UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2464

MFS SERIES TRUST IX

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: April 30*

Date of reporting period: April 30, 2009

| * | This Form N-CSR pertains to the following series of the Registrant: MFS Bond Fund, MFS Limited Maturity Fund, MFS Municipal Limited Maturity Fund, MFS Research Bond Fund and MFS Research Bond Fund J. The remaining series of the Registrant, MFS Inflation-Adjusted Bond Fund, has a fiscal year end of October 31. |

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

MFS® Bond Fund

SIPC Contact Information:

You may obtain information about the Securities Investor Protection Corporation (“SIPC”), including the SIPC Brochure, by contacting SIPC either by telephone (202-371-8300) or by accessing SIPC’s website address (www.sipc.org).

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

4/30/09

MFB-ANN

LETTER FROM THE CEO

Dear Shareholders:

The market downturns and economic setbacks of late probably rank among the worst financial declines most of us have experienced. Inevitably, people may be questioning their commitment to investing. Still, it is important to remember that downturns are an inescapable part of the business cycle. Such troughs have been seen before, and if we can use history as a guide, market recoveries typically have followed.

Recent events have clearly shown us the value of certain types of investments. In this environment, two of the hallmarks of mutual funds — transparency and liquidity — have become critically important. Unlike some other types of investments, the operations of mutual funds are relatively transparent to their shareholders. With their daily redemption feature, mutual funds also generally provide easy, convenient access to one’s money. Through these recent market upheavals, this level of liquidity enhanced the ability of mutual fund investors to respond and modify their investments as they and their advisors saw fit — a flexibility that those in less liquid investments simply did not have at their disposal.

At MFS® we take particular pride in how well mutual funds can serve investors because we invented the mutual fund in the United States. Established in 1924, Massachusetts Investors Trust was the nation’s first fund. Recent market events only reinforce what we have learned through 85 years — that mutual funds provide unique features that are important to investors in any type of market climate.

Respectfully,

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

June 15, 2009

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

Before investing, consider the fund’s investment objectives, risks, charges, and expenses. For a prospectus containing this and other information, contact your investment professional or view online. Read it carefully.

MFS Fund Distributors, Inc., 500 Boylston Street, Boston, MA 02116

1

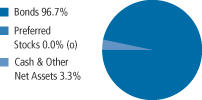

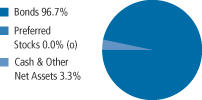

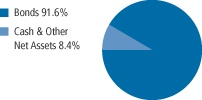

PORTFOLIO COMPOSITION

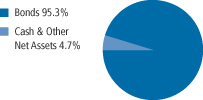

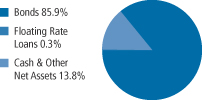

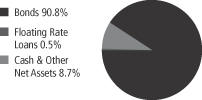

Portfolio structure (i)

| | |

| Fixed income sectors (i) | | |

| High Grade Corporates | | 63.8% |

| High Yield Corporates | | 10.7% |

| Commercial Mortgage-Backed Securities | | 8.4% |

| Mortgage-Backed Securities | | 5.2% |

| Emerging Markets Bonds | | 4.2% |

| U.S. Treasury Securities | | 2.1% |

| Non-U.S. Government Bonds | | 1.4% |

| Asset-Backed Securities | | 0.5% |

| Municipal Bonds | | 0.4% |

| Collateralized Debt Obligations (o) | | 0.0% |

| Residential Mortgage-Backed Securities (o) | | 0.0% |

| | |

| Credit quality of bonds (r) | | |

| AAA | | 14.1% |

| AA | | 8.1% |

| A | | 21.3% |

| BBB | | 44.5% |

| BB | | 8.4% |

| B | | 2.2% |

| CCC | | 1.1% |

| D (o) | | 0.0% |

| Not Rated | | 0.3% |

| |

| Portfolio facts | | |

| Average Duration (d)(i) | | 4.8 |

| Effective Maturity (i)(m) | | 7.6 yrs. |

| Average Credit Quality of Rated Securities (long-term) (a) | | A- |

| Average Credit Quality of Rated Securities (short-term) (a) | | A-1 |

| (a) | The average credit quality of rated securities is based upon a market weighted average of portfolio holdings that are rated by public rating agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

| (i) | For purposes of this presentation, the bond component includes accrued interest amounts and may be positively or negatively impacted by the equivalent exposure from any derivative holdings, if applicable. |

| (m) | In determining an instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (r) | Each security is assigned a rating from Moody’s Investors Service. If not rated by Moody’s, the rating will be that assigned by Standard & Poor’s. Likewise, if not assigned a rating by Standard & Poor’s, it will be based on the rating assigned by Fitch, Inc. For those portfolios that hold a security which is not rated by any of the three agencies, the security is considered Not Rated. Holdings in U.S. Treasuries and government agency mortgage-backed securities, if any, are included in the “AAA”-rating category. Percentages are based on the total market value of investments as of 4/30/09. |

Percentages are based on net assets as of 4/30/09, unless otherwise noted.

The portfolio is actively managed and current holdings may be different.

2

MANAGEMENT REVIEW

Summary of Results

For the twelve months ended April 30, 2009 Class A shares of the MFS Bond Fund provided a total return of –4.61%, at net asset value. This compares with a return of 2.58% for the fund’s benchmark, the Barclays Capital U.S. Government/Credit Bond Index.

Market Environment

The global economy and financial markets experienced substantial deterioration and extraordinary volatility over the reporting period. Strong headwinds in the U.S. included accelerated deterioration in the housing market, anemic corporate investment, a rapidly declining job market, and a much tighter credit environment. During the period, a seemingly continuous series of tumultuous financial events hammered markets, including: the distressed sale of failing Bear Stearns to JPMorgan Chase; the conservatorship of Government Sponsored Enterprises (GSEs) Fannie Mae and Freddie Mac; the bankruptcy of investment bank Lehman Brothers; the Fed’s complex intervention of insurance company AIG; the nationalization of several large European banks; the failure of Washington Mutual; the distressed sale of Wachovia; the virtual failure of Iceland’s banking sector; and, the collapse of the global auto industry. As a result of this barrage of turbulent news, global equity markets pushed significantly lower and credit markets witnessed the worst market decline since the beginning of the credit crisis. Though credit conditions and equity indices improved towards the end of the period, the state of financial and macroeconomic dislocation remained very severe.

While somewhat resilient during the first half of the period, the global economy and financial system increasingly experienced considerable negative spillovers from the U.S. slowdown. Not only did Europe and Japan show obvious signs of economic decline, the more powerful engine of global growth – emerging markets – also displayed weakening dynamics. The synchronized global downturn in economic activity experienced in the fourth quarter of 2008 and the first quarter of 2009 was among the most intense in the post-World War II period. However, by the end of the period there emerged tentative signs that the worst of the global macroeconomic deterioration had passed, which caused equity and credit markets to rally.

During the reporting period, the Fed cut interest rates aggressively and introduced a multitude of new lending facilities to alleviate ever-tightening credit markets, while the U.S. government designed and implemented fiscal stimulus packages. Although several other global central banks also cut interest rates during the early part of the reporting period, the dilemma of rising energy and food prices heightened concerns among central bankers that

3

Management Review – continued

inflationary expectations might become unhinged despite weaker growth. Only later in the reporting period did rapidly slowing global growth result in a very precipitous decline in commodity prices, which significantly eased inflation and inflationary expectations. As inflationary concerns diminished in the face of global deleveraging, and equity and credit markets deteriorated more sharply, a coordinated interest rate cut marked the beginning of much more aggressive easing by the major global central banks. By the end of the period, several central banks had approached their lower bound on policy rates and were examining the implementation and ramifications of quantitative easing as a means to further loosen monetary policy to offset the continuing fall in global wealth.

Detractors from Performance

Credit quality and sector allocation were the primary detractors from performance relative to the Barclays Capital U.S. Government/Credit Bond Index. Greater relative exposure to “BBB” rated (s) and below investment grade bonds had a negative impact on relative returns as investors flocked to higher quality bonds amid the credit market crisis. The fund’s lesser exposure to U.S. treasury securities also held back relative returns as treasuries significantly outperformed the benchmark. The fund’s overweighted position in the struggling financial sector was another major negative that impacted relative performance.

A shorter duration (d) stance, relative to the benchmark, also hindered performance as interest rates declined over the reporting period.

Contributors to Performance

During the reporting period, the fund’s return from yield, which was greater than that of the benchmark, was a key contributor to relative performance. This extra yield was a significant contributor to the fund’s results, particularly in the second half of the period, as credit markets steadily recovered from last year’s credit crisis.

