UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-00524 |

| |

| The Dreyfus/Laurel Funds Trust | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6400 |

| |

Date of fiscal year end: | 10/31 | |

Date of reporting period: | 10/31/18 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

Dreyfus Global Equity Income Fund

Dreyfus International Bond Fund

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Global Equity Income Fund

| | | |

| | ANNUAL REPORT

October 31, 2018 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

| | | | |

| |

Dreyfus Global Equity Income Fund

| | The Fund |

A LETTER FROM THE PRESIDENT OF DREYFUS

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Global Equity Income Fund, covering the 12-month period from November 1, 2017 through October 31, 2018. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Markets began the reporting period on solid footing as major global economies experienced above-trend growth across the board. In the United States, the Federal Reserve continued to move away from its accommodative monetary policy while other major central banks also began to consider monetary tightening. In the equity markets, both U.S. and non-U.S. markets enjoyed an upward trend, though investor concerns about volatility and inflation later began to weigh on returns. Interest rates rose across the curve, putting pressure on bond prices.

Later in the reporting period, global growth trends began to diverge. While a strong economic performance continued to bolster U.S. equity markets, slower growth and political concerns pressured markets in the Eurozone. Emerging markets also came under pressure as weakness in their currencies added to investors’ uneasiness. Fixed income markets continued to struggle as interest rates rose; the yield on the benchmark 10-year Treasury bond surged late in the reporting period, but growing investor concerns about global growth helped keep it from rising further.

Despite continuing doubts regarding trade, U.S. inflationary pressures, and global growth, we are optimistic that the U.S. economy will remain strong in the near term. However, we will stay attentive to signs that signal potential changes on the horizon. As always, we encourage you to discuss the risks and opportunities of today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Renee Laroche-Morris

President

The Dreyfus Corporation

November 15, 2018

2

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from November 1, 2017 through October 31, 2018, as provided by portfolio manager Nick Clay of Newton Investment Management (North America) Limited, Sub-Investment Adviser

Market and Fund Performance Overview

For the 12-month period ended October 31, 2018, Dreyfus Global Equity Income Fund’s Class A shares produced a total return of 3.14%, Class C shares returned 2.41%, Class I shares returned 3.43%, and Class Y shares returned 3.53%.1 In comparison, the fund’s benchmark, the FTSE World Index (the “Index”), produced a total return of 0.73% for the same period.2

Some global stock indices rose modestly over the reporting period despite an environment of slowing growth, a strong dollar, trade tensions, and geopolitical issues. The fund outperformed the Index, partly due to successful stock selection within the information technology sector and picks within U.S.-based companies.

The Fund’s Investment Approach

The fund seeks total return (consisting of capital appreciation and income). To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities. The fund seeks to focus on dividend-paying stocks of companies located in the developed capital markets, such as the United States, Canada, Japan, Australia, Hong Kong, and Western Europe. The fund may invest in the securities of companies of any market capitalization, and it may invest up to 30% of its assets in emerging markets. The fund’s portfolio managers typically will purchase stocks that, at the time of purchase, have a yield premium to the yield of the Index.

The portfolio manager will combine a top-down approach, emphasizing current economic trends and current investment themes on a global basis, with a bottom-up stock selection, based on fundamental research. Within markets and sectors determined to be relatively attractive, the portfolio manager seeks what are believed to be attractively priced companies that possess a sustainable competitive advantage in their market or sector.

Volatility Returned to Global Markets

In contrast to most of 2017, the first quarter of 2018 proved to be something of a roller coaster ride for global equity markets. After starting the year with a bang, February marked the return of volatility to markets, as worries prompted by stronger-than-expected inflation data and subsequently higher bond yields, caused a sell-off across most asset classes. Market turbulence resurfaced in March, driven by fears of a global trade war between the U.S. and China, coupled with weakness in technology stocks, notably those that had propelled the market higher during its parabolic rise. Over the second quarter of 2018, the U.S. Federal Reserve (the “Fed”) continued to increase interest rates. President Trump’s protectionist rhetoric on trade pressured markets. Another area of focus was Italy, where a constitutional crisis at the end of May, briefly roiled markets. On a more positive note, the U.S. economy continued to strengthen, as it reaped the benefits of 2017’s tax cuts, though in certain areas, faster cost inflation and tightening labor supply started to weigh upon corporate profitability.

The U.S. stock market continued to enjoy strong gains, largely attributable to robust corporate earnings, throughout the third quarter of 2018, amid a mixed performance for

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

equity indices more broadly. Emerging markets, in particular, were burdened by a slowdown in the pace of Chinese credit growth, fears over their vulnerability to tighter U.S. monetary policy, and worries about the potential repercussions of global trade tensions. Elsewhere, the United Kingdom’s (UK) impending departure from the European Union (EU) remained a significant concern for investors, while Italian politics caused volatility to return to markets, as the coalition government’s spending plans threatened to breach EU deficit thresholds. Despite a late rally, the last month of the review period was a torrid one, attributable to the escalating, U.S.-China trade dispute and other concerns, including rising U.S. debt, inflation, and interest rates. In the U.S., the S&P 500 Index endured a sharp, monthly decline as did the UK’s FTSE 100.

Information Technology and U.S.-Based Stocks Benefited Results

At the sector level, the fund benefited most from stock selection within information technology, owing largely to the holdings in Cisco Systems, CA, and India-based Infosys. Further positives came from the underweight to bank stocks and positioning in the industrials sector. At a country level, stock selection in the U.S. was particularly strong. Elsewhere, pharmaceutical stocks helped make Switzerland an area of strength, while the void in Germany was another positive. The top contributor to performance over the period was networking systems provider, Cisco Systems, which issued a series of promising results throughout the period, demonstrating progress with its transformation, as growth rates accelerated and the recurring revenue mix increased. Software company, CA, was a top performer, after Broadcom announced its plan to acquire the company in a deal worth close to $19 billion. Over the last 12 months, the luxury fashion retailer, Ralph Lauren, has performed well, with the company delivering successfully on its plan to shrink its presence and reduce its footprint, with the aim of boosting its strong brand and repairing margins.

