UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-02619 |

| |

| Exact name of registrant as specified in charter: | | MoneyMart Assets, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

| Date of fiscal year end: | | 12/31/2005 |

| |

| Date of reporting period: | | 6/30/2005 |

| Item 1 – | Reports to Stockholders – [ INSERT REPORT ] |

SEMIANNUAL REPORT

JUNE 30, 2005

MONEYMART ASSETS, INC.

FUND TYPE

Money market

OBJECTIVE

Maximum current income consistent with stability of capital and the maintenance of liquidity

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Dear Shareholder,

August 15, 2005

We hope that you find the semiannual report for MoneyMart Assets informative and useful. As a MoneyMart Assets shareholder, you may also be thinking about where you can find additional growth opportunities. You could invest in last year’s top-performing asset class and hope that history repeats itself or you could stay in cash while waiting for the “right moment” to invest.

We believe it is wise to take advantage of developing domestic and global investment opportunities through a diversified portfolio of stock and bond mutual funds. A diversified asset allocation offers two potential advantages. It helps you manage downside risk by not being overly exposed to any particular asset class, plus it gives you a better opportunity to have at least some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds that cover all the basic asset classes and is reflective of your personal investor profile and tolerance for risk.

Thank you for choosing this fund.

Sincerely,

Judy A. Rice, President

MoneyMart Assets, Inc.

Your Fund’s Performance

Fund objective

The investment objective of MoneyMart Assets, Inc. (the Fund) is to seek maximum current income consistent with stability of capital and the maintenance of liquidity. There can be no assurance that the Fund will achieve its investment objective.

The Fund is a diversified portfolio of high-quality, U.S. dollar-denominated money market securities issued by the U.S. government, its agencies and instrumentalities, and major corporations and commercial banks in the United States and foreign countries. Maturities can range from one day to 13 months. We generally only purchase securities rated in one of the two highest short-term rating categories or one of the three highest long-term rating categories by at least two major rating agencies, or if not rated, deemed to be of equivalent quality by our investment adviser.

Yields will fluctuate from time to time, and past performance does not guarantee future results. Current performance may be lower or higher than the past performance data quoted. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost. For the most recent month-end performance update, call (800) 225-1852.

| | | | | | | | | | | |

| Fund Facts as of 6/30/05 | | | | | | | | | |

| | | 7-Day

Current Yield | | | Net Asset

Value (NAV) | | Weighted Avg.

Maturity (WAM) | | Net Assets

(Millions) |

Class A | | 2.53 | % | | $ | 1.00 | | 32 Days | | $ | 785.4 |

Class B | | 2.65 | % | | $ | 1.00 | | 32 Days | | $ | 91.7 |

Class C | | 2.65 | % | | $ | 1.00 | | 32 Days | | $ | 11.8 |

Class Z* | | 2.65 | % | | $ | 1.00 | | 32 Days | | $ | 188.1 |

iMoneyNet, Inc. Taxable Prime Retail Avg.** | | 2.34 | % | | | N/A | | 40 Days | | | N/A |

| * | Class Z shares are not subject to distribution and service (12b-1) fees. |

| ** | iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. This is based on the data of all funds in the iMoneyNet, Inc. Taxable Prime Retail Average category as of June 28, 2005, the closest reported date prior to the end of our reporting period. |

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the Fund.

| | |

| 2 | | Visit our website at www.jennisondryden.com |

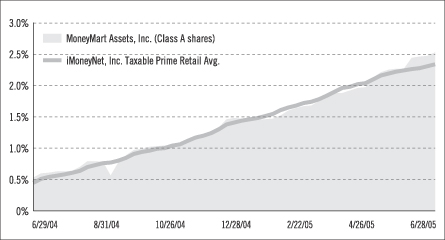

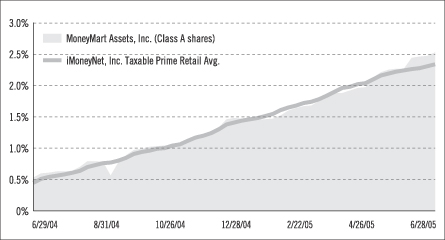

Money Market Fund Yield Comparison

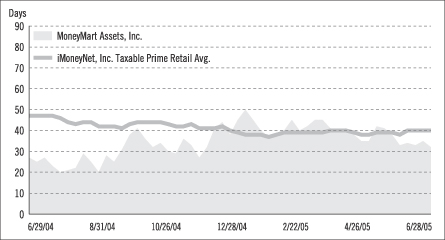

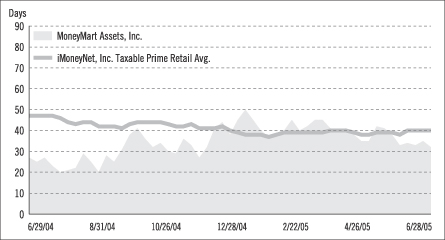

Weighted Average Maturity Comparison

Yields will fluctuate from time to time, and past performance does not guarantee future results. Current performance may be lower or higher than the past performance data quoted. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost. For the most recent month-end performance update, call (800) 225-1852.

The graphs portray weekly 7-day current yields and weekly WAMs for MoneyMart Assets, Inc. (Class A shares—yields only) and the iMoneyNet, Inc. Taxable Prime Retail Average every Tuesday from June 29, 2004 to June 28, 2005, the closest dates to the beginning and end of the Fund’s reporting period. Note: iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. As a result, the data portrayed for the Fund at the end of the reporting period in the graphs may not match the data portrayed in the Fund Facts table as of June 30, 2005.

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the Fund.

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on January 1, 2005, at the beginning of the period, and held through the six-month period ended June 30, 2005.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to Individual Retirement Accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of JennisonDryden or Strategic Partners Funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before

| | |

| 4 | | Visit our website at www.jennisondryden.com |

expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Class B and Class C have been in existence for less than six months, therefore no expenses are presented for Class B and Class C. Class B and Class C commenced March 11, 2005.

| | | | | | | | | | | | | | |

MoneyMart

Assets, Inc. | | Beginning Account

Value

January 1, 2005 | | Ending Account

Value June 30, 2005 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month

Period* |

| | | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | $ | 1,009.22 | | 0.91 | % | | $ | 4.53 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,020.28 | | 0.91 | % | | $ | 4.56 |

| | | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | $ | 1,009.82 | | 0.78 | % | | $ | 3.89 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,020.93 | | 0.78 | % | | $ | 3.91 |

| | | | | | | | | | | | | | | |

* Fund expenses for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 181 days in the six-month period ended June 30, 2005, and divided by the 365 days in the Fund’s fiscal year ending December 31, 2005 (to reflect the six-month period).

