Section 162(m) of the Internal Revenue Code limits the amount of individual compensation for certain executives that may be deducted by the employer for federal tax purposes in any one fiscal year to $1 million unless such compensation is “performance-based.” The determination of whether compensation is performance-based depends upon a number of factors, including shareholder approval of the plan under which the compensation is paid, the exercise price at which options or similar awards are granted, the disclosure to and approval by the shareholders of applicable performance standards, the composition of the Compensation Committee, and certification by the Compensation Committee that performance standards were satisfied. In order to preserve the Company’s ability to deduct certain performance-based compensation under Section 162(m) of the Internal Revenue Code, the Compensation Committee recommended that the Company seek shareholder approval for certain incentive compensation programs for the Chief Executive Officer. Pursuant to the Compensation Committee recommendation, the Company submitted to the shareholders for approval, and the shareholders approved, the CEO Bonus Plan at the 1994 Annual Meeting of Shareholders. In order to continue to preserve the Company’s ability to deduct annual incentive compensation paid to the Chief Executive Officer, the CEO Bonus Plan was reapproved at both the 1999 Annual Meeting of Shareholders and the 2004 Annual Meeting of Shareholders, and an amendment to increase the maximum annual bonus that may be paid thereunder was submitted to, and approved by, the shareholders at the 2002 Annual Meeting of Shareholders. While it is possible for the Company to compensate or make awards under incentive plans and otherwise that do not qualify as performance-based compensation deductible under Section 162(m) of the Internal Revenue Code, the Compensation Committee, in structuring compensation programs for its top executive officers, intends to give strong consideration to the deductibility of awards.

RELATED PARTY TRANSACTIONS

The Company was party to a lease with Holrob-Mercedes Place General Partnership, a Tennessee general partnership (“Holrob-Mercedes”), in which Susan Bagwell Haslam and William E. Haslam, the wife and brother of James A. Haslam, III, a director of the Company, each hold a 25 percent (25%) interest. On February 28, 2006, Holrob-Mercedes sold its interest in the leased premises to a third party unrelated to the Company. During fiscal year 2006, the Company made payments to Holrob-Mercedes under the lease in the amount of $57,263.

On or near September 8, 2005, the Company engaged the services of Rivr Media, Inc., of which Susan Bagwell Haslam, the wife of James A. Haslam, III, serves as Chief Executive Officer, to provide media production services. During fiscal year 2006, the Company paid Rivr Media, Inc. the aggregate amount of $23,679 for these services to the Company.

On or near October 12, 2005, the Company engaged the services of Blackberry Design, an affiliate of Blackberry Farm, to manage the remodel, expansion, design and furnishing of the Company’s 62-bedroom Ruby Tuesday Lodge and restaurant on a cost-plus basis. Under this arrangement, the Company paid the cost of all furnishings, fixtures, and third-party services plus a design fee of 35% of all furnishings and a fee of 15% of all third-party services contracted by Blackberry Farm on behalf of the Company. The total cost of all furnishings, fixtures and third-party services was $918,719, which included $120,325, inclusive of tax, in reimbursements to Blackberry Farm for certain furnishings and resulted in design fees being paid to Blackberry Farm in the amount of $313,585. Also during fiscal year 2006, the Company paid Blackberry Farm $31,304 for management programs held at Blackberry Farm and design consultation services provided by Blackberry Design in connection with new restaurant prototypes. Blackberry Farm is owned by Samuel E. Beall, III, the Chairman of the Board, President and Chief Executive Officer of the Company, Mr. Beall’s spouse and their children.

Mark S. Ingram, who is a brother-in-law of Samuel E. Beall, III, Chairman of the Board, President and Chief Executive Officer of the Company, is an employee of the Company. Mr. Ingram’s compensation for fiscal year 2006 consisted of base salary of $272,950, bonus compensation of $267,830 and 90,000 stock options granted under the ESOP on March 28, 2006, which will vest on September 28, 2008 and expire on March 28, 2011.

PROPOSAL 2

APPROVAL OF AN AMENDMENT TO THE COMPANY’S

STOCK INCENTIVE AND DEFERRED COMPENSATION PLAN FOR DIRECTORS

The Board of Directors has adopted, and recommends that the shareholders approve, an amendment to the Ruby Tuesday, Inc. Stock Incentive and Deferred Compensation Plan for Directors (the “Directors’ Plan”) to provide for the grant of annual option awards, annual grants of restricted stock or a combination of both, as described below. The affirmative vote of a majority of votes cast by holders of the shares of the Company’s Common Stock represented in person or by proxy at a meeting at which a quorum is present is required for adoption of the amendment to the Directors’ Plan. This amendment was adopted to provide a measure of flexibility in the types of equity incentives granted to directors with the intent that the types of incentives granted annually will reflect the composition of the differing types of awards granted to employees.

The following description of the Directors’ Planis qualified in its entirety by reference to the applicable provisions of the plan document, the full text of the amendment is set forth on Annex A and is made a part of this proxy statement.

-22-

Purpose

The purpose of the Directors’ Plan is to provide incentives to eligible directors that are aligned with the interests of shareholders, to encourage share ownership by eligible directors, and to provide a means of recruiting and retaining qualified director candidates.

Eligibility

The non-employee members of the Board of Directors are the only persons eligible to participate in the Directors’ Plan. The aggregate benefits and amounts that will be received in the future by the non-employee Directors are not presently determinable. As of the date of this proxy statement, there were seven (7) non-employee directors.

Description of General Terms

Administration.The Directors’ Plan is administered by the Board of Directors.

Shares Reserved.The Directors’ Plan reserves for issuance pursuant to equity awards authorized by the terms thereof a total of 950,000 shares of Common Stock, subject to adjustment as provided by the terms of the Directors’ Plan, approximately 294,829 of which remain available for issuance.

Deferred Compensation Accounts.The Directors’ Plan permits non-employee directors to defer all or a portion (in twenty-five percent (25%) increments) of their retainer and/or any additional meeting and committee fees to a deferred compensation account. Deferred compensation accounts are credited as of the last day of each fiscal quarter with an assumed rate of income equal to 90-day U.S. Treasury Bills, based on the weighted average balance of such accounts during such fiscal quarter. Amounts credited to a director’s deferred compensation account will be distributed not sooner than the earlier of the first January 15 or July 15 following (a) the date of the director’s 70th birthday, or (b) the date the director ceases to be a member of the Board of Directors.

Award of Restricted Stock.The Directors’ Plan, as amended, provides that each non-employee director will be granted a restricted stock award as of the date of each annual meeting of the shareholders of the Company beginning with the 2006 Annual Shareholder Meeting, if (i) the director is elected or reelected as a director of the Company at that meeting or otherwise continues to serve as a director of the Company immediately following that meeting and (ii) the Board of Directors affirmatively approves the grant of restricted stock awards to otherwise eligible directors for that annual meeting. The number of shares of Common Stock subject to each restricted stock award shall be determined by the Board of Directors at the time a determination is made to grant restricted stock awards with respect to any particular annual meeting of shareholders, but in no event shall that number exceed the maximum annual option award divided by the conversion factor. Under the current conversion factor, the maximum number of shares of stock that could be subject to each restricted stock award is 2,353. The maximum number of shares of Common Stock that may be subject to any annual restricted stock award will be adjusted in the event of recapitalizations or similar events affecting the Company.

One-third (1/3) of the shares of Common Stock subject to a restricted stock award shall vest on each of the first three (3) anniversary dates of the original grant date for that restricted stock award, provided the director remains a member of the Board of Directors as of the applicable anniversary date. If a director ceases to be a member of the Board of Directors prior to the third anniversary of the grant date of a restricted stock award, any unvested shares under that restricted stock award shall be forfeited. All shares of Common Stock subject to a restricted stock award shall become vested on the date the director ceases to be a member of the Board of Directors on account of death, disability, upon attaining age 70 or upon a change in control.

