| | UNITED STATES | |

| | SECURITIES AND EXCHANGE COMMISSION | |

| | Washington, D.C. 20549 | |

| | | |

| | FORM N-CSR | |

| | | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT | |

| | INVESTMENT COMPANIES | |

| | | |

| Investment Company Act file number 811-524 | |

| | | |

| | The Dreyfus/Laurel Funds Trust | |

| | (Exact name of Registrant as specified in charter) | |

| | | |

| | c/o The Dreyfus Corporation | |

| | 200 Park Avenue | |

| | New York, New York 10166 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Mark N. Jacobs, Esq. | |

| | 200 Park Avenue | |

| | New York, New York 10166 | |

| | (Name and address of agent for service) | |

| | | |

| Registrant's telephone number, including area code: (212) 922-6000 | |

| | | |

| Date of fiscal year end: | 12/31 | |

| | | |

| Date of reporting period: | 12/31/03 | |

FORM N-CSR

Item 1. Reports to Stockholders.

| Dreyfus Premier |

| Core Value Fund |

ANNUAL REPORT December 31, 2003

| The views expressed in this report reflect those of the portfolio |

| manager only through the end of the period covered and do not |

| necessarily represent the views of Dreyfus or any other person in |

| the Dreyfus organization. Any such views are subject to change at |

| any time based upon market or other conditions and Dreyfus dis- |

| claims any responsibility to update such views.These views may not |

| be relied on as investment advice and, because investment decisions |

| for a Dreyfus fund are based on numerous factors, may not be relied |

| on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

| |

| Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

2

| Letter from the Chairman

|

3

| Discussion of Fund Performance

|

6

| Fund Performance

|

8

| Statement of Investments

|

12

| Statement of Assets and Liabilities

|

13

| Statement of Operations

|

14

| Statement of Changes in Net Assets

|

17

| Financial Highlights

|

23

| Notes to Financial Statements

|

31

| Independent Auditors’ Report

|

32

| Important Tax Information

|

33

| Board Members Information

|

35

| Officers of the Fund

|

F O R M O R E I N F O R M AT I O N

|

Back Cover

|

| Dreyfus Premier |

| Core Value Fund |

LETTER FROM THE CHAIRMAN

Dear Shareholder:

This annual report for Dreyfus Premier Core Value Fund covers the 12-month period from January 1, 2003, through December 31, 2003. Inside, you’ll find valuable information about how the fund was managed during the reporting period, including a discussion with the fund’s portfolio manager,Valerie J. Sill.

Despite headwinds caused by economic and geopolitical uncertainty early in the year, stocks generally bounced back in 2003, with many stock market indexes generating their first full calendar year of gains since 1999. The combination of historically low interest rates, lower federal income tax rates, progress in the war on terrorism and above-trend economic growth during the second half of the year helped propel stock prices higher.

While stocks in general may no longer be priced as attractively as they were at the start of the year, we believe that market fundamentals remain favorable based on recent forecasts of continued economic growth. However, our optimism is tempered by the understanding that some companies, industries and market sectors always perform better than others.As always, we urge you to speak regularly with your financial advisor, who may be in the best position to suggest the Dreyfus funds designed to meet your current needs, future goals and tolerance for risk.

Thank you for your continued confidence and support.

Sincerely,

| Stephen E. Canter |

| Chairman and Chief Executive Officer |

| The Dreyfus Corporation |

| January 15, 2004 |

2

DISCUSSION OF FUND PERFORMANCE

Valerie J. Sill, Portfolio Manager

How did Dreyfus Premier Core Value Fund perform relative to its benchmark?

For the 12-month period ended December 31, 2003, Dreyfus Premier Core Value Fund produced total returns of 28.09% for its Class A Shares, 27.12% for its Class B Shares, 27.12% for its Class C shares, 28.25% for its Institutional shares, 28.43% for its Class R shares and 27.72% for its Class T shares.1 In comparison, the fund’s benchmark, the S&P 500/BARRA Value Index, produced a total return of 31.79% for the same period.2

After a three-year bear market, stocks bounced back in 2003 after geopolitical tensions waned and the U.S. economy finally showed signs of sustainable growth. Although the fund participated in the stock market’s rise to a significant degree, its returns trailed its benchmark, primarily because of our focus on relatively high-quality, value-oriented companies rather than the more speculative businesses whose stocks posted the market’s greatest gains during the reporting period.

What is the fund’s investment approach?

The fund invests primarily in large-cap companies that are considered undervalued based on traditional measures, such as price-to-earnings ratios. When choosing stocks, we use a “bottom-up” stock selection approach, focusing on individual companies, rather than a “top-down” approach that forecasts market trends. We also focus on a company’s relative value, financial strength, sales and earnings momentum and likely catalysts that could ignite the stock price.

What other factors influenced the fund’s performance?

Stocks began 2003 in an environment characterized by persistent economic weakness as the United States and its allies prepared for war in Iraq. After it became clear that major combat would be over quickly,

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

investors began to grow more optimistic as they turned their attention to economic fundamentals, the expected benefits of lower interest rates from the Federal Reserve Board and new tax cuts enacted by Congress. By the summer of 2003, the U.S. economy had accelerated to its highest quarterly growth rate in nearly 20 years, and the broad stock market rally that began in mid-March persisted through the end of the year.

The fund participated in the 2003 market rally, particularly through its relatively economically sensitive investments in the financial services, capital goods and technology sectors. For example, the economic upturn benefited fund holdings such as Corning, which manufactures telecommunications products and other components, and Deere & Co., which makes agricultural and construction equipment.A stronger economy and rallying stock market boosted stocks of large brokerage firms such as Goldman Sachs and Morgan Stanley, that saw trading volume increase, fees from money management services rise and underwriting volume on new stock issues begin to bounce back. Investors also began to anticipate a rebound in corporate capital spending, which benefited the fund’s holdings of technology companies such as Intel and Koninklijke (Royal) Phillips Electronics.

A number of special situations also contributed to the fund’s performance, including the takeover of FleetBoston Financial by Bank of America. In addition, the fund benefited from the turnaround at McDonald’s, where new management boosted U.S. sales.

On the other hand, the fund’s performance relative to its benchmark in 2003 was hurt by its lack of exposure to many of the lower-quality companies that led the market’s advance. Gains were particularly impressive among smaller, more speculative technology stocks, many of which had no earnings. However, we tended to focus on well-established technology leaders, such as Microsoft, one of the fund’s top-ten holdings during the year. Microsoft did not participate fully in

4

the market rally because investors perceived it as a mature company with less growth potential than many smaller technology firms.While we agree that its business is relatively mature, we see Microsoft as an attractively valued stock that is trading at the low end of its five-year price range and has the ability to produce stable earnings under a variety of economic conditions.

What is the fund’s current strategy?

The fund’s ongoing strategy is to invest in large-capitalization value stocks that, in our judgment, possess strong business fundamentals and have a catalyst in place to generate capital appreciation.We currently believe that several companies in the pharmaceutical industry appear to fit this description. Large drug manufacturers performed relatively poorly in 2003, largely because of investors’ concerns regarding the potential effects of patent expirations on their earnings. However, we believe that many of these stocks already reflect rising competition from generic drugs, and their stock prices may rise as new pharmaceutical products are introduced to the marketplace.

January 15, 2004

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charges in the case of Class A and Class T shares, or the applicable contingent deferred sales charges imposed on redemptions in the case of Class B and Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than original cost.

2 SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, where applicable, capital gain distributions.The S&P 500/BARRA Value Index is a capitalization-weighted index of all the stocks in the Standard & Poor’s 500 Composite Price Index (“S&P 500 Index”) that have low price-to-book ratios.The S&P 500 Index is a widely accepted, unmanaged index of U.S. stock market performance.

