UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-02619 |

| |

| Exact name of registrant as specified in charter: | | MoneyMart Assets, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 7/31/2008 |

| |

| Date of reporting period: | | 1/31/2008 |

Item 1 – Reports to Stockholders

SEMIANNUAL REPORT

JANUARY 31, 2008

MONEYMART ASSETS, INC.

FUND TYPE

Money market

OBJECTIVE

Maximum current income consistent with stability of capital and the maintenance of liquidity

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The accompanying financial statements as of January 31, 2008, were not audited and, accordingly, no auditor’s opinion is expressed on them.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Prudential, Prudential Financial and the Rock Prudential logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

March 14, 2008

Dear Shareholder:

We hope you find the semiannual report for MoneyMart Assets informative and useful. As a MoneyMart Assets shareholder, you may be thinking about where you can find additional growth opportunities. You could invest in last year’s top-performing asset class and hope history repeats itself or you could stay in cash while waiting for the “right moment” to invest.

Instead, we believe it is better to take advantage of developing domestic and global investment opportunities through a diversified portfolio of stock and bond mutual funds. A diversified asset allocation offers two potential advantages. It helps you manage downside risk by not being overly exposed to any particular asset class, plus it gives you a better opportunity to have at least some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds covering all the basic asset classes and that reflects your personal investor profile and tolerance for risk.

Thank you for choosing MoneyMart Assets.

Sincerely,

Judy A. Rice, President

MoneyMart Assets, Inc.

Your Fund’s Performance

Fund objective

The investment objective of MoneyMart Assets, Inc. is to seek maximum current income consistent with stability of capital and the maintenance of liquidity. There can be no assurance that the Fund will achieve its investment objective.

The Fund is a diversified portfolio of high-quality, U.S. dollar-denominated money market securities issued by the U.S. government, its agencies and instrumentalities, and major corporations and commercial banks in the United States and foreign countries. Maturities can range from one day to 13 months. The Fund generally only purchases securities rated in one of the two highest short-term rating categories or one of the three highest long-term rating categories by at least two major rating agencies, or, if not rated, deemed to be of equivalent quality by the investment subadviser.

Yields will fluctuate from time to time, and past performance does not guarantee future results. Current performance may be lower or higher than the past performance data quoted. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost. For the most recent month-end performance update, call (800) 225-1852. Gross operating expenses: Class A, 0.51%; Class B, 0.38%; Class C, 0.38%; and Class Z, 0.38%.

| | | | | | | | | | | |

| Fund Facts as of 1/31/08 | | | | | | | |

| | | 7-Day

Current Yield | | | Net Asset

Value (NAV) | | Weighted Avg.

Maturity (WAM) | | Net Assets

(Millions) |

Class A | | 4.12 | % | | $ | 1.00 | | 34 Days | | $ | 716.2 |

Class B* | | 4.24 | | | $ | 1.00 | | 34 Days | | $ | 69.1 |

Class C* | | 4.24 | | | $ | 1.00 | | 34 Days | | $ | 16.9 |

Class Z* | | 4.24 | | | $ | 1.00 | | 34 Days | | $ | 175.7 |

iMoneyNet, Inc. Prime Retail Avg.** | | 3.58 | | | | N/A | | 47 Days | | | N/A |

| * | Class B, Class C, and Class Z shares are not subject to distribution and service (12b-1) fees. |

| ** | iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. This is based on the data of all funds in the iMoneyNet, Inc. Prime Retail Average category as of January 29, 2008, the closest reported date prior to the end of our reporting period. |

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the Fund.

| | |

| 2 | | Visit our website at www.jennisondryden.com |

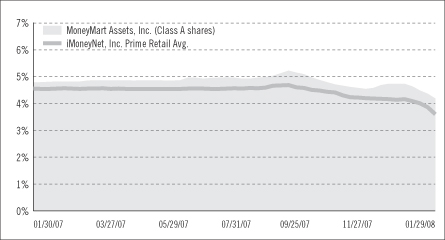

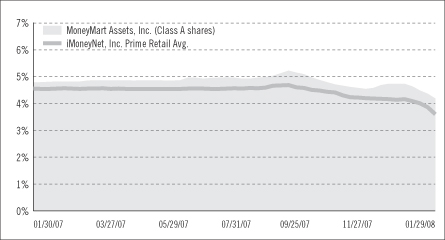

Money Market Fund Yield Comparison

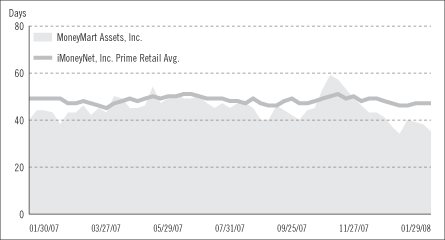

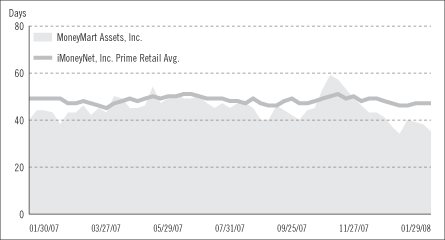

Weighted Average Maturity Comparison

Yields will fluctuate from time to time, and past performance does not guarantee future results. Current performance may be lower or higher than the past performance data quoted. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost. For the most recent month-end performance update, call (800) 225-1852. Gross operating expenses: Class A, 0.51%; Class B, 0.38%; Class C, 0.38%; and Class Z, 0.38%.

The graphs portray weekly 7-day current yields and weekly WAMs for MoneyMart Assets, Inc. (Class A shares—yields only) and the iMoneyNet, Inc. Prime Retail Average every Tuesday from January 30, 2007 to January 29, 2008, the closest dates to the beginning and end of the Fund’s reporting period. Note: iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. As a result, the data portrayed for the Fund at the end of the reporting period in the graphs may not match the data portrayed in the Fund Facts table as of January 29, 2008.