Respectfully,

| | |

| Richard Hawkins | | Robert Persons |

| Portfolio Manager | | Portfolio Manager |

| (s) | Bonds rated “BBB”, “Baa”, or higher are considered investment grade; bonds rated “BB”, “Ba”, or below are considered non-investment grade. The primary source for bond quality ratings is Moody’s Investors Service. If not available, ratings by Standard & Poor’s are used, else ratings by Fitch, Inc. For securities which are not rated by any of the three agencies, the security is considered Not Rated. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

The views expressed in this report are those of the portfolio managers only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

4

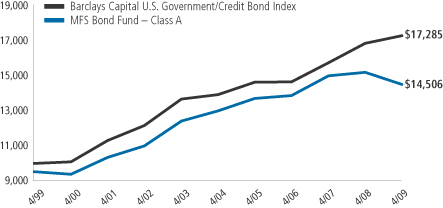

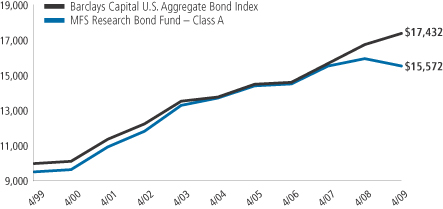

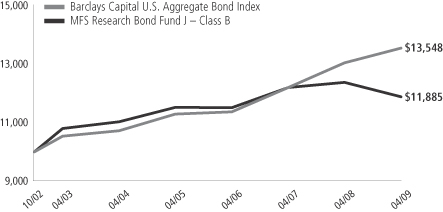

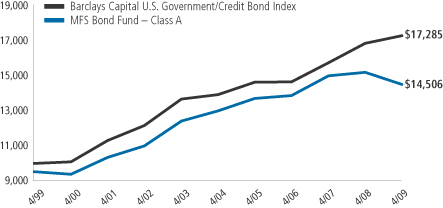

PERFORMANCE SUMMARY THROUGH 4/30/09

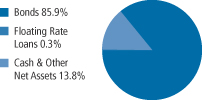

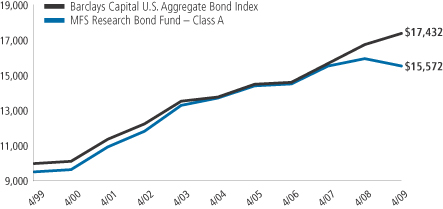

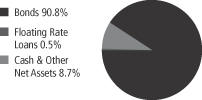

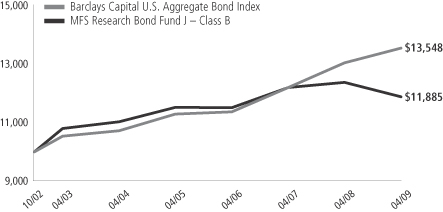

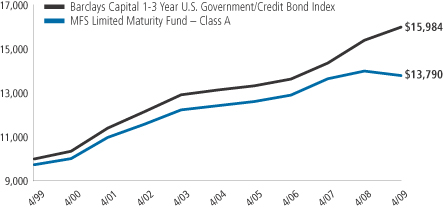

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

5

Performance Summary – continued

Total Returns through 4/30/09

Average annual without sales charge

| | | | | | | | | | | | |

| | | Share class | | Class inception date | | 1-yr | | 5-yr | | 10-yr | | |

| | | A | | 5/08/74 | | (4.61)% | | 2.23% | | 4.30% | | |

| | | B | | 9/07/93 | | (5.32)% | | 1.50% | | 3.57% | | |

| | | C | | 1/03/94 | | (5.33)% | | 1.50% | | 3.57% | | |

| | | I | | 1/02/97 | | (4.32)% | | 2.52% | | 4.60% | | |

| | | R1 | | 4/01/05 | | (5.32)% | | 1.43% | | 3.53% | | |

| | | R2 | | 10/31/03 | | (4.82)% | | 1.86% | | 3.77% | | |

| | | R3 | | 4/01/05 | | (4.65)% | | 2.17% | | 4.26% | | |

| | | R4 | | 4/01/05 | | (4.40)% | | 2.42% | | 4.39% | | |

| Comparative benchmark | | | | | | | | |

| | | Barclays Capital U.S. Government/Credit Bond Index (f) | | 2.58% | | 4.43% | | 5.63% | | |

| Average annual with sales charge | | | | | | | | |

| | | A

With Initial Sales Charge (4.75%) | | (9.14)% | | 1.24% | | 3.79% | | |

| | | B

With CDSC (Declining over six years from 4% to 0%) (x) | | (8.92)% | | 1.18% | | 3.57% | | |

| | | C

With CDSC (1% for 12 months) (x) | | (6.23)% | | 1.50% | | 3.57% | | |

Class I, R1, R2, R3 and R4 shares do not have a sales charge.

CDSC – Contingent Deferred Sales Charge.

| (f) | Source: FactSet Research Systems Inc. |

| (x) | Assuming redemption at the end of the applicable period. |

Benchmark Definitions

Barclays Capital U.S. Government/Credit Bond Index (formerly known as Lehman Brothers U.S. Government/Credit Bond Index) – a market capitalization-weighted index that measures the performance of investment-grade debt obligations of the U.S. Treasury and U.S. government agencies, as well as U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements.

It is not possible to invest directly in an index.

Notes to Performance Summary

Performance for Class R3 and Class R4 shares includes the performance of the fund’s Class A shares for periods prior to their offering. Performance for Class R1 and R2 shares includes the performance of the fund’s Class B shares for periods prior to their offering. This blended class performance has been adjusted to take into account differences in sales loads, if any, applicable to

6

Performance Summary – continued

these share classes, but has not been adjusted to take into account differences in class specific operating expenses (such as Rule 12b-1 fees). Compared to performance these share classes would have experienced had they been offered for the entire period, the use of blended performance generally results in higher performance for share classes with higher operating expenses than the share class to which it is blended, and lower performance for share classes with lower operating expenses than the share class to which it is blended.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

7

EXPENSE TABLE

Fund expenses borne by the shareholders during the period,

November 1, 2008 through April 30, 2009

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2008 through April 30, 2009.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

Expense Table – continued

| | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | Beginning

Account Value

11/01/08 | | Ending

Account Value

4/30/09 | | Expenses

Paid During

Period (p)

11/01/08-4/30/09 |

| A | | Actual | | 0.88% | | $1,000.00 | | $1,095.57 | | $4.57 |

| | Hypothetical (h) | | 0.88% | | $1,000.00 | | $1,020.43 | | $4.41 |

| B | | Actual | | 1.60% | | $1,000.00 | | $1,090.87 | | $8.29 |

| | Hypothetical (h) | | 1.60% | | $1,000.00 | | $1,016.86 | | $8.00 |

| C | | Actual | | 1.59% | | $1,000.00 | | $1,091.99 | | $8.25 |

| | Hypothetical (h) | | 1.59% | | $1,000.00 | | $1,016.91 | | $7.95 |

| I | | Actual | | 0.59% | | $1,000.00 | | $1,097.11 | | $3.07 |

| | Hypothetical (h) | | 0.59% | | $1,000.00 | | $1,021.87 | | $2.96 |

| R1 | | Actual | | 1.60% | | $1,000.00 | | $1,091.93 | | $8.30 |

| | Hypothetical (h) | | 1.60% | | $1,000.00 | | $1,016.86 | | $8.00 |

| R2 | | Actual | | 1.10% | | $1,000.00 | | $1,094.45 | | $5.71 |

| | Hypothetical (h) | | 1.10% | | $1,000.00 | | $1,019.34 | | $5.51 |

| R3 | | Actual | | 0.85% | | $1,000.00 | | $1,095.81 | | $4.42 |

| | Hypothetical (h) | | 0.85% | | $1,000.00 | | $1,020.58 | | $4.26 |

| R4 | | Actual | | 0.61% | | $1,000.00 | | $1,097.11 | | $3.17 |

| | Hypothetical (h) | | 0.61% | | $1,000.00 | | $1,021.77 | | $3.06 |

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Expense Changes Impacting The Table

Changes to the fund’s fee arrangements occurred during the six month period. Had these fee changes been in effect throughout the entire six month period, the annualized expense ratios would have been 0.91%, 1.66%, 1.65%, 0.65%, 1.66%, 1.17%, 0.91% and 0.67% for Classes A, B, C, I, R1, R2, R3 and R4 shares, respectively; the actual expenses paid during the period would have been approximately $4.73, $8.60, $8.56, $3.38, $8.61, $6.07, $4.73 and $3.48 for Classes A, B, C, I, R1, R2, R3 and R4 shares, respectively; and the hypothetical expenses paid during the period would have been approximately $4.56, $8.30, $8.25, $3.26, $8.30, $5.86, $4.56 and $3.36 for Classes A, B, C, I, R1, R2, R3 and R4 shares, respectively. For further information about the fund’s fee arrangements and changes to those fee arrangements, please see Note 3 in the Notes to Financial Statements.

9

PORTFOLIO OF INVESTMENTS

4/30/09

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | |

| Bonds - 96.8% | | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Aerospace - 0.8% | | | | | | |

| Bombardier, Inc., 6.3%, 2014 (n) | | $ | 9,225,000 | | $ | 7,749,000 |

| | |

| Asset Backed & Securitized - 8.9% | | | | | | |

| ARCap REIT, Inc., CDO, “G”, 6.1%, 2045 (n) | | $ | 2,150,000 | | $ | 150,500 |

| Asset Securitization Corp., FRN, 8.631%, 2029 | | | 2,628,020 | | | 2,902,830 |

| Banc of America Commercial Mortgage, Inc., FRN, 5.837%, 2049 | | | 6,405,710 | | | 4,833,739 |

Bayview Financial Revolving Mortgage Loan Trust, FRN,

1.235%, 2040 (z) | | | 2,930,000 | | | 1,289,200 |

| BlackRock Capital Finance LP, 7.75%, 2026 (n) | | | 507,669 | | | 65,997 |

| Brazilian Merchant Voucher Receivables Ltd., 5.911%, 2011 (z) | | | 3,073,612 | | | 2,950,668 |

| Chase Commercial Mortgage Securities Corp., 6.6%, 2029 (z) | | | 1,377,761 | | | 1,394,246 |

Citigroup/Deutsche Bank Commercial Mortgage Trust,

5.322%, 2049 | | | 3,851,426 | | | 2,867,736 |

Citigroup/Deutsche Bank Commercial Mortgage Trust, FRN,

5.366%, 2049 | | | 2,920,000 | | | 1,266,230 |

| Commercial Mortgage Acceptance Corp., FRN, 1.712%, 2030 (i) | | | 11,598,858 | | | 560,871 |

| Commercial Mortgage Pass-Through Certificates, 5.306%, 2046 | | | 2,990,290 | | | 2,286,748 |

| Countrywide Asset-Backed Certificates, FRN, 4.575%, 2035 | | | 59,132 | | | 55,532 |

| Credit Suisse Mortgage Capital Certificate, 5.311%, 2039 | | | 3,415,000 | | | 2,422,540 |

| Credit Suisse Mortgage Capital Certificate, 5.343%, 2039 | | | 5,804,213 | | | 2,777,481 |

| DLJ Commercial Mortgage Corp., 6.04%, 2031 (z) | | | 2,675,000 | | | 2,383,321 |

| Falcon Franchise Loan LLC, 6.5%, 2014 (z) | | | 2,733,000 | | | 1,448,490 |

| Falcon Franchise Loan LLC, FRN, 4.334%, 2025 (i)(z) | | | 14,024,538 | | | 1,001,352 |

