December 31, 2016

THE MERGER FUND

WCM ALTERNATIVES:

EVENT-DRIVEN FUND

| | Total Firm AUM: | $3.8 billion | |

| STANDARDIZED | Strategy Assets: | | |

| PERFORMANCE SUMMARY | Merger Arbitrage1 | $3.1 billion | |

| As of December 31, 2016 | Multi-Event2 | $711.9 million | |

| | Average Annual Total Return (%) |

| Merger Arbitrage | QTD | YTD | 1 YR | 5 YR | 10 YR | Life |

| The Merger Fund | | | | | | |

| (Investor) | 1.09 | 2.61 | 2.61 | 2.07 | 2.44 | 6.18 |

| The Merger Fund | | | | | | |

| (Institutional) | 1.15 | 2.94 | 2.94 | n/a | n/a | 1.82 |

| | Annual Operating Expense Ratio (%)3 |

| | Gross | Net | Net Expenses Before | | |

| Merger Arbitrage | Expense | Expense | Investment Related | Performance | Fund |

| | Ratio | Ratio3 | Expenses4 | Inception5 | AUM |

| The Merger Fund | | | | | |

| (Investor) | 1.90% | 1.77% | 1.34% | 01/31/1989 | $1.5 b |

| The Merger Fund | | | | | |

| (Institutional) | 1.57% | 1.44% | 1.01% | 08/01/2013 | $1.4 b |

| | Average Annual Total Return (%) |

| Insurance | | | | | | |

| Dedicated Funds | QTD | YTD | 1 YR | 5 YR | 10 YR | Life |

| The Merger Fund VL | 0.81 | 2.44 | 2.44 | 1.85 | 3.27 | 4.69 |

| | Annual Operating Expense Ratio (%)3 |

| Insurance | Gross | Net | Net Expenses Before | | |

| Dedicated Funds | Expense | Expense | Investment Related | Performance | Fund |

| | Ratio | Ratio6 | Expenses4 | Inception7 | AUM |

| The Merger Fund VL | 2.60% | 1.82% | 1.40% | 05/26/2004 | $31.8 m |

| | Average Annual Total Return (%) |

| Multi-Event | QTD | YTD | 1 YR | 5 YR | 10 YR | Life |

| Event-Driven Fund | 1.38 | 2.96 | 2.96 | n/a | n/a | 1.55 |

| | Annual Operating Expense Ratio (%)3 |

| | Gross | Net | Net Expenses Before | | |

| Multi-Event | Expense | Expense | Investment Related | Performance | Fund |

| | Ratio | Ratio8 | Expenses4 | Inception | AUM |

| Event-Driven Fund | 2.27% | 2.13% | 1.74% | 01/02/2014 | $112.9 m |

QTD and YTD performance is not annualized. Performance data quoted represent past performance; past performance does not guarantee future results. The performance results portrayed herein reflect the reinvestment of all interest, dividends and distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data included herein for periods prior to 2011 reflect that of Westchester Capital Management, Inc., the Funds’ prior investment advisor. Messrs. Behren and Shannon, the Funds’ current portfolio managers, have served as co-portfolio managers of the Funds since 2007. Performance data current to the most recent month-end may be obtained by calling (800) 343-8959 or by visiting www.westchestercapitalfunds.com.

1Includes USD 54 million in private funds advised by Westchester Capital Management, LLC’s affiliated investment advisor and USD 115 million in a sub-advised fund. 2Includes USD 599 million in sub- advised funds. 3Net expense ratios are as of a fund’s most recent prospectus and were applicable to investors. Prospectus dates vary among funds. For The Merger Fund®, expense ratios are as of the May 2, 2016 prospectus. The Advisor has contractually agreed to waive a portion of its management fee until April 30, 2017 if its assets exceed certain thresholds, beginning at $1.5 billion. For The Merger Fund VL, expense ratios are as of the April 22, 2016 prospectus. For the Event-Driven Fund, expense ratios are as of the May 2, 2016 prospectus. 4Investment related expenses for The Merger Fund, The Merger Fund VL and the WCM Alternatives: Event-Driven Fund include acquired fund fees and expenses of 0.03%, 0.03% and 0.04%, short interest and dividend expenses of 0.40%, 0.39% and 0.35% respectively. 5The inception date of the Merger Fund® Investor share class is January 31, 1989. 6The Merger Fund VL: The Adviser has contractually agreed to waive its investment advisory fee and to reimburse the Fund for other ordinary operating expenses to the extent necessary to limit ordinary operating expenses to an amount not to exceed 1.40%. The expense limitation is expected to apply until April 30, 2017, except that it may be terminated by the Board of Trustees at any time. 7The inception date of The Merger Fund VL is May 26, 2004. 8Event-Driven Fund: The Adviser has contractually agreed to waive its investment advisory fee and to reimburse the Fund for other ordinary operating expenses to the extent necessary to limit ordinary operating expenses of the institutional class of shares to an amount not to exceed 1.74%. The expense limitation is expected to apply until April 30, 2017, except that it may be terminated by the Board of Trustees at any time.

