UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES |

| Investment Company Act file number 811-524 |

The Dreyfus/Laurel Funds Trust

(Exact name of Registrant as specified in charter) |

c/o The Dreyfus Corporation

200 Park Avenue

New York, New York 10166

(Address of principal executive offices) (Zip code) |

Michael A. Rosenberg, Esq.

200 Park Avenue

New York, New York 10166

(Name and address of agent for service) |

| Registrant's telephone number, including area code: | | (212) 922-6000 |

| Date of fiscal year end: | | 10/31 | | |

| Date of reporting period: | | 10/31/2008 | | |

The following N-CSR relates only to the series of the Registrant listed below, and does not affect the other series of the Registrant, which have different fiscal year ends and, therefore, different N-CSR reporting requirements. Separate N-CSR Forms will be filed for those series, as appropriate.

Dreyfus 130/30 Growth Fund

Dreyfus Global Equity Income Fund

Dreyfus International Bond Fund |

Item 1. Reports to Stockholders.

2

Dreyfus

130/30 Growth Fund

| | ANNUAL REPORT October 31, 2008 |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured Not Bank-Guaranteed May Lose Value

| | Contents |

| |

| | THE FUND |

| |

| 2 | A Letter from the CEO |

| |

| 3 | Discussion of Fund Performance |

| |

| 6 | Fund Performance |

| |

| 8 | Understanding Your Fund’s Expenses |

| |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| |

| 9 | Statement of Investments |

| |

| 15 | Statement of Securities Sold Short |

| |

| 18 | Statement of Assets and Liabilities |

| |

| 19 | Statement of Operations |

| |

| 20 | Statement of Cash Flows |

| |

| 21 | Statement of Changes in Net Assets |

| |

| 22 | Financial Highlights |

| |

| 26 | Notes to Financial Statements |

| |

| 36 | Report of Independent Registered Public Accounting Firm |

| |

| 37 | Board Members Information |

| |

| 39 | Officers of the Fund |

| |

| | FOR MORE INFORMATION |

| |

| | Back Cover |

| |

| Dreyfus |

| 130/30 Growth Fund |

The Fund

A LETTER FROM THE CEO

Dear Shareholder: |

We present to you this annual report for Dreyfus 130/30 Growth Fund, covering the 12-month period from November 1, 2007, through October 31, 2008.

These are difficult times for equity investors. A credit crunch that began in early 2007 has developed into a full-blown global financial crisis, recently resulting in the failure of several major financial institutions and prompting a massive government rescue effort. Meanwhile, the U.S. economic slowdown has gathered momentum,depressing investor sentiment, consumer confidence and business investment.These factors undermined returns in most stock market sectors, particularly financial companies and businesses that tend to be more sensitive to economic trends.

The depth and duration of the economic downturn will depend on how quickly the financial system can be stabilized.We believe that the Temporary Guarantee Program for Money Market Funds and the $700 billion rescue package intended to promote greater liquidity in the financial markets meet several critical requirements for addressing today’s financial stresses, and we expect these measures to contribute to a more orderly deleveraging process. However, recuperation from the financial crisis is likely to take time. In the meantime, we encourage you to keep in touch with your financial advisor and maintain a long-term and disciplined perspective to investing. Indeed, we already are seeing some positive signs, including a likely peak in global inflationary pressures, a bottoming of the U.S. dollar, attractive valuations among fundamentally sound companies and a large pool of worldwide financial liquidity that could be deployed gradually as the economic cycle turns.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund’s Portfolio Managers.

Thank you for your continued confidence and support.

| | Jonathan R. Baum

Chief Executive Officer

The Dreyfus Corporation |

DISCUSSION OF FUND PERFORMANCE

For the period of November 1, 2007, through October 31, 2008, as provided by Warren Chiang, CFA; Prabhu Palani, CFA; and C. Wesley Boggs, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended October 31, 2008, Dreyfus 130/30 Growth Fund’s Class A shares produced a total return of –40.98%, Class C shares returned –41.46%, Class I shares returned –40.82% and Class T shares returned –41.14% .1 In comparison, the fund’s benchmark, the Russell 1000 Growth Index, produced a total return of –36.95% for the same period.2

Stocks declined sharply during the reporting period due to a U.S. economic slowdown and an intensifying global financial crisis.The fund produced returns that were lower than its benchmark, primarily due to a market environment in which neither the valuation nor the earnings revisions factors considered by our quantitative models were predictive of individual stocks’ performance.

The Fund’s Investment Approach

The fund seeks capital appreciation.The fund normally invests at least 80% of its net assets in equity securities.The fund intends to take both long and short positions in stocks chosen through a quantitatively-driven investment process. The fund’s portfolio managers apply a systematic, quantitative investment approach designed to identify and exploit relative misvaluations primarily within the U.S. stock market. Active investment decisions to take long or short positions in individual securities are driven by this quantitative investment process. The portfolio managers use a proprietary valuation model that identifies and ranks stocks based on a long-term relative valuation model that utilizes forward looking estimates of risk and return, an earnings sustainability model that gauges how well earnings forecasts are likely to reflect changes in future cash flows and a set of behavioral factors, including earnings revisions and share buy-backs.

The Fund 3

| DISCUSSION OF FUND PERFORMANCE (continued) |

Stocks Struggled in a Financial Crisis

Slumping housing markets, rising unemployment and sharply lower consumer confidence exacerbated a downturn in the U.S. economy, giving rise to fears regarding a potentially deep and prolonged recession. Meanwhile, a credit crunch that began in 2007 developed into a global financial crisis, and challenging liquidity conditions in some credit markets nearly led to the collapse of the global banking system in September 2008. Government authorities intervened, pumping billions of dollars into the system to restore a degree of investor confidence.These efforts included the passage of theTroubled Asset Relief Program (“TARP”) by the U.S. Congress and unprecedented, coordinated reductions of short-term interest rates by central banks, including the Federal Reserve Board.

As market conditions deteriorated, many highly leveraged institutional investors were forced to de-lever their portfolios, selling their more liquid investments to raise cash for margin calls and redemption requests.These developments triggered massive declines across all market sectors. The financials sector was particularly hard-hit, as several major financial institutions collapsed in September and October,requiring government bailouts.

Quantitative Models Produced Mixed Results

Our quantitative security selection process was rendered less effective during the reporting period by heightened market volatility and an apparent disregard of business fundamentals among risk-averse investors.The valuation factors on which our models heavily rely were relatively ineffective as inexpensively valued stocks simply got cheaper during the downturn. Certain behavioral factors considered by our models, especially analysts’ earnings revisions, failed to add value due to the lack of clarity in the outlooks for most companies.

Although the fund successfully avoided most of the financial institutions that failed during the reporting period, a long position in American International Group was one of the more substantial detractors from the fund’s relative performance, as the global insurer was effectively nationalized by the U.S. government in October.An overweighted position in insurer Genworth Financial also hindered performance as the company encountered liquidity issues.

4

Retailer Bare Escentuals was hurt by disappointing earnings and reduced guidance from management regarding future results. Auto rental chain Hertz Global Holdings suffered amid reduced customer demand and pricing pressures. In the technology sector, networking and software company Ciena Corp. declined due to lower-than-expected quarterly earnings.

The fund achieved better results from discount retailer Big Lots, where sales climbed as cash-strapped consumers turned to low-priced goods. An overweighted position in health care company Baxter International benefited performance when the company announced higher earnings. An underweighted position in electronics retailer Circuit City Stores fell sharply in anticipation of a bankruptcy filing, which occurred soon after the reporting period’s end. Agribusiness giant Monsanto benefited from rising food prices during much of the reporting period. Finally, a short position in retailer Dillard’s fared relatively well as investors worried about excessive debt, weakening consumer spending and the bankruptcy of a competitor.

Finding Opportunities in a Distressed Market

The burgeoning financial crisis appears to have punished many stocks more severely than warranted by their underlying business fundamentals, and we have identified a number of opportunities to establish long positions in healthy companies at historically attractive prices. In our judgment, the fund is well positioned to benefit from a return to fundamentals among investors when the current crisis abates.

November 17, 2008

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charges in the case of Class A and Class T shares, or the applicable contingent deferred sales charges imposed on redemptions in the case of Class C shares. |

| |

| | Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Return figures provided reflect the absorption of certain fund expenses by The Dreyfus Corporation pursuant to an agreement in effect until March 1, 2010. Had these expenses not been absorbed, the fund’s returns would have been lower. |

| |

| 2 | SOURCE: BLOOMBERG L.P. – Reflects reinvestment of net dividends and, where applicable, capital gain distributions.The Russell 1000 Growth Index is a widely accepted, unmanaged large-cap index that measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. |

| |

The Fund 5

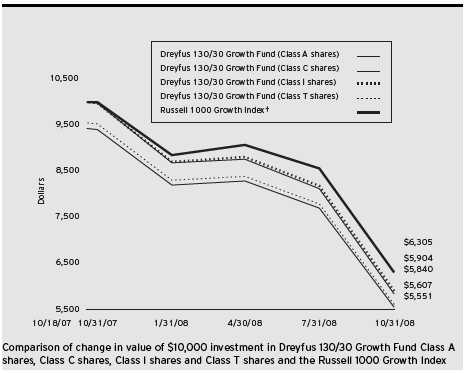

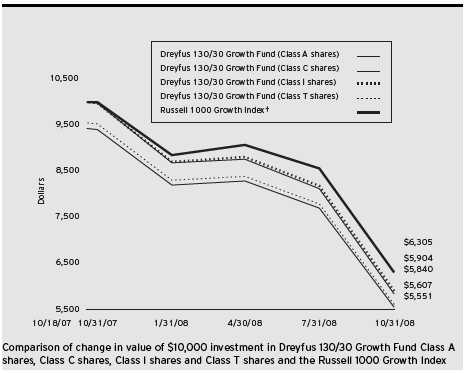

| | † Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in Class A, Class C, Class I and Class T shares of Dreyfus