Conversely, positioning within the consumer services sector was the biggest detractor, owing largely to the holding in Swedish, low-cost fashion retailer, Hennes & Mauritz, and from the void in Amazon.com, which the strategy cannot hold as it does not produce a sufficient yield. Not holding any health care equipment stocks was also a negative. At a country level, positioning in the UK detracted most, with British American Tobacco and Vodafone Group both weak over the period. British American Tobacco was the largest stock detractor, declining on continued concerns over possible price wars for next-generation products (NGP), and worries about their profitability. Hennes & Mauritz labored for much of the review period, reporting disappointing sales and ongoing challenges in its inventory position. Beauty-products manufacturer, Coty, performed poorly, as investors focused on weakness in its consumer-beauty division, following its acquisition of the Procter & Gamble cosmetics business.

Maintaining a Cautious Investment Posture

Given that abundant liquidity has explained much of the momentum seen in financial markets over the last decade, we believe its reversal is likely to create wider financial distress, a tougher economic environment, and a weakening of support for asset prices. The draining of liquidity, particularly from the offshore-dollar financial system, is already desiccating some of the more indebted corners of the global economy, such as Argentina and Turkey. We remain wary of the environment potentially created by cheap borrowing and a strengthening U.S. currency. Risks abound, too, in the spread of protectionist and nationalist politics,

4

which threaten to obstruct the cooperation that promotes economic well-being and the resolution of crises.

As the cost of money rises, and liquidity is syphoned from the financial system, the distortions wrought by previous policy are likely to be thrown more clearly into relief. Against that backdrop, a sharp focus on the specific attributes of investment candidates appears vital. We are comfortable that the fund remains exposed to stable, haven-like companies with good-quality balance sheets, with a lower weighting in more cyclical areas of the market such as industrials, financials, and mining companies.

November 15, 2018

1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Past performance is no guarantee of future results.

2 Source: Lipper Inc. — The FTSE World Index is a market capitalization-weighted index representing the performance of the large- and mid-cap stocks from the Developed and Advanced Emerging segments of the FTSE Global Equity Index Series. It reflects reinvestment of net dividends and, where applicable, capital gain distributions. Investors cannot invest directly in any index.

Equities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund’s performance will be influenced by political, social, and economic factors affecting investments in foreign companies. Special risks associated with investments in foreign companies include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability, and differing auditing and legal standards. These risks generally are greater with emerging market countries than with more economically and politically established foreign countries.

5

FUND PERFORMANCE (Unaudited)

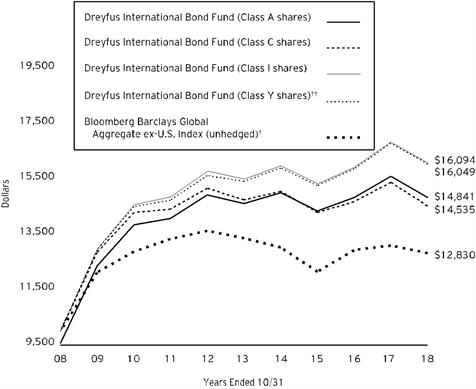

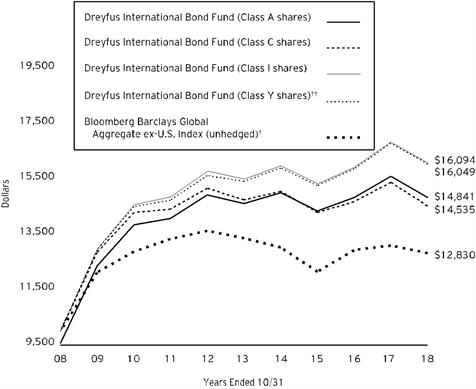

Comparison of change in value of $10,000 investment in Dreyfus Global Equity Income Fund Class A shares, Class C shares, Class I shares and Class Y shares and the FTSE World Index (the “Index”)

† Source: Lipper Inc.

†† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales charges for Class A shares.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and Class Y shares of Dreyfus Global Equity Income Fund on 10/31/08 to a $10,000 investment made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Index is a market capitalization-weighted index representing the performance of the large- and mid-cap stocks from the Developed and Advanced Emerging segments of the FTSE Global Equity Index Series. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | |

Average Annual Total Returns as of 10/31/18 |

| | Inception | | | From |

| Date | 1 Year | 5 Years | Inception |

Class A shares | | | | |

with maximum sales charge (5.75%) | 10/18/07 | -2.78% | 5.39% | 10.04% |

without sales charge | 10/18/07 | 3.14% | 6.64% | 10.69% |

Class C shares | | | | |

with applicable redemption charge† | 10/18/07 | 1.41% | 5.87% | 9.87% |

without redemption | 10/18/07 | 2.41% | 5.87% | 9.87% |

Class I shares | 10/18/07 | 3.43% | 6.92% | 11.01% |

Class Y shares | 7/1/13 | 3.53% | 7.01% | 10.54%†† |

FTSE World Index | | 0.73% | 6.95% | 10.48% |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales charges for Class A shares.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to Dreyfus.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Global Equity Income Fund from May 1, 2018 to October 31, 2018. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | |

Expenses and Value of a $1,000 Investment |

assuming actual returns for the six months ended October 31, 2018 |

| | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | | $6.02 | | $9.71 | | $4.61 | | $4.26 |

Ending value (after expenses) | | $1,008.50 | | $1,005.70 | | $1,010.40 | | $1,010.60 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | | |

Expenses and Value of a $1,000 Investment |

assuming a hypothetical 5% annualized return for the six months ended October 31, 2018 |

| | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | | $6.06 | | $9.75 | | $4.63 | | $4.28 |

