UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-02619 |

| |

| Exact name of registrant as specified in charter: | | Prudential MoneyMart Assets, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 7/31/2014 |

| |

| Date of reporting period: | | 1/31/2014 |

Item 1 – Reports to Stockholders

PRUDENTIAL INVESTMENTS»MUTUAL FUNDS

PRUDENTIAL

MONEYMART ASSETS, INC.

SEMIANNUAL REPORT · JANUARY 31, 2014

Fund Type

Money Market

Objective

Maximum current income consistent with stability of capital and the maintenance of liquidity

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

The accompanying financial statements as of January 31, 2014, were not audited and, accordingly, no auditor’s opinion is expressed on them.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS). Prudential Fixed Income is a unit of Prudential Investment Management, Inc. (PIM), a registered investment adviser. PIMS and PIM are Prudential Financial companies. ©2014 Prudential Financial, Inc., and its related entities. Prudential Investments, Prudential, the Prudential logo, Bring Your Challenges, and the Rock symbol are service marks of Prudential Financial, Inc., and its related entities, registered in many jurisdictions worldwide.

March 14, 2014

Dear Shareholder:

We hope you find the Semiannual report for Prudential MoneyMart Assets, Inc. informative and useful. The report covers performance for the six-month period that ended January 31, 2014.

We recognize that ongoing market volatility may make it a difficult time to be an investor. We continue to believe a prudent response to uncertainty is to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals.

Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. Keep in mind, however, that diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

Prudential Investments® is dedicated to helping you solve your toughest investment challenges—whether it’s capital growth, reliable income, or protection from market volatility and other risks. We offer the expertise of Prudential Financial’s affiliated asset managers* that strive to be leaders in a broad range of funds to help you stay on course to the future you envision. They also manage money for major corporations and pension funds around the world, which means you benefit from the same expertise, innovation, and attention to risk demanded by today’s most sophisticated investors.

Thank you for choosing the Prudential Investments family of funds.

Sincerely,

Stuart S. Parker, President

Prudential MoneyMart Assets, Inc.

*Most of Prudential Investments’ equity funds are advised by Jennison Associates LLC, Quantitative Management Associates LLC (QMA), or Prudential Real Estate Investors. Prudential Investments’ fixed income and money market funds are advised by Prudential Investment Management, Inc. (PIM) through its Prudential Fixed Income unit. Jennison Associates, QMA, and PIM are registered investment advisers and Prudential Financial companies. Prudential Real Estate Investors is a unit of PIM.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 1 | |

Your Fund’s Performance (Unaudited)

Yields will fluctuate from time to time, and past performance does not guarantee future results. Current performance may be lower or higher than the past performance data quoted. Although the Fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the Fund. For the most recent month-end performance update, call (800) 225-1852 or visit our website at www.prudentialfunds.com.

| | | | | | | | | | | | | | | | |

Fund Facts as of 1/31/14 | | | | | | | | | | | | | |

| | | 7-Day

Current Yield | | | Net Asset

Value (NAV) | | | Weighted Avg.

Maturity (WAM) | | | Net Assets

(Millions) | |

Class A | | | 0.01 | % | | $ | 1.00 | | | | 41 Days | | | $ | 493.80 | |

Class B | | | 0.01 | | | | 1.00 | | | | 41 Days | | | | 29.00 | |

Class C | | | 0.01 | | | | 1.00 | | | | 41 Days | | | | 19.45 | |

Class X | | | 0.01 | | | | 1.00 | | | | 41 Days | | | | 0.06 | |

Class Z | | | 0.01 | | | | 1.00 | | | | 41 Days | | | | 103.63 | |

iMoneyNet, Inc. Prime Retail Avg.* | | | 0.01 | | | | N/A | | | | 50 Days | | | | N/A | |

The Fund’s manager has voluntarily waived all or a portion of the management fee it is entitled to receive from the Fund in order to maintain a zero or positive net yield for the Fund. This voluntary waiver may be terminated at any time without prior notice. Without the waiver, the Fund’s 7-day yield would have been negative.

*iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. This is based on the data of all funds in the iMoneyNet, Inc. Prime Retail Average category as of January 28, 2014.

| | |

| 2 | | Visit our website at www.prudentialfunds.com |

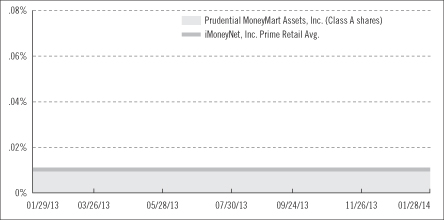

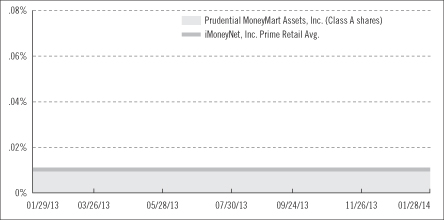

Money Market Fund Yield Comparison

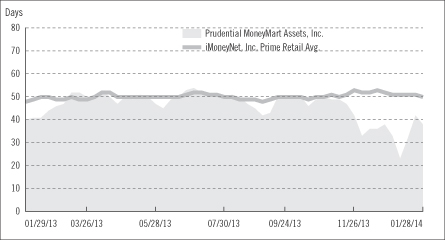

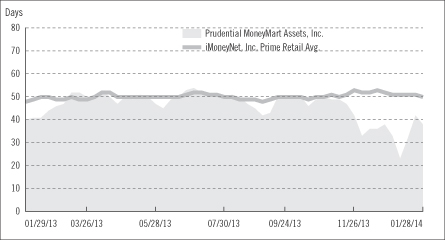

Weighted Average Maturity (WAM) Comparison

The graphs portray weekly 7-day current yields and weekly WAMs for Prudential MoneyMart Assets, Inc. (Class A shares—yields only) and the iMoneyNet, Inc. Prime Retail Average every Tuesday from January 29, 2013 to January 28, 2014, the closest dates prior to the beginning and end of the Fund’s reporting period. Note: iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. As a result, the data portrayed for the Fund at the end of the reporting period in the graphs may not match the data portrayed in the Fund Facts table as of January 31, 2014.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 3 | |

Your Fund’s Performance (continued)

The yield figures take into account applicable sales charges and fees, which are described for each share class in the table below.

| | | | | | | | | | |

| | Class A | | Class B | | Class C | | Class X | | Class Z |

Maximum initial sales charge | | None | | None | | None | | None | | None |

Contingent Deferred Sales Charge (CDSC) (as a percentage of the lower of original purchase price or sale proceeds) | | None | | None | | None | | None | | None |

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | .125% | | None | | None | | 1% | | None |

Class X shares are closed to new initial purchases. Class X shares are only available through exchanges from the same class of shares of certain other Prudential Investments funds.

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| | |

| 4 | | Visit our website at www.prudentialfunds.com |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on August 1, 2013, at the beginning of the period, and held through the six-month period ended January 31, 2014. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 5 | |

Fees and Expenses (continued)

Prudential Investments Funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Prudential MoneyMart

Assets, Inc. | | Beginning Account

Value

August 1, 2013 | | | Ending Account

Value

January 31, 2014 | | | Annualized

Expense Ratio | | | Expenses Paid

During the

Six-Month Period* | |

| | | | | | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,000.10 | | | | 0.14 | % | | $ | 0.71 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,024.50 | | | | 0.14 | % | | $ | 0.71 | |

| | | | | | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | | $ | 1,000.10 | | | | 0.14 | % | | $ | 0.71 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,024.50 | | | | 0.14 | % | | $ | 0.71 | |

| | | | | | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 1,000.10 | | | | 0.14 | % | | $ | 0.71 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,024.50 | | | | 0.14 | % | | $ | 0.71 | |

| | | | | | | | | | | | | | | | | | |

| Class X | | Actual | | $ | 1,000.00 | | | $ | 1,000.10 | | | | 0.14 | % | | $ | 0.71 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,024.50 | | | | 0.14 | % | | $ | 0.71 | |

| | | | | | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,000.10 | | | | 0.14 | % | | $ | 0.71 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,024.50 | | | | 0.14 | % | | $ | 0.71 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended January 31, 2014, and divided by the 365 days in the Fund’s fiscal year ending July 31, 2014 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| 6 | | Visit our website at www.prudentialfunds.com |