130/30 Growth Fund on 10/18/07 (inception date) to a $10,000 investment made in the Russell 1000 Growth

Index (the “Index”) on that date. For comparative purposes, the value of the Index on 10/31/07 is used as the

beginning value on 10/18/07. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph takes into account the maximum initial sales charges on Class A

shares and Class T shares and all other applicable fees and expenses on all classes.The Index is a widely accepted,

unmanaged large-cap index that measures the performance of those Russell 1000 companies with higher price-to-book

ratios and higher forecasted growth values. Unlike a mutual fund, the Index is not subject to charges, fees and other

expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including

expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere

in this report. |

6

| Average Annual Total Returns as of 10/31/08 | | | | | | |

| |

| | | Inception | | | | From |

| | | Date | | 1 Year | | Inception |

| |

| |

| |

|

| Class A shares | | | | | | |

| with maximum sales charge (5.75%) | | 10/18/07 | | (44.37)% | | (43.22)% |

| without sales charge | | 10/18/07 | | (40.98)% | | (39.91)% |

| Class C shares | | | | | | |

| with applicable redemption charge † | | 10/18/07 | | (42.05)% | | (40.38)% |

| without redemption | | 10/18/07 | | (41.46)% | | (40.38)% |

| Class I shares | | 10/18/07 | | (40.82)% | | (39.75)% |

| Class T shares | | | | | | |

| with applicable sales charge (4.5%) | | 10/18/07 | | (43.80)% | | (42.67)% |

| without sales charge | | 10/18/07 | | (41.14)% | | (40.07)% |

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| † The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| date of purchase. |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus 130/30 Growth Fund from May 1, 2008 to October 31, 2008. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended October 31, 2008 |

| | | Class A | | Class C | | Class I | | Class T |

| |

| |

| |

| |

|

| Expenses paid per $1,000† | | $ 14.90 | | $ 17.43 | | $ 14.02 | | $ 16.06 |

| Ending value (after expenses) | | $669.70 | | $666.70 | | $670.30 | | $668.50 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended October 31, 2008 |

| | | Class A | | Class C | | Class I | | Class T |

| |

| |

| |

| |

|

| Expenses paid per $1,000† | | $ 17.91 | | $ 20.96 | | $ 16.86 | | $ 19.31 |

| Ending value (after expenses) | | $1,007.29 | | $1,004.22 | | $1,008.35 | | $1,005.88 |

| † Expenses are equal to the fund’s annualized expense ratio of 3.55% for Class A, 4.16% for Class C, 3.34% for |

| Class I and 3.83% for Class T, multiplied by the average account value over the period, multiplied by 184/366 (to |

| reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

October 31, 2008 |

| Common Stocks—132.9% | | Shares | | Value ($) |

| |

| |

|

| Computers—7.2% | | | | |

| Apple | | 270 a,b | | 29,049 |

| International Business Machines | | 378 b | | 35,143 |

| Microsoft | | 3,630 b | | 81,058 |

| | | | | 145,250 |

| Consumer Discretionary—18.7% | | | | |

| Big Lots | | 1,074 a,b | | 26,238 |

| Coach | | 418 a,b | | 8,611 |

| Comcast, Cl. A | | 337 | | 5,311 |

| DIRECTV Group | | 186 a,b | | 4,072 |

| Eastman Kodak | | 741 b | | 6,802 |

| Expedia | | 200 a | | 1,902 |

| GameStop, Cl. A | | 270 a,b | | 7,395 |

| Gap | | 1,970 b | | 25,492 |

| Genuine Parts | | 600 b | | 23,610 |

| Guess? | | 1,000 b | | 21,770 |

| H & R Block | | 140 | | 2,761 |

| Harman International Industries | | 50 b | | 919 |

| Interpublic Group of Cos. | | 699 a,b | | 3,628 |

| Liberty Global, Cl. A | | 900 a,b | | 14,841 |

| Liz Claiborne | | 650 | | 5,298 |

| McDonald’s | | 1,150 b | | 66,620 |

| News, Cl. A | | 250 | | 2,660 |

| NIKE, Cl. B | | 150 | | 8,645 |

| Omnicom Group | | 1,100 b | | 32,494 |

| Polo Ralph Lauren | | 84 b | | 3,962 |

| Priceline.com | | 145 a,b | | 7,631 |

| Service Corporation International | | 3,067 b | | 21,162 |

| Snap-On | | 880 b | | 32,516 |

| Tiffany & Co. | | 180 | | 4,941 |

| Time Warner | | 84 b | | 848 |

| WABCO Holdings | | 408 | | 7,495 |

| Walt Disney | | 1,021 b | | 26,444 |

| Wyndham Worldwide | | 600 b | | 4,914 |

| | | | | 378,982 |

The Fund 9

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Consumer Staples—15.2% | | | | |

| Altria Group | | 685 b | | 13,145 |

| Anheuser-Busch | | 100 | | 6,203 |

| Avon Products | | 1,770 b | | 43,949 |

| Bare Escentuals | | 2,452 a,b | | 10,249 |

| Bunge | | 434 | | 16,670 |

| Central European Distribution | | 210 a | | 6,046 |

| ConAgra Foods | | 1,330 b | | 23,169 |

| General Mills | | 200 b | | 13,548 |

| H.J. Heinz | | 90 | | 3,944 |

| Kimberly-Clark | | 117 | | 7,171 |

| Lorillard | | 40 | | 2,634 |

| McCormick & Co. | | 950 b | | 31,977 |

| Philip Morris International | | 873 | | 37,949 |

| Safeway | | 900 b | | 19,143 |

| Sara Lee | | 2,939 b | | 32,858 |

| Wal-Mart Stores | | 670 b | | 37,393 |

| Walgreen | | 68 b | | 1,731 |

| | | | | 307,779 |

| Energy—12.1% | | | | |

| Cameron International | | 100 a | | 2,426 |

| Dresser-Rand Group | | 900 a,b | | 20,160 |

| Foundation Coal Holdings | | 100 b | | 2,076 |

| Massey Energy | | 821 b | | 18,957 |

| Murphy Oil | | 799 b | | 40,461 |

| National Oilwell Varco | | 149 a,b | | 4,454 |

| Noble Energy | | 100 b | | 5,182 |

| Occidental Petroleum | | 1,110 b | | 61,649 |

| Pioneer Natural Resources | | 600 b | | 16,698 |

| Plains Exploration & Production | | 281 a | | 7,924 |

| Quicksilver Resources | | 340 a | | 3,560 |

| Smith International | | 700 b | | 24,136 |

| Southwestern Energy | | 1,010 a,b | | 35,976 |

| Valero Energy | | 38 | | 782 |

| | | | | 244,441 |

10

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Financial—10.0% | | | | |

| Allied Capital | | 600 b | | 4,380 |

| Arch Capital Group | | 100 a | | 6,975 |

| Assurant | | 20 b | | 509 |

| Astoria Financial | | 1,150 | | 21,873 |

| Charles Schwab | | 2,500 b | | 47,800 |

| Erie Indemnity, Cl. A | | 171 | | 6,359 |

| Genworth Financial, Cl. A | | 1,940 b | | 9,390 |

| Goldman Sachs Group | | 19 | | 1,758 |

| Hartford Financial Services Group | | 130 | | 1,342 |

| Hudson City Bancorp | | 1,036 | | 19,487 |

| IntercontinentalExchange | | 125 a | | 10,695 |

| Loews | | 318 | | 10,561 |

| Moody’s | | 400 b | | 10,240 |

| Morgan Stanley | | 29 | | 507 |

| Nasdaq OMX Group | | 355 a,b | | 11,523 |

| Northern Trust | | 43 | | 2,421 |

| NYSE Euronext | | 500 b | | 15,090 |

| Prudential Financial | | 200 b | | 6,000 |

| Simon Property Group | | 100 b | | 6,703 |

| Torchmark | | 108 | | 4,511 |

| XL Capital, Cl. A | | 400 b | | 3,880 |

| | | | | 202,004 |

| Health Care—19.7% | | | | |

| Allergan | | 129 | | 5,117 |

| Applied Biosystems | | 70 | | 2,158 |

| Baxter International | | 930 b | | 56,255 |

| Becton, Dickinson & Co. | | 100 | | 6,940 |

| Biogen Idec | | 125 a | | 5,318 |

| Bristol-Myers Squibb | | 2,590 b | | 53,224 |

| Celgene | | 192 a,b | | 12,338 |

| CIGNA | | 870 b | | 14,181 |

| Endo Pharmaceuticals Holdings | | 1,338 a,b | | 24,753 |

| Genentech | | 192 a | | 15,924 |

| Genzyme | | 100 a,b | | 7,288 |

The Fund 11

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Health Care (continued) | | | | |

