Exhibit 3

| | | | |

| | | |  |

| | |

| | | | | 2012 Economic and Financial Document |

| | |

| | | | Section III: |

| | |

| | | | National Reform Programme |

| | |

The 2011 ECONOMIC AND FINANCIAL DOCUMENT is available on-line at the Internet address listed below: www.mef.gov.it www.dt.tesoro.it www.rgs.tesoro.it ISSN: 2239-5539 | |  | | |

Economic and Financial Document

2012

Section III:

National Reform Programme

Submitted by Prime Minister

and

Minister of the Economy and Finance

Mario Monti

Adopted by the Cabinet on 18 April 2012, endorsed by Parliament on 26 April 2012

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

ITALY 2020: RIGOUR, GROWTH AND EQUITY

Let’s try to envision that in 2020 some 69 per cent of people between the ages of 24 and 65 years will have a job, almost 10 percentage points more than today. Let’s try to think that a woman will not have to face an obstacle course in attempting to make home life and career compatible, because there will be a modern parental leave system, an extensive network of accessible care structures for children and the elderly, and shops that are open during hours that will make it possible for her to manage her days according to her needs. Let’s imagine that the quality of essential public services in southern Italy is not systematically inferior to those in the rest of the country. Let’s contemplate being able to rely on an efficient, modern system of insurance against the risks of job loss, which covers all workers, regardless of the contract they have, and that the number of persons at risk of poverty is cut by 2.0 million with respect to 2010. Let’s imagine being able to start up a business activity without having to request authorisations and, if we’re under 30 years old, being able to start up a business with one euro in capital. In the event of business disputes, we can count on judicial proceedings that allow for concluding a civil court case in 394 days as in Germany, instead of the 1,210 days it takes today in Italy. Let’s imagine that at least one-third of the population between the ages of 30 and 34 has a university degree, also because there is increasingly less risk of dropping out of the school system in the early years of education, as occurs today with around 18.8 per cent of young people - one-third more than in Germany and France. Let’s imagine that it’s worthwhile for a young researcher to think about a career in Italy because investment in research has grown to 1.53 per cent of GDP and there are at least seven R&D jobs for every 1,000 inhabitants, as in France, Austria or Germany. Let’s imagine less polluted cities and less expensive utility bills, because Italy is on the cutting edge in energy efficiency. Let’s imagine citizens, workers and business people interacting with the public administration via the Internet, thanks to an ultra broadband connection accessible to 100 per cent of the population. And paying less in taxes because the government is more efficient and costs less. Meanwhile, the public debt has fallen below the threshold of 100 per cent of GDP, after having reached 120 per cent in 2012.

Reflecting on scenarios such as these and on the policy actions needed for realising them is not an abstract diversion. It is the essence of the exercise that Italy and the other EU Member States must complete each year in preparing a Stability Programme and a National Reform Programme as part of the Europe 2020 Strategy for intelligent, sustainable and inclusive growth.

Thinking about national economic policy within a European frame of reference and over the long term is one of the most important changes introduced into the European Union’s economic governance with the ‘European Semester’. Coordination of structural reforms among Member States of the Union is a necessary matter of fact. The European economies have a high degree of interdependence and the reforms of certain economies have an impact on others. Setting long-term objectives is instead a useful and pragmatic way of stimulating policy and public opinion to set targets toward the future we want for the country and for Europe, initiating work today so that this future can be realised.

| | |

| MINISTERODELL’ECONOMIAEOFTHE FINANZE | | |

| | III |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

The Europe 2020 Strategy constitutes an integral part of the national agenda. On the one hand, it sheds light on the fundamental weaknesses of Italy’s economy that we have lived with for too long and that can no longer be tolerated. On the other hand, it sets long-term objectives that Italy must set in any case, even without the stimulus of Europe, in order to enable the economic and productive system to emerge stronger and reinforced from the crisis. None of these objectives is outside of Italy’s reach.

The Economic and Financial Document is thus a key step in the definition of national economic policy and represents an instrument for setting out a vision of how Italy must evolve in this decade and for plotting the path, year after year, of concrete reforms that can be verified in subsequent years.

v

The 2012 Economic and Financial Document, the second since the inauguration of the European Semester, has been drawn up against a distinct backdrop.

The financial crisis that hit Italy and the rest of Europe has seen some of its most difficult moments in the past months. Sovereign debt crisis, weakness in the financial sector and the slowdown of the international economy were intertwined, thereby causing a dangerous short circuit. The crisis steered Italy, with particular intensity, into a spiral that put the staying power of the economic and financial system at risk.

With this emergency, Parliament has instituted a Government in the national interest, supported by a broad majority of political parties that, despite their strong policy differences, have the general interest of the nation at heart, in a spirit of unity and collaboration among institutions. The experience of this Government originates from the urgency to act, but it is based on the awareness that it is not enough to focus on the short term to get over the critical phase. The flare-up of sovereign-risk premiums that led the country to the brink of a dramatic crisis is not the cause, but is the symptom of a greater malaise. The crisis originated from factors outside of the Italian economy that were linked to the European and international framework, but was furthered by the persistence of structural, fundamental weaknesses of our economy that had yet to be tackled.

It is for this reason that Italy has been hit harder by the crisis and is having difficulty emerging from it. At the end of 2011, the gross domestic product was still some five percentage points below where it was before the crisis. In the past two years, industrial production has recovered just over one-fifth of the loss experienced during the acute phase of the crisis, between 2008 and 2009. Household income has contracted by more than 4.0 per cent in real terms, while it rose during the same period, albeit only marginally, in Germany and France. The percentage of households experiencing economic hardship has risen. At the start of this year, the number of employed persons was still more than 600,000 below the peak level reached in April 2008. The crisis has had particularly hard repercussions on less educated and younger workers, workers with term contracts, and women. It has entailed a slowdown of credit to the private sector and in particular, credit to businesses, which has not yet been completely reversed.

In brief: Italy is today further away from its national objectives deriving from the Europe 2020 Strategy than when the Strategy was adopted two years ago.

| | |

| | MINISTERODELL’ECONOMIAEOFTHE FINANZE |

IV | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

The message is clear. It is not possible to wait for the storm to pass and the current parenthesis to close. The crisis that we have been experiencing since 2008 can have a profound and long-term impact on Italy’s growth, even if a destructive shock has been avoided. The logic behind the Europe 2020 Strategy is that you do not tackle a structural crisis from a defensive position, with cyclical responses. It is necessary to instil a process of change at all levels, guided by clear objectives and by an idea of the future that we seek. For our country, this means tackling the critical aspects of the economic and productive system, which are well known, and defining the terms of a profound transformation.

For this reason, the Government has established an action plan based on two elements: fiscal consolidation and promotion of growth. And an agenda of reforms based on three underlying principles: rigour, growth, and equity.

The first sphere of action is fiscal consolidation. The public debt has reached its highest level since the start of the crisis. It is necessary to manage this heavy burden by outlining a gradual, but long-term, plan for its reduction. This is a compulsory decision, necessary to avoid jeopardising the country’s economic security, even at the cost of significant sacrifices to be made by individuals, households and businesses.

And it is because this financial rigour takes its toll on the entire nation, that it must be undertaken in an equitable fashion and have the smallest impact possible on growth potential. Although a substantial part of fiscal adjustment has inevitably been achieved by adjusting tax revenues, the measures have been implemented so as to be growth-oriented, to the extent possible, through a relative increase in taxation on consumption and real property, and a relative reduction of fiscal pressure on business activity and work. The commitment to fight unacceptable levels of tax avoidance and tax evasion in Italy is also based on equity. Tax evasion is a form of unfair competition between businesses, and a way in which dishonest citizens damage other citizens, triggering higher fiscal pressure for all taxpayers. For this reason the proceeds of the fight against tax evasion will need to be used for reducing tax rates in the future, as well.

In the medium term, debt reduction will need to rely increasingly on the reduction of current expenditure. From this standpoint, the spending review will play a key role as it will favour a higher quality of public expenditure in key sectors.

In order to be credible, debt reduction must be structural and isolated from decisional variability stemming from different political administrations. With regard to the first criterion, the pension reform which brings the retirement age in Italy to the highest level in Europe and the decision not to consider proceeds from the fight against tax evasion in estimates of government revenues are, indeed, structural factors. The second criterion is ensured by the commitment to a balanced budget to be sanctioned by the Constitution through amendment of Article 81, in line with the commitment undertaken in the Euro Plus Pact and the new ‘fiscal compact’, the international treaty that sets the rules for fiscal union between the Member States of the Euro Area.

| | |

| MINISTERODELL’ECONOMIAEOFTHE FINANZE | | |

| | V |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

Still, the heart of Italy’s problem is how to get back to growth again. There is no reason to accept the fact that Italy has had a growth rate below the Euro Area average for more than 10 years. At the present time, growth cannot come from the expansionist stimuli of public spending. Nor can it be hoped that growth can be achieved by squeezing salaries and competing on price with emerging economies that have low labour costs and less protection of social rights.

The impulse to growth that will push Italy toward the Europe 2020 Strategy objectives will come from boosting the total factor productivity of the economy. In particular, this could be achieved by increasing efficiency, productivity and competitiveness in the currently more rigid structure.

Allowing more competition in the product and services market is fundamental. Experience shows that a more open market can lead to better services and lower costs, while also pushing productivity and thereby enhancing the value of the most dynamic and innovative businesses.

Liberalising the economy is a not an abstract principle, but a means for removing privileges and income arising from privileged positions. It helps to give more opportunity to do and to grow to whoever may have initiative without having inherited a certain profession or position.

The disconcerting growth of unemployment and the low level of employment, in particular of young people and women, point to the urgency of reforming the labour market, characterised by its injustices and a lack of order. It is a dual market in which workers with contracts without a termination date enjoy high levels of job security, while others with different types of contracts have modest prospects of improvement, little training and barely any job security. At present, the labour market is flexible only on the hiring side, and an all-encompassing unemployment protection system does not exist. It is necessary to reshape the labour market, as the Government has proposed with a legislative bill recently presented to Parliament, in order to help workers and businesses engage in the difficult phase of reorganisation and changing productive specialisation, and to tackle the dramatic problem of high unemployment among young people.

Tax regulations represent another fundamental part of the strategy for emerging from crisis and returning to growth. The fiscal system must be flexible, innovative and capable of giving incentives to investments in new sectors propelling growth. Tax regulations need to be simplified in order to make life easier for the honest citizen and taxpayer. These changes must also be accompanied by a public administration ever more efficient and consistent in its actions. A more transparent, result-oriented and streamlined administration will be able to make a more meaningful contribution to the nation’s economic productivity growth and will take less of a toll on the earnings of businesses and individuals.