-23-

Award of Options.The Directors’ Plan also provides for annual option grants to each non-employee director to purchase up to 8,000 shares of Common Stock if the director is elected or re-elected, or otherwise continues, to serve on the Board of Directors at each annual meeting of the shareholders of the Company. The maximum number of shares of Common Stock that may be subject to any annual option grant may be adjusted in the event of recapitalizations or similar events affecting the Company.

The number of shares of Common Stock subject to each annual option will be reduced (but not below zero) by the product of (x) the number of shares of Common Stock subject to each restricted stock award, if any, granted for the same annual meeting of shareholders, multiplied by (y) a conversion factor. The conversion factor is designed to represent the present value of an option to purchase a share of Common Stock under an accepted option valuation methodology, as described in the plan. The conversion factor is set at 3.4 initially, but is to be adjusted no less frequently than every three years applying the same valuation methodology. The annual options will be granted at fair market value as of the date of the annual meeting of shareholders. Each annual option shall expire generally upon the earlier of the fifth anniversary of the option grant date or 90 days following the date the director ceases to serve as a director of the Company other than for cause and 15 days following the date the director ceases to serve as a director of the Company for cause. The annual options will become exercisable 30 months following the date of grant or earlier in the event of death, retirement, disability or certain changes in control. Non-employee directors, whose service with the Company ends prior to the option term, other than for cause, may exercise a pro rata portion of the option.

Target Ownership Levels.Shares of Common Stock purchased through the exercise of the annual options generally may not be transferred during any period of time, prior to the director’s death, that he or she has not attained his or her target ownership level. A director will be treated as having attained the “target ownership level” if he or she owns a number of shares of Common Stock with a fair market value equal to or exceeding $250,000.

Amendments or Termination

The Directors’ Plan may be amended or terminated by the Board of Directors at any time without shareholder approval, although the Company intends to seek shareholder approval whenever obtaining shareholder approval is determined to be necessary or advisable. No amendment or termination by the Board of Directors may adversely affect the rights of participants to the extent previously accrued.

Federal Income Tax Consequences

The following discussion outlines generally the federal income tax consequences of participation in the Directors’ Plan. Individual circumstances may vary.

Restricted Stock Awards. A participant will not be taxed upon the grant of a stock award if such award is subject to a “substantial risk of forfeiture,” as defined in the Internal Revenue Code. When the shares of stock that are subject to the stock award are no longer subject to a substantial risk of forfeiture, however, the participant will recognize compensation taxable as ordinary income in an amount equal to the fair market value of the stock subject to the award, less any amount paid for such stock, and the Company will then be entitled to a corresponding deduction. If a participant so elects at the time of receipt of a stock award, he or she may include the fair market value of the stock subject to the award, less any amount paid for such stock, in income at that time and the Company will also be entitled to a corresponding deduction at that time.

-24-

Nonqualified Options. A participant will not recognize income upon the grant of a nonqualified option or at any time prior to the exercise of the option or a portion thereof. At the time the participant exercises a nonqualified option or portion thereof, he or she will recognize compensation taxable as ordinary income in an amount equal to the excess of the fair market value of the stock on the date the option is exercised over the price paid for the stock, and the Company will then be entitled to a corresponding deduction.

Depending upon the time the shares of stock are held after exercise, the sale or other taxable disposition of shares acquired through the exercise of a nonqualified option generally will result in a short or long-term capital gain or loss equal to the difference between the amount realized on such disposition and the fair market value of such shares when the nonqualified option was exercised.

Special rules apply to a participant who exercises a nonqualified option by paying the exercise price, in whole or in part, by the transfer of shares of stock to the Company.

The Board of Directors recommends that you vote

FOR the amendment to the Directors’ Plan.

PROPOSAL 3

APPROVAL OF THE 2006 EXECUTIVE INCENTIVE COMPENSATION PLAN

The Company is requesting that shareholders vote in favor of adopting the 2006 Executive Incentive Compensation Plan (the “Executive Plan”), which was approved by the Board of Directors on July 11, 2006. Approval of the proposed Executive Plan requires the affirmative vote of a majority of the votes cast by holders of the shares of Common Stock present or represented by proxy and entitled to vote at the Annual Meeting, provided that a quorum is present at such meeting. If approved by shareholders, the Executive Plan will replace the Chief Executive Officer’s Incentive Bonus Plan (“CEO Bonus Plan”), which was last approved by shareholders at the 2004 Annual Meeting.

The following description of certain major features of the Executive Plan is qualified in its entirety by reference to the applicable provisions of the plan document, the full text of which is set forth on Annex B and is made a part of this proxy statement.

Purpose

The purpose of the Executive Plan is to enable the Company to recruit and retain highly qualified individuals and to provide incentives to such individuals to attain the Company’s goals by providing eligible executives with incentive compensation based on the performance of the Company with the overall goal of enhancing shareholder value. The Executive Plan is designed with the intent that the incentive awards paid under the plan to eligible participants be deductible under Section 162(m) of the Internal Revenue Code.

Eligibility

Each employee of the Company holding the position of President or above will be eligible to receive awards under the Executive Plan, if selected by the Compensation Committee for participation. The aggregate benefits and amounts that will be received in the future by the eligible employees of the Company are not presently determinable. As of the date of this proxy statement, the Chief Executive Officer was the only eligible employee.

-25-

Description of General Terms

Administration. The administration and operation of the Executive Plan will be supervised by the Compensation Committee. The Compensation Committee may delegate responsibility for the day-to-day administration and operation of the Executive Plan to employees of the Company. The Compensation Committee will interpret and construe the provisions of the Executive Plan, and any determination by the Compensation Committee will be final and conclusive. The Executive Plan will be interpreted in view of the intention that any grant of compensation under the plan be qualified as performance-based compensation within the meaning of Internal Revenue Code Section 162(m).

Performance Periods and Performance Criteria.The Compensation Committee will establish for each eligible executive selected to participate in the Executive Plan the performance measures and the performance period to which the performance measures will relate. The performance period for any participant may consist of any continuous period of service determined by the Compensation Committee. Within ninety (90) days after the commencement of a performance period, but in any event prior to the expiration of twenty-five percent (25%) of the applicable performance period, the Compensation Committee will establish the performance measures for payment of individual awards under the Executive Plan. The Executive Plan provides that at the time any performance measures are established, the outcome as to whether the performance measures will be met must be substantially uncertain.

The Compensation Committee will establish performance measures under an objective formula or standard consisting of one or any combination of the following criteria:

| Cash flow | Retention of Company team members |

| Earnings before interest, taxes, | in general or in any specific category |

| depreciation, and amortization | or level of employment |

| (EBITDA) | Earnings before interest, depreciation |

| Earnings per share (EPS) | and amortization (EBIDA) |

| Net operating profit after taxes | Earnings before interest and taxes |

| (NOPAT) | (EBIT) |

| Return on net assets (RONA) | Earnings before interest, taxes, |

| Return on assets (ROA) | depreciation, and rent (EBITDAR) |

| Return on equity (ROE) | Gross profit |

| Return on invested capital (ROIC) | Company, franchise or system |

| Company, franchise or system | restaurant growth in number of new |

| comparable restaurant sales (SRS) | restaurants |

| Company, franchise or system traffic | Average restaurant volume growth |

| growth (Guest Count Growth) | Fixed charge coverage ratio |

| Market share or related strength of | Sales and earnings performance |

| brand measures related to consumer | Total shareholder return |

| perception, including but not limited to, | General and administrative costs (as a |

| brand relevance and guest satisfaction, | percentage of net sales or flat dollar |

| in each case based on objective data | amount) |

| such as guest or market surveys | Consolidated net income |

| Economic Value Added (dollar spread | Management of capital or operating |

| between return on capital and cost of | expenditures |

| capital) (EVA) | Appreciation of stock price |

| Gross revenues | Market Value Added (Company |

| Operating income | market value less total capital |

| Operating cash flow | employed) |

-26-

The Compensation Committee may amend or adjust the performance goals or other terms and conditions of an outstanding award in recognition of unusual or nonrecurring events affecting the Company or its financial statements or changes in law or accounting. In making any such amendments or adjustments, however, the Compensation Committee shall consider whether the changes would cause any portion of the award, upon payment, to be nondeductible pursuant to Section 162(m) of the Internal Revenue Code.