The Fund 5

FUND PERFORMANCE

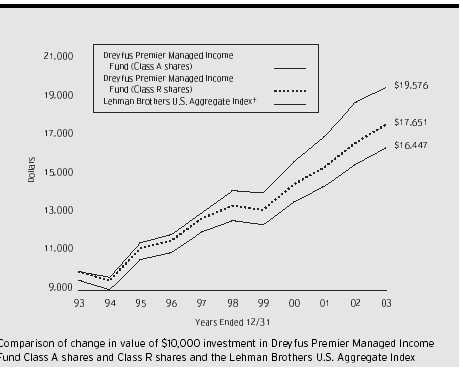

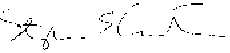

† Source: Lipper Inc.

Past performance is not predictive of future performance.

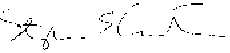

The above graph compares a $10,000 investment made in Class A shares and Institutional shares of Dreyfus Premier Core Value Fund on 12/31/93 to a $10,000 investment made in the Standard & Poor’s 500/BARRA Value Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested. Performance for Class B, Class C, Class R and Class T shares will vary from the performance of Class A and Institutional shares shown above due to differences in charges and expenses.

The fund’s performance shown in the line graph takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses for Class A shares and Institutional shares.The Index is a capitalization-weighted index of all the stocks in the S&P 500 that have low price-to-book ratios.The Index does not take into account charges, fees and other expenses. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

Average Annual Total Returns as of 12/31/03

| | Inception | | | | | | | | From | |

| | Date | | 1 Year | | 5 Years | | 10 Years | | Inception | |

|

| |

| |

| |

| |

| |

| Class A shares | | | | | | | | | | |

| with maximum sales charge (5.75%) | | | 20.70% | | 2.71% | | 9.73% | | | |

| without sales charge | | | 28.09% | | 3.93% | | 10.38% | | | |

| Class B shares | | | | | | | | | | |

| with applicable redemption charge † | 1/16/98 | | 23.12% | | 2.82% | | — | | 4.20% | |

| without redemption | 1/16/98 | | 27.12% | | 3.14% | | — | | 4.32% | |

| Class C shares | | | | | | | | | | |

| with applicable redemption charge | 1/16/98 | | 26.12% | | 3.14% | | — | | 4.32% | |

| without redemption | 1/16/98 | | 27.12% | | 3.14% | | — | | 4.32% | |

| Class R shares | 8/4/94 | | 28.43% | | 4.19% | | — | | 11.00% | |

| Institutional shares | | | 28.25% | | 4.04% | | 10.49% | | | |

| Class T shares | | | | | | | | | | |

| with applicable sales charge (4.5%) | 8/16/99 | | 21.95% | | — | | — | | 0.39% | |

| without sales charge | 8/16/99 | | 27.72% | | — | | — | | 1.45% | |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

†

| The maximum contingent deferred sales charge for Class B shares is 4%.After six years Class B shares convert to Class A shares.

|

††

| The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

|

The Fund 7

STATEMENT OF INVESTMENTS

December 31, 2003

| Common Stocks—96.8% | | Shares | | Value ($) | |

| |

| |

| |

| Advertising—.5% | | | | | |

| Interpublic Group of Companies | | 259,600 a | | 4,049,760 | |

| Appliance & Household Durables—.6% | | | | | |

| SONY, ADR | | 150,600 | | 5,221,302 | |

| Banking—13.0% | | | | | |

| American Express | | 255,900 | | 12,342,057 | |

| Bank of America | | 149,000 | | 11,984,070 | |

| Citigroup | | 784,033 | | 38,056,962 | |

| Comerica | | 78,200 b | | 4,383,892 | |

| Fannie Mae | | 124,600 | | 9,352,476 | |

| FleetBoston Financial | | 377,847 | | 16,493,021 | |

| U.S. Bancorp | | 404,700 | | 12,051,966 | |

| | | | | 104,664,444 | |

| Basic Industries—2.2% | | | | | |

| Alcoa | | 248,900 | | 9,458,200 | |

| China Steel, ADR | | 7 c | | 117 | |

| International Paper | | 199,000 | | 8,578,890 | |

| | | | | 18,037,207 | |

| Beverage & Tobacco—.8% | | | | | |

| Altria Group | | 114,200 | | 6,214,764 | |

| Brokerage—11.6% | | | | | |

| Bear Stearns Cos. | | 49,100 | | 3,925,545 | |

| Goldman Sachs | | 250,600 | | 24,741,738 | |

| J.P. Morgan Chase & Co. | | 449,600 | | 16,513,808 | |

| Lehman Brothers Holdings | | 111,600 | | 8,617,752 | |

| Merrill Lynch | | 337,950 | | 19,820,768 | |

| Morgan Stanley | | 338,200 | | 19,571,634 | |

| | | | | 93,191,245 | |

| Capital Goods—15.2% | | | | | |

| Corning | | 856,300 a | | 8,931,209 | |

| Deere & Co. | | 234,100 | | 15,228,205 | |

| Eaton | | 80,600 | | 8,703,188 | |

| Emerson Electric | | 137,760 | | 8,919,960 | |

| Ericsson, ADR—Class B | | 589,600 a,b | | 10,435,920 | |

| Nokia, ADR—Series A | | 886,000 | | 15,062,000 | |

| Pitney Bowes | | 114,900 | | 4,667,238 | |

| Rockwell Collins | | 179,200 | | 5,381,376 | |

| Stmicroelectronics (New York Shares) | | 271,500 | | 7,333,215 | |

| | | | | | |

| 8 | | | | | |

| Common Stocks (continued) | Shares | | Value ($) | |

|

| |

| |

| Capital Goods (continued) | | | | |

| United Technologies | 228,300 | | 21,635,991 | |

| Xerox | 1,146,400 a,b | | 15,820,320 | |

| | | | 122,118,622 | |

| Consumer Durables—3.4% | | | | |

| Black & Decker | 80,000 | | 3,945,600 | |

| Koninklijke (Royal) Phillips Electronics | | | | |

| (New York Shares) | 802,800 | | 23,353,452 | |

| | | | 27,299,052 | |

| Consumer Non—Durables—1.5% | | | | |

| Jones Apparel Group | 238,300 | | 8,395,309 | |

| Kimberly-Clark | 68,200 | | 4,029,938 | |

| | | | 12,425,247 | |

| Consumer Services—12.1% | | | | |

| Abercrombie & Fitch, Cl.A | 128,500 a | | 3,175,235 | |

| Brinker | 115,500 a | | 3,829,980 | |

| Gannett | 89,100 | | 7,944,156 | |

| Knight-Ridder | 72,400 | | 5,601,588 | |

| Kroger | 208,300 a | | 3,855,633 | |

| Liberty Media, Cl.A | 1,702,180 a | | 20,238,920 | |

| Limited Brands | 434,500 | | 7,834,035 | |

| McDonald’s | 774,000 | | 19,218,420 | |

| Safeway | 323,400 a | | 7,085,694 | |

| Viacom, Cl.B | 416,700 | | 18,493,146 | |

| | | | 97,276,807 | |

| Data Processing—1.5% | | | | |

| Automatic Data Processing | 301,200 | | 11,930,532 | |

| Energy—8.2% | | | | |

| Anadarko Petrolem | 160,800 | | 8,202,408 | |

| Apache | 51,600 | | 4,184,760 | |

| BP, ADR | 216,400 | | 10,679,340 | |

| Exxon Mobil | 625,632 | | 25,650,912 | |

| Royal Dutch Petroleum (New York Shares) | 127,800 | | 6,695,442 | |

| Schlumberger | 200,200 | | 10,954,944 | |

| | | | 66,367,806 | |

| Health Care—6.3% | | | | |

| Baxter | 408,000 | | 12,452,160 | |

| Becton, Dickinson & Co. | 199,900 | | 8,223,886 | |

| Johnson & Johnson | 146,900 | | 7,588,854 | |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | Shares | | Value ($) | |