Ending value (after expenses) | | $1,019.21 | | $1,015.53 | | $1,020.62 | | $1,020.97 |

† Expenses are equal to the fund’s annualized expense ratio of 1.19% for Class A, 1.92% for Class C, .91% for Class I and .84% for Class Y, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

8

STATEMENT OF INVESTMENTS

October 31, 2018

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 95.8% | | | | | |

Australia - 1.1% | | | | | |

Dexus | | | | 610,681 | | 4,422,369 | |

France - 5.2% | | | | | |

Sanofi | | | | 97,848 | | 8,745,725 | |

Television Francaise 1 | | | | 409,824 | | 4,165,619 | |

Total | | | | 142,086 | | 8,338,911 | |

| | | | | 21,250,255 | |

Hong Kong - 1.5% | | | | | |

Link REIT | | | | 680,500 | | 6,023,177 | |

India - 2.8% | | | | | |

Infosys, ADR | | | | 1,195,664 | | 11,322,938 | |

Israel - 1.5% | | | | | |

Bank Hapoalim | | | | 870,620 | | 5,880,552 | |

Japan - 1.4% | | | | | |

Japan Tobacco | | | | 216,800 | | 5,574,819 | |

Netherlands - 4.5% | | | | | |

RELX | | | | 478,398 | a | 9,466,250 | |

Royal Dutch Shell, Cl. A | | | | 282,007 | | 8,952,934 | |

| | | | | 18,419,184 | |

New Zealand - .4% | | | | | |

Spark New Zealand | | | | 617,385 | | 1,594,673 | |

Norway - 1.8% | | | | | |

Orkla | | | | 824,079 | | 7,102,663 | |

South Korea - 1.2% | | | | | |

Macquarie Korea Infrastructure Fund | | | | 616,880 | | 4,905,789 | |

Sweden - 1.8% | | | | | |

Hennes & Mauritz, Cl. B | | | | 422,147 | | 7,430,002 | |

Switzerland - 9.1% | | | | | |

Nestle | | | | 83,841 | | 7,071,030 | |

Novartis | | | | 139,547 | | 12,186,108 | |

Roche Holding | | | | 35,286 | | 8,562,083 | |

Zurich Insurance Group | | | | 28,798 | | 8,935,719 | |

| | | | | 36,754,940 | |

United Kingdom - 16.6% | | | | | |

BAE Systems | | | | 1,241,582 | | 8,340,105 | |

British American Tobacco | | | | 119,275 | | 5,175,796 | |

British American Tobacco, ADR | | | | 104,739 | | 4,545,673 | |

Centrica | | | | 4,602,969 | | 8,649,656 | |

Diageo | | | | 386,641 | | 13,372,813 | |

Informa | | | | 1,371,342 | | 12,497,426 | |

Unilever | | | | 207,083 | | 10,965,780 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 95.8% (continued) | | | | | |

United Kingdom - 16.6% (continued) | | | | | |

Vodafone Group | | | | 1,876,667 | | 3,544,607 | |

| | | | | 67,091,856 | |

United States - 46.9% | | | | | |

CA | | | | 408,796 | | 18,134,191 | |

Cisco Systems | | | | 504,196 | | 23,066,967 | |

CMS Energy | | | | 152,922 | | 7,572,697 | |

Coty, Cl. A | | | | 784,786 | | 8,279,492 | |

Emerson Electric | | | | 60,342 | | 4,096,015 | |

Eversource Energy | | | | 116,965 | | 7,399,206 | |

Gilead Sciences | | | | 143,565 | | 9,788,262 | |

Harley-Davidson | | | | 23,152 | | 884,869 | |

Maxim Integrated Products | | | | 224,446 | | 11,226,789 | |

McDonald's | | | | 24,009 | | 4,247,192 | |

Merck & Co. | | | | 130,032 | | 9,571,656 | |

Omnicom Group | | | | 136,827 | | 10,168,983 | |

Paychex | | | | 103,337 | | 6,767,540 | |

PepsiCo | | | | 120,672 | | 13,561,119 | |

Philip Morris International | | | | 85,798 | | 7,556,230 | |

Principal Financial Group | | | | 75,834 | | 3,569,506 | |

Procter & Gamble | | | | 86,765 | | 7,694,320 | |

Qualcomm | | | | 217,718 | | 13,692,284 | |

Ralph Lauren | | | | 66,003 | | 8,554,649 | |

Verizon Communications | | | | 89,423 | | 5,105,159 | |

Western Union | | | | 504,459 | | 9,100,442 | |

| | | | | 190,037,568 | |

Total Common Stocks (cost $341,597,345) | | | | 387,810,785 | |

| | | Preferred Dividend

Yield (%) | | | | | |

Preferred Stocks - 1.5% | | | | | |

South Korea - 1.5% | | | | | |

Samsung Electronics

(cost $6,367,536) | | 4.42 | | 190,758 | | 6,011,169 | |

10

| | | | | | | | |

| |

Description | | 7-Day

Yield (%) | | Shares | | Value ($) | |

Investment Companies - 1.7% | | | | | |

Registered Investment Companies - 1.7% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund

(cost $7,103,715) | | 2.21 | | 7,103,715 | b | 7,103,715 | |

Total Investments (cost $355,068,596) | | 99.0% | | 400,925,669 | |

Cash and Receivables (Net) | | 1.0% | | 4,059,017 | |

Net Assets | | 100.0% | | 404,984,686 | |

ADR—American Depository Receipt

REIT—Real Estate Investment Trust

a Non-income producing security.

b Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Food, Beverage & Tobacco | 15.8 |

Pharmaceuticals Biotechnology & Life Sciences | 12.1 |

Software & Services | 11.2 |

Technology Hardware & Equipment | 7.2 |

Household & Personal Products | 6.6 |

Media & Entertainment | 6.6 |

Semiconductors & Semiconductor Equipment | 6.2 |

Utilities | 5.8 |

Energy | 4.3 |

Insurance | 3.1 |

Capital Goods | 3.1 |

Real Estate | 2.6 |

Telecommunication Services | 2.5 |

Commercial & Professional Services | 2.3 |

Consumer Durables & Apparel | 2.1 |

Retailing | 1.8 |

Registered Investment Companies | 1.8 |

Banks | 1.5 |

Diversified Financials | 1.2 |

Consumer Services | 1.0 |

Automobiles & Components | .2 |

| | 99.0 |

† Based on net assets.