First Union-Lehman Brothers Commercial Mortgage Trust,

7%, 2029 (n) | | | 2,041,285 | | | 2,083,144 |

| GE Commercial Mortgage Corp., FRN, 5.336%, 2044 | | | 2,710,000 | | | 1,389,647 |

| GMAC LLC, FRN, 6.02%, 2033 (z) | | | 4,140,000 | | | 3,116,542 |

| GMAC LLC, FRN, 7.912%, 2034 (n) | | | 3,212,000 | | | 2,335,949 |

| Greenwich Capital Commercial Funding Corp., 4.305%, 2042 | | | 3,452,639 | | | 3,310,410 |

Greenwich Capital Commercial Funding Corp., FRN,

5.916%, 2038 | | | 2,125,000 | | | 1,106,711 |

Greenwich Capital Commercial Funding Corp., FRN,

5.916%, 2038 | | | 2,041,068 | | | 1,706,254 |

| GS Mortgage Securities Corp., 5.56%, 2039 | | | 1,591,947 | | | 1,307,719 |

JPMorgan Chase Commercial Mortgage Securities Corp.,

5.42%, 2049 | | | 1,921,947 | | | 1,457,914 |

| JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 5.505%, 2042 (n) | | | 4,734,928 | | | 813,787 |

10

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Asset Backed & Securitized - continued | | | | | | |

| JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 5.528%, 2043 | | $ | 7,331,619 | | $ | 3,214,064 |

| JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 5.855%, 2043 | | | 4,318,739 | | | 2,173,845 |

| JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 5.038%, 2046 | | | 5,520,000 | | | 4,892,234 |

| JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 5.937%, 2049 | | | 3,070,000 | | | 2,190,707 |

| JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 6.007%, 2049 | | | 1,467,768 | | | 1,153,261 |

| JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 6.188%, 2051 | | | 3,000,000 | | | 2,345,491 |

| KKR Financial CLO Ltd., “C”, CDO, FRN, 2.684%, 2021 (n) | | | 3,726,151 | | | 167,677 |

| Lehman Brothers Commercial Conduit Mortgage Trust, FRN, 0.993%, 2030 (i) | | | 11,886,398 | | | 310,903 |

| Merrill Lynch Mortgage Trust, FRN, 6.022%, 2050 | | | 1,561,000 | | | 223,747 |

| Merrill Lynch/Countrywide Commercial Mortgage Trust, FRN, 5.81%, 2050 | | | 3,070,000 | | | 2,130,599 |

| Morgan Stanley Capital I, Inc., 5.72%, 2032 | | | 2,446,407 | | | 2,454,666 |

| Morgan Stanley Capital I, Inc., FRN, 0.998%, 2030 (i)(n) | | | 24,102,988 | | | 499,638 |

| Mortgage Capital Funding, Inc., FRN, 2.416%, 2031 (i) | | | 1,335,825 | | | 68 |

| PNC Mortgage Acceptance Corp., FRN, 7.1%, 2032 (z) | | | 5,790,000 | | | 5,257,731 |

| Prudential Securities Secured Financing Corp., FRN, 7.285%, 2013 (z) | | | 3,468,000 | | | 2,841,457 |

| Spirit Master Funding LLC, 5.05%, 2023 (z) | | | 2,557,043 | | | 2,064,850 |

| Wachovia Bank Commercial Mortgage Trust, FRN, 4.847%, 2041 | | | 2,893,068 | | | 2,550,140 |

| Wachovia Bank Commercial Mortgage Trust, FRN, 6.158%, 2045 | | | 4,320,000 | | | 2,006,824 |

| | | | | | |

| | | | | | $ | 85,763,460 |

| Automotive - 0.3% | | | | | | |

| Ford Motor Credit Co. LLC, 9.75%, 2010 | | $ | 3,470,000 | | $ | 3,123,153 |

| | |

| Broadcasting - 0.8% | | | | | | |

| CBS Corp., 6.625%, 2011 | | $ | 3,534,000 | | $ | 3,538,877 |

| News America, Inc., 8.5%, 2025 | | | 4,931,000 | | | 4,504,641 |

| | | | | | |

| | | | | | $ | 8,043,518 |

| Brokerage & Asset Managers - 0.7% | | | | | | |

| INVESCO PLC, 4.5%, 2009 | | $ | 7,053,000 | | $ | 6,788,209 |

| | |

| Building - 0.5% | | | | | | |

| CRH PLC, 8.125%, 2018 | | $ | 3,493,000 | | $ | 2,913,176 |

| Hanson PLC, 7.875%, 2010 | | | 3,170,000 | | | 2,250,700 |

| | | | | | |

| | | | | | $ | 5,163,876 |

11

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Cable TV - 2.2% | | | | | | |

| Comcast Corp., 6.4%, 2038 | | $ | 1,857,000 | | $ | 1,740,715 |

| Cox Communications, Inc., 4.625%, 2013 | | | 6,087,000 | | | 5,604,307 |

| Cox Communications, Inc., 6.25%, 2018 (n) | | | 1,735,000 | | | 1,597,191 |

| TCI Communications, Inc., 9.8%, 2012 | | | 3,539,000 | | | 3,815,201 |

| Time Warner Cable, Inc., 8.25%, 2019 | | | 6,150,000 | | | 6,796,734 |

| Time Warner Entertainment Co. LP, 8.375%, 2033 | | | 1,734,000 | | | 1,802,379 |

| | | | | | |

| | | | | | $ | 21,356,527 |

| Computer Software - 0.7% | | | | | | |

| Seagate Technology HDD Holdings, 6.375%, 2011 | | $ | 7,013,000 | | $ | 6,416,895 |

| | |

| Conglomerates - 1.5% | | | | | | |

| American Standard Cos., Inc., 7.625%, 2010 | | $ | 1,955,000 | | $ | 1,989,731 |

| Fisher Scientific International, Inc., 6.125%, 2015 | | | 9,060,000 | | | 9,014,700 |

| Kennametal, Inc., 7.2%, 2012 | | | 3,091,000 | | | 3,069,919 |

| | | | | | |

| | | | | | $ | 14,074,350 |

| Construction - 0.7% | | | | | | |

| D.R. Horton, Inc., 7.875%, 2011 | | $ | 4,993,000 | | $ | 4,943,070 |

| D.R. Horton, Inc., 5.625%, 2014 | | | 1,731,000 | | | 1,462,695 |

| | | | | | |

| | | | | | $ | 6,405,765 |

| Consumer Goods & Services - 2.6% | | | | | | |

| Clorox Co., 5%, 2013 | | $ | 4,780,000 | | $ | 4,900,050 |

| Fortune Brands, Inc., 5.125%, 2011 | | | 5,910,000 | | | 5,912,187 |

| Procter & Gamble Co., 4.6%, 2014 | | | 4,400,000 | | | 4,659,538 |

| Service Corp. International, 7.375%, 2014 | | | 1,880,000 | | | 1,804,800 |

| Western Union Co., 5.4%, 2011 | | | 7,660,000 | | | 7,768,159 |

| | | | | | |

| | | | | | $ | 25,044,734 |

| Defense Electronics - 0.7% | | | | | | |

| L-3 Communications Corp., 6.375%, 2015 | | $ | 6,885,000 | | $ | 6,523,538 |

| | |

| Electronics - 0.5% | | | | | | |

| Tyco Electronics Group S.A., 6.55%, 2017 | | $ | 2,450,000 | | $ | 1,885,608 |

| Tyco Electronics Group S.A., 7.125%, 2037 | | | 4,850,000 | | | 2,957,879 |

| | | | | | |

| | | | | | $ | 4,843,487 |

| Emerging Market Quasi-Sovereign - 1.9% | | | | | | |

| Hana Bank, 6.5%, 2012 (z) | | $ | 2,285,000 | | $ | 2,327,069 |

| Industrial Bank of Korea, 7.125%, 2014 (z) | | | 3,544,000 | | | 3,486,573 |

| KazMunaiGaz Finance B.V., 8.375%, 2013 (n) | | | 843,000 | | | 750,270 |

| Korea Development Bank, 8%, 2014 | | | 1,613,000 | | | 1,693,635 |

12

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Emerging Market Quasi-Sovereign - continued | | | | | | |

| Mubadala Development Co., 7.625%, 2019 (z) | | $ | 3,276,000 | | $ | 3,252,347 |

| Pemex Finance Ltd., 9.69%, 2009 | | | 783,200 | | | 789,082 |

| Pemex Finance Ltd., 10.61%, 2017 | | | 1,500,000 | | | 1,710,870 |

| Petrobras International Finance Co., 7.875%, 2019 | | | 3,775,000 | | | 4,039,250 |