|

| |

| |

| Health Care (continued) | | | | |

| McKesson | 217,700 | | 7,001,232 | |

| Pfizer | 280,200 | | 9,899,466 | |

| Wyeth | 133,700 | | 5,675,565 | |

| | | | 50,841,163 | |

| Insurance—6.8% | | | | |

| Allstate | 334,300 | | 14,381,586 | |

| American International Group | 225,293 | | 14,932,420 | |

| Hartford Financial Services Group | 69,700 | | 4,114,391 | |

| Marsh & McLennan Cos. | 144,600 | | 6,924,894 | |

| Principal Financial Group | 210,800 | | 6,971,156 | |

| Travelers Property Casualty, Cl.A | 425,000 | | 7,131,500 | |

| | | | 54,455,947 | |

| Technology—9.4% | | | | |

| Cadence Deign System | 655,800 a | | 11,791,284 | |

| Comverse Technology | 354,500 a | | 6,235,655 | |

| Intel | 399,100 | | 12,851,020 | |

| International Business Machines | 102,900 | | 9,536,772 | |

| Microsoft | 898,300 | | 24,739,182 | |

| SunGard Data Systems | 142,900 a | | 3,959,759 | |

| Tellabs | 449,000 a | | 3,785,070 | |

| 3Com | 383,500 a | | 3,133,195 | |

| | | | 76,031,937 | |

| Telecommunications—1.3% | | | | |

| SK Telecom, ADR | 270 b | | 5,036 | |

| Sprint (FON Group) | 289,400 | | 4,751,948 | |

| Sprint (PCS Group) | 1,052,900 a | | 5,917,298 | |

| | | | 10,674,282 | |

| Transportation—1.2% | | | | |

| Union Pacific | 137,100 | | 9,525,708 | |

| Utilities—1.2% | | | | |

| Verizon Communications | 280,856 | | 9,852,428 | |

| Total Common Stocks | | | | |

| (cost $634,746,850) | | | 780,178,253 | |

10

| Preferred Stocks—1.4% | | Shares | | Value ($) | |

|

|

| |

| |

| Consumer Services; | | | | | |

| News Corp, ADR | | | | | |

| (cost $ | 6,598,190) | | 368,300 | | 11,141,075 | |

|

|

|

| |

| |

| | | | Principal | | | |

| Short-Term Investments—1.4% | Amount ($) | | Value ($) | |

|

| |

| |

| Commercial Paper; | | | | | |

| General Electric Capital, | | | | | |

| .75%, 1/02/2004 | | | | | |

| (cost $ | 11,577,000) | | 11,577,000 | | 11,577,000 | |

|

|

|

| |

| |

| Investment of Cash Collateral | | | | |

| for Securities Loaned—2.7% | Shares | | Value ($) | |

|

| |

| |

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred Money Market Fund | | | | |

| (cost $ | 21,340,730) | | 21,340,730 | | 21,340,730 | |

|

|

|

| |

| |

| | | | | | | |

| Total Investments (cost $ | 674,262,770) | 102.3% | | 824,237,058 | |

| Liabilities, Less Cash and Receivables | (2.3%) | | (18,507,908) | |

| Net Assets | | 100.0% | | 805,729,150 | |

a Non-income producing.

b

| All or a portion of these securities are on loan.At December 31, 2003, the total market value of the fund’s securities on loan is $20,942,928 and the total market value of the collateral held by the fund is $21,340,730.

|

c

| Security exempt from registration under Rule 144A of the Securities Act of 1933.This security may be resold in transactions exempt from registration, normally to qualified institutional buyers.At December 31, 2003, this security amounted to $117.

|

See notes to financial statements.

The Fund 11

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2003

| | | | | | | | | Cost | Value | |

|

|

| |

| |

|

|

|

| |

| Assets ($): | | | | | | | | | | |

| Investments in securities—See Statement of Investments | | | | |

| (including securities on loan, valued at | | | | | | |

| $20,942,928)—Note 1(b) | | | | | 674,262,770 | 824,237,058 | |

| Receivable for investment securities sold | | | | | 11,396,167 | |

| Dividends and interest receivable | | | | | 1,041,936 | |

| Receivable for shares of Beneficial Interest subscribed | | | 359,559 | |

| | | | | | | | | | 837,034,720 | |

|

|

| |

| |

|

|

|

| |

| Liabilities ($): | | | | | | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 2 | | | 812,733 | |

| Cash overdraft due to Custodian | | | | | | | 947,675 | |

| Liability for securities on loan—Note 1(b) | | | | | 21,340,730 | |

| Payable for investment securities purchased | | | | | 6,507,697 | |

| Payable for shares of Beneficial Interest redeemed | | | 1,696,735 | |

| | | | | | | | | | 31,305,570 | |

|

|

| |

| |

|

|

|

| |

| Net Assets ( | $) | | | | | | | | 805,729,150 | |

|

|

| |

| |

|

|

|

| |

| Composition of Net Assets ($): | | | | | | |

| Paid-in capital | | | | | | | | | 792,101,102 | |

| Accumulated undistributed investment income—net | | | 421,293 | |

| Accumulated net realized gain (loss) on investments | | | (136,767,533) | |

| Accumulated net unrealized appreciation | | | | | | |

| (depreciation) on investments | | | | | | | 149,974,288 | |

| |

| |

|

|

|

| |

| Net Assets ( | $) | | | | | | | | 805,729,150 | |

|

|

| |

| |

|

|

|

| |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net Asset Value Per Share | | | | | | |

| | | Class A | | Class B | | Class C | Class R | Class T | Institutional | |

|

|

| |

| |

|

|

|

| |

| Net Assets ($) | 607,632,797 | | 78,780,243 | | 22,480,325 | 52,723,271 | 2,264,199 | 41,848,315 | |

| Shares | | | | | | | | | | |

| Outstanding | | 22,146,936 | | 2,915,478 | | 831,847 | 1,922,207 | 82,539 | 1,526,240 | |

|

|

| |

| |

|

|

|

| |

| Net Asset Value | | | | | | | | |

| Per Share ( | $) 27.44 | | 27.02 | | 27.02 | 27.43 | 27.43 | 27.42 | |

| | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | |

12

STATEMENT OF OPERATIONS

Year Ended December 31, 2003

| Investment Income ( | $): | | |

| Income: | | | |

| Cash dividends (net of $239,105 foreign taxes withheld at source) | 12,880,834 | |

| Interest | | 157,458 | |

| Income on securities lending | 31,761 | |

| Total Income | | 13,070,053 | |

| Expenses: | | | |

| Management fee—Note 2(a) | | 6,321,400 | |

| Distribution and service fees—Note 2(b) | 2,256,297 | |

| Loan commitment fees—Note 4 | 5,922 | |

| Total Expenses | | 8,583,619 | |

| Investment Income—Net | | 4,486,434 | |

|

|

| |

| Realized and Unrealized Gain (Loss) on Investments—Note 3 ($): | | |

| Net realized gain (loss) on investments and | | |

| foreign currency transactions | 2,244,385 | |

| Net realized gain (loss) on forward currency | | |

| exchange contracts | | (20) | |

| Net Realized Gain (Loss) | | 2,244,365 | |

| Net unrealized appreciation (depreciation) on investments | 171,665,107 | |

| Net Realized and Unrealized Gain (Loss) on Investments | 173,909,472 | |

| Net Increase in Net Assets Resulting from Operations | 178,395,906 | |

See notes to financial statements.