Incentive Awards.The incentive award for any performance period may be established by the Compensation Committee as either a flat dollar amount or a percentage of the applicable participant’s average base compensation, in either case conditioned upon the attainment of one or more performance measures established by the Compensation Committee for such participant. The term “average base compensation” is defined to mean the average annual base salary paid to a participant over a performance period, exclusive of bonus and other incentive compensation, commissions, fringe benefits, employee benefits, expense allowances (non-accountable or otherwise) and other nonrecurring forms of remuneration. After establishing the incentive award to be paid to a particular participant during a performance period, the Compensation Committee may reduce (but may not increase) such incentive award by a maximum of twenty-five percent (25%) based upon the Compensation Committee’s assessment of such participant’s performance during the applicable performance period with respect to other quantitative and qualitative goals established by the Compensation Committee from time to time.

The amount of the incentive award payable to any participant attributable to a performance period of twelve (12) months or less may not exceed $3,000,000. The incentive award payable to any participant attributable to a performance period that is greater than twelve (12) months may not exceed $6,000,000.

An “eligible” participant shall include each participant who has remained in the employ of the Company until the last day of the performance period and any participant whose incentive award provides for a pro rata payment in the event the participant ceases to be employed by the Company during the performance period. Whether an incentive award provides for a pro rata payment in the event of certain types of cessations of employment shall be determined by the Compensation Committee in its sole discretion at the time the terms of an incentive award are established; provided that such other reason(s) will not cause the incentive award to cease to qualify as performance-based compensation.

Before any incentive award is paid to any participant or beneficiary of a participant, the Compensation Committee shall certify in writing that the applicable performance measures were in fact satisfied.

Incentive awards may be paid, at the discretion of the Compensation Committee, in cash or shares of Common Stock or a combination of cash and shares; provided, however, that any portion of an incentive award paid in shares of Common Stock must be funded under the 2003 Stock Incentive Plan (“2003 SIP”), subject to any limitations in the 2003 SIP. Incentive awards for each performance period are paid as soon as practicable after the close of such performance period, but not later than two and one-half (2½) months thereafter. The Company has the right to deduct from each incentive award payment any federal, state and local taxes required to be withheld.

The Compensation Committee may, in its discretion, institute a program allowing participants to defer the receipt of all or a portion of their incentive award otherwise payable in accordance with and subject to the rules and regulations promulgated under Code Section 409A of the Internal Revenue Code.

-27-

Amendments and Termination

The Compensation Committee may at any time amend, suspend, discontinue or terminate the Executive Plan, except to the extent that the terms of any incentive award outstanding thereunder provides otherwise, and in no event may any amendment, suspension, discontinuance or termination adversely affect the accrued rights of a participant without such participant’s consent. In addition, any such amendment, suspension, discontinuance or termination shall require shareholder approval to the extent necessary to continue to qualify the payment or other settlement of incentive awards as performance-based compensation within the meaning of Section 162(m) of the Internal Revenue Code or to the extent such shareholder approval would be required under the rules of the national securities exchange or Nasdaq quotation or market system on which the Company’s Common Stock is then traded.

Benefits to Named Executive Officers and Others

The Compensation Committee has determined that the Chief Executive Officer (who also serves as President) will participate in the Executive Plan for the 2007 fiscal year and may earn a maximum bonus of $1,968,750. If the Executive Plan is not approved by shareholders, the Chief Executive Officer will participate in the CEO Bonus Plan as previously approved by shareholders. No determinations of eligibility for, or level of, participation in the Executive Plan have been made for future fiscal years though the Compensation Committee anticipates that all persons occupying eligible positions will participate in the plan in future years. The aggregate benefits and/or amounts that will be received in the future by eligible executives pursuant to the Executive Plan are not presently determinable.

Tax Consequences

The Executive Plan is designed to ensure that the awards paid thereunder are deductible under Section 162(m) of the Internal Revenue Code. Payments to the executives under the Executive Plan will be taxable compensation to the recipient upon receipt and deductible as compensation by the Company.

The Board of Directors recommends that you vote

FOR approval of the Executive Incentive Compensation Plan.

PROPOSAL 4

AMENDMENT TO THE 2003 STOCK INCENTIVE PLAN

The Board of Directors of the Company approved, and recommends that the shareholders of the Company approve, an amendment to the Company’s 2003 Stock Incentive Plan (the “2003 SIP”) to identify specific performance measures in connection with the granting or vesting of awards made under the 2003 SIP. In addition, the amendment to the 2003 SIP has been approved by the Board of Directors to clarify how the plan is to be administered as a result of the new rules applicable to deferred compensation introduced by new Section 409A of the Internal Revenue Code.

Shareholder approval is being sought only for the amendment relating to the identification of specific performance measures. Approval of the amendment to the 2003 SIP requires the affirmative vote of a majority of the votes cast by holders of the shares of Common Stock present or represented by proxy and entitled to vote at the Annual Meeting, provided that a quorum is present. Shareholder approval is necessary in this regard to preserve the Company’s ability to deduct, for federal income tax purposes, compensation expense attributable to stock options and other awards granted under the 2003 SIP. Under Section 162(m) of the Internal Revenue Code, shareholder approval of performance-based compensation plans (including material amendments thereto) is necessary to qualify for the performance-based compensation exception to the limitation on a company’s ability to deduct compensation paid to certain specified individuals in excess of $1 million.

-28-

The following description of the 2003 SIP is qualified in its entirety by reference to the applicable provisions of the plan document, the full text of the amendment is set forth on Annex C and is made a part of this proxy statement.

Purpose

The 2003 SIP allows the Company, under the direction of the Compensation Committee, to make broad-based grants of equity-based incentives, any of which may or may not require the satisfaction of performance objectives, to officers, employees, and directors (other than non-employee directors). The primary purpose of these equity awards is to attract and retain talented employees, further align employee and shareholder interests, continue to closely link employee compensation with Company performance and maintain a culture based on employee share ownership.

Eligibility

Officers, employees, and directors (other than non-employee directors) of the Company and Company affiliates are eligible to receive awards under the 2003 SIP. The Compensation Committee determines which eligible recipients will participate in the 2003 SIP.

Description of General Terms

The 2003 SIP permits awards of a variety of equity-based incentives to purchase or acquire shares of Common Stock, including stock options, stock appreciation rights, stock awards, dividend equivalent rights, performance unit awards and phantom shares (collectively, “stock incentives”). The 2003 SIP has an indefinite term. The 2003 SIP will be administered solely by the Compensation Committee. The particular terms and provisions applicable to each stock incentive granted will be set forth in a stock incentive agreement.

Reserved Shares.The shares of Common Stock reserved for issuance pursuant to awards made or that may be made under the 2003 SIP are 30,800,000, of which approximately 20,318,218 shares were previously issued and approximately 8,140,492 are subject to stock options which are outstanding. The maximum number of shares of Common Stock from which grants or awards other than options may be made shall not exceed twenty-five percent (25%) of the total authorized shares. The maximum number of shares of Common Stock with respect to which options or stock appreciation rights and other awards (to the extent they are granted with the intent that they qualify as performance-based compensation) may be granted during any fiscal year to any employee will not exceed 750,000. The 2003 SIP provides for further adjustments in the event of certain recapitalizations to the number of shares reserved for issuance and to the fiscal year limit applicable to employees. In addition, the maximum aggregate dollar amount of cash-settled awards that may be paid during any fiscal year of the Company to any employee may not exceed $6,000,000.