| MARKET INDICES | QTD | YTD | 1 YR | 3 YR | 5 YR | 10 YR |

| BofA Merrill Lynch | | | | | | |

| 3-Month U.S. | | | | | | |

| Treasury Bill Index | 0.09% | 0.33% | 0.33% | 0.14% | 0.12% | 0.80% |

| Barclays Aggregate | | | | | | |

| Bond Index | -2.98% | 2.65% | 2.65% | 3.03% | 2.23% | 4.34% |

| S&P 500 Index | 3.82% | 11.96% | 11.96% | 8.87% | 14.66% | 6.95% |

| The Wilshire | | | | | | |

| Liquid Alternative | | | | | | |

| ED Index | 0.68% | 3.46% | 3.46% | -0.57% | 1.18% | 2.36% |

| The US OE | | | | | | |

| MultiAlternative | | | | | | |

| Category | -0.11% | 0.77% | 0.77% | -0.14% | 1.25% | 0.45% |

| The US OE Market | | | | | | |

| Neutral Index | 1.60% | 1.82% | 1.82% | 0.76% | 1.09% | 0.27% |

Fellow Shareholders,

We live in an increasingly unpredictable world. Black swans, or outlier occurrences, shock us at a mounting rate, often with counterintuitive impacts to boot. The rule of thumb that “the market hates uncertainty” seemed suspended, as markets rose in the face of longshot events which clearly should have created uncertainty. Developments such as Brexit, the election of President Trump, Russian cyber-espionage, North Korean ICBM launches, world-wide terrorism and the Cubs winning the World Series obviously create uncertainty, yet equity markets continue to hit new highs. Nobody could have forecast all of these events, let alone predicted that markets would be UP on Brexit and spike ten percent on the Trump election (not to mention that heavily-shorted Tesla stock would be up 50% during the past three months- just saying). The point is, with the effects being as equally unpredictable as the events themselves, prudent investment managers are scratching their heads seeking stable, predictable and uncorrelated investments. Volatility abounded this year, as the S&P 500 Index dug itself a -10% hole before rallying to gain 9.5% on a sharp post-election bounce.

It is unclear where we go from here, but with equity markets at all-time highs (and earnings multiples extended) and interest rates expected to lift in the near future, it is safe to say that the path of least resistance for both bonds and stocks is not much higher in the near term. The good news from our corner of the investing world is that transaction outcomes are as predictable as ever, and our historic lack of correlation has continued. As we have often discussed, unlike bond investors, we view a rising interest rate environment as attractive, and helpful for arbitrage spreads. Additionally, early indications are that we are entering a uniquely pro-business and free market environment that is conducive to transaction activity.

Although the fourth quarter was challenging and volatile, our Funds gained 1.15%, 0.81% and 1.38% respectively for The Merger Fund®, The Merger Fund VL and the WCM Alternatives: Event Driven Fund, bringing our 2016 full year performance to 2.94%, 2.44% and 2.96% respectively, with the usual fraction of equity market volatility. These returns were in-line with our excess return targets over similarly volatile risk-free investments.1 Although the strong quarter coincided with equity market strength, our performance was actually due to multiple deal completions, successful deal selection and a snap-back in some overextended arbitrage spreads. This was accomplished against a backdrop of an unprecedented number of broken deals, which reinforces the importance of a proven, repeatable investment process should storm clouds gather quickly.

__________

1 | As of 12/31/2016 the three-year trailing standard deviation for The Merger Fund® was 2.96% and for The Merger Fund VL was 2.87% versus 10.74% for the S&P 500 Index. The Standard Deviation for The WCM Event Driven Fund since it’s 1/02/2014 inception was 4.05%. |

Despite the lack of economic clarity, 2016 continued the three year bull market for merger and acquisition activity. Deal flow remained strong yet deal selection was paramount– traditionally a strength of ours. Some interesting stats, for merger transactions with an equity value of >$400mm:2

| | • | Announced deal value in 2016 was $867 billion (vs. 2015’s record level of $1.326 trillion), the fifth highest annual level since 1998. |

| | | |

| | • | Average deal size in 2016 was $5.7 billion, less than the record $8.8 billion in 2015 but greater than the $4.3 billion historical average. |

| | | |

| | • | Average annualized deal spreads narrowed during the year from 6.1% in 1Q16 to 4.6% in 4Q16. |

Interest rates began to rise in the fourth quarter, although the Fed did not officially raise the federal funds rate until December. As noted above, our December commentary, “Which Boats will Rise with the Interest Rate Tide?”3 observes that rising rate environments have traditionally been positive for merger arbitrage (“M&A”) strategies. In fact, our Funds significantly outperformed the Barclays Aggregate Bond Index which fell almost 3 percent in the last quarter of the year. Additionally, we have outperformed the Barclays Index over the last five quarters.4

Forecast for 2017

We expect clear weather for deal activity in 2017 driven by less uncertainty and more confidence than 2016. Executives remain under pressure to drive growth externally if organic growth is lacking. As companies adapt to globalization and technological innovation, many look for a merger, acquisition or other corporate reorganization to stay competitive. Additionally, companies have begun to lock in historically low deal-funding costs before interest rates rise.

Since our December commentary on rates, President Trump has vowed to follow through on his free market campaign pledges. He has pledged to reduce regulatory burdens on business, invest in infrastructure and reform the corporate tax code. Of note, he has also discussed a potential “tax holiday” to encourage repatriation of overseas cash, a move which industry leaders believe would fuel M&A activity. We agree with forecasters such as David Folkerts-Landau, chief economist at Deutsche Bank who believes “[the Trump administration’s] policy mix has the potential of reigniting

__________

2 | Source: UBS US M&A Review: 4Q16 |

3 | Available upon request by email or hard copy |

4 | Since 9/30/2015 – 12/31/2016 The Merger Fund® returned 3.11% versus 1.65% for the Barclays Aggregate Bond Index. |

productivity growth and raising the US growth potential.”5 We also expect this growth will be accompanied by a normalized (read: higher) interest rate environment, with the Federal Reserve continuing its incremental rate hike policy. As a result, we would expect deal activity to ramp and arbitrage spreads to widen in 2017.