See notes to financial statements.

11

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | | |

Registered Investment Company | Value

10/31/17($) | Purchases($) | Sales($) | Value

10/31/18($) | Net

Assets(%) | Dividends/ Distributions($) |

Dreyfus Institutional Preferred Government Plus Money Market Fund | 7,454,389 | 101,569,428 | 101,920,102 | 7,103,715 | 1.7 | 153,361 |

See notes to financial statements.

12

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2018

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments: | | | |

Unaffiliated issuers | 347,964,881 | | 393,821,954 | |

Affiliated issuers | | 7,103,715 | | 7,103,715 | |

Cash denominated in foreign currency | | | 944 | | 917 | |

Receivable for investment securities sold | | 2,702,587 | |

Tax reclaim receivable | | 1,281,481 | |

Receivable for shares of Beneficial Interest subscribed | | 1,113,031 | |

Dividends receivable | | 865,596 | |

Prepaid expenses | | | | | 41,936 | |

| | | | | 406,931,217 | |

Liabilities ($): | | | | |

Due to The Dreyfus Corporation and affiliates—Note 3(c) | | | | 343,330 | |

Payable for investment securities purchased | | 926,533 | |

Payable for shares of Beneficial Interest redeemed | | 487,482 | |

Unrealized depreciation on foreign currency transactions | | 72,635 | |

Trustees fees and expenses payable | | 5,936 | |

Accrued expenses | | | | | 110,615 | |

| | | | | 1,946,531 | |

Net Assets ($) | | | 404,984,686 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 337,939,869 | |

Total distributable earnings (loss) | | | | | 67,044,817 | |

Net Assets ($) | | | 404,984,686 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 50,381,694 | 49,067,747 | 262,268,485 | 43,266,760 | |

Shares Outstanding | 3,747,221 | 3,540,111 | 20,434,033 | 3,373,865 | |

Net Asset Value Per Share ($) | 13.45 | 13.86 | 12.83 | 12.82 | |

| | | | | | |

See notes to financial statements. | | | | | |

13

STATEMENT OF OPERATIONS

Year Ended October 31, 2018

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $943,809 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 14,910,182 | |

Affiliated issuers | | | 153,361 | |

Total Income | | | 15,063,543 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 3,274,361 | |

Shareholder servicing costs—Note 3(c) | | | 575,087 | |

Distribution fees—Note 3(b) | | | 402,933 | |

Professional fees | | | 107,723 | |

Registration fees | | | 74,228 | |

Custodian fees—Note 3(c) | | | 52,910 | |

Trustees’ fees and expenses—Note 3(d) | | | 33,831 | |

Prospectus and shareholders’ reports | | | 31,687 | |

Loan commitment fees—Note 2 | | | 9,310 | |

Miscellaneous | | | 45,922 | |

Total Expenses | | | 4,607,992 | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (30) | |

Net Expenses | | | 4,607,962 | |

Investment Income—Net | | | 10,455,581 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | 25,184,620 | |

Net realized gain (loss) on forward foreign currency exchange contracts | 72,323 | |

Net Realized Gain (Loss) | | | 25,256,943 | |

Net unrealized appreciation (depreciation) on investments

and foreign currency transactions | | | (20,398,988) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 4,857,955 | |

Net Increase in Net Assets Resulting from Operations | | 15,313,536 | |

| | | | | | | |

See notes to financial statements. | | | | | |

14

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended October 31, |

| | | | 2018 | | 2017 | a |

Operations ($): | | | | | | | | |

Investment income—net | | | 10,455,581 | | | | 9,624,359 | |

Net realized gain (loss) on investments | | 25,256,943 | | | | 10,702,222 | |

Net unrealized appreciation (depreciation)

on investments | | (20,398,988) | | | | 38,636,943 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 15,313,536 | | | | 58,963,524 | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (2,521,246) | | | | (4,798,604) | |

Class C | | | (1,787,035) | | | | (2,150,837) | |

Class I | | | (15,846,465) | | | | (13,832,262) | |

Class Y | | | (2,328,181) | | | | (2,015,754) | |

Total Distributions | | | (22,482,927) | | | | (22,797,457) | |

Beneficial Interest Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 8,984,877 | | | | 31,242,217 | |

Class C | | | 4,372,847 | | | | 8,265,220 | |

Class I | | | 64,500,690 | | | | 168,254,236 | |

Class Y | | | 1,353,406 | | | | 2,657,462 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 2,267,559 | | | | 4,502,221 | |

Class C | | | 1,417,496 | | | | 1,572,305 | |

Class I | | | 13,114,517 | | | | 11,572,448 | |

Class Y | | | 2,328,181 | | | | 2,015,754 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (14,673,704) | | | | (94,716,690) | |

