Pursuant to the terms of Mr. Beall’s employment agreement, and based on recommendations made by the Compensation Committee (which took into consideration the terms of Mr. Beall’s employment agreement and competitive market data), Mr. Beall’s base salary for fiscal year 2005 was $1,045,547.

The CEO Bonus Plan was approved by the shareholders at the 1994 Annual Meeting of Shareholders, and was reapproved at both the 1999 Annual Meeting of Shareholders and the 2004 Annual Meeting of Shareholders. In addition, at the 2002 Annual Meeting of Shareholders, the Company’s shareholders approved an amendment to the CEO Bonus Plan to increase the maximum annual bonus limit to $2,000,000. Pursuant to the CEO Bonus Plan, the Chief Executive Officer may earn a cash bonus determined as a percentage of his salary if predetermined levels of growth in earnings per share are achieved by the Company. For fiscal year 2005, the Chief Executive Officer’s bonus opportunity was 50 percent (50%), 100 percent (100%) and 175 percent (175%) of his base salary if the Company achieved or exceeded the “minimum,” “target” and “maximum” earnings per share growth level, respectively, with a proportional increase in the bonus for every one-tenth of a percent increase in earnings per share growth between such performance levels. For fiscal year 2005, Mr. Beall did not earn an incentive bonus pursuant to the CEO Bonus Plan.

Section 162(m) of the Internal Revenue Code limits the amount of individual compensation for certain executives that may be deducted by the employer for federal tax purposes in any one fiscal year to $1 million unless such compensation is “performance-based.” The determination of whether compensation is performance-based depends upon a number of factors, including shareholder approval of the plan under which the compensation is paid, the exercise price at which options or similar awards are granted, the disclosure to and approval by the shareholders of applicable performance standards, the composition of the Compensation Committee, and certification by the Compensation Committee that performance standards were satisfied. In order to preserve the Company’s ability to deduct certain performance-based compensation under Section 162(m) of the Internal Revenue Code, the Compensation Committee recommended that the Company seek shareholder approval for certain incentive compensation programs for the Chief Executive Officer. Pursuant to the Compensation Committee recommendation, the Company submitted to the shareholders for approval, and the shareholders approved, the CEO Bonus Plan at the 1994 Annual Meeting of Shareholders. In order to continue to preserve the Company’s ability to deduct annual incentive compensation paid to the Chief Executive Officer, the CEO Bonus Plan was reapproved at both the 1999 Annual Meeting of Shareholders and the 2004 Annual Meeting of Shareholders, and an amendment to increase the maximum annual bonus that may be paid thereunder was submitted to, and approved by, the shareholders at the 2002 Annual Meeting of Shareholders. While it is possible for the Company to

compensate or make awards under incentive plans and otherwise that do not qualify as performance-based compensation deductible under Section 162(m), the Compensation Committee, in structuring compensation programs for its top executive officers, intends to give strong consideration to the deductibility of awards.

Board of Directors and Compensation Committee

The Board of Directors of the Company has a standing Compensation Committee whose purpose is to review and make recommendations concerning the base salaries of all officers of the Company and to authorize all other forms of compensation, including stock options. Members of the Compensation Committee also administer the Company’s stock-based incentive plans. The Compensation Committee met two times during fiscal year 2005. The Board of Directors approved all decisions of the Compensation Committee during fiscal year 2005. The members of the Compensation Committee are named below.

Stephen I. Sadove (Chair)

| Claire L. Arnold | | | | Bernard Lanigan, Jr. |

| Dr. Donald Ratajczak | | | | John B. McKinnon |

CERTAIN TRANSACTIONS

The Company has a lease with Holrob-Mercedes Place General Partnership, a Tennessee general partnership (“Holrob-Mercedes”). The lease covers the Company’s restaurant located in the Mercedes Place Shopping Center in Knoxville, Tennessee. The lease expires on December 31, 2015, and has two five-year renewal options. The minimum annual rent under the lease is $50,000 through December 31, 2005 and gradually increases every fifth anniversary thereafter by a rate of less than $10,000 annually. On August 2, 2004, the lease was amended to provide for additional parking (the “Parking Lot Amendment”). The Parking Lot Amendment is coterminous with the term under the primary lease. The additional annual rent under the Parking Lot Amendment is $11,314 from August 1, 2004 through July 31, 2009 and gradually increases every fifth anniversary in an amount less than $2,000 annually. The lease agreement also provides for fees covering common area maintenance, which totaled $1,043 a month from June 2004 through December 2004 and increased to $1,070 from January 2005 through May 2005. Susan Bagwell Haslam, the wife of James A. Haslam, III, and William E. Haslam, the brother of James A. Haslam, III, each hold a 25 percent (25%) interest in Holrob-Mercedes.

Mark S. Ingram, who is a brother-in-law of Samuel E. Beall, III, Chairman of the Board, President and Chief Executive Officer of the Company, is an employee of the Company. Mr. Ingram’s compensation for fiscal year 2005 consisted of base salary of $259,808, and 100,000 stock options granted under the ESOP on March 30, 2005, which will vest on September 30, 2007 and expire on March 30, 2010.

