UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03445

The Merger Fund

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9683

(Address of principal executive offices) (Zip code)

Jennifer Fromm, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-2608

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 243-1574

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| | (a) | The Report to Shareholders is attached herewith. |

| | |

ANNUAL REPORT THE MERGER FUND® AND VIRTUS EVENT OPPORTUNITIES TRUST | |  |

December 31, 2021

|

The Merger Fund® |

|

Virtus Westchester Event-Driven Fund (f/k/a WCM Alternatives: Event-Driven Fund) |

|

Virtus Westchester Credit Event Fund (f/k/a WCM Alternatives: Credit Event Fund) |

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports like this one will no longer be sent by mail, unless specifically requested from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action.

You may elect at any time to receive not only shareholder reports but also certain other communications from the Fund electronically, or you may elect to receive paper copies of all future shareholder reports free of charge to you. If you own your shares directly with the Fund, you may make such elections by calling the Fund at 1-800-243-1574 or, with respect to requesting electronic delivery, by visiting www.virtus.com. An election made directly with the Fund will apply to all Virtus Mutual Funds in which you own shares directly. If you own your shares through a financial intermediary, please contact your financial intermediary to make your request and to determine whether your election will apply to all funds in which you own shares through that intermediary.

Not FDIC Insured • No Bank Guarantee • May Lose Value

Table of Contents

Proxy Voting Procedures and Voting Record (Form N-PX)

The subadviser votes proxies, if any, relating to portfolio securities in accordance with procedures that have been approved by the Board of Trustees of the Trust (“Trustees”, or the “Board”). You may obtain a description of these procedures, along with information regarding how the Funds voted proxies during the most recent 12-month period ended June 30, free of charge, by calling toll-free 1-800-243-1574. This information is also available through the Securities and Exchange Commission’s (the “SEC”) website at https://www.sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The Trust files a complete schedule of portfolio holdings for each Fund with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT-P. Form N-PORT-P is available on the SEC’s website at https://www.sec.gov.

This report is not authorized for distribution to prospective investors in the Funds of The Merger Fund® and Virtus Event Opportunities Trust unless preceded or accompanied by an effective prospectus which includes information concerning the sales charge, each Fund’s record and other pertinent information.

MESSAGE TO SHAREHOLDERS

To Shareholders of The Merger Fund® and Virtus Event Opportunities Trust Funds:

I am pleased to welcome you to the Virtus Funds. On October 1, 2021, Westchester Capital Management became an affiliated manager of Virtus Investment Partners and The Merger Fund, the Westchester Credit Event Fund and the Westchester Event-Driven Fund became part of the Virtus Funds, a family of distinctive investment options designed to help you preserve and grow your assets to meet your personal financial needs.

The relationship with Virtus Funds may be new, but your fund’s portfolio management team and process remain the same under the direction of Roy Behren and Michael Shannon, Co-Presidents and Co-Chief Investment Officers at Westchester Capital. We are excited that Roy, Mike and their team will continue to manage your fund with the same dedication to seeking to deliver consistent, absolute returns through the disciplined execution of event-driven alternative investment strategies. Roy and Mike’s review of the markets and other factors that affected the performance of your Fund for the 12 months ended December 31, 2021 follows.

As a distinctive partnership of boutique investment managers, Virtus offers access to a variety of investment styles across multiple disciplines to meet a wide array of investor needs. I encourage you to visit Virtus.com to learn more about the Virtus Funds’ diversified portfolio of investment strategies. The Virtus team also shares Westchester Capital’s unwavering commitment to exceptional client service and will be glad to address any questions you may have about your fund at 800-243-1574.

Our entire team looks forward to serving you and your investment needs. Welcome to Virtus!

Sincerely,

George R. Aylward

President, The Merger Fund® and Virtus Event Opportunities Trust

February 2022

Refer to the Fund Summary section for your Fund’s performance. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investing involves risk, including the risk of loss of principal invested.

1

The Merger Fund® and Virtus Event Opportunities Funds

DISCLOSURE OF FUND EXPENSES (Unaudited)

FOR THE SIX-MONTH PERIOD OF JULY 1, 2021 TO DECEMBER 31, 2021

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of a The Merger Fund, Virtus Westchester Event-Driven Fund and/or Virtus Westchester Credit Event Fund (each, a “Fund”), you may incur certain types of costs including investment advisory fees, and other expenses. For further information regarding applicable sales charges, see Note 1 in the Notes to Financial Statements. These examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period. The Annualized Expense Ratios may be different from the expense ratios in the Financial Highlights which are for the fiscal year ended December 31, 2021.

Please note that the expenses shown in the accompanying tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or contingent deferred sales charges. Therefore, the accompanying tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | | | | | | | | | |

| | | Annualized Net

Expense Ratio

12/31/21 | | | Beginning

Account Value

7/1/21 | | | Ending

Account Value

12/31/21 | | | Expenses Paid

During Period

7/1/2021-

12/31/21(1) | |

The Merger Fund Class A | | | | | | | | | | | | | | | | |

Actual Expenses(2)(3) | | | 1.61 | % | | $ | 1,000.00 | | | $ | 983.40 | | �� | $ | 8.05 | |

| | | | |

The Merger Fund Class I | | | | | | | | | | | | | | | | |

Actual Expenses(2)(3) | | | 1.31 | % | | $ | 1,000.00 | | | $ | 985.10 | | | $ | 6.55 | |

| | | | |

Westchester Event-Driven Fund Class A | | | | | | | | | | | | | | | | |

Actual Expenses(2)4) | | | 1.94 | % | | $ | 1,000.00 | | | $ | 977.60 | | | $ | 9.67 | |

| | | | |

Westchester Event-Driven Fund Class I | | | | | | | | | | | | | | | | |

Actual Expenses(2)(4) | | | 1.69 | % | | $ | 1,000.00 | | | $ | 977.97 | | | $ | 8.43 | |

| | | | |

Westchester Credit Event Fund Class A | | | | | | | | | | | | | | | | |

Actual Expenses(2)(5) | | | 2.06 | % | | $ | 1,000.00 | | | $ | 1,001.70 | | | $ | 10.39 | |

| | | | |

Westchester Event-Driven Fund Class I | | | | | | | | | | | | | | | | |

Actual Expenses(2)(5) | | | 1.64 | % | | $ | 1,000.00 | | | $ | 1,003.30 | | | $ | 8.28 | |

| (1) | Expenses are equal to the Fund’s annualized net expense ratio, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns of (1.66)%, (1.49)%, (2.24)%, (2.20)%, 0.17% and 0.33% for the six-month period ended December 31, 2021 for The Merger Fund Class A and I shares, Westchester Event-Driven Fund Class A and I shares and Westchester Credit Event Fund Class A and I shares, respectively. |

| (3) | Excluding dividends and interest, borrowing expenses on securities sold short and professional fees related to tax reclaims processing, your actual cost of investment in the Fund would have been $7.30 in The Merger Fund Class A shares and $5.85 in The Merger Fund Class I shares. |

| (4) | Excluding dividends and interest and borrowing expenses on securities sold short, your actual cost of investment in the Fund would have been $8.92 in Westchester Event-Driven Fund Class A shares and $7.68 in Westchester Event-Driven Fund Class I shares. |

| (5) | Excluding dividends and interest and borrowing expenses on securities sold short, your actual cost of investment in the Fund would have been $9.54 in Westchester Credit Event Fund Class A shares and $8.28 in Westchester Credit Event Fund Class I shares. |

You can find more information about a Fund’s expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, refer to that Fund’s prospectus.