The Fund’s annualized expense ratios for the period ended January 31, 2014, are as follows:

| | | | | | | | |

| Class | | Gross Operating Expenses | | | Net Operating Expenses | |

A | | | 0.60 | % | | | 0.14 | % |

B | | | 0.47 | | | | 0.14 | |

C | | | 0.47 | | | | 0.14 | |

X | | | 1.47 | | | | 0.14 | |

Z | | | 0.47 | | | | 0.14 | |

Net operating expenses shown above reflect fee waivers and/or expense reimbursements. Additional information on Fund expenses and any fee waivers and/or expense reimbursements can be found in the “Financial Highlights” tables in this report and in the Notes to the Financial Statements in this report.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 7 | |

Portfolio of Investments

as of January 31, 2014 (Unaudited)

| | | | | | | | | | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value (Note 1) | |

CERTIFICATES OF DEPOSIT 17.8% | | | | | | | | | | |

Bank of America NA | | 0.200% | | 04/21/14 | | | 6,000 | | | $ | 6,000,000 | |

Bank of Montreal | | 0.170% | | 03/14/14 | | | 2,000 | | | | 1,999,932 | |

Bank of Montreal | | 0.243%(a) | | 06/18/14 | | | 5,000 | | | | 5,000,000 | |

Bank of Nova Scotia | | 0.190% | | 04/14/14 | | | 2,000 | | | | 2,000,000 | |

Bank of Nova Scotia | | 0.244%(a) | | 06/19/14 | | | 4,000 | | | | 4,000,000 | |

Bank of Nova Scotia | | 0.409%(a) | | 11/10/14 | | | 4,000 | | | | 4,005,564 | |

Bank of Nova Scotia | | 0.597%(a) | | 09/30/14 | | | 2,000 | | | | 2,004,626 | |

Bank of Nova Scotia | | 0.739%(a) | | 02/10/14 | | | 1,600 | | | | 1,600,179 | |

Bank of Tokyo-Mitsubishi UFJ Ltd. | | 0.100% | | 02/04/14 | | | 10,000 | | | | 10,000,000 | |

Bank of Tokyo-Mitsubishi UFJ Ltd. | | 0.200% | | 04/14/14 | | | 4,000 | | | | 4,000,000 | |

Branch Banking & Trust Co. | | 0.050% | | 02/13/14 | | | 6,000 | | | | 6,000,000 | |

Canadian Imperial Bank of Commerce | | 0.244%(a) | | 06/13/14 | | | 5,000 | | | | 5,000,000 | |

Citibank NA | | 0.218%(a) | | 06/05/14 | | | 5,000 | | | | 5,000,000 | |

Deutsche Bank AG | | 0.200% | | 03/31/14 | | | 4,000 | | | | 4,000,000 | |

Deutsche Bank AG | | 0.230% | | 02/28/14 | | | 1,000 | | | | 1,000,000 | |

DNB Bank ASA | | 0.450%(a) | | 04/10/14 | | | 1,000 | | | | 1,000,511 | |

JPMorgan Chase Bank NA | | 0.280%(a) | | 07/31/14 | | | 3,500 | | | | 3,500,000 | |

JPMorgan Chase Bank NA | | 0.330% | | 02/18/14 | | | 2,000 | | | | 2,000,000 | |

Mizuho Bank Ltd. | | 0.210% | | 04/22/14 | | | 4,000 | | | | 4,000,000 | |

Nordea Bank AB | | 0.175% | | 03/24/14 | | | 6,000 | | | | 6,000,000 | |

Norinchukin Bank | | 0.210% | | 04/22/14 | | | 3,000 | | | | 3,000,000 | |

Royal Bank of Canada | | 0.259%(a) | | 10/17/14 | | | 5,000 | | | | 5,000,000 | |

Royal Bank of Canada | | 0.290%(a) | | 03/26/14 | | | 2,000 | | | | 2,000,000 | |

Sumitomo Mitsui Banking Corp. | | 0.220% | | 04/10/14 | | | 5,000 | | | | 5,000,000 | |

Sumitomo Mitsui Trust Bank Ltd. | | 0.210% | | 04/15/14 | | | 4,000 | | | | 3,999,838 | |

Svenska Handelsbanken AB | | 0.423%(a) | | 10/06/14 | | | 2,000 | | | | 2,002,542 | |

Toronto-Dominion Bank (The) | | 0.130% | | 03/06/14 | | | 4,000 | | | | 4,000,000 | |

Toronto-Dominion Bank (The) | | 0.228%(a) | | 07/26/14 | | | 2,000 | | | | 2,000,000 | |

Wells Fargo Bank NA | | 0.207%(a) | | 08/20/14 | | | 2,000 | | | | 2,000,000 | |

Wells Fargo Bank NA | | 0.210% | | 03/27/14 | | | 3,000 | | | | 3,000,000 | |

Wells Fargo Bank NA | | 0.210%(a) | | 07/11/14 | | | 1,000 | | | | 1,000,000 | |

Wells Fargo Bank NA | | 0.232%(a) | | 12/09/14 | | | 4,000 | | | | 4,000,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 115,113,192 | |

| | | | | | | | | | | | |

| | | | |

COMMERCIAL PAPER 19.6% | | | | | | | | | | | | |

ABN AMRO Funding USA LLC, 144A | | 0.210%(b) | | 04/08/14 | | | 5,000 | | | | 4,998,075 | |

Caisse Centrale Desjardins du Quebec, 144A | | 0.257%(a) | | 10/23/14 | | | 7,000 | | | | 7,000,000 | |

CDP Financial, Inc., 144A | | 0.155%(b) | | 04/28/14 | | | 3,000 | | | | 2,998,889 | |

CPPIB Capital, Inc., 144A | | 0.140%(b) | | 04/25/14 | | | 1,000 | | | | 999,677 | |

DNB Bank ASA, 144A | | 0.240%(a) | | 06/11/14 | | | 2,000 | | | | 2,000,000 | |

DNB Bank ASA, 144A | | 0.248%(a) | | 11/07/14 | | | 4,000 | | | | 4,000,000 | |

See Notes to Financial Statements.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 9 | |

Portfolio of Investments

as of January 31, 2014 (Unaudited) continued

| | | | | | | | | | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value (Note 1) | |

COMMERCIAL PAPER (Continued) | | | | | | | | | | | | |

DNB Bank ASA, 144A | | 0.252%(a) | | 01/16/15 | | | 7,000 | | | $ | 7,000,000 | |

DNB Bank ASA, 144A | | 0.266%(a) | | 09/10/14 | | | 2,000 | | | | 2,000,000 | |

Electricite de France, 144A | | 0.110%(b) | | 02/18/14 | | | 6,000 | | | | 5,999,688 | |

GDF SUEZ, 144A | | 0.210%(b) | | 02/03/14 | | | 3,000 | | | | 2,999,965 | |

General Electric Capital Corp. | | 0.200%(b) | | 06/09/14 | | | 5,000 | | | | 4,996,444 | |

HSBC Bank PLC, 144A | | 0.620%(b) | | 01/30/15 | | | 4,000 | | | | 4,000,000 | |

ING (U.S.) Funding LLC | | 0.180%(b) | | 02/18/14 | | | 3,000 | | | | 2,999,745 | |

ING (U.S.) Funding LLC | | 0.220%(b) | | 03/06/14 | | | 1,800 | | | | 1,799,637 | |

International Bank for Reconstruction & Development | | 0.100%(b) | | 03/24/14 | | | 3,000 | | | | 2,999,575 | |

International Bank for Reconstruction & Development | | 0.100%(b) | | 04/01/14 | | | 4,000 | | | | 3,999,344 | |