| | | | | | |

| | | | | | $ | 18,049,096 |

| Emerging Market Sovereign - 1.6% | | | | | | |

| Emirate of Abu Dhabi, 5.5%, 2014 (z) | | $ | 306,000 | | $ | 312,848 |

| Emirate of Abu Dhabi, 6.75%, 2019 (z) | | | 3,270,000 | | | 3,318,383 |

| Republic of Indonesia, 11.625%, 2019 (n) | | | 2,271,000 | | | 2,713,845 |

| Republic of Korea, 5.75%, 2014 | | | 2,229,000 | | | 2,287,268 |

| Republic of Korea, 7.125%, 2019 | | | 2,483,000 | | | 2,536,198 |

| Republic of Panama, 7.25%, 2015 | | | 2,169,000 | | | 2,326,253 |

| Republic of Peru, 7.125%, 2019 | | | 448,000 | | | 483,840 |

| State of Qatar, 6.55%, 2019 (z) | | | 1,380,000 | | | 1,424,850 |

| | | | | | |

| | | | | | $ | 15,403,485 |

| Energy - Independent - 2.4% | | | | | | |

| Anadarko Petroleum Corp., 6.45%, 2036 | | $ | 6,000,000 | | $ | 4,548,738 |

| Chesapeake Energy Corp., 9.5%, 2015 | | | 4,623,000 | | | 4,669,230 |

| Nexen, Inc., 6.4%, 2037 | | | 6,380,000 | | | 4,642,094 |

| Ocean Energy, Inc., 7.25%, 2011 | | | 8,687,000 | | | 9,193,513 |

| | | | | | |

| | | | | | $ | 23,053,575 |

| Energy - Integrated - 2.1% | | | | | | |

| ConocoPhillips, 6.5%, 2039 | | $ | 3,990,000 | | $ | 3,953,204 |

| Hess Corp., 8.125%, 2019 | | | 3,210,000 | | | 3,516,712 |

| Petro-Canada, 6.05%, 2018 | | | 4,468,000 | | | 4,069,168 |

| Shell International Finance, 4%, 2014 | | | 8,790,000 | | | 9,064,468 |

| | | | | | |

| | | | | | $ | 20,603,552 |

| Entertainment - 0.8% | | | | | | |

| Time Warner, Inc., 9.125%, 2013 | | $ | 6,649,000 | | $ | 7,091,704 |

| Time Warner, Inc., 6.5%, 2036 | | | 1,100,000 | | | 906,893 |

| | | | | | |

| | | | | | $ | 7,998,597 |

| Financial Institutions - 0.6% | | | | | | |

| GMAC LLC, 7.25%, 2011 (z) | | $ | 3,680,000 | | $ | 3,238,400 |

| ILFC E-Capital Trust I, 5.9% to 2010, FRN to 2065 (n) | | | 6,900,000 | | | 1,035,000 |

| International Lease Finance Corp., 5.625%, 2013 | | | 3,380,000 | | | 1,904,485 |

| | | | | | |

| | | | | | $ | 6,177,885 |

13

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Food & Beverages - 4.7% | | | | | | |

| Anheuser-Busch Companies, Inc., 7.75%, 2019 (n) | | $ | 4,630,000 | | $ | 4,847,471 |

| Conagra Foods, Inc., 7%, 2019 | | | 2,520,000 | | | 2,677,467 |

| Diageo Capital PLC, 5.5%, 2016 | | | 6,930,000 | | | 6,945,301 |

| Dr. Pepper Snapple Group, Inc., 6.82%, 2018 | | | 4,738,000 | | | 4,614,196 |

| General Mills, Inc., 5.65%, 2012 | | | 2,333,000 | | | 2,457,680 |

| General Mills, Inc., 5.65%, 2019 | | | 1,980,000 | | | 2,021,511 |

| Kraft Foods, Inc., 6.125%, 2018 | | | 6,690,000 | | | 6,795,849 |

| Miller Brewing Co., 5.5%, 2013 (n) | | | 9,815,000 | | | 9,420,692 |

| Tyson Foods, Inc., 7.85%, 2016 | | | 6,160,000 | | | 5,586,775 |

| | | | | | |

| | | | | | $ | 45,366,942 |

| Food & Drug Stores - 0.7% | | | | | | |

| CVS Caremark Corp., 5.75%, 2017 | | $ | 4,388,000 | | $ | 4,410,269 |

| CVS Caremark Corp., 6.6%, 2019 | | | 2,130,000 | | | 2,253,118 |

| | | | | | |

| | | | | | $ | 6,663,387 |

| Forest & Paper Products - 0.2% | | | | | | |

| Stora Enso Oyj, 7.25%, 2036 (n) | | $ | 4,707,000 | | $ | 2,165,220 |

| | |

| Gaming & Lodging - 0.9% | | | | | | |

| Royal Caribbean Cruises Ltd., 8%, 2010 | | $ | 4,190,000 | | $ | 4,106,200 |

| Wyndham Worldwide Corp., 6%, 2016 | | | 7,020,000 | | | 4,629,044 |

| | | | | | |

| | | | | | $ | 8,735,244 |

| Industrial - 0.5% | | | | | | |

| Steelcase, Inc., 6.5%, 2011 | | $ | 5,024,000 | | $ | 4,961,180 |

| | |

| Insurance - 1.6% | | | | | | |

| ING Groep N.V., 5.775% to 2015, FRN to 2049 | | $ | 4,906,000 | | $ | 1,815,220 |

| Metropolitan Life Global Funding, 5.125%, 2013 (n) | | | 4,190,000 | | | 4,005,347 |

| Prudential Financial, Inc., 5.1%, 2014 | | | 2,777,000 | | | 2,197,993 |

| Prudential Financial, Inc., 6%, 2017 | | | 1,075,000 | | | 756,095 |

| UnumProvident Corp., 6.85%, 2015 (n) | | | 8,751,000 | | | 6,808,366 |

| | | | | | |

| | | | | | $ | 15,583,021 |

| Insurance - Health - 0.2% | | | | | | |

| Humana, Inc., 7.2%, 2018 | | $ | 2,700,000 | | $ | 2,272,828 |

| | |

| Insurance - Property & Casualty - 1.2% | | | | | | |

| AXIS Capital Holdings Ltd., 5.75%, 2014 | | $ | 3,795,000 | | $ | 2,870,773 |

| Chubb Corp., 6.375% to 2017, FRN to 2067 | | | 1,838,000 | | | 1,111,354 |

14

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Insurance - Property & Casualty - continued | | | | | | |

| Fund American Cos., Inc., 5.875%, 2013 | | $ | 6,104,000 | | $ | 4,752,794 |

| ZFS Finance USA Trust V, 6.5% to 2017, FRN to 2037 (n) | | | 5,610,000 | | | 3,029,400 |

| | | | | | |

| | | | | | $ | 11,764,321 |

| International Market Quasi-Sovereign - 1.1% | | | | | | |

| Electricite de France, 6.95%, 2039 (n) | | $ | 5,300,000 | | $ | 5,588,235 |

| ING Bank N.V., 3.9%, 2014 (z) | | | 5,000,000 | | | 4,964,770 |

| | | | | | |

| | | | | | $ | 10,553,005 |

| Local Authorities - 1.0% | | | | | | |

| California Build America, 7.5%, 2034 | | $ | 2,255,000 | | $ | 2,332,595 |

| California Build America, 7.55%, 2039 | | | 2,130,000 | | | 2,220,845 |

| Metropolitan Transportation Authority, NY, Build America, 7.336%, 2039 | | | 2,365,000 | | | 2,525,465 |

| New Jersey Turnpike Authority Rev., Build America, “F”, 7.414%, 2040 | | | 2,193,000 | | | 2,377,431 |

| | | | | | |

| | | | | | $ | 9,456,336 |

| Major Banks - 8.4% | | | | | | |

| BAC Capital Trust XIV, 5.63% to 2012, FRN to 2049 | | $ | 4,150,000 | | $ | 1,617,848 |

| Bank of America Corp., 5.49%, 2019 | | | 2,815,000 | | | 1,866,615 |

| Barclays Bank PLC, 8.55% to 2011, FRN to 2049 (n) | | | 6,318,000 | | | 3,095,820 |

| Bear Stearns Cos., Inc., 5.85%, 2010 | | | 2,574,000 | | | 2,650,718 |

| BNP Paribas, 7.195% to 2037, FRN to 2049 (n) | | | 4,300,000 | | | 2,787,475 |

| Credit Suisse (USA), Inc., 4.875%, 2010 | | | 8,611,000 | | | 8,716,356 |

| Credit Suisse (USA), Inc., 6%, 2018 | | | 1,320,000 | | | 1,177,309 |

| Goldman Sachs Group, Inc., 5.625%, 2017 | | | 7,771,000 | | | 6,657,338 |

| Goldman Sachs Group, Inc., 7.5%, 2019 | | | 3,710,000 | | | 3,806,920 |

| JPMorgan Chase Bank, 6%, 2017 | | | 5,750,000 | | | 5,364,606 |

| Merrill Lynch & Co., Inc., 6.15%, 2013 | | | 3,390,000 | | | 3,116,766 |

| Merrill Lynch & Co., Inc., 6.05%, 2016 | | | 3,281,000 | | | 2,405,882 |

| Morgan Stanley, 5.75%, 2016 | | | 5,924,000 | | | 5,459,185 |

| Morgan Stanley, 6.625%, 2018 | | | 5,114,000 | | | 4,866,784 |

| MUFG Capital Finance 1 Ltd., 6.346% to 2016, FRN to 2049 | | | 6,191,000 | | | 4,882,978 |

| Natixis S.A., 10% to 2018, FRN to 2049 (n) | | | 4,000,000 | | | 1,640,720 |

| PNC Funding Corp., 5.625%, 2017 | | | 7,355,000 | | | 6,307,383 |

| Royal Bank of Scotland Group PLC, 9.118%, 2049 | | | 2,152,000 | | | 1,581,720 |