STRATEGY UPDATES

Merger Activity

Dealmakers appeared to be cautious during the first three quarters of the year. However, October was the most active month on record for announced deals in the U.S., according to Dealogic, and the fifth busiest month ever for global activity. As a result, full year M&A activity was strong, albeit not at the levels of the past two years.

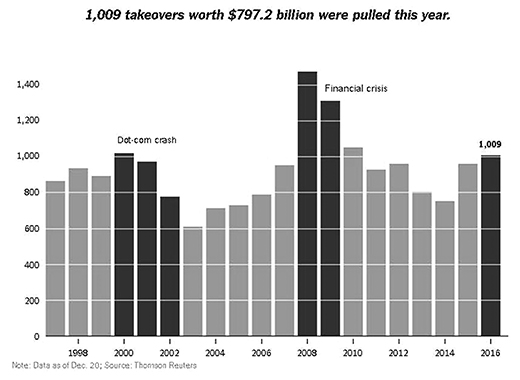

There were multiple large-scale transactions in 2016, from AT&T’s $85 billion blockbuster bid for Time Warner to German drug maker Bayer’s $56 billion offer for Monsanto, the U.S. genetically modified crop giant. However, deal terminations were plentiful as well. In fact, for definitive strategic deals, the termination rate in 2016 was 5.4% (vs. 3.3% historically), a level that has not been seen since 2008. The chart on the following page, which includes deals not subject to a definitive merger agreement, is interesting:

__________

The broken deals in this chart represent almost one quarter of the $3.55 trillion in transactions announced over the past calendar year.

Deal failures were caused, among other factors, by valuation disagreements, competing bids, and issues revealed during due diligence. Notable terminations in our universe included Allergan-Pfizer, KLA-Tencor-Lam Research, Meredith-Media General, Office Depot-Staples, Hawaiian Electric-NextEra Energy, and Baker Hughes-Halliburton. Given our focus on risk-adjusted returns, we were able to avoid most of these landmines, but caught some shrapnel in the Allergan-Pfizer (discussed in our Q1 letter) and the KLA-Tencor-Lam Research (discussed in our Q3 letter) transactions.

Portfolio Performance Summary

As mentioned above, The Merger Fund® returned 1.15% and its insurance dedicated counterpart, The Merger Fund VL posted a gain of 0.81%, bringing their year-to-date gains to 2.94% and 2.44% respectively. We held 80 investments throughout the quarter and had one terminated transaction. Reflecting a 3:1 ratio of winners to losers, 59 positions posted gains versus 21 with negative marks-to-market. We invested in 20 new situations during the quarter, and as of the end of December we held 66 positions and ended the quarter approximately 94% invested.

The three top winners for the quarter were Ingram Micro, Inc., Yahoo! Inc. and St. Jude Medical, Inc., contributing approximately 20 to 40 basis points each in performance. China-based HNA Group’s $6 billion acquisition of electronics distributor Ingram Micro closed in early December. We have attached a two-page summary of this transaction as an illustrative case study of a complicated acquisition.

Additional contributors:

| | • | While it’s unclear whether Verizon will follow through on a $4.8 billion deal to buy Yahoo’s core internet business, President Donald Trump’s plans to revamp the corporate tax code could benefit Yahoo significantly regardless of the Verizon transaction. |

| | | |

| | • | Abbott Laboratories received U.S. antitrust approval to complete its proposed acquisition of St. Jude Medical in early December. The deal closed on January 4, 2017. |

| |

| Of the 21 situations that posted negative marks the three largest were: |

| | | |

| | • | Syngenta/ChemChina: This transaction resulted in negative marks-to-market due to a number of regulatory-related risk elements; however we are optimistic that it will eventually be cleared in the U.S., E.U. and China. Additionally, we remain alert to the protective |

| | | posture of China’s foreign exchange authority, the State Administration of Foreign Exchange (“SAFE”), regarding Yuan outflows to pay for corporate transactions. SAFE approval is required for this deal. |

| | | |

| | • | Bass Pro Shops is acquiring Cabela’s Inc. for about $4.5 billion in cash, uniting two of the biggest sellers of outdoor-sports gear and rivals. As part of the deal, Capital One Financial Corp. is acquiring Cabela’s credit card business. On the last day of the calendar year the parties received a second request from U.S. antitrust regulators. Simultaneously and perhaps more disconcerting, Capital One revealed that the Office of the Comptroller of Currency (“OCC”) was reviewing its Anti-Money Laundering (“AML”) compliance and was unlikely to grant it approval to buy Cabela’s captive credit card bank prior to the October 2017 termination date. Despite the clear strategic rationale for the transaction, we have become cautious due to the OCC issue as well as weakening fundamentals in the firearm sales business, which may become more apparent as the deal is delayed by the financing business approval. |

| | | |

| | • | Macro Hedge – equities rallied, so we lost approximately 8 basis points on our market hedges. |

Our Event Driven Fund had a similar performance profile to The Merger Fund® during this quarter due to an interim large allocation to merger arbitrage. Two of the top three winners and all of the top three detractors were in similar transactions. The largest non-M&A contributor, and the second largest driver of performance, was a position in the secured debt of a late-stage reorganization candidate called Energy Future Holdings (“EFH”). EFH, a Texas-based electric utility company, is the former TXU Energy, which itself was formerly known as Texas Utilities prior to its $45 billion leveraged buyout by Kohlberg Kravis Roberts, Texas Pacific Group, and Goldman Sachs. The company filed for Chapter 11 bankruptcy protection in mid-2014 and began the emergence from bankruptcy process in mid-2016, via an agreement where NextEra Energy will acquire 100 percent of the equity of EFH and certain of its subsidiaries.

