UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-3416

THE CALVERT FUND

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Six months ended March 31, 2012

Item 1. Report to Stockholders.

[Calvert Income Fund Semi-Annual Report to Shareholders]

[Calvert Short-Duration Income Fund Semi-Annual Report to Shareholders]

[Calvert Long-Term Income Fund Semi-Annual Report to Shareholders]

[Calvert Ultra-Short Income Fund Semi-Annual Report to Shareholders]

[Calvert Government Fund Semi-Annual Report to Shareholders]

[Calvert High-Yield Bond Fund Semi-Annual Report to Shareholders]

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account at Calvert, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login/Register to open an online account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

Dear Shareholder:

After a tumultuous fourth quarter of 2011, investors breathed a sigh of relief in early 2012. Headlines about Europe’s sovereign debt crisis had reached a fever pitch during the final months of 2011 and investors worldwide held their breath, concerned about the potential fallout on markets near and far.

However, long-term refinancing operations by the European Central Bank that enabled the region’s banks to borrow at very low interest rates as well as progress on a Greek bail-out seemed to pull the eurozone back from the brink of collapse. As a result, the broad international markets of the MSCI EAFE Index improved, returning 14.73% for the reporting period.

Overall, key U.S. economic indicators such as the unemployment rate, manufacturing data, housing market fundamentals, and consumer confidence showed gradual improvement. But consumer spending remained weak, and gasoline prices topping $4.00 a gallon in some parts of the country by March did not help. As a result, economic growth continued at a snail’s pace.

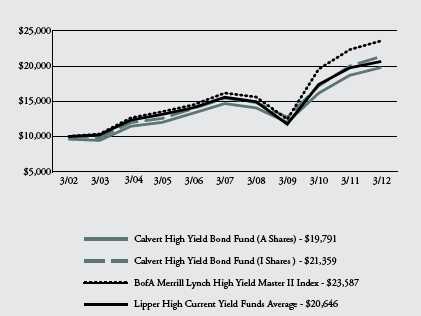

Investment-grade non-Treasury bonds, as measured by the Barclays U.S. Credit Index, fared well with a powerful rally in February and a return of 3.77% for the six-month reporting period. That’s better than the 0.02% return for three-month Treasury bills but slightly less than the 3.91% return of the Barclays Municipal Bond Index. However, both municipal and non-Treasury investment-grade bonds earned significantly less than the 11.65% return for the BofA Merrill Lynch High Yield Master II Index. In comparison, stocks in the Standard & Poor’s 500 Index gained 25.89% for the period.

Strengthening U.S. Banking System

With all the talk of crisis in the European banking system, I think it’s worth noting the improvements in the health of the banking system here in the United States. While it’s difficult to say that U.S. banks as a whole are completely out of the woods, notable strides have been made over the last year.

In 2011, assets of “problem institutions” decreased 18% from a 2010 high to $319 billion, according to Federal Deposit Insurance Corporation (FDIC) data.1 The FDIC uses a composite rating to identify problem institutions with financial, operational, or managerial weaknesses that threaten their continued financial viability. The number of failed institutions fell 70% in 2011 as well.

The quality of the debt that FDIC-insured commercial banks and savings institutions hold is improving as well. Net charge-offs for bad loans were down 40% from the prior year. In fact, the fourth quarter of 2011 was the sixth consecutive quarter with a year-over-year decline in charge-offs and the lowest quarterly level for charge-offs since the beginning of 2008. Also, the amount of loans that were more than 90 days past due declined 15% since the end of 2010.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 4

Other Calvert News

As you may know, we launched Calvert Equity Income Fund2 last fall to offer the potential for attractive income generation and competitive total return by investing in a portfolio of large-cap, dividend-paying stocks that we believe to be undervalued. Calvert Large Cap Value Fund co-portfolio managers James McGlynn, CFA and Yvonne Bishop, CFA are managing the new Fund as well. Both Funds feature Calvert’s SAGE strategy, which involves Calvert actively engaging with companies held in the Fund to engender positive change.

A Variety of Ways to Stay Informed

We are cautiously optimistic about the continued economic recovery, but much uncertainty and the potential for renewed volatility remains. That’s why we always feel it’s best to maintain a well-diversified mix of U.S. and international stocks, bonds, and cash appropriate for your goals and risk tolerance. And of course, we suggest you consult your financial advisor if you have questions or concerns.

We also invite you to visit our website, www.calvert.com, for fund information, portfolio updates, and commentary from Calvert professionals. And now you can get the same information on the go with Calvert’s new iPhone® app, which is available for free at iTunes.

As always, we thank you for investing with Calvert.

Barbara J. Krumsiek

President and CEO

Calvert Investments, Inc.

May 2012

1. FDIC, Quarterly Banking Profile Fourth Quarter 2011, www.fdic.gov/qbp/index.asp. Net charge-offs are the total uncollectible loans removed from balance sheets, less amounts recovered on assets previously recorded as a charge-off.

2. Investment in mutual funds involves risk, including possible loss of principal invested. For more information on any Calvert fund, please contact Calvert at 800.368.2748 for a free summary prospectus and/or prospectus. An investor should consider the investment objectives, risks, charges, and expenses of an investment carefully before investing. The summary prospectus and prospectus contain this and other information. Read them carefully before you invest or send money. Calvert mutual funds are underwritten and distributed by Calvert Investment Distributors, Inc., member FINRA and subsidiary of Calvert Investments, Inc.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 5

Performance

For the six-month period ended March 31, 2012, Calvert Income Fund (Class A shares at NAV) returned 2.18%. Its benchmark index, the Barclays U.S. Credit Index, returned 3.77% for the same period. The Fund’s underperformance was primarily due to the weaker performance of some out-of-index holdings. Our duration strategy helped performance, especially during the last month of the reporting period.

Market Review

The six-month reporting period began with great angst as financial markets struggled to recover from disruptions, including the

| |

CALVERT INCOME FUND

MARCH 31, 2012 |

| |

| INVESTMENT PERFORMANCE | | | |

| (total return at NAV*) | | | | |

| | 6 Months | | 12 Months | |

| | ended | | ended | |

| | 3/31/12 | # | 3/31/12 | |

| Class A | 2.18 | % | 2.16 | % |

| Class B | 1.85 | % | 1.35 | % |

| Class C | 1.82 | % | 1.44 | % |

| Class I | 2.51 | % | 2.86 | % |

| Class R | 2.12 | % | 2.04 | % |

| Class Y | 2.41 | % | 2.61 | % |

| |

| Barclays U.S. | | | | |

| Credit Index | 3.77 | % | 9.58 | % |

| |

| Lipper BBB-Rated Corp | | | |

| Debt Funds Average | 4.41 | % | 8.14 | % |

| |

| SEC YIELDS | | | | |

| | 30 DAYS ENDED | |

| | 3/31/12 | | 9/30/11 | |

| Class A | 2.65 | % | 3.09 | % |

| Class B | 2.03 | % | 2.34 | % |

| Class C | 2.07 | % | 2.51 | % |

| Class I | 3.46 | % | 3.93 | % |

| Class R | 2.69 | % | 3.00 | % |

| Class Y | 3.27 | % | 3.61 | % |

* Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 3.75% front-end sales charge or any deferred sales charge.

# The investment performance/return at NAV has been calculated in accordance with Generally Accepted Accounting Principles (GAAP) and includes certain adjustments. As a result of these adjustments, the investment return may be higher than the shareholder received during the reporting period. See Note E - Other in Notes to Financial Statements.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 6

eurozone sovereign debt crisis; the credit rating downgrade of U.S. government debt by Standard & Poor’s, which led to a sharp global selloff in “risk” assets, including U.S. corporate bonds; and reduced expectations for global economic growth. Concerted and major action by the world’s largest central banks helped stabilize markets, and continued, gradual improvement in U.S. economic data helped the market recover. By the beginning of October, equity and corporate bond markets had begun a rally that continued through the end of the reporting period.

Since the U.S. mortgage crisis began in earnest in late 2007, a major catalyst for market rallies has been the anticipated and actual moves of the world’s major central banks. The central banks did not disappoint last summer. The earliest response to the market dislocations in the summer of 2011 came from the U.S. Federal Reserve Bank (Fed), which extended the expected timeframe for its near-zero interest rate policy through late 2014. The Fed took additional actions to hold down the yields on Treasuries, encouraging investors to take more risk.

PORTFOLIO STATISTICS

MARCH 31, 2012 |

| |

| | % of Total | |

| ECONOMIC SECTORS | Investments | |

| Asset Backed Securities | 0.4 | % |

| Basic Materials | 4.6 | % |

| Communications | 6.9 | % |

| Consumer, Cyclical | 3.9 | % |

| Consumer, Non-cyclical | 6.3 | % |

| Diversified | 0.2 | % |

| Energy | 5.6 | % |

| Financials† | 43.1 | % |

| Government | 11.3 | % |

| Industrials | 6.8 | % |

| Mortgage Securities | 2.6 | % |

| Technology | 1.4 | % |

| Time Deposit | 4.8 | % |

| Utilities | 2.1 | % |

| Total | 100 | % |

| |

| † Includes government-guaranteed issues and REITs. | |

The Fed’s actions were a salve, but investors remained worried about the prospects for a disorderly Greek default, and the possibility that Italy and Spain might have difficulty in the debt markets. The euro-area banking system started to freeze. U.S. money-market funds stopped short-term lending to most euro-area banks. However, major central banks agreed to reopen currency swap lines and funding markets began to defrost. Investors’ concerns persisted until early December when the European Central Bank (ECB) stepped in with a substantial package of easing provisions that included three-year loans to banks, easier loan collateral rules, and a rate cut of 25 basis points (a basis point is 0.01 percentage points). After that, Spain and Italy were able to roll their maturing debt at much lower interest rates, Greece negotiated a debt restructuring and was approved for a new bailout, and central banks in Britain, Japan, and China eased monetary policy further.