| Gilead Sciences | | 200 a | | 9,170 |

| Humana | | 309 a | | 9,143 |

| Medtronic | | 1,120 b | | 45,170 |

| Merck & Co. | | 271 b | | 8,387 |

| Pfizer | | 1,320 b | | 23,377 |

| St. Jude Medical | | 1,150 a,b | | 43,735 |

| Watson Pharmaceuticals | | 757 a,b | | 19,811 |

| WellCare Health Plans | | 619 a,b | | 14,961 |

| WellPoint | | 560 a,b | | 21,767 |

| | | | | 399,017 |

| Industrial—16.4% | | | | |

| Cooper Industries, Cl. A | | 1,060 b | | 32,807 |

| Corporate Executive Board | | 600 b | | 17,898 |

| CSX | | 631 | | 28,849 |

| Cummins | | 61 | | 1,577 |

| FedEx | | 98 b | | 6,406 |

| First Solar | | 103 a,b | | 14,801 |

| Flowserve | | 212 | | 12,067 |

| Fluor | | 150 | | 5,990 |

| Foster Wheeler | | 200 a | | 5,480 |

| General Dynamics | | 517 | | 31,185 |

| Goodrich | | 582 b | | 21,278 |

| Honeywell International | | 250 b | | 7,613 |

| Hubbell, Cl. B | | 93 b | | 3,336 |

| Jacobs Engineering Group | | 534 a | | 19,454 |

| Kirby | | 699 a,b | | 23,990 |

| L-3 Communications Holdings | | 252 b | | 20,455 |

| Manitowoc | | 700 b | | 6,888 |

| Northrop Grumman | | 200 b | | 9,378 |

| Oshkosh | | 600 | | 4,596 |

| Pitney Bowes | | 100 b | | 2,478 |

| Precision Castparts | | 117 b | | 7,583 |

| Tyco International | | 850 b | | 21,488 |

| Union Pacific | | 295 | | 19,697 |

| United Parcel Service, Cl. B | | 65 | | 3,431 |

| Waste Management | | 100 b | | 3,123 |

| | | | | 331,848 |

12

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Information Technology—24.4% | | | | |

| Adobe Systems | | 1,266 a,b | | 33,726 |

| Automatic Data Processing | | 1,270 b | | 44,386 |

| BMC Software | | 1,400 a,b | | 36,148 |

| Brocade Communications Systems | | 3,418 a | | 12,886 |

| CA | | 2,330 b | | 41,474 |

| Cisco Systems | | 1,899 a,b | | 33,745 |

| Corning | | 200 | | 2,166 |

| Google, Cl. A | | 10 a | | 3,594 |

| Hewlett-Packard | | 2,350 b | | 89,958 |

| Integrated Device Technology | | 1,945 a | | 12,370 |

| Intel | | 3,200 b | | 51,200 |

| JDS Uniphase | | 2,000 a,b | | 10,920 |

| Juniper Networks | | 785 a | | 14,711 |

| MEMC Electronic Materials | | 740 a,b | | 13,601 |

| National Instruments | | 300 b | | 7,620 |

| National Semiconductor | | 884 b | | 11,642 |

| NCR | | 1,611 a | | 29,449 |

| Oracle | | 500 a | | 9,145 |

| Sohu.com | | 439 a | | 24,119 |

| Trimble Navigation | | 20 a | | 411 |

| Visa, Cl. A | | 79 | | 4,373 |

| WebMD Health, Cl. A | | 116 a,b | | 2,593 |

| Xerox | | 190 b | | 1,524 |

| | | | | 491,761 |

| Materials—8.0% | | | | |

| Air Products & Chemicals | | 400 b | | 23,252 |

| Airgas | | 300 b | | 11,508 |

| AK Steel Holding | | 110 b | | 1,531 |

| Alcoa | | 200 | | 2,302 |

| CF Industries Holdings | | 135 | | 8,665 |

| International Paper | | 1,026 b | | 17,668 |

| Monsanto | | 670 b | | 59,617 |

| Mosaic | | 472 b | | 18,602 |

| Newmont Mining | | 342 b | | 9,008 |

| Rohm & Haas | | 49 | | 3,447 |

| Terra Industries | | 153 | | 3,364 |

The Fund 13

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Materials (continued) | | | | |

| United States Steel | | 50 | | 1,844 |

| | | | | 160,808 |

| Telecommunication Services—.9% | | | | |

| CenturyTel | | 100 | | 2,511 |

| Qwest Communications International | | 329 b | | 941 |

| Windstream | | 1,868 | | 14,029 |

| | | | | 17,481 |

| Utilities—.3% | | | | |

| DPL | | 144 | | 3,285 |

| NRG Energy | | 100 a,b | | 2,325 |

| Reliant Energy | | 112 a | | 588 |

| | | | | 6,198 |

| |

| |

|

| |

| Total Investments (cost $3,801,150) | | 132.9% | | 2,685,569 |

| Liabilities, Less Cash and Receivables | | (32.9%) | | (664,178) |

| Net Assets | | 100.0% | | 2,021,391 |

| a | | Non-income producing security. |

| b | | Partially held by a broker as collateral for open short positions. |

| Portfolio Summary (Unaudited)† | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Information Technology | | 24.4 | | Financial | | 10.0 |

| Health Care | | 19.7 | | Materials | | 8.0 |

| Consumer Discretionary | | 18.7 | | Computers | | 7.2 |

| Industrial | | 16.4 | | Telecommunication Services | | .9 |

| Consumer Staples | | 15.2 | | Utilities | | .3 |

| Energy | | 12.1 | | | | 132.9 |

| |

| † Based on net assets. | | | | | | |

| See notes to financial statements. | | | | | | |

14

STATEMENT OF SECURITIES SOLD SHORT

October 31, 2008

| Common Stocks—32.9% | | Shares | | Value ($) |

| |

| |

|

| Consumer Discretionary—4.2% | | | | |

| Abercrombie & Fitch, Cl. A | | 140 | | 4,054 |

| Clear Channel Outdoor Holdings, Cl. A | | 2,999 a | | 18,714 |

| Gentex | | 773 | | 7,412 |

| Meredith | | 774 | | 14,992 |

| Office Depot | | 6,827 a | | 24,577 |

| OfficeMax | | 115 | | 926 |

| Sherwin-Williams | | 175 | | 9,959 |

| Starwood Hotels & Resorts Worldwide | | 214 | | 4,824 |

| | | | | 85,458 |

| Consumer Staples—2.3% | | | | |

| Clorox | | 177 | | 10,763 |

| Del Monte Foods | | 1,550 | | 9,781 |

| Estee Lauder, Cl. A | | 94 | | 3,388 |

| Hormel Foods | | 787 | | 22,241 |

| | | | | 46,173 |

| Energy—2.2% | | | | |

| Anadarko Petroleum | | 300 | | 10,590 |

| BJ Services | | 100 | | 1,285 |

| Continental Resources | | 356 a | | 11,531 |

| Hercules Offshore | | 1,284 a | | 9,360 |

| Rowan | | 229 | | 4,154 |

| Southern Union | | 390 | | 6,716 |

| | | | | 43,636 |

| Financial—4.6% | | | | |

| Cincinnati Financial | | 466 | | 12,112 |

| City National | | 100 | | 5,353 |

| Fidelity National Financial, Cl. A | | 1,470 | | 13,245 |

| First American | | 590 | | 12,042 |

| Janus Capital Group | | 281 | | 3,299 |

| Lazard, Cl. A | | 180 | | 5,430 |

| Legg Mason | | 528 | | 11,716 |

| Old Republic International | | 2,910 | | 26,801 |

| T Rowe Price Group | | 101 | | 3,994 |

| | | | | 93,992 |

The Fund 15

STATEMENT OF SECURITIES SOLD SHORT (continued)

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Health Care—6.1% | | | | |

| Barr Pharmaceuticals | | 35 a | | 2,249 |

| Cooper | | 850 | | 14,008 |

| DaVita | | 390 a | | 22,133 |

| ImClone Systems | | 70 a | | 4,813 |

| King Pharmaceuticals | | 879 a | | 7,726 |

| Sepracor | | 896 a | | 11,935 |

| UnitedHealth Group | | 1,359 | | 32,249 |

| Zimmer Holdings | | 609 a | | 28,276 |

| | | | | 123,389 |

| Industrial—6.5% | | | | |

| Con-way | | 205 | | 6,979 |

| Donaldson | | 346 | | 12,161 |

| Gardner Denver | | 500 a | | 12,810 |

| Graco | | 903 | | 22,331 |

| IDEX | | 235 | | 5,447 |

| Iron Mountain | | 1,216 a | | 29,524 |

| JB Hunt Transport Services | | 500 | | 14,215 |

| Masco | | 531 | | 5,390 |

| Pentair | | 128 | | 3,538 |

| Robert Half International | | 783 | | 14,775 |

| Timken | | 243 | | 3,859 |

| | | | | 131,029 |

| Information Technology—3.3% | | | | |

| ADC Telecommunications | | 778 a | | 4,932 |

| Cadence Design Systems | | 2,256 a | | 9,182 |

| Cognizant Technology Solutions, Cl. A | | 143 a | | 2,746 |

| Compuware | | 300 a | | 1,914 |

| Ingram Micro, Cl. A | | 535 a | | 7,132 |

16

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Information Technology (continued) | | | | |

| International Rectifier | | 143 a | | 2,208 |

| Lam Research | | 351 a | | 7,849 |

| Molex | | 1,195 | | 17,220 |

| Novellus Systems | | 905 a | | 14,299 |

| | | | | 67,482 |

| Materials—3.6% | | | | |

| Dow Chemical | | 200 | | 5,334 |

| Eagle Materials | | 347 | | 6,145 |

| Hercules | | 120 | | 2,017 |

| Scotts Miracle-Gro, Cl. A | | 1,100 | | 28,732 |

| Weyerhaeuser | | 800 | | 30,576 |

| | | | | 72,804 |

| Telecommunication Services—.1% | | | | |

| Sprint Nextel | | 648 | | 2,028 |

| Total Securities Sold Short (proceeds $886,182) | | 32.9% | | 665,991 |

| |

| a Non-income producing security. | | | | |

| See notes to financial statements. | | | | |

The Fund 17

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2008

| | | | | | | Cost | | Value |

| |

| |

| |

| |

|

| Assets ($): | | | | | | | | |

| Investments in securities—See Statement of Investments | | 3,801,150 | | 2,685,569 |