This Page Intentionally Left Blank

Portfolio of Investments

as of June 30, 2005 (Unaudited)

| | | | | | |

Principal Amount (000) | | Description | | Value (Note 1) |

| | | | | | | |

| |

| | Asset Backed Securities 0.5% | | | |

| | | | Ford Credit Auto Owner Trust | | | |

| $ | 4,907 | | 3.15%, 12/15/05 | | $ | 4,907,475 |

| | | | | |

|

|

| |

| | Certificates of Deposit 24.1% | | | |

| | | | Bank Of New York | | | |

| | 25,000 | | 3.255%, 10/31/05(b) | | | 24,997,486 |

| | | | Barclays Bank PLC | | | |

| | 40,000 | | 3.11%, 7/11/05 | | | 39,999,981 |

| | | | BNP Paribas | | | |

| | 15,000 | | 3.18%, 8/9/05 | | | 15,000,000 |

| | | | Calyon New York | | | |

| | 10,000 | | 3.02%, 7/13/05 | | | 9,999,858 |

| | | | Citibank NA | | | |

| | 40,000 | | 3.40%, 9/22/05 | | | 40,000,000 |

| | | | Dexia Bank | | | |

| | 50,000 | | 3.405%, 9/22/05 | | | 50,000,571 |

| | | | HBOS Treasury Services PLC | | | |

| | 30,000 | | 3.20%, 12/16/05(b) | | | 30,000,000 |

| | | | Natexis Banques Populaires | | | |

| | 50,000 | | 3.145%, 8/4/05 | | | 49,999,766 |

| | | | | |

|

|

| | | | | | | 259,997,662 |

| | | | | |

|

|

| |

| | Commercial Paper 35.1% | | | |

| | | | Amsterdam Funding Corp. | | | |

| | 8,000 | | 3.12%, 7/12/05 144A | | | 7,992,373 |

| | | | BankAmerica Corp. | | | |

| | 40,000 | | 3.15%, 8/9/05 | | | 39,863,500 |

| | | | Citigroup Global Markets Holdings | | | |

| | 5,000 | | 3.13%, 8/3/05 | | | 4,985,654 |

| | | | Edison Asset Securitization LLC | | | |

| | 2,131 | | 3.13%, 8/3/05 | | | 2,124,886 |

| | | | General Electric Capital Corp. | | | |

| | 12,000 | | 3.12%, 8/3/05 | | | 11,965,680 |

| | 36,189 | | 2.93%, 8/15/05 | | | 36,056,458 |

| | | | Greenwich Capital Holdings | | | |

| | 3,100 | | 3.17%, 11/14/05 | | | 3,100,000 |

| | | | HSBC Finance Corp. | | | |

| | 12,000 | | 3.22%, 8/4/05 | | | 11,963,507 |

| | | | ING America Insurance | | | |

| | 100 | | 3.13%, 7/13/05 | | | 99,896 |

See Notes to Financial Statements.

Portfolio of Investments

as of June 30, 2005 (Unaudited) Cont’d.

| | | | | | |

Principal Amount (000) | | Description | | Value (Note 1) |

| | | | Long Lane Master Trust | | | |

| $ | 12,728 | | 3.23%, 7/18/05 144A | | $ | 12,708,586 |

| | | | Market Street Funding Corp. | | | |

| | 17,000 | | 3.24%, 7/21/05 144A | | | 16,969,353 |

| | | | Norddeutsche Landesbank Luxembourg | | | |

| | 40,000 | | 3.14%, 7/18/05 144A | | | 39,940,689 |

| | 10,000 | | 3.22%, 8/17/05 144A | | | 9,957,961 |

| | 2,348 | | Old Line Funding LLC

3.14%, 7/18/05 144A | | | 2,344,518 |

| | 25,840 | | PB Finance (Delaware), Inc.

3.09%, 7/6/05 | | | 25,828,946 |

| | 11,834 | | Preferred Receivables Funding Corp.

3.12%, 7/13/05 | | | 11,821,693 |

| | 21,056 | | Prudential PLC

3.11%, 7/29/05 144A | | | 21,005,068 |

| | 14,000 | | Sheffield Receivables Corp.

3.24%, 7/21/05 144A | | | 13,974,800 |

| | 40,000 | | Skandinaviska Enskilda Banken AB

3.27%, 7/18/06(c) 144A | | | 39,999,999 |

| | 10,000 | | Spintab-SwedMortgage AB

3.30%, 7/22/05 | | | 9,980,750 |

| | | | Swiss Re Financial Products | | | |

| | 2,583 | | 2.81%, 7/13/05 144A | | | 2,580,581 |

| | 3,000 | | 2.94%, 8/8/05 144A | | | 2,990,690 |

| | | | Triple A One Funding Corp. | | | |

| | 5,649 | | 3.22%, 7/14/05 144A | | | 5,642,431 |

| | 12,523 | | 3.18%, 8/5/05 144A | | | 12,484,283 |

| | 28,000 | | Tulip Funding Corp.

3.31%, 7/29/05 144A | | | 27,927,916 |

| | 3,500 | | Windmill Funding Corp.

3.24%, 7/20/05 144A | | | 3,494,015 |

| | | | | |

|

|

| | | | | | | 377,804,233 |

| | | | | |

|

|

| |

| | Municipal Bonds 1.6% | | | |

| | 3,200 | | Fulton County Development Authority

3.36%, 3/1/26(b) | | | 3,200,000 |

| | 10,000 | | Los Angeles Department of Water & Power

3.30%, 7/1/25(b) | | | 10,000,000 |

| | 4,400 | | Stephens & Stephens XI LLC

3.42%, 11/1/34(b) | | | 4,400,000 |

| | | | | |

|

|

| | | | | | | 17,600,000 |

| | | | | |

|

|

See Notes to Financial Statements.

| | |

| 8 | | Visit our website at www.jennisondryden.com |

| | | | | | |

Principal Amount (000) | | Description | | Value (Note 1) |

| |

| | Other Corporate Obligations 30.4% | | | |

| $ | 47,000 | | American Express Credit Corp.

3.17%, 8/4/06(c) | | $ | 47,000,000 |

| | 5,000 | | General Electric Capital Corp.

