UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2464

MFS SERIES TRUST IX

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2009*

| * | This Form N-CSR pertains to the following series of the Registrant: MFS Inflation-Adjusted Bond Fund. |

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

MFS® Inflation-Adjusted Bond Fund

SIPC Contact Information:

You may obtain information about the Securities Investor Protection Corporation (“SIPC”), including the SIPC Brochure, by contacting SIPC either by telephone (202-371-8300) or by accessing SIPC’s website address (www.sipc.org).

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ

NO BANK GUARANTEE

10/31/09

IAB-ANN

LETTER FROM THE CEO

Dear Shareholders:

There remains some question as to when the global economy will achieve a sustainable recovery. While some economists and market watchers are optimistic that the worst is behind us, a number also agree with U.S. Federal Reserve Board Chairman Ben Bernanke who said in September that “even though from a technical perspective the recession is very likely over at this point, it’s still going to feel like a very weak economy for some time.”

Have we in fact turned the corner? We have seen tremendous rallies in the markets over the past six months. The Fed has cut interest rates aggressively toward zero to support credit markets, global deleveraging has helped diminish inflationary concerns, and stimulus measures have put more money in the hands of the government and individuals to keep the economy moving. Still, unemployment remains high, consumer confidence and spending continue to waiver, and the housing market, while improving, has a long way to go to recover.

Regardless of lingering market uncertainties, MFS® is confident that the fundamental principles of long-term investing will always apply. We encourage investors to speak with their advisors to identify and research long-term investment opportunities thoroughly. Global research continues to be one of the hallmarks of MFS, along with a unique collaboration between our portfolio managers and sector analysts, who regularly discuss potential investments before making both buy and sell decisions.

As we continue to dig out from the worst financial crisis in decades, keep in mind that while the road back to sustainable recovery will be slow, gradual, and even bumpy at times, conditions are significantly better than they were six months ago.

Respectfully,

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

December 15, 2009

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

PORTFOLIO COMPOSITION

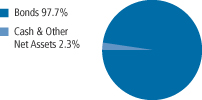

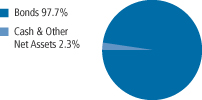

Portfolio structure (i)

| | |

| Fixed income sectors (i) | | |

| U.S. Treasury Securities | | 97.7% |

| |

| Credit quality of bonds (r) | | |

| AAA | | 100.0% |

| | |

| Portfolio facts | | |

| Average Duration (d)(i) | | 3.5 |

| Average Effective Maturity (i)(m) | | 8.9 yrs. |

| Average Credit Quality of Rated Securities (long-term) (a) | | AAA |

| Average Credit Quality of Rated Securities (short-term) (a)(c) | | A-1 |

| (a) | The average credit quality of rated securities is based upon a market weighted average of portfolio holdings that are rated by public rating agencies. |

| (c) | Includes holding in the MFS Institutional Money Market Portfolio which is not rated by a public rating agency. The average credit quality of rated securities (short-term) is based upon a market weighted average of the underlying holdings within the MFS Institutional Money Market Portfolio that are rated by public rating agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

| (i) | For purposes of this presentation, the bond component includes accrued interest amounts and may be positively or negatively impacted by the equivalent exposure from any derivative holdings, if applicable. |

| (m) | In determining an instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (r) | Each security is assigned a rating from Moody’s Investors Service. If not rated by Moody’s, the rating will be that assigned by Standard & Poor’s. Likewise, if not assigned a rating by Standard & Poor’s, it will be based on the rating assigned by Fitch, Inc. For those portfolios that hold a security which is not rated by any of the three agencies, the security is considered Not Rated. Holdings in U.S. Treasuries and government agency mortgage-backed securities, if any, are included in the “AAA”-rating category. Percentages are based on the total market value of investments as of 10/31/09. |

Percentages are based on net assets as of 10/31/09, unless otherwise noted.

The portfolio is actively managed and current holdings may be different.

2

MANAGEMENT REVIEW

Summary of Results

For the twelve months ended October 31, 2009, Class A shares of the MFS Inflation-Adjusted Bond Fund (the “fund”) provided a total return of 15.11%, at net asset value. This compares with a return of 17.15% for the fund’s benchmark, the Barclays Capital U.S. Treasury Inflation Protected Securities (TIPS) Index.

Market Environment

The global economy and financial markets experienced substantial deterioration and extraordinary volatility over most of the reporting period. Through the first quarter of 2009, the strong headwinds in the U.S. included accelerated deterioration in the housing market, anemic corporate investment, a rapidly declining job market, and a much tighter credit environment. During the very early stages of the period, a series of tumultuous financial events hammered markets. As a result of this turbulent news, global equity markets pushed significantly lower and credit markets witnessed the worst market decline since the beginning of the credit crisis. The synchronized global downturn in economic activity experienced in the fourth quarter of 2008 and the first quarter of 2009 was among the most intense in the post-World War II period. Not only did Europe and Japan fall into very deep recessions, but an increasingly powerful engine of global growth – emerging markets – also contracted almost across the board. The subsequent recovery in global activity has been similarly synchronized, led importantly by emerging Asian economies, but broadening to include most of the global economy to varying degrees. Primary drivers of the recovery included an unwinding of the inventory destocking that took place earlier, as well as massive fiscal and monetary stimulus. As a result, credit conditions and equity indices improved considerably during the second half of the period. Nevertheless, the degree of financial and macroeconomic dislocation remained significant.

During the first half of the reporting period, the Fed implemented its final interest rate cut, while making increasing use of its new lending facilities to alleviate ever-tightening credit markets. On the fiscal front, the U.S. Treasury designed and began implementing a massive fiscal stimulus package. As inflationary concerns diminished in the face of global deleveraging, and equity and credit markets deteriorated more sharply, central banks around the world also cut interest rates dramatically. Globally, policy makers increasingly sought to coordinate their rescue efforts, which resulted in a number of international actions, such as the establishment of swap lines between the Federal Reserve and a number of other central banks, as well as a substantial increase in the financial resources of the International Monetary Fund. By the middle of the period, several central banks had approached their lower bound on policy rates

3

Management Review – continued

and were examining the implementation and ramifications of quantitative easing as a means to further loosen monetary policy to offset the continuing fall in global economic activity. However, by the end of the period, there were broadening signs that the worst of the global macroeconomic deterioration had passed, which caused the subsequent rise in asset valuations. As most asset prices rebounded in the second half of the period and the demand for liquidity waned, the debate concerning monetary exit strategies had begun, creating added uncertainty regarding the forward path of policy rates.

Factors Affecting Performance

During the reporting period, the fund’s return from yield, which was lower than that of the benchmark, was a detractor from performance relative to the Barclays Capital U.S. Treasury Inflation Protected Securities Index.