Infrastructure investments can also provide a push to productivity. The Government has already freed up more than €22 billion within the Interministerial Committee for Economic Planning (CIPE) that will result in 180,000 new direct jobs, and another 100,000 indirect jobs. The ‘Cohesion Action Plan’ has begun the acceleration and requalification of investments of European Union structural funds concentrated in the southern regions of the country. It is also necessary to leverage the digital economy, which can generate new activities and help overcome territorial divides and the size limitations of Italian businesses. Furthermore, the Government is concerned about the access to credit for Italian businesses and it is determined to overcome the problem of payment delays stemming from the public administration. Broadening market accessibility is furthermore a primary objective for attracting more foreign investment to Italy.

| | |

| | MINISTERODELL’ECONOMIAEOFTHE FINANZE |

VI | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

Prices, salaries, and costs matter, but so do the human and social capital available to the nation’s economy. Growth, as broadly defined, also depends on the capacity, the talents and the propensity to innovation of a nation’s researchers, workers and firms. Innovation, a skilled work force, and research are fundamental assets that allow firms to shift into high-technology sectors, or new markets such as those offered by the green or digital economy. Italy boasts significant strengths, examples of excellence in research, a quality education system, and firms that operate on the technological frontier. But looking at the situation from the perspective offered by the Europe 2020 Strategy, our country still invests too little in research, has an insufficient number of patents, and loses too much talent because of the high number of young people who emigrate abroad.

Social capital also constitutes a factor for the sustainable growth of an economy. It is thus necessary to break the vicious circle between corruption and the informal economy.

v

In past months, Italy has undertaken a considerable degree of reforms. The ‘Save Italy’, ‘Grow Italy’, ‘Simplify Italy’ decrees and the ‘Cohesion Action Plan’ have started to tackle structural weaknesses and have responded convincingly to the requests of European and international institutions. The analyses of this National Reform Programme demonstrate that the deregulation and simplification measures will have a cumulative positive effect on growth of 2.4 percentage points of GDP in 2020. Italy has secured its public accounts, and in 2013, will have a primary surplus equal to 3.9 per cent of GDP. Public debt is now on a gradual and long-term reduction path.

These sprint results have been realised through the collective effort of Parliament, the representatives of unions and of businesses, and the Government. But much remains to be done to overcome economic lags and deep-rooted weaknesses that have accumulated over the years. Getting back to growth is a lengthy undertaking, and much remains to be done. An agenda of the things to be done is set out in the final chapter of the National Reform Programme. The actions are concrete and wide-ranging, and they round out and enhance the initiatives of past months, having an impact on all key factors related to the competitiveness of the economic and productive system: furthering the opening of the market for goods and services; reshaping the labour market in line with the outlook for growth; investing in the value of education and innovation; revising the tax system; providing incentives for investments abroad and supporting exports; speeding up civil court proceedings; modernising the public administration; preventing and stifling corruption; and investing in transport infrastructure, the digital agenda and the green economy. Such a strategy needs to take into account the conditions of the backdrop of every area of the country, with particular attention to enhancing the value of the unused growth potential of the country’s southern regions.

There is still a brief, extraordinary window of opportunity that the country must not lose. The current situation still has its ups and downs, but is more favourable than in the recent past, as we have seen Italy’s capability of response and that of all its institutions. The situation of the Euro Area with respect to the financial markets shows signs of stabilisation and improvement, thanks to the pragmatic policy of the European Central Bank and the agreement reached at a European level for resolving the crisis in Greece. Important decisions have been made in order to complete the economic governance architecture, thus reinforcing measures of fiscal discipline and firewalls. The public debt inherited from the past remains a heavy burden for Italy to bear.

| | |

| MINISTERODELL’ECONOMIAEOFTHE FINANZE | | |

| | VII |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

As indicated in the Stability Programme, the international cycle remains weak and uncertain. At a domestic level, growth cannot be expected to return until 2013. The lack of employment directly or indirectly affects almost one-half of Italian households. It is necessary to act with determination in order to complete the sequence of reforms and to enable the country to start up again, thus actively contributing to economic recovery. The year ahead must be a year of profound transformation for Italy, consistent with what has already occurred in past months.

v

In order to proceed without delay, we need to clear the field of some scepticism about the usefulness of the tool of reforms, scepticism coming from two erroneous perceptions: the first is the political timing of the reforms, and the second is the scope (of the economic and social interests) of the reforms.

With reference to the first aspect, according to some opinions it is risky to carry out structural reforms when the economy is contracting. In the short term, the reforms entail additional costs, whereas the benefits are produced only over the medium/long term. International experience demonstrates that the risk is true only in part and that it can be mitigated. Reforms do indeed require patience, but they will pay off. The most recent comparative analyses done by multilateral organisations show that the benefits of reforms may be seen earlier than expected if the measures are concentrated within a limited time period, and constructed with proper logic and over a time sequence. The Government’s action will thus be to link liberalisation and simplification measures to the reform of the labour market and the revision of the taxation system, combining them with measures to free up and to requalify investment in infrastructures, improve the effectiveness of education, strengthen childcare and care of the elderly, and promote opportunities for young people. Coordination among these measures will create virtuous circles mitigating the negative effects and allowing the positive effects to emerge more rapidly. Concentrating the reforms sends a clear signal to residents, consumers, businesses and investors, triggering a positive circuit of expectations that fuels growth.

The other aspect regards the scope of interests affected by the reforms. Reforms are difficult to pass because they affect interests concentrated in categories with strong political representation and instead bring advantages to a broad base of unorganized interests, such as consumers, or young people, or even future generations. This is an issue to that should be dealt with not in terms of political tactic, but in terms of equity. The sacrifices required for reducing the public debt and returning to economic must be distributed equitably in order to be sustainable. For this reason, the reform measures presented in past months have been conceived as systematic measures that have an effect on a wide range of sectors and issues. In this way, the weight of adjustment is not unduly put on any specific category or social group, but everyone is asked to accept a sacrifice in terms of their own particular interest in order to have advance in the general interest. The greater equity there is, the greater is the willingness to accept changes, even if difficult.

Implementing the Europe 2020 Strategy requires national reforms. But it is necessary for the European environment to supply the Member States with the best backdrop possible in order to ensure national reforms are effective and reward sacrifices made. For this reason, the Government immediately made its best effort to contribute directly and substantially to the Union’s policy orientation, so that there would be no priority higher than growth on the Union’s agenda. The Euro Area crisis is the product of short-sighted attitudes toward public finance, in particular during periods of expansion. But it was also caused by a deficit in both reforms and economic policies for growth. Focusing on growth and on its most important engine - integration of the single market - will produce the energy necessary to drive Europe out of the sovereign debt crisis.

| | |

| | MINISTERODELL’ECONOMIAEOFTHE FINANZE |

VIII | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

Finally, one can ask if the 2020 Agenda is a technocratic agenda or if it has an inspiring vision of society and the market. For some, structural reforms are needed in order to preserve the European social model with its achievements in the face of a world that is changing. For others, reforms need to signal the point of departure from that model, which is outdated and financially unsustainable. The less visible, but essential, thread that links the reforms of the Europe 2020 Strategy together is the construction of a highly competitive social market economy at a European level, and thus an economy that creates more sustainable employment. This is the fundamental objective that the Lisbon Treaty assigned to the European Union. Getting growth started again within a model of stable public finance is the way to build a modern social market economy.

The 2012 National Reform Programme is one step in a process that will repeat itself every year until 2020. The reforms presented in this document inaugurate a series of projects, whose work must continue in the years to come. Growth requires planning continuity and consistency over time. In this regard, the Europe 2020 Strategy has one strong advantage. It is a reference framework that will remain valid over the long term, even in the face of changing governments with distinct programmatic visions. It is a stable framework that can be filled with somewhat different contents depending on specific views about concrete policies, but its orientation toward reaching the 2020 objectives for Italy does not change.

A Member State which has a clear and ambitious National Reform Programme consistent with public finance targets as identified in its Stability Programme, which has political parties that share such a strategy and believe it to be an integral part of their policies, and thus which commit to respecting it, even in the future, and finally, a Member State which has a government focused on the implementation of the programme of structural reforms and is supported by Parliament, the representatives of unions and of businesses, and the public at large, is a Member State that is credible and predictable, that contributes to guiding Europe, and that can be deemed to be increasingly reliable by the markets, but even more so, by its citizens.

This Economic and Financial Document proposes a vision for the development of the country and a way for moving ahead. I hope that it offers a stimulus for fuelling solid debate among political parties, representatives of unions and of businesses, and autonomous territorial entities, about the challenges that await the nation and about the best solutions for creating more growth, more employment and more equity.

| | |

| | Mario Monti |

| |

| | President of the Council of Ministers Minister of Economy and Finance |

| | |

| MINISTERODELL’ECONOMIAEOFTHE FINANZE | | |

| | IX |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

| | |

| | MINISTERODELL’ECONOMIAEOFTHE FINANZE |

X | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

TABLE OF CONTENTS

| | | | |

| | |

| I. | | INTRODUCTION | | 1 |

| | |

| II. | | MACROECONOMIC AND STRUCTURAL SCENARIO | | 6 |

| | |

| II.1 | | Financial crisis and declining growth: cyclical and structural trends | | 6 |

| II.2 | | Growth and competitiveness in Europe and in Italy | | 9 |

| II.3 | | Factors hindering Italy’s growth | | 13 |

| II.4 | | Analysis of macroeconomic imbalances | | 22 |

| II.5 | | How much are the reforms worth? A macroeconomic impact assessment | | 30 |