Disinterested Administration.Awards under the 2003 SIP are determined by the Compensation Committee, the members of which are selected by the Board of Directors and are solely non-management members. Only persons who satisfy the criteria of “non-employee directors” set forth in Rule 16b-3(b) under the Securities Exchange Act of 1934, as amended, and the criteria of “outside directors” set forth in regulations under Section 162(m) of the Internal Revenue Code may be members of the Compensation Committee. The Compensation Committee shall have at least two members.

-29-

Awards. Awards made under the 2003 SIP may be contingent upon the achievement of performance goals or upon other conditions, as determined by the Compensation Committee. Subject to plan limits, the Compensation Committee has the discretionary authority to determine the size of an award. Outstanding stock incentives may be adjusted, accelerated, substituted or terminated by the Compensation Committee to reflect certain corporate events such as corporate reorganizations. Stock incentives may be made exercisable or settled at such prices and will terminate under such terms as will be established by the Compensation Committee, subject to the terms of the 2003 SIP.

Stock Options.A stock option is the right to purchase a certain number of shares of Common Stock, at a certain exercise price, in the future. The 2003 SIP provides for the grant of nonqualified stock options only. The Compensation Committee will establish the terms pursuant to which the option will be exercisable, so long as such terms are not otherwise inconsistent with the terms of the 2003 SIP.

The exercise price of nonqualified stock options issued under the 2003 SIP may not be less than the fair market value of Common Stock on the date of the grant, as determined by the Compensation Committee. The exercise price of outstanding options cannot be reduced without shareholder approval, except in the event of a recapitalization.

The Compensation Committee may permit an option exercise price to be paid in cash or:

The term of all nonqualified stock options may not exceed 10 years from the date of grant.

Stock Appreciation Rights. A stock appreciation right is the right to receive the net of the fair market price of a share of Common Stock at the time of exercise and the exercise price of the right, either in cash or in shares of Common Stock, in the future, all as determined by the Compensation Committee. The Compensation Committee may provide that a stock appreciation right is exercisable at the discretion of the holder or that it will be paid at a specific time or times or upon the occurrence or non-occurrence of events specified in the applicable stock incentive agreement.

Stock Awards. A stock award is an award of shares of Common Stock which may be subject to restrictions or conditions, including, without limitation, performance goals, established by the Compensation Committee. The Compensation Committee may require a cash payment from the recipient of the stock award in an amount no greater than the fair market value of the shares of stock awarded, determined at the date of the grant, or may grant the stock award without the requirement of a cash payment. Stock awards that include forfeitability provisions must have a vesting period of at least three years. Stock awards that do not include forfeitability provisions can be granted only in lieu of salary or cash bonus and may be granted at up to a fifteen percent (15%) discount to fair market value of Common Stock on the date of grant. Any stock award that contains forfeitability provisions must vest over a period of no less than three years.

Other Stock Incentives. Dividend equivalent rights, performance unit awards and phantom shares may also be granted under the 2003 SIP. A dividend equivalent right is the right to receive in the future, either in cash or in shares of Common Stock, an amount determined by reference to dividends paid on shares of Common Stock during the period such rights are effective. A performance unit award is the right to receive a specified dollar value either in cash or in shares of Common Stock, in the future, conditioned upon the achievement of performance objectives. A phantom share is the right to receive the market price of a share of Common Stock, either in cash or in Common Stock, in the future. The Compensation Committee may determine whether any of such stock incentives are subject to any conditions and restrictions and whether the stock incentive will be payable in cash or in shares of Common Stock.

-30-

Eligibility under Section 162(m).Stock incentive awards may, but need not, include performance goals that satisfy Section 162(m) of the Internal Revenue Code. To the extent that awards are intended to qualify as “performance-based compensation” under Section 162(m), the performance goals will be one or more of the following criteria. Performance goals may be described in terms of (i) company-wide objectives, (ii) objectives that are related to the performance of the division, department or function within the Company or an affiliate of the Company in which the recipient of the stock incentive is employed or on which the recipient’s efforts have the most influence, or (iii) the performance of the Company relative to the performance by a company or group of companies selected by the Compensation Committee with respect to one or more of the performance goals established by the committee:

| | Cash flow | | Retention of Company team members |

| | Earnings before interest, taxes, | | in general or in any specific category |

| | depreciation, and amortization | | or level of employment |

| | (EBITDA) | | Earnings before interest, depreciation |

| | Earnings per share (EPS) | | and amortization (EBIDA) |

| | Net operating profit after taxes | | Earnings before interest and taxes |

| | (NOPAT) | | (EBIT) |

| | Return on net assets (RONA) | | Earnings before interest, taxes, |

| | Return on assets (ROA) | | depreciation, and rent (EBITDAR) |

| | Return on equity (ROE) | | Gross profit |

| | Return on invested capital (ROIC) | | Company, franchise or system |

| | Company, franchise or system | | restaurant growth in number of new |

| | comparable restaurant sales (SRS) | | restaurants |

| | Company, franchise or system traffic | | Average restaurant volume growth |

| | growth (Guest Count Growth) | | Fixed charge coverage ratio |

| | Market share or related strength of | | Sales and earnings performance |

| | brand measures related to consumer | | Total shareholder return |

| | perception, including but not limited to, | | General and administrative costs (as a |

| | brand relevance and guest satisfaction, | | percentage of net sales or flat dollar |

| | in each case based on objective data | | amount) |

| | such as guest or market surveys | | Consolidated net income |

| | Economic Value Added (dollar spread | | Management of capital or operating |

| | between return on capital and cost of | | expenditures |

| | capital) (EVA) | | Appreciation of stock price |

| | Gross revenues | | Market Value Added (Company |

| | Operating income | | market value less total capital |

| | Operating cash flow | | employed) |

The Compensation Committee may amend or adjust the performance goals or other terms and conditions of an outstanding award in recognition of unusual or nonrecurring events affecting the Company or its financial statements or changes in law or accounting.

Tax Reimbursement Payments.The Compensation Committee may make cash tax reimbursement payments designed to cover obligations of officers and employees that result from the receipt or exercise of a stock incentive.

-31-

Termination of Stock Incentives. A particular stock incentive may terminate, as determined by the Compensation Committee, among other reasons, upon the recipient’s termination of employment or other status with the Company or any affiliate of the Company, upon a specified date, upon the recipient’s death or disability, or upon the occurrence of a change in control of the Company. Stock incentives may include exercise, conversion or settlement rights to a holder’s estate or personal representative in the event of a holder’s death or disability. At the Compensation Committee’s discretion, stock incentives that are subject to termination may be cancelled, accelerated, paid or continued, subject to the terms of the applicable stock incentive agreement and to the provisions of the 2003 SIP.

Adjustments.The number of shares of Common Stock reserved for the grant of stock incentives may be proportionately adjusted for any increase or decrease in the number of issued shares of Common Stock resulting from a subdivision or combination of shares or the payment of a stock dividend in shares of Common Stock to holders of outstanding shares of Common Stock, or any other increase or decrease in the number of shares of Common Stock outstanding, affected without receipt of consideration by the Company. In the event of certain corporate reorganizations and recapitalizations, stock incentives may be substituted, cancelled, accelerated or otherwise adjusted by the Compensation Committee, provided that any such action is not inconsistent with the terms of the 2003 SIP or any agreement reflecting the terms of the stock incentive.

Amendments or Termination

The 2003 SIP may be amended or terminated by the Board of Directors at any time without shareholder approval, except that shareholder approval will be required for any material amendment. No amendment or termination by the Board of Directors may adversely affect the rights of a holder of a stock incentive without such holder’s consent.