UniCredito Italiano Capital Trust II, 9.2% to 2010,

FRN to 2049 (n) | | | 5,204,000 | | | 2,446,400 |

| UniCredito Luxembourg Finance S.A., 6%, 2017 (n) | | | 6,850,000 | | | 4,510,588 |

| Wachovia Corp., 6.605%, 2025 | | | 7,936,000 | | | 6,670,200 |

| | | | | | |

| | | | | | $ | 81,629,611 |

15

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Medical & Health Technology & Services - 1.6% | | | | | | |

| HCA, Inc., 8.75%, 2010 | | $ | 4,117,000 | | $ | 4,106,708 |

| Hospira, Inc., 5.55%, 2012 | | | 1,390,000 | | | 1,374,087 |

| Hospira, Inc., 6.05%, 2017 | | | 5,030,000 | | | 4,507,836 |

| McKesson Corp., 5.7%, 2017 | | | 5,010,000 | | | 4,882,470 |

| McKesson Corp., 7.5%, 2019 | | | 920,000 | | | 991,189 |

| | | | | | |

| | | | | | $ | 15,862,290 |

| Metals & Mining - 1.3% | | | | | | |

| BHP Billiton Finance Ltd., 5.5%, 2014 | | $ | 100,000 | | $ | 105,287 |

| BHP Billiton Finance Ltd., 6.5%, 2019 | | | 3,730,000 | | | 4,051,422 |

| International Steel Group, Inc., 6.5%, 2014 | | | 6,119,000 | | | 5,174,055 |

| Rio Tinto Finance USA Ltd., 5.875%, 2013 | | | 3,820,000 | | | 3,602,069 |

| | | | | | |

| | | | | | $ | 12,932,833 |

| Mortgage Backed - 5.2% | | | | | | |

| Fannie Mae, 5.5%, 2017-2035 | | $ | 16,917,474 | | $ | 17,607,274 |

| Fannie Mae, 6%, 2017-2035 | | | 4,745,533 | | | 4,989,319 |

| Fannie Mae, 4.5%, 2018 | | | 7,688,263 | | | 7,960,956 |

| Fannie Mae, 7.5%, 2030-2031 | | | 1,619,991 | | | 1,764,495 |

| Fannie Mae, 6.5%, 2032-2036 | | | 5,600,226 | | | 5,997,218 |

| Freddie Mac, 6%, 2021-2034 | | | 3,366,351 | | | 3,535,512 |

| Freddie Mac, 5%, 2025-2038 | | | 8,320,922 | | | 8,550,628 |

| | | | | | |

| | | | | | $ | 50,405,402 |

| Municipals - 0.4% | | | | | | |

| Harris County, TX, “C”, FSA, 5.25%, 2028 | | $ | 3,260,000 | | $ | 3,577,133 |

| | |

| Natural Gas - Pipeline - 3.7% | | | | | | |

| CenterPoint Energy, Inc., 7.875%, 2013 | | $ | 8,438,000 | | $ | 8,849,209 |

| Energy Transfer Partners, 9.7%, 2019 | | | 3,520,000 | | | 3,910,287 |

| Energy Transfer Partners LP, 8.5%, 2014 | | | 1,276,000 | | | 1,377,280 |

| Enterprise Products Operating LP, 5.65%, 2013 | | | 2,434,000 | | | 2,298,487 |

| Enterprise Products Partners LP, 6.3%, 2017 | | | 3,590,000 | | | 3,321,342 |

| Kinder Morgan Energy Partners LP, 5.125%, 2014 | | | 2,559,000 | | | 2,433,345 |

| Kinder Morgan Energy Partners LP, 7.4%, 2031 | | | 3,627,000 | | | 3,194,223 |

| Spectra Energy Capital LLC, 8%, 2019 | | | 5,750,000 | | | 5,693,345 |

| Williams Cos., Inc., 7.125%, 2011 | | | 4,325,000 | | | 4,368,250 |

| | | | | | |

| | | | | | $ | 35,445,768 |

| Network & Telecom - 4.0% | | | | | | |

| AT&T, Inc., 5.1%, 2014 | | $ | 8,569,000 | | $ | 8,905,727 |

| AT&T, Inc., 5.8%, 2019 | | | 5,450,000 | | | 5,541,347 |

| British Telecommunications PLC, 5.15%, 2013 | | | 2,225,000 | | | 2,094,085 |

| Qwest Corp., 8.375%, 2016 (z) | | | 494,000 | | | 491,530 |

16

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Network & Telecom - continued | | | | | | |

| Telecom Italia S.p.A., 6.375%, 2033 | | $ | 3,700,000 | | $ | 2,759,068 |

| Telefonica Europe B.V., 7.75%, 2010 | | | 6,019,000 | | | 6,320,811 |

| Telemar Norte Leste S.A., 9.5%, 2019 (z) | | | 2,327,000 | | | 2,425,898 |

| Verizon Communications, Inc., 8.95%, 2039 | | | 2,640,000 | | | 3,183,785 |

| Verizon New York, Inc., 6.875%, 2012 | | | 6,786,000 | | | 7,071,548 |

| | | | | | |

| | | | | | $ | 38,793,799 |

| Oil Services - 1.3% | | | | | | |

| Halliburton Co., 7.45%, 2039 | | $ | 6,160,000 | | $ | 6,506,118 |

| Smith International, Inc., 9.75%, 2019 | | | 6,150,000 | | | 6,499,781 |

| | | | | | |

| | | | | | $ | 13,005,899 |

| Oils - 0.7% | | | | | | |

| Premcor Refining Group, Inc., 7.5%, 2015 | | $ | 6,607,000 | | $ | 6,569,525 |

| | |

| Other Banks & Diversified Financials - 2.1% | | | | | | |

| American Express Centurion Bank, 5.55%, 2012 | | $ | 3,943,000 | | $ | 3,765,403 |

| Citigroup, Inc., 6.125%, 2018 | | | 4,940,000 | | | 4,151,660 |

| Nordea Bank AB, 5.424% to 2015, FRN to 2049 (n) | | | 2,450,000 | | | 1,188,250 |

| Resona Bank Ltd., 5.85% to 2016, FRN to 2049 (n) | | | 6,312,000 | | | 3,513,259 |

| UBS Preferred Funding Trust V, 6.243% to 2016, FRN to 2049 | | | 3,471,000 | | | 1,423,110 |

| UFJ Finance Aruba AEC, 6.75%, 2013 | | | 6,193,000 | | | 6,297,643 |

| | | | | | |

| | | | | | $ | 20,339,325 |

| Pharmaceuticals - 1.4% | | | | | | |

| Pfizer, Inc., 7.2%, 2039 | | $ | 7,030,000 | | $ | 7,724,128 |

| Roche Holdings, Inc., 7%, 2039 (n) | | | 5,330,000 | | | 5,790,230 |

| | | | | | |

| | | | | | $ | 13,514,358 |

| Printing & Publishing - 0.2% | | | | | | |

| Pearson PLC, 5.5%, 2013 (n) | | $ | 1,930,000 | | $ | 1,850,432 |

| | |

| Railroad & Shipping - 1.2% | | | | | | |

| Canadian Pacific Railway Co., 6.5%, 2018 | | $ | 3,200,000 | | $ | 2,834,496 |

| CSX Corp., 6.3%, 2012 | | | 4,932,000 | | | 4,935,349 |

| CSX Corp., 7.375%, 2019 | | | 2,450,000 | | | 2,518,835 |

| Kansas City Southern, 7.375%, 2014 | | | 2,170,000 | | | 1,757,700 |

| | | | | | |

| | | | | | $ | 12,046,380 |

| Real Estate - 2.2% | | | | | | |

| HRPT Properties Trust, REIT, 6.25%, 2016 | | $ | 6,245,000 | | $ | 4,050,819 |

| Liberty Property LP, REIT, 5.5%, 2016 | | | 4,340,000 | | | 3,006,591 |

| ProLogis, REIT, 5.75%, 2016 | | | 5,547,000 | | | 3,573,688 |

17

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Real Estate - continued | | | | | | |

| ProLogis, REIT, 5.625%, 2016 | | $ | 1,300,000 | | $ | 870,158 |

| Simon Property Group, Inc., REIT, 6.35%, 2012 | | | 4,283,000 | | | 4,030,873 |

| Simon Property Group, Inc., REIT, 5.75%, 2015 | | | 6,800,000 | | | 5,586,785 |

| | | | | | |

| | | | | | $ | 21,118,914 |

| Restaurants - 0.3% | | | | | | |

| YUM! Brands, Inc., 8.875%, 2011 | | $ | 2,887,000 | | $ | 3,099,434 |

| | |

| Retailers - 2.0% | | | | | | |

| Home Depot, Inc., 5.875%, 2036 | | $ | 5,029,000 | | $ | 3,685,151 |

| J.C. Penney Corp., Inc., 8%, 2010 | | | 527,000 | | | 529,927 |

| Macy’s, Inc., 6.625%, 2011 | | | 2,861,000 | | | 2,727,755 |

| Staples, Inc., 7.75%, 2011 | | | 2,750,000 | | | 2,879,847 |

| Wal-Mart Stores, Inc., 6.2%, 2038 | | | 5,470,000 | | | 5,696,212 |

| Wesfarmers Ltd., 6.998%, 2013 (n) | | | 4,170,000 | | | 3,965,207 |

| | | | | | |

| | | | | | $ | 19,484,099 |

| Supermarkets - 0.7% | | | | | | |

| Delhaize America, Inc., 9%, 2031 | | $ | 2,407,000 | | $ | 2,640,583 |

| Kroger Co., 6.4%, 2017 | | | 3,884,000 | | | 4,042,821 |

| | | | | | |

| | | | | | $ | 6,683,404 |

| Supranational - 0.3% | | | | | | |

| Corporacion Andina de Fomento, 6.875%, 2012 | | $ | 2,747,000 | | $ | 2,751,607 |

| | |

| Telecommunications - Wireless - 0.9% | | | | | | |

| Rogers Cable, Inc., 5.5%, 2014 | | $ | 2,229,000 | | $ | 2,240,996 |

| Rogers Communications, Inc., 6.8%, 2018 | | | 1,340,000 | | | 1,404,191 |

| Rogers Wireless, Inc., 7.25%, 2012 | | | 3,315,000 | | | 3,497,849 |

| Vodafone Group PLC, 5.625%, 2017 | | | 1,452,000 | | | 1,461,072 |

| | | | | | |

| | | | | | $ | 8,604,108 |

| Telephone Services - 0.9% | | | | | | |

| Embarq Corp., 7.082%, 2016 | | $ | 3,710,000 | | $ | 3,561,600 |

| Frontier Communications Corp., 8.25%, 2014 | | | 5,120,000 | | | 5,030,400 |

| | | | | | |

| | | | | | $ | 8,592,000 |

| Tobacco - 2.9% | | | | | | |

| Altria Group, Inc., 9.95%, 2038 | | $ | 5,290,000 | | $ | 5,806,685 |

| BAT International Finance PLC, 9.5%, 2018 (n) | | | 4,400,000 | | | 4,999,711 |