The concerted action of central banks, especially the ECB, stimulated a strong rally in riskier assets such as equities and corporate bonds. Volatility in these markets dropped sharply and liquidity improved. Yields on safe-haven government bonds rose. Over the course of the reporting period, the yield on the benchmark 10-year Treasury note increased by 20 basis points to 2.22%. The trend was supported by a string of positive U.S. economic reports, especially regarding the labor market. As of March 2012, the U.S.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 7

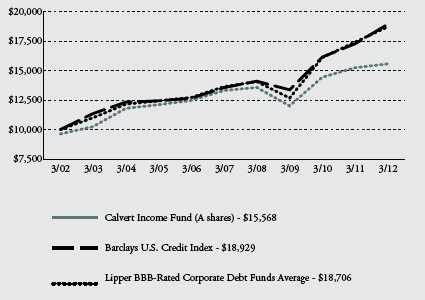

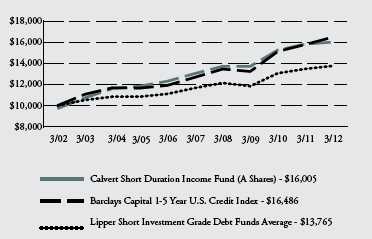

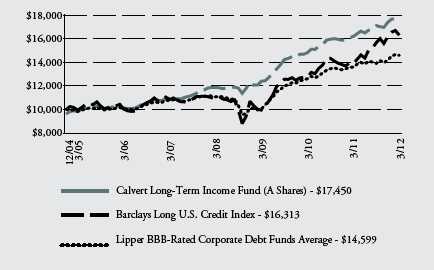

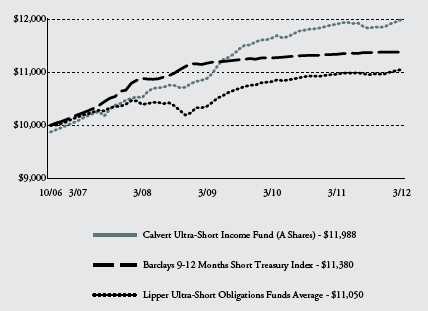

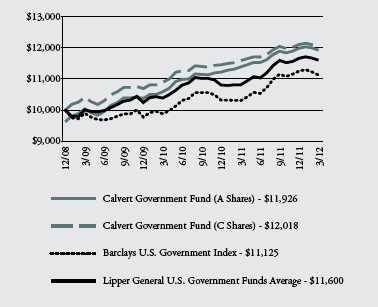

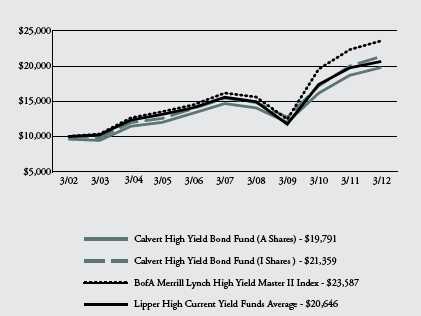

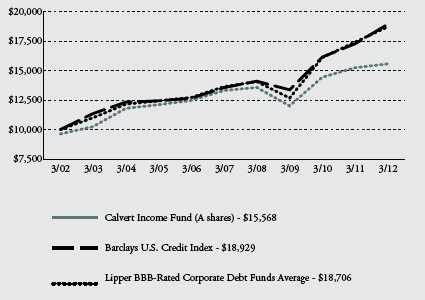

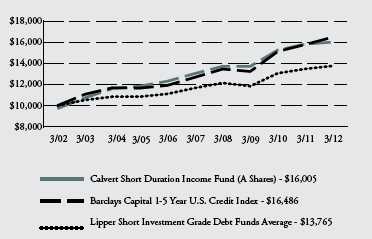

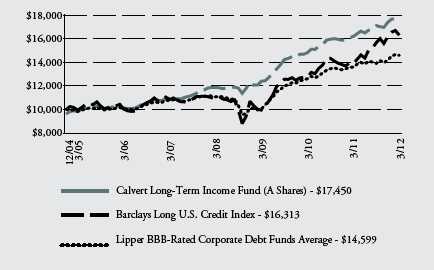

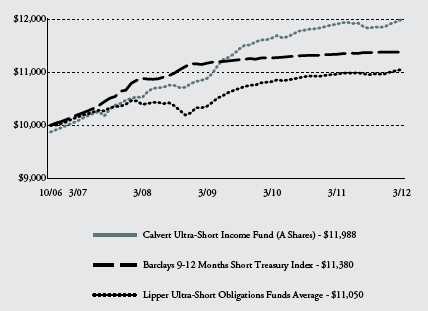

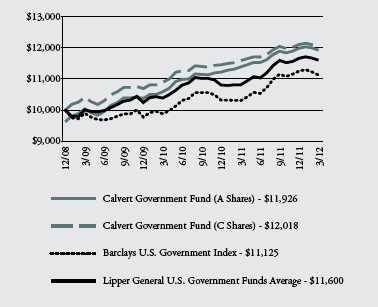

Growth of $10,000

The graph below shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal year periods. The results shown are for Class A shares and reflect the deduction of the maximum front-end sales charge of 3.75%, and assume the reinvestment of dividends. The result is compared with benchmarks that include a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. All performance data reflects fee waivers and/or expense limitations, if any are in effect; in their absence performance would be lower. See Note B in Notes to Financial Statements. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.25%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s operating expenses.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 8

unemployment rate had fallen from 9% to 8.2%. The U.S. housing market remained weak, but there were signs of a bottom. The inflation rate rose, but expectations for inflation remain constrained. Perhaps hoping to offset pressure from opponents of its unprecedented easy monetary policy, the Fed announced a 2% inflation-rate target. Money-market rates remain very low, pinned down by Fed policy.

Portfolio Strategy

During the reporting period, we repositioned the Fund to reflect a decrease in demand for thinly traded securities. We will continue to actively reduce our exposure to these types of investments and reallocate the proceeds to more liquid index-type names. This will help increase Fund liquidity as well as selectively increase our corporate credit exposure. We will continue to include out-of-index securities in the Fund when we believe they offer compelling relative value, but the size of these holdings will be smaller than it has been in the past.

We lengthened the Fund’s duration during the reporting period. Duration is a measure of a portfolio’s sensitivity to changes in interest rates. The longer the duration, the greater the change in price relative to interest rate movements. At the start of the reporting period, the Fund’s duration was 5.07 years compared to the benchmark’s 6.67 years. By the end of the period, we had extended duration to roughly 5.65 years, while the index’s duration stood at 6.74 years. Ten-year Treasury rates rose during the reporting period from 1.92% to 2.22%. The Fund’s duration, which remained shorter than that of the index,

CALVERT INCOME FUND

MARCH 31, 2012 |

| |

| AVERAGE ANNUAL TOTAL RETURNS | |

| CLASS A SHARES | (with max load) | |

| One year | -1.64 | % |

| Five year | 2.40 | % |

| Ten year | 4.53 | % |

| | |

| CLASS B SHARES | (with max load) | |

| One year | -2.65 | % |

| Five year | 2.32 | % |

| Ten year | 4.10 | % |

| | |

| CLASS C SHARES | (with max load) | |

| One year | 0.44 | % |

| Five year | 2.47 | % |

| Ten year | 4.19 | % |

| | |

| CLASS I SHARES | | |

| One year | 2.86 | % |

| Five year | 3.88 | % |

| Ten year | 5.61 | % |

| | |

| CLASS R SHARES* | | |

| One year | 2.04 | % |

| Five year | 2.94 | % |

| Ten year | 4.79 | % |

| | |

| CLASS Y SHARES** | | |

| One year | 2.61 | % |

| Five year | 3.53 | % |

| Ten year | 5.10 | % |

* Performance results for Class R shares prior to October 31, 2006 reflect the performance of Class A shares at net asset value (NAV). Actual Class R share performance would have been lower than Class A share performance because of higher Rule 12b-1 fees and other class-specific expenses that apply to the Class R shares.

** Performance for Class Y Shares prior to February 29, 2008 reflects the performance of Class A shares at net asset value (NAV). Actual Class Y share performance would have been different.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 9

helped offset some of the negative consequences of higher interest rates. The Fund uses Treasury futures to hedge its interest rate position.

The Fund’s exposure to high-yield bonds, which are not included in the index, helped performance during the period. The BofA Merrill Lynch High Yield Master II Index, which measures the performance of high-yield bonds, returned 11.65% during the six-month reporting period. At the beginning of the period, approximately 12.64% of the Fund was invested in high-yield bonds. (This percentage does not include non-rated bonds.)

Outlook

We started 2012 with a cautiously optimistic outlook, and we retain that view. Economic and financial challenges remain largely unchanged. Euro-area troubles have receded somewhat, but many of the underlying issues remain unresolved. The U.S. economy is growing at a better pace, but remains encumbered by the baggage of the financial crisis, including a weak housing market, heavier regulation, and bitterly divided political leadership in an election year. Prospects for healthy global economic growth are dimmer.

In our opinion, corporate bonds have moved from extremely undervalued relative to Treasuries to being more fairly valued. In our taxable bond Funds, we remain poised to take advantage of pricing anomalies created by rough markets, and plan to use windows of liquidity to sell positions that we believe have become fully valued.