| Cash | | | | | | | | 22,457 |

| Receivable for investment securities sold | | | | | | 107,055 |

| Receivable from broker for proceeds | | | | | | |

| on securities sold short | | | | | | | | 60,366 |

| Dividends receivable | | | | | | | | 1,968 |

| Prepaid expenses | | | | | | | | 28,380 |

| | | | | | | | | 2,905,795 |

| |

| |

| |

| |

|

| Liabilities ($): | | | | | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(d) | | | | 8,480 |

| Securities sold short, at value (proceeds $886,182)—See | | | | |

| Statement of Securities Sold Short | | | | | | 665,991 |

| Payable for investment securities purchased | | | | | | 170,487 |

| Due to Broker | | | | | | | | 415 |

| Dividends payable on securities sold short | | | | | | 387 |

| Accrued expenses | | | | | | | | 38,644 |

| | | | | | | | | 884,404 |

| |

| |

| |

| |

|

| Net Assets ($) | | | | | | | | 2,021,391 |

| |

| |

| |

| |

|

| Composition of Net Assets ($): | | | | | | | | |

| Paid-in capital | | | | | | | | 3,385,444 |

| Accumulated net realized gain (loss) on investments | | | | | | (468,663) |

| Accumulated net unrealized appreciation (depreciation) | | | | | | |

| on investments and securities sold short | | | | | | (895,390) |

| |

| |

| |

|

| Net Assets ($) | | | | | | | | 2,021,391 |

| |

| |

| |

| |

|

| |

| |

| Net Asset Value Per Share | | | | | | | | |

| | | Class A | | Class C | | Class I | | Class T |

| |

| |

| |

| |

|

| Net Assets ($) | | 1,425,980 | | 235,226 | | 183,937 | | 176,248 |

| Shares Outstanding | | 193,671 | | 32,201 | | 24,919 | | 24,000 |

| |

| |

| |

| |

|

| Net Asset Value Per Share ($) | | 7.36 | | 7.30 | | 7.38 | | 7.34 |

| |

| See notes to financial statements. | | | | | | | | |

18

| STATEMENT OF OPERATIONS | | |

| Year Ended October 31, 2008 | | |

| |

|

| |

| |

| |

| |

| Investment Income ($): | | |

| Income: | | |

| Cash dividends | | 51,144 |

| Interest | | 19,658 |

| Total Income | | 70,802 |

| Expenses: | | |

| Management fee—Note 3(a) | | 23,874 |

| Legal fees | | 84,018 |

| Auditing fees | | 38,773 |

| Interest on securities sold short | | 25,260 |

| Registration fees | | 16,609 |

| Dividends on securities sold short | | 10,031 |

| Custodian fees—Note 3(d) | | 7,935 |

| Shareholder servicing costs—Note 3(d) | | 7,524 |

| Prospectus and shareholders’ reports | | 5,638 |

| Distribution fees—Note 3(c) | | 2,897 |

| Trustees’ fees and expenses—Note 3(b) | | 1,250 |

| Loan commitment fees—Note 2 | | 1 |

| Miscellaneous | | 10,364 |

| Total Expenses | | 234,174 |

| Less—expense reimbursement from The Dreyfus | | |

| Corporation due to undertaking—Note 3(a) | | (153,915) |

| Less—reduction in fees due to earnings credits—Note 1(b) | | (553) |

| Net Expenses | | 79,706 |

| Investment (Loss)—Net | | (8,904) |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

| Net realized gain (loss) on investments: | | |

| Long transactions | | (674,924) |

| Short sale transactions | | 206,339 |

| Net Realized Gain (Loss) | | (468,585) |

| Net unrealized appreciation (depreciation) | | |

| on investments and securities sold short | | (889,263) |

| Net Realized and Unrealized Gain (Loss) on Investments | | (1,357,848) |

| Net (Decrease) in Net Assets Resulting from Operations | | (1,366,752) |

| |

| See notes to financial statements. | | |

The Fund 19

STATEMENT OF CASH FLOWS

Year Ended October 31, 2008 |

| Cash Flows from Operating Activities ($): | | | | |

| Purchases of portfolio securities | | (3,134,467) | | |

| Proceed from sales of portfolio securities | | 2,711,343 | | |

| Proceeds from securities sold short | | 110,126 | | |

| Dividends received | | 50,312 | | |

| Interest received | | 19,658 | | |

| Interest and dividends paid | | (35,023) | | |

| Operating expenses paid | | (191,627) | | |

| Paid from The Dreyfus Corporation | | 164,123 | | (305,555) |

| |

| |

|

| Cash Flows from Financing Activites ($): | | | | |

| Paid-in-capital | | | | 287497 |

| Cash at beginning of period | | | | 40,515 |

| Cash at end of period | | | | 22,457 |

| |

| |

|

| Reconciliation of Net Increase in Net Assets Resulting from | | | | |

| Operations to Net Cash Provided by Operating Activities | | | | |

| Net Decrease in Net Assets Resulting from Operations | | | | (1,366,752) |

| |

| |

|

| Adjustments to reconcile net increase in net assets resulting | | | | |

| from operations to net cash provided by operating activities ($): | | |

| Purchases of portfolio securities | | | | (3,134,467) |

| Proceeds from sales of portfolio securities | | | | 2,711,343 |

| Proceeds from securities sold short | | | | 110,126 |

| Increase in interest and dividends | | | | |

| payable on securities sold short | | | | 268 |

| Increase in accrued operating expenses | | | | 11,209 |

| Decrease in prepaid expenses | | | | (28,380) |

| Increase in Due to The Dreyfus Corporation | | | | 34,082 |

| Net realized gains on investments | | | | 468,585 |

| Net unrealized depreciation on investments | | | | 889,263 |

| Decrease in dividends and income receivable | | | | (832) |

| Net Cash Provided by Operating Activities | | | | (305,555) |

| |

| See notes to financial statements. | | | | |

20

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended October 31, |

| | |

|

| | | 2008 | | 2007a |

| |

| |

|

| Operations ($): | | | | |

| Investment (loss)—net | | (8,904) | | (816) |

| Net realized gain (loss) on investments | | (468,585) | | 25 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | (889,263) | | (6,127) |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | (1,366,752) | | (6,918) |

| |

| |

|

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A Shares | | 303,506 | | 2,207,564 |

| Class C Shares | | 144,341 | | 300,000 |

| Class I Shares | | 11,206 | | 300,000 |

| Class T Shares | | — | | 300,000 |

| Cost of shares redeemed: | | | | |

| Class A Shares | | (122,167) | | — |

| Class C Shares | | (49,389) | | — |

| Increase (Decrease) in Net Assets | | | | |

| from Beneficial Interest Transactions | | 287,497 | | 3,107,564 |

| Total Increase (Decrease) in Net Assets | | (1,079,255) | | 3,100,646 |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 3,100,646 | | — |

| End of Period | | 2,021,391 | | 3,100,646 |

| |

| |

|

| Capital Share Transactions (Shares): | | | | |

| Class A | | | | |

| Shares sold | | 28,213 | | 176,661 |

| Shares redeemed | | (11,203) | | — |

| Net Increase (Decrease) in Shares Outstanding | | 17,010 | | 176,661 |

| |

| |

|

| Class C | | | | |

| Shares sold | | 13,472 | | 24,000 |

| Shares redeemed | | (5,271) | | — |

| Net Increase (Decrease) in Shares Outstanding | | 8,201 | | 24,000 |

| |

| |

|

| Class I | | | | |

| Shares sold | | 919 | | 24,000 |

| |

| |

|

| Class T | | | | |

| Shares sold | | — | | 24,000 |

| |

| a From October 18, 2007 (commencement of operations) to October 31, 2007. | | |

| See notes to financial statements. | | | | |

The Fund 21

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | Year Ended October 31, |

| | |

|

| Class A Shares | | 2008 | | 2007a |

| |

| |

|

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | | 12.47 | | 12.50 |

| Investment Operations: | | | | |

| Investment (loss)—netb | | (.02) | | (.00)c |

| Net realized and unrealized gain (loss) on investments | | (5.09) | | (.03) |

| Total from Investment Operations | | (5.11) | | (.03) |

| Net asset value, end of period | | 7.36 | | 12.47 |

| |

| |

|

| Total Return (%)d | | (40.98) | | (.24)e |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | | 8.24 | | 25.89f |

| Ratio of net expenses to average net assets | | 2.76 | | 1.60f |

| Ratio of net investment (loss) to average net assets | | (.24) | | (.63)f |

| Portfolio Turnover Rate | | 77.50 | | .12e |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 1,426 | | 2,203 |

| a | | From October 18, 2007 (commencement of operations) to October 31, 2007. |

| b | | Based on average shares outstanding at each month end. |

| c | | Amount represents less than $.01. |

| d | | Exclusive of sales charge. |

| e | | Not annualized. |

| f | | Annualized. |

| See notes to financial statements. |

22

| | | Year Ended October 31, |

| | |

|

| Class C Shares | | 2008 | | 2007a |

| |

| |

|

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | | 12.47 | | 12.50 |

| Investment Operations: | | | | |

| Investment (loss)—netb | | (.10) | | (.01) |

| Net realized and unrealized gain (loss) on investments | | (5.07) | | (.02) |

| Total from Investment Operations | | (5.17) | | (.03) |

| Net asset value, end of period | | 7.30 | | 12.47 |

| |

| |

|

| Total Return (%)c | | (41.46) | | (.24)d |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | | 9.13 | | 26.52e |

| Ratio of net expenses to average net assets | | 3.52 | | 2.35e |

| Ratio of net investment (loss) to average net assets | | (.99) | | (1.38)e |

| Portfolio Turnover Rate | | 77.50 | | .12d |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 235 | | 299 |