2

The Merger Fund® and Virtus Event Opportunities Funds

DISCLOSURE OF FUND EXPENSES (Unaudited)

FOR THE SIX-MONTH PERIOD OF JULY 1, 2021 TO DECEMBER 31, 2021

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not your Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

| | | | | | | | | | | | | | | | |

| | | Annualized Net

Expense Ratio

12/31/21 | | | Beginning

Account Value

7/1/21 | | | Ending

Account Value

12/31/21 | | | Expenses Paid

During Period

7/1/2021-

12/31/21(1) | |

The Merger Fund Class A | | | | | | | | | | | | | | | | |

Hypothetical Example for Comparison Purposes (5% return before expenses)(2) | | | 1.61 | % | | $ | 1,000.00 | | | $ | 1,017.09 | | | $ | 8.19 | |

The Merger Fund Class I | | | | | | | | | | | | | | | | |

Hypothetical Example for Comparison Purposes (5% return before expenses)(2) | | | 1.31 | % | | $ | 1,000.00 | | | $ | 1,018.60 | | | $ | 6.67 | |

Westchester Event-Driven Fund Class A | | | | | | | | | | | | | | | | |

Hypothetical Example for Comparison Purposes (5% return before expenses)(3) | | | 1.94 | % | | $ | 1,000.00 | | | $ | 1,015.43 | | | $ | 9.86 | |

Westchester Event-Driven Fund Class I | | | | | | | | | | | | | | | | |

Hypothetical Example for Comparison Purposes (5% return before expenses)(3) | | | 1.69 | % | | $ | 1,000.00 | | | $ | 1,016.69 | | | $ | 8.59 | |

Westchester Credit Event Fund Class A | | | | | | | | | | | | | | | | |

Hypothetical Example for Comparison Purposes (5% return before expenses)(4) | | | 2.06 | % | | $ | 1,000.00 | | | $ | 1,014.82 | | | $ | 10.46 | |

Westchester Credit Event Fund Class I | | | | | | | | | | | | | | | | |

Hypothetical Example for Comparison Purposes (5% return before expenses)(4) | | | 1.64 | % | | $ | 1,000.00 | | | $ | 1,016.94 | | | $ | 8.34 | |

| (1) | Expenses are equal to the Fund’s annualized net expense ratio, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Excluding dividends and interest, borrowing expenses on securities sold short and professional fees related to tax reclaims processing, your actual cost of investment in the Fund would have been $7.43 in The Merger Fund Class A shares and $5.96 in The Merger Fund Class I shares. |

| (3) | Excluding dividends and interest and borrowing expenses on securities sold short, your actual cost of investment in the Fund would have been $9.10 in Westchester Event-Driven Fund Class A shares and $7.83 in Westchester Event-Driven Fund Class I shares. |

| (4) | Excluding dividends and interest and borrowing expenses on securities sold short, your actual cost of investment in the Fund would have been $9.60 in Westchester Credit Event Fund Class A shares and $8.34 in Westchester Credit Event Fund Class I shares. |

You can find more information about a Fund’s expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, refer to that Fund’s prospectus.

3

THE MERGER FUND® AND VIRTUS EVENT OPPORTUNITIES TRUST

KEY INVESTMENT TERMS (Unaudited)

DECEMBER 31, 2021

American Depositary Receipt (“ADR”)

Represents shares of foreign companies traded in U.S. dollars on U.S. exchanges that are held by a U.S. bank or a trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares.

Beta

Beta is a measure of the volatility – or systematic risk – of a security or portfolio compared to the market as a whole.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index measures the U.S. investment-grade fixed-rate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Consumer Price Index (“CPI”)

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care.

Exchange-Traded Fund (“ETF”)

An open-end fund that is traded on a stock exchange. Most ETFs have a portfolio of stocks or bonds that track a specific market index.

Federal Reserve (the “Fed”)

The Central Bank of the U.S., responsible for controlling the money supply, interest rates, and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches, and all national and state banks that are part of the system.

The Global Industry Classification Standard (GICS)

The Global Industry Classification Standard is a method for assigning companies to a specific economic sector and industry group that best defines its business operations. It is one of two rival systems that are used by investors, analysts, and economists to compare competing companies.

ICE BofA 3-month U.S. Treasury Bill Index

The ICE BofA 3-month U.S. Treasury Bill Index measures performance of the three-month Treasury bill, based on monthly average auction rates. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

Leveraged Loans

Leveraged loans (also known as bank, senior or floating-rate loans) consists of below investment-grade credit quality loans that are arranged by banks and other financial institutions to help companies finance acquisitions, recapitalizations, or other highly leveraged transactions. Such loans may be especially vulnerable to adverse changes in economic or market conditions, although they are senior in the capital structure which typically provides investors/lenders a degree of potential credit risk protection.

London Interbank Offered Rate (“LIBOR”)

A benchmark rate that some of the world’s leading banks charge each other for short-term loans and that serves as the first step to calculating interest rates on various loans throughout the world.

Morningstar U.S. Fund Event Driven Category Average

The Morningstar U.S. Fund Event Driven Category Average contains strategies that attempt to profit when security prices change in response to certain corporate actions, such as bankruptcies, mergers and acquisitions, emergence from bankruptcy, shifts in corporate strategy, and other atypical events. Activist shareholder and distressed investment strategies also fall into this category. These portfolios typically focus on equity securities but can invest across the capital structure. The category average is calculated on a total return basis with dividends reinvested. The category average is unmanaged and is not available for direct investment.

Prime Rate

The federal funds rate commercial banks charge their most creditworthy corporate customers.

Real Estate Investment Trust (“REIT”)

A publicly traded company that owns, develops and operates income-producing real estate such as apartments, office buildings, hotels, shopping centers and other commercial properties.

Special Purpose Acquisition Company (“SPAC”)

A special purpose acquisition company (SPAC) is a company that has no commercial operations and is formed strictly to raise capital through an initial public offering for the purpose of acquiring or merging with an existing company.

4

THE MERGER FUND® AND VIRTUS EVENT OPPORTUNITIES TRUST

KEY INVESTMENT TERMS (Unaudited) (Continued)

DECEMBER 31, 2021

Standard Deviation

The standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. The standard deviation is calculated as the square root of variance by determining each data point’s deviation relative to the mean.

Secured Overnight Financing Rate (“SOFR”)

A broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Wilshire Liquid Alternative Event Driven Index

The Wilshire Liquid Alternative Event Driven Index measures the performance of the event driven strategy component of the Wilshire Liquid Alternative Index. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

5

| | |

The Merger Fund® Fund Summary (Unaudited) | | Ticker Symbols: Class A: MERFX Class I: MERIX |

Portfolio Manager Commentary by Westchester Capital Management LLC

| ⬛ | | The Fund is diversified and has an investment objective of seeking to achieve capital growth through merger arbitrage. Merger arbitrage is a highly specialized investment approach generally designed to profit from the successful completion of publicly announced mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations and other corporate reorganizations.There is no guarantee that the Fund will meet its objective. |

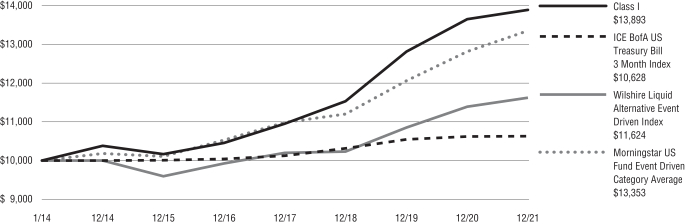

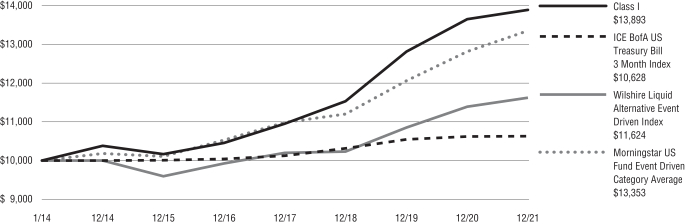

| ⬛ | | For the fiscal year ended December 31, 2021, the Fund’s Class A shares at NAV returned -0.19%, the Fund’s Class I shares at NAV returned 0.10%. For the same period, the ICE BofA U.S. Treasury Bill 3-Month Index returned 0.05%, the Wilshire Liquid Alternative Event Driven Index returned 2.05%, and the Morningstar U.S. Fund Event Driven Category Average returned 4.21%. |

How did the markets perform during the Fund’s fiscal year ended December 31, 2021?