May 2012

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 10

SHAREHOLDER EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) and redemption fees and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2011 to March 31, 2012).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 11

| | BEGINNING | ENDING ACCOUNT | EXPENSES PAID |

| | ACCOUNT VALUE | VALUE | DURING PERIOD* |

| | 10/1/11 | 3/31/12 | 10/1/11 - 3/31/12 |

| CLASS A | | | |

| Actual | $1,000.00 | $997.80 | $7.00 |

| Hypothetical | $1,000.00 | $1,017.99 | $7.07 |

| (5% return per | | | |

| year before expenses) | | | |

| | | |

| CLASS B | | | |

| Actual | $1,000.00 | $994.40 | $10.62 |

| Hypothetical | $1,000.00 | $1,014.35 | $10.73 |

| (5% return per | | | |

| year before expenses) | | | |

| | | |

| CLASS C | | | |

| Actual | $1,000.00 | $994.20 | $10.38 |

| Hypothetical | $1,000.00 | $1,014.59 | $10.49 |

| (5% return per | | | |

| year before expenses) | | | |

| | | |

| CLASS I | | | |

| Actual | $1,000.00 | $1,001.00 | $3.56 |

| Hypothetical | $1,000.00 | $1,021.44 | $3.60 |

| (5% return per | | | |

| year before expenses) | | | |

| |

| CLASS R | | | |

| Actual | $1,000.00 | $997.30 | $7.34 |

| Hypothetical | $1,000.00 | $1,017.65 | $7.41 |

| (5% return per | | | |

| year before expenses) | | | |

| |

| CLASS Y | | | |

| Actual | $1,000.00 | $1,000.30 | $4.50 |

| Hypothetical | $1,000.00 | $1,020.50 | $4.55 |

| (5% return per | | | |

| year before expenses) | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.40%, 2.13%, 2.08%, 0.71%, 1.47%, and 0.90% for Class A, Class B, Class C, Class I, Class R, and Class Y, respectively, multiplied by the average account value over the period, mutliplied by 183/366 (to reflect the one-half year period).

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 12

| | | | |

| STATEMENT OF NET ASSETS |

| MARCH 31, 2012 |

| |

| | | PRINCIPAL | | |

| ASSET-BACKED SECURITIES - 0.4% | | AMOUNT | | VALUE |

| Capital Auto Receivables Asset Trust, 5.76%, 2/18/14 (e) | $ | 665,211 | $ | 667,283 |

| DT Auto Owner Trust, 1.40%, 8/15/14 (e) | | 1,154,943 | | 1,155,237 |

| Franklin Auto Trust, 7.16%, 5/20/16 (e) | | 2,870,491 | | 2,915,967 |

| Santander Drive Auto Receivables Trust, 1.01%, 7/15/13 (e) | | 1,881,209 | | 1,882,345 |

| |

| Total Asset-Backed Securities (Cost $6,715,800) | | | | 6,620,832 |

| |

| COLLATERALIZED MORTGAGE-BACKED | | | | |

| OBLIGATIONS (PRIVATELY ORIGINATED) - 0.3% | | | | |

| Banc of America Mortgage Securities, Inc., 0.301%, 1/25/34 (r) | | 47,928,598 | | 336,411 |

| Impac CMB Trust, 0.762%, 4/25/35 (r) | | 4,804,266 | | 3,767,664 |

| |

| Total Collateralized Mortgage-Backed Obligations (Privately | | | | |

| Originated) (Cost $4,928,812) | | | | 4,104,075 |

| |

| COMMERCIAL MORTGAGE-BACKED SECURITIES - 0.5% | | |

| Banc of America Merrill Lynch Commercial Mortgage, Inc., | | | | |

| 5.118%, 7/11/43 | | 813,494 | | 814,152 |

| Commercial Mortgage Asset Trust, 7.35%, 1/17/32 (r) | | 3,000,000 | | 3,225,999 |

| Credit Suisse First Boston Mortgage Securities Corp., 5.603%, 7/15/35 | | 704,834 | | 705,368 |

| GE Capital Commercial Mortgage Corp., 4.996%, 12/10/37 | | 2,537,869 | | 2,574,686 |

| GS Mortgage Securities Corp. II, 4.295%, 1/10/40 | | 169,863 | | 170,027 |

| |

| Total Commercial Mortgage-Backed Securities (Cost $7,662,573) | | | | 7,490,232 |

| |

| CORPORATE BONDS - 81.9% | | | | |

| Affiliated Computer Services, Inc., 5.20%, 6/1/15 | | 7,000,000 | | 7,573,405 |

| Alcoa, Inc., 5.40%, 4/15/21 | | 5,150,000 | | 5,321,577 |

| Alliance Mortgage Investments, Inc.: | | | | |

| 12.61%, 6/1/10 (b)(r)(x)* | | 3,077,944 | | — |

| 15.36%, 12/1/10 (b)(r)(x)* | | 17,718,398 | | — |

| Ally Financial, Inc., 6.625%, 5/15/12 | | 4,000,000 | | 4,024,000 |

| America Movil SAB de CV, 2.375%, 9/8/16 | | 2,000,000 | | 2,024,650 |

| American Express Credit Corp.: | | | | |

| 2.80%, 9/19/16 | | 4,500,000 | | 4,623,304 |

| 2.375%, 3/24/17 | | 8,000,000 | | 8,012,304 |

| American International Group, Inc.: | | | | |

| 3.00%, 3/20/15 | | 2,000,000 | | 2,013,774 |

| 5.05%, 10/1/15 | | 4,350,000 | | 4,633,946 |

| 4.875%, 9/15/16 | | 3,000,000 | | 3,173,280 |

| 5.60%, 10/18/16 | | 3,000,000 | | 3,248,874 |

| 3.80%, 3/22/17 | | 2,750,000 | | 2,784,529 |

| 5.85%, 1/16/18 | | 3,000,000 | | 3,262,518 |

| American Tower Corp.: | | | | |

| 5.90%, 11/1/21 | | 6,000,000 | | 6,613,920 |

| 4.70%, 3/15/22 | | 2,000,000 | | 2,016,074 |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 13

| | | | |

| | | PRINCIPAL | | |

| CORPORATE BONDS - CONT’D | | AMOUNT | | VALUE |

| AmerisourceBergen Corp., 3.50%, 11/15/21 | $ | 1,000,000 | $ | 1,020,207 |

| Amgen, Inc.: | | | | |

| 2.50%, 11/15/16 | | 2,000,000 | | 2,055,250 |

| 3.875%, 11/15/21 | | 1,575,000 | | 1,612,718 |

| 5.15%, 11/15/41 | | 1,000,000 | | 1,004,031 |

| Anadarko Petroleum Corp., 6.375%, 9/15/17 | | 4,500,000 | | 5,346,976 |

| Anheuser-Busch InBev Worldwide, Inc., 1.204%, 3/26/13 (r) | | 5,000,000 | | 5,028,735 |

| ANZ National International Ltd., 1.474%, 12/20/13 (e)(r) | | 8,000,000 | | 7,962,168 |

| APL Ltd., 8.00%, 1/15/24 (b) | | 21,057,000 | | 12,844,770 |

| ArcelorMittal: | | | | |

| 4.50%, 2/25/17 | | 8,350,000 | | 8,374,432 |

| 6.75%, 3/1/41 | | 2,940,000 | | 2,755,127 |

| Aristotle Holding, Inc.: | | | | |

| 2.75%, 11/21/14 (e) | | 1,330,000 | | 1,366,526 |

| 2.65%, 2/15/17 (e) | | 1,500,000 | | 1,516,952 |

| 3.90%, 2/15/22 (e) | | 1,500,000 | | 1,516,119 |

| Asciano Finance Ltd., 5.00%, 4/7/18 (e) | | 3,500,000 | | 3,615,031 |

| AT&T, Inc.: | | | | |

| 2.95%, 5/15/16 | | 3,000,000 | | 3,170,178 |

| 1.60%, 2/15/17 | | 3,000,000 | | 2,982,972 |

| 3.875%, 8/15/21 | | 13,090,000 | | 13,845,319 |

| 3.00%, 2/15/22 | | 2,000,000 | | 1,960,030 |

| 5.55%, 8/15/41 | | 1,000,000 | | 1,108,423 |

| Atlantic Mutual Insurance Co., 8.15%, 2/15/28 (b)(e)(p)* | | 53,561,000 | | — |

| Bank of America Corp.: | | | | |

| 2.131%, 7/11/14 (r) | | 3,000,000 | | 2,938,173 |

| 4.50%, 4/1/15 | | 1,300,000 | | 1,346,493 |

| 3.75%, 7/12/16 | | 2,000,000 | | 2,009,966 |

| 5.625%, 10/14/16 | | 4,650,000 | | 4,943,820 |

| 3.875%, 3/22/17 | | 2,800,000 | | 2,815,442 |

| 5.00%, 5/13/21 | | 9,500,000 | | 9,514,658 |

| 5.70%, 1/24/22 | | 6,500,000 | | 6,880,796 |

| 5.875%, 2/7/42 | | 2,000,000 | | 1,989,220 |

| Bank of America NA: | | | | |

| 0.754%, 6/15/16 (r) | | 4,000,000 | | 3,548,724 |

| 5.30%, 3/15/17 | | 6,850,000 | | 7,148,454 |

| 6.10%, 6/15/17 | | 5,000,000 | | 5,342,325 |

| Bank of New York Mellon Corp.: | | | | |

| 1.70%, 11/24/14 | | 5,000,000 | | 5,078,260 |

| 2.40%, 1/17/17 | | 2,250,000 | | 2,303,258 |

| Bank of Nova Scotia: | | | | |

| 1.25%, 11/7/14 (e) | | 5,000,000 | | 5,040,245 |

| 2.55%, 1/12/17 | | 2,350,000 | | 2,409,377 |

| 1.95%, 1/30/17 (e) | | 2,150,000 | | 2,173,605 |

| Barrick Gold Corp.: | | | | |

| 3.85%, 4/1/22 (e) | | 4,000,000 | | 3,977,760 |

| 5.25%, 4/1/42 (e) | | 900,000 | | 887,121 |

| BHP Billiton Finance USA Ltd.: | | | | |

| 1.875%, 11/21/16 | | 5,000,000 | | 5,045,010 |

| 1.625%, 2/24/17 | | 3,000,000 | | 2,984,997 |

| 3.25%, 11/21/21 | | 650,000 | | 655,994 |

| 4.125%, 2/24/42 | | 3,000,000 | | 2,819,280 |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 14