| a | | From October 18, 2007 (commencement of operations) to October 31, 2007. |

| b | | Based on average shares outstanding at each month end. |

| c | | Exclusive of sales charge. |

| d | | Not annualized. |

| e | | Annualized. |

| See notes to financial statements. |

The Fund 23

| | FINANCIAL HIGHLIGHTS (continued) |

| | | Year Ended October 31, |

| | |

|

| Class I Shares | | 2008 | | 2007a |

| |

| |

|

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | | 12.47 | | 12.50 |

| Investment Operations: | | | | |

| Investment income (loss)—netb,c | | .00 | | (.00) |

| Net realized and unrealized gain (loss) on investments | | (5.09) | | (.03) |

| Total from Investment Operations | | (5.09) | | (.03) |

| Net asset value, end of period | | 7.38 | | 12.47 |

| |

| |

|

| Total Return (%) | | (40.82) | | (.24)d |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | | 8.00 | | 25.52e |

| Ratio of net expenses to average net assets | | 2.51 | | 1.35e |

| Ratio of net investment income (loss) to average net assets | | .01 | | (.38)e |

| Portfolio Turnover Rate | | 77.50 | | .12d |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 184 | | 299 |

| a | | From October 18, 2007 (commencement of operations) to October 31, 2007. |

| b | | Based on average shares outstanding at each month end. |

| c | | Amount represents less than $.01. |

| d | | Not annualized. |

| e | | Annualized. |

| See notes to financial statements. |

24

| | | Year Ended October 31, |

| | |

|

| Class T Shares | | 2008 | | 2007a |

| |

| |

|

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | | 12.47 | | 12.50 |

| Investment Operations: | | | | |

| Investment (loss)—netb | | (.05) | | (.00)c |

| Net realized and unrealized gain (loss) on investments | | (5.08) | | (.03) |

| Total from Investment Operations | | (5.13) | | (.03) |

| Net asset value, end of period | | 7.34 | | 12.47 |

| |

| |

|

| Total Return (%)d | | (41.14) | | (.24)e |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | | 8.46 | | 26.02f |

| Ratio of net expenses to average net assets | | 3.01 | | 1.85f |

| Ratio of net investment (loss) to average net assets | | (.49) | | (.88)f |

| Portfolio Turnover Rate | | 77.50 | | .12e |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 176 | | 299 |

| a | | From October 18, 2007 (commencement of opertions) to October 31, 2007. |

| b | | Based on average shares outstanding at each month end. |

| c | | Amount represents less than $.01. |

| d | | Exclusive of sales charge. |

| e | | Not annualized. |

| f | | Annualized. |

| See notes to financial statements. |

The Fund 25

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus 130/30 Growth Fund (the “fund”) is a separate diversified series of The Dreyfus/Laurel Funds Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company offering seven series, as of October 31, 2008, including the fund. The fund’s investment objective seeks capital appreciation. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Mellon Capital Management Corporation (“Mellon Capital”), an affiliate of BNY Mellon, serves as the fund’s sub-Investment adviser.

At a meeting of the fund’s Board of Trustees held on July 24, 2008, the Board approved, effective December 1, 2008, a proposal to change the name of the fund from “Dreyfus Premier 130/30 Growth Fund” to “Dreyfus 130/30 Growth Fund”.

Effective July 1, 2008, BNY Mellon has reorganized and consolidated a number of its banking and trust company subsidiaries. As a result of the reorganization, any services previously provided to the fund by Mellon Bank, N.A. or Mellon Trust of New England, N.A. are now provided by The Bank of New York, which has changed its name to The Bank of New York Mellon.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus is the distributor of the fund’s shares.The fund is authorized to issue an unlimited number of shares of Beneficial Interest in each of the following classes of shares: Class A, Class C, Class I and Class T. Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear a distribution fee and/or service fee. Class A shares are sold with a front-end sales charge, while Class C shares are subject to a contingent deferred sales charge (“CDSC”). Class I shares are sold primarily to bank trust departments and other financial service providers (includingThe Bank of NewYork Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus), act-

26

ing on behalf of customers having a qualified trust or investment account or relationship at such institution, and bear no distribution or service fees. Class I shares are offered without a front-end sales charge or CDSC. Class T shares are subject to a sales charge imposed at the time of purchase and bear distribution and service fees. Each class of shares has identical rights and privileges, except with respect to distribution and service fees, the allocation of certain transfer agency costs and voting rights on matters affecting a single class. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

As of October 31, 2008, MBC Investments Corp., an indirect subsidiary of BNY Mellon, held 168,000 Class A shares and 24,000 in each of Class C, Class I and Class T shares of the fund.

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sale price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is avail-

The Fund 27

| NOTES TO FINANCIAL STATEMENTS (continued) |

able. Registered investment companies that are not traded on an exchange are valued at their net asset value.When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts. For other securities that are fair valued by the Board of Trustees, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. Financial futures are valued at the last sales price.

The Financial Accounting Standards Board (“FASB”) released Statement of Financial Accounting Standards No. 157 “Fair Value Measurements” (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements. The application of FAS 157 is required for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. Management does not believe that the application of this standard will have a material impact on the financial statements of the fund.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

28

The fund has arrangements with the custodian and cash management banks whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

(c) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

(d) Concentration of risk: The fund enters into short sales. Short sales involve selling a security the fund does not own in anticipation that the security’s price will decline. Short sales may involve substantial risk and “leverage.”The fund may be required to buy the security sold short at a time when the security has appreciated in value, thus resulting in a loss to the fund. Short positions in stocks involve more risk than long positions in stocks. In theory, stocks sold short have unlimited risk.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

The fund adopted FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, pre-

The Fund 29

| NOTES TO FINANCIAL STATEMENTS (continued) |

sented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Liability for tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax expense in the current year.The adoption of FIN 48 had no impact on the operations of the fund for the period ended October 31, 2008.

As of and during the period ended October 31, 2008, the fund did not have any liabilities for any unrecognized tax positions. The fund recognizes interest and penalties, if any, related to unrecognized tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the four-year period ended October 31, 2008 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At October 31, 2008, the components of accumulated earnings on a tax basis were as follows: accumulated capital losses $462,837 and unrealized depreciation $901,216.

The accumulated capital loss carryover is available for federal tax purposes to be applied against future net securities profits, if any, realized subsequent to October 31, 2008. If not applied the carryover expires in fiscal 2016.

During the period ended October 31, 2008, as a result of permanent book to tax differences, primarily due to the tax treatment for net operating losses, the fund increased accumulated undistributed investment income-net by $8,904, decreased accumulated net realized gain (loss) on investments by $78 and decreased paid-in capital by $8,826. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

Prior to October 15, 2008, the fund participated with other Dreyfus-managed funds in a $350 million redemption credit facility. Effective

30

October 15, 2008 the fund participates with other Dreyfus-managed funds in a $145 million redemption credit facility (the “Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowing. During the period ended October 31, 2008, the fund did not borrow under either Facility.

NOTE 3—Investment Management Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to an Investment Management agreement between the Manager and the Trust, the Trust has agreed to pay the Manager a management fee computed at the annual rate of .85% of the value of the fund’s average daily net assets and is payable monthly.The Manager has contractually agreed until March 1, 2010, to waive receipt of its fees and/or assume the expenses of the fund so that annual fund operating expenses (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest, brokerage commissions, commitments fess on borrowings such as interest charged by the fund’s prime broker, substitute dividend expenses on securities sold short, and extraordinary expenses) do not exceed 1.25% .The expense reimbursement, pursuant to the undertaking, amounted to $153,915 during the period ended October 31, 2008.

Pursuant to a Sub-Investment Advisory Agreement between Dreyfus and Mellon Capital, Dreyfus pays Mellon Capital an annual fee of .41% of the value of the fund’s average net assets, payable monthly.

During the period ended October 31, 2008, the Distributor retained $28 from commissions earned on sales of the fund’s Class A shares.

(b) Each Trustee receives $45,000 per year, plus $6,000 for each joint Board meeting of The Dreyfus/Laurel Funds, Inc., The Trust and The Dreyfus/Laurel Tax-Free Municipal Funds, (collectively, the “Dreyfus/Laurel Funds”) attended, $2,000 for separate in-person committee meetings attended which are not held in conjunction with a

The Fund 31

| NOTES TO FINANCIAL STATEMENTS (continued) |

regularly scheduled Board meeting and $1,500 for Board meetings and separate committee meetings attended that are conducted by telephone and is reimbursed for travel and out-of-pocket expenses.With respect to Board meetings, the Chairman of the Board receives an additional 25% of such compensation (with the exception of reimbursable amounts). With respect to compensation committee meetings, the Chair of the compensation committee receives $900 per meeting and, with respect to audit committee meetings, prior to April 12, 2008, the Chair of the audit committee received $1,350 per meeting. In the event that there is an in-person joint meeting of the Dreyfus/Laurel Funds and Dreyfus High Yield Strategies Fund, the $2,000 or $1,500 fee, as applicable, will be allocated between the Dreyfus/Laurel Funds and Dreyfus High Yield Strategies Fund. These fees and expenses are changed and allocated to each series based on net assets. Amounts required to be paid by the Trust directly to the non-interested Trustees, that would be applied to offset a portion of the management fee payable by certain other series of the Trust to the Manager, are in fact paid directly by the Manager to the non-interested Trustees.

(c) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Class C and Class T shares pay the Distributor for distributing their shares at an annual rate of .75% of the value of their average daily net assets of Class C shares and .25% of the value of the average daily net assets of Class T shares. During the period ended October 31, 2008, Class C and Class T shares were charged $2,264 and $633, pursuant to the Plan.