The Fund 13

STATEMENT OF CHANGES IN NET ASSETS

| | Year Ended December 31, | |

| |

| |

| | 2003 | | 2002 | |

|

| |

| |

| Operations ($): | | | | |

| Investment income—net | 4,486,434 | | 2,706,736 | |

| Net realized gain (loss) on investments | 2,244,365 | | (129,369,521) | |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | 171,665,107 | | (100,428,701) | |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | 178,395,906 | | (227,091,486) | |

|

| |

| |

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A shares | (3,672,165) | | (2,095,693) | |

| Class B shares | (42,807) | | — | |

| Class C shares | (12,034) | | — | |

| Class R shares | (431,331) | | (275,395) | |

| Class T shares | (8,129) | | (2,550) | |

| Institutional shares | (294,312) | | (210,983) | |

| Total Dividends | (4,460,778) | | (2,584,621) | |

|

| |

| |

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A shares | 69,547,747 | | 128,962,355 | |

| Class B shares | 11,334,683 | | 32,985,741 | |

| Class C shares | 9,950,055 | | 11,227,556 | |

| Class R shares | 6,484,312 | | 10,959,857 | |

| Class T shares | 466,996 | | 1,669,295 | |

| Institutional shares | 674,229 | | 1,898,103 | |

14

| | Year Ended December 31, | |

| |

| |

| | 2003 | | 2002 | |

|

| |

| |

| Beneficial Interest Transactions ($) (continued): | | | | |

| Dividends reinvested: | | | | |

| Class A shares | 3,178,046 | | 1,778,780 | |

| Class B shares | 36,527 | | — | |

| Class C shares | 9,238 | | — | |

| Class R shares | 431,021 | | 275,318 | |

| Class T shares | 8,023 | | 2,504 | |

| Institutional shares | 285,477 | | 206,052 | |

| Cost of shares redeemed: | | | | |

| Class A shares | (101,503,555) | | (147,319,203) | |

| Class B shares | (11,884,065) | | (17,126,987) | |

| Class C shares | (12,880,056) | | (7,309,501) | |

| Class R shares | (5,795,921) | | (4,385,465) | |

| Class T shares | (246,690) | | (830,523) | |

| Institutional shares | (5,373,560) | | (9,278,390) | |

| Increase (Decrease) in Net Assets | | | | |

| from Beneficial Interest Transactions | (35,277,493) | | 3,715,492 | |

| Total Increase (Decrease) in Net Assets | 138,657,635 | | (225,960,615) | |

|

| |

| |

| Net Assets ($): | | | | |

| Beginning of Period | 667,071,515 | | 893,032,130 | |

| End of Period | 805,729,150 | | 667,071,515 | |

| Undistributed investment income—net | 421,293 | | 395,675 | |

The Fund 15

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | Year Ended December 31, | |

| |

| |

| | 2003 | | 2002 | |

|

| |

| |

| Capital Share Transactions: | | | | |

| Class Aa | | | | |

| Shares sold | 2,953,000 | | 5,072,535 | |

| Shares issued for dividends reinvested | 134,142 | | 79,513 | |

| Shares redeemed | (4,326,654) | | (6,047,472) | |

| Net Increase (Decrease) in Shares Outstanding | (1,239,512) | | (895,424) | |

|

| |

| |

| Class Ba | | | | |

| Shares sold | 486,046 | | 1,284,876 | |

| Shares issued for dividends reinvested | 1,655 | | — | |

| Shares redeemed | (525,823) | | (736,243) | |

| Net Increase (Decrease) in Shares Outstanding | (38,122) | | 548,633 | |

|

| |

| |

| Class C | | | | |

| Shares sold | 452,412 | | 448,815 | |

| Shares issued for dividends reinvested | 421 | | — | |

| Shares redeemed | (599,607) | | (303,397) | |

| Net Increase (Decrease) in Shares Outstanding | (146,774) | | 145,418 | |

|

| |

| |

| Class R | | | | |

| Shares sold | 271,825 | | 412,401 | |

| Shares issued for dividends reinvested | 18,131 | | 12,008 | |

| Shares redeemed | (237,711) | | (181,176) | |

| Net Increase (Decrease) in Shares Outstanding | 52,245 | | 243,233 | |

|

| |

| |

| Class T | | | | |

| Shares sold | 20,540 | | 67,153 | |

| Shares issued for dividends reinvested | 338 | | 119 | |

| Shares redeemed | (10,977) | | (34,178) | |

| Net Increase (Decrease) in Shares Outstanding | 9,901 | | 33,094 | |

|

| |

| |

| Institutional Shares | | | | |

| Shares sold | 29,399 | | 76,740 | |

| Shares issued for dividends reinvested | 12,070 | | 9,072 | |

| Shares redeemed | (240,152) | | (408,160) | |

| Net Increase (Decrease) in Shares Outstanding | (198,683) | | (322,348) | |

a During the period ended December 31, 2003, 33,502 Class B shares representing $773,643 were automatically converted to 32,995 Class A shares and during the period ended December 31, 2002, 11,870 Class B shares representing $291,033 were automatically converted to 11,716 Class A shares.

See notes to financial statements.

16

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | Year Ended December 31, | | | |

| | | |

| | | |

| Class A Shares | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | |

|

| |

| |

| |

| |

| |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 21.57 | | 28.62 | | 30.93 | | 30.83 | | 29.26 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .17 | | .10 | | .17 | | .24 | | .13 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 5.86 | | (7.06) | | (1.46) | | 3.04 | | 4.78 | |

| Total from Investment Operations | 6.03 | | (6.96) | | (1.29) | | 3.28 | | 4.91 | |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.16) | | (.09) | | (.16) | | (.23) | | (.13) | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | — | | — | | (.86) | | (2.95) | | (3.21) | |

| Total Distributions | (.16) | | (.09) | | (1.02) | | (3.18) | | (3.34) | |

| Net asset value, end of period | 27.44 | | 21.57 | | 28.62 | | 30.93 | | 30.83 | |

|

| |

| |

| |

| |

| |

| Total Return (%)b | 28.09 | | (24.36) | | (4.04) | | 11.21 | | 17.29 | |

|

| |

| |

| |

| |

| |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of expenses to average net assets | 1.15 | | 1.15 | | 1.15 | | 1.15 | | 1.15 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | .71 | | .41 | | .58 | | .79 | | .41 | |

| Portfolio Turnover Rate | 54.58 | | 67.21 | | 68.77 | | 88.70 | | 91.22 | |

|

| |

| |

| |

| |

| |

| Net Assets, end of period ($ X 1,000) | 607,633 | | 504,371 | | 695,054 | | 634,410 | | 590,129 | |

a Based on average shares outstanding at each month end.

b Exclusive of sales charge.

See notes to financial statements.

The Fund 17

FINANCIAL HIGHLIGHTS (continued)

| | | | Year Ended December 31, | | | |

| | | |

| | | |

| Class B Shares | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | |

|

| |

| |

| |

| |

| |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 21.27 | | 28.33 | | 30.68 | | 30.64 | | 29.19 | |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—neta | (.01) | | (.08) | | (.07) | | .01 | | (.10) | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 5.77 | | (6.98) | | (1.42) | | 3.01 | | 4.76 | |

| Total from Investment Operations | 5.76 | | (7.06) | | (1.49) | | 3.02 | | 4.66 | |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.01) | | — | | (.00)b | | (.03) | | — | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | — | | — | | (.86) | | (2.95) | | (3.21) | |

| Total Distributions | (.01) | | — | | (.86) | | (2.98) | | (3.21) | |

| Net asset value, end of period | 27.02 | | 21.27 | | 28.33 | | 30.68 | | 30.64 | |

|

| |

| |

| |

| |

| |

| Total Return (%)c | 27.12 | | (24.92) | | (4.79) | | 10.39 | | 16.37 | |

|

| |

| |

| |

| |

| |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of expenses to average net assets | 1.90 | | 1.90 | | 1.90 | | 1.90 | | 1.90 | |

| Ratio of net investment income | | | | | | | | | | |

| (loss) to average net assets | (.04) | | (.33) | | (.24) | | .03 | | (.33) | |

| Portfolio Turnover Rate | 54.58 | | 67.21 | | 68.77 | | 88.70 | | 91.22 | |

|

| |

| |

| |

| |

| |

| Net Assets, end of period ($ X 1,000) | 78,780 | | 62,820 | | 68,123 | | 17,209 | | 6,792 | |

a Based on average shares outstanding at each month end.

b

| Amount represents less than $.01 per share.

|

c

| Exclusive of sales charge.

|

See notes to financial statements.