| | | | | |

| | | | PRINCIPAL | | |

| CORPORATE BONDS - CONT’D | | | AMOUNT | | VALUE |

| BNSF Funding Trust I, 6.613% to 1/15/26, floating rate thereafter | | | | | |

| to 12/15/55(r) | | $ | 37,001,000 | $ | 38,481,040 |

| Boston Properties LP, 3.70%, 11/15/18 | | | 2,400,000 | | 2,482,253 |

| Calpine Corp. Escrow (b)* | | | 375,000 | | — |

| Cantor Fitzgerald LP: | | | | | |

| 6.375%, 6/26/15 (e) | | | 2,000,000 | | 2,024,050 |

| 7.875%, 10/15/19 (e) | | | 17,572,000 | | 17,285,805 |

| Capital One Financial Corp.: | | | | | |

| 2.15%, 3/23/15 | | | 1,200,000 | | 1,201,853 |

| 4.75%, 7/15/21 | | | 6,230,000 | | 6,555,343 |

| Cemex Espana Luxembourg, 9.875%, 4/30/19 (e) | | | 16,376,000 | | 15,720,960 |

| Cemex SAB de CV, 5.47%, 9/30/15 (e)(r) | | | 1,500,000 | | 1,353,750 |

| Charter One Bank, 6.375%, 5/15/12 | | | 10,000,000 | | 10,041,690 |

| CIT Group, Inc.: | | | | | |

| 5.25%, 4/1/14 (e) | | | 3,125,000 | | 3,191,406 |

| 5.25%, 3/15/18 | | | 1,550,000 | | 1,581,000 |

| Citigroup, Inc.: | | | | | |

| 2.51%, 8/13/13 (r) | | | 11,000,000 | | 11,032,736 |

| 0.60%, 3/7/14 (r) | | | 5,020,000 | | 4,854,114 |

| 4.75%, 5/19/15 | | | 3,000,000 | | 3,158,514 |

| 3.953%, 6/15/16 | | | 7,400,000 | | 7,604,640 |

| 4.45%, 1/10/17 | | | 2,000,000 | | 2,095,012 |

| CNPC HK Overseas Capital Ltd., 3.125%, 4/28/16 (e) | | | 3,250,000 | | 3,339,983 |

| Colgate-Palmolive Co., 2.45%, 11/15/21 | | | 2,000,000 | | 1,971,574 |

| Cooperatieve Centrale Raiffeisen-Boerenleenbank BA, 3.375%, 1/19/17 | | | 2,450,000 | | 2,504,731 |

| Corning, Inc., 4.75%, 3/15/42 | | | 6,000,000 | | 5,810,328 |

| Crown Castle Towers LLC: | | | | | |

| 4.174%, 8/15/37 (e) | | | 2,825,000 | | 2,914,903 |

| 4.883%, 8/15/40 (e) | | | 4,558,000 | | 4,689,799 |

| CVS Pass-Through Trust: | | | | | |

| 5.789%, 1/10/26 (e) | | | 3,738,161 | | 4,027,869 |

| 5.88%, 1/10/28 | | | 223,880 | | 237,931 |

| 6.036%, 12/10/28 | | | 7,779,917 | | 8,529,823 |

| 6.943%, 1/10/30 | | | 6,671,272 | | 7,677,166 |

| 7.507%, 1/10/32 (e) | | | 3,259,352 | | 3,904,019 |

| Daimler Finance North America LLC, 2.625%, 9/15/16 (e) | | | 1,800,000 | | 1,857,568 |

| DDR Corp., 4.75%, 4/15/18 | | | 4,700,000 | | 4,868,815 |

| Delta Air Lines Pass Through Trust, 6.75%, 5/23/17 | | | 2,500,000 | | 2,406,250 |

| Deutsche Telekom International Finance BV, 4.875%, 3/6/42 (e) | | | 3,000,000 | | 2,834,064 |

| Discover Bank, 7.00%, 4/15/20 | | | 2,500,000 | | 2,868,640 |

| Discover Financial Services: | | | | | |

| 6.45%, 6/12/17 | | | 1,375,000 | | 1,536,670 |

| 10.25%, 7/15/19 | | | 7,104,000 | | 9,326,131 |

| Dow Chemical Co.: | | | | | |

| 4.125%, 11/15/21 | | | 2,500,000 | | 2,571,863 |

| 5.25%, 11/15/41 | | | 3,350,000 | | 3,460,265 |

| Dr Pepper Snapple Group, Inc., 3.20%, 11/15/21 | | | 2,555,000 | | 2,530,298 |

| Ecolab, Inc.: | | | | | |

| 4.35%, 12/8/21 | | | 1,560,000 | | 1,653,781 |

| 5.50%, 12/8/41 | | | 1,000,000 | | 1,084,508 |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 15

| | | | |

| | | PRINCIPAL | | |

| CORPORATE BONDS - CONT’D | | AMOUNT | | VALUE |

| El Paso Corp., 7.875%, 6/15/12 | $ | 3,000,000 | $ | 3,029,955 |

| Enterprise Products Operating LLC, 7.034% to 1/15/18, floating rate | | | | |

| thereafter to 1/15/68 (r) | | 22,975,000 | | 24,698,125 |

| ERP Operating LP, 4.625%, 12/15/21 | | 5,450,000 | | 5,738,507 |

| FBG Finance Ltd., 5.125%, 6/15/15 (e) | | 4,000,000 | | 4,423,680 |

| FIA Card Services NA, 7.125%, 11/15/12 | | 4,000,000 | | 4,100,184 |

| Fifth Third Bank, 0.605%, 5/17/13 (r) | | 5,000,000 | | 4,956,605 |

| First Niagara Financial Group, Inc., 6.75%, 3/19/20 | | 3,000,000 | | 3,285,900 |

| First Republic Bank, 7.75%, 9/15/12 | | 500 | | 504 |

| FMG Resources August 2006 Pty. Ltd.: | | | | |

| 7.00%, 11/1/15 (e) | | 3,500,000 | | 3,570,000 |

| 6.875%, 4/1/22 (e) | | 4,550,000 | | 4,436,250 |

| Ford Motor Credit Co. LLC: | | | | |

| 7.50%, 8/1/12 | | 6,129,000 | | 6,220,432 |

| 3.875%, 1/15/15 | | 4,400,000 | | 4,442,953 |

| 4.25%, 2/3/17 | | 5,000,000 | | 5,053,740 |

| France Telecom SA, 5.375%, 1/13/42 | | 4,000,000 | | 4,228,800 |

| Freeport-McMoRan Copper & Gold, Inc., 3.55%, 3/1/22 | | 4,850,000 | | 4,658,027 |

| FUEL Trust: | | | | |

| 4.207%, 4/15/16 (e) | | 7,295,000 | | 7,486,691 |

| 3.984%, 12/15/22 (e) | | 7,450,000 | | 7,558,621 |

| General Electric Capital Corp.: | | | | |

| 0.594%, 6/20/13 (r) | | 7,000,000 | | 6,925,618 |

| 3.35%, 10/17/16 | | 2,900,000 | | 3,076,462 |

| 2.90%, 1/9/17 | | 4,000,000 | | 4,149,432 |

| 5.40%, 2/15/17 | | 3,000,000 | | 3,435,669 |

| 5.625%, 9/15/17 | | 1,850,000 | | 2,153,742 |

| 5.625%, 5/1/18 | | 5,000,000 | | 5,795,435 |

| 4.65%, 10/17/21 | | 9,900,000 | | 10,536,768 |

| General Motors Corp. Escrow (b)* | | 5,000,000 | | 37,500 |

| General Motors Corp. Escrow (b)* | | 10,000,000 | | 75,000 |

| General Motors Corp. Escrow (b)* | | 5,000,000 | | 37,500 |

| General Motors Corp. Escrow (b)* | | 7,150,000 | | 53,625 |

| General Motors Corp. Escrow (b)* | | 2,950,000 | | 22,125 |

| Georgia-Pacific LLC, 8.25%, 5/1/16 (e) | | 2,000,000 | | 2,205,896 |

| Gilead Sciences, Inc.: | | | | |

| 4.40%, 12/1/21 | | 3,650,000 | | 3,831,314 |

| 5.65%, 12/1/41 | | 1,000,000 | | 1,068,203 |

| Glitnir Banki HF: | | | | |

| 3.046%, 4/20/10 (e)(r)(y)* | | 42,295,000 | | 11,419,650 |

| 3.226%, 1/21/11 (e)(r)(y)* | | 32,920,000 | | 8,888,400 |

| 6.375%, 9/25/12 (e)(y)* | | 600,000 | | 162,000 |

| 6.693% to 6/15/11, floating rate thereafter to 6/15/16 (e)(r)(y)* | | 8,400,000 | | 840 |

| Golden State Petroleum Transport Corp., 8.04%, 2/1/19 | | 9,259,062 | | 8,018,348 |

| Goldman Sachs Group, Inc.: | | | | |

| 6.15%, 4/1/18 | | 10,500,000 | | 11,325,615 |

| 5.375%, 3/15/20 | | 1,800,000 | | 1,829,839 |

| 6.00%, 6/15/20 | | 5,000,000 | | 5,261,035 |

| 5.75%, 1/24/22 | | 7,550,000 | | 7,766,987 |

| Great River Energy, 5.829%, 7/1/17 (e) | | 20,516,513 | | 22,257,749 |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 16

| | | | |

| | | PRINCIPAL | | |

| CORPORATE BONDS - CONT’D | | AMOUNT | | VALUE |

| Harley-Davidson Funding Corp., 5.25%, 12/15/12 (e) | $ | 3,000,000 | $ | 3,078,987 |

| Hartford Financial Services Group, Inc., 6.10%, 10/1/41 | | 4,000,000 | | 3,871,028 |