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the Fund.

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on August 1, 2007, at the beginning of the period, and held through the six-month period ended January 31, 2008. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the seven-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of JennisonDryden Funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the seven-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Seven-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before

| | |

| 4 | | Visit our website at www.jennisondryden.com |

expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

MoneyMart

Assets, Inc. | | Beginning Account

Value

August 1, 2007 | | Ending Account

Value January 31, 2008 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month

Period* |

| | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | $ | 1,024.40 | | 0.51 | % | | $ | 2.60 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.57 | | 0.51 | % | | $ | 2.59 |

| | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | $ | 1,025.00 | | 0.38 | % | | $ | 1.93 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,023.23 | | 0.38 | % | | $ | 1.93 |

| | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | $ | 1,025.00 | | 0.38 | % | | $ | 1.93 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,023.23 | | 0.38 | % | | $ | 1.93 |

| | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | $ | 1,025.00 | | 0.38 | % | | $ | 1.93 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,023.23 | | 0.38 | % | | $ | 1.93 |

| | | | | | | | | | | | | | |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended January 31, 2008, and divided by the 366 days in the Fund’s fiscal year ending July 31, 2008 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

Portfolio of Investments

as of January 31, 2008 (Unaudited)

| | | | | | |

Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | |

| | Certificates of Deposit 15.6% |

| $ | 10,000 | | Bank of Scotland PLC

5.05%, 3/14/08 | | $ | 10,000,544 |

| | 30,000 | | Barclays Bank PLC

5.16%, 2/19/08 | | | 30,000,000 |

| | 10,000 | | 5.20%, 4/11/08 | | | 10,000,000 |

| | 10,000 | | M&I Marshall & Ilsley Bank

4.82%, 2/11/08 | | | 10,000,000 |

| | 38,000 | | National Bank of Canada

4.28%, 4/11/08 | | | 38,000,731 |

| | 20,000 | | Regions Bank

4.85%, 2/20/08 | | | 20,000,000 |

| | 20,000 | | Royal Bank of Scotland NY

5.17%, 2/11/08 | | | 20,000,000 |

| | 5,000 | | Unicredito Italiano New York

5.01%, 2/1/08 | | | 5,000,000 |

| | 10,000 | | 5.19%, 2/19/08 | | | 10,000,000 |

| | | | | | |

| | | | | | 153,001,275 |

| | | | | | |

|

| | Commercial Paper 39.7% |

| | 5,000 | | Allianz Finance Corp., 144A

3.22%, 2/27/08(a) | | | 4,988,372 |

| | 10,000 | | Amsterdam Funding Corp., 144A

4.11%, 2/22/08(a) | | | 9,976,025 |

| | 10,000 | | Australia and New Zealand Banking Group, 144A

4.37%, 4/7/08(a) | | | 9,919,792 |

| | 5,000 | | Bank of America Corp.

4.98%, 2/15/08(a) | | | 4,990,307 |

| | 10,000 | | Bryant Park Funding, 144A

4.20%, 2/12/08(a) | | | 9,987,167 |

| | 40,000 | | Calyon North America, Inc.

4.30%, 4/10/08(a) | | | 39,670,333 |

| | 7,717 | | Citigroup Funding, Inc.

5.46%, 2/6/08(a) | | | 7,711,148 |

| | 10,000 | | General Electric Capital Corp.

3.47%, 3/18/08(a) | | | 9,955,661 |

| | 36,000 | | 4.56%, 3/24/08(a) | | | 35,762,880 |

| | 11,000 | | Long Lane Master Trust IV, 144A

3.10%, 2/27/08(a) | | | 10,975,372 |

| | 15,000 | | Old Line Funding Corp., 144A

3.15%, 2/15/08(a) | | | 14,981,625 |

See Notes to Financial Statements.

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

| | | | | | |

Principal

Amount (000) | | Description | | Value (Note 1) |

| | | | | | |

| $ | 19,000 | | PNC Funding Corp.

3.22%, 4/28/08(a) | | $ | 18,851,919 |

| | 12,441 | | Prudential PLC, 144A

5.10%, 2/11/08(a) | | | 12,423,375 |

| | 5,000 | | 3.50%, 4/22/08(a) | | | 4,960,625 |

| | 20,000 | | Royal Bank of Scotland, 144A

4.62%, 4/2/08(a) | | | 19,843,433 |

| | 7,800 | | Societe Generale NA

4.56%, 4/3/08(a) | | | 7,738,744 |

| | 25,000 | | 4.53%, 4/8/08(a) | | | 24,788,997 |

| | 20,000 | | Swedbank AB

3.30%, 4/4/08(a) | | | 19,884,500 |

| | 10,000 | | Swedbank Mortgage AB

5.14%, 2/21/08(a) | | | 9,971,472 |

| | 5,000 | | 5.13%, 2/22/08(a) | | | 4,985,023 |

| | 40,000 | | Toyota Motor Credit Corp.

4.77%, 2/22/08(a) | | | 39,888,700 |

| | 32,000 | | Tulip Funding Corp., 144A

4.31%, 2/8/08(a) | | | 31,973,182 |

| | 25,000 | | UBS Financial Delaware LLC

5.32%, 3/13/08(a) | | | 24,848,528 |

| | 9,000 | | Westpac Securities NZ LT, 144A

3.141%, 1/28/09(a) | | | 9,000,000 |

| | | | | | |

| | | | | | 388,077,180 |

| | | | | | |

|

| | Loan Participation 0.7% |

| | 7,000 | | Cargill, Inc.