When the price just doesn’t add up: Appraisal Actions

After not participating for many years, we have commenced two appraisal actions in Delaware Chancery Court on behalf of our Funds. The concept behind exercising appraisal rights is to allow shareholders judicial recourse when they believe they are receiving less than fair value for their shares pursuant to a merger transaction. The majority of U.S. public companies

are incorporated in Delaware, and these claims would be governed by the Delaware General Corporation Law. In circumstances where plaintiff shareholders can persuade the court that fair value was not paid for the target company’s shares, or where price paid was not determined on an arm’s length basis, dissenting shareholders can often be awarded significantly more by the Court than the consideration offered in the transaction. The plaintiffs need not prove any claimed wrongdoing, but merely that less than “fair value” was to be paid for the shares.

Based on our internal models and discounted cash flow methodology, we have concluded that Newell Brands Inc. significantly underpaid for Jarden Corp. and shareholders of Columbia Pipeline Group received less than fair value from TransCanada Corp. There are many factors and methodologies that may affect the analysis, such as growth assumptions, cost of capital, and the history of the negotiation and sale process.

Here, briefly, are some of the allegations contained in our complaints, which form the basis for our claims:

Jarden

| | • | Jarden ran a single bidder process and did not run a market check to see whether other strategic or financial buyers would pay a higher price than Newell. |

| | | |

| | • | Martin Franklin, the Company’s Executive Chairman, was the lead negotiator for Jarden. He, along with the Company’s Vice Chairman and President and the Company’s CEO, received substantial golden parachute payments estimated at hundreds of millions dollars. This included the accelerated vesting of equity awards that may never have vested, an option to acquire the Company’s Aspen office, an option to purchase Jarden’s aircraft, and a post-closing consulting agreement. |

| | | |

| | • | When the Merger Agreement was signed, Jarden had not yet realized expected synergies from some of its prior acquisitions, which appear not to have been incorporated into the deal price. |

| | | |

| | • | Based on the above, we believe that the $59.21 per share value of cash and Newell stock offered significantly less than fair value consideration. |

Columbia Pipeline

| | • | Columbia Pipeline Group was spun off from NiSource Inc. in a structure that incentivized management and insiders to sell the company and trigger lucrative change-of-control compensation awards. |

| | • | We believe that within two days of being spun-off, Columbia was marketed to be sold. Reflecting the board’s sense of company value, they rejected a $32.50 to $35.50 per share takeover bid in August 2015, asserting that a more appropriate price would be in the upper $30s. |

| | | |

| | • | The energy market plummeted thereafter, and Columbia’s management subsequently began to negotiate solely with TransCanada, ultimately agreeing to sell the company at what we believe was a “fire sale” price close to the trough of the energy market decline (March 2016). |

| | | |

| | • | Pursuant to this agreed transaction, Columbia board members received approximately $72 million, with the CEO and CFO alone receiving over $63 million. |

| | | |

| | • | Significantly, energy prices spiked during the pendency of the transaction, causing the agreed deal value on the closing date to be significantly below fair value. |

| | | |

| | • | Based on the above, we believe that the Columbia Pipeline merger price of $25.50 significantly undervalued the company. |

We intend to pursue these actions to an appropriate conclusion on behalf of our investors, which we think will deliver an attractive outcome. We view these positions as we would any other investment, carefully balancing risk and liquidity versus the potential reward. Both position sizes are moderate, and are part of our diversified portfolio of merger investments.

OUR COMPANY

WCM manages a total of five SEC-registered mutual funds. Our other vehicles span a spectrum from lower-return, lower-volatility expectations to higher volatility with potentially higher return expectations:

| Account | Vehicle | Strategy | Inception |

The Merger Fund® | | | |

| Investor Share | | | |

| Class (MERFX) | SEC ‘40-Act Fund | Merger Arbitrage | 1989 |

| Institutional Share | | | |

| Class (MERIX) | SEC ‘40-Act Fund | Merger Arbitrage | 2013 |

| The Merger | | | |

| Fund VL (MERVX) | Variable Insurance Trust | Merger Arbitrage | 2004 |

| Dunham Monthly | | | |

| Distribution Fund | Sub-advised | | |

| (DNMDX) | SEC ‘40-Act Fund | Event-Driven | 2008 |

| WCM Alternatives: | | | |

| Event-Driven | | | |

| Fund (WCEIX) | SEC ‘40-Act Fund | Event-Driven | 2014 |

| JNL/Westchester | | | |

| Capital Event | Sub-advised | | |

| Driven Fund | SEC ‘40-Act Fund | Event-Driven | 2015 |

| Westchester Merger | | | |

| Arbitrage Strategy | | | |

| of theJNL | | | |

Multi-Manager | Sub-advised | | |

| Alternative Fund | SEC ‘40-Act Fund | Merger Arbitrage | 2016 |

As usual, quarterly statistical summaries for any of our vehicles are provided within two weeks of the end of the quarter- typically one month prior to the release of the quarterly letter. They are available electronically on our website, and we would be happy to provide a scheduled email as soon as the data becomes available. For convenience, investors can arrange for e-alerts of important Fund communications. Through our website at www.westchestercapitalfunds.com, you can check direct account balances, make purchases and sales, and sign up for notification of trade confirmations, statements and shareholder communications via e-mail.