Yield curve (y) positioning was another negative factor for the fund’s relative results. However, during the first half of the reporting period, as real yields fell, the fund benefited from being long duration.(d)

Respectfully,

Erik Weisman

Portfolio Manager

| (y) | A yield curve graphically depicts the yields of different maturity bonds of the same credit quality and type; a normal yield curve is upward sloping, with short-term rates lower than long-term rates. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

The views expressed in this report are those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

4

PERFORMANCE SUMMARY THROUGH 10/31/09

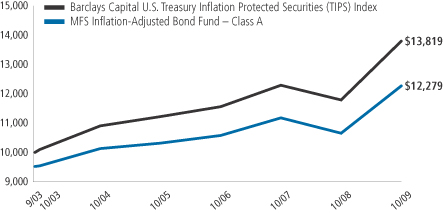

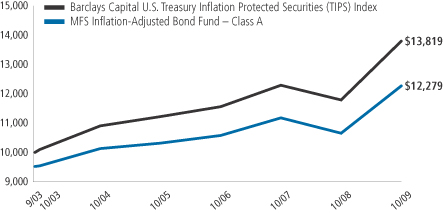

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment (t)

5

Performance Summary – continued

Total Returns through 10/31/09

Average annual without sales charge

| | | | | | | | | | | | |

| | | Share class | | Class inception date | | 1-yr | | 5-yr | | Life (t) | | |

| | | A | | 9/30/03 | | 15.11% | | 3.90% | | 4.26% | | |

| | | B | | 9/01/04 | | 14.34% | | 3.09% | | 3.15% | | |

| | | C | | 9/01/04 | | 14.11% | | 3.06% | | 3.14% | | |

| | | I | | 9/30/03 | | 15.40% | | 4.08% | | 4.41% | | |

| | | R1 | | 4/01/05 | | 14.14% | | N/A | | 3.14% | | |

| | | R2 | | 9/01/04 | | 14.70% | | 3.44% | | 3.52% | | |

| | | R3 | | 4/01/05 | | 15.00% | | N/A | | 3.89% | | |

| | | R4 | | 4/01/05 | | 15.28% | | N/A | | 4.18% | | |

| Comparative benchmark | | | | | | | | |

| | | Barclays Capital U.S. Treasury Inflation Protected

Securities (TIPS) Index (f) | | 17.15% | | 4.83% | | N/A | | |

| Average annual with sales charge | | | | | | | | |

| | | A

With Initial Sales Charge (4.75%) | | 9.64% | | 2.90% | | 3.43% | | |

| | | B

With CDSC (Declining over six years

from 4% to 0%) (x) | | 10.34% | | 2.74% | | 2.98% | | |

| | | C

With CDSC (1% for 12 months) (x) | | 13.11% | | 3.06% | | 3.14% | | |

Class I, R1, R2, R3, and R4 shares do not have a sales charge.

CDSC – Contingent Deferred Sales Charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). The benchmark’s return for the period from the inception date of Class A shares, September 30, 2003, through the stated period end was 5.43%. No comparative benchmark information is provided for “life” periods for the fund’s other share classes. (See Notes to Performance Summary.) |

| (x) | Assuming redemption at the end of the applicable period. |

Benchmark Definition

Barclays Capital U.S. Treasury Inflation Protected Securities (TIPS) Index – measures the performance of inflation-protected securities issued by the U.S. Treasury.

It is not possible to invest directly in an index.

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period

6

Performance Summary – continued

end date. As the fund’s share classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

7

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, May 1, 2009 through October 31, 2009

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period May 1, 2009 through October 31, 2009.

The expenses include the payment of a portion of the transfer-agent-related expenses of MFS funds that invest in the fund. For further information, please see the Notes to the Financial Statements.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

Expense Table – continued

| | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | Beginning

Account Value

5/01/09 | | Ending

Account Value

10/31/09 | | Expenses

Paid During

Period (p)

5/01/09-10/31/09 |

| A | | Actual | | 0.65% | | $1,000.00 | | $1,065.15 | | $3.38 |

| | Hypothetical (h) | | 0.65% | | $1,000.00 | | $1,021.93 | | $3.31 |

| B | | Actual | | 1.41% | | $1,000.00 | | $1,061.11 | | $7.33 |

| | Hypothetical (h) | | 1.41% | | $1,000.00 | | $1,018.10 | | $7.17 |

| C | | Actual | | 1.50% | | $1,000.00 | | $1,060.58 | | $7.79 |

| | Hypothetical (h) | | 1.50% | | $1,000.00 | | $1,017.64 | | $7.63 |

| I | | Actual | | 0.50% | | $1,000.00 | | $1,065.88 | | $2.60 |

| | Hypothetical (h) | | 0.50% | | $1,000.00 | | $1,022.68 | | $2.55 |

| R1 | | Actual | | 1.50% | | $1,000.00 | | $1,060.68 | | $7.79 |

| | Hypothetical (h) | | 1.50% | | $1,000.00 | | $1,017.64 | | $7.63 |

| R2 | | Actual | | 1.00% | | $1,000.00 | | $1,063.25 | | $5.20 |

| | Hypothetical (h) | | 1.00% | | $1,000.00 | | $1,020.16 | | $5.09 |

| R3 | | Actual | | 0.74% | | $1,000.00 | | $1,064.62 | | $3.85 |

| | Hypothetical (h) | | 0.74% | | $1,000.00 | | $1,021.48 | | $3.77 |

| R4 | | Actual | | 0.50% | | $1,000.00 | | $1,065.95 | | $2.60 |

| | Hypothetical (h) | | 0.50% | | $1,000.00 | | $1,022.68 | | $2.55 |

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

9

PORTFOLIO OF INVESTMENTS

10/31/09

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | |

| Bonds - 97.3% | | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| U.S. Treasury Inflation Protected Securities - 97.3% | | | | | | |