| | |

| III. | | A YEAR OF REFORMS | | 40 |

| | |

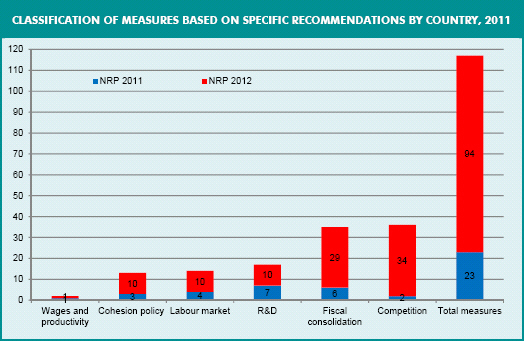

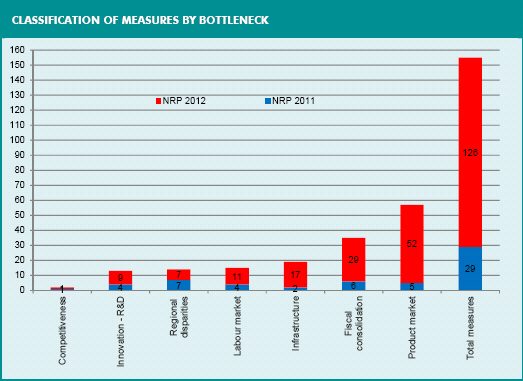

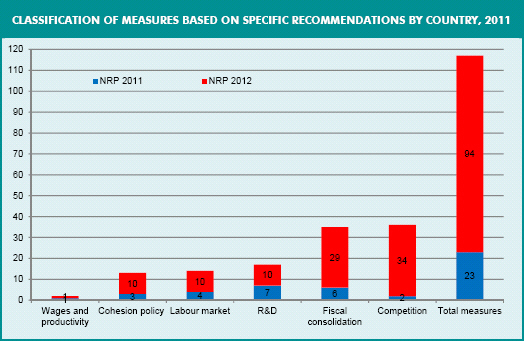

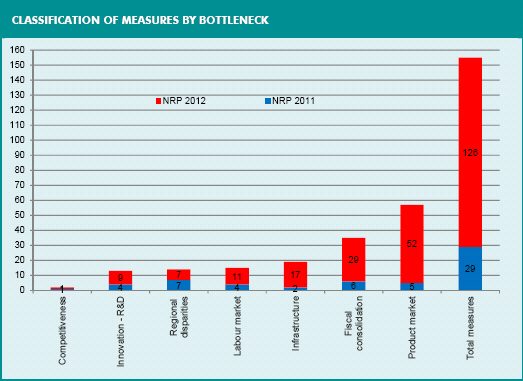

| III.1 | | National measures in response to the council recommendations | | 40 |

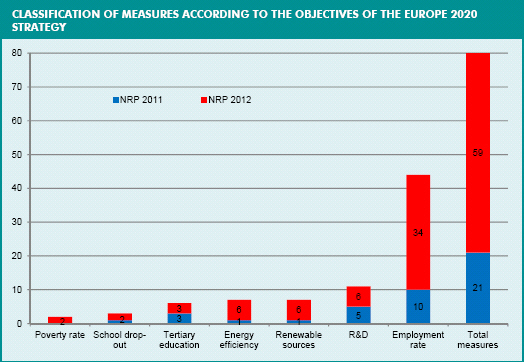

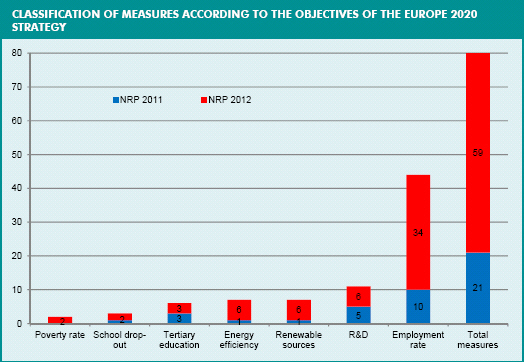

| III.2 | | Actions for the achievement of the national targets provided by the Europe 2020 Strategy | | 69 |

| | |

| IV. | | OVERCOMING THE CRISIS: THE GROWTH AGENDA | | 87 |

| | |

| IV.1 | | Fiscal consolidation, reform of the tax system, spending review | | 87 |

| IV.2 | | Access to credit for business lending | | 90 |

| IV.3 | | Promoting economic growth and competitiveness | | 91 |

| IV.4 | | A more efficient, equitable and inclusive labour market | | 98 |

| IV.5 | | A more efficient Public Administration at the service of citizens and businesses | | 103 |

| IV.6 | | Creating new skills and generating innovation: school and university education, research and culture | | 105 |

| IV.7 | | Toward more sustainable growth | | 107 |

| IV.8 | | Effectively using cohesion policy to reduce regional disparities | | 110 |

ANNEXES

Grid of National Reform Programme measures

Regional measures for the National Reform Programme

Report of the Minister of the Environment, Land and Sea on the status of implementation of commitments for reduction of greenhouse gas emissions

Guidelines for Infrastructure 2013-2015

| | |

| MINISTERODELL’ECONOMIAEDELLE FINANZE | | |

| | XI |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

TABLES

| | |

| Table II.1 | | Macroeconomic framework (% change unless indicated otherwise) |

| Table II.2 | | Relative performance of GDP components (versus EU15 average) |

| Table II.3 | | Analysis of policy areas’ performance |

| Table II.4 | | EU15 - Scoreboard indicators for macroeconomic imbalances |

| Table II.5 | | Italy - Scoreboard indicators for macroeconomic imbalances |

| Table II.6 | | Macroeconomic imbalances registered per country |

| Table II.7 | | Number of macroeconomic imbalances by country in EU15 |

| Table II.8 | | Financial impact of the 2012 NRP measures (in mn of euros) |

| Table II.9 | | Rationalisation of healthcare expenditure (in mn of euros) |

| Table II.10 | | Costs related to infrastructure and transport (in mn of euros) |

| Table II.11 | | Normative references for simulated measures |

| Table II.12 | | Specification of the reform scenario in QUEST-III and size of interventions |

| Table II.13 | | Overall macroeconomic effects of Decree-Law 1/2012 (converted into Law 27/2012) and Decree-Law 5/2012 (converted into Law 35/2012) (in % points of differences with base simulation) |

| Table II.14 | | Macroeconomic effects of individual measures of Decree-Law 1/2012 (converted into Law 27/2012) and Decree-Law 5/2012 (converted into Law 35/2012) (in % points of differences with base simulation) |

| Table II.15 | | Specification of the Reform scenario to bridge the gap with Europe’ Best Performers |

| Table II.16 | | Overall macroeconomic effects of structural reforms to bridge the gap with Europe’s Best Performers |

| Table II.17 | | Update of NRP reforms’ impact on main macroeconomic variables (in % points of difference from average in rates of change) |

| Table III.1 | | Cost of SME administrative compliance by area of regulation and estimated cost reduction (in bn of euros) |

| Table III.2 | | Employment rate target |

| Table III.3 | | Employment rate of population aged 20-64 years by gender and geographic location – Years 2009-2011 (in % and p.p.) |

| Table III.4 | | R&D objective |

| Table III.5 | | Greenhouse gas emissions objective |

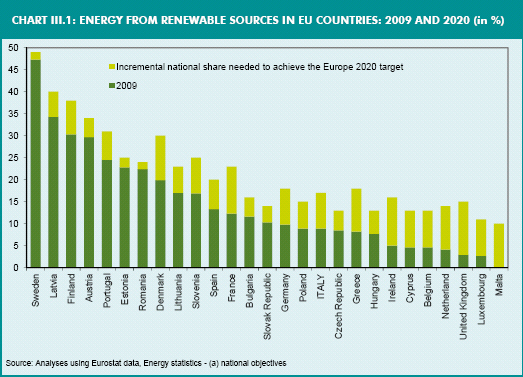

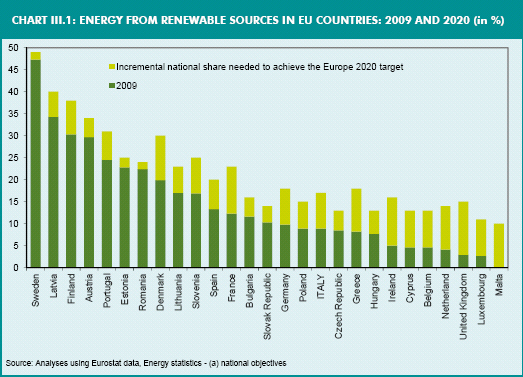

| Table III.6 | | Renewable sources target |

| Table III.7 | | Energy efficiency target |

| Table III.8 | | Energy efficiency measures |

| Table III.9 | | Impact of energy efficiency measures by 2010 |

| Table III.10 | | Impact of energy efficiency measures by 2016 |

| Table III.11 | | Impact of energy efficiency measures by 2020 |

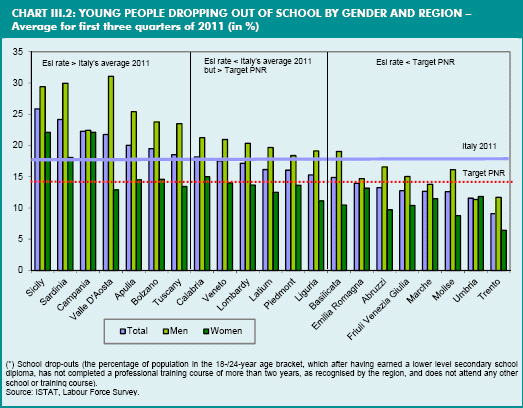

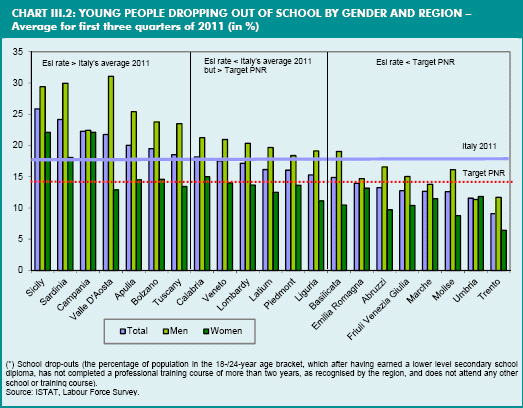

| Table III.12 | | School drop-out target |

| Table III.13 | | University education target |

| Table III.14 | | Target for poverty reduction |

| | |

| | MINISTERODELL’ECONOMIAEDELLE FINANZE |

XII | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

CHARTS

| | |

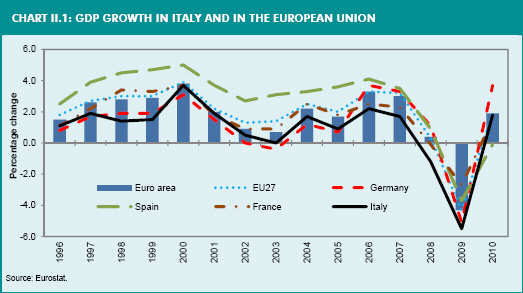

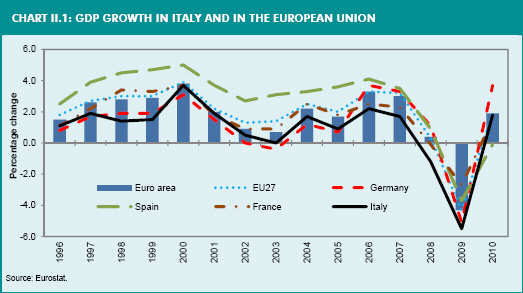

| Chart II.1 | | GDP growth in Italy and the European Union |

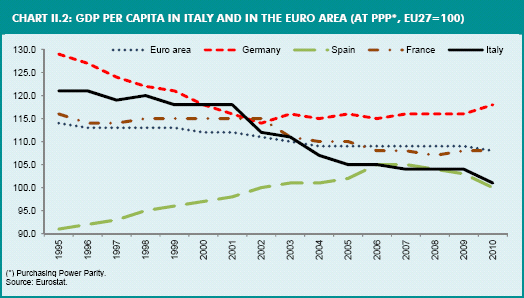

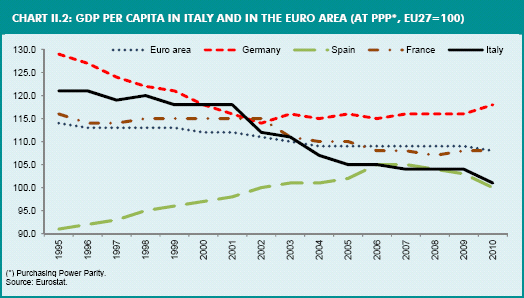

| Chart II.2 | | GDP per capita in Italy and the Euro Area (at PPP, EU27 indices=100) |