18

| | | | Year Ended December 31, | | | |

| | | |

| | | |

| Class C Shares | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | |

|

| |

| |

| |

| |

| |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 21.27 | | 28.34 | | 30.68 | | 30.64 | | 29.19 | |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—neta | (.01) | | (.08) | | (.06) | | .00b | | (.11) | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 5.77 | | (6.99) | | (1.42) | | 3.02 | | 4.77 | |

| Total from Investment Operations | 5.76 | | (7.07) | | (1.48) | | 3.02 | | 4.66 | |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.01) | | — | | (.00)b | | (.03) | | — | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | — | | — | | (.86) | | (2.95) | | (3.21) | |

| Total Distributions | (.01) | | — | | (.86) | | (2.98) | | (3.21) | |

| Net asset value, end of period | 27.02 | | 21.27 | | 28.34 | | 30.68 | | 30.64 | |

|

| |

| |

| |

| |

| |

| Total Return (%)c | 27.12 | | (24.95) | | (4.75) | | 10.35 | | 16.41 | |

|

| |

| |

| |

| |

| |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of expenses to average net assets | 1.90 | | 1.90 | | 1.90 | | 1.90 | | 1.90 | |

| Ratio of net investment income | | | | | | | | | | |

| (loss) to average net assets | (.04) | | (.32) | | (.24) | | .01 | | (.35) | |

| Portfolio Turnover Rate | 54.58 | | 67.21 | | 68.77 | | 88.70 | | 91.22 | |

|

| |

| |

| |

| |

| |

| Net Assets, end of period ($ X 1,000) | 22,480 | | 20,819 | | 23,612 | | 3,459 | | 1,192 | |

a Based on average shares outstanding at each month end.

b

| Amount represents less than $.01 per share.

|

c

| Exclusive of sales charge.

|

See notes to financial statements.

The Fund 19

FINANCIAL HIGHLIGHTS (continued)

| | | | Year Ended December 31, | | | |

| | | |

| | | |

| Class R Shares | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | |

|

| |

| |

| |

| |

| |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 21.56 | | 28.62 | | 30.92 | | 30.82 | | 29.25 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .22 | | .17 | | .23 | | .32 | | .20 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 5.87 | | (7.08) | | (1.44) | | 3.04 | | 4.79 | |

| Total from Investment Operations | 6.09 | | (6.91) | | (1.21) | | 3.36 | | 4.99 | |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.22) | | (.15) | | (.23) | | (.31) | | (.21) | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | — | | — | | (.86) | | (2.95) | | (3.21) | |

| Total Distributions | (.22) | | (.15) | | (1.09) | | (3.26) | | (3.42) | |

| Net asset value, end of period | 27.43 | | 21.56 | | 28.62 | | 30.92 | | 30.82 | |

|

| |

| |

| |

| |

| |

| Total Return (%) | 28.43 | | (24.18) | | (3.80) | | 11.49 | | 17.59 | |

|

| |

| |

| |

| |

| |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of expenses to average net assets | .90 | | .90 | | .90 | | .90 | | .90 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | .95 | | .67 | | .78 | | 1.03 | | .65 | |

| Portfolio Turnover Rate | 54.58 | | 67.21 | | 68.77 | | 88.70 | | 91.22 | |

|

| |

| |

| |

| |

| |

| Net Assets, end of period ($ X 1,000) | 52,723 | | 40,320 | | 46,555 | | 1,138 | | 885 | |

a Based on average shares outstanding at each month end. See notes to financial statements.

20

| | | | Year Ended December 31, | | | |

| | | |

| | | |

| Class T Shares | 2003 | | 2002 | | 2001 | | 2000 | | 1999a | |

|

| |

| |

| |

| |

| |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 21.57 | | 28.63 | | 30.93 | | 30.84 | | 32.45 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—netb | .11 | | .05 | | .07 | | .17 | | .01 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 5.85 | | (7.07) | | (1.42) | | 3.03 | | 1.23 | |

| Total from Investment Operations | 5.96 | | (7.02) | | (1.35) | | 3.20 | | 1.24 | |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.10) | | (.04) | | (.09) | | (.16) | | (.02) | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | — | | — | | (.86) | | (2.95) | | (2.83) | |

| Total Distributions | (.10) | | (.04) | | (.95) | | (3.11) | | (2.85) | |

| Net asset value, end of period | 27.43 | | 21.57 | | 28.63 | | 30.93 | | 30.84 | |

|

| |

| |

| |

| |

| |

| Total Return (%)c | 27.72 | | (24.53) | | (4.28) | | 10.89 | | 4.10d | |

|

| |

| |

| |

| |

| |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of expenses to average net assets | 1.40 | | 1.40 | | 1.40 | | 1.40 | | .53d | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | .45 | | .21 | | .25 | | .57 | | .05d | |

| Portfolio Turnover Rate | 54.58 | | 67.21 | | 68.77 | | 88.70 | | 91.22 | |

|

| |

| |

| |

| |

| |

| Net Assets, end of period ($ X 1,000) | 2,264 | | 1,567 | | 1,132 | | 154 | | 18 | |

a From August 16, 1999 (commencement of initial offering) to December 31, 1999.

b

| Based on average shares outstanding at each month end.

|

c

| Exclusive of sales charge.

|

d

| Not annualized.

|

See notes to financial statements.

The Fund 21

FINANCIAL HIGHLIGHTS (continued)

| | | | Year Ended December 31, | | | |

| | | |

| | | |

| Institutional Shares | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | |

|

| |

| |

| |

| |

| |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 21.55 | | 28.60 | | 30.90 | | 30.81 | | 29.24 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .19 | | .13 | | .20 | | .27 | | .16 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 5.87 | | (7.07) | | (1.45) | | 3.04 | | 4.78 | |

| Total from Investment Operations | 6.06 | | (6.94) | | (1.25) | | 3.31 | | 4.94 | |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.19) | | (.11) | | (.19) | | (.27) | | (.16) | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | — | | — | | (.86) | | (2.95) | | (3.21) | |

| Total Distributions | (.19) | | (.11) | | (1.05) | | (3.22) | | (3.37) | |

| Net asset value, end of period | 27.42 | | 21.55 | | 28.60 | | 30.90 | | 30.81 | |

|

| |

| |

| |

| |

| |

| Total Return (%) | 28.25 | | (24.28) | | (3.96) | | 11.30 | | 17.41 | |

|

| |

| |

| |

| |

| |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of expenses to average net assets | 1.05 | | 1.05 | | 1.05 | | 1.05 | | 1.05 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | .81 | | .51 | | .70 | | .89 | | .50 | |

| Portfolio Turnover Rate | 54.58 | | 67.21 | | 68.77 | | 88.70 | | 91.22 | |

|

| |

| |

| |

| |

| |

| Net Assets, end of period ($ X 1,000) | 41,848 | | 37,174 | | 58,557 | | 63,473 | | 65,111 | |

a Based on average shares outstanding at each month end. See notes to financial statements.

22

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Premier Core Value Fund (the “fund”) is a separate diversified series of The Dreyfus/Laurel Funds Trust (the “Trust”) which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering three series, including the fund. The fund’s investment objective is to seek long-term capital growth.The Dreyfus Corporation (the “Manager”) serves as the fund’s investment manager. The Manager is a wholly-owned subsidiary of Mellon Bank, N.A. (“Mellon Bank”), which is a wholly-owned subsidiary of Mellon Financial Corporation.