CASE STUDY: INGRAM MICRO INC.

Merger arbitrage investing is often complex. As investors have asked to better understand our process and its application to individual deals, we thought it would be helpful to provide a case study on a successful deal.

The acquisition of Ingram Micro (“Ingram”) for US $6bln in cash ($38.90/share) by Tianjin Tianhai Investment Company Ltd. (“TTI”) which closed in December, contributed almost 40 basis points (gross, not annualized) to our funds’ performance for the year. The deal is particularly interesting because of the multiple facets that needed to be investigated, analyzed and forecasted by our team, counsel and consultants. It also

showcases the importance of a thorough investment and risk management process.

The transaction was announced in February of 2016 and was completed 10 months later after many ups and downs.

The Courtship

Ingram is a distributor of IT hardware, software and logistics services to suppliers and reseller customers. TTI, a majority-owned subsidiary of HNA group (a China-based Fortune Global 500 conglomerate), provides international transportation services, among other operations. HNA is not a State-Owned Entity but many of its executives are well-connected in the Chinese government. The rationale for this strategic transaction was to expand HNA’s expertise, capabilities and geographic reach.

It was an immediate love fest— Ingram stated that it “will now be part of a larger organization that has complementary logistics capabilities and a strong presence in China that can further support the growth and profitability objectives of our vendor and customer partners.” The CEO of HNA group chimed in with “After the transaction, Ingram Micro would become the largest member enterprise of HNA Group in terms of revenue, and facilitate the internationalization process of the group. With the help of Ingram Micro, HNA Group would have access to business opportunities in emerging markets…Furthermore, the addition of Ingram Micro would help…HNA Group transform from a logistics operator to a supply chain operator, and provide one-stop services while improving efficiencies.”

But Hold Off on the Nuptials

Sounds great, right? On the surface, this was a great strategic fit for both companies. But a deeper dive revealed an apparent tough road to completion. Here are some of the litany of conditions that were required for the transaction:

| | • | SEC proxy review |

| | | |

| | �� | Antitrust approvals in U.S. (Hart-Scott Rodino), Canada, Brazil, India, China, Turkey, Mexico, South Africa, Italy, Austria, Poland, and Slovakia |

| | | |

| | • | Chinese SAFE; Committee on Foreign Investment in the U.S. (“CFIUS”) |

| | | |

| | • | Shanghai Stock Exchange Clearance; Tianjin Tianhai shareholder approval |

| | | |

| | • | Ingram shareholder approval |

Uncertainty Creates Opportunity

The merger agreement was filed the day of the announcement, which disclosed the conditions, representations of the parties, termination provisions and other important details of the transaction, including a commitment by HNA to pay a USD $400mm termination fee if it were unable to close the deal. This provision signaled a high level of commitment on the part of the Chinese acquirer. However, this transaction traded at an extremely wide arbitrage spread, which reflected the level of risk stemming from the plethora of approvals, the 35% premium paid and the “X factor” of a Chinese buyer.

Our Analysis & Conclusions

We immediately went to work tracking the various approval processes, which is typical; however, overlaid on this assessment were Chinese currency and antitrust reviews as well as an assessment by CFIUS, which investigates any transaction or investment in a U.S. business or asset by a foreign person that may raise national security concerns or involve critical infrastructure. Antitrust review appeared not to be a problem since the parties did not compete with each other. The majority of our resources were spent on the most complicated and opaque approvals, which were the CFIUS and SAFE reviews.

We ultimately concluded that the transaction was attractive as an investment for the following reasons:

| | • | It had a high likelihood of being successfully completed because the merger agreement was tightly written in favor of the target company |

| | | |

| | • | The buyer had committed to a larger than typical termination fee |

| | | |

| | • | The regulatory conditions seemed surmountable, including the Chinese approvals |

| | | |

| | • | Most importantly, the stock appeared mispriced in the market, trading at a level that implied successful completion was more or less a coin toss |

Regarding CFIUS, our take, in consultation with counsel, was that Ingram was merely a reseller of generic electronic equipment, with less than 3% of its sales reaching the U.S. government as end customers, and the transaction posed no threat to national security. After initially claiming that CFIUS approval was not even needed, several months later TTI decided to make the filing. The stock promptly dropped below $33 in July, creating an arbitrage spread of $5.90/share, which implied an approximately 40% likelihood of deal success. We viewed this as mispriced and added to our positions.

As the CFIUS process played out behind closed doors, China’s currency came under extreme pressure and its government, through SAFE, began a policy of limiting the outflow of money to purchase external assets. Through consultants, we became informed enough to forecast the likelihood of SAFE approval and concluded that currency market fears were overblown as well. We concluded that the SAFE crackdown was more targeted at speculative flows and financially-driven transactions designed to spirit yuan out of the country, rather than strategic deals by Chinese buyers.