PROPOSAL 2

AMENDMENT TO THE 2003 STOCK INCENTIVE PLAN

The Board of Directors of the Company approved, and recommends the shareholders of the Company approve, the amendment to the Company’s 2003 SIP to increase the number of shares authorized for issuance by 2,800,000 shares. Shareholder approval is being sought to preserve the Company’s ability to deduct, for Federal income tax purposes, compensation expense attributable to stock options and other awards granted under the 2003 SIP. Under Section 162(m) of the Internal Revenue Code, shareholder approval of performance-based compensation plans (including material amendments thereto) is necessary to qualify for the performance-based compensation exception to the limitation on a company’s ability to deduct compensation paid to certain specified individuals in excess of $1 million. Approval of the proposed amendment to the 2003 SIP requires the affirmative vote of

- 21 -

the holders of at least a majority of the outstanding shares of Common Stock of the Company represented and entitled to vote at the Annual Meeting.

The following is a description of the 2003 SIP, if amended as proposed hereby.

Reserved Shares. The shares of Common Stock reserved for issuance pursuant to awards made or that may be made under the 2003 SIP will be 18,800,000, of which approximately 10,636,832 shares were previously issued and approximately 4,187,258 are subject to stock options which are outstanding. The maximum number of shares of Common Stock from which grants or awards other than options may be made shall not exceed twenty-five percent (25%) of the total authorized shares. The maximum number of shares of Common Stock with respect to which options or stock appreciation rights may be granted during any fiscal year to any eligible recipient who is a “covered employee,” within the meaning of Section 162(m) of the Internal Revenue Code, will not exceed 750,000. The 2003 SIP provides for further adjustments in the event of certain recapitalizations to the number of shares reserved for issuance and to the fiscal year limit applicable to covered employees.

Disinterested Administration. Awards under the 2003 SIP are determined by the Compensation Committee (the “Committee”), the members of which are selected by the Board of Directors and are solely non-management members. Only persons who satisfy the criteria of “non-employee directors” set forth in Rule 16b-3(b) under the Securities Exchange Act of 1934, as amended, and the criteria of “outside directors” set forth in regulations under Section 162(m) of the Internal Revenue Code may be members of the Committee. The Committee shall have at least two members.

Awards. The 2003 SIP permits the Committee to make awards of shares of Common Stock, awards of derivative securities related to the value of the Common Stock and certain cash awards to directors, officers and employees of the Company or its affiliates (“Eligible Persons”). These discretionary awards may be made on an individual basis, or pursuant to a program approved by the Committee for the benefit of a group of Eligible Persons. The 2003 SIP permits the Committee to make awards of a variety of Stock Incentives (as defined below), including, but not limited to, stock awards, options to purchase shares of Common Stock, stock appreciation rights, so-called “cashout” or “limited stock appreciation rights” (which the Committee may make exercisable in the event of a Change in Control of the Company (as defined therein) or other event), phantom shares, performance units, dividend equivalent rights and similar rights (together, “Stock Incentives”). Outstanding Stock Incentives may be adjusted, accelerated, substituted or terminated by the Committee to reflect certain corporate events such as corporate reorganizations.

Stock Incentives may be made exercisable or settled at such prices and will terminate under such terms as will be established by the Committee, subject to the terms of the 2003 SIP. Options may be made exercisable at a price, of no less than the fair market value of the Common Stock as of a date generally no later than sixty (60) days following the date all material terms of the options are determinable. The Committee may permit an option exercise price to be paid in cash or by the delivery of previously-owned shares of Common Stock, or to be satisfied through a cashless exercise executed through a broker or by having a number of shares of Common Stock otherwise issuable at the time of exercise withheld. No option will have a maximum term in excess of ten (10) years. The 2003 SIP permits the grant of nonqualified stock options only.

Stock awards containing forfeitability provisions will vest over a period of no less than three (3) years and any stock award that does not contain forfeitability provisions will be granted only in lieu of salary or cash bonus and only at up to a fifteen percent (15%) discount from fair market value.

Stock appreciation rights may be granted separately or in connection with another Stock Incentive, and the Committee may provide that they are exercisable at the discretion of the holder or that they will be paid at a time or times certain or upon the occurrence or non-occurrence of certain events. Under certain circumstances, the per unit base value of stock appreciation rights must be set by the Committee at no less than the fair market value of a share of Common Stock. Stock appreciation rights may be settled in shares of Common Stock or in cash, according to terms established by the

- 22 -

Committee with respect to any particular award. The Committee may make cash awards designed to cover tax obligations of holders that result from the receipt or exercise of a Stock Incentive.

Performance units, phantom shares and dividend equivalent rights may be granted in numbers or units, as applicable, and will be subject to such terms and conditions as the Committee may determine. Such awards may be payable in cash or shares of Common Stock, as determined by the Committee.

The terms of particular Stock Incentives may provide that they terminate or expire upon the occurrence of one or more events, including, but not limited to, the holder’s termination of employment or other status with respect to the Company, passage of a specified period of time, the holder’s death or disability, or the occurrence of a Change in Control of the Company. Stock Incentives may include exercise, conversion or settlement rights to a holder’s estate or legal representative in the event of the holder’s death or disability. At the Committee’s discretion, Stock Incentives that are held by a holder who suffers a termination of employment or other status may be canceled, accelerated, paid or continued.