| U.S. Treasury Bonds, 2.5%, 2016 | | $ | 14,402,340 | | $ | 15,650,175 |

| U.S. Treasury Bonds, 1.625%, 2018 | | | 16,070,870 | | | 16,462,597 |

| U.S. Treasury Bonds, 2.375%, 2025 | | | 21,354,810 | | | 22,697,835 |

| U.S. Treasury Bonds, 2%, 2026 | | | 12,241,425 | | | 12,350,447 |

| U.S. Treasury Bonds, 2.375%, 2027 | | | 20,455,879 | | | 21,632,092 |

| U.S. Treasury Bonds, 1.75%, 2028 | | | 10,175,779 | | | 9,795,775 |

| U.S. Treasury Bonds, 3.625%, 2028 | | | 12,960,178 | | | 16,069,610 |

| U.S. Treasury Bonds, 2.5%, 2029 | | | 12,081,455 | | | 13,000,781 |

| U.S. Treasury Bonds, 3.875%, 2029 | | | 15,720,784 | | | 20,261,387 |

| U.S. Treasury Bonds, 3.375%, 2032 | | | 4,278,998 | | | 5,294,593 |

| U.S. Treasury Notes, 3.5%, 2011 | | | 4,340,350 | | | 4,530,917 |

| U.S. Treasury Notes, 2.375%, 2011 | | | 12,701,919 | | | 13,135,576 |

| U.S. Treasury Notes, 3.375%, 2012 | | | 1,823,280 | | | 1,950,910 |

| U.S. Treasury Notes, 2%, 2012 | | | 9,890,695 | | | 10,328,824 |

| U.S. Treasury Notes, 3%, 2012 | | | 25,304,643 | | | 27,168,886 |

| U.S. Treasury Notes, 0.625%, 2013 | | | 9,828,473 | | | 9,914,472 |

| U.S. Treasury Notes, 1.875%, 2013 | | | 17,006,771 | | | 17,803,963 |

| U.S. Treasury Notes, 2%, 2014 | | | 21,376,230 | | | 22,440,039 |

| U.S. Treasury Notes, 1.25%, 2014 | | | 3,511,344 | | | 3,605,848 |

| U.S. Treasury Notes, 2%, 2014 | | | 20,210,925 | | | 21,317,796 |

| U.S. Treasury Notes, 1.625%, 2015 | | | 20,053,539 | | | 20,735,039 |

| U.S. Treasury Notes, 1.875%, 2015 | | | 15,645,783 | | | 16,402,397 |

| U.S. Treasury Notes, 2%, 2016 | | | 16,018,139 | | | 16,849,079 |

| U.S. Treasury Notes, 2.375%, 2017 | | | 14,525,569 | | | 15,663,778 |

| U.S. Treasury Notes, 2.625%, 2017 | | | 11,081,431 | | | 12,193,907 |

| U.S. Treasury Notes, 1.375%, 2018 | | | 11,181,054 | | | 11,230,843 |

| U.S. Treasury Notes, 2.125%, 2019 | | | 9,423,495 | | | 10,030,867 |

| U.S. Treasury Notes, 1.875%, 2019 | | | 5,952,896 | | | 6,218,919 |

| Total Bonds (Identified Cost, $382,953,570) | | | | | $ | 394,737,352 |

10

Portfolio of Investments – continued

| | | | | |

| Money Market Funds (v) - 2.1% | | | | | |

| Issuer | | Shares/Par | | Value ($) |

MFS Institutional Money Market Portfolio, 0.13%,

at Cost and Net Asset Value | | 8,647,508 | | $ | 8,647,508 |

| Total Investments (Identified Cost, $391,601,078) | | | | $ | 403,384,860 |

| | |

| Other Assets, Less Liabilities - 0.6% | | | | | 2,516,248 |

| Net Assets - 100.0% | | | | $ | 405,901,108 |

| (v) | Underlying fund that is available only to investment companies managed by MFS. The rate quoted is the annualized seven-day yield of the fund at period end. |

See Notes to Financial Statements

11

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 10/31/09

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | |

| Assets | | | |

Investments- | | | |

Non-affiliated issuers, at value (identified cost, $382,953,570) | | $394,737,352 | |

Underlying funds, at cost and value | | 8,647,508 | |

Total investments, at value (identified cost, $391,601,078) | | $403,384,860 | |

Receivables for | | | |

Fund shares sold | | 1,102,118 | |

Interest | | 2,011,670 | |

Receivable from investment adviser | | 64,680 | |

Total assets | | $406,563,328 | |

| Liabilities | | | |

Payables for | | | |

Distributions | | $34,803 | |

Fund shares reacquired | | 459,819 | |

Payable to affiliates | | | |

Investment adviser | | 11,576 | |

Shareholder servicing costs | | 81,494 | |

Distribution and service fees | | 6,560 | |

Administrative services fee | | 584 | |

Payable for independent Trustees’ compensation | | 750 | |

Accrued expenses and other liabilities | | 66,634 | |

Total liabilities | | $662,220 | |

Net assets | | $405,901,108 | |

| Net assets consist of | | | |

Paid-in capital | | $394,522,665 | |

Unrealized appreciation (depreciation) on investments | | 11,783,782 | |

Accumulated net realized gain (loss) on investments and foreign currency transactions | | (3,222,320 | ) |

Undistributed net investment income | | 2,816,981 | |

Net assets | | $405,901,108 | |

Shares of beneficial interest outstanding | | 40,269,214 | |

| | | | | | |

| | | Net assets | | Shares

outstanding | | Net asset value

per share (a) |

Class A | | $65,258,635 | | 6,478,160 | | $10.07 |

Class B | | 16,250,840 | | 1,612,698 | | 10.08 |

Class C | | 27,364,249 | | 2,712,557 | | 10.09 |

Class I | | 290,284,101 | | 28,796,519 | | 10.08 |

Class R1 | | 747,348 | | 74,213 | | 10.07 |

Class R2 | | 3,935,946 | | 390,549 | | 10.08 |

Class R3 | | 1,832,801 | | 181,961 | | 10.07 |

Class R4 | | 227,188 | | 22,557 | | 10.07 |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $10.57. On sales of $50,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for classes I, R1, R2, R3, and R4. |

See Notes to Financial Statements

12

Financial Statements

STATEMENT OF OPERATIONS

Year ended 10/31/09

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | |

| Net investment income | | | |

Interest (Net of $399,960 deflation adjustment on inflation protected securities) | | $8,626,227 | |

Dividends from underlying funds | | 11,332 | |

Total investment income | | $8,637,559 | |

Expenses | | | |

Management fee | | $1,253,071 | |

Distribution and service fees | | 519,941 | |

Shareholder servicing costs | | 595,792 | |

Administrative services fee | | 54,219 | |

Independent Trustees’ compensation | | 5,571 | |

Custodian fee | | 76,772 | |

Shareholder communications | | 30,150 | |

Auditing fees | | 33,044 | |

Legal fees | | 7,784 | |

Miscellaneous | | 143,158 | |

Total expenses | | $2,719,502 | |

Fees paid indirectly | | (2 | ) |

Reduction of expenses by investment adviser and distributor | | (1,013,902 | ) |

Net expenses | | $1,705,598 | |

Net investment income | | $6,931,961 | |

| Realized and unrealized gain (loss) on investments | | | |

Realized gain (loss) (identified cost basis) | | | |

Investment transactions | | $(978,645 | ) |

Futures contracts | | 299,302 | |

Net realized gain (loss) on investments | | $(679,343 | ) |

Change in unrealized appreciation (depreciation) | | | |

Investments | | $24,925,731 | |

Net realized and unrealized gain (loss) on investments | | $24,246,388 | |

Change in net assets from operations | | $31,178,349 | |

See Notes to Financial Statements

13

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | |

| | | Years ended 10/31 | |

| | | 2009 | | | 2008 | |

| Change in net assets | | | | | | |

| From operations | | | | | | |

Net investment income | | $6,931,961 | | | $3,376,600 | |

Net realized gain (loss) on investments and

foreign currency transactions | | (679,343 | ) | | 5,643 | |

Net unrealized gain (loss) on investments | | 24,925,731 | | | (13,536,078 | ) |

Change in net assets from operations | | $31,178,349 | | | $(10,153,835 | ) |

| Distributions declared to shareholders | | | | | | |

From net investment income | | $(6,371,809 | ) | | $(2,813,766 | ) |

Change in net assets from fund share transactions | | $292,591,897 | | | $81,492,561 | |