We ultimately concluded that the stock was significantly mispriced because:

| | 1. | We were comfortable that CFIUS approval was highly likely |

| | | |

| | 2. | SAFE concerns were a red herring because the deal was highly strategic; the buyer was a known, favored corporate citizen in China, and the deal was being funded by U.S. dollars, not yuan, borrowed from banks outside of China |

| | | |

| | 3. | The $400mm break fee showed that the buyer was willing to put significant skin in the game. Additionally, Ingram’s business remained strong throughout the year, consistently increasing its standalone value (giving us less downside) in the event of deal termination |

Consequently, our position size peaked in excess of 4% in late November, exposing the Funds to approximately 0.6% of value-at-risk. The companies continued to knock out the required approvals as they awaited CFIUS, and by the time they received CFIUS approval on November 1st, all approvals except SAFE had been received.

The spread remained wide and we held onto the position, optimistic that the final approval was in sight. The parties, after agreeing to extend the termination (also known as “walkaway date”) from mid-August to mid-November, agreed again to extend the date to mid-December. This was another positive data point for the good guys, so we stuck with the position. The parties received SAFE approval on December 2nd, the deal closed on December 5th, capping one of our most interesting deals to date. We would be happy to discuss this deal and our investment process in greater detail with any investor who may be interested.

|  |

| | |

| Roy Behren | Mike Shannon |

IMPORTANT DISCLOSURES

Before investing in The Merger Fund® and/or WCM Alternatives: Event-Driven Fund, carefully consider the investment objectives, risks, charges and expenses. For a prospectus or summary prospectus containing this and other information, please call (800) 343-8959. Please read the prospectus carefully before investing. The Merger Fund VL is available through variable products offered by third-party insurance companies. For a prospectus containing information for any variable annuity or variable life product that invests in The Merger Fund VL, contact your financial advisor or the offering insurance company for a contract prospectus and prospectus for the underlying funds. To obtain a prospectus for the Dunham Monthly Distribution Fund, please visit www.dunham.com. Please read it carefully before investing. Shares of JNL/Westchester Capital Event Driven Fund are offered to separate accounts of participating life insurance companies for the purpose of funding variable annuity contracts and variable life insurance policies. Shares of the fund are not offered directly to the public. For a prospectus containing information for any variable annuity or variable life product that invests in the Fund, contact your financial advisor or the offering insurance company for a contract prospectus and prospectus for the underlying funds. Please read it carefully before investing. Variable annuities are long-term, tax-deferred investments designed for retirement, involve investment risks and may lose value. Earnings are taxable as ordinary income when distributed and may be subject to a 10% federal tax penalty if withdrawn before age 59½. Optional benefit costs are added to the ongoing fees and expenses of the variable annuity.

Variable annuities (VA650, VA660) are issued by Jackson National Life Insurance Company® (Home Office: Lansing, Michigan) and in New York (VA650NY, VA660NY) by Jackson National Life Insurance Company of New York® (Home Office: Purchase, New York). Variable annuities are distributed by Jackson National Life Distributors LLC, member FINRA. May not be available in all states and state variations may apply. These products have limitations and restrictions, including withdrawal charges, recapture charges and excess interest adjustments (interest rate adjustments in New York) where applicable. Jackson® issues other annuities with similar features, benefits, limitations and charges. Contact Jackson for more information. Jackson is the marketing name for Jackson National Life Insurance Company and Jackson National Life Insurance Company of New York.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. The Ten Largest Positions as a Percent of Net Assets for The Merger Fund® as of December 31, 2016 were: Yahoo! Inc. (4.87%), Jarden Corporation (4.36%), St. Jude Medical, Inc. (3.96%), Harman International Industries, Inc. (3.54%), American Capital Ltd. (3.25%), Syngenta AG (3.24%), NXP Semiconductors NV (3.10%), Sky PLC (3.00%), Endurance Specialty Holdings Limited (2.85%), Linear Technology Corporation (2.83%). The Ten Largest Positions as a Percent of Net Assets for The Merger Fund VL as of December 31, 2016 were: Yahoo! Inc. (4.17%), Harman International Industries, Inc. (3.47%), American Capital Ltd. (3.18%), Jarden Corporation (3.17%), Syngenta AG (3.05%), NXP Semiconductors NV (3.04%), St. Jude Medical, Inc. (3.03%), Sky PLC (2.96%), The Valspar Corporation (2.77%), Linear Technology Corporation (2.75%). The Ten Largest Positions as a Percent of Net Assets for WCM Alternatives: Event-Driven Fund as of December 31, 2016 were: Yahoo! Inc. (4.50%), Hewlett Packard Enterprise Company (3.94%), American Capital Ltd. (3.78%), Harman International Industries, Inc. (3.70%), Sky PLC (3.56%), Syngenta AG (3.54%), Jarden Corporation (3.43%), Reynolds American Inc. (3.37%), St. Jude Medical, Inc. (3.37%), NXP Semiconductors NV (3.33%).

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. Merger‐arbitrage and event‐driven investing involves the risk that the adviser’s evaluation of the outcome of a proposed event, whether it be a merger, reorganization, regulatory issue or other event, will prove incorrect and that the Funds’ return on the investment will be

negative. Investments in foreign companies may entail political, cultural, regulatory, legal, and tax risks different from those associated with comparable transactions in the United States. The frequency of the Fund’s transactions will vary from year to year, though merger arbitrage portfolios typically have higher turnover rates than portfolios of typical long‐only funds. Increased portfolio turnover may result in higher brokerage commissions, dealer mark‐ups and other transaction costs. The higher costs associated with increased portfolio turnover may offset gains in the Fund’s performance. The Funds’ may enter into short sale transactions for, among other reasons, purposes of protecting against a decline in the market value of the acquiring company’s shares prior to the acquisition completion. If the price of a security sold short increases between the time of the short sale and the time the Fund covers its short position, the Fund will incur a loss. The amount of a potential loss on an uncovered short sale transaction is theoretically unlimited. Debt securities may fluctuate in value due to, among other things, changes in interest rates, general economic conditions, industry fundamentals, market sentiment and the financial condition of the issuer, including the issuer’s credit rating or financial performance. Derivatives may create leverage which will amplify the effect of the performance of those instruments on the Funds’ and may produce significant losses. The Funds’ hedging strategy will be subject to the Funds’ investment adviser’s ability to assess correctly the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged.