3.34%, 6/16/06(c) | | | 5,000,000 |

| | 13,475 | | Household Finance Corp.

3.37%, 8/18/05(c) | | | 13,476,689 |

| | 50,000 | | Irish Life & Permanent PLC

3.27%, 6/22/06(c) 144A | | | 49,996,672 |

| | 45,000 | | Merrill Lynch & Co., Inc.

3.36%, 6/11/06(c) | | | 45,000,000 |

| | 20,000 | | Metropolitan Life Insurance

3.1613%, 10/3/05(b)(e)

(cost $20,000,000, purchased 10/4/04) | | | 20,000,000 |

| | 48,000 | | Morgan Stanley Dean Witter Co.

3.13%, 8/3/06(c) | | | 48,000,000 |

| | 5,000 | | National City Bank

3.26%, 10/3/05(c) | | | 4,999,584 |

| | 1,000 | | Pacific Life Insurance

3.5337%, 1/13/06 | | | 1,000,000 |

| | 1,000 | | US Bank NA

3.35%, 12/5/05(c) | | | 1,000,168 |

| | 25,000 | | US Bank NA

2.22%, 7/18/05 | | | 24,989,107 |

| | 35,000 | | Wells Fargo & Co.

3.1438%, 7/3/06(c) | | | 35,000,000 |

| | 32,000 | | Westpac Banking Corp.

3.40%, 4/11/06(c) | | | 32,000,000 |

| | | | | |

|

|

| | | | | | | 327,462,220 |

| | | | | |

|

|

| |

| | U.S. Government Agency Obligations 7.3% | | | |

| | 38,989 | | Federal Home Loan Mortgage Corp.

zero coupon, 11/28/05 | | | 38,517,883 |

| | 40,000 | | Federal National Mortgage Assoc.

3.04%, 9/7/06(c) | | | 39,964,723 |

| | | | | |

|

|

| | | | | | | 78,482,606 |

| | | | | |

|

|

See Notes to Financial Statements.

Portfolio of Investments

as of June 30, 2005 (Unaudited) Cont’d.

| | | | | | | |

Principal Amount (000) | | Description | | Value (Note 1) | |

| |

| | Repurchase Agreements 1.6% | | | | |

| $ | 17,422 | | Greenwich Capital Markets.,

3.45%, dated 6/30/05,

due 7/1/05 in the amount of $17,423,670(d)

(cost $ 17,422,000) | | $ | 17,422,000 | |

| | | | | |

|

|

|

| | | | Total Investments 100.6%

(amortized cost $1,083,676,196(a)) | | | 1,083,676,196 | |

| | | | Liabilities in excess of other assets (0.6%) | | | (6,702,553 | ) |

| | | | | |

|

|

|

| | | | Net Assets 100% | | $ | 1,076,973,643 | |

| | | | | |

|

|

|

144A Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted 144A securities are deemed to be liquid.

| (a) | The cost of securities for federal income tax purposes is substantially the same as for financial reporting purposes. |

| (b) | Variable rate instrument. The maturity date presented for these instruments is the later of the next date on which the security can be redeemed at par or the next date on which the rate of interest is adjusted. |

| (c) | Floating Rate Security. The interest rate shown reflects the rate in effect at June 30, 2005. |

| (d) | Repurchase price of $17,423,670 due 7/1/05. Collateralized by $23,330,000 Federal National Mortgage Association Strip with principal only, maturity date of 3/1/2035. The value of the collateral was $17,772,057. |

| (e) | Indicates a security that is restricted and has been deemed illiquid. The aggregate cost of the illiquid security is $20,000,000. The aggregate value, $20,000,000 represents 1.9% of net assets. |

The major asset categories of portfolio holdings and liabilities in excess of other assets calculated as a percentage of net assets as of June 30, 2005 was as follows:

| | | |

Commercial Paper | | 35.1 | % |

Other Corporate Obligations | | 30.4 | |

Certificates of Deposit | | 24.1 | |

U.S. Government Agency Obligations | | 7.3 | |

Municipal Bonds | | 1.6 | |

Repurchase Agreements | | 1.6 | |

Asset Backed Securities | | 0.5 | |

| | |

|

|

| | | 100.6 | |

Liabilities in excess of other assets | | (0.6 | ) |

| | |

|

|

| | | 100.0 | % |

| | |

|

|

See Notes to Financial Statements.

| | |

| 10 | | Visit our website at www.jennisondryden.com |

Financial Statements

| | |

| JUNE 30, 2005 | | SEMIANNUAL REPORT |

MoneyMart Assets, Inc.

Statement of Assets and Liabilities

as of June 30, 2005 (Unaudited)

| | | |

Assets | | | |

Investments, at amortized cost which approximates market value | | $ | 1,083,676,196 |

Cash | | | 924,442 |

Receivable for Fund shares sold | | | 5,682,054 |

Interest receivable | | | 2,042,526 |

Prepaid expenses | | | 12,532 |

| | |

|

|

Total assets | | | 1,092,337,750 |

| | |

|

|

| |

Liabilities | | | |

Payable for Fund shares reacquired | | | 10,807,514 |

Accrued expenses | | | 2,782,407 |

Transfer agent fee payable | | | 903,119 |

Dividends payable | | | 508,138 |

Management fee payable | | | 276,261 |

Distribution fee payable | | | 82,012 |

Deferred directors’ fees | | | 4,656 |

| | |

|

|

Total liabilities | | | 15,364,107 |

| | |

|

|

| |

Net Assets | | $ | 1,076,973,643 |

| | |

|

|

| | | | |

Net assets were comprised of: | | | |

Common stock, at par ($.001 par value; 15 billion shares authorized for issuance) | | | 1,076,974 |