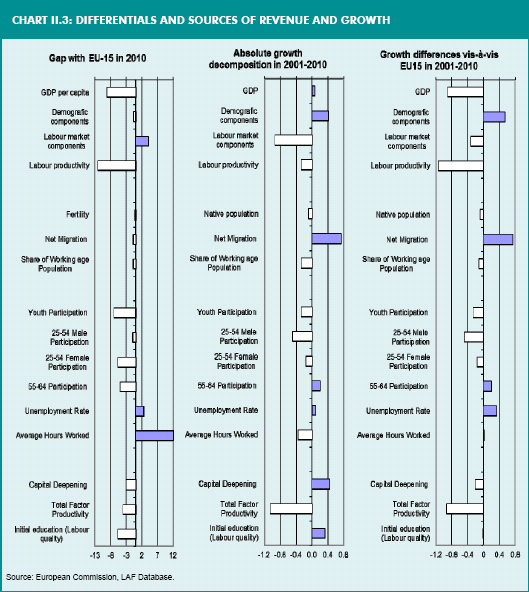

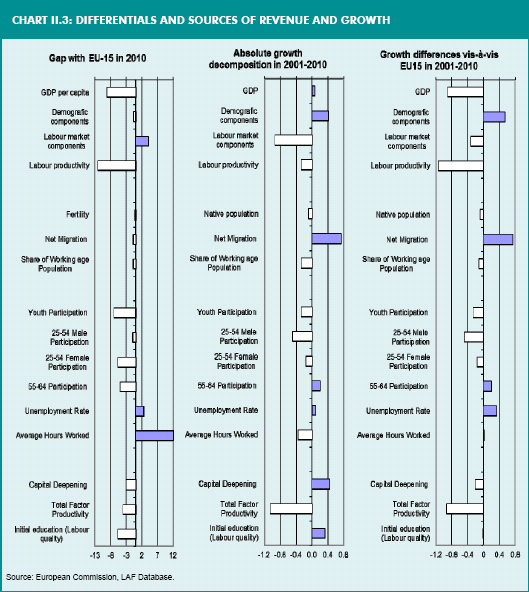

| Chart II.3 | | Differentials and sources of income and growth |

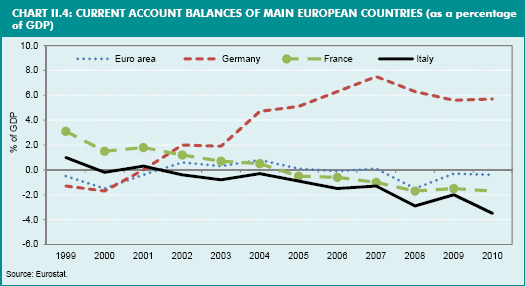

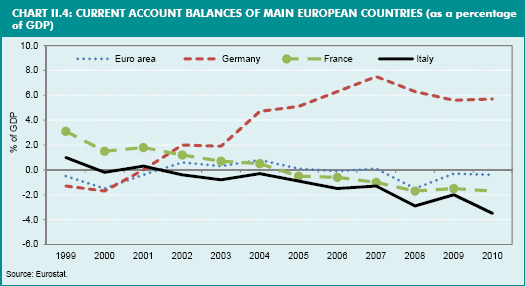

| Chart II.4 | | Current account balances of main European countries (as a percentage of GDP) |

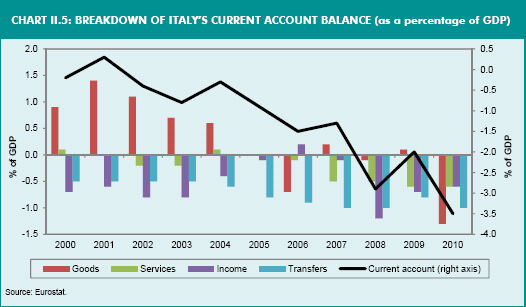

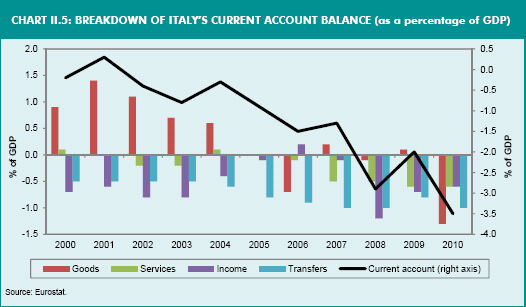

| Chart II.5 | | Breakdown of Italy’s current account balance (as a percentage of GDP) |

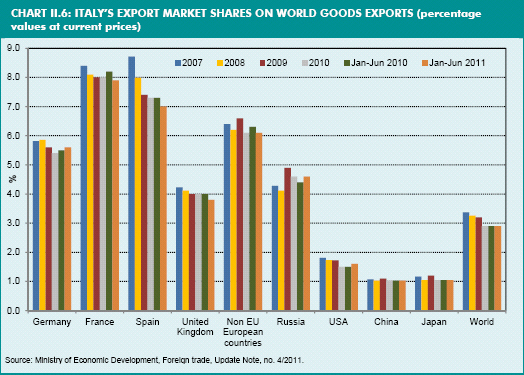

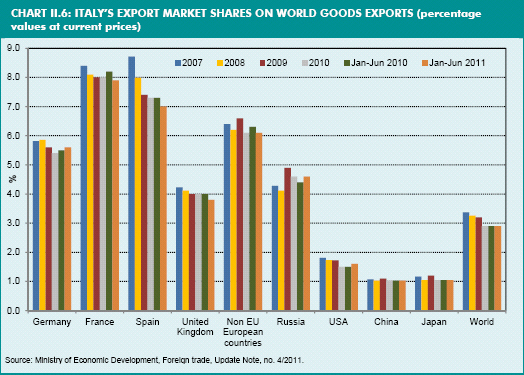

| Chart II.6 | | Italy’s export market share on world goods exports (percentage values at current prices) |

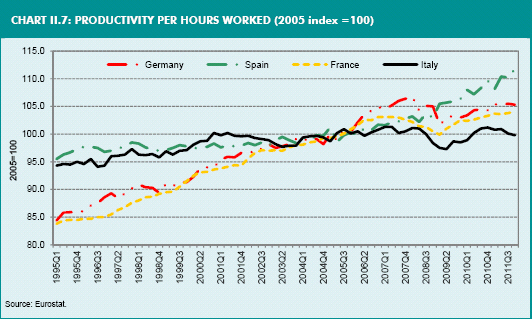

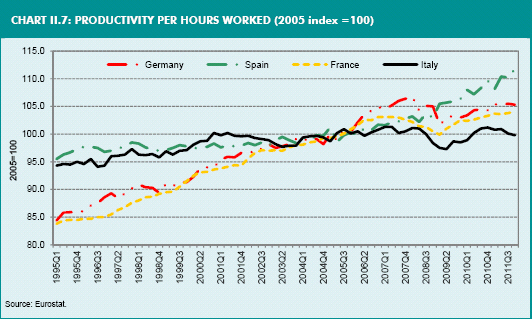

| Chart II.7 | | Productivity per hours worked (2005=100) |

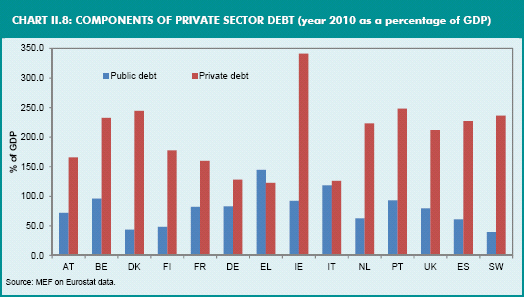

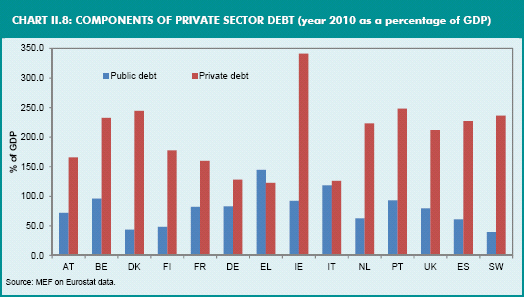

| Chart II.8 | | Components of private sector debt (year 2010 - as a percentage of GDP) |

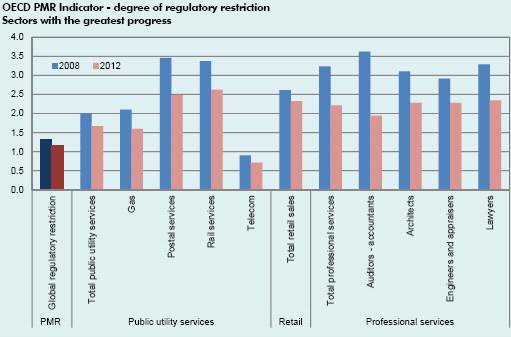

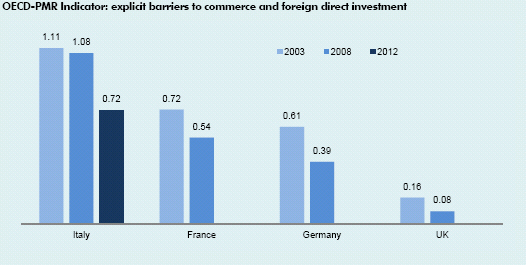

| Chart III.1 | | Energy from renewable sources in EU countries: 2009 and 2020 (in %) |

| Chart III.2 | | School drop-out rates for young people by gender and region – Average for first three quarters of 2011 (in %) |