| Philip Morris International, Inc., 4.875%, 2013 | | | 5,728,000 | | | 5,925,725 |

| Reynolds American, Inc., 7.25%, 2012 | | | 5,112,000 | | | 4,965,255 |

| Reynolds American, Inc., 6.75%, 2017 | | | 7,310,000 | | | 6,570,243 |

| | | | | | |

| | | | | | $ | 28,267,619 |

18

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| U.S. Treasury Obligations - 2.1% | | | | | | |

| U.S. Treasury Notes, 4.875%, 2016 | | $ | 17,914,000 | | $ | 20,494,727 |

| | |

| Utilities - Electric Power - 10.6% | | | | | | |

| AES Corp., 9.75%, 2016 (z) | | $ | 5,275,000 | | $ | 5,222,250 |

| Allegheny Energy Supply Co. LLC, 8.25%, 2012 (n) | | | 8,890,000 | | | 8,978,633 |

| Beaver Valley Funding Corp., 9%, 2017 | | | 8,961,000 | | | 8,806,602 |

| CenterPoint Energy, Inc., 5.95%, 2017 | | | 2,950,000 | | | 2,437,762 |

| Consumers Energy Co., 6.7%, 2019 | | | 3,190,000 | | | 3,366,694 |

| Dominion Resources, Inc., 6.4%, 2018 | | | 3,160,000 | | | 3,264,485 |

| DPL, Inc., 6.875%, 2011 | | | 3,644,000 | | | 3,721,624 |

| Duke Energy Corp., 5.65%, 2013 | | | 6,740,000 | | | 6,928,046 |

| E.ON International Finance B.V., 6.65%, 2038 (n) | | | 1,583,000 | | | 1,504,841 |

| EDP Finance B.V., 6%, 2018 (n) | | | 6,800,000 | | | 6,586,568 |

| Enersis S.A., 7.375%, 2014 | | | 4,189,000 | | | 4,419,177 |

| Exelon Generation Co. LLC, 6.95%, 2011 | | | 11,821,000 | | | 12,270,564 |

| Mirant Americas Generation LLC, 8.3%, 2011 | | | 5,000,000 | | | 5,000,000 |

| NiSource Finance Corp., 7.875%, 2010 | | | 4,669,000 | | | 4,664,448 |

| NorthWestern Corp., 5.875%, 2014 | | | 4,275,000 | | | 4,321,623 |

| NRG Energy, Inc., 7.375%, 2016 | | | 5,015,000 | | | 4,826,938 |

| Oncor Electric Delivery Co. LLC, 6.8%, 2018 (n) | | | 4,102,000 | | | 4,094,756 |

| Progress Energy, Inc., 6.05%, 2014 | | | 100,000 | | | 104,295 |

| Progress Energy, Inc., 7.05%, 2019 | | | 2,730,000 | | | 2,894,046 |

| PSEG Power LLC, 5.5%, 2015 | | | 1,705,000 | | | 1,578,426 |

| System Energy Resources, Inc., 5.129%, 2014 (z) | | | 2,343,370 | | | 2,157,916 |

| Waterford 3 Funding Corp., 8.09%, 2017 | | | 5,462,787 | | | 5,393,410 |

| | | | | | |

| | | | | | $ | 102,543,104 |

| Total Bonds (Identified Cost, $1,039,031,232) | | | | | $ | 937,715,957 |

| | |

| Preferred Stocks - 0.0% | | | | | | |

| Automotive - 0.0% | | | | | | |

| Preferred Blocker, Inc., 7% (Identified Cost, $600,600) (z) | | $ | 780 | | $ | 234,000 |

| | |

| Money Market Funds (v) - 1.8% | | | | | | |

MFS Institutional Money Market Portfolio, 0.23%,

at Cost and Net Asset Value | | | 17,666,146 | | $ | 17,666,146 |

| Total Investments (Identified Cost, $1,057,297,978) | | | | | $ | 955,616,103 |

| | |

| Other Assets, Less Liabilities - 1.4% | | | | | | 13,535,864 |

| Net Assets - 100.0% | | | | | $ | 969,151,967 |

19

Portfolio of Investments – continued

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $112,779,619, representing 11.6% of net assets. |

| (v) | Underlying fund that is available only to investment companies managed by MFS. The rate quoted is the annualized seven-day yield of the fund at period end. |

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| | | | | | |

| Restricted Securities | | Acquisition

Date | | Cost | | Current

Market

Value |

| AES Corp., 9.75%, 2016 | | 3/30/09 | | $4,959,701 | | $5,222,250 |

| Bayview Financial Revolving Mortgage Loan Trust, FRN, 1.235%, 2040 | | 3/01/06 | | 2,930,000 | | 1,289,200 |

| Brazilian Merchant Voucher Receivables Ltd., 5.911%, 2011 | | 7/02/03-3/08/07 | | 3,076,031 | | 2,950,668 |

| Chase Commercial Mortgage Securities Corp., 6.6%, 2029 | | 6/07/00 | | 1,356,436 | | 1,394,246 |

| DLJ Commercial Mortgage Corp., 6.04%, 2031 | | 7/23/04 | | 2,638,083 | | 2,383,321 |

| Emirate of Abu Dhabi, 5.5%, 2014 | | 4/01/09 | | 304,021 | | 312,848 |

| Emirate of Abu Dhabi, 6.75%, 2019 | | 4/01/09 | | 3,259,641 | | 3,318,383 |

| Falcon Franchise Loan LLC, 6.5%, 2014 | | 7/15/05 | | 2,522,763 | | 1,448,490 |

Falcon Franchise Loan LLC, FRN,

4.334%, 2025 | | 1/29/03 | | 1,602,810 | | 1,001,352 |

| GMAC LLC, 7.25%, 2011 | | 12/29/08 | | 3,231,700 | | 3,238,400 |

| GMAC LLC, FRN, 6.02%, 2033 | | 3/20/02 | | 3,957,294 | | 3,116,542 |

| Hana Bank, 6.5%, 2012 | | 4/02/09-4/03/09 | | 2,306,952 | | 2,327,069 |

| ING Bank N.V., 3.9%, 2014 | | 3/12/09 | | 4,990,555 | | 4,964,770 |

| Industrial Bank of Korea, 7.125%, 2014 | | 4/16/09 | | 3,518,046 | | 3,486,573 |

| Mubadala Development Co., 7.625%, 2019 | | 4/30/09 | | 3,252,347 | | 3,252,347 |

PNC Mortgage Acceptance Corp., FRN,

7.1%, 2032 | | 3/25/08 | | 5,790,000 | | 5,257,731 |

| Preferred Blocker, Inc., 7% (Preferred Stock) | | 12/29/08 | | 600,600 | | 234,000 |

| Prudential Securities Secured Financing Corp., FRN, 7.285%, 2013 | | 12/06/04 | | 3,663,085 | | 2,841,457 |

| Qwest Corp., 8.375%, 2016 | | 4/07/09 | | 457,123 | | 491,530 |

| Spirit Master Funding LLC, 5.05%, 2023 | | 10/04/05 | | 2,528,580 | | 2,064,850 |

| State of Qatar, 6.55%, 2019 | | 4/02/09 | | 1,375,630 | | 1,424,850 |

| System Energy Resources, Inc., 5.129%, 2014 | | 4/16/04 | | 2,343,370 | | 2,157,916 |

| Telemar Norte Leste S.A., 9.5%, 2019 | | 4/16/09-4/24/09 | | 2,361,762 | | 2,425,898 |

| Total Restricted Securities | | | | | | $56,604,691 |

| % of Net Assets | | | | | | 5.8% |

20

Portfolio of Investments – continued

The following abbreviations are used in this report and are defined:

| CDO | | Collateralized Debt Obligation |

| CLO | | Collateralized Loan Obligation |

| FRN | | Floating Rate Note. Interest rate resets periodically and may not be the rate reported at period end. |

| PLC | | Public Limited Company |

| REIT | | Real Estate Investment Trust |

| | | | | | |

| Insurers | | |

| FSA | | Financial Security Assurance Inc. | | | | |

Derivative Contracts at 4/30/09

Swap Agreements at 4/30/09

| | | | | | | | | | | | | |

| Expiration | | | | Notional

Amount | | Counterparty | | Cash Flows

to Receive | | Cash Flows

to Pay | | Fair Value | |

| Asset Derivatives | | | | | | | |

| Credit Default Swaps | | | | | | | |

| 6/20/13 | | USD | | 2,670,000 | | Morgan Stanley Capital Services, Inc. | | (1) | | 1.48% (fixed rate) | | $38,974 | |

| 3/20/14 | | USD | | 2,180,000 | | Morgan Stanley Capital Services, Inc. | | (1) | | 1.75% (fixed rate) | | 22,134 | |

| 9/20/13 | | USD | | 2,680,000 | | Morgan Stanley Capital Services, Inc. | | (2) | | 0.99% (fixed rate) | | 99,149 | |

| 12/20/13 | | USD | | 2,680,000 | | Goldman Sachs International | | (2) | | 1.50% (fixed rate) | | 45,447 | |

| 12/20/13 | | USD | | 1,330,000 | | Merrill Lynch International | | (3) | | 1.43% (fixed rate) | | 24,445 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | $230,149 | |

| | | | | | | | | | | | | |

| Liability Derivatives | | | | | | | |

| Credit Default Swaps | | | | | | | |

| 12/20/12 | | USD | | 6,090,000 | | Merrill Lynch International | | 1.00% (fixed rate) | | (4) | | $(3,871,385 | ) |

| 6/20/13 | | USD | | 2,740,000 | | Morgan Stanley Capital Services, Inc. | | (5) | | 1.07% (fixed rate) | | (39,773 | ) |

| 12/20/13 | | USD | | 2,660,000 | | JPMorgan Chase Bank | | (5) | | 0.78% (fixed rate) | | (5,409 | ) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | $(3,916,567 | ) |

| | | | | | | | | | | | | |

| (1) | Fund, as protection buyer, to receive notional amount upon a defined credit event by Weyerhaeuser Co., 7.125%, 7/15/23. |

| (2) | Fund, as protection buyer, to receive notional amount upon a defined credit event by British Telecommunications PLC, 5.75%, 12/07/28. |

| (3) | Fund, as protection buyer, to receive notional amount upon a defined credit event by CIGNA Corp., 7.875%, 5/15/27. |

| (4) | Fund, as protection seller, to pay notional amount upon a defined credit event by MBIA, Inc., 1.756%, 10/06/10, a BBB+ rated bond. The fund entered into the contract to gain issuer exposure. |

| (5) | Fund, as protection buyer, to receive notional amount upon a defined credit event by Arrow Electronic, Inc., 6.875%, 6/01/18. |