The Board of Directors at any time may terminate the 2003 SIP or amend it in any respect although any material amendment must be conditioned upon the approval of shareholders. No such termination or amendment without the consent of the holder of a Stock Incentive shall adversely affect the rights of the holder under such Stock Incentive.

Tax Consequences. A participant will not recognize income upon the grant of an option or at any time prior to the exercise of the option or a portion thereof. At the time the participant exercises a nonqualified option or portion thereof, he or she will recognize compensation taxable as ordinary income in an amount equal to the excess of the fair market value of the Common Stock on the date the option is exercised over the price paid for the Common Stock, and the Company will then be entitled to a corresponding deduction.

A participant generally will not recognize income upon the grant of a stock appreciation right, dividend equivalent right, performance unit award or phantom share (the “Equity Incentives”). At the time a participant receives payment under any Equity Incentive, he or she generally will recognize compensation taxable as ordinary income in an amount equal to the cash or the fair market value of the Common Stock received, and the Company then will be entitled to a corresponding deduction.

A participant will not be taxed upon the grant of a stock award if such award is not transferable by the participant or is subject to a “substantial risk of forfeiture,” as defined in the Internal Revenue Code. However, when the shares of Common Stock that are subject to the stock award are transferable by the participant and are no longer subject to a substantial risk of forfeiture, the participant will recognize compensation taxable as ordinary income in an amount equal to the fair market value of the stock subject to the stock award, less any amount paid for such stock, and the Company then will be entitled to a corresponding deduction. However, if a participant so elects at the time of receipt of a stock award, he or she may include the fair market value of the stock subject to the stock award, less any amount paid for such stock, in income at that time and the Company also will be entitled to a corresponding deduction at that time.

The 2003 SIP is not qualified under Section 401(a) of the Internal Revenue Code.

- 23 -

The following table sets forth information regarding stock options granted and other awards made under the 2003 SIP during fiscal year 2005 to each of the Named Executives, all persons who serve as executive officers of the Company as a group, and all persons who are employees of the Company as a group.

Name and Position with the Company or Group

| | | | Bonus

Shares (#)(1)

| | Options

(#)(2)

|

|---|

| S. E. Beall, III | | | | | 559 | | | | 484,344 | |

Chairman of the Board, Chief Executive Officer and President

| | | | | | | | | | |

| |

| M. N. Duffy | | | | | 339 | | | | 91,017 | |

Senior Vice President and Chief Financial Officer

| | | | | | | | | | |

| |

| A. R. Johnson | | | | | 0 | | | | 90,000 | |

Senior Vice President

| | | | | | | | | | |

| |

| N. N. Ibrahim | | | | | 339 | | | | 101,017 | |

Senior Vice President and Chief Technology Officer

| | | | | | | | | | |

| |

| M. S. Ingram | | | | | 399 | | | | 101,197 | |

President, Franchise

| | | | | | | | | | |

| |

| All executive officers of the Company as a group | | | | | 2,374 | | | | 1,049,789 | |

| |

| All other employees of the Company as a group | | | | | 14,040 | | | | 377,120 | |

| (1) | | “Bonus Shares” refers to bonus shares issued under the MSOP, a program maintained by the Company under the 2003 SIP, to the extent applicable to executive officers. See footnote 1 to the Summary Compensation Table above for a description of the MSOP. Any options granted under the MSOP are included in the “Options” column. |

| (2) | | Includes options granted under the MSOP. |

The Board of Directors recommends that you vote FOR the amendment to the 2003 SIP.

- 24 -

AUDIT COMMITTEE MATTERS

Audit Committee Report

The Audit Committee reports as follows with respect to the audit of the Company’s fiscal year 2005 consolidated financial statements (the “Financial Statements”):

| • | | the Audit Committee has held meetings with KPMG throughout the fiscal year, without management present, to discuss financial reporting matters; |

| • | | the Audit Committee has reviewed and discussed the Financial Statements with KPMG and the Company’s management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant accounting judgments and the transparency of disclosures in the Financial Statements; |

| • | | the Audit Committee has been updated quarterly on management’s process to assess the adequacy for the Company’s system of internal control over financial reporting, the framework used to make the assessment, and management’s conclusions on the effectiveness of the Company’s internal control over financial reporting; |

| • | | the Audit Committee has discussed with KPMG the matters required to be discussed by SAS 61,Communication with Audit Committees, which include, without limitation, matters related to the conduct of the audit of the Financial Statements; |

| • | | the Audit Committee has received written disclosures from KPMG required by the NYSE Listing Standards (which relate to KPMG’s independence from the Company) and has discussed with KPMG the independent registered accounting firm’s independence; and |

| • | | in its meetings with KPMG, the Audit Committee asks KPMG to address several topics that the Audit Committee believes are particularly relevant to its oversight, including: whether KPMG would have in any way prepared the Financial Statements differently from the manner selected by management; whether investors received, in plain English, the information essential to understanding the Company’s financial performance during the reporting period; and, whether the Company is following the same internal audit procedure that would be followed if KPMG were the Company’s Chief Executive Officer. |

Based on reviews and discussions of the Financial Statements with management and discussions with KPMG described above, the Audit Committee recommended to the Board of Directors that such Financial Statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2005.