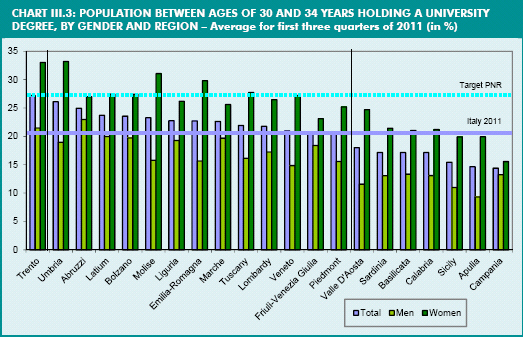

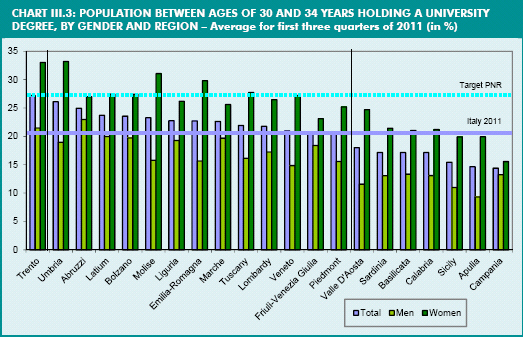

| Chart III.3 | | Population between ages 30 and 34 years holding a university degree, by gender and region – Average for first three quarters of 2011 (in %) |

| | |

| MINISTERODELL’ECONOMIAEDELLE FINANZE | | |

| | XIII |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

| | |

| | MINISTERODELL’ECONOMIAEDELLE FINANZE |

XIV | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

Italy’s National Reform Programme as part of the European Semester and the Europe 2020 strategy

The 2012 National Reform Programme is the second document submitted by Italy within the ‘European Semester’ framework for the coordination of macroeconomic and fiscal policies. The Programme submitted this year is especially important for the following two reasons.

First of all, Italy’s reform agenda has acquired a significance that goes beyond the national dimension. Over the past few months, Italy has been caught in the eye of the financial storm and worsening sovereign debt crisis in Europe. Market pressure and increasing risk premiums on debt pushed Italy to the verge of a crisis that could have had a tragic outcome for our Country and the stability of the whole Euro Area. On November 17, 2011, in the midst of this emergency, the Italian Parliament voted in a new Government by an ample majority of political parties, which, in spite of their different policy approaches, decided to give the Government their support in a joint institutional effort. The so-called ‘national effort Government’ was born out of the awareness that the future of the euro also depends on what happens to Italy. At this stage, the quality of Italian reforms can make a difference in terms of the economic and financial health of the economic and monetary union.

Secondly, the EU institutions play a bigger role than in the past in influencing national economic policy decisions. In its recommendations to Italy in June 2011, the EU Council judged the policies set out in the 2011 National Reform Programme to be insufficient to address the structural weaknesses affecting the Country and identified six areas in which more effective reforms were needed 1.

The Council’s Recommendations were supplemented by requests from the European Central Bank, which last summer called for ‘pressing action by the Italian authorities to restore investor confidence’ and stressed the need for a ‘comprehensive, radical and credible reform strategy’ based on the sustainability of public finances and measures to improve competition and the quality of public services as well as a review of regulatory frameworks and tax regimes to support business competitiveness and labour market efficiency.

Subsequently, also because of the further weakening of economic conditions , the Euro Area Summit held in Brussels on October 26, 2011 - while taking note of the commitments, in terms of structural reforms and budget consolidation, undertaken by Italy in a letter sent to the President of the EU Council and to the Commission – urged the Italian Government to swiftly implement the commitments it had undertaken and called on the Commission to ‘provide a detailed assessment of the measures adopted and monitor their implementation’.

| 1 | ‘Council Recommendation of 12 July 2011 on the National Reform Programme 2011 of Italy and delivering a Council opinion on the updated Stability Programme of Italy, 2011-2014’. |

| | |

| MINISTERODELL’ECONOMIAEDELLE FINANZE | | |

| | 1 |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

As part of this ‘strengthened surveillance’, the European Commission submitted to the Eurogroup meeting of November 29, 2011 a report on ‘Addressing Italy’s high-debt/low-growth challenge’ that calls upon Italy to continue in its resolve to put public debt on a firmly declining path and to implement a consistent package of measures that can restore confidence and boost growth, taking into account the principle of social justice. The ‘strengthened surveillance’ process is still ongoing and the National Reform Programme is an important step to assess progress made towards implementing the reforms called for by the European institutions.

The National Reform Programme for 2012 is therefore a key occasion in which to set economic policy guidelines consistent with policy indications established within the European Union, by defining a medium-to-long term reform agenda within the Europe 2020 Strategy.

Strategy for financial consolidation and growth

Against a backdrop of slow and uncertain stabilisation of the European economy, the Commission’s Annual Growth Survey 20122 stresses the need for continuing the effort to consolidate public finances with determination and to put even greater emphasis on measures to boost growth. There are five main priorities for 2012: continuing the process of fiscal consolidation, by favouring growth-friendly measures; restoring lending conditions; promoting growth and competitiveness in the short and long term; fighting unemployment and the social consequences of the crisis; modernising the Public Administration. The Commission’s report3 finds the overall efforts made by Member States in the first year of implementation of the Europe 2020 Strategy to be insufficient and calls for a ‘greater sense of urgency’ accompanying the next European Semester.

Italy agrees with this view and also calls for the need for more growth-friendly policies in Europe while abiding by the principle of public finance stability. To that effect Italy, together with other 12 Member States, signed a document that calls on EU institutions to accelerate the modernisation of the single market.

However, a return to growth largely depends on the reforms that will be implemented at the national level. Against a backdrop of a worsening economic and sovereign-debt crisis, the Government has taken a policy approach aimed at meeting two targets: a) structural rebalancing of public accounts in order to swiftly reduce the debt burden; b) establishment of conditions enabling a resumption of growth. This has been done in an awareness that every effort must be made to ensure that the burden of balancing the budget is shared equally among all citizens.

With a view to achieving the first target and keeping public finances under control, the Government first and foremost committed itself to reaching a balanced budget by 2013, in line with the agreements reached at the European Council meeting held in October 2011. This commitment to balancing the budget was then followed by a challenging economic policy endeavour, adopted at the end of 2011 with the ‘Salva Italia’ decree, to ensure financial stability, growth and social justice. The Government has also

| 2 | Communication from the Commission, ‘Annual Growth Survey 2012’, COM (2011) 815. |

| 3 | ‘Progress report on the Europe 2020 Strategy’, annexed to the Annual Growth Survey 2012. |

| | |

| | MINISTERODELL’ECONOMIAEDELLE FINANZE |

2 | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

launched a series of actions to sustain growth and competitiveness. With the ‘Cresci Italia’ and ‘Semplifica Italia’ decrees, measures have been adopted to encourage private entrepreneurship, remove barriers that prevent access to markets, create an environment more conducive to domestic and foreign investment, promote innovation, efficiency and transparency in Public Administration, accelerating ICT adoption. By freeing up public funds and through the start of the ‘Cohesion Action Plan’, the stage has been set for resuming public investment in infrastructure and improving quality of collective services in the South.

In this way the Government has launched a phase of structural reforms based on the principals of rigour, growth and social justice, aimed at deeply changing the way in which Italy’s economy works, so as to correct its weaknesses in the long-term and realize fully its potential, thereby enabling it to achieve the European objectives set out in the Europe 2020 Strategy.

The measures introduced by these packages affect all the areas of concern highlighted in analyses made by European and international bodies. The fact that all measures are being implemented at the same time should not only magnify their impact in the short term, but also clarify their scope and the direction in which the reform process is heading. The twin strategy of balancing the budget and implementing structural reforms for growth will continue to be the guiding principle for Government action over the next months. In line with European policies, priority shall be given to action enabling structural reduction in expenditure, protecting growth-friendly investment that can improve the efficiency, productivity and competitiveness of the economy. In particular, special attention should be given to action programmes needed to take full advantage of new engines for growth, such as the digital agenda and the green economy, and to bridge regional gaps and remove social inequality.

The 2012 National Reform Programme

The 2012 National Reform Programme has a twofold objective. On the one hand it takes stock of reforms implemented following last year’s approval of the National Reform Programme, with reference to ongoing programmes and their consistency with EU objectives as well as their expected impact. On the other hand, it sets out an agenda of actions for next year, thereby tracing the path Italy intends to follow to achieve the objectives of the Europe 2020 Strategy. Hence, its structure reflects the key steps in Italy’s effort over the medium and long term.

After this introductory overview, the second chapter of this Report contains an analysis of key problems and factors that have been hampering the Country’s growth and competitiveness for some time. The use of analytical tools developed at European level and a comparison with other EU Member States ensures consistency between the national and European approach. A specific section is devoted to a mechanism for the prevention of macroeconomic imbalances that was introduced at the end of 2011 as part of the new European economic governance. The section contains an outline of the weaknesses underlying the national economy and identifies the gradual decline in total factor productivity as being one of the main causes of Italy’s low growth. Without a change of course these weaknesses will doom the Country to a future of very low or non-

| | |

| MINISTERODELL’ECONOMIAEDELLE FINANZE | | |

| | 3 |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

existent growth, high unemployment and high public debt. Conversely, the reforms implemented as part of the Europe 2020 Strategy may lead to a cumulative GDP growth of about 2.4 per cent in 2020.

The third chapter contains a detailed picture of the reforms that have been implemented or started this year, relating them to the Recommendations of the European Council and the path by which to achieve the objectives of the Europe 2020 Strategy. It provides an analysis of the measures adopted up to the time this Programme was submitted.

Lastly, the fourth chapter gives an overview of reforms that are in the pipeline and the main challenges that still have to be addressed to bring the Country back on to a path of durable and sustainable growth.

Four major annexes complete the National Reform Programme that include: a complete table showing national legislative measures; the Regional Authorities’ contribution to the Programme and a table of regional measures; the Report by the Minister of the Environment on the implementation of commitments undertaken to reduce GHG emissions; Guidelines regarding Infrastructure Annex for the 2013-2015 period. Mention is also made of the Cohesion Report.

Consulting political parties, Local Governments and social partners

The 2012 National Reform Programme was the product of the Government’s team work – both central and regional administration contributed to it through the CIACE Technical Committee.

In drawing it up, the Government laid great emphasis on the interaction and consultation with political parties, Regional and other Local Government and social partners. The National Reform Programme was sent to Parliament on April 18, 2012, as envisaged by law.