(d) Under the Shareholder Services Plan, Class A, Class C and Class T shares pay the Distributor at an annual rate of ..25% of the value of their average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to

32

the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended October 31, 2008, Class A, Class C and Class T shares were charged $4,975, $755 and $633, respectively, pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended October 31, 2008, the fund was charged $661 pursuant to the transfer agency agreement.

The fund compensates The Bank of New York Mellon under a cash management agreement for performing cash management services related to fund subscriptions and redemptions. During the period ended October 31, 2008, the fund was charged $157 pursuant to the cash management agreement.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended October 31, 2008, the fund was charged $7,935 pursuant to the custody agreement.

During the period ended October 31, 2008, the fund was charged $6,203 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $1,442, Rule 12b-1 distribution plan fees $186, shareholder services plan fees $385, custodian fees $4,374, chief compliance officer fees $1,973 and transfer agency per account fees $120.

The Fund 33

| NOTES TO FINANCIAL STATEMENTS (continued) |

(e) Prime broker fees charged on the fund are included in interest expense.

NOTE 4—Securities Transactions:

The following summarizes the aggregate amount of purchases and sales of investment securities and securities sold short, excluding short-term securities, during the period ended October 31, 2008.

| | | Purchases ($) | | Sales ($) |

| |

| |

|

| Long transactions | | 3,304,954 | | 2,818,398 |

| Short sale transactions | | 1,133,910 | | 1,303,986 |

| Total | | 4,438,864 | | 4,122,384 |

The fund is engaged in short-selling which obligates the fund to replace the security borrowed by purchasing the security at current market value.The fund would incur a loss if the price of the security increases between the date of the short sale and the date on which the fund replaces the borrowed security.The fund would realize a gain if the price of the security declines between those dates. Until the fund replaces the borrowed security, the fund will maintain daily a segregated account with a broker or custodian, of permissible liquid assets sufficient to cover its short position. Securities sold short at October 31, 2008, and their related market values and proceeds are set forth in the Statement of Securities Sold Short.

At October 31, 2008, the cost of investments for federal income tax purposes was $3,806,976; accordingly, accumulated net unrealized depreciation on investments was $1,121,407, consisting of $25,299 gross unrealized appreciation and $1,146,706 gross unrealized depreciation.

In March 2008, the FASB released Statement of Financial Accounting Standards No. 161 “Disclosures about Derivative Instruments and Hedging Activities” (“FAS 161”). FAS 161 requires qualitative disclosures about objectives and strategies for using derivatives, quantitative

34

disclosures about fair value amounts of gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements.The application of FAS 161 is required for fiscal years and interim periods beginning after November 15, 2008. At this time, management is evaluating the implications of FAS 161 and its impact on the financial statements and the accompanying notes has not yet been determined.

NOTE 5—Subsequent Event:

Effective on or about February 4, 2009 (the “Effective Date”), the fund will issue to each holder of its Class T shares, in exchange for said shares, Class A shares of the fund having an aggregate net asset value equal to the aggregate net asset value of the shareholder’s Class T shares.Thereafter, the fund will no longer offer Class T shares.

Effective on or about December 3, 2008, no investments for new accounts were permitted in Class T of the fund, except that participants in certain group retirement plans were able to open a new account in Class T of the fund, provided that the fund was established as an investment option under the plans before December 3, 2008. After the Effective Date, subsequent investments in the fund’s Class A shares made by holders of the fund’s Class T shares who received Class A shares of the fund in exchange for their Class T shares will be subject to the front-end sales load schedule currently in effect for Class T shares. Otherwise, all other Class A share attributes will be in effect.

The Fund 35

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM |

The Board of Trustees and Shareholders The Dreyfus/Laurel Funds Trust:

We have audited the accompanying statement of assets and liabilities of Dreyfus 130/30 Growth Fund (formerly Dreyfus Premier 130/30 Growth Fund), a series ofThe Dreyfus/Laurel FundsTrust (the “Fund”), including the statements of investments and securities sold short, as of October 31, 2008, and the related statement of operations for the year then ended, the statement of cash flows, the statement of changes in net assets and the financial highlights for the year then ended and for the period from October 18, 2007 (commencement of operations) to October 31, 2007.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2008, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received.An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus 130/30 Growth Fund as of October 31, 2008, the results of its operations for the year ended, its cash flows, the changes in its net assets and its financial highlights for the year then ended and for the period from October 18, 2007 (commencement of operations) to October 31, 2007, in conformity with U.S. generally accepted accounting principles.