Paid-in capital in excess of par | | | 1,075,896,669 |

| | |

|

|

Net assets, June 30, 2005 | | $ | 1,076,973,643 |

| | |

|

|

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.jennisondryden.com |

| | | |

Class A | | | |

Net asset value, offering price and redemption price per share

($785,397,005 ÷ 785,397,005 shares of common stock issued and outstanding) | | $ | 1.00 |

| | |

|

|

| |

Class B | | | |

Net asset value, offering price and redemption price per share

($91,656,599 ÷ 91,656,599 shares of common stock issued and outstanding) | | $ | 1.00 |

| | |

|

|

| |

Class C | | | |

Net asset value, offering price and redemption price per share

($11,781,626 ÷ 11,781,626 shares of common stock issued and outstanding) | | $ | 1.00 |

| | |

|

|

| |

Class Z | | | |

Net asset value, offering price and redemption price per share

($188,138,413 ÷ 188,138,413 shares of common stock issued and outstanding) | | $ | 1.00 |

| | |

|

|

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 13 |

Statement of Operations

Six Months Ended June 30, 2005 (Unaudited)

| | | |

Net Investment Income | | | |

Income | | | |

Interest | | $ | 15,374,481 |

| | |

|

|

| |

Expenses | | | |

Management fee | | | 1,678,376 |

Distribution fee—Class A | | | 520,641 |

Transfer agent’s fees and expenses (including affiliated expense of $1,367,000) | | | 2,250,000 |

Reports to shareholders | | | 164,000 |

Custodian’s fees and expenses | | | 61,000 |

Registration fees | | | 23,000 |

Insurance | | | 16,000 |

Directors’ fees and expenses | | | 15,000 |

Legal fees and expenses | | | 12,000 |

Audit fee | | | 8,000 |

Miscellaneous | | | 12,394 |

| | |

|

|

Total expenses | | | 4,760,411 |

| | |

|

|

Net Investment Income | | | 10,614,070 |

| | |

|

|

| |

Net Realized Gain on Investments | | | |

Net realized gain on investment transactions | | | 59,577 |

| | |

|

|

Net Increase In Net Assets Resulting From Operations | | $ | 10,673,647 |

| | |

|

|

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

(Unaudited)

| | | | | | | | |

| | | Six Months Ended June 30, 2005 | | | Year Ended December 31, 2004 | |

Decrease In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 10,614,070 | | | $ | 16,921,182 | |

Net realized gain on investment transactions | | | 59,577 | | | | 30,804 | |

| | |

|

|

| |

|

|

|

Net increase in net assets resulting from operations | | | 10,673,647 | | | | 16,951,986 | |

| | |

|

|

| |

|

|

|

Dividends and distributions to shareholders (Note 1) | | | | | | | | |

Class A | | | (7,998,777 | ) | | | (15,385,425 | ) |

Class B | | | (666,388 | ) | | | — | |

Class C | | | (87,240 | ) | | | — | |

Class Z | | | (1,921,242 | ) | | | (1,566,561 | ) |

| | |

|

|

| |

|

|

|

| | | | (10,673,647 | ) | | | (16,951,986 | ) |

| | |

|

|

| |

|

|

|

| | |

Fund share transactions (Note 4 and 5) (at $1.00 per share) | | | | | | | | |

Proceeds from shares sold(a) | | | 977,816,894 | | | | 5,236,131,233 | |

Net asset value of shares issued to shareholders in reinvestment of dividends and distributions | | | 10,060,271 | | | | 14,417,894 | |

Cost of shares reacquired | | | (994,152,971 | ) | | | (9,444,422,541 | ) |

| | |

|

|

| |

|

|

|

Net decrease in net assets from Fund share transactions | | | (6,275,806 | ) | | | (4,193,873,414 | ) |

| | |

|

|

| |

|

|

|

Total decrease | | | (6,275,806 | ) | | | (4,193,873,414 | ) |

| | |

Net Assets | | | | | | | | |

Beginning of period | | | 1,083,249,449 | | | | 5,277,122,863 | |

| | |

|

|

| |

|

|

|

End of period | | $ | 1,076,973,643 | | | $ | 1,083,249,449 | |

| | |

|

|

| |

|

|

|

| a) | For the period ended June 30, 2005, includes $115,574,951 for shares issued in connection with the merger of Special Money Market Fund, Inc. |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 15 |

Notes to Financial Statements

(Unaudited)

MoneyMart Assets, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The Fund invests primarily in a portfolio of money market instruments maturing in thirteen months or less whose ratings are within the two highest rating categories by a nationally recognized statistical rating organization or, if not rated, are of comparable quality. The ability of the issuers of the securities held by the Fund to meet their obligations may be affected by economic developments in a specific industry or region.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuations: Portfolio securities are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of any discount or premium. If the amortized cost method is determined not to represent fair value, the fair value shall be determined by or under the direction of the Board of Directors.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses on sales of securities are calculated on the identified cost basis. Interest income including amortization of premium and accretion of discount on debt securities, as required is recorded on the accrual basis. Expenses are recorded on the accrual basis.

Net investment income or loss (other than distribution fees, which are charged directly to the respective class) and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Repurchase Agreements: In connection with transactions in repurchase agreements with United States financial institutions, it is the Fund’s policy that its custodian or designated subcustodians under triparty repurchase agreements, as the case may be, take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transactions, including accrued interest. To the

| | |

| 16 | | Visit our website at www.jennisondryden.com |

extent that any repurchase transaction exceeds one business day, the value of the collateral is marked to market on a daily basis to ensure the adequacy of the collateral. If the seller defaults and the value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

Loan Participation: The Fund may invest in loan participation. When the Fund purchases a loan participation, the Fund typically enters into a contractual relationship with the lender or third party selling such participations (“Selling Participant”), but not the borrower. As a result, the Fund assumes the credit risk of the borrower, the selling participant and any other persons interpositioned between the Fund and borrower (“intermediate participants”). The Fund may not directly benefit from the collateral supporting the senior loan in which it has purchased the loan participation.

Federal Income Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to shareholders. Therefore, no federal income tax provision is required.

Dividends and Distributions: The Fund declares daily dividends from net investment income and net realized short-term capital gains or losses. Payment of dividends is made monthly. Income distributions and capital gain distributions are determined in accordance with federal income tax regulations which differ from generally accepted accounting principles.

Restricted Securities: The Fund may hold up to 10% of its net assets in illiquid securities, including those which are restricted as to disposition under securities law (“restricted securities”). Restricted securities, sometimes referred to as private placements, are valued pursuant to the valuation procedures noted above.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has a management agreement with Prudential Investments LLC (“PI”). Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadvisor’s performance of such services. PI has entered into a

| | |

| MoneyMart Assets, Inc. | | 17 |

Notes to Financial Statements

Cont’d

subadvisory agreement with Prudential Investment Management, Inc. (“PIM”). The subadvisory agreement provides that PIM will furnish investment advisory services in connection with the management of the Fund. In connection therewith, PIM is obligated to keep certain books and records of the Fund. PI pays for the services of

PIM, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The management fee paid to PI is computed daily and payable monthly, at an annual rate of .50 of 1% of the Fund’s average daily net assets up to $50 million and .30 of 1% of the Fund’s average daily net assets in excess of $50 million. The effective management fee rate was .309 of 1% for six months ended June 30, 2005.