International Bank for Reconstruction & Development | | 0.110%(b) | | 04/07/14 | | | 10,000 | | | | 9,998,014 | |

International Finance Corp. | | 0.070%(b) | | 03/13/14 | | | 3,000 | | | | 2,999,767 | |

International Finance Corp. | | 0.110%(b) | | 02/19/14 | | | 3,000 | | | | 2,999,835 | |

JPMorgan Securities LLC, 144A | | 0.300%(b) | | 04/21/14 | | | 4,000 | | | | 3,997,367 | |

JPMorgan Securities LLC, 144A | | 0.357%(a) | | 11/18/14 | | | 3,000 | | | | 3,000,000 | |

JPMorgan Securities LLC, 144A | | 0.359%(a) | | 12/16/14 | | | 3,000 | | | | 3,000,000 | |

Nordea Bank AB, 144A | | 0.250%(b) | | 02/18/14 | | | 1,000 | | | | 999,882 | |

Philip Morris International, Inc., 144A | | 0.120%(b) | | 03/04/14 | | | 6,000 | | | | 5,999,380 | |

Philip Morris International, Inc., 144A | | 0.120%(b) | | 03/06/14 | | | 7,000 | | | | 6,999,230 | |

PNC Bank NA | | 0.240%(b) | | 07/07/14 | | | 3,000 | | | | 2,996,880 | |

PNC Bank NA | | 0.301%(b) | | 08/25/14 | | | 5,000 | | | | 4,991,458 | |

PSP Capital, Inc., 144A | | 0.130%(b) | | 03/18/14 | | | 4,000 | | | | 3,999,350 | |

PSP Capital, Inc., 144A | | 0.150%(b) | | 04/07/14 | | | 2,000 | | | | 1,999,458 | |

PSP Capital, Inc., 144A | | 0.150%(b) | | 04/14/14 | | | 4,000 | | | | 3,998,800 | |

Sanofi Aventis, 144A | | 0.120%(b) | | 03/31/14 | | | 1,000 | | | | 999,807 | |

Skandinaviska Enskilda Banken AB, 144A | | 0.175%(b) | | 04/16/14 | | | 3,000 | | | | 2,998,921 | |

State Street Corp. | | 0.160%(b) | | 02/25/14 | | | 3,000 | | | | 2,999,680 | |

Toronto Dominion Holdings USA, Inc., 144A | | 0.250%(b) | | 02/18/14 | | | 1,000 | | | | 999,882 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 126,768,750 | |

| | | | | | | | | | | | |

| | | | |

OTHER CORPORATE OBLIGATIONS 6.3% | | | | | | | | | | | | |

General Electric Capital Corp., MTN | | 0.503%(a) | | 09/15/14 | | | 2,000 | | | | 2,003,346 | |

General Electric Capital Corp., MTN | | 0.750%(a) | | 02/06/14 | | | 2,455 | | | | 2,455,162 | |

New York Life Global Funding, 144A | | 0.503%(a) | | 04/04/14 | | | 1,000 | | | | 1,000,444 | |

Principal Life Global Funding II, 144A | | 0.404%(a) | | 09/19/14 | | | 3,000 | | | | 3,003,239 | |

Principal Life Global Funding II, 144A | | 0.867%(a) | | 07/09/14 | | | 4,000 | | | | 4,011,385 | |

Royal Bank of Canada, MTN | | 0.473%(a) | | 01/06/15 | | | 2,000 | | | | 2,004,226 | �� |

Royal Bank of Canada, MTN | | 0.538%(a) | | 04/17/14 | | | 2,000 | | | | 2,001,238 | |

See Notes to Financial Statements.

| | | | | | | | | | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value (Note 1) | |

OTHER CORPORATE OBLIGATIONS (Continued) | | | | | | | | |

Toronto-Dominion Bank (The) | | 0.542%(a) | | 07/14/14 | | | 3,000 | | | $ | 3,004,347 | |

Toyota Motor Credit Corp., MTN | | 0.239%(a) | | 10/08/14 | | | 3,000 | | | | 3,000,000 | |

Toyota Motor Credit Corp., MTN | | 0.242%(a) | | 01/14/15 | | | 4,000 | | | | 4,000,000 | |

Toyota Motor Credit Corp., MTN | | 0.250%(a) | | 04/07/14 | | | 6,000 | | | | 6,000,000 | |

Wal-Mart Stores, Inc. | | 5.403%(a) | | 06/01/14 | | | 3,000 | | | | 3,050,871 | |

Westpac Banking Corp., 144A | | 0.977%(a) | | 03/31/14 | | | 5,000 | | | | 5,006,256 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 40,540,514 | |

| | | | | | | | | | | | |

| | | | |

TIME DEPOSITS 6.3% | | | | | | | | | | | | |

Australia & New Zealand Banking Group Ltd. | | 0.230% | | 03/03/14(d) | | | 5,000 | | | | 5,000,000 | |

Australia & New Zealand Banking Group Ltd. | | 0.230% | | 03/18/14(d) | | | 8,000 | | | | 8,000,000 | |

Credit Agricole SA | | 0.100% | | 02/03/14 | | | 6,000 | | | | 6,000,000 | |

U.S. Bank National Association | | 0.150% | | 02/03/14 | | | 15,376 | | | | 15,376,000 | |

U.S. Bank National Association | | 0.150% | | 02/06/14 | | | 6,000 | | | | 6,000,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 40,376,000 | |

| | | | | | | | | | | | |

| | |

U.S. GOVERNMENT AGENCY OBLIGATIONS 35.5% | | | | | | | | |

Federal Farm Credit Bank | | 0.120%(a) | | 05/12/14 | | | 2,955 | | | | 2,955,135 | |

Federal Home Loan Bank | | 0.040%(b) | | 03/18/14 - 03/25/14 | | | 13,000 | | | | 12,999,280 | |

Federal Home Loan Bank | | 0.050%(b) | | 03/04/14 | | | 3,000 | | | | 2,999,871 | |

Federal Home Loan Bank | | 0.060%(b) | | 02/10/14 - 04/16/14 | | | 12,000 | | | | 11,999,223 | |

Federal Home Loan Bank | | 0.070%(b) | | 03/12/14 - 04/09/14 | | | 16,000 | | | | 15,998,079 | |

Federal Home Loan Bank | | 0.072%(b) | | 03/26/14 | | | 7,000 | | | | 6,999,258 | |

Federal Home Loan Bank | | 0.074%(b) | | 02/07/14 - 05/02/14 | | | 40,000 | | | | 39,995,698 | |

Federal Home Loan Bank | | 0.075%(b) | | 04/25/14 | | | 4,000 | | | | 3,999,308 | |

Federal Home Loan Bank | | 0.075%(a) | | 08/15/14 | | | 7,000 | | | | 6,998,094 | |

Federal Home Loan Bank | | 0.076%(b) | | 03/19/14 | | | 9,000 | | | | 8,999,128 | |

Federal Home Loan Bank | | 0.080%(b) | | 02/03/14 | | | 4,000 | | | | 3,999,982 | |

Federal Home Loan Bank | | 0.082%(a) | | 06/18/14 | | | 4,000 | | | | 4,000,000 | |

Federal Home Loan Bank | | 0.090%(b) | | 03/21/14 | | | 10,000 | | | | 9,998,800 | |

Federal Home Loan Bank | | 0.092%(b) | | 04/04/14 | | | 8,000 | | | | 7,998,732 | |

Federal Home Loan Bank | | 0.097%(a) | | 11/18/14 | | | 1,000 | | | | 999,867 | |

Federal Home Loan Bank | | 0.100%(a) | | 06/12/14 - 08/12/14 | | | 10,000 | | | | 9,999,681 | |

Federal Home Loan Bank | | 0.102%(a) | | 05/09/14 - 08/20/14 | | | 14,000 | | | | 13,999,973 | |

Federal Home Loan Bank | | 0.107%(a) | | 02/28/14 - 12/19/14 | | | 13,000 | | | | 12,999,180 | |