Benefits to Named Executive Officers and Others

The following table sets forth information regarding stock options granted and other awards made under the 2003 SIP during fiscal year 2006 to each of the Named Executives, all persons who serve as executive officers of the Company as a group, and all persons who are employees of the Company as a group.

| | | Shares and | | |

| Name and Position with the Company or Group | | Bonus Shares (#)(1) | | Options (#)(2) |

| S. E. Beall, III | | 0 | | | 516,454 | |

| Chairman of the Board, Chief Executive Officer | | | | | | |

| and President | | | | | | |

| M. N. Duffy | | 0 | | | 100,000 | |

| Senior Vice President and Chief Financial Officer | | | | | | |

| A. R. Johnson | | 0 | | | 90,000 | |

| Senior Vice President | | | | | | |

| N. N. Ibrahim | | 0 | | | 100,000 | |

| Senior Vice President and Chief Technology Officer | | | | | | |

| M. S. Ingram | | 0 | | | 90,000 | |

| President, Franchise | | | | | | |

| All executive officers of the Company as a group | | 0 | | | 1,186,454 | |

| All other employees of the Company as a group | | 16,774 | | | 462,822 | |

____________________

| (1) | | “Bonus Shares” refers to bonus shares issued under the MSOP, a program maintained by the Company under the 2003 SIP, to the extent applicable, to executive officers. See footnote 2 to the Summary Compensation Table above for a description of the MSOP. Any options granted under the MSOP are included in the “Options” column. |

| |

| (2) | | Includes options granted under the MSOP. |

-32-

The Compensation Committee has not yet made any determination as to which eligible participants will be granted incentives under the 2003 SIP in the future. Consequently, the aggregate benefits and/or amounts that will be received in the future by directors, executive officers or any other persons pursuant to the 2003 SIP are not presently determinable.

Federal Income Tax Consequences

The following discussion outlines generally the federal income tax consequences of participation in the 2003 SIP. Individual circumstances may vary and each participant in the 2003 SIP should rely on his or her own tax counsel for advice regarding such federal income tax treatment.

Nonqualified Options. A participant will not recognize income upon the grant of a nonqualified option or at any time prior to the exercise of the option or a portion thereof. At the time the participant exercises a nonqualified option, or portion thereof, he or she will recognize compensation taxable as ordinary income in an amount equal to the excess of the fair market value of the stock on the date the option is exercised over the price paid for the stock, and the Company will then be entitled to a corresponding deduction.

Depending upon the time the shares of stock are held after exercise, the sale or other taxable disposition of shares acquired through the exercise of a nonqualified option generally will result in a short or long-term capital gain or loss equal to the difference between the amount realized on such disposition and the fair market value of such shares when the nonqualified option was exercised.

Special rules apply to a participant who exercises a nonqualified option by paying the exercise price, in whole or in part, by the transfer of shares of stock to the Company.

Restricted Stock Awards. A participant will not be taxed upon the grant of a stock award if such award is subject to a “substantial risk of forfeiture,” as defined in the Internal Revenue Code. When the shares of stock that are subject to the stock award are no longer subject to a substantial risk of forfeiture, however, the participant will recognize compensation taxable as ordinary income in an amount equal to the fair market value of the stock subject to the award, less any amount paid for such stock, and the Company will then be entitled to a corresponding deduction. If a participant so elects at the time of receipt of a stock award, he or she may include the fair market value of the stock subject to the award, less any amount paid for such stock, in income at that time and the Company will also be entitled to a corresponding deduction at that time.

Other Stock Incentives.A participant will not recognize income upon the grant of a stock appreciation right, dividend equivalent right, performance unit award or phantom share (collectively, the “Other Equity Incentives”). Generally, at the time a participant receives payment under any Other Equity Incentive, he or she will recognize compensation taxable as ordinary income in an amount equal to the cash or fair market value of the stock received, and the Company will then be entitled to a corresponding deduction.

The Board of Directors recommends that you vote

FOR the amendment to the 2003 SIP.

-33-

AUDIT COMMITTEE MATTERS

Audit Committee Report

The Audit Committee reports as follows with respect to the audit of the Company’s fiscal year 2006 consolidated financial statements (the “Financial Statements”):

the Audit Committee has held meetings with KPMG throughout the fiscal year, without management present, to discuss financial reporting matters;

the Audit Committee has reviewed and discussed the Financial Statements with KPMG and the Company’s management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant estimates and accounting judgments and the transparency of disclosures in the Financial Statements;

the Audit Committee has been updated quarterly on management’s process to assess the adequacy of the Company’s system of internal control over financial reporting, the framework used to make the assessment, and management’s conclusions on the effectiveness of the Company’s internal control over financial reporting;

the Audit Committee has discussed with KPMG the matters required to be discussed by SAS 61,Communication with Audit Committees, which include, without limitation, matters related to the conduct of the audit of the Financial Statements;

the Audit Committee has received written disclosures from KPMG required by the NYSE ListingStandards and Independence Standards Board Standard No. 1 (which relate to KPMG’s independence from the Company) and has discussed with KPMG the independent registered accounting firm’s independence; and

in its meetings with KPMG, the Audit Committee asks KPMG to address several topics that the Audit Committee believes are particularly relevant to its oversight, including: whether KPMG would have in any way prepared the Financial Statements differently from the manner selected by management; whether investors received, in plain English, the information essential to understanding the Company’s financial performance during the reporting period; and, whether the Company is following the same internal audit procedure that would be followed if KPMG were the Company’s Chief Executive Officer.

Based on reviews and discussions of the Financial Statements with management and discussions with KPMG described above, the Audit Committee recommended to the Board of Directors that the Financial Statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 6, 2006.

The Audit Committee, comprised of all non-management directors, meets at regularly scheduled executive sessions at which Mr. Lanigan, the Audit Committee Chairman, presides.

This report is submitted by the Audit Committee, the members of which are named below.

| Bernard Lanigan, Jr. (Chair) | John B. McKinnon | Dr. Donald Ratajczak |

Audit Committee Charter

The Board of Directors has adopted a written charter for the Audit Committee, a copy of which, as amended to date, is available on the Company’s web site atwww.rubytuesday.com. The Audit Committee reviews and reassesses the adequacy of the Audit Committee Charter, and the Board of Directors approves the Audit Committee Charter, on an annual basis.

-34-

Independence of Audit Committee Members

Each of the members of the Company’s Audit Committee meets the requirements for independence as defined by the applicable listing standards of the NYSE and the SEC rules.

PROPOSAL 5

RATIFICATION OF

INDEPENDENT PUBLIC ACCOUNTANTS

The Board of Directors has selected KPMG to serve as the Company’s independent registered public accounting firm for the fiscal year ending June 5, 2007. At the Annual Meeting, the Company will ask shareholders to ratify the Board’s selection. KPMG, which has served in the same capacity since 2000, is expected to be represented at the Annual Meeting. A representative of KPMG will have an opportunity to make a statement if the representative so desires and will be available to respond to appropriate questions.

If the shareholders do not ratify the Board’s proposal, the Board of Directors will reconsider its action with respect to the appointment. Approval of the resolution, however, will in no way limit the Board’s authority to terminate or otherwise change the engagement of KPMG during the fiscal year ending June 5, 2007.

Accountants’ Fees and Expenses

The following table sets forth the aggregate fees billed to the Company for the fiscal years ended June 6, 2006 and May 31, 2005 by KPMG.

| | | Fiscal Year Ended |

| | | June 6, 2006 | | May 31, 2005 |

| Audit Fees(1) | | | $599,750 | | | | $684,000 | |

| Audit-related Fees(2) | | | 27,158 | | | | 51,015 | |

| Tax Fees(3) | | | 0 | | | | 13,000 | |

| All Other Fees | | | 0 | | | | 0 | |

| Total Fees | | | $626,908 | | | | $748,015 | |

____________________

| (1) | | Includes fees for professional services rendered for the audit of the Company’s annual consolidated Financial Statements, reviews of the condensed consolidated financial statements included in the Company’s quarterly reports on Form 10-Q for the first three quarters of fiscal 2006 and fiscal 2005 and fees associated with the audits of internal control over financial reporting. |

| |

| (2) | | Includes fees for professional services rendered in fiscal 2006 and fiscal 2005 in connection with audits of employee benefit plans and certain agreed upon procedures for state compliance purposes. |

| |

| (3) | | Includes fees for professional services rendered in fiscal 2005 in connection with compliance. |

The Audit Committee has adopted a policy governing the provision of audit and permitted non-audit services by the Company’s independent registered public accounting firm. Pursuant to this policy, the Audit Committee will consider annually, and, if appropriate, approve, the engagement of the independent registered public accounting firm to provide audit, review and attest services for the relevant fiscal year. Any changes to the terms and conditions of the annual engagement, resulting from changes in audit scope or Company structure, or from other subsequent events, must be approved in advance by the Audit Committee.