The Fund has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, B, C and Z shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A shares pursuant to the plan of distribution at an annual rate of .125 of 1% of the average daily net assets of the Class A shares. The Class A distribution fee is accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor of Class B, C or Z shares of the Fund.

PIMS has advised the Fund that for the six months ended June 30, 2005, it received approximately $600 in contingent deferred sales charges imposed upon certain redemptions by certain Class B shareholders.

PI, PIM and PIMS are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

Note 3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent fees and expenses in the Statement of Operations include certain out-of-pocket and sub-transfer agent expenses paid to non-affiliates, where applicable.

The Fund pays networking fees to affiliated and unaffiliated broker/dealers. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. For the six months ended June 30,

| | |

| 18 | | Visit our website at www.jennisondryden.com |

2005, the Fund incurred approximately $35,600 in total networking fees. These amounts are included in transfer agent’s fees and expenses in the Statement of Operations.

Note 4. Capital

The Fund offers Class A, Class B, Class C and Class Z shares. Class B, C and Z shares are not subject to any distribution and/or service fees and are offered exclusively for sale to a limited group of investors.

There are 20 billion authorized shares of $.001 par value common stock divided into two classes, which consist of 13 billion Class A, 2.5 billion Class B, 2.5 billion Class C and 2 billion Class Z shares.

Transactions in shares of common stock (at $1 net asset value per share) were as follows:

| | | | |

Class A

| | | |

Six months ended June 30, 2005: | | | | |

Shares sold | | $ | 799,575,225 | |

Shares issued in reinvestment of dividends and distributions | | | 7,602,693 | |

Shares issued in connection with reorganization (Note 5) | | | 5,451,729 | |

Shares reacquired | | | (917,869,432 | ) |

| | |

|

|

|

Net decrease in shares outstanding | | $ | (105,239,785 | ) |

| | |

|

|

|

Year ended December 31 ,2004 | | | | |

Shares sold | | $ | 5,143,442,959 | |

Shares issued in reinvestment of dividends and distributions | | | 12,862,324 | |

Shares reacquired | | | (9,355,073,761 | ) |

| | |

|

|

|

Net increase in shares outstanding | | $ | (4,198,768,478 | ) |

| | |

|

|

|

Class B

| | | |

For the period ended June 30, 2005:* | | | | |

Shares sold | | $ | 12,991,626 | |

Shares issued in reinvestment of dividends and distributions | | | 551,010 | |

Shares issued in connection with reorganization (Note 5) | | | 99,278,444 | |

Shares reacquired | | | (21,164,481 | ) |

| | |

|

|

|

Net increase in shares outstanding | | $ | 91,656,599 | |

| | |

|

|

|

Class C

| | | |

For the period ended June 30, 2005:* | | | | |

Shares sold | | $ | 10,791,009 | |

Shares issued in reinvestment of dividends and distributions | | | 71,985 | |

Shares issued in connection with reorganization (Note 5) | | | 9,444,871 | |

Shares reacquired | | | (8,526,239 | ) |

| | |

|

|

|

Net increase in shares outstanding | | $ | 11,781,626 | |

| | |

|

|

|

| * | Commenced offering on March 11, 2005. |

| | |

| MoneyMart Assets, Inc. | | 19 |

Notes to Financial Statements

Cont’d

| | | | |

Class Z

| | | |

Six months ended June 30, 2005: | | | | |

Shares sold | | $ | 38,884,083 | |

Shares issued in reinvestment of dividends and distributions | | | 1,834,583 | |

Shares issued in connection with reorganization (Note 5) | | | 1,399,907 | |

Shares reacquired | | | (46,592,819 | ) |

| | |

|

|

|

Net decrease in shares outstanding | | $ | (4,474,246 | ) |

| | |

|

|

|

Year ended December 31 ,2004 | | | | |

Shares sold | | $ | 92,688,274 | |

Shares issued in reinvestment of dividends and distributions | | | 1,555,570 | |

Shares reacquired | | | (89,348,780 | ) |

| | |

|

|

|

Net increase in shares outstanding | | $ | 4,895,064 | |

| | |

|

|

|

Note 5. Plan of Reorganization

At the close of business on March 11, 2005 MoneyMart Assets, Inc. acquired all of the net assets of Special Money Market Fund, Inc. pursuant to a plan of reorganization approved by the Special Money Market Fund, Inc. shareholders on February 17, 2005. The acquisition was accomplished by a tax-free exchange of Class A, Class B, Class C and Class Z shares.

| | | | | | | | | | |

Special Money Market Fund, Inc.

| | MoneyMart Assets, Inc.

| | Value

|

| Class A | | 5,451,729 | | Class A | | 5,451,729 | | Class A | | $ 5,451,729 |

| Class B | | 99,278,444 | | Class B | | 99,278,444 | | Class B | | $99,278,444 |

| Class C | | 9,444,871 | | Class C | | 9,444,871 | | Class C | | $ 9,444,871 |

| Class Z | | 1,399,907 | | Class Z | | 1,399,907 | | Class Z | | $ 1,399,907 |

The aggregate net assets of the Special Money Market Fund, Inc. and MoneyMart Assets, Inc. immediately before the acquisition were $115,574,951 and $1,033,223,410, respectively.

| | |

| 20 | | Visit our website at www.jennisondryden.com |

Financial Highlights

| | |

| JUNE 30, 2005 | | SEMIANNUAL REPORT |

MoneyMart Assets, Inc.