Class C | | | (13,313,233) | | | | (15,508,713) | |

Class I | | | (106,425,860) | | | | (128,923,452) | |

Class Y | | | (288,536) | | | | (168,315) | |

Increase (Decrease) in Net Assets

from Beneficial Interest Transactions | (36,361,760) | | | | (9,235,307) | |

Total Increase (Decrease) in Net Assets | (43,531,151) | | | | 26,930,760 | |

Net Assets ($): | |

Beginning of Period | | | 448,515,837 | | | | 421,585,077 | |

End of Period | | | 404,984,686 | | | | 448,515,837 | |

15

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | | | | | | | | |

| | | | Year Ended October 31, |

| | | | 2018 | | 2017 | a |

Capital Share Transactions (Shares): | |

Class Ab,c | | | | | | | | |

Shares sold | | | 654,298 | | | | 2,462,302 | |

Shares issued for distributions reinvested | | | 166,259 | | | | 365,278 | |

Shares redeemed | | | (1,069,107) | | | | (7,440,200) | |

Net Increase (Decrease) in Shares Outstanding | (248,550) | | | | (4,612,620) | |

Class Cc | | | | | | | | |

Shares sold | | | 309,150 | | | | 627,440 | |

Shares issued for distributions reinvested | | | 100,890 | | | | 123,960 | |

Shares redeemed | | | (945,361) | | | | (1,167,121) | |

Net Increase (Decrease) in Shares Outstanding | (535,321) | | | | (415,721) | |

Class Ib | | | | | | | | |

Shares sold | | | 4,921,022 | | | | 13,619,577 | |

Shares issued for distributions reinvested | | | 1,006,935 | | | | 963,569 | |

Shares redeemed | | | (8,101,980) | | | | (10,356,032) | |

Net Increase (Decrease) in Shares Outstanding | (2,174,023) | | | | 4,227,114 | |

Class Y | | | | | | | | |

Shares sold | | | 102,157 | | | | 205,855 | |

Shares issued for distributions reinvested | | | 178,961 | | | | 168,389 | |

Shares redeemed | | | (21,939) | | | | (13,626) | |

Net Increase (Decrease) in Shares Outstanding | 259,179 | | | | 360,618 | |

| | | | | | | | | | |

a | Distributions to shareholders include $1,600,237 Class A, $474,957 Class C, $6,867,270 Class I and $975,360 Class Y of distributions from net investment income and $3,198,367 Class A, $1,675,880 Class C, $6,964,992 Class I and $1,040,394 Class Y distributions from net realized gains. Distributions in excess of investment income—net was $832,481 in 2017 and is no longer presented as a result of the adoption of SEC’s Disclosure Update and Simplification Rule. | |

b | During the period ending October 31, 2017, 3,813 Class A shares representing $49,347 were exchanged for 3,973 Class I shares. | |

c | During the period ended October 31, 2018, 13,617 Class C shares representing $191,642 were automatically converted to 14,036 Class A shares. | |

See notes to financial statements. | | | | | | | | |

16

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class A Shares | | 2018 | 2017 | 2016 | 2015 | 2014 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 13.65 | 12.57 | 12.62 | 12.56 | 12.31 |

Investment Operations: | | | | | | |

Investment income—neta | | .31 | .24 | .27 | .30 | .44 |

Net realized and unrealized

gain (loss) on investments | | .13 | 1.49 | .48 | .21 | .24 |

Total from Investment Operations | | .44 | 1.73 | .75 | .51 | .68 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.32) | (.27) | (.27) | (.33) | (.43) |

Dividends from net realized

gain on investments | | (.32) | (.38) | (.53) | (.12) | - |

Total Distributions | | (.64) | (.65) | (.80) | (.45) | (.43) |

Net asset value, end of period | | 13.45 | 13.65 | 12.57 | 12.62 | 12.56 |

Total Return (%)b | | 3.14 | 14.30 | 6.31 | 4.33 | 5.48 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.18 | 1.28 | 1.27 | 1.28 | 1.30 |

Ratio of net expenses

to average net assets | | 1.18 | 1.28 | 1.27 | 1.28 | 1.30 |

Ratio of net investment income

to average net assets | | 2.26 | 1.93 | 2.16 | 2.42 | 3.49 |

Portfolio Turnover Rate | | 21.82 | 26.35 | 27.90 | 30.89 | 33.28 |

Net Assets, end of period ($ x 1,000) | | 50,382 | 54,546 | 108,189 | 78,449 | 97,153 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

17

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class C Shares | | 2018 | 2017 | 2016 | 2015 | 2014 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 13.98 | 12.79 | 12.84 | 12.76 | 12.50 |

Investment Operations: | | | | | | |

Investment income—neta | | .22 | .18 | .18 | .21 | .35 |

Net realized and unrealized

gain (loss) on investments | | .12 | 1.50 | .48 | .22 | .24 |

Total from Investment Operations | | .34 | 1.68 | .66 | .43 | .59 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.14) | (.11) | (.18) | (.23) | (.33) |

Dividends from net realized

gain on investments | | (.32) | (.38) | (.53) | (.12) | - |

Total Distributions | | (.46) | (.49) | (.71) | (.35) | (.33) |

Net asset value, end of period | | 13.86 | 13.98 | 12.79 | 12.84 | 12.76 |

Total Return (%)b | | 2.41 | 13.56 | 5.49 | 3.53 | 4.71 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.91 | 2.01 | 2.02 | 2.03 | 2.04 |

Ratio of net expenses

to average net assets | | 1.91 | 2.01 | 2.02 | 2.03 | 2.04 |

Ratio of net investment income

to average net assets | | 1.53 | 1.36 | 1.42 | 1.64 | 2.71 |

Portfolio Turnover Rate | | 21.82 | 26.35 | 27.90 | 30.89 | 33.28 |

Net Assets, end of period ($ x 1,000) | | 49,068 | 56,969 | 57,459 | 46,177 | 51,409 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

18

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class I Shares | | 2018 | 2017 | 2016 | 2015 | 2014 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 13.10 | 12.11 | 12.19 | 12.15 | 11.93 |

Investment Operations: | | | | | | |

Investment income—neta | | .33 | .31 | .28 | .32 | .45 |

Net realized and unrealized

gain (loss) on investments | | .12 | 1.39 | .47 | .20 | .23 |

Total from Investment Operations | | .45 | 1.70 | .75 | .52 | .68 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.40) | (.33) | (.30) | (.36) | (.46) |