-35-

The policy also provides that any proposed engagement of the independent registered public accounting firm for non-audit services, which are permitted under applicable law, rules and regulations, must be approved in advance by the Audit Committee, except that the pre-approval requirement is waived with respect to the provision of non-audit services if (i) the aggregate amount of such services, other than tax planning or tax strategies services, does not exceed $25,000 in a single instance; (ii) such services were not recognized to constitute non-audit services at the time of engagement of the independent registered public accounting firm; and (iii) such services were promptly brought to the attention of the Audit Committee and approved prior to completion of the service by the Audit Committee or by a majority of the members of the Audit Committee. Such approvals are required to be obtained in advance at regularly scheduled meetings of the Audit Committee, except in special circumstances where delaying such approval until the next regularly scheduled meeting of the Audit Committee is impractical. In such special circumstances, approval of such engagements may be obtained by (i) telephonic meeting of the Audit Committee; (ii) unanimous consent action of all of the members of the Audit Committee; or (iii) electronic mail, facsimile or other form of written communication so long as such written communication is ratified by unanimous consent action prior to the next regularly scheduled meeting of the Audit Committee or by resolution at the next regularly scheduled meeting of the Audit Committee. The policy prohibits the engagement of an independent registered public accounting firm in instances in which the engagement is prohibited by applicable law, rules and regulations.

All of the services provided under Audit Fees, Audit-related Fees, Tax Fees and All Other Fees were pre-approved by the Audit Committee.

Determination of Auditor Independence

The Audit Committee has considered and evaluated the services provided by KPMG and has determined that the provision of such services was not incompatible with maintaining KPMG’s independence.

The Board of Directors recommends that you vote FOR the Ratification of the Selection

of KPMG as the Company’s Independent Registered Public Accounting Firm.

-36-

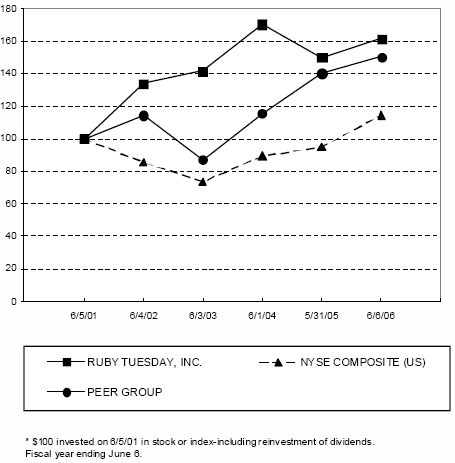

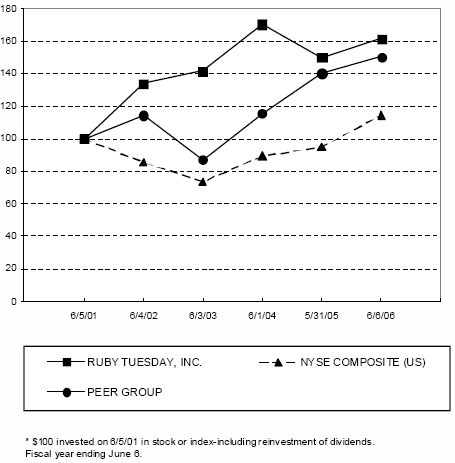

PERFORMANCE GRAPH

The following chart and table compare the cumulative total return of the Company’s Common Stock with the cumulative total return of the NYSE Stock Market (U.S. Companies) Index and a peer group consisting of U.S. companies listed on the NYSE whose business activities are included in the same standard industrial classification industry group as the Company’s business (SIC industry group code 5812, Eating and Drinking Places).

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG RUBY TUESDAY, INC.,

THE NYSE COMPOSITE (U.S.) INDEX AND A PEER GROUP

| | | 06/05/01 | | 06/04/02 | | 06/03/03 | | 06/01/04 | | 05/31/05 | | 06/06/06 |

| Ruby Tuesday, Inc. | | $ | 100.00 | | | $ | 133.99 | | | $ | 141.74 | | | $ | 170.40 | | | $ | 149.94 | | | $ | 161.44 | |

| Peer Group (NYSE Stocks, SIC | | | | | | | | | | | | | | | | | | | | | | | | |

| 5812-Eating and Drinking | | $ | 100.00 | | | $ | 114.33 | | | $ | 87.19 | | | $ | 115.33 | | | $ | 140.13 | | | $ | 150.25 | |

| Places, U.S. Companies) | | | | | | | | | | | | | | | | | | | | | | | | |

| NYSE Stock Market | | $ | 100.00 | | | $ | 85.31 | | | $ | 73.42 | | | $ | 89.36 | | | $ | 94.77 | | | $ | 114.32 | |

| (U.S. Companies) | | | | | | | | | | | | | | | | | | | | | | | | |

-37-

Notes:

A. The lines represent monthly index levels derived from compounded daily returns that include all dividends.

B. The indexes are reweighed daily, using the market capitalization on the previous trading day.

C. If the monthly interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used.

D. The index level for all shares was set to $100.00 on June 5, 2001.

SHAREHOLDER PROPOSALS

Any shareholder of the Company who wishes to submit a proposal for action at the Company’s 2007 Annual Meeting of Shareholders and who desires the proposal to be considered for inclusion in the Company’s proxy materials must provide a written copy of the proposal to the Company not later than April 25, 2007, and must otherwise comply with the rules of the SEC relating to shareholder proposals. Shareholder proposals should be sent by mail to the Company’s principal executive office or by fax at (865) 379-6826 followed by mail submission, in each case to the attention of Scarlett May, Vice President, General Counsel and Secretary of the Company.

The proxy or proxies designated by the Company will have discretionary authority to vote on any matter properly presented by a shareholder for consideration at the 2007 Annual Meeting of Shareholders but not submitted for inclusion in the proxy materials for such meeting unless (a) with respect to any nomination for director, written notice of the intent to make the nomination is submitted to the Company at least 90 days in advance of the meeting and is otherwise made in accordance with the nomination procedures contained in the Articles of Incorporation of the Company, or (b) with respect to any other shareholder proposal, notice of the matter is received by the Company at its principal executive office not later than April 25, 2007 and, in either case, certain other conditions of the applicable rules of the SEC are satisfied.

GENERAL

Management does not know of any other business to come before the Annual Meeting. If, however, other matters do properly come before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

A list of shareholders entitled to be present and vote at the Annual Meeting will be available for inspection by shareholders at the time and place of the Annual Meeting.

The Annual Report of the Company for fiscal year 2006 (which is not part of the proxy soliciting materials) is being mailed with this Proxy Statement to all shareholders of record as of the record date for the Annual Meeting.

-38-

THE COMPANY WILL, UPON THE WRITTEN REQUEST OF ANY SHAREHOLDER, FURNISH WITHOUT CHARGE A COPY OF ITS ANNUAL REPORT ON FORM 10-K FILED WITH THE SEC FOR THE FISCAL YEAR ENDED JUNE 6, 2006. REQUESTS FOR COPIES SHOULD BE DIRECTED TO SCARLETT MAY, VICE PRESIDENT, GENERAL COUNSEL AND SECRETARY, RUBY TUESDAY, INC., 150 WEST CHURCH AVENUE, MARYVILLE, TENNESSEE 37801, TELEPHONE NUMBER (865) 379-5700.

| By Order of the Board of Directors, |

|  |

| Scarlett May |

| Vice President, General Counsel |

| and Secretary |

August 23, 2006

Maryville, Tennessee

-39-

ANNEX A

SIXTH AMENDMENT TO THE

RUBY TUESDAY, INC. STOCK INCENTIVE

AND DEFERRED COMPENSATION PLAN FOR DIRECTORS

THIS SIXTH AMENDMENT is made this 11th day of July, 2006, by Ruby Tuesday, Inc., a corporation duly organized and existing under the laws of the State of Georgia (hereinafter called the “Company”).