Financial Highlights

| | | | |

| | | Class A

| |

| | | Six Months Ended

June 30, 2005 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 1.000 | |

| | |

|

|

|

Income from investment operations: | | | | |

Net investment income and net realized gains | | | 0.009 | |

Dividends and distributions to shareholders | | | (0.009 | ) |

| | |

|

|

|

Net asset value, end of period | | $ | 1.00 | |

| | |

|

|

|

Total Return(a): | | | 0.92 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 785,397 | |

Average net assets (000) | | $ | 839,952 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | 0.91 | %(b) |

Expenses, excluding distribution and service (12b-1) fees | | | 0.78 | %(b) |

Net investment income | | | 1.91 | %(b) |

| (a) | Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. Total returns for less than a full year are not annualized. |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | | | | | |

| Class A | |

| Year Ended December 31, | |

| 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| | 0.007 | | | | 0.006 | | | | 0.013 | | | | 0.037 | | | | 0.058 | |

| | (0.007 | ) | | | (0.006 | ) | | | (0.013 | ) | | | (0.037 | ) | | | (0.058 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 0.70 | % | | | 0.65 | % | | | 1.35 | % | | | 3.85 | % | | | 5.94 | % |

| | | | | | | | | | | | | | | | | | | |

| $ | 890,637 | | | $ | 5,089,405 | | | $ | 6,930,229 | | | $ | 6,440,760 | | | $ | 6,529,282 | |

| $ | 2,823,600 | | | $ | 6,535,734 | | | $ | 6,947,463 | | | $ | 6,846,656 | | | $ | 6,538,256 | |

| | | | | | | | | | | | | | | | | | | |

| | 0.71 | % | | | 0.62 | % | | | 0.61 | % | | | 0.65 | % | | | 0.67 | % |

| | 0.58 | % | | | 0.49 | % | | | 0.48 | % | | | 0.52 | % | | | 0.54 | % |

| | 0.54 | % | | | 0.63 | % | | | 1.34 | % | | | 3.76 | % | | | 5.81 | % |

| | |

| MoneyMart Assets, Inc. | | 23 |

Financial Highlights

(Unaudited) Cont’d

| | | | |

| | | Class B

| |

| | | March 11, 2005(a) Through June 30, 2005 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 1.000 | |

| | |

|

|

|

Income from investment operations: | | | | |

Net investment income and net realized gains | | | 0.006 | |

Dividends and distributions to shareholders | | | (0.006 | ) |

| | |

|

|

|

Net asset value, end of period | | $ | 1.000 | |

| | |

|

|

|

Total Return(b): | | | 0.65 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 91,657 | |

Average net assets (000) | | $ | 96,040 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | 0.74 | %(c) |

Expenses, excluding distribution and service (12b-1) fees | | | 0.74 | %(c) |

Net investment income | | | 2.28 | %(c) |

| (a) | Commencement of offering. |

| (b) | Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. Total returns for less than a full year are not annualized. |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.jennisondryden.com |

| | | | |

| | | Class C

| |

| | | March 11, 2005(a) Through June 30, 2005 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 1.000 | |

| | |

|

|

|

Income from investment operations: | | | | |

Net investment income and net realized gains | | | 0.006 | |

Dividends and distributions to shareholders | | | (0.006 | ) |

| | |

|

|

|

Net asset value, end of period | | $ | 1.000 | |

| | |

|

|

|

Total Return(a): | | | 0.65 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 11,782 | |

Average net assets (000) | | $ | 12,521 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | 0.74 | %(c) |

Expenses, excluding distribution and service (12b-1) fees | | | 0.74 | %(c) |

Net investment income | | | 2.29 | %(c) |

| (a) | Commencement of offering. |

| (b) | Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. Total returns for less than a full year are not annualized. |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 25 |

Financial Highlights

(Unaudited) Cont’d

| | | | |

| | | Class Z

| |

| | | Six Months Ended

June 30, 2005 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 1.000 | |

| | |

|

|

|

Income from investment operations: | | | | |

Net investment income and net realized gains | | | 0.010 | |

Dividends and distributions to shareholders | | | (0.010 | ) |

| | |

|

|

|

Net asset value, end of period | | $ | 1.000 | |

| | |

|

|

|

Total Return(a): | | | 0.98 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 188,138 | |

Average net assets (000) | | $ | 188,328 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | 0.78 | %(b) |

Expenses, excluding distribution and service (12b-1) fees | | | 0.78 | %(b) |

Net investment income | | | 2.05 | %(b) |

| (a) | Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. Total returns for less than a full year are not annualized. |

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | | | | | |

| Class Z | |

| Year Ended December 31, | |

| 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| | 0.008 | | | | 0.008 | | | | 0.015 | | | | 0.039 | | | | 0.059 | |

| | (0.008 | ) | | | (0.008 | ) | | | (0.015 | ) | | | (0.039 | ) | | | (0.059 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 0.82 | % | | | 0.77 | % | | | 1.48 | % | | | 3.98 | % | | | 6.07 | % |

| | | | | | | | | | | | | | | | | | | |

| $ | 192,613 | | | $ | 187,718 | | | $ | 200,583 | | | $ | 272,733 | | | $ | 253,173 | |

| $ | 188,931 | | | $ | 198,143 | | | $ | 291,473 | | | $ | 283,850 | | | $ | 267,611 | |

| | | | | | | | | | | | | | | | | | | |

| | 0.58 | % | | | 0.49 | % | | | 0.48 | % | | | 0.52 | % | | | 0.54 | % |

| | 0.58 | % | | | 0.49 | % | | | 0.48 | % | | | 0.52 | % | | | 0.54 | % |

| | 0.83 | % | | | 0.75 | % | | | 1.48 | % | | | 3.84 | % | | | 5.95 | % |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 27 |

Approval of Advisory Agreements

The Board of Directors (the “Board”) of MoneyMart Assets, Inc. (the “Fund”) oversees the management of the Fund, and, as required by law, determines annually whether to renew the Fund’s management agreement with Prudential Investments LLC (“PI”) and the Fund’s subadvisory agreement with Prudential Investment Management, Inc. (“PIM”). In considering the renewal of the agreements, the Board, including a majority of the Independent Directors, met on May 24, 2005 and June 23, 2005 and approved the renewal of the agreements through July 31, 2006, after concluding that renewal of the agreements was in the best interests of the Fund and its shareholders.

In advance of the meetings, the Board received materials relating to the agreements, and had the opportunity to ask questions and request further information in connection with their consideration. Among other things, the Board considered comparisons with other mutual funds in relevant Peer Universes and Peer Groups. The mutual funds included in each Peer Universe or Peer Group was objectively determined solely by Lipper Inc., an independent provider of mutual fund data. The comparisons placed the Fund in various quartiles over one-year, three-year and five-year time periods ending December 31, with the first quartile being the best 25% of the mutual funds (for performance, the best performing mutual funds and, for expenses, the lowest cost mutual funds).