Both Regional and other Local Authorities participated in drawing up the National Reform Programme. The CIACE Technical Committee was the forum for an exchange of views on the regional dimension of the implementation policies of the Europe 2020 Strategy, as well as for the presentation of best practices and innovative strategies developed by Regional Authorities and Autonomous Provinces within their responsibilities.

Their contribution, set out in the annex to the National Reform Programme, highlights the crucial importance of regional action for the implementation and efficacy of reforms.

The National Reform Programme was also enriched by inputs from the main stakeholders involved in the Country’s economic and social development. Social partners were given the opportunity to make their contribution to designing the National Reform Programme’s specific policies through special sectoral consultations, like for the ‘Cohesion Action Plan’ or the labour market reform. CNEL actively cooperated with the Government, submitting a document relating to the 2012 National Reform Programme, adopted in plenary on March 7, 2012.

| | |

| | MINISTERODELL’ECONOMIAEDELLE FINANZE |

4 | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

While the National Reform Programme was being drafted, suggestions made to the Government by social partners were also taken into consideration, along with the documents submitted during the year on issues related to the competitiveness and growth of the Italian economy.

Lastly, particular attention was given to young people’s views, as a debate on key reforms to build a ‘Italy 2020 Strategy’ was launched with the National Youth Forum.

| | |

| MINISTERODELL’ECONOMIAEDELLE FINANZE | | |

| | 5 |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

| II. | MACROECONOMIC AND STRUCTURAL SCENARIO |

| II.1 | FINANCIAL CRISIS AND DECLINING GROWTH: ECONOMIC AND STRUCTURAL TRENDS |

Since the early ‘90’s the Italian economy has been characterised by very low growth rates, significantly weaker compared both to the performance achieved in previous decades and to the Euro Area average over the last decade. Italian average annual GDP growth, 3.8 per cent in the ‘70’s and 2.4 per cent in the ‘80’s, was 1.6 per cent in the period 1991-2000, and fell to 0.4 per cent from year 2000 on1.

From the second half of the ‘90’s, the negative growth gap with the Euro Area was an average of 1.0 percentage points, 0.5 percentage points with Germany, 0.8 percentage points with France and 1.8 percentage points with Spain. Until the second half of the ‘90’s, Italian GDP per capita was higher than the Euro Area average; from 2003 it fell below the average. In 2010, Italian GDP per capita was 6.9 per cent lower than that of France, 7.7 per cent lower than that of the Euro Area average and 17.1 per cent lower than that of Germany. On the other hand, it was still 0.4 per cent higher than that of Spain and 0.8 per cent higher than the EU average. At the root of the Italian economy’s progressive weakening in growth capacity lies low productivity dynamics. The Euro Area was also affected by a general slowdown in productivity, but in Italy the trend was comparatively worse and entered into negative territory over the last decade.

| 1 | Historical data from 1990 refer to the new series of National Accounts published by ISTAT on 2 March 2012. The annual averages of previous decades are calculated on the basis of the old series of National Accounts. The period averages are calculated using the compound interest method. |

| | |

| | MINISTRYOF ECONOMYAND FINANCE |

6 | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

The decline in Italian productivity reflects a number of factors, including:

| | i) | the decrease in the relative weight of manufacturing and the rise of the service sector, characterised by a more intensive use of labour, lower levels of efficiency and less exposure to international competition; |

| | ii) | a development model mainly based on small- and medium-sized manufacturing enterprises, which have a lower capacity to absorb new technologies and penetrate international markets, especially those of emerging countries; |

| | iii) | lower skilled human capital. |

Lower growth in productivity resulted in a loss of competitiveness in international markets by increasing unit labour costs, which led to negative trade balances and a loss of global market shares.

The structural problems highlighted above influenced Italian economic growth in 2011 and will in part affect growth in the coming years. In 2011, the Italian economy grew by 0.4 per cent, impacted by the recession of the last two quarters which was due to external and domestic factors. The result is slightly lower than the official estimate of the 2011 Report to Parliament (0.6 per cent). The weakening of the domestic cycle during 2011 also contributed to the deterioration of estimated GDP for the current year, which is now expected to contract by 1.2 per cent, about 0.8 percentage points less than the previous forecast. The short term tone of the economy is expected to remain weak in the first half of 2012, albeit gradually improving, due to weak domestic demand and the effects of the pass-through of past tensions in the credit market. These trends should be partially offset by support coming from net exports. The recovery in economic activity is expected to begin gradually from the second half of the year. In 2013, GDP should grow at a moderate pace of 0.5 per cent, slightly above the previous estimate, and accelerate in 2014 (1.0 per cent, unchanged from the previous estimate) and 2015 (1.2 per cent).

| | |

| MINISTRYOF ECONOMYAND FINANCE | | |

| | 7 |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

TABLE II.1: MACROECONOMIC FRAMEWORK (percentage changes unless indicated otherwise)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

INTERNATIONAL EXOGENOUS VARIABLES | | | | | | | | | | | | | | | | | | | | | | | | |

International trade | | | 12.9 | | | | 6.1 | | | | 3.4 | | | | 5.2 | | | | 6.3 | | | | 6.7 | |

Oil price (Brent FOB dollars/barrel) | | | 80.2 | | | | 111.3 | | | | 119.5 | | | | 119.7 | | | | 119.7 | | | | 119.7 | |

Dollar/euro exchange rate | | | 1.327 | | | | 1.392 | | | | 1.329 | | | | 1.329 | | | | 1.329 | | | | 1.329 | |

| | | | | | |

ITALIAN MACRO VARIABLES (VOLUMES) GDP | | | 1.8 | | | | 0.4 | | | | -1.2 | | | | 0.5 | | | | 1.0 | | | | 1.2 | |

Imports | | | 12.7 | | | | 0.4 | | | | -2.3 | | | | 2.2 | | | | 3.6 | | | | 3.9 | |

Final national consumption | | | 0.7 | | | | 0.0 | | | | -1.5 | | | | -0.1 | | | | 0.3 | | | | 0.5 | |

- Expenditure of resident households | | | 1.2 | | | | 0.2 | | | | -1.7 | | | | 0.2 | | | | 0.5 | | | | 0.7 | |

- General government expenditure and NPISH | | | -0.6 | | | | -0.9 | | | | -0.8 | | | | -1.1 | | | | -0.3 | | | | 0.2 | |

Gross fixed investment | | | 2.1 | | | | -1.9 | | | | -3.5 | | | | 1.7 | | | | 2.5 | | | | 2.8 | |

- Machinery and equipment | | | 10.4 | | | | -0.9 | | | | -5.5 | | | | 2.6 | | | | 4.0 | | | | 4.3 | |

- Construction | | | -4.8 | | | | -2.8 | | | | -1.6 | | | | 0.8 | | | | 1.0 | | | | 1.2 | |

Exports | | | 11.6 | | | | 5.6 | | | | 1.2 | | | | 2.6 | | | | 4.2 | | | | 4.6 | |

memo item current account balance. in % GDP | | | -3.5 | | | | -3.1 | | | | -2.3 | | | | -2.0 | | | | -1.7 | | | | -1.3 | |

| | | | | | |

CONTRIBUTION TO GDP GROWTH (*) | | | | | | | | | | | | | | | | | | | | | | | | |

Net export | | | -0.4 | | | | 1.4 | | | | 1.0 | | | | 0.1 | | | | 0.2 | | | | 0.3 | |

Inventories | | | 1.2 | | | | -0.5 | | | | -0.3 | | | | 0.1 | | | | 0.0 | | | | 0.0 | |

Domestic demand net of stock | | | 1.0 | | | | -0.4 | | | | -1.8 | | | | 0.2 | | | | 0.7 | | | | 1.0 | |

PRICES | | | | | | | | | | | | | | | | | | | | | | | | |

Import deflator | | | 6.7 | | | | 7.3 | | | | 3.9 | | | | 1.7 | | | | 1.6 | | | | 1.6 | |

Export deflator | | | 2.6 | | | | 4.1 | | | | 2.0 | | | | 2.2 | | | | 2.1 | | | | 2.0 | |

GDP deflator | | | 0.4 | | | | 1.3 | | | | 1.8 | | | | 1.9 | | | | 1.9 | | | | 1.9 | |

Nominal GDP | | | 2.2 | | | | 1.7 | | | | 0.5 | | | | 2.4 | | | | 2.8 | | | | 3.2 | |

Consumption deflator | | | 1.5 | | | | 2.7 | | | | 2.8 | | | | 2.1 | | | | 1.9 | | | | 1.9 | |

Inflation (planned) | | | 1.5 | | | | 2.0 | | | | 1.5 | | | | 1.5 | | | | 1.5 | | | | 1.5 | |

HICP net of imported energy (**) | | | 1.1 | | | | 2.3 | | | | 2.0 | | | | 1.9 | | | | 1.9 | | | | n.a. | |

| | | | | | |

LABOUR | | | | | | | | | | | | | | | | | | | | | | | | |

Labour cost | | | 2.3 | | | | 1.4 | | | | 1.1 | | | | 1.1 | | | | 1.4 | | | | 1.3 | |

Productivity (measured on GDP) | | | 2.7 | | | | 0.3 | | | | -0.6 | | | | 0.4 | | | | 0.5 | | | | 0.6 | |

ULC (measured on GDP) | | | -0.4 | | | | 1.0 | | | | 1.7 | | | | 0.7 | | | | 0.9 | | | | 0.7 | |

Employment (FTE) | | | -0.9 | | | | 0.1 | | | | -0.6 | | | | 0.1 | | | | 0.4 | | | | 0.6 | |

Unemployment rate | | | 8.4 | | | | 8.4 | | | | 9.3 | | | | 9.2 | | | | 8.9 | | | | 8.6 | |

15-64 Employment rate | | | 56.9 | | | | 56.9 | | | | 56.7 | | | | 56.9 | | | | 57.3 | | | | 57.6 | |

| | | | | | |

memo item: nominal GDP (values in absolute million €) | | | 1,553,166 | | | | 1,580,220 | | | | 1,588,662 | | | | 1,626,858 | | | | 1,672,782 | | | | 1,725,526 | |

Note: (*) Possible inaccuracies are due to rounding.

(**) Source: ISTAT.

Note: The macroeconomic framework was developed based on information available up to 2nd April 2012.

GDP and components in volume (base year 2005, chained prices), unadjusted for working days.