Dividends from net realized

gain on investments | | (.32) | (.38) | (.53) | (.12) | - |

Total Distributions | | (.72) | (.71) | (.83) | (.48) | (.46) |

Net asset value, end of period | | 12.83 | 13.10 | 12.11 | 12.19 | 12.15 |

Total Return (%) | | 3.43 | 14.65 | 6.65 | 4.52 | 5.71 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | .90 | .99 | 1.01 | 1.03 | 1.04 |

Ratio of net expenses

to average net assets | | .90 | .99 | 1.01 | 1.03 | 1.04 |

Ratio of net investment income

to average net assets | | 2.55 | 2.42 | 2.32 | 2.65 | 3.66 |

Portfolio Turnover Rate | | 21.82 | 26.35 | 27.90 | 30.89 | 33.28 |

Net Assets, end of period ($ x 1,000) | | 262,268 | 296,215 | 222,595 | 102,827 | 121,131 |

a Based on average shares outstanding.

See notes to financial statements.

19

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class Y Shares | | 2018 | 2017 | 2016 | 2015 | 2014 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 13.09 | 12.11 | 12.19 | 12.14 | 11.92 |

Investment Operations: | | | | | | |

Investment income—neta | | .34 | .31 | .30 | .33 | .46 |

Net realized and unrealized

gain (loss) on investments | | .12 | 1.39 | .46 | .21 | .23 |

Total from Investment Operations | | .46 | 1.70 | .76 | .54 | .69 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.41) | (.34) | (.31) | (.37) | (.47) |

Dividends from net realized

gain on investments | | (.32) | (.38) | (.53) | (.12) | - |

Total Distributions | | (.73) | (.72) | (.84) | (.49) | (.47) |

Net asset value, end of period | | 12.82 | 13.09 | 12.11 | 12.19 | 12.14 |

Total Return (%) | | 3.53 | 14.68 | 6.72 | 4.68 | 5.78 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | .83 | .92 | .94 | .95 | .96 |

Ratio of net expenses

to average net assets | | .83 | .92 | .94 | .95 | .96 |

Ratio of net investment income

to average net assets | | 2.61 | 2.45 | 2.52 | 2.71 | 3.80 |

Portfolio Turnover Rate | | 21.82 | 26.35 | 27.90 | 30.89 | 33.28 |

Net Assets, end of period ($ x 1,000) | | 43,267 | 40,786 | 33,342 | 26,519 | 28,394 |

a Based on average shares outstanding.

See notes to financial statements.

20

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Global Equity Income Fund (the “fund”) is a separate diversified series of The Dreyfus/Laurel Funds Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering four series, including the fund. The fund’s investment objective is to seek total return (consisting of capital appreciation and income). The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Newton Investment Management (North America) Limited (“Newton”), a wholly-owned subsidiary of BNY Mellon and an affiliate of Dreyfus, serves as the fund’s sub-investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class C, Class I, Class T and Class Y. Class A, Class C and Class T shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A and Class T shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares ten years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. As of the date of this report, the fund did not offer Class T shares for purchase. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

21

NOTES TO FINANCIAL STATEMENTS (continued)

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

22

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Trust’s Board of Trustees (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

23

NOTES TO FINANCIAL STATEMENTS (continued)

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

Forward foreign currency exchange contracts (“forward contracts”) are valued at the forward rate and are generally categorized within Level 2 of the fair value hierarchy.

The following is a summary of the inputs used as of October 31, 2018 in valuing the fund’s investments:

| | | | | |

| | Level 1 - Unadjusted Quoted Prices | Level 2 - Other Significant Observable Inputs | Level 3 -Significant Unobservable Inputs | Total |

Assets ($) | | | |

Investments in Securities: | | | |

Equity Securities - Common Stocks | 205,906,179 | 181,904,606† | - | 387,810,785 |

Equity Securities - Preferred Stocks | - | 6,011,169† | - | 6,011,169 |

Investment Company | 7,103,715 | - | - | 7,103,715 |

† Securities classified within Level 2 at period end as the values were determined pursuant to the fund’s fair valuation procedures.

At October 31, 2018, the amount of securities transferred between levels equals fair value of exchange traded foreign equity securities reported as Level 2 in the table above. At October 31, 2017, there were no transfers between levels of the fair value hierarchy. It is the fund’s policy to recognize transfers between levels at the end of the reporting period.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

24

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are considered “affiliated” under the Act.

(e) Risk: Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

(f) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from investment income-net are normally declared and paid quarterly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended October 31, 2018, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended October 31, 2018, the fund did not incur any interest or penalties.

25

NOTES TO FINANCIAL STATEMENTS (continued)

Each tax year in the four-year period ended October 31, 2018 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At October 31, 2018, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $5,446,470, undistributed capital gains $21,133,588 and unrealized appreciation $40,464,759.

The tax character of distributions paid to shareholders during the fiscal periods ended October 31, 2018 and October 31, 2017 were as follows: ordinary income $13,088,539 and $12,986,187, and long-term capital gains $9,394,388 and $9,811,270 , respectively.

(h) New Accounting Pronouncements: In August 2018, the FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The update provides guidance that eliminates, adds and modifies certain disclosure requirements for fair value measurements. ASU 2018-13 will be effective for annual periods beginning after December 15, 2019. Management is currently assessing the potential impact of these changes to future financial statements.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in an $830 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended October 31, 2018, the fund did not borrow under the Facilities.

NOTE 3—Management Fee, Sub-Investment Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with Dreyfus and the Trust, the Trust had agreed to pay Dreyfus a management fee computed at the annual rate of .75% of the value of the fund’s average daily net assets and is payable monthly.

26

Pursuant to a sub-investment advisory agreement between Dreyfus and Newton, Dreyfus pays Newton an annual fee of .41% of the value of the fund’s average daily net assets.