In approving the agreements, the Board, including the Independent Directors advised by independent legal counsel, considered the factors they deemed relevant, including the nature, quality and extent of services provided, the performance of the Fund, the profitability of PI and its affiliates, expenses and fees, and the potential for economies of scale that may be shared with the Fund and its shareholders. In their deliberations, the Directors did not identify any single factor that was dispositive and each Director attributed different weights to the various factors. In connection with their deliberations, the Board considered information provided by PI throughout the year at regular Board meetings, presentations from portfolio managers and other information, as well as information furnished at or in advance of the meetings on May 24, 2005 and June 23, 2005.

The Directors determined that the overall arrangements between the Fund and PI, which serves as the Fund’s investment manager pursuant to a management agreement, and between PI and PIM, which serves as the Fund’s subadviser pursuant to the terms of a subadvisory agreement with PI, are fair and reasonable in light of the services performed, fees charged and such other matters as the Directors considered relevant in the exercise of their business judgment.

Several of the material factors and conclusions that formed the basis for the Directors’ reaching their determinations to approve the continuance of the agreements are separately discussed below.

Nature, Quality and Extent of Services

The Board received and considered information regarding the nature and extent of services provided to the Fund by PI and PIM. The Board considered the services provided by PI, including but not limited to the oversight of the subadviser for the Fund, as well as the provision of fund accounting, recordkeeping, compliance, and other services to the Fund. With respect to PI’s oversight of the subadviser, the Board noted that PI’s Strategic Investment Research Group (“SIRG”), which is a business unit of PI, is responsible for monitoring and reporting to PI’s senior management on the performance and operations of the subadviser. The Board also considered that PI pays the salaries of all of the officers and non-independent Directors of the Fund. The Board also considered the investment subadvisory services provided by PIM, as well as adherence to the Fund’s investment restrictions and compliance with applicable Fund policies and procedures.

The Board reviewed the qualifications, backgrounds and responsibilities of PI’s senior management responsible for the oversight of the Fund and PIM, and also reviewed the qualifications, backgrounds and responsibilities of PIM’s portfolio managers who are responsible for the day-to-day management of the Fund’s portfolio. The Board was provided with information pertaining to PI’s and PIM’s organizational structure, senior management, investment operations, and other relevant information pertaining to both PI and PIM. The Board also noted that it received favorable compliance reports from the Fund’s Chief Compliance Officer (CCO) as to both PI and PIM. The Board noted that PIM is affiliated with PI.

The Board concluded that it was satisfied with the nature, extent and quality of the investment management services provided by PI and the subadvisory services provided to the Fund by PIM, and that there was a reasonable basis on which to conclude that the Fund benefits from the services provided by PI and PIM under the management and subadvisory agreements.

Performance of MoneyMart Assets

The Board received and considered information about the Fund’s historical performance, noting that the Fund had achieved performance that was in the second quartile over one-year and three-year periods ending December 31, and performance that was in the first quartile over five-year and ten-year periods ending December 31 in relation to the group of comparable funds in a peer universe (the “Peer Universe”). The Board noted that the Fund’s performance over three-year, five-year and ten-year time periods was above the median performance of the other mutual funds included in the Peer Universe.

The Board determined that the Fund’s performance was satisfactory.

| | |

| | | Visit our website at www.jennisondryden.com |

The funds included in the Peer Universe are objectively determined solely by Lipper Inc., independent provider of investment company data.

Fees and Expenses

The Board considered the management fee for the Fund as compared to the management fee charged by PI to other funds and accounts and the fee charged by other advisers to comparable mutual funds provided by Lipper Inc.

The Fund’s contractual management fee of 0.309% and actual management fee of 0.303% ranked in the first quartile and second quartile, respectively, in its Lipper 15(c) Peer Group. The contractual management fee is computed based on assumed common levels of Fund net assets for each mutual fund included in the Lipper 15(c) Peer Group, while the actual management fee represents the fee rate actually paid by Fund shareholders and includes any fee waivers or reimbursements. The Board concluded that the management and subadvisory fees are reasonable.

Costs of Services and Profits Realized by PI

The Board was provided with information on the profitability of PI and its affiliates in serving as the Fund’s investment manager. The Board discussed with PI the methodology utilized in assembling the information regarding profitability and considered its reasonableness. The Board recognized that it is difficult to make comparisons of profitability from fund management contracts because comparative information is not generally publicly available and is affected by numerous factors, including the structure of the particular adviser, the types of funds it manages, its business mix, numerous assumptions regarding allocations and the adviser’s capital structure and cost of capital. The Board did not separately consider the profitability of the subadviser, an affiliate of PI, as its profitability was reflected in the profitability report for PI. Taking these factors into account, the Board concluded that the profitability of PI and its affiliates in relation to the services rendered was not unreasonable.

Economies of Scale

The Board noted that the management fee schedule for the Fund includes breakpoints, which have the effect of decreasing the fee rate as assets increase, and that at its current level of assets the Fund’s effective fee rate reflected some of those rate reductions. The Board received and discussed information concerning whether PI realizes economies of scale as the Fund’s assets grow beyond current levels. The Board took note that the Fund’s fee structure currently results in benefits to Fund shareholders whether or not PI realizes any economies of scale.

Other Benefits to PI and PIM

The Board considered potential ancillary benefits that might be received by PI and PIM and their affiliates as a result of their relationship with the Fund. The Board concluded that potential benefits to be derived by PI included transfer agency fees received by the Fund’s transfer agent (which is affiliated with PI), as well as reputational or other intangible benefits resulting from PI’s association with the Fund. The Board concluded that the potential benefits to be derived by PIM included those generally resulting from an increase in assets under management, specifically, potential access to additional research resources and reputational benefits. The Board concluded that the benefits derived by PI and PIM were consistent with the types of benefits generally derived by investment managers and subadvisers to mutual funds.