The current account balance (Source Bank of Italy) is consistent with ISTAT national accounts released on 2nd March 2012.

| | |

| | MINISTRYOF ECONOMYAND FINANCE |

8 | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

| II.2 | GROWTH AND COMPETITIVENESS IN EUROPE AND IN ITALY |

This section analyses the dynamics of medium/long-term economic growth through growth accounting and structural indicators, making use of the Lisbon Assessment Framework (LAF)2 new database. The next section focuses on economic policy priorities and on policy areas that need to be strengthened.

2 The Lisbon Assessment Framework (LAF) methodology helps to identify economic policy priorities and member countries’ critical policy areas, contributing to the definition of ‘bottlenecks’ to be removed in order to improve the position of each country with respect to the EU15 (Belgium, Denmark, Germany, Ireland, Greece, Spain, France, Italy, Luxembourg, Netherlands, Austria, Portugal, Finland, United Kingdom and Sweden).

| | |

| MINISTRYOF ECONOMYAND FINANCE | | |

| | 9 |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

The analysis shows how the significant slowdown of the Italian economy in recent years reflects the persistence of critical issues in the structural components of growth, such as rigidities in the labour market and the low degree of competition in the product markets. These problems have had a dampening effect, despite the efforts in recent years (especially in product markets, education and labour markets) that have improved work participation and reduced the unemployment rate, though to a lesser degree than in other European countries.

Over the 2001-2010 period, the distance between Italian GDP and the European average gradually grew, with the average annual growth rate in Italy being almost one per cent lower than that in the EU. GDP per capita and its growth rate are also now below the EU15 average.

TABLE II. 2: RELATIVE PERFORMANCE OF GDP COMPONENTS (versus EU15 average) – YEAR 2010

| | | | | | | | | | | | |

| | | GDP breakdown scores | | | Absolute contribution

to annual growth | |

| | | Level | | | Growth | | |

Demographic component | | | -6 | | | | 7 | | | | 0.4 | |

| | | | | | | | | | | | |

Fertility / native population | | | -10 | | | | -3 | | | | -0.1 | |

Share of foreign population / net migration | | | -3 | | | | 13 | | | | 0.7 | |

Share of working age population | | | -5 | | | | -8 | | | | -0.3 | |

| | | | | | | | | | | | |

Labour market component | | | 4 | | | | -9 | | | | -0.9 | |

| | | | | | | | | | | | |

Youth participation | | | -15 | | | | -14 | | | | -0.3 | |

25-54 Male participation | | | -17 | | | | -21 | | | | -0.5 | |

25-54 Female participation | | | -21 | | | | -9 | | | | -0.2 | |

55-64 participation | | | -14 | | | | 7 | | | | 0.2 | |

Unemployment rate | | | 4 | | | | 8 | | | | 0.1 | |

Average hours worked | | | 12 | | | | 1 | | | | -0.3 | |

| | | | | | | | | | | | |

Labour productivity component | | | -9 | | | | -19 | | | | -0.3 | |

| | | | | | | | | | | | |

Capital Deepening | | | -5 | | | | -9 | | | | 0.5 | |

Total factor productivity | | | -5 | | | | -18 | | | | -1.0 | |

Initial workers’ education level (work quality) | | | -18 | | | | 0 | | | | 0.3 | |

| | | | | | | | | | | | |

GDP per capita (level) / GDP (growth) | | | -8 | | | | -14 | | | | 0.1 | |

| | | | | | | | | | | | |

Note: Scores for the single components are calculated as follows: 10 * (average benchmark indicator) / standard deviation of the benchmark. The results indicate the level for the last year available and progress (change). Thus, a score of 10 means that the value of the indicator is higher than the average standard deviation of the benchmark. The indicator is underperforming if the aggregate score is less then -4. The benchmark may be EU15 or EU27.

Source: European Commission, LAF Database.

This performance reflects not only low productivity, but also wide regional growth differentials. The productivity problem is largely due to reduced growth of Total Factor Productivity (TFP)3 and, to a lesser extent, the low contribution of capital deepening4. Another important factor is the low level of ‘work quality’ (in this exercise measured by the workforce’s initial level of education). In the 2001-2010 period the contribution of TFP to growth in the EU15 was a negative 0.1 per cent per year, whereas in Italy there was a decline of 1.0 per cent, the difference being rather striking. The reduction of TFP could partially depend on structural aspects of the labour market in terms of youth participation, average hours worked and ‘work quality’, due to Italy’s specialisation in low/medium-technology products.

| 3 | The concept of total factor productivity includes ‘zero cost’ improvements in the way in which labour and capital are integrated to produce GDP growth. It tends to describe technological progress, even if the concept does not coincide perfectly as, for example, it also includes progress in the organisation of the production process. |

| 4 | Capital deepening describes the relationship between workers and capital employed in an enterprise. Capital deepening occurs when there is greater availability of capital, such as the number of machines per worker. |

| | |

| | MINISTRYOF ECONOMYAND FINANCE |

10 | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

The demographic component also contributes to lower Italy’s growth potential, given the substantial decline in the working age and native population, even if offset by net migration characterised, however, by a low level of education.

As for labour market components, Italy presented better growth rates than the EU15 in participation rates for workers over 55 years of age – for whom, however, there remains a considerable disadvantage compared to Europe – and the unemployment rate and average hours worked per capita, where, instead, Italy’s advantage was reinforced. These improvements were partially offset by poorer performance in terms of youth participation and of workers over 25 years of age, areas in which Italy’s overall position was weakened.

The contribution of capital to growth, instead, increased during the 2001-2010 period, but at a slower pace than in the EU15 countries, reaching a level below the European average in 2010. ‘Work quality’ improved somewhat, in line with other European countries, but is still below the European average.

Another crucial factor for low national performance is the large gap between Italian regions; in fact, in the Centre-North GDP per capita is above the EU15 average, while in the South it is only about 60 per cent of that average. On the other hand, even the demographic components, whose effects are generally positive on growth due to immigration, show pronounced regional differences.

Italian companies are potentially too small to compete fully at the international level, given their organisation in vertically disintegrated supply chains, a trend that emerged over the past decade. Moreover, cost competition may have caused the displacement of some industrial segments specialised in lines of production close to those of emerging countries, an experience that has more frequently touched traditional sectors, those typical of Made in Italy.

| | |

| MINISTRYOF ECONOMYAND FINANCE | | |

| | 11 |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

TABLE II. 3: ANALYSIS OF POLICY AREAS’ PERFORMANCE– 2010

| | | | | | | | |

| Policies – Aggregate scores for Italy | | Assessment based on (LAF) indicators

with respect to EU15 | |

| | | Level | | | Change | |

LABOUR MARKET | | | | | | | | |

Active labour market policies | | | -4 | | | | 2 | |

Making work pay: Interplay between tax and benefit systems | | | 5 | | | | -1 | |

Labour taxation to stimulate labour demand | | | -8 | | | | -14 | |

Job protection and labour market segmentation/ dualism | | | -1 | | | | 2 | |

Policies increasing working time | | | -6 | | | | -3 | |

Specific labour supply measures for women | | | 1 | | | | 1 | |

Specific labour supply measures for older workers | | | -3 | | | | 3 | |

Wage bargaining and wage setting policies | | | -10 | | | | -2 | |

Immigration and integration policies | | | 5 | | | | -7 | |

Labour market mismatch and labour mobility | | | 9 | | | | 1 | |

| | | | | | | | |

PRODUCT AND CAPITAL MARKET REGULATION | | | | | | | | |

Competition policies framework | | | 3 | | | | 1 | |

Sector specific regulation (telecom, energy) | | | 0 | | | | 6 | |

Business environment- Regulatory barriers to entrepreneurship | | | -9 | | | | 1 | |

Business dynamics - Start-up conditions | | | -4 | | | | -3 | |

Market integration - Openness to trade and investment | | | -3 | | | | -1 | |

| | | | | | | | |

INNOVATION AND KNOWLEDGE | | | | | | | | |

R&D and innovation | | | -7 | | | | 0 | |

ICT | | | -3 | | | | -2 | |

Education and lifelong learning | | | -2 | | | | -14 | |

| | | | | | | | |

Note: This table shows the aggregate score for each policy defined as a weighted average of the underlying indicators. Scores for the individual indicators are calculated as follows: 10 * (average benchmark indicator) / standard deviation of the benchmark. The results indicate the level for the last available year and progress (change). Thus, a score of 10 means that the value of the indicator is higher than the average standard deviation of the benchmark. The policy is considered to be underperforming if the aggregate score is less than -4. The benchmark can be EU15 or EU27.

Source: European Commission, LAF Database.

Regarding the second part of the analysis related to policy areas based on LAF findings, Italy is positioned, in terms of levels, generally in line with the European average, with recent improvements in some areas as well.

On the labour supply side, progress is registered in the field of active labour policies, in policies concerning the supply of older workers and women, in protection and labour market segmentation, and in mismatch and labour market integration, areas in which Italy stands well above the European average.

On the labour demand side, data point to an overall deterioration concerning, in particular, tax policies aimed at encouraging labour demand, policies targeted to increase working time and wage bargaining policies, which remain below average level. For immigration policies and, to a lesser extent, those regarding the interaction between taxation and social benefits, a negative performance is recorded, even though a position of advantage is maintained.

In the product markets, Italy is positioned within the general European average, except for the business environment, where there remains a considerable disadvantage. Improvements in performance were achieved in policies for the regulation of specific sectors and, to a lesser extent, in those for the promotion of competition and for the business environment in terms of the removal of barriers to entrepreneurship. Policies for the business environment in terms of start-ups, for which Italy is just below the benchmark, and for the openness of trade and investment, record a deterioration.

| | |

| | MINISTRYOF ECONOMYAND FINANCE |

12 | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

Policies on innovation point to a disadvantage for R&D; in ICT, education and lifelong training, however, Italy’s position is not far from the European average. However, while the area of R&D shows no improvements, education and ICT recorded negative performances.

It must be noted that this analysis is based on data up to 2010; more recent reforms may have significantly altered Italy’s position compared to EU15 countries.

| II.3 | FACTORS HINDERING ITALY’S GROWTH |

The previous analyses identify some structural trends in the Italian economy and help to identify elements of weakness. In more detail, what are the factors behind the modest growth registered by the Italian economy? The boxes that follow highlight Italy’s critical points compared to EU27 averages for the most relevant synthetic indicators.

PUBLIC FINANCE5

| | | | | | | | | | | | |

| | | Difference with EU27 | | | Italy | | | EU27 | |

Primary balance / GDP | | | 3.8 | | | | -0.1 | | | | -3.9 | |

Interest on GDP | | | 1.7 | | | | 4.4 | | | | 2.7 | |

Short-term public debt / GDP | | | 1.6 | | | | 8.3 | | | | 6.7 | |

Public debt / GDP | | | 38.3 | | | | 118.4 | | | | 80.1 | |

Net lending / borrowing on GDP | | | 2.0 | | | | -4.6 | | | | -6.6 | |

Source: Eurostat data (years 2007-2011).