WITNESSETH:

WHEREAS, the Company maintains the Ruby Tuesday, Inc. Stock Incentive and Deferred Compensation Plan for Directors, which is currently maintained under an amended and restated indenture which became effective as of September 28, 1994 (the “Plan”);

WHEREAS, the Company desires to amend the Plan to provide for the grant of annual option awards, annual grants of restricted stock or a combination of both, as provided herein; and

WHEREAS, the Board of Directors of the Company has duly approved and authorized this amendment to the Plan;

NOW, THEREFORE, the Company does hereby amend the Plan, effective as of the date of the 2006 annual meeting of the Company’s shareholders, as follows:

1.By adding a new Section 1.1(g-1):

“(g-1) ‘Conversion Multiple’ means a multiple derived from the Black-Scholes-Merton stock option valuation methodology which is intended to convert the present value of an Option to the value of a share of Stock. The value of the Conversion Multiple equals 3.4 as of the date of the 2006 annual meeting of the Company’s shareholders. From time to time and in any event no later than every third anniversary of the annual meeting of the Company’s shareholders, the Committee shall cause the Conversion Multiple to be further evaluated under the Black-Scholes-Merton methodology to determine whether the Conversion Multiple should be adjusted for the purpose of converting the present value of an Option to the value of a share of Stock. Such adjustment, if any, shall be made by the Committee in its sole discretion.”

2.By deleting the first sentence of the head language of Section 3A.2 and by substituting therefor the following:

“An Annual Option shall represent the right to purchase shares of Stock at a per share exercise price equal to the Fair Market Value of a share of Stock on the date of grant, which is the date of the annual meeting of the shareholders of the Company for which the award is made. The number of shares of Stock subject to each Annual Option shall be 8,000, reduced (but not below zero) by the product of the number of shares of Stock subject to each Restricted Stock Award, if any, granted pursuant to Section 3 respecting the same annual meeting of shareholders, multiplied by the Conversion Multiple.”

A - 1

3.By deleting Section 3 in its entirety and by substituting therefor the following:

“SECTION 3 RESTRICTED STOCK AWARDS

3.1Awards. Each Participant who is a director and who is not an employee of the Company shall be granted a Restricted Stock Award as of the date of each annual meeting of the shareholders of the Company beginning with the 2006 annual shareholder meeting, if such Participant is elected or re-elected as a director of the Company at that meeting or otherwise continues to serve as a director of the Company immediately following that meeting and if the Board of Directors affirmatively approves the grant of Restricted Stock Awards to otherwise eligible directors with respect to each such annual meeting no later than the date of that annual meeting. In the event the number of Maximum Plan Shares, reduced by the number of such Maximum Plan Shares previously issued or issuable under the Plan, is insufficient to fund all of the Restricted Stock Awards to be granted as of any annual meeting of the shareholders of the Company, then no Restricted Stock Awards with respect to that meeting or any subsequent meeting shall be granted unless and until the Plan is amended to increase the number of Maximum Plan Shares; provided, further, that no Restricted Stock Awards shall be granted with respect to annual meetings that take place prior to the effective date of any such amendment. Each Restricted Stock Award shall be evidenced by a Stock Incentive Agreement which shall incorporate the applicable terms of the Plan.

3.2Shares Subject to Each Award. The number of shares of Stock subject to each Restricted Stock Award shall be determined by the Board of Directors at the time a determination is made to grant Restricted Stock Awards with respect to any particular annual meeting of shareholders, but in no event shall that number exceed the maximum potential Annual Option award divided by the Conversion Multiple.

3.3Vesting. One-third (1/3) of the shares of Stock subject to a Restricted Stock Award shall vest on each of the first three (3) anniversary dates of the original grant date for that Restricted Stock Award, provided the Participant remains a member of the Board of Directors as of the applicable anniversary date. In the event a Participant ceases to be a member of the Board of Directors prior to the third anniversary of the grant date of a Restricted Stock Award, any unvested shares under that Restricted Stock Award shall be forfeited. Notwithstanding the preceding, all shares of Stock subject to the Restricted Stock Award shall become vested on the date the Participant ceases to be a member of the Board of Directors on account of death, Disability, upon attaining age 70 or upon a Change in Control.

3.4Escrow of Shares. Any certificates representing the shares of Stock awarded pursuant to a Restricted Stock Award shall be issued in the Participant's name, but shall be held by a custodian designated by the Committee (the “Custodian”) until such time as such shares of Stock become vested or are forfeited. Each Stock Incentive Agreement governing a Restricted Stock Award shall appoint the Custodian as the attorney-in-fact for the Participant until such time as shares of Stock become vested or are forfeited in accordance with Plan Section 3.3 with full power and authority in the Participant's name, place and stead to transfer, assign and convey to the Company any shares of Stock held by the Custodian for such Participant if the Participant forfeits such shares. In the event the shares of Stock subject to the Restricted Stock Award become vested, the Custodian shall deliver the certificate for such shares to the Participant. In the event the Participant forfeits any or all of the shares of Stock subject to the Restricted Stock Award, the Custodian shall deliver the certificate for such shares to the Company. During the period that the Custodian holds the shares subject to this Section, the Participant shall be entitled to all rights, except as provided in the Stock Incentive Agreement, applicable to shares of Stock not so held.

A - 2

3.5Limitations on Transfer. The Participant shall not have the right to make or permit to exist any Disposition of the shares of Stock held by the Custodian until the applicable vesting date determined pursuant to Plan Section 3.3 and any Disposition attempted prior to that date shall be void. The Company shall not recognize and shall not have the duty to recognize any Disposition not made in accordance with the Plan.

3.6Withholding. Upon the vesting of any Restricted Stock Award or the making of any election under Section 83(b) of the Code, the Company has the right to require the Participant to remit to the Company an amount sufficient to satisfy any federal, state and local tax withholding requirements. A Participant may pay the withholding obligation in cash, or, if the applicable Stock Incentive Agreement provides, a Participant may elect (a “Withholding Election”) to tender back to the Company the smallest number of whole shares of Stock which, when multiplied by the Fair Market Value of the shares of Stock determined as of the date of vesting or election (as applicable), is sufficient to satisfy the minimum required federal, state and local, if any, withholding taxes arising from vesting of the Restricted Stock Award or the making of the Section 83(b) election. A Participant may make a Withholding Election by executing and delivering to the Company a properly completed notice of Withholding Election prior to the date on which the amount of tax required to be withheld is determined in such manner as may be further prescribed by the Committee. Any Withholding Election made will be irrevocable; provided further, however, that the Committee may in its sole discretion disapprove and give no effect to any Withholding Election. Any failure of a Participant to satisfy his or her tax withholding obligations in the manner provided in this Section 3.6 shall result in a forfeiture of the shares of Stock as to which the tax withholding obligations apply and to any other shares of Stock still subject to the Restricted Stock Award.”

4.By deleting Subsection (a) of Section 7.1 in its entirety and substituting therefor the following:

“(a) The number of shares of Stock reserved for the award of Stock Incentives, the number of shares of Stock subject to outstanding Stock Incentives, the number of shares to be awarded under an Annual Option or Restricted Stock Award and the exercise price of each outstanding Annual Option and Option shall be proportionately adjusted for any increase or decrease in the number of shares of Stock resulting from a subdivision or combination of shares or the payment of a stock dividend (including, but not limited to, an extraordinary dividend) in shares of Stock to holders of outstanding shares of Stock or any other increase or decrease in the number of shares of Stock outstanding effected without receipt of consideration by the Company.”