Total change in net assets | | $317,398,437 | | | $68,524,960 | |

| Net assets | | | | | | |

At beginning of period | | 88,502,671 | | | 19,977,711 | |

At end of period (including undistributed net investment income of $2,816,981 and $1,262,965, respectively) | | $405,901,108 | | | $88,502,671 | |

See Notes to Financial Statements

14

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | |

| Class A | | Years ended 10/31 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net asset value, beginning of period | | $9.00 | | | $9.97 | | | $9.69 | | | $9.92 | | | $10.24 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.02 | (g) | | $0.58 | | | $0.36 | | | $0.48 | | | $0.46 | |

Net realized and unrealized gain (loss) on investments and foreign currency | | 1.32 | (g) | | (0.99 | ) | | 0.19 | | | (0.24 | ) | | (0.27 | ) |

Total from investment operations | | $1.34 | | | $(0.41 | ) | | $0.55 | | | $0.24 | | | $0.19 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.27 | ) | | $(0.56 | ) | | $(0.27 | ) | | $(0.47 | ) | | $(0.51 | ) |

From net realized gain on investments | | — | | | — | | | — | | | (0.00 | )(w) | | — | |

Total distributions declared to shareholders | | $(0.27 | ) | | $(0.56 | ) | | $(0.27 | ) | | $(0.47 | ) | | $(0.51 | ) |

Net asset value, end of period | | $10.07 | | | $9.00 | | | $9.97 | | | $9.69 | | | $9.92 | |

Total return (%) (r)(s)(t) | | 15.11 | | | (4.68 | ) | | 5.72 | | | 2.49 | | | 1.85 | |

| Ratios (%) (to average net assets) and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.18 | | | 1.37 | | | 2.27 | | | 2.29 | | | 3.22 | |

Expenses after expense reductions (f) | | 0.65 | | | 0.65 | | | 0.65 | | | 0.65 | | | 0.64 | |

Net investment income | | 0.17 | | | 5.65 | | | 3.71 | | | 4.89 | | | 4.64 | |

Portfolio turnover | | 14 | | | 67 | | | 97 | | | 231 | | | 203 | |

Net assets at end of period (000 omitted) | | $65,259 | | | $44,922 | | | $8,565 | | | $7,698 | | | $8,831 | |

See Notes to Financial Statements

15

Financial Highlights – continued

| | | | | | | | | | | | | | | |

| Class B | | Years ended 10/31 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net asset value, beginning of period | | $9.00 | | | $9.97 | | | $9.69 | | | $9.92 | | | $10.23 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.09 | )(g) | | $0.51 | | | $0.27 | | | $0.40 | | | $0.37 | |

Net realized and unrealized gain (loss) on investments and foreign currency | | 1.37 | (g) | | (1.00 | ) | | 0.19 | | | (0.25 | ) | | (0.26 | ) |

Total from investment operations | | $1.28 | | | $(0.49 | ) | | $0.46 | | | $0.15 | | | $0.11 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.20 | ) | | $(0.48 | ) | | $(0.18 | ) | | $(0.38 | ) | | $(0.42 | ) |

From net realized gain on investments | | — | | | — | | | — | | | (0.00 | )(w) | | — | |

Total distributions declared to shareholders | | $(0.20 | ) | | $(0.48 | ) | | $(0.18 | ) | | $(0.38 | ) | | $(0.42 | ) |

Net asset value, end of period | | $10.08 | | | $9.00 | | | $9.97 | | | $9.69 | | | $9.92 | |

Total return (%) (r)(s)(t) | | 14.34 | | | (5.42 | ) | | 4.85 | | | 1.63 | | | 1.04 | |

| Ratios (%) (to average net assets) and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.83 | | | 1.96 | | | 2.90 | | | 2.88 | | | 3.87 | |

Expenses after expense reductions (f) | | 1.43 | | | 1.43 | | | 1.47 | | | 1.50 | | | 1.49 | |

Net investment income (loss) | | (0.90 | ) | | 4.94 | | | 2.82 | | | 4.16 | | | 3.69 | |

Portfolio turnover | | 14 | | | 67 | | | 97 | | | 231 | | | 203 | |

Net assets at end of period (000 omitted) | | $16,251 | | | $16,548 | | | $3,708 | | | $4,437 | | | $4,818 | |

| |

| Class C | | Years ended 10/31 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net asset value, beginning of period | | $9.02 | | | $9.98 | | | $9.70 | | | $9.94 | | | $10.24 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.02 | )(g) | | $0.51 | | | $0.26 | | | $0.40 | | | $0.38 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | 1.28 | (g) | | (1.00 | ) | | 0.20 | | | (0.26 | ) | | (0.26 | ) |

Total from investment operations | | $1.26 | | | $(0.49 | ) | | $0.46 | | | $0.14 | | | $0.12 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.19 | ) | | $(0.47 | ) | | $(0.18 | ) | | $(0.38 | ) | | $(0.42 | ) |

From net realized gain on investments | | — | | | — | | | — | | | (0.00 | )(w) | | — | |

Total distributions declared to shareholders | | $(0.19 | ) | | $(0.47 | ) | | $(0.18 | ) | | $(0.38 | ) | | $(0.42 | ) |

Net asset value, end of period | | $10.09 | | | $9.02 | | | $9.98 | | | $9.70 | | | $9.94 | |

Total return (%) (r)(s)(t) | | 14.11 | | | (5.37 | ) | | 4.83 | | | 1.53 | | | 1.15 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.90 | | | 2.00 | | | 2.93 | | | 2.90 | | | 3.87 | |

Expenses after expense reductions (f) | | 1.50 | | | 1.50 | | | 1.50 | | | 1.50 | | | 1.49 | |

Net investment income (loss) | | (0.22 | ) | | 4.96 | | | 2.73 | | | 4.11 | | | 3.74 | |

Portfolio turnover | | 14 | | | 67 | | | 97 | | | 231 | | | 203 | |

Net assets at end of period (000 omitted) | | $27,364 | | | $15,534 | | | $2,263 | | | $2,294 | | | $2,548 | |

See Notes to Financial Statements

16

Financial Highlights – continued

| | | | | | | | | | | | | | | |

| Class I | | Years ended 10/31 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net asset value, beginning of period | | $9.00 | | | $9.97 | | | $9.69 | | | $9.92 | | | $10.24 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.43 | (g) | | $0.58 | | | $0.41 | | | $0.51 | | | $0.43 | |

Net realized and unrealized gain (loss) on investments and foreign currency | | 0.94 | (g) | | (0.98 | ) | | 0.15 | | | (0.26 | ) | | (0.22 | ) |

Total from investment operations | | $1.37 | | | $(0.40 | ) | | $0.56 | | | $0.25 | | | $0.21 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.29 | ) | | $(0.57 | ) | | $(0.28 | ) | | $(0.48 | ) | | $(0.53 | ) |

From net realized gain on investments | | — | | | — | | | — | | | (0.00 | )(w) | | — | |

Total distributions declared to shareholders | | $(0.29 | ) | | $(0.57 | ) | | $(0.28 | ) | | $(0.48 | ) | | $(0.53 | ) |