21

Portfolio of Investments – continued

The credit ratings presented here are an indicator of the current payment/performance risk of the related swap, the reference obligation for which may be either a single security or, in case of a credit default index, a basket of securities issued by corporate or sovereign issuers. Each reference security, including each individual security within a reference basket of securities, is assigned a rating from Moody’s Investor Service. If not rated by Moody’s, the rating will be that assigned by Standard & Poor’s. Likewise, if not assigned by Standard & Poor’s, it will be based on the rating assigned by Fitch, Inc. The ratings for a credit default index are calculated by MFS as a weighted average of the external credit ratings of the individual securities that compose the index’s reference basket of basket.

At April 30, 2009, the fund had sufficient cash and/or other liquid securities to cover any commitments under these derivative contracts.

See Notes to Financial Statements

22

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 4/30/09

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | |

| Assets | | | |

Investments- | | | |

Non-affiliated issuers, at value (identified cost, $1,039,631,832) | | $937,949,957 | |

Underlying funds, at cost and value | | 17,666,146 | |

Total investments, at value (identified cost, $1,057,297,978) | | $955,616,103 | |

Cash | | 200,000 | |

Restricted cash | | 3,930,000 | |

Receivables for | | | |

Investments sold | | 5,008,517 | |

Fund shares sold | | 4,687,442 | |

Interest and dividends | | 14,304,162 | |

Swaps, at value | | 230,149 | |

Other assets | | 10,946 | |

Total assets | | $983,987,319 | |

| Liabilities | | | |

Payables for | | | |

Distributions | | $710,524 | |

Investments purchased | | 5,081,867 | |

Fund shares reacquired | | 4,530,424 | |

Swaps, at value | | 3,916,567 | |

Payable to affiliates | | | |

Management fee | | 20,556 | |

Shareholder servicing costs | | 345,495 | |

Distribution and service fees | | 18,666 | |

Administrative services fee | | 1,075 | |

Payable for independent trustees’ compensation | | 64,128 | |

Accrued expenses and other liabilities | | 146,050 | |

Total liabilities | | $14,835,352 | |

Net assets | | $969,151,967 | |

| Net assets consist of | | | |

Paid-in capital | | $1,188,984,432 | |

Unrealized appreciation (depreciation) on investments | | (105,368,293 | ) |

Accumulated net realized gain (loss) on investments | | (117,191,030 | ) |

Undistributed net investment income | | 2,726,858 | |

Net assets | | $969,151,967 | |

Shares of beneficial interest outstanding | | 88,592,318 | |

| | | | | | |

| | | Net assets | | Shares

outstanding | | Net asset value

per share (a) |

Class A | | $618,093,112 | | 56,471,040 | | $10.95 |

Class B | | 67,148,891 | | 6,152,538 | | 10.91 |

Class C | | 74,651,436 | | 6,848,149 | | 10.90 |

Class I | | 53,906,055 | | 4,923,816 | | 10.95 |

Class R1 | | 7,911,923 | | 725,267 | | 10.91 |

Class R2 | | 55,412,747 | | 5,064,039 | | 10.94 |

Class R3 | | 46,013,663 | | 4,204,607 | | 10.94 |

Class R4 | | 46,014,140 | | 4,202,862 | | 10.95 |

On sales of $50,000 or more, the offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares.

| (a) | Maximum offering price and redemption price per share were equal to the net asset value per share for all shares classes, except for Class A, for which the maximum offering price per share was $11.50. |

See Notes to Financial Statements

23

Financial Statements

STATEMENT OF OPERATIONS

Year ended 4/30/09

This statement describes how much your fund earned in investment income and accrued in expenses.

It also describes any gains and/or losses generated by fund operations.

| | | | | | |

| Net investment income | | | | | | |

Income | | | | | | |

Interest | | $68,704,590 | | | | |

Dividends | | 21,169 | | | | |

Dividends from underlying funds | | 335,039 | | | | |

Total investment income | | | | | $69,060,798 | |

Expenses | | | | | | |

Management fee | | $4,046,901 | | | | |

Distribution and service fees | | 3,909,103 | | | | |

Shareholder servicing costs | | 2,113,841 | | | | |

Administrative services fee | | 184,450 | | | | |

Independent trustees’ compensation | | 34,248 | | | | |

Custodian fee | | 132,385 | | | | |

Shareholder communications | | 182,971 | | | | |

Auditing fees | | 60,781 | | | | |

Legal fees | | 31,557 | | | | |

Miscellaneous | | 191,862 | | | | |

Total expenses | | | | | $10,888,099 | |

Fees paid indirectly | | (34,909 | ) | | | |

Reduction of expenses by investment adviser | | (797,866 | ) | | | |

Net expenses | | | | | $10,055,324 | |

Net investment income | | | | | $59,005,474 | |

| Realized and unrealized gain (loss) on investments | | | | | | |

Realized gain (loss) (identified cost basis) | | | | | | |

Investment transactions | | $(47,418,447 | ) | | | |

Swap transactions | | 1,006,357 | | | | |

Net realized gain (loss) on investments | | | | | $(46,412,090 | ) |

Change in unrealized appreciation (depreciation) | | | | | | |

Investments | | $(75,227,037 | ) | | | |

Swap transactions | | (1,164,529 | ) | | | |

Net unrealized gain (loss) on investments | | | | | $(76,391,566 | ) |

Net realized and unrealized gain (loss) on investments | | | | | $(122,803,656 | ) |

Change in net assets from operations | | | | | $(63,798,182 | ) |

See Notes to Financial Statements

24

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | |

| | | Years ended 4/30 | |

| | | 2009 | | | 2008 | |

| Change in net assets | | | | | | |

| From operations | | | | | | |

Net investment income | | $59,005,474 | | | $64,840,523 | |

Net realized gain (loss) on investments | | (46,412,090 | ) | | (12,359,941 | ) |

Net unrealized gain (loss) on investments | | (76,391,566 | ) | | (36,795,748 | ) |

Change in net assets from operations | | $(63,798,182 | ) | | $15,684,834 | |

| Distributions declared to shareholders | | | | | | |

From net investment income | | $(60,324,168 | ) | | $(68,644,061 | ) |

Change in net assets from fund share transactions | | $(142,349,057 | ) | | $(20,590,584 | ) |

Total change in net assets | | $(266,471,407 | ) | | $(73,549,811 | ) |

| Net assets | | | | | | |

At beginning of period | | 1,235,623,374 | | | 1,309,173,185 | |

At end of period (including undistributed net investment income of $2,726,858 and accumulated distributions in excess of net investment income of $206,996) | | $969,151,967 | | | $1,235,623,374 | |

See Notes to Financial Statements

25

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | |

| Class A | | Years ended 4/30 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net asset value, beginning of period | | $12.18 | | | $12.69 | | | $12.38 | | | $12.91 | | | $12.92 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.64 | | | $0.64 | | | $0.66 | | | $0.64 | | | $0.65 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (1.22 | ) | | (0.47 | ) | | 0.32 | | | (0.49 | ) | | 0.05 | |

Total from investment operations | | $(0.58 | ) | | $0.17 | | | $0.98 | | | $0.15 | | | $0.70 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.65 | ) | | $(0.68 | ) | | $(0.67 | ) | | $(0.68 | ) | | $(0.71 | ) |

Net asset value, end of period | | $10.95 | | | $12.18 | | | $12.69 | | | $12.38 | | | $12.91 | |

Total return (%) (r)(s)(t) | | (4.61 | ) | | 1.41 | | | 8.13 | | | 1.11 | | | 5.55 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 0.96 | | | 0.98 | | | 0.93 | | | 0.97 | | | 0.93 | |

Expenses after expense reductions (f) | | 0.89 | | | 0.89 | | | 0.84 | | | 0.88 | | | 0.84 | |

Net investment income | | 5.76 | | | 5.21 | | | 5.29 | | | 4.99 | | | 4.98 | |

Portfolio turnover | | 44 | | | 56 | | | 45 | | | 55 | | | 40 | |

Net assets at end of period (000 Omitted) | | $618,093 | | | $769,599 | | | $832,752 | | | $896,891 | | | $926,909 | |

See Notes to Financial Statements

26

Financial Highlights – continued

| | | | | | | | | | | | | | | |

| Class B | | Years ended 4/30 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net asset value, beginning of period | | $12.14 | | | $12.65 | | | $12.34 | | | $12.86 | | | $12.88 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.56 | | | $0.56 | | | $0.57 | | | $0.55 | | | $0.56 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (1.22 | ) | | (0.48 | ) | | 0.32 | | | (0.48 | ) | | 0.04 | |

Total from investment operations | | $(0.66 | ) | | $0.08 | | | $0.89 | | | $0.07 | | | $0.60 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.57 | ) | | $(0.59 | ) | | $(0.58 | ) | | $(0.59 | ) | | $(0.62 | ) |

Net asset value, end of period | | $10.91 | | | $12.14 | | | $12.65 | | | $12.34 | | | $12.86 | |