During the period ended October 31, 2018, the Distributor retained $9,670 from commissions earned on sales of the fund’s Class A shares and $3,286 from CDSC fees on redemptions of the fund’s Class C shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. During the period ended October 31, 2018, Class C shares were charged $402,933 pursuant to the Distribution Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended October 31, 2018, Class A and Class C shares were charged $135,427 and $134,311, respectively, pursuant to the Shareholder Services Plan.

Under its terms, the Distribution Plan and Shareholder Services Plan shall remain in effect from year to year, provided such continuance is approved annually by a vote of a majority of those Trustees who are not “interested persons” of the Trust and who have no direct or indirect financial interest in the operation of or in any agreement related to the Distribution Plan or Shareholder Services Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits, if any, as an expense offset in the Statement of Operations.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing transfer agency and cash management services for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended October 31, 2018, the fund was

27

NOTES TO FINANCIAL STATEMENTS (continued)

charged $13,033 for transfer agency services. These fees are included in Shareholder servicing costs in the Statement of Operations.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended October 31, 2018, the fund was charged $52,910 pursuant to the custody agreement. These fees were partially offset by earnings credits of $30.

During the period ended October 31, 2018, the fund was charged $12,797 for services performed by the Chief Compliance Officer and his staff. These fees are included in Miscellaneous in the Statement of Operations.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $261,127, Distribution Plan fees $31,719, Shareholder Services Plan fees $21,493, custodian fees $22,471, Chief Compliance Officer fees $4,193 and transfer agency fees $2,327.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward contracts, during the period ended October 31, 2018, amounted to $92,681,586 and $143,708,161, respectively.

Derivatives: A derivative is a financial instrument whose performance is derived from the performance of another asset. The fund enters into International Swaps and Derivatives Association, Inc. Master Agreements or similar agreements (collectively, “Master Agreements”) with its over-the-counter (“OTC”) derivative contract counterparties in order to, among other things, reduce its credit risk to counterparties. Master Agreements include provisions for general obligations, representations, collateral and events of default or termination. Under a Master Agreement, the fund may offset with the counterparty certain derivative financial instrument’s payables and/or receivables with collateral held and/or posted and create one single net payment in the event of default or termination.

Each type of derivative instrument that was held by the fund during the period ended October 31, 2018 is discussed below.

28

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract decreases between those dates. With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract increases between those dates. Any realized or unrealized gains or losses which occurred during the period are reflected in the Statement of Operations. The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments. The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is generally limited to the unrealized gain on each open contract. This risk may be mitigated by Master Agreements, if any, between the fund and the counterparty and the posting of collateral, if any, by the counterparty to the fund to cover the fund’s exposure to the counterparty. At October 31, 2018, there were no forward contracts outstanding.

The following summarizes the average market value of derivatives outstanding during the period ended October 31, 2018:

| | | |

| | Average Market Value ($) |

Forward contracts | | 455,991 |

| | | |

At October 31, 2018, the cost of investments for federal income tax purposes was $360,388,248; accordingly, accumulated net unrealized appreciation on investments was $40,537,421, consisting of $69,936,401 gross unrealized appreciation and $29,398,980 gross unrealized depreciation.

29

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees

The Dreyfus/Laurel Funds Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Dreyfus Global Equity Income Fund (the “Fund”), a series of The Dreyfus/Laurel Funds Trust, including the statements of investments and investments in affiliated issuers, as of October 31, 2018, the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of October 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of October 31, 2018, by correspondence with the custodian and brokers or by other appropriate auditing procedures when replies from brokers were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Dreyfus Corporation investment companies since 1994.

New York, New York

December 28, 2018

30

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund elects to provide each shareholder with their portion of the fund's income sourced from foreign countries and taxes paid from foreign countries. The fund reports the maximum amount allowable but not less than $9,925,284 as income sourced from foreign countries for the fiscal year ended October 31, 2018 in accordance with Section 853(c)(2) of the Internal Revenue Code and also the fund reports the maximum amount allowable but not less than $891,786 as taxes paid from foreign countries for the fiscal year ended October 31, 2018 in accordance with Section 853(a) of the Internal Revenue Code. Where required by federal tax rules, shareholders will receive notification of their proportionate share of foreign sourced income and foreign taxes paid for the 2018 calendar year with Form 1099-DIV which will be mailed in early 2019. Also the fund designates the maximum amount allowable, but not less than $13,088,539 as ordinary income dividends paid during the fiscal year ended October 31, 2018 as qualified dividend income in accordance with Section 854(b)(1)(B) of the Internal Revenue Code. Also the fund reports the maximum amount allowable but not less than $.2813 per share as a capital gain dividend in accordance with Section 852(b)(3)(C) of the Internal Revenue Code. Also, the fund reports the maximum amount allowable but not less than $.0352 as a short-term capital gain dividend paid on December 15, 2017 and not less than $.0019 as a short-term capital gain dividend paid on December 28, 2017 in accordance with Sections 871(k)(2) and 881(e) of the Internal Revenue Code. Also, the fund reports the maximum amount allowable but not less than 26.33% of ordinary income dividends paid during the year ended October 31, 2018 as eligible for the corporate dividends received deduction provided under Section 243 of the Internal Revenue Code in accordance with Section 854(b)(1)(A) of the Internal Revenue Code.