Italy has a better primary surplus than the EU average. This translates into a better net lending / borrowing on GDP ratio, even though the gap in terms of interest payments has a crucial role. The public debt/GDP ratio has a decisive impact on the latter.

Italy’s vulnerability depends primarily on public debt accumulated over decades, albeit offset by rich public assets and the net wealth of households and firms.

Over the last decade, the general government primary balance presented an uneven trend, starting from a situation of surplus that was nearly cancelled in 2005; following a subsequent reconstitution of the surplus, the primary balance again reverted to zero in more recent times. At the end of the last decade, with the beginning and subsequent escalation of the economic and financial crisis, fiscal policy was characterised by extreme caution given the high level of debt.

A factor of weakness is the extent of the underground economy and tax evasion. According to ISTAT, in 2008 the value added produced in the underground economy was worth between a minimum of 255 and a maximum of 275 billion euros, respectively 16.3 and 17.5 per cent of GDP.

| 5 | http://epp.eurostat.ec.europa.eu/portal/page/portal/statistics/search_database. |

| | |

| MINISTRYOF ECONOMYAND FINANCE | | |

| | 13 |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

WAGES AND COMPETITIVENESS6

| | | | | | | | | | | | |

| | | Difference with EU27 | | | Italy | | | EU27 | |

Real unit labour costs (2005=100) | | | 2.3 | | | | 102.4 | | | | 100.1 | |

Nominal unit labour costs (2005=100) | | | 5.8 | | | | 112.0 | | | | 106.2 | |

Labour costs (2008=100) | | | 2.2 | | | | 109.2 | | | | 107.0 | |

Labour productivity (2005=100) | | | -3.3 | | | | 100.2 | | | | 103.5 | |

REER (2005=100) | | | 1.9 | | | | 105.3 | | | | 103.4 | |

Fiscal wedge | | | 4.3 | | | | 43.6 | | | | 39.3 | |

Source: LAF Database, European Commission and Eurostat (years 2007-2011).

Real unit labour costs rose in Italy by about two percentage points more than in Europe. This seems to be linked both to adverse productivity trends, also due to insufficient amounts of investment, and to the trend in wages. In any case, the comparison in terms of real effective exchange rate shows a slightly negative result for Italy.

In terms of productivity Italy lies at the bottom of the EU list both in the 2001-2007 period and in the 2001-20107 decade. These feeble trends also produced comparatively stronger growth of unit labour costs compared to other countries, which made Italian products less competitive in international markets.

In recent years, Italy’s market share of global exports steadily decreased both in value and, above all, in quantity, also because of the production characteristics of the export industries. The large export companies are, in fact, specialised in products with low levels of technology8, while medium and small exporters are present with the most technologically advanced products, which quantitatively represent a lesser proportion of total exports. It is against this backdrop that the recent economic crisis occurred, severely hitting the sector of large exporters, as opposed to small and medium exporters who seem to have responded better to the new market conditions.

COMPETITION AND PRODUCT MARKETS

| | | | | | | | | | | | |

| | | Difference with EU27 | | | Italy | | | EU27 | |

Expenditure in technological innovation as % of GDP | | | -0.9 | | | | 1.6 | | | | 2.5 | |

HICP gap Italy vs Europe (core inflation) | | | 0.1 | | | | 2.2 | | | | 2.1 | |

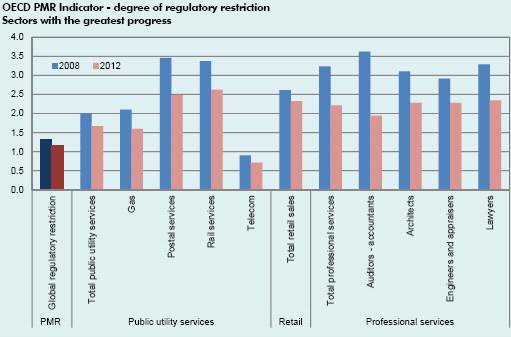

Regulatory conditions in professional services | | | 1.7 | | | | 3.8 | | | | 2.1 | |

Regulatory conditions on prices in retail trade | | | 0.5 | | | | 2.3 | | | | 1.8 | |

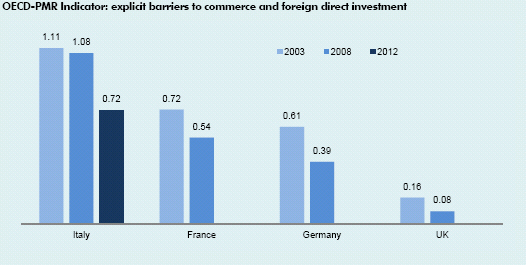

Barriers to foreign investment | | | 1.3 | | | | 2.6 | | | | 1.3 | |

FDI flows as % of GDP | | | 0.0 | | | | 1.0 | | | | 1.0 | |

Getting credit – Legal Rights Index | | | -4.0 | | | | 3.0 | | | | 7.0 | |

Source: LAF Database, European Commission and Eurostat (years 2007-2011).

Some of the problems that Italian companies must face are: difficulty in obtaining credit, especially for investments in innovation, scarce development of next-generation internet services, investment barriers and regulatory barriers in professional services.

Increasing productivity requires an open and competitive environment, as well as a regulatory environment conducive to economic growth. In Italy, the product and labour

| 6 | http://ec.europa.eu/economy_finance/indicators/economic_reforms/Quantitative/laf/ |

| 7 | Productivity grew only moderately in 2006-2007. It dropped 3.6 per cent in the following two years, marking a recovery of 2.2 per cent in 2010, bringing that level just below that of 2000 (representing a weaker recovery, however, than in the other major European economies). |

| 8 | In particular, petroleum refining, means of transport, chemical and pharmaceutical, steel and electrical equipment. |

| | |

| | MINISTRYOF ECONOMYAND FINANCE |

14 | | |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

markets are often hampered by unnecessary regulation: reducing the excess of rules is essential, especially in the public sector. The administrative burden on businesses and the numerous obligations required to conduct private business increase, among other factors, the costs faced by firms.

The tax system, in particular, represents one of the most important factors for competitiveness. Not only are the rates high, especially those on corporate profits and labour income, even the act of paying taxes (tax calculations, filling in declarations, payment of dues and possible litigation) requires a great deal from the taxpayer in terms of economic resources and time.

ADMINISTRATIVE EFFICIENCY

| | | | | | | | | | | | |

| | | Difference with EU27 | | | Italy | | | EU27 | |

Number of procedures to enforce contracts | | | 10.0 | | | | 41.0 | | | | 31.0 | |

Number of procedures to register a property | | | 2.0 | | | | 7.0 | | | | 5.0 | |

Number of tax payments | | | 4.0 | | | | 15.0 | | | | 11.0 | |

Number of years to close a business | | | -0.2 | | | | 1.8 | | | | 2.0 | |

E-government use by individuals | | | -15.0 | | | | 17.0 | | | | 32.0 | |

Source: LAF Database and European Commission (years 2007-2011).

A wide gap separates Italy from Europe. Italian citizens and businesses face a higher number of procedures compared to their European counterparts in order to start a business. There is a high differential with respect to obligations to register a property. Civil law does not ensure a speedy enforcement of contracts.

Innovation in the Italian Public Administration still shows shortcomings with respect to Europe. In fact, a smaller share of services is available online and citizens make little use of them.

All this leads to less investment, as well as persistent obstacles to the growth of new firms in innovative sectors. The measurement of the administrative burden made by the Department of Public Administration, together with the business associations and with the technical assistance of ISTAT, has resulted in an estimate of administrative costs amounting to 23 billion euro per year. These costs, on average higher than both those of OECD countries and European partners, are one of the factors hindering foreign investments, as evidenced by the continuing contraction of inward investments in recent years, as opposed to the stability of outward ones.

R&D AND INNOVATION

| | | | | | | | | | | | |

| | | Difference with EU27 | | | Italy | | | EU27 | |

SMEs innovating in-house (% of total SMEs) | | | 1.4 | | | | 34.1 | | | | 32.7 | |

Public sector R&D expenditure (% of GDP) | | | -0.2 | | | | 0.5 | | | | 0.7 | |

Private sector R&D expenditure (% of GDP) | | | -0.53 | | | | 0.56 | | | | 1.09 | |

Patents per million inhabitants | | | -33.8 | | | | 82.0 | | | | 115.8 | |

Source: LAF Database, European Commission and Eurostat (years 2007-2011).

Note: EU15 reference for public and private R&D.

The main indicators related to research and innovation highlight a significant distance from the results achieved on average by EU15 countries. What emerges, in particular, is the significant difference in the number of patents per million inhabitants. There is lower discrepancy with respect to expenditure on research and the number of innovative small and medium enterprises (SMEs) on the total number of SMEs.

| | |

| MINISTRYOF ECONOMYAND FINANCE | | |

| | 15 |

ECONOMICAND FINANCIAL DOCUMENT – NATIONAL REFORM PROGRAMME

An equally important factor to increase productivity is related to the skill level of the labour force, which is still too low. In general, human capital, measured by years of study, has a considerable impact on productivity, but the Italian level of academic performance remains comparatively low, with significant regional differences in the levels achieved by students. The percentage of Italian graduates in the labour force is lower than that of Germany, France, United Kingdom and Spain, with negative effects on firms’ R&D activity and spending .

International comparison shows how the composition of investment in R&D in Italy is still characterised by a lower share of private expenditure. One of the main causes of these findings probably lies in the size structure of the Italian production system, which makes it difficult to achieve the three per cent of GDP expenditure on R&D set out in the Europe 2020 Strategy. The Italian production sector has a slightly smaller number of innovative enterprises compared to those of continental European countries, but their innovative activity requires less organisational and financial commitment.

LABOUR MARKET

| | | | | | | | | | | | |

| | | Difference with EU27 | | | Italy | | | EU27 | |

Employment rate (20-64 age group) | | | -7.5 | | | | 61.1 | | | | 68.6 | |

Unemployment rate (=>15 age group) | | | -1.3 | | | | 8.4 | | | | 9.7 | |

Spending on active labour market policies for employment * | | | -3,235 | | | | 4,565 | | | | 7,801 | |

Spending on passive labour market policies for employment* | | | 327.7 | | | | 3,552.3 | | | | 3,224.6 | |

(*) Per person seeking work.

Source: LAF Database, European Commission and Eurostat (years 2007-2011).