For the 12 months ended December 31, 2021, global merger and acquisition (M&A) deal value topped $5 trillion for the first time. This surpassed the previous record high set in 2007 by about 30%, with activity up roughly 65% year-over-year, according to Dealogic. In fact, each quarter in 2021 recorded more than $1 trillion in M&A volume for the first time in history. Fueled by pent-up demand coming out of the pandemic, low interest rates, and an aggressively growing economy, companies struck deals to boost growth, acquire new capabilities, realize operational efficiencies, or some combination of the three.

Largely undaunted by concerns around inflation and geopolitical factors, the increase in merger activity reflected a growing understanding among business leaders that creating value requires more than cost-cutting. During 2021, company leaders proved willing to purchase assets that created revenue synergies, accelerated long-term growth, and increased scale. Moreover, accommodative monetary policies from the U.S. Federal Reserve (the Fed) gave company executives access to cheap financing, which facilitated transaction activity. In 2021, there were 58 mega-deals – transactions with equity value in excess

of $10 billion – the highest annual deal count ever, accounting for one-fifth of total M&A volumes, according to Citigroup. The number of deals worth $1 billion or more were also at their highest levels, up 90% year-over-year and 40% higher than the prior record in 2007.

Private equity-related M&A was a driver of deal flow as well, with spending on acquisitions accounting for a record 36% of global transaction volume this year, the highest share ever. No matter their size, most private equity firms were under pressure to deploy their investors’ funds, with more than $2.3 trillion of uninvested committed capital in their coffers, which can create multiples of that amount of potential transaction activity.

Despite a slowdown in the second half of 2021, the creation of new special purpose acquisition companies (SPACs) accounted for about 10% of the global M&A volumes. Additionally, there was approximately $140 billion of cash in trust inside existing SPACs searching for targets, which was estimated to amount to as much as a half-trillion U.S. dollars in combined cash and leverage specifically reserved for future M&A.

But this year’s burst of M&A was not without some headwinds. Because there is some risk of any M&A transaction being delayed or terminated, the target company will typically trade at a discount to the offer price. This discount, called the deal spread, measures potential returns for this strategy. During the fiscal year, deal spreads increased as a result of increased scrutiny from regulators around the globe, particularly the U.S. and China, which caused mark-to-market volatility, or unrealized losses, on existing deals awaiting regulatory approval. Rising inflation, rising interest rates, and the resurgence of COVID created additional execution uncertainty. However, our view on approvals remained consistent as of year end. Regardless of market movements and volatility, should deal spreads tighten to zero for those transactions that proceed to closure, the negative marks-to-market on those particular positions would be reversed. Unfortunately, this does not always happen on a calendar year basis.

What factors affected the Fund’s performance during its fiscal year?

The Fund has an absolute return focus and is not managed to a benchmark. However, because merger

arbitrage has a historically low correlation to stocks and bonds, with volatility that has historically been similar to that of a short-to-medium-term bond, the Fund is often compared to the Bloomberg U.S. Aggregate Bond Index in addition to the U.S. 3-month Treasury bill. For the fiscal year ended December 31, 2021, the Bloomberg U.S. Aggregate Bond Index was down 1.54% and the ICE BofA US Treasury Bill 3 Month Index return was 0.05%.

The Fund’s performance for the fiscal year ended December 31, 2021, was well below our targeted rate of return. While the Fund experienced its fourth down year (in the retail share class) in the 33 years since its inception in 1989, the Fund demonstrated lower volatility. At the end of the 12-month period, the Fund’s three-year standard deviation was approximately 3.15, and its beta, or volatility compared with the market, was 0.11 to the S&P 500® Index and 0.07 to the Bloomberg U.S. Aggregate Bond Index.

The second half of 2021 introduced a number of challenges, beginning with the deal break between Aon and Willis Towers Watson. The M&A space saw increased volatility in deal spreads in general, as investors began to question the impact of an increase in worldwide concerns relating to international and national security issues and consumer protections. Lack of transparency at China’s oversight agency, the State Administration for Market Regulation (SAMR), particularly regarding technology sector transactions, exacerbated China-U.S. tensions, causing wild fluctuations among deals that required Chinese approval.

As with any investment program, losses are inevitable from time to time. The Fund continues to manage concentration risk to minimize the impact of these periodic unpredictable events. The majority of the drawdowns in the Fund were unrealized losses, and we are confident that many of these positions will recover.

The biggest contributors to performance for the 12-month period were Coherent Inc./II-VI Inc., Churchill Capital Corp. IV, and Inphi Corp./Marvell Technology Group.

The Fund’s biggest detractors for the fiscal year were Willis Towers Watson PLC/Aon PLC, Xilinx Inc./Advanced Micro Devices Inc., and Macro Portfolio Hedge.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

6

|

The Merger Fund® (Continued) |

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Fundamental Risk of Investing: There can be no assurance that the portfolio will achieve its investment objectives. An investment in the portfolio is subject to the risk of loss of principal; shares may decrease in value.

Merger-arbitrage & Event-driven Investing: Merger-arbitrage and event-driven investing involve the risk that the adviser’s evaluation of the outcome of a proposed event, whether it be a merger, reorganization, regulatory issue, or other event, will prove incorrect and that the Fund’s return on the investment may be negative.

Short Sales: The portfolio may engage in short sales, and may incur a loss if the price of a borrowed security increases before the date on which the portfolio replaces the security.

Foreign Investing: Investing in foreign securities subjects the portfolio to additional risks such as increased volatility, currency fluctuations, less liquidity, and political, regulatory, economic, and market risk.

Portfolio Turnover: The portfolio’s principal investment strategies may result in a consistently high portfolio turnover rate. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the portfolio is held in a taxable account.

Credit & Interest: Debt instruments are subject to various risks, including credit and interest rate risk. The issuer of a debt security may fail to make interest and/or principal payments. Values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced with longer-term maturities.

Derivatives: Investments in derivatives such as futures, options, forwards, and swaps may increase volatility or cause a loss greater than the principal investment.

Hedging: The portfolio’s hedging strategy will be subject to the portfolio’s investment adviser’s ability to correctly assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged.

Sector Focused Investing: Events negatively affecting a particular industry or market sector in which the portfolio focuses its investments may cause the value of the portfolio to decrease.

Technology Concentration: Because the portfolio is presently heavily weighted in the technology sector, it will be impacted by that sector’s performance more than a portfolio with broader sector diversification.

Market Volatility: Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the portfolio and its investments, including hampering the ability of the portfolio manager(s) to invest the portfolio’s assets as intended.

Prospectus: For additional information on risks, please see the fund’s prospectus.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

7

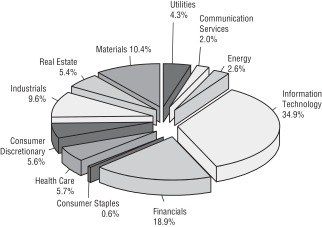

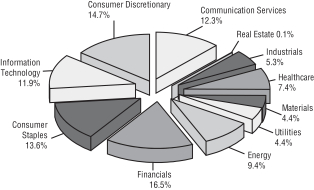

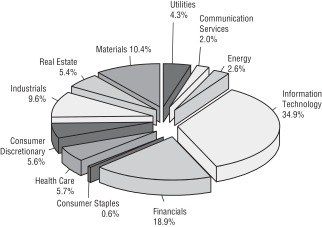

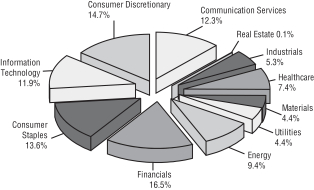

PORTFOLIO COMPOSITION*

The Merger Fund (Unaudited)

By Sector

By Region

| * | Data expressed as a percentage of long common stocks, private investments in public equity, preferred stocks, contingent value rights, rights, warrants, bank loans, convertible bonds, corporate bonds and long total return swap contract positions as of December 31, 2021. Data expressed excludes special purpose acquisition companies, escrow notes, short-term investments, securities sold short, written and purchased options, forward currency exchange contracts and short total return swap contracts. Please refer to the Schedule of Investments for more details on the Fund’s individual holdings. |

8

DEAL COMPOSITION

The Merger Fund (Unaudited)

| | | | | | | | | | | | |

| | | | | |

| Type of Buyer | | | | | | | Deal Terms* | | | |

| | | | | |

| Strategic | | | 95.5 | % | | | | Cash | | | 58.6 | % |

| | | | | |

| Financial | | | 4.5 | % | | | | Stock with Fixed Exchange Ratio | | | 27.8 | % |

| | | | |

| | | | | | | | Cash & Stock | | | 10.0 | % |

| | | | | |

| By Deal Type | | | | | | | | Stock and Stub(1) | | | 2.7 | % |

| | | | | |

| Friendly | | | 99.8 | % | | | | Risk Reversal | | | 0.7 | % |

| | | | | |

| Hostile | | | 0.2 | % | | | | Undetermined(2) | | | 0.1 | % |

| | | | |

| | | | | | | | Stock with Flexible Exchange Ratio (Collar) | | | 0.1 | % |

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of December 31, 2021. |

| (1) | “Stub” includes assets other than cash and stock (e.g., escrow notes). |

| (2) | The compensation is undetermined because the compensation to be received (e.g., stock, cash, escrow notes, other) will be determined at a later date, potentially at the option of the Fund’s investment adviser. |

9

The Merger Fund®

| | | | | | | | | | | | | | | | | | | | |

| | | |

Average Annual Total Returns(1) for the period ended 12/31/21 | | | | | | | | | | |

| | | | | |

| | | 1 Yr | | | 5 Yr | | | 10 Yr | | | Life | | | Inception

Date | |

| | | | | | |

| Class A NAV2 | | | -0.19 | % | | | 4.11 | % | | | 3.08 | % | | | — | % | | | — | |

| | | | | | |

| Class A POP3,4 | | | -5.68 | | | | 2.93 | | | | 2.50 | | | | — | | | | — | |

| | | | | | |

| Class I NAV | | | 0.10 | | | | 4.42 | | | | — | | | | 3.35 | | | | 8/1/2013 | |

| | | | | | |

| ICE Bof A US Treasury Bill 3 Month Index | | | 0.05 | | | | 1.14 | | | | 0.63 | | | | 0.73 | 5 | | | — | |

| | | | | | |

| Wilshire Liquid Alternative Event Driven Index | | | 2.05 | | | | 3.21 | | | | — | | | | — | | | | — | |

| | | | | | |

| Morningstar US Fund Event Driven Category Average | | | 4.21 | | | | 4.85 | | | | 4.23 | | | | 3.85 | 5 | | | — | |

Fund Expense Ratio6: Class A shares: Gross 1.63%, Net 1.53%; Class I shares: Gross 1.33%, Net 1.24%

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

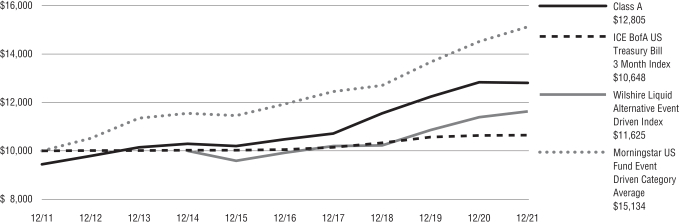

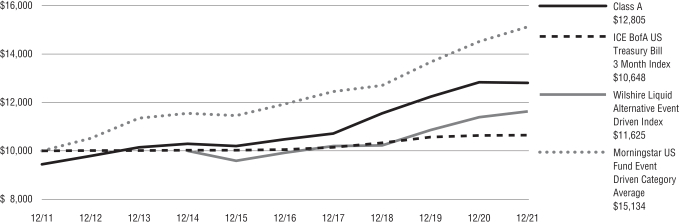

Growth of $10,000 (from lesser of 10 years or since inception)

This chart assumes an initial gross investment of $10,000 made on December 31, 2011. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or upon redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class I shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class I shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective October 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through September 30, 2023. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

10

| | |

Westchester Event-Driven Fund Fund Summary (Unaudited) | | Ticker Symbols: Class A: WCERX Class I: WCEIX |

Portfolio Manager Commentary by Westchester Capital Management LLC

| ⬛ | | The Fund is diversified and has an investment objective of seeking to provide attractive risk-adjusted returns with low relative volatility in virtually all market environments. Risk-adjusted return is a concept that considers not only an investment’s return, but also the amount of potential risk involved in producing that return. There is no guarantee that the Fund will meet its objective. |

| ⬛ | | For the fiscal year ended December 31, 2021, the Fund’s Class A shares at NAV returned 1.57%,the Fund’s Class I shares at NAV returned 1.75%. For the same period, the ICE BofA U.S. Treasury Bill 3 Month Index returned 0.05%, the Wilshire Liquid Alternative Event Driven Index returned 2.04%, and the Morningstar U.S. Fund Event Driven Category Average returned 4.21%. |

How did the markets perform during the Fund’s fiscal year ended December 31, 2021?

For the 12 months ended December 31, 2021, global merger and acquisition (M&A) deal value topped $5 trillion for the first time. This surpassed the previous record high set in 2007 by about 30%, with activity up roughly 65% year-over-year, according to Dealogic. In fact, each quarter in 2021 recorded more than $1 trillion in M&A volume for the first time in history. Fueled by pent-up demand coming out of the pandemic, low interest rates, and an aggressively growing economy, companies struck deals to boost growth, acquire new capabilities, realize operational efficiencies, or some combination of the three.

Largely undaunted by concerns around inflation and geopolitical factors, the increase in merger activity reflected a growing understanding among business leaders that creating value requires more than cost-cutting. During 2021, company leaders proved willing to purchase assets that created revenue synergies, accelerated long-term growth, and increased scale. Moreover, accommodative monetary policies from the U.S. Federal Reserve (the Fed) gave company executives access to cheap financing, which

facilitated transaction activity. In 2021, there were 58 mega-deals – transactions with equity value in excess of $10 billion – the highest annual deal count ever, accounting for one-fifth of total M&A volumes, according to Citigroup. The number of deals worth $1 billion or more were also at their highest levels, up 90% year-over-year and 40% higher than the prior record in 2007.

Private equity-related M&A was a driver of deal flow as well, with spending on acquisitions accounting for a record 36% of global transaction volume this year, the highest share ever. No matter their size, most private equity firms were under pressure to deploy their investors’ funds, with more than $2.3 trillion of uninvested committed capital, which can create multiples of that amount of potential transaction activity.

Despite a slowdown in the second half of 2021, the creation of new special purpose acquisition companies (SPACs) accounted for about 10% of the global M&A volumes. Additionally, there was approximately $140 billion of cash in trust inside existing SPACs searching for targets, which was estimated to amount to as much as a half-trillion U.S. dollars in combined cash and leverage specifically reserved for future M&A.

With regard to corporate divestitures – the disposal of a company’s assets or a business unit through a sale, closure or bankruptcy – investors continued to increase their focus on growth, which made it increasingly difficult for larger companies to move the needle off a large revenue base. Sometimes the value of keeping businesses together can be less than the value of breaking the company up. Removing the conglomerate discount enables individual companies to trade on their own and be valued more easily by the market, as evidenced by the fact corporate divestiture activity reached its highest levels ever during the period, with $1.2 trillion of volumes.

But this year’s burst of M&A was not without some headwinds. Because there is some risk of any M&A transaction being delayed or terminated, the target company will typically trade at a discount to the offer price. This discount, called the deal spread, measures potential returns for this strategy. During the fiscal year, deal spreads increased as a result of increased scrutiny from regulators around the globe, particularly the U.S. and China, which caused

mark-to-market volatility, or unrealized losses, on existing deals awaiting regulatory approval. Rising inflation, rising interest rates, and the resurgence of COVID created additional execution uncertainty. However, our view on approvals remained consistent as of year end. Regardless of market movements and volatility, should deal spreads tighten to zero for those transactions that proceed to closure, the negative marks-to-market on those particular positions would be reversed. Unfortunately, this does not always happen on a calendar year basis.

What factors affected the Fund’s performance during its fiscal year?

The Fund’s performance for the 12 months ended December 31, 2021, was well below our targeted rate of return. The special situations investment strategy was the Fund’s biggest contributor (+0.57%). The credit opportunities (+0.08), arbitrage (+0.05%), and restructurings (-0.37%) strategies accounted for the remainder of the Fund’s performance. At the end of the fiscal year, the Fund’s three-year standard deviation was approximately 9.21 (compared with 17.41 for the S&P 500® Index), and its beta, or volatility compared with the market, was 0.39 to the S&P 500® Index and 0.30 to the Bloomberg U.S. Aggregate Bond Index.

The second half of 2021 introduced a number of challenges, beginning with the deal break between Aon and Willis Towers Watson. The M&A space saw increased volatility in deal spreads in general, as investors began to question the impact of an increase in worldwide concerns relating to international and national security issues and consumer protections. Lack of transparency at China’s oversight agency, the State Administration for Market Regulation (SAMR), particularly regarding technology sector transactions, exacerbated China-U.S. tensions, causing wild fluctuations among deals that required Chinese approval.

As with any investment program, losses are inevitable from time to time. The Fund continues to manage concentration risk to minimize the impact of these periodic unpredictable events. The majority of the drawdowns in the Fund were unrealized losses, and we are confident that many of these positions will recover.

The biggest contributors to performance for the 12-month period were Churchill Capital Corp IV, Coherent Inc. /II-VI Inc., and RentPath LLC.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

11

| | |

Westchester Event Driven Fund (Continued) | | |

The Fund’s biggest detractors for the fiscal year were Willis Towers Watson PLC/Aon PLC., Government Sponsored Entities, and Xilinx Inc. /Advanced Micro Devices Inc.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Fundamental Risk of Investing: There can be no assurance that the portfolio will achieve its investment objectives. An investment in the portfolio is subject to the risk of loss of principal; shares may decrease in value.

Merger-arbitrage & Event-driven Investing: Merger-arbitrage and event-driven investing involve the risk that the adviser’s evaluation of the outcome of a proposed event, whether it be a merger, reorganization, regulatory issue, or other event, will prove incorrect and that the Fund’s return on the investment may be negative.

Foreign Investing: Investing in foreign securities subjects the portfolio to additional risks such as increased volatility, currency fluctuations, less liquidity, and political, regulatory, economic, and market risk.

Short Sales: The portfolio may engage in short sales, and may incur a loss if the price of a borrowed security increases before the date on which the portfolio replaces the security.

Portfolio Turnover: The portfolio’s principal investment strategies may result in a consistently high portfolio turnover rate. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the portfolio is held in a taxable account.

Credit & Interest: Debt instruments are subject to various risks, including credit and interest rate risk. The issuer of a debt security may fail to make interest and/or principal payments. Values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced with longer-term maturities.

Derivatives: Investments in derivatives such as futures, options, forwards, and swaps may increase volatility or cause a loss greater than the principal investment.

Hedging: The portfolio’s hedging strategy will be subject to the portfolio’s investment adviser’s ability to correctly assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged.

Market Volatility: Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the portfolio and its investments, including hampering the ability of the portfolio manager(s) to invest the portfolio’s assets as intended.

Prospectus: For additional information on risks, please see the fund’s prospectus.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

12

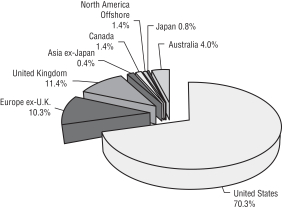

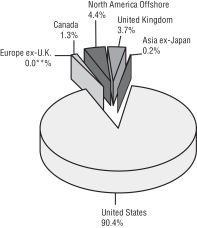

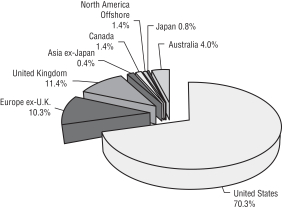

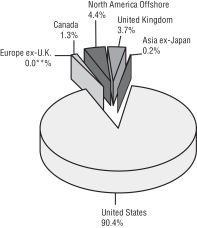

PORTFOLIO COMPOSITION*

Westchester Event-Driven Fund (Unaudited)

By Sector

By Region

| * | Data expressed as a percentage of long common stocks, private investments in public equity, closed-end funds, preferred stocks, contingent value rights, rights, warrants, bank loans, convertible bonds, corporate bonds and long total return swap contract positions as of December 31, 2021. Data expressed excludes special purpose acquisition companies, escrow notes, short-term investments, securities sold short, written and purchased options, forward currency exchange contracts and short total return swap contracts. Please refer to the Schedule of Investments for more details on the Fund’s individual holdings. |

13

Westchester Event-Driven Fund

| | | | | | | | | | | | | | | | |

| | |

Average Annual Total Returns(1) for the period ended 12/31/21 | | | | | | | |

| | | | |

| | | 1 Yr | | | 5 Yr | | | Life | | | Inception

Date | |

| | | | | |

| Class A NAV2 | | | 1.57 | % | | | — | % | | | 5.68 | % | | | 3/22/2017 | |

| | | | | |

| Class A POP3,4 | | | -4.02 | | | | — | | | | 4.43 | | | | 3/22/2017 | |

| | | | | |

| Class I NAV | | | 1.75 | | | | 5.84 | | | | 4.20 | | | | 1/2/2014 | |

| | | | | |

| ICE Bof A US Treasury Bill 3 Month Index | | | 0.05 | | | | 1.14 | | | | —5 | | | | — | |

| | | | | |

| Wilshire Liquid Alternative Event Driven Index | | | 2.04 | | | | 3.21 | | | | 3.286 | | | | — | |

| | | | | |

| Morningstar US Fund Event Driven Category Average | | | 4.21 | | | | 4.85 | | | | —7 | | | | — | |

Fund Expense Ratio8: Class A shares: Gross 2.05%, Net 2.01%; Class I shares: Gross 1.77%, Net 1.76%

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

Growth of $10,000 (from lesser of 10 years or since inception)

This chart assumes an initial gross investment of $10,000 made on January 2, 2014. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or upon redemptions of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class I shares are 1% within the first year and 0% thereafter. |

| 5 | The index return is 0.76% since inception of Class A shares and 1.18% since inception of Class I shares. |

| 6 | The since inception index return is from the inception date of Class I shares. |

| 7 | The index return is 3.68% since inception of Class A shares and 4.94% since inception of Class I shares. |

| 8 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective October 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through September 30, 2023. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

14

| | |

Westchester Credit Event Fund Fund Summary (Unaudited) | | Ticker Symbols: Class A: WCFRX Class I: WCFIX |

Portfolio Manager Commentary by Westchester Capital Management LLC

| ⬛ | | The Fund is diversified and has an investment objective of seeking to provide attractive risk-adjusted returns independent of market cycles. The intent is to provide such returns through both current income and capital appreciation. Risk-adjusted return is a concept that considers not only an investment’s return, but also the amount of potential risk involved in producing that return. There is no guarantee that the Fund will meet its objective. |

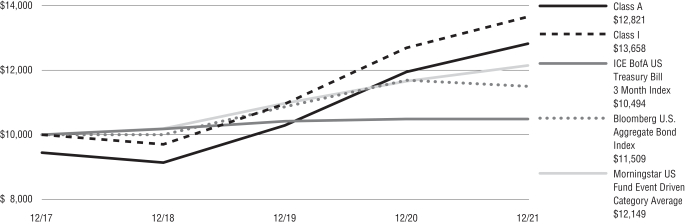

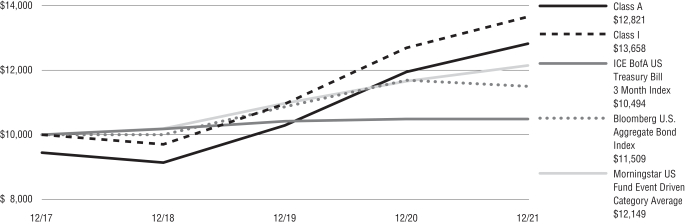

| ⬛ | | For the fiscal year ended December 31, 2021, the Fund’s Class A shares at NAV returned 7.27%,the Fund’s Class I shares at NAV returned 7.57%. For the same period, the ICE BofA U.S. Treasury Bill 3 Month Index returned 0.05%, the Bloomberg U.S. Aggregate Bond Index returned -1.54%, and the Morningstar U.S. Fund Event Driven Category Average returned 4.21%. |

How did the markets perform during the Fund’s fiscal year ended December 31, 2021?

Buoyed by accommodative fiscal and monetary policies, the S&P 500® Index advanced by 26.89% for the 12 months, marking its third straight positive year. The Bloomberg U.S. Aggregate Bond Index, which broadly tracks the U.S. investment grade bond market, lost 1.54% in 2021, the fifth time the index posted a negative calendar-year return since 1980. Importantly, inflation, as measured by the Consumer Price Index (CPI) for all items, rose to 7%, the largest year-over-year percent change since 1981. After factoring in inflation, therefore, the Bloomberg U.S. Aggregate Bond Index saw a real return of -8.54%.

The 10-year U.S. Treasury yield rose to 1.52% from 0.93% at the start of the year, which caused a decline in bond prices. The yield on the two-year Treasury climbed to 0.73% from 0.13%. The Federal Reserve (the Fed) indicated the potential for three interest rate hikes in 2022. While that may sound positive to those who primarily seek yield from their bond portfolios, it is less appealing to those who own bonds primarily because they want prices to rise. Spiking inflation tends to drive bond yields higher because investors seek returns in excess of inflation. But because yields and prices move in opposite directions, rising yields typically depress the prices of outstanding bonds.

What factors affected the Fund’s performance during its fiscal year?

The Fund posted positive returns for the 12 months ended December 31, 2021. At the end of the period, the Fund’s effective duration was 1.4 years and its average weighted maturity (not the expected holding period) was 3.4 years. The Fund’s three-year standard deviation was approximately 9.21 at year-end, compared with 17.41 for the S&P 500® Index, and its beta, or volatility compared with the market, was 0.24 to the S&P 500® Index and 0.45 to the Bloomberg U.S. Aggregate Bond Index.

Event-driven strategies experienced higher volatility in 2021, due in part to international and national security issues and potential consumer protection legislation. Concerns about China’s oversight agency, the State Administration for Market Regulation (SAMR), arose amid China-U.S. tensions, particularly in the technology sector, causing wild fluctuations among transactions that require Chinese approval. However, although the Fund’s strategy is focused on event-driven investments, it did not experience the same level of volatility as was experienced by more traditional event-driven managers during the year.

The Fund tactically invests in opportunities such as late-stage bankruptcies where the exit plan for the company’s securities has already been drafted; capital structure arbitrage; and also opportunities in the post-emergence space which usually create an endgame whereby we can calculate expected proceeds and timing of receipt, typically seeking muted downside and attractive risk-adjusted returns, driven by current yield and/or capital appreciation.

The biggest contributors to performance during the 12-month period were RentPath LLC, Equity/Debt Capital Markets, and Claire’s Stores.

The Fund’s biggest detractors for the period were Government Sponsored Entities, Heritage Power, and GMAC Capital Trust I float.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Fundamental Risk of Investing: There can be no assurance that the portfolio will achieve its investment objectives. An investment in the portfolio is subject to the risk of loss of principal; shares may decrease in value.

Merger-arbitrage & Event-driven Investing: Merger-arbitrage and event-driven investing involve the risk that the adviser’s evaluation of the outcome of a proposed event, whether it be a merger, reorganization, regulatory issue, or other event, will prove incorrect and that the Fund’s return on the investment may be negative.

Credit & Interest: Debt instruments are subject to various risks, including credit and interest rate risk. The issuer of a debt security may fail to make interest and/or principal payments. Values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced with longer-term maturities.

Short Sales: The portfolio may engage in short sales, and may incur a loss if the price of a borrowed security increases before the date on which the portfolio replaces the security.

Portfolio Turnover: The portfolio’s principal investment strategies may result in a consistently high portfolio turnover rate. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the portfolio is held in a taxable account.

Derivatives: Investments in derivatives such as futures, options, forwards, and swaps may increase volatility or cause a loss greater than the principal investment.

Hedging: The portfolio’s hedging strategy will be subject to the portfolio’s investment adviser’s ability to correctly assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged.

Lower-rated securities: Instruments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities.

Foreign Investing: Investing in foreign securities subjects the portfolio to additional risks such as increased volatility, currency fluctuations, less liquidity, and political, regulatory, economic, and market risk.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

15

| | |

| Westchester Credit Event Fund (Continued) | | |

Market Volatility: Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the portfolio and its investments, including hampering the ability of the portfolio manager(s) to invest the portfolio’s assets as intended.

Prospectus: For additional information on risks, please see the fund’s prospectus.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

16

PORTFOLIO COMPOSITION*

Westchester Credit Event Fund (Unaudited)

By Sector

By Region

| * | Data expressed as a percentage of long common stocks, private investments in public equity, preferred stocks, warrants, bank loans, convertible bonds, corporate bonds and long total return swap contract positions as of December 31, 2021. Data expressed excludes special purpose acquisition companies, escrow notes, short-term investments and written options. Please refer to the Schedule of Investments for more details on the Fund’s individual holdings. |

| ** | Amount less than 0.005%. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”).

17

Westchester Credit Event Fund

| | | | | | | | | | | | |

| |

Average Annual Total Returns(1) for the period ended 12/31/21 | | | | |

| | | |

| | | 1 Yr | | | Life | | | Inception

Date | |

| | | | |

| Class A NAV2 | | | 7.27 | % | | | 7.91 | % | | | 12/29/2017 | |

| | | | |

| Class A POP3,4 | | | 1.37 | | | | 6.40 | | | | 12/29/2017 | |

| | | | |

| Class I NAV | | | 7.57 | | | | 8.09 | | | | 12/29/2017 | |

| | | | |

| ICE Bof A US Treasury Bill 3 Month Index | | | 0.05 | | | | 1.21 | | | | — | |

| | | | |

| Bloomberg U.S. Aggregate Bond Index | | | -1.54 | | | | 3.57 | | | | — | |

| | | | |

| Morningstar US Fund Event Driven Category Average | | | 4.21 | | | | 4.98 | | | | — | |

Fund Expense Ratio5: Class A shares: Gross 2.92%, Net 2.63%; Class I shares: Gross 2.72%, Net 2.38%

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

Growth of $10,000 (from lesser of 10 years or since inception)

This chart assumes an initial gross investment of $10,000 made on December 29, 2017. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or upon redemptions of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class I shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective October 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through September 30, 2023. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

18

THE MERGER FUND®

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares | | | | | | Value | |

| LONG INVESTMENTS — 95.68% | | | | | | | | | | | | |

| COMMON STOCKS — 48.80% | | | | | | | | | | | | |

| AEROSPACE & DEFENSE — 1.37% | | | | | | | | | |

Aerojet Rocketdyne Holdings, Inc. | | | 1,252,837 | | | | | | | $ | 58,582,658 | |

| | | | | | | | | | | | |

| | | |

| AIRLINES — 0.01% | | | | | | | | | |

American Airlines Group, Inc. (a) | | | 12,588 | | | | | | | | 226,085 | |

| | | | | | | | | | | | |

| | | |

| AUTO COMPONENTS — 0.35% | | | | | | | | | |

Veoneer, Inc. (a) | | | 421,827 | | | | | | | | 14,966,422 | |

| | | | | | | | | | | | |

| | | |

| BANKS — 0.38% | | | | | | | | | |

People’s United Financial, Inc. | | | 919,111 | | | | | | | | 16,378,558 | |

| | | | | | | | | | | | |

| | | |

| BIOTECHNOLOGY — 0.41% | | | | | | | | | |

Arena Pharmaceuticals, Inc. (a)(j) | | | 188,114 | | | | | | | | 17,483,315 | |

| | | | | | | | | | | | |

| | | |

| CHEMICALS — 1.32% | | | | | | | | | |

Atotech Ltd. (a) | | | 1,307,436 | | | | | | | | 33,365,767 | |

Ferro Corporation (a) | | | 1,063,628 | | | | | | | | 23,218,999 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 56,584,766 | |

| | | | | | | | | | | | |

| | | |

| COMMERCIAL SERVICES & SUPPLIES — 0.16% | | | | | | | | | |

RR Donnelley & Sons Company (a) | | | 596,340 | | | | | | | | 6,714,788 | |

| | | | | | | | | | | | |

| | | |

| COMMERICAL BANKS — 0.12% | | | | | | | | | |

Flagstar Bancorp, Inc. | | | 107,110 | | | | | | | | 5,134,853 | |

| | | | | | | | | | | | |

| | | |

| COMPUTERS SERVICES — 0.11% | | | | | | | | | |

PAE, Inc. (a) | | | 471,143 | | | | | | | | 4,678,450 | |

| | | | | | | | | | | | |

| | | |

| CONSTRUCTION MATERIALS — 0.45% | | | | | | | | | |

Forterra, Inc. (a) | | | 804,911 | | | | | | | | 19,140,784 | |

| | | | | | | | | | | | |

| | | |

| ELECTRIC UTILITIES — 0.34% | | | | | | | | | |

PNM Resources, Inc. | | | 316,534 | | | | | | | | 14,437,116 | |

| | | | | | | | | | | | |

| | | |

| ELECTRONIC EQUIPMENT & INSTRUMENTS — 4.66% | | | | | | | | | |

Coherent, Inc. (a) | | | 746,803 | | | | | | | | 199,052,872 | |

| | | | | | | | | | | | |

| | | |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 1.14% | | | | | | | | | |

Rogers Corporation (a) | | | 177,962 | | | | | | | | 48,583,626 | |

| | | | | | | | | | | | |

| | | |

| ENTERTAINMENT — 0.52% | | | | | | | | | |

MGM Holdings, Inc. (a)(f) | | | 131,269 | | | | | | | | 17,590,046 | |

Sciplay Corporation (a) | | | 327,926 | | | | | | | | 4,518,820 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 22,108,866 | |

| | | | | | | | | | | | |

| | | |

| FOOD PRODUCTS — 0.22% | | | | | | | | | |

Sanderson Farms, Inc. | | | 48,525 | | | | | | | | 9,272,157 | |

| | | | | | | | | | | | |

| | | |

| HEALTH CARE EQUIPMENT & SUPPLIES — 0.33% | | | | | | | | | |

Intersect ENT, Inc. (a) | | | 515,698 | | | | | | | | 14,083,712 | |

| | | | | | | | | | | | |

| | | |

| HEALTH CARE PROVIDERS & SERVICES — 0.02% | | | | | | | | | |

ATI Physical Therapy, Inc. (a) | | | 306,157 | | | | | | | | 1,037,872 | |

| | | | | | | | | | | | |

| | | |

| HEALTH CARE TECHNOLOGY — 1.93% | | | | | | | | | |

Cerner Corporation (j) | | | 885,799 | | | | | | | | 82,264,153 | |

Convey Health Solutions Holdings, Inc. (a) | | | 3,901 | | | | | | | | 32,612 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 82,296,765 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

19

THE MERGER FUND®

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares | | | | | | Value | |

| | | |

| IT SERVICES — 0.43% | | | | | | | | | |

Afterpay Ltd. — ADR (a) | | | 304,052 | | | | | | | $ | 18,212,715 | |

| | | | | | | | | | | | |

| | | |

| LIFE & HEALTH INSURANCE — 3.46% | | | | | | | | | |

American National Group, Inc. | | | 125,278 | | | | | | | | 23,657,498 | |

Athene Holding Ltd. — ADR (a)(e) | | | 1,489,734 | | | | | | | | 124,139,534 | |

Oscar Health, Inc. Class A (a) | | | 500 | | | | | | | | 3,925 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 147,800,957 | |

| | | | | | | | | | | | |

| | | |

| MACHINERY — 0.83% | | | | | | | | | |

Welbilt, Inc. (a) | | | 1,487,326 | | | | | | | | 35,353,739 | |

| | | | | | | | | | | | |

| | | |

| MEDIA — 0.97% | | | | | | | | | |

Shaw Communications, Inc. (b) | | | 1,360,389 | | | | | | | | 41,274,202 | |

| | | | | | | | | | | | |

| | | |

| METALS & MINING — 4.01% | | | | | | | | | |

BHP Group plc — ADR (e) | | | 2,862,387 | | | | | | | | 171,084,871 | |

| | | | | | | | | | | | |

| | | |

| MULTI-LINE INSURANCE — 0.56% | | | | | | | | | |

The Hartford Financial Services Group, Inc. (j) | | | 349,090 | | | | | | | | 24,101,174 | |

| | | | | | | | | | | | |

| | | |

| OIL, GAS & CONSUMABLE FUELS — 0.75% | | | | | | | | | |

Teekay LNG Partners LP (b) | | | 1,901,746 | | | | | | | | 32,196,560 | |

| | | | | | | | | | | | |

| | | |

| PHARMACEUTICALS — 0.06% | | | | | | | | | |

TPCO Holding Corporation — ADR (a) | | | 1,816,240 | | | | | | | | 2,488,249 | |

| | | | | | | | | | | | |

| | | |

| PROFESSIONAL SERVICES — 0.14% | | | | | | | | | |

51job, Inc. — ADR (a) | | | 123,954 | | | | | | | | 6,065,069 | |

| | | | | | | | | | | | |

| | | |

| REITs — 3.12% | | | | | | | | | |

Bluerock Residential Growth REIT, Inc. | | | 377,021 | | | | | | | | 9,949,584 | |

CyrusOne, Inc. | | | 1,375,907 | | | | | | | | 123,446,376 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 133,395,960 | |

| | | | | | | | | | | | |

| | | |

| RESEARCH & CONSULTING SERVICES — 6.51% | | | | | | | | | |

IHS Markit Ltd. (e) | | | 2,092,830 | | | | | | | | 278,178,964 | |

| | | | | | | | | | | | |

| | | |

| ROAD & RAIL — 0.01% | | | | | | | | | |

Hertz Global Holdings, Inc. (a) | | | 16,825 | | | | | | | | 420,457 | |

| | | | | | | | | | | | |

| | | |

| SEMICONDUCTORS — 5.92% | | | | | | | | | |

Magnachip Semiconductor Corporation (a) | | | 69,814 | | | | | | | | 1,463,999 | |

Xilinx, Inc. (e) | | | 1,185,832 | | | | | | | | 251,431,959 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 252,895,958 | |

| | | | | | | | | | | | |

| | | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 0.26% | | | | | | | | | |

NeoPhotonics Corporation (a) | | | 715,683 | | | | | | | | 11,000,048 | |

| | | | | | | | | | | | |

| | | |

| SOFTWARE — 7.58% | | | | | | | | | |

Five9, Inc. (a)(j) | | | 117,700 | | | | | | | | 16,162,564 | |

Nuance Communications, Inc. (a)(e) | | | 3,879,461 | | | | | | | | 214,611,783 | |

UserTesting, Inc. (a) | | | 400 | | | | | | | | 3,368 | |

Vonage Holdings Corporation (a)(j) | | | 4,467,708 | | | | | | | | 92,883,649 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 323,661,364 | |

| | | | | | | | | | | | |

| | | |

| SPECIALTY RETAIL — 0.35% | | | | | | | | | |

Sportsman’s Warehouse Holdings, Inc. (a)(j) | | | 1,260,908 | | | | | | | | 14,878,714 | |

| | | | | | | | | | | | |

| TOTAL COMMON STOCKS (Cost $1,867,097,983) | | | | | | | | 2,083,772,666 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

20

THE MERGER FUND®

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | |

| | | Shares/Units | | | | | | Value | |

| SPECIAL PURPOSE ACQUISITION COMPANIES — 15.85% (a) | | | | | | | | | |

26 Capital Acquisition Corporation | | | 122,000 | | | | | | | $ | 1,235,860 | |

Accelerate Acquisition Corporation Class A | | | 604,200 | | | | | | | | 5,872,824 | |

ACE Convergence Acquisition Corporation Class A — ADR | | | 155,096 | | | | | | | | 1,544,756 | |

AfterNext HealthTech Acquisition Corporation Class A — ADR | | | 527,310 | | | | | | | | 5,141,272 | |

Agile Growth Corporation Class A — ADR | | | 210,000 | | | | | | | | 2,037,000 | |

Alpha Partners Technology Merger Corporation Class A — ADR | | | 441,459 | | | | | | | | 4,264,494 | |

AltEnergy Acquisition Corporation | | | 125,618 | | | | | | | | 1,267,486 | |

Altimar Acquisition Corporation III — ADR | | | 163,357 | | | | | | | | 1,605,799 | |

Altimar Acquisition Corporation III Class A — ADR | | | 150,000 | | | | | | | | 1,464,000 | |

Altimeter Growth Corporation 2 Class A — ADR | | | 298,403 | | | | | | | | 2,942,254 | |

Altitude Acquisition Corporation Class A | | | 481,728 | | | | | | | | 4,769,107 | |

Anzu Special Acquisition Corporation I | | | 15,412 | | | | | | | | 153,504 | |

Anzu Special Acquisition Corporation I Class A | | | 441,364 | | | | | | | | 4,303,299 | |

Apollo Strategic Growth Capital Class A — ADR | | | 547,190 | | | | | | | | 5,400,765 | |

Apollo Strategic Growth Capital II Class A — ADR | | | 200,000 | | | | | | | | 1,956,000 | |

Archimedes Tech SPAC Partners Company | | | 13,489 | | | | | | | | 135,430 | |

ArcLight Clean Transition Corporation II Class A — ADR | | | 395,206 | | | | | | | | 3,944,156 | |

Ares Acquisition Corporation — ADR | | | 157,500 | | | | | | | | 1,563,975 | |

Ares Acquisition Corporation Class A — ADR | | | 100,000 | | | | | | | | 974,000 | |

Arrowroot Acquisition Corporation Class A | | | 575,536 | | | | | | | | 5,582,699 | |

Artisan Acquisition Corporation Class A — ADR | | | 110,355 | | | | | | | | 1,093,618 | |

Astrea Acquisition Corporation Class A | | | 430,908 | | | | | | | | 4,257,371 | |

Athena Consumer Acquisition Corporation | | | 83,859 | | | | | | | | 852,846 | |

Atlas Crest Investment Corporation II | | | 107,500 | | | | | | | | 1,067,475 | |

Atlas Crest Investment Corporation II Class A | | | 306,631 | | | | | | | | 2,983,520 | |

Aurora Acquisition Corporation Class A (b) | | | 175,172 | | | | | | | | 1,734,203 | |

Austerlitz Acquisition Corporation I Class A — ADR | | | 820,401 | | | | | | | | 7,966,094 | |

Austerlitz Acquisition Corporation II — ADR | | | 63,000 | | | | | | | | 630,630 | |

Austerlitz Acquisition Corporation II Class A — ADR | | | 392,818 | | | | | | | | 3,818,191 | |

Authentic Equity Acquisition Corporation — ADR | | | 21,600 | | | | | | | | 216,000 | |

Avanti Acquisition Corporation Class A (b) | | | 609,156 | | | | | | | | 5,981,912 | |

AxonPrime Infrastructure Acquisition Corporation | | | 500 | | | | | | | | 4,960 | |

Bilander Acquisition Corporation Class A | | | 441,893 | | | | | | | | 4,273,105 | |

Biotech Acquisition Company — ADR | | | 40,000 | | | | | | | | 400,800 | |

Biotech Acquisition Company Class A — ADR | | | 434,517 | | | | | | | | 4,275,647 | |

BlueRiver Acquisition Corporation — ADR | | | 10,650 | | | | | | | | 105,116 | |

BOA Acquisition Corporation Class A | | | 89,914 | | | | | | | | 883,855 | |

Bridgetown 2 Holdings Ltd. Class A — ADR | | | 40,000 | | | | | | | | 396,400 | |

Brigade-M3 European Acquisition Corporation (b) | | | 250,490 | | | | | | | | 2,454,802 | |

Build Acquisition Corporation | | | 76,056 | | | | | | | | 749,152 | |

Burgundy Technology Acquisition Corporation — ADR | | | 60,045 | | | | | | | | 616,062 | |

Burgundy Technology Acquisition Corporation Class A — ADR | | | 1,028,951 | | | | | | | | 10,299,800 | |

Capstar Special Purpose Acquisition Corporation Class A | | | 428,525 | | | | | | | | 4,268,109 | |

Catalyst Partners Acquisition Corporation Class A — ADR | | | 440,985 | | | | | | | | 4,295,194 | |

CC Neuberger Principal Holdings II Class A — ADR | | | 754,616 | | | | | | | | 7,470,698 | |

CC Neuberger Principal Holdings III — ADR | | | 114,000 | | | | | | | | 1,140,000 | |

CF Acquisition Corporation VI Class A | | | 29,117 | | | | | | | | 315,337 | |

CF Acquisition Corporation VIII Class A | | | 160,000 | | | | | | | | 1,616,000 | |

CHP Merger Corporation Class A | | | 274,195 | | | | | | | | 2,774,853 | |

Churchill Capital Corporation V Class A | | | 184,334 | | | | | | | | 1,813,847 | |

Churchill Capital Corporation VII Class A | | | 873,520 | | | | | | | | 8,586,702 | |

CIIG Capital Partners II, Inc. | | | 337,246 | | | | | | | | 3,477,006 | |

Class Acceleration Corporation | | | 11,750 | | | | | | | | 116,325 | |

Climate Real Impact Solutions Acquisition Corporation II | | | 4,860 | | | | | | | | 48,454 | |

Climate Real Impact Solutions Acquisition Corporation II Class A | | | 436,069 | | | | | | | | 4,256,033 | |

Cohn Robbins Holdings Corporation Class A — ADR | | | 1,092,312 | | | | | | | | 10,737,427 | |

Colicity, Inc. Class A | | | 368,445 | | | | | | | | 3,662,343 | |

Colonnade Acquisition Corporation II — ADR | | | 62,933 | | | | | | | | 621,778 | |

Compute Health Acquisition Corporation | | | 413,002 | | | | | | | | 4,105,240 | |