| | New York, New York

December 23, 2008 |

36

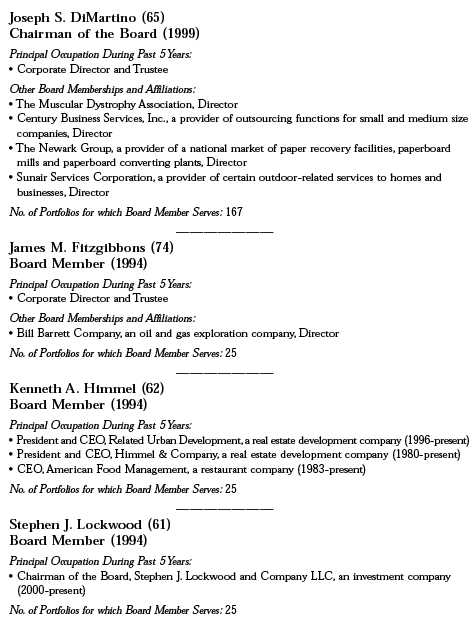

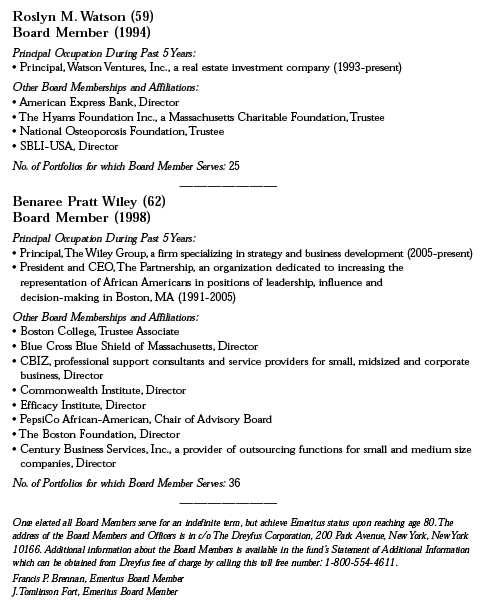

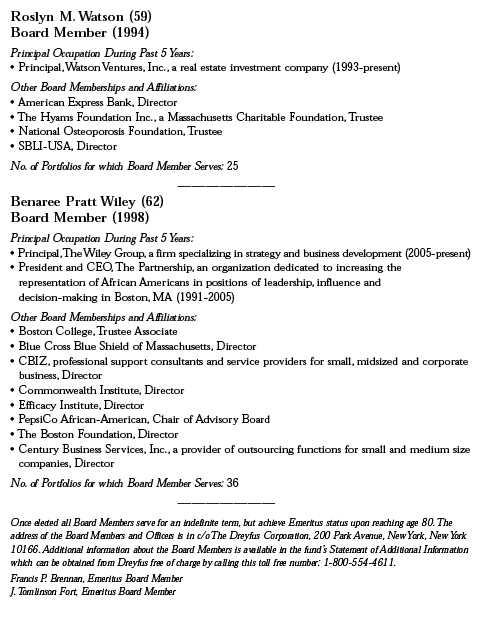

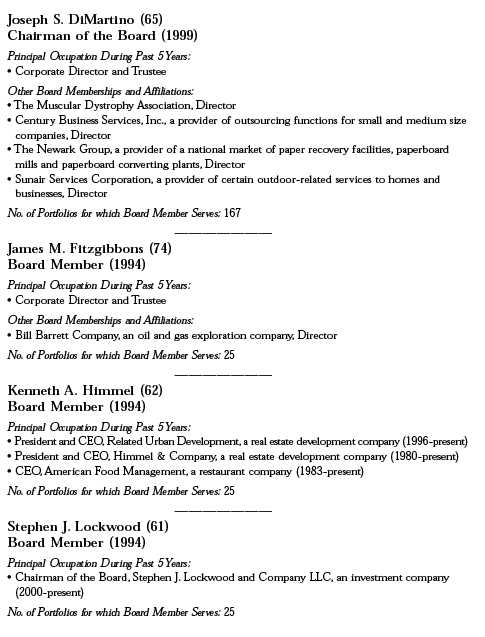

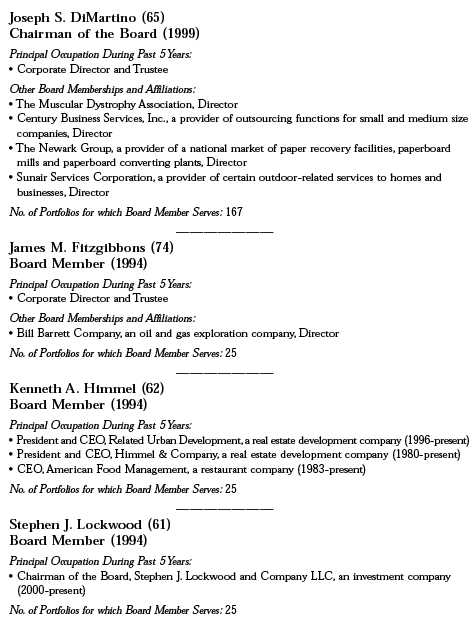

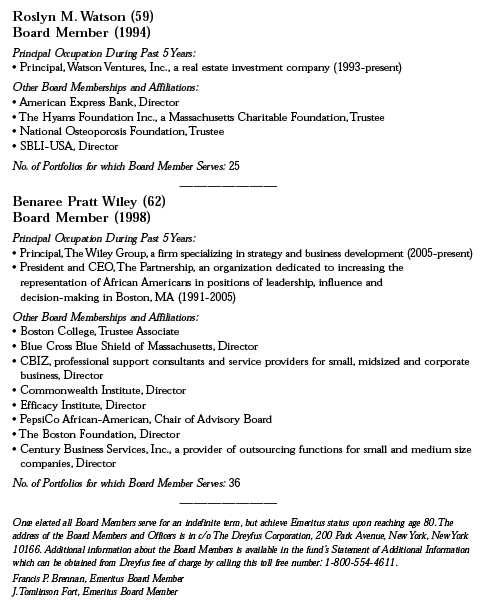

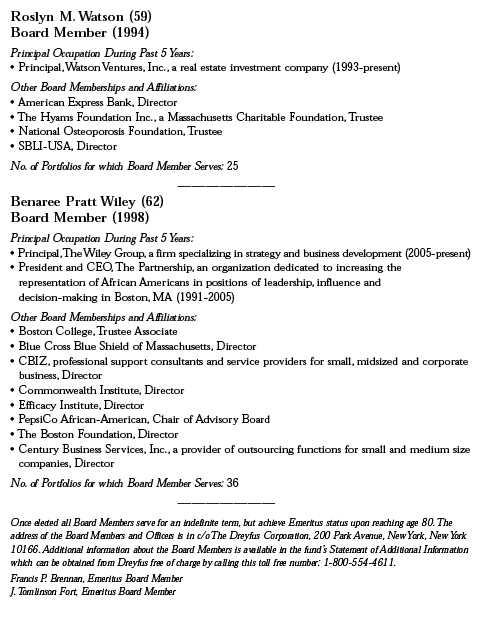

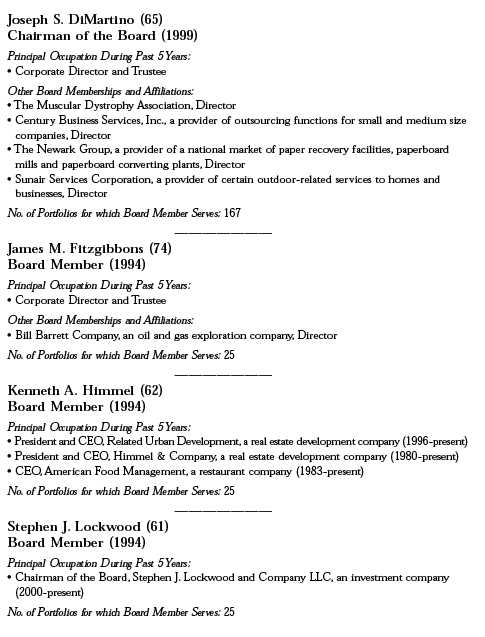

BOARD MEMBERS INFORMATION (Unaudited)

The Fund 37

BOARD MEMBERS INFORMATION (Unaudited) (continued)