3.27%, 2/28/08(c) | | | 7,000,000 |

| | | | | | |

|

| | Other Corporate Obligations 42.6% |

| | 42,500 | | American Express Credit Corp., MTN

4.64%, 3/5/08(b) | | | 42,500,000 |

| | 24,000 | | Bank of America NA

5.29%, 5/22/08(b) | | | 24,000,000 |

| | 6,000 | | Caterpillar Financial Services Corp., MTN

4.485%, 3/4/08(b) | | | 6,000,000 |

| | 6,000 | | Depfa Bank PLC, 144A

5.051%, 7/15/08(b) | | | 6,000,058 |

| | 17,000 | | Fortis Bank NY, 144A

3.864%, 7/18/08(b) | | | 16,998,454 |

| | 10,000 | | HSBC Finance Corp.

4.55%, 9/6/08(b) | | | 10,000,000 |

See Notes to Financial Statements.

| | |

| 8 | | Visit our website at www.jennisondryden.com |

| | | | | | | |

Principal

Amount (000) | | Description | | Value (Note 1) | |

| | | | | | | |

| $ | 30,000 | | HSBC USA, Inc., MTN

4.246%, 8/14/08(b) | | $ | 30,000,000 | |

| | 40,000 | | Irish Life & Permanent PLC, MTN, 144A

3.984%, 8/20/08(b) | | | 39,999,598 | |

| | 15,000 | | JP Morgan Chase & Co., MTN

4.621%, 9/2/08(b) | | | 15,000,000 | |

| | 5,000 | | Kommunalkredit Austria, 144A

3.954%, 8/22/08(b) | | | 5,000,000 | |

| | 15,000 | | Metropolitan Life Insurance Co.

(cost: $15,000,000; purchased 4/2/07)

4.691%, 4/1/08(b)(c)(d) | | | 15,000,000 | |

| | 38,800 | | Morgan Stanley Dean Witter Co., MTN

4.725%, 10/31/08(b) | | | 38,800,000 | |

| | 30,000 | | Nationwide Building Society, 144A

4.923%, 7/28/08(b) | | | 30,004,355 | |

| | 30,000 | | Nordea Bank AB, 144A

4.391%, 8/8/08(b) | | | 30,000,000 | |

| | 40,000 | | Skandinaviska Enskilda Banken AB, 144A

4.009%, 8/19/08(b) | | | 40,000,000 | |

| | 35,000 | | Wells Fargo & Co., MTN

4.65%, 9/3/08(b) | | | 35,000,000 | |

| | 32,000 | | Westpac Banking Corp., MTN

5.201%, 7/11/08(b) | | | 32,000,000 | |

| | | | | | | |

| | | | | | 416,302,465 | |

| | | | | | | |

|

| | U.S. Government Agency Obligations 2.4% | |

| | 9,000 | | Federal Home Loan Bank,

3.803%, 2/17/09(b) | | | 9,000,000 | |

| | 15,000 | | Federal Home Loan Bank, Discount Note,

3.12%, 2/22/08(a) | | | 14,972,700 | |

| | | | | | | |

| | | | | | 23,972,700 | |

| | | | | | | |

|

| | Repurchase Agreement 0.1% | |

| | 525 | | Greenwich Capital Markets, Inc.,

3.00%, dated 2/1/08 in the amount of $525,044 (cost $525,000; the value of collateral including accrued interest was $535,610)(e) | | | 525,000 | |

| | | | | | | |

| | | Total Investments 101.1%

(amortized cost $988,878,620)(f) | | | 988,878,620 | |

| | | Liabilities in excess of other assets (1.1%) | | | (10,986,788 | ) |

| | | | | | | |

| | | Net Assets 100.0% | | $ | 977,891,832 | |

| | | | | | | |

See Notes to Financial Statements.

Portfolio of Investments

as of January 31, 2008 (Unaudited) continued

MTN—Medium Term Note.

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted, 144A securities are deemed to be liquid.

| (a) | Rate quoted represents yield-to-maturity as of purchase date. |

| (b) | Floating Rate Security. The interest rate shown reflects the rate in effect at January 31, 2008. |

| (c) | Indicates a security that has been deemed illiquid. |

| (d) | Indicates a restricted security; the aggregate cost and value of restricted securities is $15,000,000 and represents 1.5% of net assets. |

| (e) | Repurchase agreements are collateralized by United States Treasury or federal Agency obligations. |

| (f) | The cost of securities for federal income tax purposes is substantially the same as for financial reporting purposes. |

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of January 31, 2008 was as follows:

| | | |

Foreign Banks | | 36.4 | % |

Commercial Banks | | 25.3 | |

Financial Services | | 12.7 | |

Asset Backed Securities | | 8.0 | |

Non-Captive Finance | | 5.4 | |

Security Brokers & Dealers | | 4.8 | |

Life Insurance | | 3.3 | |

U.S. Government Agency Obligations | | 2.4 | |

Mortgage Banks | | 1.5 | |

Foods | | 0.7 | |

Capital Goods | | 0.6 | |

| | | |

| | 101.1 | |

Liabilities in excess of other assets | | (1.1 | ) |

| | | |

| | 100.0 | % |

| | | |

See Notes to Financial Statements.

| | |

| 10 | | Visit our website at www.jennisondryden.com |

Statement of Assets and Liabilities

as of January 31, 2008 (Unaudited)

| | | |

Assets | | | |

Investments, at amortized cost which approximates market value | | $ | 988,878,620 |