References to other mutual funds do not construe an offer of those securities. Any tax or legal information provided is merely a summary of our understanding and interpretation of some of the current income tax regulations and is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Funds’ nor any of their representatives may give legal or tax advice.

The views expressed are as of February 14, 2017 and are a general guide to the views of Westchester Capital Management, are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. This document does not replace portfolio and fund-specific materials.

The Morningstar Rating™ for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating™ metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. As of December 31, 2016, The Merger Fund® was rated against the following numbers of U.S.-domiciled Market Neutral funds over the following time periods: 118 funds in the last three years, 70 funds in the last five years, and 27 funds in the last ten years. With respect to these Market Neutral funds, The Merger Fund®- Investor received a Morningstar Rating of 3 stars, 3 stars and 4 stars for the three-, five- and ten year periods, respectively; The Merger Fund® - Institutional received a Morningstar Rating of 3 stars, 4 stars and 4 stars for the three-, five- and ten-year periods, respectively. 5 and 10 year ratings are Extended Performance Ratings computed by

Morningstar based on the MERFX share class. © 2016 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely.

Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Absolute return strategies are not intended to outperform stocks and bonds during strong market rallies. An absolute return fund may not achieve its goals and may underperform during periods of strong positive market performance.

Definitions: The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general; The Barclays Aggregate Bond Index is an intermediate term index comprised of investment grade bonds; The Morningstar Category: US Fund Market Neutral is comprised of a universe of funds with similar investment objectives; The Morningstar Category: The US Fund MultiAlternative encompasses funds that have a majority of their assets exposed to alternative strategies and include both funds with static allocations to alternative strategies and funds tactically allocating among alternative strategies and asset classes. The BofA Merrill Lynch US 3-Month Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Indices are unavailable for direct investment. The Wilshire Liquid Alternative Event Driven IndexSM measures the performance of the event driven strategy component of The Wilshire Liquid Alternative IndexSM. Event driven strategies predominantly invest in companies involved in corporate transactions such as mergers, restructuring, distressed, buy backs, or other capital structure changes. The Wilshire Liquid Alternative Event Driven Index (WLIQAED) is designed to provide a broad measure of the liquid alternative event driven market. Standard Deviation is the degree by which returns vary relative to the average return. The higher the standard deviation, the greater the variability of the investment; A basis point (often denoted as bps) is a unit equal to 1/100 of a percentage point and can be summarized as follows: 1% change = 100 basis points and 0.01% = 1 basis point; Correlation is calculated using R-Squared; which is a measure that represents the percentage of a fund’s movements that can be explained by movements in a benchmark index. A fund with low R-squared doesn’t act much like the index.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights of the annual report, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Expense ratios are as of a Fund’s most recent prospectus and may differ from the more recent expense ratios reported in the financial highlights of the most recent annual or semi-annual report.

The SEC does not endorse, indemnify, approve nor disapprove of any security.

The Merger Fund® and WCM Alternatives: Event-Driven Fund is distributed by Quasar Distributors, LLC. The Merger VL is available through variable products offered by third-party insurance companies and is not affiliated with Quasar Distributors, LLC. The Dunham Monthly Distribution Fund, which is sub-advised by Westchester Capital Management, LLC, is distributed by Dunham and Associates Investment Counsel, which have no affiliation with Quasar Distributors, LLC.

DEAL COMPOSITION

The Merger Fund (Unaudited)

| Type of Buyer | | | Deal Terms* | |

| Strategic | 100.0% | | Cash | 41.1% |

| Financial | 0.0% | | Cash & Stock | 29.7% |

| | | | Stock and Stub(1) | 20.6% |

| By Deal Type | | | Stock with Fixed Exchange Ratio | 5.6% |

| Friendly | 97.2% | | Undetermined(2) | 2.7% |

| Hostile | 2.8% | | Stock with Flexible | |

| | | | Exchange Ratio (Collar) | 0.3% |

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of December 31, 2016. |

1 | “Stub” includes assets other than cash and stock (e.g., escrow notes). |

2 | The compensation is undetermined because the compensation to be received (e.g., stock, cash, escrow notes, other) will be determined at a later date, potentially at the option of the Fund’s investment adviser. |

PORTFOLIO COMPOSITION*

The Merger Fund (Unaudited)

By Sector

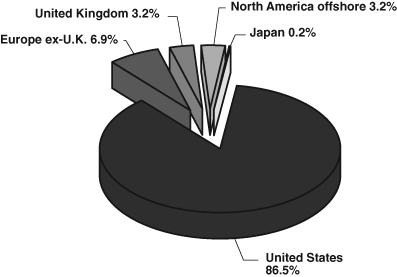

By Region

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of December 31, 2016. Data expressed excludes short-term investments, short investments, written options, forward currency exchange contracts and short total return swap contracts. Please refer to the Schedule of Investments, Schedule of Options Written, Schedule of Forward Currency Exchange Contracts and Schedule of Swap Contracts for more details on the Fund’s individual holdings. |