This report is submitted by the Audit Committee, the members of which are named below.

Bernard Lanigan, Jr. (Chair)

John B. McKinnon

Dr. Donald Ratajczak

- 25 -

Audit Committee Charter

The Board of Directors has adopted a written charter for the Audit Committee, a copy of which, as amended to date, is available on the Company’s web site atwww.rubytuesday.com. The Audit Committee reviews and reassesses the adequacy of the Audit Committee Charter, and the Board of Directors approves the Audit Committee Charter, on an annual basis.

Independence of Audit Committee Members

Each of the members of the Company’s Audit Committee meets the requirements for independence as defined by the applicable listing standards of the SEC and the NYSE.

PROPOSAL 3

INDEPENDENT PUBLIC ACCOUNTANTS

The Board of Directors has selected KPMG to serve as the Company’s independent registered public accounting firm for the fiscal year ending June 6, 2006. At the Annual Meeting, the Company will ask shareholders to ratify the Board’s selection. KPMG, which served in the same capacity in 2003, 2004 and 2005 is expected to be represented at the Annual Meeting. A representative of KPMG will have an opportunity to make a statement if the representative so desires and will be available to respond to appropriate questions.

If the shareholders do not ratify the Board’s proposal, the Board of Directors will reconsider its action with respect to the appointment. Approval of the resolution, however, will in no way limit the Board’s authority to terminate or otherwise change the engagement of KPMG during the fiscal year ending June 6, 2006.

Accountants Fees and Expenses

The following table sets forth the aggregate fees billed to the Company for the fiscal years ended May 31, 2005 and June 1, 2004 by KPMG.

| | | | Fiscal Year Ended,

| |

|---|

| | | | May 31, 2005

| | June 1, 2004

|

|---|

| Audit Fees (1) | | | | $ | 684,000 | | | $ | 420,000 | |

| Audit-related Fees (2) | | | | | 51,015 | | | | 43,500 | |

| Tax Fees (3) | | | | | 13,000 | | | | 45,400 | |

| All Other Fees | | | | | 0 | | | | 0 | |

| Total Fees | | | | $ | 748,015 | | | $ | 508,900 | |

| (1) | | Includes fees for professional services rendered for the audit of the Company’s annual consolidated Financial Statements, reviews of the condensed consolidated financial statements included in the Company’s quarterly reports on Form 10-Q for the first three quarters of fiscal 2005 and 2004 and fees associated with the audit of internal control over financial reporting for fiscal year 2005. |

| (2) | | Includes fees for professional services rendered in fiscal 2005 and 2004 in connection with audits of employee benefit plans, agreed upon procedures for state compliance audits and internal control matters for fiscal 2004. |

| (3) | | Includes fees for professional services rendered in fiscal 2005 and 2004 in connection with tax planning and compliance. |

The Audit Committee has adopted a policy governing the provision of audit and permitted non-audit services by the Company’s independent registered public accounting firm. Pursuant to this policy, the Audit Committee will consider annually and, if appropriate, approve the engagement of the independent registered public accounting firm to provide audit, review and attest services for the relevant

- 26 -

fiscal year. Any changes to the terms and conditions of the annual engagement, resulting from changes in audit scope or company structure or from other subsequent events, must be approved in advance by the Audit Committee.

The policy also provides that any proposed engagement of the independent registered public accounting firm for non-audit services, which are permitted under applicable law, rules and regulations, must be approved in advance by the Audit Committee, except that the pre-approval requirement is waived with respect to the provision of non-audit services if (i) the aggregate amount of such services, other than tax planning or tax strategies services, does not exceed $25,000 in a single instance; (ii) such services were not recognized to constitute non-audit services at the time of engagement of the independent auditor; and (iii) such services were promptly brought to the attention of the Audit Committee and approved prior to completion of the audit by the Audit Committee or by a majority of the members of the Audit Committee. Such approvals are required to be obtained in advance at regularly scheduled meetings of the Audit Committee, except in special circumstances where delaying such approval until the next regularly scheduled meeting of the Audit Committee is impractical. In such special circumstances, approval of such engagements may be obtained by (i) telephonic meeting of the Audit Committee; (ii) unanimous consent action of all of the members of the Audit Committee; or (iii) electronic mail, facsimile or other form of written communication so long as such written communication is ratified by unanimous consent action prior to the next regularly scheduled meeting of the Audit Committee or by resolution at the next regularly scheduled meeting of the Audit Committee. The policy prohibits the engagement of an independent registered public accounting firm in instances in which the engagement is prohibited by applicable law, rules and regulations.

All of the services provided under Audit Fees, Audit-related Fees, Tax Fees and All Other Fees were approved by the Audit Committee.

Determination of Auditor Independence

The Audit Committee has considered and evaluated the provision of non-audit services by KPMG and has determined that the provision of such services was not incompatible with maintaining KPMG’s independence.

The Board of Directors recommends that you vote FOR the Ratification of the Selection

of KPMG as the Company’s Independent Registered Public Accounting Firm.