Cash | | | 22,574 |

Receivable for Fund shares sold | | | 4,467,736 |

Interest receivable | | | 3,905,015 |

Prepaid expenses | | | 9,394 |

| | | |

Total assets | | | 997,283,339 |

| | | |

| |

Liabilities | | | |

Payable for investments purchased | | | 9,000,000 |

Payable for Fund shares reacquired | | | 7,411,620 |

Accrued expenses | | | 1,726,398 |

Dividends payable | | | 892,774 |

Management fee payable | | | 252,211 |

Distribution fee payable | | | 74,465 |

Transfer agent fee payable | | | 24,750 |

Deferred directors’ fees | | | 9,289 |

| | | |

Total liabilities | | | 19,391,507 |

| | | |

| |

Net Assets | | $ | 977,891,832 |

| | | |

| | | | |

Net assets were comprised of: | | | |

Common stock, at par ($.001 par value; 20 billion shares authorized for issuance) | | $ | 977,892 |

Paid-in capital in excess of par | | | 976,913,940 |

| | | |

Net assets, January 31, 2008 | | $ | 977,891,832 |

| | | |

| |

Class A | | | |

Net asset value, offering price and redemption price per share

($716,240,362 ÷ 716,240,362 shares of common stock issued and outstanding) | | | $1.00 |

| | | |

| |

Class B | | | |

Net asset value, offering price and redemption price per share

($69,077,634 ÷ 69,077,634 shares of common stock issued and outstanding) | | | $1.00 |

| | | |

| |

Class C | | | |

Net asset value, offering price and redemption price per share

($16,894,349 ÷ 16,894,349 shares of common stock issued and outstanding) | | | $1.00 |

| | | |

| |

Class Z | | | |

Net asset value, offering price and redemption price per share

($175,679,487 ÷ 175,679,487 shares of common stock issued and outstanding) | | | $1.00 |

| | | |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 11 |

Statement of Operations

Six Months Ended January 31, 2008 (Unaudited)

| | | |

Net Investment Income | | | |

Income | | | |

Interest | | $ | 23,926,728 |

| | | |

| |

Expenses | | | |

Management fee | | | 1,411,099 |

Distribution fee—Class A | | | 409,343 |

Transfer agent’s fees and expenses (including affiliated expense of $153,100) | | | 181,000 |

Reports to shareholders | | | 45,000 |

Custodian’s fees and expenses | | | 40,000 |

Registration fees | | | 11,000 |

Audit fee | | | 10,000 |

Legal fees and expenses | | | 10,000 |

Directors’ fees | | | 8,000 |

Insurance | | | 8,000 |

Interest expense | | | 1,636 |

Miscellaneous | | | 2,484 |

| | | |

Total expenses | | | 2,137,562 |

| | | |

Net investment income | | | 21,789,166 |

| | | |

| |

Net Realized Gain On Investments | | | |

Net realized gain on investment transactions | | | 21,621 |

| | | |

Net Increase In Net Assets Resulting From Operations | | $ | 21,810,787 |

| | | |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

(Unaudited)

| | | | | | | | | | | | |

| | | Six Months

Ended

January 31, 2008 | | | Seven Months

Ended

July 31, 2007 | | | Year Ended

December 31,

2006 | |

Increase (Decrease) In Net Assets | | | | | | | | | | | | |

Operations | | | | | | | | | | | | |

Net investment income | | $ | 21,789,166 | | | $ | 24,678,640 | | | $ | 40,507,180 | |

Net realized gain on investment transactions | | | 21,621 | | | | 280 | | | | 3,717 | |

| | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | 21,810,787 | | | | 24,678,920 | | | | 40,510,897 | |

| | | | | | | | | | | | |

Dividends and distributions to shareholders (Note 1) | | | | | | | | | | | | |

Class A | | | (15,624,848 | ) | | | (18,029,235 | ) | | | (28,520,298 | ) |

Class B | | | (1,628,737 | ) | | | (1,947,971 | ) | | | (3,469,005 | ) |

Class C | | | (336,822 | ) | | | (371,307 | ) | | | (606,698 | ) |

Class Z | | | (4,220,380 | ) | | | (4,330,407 | ) | | | (7,914,896 | ) |

| | | | | | | | | | | | |

| | | (21,810,787 | ) | | | (24,678,920 | ) | | | (40,510,897 | ) |

| | | | | | | | | | | | |

| | | |

Fund share transactions (Note 4) (at $1.00 per share) | | | | | | | | | | | | |

Net proceeds from shares sold | | | 909,372,953 | | | | 789,872,196 | | | | 1,887,263,370 | |

Net asset value of shares issued to shareholders in reinvestment of dividends and distributions | | | 21,435,109 | | | | 23,387,746 | | | | 39,616,340 | |

Cost of shares reacquired | | | (832,147,044 | ) | | | (819,921,911 | ) | | | (2,021,725,130 | ) |

| | | | | | | | | | | | |

Net increase (decrease) in net assets from Fund share transactions | | | 98,661,018 | | | | (6,661,969 | ) | | | (94,845,420 | ) |

| | | | | | | | | | | | |

Total increase (decrease) | | | 98,661,018 | | | | (6,661,969 | ) | | | (94,845,420 | ) |

| | | |

Net Assets | | | | | | | | | | | | |

Beginning of period | | | 879,230,814 | | | | 885,892,783 | | | | 980,738,203 | |

| | | | | | | | | | | | |

End of period | | $ | 977,891,832 | | | $ | 879,230,814 | | | $ | 885,892,783 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 13 |

Notes to Financial Statements

(Unaudited)

MoneyMart Assets, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The Fund invests primarily in a portfolio of money market instruments maturing in thirteen months or less whose ratings are within the two highest rating categories by a nationally recognized statistical rating organization or, if not rated, are of comparable quality. The ability of the issuers of the securities held by the Fund to meet their obligations may be affected by economic developments in a specific industry or region.