Federal Home Loan Bank | | 0.108%(a) | | 12/08/14 - 03/26/15 | | | 10,000 | | | | 9,999,869 | |

Federal Home Loan Bank | | 0.110%(a) | | 12/12/14 | | | 2,000 | | | | 1,999,842 | |

Federal Home Loan Bank | | 0.111%(a) | | 07/10/14 | | | 3,000 | | | | 2,999,931 | |

Federal Home Loan Bank | | 0.118%(a) | | 04/04/14 | | | 4,000 | | | | 3,999,966 | |

Federal Home Loan Bank | | 0.122%(a) | | 12/09/14 | | | 5,000 | | | | 5,000,000 | |

See Notes to Financial Statements.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 11 | |

Portfolio of Investments

as of January 31, 2014 (Unaudited) continued

| | | | | | | | | | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value (Note 1) | |

U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) | | | | | | | | |

Federal Home Loan Bank | | 0.125% | | 03/24/14 | | | 7,000 | | | $ | 7,000,462 | |

Federal Home Loan Bank | | 0.127%(a) | | 05/23/14 | | | 2,000 | | | | 2,000,157 | |

Federal Home Loan Bank | | 0.142%(a) | | 11/18/14 | | | 5,000 | | | | 4,999,800 | |

Federal Home Loan Bank | | 0.250% | | 02/14/14 | | | 6,500 | | | | 6,500,432 | |

Federal Home Loan Bank | | 1.530%(b) | | 02/12/14 | | | 7,000 | | | | 6,999,836 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 229,439,584 | |

| | | | | | | | | | | | |

| | |

U.S. TREASURY OBLIGATIONS 10.9% | | | | | | | | |

U.S. Treasury Bills | | 0.040%(b) | | 03/06/14 | | | 4,000 | | | | 3,999,853 | |

U.S. Treasury Bills | | 0.050%(b) | | 02/06/14 | | | 7,000 | | | | 6,999,951 | |

U.S. Treasury Bills | | 0.070%(b) | | 02/13/14 | | | 5,000 | | | | 4,999,883 | |

U.S. Treasury Bills | | 0.083%(b) | | 02/20/14 | | | 5,000 | | | | 4,999,782 | |

U.S. Treasury Notes | | 0.250% | | 02/28/14 - 03/31/14 | | | 24,000 | | | | 24,004,771 | |

U.S. Treasury Notes | | 1.250% | | 02/15/14 - 03/15/14 | | | 16,000 | | | | 16,015,067 | |

U.S. Treasury Notes | | 1.750% | | 03/31/14 | | | 6,000 | | | | 6,015,889 | |

U.S. Treasury Notes | | 1.875% | | 04/30/14 | | | 3,000 | | | | 3,012,947 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 70,048,143 | |

| | | | | | | | | | | | |

| | | |

REPURCHASE AGREEMENTS(c) 4.3% | | | | | | | | | | |

Barclays Capital, Inc.

0.03%, dated 01/30/14, due

02/06/14 in the amount of

$7,000,041 | | | 7,000 | | | | 7,000,000 | |

Deutsche Bank Securities, Inc.

0.04%, dated 01/31/14, due

02/07/14 in the amount of

$7,000,054 | | | 7,000 | | | | 7,000,000 | |

Morgan Stanley & Co., Inc.

0.03%, dated 01/28/14, due

02/04/14 in the amount of

$7,000,041 | | | 7,000 | | | | 7,000,000 | |

Morgan Stanley & Co., Inc.

0.03%, dated 01/31/14, due

02/07/14 in the amount of

$7,000,041 | | | 7,000 | | | | 7,000,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 28,000,000 | |

| | | | | | | | | | | | |

| | | | |

TOTAL INVESTMENTS 100.7%

(amortized cost $650,286,183)(e) | | | | | | | | | | | 650,286,183 | |

Liabilities in excess of other assets (0.7)% | | | | | | | | | (4,343,650 | ) |

| | | | | | | | | | | | |

NET ASSETS 100.0% | | | | | | | | | | $ | 645,942,533 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

The following abbreviations are used in the portfolio descriptions:

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted, 144A securities are deemed to be liquid.

FHLMC—Federal Home Loan Mortgage Corp.

FNMA—Federal National Mortgage Association

MTN—Medium Term Note

| # | Principal or notional amount is shown in U.S. dollars unless otherwise stated. |

| (a) | Variable rate instrument. The interest rate shown reflects the rate in effect at January 31, 2014. |

| (b) | Rate quoted represents yield-to-maturity as of purchase date. |

| (c) | Repurchase agreements are collateralized by FNMA (coupon rates 3.000% - 5.000%, maturity dates 04/01/27 - 07/01/40), FHLMC (coupon rates 2.000% - 3.500%, maturity dates 03/01/28 - 09/01/42) and U.S. Treasury Notes (coupon rates 0.250% - 2.000%, maturity dates 12/31/15 - 11/30/20) with the aggregate value, including accrued interest of $28,560,164. |

| (d) | Indicates a security or securities that have been deemed illiquid. |

| (e) | The cost of securities for federal income tax purposes is substantially the same as for financial reporting purposes. |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices generally in active markets for identical securities.

Level 2—other significant observable inputs including, but not limited to, quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates, and amortized cost.

Level 3—significant unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of January 31, 2014 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Certificates of Deposit | | $ | — | | | $ | 115,113,192 | | | $ | — | |

Commercial Paper | | | — | | | | 126,768,750 | | | | — | |

Other Corporate Obligations | | | — | | | | 40,540,514 | | | | — | |

Time Deposits | | | — | | | | 40,376,000 | | | | — | |

U.S. Government Agency Obligations | | | — | | | | 229,439,584 | | | | — | |

U.S. Treasury Obligations | | | — | | | | 70,048,143 | | | | — | |

Repurchase Agreements | | | — | | | | 28,000,000 | | | | — | |

| | | | | | | | | | | | |

Total | | $ | — | | | $ | 650,286,183 | | | $ | — | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 13 | |

Portfolio of Investments

as of January 31, 2014 (Unaudited) continued

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of January 31, 2014 was as follows:

| | | | |

U.S. Government Agency Obligations | | | 35.5 | % |

Commercial Paper | | | 19.6 | |

Certificates of Deposit | | | 17.8 | |

U.S. Treasury Obligations | | | 10.9 | |

Other Corporate Obligations | | | 6.3 | |

Time Deposits | | | 6.3 | % |

Repurchase Agreements | | | 4.3 | |

| | | | |

| | | 100.7 | |

Liabilities in excess of other assets | | | (0.7 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

PRUDENTIAL INVESTMENTS»MUTUAL FUNDS

FINANCIAL STATEMENTS

(UNAUDITED)

SEMIANNUAL REPORT · JANUARY 31, 2014

Prudential MoneyMart Assets, Inc.

Statement of Assets & Liabilities

as of January 31, 2014 (Unaudited)

| | | | |

Assets | | | | |

Investments, at amortized cost which approximates fair value: | | $ | 622,286,183 | |

Repurchase agreements (cost $28,000,000) | | | 28,000,000 | |

Cash | | | 332,502 | |

Interest receivable | | | 337,226 | |

Receivable for Fund shares sold | | | 5,391,110 | |

Due from Manager | | | 15,333 | |

Prepaid expenses | | | 5,281 | |

| | | | |

Total assets | | | 656,367,635 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 4,000,000 | |

Accrued expenses and other liabilities | | | 176,726 | |

Payable for Fund shares reacquired | | | 6,177,918 | |

Affiliated transfer agent fee payable | | | 63,167 | |

Dividends payable | | | 7,291 | |

| | | | |

Total liabilities | | | 10,425,102 | |

| | | | |

| |

Net Assets | | $ | 645,942,533 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par ($.001 par value; 20 billion shares authorized for issuance) | | $ | 645,925 | |

Paid-in capital in excess of par | | | 645,296,982 | |

| | | | |

| | | 645,942,907 | |

Distributions in excess of net investment income | | | (374 | ) |

| | | | |

Net assets, January 31, 2014 | | $ | 645,942,533 | |

| | | | |

See Notes to Financial Statements.