- 27 -

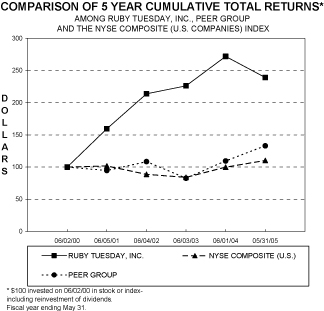

PERFORMANCE GRAPH

The following chart and table compare the cumulative total return of the Company’s Common Stock with the cumulative total return of the NYSE Stock Market (U.S. Companies) Index and a peer group consisting of U.S. companies listed on the NYSE whose business activities are included in the same standard industrial classification industry group as the Company’s business (SIC industry group code 5812, Eating and Drinking Places).

| | | | 06/02/00

| | 06/05/01

| | 06/04/02

| | 06/03/03

| | 06/01/04

| | 05/31/05

|

|---|

| Ruby Tuesday, Inc. | | | | $ | 100.00 | | | $ | 159.54 | | | $ | 213.77 | | | $ | 226.14 | | | $ | 271.87 | | | $ | 239.22 | |

| Peer Group (NYSE Stocks, SIC 5812-Eating and Drinking Places, U.S. Companies) | | | | $ | 100.00 | | | $ | 94.71 | | | $ | 108.38 | | | $ | 82.70 | | | $ | 109.49 | | | $ | 133.04 | |

NYSE Stock Market

(U.S. Companies) | | | | $ | 100.00 | | | $ | 101.79 | | | $ | 88.79 | | | $ | 84.07 | | | $ | 99.83 | | | $ | 110.22 | |

Notes:

| A. | | The lines represent monthly index levels derived from compounded daily returns that include all dividends. |

| B. | | The indexes are reweighed daily, using the market capitalization on the previous trading day. |

| C. | | If the monthly interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used. |

| D. | | The index level for all shares was set to $100.00 on June 2, 2000. |

- 28 -

PROPOSAL 4

SHAREHOLDER PROPOSAL

The Company has received a shareholder proposal to be included in the Proxy Statement submitted by the General Board of Pension and Health Benefits of the United Methodist Church, 1201 Davis Street, Evanston, Illinois 60201-4118 and the Sisters of Mercy Regional Community of Detroit Charitable Trust (the “Trust”), 29000 Eleven Mile Road, Farmington Hills, Michigan 48336-1405, beneficial owners of 2,400 shares of Common Stock. Rule 14a-8, promulgated by the SEC under the Exchange Act, requires the Company to include in the Proxy Statement the shareholder proposal and supporting statement exactly as submitted by the Trust. The Shareholder Proposal will be approved if the votes cast by holders of shares of Common Stock present or represented by proxy and entitled to vote at the Annual Meeting in favor of the Shareholder Proposal exceed the votes cast against it. The Board of Directors and the Company accept no responsibility for the Shareholder Proposal. For the reasons stated below in the Company management’s statement in opposition to the Shareholder Proposal, the Board of Directors recommends that you voteAGAINST the Shareholder Proposal.

Shareholder Proposal and Supporting Statement

Report on Impacts of Genetically Engineered Food

Ruby Tuesday 2005

RESOLVED: Shareholders request that an independent committee of the Board of Directors review the Company’s policies and procedures for monitoring genetically engineered (“GE”) products and report (at reasonable cost and omitting proprietary information) to shareholders within six months of the Annual Meeting on the results of the review, including:

| (i) | | the scope of the Company’s food products derived from or containing GE ingredients; and |

| (ii) | | a contingency plan for sourcing non-GE food ingredients should circumstances so require. |

Supporting Statement

Disclosure of material information is a fundamental principle of our capital markets. Investors, their confidence in corporate bookkeeping shaken, are starting to scrutinize other possible “off-balance sheet” liabilities, such as risks associated with activities harmful to human health and the environment, that can impact long-term shareholder value.

SEC reporting requirements include disclosure of trends and uncertainties that the company reasonably expects will have a material impact on revenues. Company directors and officers must proactively identify and assess trends or uncertainties that may adversely impact their revenues and disclose the information to shareholders.

Between 2001 and 2004, approximately 15,000 hectares (150 square kilometers) in four U.S. states were planted with an unapproved variety of GE seed corn, resulting in about 133 million kilograms of the unapproved corn in the food chain. (New Scientist 3/23/05; Nature 3/22/05)

StarLink corn, not approved for human consumption, has been detected in U.S. Food Aid (12/04) as well as in a U.S. corn shipment to Japan (12/02). StarLink first contaminated U.S. corn supplies in September 2000, triggering a recall of 300 products.

The FDA does not require producers of GE food products to seek prior FDA approval of finished GE food products; producers of GE products are merely encouraged to have voluntary safety consultations with the FDA.

Indicators that genetically engineered organisms MAY be harmful to humans, animals or the environment include:

- 29 -

| • | | The report Safety of Genetically Engineered Foods: Approaches to Assessing Unintended Health Effects (National Academy of Sciences [NAS] 7/2004) states: ...“there remain sizable gaps in our ability to identify compositional changes that result from genetic modification of organisms intended for food; to determine the biological relevance of such changes to human health; to devise appropriate scientific methods to predict and assess unintended adverse effects on human health.” (p.15) Post-marketing surveillance has not been used to evaluate any of the GE crops currently on the market. (p. 153) |

| • | | Gone to Seed (Union of Concerned Scientists) reports that genetically engineered DNA is contaminating U.S. traditional seeds stocks, of corn, soybeans and canola ... if left unchecked could disrupt agricultural trade, unfairly burden the organic foods industry and allow hazardous materials into the food supply. |

Producers of salmon genetically engineered to speed the fish’s growth to maturity expect their federal application to sell the fish in the United States to be decided within a year, renewing concern among commercial fishermen concerned about consequences if the genetically modified fish escapes and mingles with wild salmon. (AP 3/9/05)

We believe such a report will disclose information material to the company’s future.