The Fund’s fiscal year had changed from an annual reporting period that ended December 31 to one that ends July 31. This change should have no impact on the way the Fund is managed. Shareholders will receive future annual and semi-annual reports on the new fiscal year-end schedule.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuations: Portfolio securities are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of any discount or premium. If the amortized cost method is determined not to represent fair value, the fair value shall be determined by or under the direction of the Board of Directors. When determining the fair valuation of securities some of the factors influencing the valuation include the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses on sales of securities are calculated on the identified cost basis. Interest income including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis. Expenses are recorded on the accrual basis.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

Net investment income or loss (other than distribution fees, which are charged directly to the respective class) and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Repurchase Agreements: In connection with transactions in repurchase agreements with United States financial institutions, it is the Fund’s policy that its custodian or designated subcustodians under triparty repurchase agreements, as the case may be, take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transactions, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked to market on a daily basis to ensure the adequacy of the collateral. If the seller defaults and the value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

Loan Participations: The Fund may invest in loan participations. When the Fund purchases a loan participation, the Fund typically enters into a contractual relationship with the lender or third party selling such participations (“Selling Participant”), but not the borrower. As a result, the Fund assumes the credit risk of the borrower, the selling participant and any other persons interpositioned between the Fund and borrower (“intermediate participants”). The Fund may not directly benefit from the collateral supporting the senior loan in which it has purchased the loan participation.

Federal Income Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to shareholders. Therefore, no federal income tax provision is required.

Dividends and Distributions: The Fund declares daily dividends from net investment income and net realized short-term capital gains or losses. Payment of dividends is made monthly. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles are recorded on the ex-dividend date.

Restricted Securities: The Fund may hold up to 10% of its net assets in illiquid securities, including those which are restricted as to disposition under securities law (“restricted securities”). Restricted securities, sometimes referred to as private placements, are valued pursuant to the valuation procedures noted above.

| | |

| MoneyMart Assets, Inc. | | 15 |

Notes to Financial Statements

(Unaudited) continued

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has a management agreement with Prudential Investments LLC (“PI”). Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadvisor’s performance of such services. PI has entered into a subadvisory agreement with Prudential Investment Management, Inc. (“PIM”). The subadvisory agreement provides that PIM will furnish investment advisory services in connection with the management of the Fund. In connection therewith, PIM is obligated to keep certain books and records of the Fund. PI pays for the services of PIM, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The management fee paid to PI is accrued daily and payable monthly, at an annual rate of .50 of 1% of the Fund’s average daily net assets up to $50 million and .30 of 1% of the Fund’s average daily net assets in excess of $50 million. The effective management fee rate was .311 of 1% for the six months ended January 31, 2008.

The Fund has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class B, Class C and Class Z shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A shares pursuant to the plan of distribution at an annual rate of .125 of 1% of the average daily net assets of the Class A shares. The Class A distribution fee is accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor of Class B, C or Z shares of the Fund.

PI, PIM and PIMS are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

Note 3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certain out-of-pocket and sub-transfer agent expenses paid to non-affiliates, where applicable.

| | |

| 16 | | Visit our website at www.jennisondryden.com |

The Fund pays networking fees to affiliated and unaffiliated broker/dealers including fees related to the services of Pruco LLP (“Pruco”) and First Clearing, LLC (“First Clearing”), affiliates of PI. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. For the six months ended January 31, 2008, the Fund incurred approximately $89,500 in total networking fees of which $77,700 was paid to Pruco and First Clearing. These amounts are included in transfer agent’s fees and expenses in the Statement of Operations.

Note 4. Capital

The Fund offers Class A, Class B, Class C and Class Z shares. Class B, C and Z shares are not subject to any distribution and/or service fees and are offered exclusively for sale to a limited group of investors. There are 20 billion authorized shares of $.001 par value common stock divided into four classes, which consist of 13 billion Class A, 2.5 billion Class B, 2.5 billion Class C and 2 billion Class Z shares.

Transactions in shares and dollars of common stock (at $1 net asset value per share) were as follows:

| | | | |

Class A | | Amount | |

Six months ended January 31, 2008: | | | | |

Shares sold | | $ | 819,322,772 | |

Shares issued in reinvestment of dividends and distributions | | | 15,399,552 | |

Shares reacquired | | | (765,441,024 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | 69,281,300 | |

| | | | |

Seven months ended July 31, 2007: | | | | |

Shares sold | | $ | 727,641,391 | |

Shares issued in reinvestment of dividends and distributions | | | 17,188,465 | |

Shares reacquired | | | (750,273,603 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | (5,443,747 | ) |

| | | | |

Year ended December 31, 2006: | | | | |

Shares sold | | $ | 1,322,985,711 | |

Shares issued in reinvestment of dividends and distributions | | | 28,012,480 | |

Shares reacquired | | | (1,396,635,296 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | (45,637,105 | ) |

| | | | |

| | |

| MoneyMart Assets, Inc. | | 17 |

Notes to Financial Statements

(Unaudited) continued

| | | | |

Class B | | Amount | |

Six months ended January 31, 2008: | | | | |

Shares sold | | $ | 19,904,239 | |

Shares issued in reinvestment of dividends and distributions | | | 1,498,995 | |

Shares reacquired | | | (16,513,237 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | 4,889,997 | |

| | | | |

Seven months ended July 31, 2007: | | | | |

Shares sold | | $ | 12,166,754 | |

Shares issued in reinvestment of dividends and distributions | | | 1,711,369 | |

Shares reacquired | | | (20,652,219 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | (6,774,096 | ) |

| | | | |

Year ended December 31, 2006: | | | | |

Shares sold | | $ | 30,823,981 | |

Shares issued in reinvestment of dividends and distributions | | | 3,132,707 | |

Shares reacquired | | | (46,885,671 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | (12,928,983 | ) |

| | | | |

Class C | | | |

Six months ended January 31, 2008: | | | | |

Shares sold | | $ | 14,820,892 | |

Shares issued in reinvestment of dividends and distributions | | | 311,666 | |

Shares reacquired | | | (11,660,004 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | 3,472,554 | |