| | | | |

Class A | | | | |

Net asset value, offering price and redemption price per share

($493,803,530 ÷ 493,789,821 shares of common stock issued and outstanding) | | $ | 1.00 | |

| | | | |

| |

Class B | | | | |

Net asset value, offering price and redemption price per share

($28,998,114 ÷ 28,995,759 shares of common stock issued and outstanding) | | $ | 1.00 | |

| | | | |

| |

Class C | | | | |

Net asset value, offering price and redemption price per share

($19,449,923 ÷ 19,449,207 shares of common stock issued and outstanding) | | $ | 1.00 | |

| | | | |

| |

Class X | | | | |

Net asset value, offering price and redemption price per share

($61,356 ÷ 61,313 shares of common stock issued and outstanding) | | $ | 1.00 | |

| | | | |

| |

Class Z | | | | |

Net asset value, offering price and redemption price per share

($103,629,610 ÷ 103,628,514 shares of common stock issued and outstanding) | | $ | 1.00 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 17 | |

Statement of Operations

Six Months Ended January 31, 2014 (Unaudited)

| | | | |

Net Investment Income | | | | |

Income | | | | |

Interest income (net of foreign withholding taxes of $3,760) | | $ | 526,575 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 1,103,646 | |

Distribution fee—Class A (Note 2) | | | 336,350 | |

Distribution fee—Class X (Note 2) | | | 797 | |

Transfer agent’s fees and expenses (including affiliated expense of $136,300) (Note 3) | | | 349,000 | |

Custodian’s fees and expenses | | | 67,000 | |

Registration fees | | | 47,000 | |

Shareholders’ reports | | | 40,000 | |

Legal fees and expenses | | | 13,000 | |

Audit fee | | | 11,000 | |

Directors’ fees | | | 11,000 | |

Insurance expenses | | | 5,000 | |

Miscellaneous | | | 6,227 | |

| | | | |

Total expenses | | | 1,990,020 | |

| | | | |

Less: Management fee waiver (Note 2) | | | (1,161,880 | ) |

Distribution fee waiver—Class A (Note 2) | | | (336,350 | ) |

Distribution fee waiver—Class X (Note 2) | | | (797 | ) |

| | | | |

Net expenses | | | 490,993 | |

| | | | |

Net investment income | | | 35,582 | |

| | | | |

| |

Realized Gain on Investments | | | | |

Net realized gain on investment transactions | | | 3,296 | |

| | | | |

Net Increase In Net Assets Resulting From Operations | | $ | 38,878 | |

| | | | |

See Notes to Financial Statements.

Statement of Changes in Net Assets

(Unaudited)

| | | | | | | | |

| | | Six Months

Ended

January 31, 2014 | | | Year Ended

July 31, 2013 | |

Increase (Decrease) in Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 35,582 | | | $ | 68,039 | |

Net realized gain on investment transactions | | | 3,296 | | | | 11,705 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 38,878 | | | | 79,744 | |

| | | | | | | | |

| | |

Dividends to shareholders (Note 1) | | | | | | | | |

Class A | | | (29,886 | ) | | | (60,757 | ) |

Class B | | | (1,709 | ) | | | (3,892 | ) |

Class C | | | (1,287 | ) | | | (1,977 | ) |

Class L | | | — | | | | (26 | ) |

Class X | | | (9 | ) | | | (55 | ) |

Class Z | | | (5,988 | ) | | | (13,090 | ) |

| | | | | | | | |

| | | (38,879 | ) | | | (79,797 | ) |

| | | | | | | | |

| | |

Fund share transactions (Note 4) (at $1.00 per share) | | | | | | | | |

Net proceeds from shares sold | | | 1,126,916,375 | | | | 1,660,982,161 | |

Net asset value of shares issued in reinvestment of dividends | | | 35,482 | | | | 75,348 | |

Cost of shares reacquired | | | (1,159,072,754 | ) | | | (1,687,308,780 | ) |

| | | | | | | | |

Net decrease in net assets from Fund share transactions | | | (32,120,897 | ) | | | (26,251,271 | ) |

| | | | | | | | |

Total decrease | | | (32,120,898 | ) | | | (26,251,324 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of period | | | 678,063,431 | | | | 704,314,755 | |

| | | | | | | | |

End of period | | $ | 645,942,533 | | | $ | 678,063,431 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 19 | |

Notes to Financial Statements

(Unaudited)

Prudential MoneyMart Assets, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a diversified, open-end management investment company. The investment objective of the Fund is maximum current income consistent with stability of capital and the maintenance of liquidity.

1. Accounting Policies

The following accounting policies are in conformity with U.S. generally accepted accounting principles. The Fund consistently follows such policies in the preparation of the financial statements.

Security Valuation: The Fund holds securities and other assets that are fair valued at the close of each day the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Board of Directors (the “Board”) has adopted Valuation Procedures for security valuation under which fair valuation responsibilities have been delegated to Prudential Investments LLC (“PI” or “Manager”). Under the current Valuation Procedures, the established Valuation Committee is responsible for supervising the valuation of portfolio securities and other assets. The Valuation Procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the Valuation Committee’s actions is subject to the Board’s review, approval, and ratification at its next regularly-scheduled quarterly meeting.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the table following the Portfolio of Investments.

Common stocks, exchange-traded funds, and derivative instruments that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy.

In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and asked prices, or at the last bid price in the absence of an asked price. These securities are classified as Level 2 in the fair value hierarchy, as the inputs are observable and considered to be significant to the valuation.

Common stocks traded on foreign securities exchanges are valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy, as the adjustment factors are observable and considered to be significant to the valuation.

Investments in open-end, non-exchange-traded mutual funds are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Fixed income securities traded in the over-the-counter market are generally valued at prices provided by approved independent pricing vendors. The pricing vendors provide these prices after evaluating observable inputs including, but not limited to yield curves, yield spreads, credit ratings, deal terms, tranche level attributes, default rates, cash flows, prepayment speeds, broker/dealer quotations, and reported trades. Securities valued using such vendor prices are classified as Level 2 in the fair value hierarchy.

Over-the-counter derivative instruments are generally valued using pricing vendor services, which derive the valuation based on inputs such as underlying asset prices, indices, spreads, interest rates, and exchange rates. These instruments are categorized as Level 2 in the fair value hierarchy.

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that significant unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 21 | |

Notes to Financial Statements

(Unaudited) continued

bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

Repurchase Agreements: In connection with transactions in repurchase agreements with United States financial institutions, it is the Fund’s policy that its custodian or designated subcustodians under triparty repurchase agreements, as the case may be, take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transactions, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market on a daily basis to ensure the adequacy of the collateral. If the seller defaults and the value of the collateral declines or, if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

Loan Participations: The Fund may invest in loan participations. When the Fund purchases a loan participation, the Fund typically enters into a contractual relationship with the lender or third party selling such participations (“Selling Participant”), but not the borrower. As a result, the Fund assumes the credit risk of the borrower, the Selling Participant and any other persons interpositioned between the Fund and the borrower. The Fund may not directly benefit from the collateral supporting the senior loan in which it has purchased the loan participation.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses from investment transactions are calculated on the identified cost basis. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis. Expenses are recorded on the accrual basis which may require the use of certain estimates by management, that may differ from actual.

Net investment income or loss (other than distribution fees, which are charged directly to the respective class) and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of adjusted net assets of each class at the beginning of the day.

Dividends and Distributions to Shareholders: The Fund declares daily dividends from net investment income and net realized short-term capital gains or losses. Payment of dividends is made monthly. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles are recorded on the ex-dividend date.

Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to shareholders. Therefore, no federal income tax provision is required. Withholding taxes on foreign interest are recorded net of reclaimable amounts, at the time the related income is earned.

Restricted and Illiquid Securities: The Fund may hold up to 5% of its net assets in illiquid securities, including those which are restricted as to disposition under securities law (“restricted securities”). Restricted securities are valued pursuant to the valuation procedures noted above.