Net asset value, end of period | | $10.08 | | | $9.00 | | | $9.97 | | | $9.69 | | | $9.92 | |

Total return (%) (r)(s) | | 15.40 | | | (4.53 | ) | | 5.88 | | | 2.65 | | | 2.02 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 0.86 | | | 1.06 | | | 1.89 | | | 1.87 | | | 2.88 | |

Expenses after expense reductions (f) | | 0.50 | | | 0.50 | | | 0.50 | | | 0.50 | | | 0.50 | |

Net investment income | | 4.46 | | | 5.69 | | | 4.22 | | | 5.26 | | | 4.23 | |

Portfolio turnover | | 14 | | | 67 | | | 97 | | | 231 | | | 203 | |

Net assets at end of period (000 omitted) | | $290,284 | | | $7,044 | | | $3,846 | | | $1,932 | | | $1,339 | |

| |

| Class R1 | | Years ended 10/31 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 (i) | |

Net asset value, beginning of period | | $9.00 | | | $9.96 | | | $9.69 | | | $9.92 | | | $10.10 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.12 | )(g) | | $0.46 | | | $0.33 | | | $0.43 | | | $0.24 | |

Net realized and unrealized gain (loss) on investments and foreign currency | | 1.38 | (g) | | (0.96 | ) | | 0.11 | | | (0.29 | ) | | (0.19 | ) |

Total from investment operations | | $1.26 | | | $(0.50 | ) | | $0.44 | | | $0.14 | | | $0.05 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.19 | ) | | $(0.46 | ) | | $(0.17 | ) | | $(0.37 | ) | | $(0.23 | ) |

From net realized gain on investments | | — | | | — | | | — | | | (0.00 | )(w) | | — | |

Total distributions declared to shareholders | | $(0.19 | ) | | $(0.46 | ) | | $(0.17 | ) | | $(0.37 | ) | | $(0.23 | ) |

Net asset value, end of period | | $10.07 | | | $9.00 | | | $9.96 | | | $9.69 | | | $9.92 | |

Total return (%) (r)(s) | | 14.14 | | | (5.42 | ) | | 4.63 | | | 1.53 | | | 0.47 | (n) |

| Ratios (%) (to average net assets) and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.91 | | | 2.13 | | | 3.07 | | | 2.96 | | | 4.08 | (a) |

Expenses after expense reductions (f) | | 1.51 | | | 1.53 | | | 1.60 | | | 1.60 | | | 1.69 | (a) |

Net investment income (loss) | | (1.28 | ) | | 4.47 | | | 3.34 | | | 4.44 | | | 3.97 | (a) |

Portfolio turnover | | 14 | | | 67 | | | 97 | | | 231 | | | 203 | |

Net assets at end of period (000 omitted) | | $747 | | | $813 | | | $324 | | | $233 | | | $50 | |

See Notes to Financial Statements

17

Financial Highlights – continued

| | | | | | | | | | | | | | | |

| Class R2 | | Years ended 10/31 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net asset value, beginning of period | | $9.01 | | | $9.97 | | | $9.69 | | | $9.93 | | | $10.24 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.00 | )(g)(w) | | $0.56 | | | $0.34 | | | $0.46 | | | $0.29 | |

Net realized and unrealized gain (loss) on investments and foreign currency | | 1.31 | (g) | | (1.00 | ) | | 0.16 | | | (0.28 | ) | | (0.15 | )(g) |

Total from investment operations | | $1.31 | | | $(0.44 | ) | | $0.50 | | | $0.18 | | | $0.14 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.24 | ) | | $(0.52 | ) | | $(0.22 | ) | | $(0.42 | ) | | $(0.45 | ) |

From net realized gain on investments | | — | | | — | | | — | | | (0.00 | )(w) | | — | |

Total distributions declared to shareholders | | $(0.24 | ) | | $(0.52 | ) | | $(0.22 | ) | | $(0.42 | ) | | $(0.45 | ) |

Net asset value, end of period | | $10.08 | | | $9.01 | | | $9.97 | | | $9.69 | | | $9.93 | |

Total return (%) (r)(s) | | 14.70 | | | (4.93 | ) | | 5.20 | | | 1.88 | | | 1.32 | |

| Ratios (%) (to average net assets) and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.40 | | | 1.54 | | | 2.59 | | | 2.66 | | | 3.59 | |

Expenses after expense reductions (f) | | 1.00 | | | 1.01 | | | 1.15 | | | 1.15 | | | 1.21 | |

Net investment income (loss) | | (0.02 | ) | | 5.49 | | | 3.50 | | | 4.73 | | | 3.77 | |

Portfolio turnover | | 14 | | | 67 | | | 97 | | | 231 | | | 203 | |

Net assets at end of period (000 omitted) | | $3,936 | | | $2,565 | | | $725 | | | $372 | | | $255 | |

| |

| Class R3 | | Years ended 10/31 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 (i) | |

Net asset value, beginning of period | | $9.00 | | | $9.96 | | | $9.69 | | | $9.92 | | | $10.10 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.02 | (g) | | $0.54 | | | $0.38 | | | $0.50 | | | $0.28 | |

Net realized and unrealized gain (loss) on investments and foreign currency | | 1.31 | (g) | | (0.96 | ) | | 0.13 | | | (0.29 | ) | | (0.18 | ) |

Total from investment operations | | $1.33 | | | $(0.42 | ) | | $0.51 | | | $0.21 | | | $0.10 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.26 | ) | | $(0.54 | ) | | $(0.24 | ) | | $(0.44 | ) | | $(0.28 | ) |

From net realized gain on investments | | — | | | — | | | — | | | (0.00 | )(w) | | — | |

Total distributions declared to shareholders | | $(0.26 | ) | | $(0.54 | ) | | $(0.24 | ) | | $(0.44 | ) | | $(0.28 | ) |

Net asset value, end of period | | $10.07 | | | $9.00 | | | $9.96 | | | $9.69 | | | $9.92 | |

Total return (%) (r)(s) | | 15.00 | | | (4.70 | ) | | 5.36 | | | 2.24 | | | 0.93 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.15 | | | 1.33 | | | 2.33 | | | 2.28 | | | 3.28 | (a) |

Expenses after expense reductions (f) | | 0.75 | | | 0.76 | | | 0.90 | | | 0.90 | | | 0.90 | (a) |

Net investment income | | 0.18 | | | 5.27 | | | 3.94 | | | 5.16 | | | 4.76 | (a) |

Portfolio turnover | | 14 | | | 67 | | | 97 | | | 231 | | | 203 | |

Net assets at end of period (000 omitted) | | $1,833 | | | $982 | | | $392 | | | $236 | | | $50 | |

See Notes to Financial Statements

18

Financial Highlights – continued

| | | | | | | | | | | | | | | |

| Class R4 | | Years ended 10/31 | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 (i) | |

Net asset value, beginning of period | | $9.00 | | | $9.96 | | | $9.69 | | | $9.92 | | | $10.10 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.07 | (g) | | $0.62 | | | $0.38 | | | $0.49 | | | $0.30 | |