| Health Care REIT, Inc., 5.25%, 1/15/22 | | 2,000,000 | | 2,092,018 |

| Hewlett-Packard Co.: | | | | |

| 0.891%, 5/30/14 (r) | | 6,950,000 | | 6,869,568 |

| 4.30%, 6/1/21 | | 1,500,000 | | 1,529,769 |

| HSBC Bank plc, 1.367%, 1/17/14 (e)(r) | | 4,000,000 | | 4,010,060 |

| HSBC Holdings plc, 4.00%, 3/30/22 | | 2,000,000 | | 1,982,440 |

| International Business Machines Corp.: | | | | |

| 1.25%, 2/6/17 | | 5,000,000 | | 4,959,900 |

| 2.90%, 11/1/21 | | 3,100,000 | | 3,144,624 |

| International Lease Finance Corp., 5.875%, 4/1/19 | | 6,800,000 | | 6,571,887 |

| Interpublic Group of Cos, Inc., 10.00%, 7/15/17 | | 2,575,000 | | 2,948,375 |

| Jefferies Group, Inc., 5.125%, 4/13/18 | | 2,000,000 | | 1,940,000 |

| JET Equipment Trust, 7.63%, 8/15/12 (b)(e)(w)* | | 109,297 | | 109 |

| John Deere Capital Corp.: | | | | |

| 1.25%, 12/2/14 | | 1,000,000 | | 1,012,935 |

| 2.00%, 1/13/17 | | 1,500,000 | | 1,530,089 |

| Jones Group, Inc., 6.875%, 3/15/19 | | 2,000,000 | | 1,957,500 |

| JPMorgan Chase & Co.: | | | | |

| 1.599%, 9/22/15 (r) | | 4,000,000 | | 3,996,728 |

| 4.40%, 7/22/20 | | 3,000,000 | | 3,112,239 |

| 4.35%, 8/15/21 | | 11,600,000 | | 11,852,114 |

| 4.50%, 1/24/22 | | 9,600,000 | | 9,987,254 |

| JPMorgan Chase Capital XXV, 6.80%, 10/1/37 | | 5,900,000 | | 5,933,040 |

| Kaupthing Bank HF, 3.491%, 1/15/10 (e)(r)(y)* | | 39,000,000 | | 10,335,000 |

| Kellogg Co., 1.875%, 11/17/16 | | 1,330,000 | | 1,341,945 |

| Kennametal, Inc., 3.875%, 2/15/22 | | 3,900,000 | | 3,927,105 |

| Kern River Funding Corp., 6.676%, 7/31/16 (e) | | 73,627 | | 82,051 |

| Kinder Morgan Energy Partners LP, 5.625%, 9/1/41 | | 2,960,000 | | 3,016,509 |

| Kraft Foods, Inc., 1.457%, 7/10/13 (r) | | 3,900,000 | | 3,924,862 |

| Land O’Lakes Capital Trust I, 7.45%, 3/15/28 (e) | | 47,569,000 | | 45,725,701 |

| Leucadia National Corp., 8.125%, 9/15/15 | | 3,320,000 | | 3,718,400 |

| Linn Energy LLC/Linn Energy Finance Corp., 6.25%, 11/1/19 (e) | | 3,700,000 | | 3,589,000 |

| LL & P Wind Energy, Inc. Washington Revenue Bonds: | | | | |

| 5.733%, 12/1/17 (e) | | 8,060,000 | | 8,459,051 |

| 5.983%, 12/1/22 (e) | | 14,695,000 | | 15,100,435 |

| 6.192%, 12/1/27 (e) | | 2,675,000 | | 2,245,529 |

| Lowe’s Co.’s, Inc.: | | | | |

| 3.80%, 11/15/21 | | 2,220,000 | | 2,355,118 |

| 5.125%, 11/15/41 | | 500,000 | | 545,198 |

| Lumbermens Mutual Casualty Co.: | | | | |

| 9.15%, 7/1/26 (e)(m)* | | 51,271,000 | | 128,178 |

| 8.30%, 12/1/37 (e)(m)* | | 33,720,000 | | 84,300 |

| 8.45%, 12/1/49 (e)(m)* | | 1,000,000 | | 2,500 |

| Macy’s Retail Holdings, Inc., 3.875%, 1/15/22 | | 1,900,000 | | 1,905,539 |

| Masco Corp.: | | | | |

| 4.80%, 6/15/15 | | 4,540,000 | | 4,651,026 |

| 5.85%, 3/15/17 | | 1,990,000 | | 2,039,448 |

| MetLife Institutional Funding II, 1.481%, 4/4/14 (r)(e) | | 4,800,000 | | 4,817,059 |

| MGM Resorts International, 6.75%, 9/1/12 | | 4,000,000 | | 4,067,500 |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 17

| | | | |

| | | PRINCIPAL | | |

| CORPORATE BONDS - CONT’D | | AMOUNT | | VALUE |

| MMA Financial Holdings, Inc., 0.75%, 5/3/34 (b) | $ | 40,302,500 | $ | 8,574,760 |

| Morgan Stanley: | | | | |

| 6.25%, 8/28/17 | | 7,000,000 | | 7,371,350 |

| 5.50%, 1/26/20 | | 6,000,000 | | 5,851,680 |

| 5.50%, 7/24/20 | | 6,500,000 | | 6,343,902 |

| National Fuel Gas Co., 6.50%, 4/15/18 | | 4,800,000 | | 5,403,912 |

| Nationwide Health Properties, Inc.: | | | | |

| 6.90%, 10/1/37 | | 10,460,000 | | 11,201,133 |

| 6.59%, 7/7/38 | | 4,023,000 | | 4,188,301 |

| NBCUniversal Media LLC, 4.375%, 4/1/21 | | 9,500,000 | | 10,175,877 |

| New York Life Global Funding, 1.65%, 5/15/17 (e) | | 2,000,000 | | 1,983,280 |

| Newmont Mining Corp.: | | | | |

| 3.50%, 3/15/22 | | 3,900,000 | | 3,757,303 |

| 4.875%, 3/15/42 | | 3,900,000 | | 3,628,618 |

| Noble Holding International Ltd., 3.95%, 3/15/22 | | 3,000,000 | | 2,997,786 |

| Norfolk Southern Corp., 3.00%, 4/1/22 | | 3,000,000 | | 2,949,471 |

| O’Reilly Automotive, Inc., 4.625%, 9/15/21 | | 5,000,000 | | 5,270,885 |

| Orkney Re II plc, Series B, 6.096%, 12/21/35 (b)(e)(r)(w)* | | 19,550,000 | | — |

| Overseas Shipholding Group, Inc.: | | | | |

| 8.125%, 3/30/18 | | 3,600,000 | | 2,718,000 |

| 7.50%, 2/15/24 | | 5,080,000 | | 3,371,850 |

| PacifiCorp: | | | | |

| 2.95%, 2/1/22 | | 2,000,000 | | 1,971,660 |

| 4.10%, 2/1/42 | | 4,000,000 | | 3,844,444 |

| PepsiCo, Inc.: | | | | |

| 2.75%, 3/5/22 | | 4,950,000 | | 4,816,187 |

| 4.00%, 3/5/42 | | 2,150,000 | | 2,037,435 |

| Pernod-Ricard SA: | | | | |

| 4.25%, 7/15/22 (e) | | 1,950,000 | | 1,955,047 |

| 5.50%, 1/15/42 (e) | | 3,900,000 | | 3,920,725 |

| Pioneer Natural Resources Co., 5.875%, 7/15/16 | | 17,840,000 | | 19,792,695 |

| PNC Funding Corp., 5.625%, 2/1/17 | | 2,000,000 | | 2,232,014 |

| PPF Funding, Inc., 5.50%, 1/15/14 (e) | | 500,000 | | 510,523 |

| Rio Tinto Finance USA Ltd., 3.75%, 9/20/21 | | 3,000,000 | | 3,097,074 |

| Rio Tinto Finance USA plc: | | | | |

| 3.50%, 3/22/22 | | 4,850,000 | | 4,858,875 |

| 4.75%, 3/22/42 | | 3,900,000 | | 3,891,884 |

| Rock-Tenn Co., 4.90%, 3/1/22 (e) | | 1,000,000 | | 998,533 |

| Royal Bank of Canada, 1.45%, 10/30/14 | | 4,650,000 | | 4,711,547 |

| SABMiller Holdings, Inc.: | | | | |

| 3.75%, 1/15/22 (e) | | 4,215,000 | | 4,288,177 |

| 4.95%, 1/15/42 (e) | | 3,000,000 | | 3,108,078 |

| SABMiller plc, 6.50%, 7/1/16 (e) | | 2,000,000 | | 2,291,194 |

| SBA Tower Trust, 4.254%, 4/15/40 (e) | | 5,772,000 | | 6,018,187 |

| Schlumberger Investment SA, 3.30%, 9/14/21 (e) | | 1,300,000 | | 1,317,082 |

| Simon Property Group LP: | | | | |

| 6.125%, 5/30/18 | | 3,593,000 | | 4,230,251 |

| 4.125%, 12/1/21 | | 5,000,000 | | 5,246,465 |

| Southern Power Co., 5.15%, 9/15/41 | | 1,925,000 | | 2,017,154 |

| SPARCS Trust 99-1, STEP, 0.00% to 4/15/19, 7.697% thereafter | | | | |

| to 10/15/97 (b)(e)(r) | | 26,500,000 | | 11,296,685 |

| Spencer Spirit Holdings, Inc., 11.00%, 5/1/17 (e) | | 8,650,000 | | 8,823,000 |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 18