| | | | |

Seven months ended July 31, 2007: | | | | |

Shares sold | | $ | 14,517,190 | |

Shares issued in reinvestment of dividends and distributions | | | 329,471 | |

Shares reacquired | | | (13,797,422 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | 1,049,239 | |

| | | | |

Year ended December 31, 2006: | | | | |

Shares sold | | $ | 28,306,445 | |

Shares issued in reinvestment of dividends and distributions | | | 555,954 | |

Shares reacquired | | | (27,371,991 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | 1,490,408 | |

| | | | |

| | |

| 18 | | Visit our website at www.jennisondryden.com |

| | | | |

Class Z | | Amount | |

Six months ended January 31, 2008: | | | | |

Shares sold | | $ | 55,325,050 | |

Shares issued in reinvestment of dividends and distributions | | | 4,224,896 | |

Shares reacquired | | | (38,532,779 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | 21,017,167 | |

| | | | |

Seven months ended July 31, 2007: | | | | |

Shares sold | | $ | 35,546,861 | |

Shares issued in reinvestment of dividends and distributions | | | 4,158,441 | |

Shares reacquired | | | (35,198,667 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | 4,506,635 | |

| | | | |

Year ended December 31, 2006: | | | | |

Shares sold | | $ | 505,147,233 | |

Shares issued in reinvestment of dividends and distributions | | | 7,915,199 | |

Shares reacquired | | | (550,832,172 | ) |

| | | | |

Net increase (decrease) in shares outstanding | | $ | (37,769,740 | ) |

| | | | |

Note 5. Tax Information

Management has analyzed the Funds’ tax positions taken on federal income tax returns for all open tax years and has concluded that as of January 31, 2008, no provision for income tax would be required in the Funds’ financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Note 6. New Accounting Pronouncements

On September 20, 2006, the FASB released Statement of Financial Accounting Standards No. 157 “Fair Value Measurements” (FAS 157). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements. The application of FAS 157 is required for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. At this time, management is evaluating the implications of FAS 157 and its impact, if any, in the financial statements has not yet been determined.

| | |

| MoneyMart Assets, Inc. | | 19 |

Financial Highlights

(Unaudited)

| | | | |

| | | Class A | |

| | | Six Months

Ended

January 31, 2008 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 1.000 | |

| | | | |

Income from investment operations: | | | | |

Net investment income and net realized gains | | | .024 | |

Dividends and distributions to shareholders | | | (.024 | ) |

| | | | |

Net asset value, end of period | | $ | 1.000 | |

| | | | |

Total Return(b): | | | 2.44 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 716,240 | |

Average net assets (000) | | $ | 651,389 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | .51 | %(c) |

Expenses, excluding distribution and service (12b-1) fees | | | .38 | %(c) |

Net investment income | | | 4.77 | %(c) |

| (a) | For the seven-month period ended July 31, 2007. The Fund changed its fiscal year end from December 31 to July 31, effective July 31, 2007. |

| (b) | Total investment return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. Total investment returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods of less than one full year are not annualized. |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | | | | | |

| Class A | |

Seven-Month

Period Ended

July 31, 2007(a) | | | Year Ended December 31, | |

| | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | .028 | | | | .044 | | | | .025 | | | | .007 | | | | .006 | |

| | (.028 | ) | | | (.044 | ) | | | (.025 | ) | | | (.007 | ) | | | (.006 | ) |

| | | | | | | | | | | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | | | | | | | | | |

| | 2.74 | % | | | 4.46 | % | | | 2.58 | % | | | .70 | % | | | .65 | % |

| | | | | | | | | | | | | | | | | | |

| $ | 646,959 | | | $ | 652,403 | | | $ | 698,040 | | | $ | 890,637 | | | $ | 5,089,405 | |

| $ | 640,915 | | | $ | 651,453 | | | $ | 786,418 | | | $ | 2,823,600 | | | $ | 6,535,734 | |

| | | | | | | | | | | | | | | | | | |

| | .58 | %(c) | | | .68 | % | | | .80 | % | | | .71 | % | | | .62 | % |

| | .45 | %(c) | | | .56 | % | | | .67 | % | | | .58 | % | | | .49 | % |

| | 4.84 | %(c) | | | 4.38 | % | | | 2.46 | % | | | .54 | % | | | .63 | % |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 21 |

Financial Highlights

(Unaudited) continued

| | | | |

| | | Class B | |

| | | Six Months

Ended

January 31, 2008 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 1.000 | |

| | | | |

Income from investment operations: | | | | |

Net investment income and net realized gains | | | .025 | |

Dividends and distributions to shareholders | | | (.025 | ) |

| | | | |

Net asset value, end of period | | $ | 1.000 | |

| | | | |

Total Return(c): | | | 2.50 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 69,078 | |

Average net assets (000) | | $ | 65,982 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | .38 | %(d) |

Expenses, excluding distribution and service (12b-1) fees | | | .38 | %(d) |

Net investment income | | | 4.91 | %(d) |

| (a) | For the seven-month period ended July 31, 2007. The Fund changed its fiscal year end from December 31 to July 31, effective July 31, 2007. |

| (b) | Commencement of offering. |

| (c) | Total investment return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. Total investment returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods of less than one full year are not annualized. |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | |

| Class B | |

Seven-Month

Period Ended

July 31, 2007(a) | | | Year Ended

December 31, 2006 | | | March 11, 2005(b)

through

December 31, 2005 | |

| | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | |

| | | | | | | | | | |

| | .029 | | | | .045 | | | | .023 | |

| | (.029 | ) | | | (.045 | ) | | | (.023 | ) |

| | | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | |

| | 2.81 | % | | | 4.59 | % | | | 2.37 | % |

| | | | | | | | | | |

| $ | 64,188 | | | $ | 70,962 | | | $ | 83,891 | |

| $ | 67,491 | | | $ | 76,873 | | | $ | 90,153 | |

| | | | | | | | | | |

| | .45 | %(d) | | | .56 | % | | | .65 | %(d) |

| | .45 | %(d) | | | .56 | % | | | .65 | %(d) |

| | 4.97 | %(d) | | | 4.51 | % | | | 2.84 | %(d) |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 23 |