Net realized and unrealized gain (loss) on investments and foreign currency | | 1.29 | (g) | | (1.01 | ) | | 0.16 | | | (0.25 | ) | | (0.19 | ) |

Total from investment operations | | $1.36 | | | $(0.39 | ) | | $0.54 | | | $0.24 | | | $0.11 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.29 | ) | | $(0.57 | ) | | $(0.27 | ) | | $(0.47 | ) | | $(0.29 | ) |

From net realized gain on investments | | — | | | — | | | — | | | (0.00 | )(w) | | — | |

Total distributions declared to shareholders | | $(0.29 | ) | | $(0.57 | ) | | $(0.27 | ) | | $(0.47 | ) | | $(0.29 | ) |

Net asset value, end of period | | $10.07 | | | $9.00 | | | $9.96 | | | $9.69 | | | $9.92 | |

Total return (%) (r)(s) | | 15.28 | | | (4.45 | ) | | 5.67 | | | 2.54 | | | 1.10 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 0.90 | | | 1.05 | | | 2.03 | | | 1.99 | | | 2.98 | (a) |

Expenses after expense reductions (f) | | 0.50 | | | 0.51 | | | 0.60 | | | 0.60 | | | 0.60 | (a) |

Net investment income | | 0.76 | | | 6.09 | | | 3.98 | | | 5.08 | | | 5.06 | (a) |

Portfolio turnover | | 14 | | | 67 | | | 97 | | | 231 | | | 203 | |

Net assets at end of period (000 omitted) | | $227 | | | $96 | | | $55 | | | $52 | | | $51 | |

Any redemption fees charged by the fund during the 2005 fiscal year resulted in a per share impact of less than $0.01.

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (g) | The per share amount varies from the net investment income and/or net realized and unrealized gain/loss for the period because of the timing of sales of fund shares and the per share amounts of realized and unrealized gains and losses and/or inflation/deflation adjustments at such time. |

| (i) | For the period from the class’ inception, April 1, 2005 (Classes R1, R3, and R4) through the stated period end. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01. |

See Notes to Financial Statements

19

NOTES TO FINANCIAL STATEMENTS

| (1) | | Business and Organization |

MFS Inflation-Adjusted Bond Fund (the fund) is a series of MFS Series Trust IX (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

| (2) | | Significant Accounting Policies |

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. In making these estimates and assumptions, management has considered the effects, if any, of events occurring after the date of the fund’s Statement of Assets and Liabilities through December 17, 2009 which is the date that the financial statements were issued. Actual results could differ from those estimates.

Investment Valuations – Debt instruments and floating rate loans (other than short-term instruments), including restricted debt instruments, are generally valued at an evaluated or composite bid as provided by a third-party pricing service. Short-term instruments with a maturity at issuance of 60 days or less generally are valued at amortized cost, which approximates market value. Exchange-traded options are generally valued at the last sale or official closing price as provided by a third-party pricing service on the exchange on which such options are primarily traded. Exchange-traded options for which there were no sales reported that day are generally valued at the last daily bid quotation as provided by a third-party pricing service on the exchange on which such options are primarily traded. Options not traded on an exchange are generally valued at a broker/dealer bid quotation. Foreign currency options are generally valued using an external pricing model that uses market data from a third-party source. Futures contracts are generally valued at last posted settlement price as provided by a third-party pricing service on the market on which they are primarily traded. Futures contracts for which there were no trades that day for a particular position are generally valued at the closing bid quotation as provided by a third-party pricing service on the market on which such futures contracts are primarily traded. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. Values obtained from third-party pricing services can utilize both transaction data and market

20

Notes to Financial Statements – continued

information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

The fund has adopted FASB Accounting Standard Codification 820, Fair Value Measurements and Disclosures (“ASC 820”), which provides a single definition of fair value, a hierarchy for measuring fair value and expanded disclosures about fair value measurements.

Various inputs are used in determining the value of the fund’s assets or liabilities carried at market value. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is

21

Notes to Financial Statements – continued

significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. Other financial instruments are derivative instruments not reflected in total investments, such as futures, forwards, swap contracts, and written options. The following is a summary of the levels used as of October 31, 2009 in valuing the fund’s assets or liabilities carried at market value:

| | | | | | | | |

| Investments at Value | | Level 1 | | Level 2 | | Level 3 | | Total |

| U.S. Treasury Bonds & U.S. Government Agency & Equivalents | | $— | | $394,737,352 | | $— | | $394,737,352 |

| Mutual Funds | | 8,647,508 | | — | | — | | 8,647,508 |

| Total Investments | | $8,647,508 | | $394,737,352 | | $— | | $403,384,860 |

For further information regarding security characteristics, see the Portfolio of Investments.

Repurchase Agreements – The fund may enter into repurchase agreements with approved counterparties. Each repurchase agreement is recorded at cost. The fund requires that the securities collateral in a repurchase transaction be transferred to a custodian. The fund monitors, on a daily basis, the value of the collateral to ensure that its value, including accrued interest, is greater than amounts owed to the fund under each such repurchase agreement. The fund and other funds managed by MFS may utilize a joint trading account for the purpose of entering into one or more repurchase agreements.

Inflation-Adjusted Debt Securities – The fund invests in inflation-adjusted debt securities issued by the U.S. Treasury. The fund may also invest in inflation-adjusted debt securities issued by U.S. Government agencies and instrumentalities other than the U.S. Treasury and by other entities such as U.S. and foreign corporations and foreign governments. The principal value of these debt securities is adjusted through income according to changes in the Consumer Price Index or another general price or wage index. These debt securities typically pay a fixed rate of interest, but this fixed rate is applied to the inflation-adjusted principal amount. The principal paid at maturity of the debt security is typically equal to the inflation-adjusted principal amount, or the security’s original par value, whichever is greater. Other types of inflation-adjusted securities may use other methods to adjust for other measures of inflation.

22

Notes to Financial Statements – continued

Derivatives – The fund may use derivatives for different purposes, including to earn income and enhance returns, to increase or decrease exposure to a particular market, to manage or adjust the risk profile of the fund, or as alternatives to direct investments. Derivatives may be used for hedging or non-hedging purposes. While hedging can reduce or eliminate losses, it can also reduce or eliminate gains. When the fund uses derivatives as an investment to increase market exposure, or for hedging purposes, gains and losses from derivative instruments may be substantially greater than the derivative’s original cost.

In this reporting period the fund adopted the disclosure provisions of FASB Accounting Standard Codification 815, Derivatives and Hedging (“ASC 815”). ASC 815 requires enhanced disclosures about the fund’s use of and accounting for derivative instruments and the effect of derivative instruments on the fund’s results of operations and financial position. Tabular disclosure regarding derivative fair value and gain/loss by contract type (e.g., interest rate contracts, foreign exchange contracts, credit contracts, etc.) is required and derivatives accounted for as hedging instruments under ASC 815 must be disclosed separately from those that do not qualify for hedge accounting. Even though the fund may use derivatives in an attempt to achieve an economic hedge, the fund’s derivatives are not accounted for as hedging instruments under ASC 815 because investment companies account for their derivatives at fair value and record any changes in fair value in current period earnings.