31

BOARD MEMBERS INFORMATION (Unaudited)

INDEPENDENT BOARD MEMBERS

Joseph S. DiMartino (75)

Chairman of the Board (1999)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1995-present)

Other Public Company Board Memberships During Past 5 Years:

· CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director (1997-present)

No. of Portfolios for which Board Member Serves: 124

———————

Francine J. Bovich (67)

Board Member (2012)

Principal Occupation During Past 5 Years:

· Trustee, The Bradley Trusts, private trust funds (2011-present)

Other Public Company Board Memberships During Past 5 Years:

· Annaly Capital Management, Inc., a real estate trust, Director (2014-present)

No. of Portfolios for which Board Member Serves: 72

———————

Kenneth A. Himmel (72)

Board Member (1994)

Principal Occupation During Past 5 Years:

· Managing Partner, Gulf Related, an international real estate development company (2010-present)

· President and CEO, Related Urban Development, a real estate development company (1996-present)

· President and CEO, Himmel & Company, a real estate development company (1980-present)

· CEO, American Food Management, a restaurant company (1983-present)

No. of Portfolios for which Board Member Serves: 25

———————

32

Stephen J. Lockwood (71)

Board Member (1994)

Principal Occupation During Past 5 Years:

· Chairman of the Board, Stephen J. Lockwood and Company LLC, a real estate investment company (2000-present)

No. of Portfolios for which Board Member Serves: 25

———————

Roslyn M. Watson (69)

Board Member (1994)

Principal Occupation During Past 5 Years:

· Principal, Watson Ventures, Inc., a real estate investment company (1993-present)

No. of Portfolios for which Board Member Serves: 58

———————

Benaree Pratt Wiley (72)

Board Member (1998)

Principal Occupation During Past 5 Years:

· Principal, The Wiley Group, a firm specializing in strategy and business development (2005-present)

Other Public Company Board Memberships During Past 5 Years:

· CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director (2008-present)

No. of Portfolios for which Board Member Serves: 79

———————

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80. The address of the Board Members and Officers is c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-DREYFUS.

James M. Fitzgibbons, Emeritus Board Member

33

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009, Chairman of Dreyfus Transfer, Inc., an affiliate of the Manager and the transfer agent of the funds, since May 2011 and Chief Executive Officer of MBSC Securities Corporation since August 2016. He is an officer of 62 investment companies (comprised of 124 portfolios) managed by the Manager. He is 59 years old and has been an employee of the Manager since February 1988.

BENNETT A. MACDOUGALL, Chief Legal Officer since October 2015.

Chief Legal Officer of the Manager and Associate General Counsel and Managing Director of BNY Mellon since June 2015; from June 2005 to June 2015, he served in various capacities with Deutsche Bank – Asset & Wealth Management Division, including as Director and Associate General Counsel, and Chief Legal Officer of Deutsche Investment Management Americas Inc. from June 2012 to May 2015. He is an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since June 2015.

JAMES BITETTO, Vice President since August 2005 and Secretary since February 2018.

Managing Counsel of BNY Mellon and Secretary of the Manager, and an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since December 1996.

JOSEPH M. CHIOFFI, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. He is 56 years old and has been an employee of the Manager since June 2000.

SONALEE CROSS, Vice President and Assistant Secretary since March 2018.

Counsel of BNY Mellon since October 2016; Associate at Proskauer Rose LLP from April 2016 to September 2016; Attorney at EnTrust Capital from August 2015 to February 2016; Associate at Sidley Austin LLP from September 2013 until August 2015. She is an officer of 63 investment companies (comprised of 149 portfolios) managed by Dreyfus. She is 31 years old and has been an employee of the Manager since October 2016.

MAUREEN E. KANE, Vice President and Assistant Secretary since April 2015.

Managing Counsel of BNY Mellon since July 2014; from October 2004 until July 2014, General Counsel, and from May 2009 until July 2014, Chief Compliance Officer of Century Capital Management. She is an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. She is 56 years old and has been an employee of the Manager since July 2014.

SARAH S. KELLEHER, Vice President and Assistant Secretary since April 2014.

Managing Counsel of BNY Mellon since December 2017, from March 2013 to December 2017, Senior Counsel of BNY Mellon. She is an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. She is 43 years old and has been an employee of the Manager since March 2013.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. He is 53 years old and has been an employee of the Manager since October 1990.

NATALYA ZELENSKY, Vice President and Assistant Secretary since March 2017.

Counsel of BNY Mellon since May 2016; Attorney at Wildermuth Endowment Strategy Fund/Wildermuth Advisory, LLC from November 2015 until May 2016; Assistant General Counsel at RCS Advisory Services from July 2014 until November 2015; Associate at Sutherland, Asbill & Brennan from January 2013 until January 2014. She is an officer of 63 investment companies (comprised of 149 portfolios) managed by Dreyfus. She is 33 years old and has been an employee of the Manager since May 2016.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. He is 60 years old and has been an employee of the Manager since April 1985.

34

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since April 1991.

ROBERT S. ROBOL, Assistant Treasurer since August 2005.

Senior Accounting Manager – Dreyfus Financial Reporting of the Manager, and an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. He is 54 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager – Fixed Income and Equity Funds of the Manager, and an officer of 63 investment companies (comprised of 149 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager, the Dreyfus Family of Funds and BNY Mellon Funds Trust (63 investment companies, comprised of 149 portfolios). He is 61 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

CARIDAD M. CAROSELLA, Anti-Money Laundering Compliance Officer since January 2016.

Anti-Money Laundering Compliance Officer of the Dreyfus Family of Funds and BNY Mellon Funds Trust since January 2016; from May 2015 to December 2015, Interim Anti-Money Laundering Compliance Officer of the Dreyfus Family of Funds and BNY Mellon Funds Trust and the Distributor; from January 2012 to May 2015, AML Surveillance Officer of the Distributor and from 2007 to December 2011, Financial Processing Manager of the Distributor. She is an officer of 57 investment companies (comprised of 143 portfolios) managed by the Manager. She is 50 years old and has been an employee of the Distributor since 1997.

35

NOTES

36

NOTES

37

Dreyfus Global Equity Income Fund

200 Park Avenue

New York, NY 10166

Manager

The Dreyfus Corporation

200 Park Avenue

New York, NY 10166

Sub-Investment Adviser

Newton Investment Management

(North America) Limited