Board of Directors’ Statement in Opposition of the Shareholder Proposal

The Company has food safety as its highest priority and cares about and actively supports its customers’ interest in food safety. The Company believes that the United States Food and Drug Administration (“FDA”), the Environmental Protection Agency (“EPA”), and other regulatory authorities that are charged with protecting the health and safety of the public and the environment are the proper authorities, rather than a single restauranteur like the Company, to evaluate and make judgments about environmental risks presented by crops enhanced through biotechnology and about safety concerns caused by the use of biotechnology-derived ingredients. These agencies have the responsibility, scientific resources and legal authority necessary to evaluate the issues and apply uniform resolutions based on sound scientific principles. The FDA has been reviewing information about genetically modified foods provided by biotech companies since 1994, and has issued biotechnology agency response letters with respect to a variety of genetically modified foods. The U.S. Department of Agriculture (“USDA”) has reviewed the safety of bioengineered plants since 1987, and the EPA has been doing the same with respect to pesticidal plants since approximately 1993. In these comments and reviews, none of these federal agencies found any of the food products that the Company currently sells to be unsafe or to pose health risks to its customers.

The Company invests significant resources to comply with all regulations applicable to food safety and will continue to do so in the future. The Company understands that the use of genetic engineering with respect to certain staple foods is widespread in the United States. Even when these foods are produced in an unmodified form, under current practices such foods are combined with biotechnology-derived foods during storage and distribution. However, requiring the Company to provide the requested report to shareholders would involve unnecessary expenditures of time and resources. The Company firmly believes that all products sold at its restaurants, including those that may contain ingredients developed through biotechnology, are safe. In addition, many believe that the use of biotechnology in foods creates numerous benefits, including the reduction of the use of pesticides, the creation of more nutritious foods, and the possibility of finding new ways to help feed the world. The Company believes that the FDA and EPA are in the best position to evaluate and make decisions about the safety of biotechnology-derived food ingredients, while the Company continues to focus on providing its customers with a high-quality, moderately-priced dining experience.

The Company believes that there is ample evidence that biotechnology is facilitating fundamental changes in agricultural production methods, resulting in decreased use of traditional pesticides and increased use of farm inputs that will protect the environment and potentially provide more food for the world’s rapidly increasing population. Such evidence suggests that biotechnology brings many benefits to people and the environment. For example, in June 2002, the National Center

- 30 -

for Food and Agricultural Policy (NCFAP), a Washington D.C.-based research group, issued a report that confirms and quantifies many of the benefits of biotech crops. This report found that the widespread adoption of biotechnology in major commodity crops in the United States has resulted in significant yield increases, significant savings for growers and significant reductions in pesticide use. Most notably, in 2001, NCFAP reported that the eight biotech crops grown in the United States increased crop yields by four billion pounds, saved growers $1.5 billion, and reduced pesticide use by 46 million pounds. The Company understands that some dispute these studies.

Under the food and safety regulatory review, the Company believes that the foods derived from genetically engineered plant products are as safe as foods derived from other plant varieties using principles recommended by the World Health Organization, the Food and Agricultural Organization of the United Nations, and the Organization for Economic Cooperation and Development. Similarly, genetically engineered plants must be shown to meet regulatory standards and be approved for environmental release. The FDA, the EPA, and the USDA provide regulatory oversight of genetically engineered products in the United States. In addition, other countries have developed regulations to ensure that the foods derived from genetically engineered plants are assessed for their safety. For example, such regulations have been implemented in the United Kingdom, Canada, Brazil, Argentina, the Netherlands, Japan, Australia, China, South Africa, India and the European Union.

Safety information for genetically engineered products such as soybean, corn, canola and cotton has been published in peer-reviewed scientific journals. Reviews by medical professionals, including organizations such as the Council of Scientific Affairs of the American Medical Association, have concluded that plant biotechnology is a safe and useful tool to enhance food safety, quality and nutrition. In addition, published reviews by nutrition and dietetic experts, such as the American Dietetic Association, have concluded, “foods produced using biotechnology are as safe as traditional foods.” International expert bodies, such as the World Health Organization, the U.S. National Research Council, the Australia/New Zealand Food Authority, and other scientific organizations have reviewed the safety information on the plant biotechnology products which are currently on the market and have concluded that there has not been a single confirmed adverse human health effect caused by the production or consumption of crops developed through biotechnology. The Company believes that the breadth and depth of scientific knowledge in molecular biology, plant physiology, animal nutrition and physiology establish that there is no basis for allegations of potential unknown effects or long-term harm that would result from the consumption of registered genetically engineered crops. The Company believes that genetic engineering is improving commonly used agricultural crops in ways that benefit the environment as well as the farmers and the agricultural, food and fiber industries.