Financial Highlights

(Unaudited) continued

| | | | |

| | | Class C | |

| | | Six Months

Ended

January 31, 2008 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 1.000 | |

| | | | |

Income from investment operations: | | | | |

Net investment income and net realized gains | | | .025 | |

Dividends and distributions to shareholders | | | (.025 | ) |

| | | | |

Net asset value, end of period | | $ | 1.000 | |

| | | | |

Total Return(c): | | | 2.50 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 16,894 | |

Average net assets (000) | | $ | 13,598 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | .38 | %(d) |

Expenses, excluding distribution and service (12b-1) fees | | | .38 | %(d) |

Net investment income | | | 4.92 | %(d) |

| (a) | For the seven-month period ended July 31, 2007. The Fund changed its fiscal year end from December 31 to July 31, effective July 31, 2007. |

| (b) | Commencement of offering. |

| (c) | Total investment return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. Total investment returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods of less than one full year are not annualized. |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | |

| Class C | |

Seven-Month

Period Ended

July 31, 2007(a) | | | Year Ended

December 31, 2006 | | | March 11, 2005(b)

through

December 31, 2005 | |

| | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | |

| | | | | | | | | | |

| | .029 | | | | .045 | | | | .023 | |

| | (.029 | ) | | | (.045 | ) | | | (.023 | ) |

| | | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | |

| | 2.81 | % | | | 4.59 | % | | | 2.37 | % |

| | | | | | | | | | |

| $ | 13,422 | | | $ | 12,373 | | | $ | 10,882 | |

| $ | 12,867 | | | $ | 13,294 | | | $ | 12,218 | |

| | | | | | | | | | |

| | .45 | %(d) | | | .56 | % | | | .65 | %(d) |

| | .45 | %(d) | | | .56 | % | | | .65 | %(d) |

| | 4.97 | %(d) | | | 4.56 | % | | | 2.87 | %(d) |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 25 |

Financial Highlights

(Unaudited) continued

| | | | |

| | | Class Z | |

| | | Six Months

Ended

January 31, 2008 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 1.000 | |

| | | | |

Income from investment operations: | | | | |

Net investment income and net realized gains | | | .025 | |

Dividends and distributions to shareholders | | | (.025 | ) |

| | | | |

Net asset value, end of period | | $ | 1.000 | |

| | | | |

Total Return(b): | | | 2.50 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 175,680 | |

Average net assets (000) | | $ | 171,317 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | .38 | %(c) |

Expenses, excluding distribution and service (12b-1) fees | | | .38 | %(c) |

Net investment income | | | 4.90 | %(c) |

| (a) | For the seven-month period ended July 31, 2007. The Fund changed its fiscal year end from December 31 to July 31, effective July 31, 2007. |

| (b) | Total investment return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. Total investment returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods of less than one full year are not annualized. |

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | | | | | |

| Class Z | |

Seven-Month

Period Ended

July 31, 2007(a) | | | Year Ended December 31, | |

| | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | .029 | | | | .045 | | | | .027 | | | | .008 | | | | .008 | |

| | (.029 | ) | | | (.045 | ) | | | (.027 | ) | | | (.008 | ) | | | (.008 | ) |

| | | | | | | | | | | | | | | | | | | |

| $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | | | | | | | | | |

| | 2.81 | % | | | 4.59 | % | | | 2.70 | % | | | .82 | % | | | .77 | % |

| | | | | | | | | | | | | | | | | | |

| $ | 154,662 | | | $ | 150,156 | | | $ | 187,925 | | | $ | 192,613 | | | $ | 187,718 | |

| $ | 150,056 | | | $ | 178,667 | | | $ | 187,379 | | | $ | 188,931 | | | $ | 198,143 | |

| | | | | | | | | | | | | | | | | | |

| | .45 | %(c) | | | .56 | % | | | .67 | % | | | .58 | % | | | .49 | % |

| | .45 | %(c) | | | .56 | % | | | .67 | % | | | .58 | % | | | .49 | % |

| | 4.97 | %(c) | | | 4.43 | % | | | 2.64 | % | | | .83 | % | | | .75 | % |

See Notes to Financial Statements.

| | |

| MoneyMart Assets, Inc. | | 27 |

| | | | |

| n MAIL | | n TELEPHONE | | n WEBSITE |

Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 | | (800) 225-1852 | | www.jennisondryden.com |

|

| PROXY VOTING |

| The Board of Directors of the Fund has delegated to the Fund’s investment subadviser the responsibility for voting any proxies and maintaining proxy recordkeeping with respect to the Fund. A description of these proxy voting policies and procedures is available without charge, upon request, by calling (800) 225-1852 or by visiting the Securities and Exchange Commission’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Fund’s website and on the Commission’s website. |

|

| DIRECTORS |

| David E. A. Carson • Robert F. Gunia • Robert E. La Blanc • Robin B. Smith • Stephen G. Stoneburn • Clay T. Whitehead |