| | | | |

| | | PRINCIPAL | | |

| CORPORATE BONDS - CONT’D | | AMOUNT | | VALUE |

| SSIF Nevada LP, 1.267%, 4/14/14 (e)(r) | $ | 16,000,000 | $ | 15,877,984 |

| Stadshypotek AB, 1.02%, 9/30/13 (e)(r) | | 11,000,000 | | 10,987,218 |

| SunTrust Bank: | | | | |

| 0.782%, 8/24/15 (r) | | 3,350,000 | | 3,057,511 |

| 7.25%, 3/15/18 | | 2,500,000 | | 2,859,085 |

| Symantec Corp., 4.20%, 9/15/20 | | 2,000,000 | | 2,040,190 |

| Syngenta Finance NV: | | | | |

| 3.125%, 3/28/22 | | 2,000,000 | | 2,013,162 |

| 4.375%, 3/28/42 | | 2,000,000 | | 2,010,658 |

| Target Corp., 2.90%, 1/15/22 | | 3,550,000 | | 3,508,713 |

| Telefonica Emisiones SAU: | | | | |

| 6.421%, 6/20/16 | | 7,670,000 | | 8,176,780 |

| 5.134%, 4/27/20 | | 8,500,000 | | 8,129,638 |

| The Gap, Inc., 5.95%, 4/12/21 | | 5,940,000 | | 5,994,333 |

| TIERS Trust: | | | | |

| 8.45%, 12/1/17 (b)(e)(n)* | | 8,559,893 | | 8,560 |

| STEP, 0.00% to 10/15/33, 7.697% thereafter to 10/15/97 (b)(e)(r) | | 12,295,000 | | 1,376,302 |

| 7.697%, 10/15/97 (b)(e)(r) | | 11,001,000 | | 5,142,747 |

| Time Warner Cable, Inc.: | | | | |

| 4.00%, 9/1/21 | | 4,200,000 | | 4,303,261 |

| 5.50%, 9/1/41 | | 3,200,000 | | 3,352,090 |

| Time Warner, Inc., 5.375%, 10/15/41 | | 4,940,000 | | 5,190,409 |

| Toll Road Investors Partnership II LP, Zero Coupon: | | | | |

| 2/15/43(b)(e) | | 196,950,000 | | 21,369,075 |

| 2/15/45(b)(e) | | 470,599,136 | | 72,613,447 |

| Toronto-Dominion Bank, 2.375%, 10/19/16 | | 4,250,000 | | 4,359,467 |

| Toyota Motor Credit Corp.: | | | | |

| 2.05%, 1/12/17 | | 3,500,000 | | 3,552,339 |

| 3.30%, 1/12/22 | | 1,750,000 | | 1,784,003 |

| United Airlines, Inc., 12.75%, 7/15/12 | | 5,892,480 | | 6,054,523 |

| UnitedHealth Group, Inc.: | | | | |

| 3.375%, 11/15/21 | | 1,750,000 | | 1,796,312 |

| 4.625%, 11/15/41 | | 1,750,000 | | 1,750,469 |

| US Bank, 3.778% to 4/29/15, floating rate thereafter to 4/29/20 (r) | | 25,000,000 | | 26,101,650 |

| Verizon Communications, Inc.: | | | | |

| 3.50%, 11/1/21 | | 4,750,000 | | 4,859,544 |

| 4.75%, 11/1/41 | | 5,000,000 | | 5,061,200 |

| Volkswagen International Finance NV, 1.191%, 4/1/14 (e)(r) | | 5,000,000 | | 4,984,365 |

| Wachovia Capital Trust III, 5.57%, 12/31/49 (r) | | 30,200,000 | | 28,539,000 |

| Walt Disney Co.: | | | | |

| 0.875%, 12/1/14 | | 1,000,000 | | 1,004,441 |

| 2.55%, 2/15/22 | | 4,900,000 | | 4,758,630 |

| 4.125%, 12/1/41 | | 2,750,000 | | 2,681,806 |

| Willis North America, Inc., 5.625%, 7/15/15 | | 2,430,000 | | 2,619,392 |

| Windsor Petroleum Transport Corp., 7.84%, 1/15/21 (e) | | 20,989,950 | | 13,044,205 |

| Xstrata Finance Canada Ltd., 2.85%, 11/10/14 (e) | | 1,500,000 | | 1,527,234 |

| |

| Total Corporate Bonds (Cost $1,566,362,701) | | | | 1,339,754,853 |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 19

| | | | |

| | | PRINCIPAL | | |

| MUNICIPAL OBLIGATIONS - 6.6% | | AMOUNT | | VALUE |

| Azusa California Redevelopment Agency Tax Allocation Bonds, | | | | |

| 5.765%, 8/1/17 | $ | 2,965,000 | $ | 3,036,516 |

| La Verne California Revenue Bonds, 5.62%, 6/1/16 | | 1,000,000 | | 1,109,500 |

| Mississippi Business Finance Corp. Revenue VRDN, 0.32%, 9/1/21(r) | | 3,165,000 | | 3,165,000 |

| Mississippi Home Corp. MFH Revenue VRDN, 0.25%, 8/15/40 (r) | | 2,500,000 | | 2,500,000 |

| Moreno Valley California Public Financing Authority Revenue | | | | |

| Bonds, 5.549%, 5/1/27 | | 4,385,000 | | 4,437,576 |

| Nevada Housing Division Revenue VRDN, 0.19%, 4/15/39 (r) | | 10,200,000 | | 10,200,000 |

| New York City Housing Development Corp. MFH Revenue | | | | |

| VRDN, 0.15%, 12/1/35 (r) | | 4,790,000 | | 4,790,000 |

| Oakland California Redevelopment Agency Tax Allocation | | | | |

| Bonds, 5.653%, 9/1/21 | | 9,485,000 | | 9,791,935 |

| Pomona California Public Financing Authority Revenue Bonds, | | | | |

| 5.718%, 2/1/27 | | 6,015,000 | | 6,130,007 |

| San Diego California Redevelopment Agency Tax Allocation Bonds, | | | | |

| 6.00%, 9/1/21 | | 2,515,000 | | 2,594,399 |

| San Jose California Redevelopment Agency Tax Allocation | | | | |

| Bonds, 4.54%, 8/1/12 | | 3,105,000 | | 3,136,143 |

| Santa Fe Springs California Community Development Commission | | | | |

| Tax Allocation Bonds, 5.35%, 9/1/18 | | 1,265,000 | | 1,298,889 |

| Wells Fargo Bank NA Custodial Receipts Revenue Bonds: | | | | |

| 6.584%, 9/1/27 (e) | | 6,080,000 | | 6,909,312 |

| 6.734%, 9/1/47 (e) | | 37,970,000 | | 44,662,592 |

| West Contra Costa California Unified School District COPs, | | | | |

| 5.15%, 1/1/24 | | 3,630,000 | | 3,496,452 |

| |

| Total Municipal Obligations (Cost $98,974,008) | | | | 107,258,321 |

| |

| U.S. GOVERNMENT AGENCIES | | | | |

| AND INSTRUMENTALITIES - 0.1% | | | | |

| Overseas Private Investment Corp., 4.05%, 11/15/14 | | 702,400 | | 715,542 |

| Premier Aircraft Leasing EXIM 1 Ltd., 3.547%, 4/10/22 | | 133 | | 140 |

| |

| Total U.S. Government Agencies and Instrumentalities (Cost $703,050) | | 715,682 |

| |

| U.S. GOVERNMENT AGENCY | | | | |

| MORTGAGE-BACKED SECURITIES - 1.9% | | | | |

| Fannie Mae: | | | | |

| 3.50%, 4/12/12 | | 21,985,000 | | 22,575,847 |

| 4.00%, 4/12/12 | | 8,350,000 | | 8,754,453 |

| Ginnie Mae, 11.00%, 10/15/15 | | 299 | | 313 |

| |

| Total U.S. Government Agency Mortgage-Backed | | | | |

| Securities (Cost $31,515,670) | | | | 31,330,613 |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 20

| | | | | |

| | | PRINCIPAL | | | |

| U.S. TREASURY - 4.6% | | AMOUNT | | VALUE | |

| United States Treasury Bonds: | | | | | |

| 3.125%, 11/15/41 | $ | 16,604,000 | $ | 15,926,872 | |

| 3.125%, 2/15/42 | | 17,803,000 | | 17,065,849 | |

| United States Treasury Notes: | | | | | |

| 0.375%, 3/15/15 | | 485,000 | | 483,144 | |

| 0.875%, 2/28/17 | | 510,000 | | 506,414 | |

| 2.00%, 2/15/22 | | 41,551,000 | | 40,752,431 | |

| |

| Total U.S. Treasury (Cost $75,842,946) | | | | 74,734,710 | |

| |

| SOVEREIGN GOVERNMENT BONDS - 0.4% | | | | | |

| Province of Ontario Canada, 3.00%, 7/16/18 | | 6,700,000 | | 7,092,419 | |

| |

| Total Sovereign Government Bonds (Cost $7,021,592) | | | | 7,092,419 | |

| |

| FLOATING RATE LOANS(d)- 0.1% | | | | | |

| Clear Channel Communications, Inc., 3.673%, 1/29/16 (r) | | 2,586,677 | | 2,093,269 | |

| |

| Total Floating Rate Loans (Cost $2,434,762) | | | | 2,093,269 | |

| |

| TIME DEPOSIT - 4.9% | | | | | |

| State Street Bank Time Deposit, 0.113%, 4/2/12 | | 80,739,525 | | 80,739,525 | |

| |

| Total Time Deposit (Cost $80,739,525) | | | | 80,739,525 | |

| |

| EQUITY SECURITIES - 0.8% | | SHARES | | | |

| Avado Brands, Inc. (b)* | | 4,803 | | — | |

| CoBank ACB, Preferred (e)* | | 3,000 | | 2,193,750 | |

| Intermet Corp. (b)* | | 4,772 | | — | |

| Woodbourne Capital: | | | | | |

| Trust I, Preferred (b)(e) | | 6,450,000 | | 2,858,640 | |

| Trust II, Preferred (b)(e) | | 6,450,000 | | 2,858,640 | |

| Trust III, Preferred (b)(e) | | 6,450,000 | | 2,858,640 | |

| Trust IV, Preferred (b)(e) | | 6,450,000 | | 2,858,640 | |

| |

| Total Equity Securities (Cost $27,133,573) | | | | 13,628,310 | |

| |

| TOTAL INVESTMENTS (Cost $1,910,035,012) - 102.5% | | | | 1,675,562,841 | |

| Other assets and liabilities, net - (2.5%) | | | | (40,443,772 | ) |

| NET ASSETS - 100% | | | $ | 1,635,119,069 | |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 21

| | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | |

| Paid-in capital applicable to the following shares of beneficial interest, unlimited number of no par value shares authorized: | | | | | |

| | | | | |

| Class A: 76,775,645 shares outstanding | | | | $ | 1,735,917,736 | |

| Class B: 957,066 shares outstanding | | | | | 32,808,322 | |

| Class C: 12,068,054 shares outstanding | | | | | 236,897,616 | |

| Class I: 7,185,834 shares outstanding | | | | | 145,859,514 | |

| Class R: 568,967 shares outstanding | | | | | 8,586,704 | |

| Class Y: 5,516,625 shares outstanding | | | | | 86,869,539 | |

| Undistributed net investment income (loss) | | | | | (147,292 | ) |

| Accumulated net realized gain (loss) on investments | | | | (377,101,765 | ) |

| Net unrealized appreciation (depreciation) on investments | | | (234,571,305 | ) |

| |

| NET ASSETS | | | | | $ | 1,635,119,069 | |

| |

| NET ASSET VALUE PER SHARE | | | | | | |

| Class A (based on net assets of $1,217,193,842) | | | | $ | 15.85 | |

| Class B (based on net aasets of $15,090,471) | | | | $ | 15.77 | |

| Class C (based on net assets of $191,312,673) | | | | $ | 15.85 | |

| Class I (based on net assets of $114,039,315) | | | | $ | 15.87 | |

| Class R (based on net assets of $9,079,962) | | | | $ | 15.96 | |

| Class Y (based on net assets of $88,402,806) | | | | $ | 16.02 | |

| |

| |

| |

| | | | | UNDERLYING | | UNREALIZED | |

| NUMBER OF | EXPIRATION | | FACEAMOUNT | | APPRECIATION | |

| FUTURES | CONTRACTS | DATE | | AT VALUE | | (DEPRECIATION) | |

| Purchased: | | | | | | | |

| 10 Year U.S. Treasury Notes | 211 | 6/12 | | $27,321,203 | | ($298,858) | |

| |

| Sold: | | | | | | | |

| 2 Year U.S. Treasury Notes | 1,746 | 6/12 | | $384,365,533 | | $173,082 | |

| 5 Year U.S. Treasury Notes | 205 | 6/12 | | 25,120,508 | | 26,642 | |

| Total Sold | | | | | | $199,724 | |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 22

(b) This security was valued by the Board of Trustees. See Note A.

(d) Remaining maturities of floating rate loans may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. Floating rate loans generally pay interest at rates which are periodically re-determined at a margin above the London InterBank Offered Rate (“LIBOR”) or other short-term rates. The rate shown is the rate in effect at period end. Floating rate loans are generally considered restrictive in that the Fund is ordinarily contractually obligated to receive consent from the Agent Bank and/or Borrower prior to disposition of a floating rate loan.

(e) Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

(m) The Illinois Insurance Department prohibited Lumbermens from making interest payments. This security is no longer accruing interest.

(n) The Illinois Insurance Department prohibited Lumbermens from making interest payments. This TIERS security is based on interest payments from Lumbermens. This security is no longer accruing interest.

(p) The State of New York Insurance Department has prohibited Atlantic Mutual Insurance Co. from making interest payments. This security is no longer accruing interest.

(r) The coupon rate shown on floating or adjustable rate securities represents the rate at period end.

(w) Security is in default and is no longer accruing interest.

(x) Alliance Bancorp and its affiliates filed for Chapter 7 bankruptcy on July 13, 2007. This security is no longer accruing interest.

(y) The government of Iceland took control of Glitnir Banki HF and Kaupthing Bank HF (the “Banks”) on October 8, 2008 and October 9, 2008, respectively. The government has prohibited the Banks from paying any claims owed to foreign entities. These securities are no longer accruing interest.

* Non-income producing security.

Abbreviations:

COPs: Certificates of Participation

LLC: Limited Liability Corporation

LP: Limited Partnership

MFH: Multi-Family Housing

plc: Public Limited Company

REIT: Real Estate Investment Trust

STEP: Stepped coupon bond for which the coupon rate of interest will adjust on specified future date(s)

VRDN: Variable Rate Demand Notes

See notes to financial statements.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 23

STATEMENT OF OPERATIONS

SIX MONTHS ENDED MARCH 31, 2012 | |

| |

| NET INVESTMENT INCOME | | | |

| Investment Income: | | | |

| Interest income | $ | 41,699,716 | |

| Dividend income | | 793,400 | |

| Total investment income | | 42,493,116 | |

| |

| Expenses: | | | |

| Investment advisory fee | | 3,651,397 | |

| Administrative fees | | 2,601,657 | |

| Transfer agency fees and expenses | | 1,954,664 | |

| Distribution Plan expenses: | | | |

| Class A | | 1,704,215 | |

| Class B | | 92,050 | |

| Class C | | 1,017,743 | |

| Class R | | 23,374 | |

| Trustees’ fees and expenses | | 65,692 | |

| Custodian fees | | 99,390 | |

| Registration fees | | 39,416 | |

| Reports to shareholders | | 335,021 | |

| Professional fees | | 323,811 | |

| Accounting fees | | 103,228 | |

| Contract services fees | | 877,566 | |

| Miscellaneous | | 33,891 | |

| Total expenses | | 12,923,115 | |

| Reimbursement from Advisor: | | | |

| Class B | | (11,663 | ) |

| Class R | | (8,082 | ) |

| Class Y | | (53,939 | ) |

| Fees paid indirectly | | (363 | ) |

| Net expenses | | 12,849,068 | |

| |

| |

| NET INVESTMENT INCOME | | 29,644,048 | |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) | | | |

| Net realized gain (loss) on: | | | |

| Investments | | (17,073,593 | ) |

| Futures | | 2,879,759 | |

| | | (14,193,834 | ) |

| |

| Change in unrealized appreciation (depreciation) on: | | | |

| Investments | | 26,590,138 | |

| Futures | | (2,220,718 | ) |

| | | 24,369,420 | |

| NET REALIZED AND UNREALIZED GAIN | | | |

| (LOSS) | | 10,175,586 | |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | |

| RESULTING FROM OPERATIONS | $ | 39,819,634 | |

| | | |

| See notes to financial statements. | | | |

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 24

| | | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | | SIX MONTHS

ENDED | | | YEAR

ENDED | |

| | | MARCH

31, | | | SEPTEMBER

30, | |

| INCREASE (DECREASE) IN NET ASSETS | | 2012 | | | 2011 | |

| Operations: | | | | | | |

| Net investment income | $ | 29,644,048 | | $ | 79,224,957 | |

| Net realized gain (loss) | | (14,193,834 | ) | | 8,002,443 | |

| Change in unrealized appreciation (depreciation) | | 24,369,420 | | | (57,954,825 | ) |

| |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | |

| RESULTING FROM OPERATIONS | | 39,819,634 | | | 29,272,575 | |

| |

| Distributions to shareholders from: | | | | | | |

| Net investment income: | | | | | | |

| Class A shares | | (22,299,035 | ) | | (60,587,634 | ) |

| Class B shares | | (237,366 | ) | | (688,609 | ) |

| Class C shares | | (2,614,171 | ) | | (6,433,930 | ) |

| Class I shares | | (2,696,230 | ) | | (7,884,658 | ) |

| Class R shares | | (148,650 | ) | | (334,565 | ) |

| Class Y shares | | (1,795,888 | ) | | (3,487,062 | ) |

| Total distributions | | (29,791,340 | ) | | (79,416,458 | ) |

| |

| Capital share transactions: | | | | | | |

| Shares sold: | | | | | | |

| Class A shares | | 68,454,346 | | | 194,409,378 | |

| Class B shares | | 214,304 | | | 312,672 | |

| Class C shares | | 5,114,953 | | | 9,795,124 | |

| Class I shares | | 15,145,781 | | | 36,187,405 | |

| Class R shares | | 790,235 | | | 2,319,034 | |

| Class Y shares | | 9,375,978 | | | 59,965,750 | |

| Reinvestment of distributions: | | | | | | |

| Class A shares | | 19,345,498 | | | 52,455,654 | |

| Class B shares | | 178,374 | | | 527,863 | |

| Class C shares | | 1,553,001 | | | 3,666,211 | |

| Class I shares | | 2,261,013 | | | 5,747,673 | |

| Class R shares | | 124,500 | | | 270,325 | |

| Class Y shares | | 860,090 | | | 1,173,274 | |

| Redemption fees: | | | | | | |

| Class A shares | | 7,832 | | | 32,202 | |

| Class C shares | | 341 | | | 515 | |

| Class I shares | | 396 | | | 13 | |

| Class R shares | | — | | | 5 | |

| Class Y shares | | 1,554 | | | 1,143 | |

| Shares redeemed: | | | | | | |

| Class A shares | | (399,436,014 | ) | | (1,009,871,302 | ) |

| Class B shares | | (6,622,799 | ) | | (17,823,743 | ) |

| Class C shares | | (30,298,374 | ) | | (98,162,160 | ) |

| Class I shares | | (61,638,591 | ) | | (141,682,187 | ) |

| Class R shares | | (1,228,777 | ) | | (5,343,289 | ) |

| Class Y shares | | (34,145,625 | ) | | (51,210,235 | ) |

| Total capital share transactions | | (409,941,984 | ) | | (957,228,675 | ) |

| |

| |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | (399,913,690 | ) | | (1,007,372,558 | ) |

See notes to financial statements.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 25