The Company is aware of the concerns of some who oppose the development of genetically modified ingredients in agriculture, as well as the strong contrary views of those who believe that the use of such ingredients will benefit humanity and the environment by increasing the world’s food supply and decreasing the use of pesticides. The Company does not believe that preparation of the report requested by the proponents of the Shareholder Proposal would add new information to the ongoing dialogue on this issue. The Company believes the subject is more appropriately addressed under regulatory authority and leadership, and in light of scientific findings and the conclusions, of regulatory authorities. It would be an imprudent expenditure of the Company’s limited resources to require its management to devote time, attention and funds to research the complex issues involved and compile the report requested by the Shareholder Proposal.

In addition, the Shareholder Proposal as written is not practicable because the Company would have serious difficulty determining what constitutes “products that are derived from or contain GE ingredients.” Even if the Company could determine what constitutes “genetically engineered” ingredients, the Company believes it is impracticable to identify which products contain these ingredients. Since genetic markers used to identify genetically engineered ingredients are sometimes damaged or eliminated during processing, a genetically engineered ingredient can remain virtually undetected in certain foods. It would be impracticable (even if the Company had the testing capability) for the Company to identify all genetically engineered ingredients used in its products. Therefore, the Company does not believe the report apparently requested by the Shareholder Proposal would be meaningful.

- 31 -

The Company will continue to develop and revise plans to address business and food safety issues as they arise. These issues are critical to the Company’s business. However, the publication of the report requested by the Shareholder Proposal would compromise the Company’s efforts and business. Such a report would not advance consumer safety, but it may potentially jeopardize the business interests of the Company and its shareholders as a result of the publication of confidential business plans and proprietary information.

The Company also opposes the Shareholder Proposal on the basis that compliance with them would require significant cost and business risks without the prospect of advancing food safety. The Company does emphasize that it is committed to the use of only those ingredients that meet its high quality and safety standards and will continue to support the efforts of regulatory authorities to take whatever steps are necessary to assure that any new food technology is safe for consumers and the environment. The Company’s shareholders and consumers can count on the Company’s compliance with all such regulations. Particularly in light of the scientific and regulatory attention being given to the use of genetically modified ingredients, the Company believes that preparation and publication of the report requested in the Shareholder Proposal would not constitute an effective use of the Company’s assets.

Finally, a similar shareholder proposal was introduced at the 2004 Annual Meeting of Shareholders requesting that the Board of Directors review the Company’s policies for food products containing GE ingredients and report back to shareholders. The shareholder proposal was soundly defeated by a vote of 5.1 million shares “For,” 39.2 million shares “Against,” with 5.9 million shares “Abstaining.”

Accordingly, the Board of Directors recommends that shareholders voteAGAINST the Shareholder Proposal.

Vote Required

The Shareholder Proposal will be approved if the votes cast by holders of shares of Common Stock present or represented and entitled to vote at the Annual Meeting in favor of the Shareholder Proposal exceed the votes cast against it. Abstentions and broker non-votes will have no effect on the outcome of the voting on the Shareholder Proposal.

The Board of Directors recommends that you vote AGAINST the Shareholder Proposal.

- 32 -

SHAREHOLDER PROPOSALS

Any shareholder of the Company who wishes to submit a proposal for action at the Company’s 2006 Annual Meeting of Shareholders and who desires the proposal to be considered for inclusion in the Company’s proxy materials must provide a written copy of the proposal to the Company not later than April 28, 2006, and must otherwise comply with the rules of the SEC relating to shareholder proposals. Shareholder proposals should be sent by mail to the Company’s principal executive office or by fax at (865) 379-6826 followed by mail submission, in each case to the attention of Scarlett May, Vice President, General Counsel and Secretary of the Company.

The proxy or proxies designated by the Company will have discretionary authority to vote on any matter properly presented by a shareholder for consideration at the 2006 Annual Meeting of Shareholders but not submitted for inclusion in the proxy materials for such meeting unless (a) with respect to any nomination for director, written notice of the intent to make the nomination is submitted to the Company at least 90 days in advance of the meeting and is otherwise made in accordance with the nomination procedures contained in the Articles of Incorporation of the Company, or (b) with respect to any other shareholder proposal, notice of the matter is received by the Company at its principal executive office not later than April 28, 2006 and, in either case, certain other conditions of the applicable rules of the SEC are satisfied.

GENERAL

Management does not know of any other business to come before the Annual Meeting. If, however, other matters do properly come before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

A list of shareholders entitled to be present and vote at the Annual Meeting will be available for inspection by shareholders at the time and place of the Annual Meeting.

The Annual Report of the Company for fiscal year 2005 (which is not part of the proxy soliciting materials) is being mailed with this Proxy Statement to all shareholders of record as of the record date for the Annual Meeting.

THE COMPANY WILL, UPON THE WRITTEN REQUEST OF ANY SHAREHOLDER, FURNISH WITHOUT CHARGE A COPY OF ITS ANNUAL REPORT ON FORM 10-K FILED WITH THE SEC FOR THE FISCAL YEAR ENDED MAY 31, 2005. REQUESTS FOR COPIES SHOULD BE DIRECTED TO SCARLETT MAY, VICE PRESIDENT, GENERAL COUNSEL AND SECRETARY, RUBY TUESDAY, INC., 150 WEST CHURCH AVENUE, MARYVILLE, TENNESSEE 37801, TELEPHONE NUMBER (865) 379-5700.