| | |

| | | Visit our website at www.jennisondryden.com |

| | | | |

| n MAIL | | n TELEPHONE | | n WEBSITE |

Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 | | (800) 225-1852 | | www.jennisondryden.com |

|

| PROXY VOTING |

| The Board of Directors of the Fund has delegated to the Fund’s investment adviser the responsibility for voting any proxies and maintaining proxy recordkeeping with respect to the Fund. A description of these proxy voting policies and procedures is available without charge, upon request, by calling (800) 225-1852 or by visiting the Securities and Exchange Commission’s (the Commission) website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, 2005, is available on the Fund’s website at www.prudential.com and on the Commission’s website at www.sec.gov. |

|

| DIRECTORS |

| David E. A. Carson • Robert F. Gunia • Robert E. La Blanc • Robin B. Smith • Stephen G. Stoneburn • Clay T. Whitehead • Douglas H. McCorkindale |

|

| OFFICERS |

| Judy A. Rice, President • Robert F. Gunia, Vice President • Grace C. Torres, Treasurer and Principal Financial and Accounting Officer • Kathryn L. Quirk, Chief Legal Officer • Deborah A. Docs, Secretary • Jonathan D. Shain, Assistant Secretary • Maryanne Ryan, Anti-Money Laundering Compliance Officer • Lee D. Augsburger, Chief Compliance Officer |

| | | | |

| MANAGER | | Prudential Investments LLC | | Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 |

|

| INVESTMENT ADVISER | | Prudential Investment

Management, Inc. | | Gateway Center Two

100 Mulberry Street

Newark, NJ 07102 |

|

| DISTRIBUTOR | | Prudential Investment

Management Services LLC | | Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 |

|

| CUSTODIAN | | | | |

| Through June 5, 2005 | | State Street Bank

and Trust Company | | One Heritage Drive

North Quincy, MA 02171 |

| Effective June 6, 2005 | | The Bank of New York | | One Wall Street

New York, New York 10286 |

|

| TRANSFER AGENT | | Prudential Mutual Fund

Services LLC | | PO Box 8098

Philadelphia, PA 19176 |

|

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | KPMG LLP | | 345 Park Avenue

New York, NY 10154 |

|

| FUND COUNSEL | | Sullivan & Cromwell LLP | | 125 Broad Street

New York, NY 10004 |

| | | | | | | | | | | | |

| MoneyMart Assets, Inc. | | |

| | | Share Class | | A | | B | | C | | Z | | |

| | | NASDAQ | | N/A | | PBBXX | | N/A | | PMZXX | | |

| | | CUSIP | | 60936A100 | | 60936A506 | | 60936A605 | | 60936A407 | | |

| | | | | | | | | | | | | |

|

| An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The prospectus for the Fund contains this and other information about the Fund. An investor may obtain a prospectus by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. The prospectus should be read carefully before investing. |

|

| The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter. The accompanying financial statements as of June 30, 2005, were not audited, and accordingly, no auditor’s opinion is expressed on them. |

E-DELIVERY

To receive your mutual fund documents on-line, go to www.icsdelivery.com/prudential/funds and enroll. Instead of receiving printed documents by mail, you will receive notification via e-mail when new materials are available. You can cancel your enrollment or change your e-mail address at any time by clicking on the change/cancel enrollment option at the icsdelivery website address.

SHAREHOLDER COMMUNICATIONS WITH DIRECTORS

Shareholders of the Fund can communicate directly with the Board of Directors by writing to the Chair of the Board, MoneyMart Assets, Inc., PO Box 13964, Philadelphia, PA 19176. Shareholders can communicate directly with an individual Director by writing to that Director at MoneyMart Assets, Inc., PO Box 13964, Philadelphia, PA 19176. Communications to the Board or individual Directors are not screened before being delivered to the addressee.

|

| AVAILABILITY OF PORTFOLIO SCHEDULE |

| The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the Commission) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation and location of the Public Reference Room may be obtained by calling (800) SEC-0330 (732-0330). The Fund will provide a full list of its portfolio holdings as of the end of each month on its website at www.jennisondryden.com approximately 30 days after the end of the month. |

Mutual Funds:

| | | | |

| ARE NOT INSURED BY THE FDIC OR ANY FEDERAL GOVERNMENT AGENCY | | MAY LOSE VALUE | | ARE NOT A DEPOSIT OF OR GUARANTEED BY ANY BANK OR ANY BANK AFFILIATE |

| | | | | | | | | | | | |

| MoneyMart Assets, Inc. | | |

| | | Share Class | | A | | B | | C | | Z | | |

| | | NASDAQ | | N/A | | PBBXX | | N/A | | PMZXX | | |

| | | CUSIP | | 60936A100 | | 60936A506 | | 60936A605 | | 60936A407 | | |

| | | | | | | | | | | | | |

MF108E2 IFS-A107719 Ed. 08/2005

| Item 2 – | Code of Ethics — Not required as this is not an annual filing. |

| Item 3 – | Audit Committee Financial Expert – Not applicable with semi-annual filing |

| Item 4 – | Principal Accountant Fees and Services – Not applicable with semi-annual filing. |

| Item 5 – | Audit Committee of Listed Registrants – Not applicable. |

| Item 6 – | Schedule of Investments – The schedule is included as part of the report to shareholders filed under Item 1 of this Form. |

| Item 7 – | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies – Not applicable. |

| Item 8 – | Portfolio Managers of Closed-End Management Investment Companies – Not applicable. |

| Item 9 – | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers – Not applicable. |

| Item 10 – | Submission of Matters to a Vote of Security Holders – Not applicable. |

| Item 11 – | Controls and Procedures |

| | (a) | It is the conclusion of the registrant’s principal executive officer and principal financial officer that the effectiveness of the registrant’s current disclosure controls and procedures (such disclosure controls and procedures having been evaluated within 90 days of the date of this filing) provide reasonable assurance that the information required to be disclosed by the registrant has been recorded, processed, summarized and reported within the time period specified in the Commission’s rules and forms and that the information required to be disclosed by the registrant has been accumulated and communicated to the registrant’s principal executive officer and principal financial officer in order to allow timely decisions regarding required disclosure. |

| | (b) | There has been no significant change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal half-year if the period covered by this report that has materially affected, or is likely to materially affect, the registrant’s internal control over financial reporting. |

| | (a) (1) | Code of Ethics – Not applicable with semi-annual filing. |

| | (2) | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act – Attached hereto as Exhibit EX-99.CERT. |

| | (3) | Any written solicitation to purchase securities under Rule 23c-1. – Not applicable. |

| | (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act – Attached hereto as Exhibit EX-99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| (Registrant) MoneyMart Assets, Inc. |

| |

| By (Signature and Title)* | | /s/ DEBORAH A. DOCS |

| | | Deborah A. Docs Secretary |

Date August 24, 2005

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

| By (Signature and Title)* | | /s/ JUDY A. RICE |

| | | Judy A. Rice President and Principal Executive Officer |

Date August 24, 2005

| | |

| By (Signature and Title)* | | /s/ GRACE C. TORRES |

| | | Grace C. Torres Treasurer and Principal Financial Officer |

Date August 24, 2005

| * | Print the name and title of each signing officer under his or her signature. |