Derivative instruments include written options, purchased options, futures contracts, forward foreign currency exchange contracts, and swap agreements. At October 31, 2009, the fund did not have any outstanding derivative instruments.

The following table presents, by major type of derivative contract, the realized gain (loss) on derivatives held by the fund for the year ended October 31, 2009 as reported in the Statement of Operations:

| | | | | | |

| | | Investment

Transactions

(i.e.,

Purchased

Options) | | Futures

Contracts | | Total |

| Interest Rate Contracts | | $(32,505) | | $299,302 | | $266,797 |

Derivative counterparty credit risk is managed through formal evaluation of the creditworthiness of all potential counterparties. On certain over-the-counter derivatives, the fund attempts to reduce its exposure to counterparty credit risk by entering into an International Swaps and Derivatives Association (ISDA) Master Agreement on a bilateral basis with each of the counterparties with whom it undertakes a significant volume of transactions. The ISDA Master

23

Notes to Financial Statements – continued

Agreement gives each party to the agreement the right to terminate all transactions traded under such agreement if there is a certain deterioration in the credit quality of the other party. The ISDA Master Agreement gives the fund the right, upon an event of default by the applicable counterparty or a termination of the agreement, to close out all transactions traded under such agreement and to net amounts owed under each transaction to one net amount payable by one party to the other. This right to close out and net payments across all transactions traded under the ISDA Master Agreement could result in a reduction of the fund’s credit risk to such counterparty equal to any amounts payable by the fund under the applicable transactions, if any. However, absent an event of default by the counterparty or a termination of the agreement, the ISDA Master Agreement does not result in an offset of reported balance sheet assets and liabilities across transactions between the fund and the applicable counterparty.

Collateral requirements differ by type of derivative. Collateral or margin requirements are set by the broker or exchange clearing house for exchange traded derivatives (i.e., futures and exchange-traded options) while collateral terms are contract specific for over-the-counter traded derivatives (i.e., forwards, swaps and over-the-counter options). For derivatives traded under an ISDA Master Agreement, the collateral requirements are netted across all transactions traded under such agreement and one amount is posted from one party to the other to collateralize such obligations. Cash collateral that has been pledged to cover obligations of the fund under derivative contracts will be reported separately on the Statement of Assets and Liabilities as restricted cash. Securities collateral pledged for the same purpose is noted in the Portfolio of Investments.

Purchased Options – The fund may purchase call or put options for a premium. Purchased options entitle the holder to buy or sell a specified number of shares or units of a particular security, currency or index at a specified price at a specified date or within a specified period of time. Purchasing call options may be used to hedge against an anticipated increase in the dollar cost of securities or currency to be acquired or to increase the fund’s exposure to an underlying instrument. Purchasing put options may hedge against a decline in the value of portfolio securities or currency.

The premium paid is initially recorded as an investment in the Statement of Assets and Liabilities. That investment is subsequently marked-to-market daily with the difference between the premium paid and the market value of the purchased option being recorded as unrealized appreciation or depreciation. Premiums paid for purchased options which have expired are treated as realized losses on investments in the Statement of Operations. Upon the exercise or closing of a purchased option, the premium paid is either added to

24

Notes to Financial Statements – continued

the cost of the security or financial instrument in the case of a call option, or offset against the proceeds on the sale of the underlying security or financial instrument in the case of a put option, in order to determine the realized gain or loss on investments.

The risk in purchasing an option is that the fund pays a premium whether or not the option is exercised. The fund’s maximum risk of loss due to counterparty credit risk is limited to the market value of the option. For over-the-counter options, this risk is mitigated in cases where there is an ISDA Master Agreement between the fund and the counterparty providing for netting as described above and for posting of collateral by the counterparty to the fund to cover the fund’s exposure to the counterparty under such ISDA Master Agreement.

Futures Contracts – The fund may use futures contracts to gain or to hedge against broad market, interest rate or currency exposure. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date.

Upon entering into a futures contract, the fund is required to deposit with the broker, either in cash or securities, an initial margin in an amount equal to a certain percentage of the notional amount of the contract. Subsequent payments (variation margin) are made or received by the fund each day, depending on the daily fluctuations in the value of the contract, and are recorded for financial statement purposes as unrealized gain or loss by the fund until the contract is closed or expires at which point the gain or loss on futures is realized.

The fund bears the risk of interest rates, exchange rates or securities prices moving unexpectedly, in which case, the fund may not achieve the anticipated benefits of the futures contracts and may realize a loss. While futures may present less counterparty risk to the fund since the contracts are exchange traded and the exchange’s clearinghouse guarantees payments to the broker, there is still counterparty credit risk due to the insolvency of the broker. The fund’s maximum risk of loss due to counterparty credit risk is equal to the margin posted by the fund to the broker plus any gains or minus any losses on the outstanding futures contracts.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

25

Notes to Financial Statements – continued

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. All premium and discount is amortized or accreted for financial statement purposes in accordance with U.S. generally accepted accounting principles. Inflation-indexed bonds are fixed-income securities whose principal value is periodically adjusted upward or downward to the rate of inflation. Interest is accrued based on the principal value, which is adjusted for inflation. Any increase or decrease in the principal amount of an inflation-indexed bond is generally recorded as an increase or decrease in interest income, respectively, even though the adjusted principal is not received until maturity. Dividends received in cash are recorded on the ex-dividend date. Dividend and interest payments received in additional securities are recorded on the ex-dividend or ex-interest date in an amount equal to the value of the security on such date.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the year ended October 31, 2009, is shown as a reduction of total expenses on the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for

26

Notes to Financial Statements – continued

financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate to amortization and accretion of debt securities, wash sale loss deferrals, and U.S. Treasury Income Protection Securities deflationary income adjustments.

The tax character of distributions declared to shareholders for the last two fiscal years is as follows:

| | | | |

| | | 10/31/09 | | 10/31/08 |

| Ordinary income (including any short-term capital gains) | | $6,371,809 | | $2,813,766 |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| | | |

| As of 10/31/09 | | | |

| Cost of investments | | $393,413,370 | |

| Gross appreciation | | 10,031,119 | |

| Gross depreciation | | (59,629 | ) |

| Net unrealized appreciation (depreciation) | | $9,971,490 | |

| |

| Undistributed ordinary income | | 3,616,371 | |

| Capital loss carryforwards | | (1,410,028 | ) |

| Other temporary differences | | (799,390 | ) |

As of October 31, 2009, the fund had capital loss carryforwards available to offset future realized gains. Such losses expire as follows:

| | | |

| 10/31/14 | | $(317,872 | ) |

| 10/31/15 | | (265,457 | ) |

| 10/31/17 | | (826,699 | ) |

| | $(1,410,028 | ) |

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution and service fees. The fund’s income and common expenses are allocated to shareholders based on the value of settled shares outstanding of each class. The fund’s realized and unrealized gain (loss) are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. Class B shares will convert to Class A shares approximately eight