By Order of the Board of Directors,

Scarlett May

Vice President, General Counsel

and Secretary

August 24, 2005

Maryville, Tennessee

- 33 -

o | € DETACH PROXY CARD HERE € |

| | | |

| PLEASE COMPLETE, DATE, SIGN | x | |

| AND RETURN THIS PROXY | |

| PROMPTLY USING THE ENCLOSED | Votes must be indicated | |

| ENVELOPE. | (x) in Black or Blue ink. | |

| |

1. | TO ELECT THREE CLASSI DIRECTORS FOR A TERM OF THREE YEARS TO THE BOARD OF DIRECTORS. | 3. | TO RATIFY THE SELECTION OF KPMG LLP TO SERVE AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JUNE 6, 2006. |

FORall nominees listed below (except as marked to the contrary below) | o | WITHHOLD AUTHORITY to vote forALL nominees listed below | o | *EXCEPTIONS | o | FORratification of the selection of KPMG LLP | | AGAINSTratification of the selection of KPMG LLP | | ABSTAIN |

| | | | | | o | | o | | o |

CLASSINominees: BERNARD LANIGAN, JR., JAMES A. HASLAM, III AND STEPHEN I. SADOVE

*(INSTRUCTIONS: To withhold authority for any individual nominee, mark the “EXCEPTIONS” box above and strike a line through that nominee’s name in the list of nominees below the boxes.) | | |

| The Board of Directors recommends a vote FOR the ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 6, 2006. |

The Board of Directors recommends a vote FOR all director nominees listed above. | 4. | TO CONSIDER THE SHAREHOLDER PROPOSAL DESCRIBED ON THE REVERSE SIDE HEREOF. |

2. | TO APPROVE AN AMENDMENT TO THE COMPANY’S 2003 STOCK INCENTIVE PLAN. | | FORapproval of the shareholder proposal | | AGAINSTapproval of the shareholder proposal | | ABSTAIN |

FORapproval of the amendment to the 2003 Stock Incentive Plan | | AGAINSTapproval of the amendment to the 2003 Stock Incentive Plan | | ABSTAIN | |

o

| |

o

| |

o

|

o

| |

o

| |

o

| | | The Board of Directors recommends a vote AGAINST the approval of the Shareholder Proposal. |

The Board of Directors recommends a vote FOR the approval of the amendment to the 2003 Stock Incentive Plan.

| 5. | In their discretion, the proxies are authorized to vote upon such other business as may properly come before this meeting. |

| | | | | | | | | | | | | | | | | | |

PLEASE COMPLETE, DATE, SIGN AND RETURN THIS PROXY PROMPTLY. Please sign exactly as your name(s) appear(s) hereon. If shares are held jointly, each shareholder named should sign. When signing as attorney, executor, administrator, trustee or guardian, give your full title as such. If the signatory is a corporation, sign the full corporate name by a duly authorized officer. | |

| | |

| Date Share Owner sign here | | Co-Owner sign here |

| | | |

| RUBY TUESDAY, INC. | | |

| PROXY/VOTING INSTRUCTION CARD | | |

| THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS | | |

| |

The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Shareholders and Proxy Statement, each dated August 24, 2005, and does hereby appoint Samuel E. Beall, III and Marguerite N. Duffy, and either of them, with full power of substitution, as proxy or proxies of the undersigned to represent the undersigned and to vote all shares of Ruby Tuesday, Inc. (the “Company”) common stock, par value $.01 per share, which the undersigned would be entitled to vote if personally present at the Annual Meeting of Shareholders of the Company, to be held at the Company’s headquarters located at 150 West Church Avenue, Maryville, Tennessee 37801 at 11:00 a.m., local time, on October 5, 2005, and at any adjournment(s) thereof. | |

| |

IF YOUR REGISTRATIONS ARE NOT IDENTICAL, YOU MAY RECEIVE MORE THAN ONE SET OF PROXY MATERIALS. PLEASE SIGN AND RETURN ALL CARDS YOU RECEIVE. | |

| |

This proxy/voting instruction card, when properly executed, will be voted in accordance with the directions given by the undersigned shareholder. If no direction is made, it will be voted (i)FORall director nominees listed on the reverse side hereof, (ii)FORthe approval of the amendment to the Company’s 2003 Stock Incentive Plan (formerly known as the 1996 Non-Executive Stock Incentive Plan), (iii)FORthe ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 6, 2006; and (iv)AGAINSTthe shareholder proposal requesting that an independent committee of the Board of Directors review the Company’s policies for monitoring food products containing genetically engineered ingredients and issue a report to shareholders within six months on the extent that the Company’s food products are derived from genetically engineered ingredients and any contingency plan for sourcing non-genetically engineered foods (the “Shareholder Proposal”). | |

| | | |

| | To change your address,

please mark this box. | o |

| RUBY TUESDAY, INC. | | |

| P.O. BOX 11237 | To include any comments, | o |

(continued on other side) | NEW YORK, N.Y. 10203-0237 | please mark this box. |

| | | |

| | | |