|

| OFFICERS |

| Judy A. Rice, President • Robert F. Gunia, Vice President • Grace C. Torres, Treasurer and Principal Financial and Accounting Officer • Kathryn L. Quirk, Chief Legal Officer • Deborah A. Docs, Secretary • Timothy J. Knierim, Chief Compliance Officer • Valerie M. Simpson, Deputy Chief Compliance Officer • Noreen M. Fierro, Anti-Money Laundering Compliance Officer • Jonathan D. Shain, Assistant Secretary • Claudia DiGiacomo, Assistant Secretary • John P. Schwartz, Assistant Secretary • Andrew R. French, Assistant Secretary • M. Sadiq Peshimam, Assistant Treasurer • Peter Parrella, Assistant Treasurer |

| | | | |

| MANAGER | | Prudential Investments LLC | | Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 |

|

| INVESTMENT SUBADVISER | | Prudential Investment

Management, Inc. | | Gateway Center Two

100 Mulberry Street

Newark, NJ 07102 |

|

| DISTRIBUTOR | | Prudential Investment

Management Services LLC | | Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 |

|

| CUSTODIAN | | The Bank of New York | | One Wall Street

New York, NY 10286 |

|

| TRANSFER AGENT | | Prudential Mutual Fund

Services LLC | | PO Box 9658

Providence, RI 02940 |

|

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | KPMG LLP | | 345 Park Avenue

New York, NY 10154 |

|

| FUND COUNSEL | | Sullivan & Cromwell LLP | | 125 Broad Street

New York, NY 10004 |

|

| An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The prospectus for the Fund contains this and other information about the Fund. An investor may obtain a prospectus by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. The prospectus should be read carefully before investing. |

E-DELIVERY

To receive your mutual fund documents on-line, go to www.icsdelivery.com/prudential/funds and enroll. Instead of receiving printed documents by mail, you will receive notification via e-mail when new materials are available. You can cancel your enrollment or change your e-mail address at any time by clicking on the change/cancel enrollment option at the icsdelivery website address.

SHAREHOLDER COMMUNICATIONS WITH DIRECTORS

Shareholders can communicate directly with the Board of Directors by writing to the Chair of the Board, MoneyMart Assets, Inc., Attn: Board of Directors, 100 Mulberry Street, Gateway Center Three, Newark, NJ 07102. Shareholders can communicate directly with an individual Director by writing to the same address. Communications to the Board or individual Directors are not screened before being delivered to the addressee.

|

| AVAILABILITY OF PORTFOLIO SCHEDULE |

| The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation and location of the Public Reference Room may be obtained by calling (800) SEC-0330 (732-0330). The Fund’s schedule of portfolio holdings is also available on the Fund’s website as of the end of each fiscal quarter. |

Mutual Funds:

| | | | |

| ARE NOT INSURED BY THE FDIC OR ANY FEDERAL GOVERNMENT AGENCY | | MAY LOSE VALUE | | ARE NOT A DEPOSIT OF OR GUARANTEED BY ANY BANK OR ANY BANK AFFILIATE |

| | | | | | | | | | | | |

| MoneyMart Assets, Inc. | | |

| | | Share Class | | A | | B | | C | | Z | | |

| | NASDAQ | | PBMXX | | N/A | | N/A | | PMZXX | | |

| | CUSIP | | 60936A308 | | 60936A506 | | 60936A605 | | 60936A407 | | |

| | | | | | | | | | | | |

MF108E2 IFS-A145514 Ed. 03/2008

Item 2 – Code of Ethics – Not required, as this is not an annual filing.

Item 3 – Audit Committee Financial Expert – Not required, as this is not an annual filing.

Item 4 – Principal Accountant Fees and Services – Not required, as this is not an annual filing.

Item 5 – Audit Committee of Listed Registrants – Not applicable.

Item 6 – Schedule of Investments – The schedule is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7 – Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies – Not applicable.

Item 8 – Portfolio Managers of Closed-End Management Investment Companies – Not applicable.

Item 9 – Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers – Not applicable.

Item 10 – Submission of Matters to a Vote of Security Holders – Not applicable.

Item 11 – Controls and Procedures

| | (a) | It is the conclusion of the registrant’s principal executive officer and principal financial officer that the effectiveness of the registrant’s current disclosure controls and procedures (such disclosure controls and procedures having been evaluated within 90 days of the date of this filing) provide reasonable assurance that the information required to be disclosed by the registrant has been recorded, processed, summarized and reported within the time period specified in the Commission’s rules and forms and that the information required to be disclosed by the registrant has been accumulated and communicated to the registrant’s principal executive officer and principal financial officer in order to allow timely decisions regarding required disclosure. |

| | (b) | There has been no significant change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter of the period covered by this report that has materially affected, or is likely to materially affect, the registrant’s internal control over financial reporting. |

Item 12 – Exhibits

| | | | | | | | |

| | (a) | | | | (1) | | Code of Ethics – Not required, as this is not an annual filing. |

| | | | |

| | | | | | (2) | | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act – Attached hereto as Exhibit EX-99.CERT. |

| | | | |

| | | | | | (3) | | Any written solicitation to purchase securities under Rule 23c-1. – Not applicable. |

| | (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act – Attached hereto as Exhibit EX-99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| (Registrant) MoneyMart Assets, Inc. | | |

| | | |

| By (Signature and Title)* | | /s/ Deborah A. Docs | | | | |

| | Deborah A. Docs | | | | |

| | Secretary | | | | |

| | |

| Date March 25, 2008 | | | | |

|

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. |

| | | |

| By (Signature and Title)* | | /s/ Judy A. Rice | | | | |

| | Judy A. Rice | | | | |

| | President and Principal Executive Officer | | |

| | |

| Date March 25, 2008 | | | | |

| | | |

| By (Signature and Title)* | | /s/ Grace C. Torres | | | | |

| | Grace C. Torres | | | | |

| | Treasurer and Principal Financial Officer | | |

| | |

| Date March 25, 2008 | | | | |

* | Print the name and title of each signing officer under his or her signature. |