Estimates: The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

2. Agreements

The Fund has a management agreement with PI. Pursuant to this agreement, PI has responsibility for all investment advisory services for the Fund and supervises the subadvisor’s performance of such services. PI has entered into a subadvisory agreement with Prudential Investment Management, Inc. (“PIM”). The subadvisory agreement provides that PIM furnishes investment advisory services in connection with the management of the Fund. In connection therewith, PIM is obligated to keep certain books and records of the Fund. PI pays for the services of PIM, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The management fee paid to PI is computed daily and payable monthly at an annual rate of .50% of average daily net assets on the first $50 million and .30% of average daily net assets in excess of $50 million. The management fee amount waived exceeded the management fee for the six months ended January 31, 2014.

The Fund has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class B, Class C and Class Z shares of the Fund. In addition, the Fund has a distribution agreement

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 23 | |

Notes to Financial Statements

(Unaudited) continued

with Prudential Annuities Distributors, Inc. (“PAD”), which, together with PIMS, serves as co-distributor of the Class X shares of the Fund. The Fund compensates PIMS and PAD, as applicable, for distributing and servicing the Fund’s Class A and Class X shares, pursuant to plans of distribution (the “Class A and X Plans”), regardless of expenses actually incurred by PIMS or PAD. The distribution fees are accrued daily and payable monthly.

Pursuant to the Class A and X Plans, the Fund compensates PIMS and PAD, as applicable, for distribution related activities at an annual rate of up to .125% and 1% of the average daily net assets of the Class A and X shares, respectively. No distribution or service fees are paid to PIMS as distributor of Class B, Class C and Class Z shares of the Fund.

Effective December 1, 2011, in order to support the income yield, PIMS and PAD, as applicable, and PI have voluntarily undertaken to waive distribution and service (12b-1) fees of Class A and Class X shares and to waive/subsidize management fees of the Fund, respectively, such that the 1-day income yield (excluding capital gain or loss) does not fall below .01%. The income yield limit was set at .02% on March 1, 2010 and at .05% on September 1, 2009. The waivers/subsidies are voluntary and may be modified or terminated at any time. Pursuant to this undertaking, during the six months ended January 31, 2014, PIMS waived $336,350 and $797 of Class A’s and Class X’s distribution and service (12b-1) fees, respectively and PI has waived $1,161,880 of the Fund’s management fees. The Fund is not required to reimburse PIMS, PAD and PI for the amounts waived during the six months ended January 31, 2014.

PI, PIM, PIMS, PAD and Jennison are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

4. Capital

The Fund offers Class A, Class B, Class C, Class X and Class Z shares. Class B, C and Z shares are not subject to any distribution and/or service fees and are offered exclusively for sale to a limited group of investors. Class X shares will automatically convert to Class A shares approximately ten years after purchase. The last conversion of Class L shares to Class A shares was completed as of August 24, 2012. There are no Class L shares outstanding and Class L shares are no longer being offered for sale. Class X shares are not offered to new purchasers and are only available through exchange from the same class of shares offered by certain Prudential funds.

Under certain circumstances, an exchange may be made from specified share classes of the Fund to one or more other share classes of the Fund as presented in the table of transactions in shares of common stock.

There are 20 billion authorized shares of $.001 par value common stock divided into six classes, which consist of 11 billion Class A, 2.5 billion Class B, 2.5 billion Class C, 1 billion Class M, 1 billion Class X and 2 billion Class Z shares as of January 31, 2014.

Transactions in shares and dollars of common stock (at $1 net asset value per share) were as follows:

| | | | | | | | |

Class A | | Shares | | | Amount | |

Six months ended January 31, 2014: | | | | | | | | |

Shares sold | | | 1,080,308,506 | | | $ | 1,080,308,506 | |

Shares issued in reinvestment of dividends | | | 26,909 | | | | 26,909 | |

Shares reacquired | | | (1,100,348,765 | ) | | | (1,100,348,765 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (20,013,350 | ) | | | (20,013,350 | ) |

Shares issued upon conversion from Class B and Class X | | | 223,724 | | | | 223,724 | |

Shares reacquired upon conversion into Class Z | | | (8,573 | ) | | | (8,573 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (19,798,199 | ) | | $ | (19,798,199 | ) |

| | | | | | | | |

Year ended July 31, 2013: | | | | | | | | |

Shares sold | | | 1,571,580,583 | | | $ | 1,571,580,583 | |

Shares issued in reinvestment of dividends | | | 57,111 | | | | 57,111 | |

Shares reacquired | | | (1,592,358,167 | ) | | | (1,592,358,167 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (20,720,473 | ) | | | (20,720,473 | ) |

Shares issued upon conversion from Class L and Class X | | | 3,653,339 | | | | 3,653,339 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (17,067,134 | ) | | $ | (17,067,134 | ) |

| | | | | | | | |

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 25 | |

Notes to Financial Statements

(Unaudited) continued

| | | | | | | | |

Class B | | Shares | | | Amount | |

Six months ended January 31, 2014: | | | | | | | | |

Shares sold | | | 4,333,226 | | | $ | 4,333,226 | |

Shares issued in reinvestment of dividends | | | 1,449 | | | | 1,449 | |

Shares reacquired | | | (7,344,955 | ) | | | (7,344,955 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (3,010,280 | ) | | | (3,010,280 | ) |

Shares reacquired upon conversion into Class A | | | (77,497 | ) | | | (77,497 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (3,087,777 | ) | | $ | (3,087,777 | ) |

| | | | | | | | |

Year ended July 31, 2013: | | | | | | | | |

Shares sold | | | 8,923,232 | | | $ | 8,923,232 | |

Shares issued in reinvestment of dividends | | | 3,413 | | | | 3,413 | |

Shares reacquired | | | (12,030,861 | ) | | | (12,030,860 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (3,104,216 | ) | | $ | (3,104,215 | ) |

| | | | | | | | |

Class C | | | | | | |

Six months ended January 31, 2014: | | | | | | | | |

Shares sold | | | 12,358,841 | | | $ | 12,358,841 | |

Shares issued in reinvestment of dividends | | | 1,152 | | | | 1,152 | |

Shares reacquired | | | (15,414,385 | ) | | | (15,414,385 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (3,054,392 | ) | | $ | (3,054,392 | ) |

| | | | | | | | |

Year ended July 31, 2013: | | | | | | | | |

Shares sold | | | 23,600,310 | | | $ | 23,600,310 | |

Shares issued in reinvestment of dividends | | | 1,745 | | | | 1,745 | |

Shares reacquired | | | (17,335,783 | ) | | | (17,335,782 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 6,266,272 | | | $ | 6,266,273 | |

| | | | | | | | |

Class L | | | | | | |

Period ended August 24, 2012*: | | | | | | | | |

Shares sold | | | 32,648 | | | $ | 32,648 | |

Shares reacquired | | | (41,886 | ) | | | (41,886 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (9,238 | ) | | | (9,238 | ) |

Shares reacquired upon conversion into Class A | | | (3,365,498 | ) | | | (3,365,498 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (3,374,736 | ) | | $ | (3,374,736 | ) |

| | | | | | | | |

| | | | | | | | |

Class X | | Shares | | | Amount | |

Six months ended January 31, 2014: | | | | | | | | |

Shares sold | | | 10,279 | | | $ | 10,279 | |

Shares issued in reinvestment of dividends | | | 4 | | | | 4 | |

Shares reacquired | | | (112,357 | ) | | | (112,357 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (102,074 | ) | | | (102,074 | ) |

Shares reacquired upon conversion into Class A | | | (146,227 | ) | | | (146,227 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (248,301 | ) | | $ | (248,301 | ) |

| | | | | | | | |

Year ended July 31, 2013: | | | | | | | | |

Shares sold | | | 148,568 | | | $ | 148,568 | |

Shares issued in reinvestment of dividends | | | 33 | | | | 33 | |

Shares reacquired | | | (208,734 | ) | | | (208,734 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (60,133 | ) | | | (60,133 | ) |