27

Notes to Financial Statements – continued

years after purchase. The fund’s distributions declared to shareholders as reported on the Statements of Changes in Net Assets are presented by class as follows:

| | | | |

| | | From net investment

income |

| | | Year ended

10/31/09 | | Year ended

10/31/08 |

| Class A | | $1,461,175 | | $1,454,592 |

| Class B | | 333,430 | | 472,385 |

| Class C | | 386,335 | | 398,175 |

| Class I | | 4,080,663 | | 323,034 |

| Class R (b) | | — | | 1,080 |

| Class R1 | | 14,682 | | 23,663 |

| Former Class R2 (b) | | — | | 6,511 |

| Class R2 | | 63,538 | | 97,468 |

| Class R3 | | 28,274 | | 31,718 |

| Class R4 | | 3,712 | | 5,140 |

| Total | | $6,371,809 | | $2,813,766 |

| (b) | At the close of business on April 18, 2008, Class R and Class R2 shares converted into Class R3 shares. Following the conversion, Class R3, Class R4, and Class R5 shares were renamed Class R2, Class R3, and Class R4 shares, respectively. |

| (3) | | Transactions with Affiliates |

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at an annual rate of 0.50% of the fund’s average daily net assets.

The investment adviser has agreed in writing to reduce its management fee to 0.35% of average daily net assets. This written agreement will continue until modified by the fund’s Board of Trustees, but such an agreement will continue at least until February 28, 2010. This management fee reduction amounted to $375,380, which is shown as a reduction of total expenses in the Statement of Operations.

The management fee incurred for the year ended October 31, 2009 was equivalent to an annual effective rate of 0.35% of the fund’s average daily net assets.

The investment adviser has agreed in writing to pay a portion of the fund’s operating expenses, exclusive of management fee, distribution and service fee, interest, taxes, extraordinary expenses, brokerage and transaction costs and investment-related expenses, such that operating expenses do not exceed 0.15% annually of the fund’s average daily net assets. This written agreement will continue until modified by the fund’s Board of Trustees, but such agreement will continue at least until February 28, 2010. For the year ended

28

Notes to Financial Statements – continued

October 31, 2009, this reduction amounted to $569,184 and is reflected as a reduction of total expenses in the Statement of Operations.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, as distributor, received $52,388 for the year ended October 31, 2009, as its portion of the initial sales charge on sales of Class A shares of the fund.

The Board of Trustees has adopted a distribution plan for certain class shares pursuant to Rule 12b-1 of the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD for services provided by MFD and financial intermediaries in connection with the distribution and servicing of certain share classes. One component of the plan is a distribution fee paid to MFD and another component of the plan is a service fee paid to MFD. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Distribution Plan Fee Table:

| | | | | | | | | | |

| | | Distribution

Fee Rate (d) | | Service

Fee Rate (d) | | Total

Distribution

Plan (d) | | Annual

Effective

Rate (e) | | Distribution

and Service

Fee |

| Class A | | — | | 0.25% | | 0.25% | | 0.15% | | $146,399 |

| Class B | | 0.75% | | 0.25% | | 1.00% | | 0.93% | | 147,942 |

| Class C | | 0.75% | | 0.25% | | 1.00% | | 1.00% | | 203,055 |

| Class R1 | | 0.75% | | 0.25% | | 1.00% | | 1.00% | | 7,103 |

| Class R2 | | 0.25% | | 0.25% | | 0.50% | | 0.50% | | 12,827 |

| Class R3 | | — | | 0.25% | | 0.25% | | 0.25% | | 2,615 |

| Total Distribution and Service Fees | | | | | | $519,941 |

| (d) | In accordance with the distribution plan for certain classes, the fund pays distribution and/or service fees equal to these annual percentage rates of each class’ average daily net assets. The distribution and service fee rates disclosed by class represent the current rates in effect at the end of the reporting period. Any rate changes, if applicable, are detailed below. |

| (e) | The annual effective rates represent actual fees incurred under the distribution plan for the year ended October 31, 2009 based on each class’ average daily net assets. Effective March 1, 2009, the 0.10% Class A distribution fee was eliminated. Prior to March 1, 2009, the 0.10% Class A distribution fee was being waived under a written waiver arrangement. For the year ended October 31, 2009, this waiver amounted to $15,223 and is reflected as a reduction of total expenses in the Statement of Operations. 0.10% of the Class A service fee is currently being waived under a written waiver agreement. This written agreement will continue until modified by the fund’s Board of Trustees, but such agreement will continue at least until February 28, 2010. For the year ended October 31, 2009, this waiver amounted to $52,470 and is reflected as a reduction of total expenses in the Statement of Operations. Assets attributable to Class B shares sold prior to May 1, 2006 are subject to the 0.25% annual Class B service fee. Assets attributable to all other Class B shares are currently subject to a Class B service fee of 0.15% annually. The remaining portion of the Class B service fee is not in effect on such assets but may be implemented on such date as the fund’s Board of Trustees may determine. |

Certain Class A shares purchased prior to September 1, 2008 are subject to a contingent deferred sales charge (CDSC) in the event of a shareholder redemption within 12 months of purchase. Certain Class A shares purchased

29

Notes to Financial Statements – continued

on or subsequent to September 1, 2008 are subject to a CDSC in the event of a shareholder redemption within 24 months of purchase. Class C shares are subject to a CDSC in the event of a shareholder redemption within 12 months of purchase. Class B shares are subject to a CDSC in the event of a shareholder redemption within six years of purchase. All contingent deferred sales charges are paid to MFD and during the year ended October 31, 2009, were as follows:

| | |

| | | Amount |

| Class A | | $— |

| Class B | | 27,759 |

| Class C | | 8,647 |

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent calculated as a percentage of the average daily net assets of the fund as determined periodically under the supervision of the fund’s Board of Trustees. For the year ended October 31, 2009, the fee was $205,602, which equated to 0.0819% annually of the fund’s average daily net assets. MFSC also receives payment from the fund for out-of-pocket expenses, sub-accounting and other shareholder servicing costs which may be paid to affiliated and unaffiliated service providers. For the year ended October 31, 2009, these out-of-pocket expenses, sub-accounting and other shareholder servicing costs amounted to $100,770.

Under a Special Servicing Agreement among MFS, each MFS fund which invests in other MFS funds (“MFS fund-of-funds”) and certain underlying funds in which a MFS fund-of-funds invests (“underlying funds”), each underlying fund may pay a portion of each MFS fund-of-fund’s transfer agent-related expenses, including sub-accounting fees payable to financial intermediaries, to the extent such payments do not exceed the benefits realized or expected to be realized by the underlying fund from the investment in the underlying fund by the MFS fund-of-fund. For the year ended October 31, 2009, these costs for the fund amounted to $289,420 and are reflected in the shareholder servicing costs on the Statement of Operations.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund partially reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the year ended October 31, 2009 was equivalent to an annual effective rate of 0.0216% of the fund’s average daily net assets.

Trustees’ and Officers’ Compensation – The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional

30

Notes to Financial Statements – continued

compensation to Board and Committee chairpersons. The fund does not pay compensation directly to trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers and trustees of the fund are officers or directors of MFS, MFD, and MFSC.