Total return (%) (r)(s)(t) | | (5.32 | ) | | 0.69 | | | 7.39 | | | 0.47 | | | 4.74 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.67 | | | 1.68 | | | 1.63 | | | 1.67 | | | 1.63 | |

Expenses after expense reductions (f) | | 1.59 | | | 1.59 | | | 1.54 | | | 1.58 | | | 1.54 | |

Net investment income | | 5.06 | | | 4.52 | | | 4.60 | | | 4.28 | | | 4.29 | |

Portfolio turnover | | 44 | | | 56 | | | 45 | | | 55 | | | 40 | |

Net assets at end of period (000 Omitted) | | $67,149 | | | $98,671 | | | $164,852 | | | $230,360 | | | $307,017 | |

| |

| Class C | | Years ended 4/30 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net asset value, beginning of period | | $12.13 | | | $12.63 | | | $12.33 | | | $12.85 | | | $12.87 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.56 | | | $0.56 | | | $0.57 | | | $0.54 | | | $0.55 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (1.22 | ) | | (0.47 | ) | | 0.31 | | | (0.48 | ) | | 0.05 | |

Total from investment operations | | $(0.66 | ) | | $0.09 | | | $0.88 | | | $0.06 | | | $0.60 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.57 | ) | | $(0.59 | ) | | $(0.58 | ) | | $(0.58 | ) | | $(0.62 | ) |

Net asset value, end of period | | $10.90 | | | $12.13 | | | $12.63 | | | $12.33 | | | $12.85 | |

Total return (%) (r)(s)(t) | | (5.33 | ) | | 0.77 | | | 7.31 | | | 0.47 | | | 4.74 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.67 | | | 1.68 | | | 1.63 | | | 1.67 | | | 1.63 | |

Expenses after expense reductions (f) | | 1.59 | | | 1.59 | | | 1.54 | | | 1.58 | | | 1.54 | |

Net investment income | | 5.09 | | | 4.52 | | | 4.59 | | | 4.29 | | | 4.28 | |

Portfolio turnover | | 44 | | | 56 | | | 45 | | | 55 | | | 40 | |

Net assets at end of period (000 Omitted) | | $74,651 | | | $75,666 | | | $79,473 | | | $79,921 | | | $82,890 | |

See Notes to Financial Statements

27

Financial Highlights – continued

| | | | | | | | | | | | | | | |

| Class I | | Years ended 4/30 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net asset value, beginning of period | | $12.18 | | | $12.70 | | | $12.39 | | | $12.91 | | | $12.93 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.67 | | | $0.68 | | | $0.70 | | | $0.67 | | | $0.69 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (1.21 | ) | | (0.48 | ) | | 0.32 | | | (0.47 | ) | | 0.04 | |

Total from investment operations | | $(0.54 | ) | | $0.20 | | | $1.02 | | | $0.20 | | | $0.73 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.69 | ) | | $(0.72 | ) | | $(0.71 | ) | | $(0.72 | ) | | $(0.75 | ) |

Net asset value, end of period | | $10.95 | | | $12.18 | | | $12.70 | | | $12.39 | | | $12.91 | |

Total return (%) (r)(s) | | (4.32 | ) | | 1.64 | | | 8.45 | | | 1.50 | | | 5.79 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 0.67 | | | 0.67 | | | 0.63 | | | 0.67 | | | 0.63 | |

Expenses after expense reductions (f) | | 0.59 | | | 0.58 | | | 0.54 | | | 0.58 | | | 0.54 | |

Net investment income | | 6.06 | | | 5.50 | | | 5.59 | | | 5.29 | | | 5.28 | |

Portfolio turnover | | 44 | | | 56 | | | 45 | | | 55 | | | 40 | |

Net assets at end of period (000 Omitted) | | $53,906 | | | $56,574 | | | $49,251 | | | $41,976 | | | $44,604 | |

| |

| Class R1 | | Years ended 4/30 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 (i) | |

Net asset value, beginning of period | | $12.14 | | | $12.65 | | | $12.34 | | | $12.86 | | | $12.80 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.56 | | | $0.55 | | | $0.56 | | | $0.53 | | | $0.04 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (1.22 | ) | | (0.48 | ) | | 0.32 | | | (0.48 | ) | | 0.07 | (g) |

Total from investment operations | | $(0.66 | ) | | $0.07 | | | $0.88 | | | $0.05 | | | $0.11 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.57 | ) | | $(0.58 | ) | | $(0.57 | ) | | $(0.57 | ) | | $(0.05 | ) |

Net asset value, end of period | | $10.91 | | | $12.14 | | | $12.65 | | | $12.34 | | | $12.86 | |

Total return (%) (r)(s) | | (5.32 | ) | | 0.61 | | | 7.29 | | | 0.33 | | | 0.85 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.67 | | | 1.75 | | | 1.81 | | | 1.87 | | | 1.96 | (a) |

Expenses after expense reductions (f) | | 1.59 | | | 1.66 | | | 1.64 | | | 1.70 | | | 1.87 | (a) |

Net investment income | | 5.09 | | | 4.42 | | | 4.49 | | | 4.28 | | | 4.06 | (a) |

Portfolio turnover | | 44 | | | 56 | | | 45 | | | 55 | | | 40 | |

Net assets at end of period (000 Omitted) | | $7,912 | | | $8,351 | | | $3,612 | | | $1,900 | | | $50 | |

See Notes to Financial Statements

28

Financial Highlights – continued

| | | | | | | | | | | | | | | |

| Class R2 | | Years ended 4/30 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net asset value, beginning of period | | $12.17 | | | $12.69 | | | $12.38 | | | $12.90 | | | $12.92 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.62 | | | $0.59 | | | $0.62 | | | $0.58 | | | $0.53 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (1.22 | ) | | (0.47 | ) | | 0.32 | | | (0.47 | ) | | 0.11 | |

Total from investment operations | | $(0.60 | ) | | $0.12 | | | $0.94 | | | $0.11 | | | $0.64 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.63 | ) | | $(0.64 | ) | | $(0.63 | ) | | $(0.63 | ) | | $(0.66 | ) |

Net asset value, end of period | | $10.94 | | | $12.17 | | | $12.69 | | | $12.38 | | | $12.90 | |

Total return (%) (r)(s) | | (4.82 | ) | | 1.03 | | | 7.76 | | | 0.80 | | | 5.00 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.17 | | | 1.26 | | | 1.36 | | | 1.42 | | | 1.45 | |

Expenses after expense reductions (f) | | 1.10 | | | 1.17 | | | 1.19 | | | 1.26 | | | 1.36 | |

Net investment income | | 5.53 | | | 4.91 | | | 4.94 | | | 4.65 | | | 4.48 | |

Portfolio turnover | | 44 | | | 56 | | | 45 | | | 55 | | | 40 | |

Net assets at end of period (000 Omitted) | | $55,413 | | | $81,433 | | | $27,069 | | | $9,992 | | | $4,039 | |

| |

| Class R3 | | Years ended 4/30 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 (i) | |

Net asset value, beginning of period | | $12.18 | | | $12.69 | | | $12.38 | | | $12.91 | | | $12.85 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.65 | | | $0.64 | | | $0.65 | | | $0.56 | | | $0.05 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (1.23 | ) | | (0.47 | ) | | 0.32 | | | (0.43 | ) | | 0.07 | (g) |

Total from investment operations | | $(0.58 | ) | | $0.17 | | | $0.97 | | | $0.13 | | | $0.12 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.66 | ) | | $(0.68 | ) | | $(0.66 | ) | | $(0.66 | ) | | $(0.06 | ) |

Net asset value, end of period | | $10.94 | | | $12.18 | | | $12.69 | | | $12.38 | | | $12.91 | |

Total return (%) (r)(s) | | (4.65 | ) | | 1.36 | | | 8.03 | | | 1.01 | | | 0.91 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 0.92 | | | 1.02 | | | 1.02 | | | 1.09 | | | 1.19 | (a) |

Expenses after expense reductions (f) | | 0.84 | | | 0.93 | | | 0.94 | | | 1.00 | | | 1.10 | (a) |

Net investment income | | 5.80 | | | 5.16 | | | 5.19 | | | 5.08 | | | 4.93 | (a) |

Portfolio turnover | | 44 | | | 56 | | | 45 | | | 55 | | | 40 | |

Net assets at end of period (000 Omitted) | | $46,014 | | | $59,233 | | | $38,827 | | | $4,170 | | | $50 | |

See Notes to Financial Statements

29

Financial Highlights – continued

| | | | | | | | | | | | | | | |

| Class R4 | | Years ended 4/30 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 (i) | |

Net asset value, beginning of period | | $12.19 | | | $12.70 | | | $12.38 | | | $12.91 | | | $12.85 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.67 | | | $0.67 | | | $0.68 | | | $0.66 | | | $0.06 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (1.22 | ) | | (0.47 | ) | | 0.34 | | | (0.49 | ) | | 0.06 | (g) |

Total from investment operations | | $(0.55 | ) | | $0.20 | | | $1.02 | | | $0.17 | | | $0.12 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.69 | ) | | $(0.71 | ) | | $(0.70 | ) | | $(0.70 | ) | | $(0.06 | ) |

Net asset value, end of period | | $10.95 | | | $12.19 | | | $12.70 | | | $12.38 | | | $12.91 | |

Total return (%) (r)(s) | | (4.40 | ) | | 1.65 | | | 8.43 | | | 1.32 | | | 0.93 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 0.68 | | | 0.74 | | | 0.73 | | | 0.77 | | | 0.90 | (a) |

Expenses after expense reductions (f) | | 0.60 | | | 0.65 | | | 0.64 | | | 0.68 | | | 0.81 | (a) |

Net investment income | | 6.01 | | | 5.44 | | | 5.84 | | | 5.19 | | | 5.14 | (a) |

Portfolio turnover | | 44 | | | 56 | | | 45 | | | 55 | | | 40 | |

Net assets at end of period (000 Omitted) | | $46,014 | | | $86,097 | | | $69,694 | | | $51 | | | $50 | |