Shares reacquired upon conversion into Class A | | | (287,841 | ) | | | (287,841 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (347,974 | ) | | $ | (347,974 | ) |

| | | | | | | | |

Class Z | | | | | | |

Six months ended January 31, 2014: | | | | | | | | |

Shares sold | | | 29,905,523 | | | $ | 29,905,523 | |

Shares issued in reinvestment of dividends | | | 5,968 | | | | 5,968 | |

Shares reacquired | | | (35,852,292 | ) | | | (35,852,292 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (5,940,801 | ) | | | (5,940,801 | ) |

Shares issued upon conversion from Class A | | | 8,573 | | | | 8,573 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (5,932,228 | ) | | $ | (5,932,228 | ) |

| | | | | | | | |

Year ended July 31, 2013: | | | | | | | | |

Shares sold | | | 56,696,820 | | | $ | 56,696,820 | |

Shares issued in reinvestment of dividends | | | 13,046 | | | | 13,046 | |

Shares reacquired | | | (65,333,351 | ) | | | (65,333,351 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (8,623,485 | ) | | $ | (8,623,485 | ) |

| | | | | | | | |

| * | As of August 24, 2012, the last conversion of Class L shares to Class A shares was completed. There are no Class L shares outstanding and Class L shares are no longer being offered for sale. |

5. Tax Information

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years and has concluded that no provision for income tax is required in the Fund’s financial statements for the current reporting period. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 27 | |

Financial Highlights

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

January 31, | | | | | Year Ended July 31, | |

| | | 2014 | | | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning Of Period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | |

| Net investment income and net realized gain on investment transactions | | | - | (c) | | | | | - | (c) | | | - | (c) | | | - | (c) | | | - | (c) | | | .011 | |

| Dividends to shareholders | | | - | (c) | | | | | - | (c) | | | - | (c) | | | - | (c) | | | - | (c) | | | (.011 | ) |

| Net asset value, end of period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | |

| Total Return(a) | | | .01% | | | | | | .01% | | | | .02% | | | | .02% | | | | .05% | | | | 1.10% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | |

| Net assets, end of period (000) | | | $493,804 | | | | | | $513,602 | | | | $530,669 | | | | $566,158 | | | | $606,100 | | | | $759,704 | |

| Average net assets (000) | | | $533,776 | | | | | | $514,563 | | | | $554,682 | | | | $571,572 | | | | $668,825 | | | | $783,488 | |

| Ratios to average net assets(b): | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expense after management fee and distribution and service (12b-1) fees waiver | | | .14% | (d) | | | | | .19% | | | | .18% | | | | .22% | | | | .31% | | | | .55% | |

| Expense before management fee and distribution and service (12b-1) fees waiver | | | .60% | (d) | | | | | .60% | | | | .61% | | | | .60% | | | | .59% | | | | .56% | |

| Net investment income | | | .01% | (d) | | | | | .01% | | | | .02% | | | | .02% | | | | .04% | | | | 1.09% | |

(a) Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported, and includes reinvestment of dividends and distributions. Total returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods less than one full year are not annualized.

(b) Includes .01% and .03% of the U.S. Treasury Money Market Fund Guarantee Program fee for the years ended July 31, 2010 and July 31, 2009, respectively.

(c) Less than $.0005 per share.

(d) Annualized.

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class B Shares | |

| | | Six Months

Ended

January 31, | | | | | Year Ended July 31, | |

| | | 2014 | | | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning Of Period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | |

| Net investment income and net realized gain on investment transactions | | | - | (c) | | | | | - | (c) | | | - | (c) | | | - | (c) | | | .001 | | | | .012 | |

| Dividends to shareholders | | | - | (c) | | | | | - | (c) | | | - | (c) | | | - | (c) | | | (.001 | ) | | | (.012 | ) |

| Net asset value, end of period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | |

| Total Return(a) | | | .01% | | | | | | .01% | | | | .02% | | | | .02% | | | | .05% | | | | 1.22% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | |

| Net assets, end of period (000) | | | $28,998 | | | | | | $32,086 | | | | $35,190 | | | | $43,517 | | | | $52,720 | | | | $72,931 | |

| Average net assets (000) | | | $30,882 | | | | | | $32,953 | | | | $40,272 | | | | $45,662 | | | | $60,695 | | | | $78,763 | |

| Ratios to average net assets(b): | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expense after management fee and distribution and service (12b-1) fees waiver | | | .14% | (d) | | | | | .19% | | | | .18% | | | | .22% | | | | .31% | | | | .43% | |

| Expense before management fee and distribution and service (12b-1) fees waiver | | | .47% | (d) | | | | | .48% | | | | .48% | | | | .48% | | | | .47% | | | | .43% | |

| Net investment income | | | .01% | (d) | | | | | .01% | | | | .02% | | | | .02% | | | | .05% | | | | 1.20% | |

(a) Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported, and includes reinvestment of dividends and distributions. Total returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods less than one full year are not annualized.

(b) Includes .01% and .03% of the U.S. Treasury Money Market Fund Guarantee Program fee for the years ended July 31, 2010 and July 31, 2009, respectively.

(c) Less than $.0005 per share.

(d) Annualized.

See Notes to Financial Statements.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 29 | |

Financial Highlights

(Unaudited) continued

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C Shares | |

| | | Six Months

Ended

January 31, | | | | | Year Ended July 31, | |

| | | 2014 | | | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning Of Period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | |

Net investment income and net realized gain on investment transactions | | | - | (c) | | | | | - | (c) | | | - | (c) | | | - | (c) | | | .001 | | | | .012 | |

Dividends to shareholders | | | - | (c) | | | | | - | (c) | | | - | (c) | | | - | (c) | | | (.001 | ) | | | (.012 | ) |

Net asset value, end of period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | |

Total Return(a) | | | .01% | | | | | | .01% | | | | .02% | | | | .02% | | | | .05% | | | | 1.22% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | |

Net assets, end of period (000) | | | $19,450 | | | | | | $22,504 | | | | $16,238 | | | | $20,031 | | | | $20,125 | | | | $24,747 | |

Average net assets (000) | | | $23,267 | | | | | | $16,670 | | | | $20,032 | | | | $17,071 | | | | $21,593 | | | | $27,653 | |

Ratios to average net assets(b): | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expense after management fee and distribution and service (12b-1) fees waiver | | | .14% | (d) | | | | | .19% | | | | .18% | | | | .22% | | | | .31% | | | | .43% | |

Expense before management fee and distribution and service (12b-1) fees waiver | | | .47% | (d) | | | | | .48% | | | | .48% | | | | .48% | | | | .47% | | | | .43% | |

Net investment income | | | .01% | (d) | | | | | .01% | | | | .02% | | | | .02% | | | | .05% | | | | 1.16% | |

(a) Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported, and includes reinvestment of dividends and distributions. Total returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods less than one full year are not annualized.

(b) Includes .01% and .03% of the U.S. Treasury Money Market Fund Guarantee Program fee for the years ended July 31, 2010 and July 31, 2009, respectively.

(c) Less than $.0005 per share.

(d) Annualized.

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class L Shares | |

| | | Period

Ended

August 24, | | | | | Year Ended July 31, | | | | | October 27,

2008(a)

through July 31, | |

| | | 2012(g) | | | | | 2012 | | | 2011 | | | 2010 | | | | | 2009 | |

| Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning Of Period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | | | $1.000 | |

Net investment income and net realized

gain on investment transactions | | | - | (e) | | | | | - | (e) | | | - | (e) | | | - | (e) | | | | | .004 | |

| Dividends to shareholders | | | - | (e) | | | | | - | (e) | | | - | (e) | | | - | (e) | | | | | (.004 | ) |

| Net asset value, end of period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | | | $1.000 | |

| Total Return(b): | | | -% | (f) | | | | | .02% | | | | .02% | | | | .05% | | | | | | .45% | |

| | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | | $3,366 | | | | | | $3,375 | | | | $3,528 | | | | $4,438 | | | | | | $6,255 | |

| Average net assets (000) | | | $3,361 | | | | | | $3,462 | | | | $3,975 | | | | $5,421 | | | | | | $5,397 | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses after management fee and distribution and service (12b-1) fees waiver | | | .21% | (c) | | | | | .18% | | | | .22% | | | | .32% | | | | | | .68% | (c) |

| Expenses before management fee and distribution and service (12b-1) fees waiver | | | .99% | (c) | | | | | .98% | | | | .98% | | | | .97% | | | | | | .93% | (c) |

| Net investment income | | | .01% | (c) | | | | | .02% | | | | .02% | | | | .04% | | | | | | .33% | (c) |

(a) Commencement of offering.