Dreyfus Service Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of shares of Beneficial Interest in each of the following classes of shares: Class A, Class B, Class C, Class R, Class T and Institutional shares. Class A, Class B, Class C and Class T shares are sold primarily to retail investors through financial intermediaries and bear a distribution fee and/or service fee. Class A and Class T shares are subject to a front-end sales charge, while Class B and Class C shares are subject to a contingent deferred sales charge (“CDSC”). Class B shares automatically convert to Class A shares after six years. Class R shares are sold primarily to bank trust departments and other financial service providers (including Mellon Bank and its affiliates) acting on behalf of customers having a qualified trust or investment account or relationship at such institution, and bear no distribution or service fees. Class R and Institutional shares are offered without a front-end sales charge or CDSC. Institutional shares are offered only to those customers of certain financial planners and investment advisers who held shares of a predecessor class of the fund as of April 4, 1994, and bear a distribution fee. Each class of shares has identical rights and privileges, except with respect to the distribution and service fees and voting rights on matters affecting a single class.

The Fund 23

NOTES TO FINANCIAL STATEMENTS (continued)

Investment income, net of expenses (other than class specific expenses) and realized and unrealized gains and losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class.

The fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange on which such securities are primarily traded or at the last sales price on the national securities market. Effective April 14, 2003, the fund began pricing securities on the NASDAQ stock market using the NASDAQ official closing price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Securities for which there are no such valuations are valued at fair value as determined in good faith under the direction of the Board of Trustees. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward currency exchange contracts are valued at the forward rate.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The fund may lend securities to qualified institutions. At origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities

24

on loan will be maintained at all times. Cash collateral is invested in certain money market mutual funds managed by the Manager as shown in the fund’s Statement of Investments.The fund will be entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund would bear the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner.

(c) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized on securities transactions and the difference between the amount of dividends, interest, and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in exchange rates. Such gains and losses are included with net realized and unrealized gain or loss on investments.

(d) Forward currency exchange contracts:The fund enters into forward currency exchange contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings and to settle foreign currency transactions. When executing forward currency exchange contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward currency exchange contracts, the fund would incur a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

is closed.The fund realizes a gain if the value of the contract decreases between those dates. With respect to purchases of forward currency exchange contracts, the fund would incur a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract increases between those dates. The fund is also exposed to credit risk associated with counter party nonperformance on these forward currency exchange contracts which is typically limited to the unrealized gain on each open contract. At December 31, 2003, there were no open forward currency exchange contracts.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net are declared and paid on a quarterly basis. Dividends from net realized capital gain, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gain can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

At December 31, 2003, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $421,293, accumulated capital losses $136,140,578 and unrealized appreciation $149,347,333.

The accumulated capital loss carryover is available to be applied against future net securities profits, if any, realized subsequent to December 31, 2003. If not applied, $4,087,843 of the carryover expires

26

in fiscal 2009, $118,801,482 expires in fiscal 2010 and $13,251,253 expires in fiscal 2011.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2003 and December 31, 2002, respectively, were as follows: ordinary income $4,460,778 and $2,584,621.

During the period ended December 31, 2003, as a result of permanent book to tax differences, the fund decreased accumulated undistributed investment income-net by $38 and increased accumulated net realized gain (loss) on investments by the same amount. Net assets were not affected by this reclassification.

NOTE 2—Investment Management Fee and Other Transactions With Affiliates:

(a) Investment management fee: Pursuant to an Investment Management agreement with the Manager, the Manager provides or arranges for one or more third parties and/or affiliates to provide investment advisory, administrative, custody, fund accounting and transfer agency services to the fund. The Manager also directs the investments of the fund in accordance with its investment objective, policies and limitations. For these services, the fund is contractually obligated to pay the Manager a fee, calculated daily and paid monthly, at the annual rate of .90% of the value of the fund’s average daily net assets. Out of its fee, the Manager pays all of the expenses of the fund except brokerage fees, taxes, interest, commitment fees, Rule 12b-1 distribution fees and expenses, service fees, fees and expenses of non-interested Trustees (including counsel fees) and extraordinary expenses. In addition, the Manager is required to reduce its fee in an amount equal to the fund’s allocable portion of fees and expenses of the non-interested Trustees (including counsel fees). Each Trustee receives $40,000 per year, plus $5,000 for each joint Board meeting of The Dreyfus/Laurel Funds, Inc., The Dreyfus/Laurel Tax-Free Municipal Funds, and the Trust (the “Dreyfus/Laurel Funds”) attended, $2,000 for separate committee meetings attended which are not held in conjunction with a regularly scheduled board meeting and

The Fund 27

NOTES TO FINANCIAL STATEMENTS (continued)

$500 for Board meetings and separate committee meetings attended that are conducted by telephone and is reimbursed for travel and out-of-pocket expenses.The Chairman of the Board receives an additional 25% of such compensation (with the exception of reimbursable amounts).These fees are charged and allocated to each series based on net assets. In the event that there is a joint committee meeting of the Dreyfus/Laurel Funds and the Dreyfus High Yield Strategies Fund, the $2,000 fee will be allocated between the Dreyfus/Laurel Funds and the Dreyfus High Yield Strategies Fund. Amounts required to be paid by the Trust directly to the non-interested Trustees, that would be applied to offset a portion of the management fee payable to the Manager, are in fact paid directly by the Manager to the non-interested Trustees.

During the period ended December 31, 2003, the Distributor retained $55,627 and $462 from commissions earned on sales of the fund’s Class A and Class T shares, respectively, and $231,645 and $6,088 from contingent deferred sales charges on redemptions on the fund’s Class B and Class C shares, respectively.

(b) Distribution and service plan: Under separate Distribution Plans (the “Plans”) adopted pursuant to Rule 12b-1 under the Act, Class A shares and Institutional shares may pay annually up to .25% and .15%, respectively, of the value of their average daily net assets to compensate the Distributor for shareholder servicing activities and expenses primarily intended to result in the sale of Class A shares and Institutional shares. Class B, Class C and Class T shares pay the Distributor for distributing their shares at an aggregate annual rate of .75% of the value of the average daily net assets of Class B and Class C shares, and .25% of the value of average daily net assets of Class T shares. The Distributor may pay one or more agents in respect of advertising, marketing and other distribution services for Class T shares and determines the amounts, if any, to be paid to agents and the basis on which such payments are made. Class B, Class C and Class T shares are also subject to a service plan adopted pursuant to Rule 12b-1 (the

28

“Service Plan”), under which Class B, Class C and Class T shares pay the Distributor for providing certain services to the holders of their shares a fee at the annual rate of .25% of the value of the average daily net assets of Class B, Class C and Class T shares, respectively. During the period ended December 31, 2003, Class A, Class B, Class C, Class T and Institutional shares were charged $1,329,963, $500,307, $145,591, $4,576 and $55,984, respectively, pursuant to their respective Plans. During the period ended December 31, 2003, Class B, Class C and Class T shares were charged $166,769, $48,531 and $4,576, respectively, pursuant to the Service Plan.

Under its terms, the Plans and Service Plan shall remain in effect from year to year, provided such continuance is approved annually by a vote of majority of those Trustees who are not “interested persons” of the Trust and who have no direct or indirect financial interest in the operation of or in any agreement related to the Plans or Service Plan.

On December 9, 2003, the Manager was named in a lawsuit filed in the United States District Court for the Southern District of New York which seeks relief on behalf of the fund and various other funds managed by the Manager. Plaintiffs amended their complaint on February 12, 2004, among other things, by asserting claims derivatively on behalf of the fund and, purportedly, other funds which are named as nominal defendants, and by adding the funds’ directors as defendants. The complaint alleges, in substance, that the Manager and the directors breached their fiduciary duty to fund shareholders under the Investment Company Act of 1940, as amended, and at common law by continuing to charge, and in the case of the directors, by allowing the Manager to continue to charge, 12b-1 fees after the Manager closed certain classes of shares of the funds to new investors.The complaint seeks to recover those 12b-1 fees as well as a portion of the management fees and to enjoin the Manager and its affiliates from charging closed funds 12b-1 fees. The Manager believes that the lawsuit is without merit and intends to contest it vigorously.

The Fund 29

NOTES TO FINANCIAL STATEMENTS (continued)

(c) The Company and the Manager have received an exemptive order from the SEC which, among other things, permits the fund to use cash collateral received in connection with lending the fund’s securities and other uninvested cash to purchase shares of one or more registered money market mutual funds advised by the Manager in excess of the limitations imposed by the Act.

NOTE 3—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward currency exchange contracts, during the period ended December 31, 2003, amounted to $375,370,474 and $413,144,142, respectively.

At December 31, 2003, the cost of investments for federal income tax purposes was $674,889,725; accordingly, accumulated net unrealized appreciation on investments was $149,347,333, consisting of $154,968,795 gross unrealized appreciation and $5,621,462 gross unrealized depreciation.

NOTE 4—Bank Line of Credit:

The fund participates with other Dreyfus-managed funds in a $350 million redemption credit facility (“the Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowings. During the year ended December 31, 2003, the fund did not borrow under the Facility.

30

INDEPENDENT AUDITORS’ REPORT

The Board of Trustees and Shareholders The Dreyfus/Laurel Funds Trust:

We have audited the accompanying statement of assets and liabilities of Dreyfus Premier Core Value Fund (the “Fund”) of The Dreyfus/Laurel Funds Trust, including the statement of investments, as of December 31, 2003, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated herein.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America.Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2003, by correspondence with the custodian. As to securities purchased and sold but not yet received or delivered, we performed other appropriate auditing procedures.An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Premier Core Value Fund of The Dreyfus/Laurel Funds Trust as of December 31, 2003, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the periods indicated herein, in conformity with accounting principles generally accepted in the United States of America.

| NewYork, NewYork |

| February 20, 2004 |

The Fund 31

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby designates 100% of the ordinary dividends paid during the fiscal year ended December 31, 2003 as qualifying for the corporate dividends received deduction.The fund also designates 100% of the ordinary dividends paid during 2003 as qualified dividends, subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003.

32

| BOARD MEMBERS INFORMATION (Unaudited) |

| |

| |

| Joseph S. DiMartino (60) |

| Chairman of the Board (1999) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • The Muscular Dystrophy Association, Director |

| • Levcor International, Inc., an apparel fabric processor, Director |

| • Century Business Services, Inc., a provider of outsourcing functions for small and medium size |

| companies, Director |

| • The Newark Group, a provider of a national market of paper recovery facilities, |

| paperboard mills and paperboard converting plants, Director |

| No. of Portfolios for which Board Member Serves: 186 |

| ——————— |

| James Fitzgibbons (69) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Chairman of the Board, Davidson Cotton Company (1998-2002) |

| Other Board Memberships and Affiliations: |

| • Howes Leather Corporation, Director |

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

| J.Tomlinson Fort (75) |

| Board Member (1987) |

| Principal Occupation During Past 5 Years: |

| • Retired; Of Counsel, Reed Smith LLP (1998-January 2003) |

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

| Kenneth A. Himmel (57) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • President and CEO, Related Urban Development, a real estate development company |

| (1996-present) |

| • President and CEO, Himmel & Company, a real estate development company (1980-present) |

| • CEO, American Food Management, a restaurant company (1983-present) |

| No. of Portfolios for which Board Member Serves: 23 |

The Fund 33

BOARD MEMBERS INFORMATION (Unaudited) (continued)

| Stephen J. Lockwood (56) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Chairman of the Board, Stephen J. Lockwood and Company LLC, an investment company |

| (2000-present) |

| • Chairman of the Board and CEO, LDG Reinsurance Corporation (1977-2000) |

| Other Board Memberships and Affiliations: |

| • BDML Holdings, an insurance company, Chairman of the Board |

| • Affiliated Managers Group, an investment management company, Director |

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

| Roslyn Watson (54) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Principal,Watson Ventures, Inc., a real estate investment company (1993-present) |

| Other Board Memberships and Affiliations: |

| • American Express Centurion Bank, Director |

| • The Hyams Foundation Inc., a Massachusetts Charitable Foundation,Trustee |

| • National Osteoporosis Foundation,Trustee |

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

| Benaree Pratt Wiley (57) |

| Board Member (1998) |

| Principal Occupation During Past 5 Years: |

| • President and CEO,The Partnership, an organization dedicated to increasing the |

| representation of African Americans in positions of leadership, influence and |

| decision-making in Boston, MA (1991-present) |

| Other Board Memberships and Affiliations: |

| • Boston College,Trustee |

| • The Greater Boston Chamber of Commerce, Director |

| • The First Albany Companies, Inc., an investment bank, Director |

| • Mass. Development, Director |

| • Commonwealth Institute, Director |

| • Efficacy Institute, Director |

| • PepsiCo Africa-America, Advisory Board |

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

| Once elected all Board Members serve for an indefinite term.Additional information about the Board Members, including |

| their address is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of |

| charge by calling this toll free number: 1-800-554-4611. |

| |

| Ruth Marie Adams, Emeritus Board Member |

| Francis P. Brennan, Emeritus Board Member |

34

OFFICERS OF THE FUND (Unaudited)

| STEPHEN E. CANTER, President since |

| March 2000. |

| Chairman of the Board, Chief Executive |

| Officer and Chief Operating Officer of the |

| Manager, and an officer of 95 investment |

| companies (comprised of 185 portfolios) |

| managed by the Manager. Mr. Canter also is a |

| Board member and, where applicable, an |

| Executive Committee Member of the other |

| investment management subsidiaries of Mellon |

| Financial Corporation, each of which is an |

| affiliate of the Manager. He is 58 years old and |

| has been an employee of the Manager since |

| May 1995. |

| STEPHEN R. BYERS, Executive Vice |

| President since November 2002. |

| Chief Investment Officer,Vice Chairman and a |

| Director of the Manager, and an officer of 95 |

| investment companies (comprised of 185 |

| portfolios) managed by the Manager. Mr. Byers |

| also is an officer, director or an Executive |

| Committee Member of certain other |

| investment management subsidiaries of Mellon |

| Financial Corporation, each of which is an |

| affiliate of the Manager. He is 50 years old and |

| has been an employee of the Manager since |

| January 2000. Prior to joining the Manager, he |

| served as an Executive Vice President-Capital |

| Markets, Chief Financial Officer and Treasurer |

| at Gruntal & Co., L.L.C. |

| MARK N. JACOBS, Vice President since |

| March 2000. |

| Executive Vice President, Secretary and |

| General Counsel of the Manager, and an |

| officer of 96 investment companies (comprised |

| of 201 portfolios) managed by the Manager. |

| He is 57 years old and has been an employee |

| of the Manager since June 1977. |

| STEVEN F. NEWMAN, Secretary since |

| March 2000. |

| Associate General Counsel and Assistant |

| Secretary of the Manager, and an officer of 96 |

| investment companies (comprised of 201 |

| portfolios) managed by the Manager. He is 54 |

| years old and has been an employee of the |

| Manager since July 1980. |

| JEFF PRUSNOFSKY, Assistant Secretary |

| since March 2000. |

| Associate General Counsel of the Manager, |

| and an officer of 24 investment companies |

| (comprised of 81 portfolios) managed by the |

| Manager. He is 38 years old and has been an |

| employee of the Manager since October 1990. |

| MICHAEL A. ROSENBERG, Assistant |

| Secretary since March 2000. |

| Associate General Counsel of the Manager, |

| and an officer of 93 investment companies |

| (comprised of 194 portfolios) managed by the |

| Manager. He is 43 years old and has been an |

| employee of the Manager since October 1991. |

| JAMES WINDELS, Treasurer since |

| November 2001. |

| Director – Mutual Fund Accounting of the |

| Manager, and an officer of 96 investment |

| companies (comprised of 201 portfolios) |

| managed by the Manager. He is 45 years old |

| and has been an employee of the Manager |

| since April 1985. |

| RICHARD CASSARO, Assistant Treasurer |

| since August 2003. |

| Senior Accounting Manager – Equity Funds of |

| the Manager, and an officer of 25 investment |

| companies (comprised of 100 portfolios) |

| managed by the Manager. He is 44 years old |

| and has been an employee of the Manager |

| since September 1982. |

| ERIK D. NAVILOFF, Assistant Treasurer |

| since December 2002. |

| Senior Accounting Manager – Taxable Fixed |

| Income Funds of the Manager, and an officer |

| of 18 investment companies (comprised of 73 |

| portfolios) managed by the Manager. He is 35 |

| years old and has been an employee of the |

| Manager since November 1992. |

The Fund 35

OFFICERS OF THE FUND (Unaudited) (continued)