38

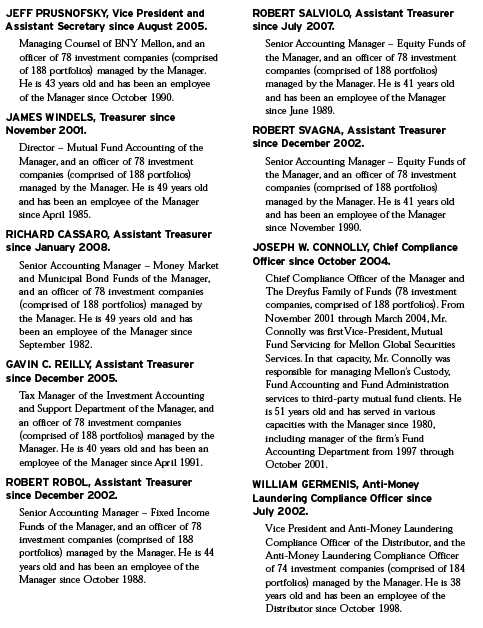

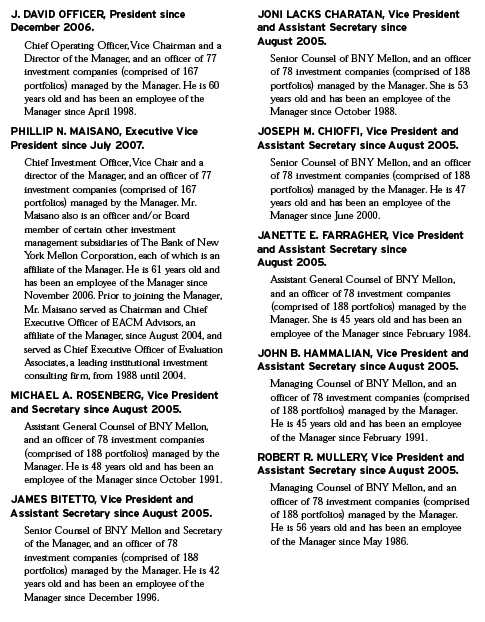

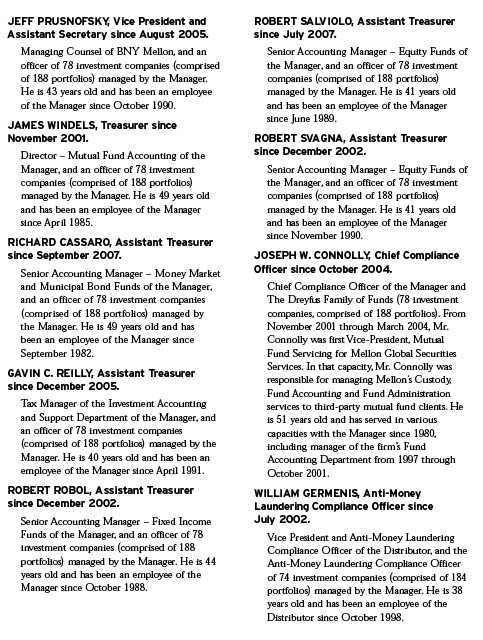

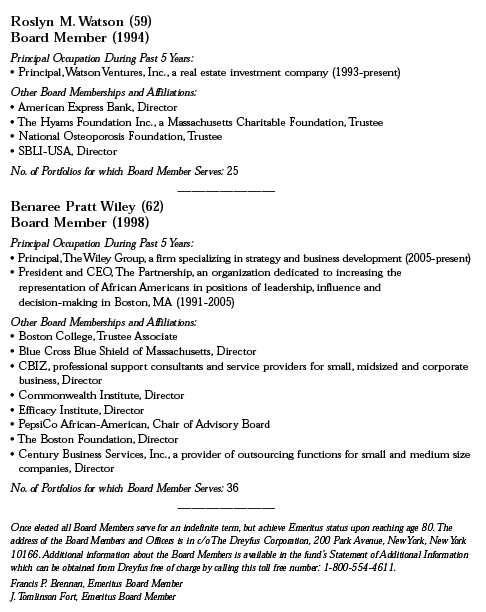

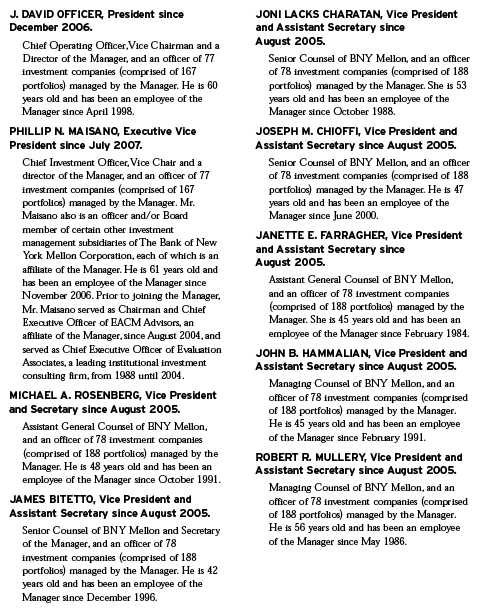

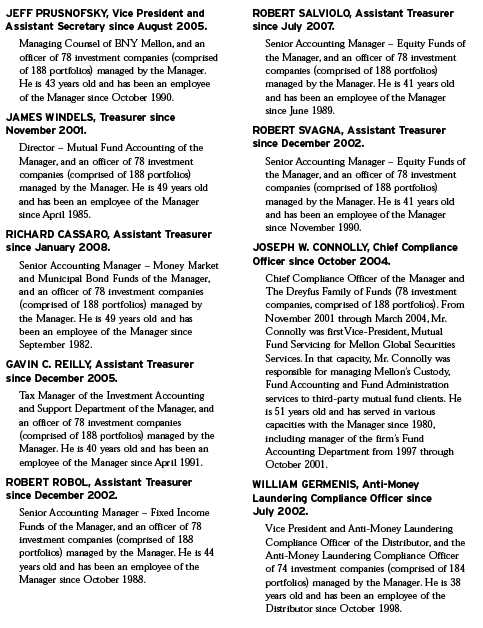

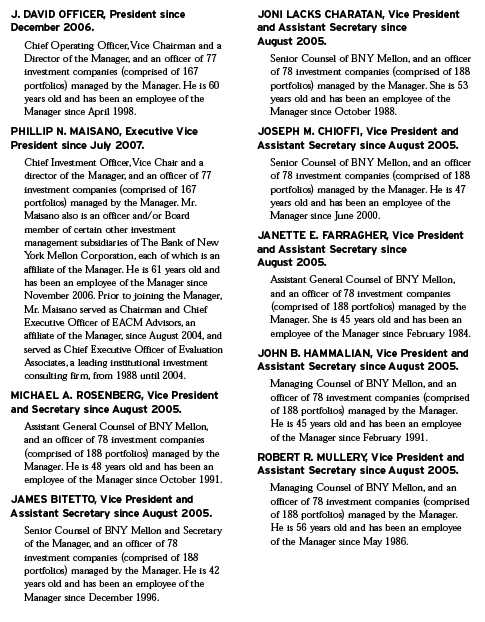

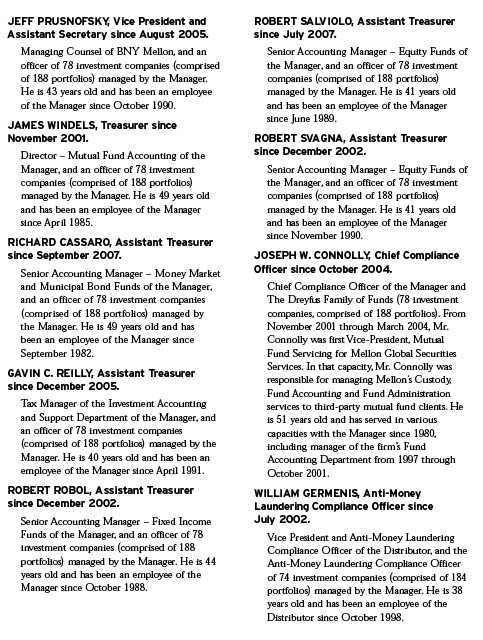

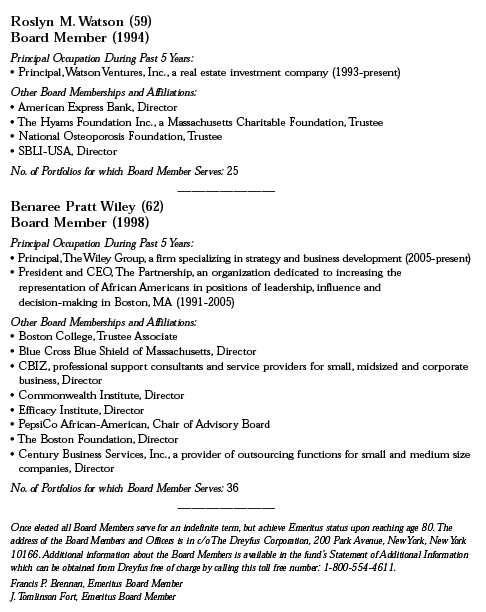

OFFICERS OF THE FUND (Unaudited)

The Fund 39

OFFICERS OF THE FUND (Unaudited) (continued)

40

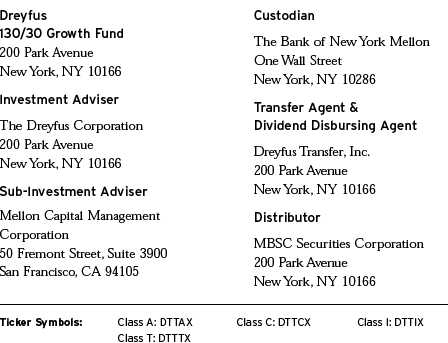

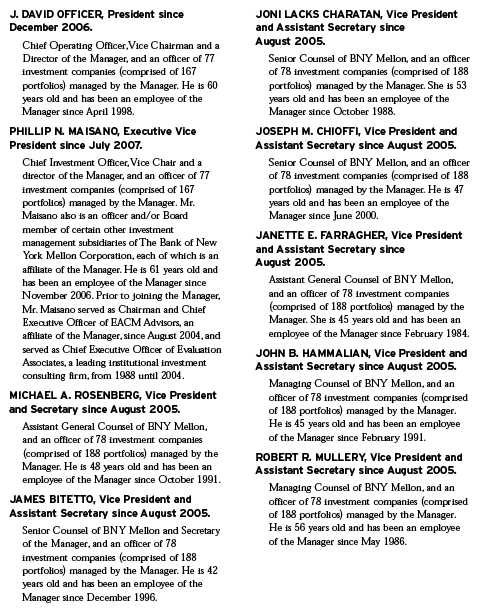

For More Information

Telephone Call your financial representative or 1-800-554-4611

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the fund voted these proxies for the 12-month period ended June 30, 2008, is available at http://www.dreyfus.com. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-645-6561.

| © 2008 MBSC Securities Corporation |

| | Dreyfus

Global Equity

Income Fund |

| | ANNUAL REPORT October 31, 2008 |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured Not Bank-Guaranteed May Lose Value

| | Contents |

| |

| | THE FUND |

| |

| 2 | A Letter from the CEO |

| |

| 3 | Discussion of Fund Performance |

| |

| 6 | Fund Performance |

| |

| 8 | Understanding Your Fund’s Expenses |

| |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| |

| 9 | Statement of Investments |

| |

| 13 | Statement of Assets and Liabilities |

| |

| 14 | Statement of Operations |

| |

| 15 | Statement of Changes in Net Assets |

| |

| 17 | Financial Highlights |

| |

| 21 | Notes to Financial Statements |

| |

| 34 | Report of Independent Registered Public Accounting Firm |

| |

| 35 | Important Tax Information |

| |

| 36 | Board Members Information |

| |

| 38 | Officers of the Fund |

| |

| | FOR MORE INFORMATION |

| |

| | Back Cover |

| |

| Dreyfus |

| Global Equity |

| Income Fund |

The Fund

A LETTER FROM THE CEO

Dear Shareholder:

We present to you this annual report for Dreyfus Global Equity Income Fund, covering the 12-month period from November 1, 2007, through October 31, 2008.

These are difficult times for international investors. A credit crunch that began in the United States in 2007 has developed into a full-blown global financial crisis, recently resulting in the failure of several major financial institutions. Meanwhile, the global economic slowdown has gathered momentum, depressing investor sentiment, consumer confidence and business investment around the world.These factors undermined equity returns in most regions, including formerly high-flying emerging markets.

The depth and duration of the economic downturn will depend on how quickly the global financial system can be stabilized. We believe that government efforts in the United States and Europe meet several critical requirements for addressing today’s financial stresses, and we expect them to contribute to a more orderly deleveraging process. However, recuperation from the financial crisis is likely to take time. In the meantime, we encourage you to keep in touch with your financial advisor and maintain a long-term and disciplined perspective to investing.Indeed,we already are seeing some positive signs, including a likely peak in global inflationary pressures, attractive valuations among fundamentally sound companies and a large pool of worldwide financial liquidity that could be deployed gradually as the economic cycle turns.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund’s Portfolio Manager.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chief Executive Officer

The Dreyfus Corporation

November 17, 2008 |

2

DISCUSSION OF FUND PERFORMANCE

For the period of November 1, 2007, through October 31, 2008, as provided by James Harries, Portfolio Manager

Fund and Market Performance Overview

For the 12-month period ended October 31, 2008, Dreyfus Global Equity Income Fund’s Class A shares produced a total return of –42.41%, Class C shares returned –42.76%, Class I shares returned –42.27% and Class T shares returned –42.54% .1 In comparison, the fund’s benchmark, the FTSEWorld Index (the“Index”),produced a total return of –42.31% for the same period.2

Stock markets throughout the world posted sharp declines due to a slowing global economy and a severe banking crisis. Relatively strong fund performance over the first half of the reporting period was offset by weakness during the second half stemming from underweighted exposure to the United States and relatively heavy positions in the emerging markets, causing the fund to produce returns that were in line with its benchmark.

The Fund’s Investment Approach

The fund seeks total return, consisting of capital appreciation and income.To pursue this goal, the fund normally invests at least 80% of its assets in equity securities.The fund seeks to focus on dividend-paying stocks of companies located in the developed capital markets, such as the United States,Canada,Japan,Australia,Hong Kong andWestern Europe. The fund may invest in the securities of companies of any market capitalization, and it may invest up to 30% of its assets in emerging markets.

We combine “top-down” analysis of current economic trends and investment themes with “bottom-up” stock selection based on fundamental research. Within markets and sectors deemed to be relatively attractive, we seek attractively priced stocks of companies that we believe to have sustainable competitive advantages.

Global Financial Crisis Sparked Broad Declines

Following a downward trend established by the United States, most regions of the world suffered from slowing economic growth, fueling

The Fund 3

| DISCUSSION OF FUND PERFORMANCE (continued) |

fears of a potentially deep and prolonged global recession. Commodity prices that had soared over the reporting period’s first half plummeted over the second half as global demand eased.

Meanwhile, a global credit crunch that began in 2007 developed into a full-blown financial crisis later in the reporting period, and poor liquidity conditions in the credit markets nearly led to the collapse of the global banking system in September 2008. Government and regulatory authorities intervened, pumping billions of dollars into the system to restore a degree of investor confidence. These efforts included capital infusions by the United States, United Kingdom and other governments, as well as coordinated reductions of short-term interest rates by major central banks.

As market conditions deteriorated, many highly leveraged institutional investors were forced to de-lever their portfolios, selling their more liquid investments to raise cash for margin calls and redemptions. Selling pressure led to broadly lower prices even among fundamentally sound markets and stocks.The financials sector was particularly hard-hit.

Early Gains Erased by “Flight to Quality”

The fund produced relatively strong results over the reporting period’s first half, when overweighted exposure to faster-growing emerging markets enabled the fund to participate more fully in their gains.At the same time, relatively light exposure to dollar- and yen-denominated stocks in the U.S. and Japanese markets, respectively, helped the fund avoid the full brunt of those equities’ and currencies’ early declines. However, the trends supporting these results later reversed.When the global banking system almost ground to a halt, investors responded by flocking to traditional safe havens, including the U.S. dollar and Japanese yen, which strengthened relative to most other currencies. Conversely, currencies in the emerging markets lost value.