | | 2,300,000 | |

| | 3,000,000 | | | Latham Pool Products, Inc., 2022 Term Loan B, 2/23/2029(a) | | | 2,722,500 | |

| | 7,989,892 | | | Signal Parent, Inc., Term Loan B, 1-month LIBOR + 3.500%, 7.571%, 4/03/2028(b)(c) | | | 5,050,730 | |

| | 6,659,809 | | | SurveyMonkey, Inc., 2018 Term Loan B, 1-month LIBOR + 3.750%, 7.830%, 10/10/2025(c)(f) | | | 6,426,715 | |

| | 3,355,035 | | | Sweetwater Borrower LLC, Term Loan B, 1-month LIBOR + 4.250%, 8.375%, 8/07/2028(b)(c) | | | 3,103,408 | |

| | 5,079,430 | | | The Knot Worldwide, Inc., 2022 Term Loan, 1-month SOFR + 4.50%, 8.687%, 12/19/2025(c)(f) | | | 4,965,143 | |

| | 4,989,756 | | | Vaco Holdings LLC, 2022 Term Loan, SOFR + 5.000%, 8.720%, 1/21/2029(f)(g) | | | 4,755,886 | |

| | 11,338,759 | | | WW International, Inc., 2021 Term Loan B, 1-month LIBOR + 3.500%, 7.580%, 4/13/2028(c)(e) | | | 6,987,510 | |

| | | | | | | | |

| | | | | | | 45,999,623 | |

| | | | | | | | |

| | | | Consumer Products — 3.3% | |

| | 2,623,425 | | | AI Aqua Merger Sub, Inc., 2021 1st Lien Term Loan B, 1-month SOFR + 3.750%, 7.544%, 7/31/2028(c)(e) | | | 2,487,873 | |

| | 483,333 | | | AI Aqua Merger Sub, Inc., 2022 Delayed Draw Term loan, 7/31/2028(a) | | | 458,359 | |

| | 2,126,667 | | | AI Aqua Merger Sub, Inc., 2022 Term Loan B, 7/31/2028(a) | | | 2,016,782 | |

| | 1,817,523 | | | Callaway Golf Co., Term Loan B, 1-month LIBOR + 4.500%, 8.571%, 1/02/2026(c)(f) | | | 1,812,416 | |

| | 4,179,305 | | | Illuminate Merger Sub Corp., Term Loan, 3-month LIBOR + 3.500%, 6.377%, 7/21/2028(c)(e) | | | 3,831,545 | |

| | 6,015,052 | | | Mattress Firm, Inc., 2021 Term Loan B, 3-month LIBOR + 4.250%, 8.433%, 9/25/2028(b)(c) | | | 5,076,704 | |

| | 1,848,476 | | | Playpower, Inc., 2019 Term Loan, 3-month LIBOR + 5.500%, 9.174%, 5/08/2026(c)(f) | | | 1,409,463 | |

| | 8,190,208 | | | Solis IV BV, USD Term Loan B1, 3-month SOFR + 3.50%, 7.859%, 2/26/2029(c)(f) | | | 7,129,903 | |

| | 5,248,638 | | | Springs Windows Fashions LLC, 2021 Term Loan B, 3-month LIBOR + 4.000%, 7.602%, 10/06/2028(b)(c) | | | 4,098,294 | |

| | 2,723,315 | | | Weber-Stephen Products LLC, 2022 Incremental Term Loan B, 1-month SOFR + 4.25%, 8.437%, 10/30/2027(b)(c) | | | 2,287,584 | |

| | 3,348,475 | | | Weber-Stephen Products LLC, Term Loan B, 1-month LIBOR + 3.250%, 7.321%, 10/30/2027(b)(c) | | | 2,799,325 | |

| | | | | | | | |

| | | | | | | 33,408,248 | |

| | | | | | | | |

| | | | Diversified Manufacturing — 2.7% | |

| | 4,078,700 | | | Arcline FM Holdings LLC, 2021 1st Lien Term Loan, 6-month LIBOR + 4.750%, 7.000%, 6/23/2028(b)(c) | | | 3,925,749 | |