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| INCREASE (DECREASE) IN NET ASSETS - CONT’D | | | | |

| | | SIX MONTHS

ENDED | | | YEAR

ENDED | |

| | | MARCH 31, | | | SEPTEMBER 30, | |

| NET ASSETS | | 2012 | | | 2011 | |

| Beginning of period | $ | 2,035,032,759 | | $ | 3,042,405,317 | |

| End of period (including distributions in excess of | | | | | | |

| net investment income of $147,292 and $0, respectively) | $ | 1,635,119,069 | | $ | 2,035,032,759 | |

| |

| |

| CAPITAL SHARE ACTIVITY | | | | | | |

| Shares sold: | | | | | | |

| Class A shares | | 4,322,495 | | | 12,102,239 | |

| Class B shares | | 13,608 | | | 19,614 | |

| Class C shares | | 323,400 | | | 610,012 | |

| Class I shares | | 955,641 | | | 2,248,798 | |

| Class R shares | | 49,675 | | | 143,278 | |

| Class Y shares | | 585,225 | | | 3,663,454 | |

| Reinvestment of distributions: | | | | | | |

| Class A shares | | 1,227,370 | | | 3,273,571 | |

| Class B shares | | 11,372 | | | 33,106 | |

| Class C shares | | 98,525 | | | 228,789 | |

| Class I shares | | 143,250 | | | 358,413 | |

| Class R shares | | 7,842 | | | 16,758 | |

| Class Y shares | | 53,931 | | | 72,277 | |

| Shares redeemed: | | | | | | |

| Class A shares | | (25,219,713 | ) | | (62,932,411 | ) |

| Class B shares | | (421,173 | ) | | (1,115,745 | ) |

| Class C shares | | (1,915,258 | ) | | (6,117,483 | ) |

| Class I shares | | (3,891,736 | ) | | (8,834,865 | ) |

| Class R shares | | (76,907 | ) | | (330,435 | ) |

| Class Y shares | | (2,124,084 | ) | | (3,159,253 | ) |

| Total capital share activity | | (25,856,537 | ) | | (59,719,883 | ) |

See notes to financial statements.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 26

NOTES TO FINANCIAL STATEMENTS

NOTE A –– SIGNIFICANT ACCOUNTING POLICIES

General: The Calvert Income Fund (the “Fund”), a series of The Calvert Fund, is registered under the Investment Company Act of 1940 as a non-diversified, open-end management investment company. The Calvert Fund is comprised of six separate series. The operations of each series are accounted for separately. The Fund offers six classes of shares of beneficial interest - Classes A, B, C, I, R, and Y. Class A shares are sold with a maximum front-end sales charge of 3.75%. Class B shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge at the time of redemption, depending on how long investors have owned the shares. Effective March 1, 2010, Class B shares are no longer offered for purchase, except through reinvestment of dividends and/or distributions and through certain exchanges. Class C shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge on shares sold within one year of purchase. Class B and Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment may be waived for certain institutional accounts where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Class R shares are generally only available to certain retirement plans where plan level or omnibus accounts are held on the books of the Fund. Class R shares have no front-end or deferred sales charge and have a higher level of expenses than Class A Shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Each class has different: (a) dividend rates due to differences in Distribution Plan expenses and other class specific expenses, (b) exchange privileges and (c) class specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Trustees to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board of Trustees. In determining fair value, the Board considers all relevant qualitative and quantitative information available. These factors are subject to change over time and are reviewed periodically. The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material.

At March 31, 2012, securities valued at $144,886,765 or 8.9% of net assets were fair valued in good faith under the direction of the Board of Trustees.

The Fund utilizes various methods to measure the fair value of its investments.

Generally Accepted Accounting Principles (GAAP) establishes a disclosure hierarchy that

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 27

categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. Valuation techniques used to value the Fund’s investments by major category are as follows.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities. For corporate bonds, sovereign government bonds, floating rate loans, municipal securities, and U.S. government and government agency obligations, pricing services utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices and such securities are generally categorized as Level 2 in the hierarchy. For asset backed securities, collateralized mortgage obligations, commercial mortgage securities and U.S. government agency mortgage securities, pricing services utilize matrix pricing which considers prepayment speed assumptions, attributes of the collateral, yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices and, accordingly, such securities are generally categorized as Level 2 in the hierarchy. Short-term securities of sufficient credit quality with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and categorized as Level 2 in the hierarchy. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. For restricted securities and

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 28

private placements where observable inputs are limited, assumptions about market activity and risk are used and such securities are categorized as Level 3 in the hierarchy.

The following is a summary of the inputs used to value the Fund’s net assets as of March 31, 2012:

| | | VALUATION INPUTS | | | |

| Investments in Securities* | Level 1 | Level 2 | Level 3 | | Total | |

| Asset-backed securities | — | $6,620,832 | — | | $6,620,832 | |

| Collateralized mortgage-backed | | | | | | |

| obligations | — | 4,104,075 | — | | 4,104,075 | |

| Commercial mortgage-backed | | | | | | |

| securities | — | 7,490,232 | — | | 7,490,232 | |

| Corporate debt | — | 1,237,188,902 | $102,565,951 | | 1,339,754,853 | |

| Equity securities | $2,193,750 | 11,434,560 | — | | 13,628,310 | |

| Floating rate loans | — | 2,093,269 | — | | 2,093,269 | |

| Municipal obligations | — | 107,258,321 | — | | 107,258,321 | |

| Sovereign government bonds | — | 7,092,419 | — | | 7,092,419 | |

| U.S. government obligations | — | 106,781,005 | — | | 106,781,005 | |

| Other debt obligations | — | 80,739,525 | — | | 80,739,525 | |

| TOTAL | $2,193,750 | $1,570,803,140 | $102,565,951 | *** | $1,675,562,841 | |

| |

| Other financial instruments** | ($99,134) | — | — | | ($99,134 | ) |

* For a complete listing of investments, please refer to the Statement of Net Assets.

** Other financial instruments are derivative instruments not reflected in the Statement of Net Assets, such as futures, which are valued at the unrealized appreciation/depreciation on the instrument.

*** Level 3 Securities represent 6.3% of net assets.

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | EQUITY | CORPORATE | |

| | SECURITIES | DEBT | TOTAL |

| Balance as of 9/30/11 | $96 | $114,466,189 | $114,466,285 |

| Accrued discounts/premiums | — | 182,712 | 182,712 |

| Realized gain (loss) | — | 1,944,962 | 1,944,962 |

| Change in unrealized appreciation (depreciation) | (96) | (9,902,912) | (9,903,008) |

| Purchases | — | — | — |

| Sales | — | (4,125,000) | (4,125,000) |

| Transfers in and/or out of Level 31 | — | — | — |

| Balance as of 3/31/12 | — | $102,565,951 | $102,565,951 |

1 The Fund’s policy is to recognize transfers into and transfers out of Level 3 as of the end of the reporting period.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 29

For the six months ended March 31, 2012, total change in unrealized gain (loss) on Level 3 securities included in the change in net assets was ($9,903,008). Total unrealized gain (loss) for all securities (including Level 1 and Level 2) can be found on the accompanying Statement of Operations.

Loan Participations and Assignments: The Fund may invest in direct debt instruments which are interests in amounts owed to lenders or lending syndicates by corporate, governmental, or other borrowers. A Fund’s investments in loans may be in the form of participations in loans or assignments of all or a portion of loans from third parties. A loan is often administered by a bank or other financial institution (the “lender”) that acts as agent for all holders. The agent administers the terms of the loan, as specified in the loan agreement. A Fund may invest in multiple series or tranches of a loan, which may have varying terms and carry different associated risks. A Fund generally has no right to enforce compliance with the terms of the loan agreement with the borrower. As a result, a Fund may be subject to the credit risk of both the borrower and the lender that is selling the loan agreement. When a Fund purchases assignments from lenders it acquires direct rights against the borrower of the loan. When investing in a loan participation, a Fund has the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the loan agreement and only upon receipt of payments by the lender from the borrower.

Futures Contracts: The Fund may purchase and sell futures contracts, but only when, in the judgment of the Advisor, such a position acts as a hedge. The Fund may not enter into futures contracts for the purpose of speculation or leverage. These futures contracts may include, but are not limited to, futures contracts based on U.S. Government obligations. The Fund is subject to interest rate risk in the normal course of pursuing its investment objectives. The Fund may use futures contracts to hedge against changes in the value of interest rates. The Fund may enter into futures contracts agreeing to buy or sell a financial instrument for a set price at a future date. Initial margin deposits of either cash or securities as required by the broker are made upon entering into the contract. While the contract is open, daily variation margin payments are made to or received from the broker reflecting the daily change in market value of the contract and are recorded for financial reporting purposes as unrealized gains or losses by the Fund. When a futures contract is closed, a realized gain or loss is recorded equal to the difference between the opening and closing value of the contract. The risks associated with entering into futures contracts may include the possible illiquidity of the secondary market which would limit the Fund’s ability to close out a futures contract prior to the settlement date, an imperfect correlation between the value of the contracts and the underlying financial instruments, or that the counterparty will fail to perform its obligations under the contracts’ terms. Futures contracts are designed by boards of trade which are designated “contracts markets” by the Commodities Futures Trading Commission. Futures contracts trade on the contracts markets in a manner that is similar to the way a stock trades on a stock exchange and the boards of trade, through their clearing corporations, guarantee the futures contracts against default. As a result, there is minimal counterparty credit risk to the Fund. During the period, the Fund used U.S. Treasury futures contracts to hedge against interest rate changes and to manage overall duration of the Fund. The Fund’s futures contracts at period end are presented in the Statement of Net Assets.

www.calvert.com CALVERT INCOME FUND SEMI-ANNUAL REPORT (UNAUDITED) 30

During the six month period, the Fund invested in 2 year, 5 year, and 10 year U.S. Treasury Bond Futures. The volume of activity has varied throughout the year with a weighted average of 4,142 contracts and $27,967,881 weighted average notional value.

Short Sales: The Fund may use a hedging technique that involves short sales of U.S. Treasury securities for the purpose of managing the duration of the Fund. Any short sales are covered with an equivalent amount of high-quality, liquid securities.

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. (See the Statement of Net Assets footnotes on page 23.) A debt obligation may be removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured. The Fund earns certain fees in connection with its floating rate loan purchasing activities. These fees are in addition to interest payments earned and may include amendment fees, consent fees and prepayment fees. These fees are recorded as income in the accompanying financial statements. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets.