December 31, 2019

Annual Report

THE MERGER FUND

WCM ALTERNATIVES:

EVENT-DRIVEN FUND

WCM ALTERNATIVES:

CREDIT EVENT FUND

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (or from your financial intermediary, such as a broker-dealer or bank). Instead, the reports will be made available free of charge on a website, and if you have not previously elected electronic delivery of your shareholder reports, you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund (or your financial intermediary) electronically by calling 1-800-343-8959 (or by contacting your financial intermediary). You may elect to receive all future reports in paper free of charge. You can inform the Fund (or your financial intermediary) that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-343-8959 (or by contacting your financial intermediary). Your election to receive reports in paper will apply to all funds held with Westchester Capital Funds if you invest directly with the Fund or all funds held in your account if you invest through your financial intermediary.

| STANDARDIZED | Mutual Fund Assets: | |

| PERFORMANCE SUMMARY | Merger Arbitrage1 | $3.5 billion |

| As of December 31, 2019 | Opportunistic Credit | $5.2 million |

| | Multi-Event2 | $526.8 million |

| | | Average Annual Total Return (%) | |

Merger Arbitrage4 | QTD | YTD | 1 YR | 5 YR | 10 YR | Life |

The Merger Fund | | | | | | |

(Institutional) | 1.76 | 6.32 | 6.32 | 3.85 | n/a | 3.59 |

The Merger Fund | | | | | | |

(Investor) | 1.69 | 5.96 | 5.96 | 3.52 | 3.13 | 6.10 |

| Insurance | | | | | | |

Dedicated Funds4 | | | | | | |

The Merger Fund VL | 1.69 | 6.17 | 6.17 | 3.43 | 3.10 | 4.80 |

Opportunistic Credit4 | | | | | | |

Credit Event Fund | | | | | | |

(Institutional) | 1.59 | 12.87 | 12.87 | n/a | n/a | 4.66 |

Credit Event Fund | | | | | | |

(Investor) | 1.53 | 12.60 | 12.60 | n/a | n/a | 4.37 |

Multi Event4 | | | | | | |

Event-Driven Fund | | | | | | |

(Institutional) | 2.72 | 11.13 | 11.13 | 4.29 | n/a | 4.22 |

Event-Driven Fund | | | | | | |

(Investor) | 2.62 | 10.73 | 10.73 | n/a | n/a | 6.97 |

| | Annual Operating Expense Ratio (%)3 |

| | | | Net Expenses | | |

| | Gross | Net | excluding | | |

| | Expense | Expense | Investment- | Performance | |

Merger Arbitrage4 | Ratio | Ratio3,4 | Related Expenses4,5 | Inception | Ticker |

The Merger Fund | | | | | |

(Institutional) | 1.74% | 1.71% | 1.20% | 08/01/2013 | MERIX |

The Merger Fund | | | | | |

(Investor) | 2.04% | 2.01% | 1.50% | 01/31/1989 | MERFX |

| Insurance | | | | | |

Dedicated Funds4 | | | | | |

The Merger Fund VL | 2.67% | 1.94% | 1.40% | 05/26/2004 | MERVX |

Opportunistic Credit4 | | | | | |

Credit Event Fund | | | | | |

(Institutional) | 6.29% | 1.78% | 1.64% | 12/29/2017 | WCFIX |

Credit Event Fund | | | | | |

(Investor) | 6.61% | 2.03% | 1.89% | 12/29/2017 | WCFRX |

Multi Event4 | | | | | |

Event-Driven Fund | | | | | |

(Institutional) | 2.31% | 2.31% | 1.74% | 01/02/2014 | WCEIX |

Event-Driven Fund | | | | | |

(Investor) | 2.56% | 2.56% | 1.99% | 03/22/2017 | WCERX |

| | | | | | |

QTD and YTD performance is not annualized. Performance data quoted represent past performance; past performance does not guarantee future results. The performance results portrayed herein reflect the reinvestment of all interest, dividends and distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data included herein for periods prior to 2011 reflect that of Westchester Capital Management, Inc., the Funds’ prior investment advisor. Messrs. Behren and Shannon, The Merger Fund’s and The Merger Fund VL’s current portfolio managers, have served as co-portfolio managers of The Merger Fund and The Merger Fund VL since 2007. Performance data current to the most recent month-end may be obtained by calling (800) 343-8959 or by visiting www.westchestercapitalfunds.com.

1Includes USD 180 million in a sub-advised fund. 2Includes USD 308 million in a sub-advised fund. 3Net expense ratios are as of a fund’s most recent prospectus. 4For The Merger Fund, the Adviser contractually agreed to reduce its management fee so that the management fee will be: (i) 1.00% of the first $2 billion in average daily net assets of the Fund; and (ii) 0.93% of the average daily net assets of the Fund above $2 billion. This fee waiver arrangement will apply until April 30, 2020, unless it is terminated at an earlier time by the Board of Trustees. For The Merger Fund VL, the Adviser contractually agreed to reduce all or a portion of its management fee and, if necessary, to bear certain other expenses (to the extent permitted by the Internal Revenue Code of 1986, as amended, but not including brokerage commissions, short dividends, interest expense, taxes, acquired fund fees and expenses or extraordinary expenses) associated with operating the Fund to the extent necessary to limit the annualized expenses of the Fund to 1.40% of the Fund’s average daily net assets. This expense limitation agreement will apply until April 30, 2020, unless it is terminated at an earlier time by the Board of Trustees. For WCM Alternatives: Credit Event Fund, the Adviser contractually agreed to waive its investment advisory fee and to reimburse the Fund for other ordinary operating expenses to the extent necessary to limit ordinary operating expenses to an amount not to exceed 1.64% and 1.89% for Institutional Class shares and Investor Class shares, respectively. These expense limitations will apply through April 30, 2020, unless terminated by the Board of Trustees at an earlier date. Beginning January 1, 2020, the Adviser has agreed to waive its investment advisory fee and to reimburse the WCM Alternatives: Event-Driven Fund for other ordinary operating expenses to the extent necessary to limit ordinary operating expenses to an amount not to exceed 1.57% and 1.82% for Institutional Class shares and Investor Class shares, respectively. This expense limitation will apply January 1, 2020 through December 31, 2020, unless it is terminated by the Board of Trustees at an earlier time. 5Investment related expenses include expenses related to short sales and interest on any borrowing or interest on reverse repurchase agreements, as applicable, and acquired fund fees and expenses.

Trailing Returns

As of Date: 12/31/2019

| | QTD | YTD | 1 Year | 5 Years | 10 Years | 15 Years |

| Wilshire Liq Alt Event Driven | 1.29% | 6.11% | 6.11% | 1.66% | 1.94% | 2.91% |

| BBgBarc US Agg Bond | 0.18% | 8.72% | 8.72% | 3.05% | 3.75% | 4.15% |

| ICE B of AML | | | | | | |

| US 3M Trsy Bill | 0.46% | 2.28% | 2.28% | 1.07% | 0.58% | 1.39% |

Fellow Shareholders,

By most measures, 2019 was a rewarding year for our fellow investors. The Merger Fund®, The Merger Fund VL, WCM Alternatives: Event-Driven Fund and WCM Alternatives: Credit Event Fund all performed solidly in line with their performance targets. MERIX was up 6.32%, MERVX 6.17%, WCEIX 11.13%, and WCFIX 12.87% respectively for the year as a whole. And just as important (we believe), we achieved this goal with less correlation and volatility than conventional equity funds and ETFs, and exhibited a fraction of the trailing three-year standard deviation of the S&P 500 Index at period end.1

A constructive environment for corporate mergers and acquisitions (“M&A”) contributed to both our fourth-quarter and full-year results. The value of M&A globally totaled about $3.9 trillion in 2019, the fourth highest total on record, according to figures published by financial data provider Refinitiv. This is slightly lower than the $3.96 trillion in transactions recorded in 2018.2

Megadeals (>$10 billion) and strategic domestic transactions dominated the landscape as deals were facilitated by rising equity values and cheap financing. The number of mergers valued at more than $10 billion increased 8% year-over-year to 43 in 2019, the highest level since 2015 (the busiest-year ever for M&A), according to Refinitiv. 21 deals greater than $20 billion were inked, accounting for almost a quarter of 2019’s global volume.

The biggest deals in 2019 included U.S. drugmaker Bristol-Myers Squibb Company’s (BMY.N) $74 billion acquisition of Celgene Corporation; U.S. defense contractor Raytheon Company’s (RTN.N) merger with the aerospace business of United Technologies Corp (UTX.N), creating a $135 billion giant; and U.S. pharmaceutical company AbbVie Inc’s (ABBV.N) $64 billion purchase of Botox maker Allergan Plc (AGN.N). Additional consolidation occurred in the fintech (financial technology) sector, with a trio of large payments deals including Global Payments Inc.’s (GPN) $21.5 billion acquisition of Total System Services (TSS), Fiserv Inc.’s (FISV) $22 billion purchase of First Data Corporation, and Fidelity National Information Services Inc.’s (FIS) $35 billion merger with WorldPay Inc.

A Look Ahead

Companies have generated significant amounts of cash from operations over the last several years, which has been deployed not just on share

__________

1 | 3-year Standard deviation of: The Merger Fund (MERIX) 2.59%, The Merger Fund VL (MERVX) 2.58%, and WCM Alternatives: Event-Driven Fund (WCEIX) 3.78% versus the S&P 500 Index 12.12%. WCM Alternatives: Credit Event Fund does not yet have a 3-year track record. |

2 | Dealmakers eye cross-border M&A recovery as mega mergers roll on, Reuters, December 31, 2019 |

buy-backs but externally on acquisitions. According to accounting firm PricewaterhouseCoopers, total cash spent on acquisitions has more than doubled during this latest M&A wave beginning 2010. The report speculated that total capital available for business investment going into 2020 may be unprecedented.3

In addition, capital held or committed by US private equity (PE) firms, but not yet invested, continues to grow as well, standing at $1.5 trillion at the end of 2019, the highest on record and more than doubling in the last seven years, according to data from Preqin.4 Considering that PE firms typically undertake levered transactions, assuming typical gearing of 4x debt to equity would create potential capacity for $7.5 TRILLION worth of transactions. Last year saw roughly $450 billion worth of private equity transactions worldwide. One of the largest was the $14 billion buyout of fiber network company Zayo Group Holdings, Inc., in which we invested, by Stockholm-based private equity firm EQT AB and Digital Colony Partners. Confidence in the market appears to be rising as evidenced by media coverage of potentially the biggest-ever leveraged buyout, between KKR & Co. and drugstore giant Walgreens Boots Alliance Inc., to which the former made a $70 billion take-private offer in November.

We believe the environment remains favorable for high levels of corporate restructurings, mergers, and acquisitions. The bankers that we speak to report active deal pipelines with interest in both stock and cash transactions, as well as hybrid stock/cash consideration. Financing remains cheap and plentiful, and with the major indices at record levels, equity consideration has become more valuable. Additionally, motivation for transactions remains strong both in the U.S. and abroad as slowing economic growth incentivizes strategic transactions in order to realize economies of scale as well as distribution and administrative efficiencies.

MERGER ARBITRAGE

The Merger Fund® – Institutional and Investor share classes advanced by 1.76 % and 1.69% during the fourth quarter, bringing its year-to-date performance to 6.32% and 5.96%, respectively, and marking the Fund’s 98th gain in the 124 quarters since its 1989 inception. We held 144 investments during the quarter and experienced one terminated deal. Reflecting a nearly 5:1 ratio of winners to losers, 119 positions posted positive gains while only 25 had negative marks-to-market. We invested in 34 new situations during the quarter and as of the end of December, we held 124 positions and were approximately 85% invested.

__________

3 | Winning through M&A in the next recession, PwC, December 31, 2019 |

4 | Private equity’s record $1.5 trillion cash pile comes with a new set of challenges, CNBC, January 3, 2020 |

| Winners | Losers |

| • | Allergan PLC/ | • | Macro Portfolio |

| | AbbVie Inc (+0.29%) | | Hedge (-0.12%) |

| • | Alibaba/Altaba (+0.21%) | • | Qiagen NV/Thermo |

| • | Celgene Corp/Bristol-Myers | | Fisher Scientific (-0.08%) |

| | Squibb Co (+0.15%) | | |

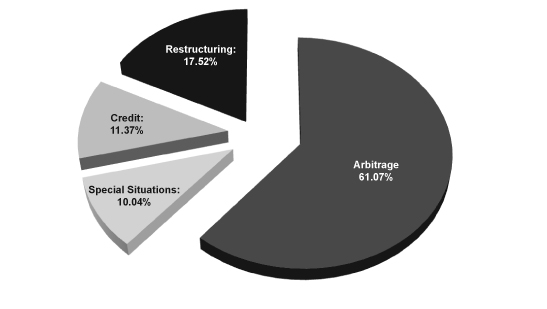

EVENT-DRIVEN

Strategy allocations result from our bottom-up process; our investment decisions are based on each opportunity’s unique characteristics. Every investment is based on public information rather than speculation, has a defined timeline and a calculable expected return. The strategy is designed to “go where the events are.” We do not weight the portfolio according to pre-determined allocations to macro-factors such as strategy, sector or geography.

The WCM Alternatives: Event-Driven Fund returned 2.72% and 2.62% for the Institutional and Investor share classes respectively during the quarter, advancing 11.13% and 10.73% year-to-date. The Fund participated in 171 events, and 137 positions posted gains versus 34 with negative marks-to-market. Winners outnumbered losers by 4:1, we entered 34 new positions and the Fund was fully invested at quarter-end.

Two of the top three winners for WCEIX were similar to The Merger Fund® due to a set of attractive merger arbitrage opportunities. The largest non-M&A contributor was Apollo Global Management, Inc. (+0.20%). Like KKR & Co. Inc., Ares Management Corporation, and the Blackstone Group before it, the catalyst for Apollo’s outperformance was its conversion from a publicly traded partnership to a typical “C-corporation” on September 5, 2019. Under this more straightforward structure, Apollo would have an increased tax burden because it would no longer be treated as a pass-through entity for tax purposes but investors, including funds and institutions, would no longer receive a schedule K-1, and the stock would be more appropriate and investable for a much broader investor base. One of the rationales for the change was that its stock was not reflecting the value of the sum of its parts, and therefore the simplified structure and expanded investor base would cause a re-rating of the stock.

Another winner of interest was Twenty-First Century Fox/Walt Disney Co (+0.14%). The new Fox security, resulting in a “stub” left over after the merger with Disney (and exchange of FOX for DIS shares) was completed,

is comprised of the sports and news assets that Fox Corp retained after selling its entertainment assets to Disney. We were able to create “stub-co” during the pending close of the Disney deal. These situations often present opportunities to buy companies at inefficiently-priced levels because traditional institutional investors often must wait to buy stub-co until after the deal closes.

The biggest detractor was the Government-Sponsored Entities (GSEs), discussed further in the Credit Event section below (-0.28%). The second biggest detractor was Qiagen N.V./Thermo Fisher Scientific (-0.22%).

CREDIT EVENT

The WCM Alternatives: Credit Event Fund was 113% invested through quarter-end. Performance in Q4 added 1.59% for the Institutional share class and 1.53% for the Investor share class, finishing the year at 12.87% and 12.60%, respectively. Winners outnumbered losers by almost 5:1. The Fund invested in 70 situations throughout the quarter, 7 of which were new situations, and as of December 31 had 65 credit-related event investments in the portfolio, including multiple SPAC positions.

In the winner column, contributing 0.66% was the continued presence of SPAC investments. The second largest winner was CEC Entertainment, Inc. (+0.23%) as the bond price increased from $95 to $99. We invested in the bonds because we believed the deal to acquire CEC (Chuck E Cheese!) would allow the bonds to be redeemed. However, the transaction was canceled as the buyer’s shareholders did not support the transaction. Upon deal cancelation, the bond price traded down to $95, which we determined was an overreaction, based upon our assessment of the issuer’s asset coverage, cash flow coverage and credit quality. We remained constructive about the improving fundamentals of CEC as the recapitalization and reinvestment in store infrastructure began to play out over the next several quarters. Since September 2019, other fundamental investors began to agree with our thesis, and buyer demand pushed the bond price back up to $99. Avaya, Inc. credit was a contributor as well (+0.17%), as the price of its term loan increased from $96 to $98 in the fourth quarter of 2019. As part of the company’s strategic review, Avaya announced a favorable joint venture with RingCentral. The joint venture is intended to increase Avaya’s presence in cloud telephony. Additionally, Avaya received a $250 million up-front cash payment from RingCentral, which helped retire a portion of Avaya’s term loans.

As with the Event-Driven Fund, the Credit Event Fund’s largest detractor is its holdings in the GSE preferred securities (-0.24%), whose recent negative performance this quarter is a function both of a potential extended timeline as well as increased volatility and timing of the end-of

quarter mark. For a refresher, recall that the GSEs (Freddie Mac and Fannie Mae) have remained in conservatorship more than 10 years after the financial crisis and they continue to be dominant players in America’s housing finance system. Although they remain critical to the functioning of that system, they have not yet transitioned back into private entities and are therefore not subject to the typical net capital and other regulatory requirements of other private financial institutions. On March 27, 2019, President Trump issued a Memorandum directing the Secretary of the Treasury to develop a plan for administrative and legislative reforms to (i) end the conservatorship of the GSEs upon the completion of specified reforms, (ii) facilitate competition in the housing finance market, (iii) establish regulation of the GSEs in order to minimize potential risks posed to the U.S. financial system, and (iv) provide that the Federal Government is properly compensated for any support it provides to the GSEs or the housing finance market. In early September 2019, The Federal Housing Finance Agency (FHFA) released a new Strategic Plan for the conservatorships of Fannie Mae and Freddie Mac addressing many of these goals. In addition, an appellate court ruled the government’s net worth sweep of Fannie Mae and Freddie Mac to be unconstitutional, which the Trump administration may appeal further if there is no near-term resolution. Full implementation of the plan will likely take place in Trump’s second term (if there is one). As we have discussed in the past, there may be bumps in the road, and as the capital requirements and other regulatory oversight are finalized, there may be volatility; however, we believe that the securities of both Fannie Mae and Freddie Mac are significantly undervalued and we believe have a high likelihood of being successful investments. Accordingly, given the long timeline and potential for unanticipated developments, we opted to construct a more conservative position by investing in the subordinated preferred securities rather than common stock, which puts us towards the front of the line, so to speak, in the event of an asset distribution or liquidation. However, we have reduced the value-at-risk of this position into strength over the past two quarters, realizing some profits but retaining exposure. The second biggest detractor was EIG Investors Corp (-0.10%).

In all, we are pleased with our Funds’ performance in 2019, because we performed “as promised:” we did not stray in our strategy, nor did we chase performance or hot stocks or increase directional exposure, all of which may have aided our gross returns, because that is not in keeping with our investment philosophy. We measure success by whether our performance provides attractive risk-adjusted returns in a variety of market environments, with minimal market correlation and minimal volatility. That means that we accept that we may have notionally

excellent performance but nonetheless underperform equities in a year when the S&P 500 Index is up by 31%, as long as we properly hedge and diversify the portfolio. The flip side of the coin would be a year like 2018 where we provided similar positive performance, even in the treacherous fourth quarter, while the S&P 500 Index was down 4.4% for the year.

We thank you for allowing us to safeguard your capital this year and you have our commitment that we will endeavor to do so in the years ahead. We hope you had a happy new year (even though Larry David claimed that it is too late for such wishes) and we will be back with another report in three months.

As usual, quarterly statistical summaries for all of our vehicles are provided within two weeks of the end of the quarter – typically one month prior to the release of the quarterly letter. They are available electronically on our website, and we would be happy to provide a scheduled email as soon as the data becomes available. For convenience, investors can arrange for e-alerts of important Fund communications. Through our website at www.westchestercapitalfunds.com, you can check direct account balances, make purchases and sales, and sign up for notification of trade confirmations, statements, and shareholder communications via e-mail.

Please contact us with any questions or comments. We are always available and we enjoy speaking with our investors.

|  |

Roy Behren | Mike Shannon |

IMPORTANT DISCLOSURES

Before investing in The Merger Fund®, WCM Alternatives: Event-Driven Fund, and/or WCM Alternatives: Credit Event Fund, carefully consider the investment objectives, risks, charges, and expenses. For a prospectus or summary prospectus containing this and other information, please call (800) 343-8959. Please read the prospectus carefully before investing. The Merger Fund VL is available through variable products offered by third-party insurance companies. For a prospectus containing information for any variable annuity or variable life product that invests in The Merger Fund VL, contact your financial advisor or the offering insurance company for a contract prospectus and prospectus for the underlying funds. Please read it carefully before investing. Shares of the fund are not offered directly to the public. For a prospectus containing information for any variable annuity or variable life product that invests in the Fund, contact your financial advisor or the offering insurance company for a contract prospectus and prospectus for the underlying funds. Please read it carefully before investing. Variable annuities are long-term, tax-deferred investments designed for retirement, involve investment risks and may lose value. Earnings are taxable as ordinary income when distributed and may be subject to a 10% federal tax penalty if withdrawn before age 59½. Optional benefit costs are added to the ongoing fees and expenses of the variable annuity.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. The Ten Largest Positions as a Percent of Net Assets for The Merger Fund® as of December 31, 2019, were: Allergan PLC (5.17%), Osram Licht AG (4.12%), Altaba Inc. (3.90%), Zayo Group Holdings, Inc. (3.25%), Cypress Semiconductor Corporation (3.08%), The Stars Group Inc. (2.96%), Cobham PLC (2.90%), Tiffany & Co. (2.76%), Wright Medical Group N.V. (2.75%), Liberty Property Trust (2.52%). The Ten Largest Positions as a Percent of Net Assets for The Merger Fund VL as of December 31, 2019, were: Allergan PLC (5.16%), Osram Licht AG (4.10%), Altaba Inc. (3.69%), Zayo Group Holdings, Inc. (3.25%), Cypress Semiconductor Corporation (3.06 %), The Stars Group Inc. (2.96%), Cobham PLC (2.91%), Wright Medical Group N.V. (2.78%), Tiffany & Co. (2.77%), Liberty Property Trust (2.40%). The Ten Largest Positions as a Percent of Net Assets for WCM Alternatives: Event-Driven Fund as of December 31, 2019, were: Allergan PLC (5.95%), Osram Licht AG (4.58%), Zayo Group Holdings, Inc. (4.33%), Altaba Inc. (4.00%), Cypress Semiconductor Corporation (3.57%), The Stars Group Inc. (3.40%), Cobham PLC (3.30%), Wright Medical Group N.V. (3.28%), Tiffany & Co. (3.09%), IAC/InterActiveCorp (2.79%). The Ten Largest Positions as a Percent of Net Assets for WCM Alternatives: Credit Event Fund as of December 31, 2019, were: Refinitiv US Holdings Inc. (6.63%), Vertiv Group Corp (5.49%), NII Holdings Inc. (4.67%), GMAC Capital Trust (4.48%), Heritage Power (4.34%), Alberton Acquisition Corporation (4.01%), Colony Capital, Inc. (3.98%), Nielsen Finance LLC (3.96%), SRC Energy Inc. (3.93%), Broadmark Realty Capital Inc. (3.64%).

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. Merger-arbitrage and event-driven investing involve the risk that the adviser’s evaluation of the outcome of a proposed event, whether it be a merger, reorganization, regulatory issue or other events, will prove incorrect and that the Funds’ return on the investment will be negative. Investments in foreign companies may entail political, cultural, regulatory, legal, and tax risks different from those associated with comparable transactions in the United States. The frequency of the Fund’s transactions will vary from year to year, though merger arbitrage portfolios typically have higher turnover rates than portfolios of typical long-only funds. Increased portfolio turnover may result in higher brokerage commissions, dealer mark-ups, and other transaction costs. The higher costs associated with increased portfolio turnover may offset gains in the Fund’s performance. The Funds’ may enter into short sale transactions for, among other reasons, purposes of protecting against a decline in the market value of the acquiring company’s shares prior to the acquisition completion. If the price of a security sold short

increases between the time of the short sale and the time the Fund covers its short position, the Fund will incur a loss. The amount of a potential loss on an uncovered short sale transaction is theoretically unlimited. Debt securities may fluctuate in value due to, among other things, changes in interest rates, general economic conditions, industry fundamentals, market sentiment and the financial condition of the issuer, including the issuer’s credit rating or financial performance. Derivatives may create leverage which will amplify the effect of the performance of those instruments on the Funds and may produce significant losses. The Funds’ hedging strategy will be subject to the Funds’ investment adviser’s ability to assess correctly the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged. Investments in lower-rated and non-rated securities present a great risk of loss to principal and interest than higher-rated securities.

The WCM Alternatives: Credit Event Fund is non-diversified and therefore has a greater potential to realize losses upon the occurrence of adverse events affecting an issuer in its portfolio.

Any tax or legal information provided is merely a summary of our understanding and interpretation of some of the current income tax regulations and is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Funds nor any of their representatives may give legal or tax advice.

The views expressed are as of January 31, 2020, and are a general guide to the views of Westchester Capital Management, are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. Distributions are not guaranteed. This document does not replace portfolio and fund-specific materials.

The Morningstar Rating™ for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity, and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, and the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating™ metrics.

The weights are 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. As of December 31, 2019, The Merger Fund® was rated against the following numbers of U.S.-domiciled Market Neutral funds over the following time periods: 109 funds in the last three years, 88 funds in the last five years, and 30 funds in the last ten years. With respect to these Market Neutral funds, The Merger Fund® – Investor share class (MERFX) received a Morningstar Rating of 5 stars, 4 stars and 5 stars for the three-, five- and ten-year periods, respectively. The Merger Fund® – Institutional share class (MERIX) received a Morningstar rating of 5 stars, 5 stars and 5 stars for the three-, five- and ten-year periods, respectively. Ten-year ratings are Extended Performance Ratings computed by Morningstar using historical adjusted returns prior to the 8/1/2013 inception date of MERIX and reflect the historical performance of MERFX, (inception date 1/31/1989), adjusted to reflect the fees and expenses of the Institutional shares. As of December 31, 2019, WCM Alternatives: Event-Driven Fund was rated against the

following numbers of U.S.-domiciled Multi Alternative funds over the following time periods: 237 funds in the last three years and 187 funds in the last five years. With respect to these Multi Alternative funds, WCM Alternatives: Event-Driven Fund – Institutional share class (WCEIX) received a Morningstar Rating of 5 stars for both the three- and five-year periods. WCM Alternatives: Event-Driven Fund – Investor share class (WCERX) received a Morningstar Rating of 5 stars for both the three- and five-year periods. Overall, 3-year and 5-year ratings are Extended Performance Ratings computed by Morningstar using historical adjusted returns prior to the 3/22/2017 inception date of WCERX and reflect the historical performance of WCEIX, (inception date 1/2/2014), adjusted to reflect the fees and expenses of the Investor shares. © 2019 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Absolute return strategies are not intended to outperform stocks and bonds during strong market rallies. An absolute return fund may not achieve its goals and may underperform during periods of strong positive market performance.

With respect to Envestnet’s 2019 Asset Manager Award, the award finalists and winners were chosen from hundreds of best-in-breed performers for each class, which includes alternatives as a new strategy category this year due to its growing importance as market volatility rises. Envestnet | PMC analysts research and evaluate managers using a systematic, proprietary and multi-factor evaluation methodology that considers a number of metrics: performance, firm profile, customer service, investment process and style, composite, tax efficiency and other quantitative and qualitative criteria. To be eligible for a Manager and Strategist of the Year Award, a manager must have at least $200 million in assets, be broadly available on the Envestnet platform and be open to new investors. A minimum three-year tenure is also required by the lead manager.

A number of the comments in this document are based on current expectations and are considered “forward-looking statements”. Actual future results, however, may prove to be different from expectations. The opinions expressed are a reflection of Westchester Capital Management’s best judgment at the time this document is compiled and any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise is disclaimed. Furthermore, these views are not intended to predict or guarantee the future performance of any individual security, asset class, markets generally, nor are they intended to predict the future performance of any Westchester Capital Management account, portfolio or fund.

Definitions: The S&P 500 Index is a broad-based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general; The Bloomberg Barclays Aggregate Bond Index is an intermediate-term index comprised of investment-grade bonds. The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P are Ba1/BB+/BB+ or below. The Morningstar Category: US Fund Market Neutral is comprised of a universe of funds with similar investment objectives. The Morningstar Category: The US Fund MultiAlternative encompasses funds that have a majority of their assets exposed to alternative strategies and include both funds with static allocations to alternative strategies and funds tactically allocating among alternative strategies and asset classes. The ICE BofA Merrill Lynch US 3-Month Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Indices are unavailable for direct investment. The Dow Jones Industrial Average, or simply the Dow, is a stock market index that shows how 30 large, publicly owned companies based in the United States have traded during a standard trading session in the stock market. Nasdaq is a global electronic marketplace for buying and selling securities, as well as the benchmark index for U.S. technology stocks.

Indices are unavailable for direct investment. The Wilshire Liquid Alternative Event Driven IndexSM measures the performance of the event-driven strategy component of The Wilshire Liquid Alternative IndexSM. Event-driven strategies predominantly invest in companies involved in corporate transactions such as mergers, restructuring, distressed, buy-backs, or other capital structure changes. The Wilshire Liquid Alternative Event Driven Index (WLIQAED) is designed to provide a broad measure of the liquid alternative event-driven market. HFRX Event Driven Index is comprised of investment Managers who maintain positions in companies currently or prospectively involved in corporate transactions of a wide variety including but not limited to mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. DOJ or The United States Department of Justice Antitrust Division is a law enforcement agency responsible for enforcing the antitrust laws of the United States. Standard Deviation is the degree to which returns vary relative to the average return: The higher the standard deviation, the greater the variability of the investment. Beta is a measure of the fund’s sensitivity to market movements. A portfolio with a beta greater than 1 is more volatile than the market and a portfolio with a beta less than 1 is less volatile than the market; Correlation is calculated using R-Squared; which is a measure that represents the percentage of a fund’s movements that can be explained by movements in a benchmark index. A fund with low R-squared doesn’t act much like the index; A special purpose acquisition company (SPAC) is a corporation formed by private individuals to facilitate investment through an initial public offering (IPO). The proceeds are used to buy one or more existing companies. Alpha is used in finance as a measure of performance, indicating when a strategy, trader, or portfolio manager has managed to beat the market return over some period. Alpha, often considered the active return on an investment, gauges the performance of an investment against a market index or benchmark that is considered to represent the market’s movement as a whole. A put option is an option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time frame. This is the opposite of a call option, which gives the holder the right to buy an underlying security at a specified price before the option expires. The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights of the annual report, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The Merger Fund®, WCM Alternatives: Event-Driven Fund and WCM Alternatives: Credit Event Fund are distributed by Compass Distributors, LLC. The Merger Fund VL is available through variable products offered by third-party insurance companies and is not affiliated with Compass Distributors, LLC.

DEAL COMPOSITION

The Merger Fund (Unaudited)

| Type of Buyer | | | | Deal Terms* | | |

Strategic | | | 90.8 | % | | | Cash | | | 57.9 | % | |

Financial | | | 9.2 | % | | | Stock and Stub(1) | | | 14.9 | % | |

| | | | | | | | Stock with Fixed Exchange Ratio | | | 14.3 | % | |

| By Deal Type | | | | Cash & Stock | | | 11.9 | % | |

Friendly | | | 100.0 | % | | | Undetermined(2) | | | 1.0 | % | |

Hostile | | | — | % | | | Stock with Flexible | | | | | |

| | | | | | | | Exchange Ratio (Collar) | | | — | %** | |

| * | | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of December 31, 2019. |

| ** | | Less than 0.05%. |

(1) | | “Stub” includes assets other than cash and stock (e.g., escrow notes). |

(2) | | The compensation is undetermined because the compensation to be received (e.g., stock, cash, escrow notes, other) will be determined at a later date, potentially at the option of the Fund’s investment adviser. |

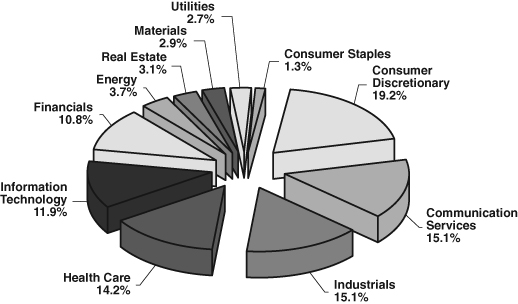

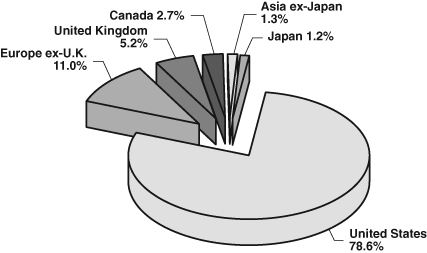

PORTFOLIO COMPOSITION*

The Merger Fund (Unaudited)

By Sector

By Region

* | Data expressed as a percentage of long common stocks, preferred stocks, contingent value rights, warrants, bank loans, corporate bonds and swap contract positions as of December 31, 2019. Data expressed excludes special purpose acquisition companies, escrow notes, short-term investments, investments purchased with the cash proceeds from securities lending collateral, securities sold short, written and purchased options, forward currency exchange contracts and short total return swap contracts. Please refer to the Schedule of Investments for more details on the Fund’s individual holdings. |

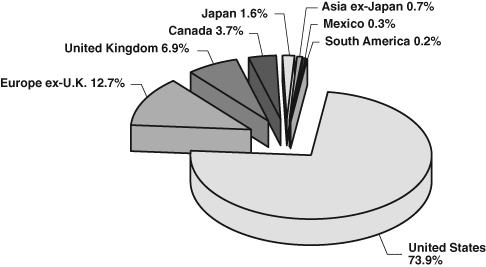

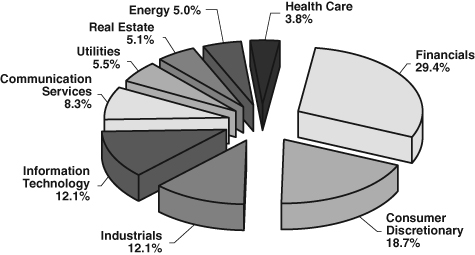

PORTFOLIO COMPOSITION*

WCM Alternatives: Event-Driven Fund (Unaudited)

By Sector

By Region

* | Data expressed as a percentage of long common stocks, closed-end funds, preferred stocks, contingent value rights, rights, warrants, bank loans, convertible bonds, corporate bonds and swap contract positions as of December 31, 2019. Data expressed excludes special purpose acquisition companies, escrow notes, short-term investments, securities sold short, written and purchased options, forward currency exchange contracts and short total return swap contracts. Please refer to the Schedule of Investments for more details on the Fund’s individual holdings. |

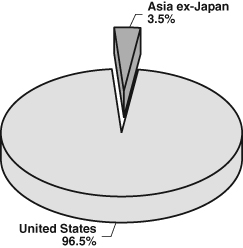

PORTFOLIO COMPOSITION*

WCM Alternatives: Credit Event Fund (Unaudited)

By Sector

By Region

* | Data expressed as a percentage of long common stocks, closed-end funds, preferred stocks, warrants, bank loans, convertible bonds, corporate bonds and swap contract positions as of December 31, 2019. Data expressed excludes special purpose acquisition companies, short-term investments, securities sold short and short total return swap contracts. Please refer to the Schedule of Investments for more details on the Fund’s individual holdings. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”).

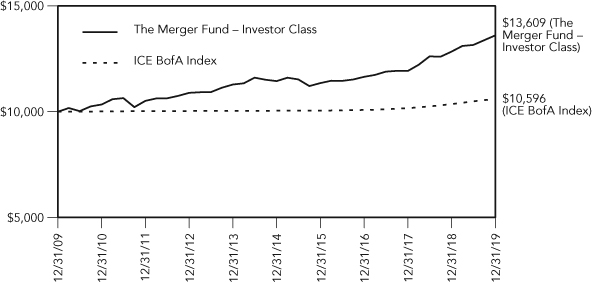

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT

IN THE MERGER FUND AND THE ICE BofA INDEX (Unaudited)

THE MERGER FUND

AVERAGE ANNUAL TOTAL RETURNS

as of December 31, 2019

| | 1 Yr. | 3 Yr. | 5 Yr. | 10 Yr. |

Investor Class | 5.96% | 5.32% | 3.52% | 3.13% |

ICE BofA Index | 2.28% | 1.67% | 1.07% | 0.58% |

| | | | | |

| | | | | Since |

| | | | | Inception |

| | 1 Yr. | 3 Yr. | 5 Yr | (8/1/2013) |

Institutional Class | 6.32% | 5.65% | 3.85% | 3.59% |

ICE BofA Index | 2.28% | 1.67% | 1.07% | 0.85% |

This chart assumes an initial gross investment of $10,000 made on December 31, 2009. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or upon redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index (“ICE BofA Index”) is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding U.S. Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date. The index is unmanaged and does not include any expenses, fees or sales charges. It is not possible to invest directly in an index.

COMPARISON OF CHANGE IN VALUE OF $1,000,000 INVESTMENT

IN THE WCM ALTERNATIVES: EVENT-DRIVEN FUND AND

THE ICE BofA INDEX (Unaudited)

WCM ALTERNATIVES: EVENT-DRIVEN FUND

AVERAGE ANNUAL TOTAL RETURNS

as of December 31, 2019

| | | | | Since |

| | | | | Inception |

| | 1 Yr. | 3 Yr. | 5 Yr. | (1/2/2014) |

Institutional Class | 11.13% | 7.00% | 4.29% | 4.22% |

ICE BofA Index | 2.28% | 1.67% | 1.07% | 0.90% |

| | | | | |

| | | | | Since |

| | | | | Inception |

| | | | 1 Yr. | (3/22/2017) |

Investor Class | | | 10.73% | 6.97% |

ICE BofA Index | | | 2.28% | 1.77% |

This chart assumes an initial gross investment of $1,000,000 made on January 2, 2014. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or upon redemptions of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

COMPARISON OF CHANGE IN VALUE OF $1,000,000 INVESTMENT

IN THE WCM ALTERNATIVES: CREDIT EVENT FUND AND

THE ICE BofA INDEX (Unaudited)

WCM ALTERNATIVES: CREDIT EVENT FUND

AVERAGE ANNUAL TOTAL RETURNS

as of December 31, 2019

| | | Since Inception |

| | 1 Yr. | (12/29/2017) |

Institutional Class | 12.87% | 4.66% |

ICE BofA Index | 2.28% | 2.07% |

| | | |

| | | Since Inception |

| | 1 Yr. | (12/29/2017) |

Investor Class | 12.60% | 4.37% |

ICE BofA Index | 2.28% | 2.07% |

This chart assumes an initial gross investment of $1,000,000 made on December 29, 2017. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or upon redemptions of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Merger Fund and Westchester Capital Funds

EXPENSE EXAMPLE

December 31, 2019 (Unaudited)

As a shareholder of The Merger Fund, WCM Alternatives: Event-Driven Fund and/or WCM Alternatives: Credit Event Fund (the “Funds”), you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, and other Fund specific expenses. The expense example is intended to help a shareholder understand ongoing costs (in dollars) of investing in the Fund(s) and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the most recent six-month period.

The Actual Expenses comparison provides information about actual account values and actual expenses. A shareholder may use the information in this line, together with the amount invested, to estimate the expenses paid over the period. A shareholder may divide his/her account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses paid on his/her account during this period. The example below includes, among other fees, management fees, fund accounting, custody and transfer agent fees. However, the example does not include portfolio trading commissions and related expenses or extraordinary expenses.

The Hypothetical Example for Comparison Purposes provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Fund’s actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid for the period. A shareholder may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, a shareholder would compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemptions fees, or exchange fees. Therefore, the Hypothetical Example for Comparison Purposes is useful in comparing ongoing costs only, and will not help to determine the relevant total costs of owning different funds. In addition, if these transactional costs were included, shareholder costs would have been higher.

The Merger Fund and Westchester Capital Funds

EXPENSE EXAMPLE (continued)

December 31, 2019 (Unaudited)

| | Annualized | Beginning | Ending | Expenses Paid |

| | Net Expense | Account | Account | During Period |

| | Ratio | Value | Value | 7/1/19- |

| | 12/31/19 | 7/1/19 | 12/31/19 | 12/31/19(1) |

| The Merger Fund | | | | |

Investor Class | | | | |

Actual Expenses(2)(3) | 1.91% | $1,000.00 | $1,034.40 | $9.79 |

Hypothetical Example for | | | | |

Comparison Purposes | | | | |

(5% return before | | | | |

expenses)(3) | 1.91% | $1,000.00 | $1,015.58 | $9.70 |

Institutional Class | | | | |

Actual Expenses(2)(3) | 1.65% | $1,000.00 | $1,036.50 | $8.47 |

Hypothetical Example for | | | | |

Comparison Purposes | | | | |

(5% return before | | | | |

expenses)(3) | 1.65% | $1,000.00 | $1,016.89 | $8.39 |

| | | | | |

| | Annualized | Beginning | Ending | Expenses Paid |

| | Net Expense | Account | Account | During Period |

| | Ratio | Value | Value | 7/1/19- |

| | 12/31/19 | 7/1/19 | 12/31/19 | 12/31/19(1) |

| WCM Alternatives: Event-Driven Fund | | | | |

Investor Class | | | | |

Actual Expenses(2)(4) | 2.23% | $1,000.00 | $1,045.30 | $11.50 |

Hypothetical Example for | | | | |

Comparison Purposes | | | | |

(5% return before | | | | |

expenses)(4) | 2.23% | $1,000.00 | $1,013.96 | $11.32 |

Institutional Class | | | | |

Actual Expenses(2)(4) | 1.97% | $1,000.00 | $1,047.20 | $10.17 |

Hypothetical Example for | | | | |

Comparison Purposes | | | | |

(5% return before | | | | |

expenses)(4) | 1.97% | $1,000.00 | $1,015.27 | $10.01 |

The Merger Fund and Westchester Capital Funds

EXPENSE EXAMPLE (continued)

December 31, 2019 (Unaudited)

| | Annualized | Beginning | Ending | Expenses Paid |

| | Net Expense | Account | Account | During Period |

| | Ratio | Value | Value | 7/1/19- |

| | 12/31/19 | 7/1/19 | 12/31/19 | 12/31/19(1) |

| WCM Alternatives: Credit Event Fund | | | | |

Investor Class | | | | |

Actual Expenses(2)(5) | 2.12% | $1,000.00 | $1,028.90 | $10.84 |

Hypothetical Example for | | | | |

Comparison Purposes | | | | |

(5% return before | | | | |

expenses)(5) | 2.12% | $1,000.00 | $1,014.52 | $10.76 |

Institutional Class | | | | |

Actual Expenses(2)(5) | 1.82% | $1,000.00 | $1,030.50 | $9.31 |

Hypothetical Example for | | | | |

Comparison Purposes | | | | |

(5% return before | | | | |

expenses)(5) | 1.82% | $1,000.00 | $1,016.03 | $9.25 |

(1) | Expenses are equal to the Fund’s annualized net expense ratio, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

(2) | Based on the actual returns of 3.44%, 3.65%, 4.53%, 4.72%, 2.89% and 3.05% for the six-month period ended December 31, 2019 for The Merger Fund Investor and Institutional Classes, WCM Alternatives: Event-Driven Fund Investor and Institutional Classes and WCM Alternatives: Credit Event Fund Investor and Institutional Classes, respectively. |

(3) | Excluding dividends on securities sold short, borrowing expense on securities sold short and legal expenses related to the settlement of an appraisal right, your actual cost of investment and your hypothetical cost of investment would have been $7.54 and $7.48, respectively in the The Merger Fund Investor Class and $6.11 and $6.06, respectively in The Merger Fund Institutional Class. |

(4) | Excluding dividends and interest on securities sold short, borrowing expense on securities sold short and legal expenses related to the settlement of an appraisal right, your actual cost of investment and your hypothetical cost of investment would have been $9.54 and $9.40, respectively in WCM Alternatives: Event-Driven Fund Investor Class and $8.26 and $8.13, respectively in WCM Alternatives: Event-Driven Fund Institutional Class. |

(5) | Excluding interest on securities sold short, borrowing expense on securities sold short and interest on reverse repurchase agreements, your actual cost of investment and your hypothetical cost of investment would have been $9.67 and $9.60, respectively in WCM Alternatives: Credit Event Fund Investor Class and $8.39 and $8.34, respectively in WCM Alternatives: Credit Event Fund Institutional Class. |

The Merger Fund

SCHEDULE OF INVESTMENTS

December 31, 2019

| | | Shares | | | Value | |

LONG INVESTMENTS — 101.61% | | | | | | |

| | | | | | | |

COMMON STOCKS — 47.36% | | | | | | |

| | | | | | | |

AEROSPACE & DEFENSE — 2.09% | | | | | | |

| Raytheon Company (e)(j) | | | 145,800 | | | $ | 32,038,092 | |

| United Technologies Corporation (j) | | | 230,800 | | | | 34,564,608 | |

| | | | | | | | 66,602,700 | |

ALTERNATIVE CARRIERS — 3.25% | | | | | | | | |

| Zayo Group Holdings, Inc. (a)(e) | | | 2,996,105 | | | | 103,815,038 | |

| | | | | | | | | |

BIOTECHNOLOGY — 0.65% | | | | | | | | |

| ArQule, Inc. (a)(j) | | | 674,908 | | | | 13,471,164 | |

| The Medicines Company (a)(j) | | | 37,300 | | | | 3,168,262 | |

| Ra Pharmaceuticals, Inc. (a) | | | 84,228 | | | | 3,952,820 | |

| | | | | | | | 20,592,246 | |

BROADCASTING — 1.53% | | | | | | | | |

| Discovery, Inc. Class C (a) | | | 133,231 | | | | 4,062,213 | |

| Fox Corporation Class B (k) | | | 343,866 | | | | 12,516,723 | |

| ViacomCBS, Inc. Class B (j) | | | 765,800 | | | | 32,140,626 | |

| | | | | | | | 48,719,562 | |

BUILDING PRODUCTS — 1.08% | | | | | | | | |

| Continental Building Products, Inc. (a) | | | 40,639 | | | | 1,480,479 | |

| Masco Corporation (j)(k) | | | 689,800 | | | | 33,103,502 | |

| | | | | | | | 34,583,981 | |

CASINOS & GAMING — 5.03% | | | | | | | | |

| Caesars Entertainment | | | | | | | | |

| Corporation (a)(e)(k) | | | 4,854,118 | | | | 66,016,005 | |

| The Stars Group, Inc. (a)(b)(e)(f)(k) | | | 3,663,384 | | | | 94,625,208 | |

| | | | | | | | 160,641,213 | |

CHEMICALS — 0.31% | | | | | | | | |

| DuPont de Nemours, Inc. (e)(j) | | | 155,735 | | | | 9,998,187 | |

| | | | | | | | | |

CONSTRUCTION MACHINERY | | | | | | | | |

& HEAVY TRUCKS — 1.82% | | | | | | | | |

| WABCO Holdings, Inc. (a)(e) | | | 428,747 | | | | 58,095,218 | |

| | | | | | | | | |

ELECTRONIC EQUIPMENT | | | | | | | | |

& INSTRUMENTS — 0.46% | | | | | | | | |

| Fitbit, Inc. Class A (a)(j)(k) | | | 2,225,272 | | | | 14,620,037 | |

| | | | | | | | | |

ENVIRONMENTAL & | | | | | | | | |

FACILITIES SERVICES — 0.63% | | | | | | | | |

| Advanced Disposal Services, Inc. (a) | | | 605,687 | | | | 19,908,932 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| | | Shares | | | Value | |

HEALTH CARE EQUIPMENT — 2.75% | | | | | | |

| Wright Medical Group N.V. (a)(b)(j)(k) | | | 2,875,117 | | | $ | 87,633,566 | |

| | | | | | | | | |

INTERACTIVE MEDIA & SERVICES — 2.19% | | | | | | | | |

| IAC/InterActiveCorp (a)(j)(k) | | | 280,300 | | | | 69,825,533 | |

| | | | | | | | | |

INVESTMENT BANK | | | | | | | | |

& BROKERAGE — 1.62% | | | | | | | | |

| TD Ameritrade Holdings Corporation | | | 1,039,893 | | | | 51,682,682 | |

| | | | | | | | | |

IT CONSULTING & | | | | | | | | |

OTHER SERVICES — 0.10% | | | | | | | | |

| InterXion Holding N.V. (a)(b) | | | 38,517 | | | | 3,228,110 | |

| | | | | | | | | |

LIFE & HEALTH INSURANCE — 0.04% | | | | | | | | |

| Genworth Financial, Inc. Class A (a)(k) | | | 306,379 | | | | 1,348,068 | |

| | | | | | | | | |

LIFE SCIENCES TOOLS & SERVICES — 0.33% | | | | | | | | |

| Qiagen N.V. (a)(b)(j) | | | 314,925 | | | | 10,644,465 | |

| | | | | | | | | |

MANAGED HEALTH CARE — 2.12% | | | | | | | | |

| WellCare Health Plans, Inc. (a)(e) | | | 204,874 | | | | 67,651,443 | |

| | | | | | | | | |

MOVIES & ENTERTAINMENT — 1.55% | | | | | | | | |

| Akazoo S.A. (a)(b)(k) | | | 47,770 | | | | 251,748 | |

| The Madison Square Garden | | | | | | | | |

| Company Class A (a)(j) | | | 166,800 | | | | 49,070,892 | |

| | | | | | | | 49,322,640 | |

OIL & GAS REFINING | | | | | | | | |

& MARKETING — 1.54% | | | | | | | | |

| Marathon Petroleum Corporation (j) | | | 816,500 | | | | 49,194,125 | |

| | | | | | | | | |

OIL & GAS STORAGE | | | | | | | | |

& TRANSPORTATION — 1.42% | | | | | | | | |

| Tallgrass Energy LP Class A | | | 2,048,698 | | | | 45,317,200 | |

| | | | | | | | | |

PHARMACEUTICALS — 5.17% | | | | | | | | |

| Allergan plc (b) | | | 863,686 | | | | 165,110,853 | |

| | | | | | | | | |

REITs — 2.72% | | | | | | | | |

| Broadmark Realty Capital, Inc. (k) | | | 501,551 | | | | 6,394,775 | |

| Liberty Property Trust | | | 1,341,004 | | | | 80,527,290 | |

| | | | | | | | 86,922,065 | |

SEMICONDUCTORS — 1.59% | | | | | | | | |

| Mellanox Technologies Ltd. (a)(b)(e) | | | 432,871 | | | | 50,723,824 | |

| | | | | | | | | |

SEMICONDUCTORS & | | | | | | | | |

SEMICONDUCTOR EQUIPMENT — 3.08% | | | | | | | | |

| Cypress Semiconductor Corporation (e) | | | 4,217,278 | | | | 98,389,096 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| | | Shares | | | Value | |

SPECIALTY STORES — 2.76% | | | | | | |

| Tiffany & Company (e)(j)(k) | | | 660,038 | | | $ | 88,214,079 | |

| | | | | | | | | |

TECHNOLOGY DISTRIBUTORS — 0.37% | | | | | | | | |

| Anixter International, Inc. (a) | | | 7,522 | | | | 692,776 | |

| Tech Data Corporation (a) | | | 77,357 | | | | 11,108,465 | |

| | | | | | | | 11,801,241 | |

WIRELESS TELECOMMUNICATION | | | | | | | | |

SERVICES — 1.16% | | | | | | | | |

| Sprint Corporation (a)(k) | | | 342,725 | | | | 1,785,597 | |

| T-Mobile USA, Inc. (a)(j) | | | 450,629 | | | | 35,338,326 | |

| | | | | | | | 37,123,923 | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $1,420,082,805) | | | | | | | 1,511,710,027 | |

| | | | | | | | | |

SPECIAL PURPOSE ACQUISITION | | | | | | | | |

COMPANIES — 7.20% (a) | | | | | | | | |

| Act II Global Acquisition | | | | | | | | |

| Corporation Class A (b) | | | 675,184 | | | | 6,832,862 | |

| Alberton Acquisition Corporation (b) | | | 541,885 | | | | 5,608,510 | |

| Andina Acquisition Corporation III (b) | | | 584,088 | | | | 5,928,493 | |

| Apex Technology Acquisition | | | | | | | | |

| Corporation Class A (f) | | | 604,500 | | | | 5,993,617 | |

| B. Riley Principal Merger | | | | | | | | |

| Corporation Class A | | | 74,287 | | | | 743,613 | |

| CF Finance Acquisition | | | | | | | | |

| Corporation Class A (f) | | | 390,688 | | | | 4,004,552 | |

| ChaSerg Technology Acquisition | | | | | | | | |

| Corporation Class A | | | 439,436 | | | | 4,767,881 | |

| Churchill Capital Corporation II Class A | | | 302,610 | | | | 3,124,872 | |

| CIIG Merger Corporation (k) | | | 315,662 | | | | 3,207,126 | |

| Collier Creek Holdings Class A (b)(f) | | | 195,000 | | | | 2,006,550 | |

| Fellazo, Inc. (b)(k) | | | 187,945 | | | | 1,871,594 | |

| FinTech Acquisition | | | | | | | | |

| Corporation III Class A | | | 328,770 | | | | 3,327,152 | |

| Forum Merger II Corporation Class A | | | 334,654 | | | | 3,416,817 | |

| Galileo Acquisition Corporation (b)(f) | | | 112,274 | | | | 1,153,615 | |

| Gordon Pointe Acquisition Corporation | | | 424,801 | | | | 4,498,643 | |

| Graf Industrial Corporation | | | 1,034,606 | | | | 10,542,635 | |

| Haymaker Acquisition | | | | | | | | |

| Corporation II Class A | | | 893,499 | | | | 8,980,558 | |

| Hennessy Capital Acquisition | | | | | | | | |

| Corporation IV Class A | | | 175,540 | | | | 1,783,486 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| | | Shares | | | Value | |

| Juniper Industrial Holdings, Inc. (f) | | | 817,774 | | | $ | 8,353,561 | |

| Legacy Acquisition Corporation Class A | | | 1,293,025 | | | | 13,279,367 | |

| Leisure Acquisition Corporation | | | 578,466 | | | | 6,027,616 | |

| Leo Holdings Corporation Class A (b)(f) | | | 985,877 | | | | 10,203,827 | |

| LF Capital Acquisition | | | | | | | | |

| Corporation Class A (f) | | | 89,230 | | | | 922,638 | |

| LGL Systems Acquisition Corporation | | | 15,818 | | | | 161,344 | |

| Longevity Acquisition Corporation (b)(f) | | | 262,500 | | | | 2,743,125 | |

| Megalith Financial Acquisition | | | | | | | | |

| Corporation Class A | | | 260,768 | | | | 2,675,480 | |

| Merida Merger Corporation I | | | 240,205 | | | | 2,339,597 | |

| Monocle Acquisition Corporation | | | 204,085 | | | | 2,077,585 | |

| Mosaic Acquisition Corporation Class A | | | 1,040,046 | | | | 10,696,873 | |

| Mudrick Capital Acquisition | | | | | | | | |

| Corporation Class A (f) | | | 428,413 | | | | 4,423,364 | |

| Nebula Acquisition Corporation Class A | | | 701,282 | | | | 7,391,512 | |

| New Providence Acquisition | | | | | | | | |

| Corporation Class A (f) | | | 454,276 | | | | 4,485,976 | |

| Opes Acquisition Corporation (f) | | | 614,585 | | | | 6,468,507 | |

| Orisun Acquisition Corporation | | | 113,258 | | | | 1,126,917 | |

| Pivotal Investment Corporation II Class A | | | 121,848 | | | | 1,211,169 | |

| PropTech Acquisition Corporation (f) | | | 183,000 | | | | 1,892,220 | |

| Pure Acquisition Corporation | | | 1,413,170 | | | | 14,654,573 | |

| Software Acquisition Group, Inc. | | | 567,175 | | | | 5,762,498 | |

| Spartan Energy Acquisition | | | | | | | | |

| Corporation Class A | | | 659,936 | | | | 6,710,229 | |

| Thunder Bridge | | | | | | | | |

| Acquisition II Ltd. Class A (b) | | | 516,986 | | | | 5,144,011 | |

| Tiberius Acquisition Corporation (f)(k) | | | 311,172 | | | | 3,259,527 | |

| TKK Symphony Acquisition | | | | | | | | |

| Corporation (b) | | | 728,623 | | | | 7,461,100 | |

| Trident Acquisitions Corporation (f) | | | 654,925 | | | | 6,902,910 | |

| Tuscan Holdings Corporation (e) | | | 610,840 | | | | 6,083,966 | |

| Tuscan Holdings Corporation II | | | 331,070 | | | | 3,264,350 | |

| VectoIQ Acquisition Corporation | | | 620,727 | | | | 6,405,841 | |

TOTAL SPECIAL PURPOSE ACQUISITION | | | | | | | | |

COMPANIES (Cost $220,853,098) | | | | | | | 229,922,259 | |

| | | | | | | | | |

PREFERRED STOCKS — 0.08% | | | | | | | | |

| Colony Capital, Inc., 8.750%, Series E | | | 97,704 | | | | 2,471,911 | |

TOTAL PREFERRED STOCKS | | | | | | | | |

(Cost $2,452,748) | | | | | | | 2,471,911 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| | | Shares | | | Value | |

CONTINGENT VALUE RIGHTS — 0.07% (a)(f) | | | | | | |

| Alder Biopharmaceuticals, Inc. | | | 2,217,560 | | | $ | 2,078,962 | |

| Media General, Inc. (e) | | | 891,153 | | | | 44,558 | |

TOTAL CONTINGENT VALUE RIGHTS | | | | | | | | |

(Cost $0) | | | | | | | 2,123,520 | |

| | | | | | | | | |

WARRANTS — 0.17% (a) | | | | | | | | |

| Act II Global Acquisition | | | | | | | | |

| Corporation Class A | | | | | | | | |

| Expiration: April 2024, | | | | | | | | |

| Exercise Price: $11.50 (b) | | | 337,592 | | | | 337,592 | |

| Akazoo S.A. | | | | | | | | |

| Expiration: December 2024, | | | | | | | | |

| Exercise Price: $11.50 (b) | | | 238,850 | | | | 119,425 | |

| Apex Technology Acquisition | | | | | | | | |

| Corporation Class A | | | | | | | | |

| Expiration: September 2026, | | | | | | | | |

| Exercise Price: $11.50 | | | 302,250 | | | | 347,588 | |

| CF Finance Acquisition Corporation Class A | | | | | | | | |

| Expiration: April 2025, | | | | | | | | |

| Exercise Price: $11.50 (f) | | | 293,016 | | | | 259,319 | |

| ChaSerg Technology Acquisition | | | | | | | | |

| Corporation Class A | | | | | | | | |

| Expiration: September 2023, | | | | | | | | |

| Exercise Price: $11.50 | | | 219,718 | | | | 483,380 | |

| Churchill Capital Corporation II Class A | | | | | | | | |

| Expiration: July 2024, | | | | | | | | |

| Exercise Price: $11.50 | | | 100,870 | | | | 143,558 | |

| Collier Creek Holdings Class A | | | | | | | | |

| Expiration: November 2023, | | | | | | | | |

| Exercise Price: $11.50 (b)(f) | | | 65,000 | | | | 89,050 | |

| FinTech Acquisition Corporation III Class A | | | | | | | | |

| Expiration: December 2023, | | | | | | | | |

| Exercise Price: $11.50 | | | 164,385 | | | | 225,799 | |

| Graf Industrial Corporation | | | | | | | | |

| Expiration: December 2025, | | | | | | | | |

| Exercise Price: $11.50 | | | 434,606 | | | | 190,357 | |

| Haymaker Acquisition | | | | | | | | |

| Corporation II Class A | | | | | | | | |

| Expiration: October 2026, | | | | | | | | |

| Exercise Price: $11.50 | | | 297,833 | | | | 419,945 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| | | Shares | | | Value | |

| Hennessy Capital Acquisition | | | | | | |

| Corporation IV Class A | | | | | | |

| Expiration: September 2025, | | | | | | |

| Exercise Price: $11.50 | | | 131,655 | | | $ | 105,324 | |

| Merida Merger Corporation I | | | | | | | | |

| Expiration: November 2026, | | | | | | | | |

| Exercise Price: $11.50 | | | 120,103 | | | | 59,883 | |

| Monocle Acquisition Corporation | | | | | | | | |

| Expiration: June 2024, | | | | | | | | |

| Exercise Price: $11.50 | | | 204,085 | | | | 153,064 | |

| Mudrick Capital Acquisition | | | | | | | | |

| Corporation Class A | | | | | | | | |

| Expiration: March 2025, | | | | | | | | |

| Exercise Price: $11.50 | | | 428,413 | | | | 209,922 | |

| New Providence Acquisition | | | | | | | | |

| Corporation Class A | | | | | | | | |

| Expiration: September 2024, | | | | | | | | |

| Exercise Price: $11.50 (f) | | | 227,138 | | | | 193,067 | |

| Pivotal Acquisition Corporation | | | | | | | | |

| Expiration: December 2025, | | | | | | | | |

| Exercise Price: $11.50 (f) | | | 677,651 | | | | 406,591 | |

| Pivotal Investment Corporation II Class A | | | | | | | | |

| Expiration: June 2025, | | | | | | | | |

| Exercise Price: $11.50 (f) | | | 40,616 | | | | 32,493 | |

| Pure Acquisition Corporation | | | | | | | | |

| Expiration: April 2023, | | | | | | | | |

| Exercise Price: $11.50 | | | 342,226 | | | | 337,435 | |

| Repay Holdings Corporation | | | | | | | | |

| Expiration: July 2024, | | | | | | | | |

| Exercise Price: $11.50 | | | 338,801 | | | | 379,457 | |

| Thunder Bridge Acquisition II Ltd. Class A | | | | | | | | |

| Expiration: November 2026, | | | | | | | | |

| Exercise Price: $11.50 (b) | | | 258,496 | | | | 232,646 | |

| Tiberius Acquisition Corporation | | | | | | | | |

| Expiration: April 2023, | | | | | | | | |

| Exercise Price: $11.50 | | | 311,172 | | | | 354,736 | |

| Tuscan Holdings Corporation | | | | | | | | |

| Expiration: April 2026, | | | | | | | | |

| Exercise Price: $11.50 (f) | | | 610,840 | | | | 351,233 | |

| Tuscan Holdings Corporation II | | | | | | | | |

| Expiration: July 2025, | | | | | | | | |

| Exercise Price: $11.50 (f) | | | 165,535 | | | | 74,491 | |

TOTAL WARRANTS (Cost $4,572,599) | | | | | | | 5,506,355 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| | | Principal | | | | |

| | | Amount | | | Value | |

BANK LOANS — 2.96% (f)(i) | | | | | | |

| Avaya Holdings Corporation | | | | | | |

| 5.990% (1 Month U.S. | | | | | | |

| LIBOR + 4.250%), 12/16/2024 | | $ | 16,332,815 | | | $ | 16,074,267 | |

| Cengage Learning Holdings II, Inc. | | | | | | | | |

| 6.049% (1 Month U.S. | | | | | | | | |

| LIBOR + 4.250%), 6/7/2023 | | | 10,841,633 | | | | 10,353,759 | |

| McGraw-Hill Global | | | | | | | | |

| Education Holdings LLC | | | | | | | | |

| 5.799% (1 Month U.S. | | | | | | | | |

| LIBOR + 4.000%), 5/4/2022 | | | 11,596,736 | | | | 11,147,363 | |

| Refinitiv U.S. Holdings, Inc. | | | | | | | | |

| 5.049% (1 Month U.S. | | | | | | | | |

| LIBOR + 3.250%), 10/1/2025 | | | 30,141,271 | | | | 30,412,091 | |

| Zayo Group LLC | | | | | | | | |

| 3.799% (1 Month U.S. | | | | | | | | |

| LIBOR + 2.000%), 1/19/2021 | | | 26,191,104 | | | | 26,322,190 | |

TOTAL BANK LOANS (Cost $94,612,558) | | | | | | | 94,309,670 | |

| | | | | | | | | |

CORPORATE BONDS — 4.89% (f) | | | | | | | | |

| Arconic, Inc. | | | | | | | | |

| 5.400%, 4/15/2021 (k) | | | 7,553,000 | | | | 7,789,301 | |

| CEC Entertainment, Inc. | | | | | | | | |

| 8.000%, 2/15/2022 (k) | | | 11,217,000 | | | | 11,080,287 | |

| Cincinnati Bell, Inc. | | | | | | | | |

| 7.000%, 7/15/2024 (h) | | | 824,000 | | | | 866,222 | |

| EIG Investors Corporation | | | | | | | | |

| 10.875%, 2/1/2024 | | | 8,231,000 | | | | 8,234,416 | |

| Kinetic Concepts, Inc. / KCI USA, Inc. | | | | | | | | |

| 12.500%, 11/1/2021 (h) | | | 15,253,000 | | | | 15,735,757 | |

| Nationstar Mortgage LLC / | | | | | | | | |

| Nationstar Capital Corporation | | | | | | | | |

| 6.500%, 7/1/2021 (k) | | | 2,438,000 | | | | 2,451,165 | |

| 6.500%, 6/1/2022 | | | 1,939,000 | | | | 1,943,936 | |

| Nielsen Finance LLC / | | | | | | | | |

| Nielsen Finance Company | | | | | | | | |

| 5.000%, 4/15/2022 (h) | | | 12,171,000 | | | | 12,238,306 | |

| Refinitiv U.S. Holdings, Inc. | | | | | | | | |

| 8.250%, 11/15/2026 (h)(k) | | | 26,960,000 | | | | 30,413,576 | |

| SRC Energy, Inc. | | | | | | | | |

| 6.250%, 12/1/2025 (k) | | | 10,218,000 | | | | 10,320,078 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| | | Principal | | | | | | | |

| | | Amount | | | | | | Value | |

| T-Mobile USA, Inc. | | | | | | | | | |

| 6.500%, 1/15/2024 | | $ | 9,842,000 | | | | | | $ | 10,149,661 | |

| 6.375%, 3/1/2025 | | | 3,180,000 | | | | | | | 3,292,620 | |

| Vertiv Group Corporation | | | | | | | | | | | |

| 9.250%, 10/15/2024 (h) | | | 3,422,000 | | | | | | | 3,685,785 | |

| Vistra Energy Corporation | | | | | | | | | | | |

| 5.875%, 6/1/2023 | | | 15,354,000 | | | | | | | 15,745,987 | |

| Zayo Group LLC / Zayo Capital, Inc. | | | | | | | | | | | |

| 5.750%, 1/15/2027 (h) | | | 21,763,000 | | | | | | | 22,178,619 | |

TOTAL CORPORATE BONDS | | | | | | | | | | | |

(Cost $156,670,936) | | | | | | | | | | 156,125,716 | |

| | | | | | | | | | | | |

| | | Contracts | | | | | | | | |

| | | (100 shares | | | Notional | | | | | |

| | | per contract) | | | Amount | | | | | |

PURCHASED PUT OPTIONS — 0.08% (a) | | | | | | | | | | | |

| DuPont de Nemours, Inc. | | | | | | | | | | | |

| Expiration: April 2020, | | | | | | | | | | | |

| Exercise Price: $55.00 | | | 1,557 | | | $ | 9,995,940 | | | | 146,358 | |

| IAC/InterActiveCorp | | | | | | | | | | | | |

| Expiration: January 2020, | | | | | | | | | | | | |

| Exercise Price: $175.00 | | | 2,803 | | | | 69,825,533 | | | | 21,022 | |

| The Madison Square Garden | | | | | | | | | | | | |

| Company Class A | | | | | | | | | | | | |

| Expiration: February 2020, | | | | | | | | | | | | |

| Exercise Price: $230.00 | | | 1,668 | | | | 49,070,892 | | | | 66,720 | |

| Marathon Petroleum Corporation | | | | | | | | | | | | |

| Expiration: January 2020, | | | | | | | | | | | | |

| Exercise Price: $47.50 | | | 1,041 | | | | 6,272,025 | | | | 4,164 | |

| Expiration: January 2020, | | | | | | | | | | | | |

| Exercise Price: $50.00 | | | 1,250 | | | | 7,531,250 | | | | 8,750 | |

| Expiration: January 2020, | | | | | | | | | | | | |

| Exercise Price: $52.50 | | | 1,389 | | | | 8,368,725 | | | | 19,446 | |

| Expiration: January 2020, | | | | | | | | | | | | |

| Exercise Price: $55.50 | | | 4,485 | | | | 27,022,125 | | | | 352,072 | |

| Masco Corporation | | | | | | | | | | | | |

| Expiration: April 2020, | | | | | | | | | | | | |

| Exercise Price: $41.00 | | | 6,898 | | | | 33,103,502 | | | | 379,390 | |

| Ra Pharmaceuticals, Inc. | | | | | | | | | | | | |

| Expiration: April 2020, | | | | | | | | | | | | |

| Exercise Price: $40.00 | | | 58 | | | | 272,194 | | | | 2,030 | |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| | | Contracts | | | | | | | |

| | | (100 shares | | | Notional | | | | |

| | | per contract) | | | Amount | | | Value | |

| Raytheon Company | | | | | | | | | |

| Expiration: January 2020, | | | | | | | | | |

| Exercise Price: $175.00 | | | 1,458 | | | $ | 32,038,092 | | | $ | 13,122 | |

| SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

| Expiration: January 2020, | | | | | | | | | | | | |

| Exercise Price: $316.00 | | | 2,093 | | | | 67,365,298 | | | | 277,323 | |

| Expiration: February 2020, | | | | | | | | | | | | |

| Exercise Price: $320.00 | | | 837 | | | | 26,939,682 | | | | 390,879 | |

| T-Mobile USA, Inc. | | | | | | | | | | | | |

| Expiration: January 2020, | | | | | | | | | | | | |

| Exercise Price: $70.00 | | | 3,956 | | | | 31,022,952 | | | | 31,648 | |

| United Technologies Corporation | | | | | | | | | | | | |

| Expiration: January 2020, | | | | | | | | | | | | |

| Exercise Price: $110.00 | | | 2,458 | | | | 36,811,008 | | | | 17,206 | |

| VanEck Vectors Semiconductor ETF | | | | | | | | | | | | |

| Expiration: February 2020, | | | | | | | | | | | | |

| Exercise Price: $140.00 | | | 1,157 | | | | 16,361,137 | | | | 468,585 | |

| ViacomCBS, Inc. Class B | | | | | | | | | | | | |

| Expiration: March 2020, | | | | | | | | | | | | |

| Exercise Price: $35.00 | | | 7,658 | | | | 32,140,626 | | | | 291,004 | |

TOTAL PURCHASED PUT OPTIONS | | | | | | | | | | | | |

(Cost $4,943,501) | | | | | | | | | | | 2,489,719 | |

| | | | | | | | | | | | | |

| | | Shares | | | | | | | | | |

ESCROW NOTES — 3.91% (a) | | | | | | | | | | | | |

| Altaba, Inc. (f) | | | 6,012,284 | | | | | | | | 124,504,361 | |

| AMR Corporation (d)(g) | | | 1,243,406 | | | | | | | | 285,983 | |

| Sentinel Energy Services, Inc. Class B (f) | | | 1,689,936 | | | | | | | | 9,295 | |

| T-Mobile USA, Inc. (d)(g) | | | 7,594,000 | | | | | | | | — | |

TOTAL ESCROW NOTES | | | | | | | | | | | | |

(Cost $67,047,988) | | | | | | | | | | | 124,799,639 | |

| | | | | | | | | | | | | |

SHORT-TERM INVESTMENTS — 34.89% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

MONEY MARKET FUNDS — 29.89% (c) | | | | | | | | | | | | |

| Fidelity Institutional Government Portfolio, | | | | | | | | | | | | |

| Institutional Share Class, 1.49% | | | 142,776 | | | | | | | | 142,776 | |

| First American Government Obligations | | | | | | | | | | | | |

| Fund, Institutional Share Class, 1.47% | | | 155,777,000 | | | | | | | | 155,777,000 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| | | Shares | | | Value | |

| Goldman Sachs Government Fund, | | | | | | |

| Institutional Share Class, 1.48% | | | 19,530,815 | | | $ | 19,530,815 | |

| The Government & Agency Portfolio, | | | | | | | | |

| Institutional Share Class, 1.50% | | | 155,777,000 | | | | 155,777,000 | |

| JPMorgan Prime Money Market Fund, | | | | | | | | |

| Institutional Share Class, 1.75% | | | 155,730,910 | | | | 155,768,080 | |

| JPMorgan U.S. Government Money Market | | | | | | | | |

| Fund, Institutional Share Class, 1.51% | | | 155,777,000 | | | | 155,777,000 | |

| Morgan Stanley Institutional Liquidity | | | | | | | | |

| Fund — Government Portfolio, | | | | | | | | |

| Institutional Share Class, 1.51% | | | 155,777,000 | | | | 155,777,000 | |