The adoption of the Sixth Amendment is subject to the approval of the Company’s shareholders and if such approval is not obtained at the next regularly scheduled annual meeting of shareholders, the adoption of this Sixth Amendment shall become null and void and its provisions shall have no force or effect.

Except as specifically amended hereby, the Plan shall remain in full force and effect as prior to the adoption of this Sixth Amendment.

A - 3

IN WITNESS WHEREOF, the Company has caused this Sixth Amendment to be executed on the day and year first above written.

| RUBY TUESDAY, INC. |

| | |

| By: |  |

| | | |

| Title: | Chairman of the Board, |

| | Chief Executive Officer and President |

| ATTEST: | | |

| By: |  | | |

| Title: | Vice President, General Counsel | | |

| | and Secretary | | |

| | | | |

| | | | |

| [CORPORATE SEAL] | | |

A - 4

ANNEX B

RUBY TUESDAY, INC.

2006 EXECUTIVE INCENTIVE COMPENSATION PLAN

I. INTRODUCTION

1.1.Purpose. The purpose of this Plan is to enable Ruby Tuesday, Inc. (the “Company”) to recruit and retain highly qualified eligible executives, provide incentives to such individuals to attain the goals of the Company and its Affiliates (as defined below) and provide such executives with incentive compensation based on the performance of the Company consistent with the overall goal of enhancing shareholder value. The Plan is designed to ensure that the incentive awards paid hereunder to eligible participants are deductible under Section 162(m) of the Code (as defined below). This Plan is meant to supercede in its entirety the Ruby Tuesday, Inc. Chief Executive Officer’s Incentive Bonus Plan (the “Prior Plan”) effective as of the Company’s 2007 fiscal year; provided, however, that the adoption of this Plan shall not affect incentive compensation awards for the Company’s 2006 fiscal year previously established under the Prior Plan or, if the Plan, as amended and restated, is not approved by shareholders of the Company at the 2006 annual meeting of shareholders, the operation of the Prior Plan during the 2007 fiscal year or future fiscal years.

1.2.Description. This Plan is the means by which the Committee (as defined below) shall determine incentive awards and implement awards for participating employees hereunder.

II. DEFINITIONS

As used in this Plan, the following terms shall have the following meanings:

“Affiliate” means (a) an entity that directly or through one or more intermediaries is controlled by the Company, and (b) any entity in which the Company has a significant equity interest, as determined by the Company.

“Average Base Compensation” means the average annual base salary paid to a Participant over a Performance Period, exclusive of bonus and other incentive compensation, commissions, fringe benefits, employee benefits, expense allowances (nonaccountable or otherwise) and other nonrecurring forms of remuneration.

“Board” means the Board of Directors of the Company.

“Code” means the Internal Revenue Code of 1986, as amended.

“Committee” means the Compensation Committee of the Board, which shall consist of two or more members of the Board of Directors of the Company, each of whom shall be an “outside director” within the meaning of Section 162(m) of the Code; provided, however, that, if the Compensation Committee of the Board is not comprised solely of members who are “outside directors”, the term “Committee” shall mean the subcommittee of the Compensation Committee established by the Compensation Committee and comprised of two or more members of the Compensation Committee, each of whom shall be an “outside director” within the meaning of Section 162(m) of the Code.

“Eligible Employee” means each employee of the Company holding a position of President or above. No employees of an Affiliate shall be eligible for the Plan.

“Incentive Award” means an award payable with respect to a Performance Period determined in accordance with Article V hereof.

B - 1

“Participant” means any Eligible Employee for the Performance Period(s) as to which he or she is eligible to receive an Incentive Award, as designated by the Committee.

“Performance Measures” means the measurable performance objectives, if any, established by the Committee for a Performance Period that are to be achieved with respect to an Incentive Award granted to a Participant under the Plan. Performance Measures may be described in terms of (i) Company-wide objectives, (ii) objectives that are related to performance of the division, department or function within the Company or an Affiliate in which the Participant receiving the Incentive Award is employed or on which the Participant’s efforts have the most influence, (iii) performance solely in relation to objectives achieved during the Performance Period or as compared to past performance periods, and/or (iv) performance relative to the performance by a company or group of companies selected by the Committee with respect to one or more Performance Measures established by the Committee.

The Compensation Committee will establish Performance Measures under an objective formula or standard consisting of one or any combination of the following criteria:

| Cash flow | Retention of Company team members |

| Earnings before interest, taxes, | in general or in any specific category |

| depreciation, and amortization | or level of employment |

| (EBITDA) | Earnings before interest, depreciation |

| Earnings per share (EPS) | and amortization (EBIDA) |

| Net operating profit after taxes | Earnings before interest and taxes |

| (NOPAT) | (EBIT) |

| Return on net assets (RONA) | Earnings before interest, taxes, |

| Return on assets (ROA) | depreciation, and rent (EBITDAR) |

| Return on equity (ROE) | Gross profit |

| Return on invested capital (ROIC) | Company, franchise or system |

| Company, franchise or system | restaurant growth in number of new |

| comparable restaurant sales (SRS) | restaurants |

| Company, franchise or system traffic | Average restaurant volume growth |

| growth (Guest Count Growth) | Fixed charge coverage ratio |

| Market share or related strength of | Sales and earnings performance |

| brand measures related to consumer | Total shareholder return |

| perception, including but not limited to, | General and administrative costs (as a |

| brand relevance and guest satisfaction, | percentage of net sales or flat dollar |

| in each case based on objective data | amount) |

| such as guest or market surveys | Consolidated net income |

| Economic Value Added (dollar spread | Management of capital or operating |

| between return on capital and cost of | expenditures |

| capital) (EVA) | Appreciation of stock price |

| Gross revenues | Market Value Added (Company |

| Operating income | market value less total capital |

| Operating cash flow | employed) |

If the Committee determines that, as a result of a change in the business, operations, corporate structure or capital structure of the Company, or the manner in which the Company conducts its business, or any other events or circumstances, including, but not limited to a change in applicable law, the Performance Measures are no longer suitable, the Committee may in its discretion modify such Performance Measures or the related minimum acceptable level of achievement, in whole or in part, with respect to a period as the Committee deems appropriate and equitable. In such case, the Committee shall consider whether any modification of the Performance Measures or minimum

B - 2

acceptable level of achievement would cause the exemption under Code Section 162(m) to become unavailable.

“Performance Period” means, with respect to an Incentive Award, a period of time within which the Performance Measures relating to such Incentive Award are to be measured. The Performance Period, if any, will be established by the Committee pursuant to Section 5.1 at the time the Incentive Award is granted.

“Plan” means the Ruby Tuesday, Inc. 2006 Executive Incentive Compensation Plan, as in effect and as amended from time to time.

III. ADMINISTRATION

The administration and operation of the Plan shall be supervised by the Committee with respect to all matters. The Committee may delegate responsibility for the day-to-day administration and operation of the Plan to such employees of the Company as it shall designate from time-to-time. The Committee shall interpret and construe any and all provisions of the Plan and any determination made by the Committee under the Plan shall be final and conclusive. Neither the Board nor the Committee, nor any member of the Board, nor any employee of the Company shall be liable for any act, omission, interpretation, construction or determination made in connection with the Plan (other than acts of willful misconduct) and the members of the Board and the Committee and the employees of the Company shall be entitled to indemnification and reimbursement by the Company to the maximum extent permitted at law in respect of any claim, loss, damage or expense (including counsel’s fees) arising from their acts, omissions and conduct in their official capacity with respect to the Plan. The Plan shall be interpreted in view of the intention that any grant of compensation pursuant to the Plan is intended to qualify as performance-based compensation within the meaning of Code Section 162(m) and the regulations and interpretations promulgated thereunder.

IV. PARTICIPATION

The Committee shall designate those Eligible Employees who are to be Participant(s) for a Performance Period within ninety (90) days of the first day of the Performance Period. A Participant may be eligible to receive awards under the Plan for one or more Performance Periods, as determined by the Committee.

V. INCENTIVE AWARD