| ROBERT SVAGNA, Assistant Treasurer |

| since December 2002. |

| Senior Accounting Manager – Equity Funds of |

| the Manager, and an officer of 25 investment |

| companies (comprised of 101 portfolios) |

| managed by the Manager. He is 36 years old |

| and has been an employee of the Manager |

| since November 1990. |

| KENNETH J. SANDGREN, Assistant |

| Treasurer since November 2001. |

| Mutual Funds Tax Director of the Manager, |

| and an officer of 96 investment companies |

| (comprised of 201 portfolios) managed by the |

| Manager. He is 49 years old and has been an |

| employee of the Manager since June 1993. |

| WILLIAM GERMENIS, Anti-Money |

| Laundering Compliance Officer since |

| September 2002. |

| Vice President and Anti-Money Laundering |

| Compliance Officer of the Distributor, and the |

| Anti-Money Laundering Compliance Officer |

| of 91 investment companies (comprised of 196 |

| portfolios) managed by the Manager. He is 33 |

| years old and has been an employee of the |

| Distributor since October 1998. Prior to |

| joining the Distributor, he was a Vice President |

| of Compliance Data Center, Inc. |

36

For More Information

| Dreyfus Premier |

| Core Value Fund |

| 200 Park Avenue |

| New York, NY 10166 |

| |

| Manager |

| The Dreyfus Corporation |

| 200 Park Avenue |

| New York, NY 10166 |

|

| |

| Custodian |

| Mellon Bank, N.A. |

| One Mellon Bank Center |

| Pittsburgh, PA 15258 |

| |

| Transfer Agent & |

| Dividend Disbursing Agent |

| Dreyfus Transfer, Inc. |

| 200 Park Avenue |

| New York, NY 10166 |

| |

| Distributor |

| Dreyfus Service Corporation |

| 200 Park Avenue |

| New York, NY 10166 |

| To obtain information: |

|

| |

| By telephone |

| Call your financial |

| representative or |

| 1-800-554-4611 |

| By mail Write to: |

| The Dreyfus Premier |

| Family of Funds |

| 144 Glenn Curtiss Boulevard |

| Uniondale, NY 11556-0144 |

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, by calling the telephone number listed above, or by visiting the SEC’s website at http://www.sec.gov

© 2004 Dreyfus Service Corporation 312AR1203

| Dreyfus Premier |

| Limited Term |

| High Yield Fund |

| ANNUAL REPORT December 31, 2003 |

| The views expressed in this report reflect those of the portfolio |

| manager only through the end of the period covered and do not |

| necessarily represent the views of Dreyfus or any other person in |

| the Dreyfus organization. Any such views are subject to change at |

| any time based upon market or other conditions and Dreyfus dis- |

| claims any responsibility to update such views.These views may not |

| be relied on as investment advice and, because investment decisions |

| for a Dreyfus fund are based on numerous factors, may not be relied |

| on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

| |

| Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

2

| Letter from the Chairman

|

3

| Discussion of Fund Performance

|

6

| Fund Performance

|

8

| Statement of Investments

|

22

| Statement of Assets and Liabilities

|

23

| Statement of Operations

|

24

| Statement of Changes in Net Assets

|

26

| Financial Highlights

|

30

| Notes to Financial Statements

|

42

| Independent Auditors’ Report

|

43

| Important Tax Information

|

44

| Board Members Information

|

46

| Officers of the Fund

|

FOR MORE INFORMATION

|

Back Cover

|

| Dreyfus Premier |

| Limited Term High Yield Fund |

LETTER FROM THE CHAIRMAN

Dear Shareholder:

This annual report for Dreyfus Premier Limited Term High Yield Fund covers the 12-month period from January 1, 2003, through December 31, 2003. Inside, you’ll find valuable information about how the fund was managed during the reporting period, including a discussion with Gerald E.Thunelius, portfolio manager and director of the Dreyfus Taxable Fixed Income Team that manages the fund.

The bond market produced mixed results in 2003 as investor sentiment apparently shifted from pessimism at the start of the year toward a more optimistic outlook by year-end.As the U.S. economy gathered momentum, the more interest-rate-sensitive areas of the bond market began to retreat, and U.S. government securities finished the year with modestly positive total returns. On the other hand, the bond market’s more credit-sensitive areas generally benefited from the stronger economy, producing more robust gains for corporate bonds.

While recent economic developments suggest to us that interest rates are more likely to rise in 2004 than to fall further, we continue to believe that bonds deserve a prominent place in most investors’ portfolios. As always, we urge you to speak regularly with your financial advisor, who may be in the best position to suggest the Dreyfus funds designed to meet your current needs, future goals and tolerance for risk.

Thank you for your continued confidence and support.

Sincerely,

| Stephen E. Canter |

| Chairman and Chief Executive Officer |

| The Dreyfus Corporation |

| January 15, 2004 |

2

DISCUSSION OF FUND PERFORMANCE

Gerald E. Thunelius, Senior Portfolio Manager Dreyfus Taxable Fixed Income Team

How did Dreyfus Premier Limited Term High Yield Fund perform relative to its benchmark?

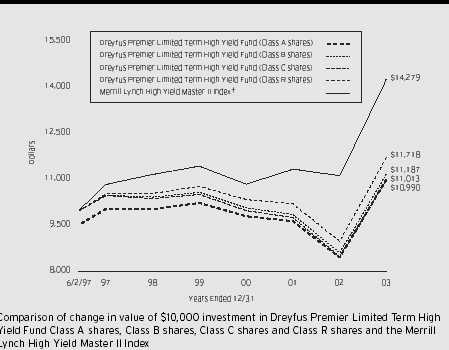

For the 12-month period ended December 31, 2003, the fund achieved total returns of 29.87% for its Class A shares, 29.25% for Class B shares, 29.10% for Class C shares and 30.15% for Class R shares.The fund generated aggregate income dividends of $0.6512 for Class A shares, $0.6175 for Class B shares, $0.6003 for Class C shares and $0.6660 for Class R shares.1 In comparison, the Merrill Lynch High Yield Master II Index, the fund’s benchmark, achieved a total return of 28.15% for the same period.2

The fund’s strong performance was primarily the result of a sharp and sustained rally among high-yield corporate bonds, especially during the first half of 2003, when investors began to anticipate a stronger U.S. economy.The fund’s returns were higher than its benchmark over the reporting period, primarily due to strong results from “fallen angels” held by the fund that rebounded from depressed price levels.

What is the fund’s investment approach?

The fund seeks to maximize total return consisting of capital appreciation and current income.The average effective maturity of the fund is limited to a maximum of 5.5 years.

We normally invest most of the fund’s assets in fixed-income securities of below investment-grade credit quality. Our approach to selecting individual issues is based on careful credit analysis.We thoroughly analyze the business, management and financial strength of each of the companies whose bonds we buy, then project each issuer’s ability to repay its debt.

The Fund 3