(b) Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported, and includes reinvestment of dividends and distributions. Total returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods less than one full year are not annualized.

(c) Annualized.

(d) Includes .01% and .03% of the U.S. Treasury Money Market Fund Guarantee Program fee for the year ended July 31, 2010 and the period ended July 31, 2009, respectively.

(e) Less than $.0005 per share.

(f) Less than .005%.

(g) As of August 24, 2012, the last conversion of Class L shares to Class A shares was completed. There are no Class L shares outstanding and Class L shares are no longer being offered for sale.

See Notes to Financial Statements.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 31 | |

Financial Highlights

(Unaudited) continued

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class X Shares | | | | | | | | | | | |

| | | Six Months

Ended

January 31, | | | | | Year Ended July 31, | | | | | October 27,

2008(a)

through

July 31, | |

| | | 2014 | | | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | | | 2009 | |

| Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning Of Period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | | | $1.000 | |

| Net investment income and net realized gain on investment transactions | | | - | (e) | | | | | - | (e) | | | - | (e) | | | - | (e) | | | - | (e) | | | | | .004 | |

| Dividends to shareholders | | | - | (e) | | | | | - | (e) | | | - | (e) | | | - | (e) | | | - | (e) | | | | | (.004 | ) |

| Net asset value, end of period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | | | $1.000 | |

| Total Return(b) | | | .01% | | | | | | .01% | | | | .02% | | | | .02% | | | | .05% | | | | | | .39% | |

| |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | | $61 | | | | | | $310 | | | | $658 | | | | $1,300 | | | | $2,515 | | | | | | $5,337 | |

| Average net assets (000) | | | $158 | | | | | | $456 | | | | $916 | | | | $1,741 | | | | $3,722 | | | | | | $5,119 | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expense after management fee and distribution and service (12b-1) fees waiver | | | .14% | (c) | | | | | .19% | | | | .18% | | | | .22% | | | | .32% | | | | | | .71% | (c) |

| Expense before management fee and distribution and service (12b-1) fees waiver | | | 1.47% | (c) | | | | | 1.48% | | | | 1.48% | | | | 1.48% | | | | 1.47% | | | | | | 1.43% | (c) |

| Net investment income | | | .01% | (c) | | | | | .01% | | | | .02% | | | | .02% | | | | .05% | | | | | | .30% | (c) |

(a) Commencement of offering.

(b) Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported, and includes reinvestment of dividends and distributions. Total returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods less than one full year are not annualized.

(c) Annualized.

(d) Includes .01% and .03% of the U.S. Treasury Money Market Fund Guarantee Program fee for the year ended July 31, 2010 and the period ended July 31, 2009, respectively.

(e) Less than $.0005 per share.

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class Z Shares | |

| | | Six Months

Ended

January 31, | | | | | Year Ended July 31, | |

| | | 2014 | | | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning Of Period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | |

| Net investment income and net realized gain on investment transactions | | | - | (c) | | | | | - | (c) | | | - | (c) | | | - | (c) | | | .001 | | | | .012 | |

| Dividends to shareholders | | | - | (c) | | | | | - | (c) | | | - | (c) | | | - | (c) | | | (.001 | ) | | | (.012 | ) |

| Net asset value, end of period | | | $1.000 | | | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | |

| Total Return(a) | | | .01% | | | | | | .01% | | | | .02% | | | | .02% | | | | .05% | | | | 1.22% | |

| |

| Ratios/Supplemental Data: | |

| Net assets, end of period (000) | | | $103,630 | | | | | | $109,562 | | | | $118,185 | | | | $153,807 | | | | $183,736 | | | | $181,906 | |

| Average net assets (000) | | | $108,353 | | | | | | $110,803 | | | | $119,232 | | | | $165,586 | | | | $181,652 | | | | $180,110 | |

| Ratios to average net assets(b): | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expense after management fee and distribution and service (12b-1) fees waiver | | | .14% | (d) | | | | | .19% | | | | .18% | | | | .22% | | | | .31% | | | | .43% | |

| Expense before management fee and distribution and service (12b-1) fees waiver | | | .47% | (d) | | | | | .48% | | | | .48% | | | | .48% | | | | .47% | | | | .43% | |

| Net investment income | | | .01% | (d) | | | | | .01% | | | | .02% | | | | .02% | | | | .05% | | | | 1.20% | |

(a) Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported, and includes reinvestment of dividends and distributions. Total returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods less than one full year are not annualized.

(b) Includes .01% and .03% of the U.S. Treasury Money Market Fund Guarantee Program fee for the years ended July 31, 2010 and July 31, 2009, respectively.

(c) Less than $.0005 per share.

(d) Annualized.

See Notes to Financial Statements.

| | | | |

| Prudential MoneyMart Assets, Inc. | | | 33 | |

| | | | |

| n MAIL | | n TELEPHONE | | n WEBSITE |

Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 | | (800) 225-1852 | | www.prudentialfunds.com |

|

| PROXY VOTING |

| The Board of Directors of the Fund has delegated to the Fund’s investment subadviser the responsibility for voting any proxies and maintaining proxy recordkeeping with respect to the Fund. A description of these proxy voting policies and procedures is available without charge, upon request, by calling (800) 225-1852. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Fund’s website and on the Securities and Exchange Commission’s website. |

|

| DIRECTORS |

| Ellen S. Alberding • Kevin J. Bannon • Scott E. Benjamin • Linda W. Bynoe • Keith F. Hartstein • Michael S. Hyland • Douglas H. McCorkindale • Stephen P. Munn • James E. Quinn • Richard A. Redeker • Robin B. Smith • Stephen G. Stoneburn |

|

| OFFICERS |

| Stuart S. Parker, President • Scott E. Benjamin, Vice President • Grace C. Torres, Treasurer and Principal Financial and Accounting Officer • Raymond A. O’Hara, Chief Legal Officer • Deborah A. Docs, Secretary • Lee D. Augsburger, Chief Compliance Officer • Theresa C. Thompson, Deputy Chief Compliance Officer • Richard W. Kinville, Anti-Money Laundering Compliance Officer • Jonathan D. Shain, Assistant Secretary • Claudia DiGiacomo, Assistant Secretary • Amanda S. Ryan, Assistant Secretary • Andrew R. French, Assistant Secretary • M. Sadiq Peshimam, Assistant Treasurer • Peter Parrella, Assistant Treasurer |

| | | | |

| MANAGER | | Prudential Investments LLC | | Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 |

|

| INVESTMENT SUBADVISER | | Prudential Investment

Management, Inc. | | Gateway Center Two

100 Mulberry Street

Newark, NJ 07102 |

|

| DISTRIBUTOR | | Prudential Investment

Management Services LLC | | Gateway Center Three

100 Mulberry Street

Newark, NJ 07102 |

|

| CUSTODIAN | | The Bank of New York Mellon | | One Wall Street

New York, NY 10286 |

|

| TRANSFER AGENT | | Prudential Mutual Fund

Services LLC | | PO Box 9658

Providence, RI 02940 |

|

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | KPMG LLP | | 345 Park Avenue

New York, NY 10154 |

|

| FUND COUNSEL | | Willkie Farr & Gallagher LLP | | 787 Seventh Avenue

New York, NY 10019 |

|