| | | | Diversified Manufacturing — continued | | | | |

| $ | 4,367,952 | | | CMBF LLC, Term Loan, 1-month LIBOR + 6.000%, 9.879%, 8/02/2028(c)(e) | | $ | 3,690,920 | |

| | 1,506,000 | | | Gates Global LLC, 2022 Term Loan B, 11/16/2029(a) | | | 1,478,892 | |

| | 3,000,000 | | | Infinite Bidco LLC, 2nd Lien Term Loan, 3-month LIBOR + 7.000%, 10.674%, 3/02/2029(c)(e) | | | 2,745,000 | |

| | 4,740,000 | | | Project Castle, Inc., Term Loan B, 3-month SOFR + 5.500%, 9.053%, 6/01/2029(c)(e) | | | 3,880,875 | |

| | 2,626,860 | | | Shape Technologies Group, Inc., Term Loan, 1-month LIBOR + 3.000%, 7.071%, 4/21/2025(c)(f) | | | 2,402,474 | |

| | 4,139,375 | | | U.S. Farathane LLC, 2021 Term Loan B, 3-month LIBOR + 4.250%, 7.924%, 12/23/2024(c)(d) | | | 3,725,437 | |

| | 4,465,038 | | | Vertiv Group Corp., 2021 Term Loan B, 1-month LIBOR + 2.750%, 6.555%, 3/02/2027(c)(f) | | | 4,347,830 | |

| | 1,807,000 | | | Watlow Electric Manufacturing Co., 2022 Incremental Term Loan B, 3-month SOFR + 5.000%, 9.269%, 3/02/2028(c)(e) | | | 1,770,860 | |

| | | | | | | | |

| | | | | | | 27,968,037 | |

| | | | | | | | |

| | | | Electric — 0.4% | |

| | 5,074,068 | | | KAMC Holdings, Inc., 2019 Term Loan, 3-month LIBOR + 4.000%, 8.735%, 8/14/2026(c)(f) | | | 4,084,624 | |

| | | | | | | | |

| | | | Environmental – 0.7% | |

| | 4,331,067 | | | Liberty Tire Recycling Holdco LLC, 2021 Term Loan, 3-month LIBOR + 4.500%, 8.174%, 5/05/2028(c)(d) | | | 3,922,344 | |

| | 3,106,969 | | | Northstar Group Services, Inc., 2020 Term Loan B, 1-month LIBOR + 5.500%, 9.571%, 11/12/2026(c)(d) | | | 3,047,409 | |

| | | | | | | | |

| | | | | | | 6,969,753 | |

| | | | | | | | |

| | | | Financial Other — 0.6% | |

| | 4,572,613 | | | GT Polaris, Inc., 2021 Term Loan, 3-month LIBOR + 3.750%, 8.165%, 9/24/2027(b)(c) | | | 4,109,636 | |

| | 619 | | | Mariner Wealth Advisors LLC, Term Loan B, 3-month SOFR + 3.250%, 7.096%, 8/18/2028(c)(e) | | | 592 | |

| | 2,114,839 | | | Mermaid BidCo, Inc., 2021 USD Term Loan, 3-month LIBOR + 3.500%, 7.960%, 12/22/2027(b)(c) | | | 1,977,375 | |

| | | | | | | | |

| | | | | | | 6,087,603 | |

| | | | | | | | |

| | | | Food & Beverage — 1.8% | |

| | 7,014,448 | | | City Brewing Co. LLC, Closing Date Term Loan, 1-month LIBOR + 3.500%, 7.379%, 4/05/2028(b)(c) | | | 4,305,118 | |

| | 3,032,000 | | | Del Monte Foods, Inc., 2022 Term Loan, 1-month SOFR + 4.350%, 8.261%, 5/16/2029(c)(e) | | | 2,934,733 | |

| | 5,000,000 | | | Naked Juice LLC, 2nd Lien Term Loan, 3-month SOFR + 6.000%, 9.653%, 1/24/2030(c)(e) | | | 4,343,750 | |

| | 775,000 | | | Nomad Foods Europe Midco Ltd., 2022 Term Loan B, 3-month SOFR + 3.750%, 8.225%, 11/04/2029(c)(e) | | | 769,025 | |