PORTFOLIO COMPOSITION*

The Merger Fund (Unaudited)

By Sector

By Region

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of December 31, 2016. Data expressed excludes short-term investments, short investments, written options, forward currency exchange contracts and short total return swap contracts. Please refer to the Schedule of Investments, Schedule of Options Written, Schedule of Forward Currency Exchange Contracts and Schedule of Swap Contracts for more details on the Fund’s individual holdings. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT

IN THE MERGER FUND, S&P 500 AND BofA MERRILL LYNCH

3-MONTH U.S. TREASURY BILL INDEX*

THE MERGER FUND

AVERAGE ANNUAL TOTAL RETURNS

as of December 31, 2016

| | 1 Yr. | 3 Yr. | 5 Yr. | 10 Yr. |

| Investor Class | 2.61% | 1.06% | 2.07% | 2.44% |

| BofA Index | 0.33% | 0.14% | 0.12% | 0.80% |

| S&P 500 | 11.96% | 8.87% | 14.66% | 6.95% |

| | | | |

| | | | Since Inception |

| | 1 Yr. | 3 Yr. | (8/1/2013) |

| Institutional Class | 2.94% | 1.34% | 1.82% |

| BofA Index | 0.33% | 0.14% | 0.13% |

| S&P 500 | 11.96% | 8.87% | 10.59% |

This chart assumes an initial gross investment of $10,000 made on December 31, 2006. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or upon redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. The Standard & Poor’s 500 Index (“S&P 500”) is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The BofA Merrill Lynch U.S. 3-Month Treasury Bill Index (“BofA Index”) is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date. The index is unmanaged and does not include any expenses, fees or sales charges. It is not possible to invest directly in an index.

| * | The Funds compare their performance in this annual report to the BofA Index. The Funds’ Advisor believes the BofA Index is a more appropriate index against which to compare the Funds’ performance than the Funds’ former index, the S&P 500, in light of the Funds’ investment strategies, including those that may be characterized as market neutral strategies. |

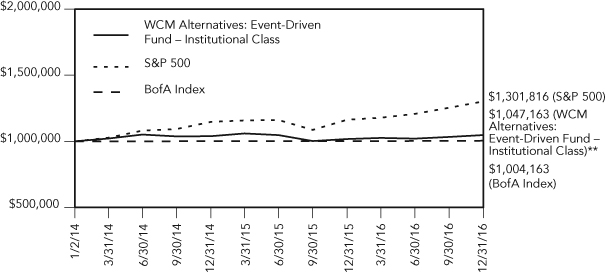

COMPARISON OF CHANGE IN VALUE OF $1,000,000 INVESTMENT

IN THE WCM ALTERNATIVES: EVENT-DRIVEN FUND, S&P 500

AND BofA MERRILL LYNCH 3-MONTH U.S. TREASURY BILL INDEX*

WCM ALTERNATIVES: EVENT-DRIVEN FUND

AVERAGE ANNUAL TOTAL RETURNS

as of December 31, 2016

| | | Since Inception |

| | 1 Yr. | (1/2/2014) |

| Institutional Class | 2.96%** | 1.55% |

| BofA Index | 0.33% | 0.14% |

| S&P 500 | 11.96% | 9.21% |

This chart assumes an initial gross investment of $1,000,000 made on January 2, 2014. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or upon redemptions of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. The Standard & Poor’s 500 Index (“S&P 500”) is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The BofA Merrill Lynch U.S. 3-Month Treasury Bill Index (“BofA Index”) is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date. The index is unmanaged and does not include any expenses, fees or sales charges. It is not possible to invest directly in an index.

| * | | The Fund compares its performance in this annual report to the BofA Index. The Fund’s Advisor believes the BofA Index is a more appropriate index against which to compare the Fund’s performance than the Fund’s former index, the S&P 500, in light of the Fund’s investment strategies, including those that may be characterized as market neutral strategies. |

| | | |

| ** | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

The Merger Fund and WCM Alternatives: Event-Driven Fund

EXPENSE EXAMPLE

December 31, 2016 (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, distribution and/or service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the period 7/1/16 — 12/31/16.

Actual Expenses

The first line of the table for each share class provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. The example below includes, among other fees, management fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, or extraordinary expenses.

Hypothetical Example for Comparison Purposes

The second line of the table for each share class provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

The Merger Fund and WCM Alternatives: Event-Driven Fund

EXPENSE EXAMPLE (continued)

December 31, 2016 (Unaudited)

| | | | | Expenses |

| | | | | Paid |

| | Beginning | Ending | | During |

| | Account | Account | Annualized | Period |

| | Value | Value | Expense | 7/1/16 — |

| | 7/1/16 | 12/31/16 | Ratio | 12/31/16* |

| | | | | |

| The Merger Fund | | | | |

| Investor Class | | | | |

Actual+(1) | $1,000.00 | $1,016.80 | 2.04% | $10.34 |

Hypothetical+(2) | $1,000.00 | $1,014.88 | 2.04% | $10.33 |

| | | | | |

| Institutional Class | | | | |

Actual++(3) | $1,000.00 | $1,018.70 | 1.72% | $8.73 |

Hypothetical++(2) | $1,000.00 | $1,016.49 | 1.72% | $8.72 |

| | | | | |

| WCM Alternatives: Event-Driven Fund | | | | |

| Institutional Class | | | | |

Actual+++(4) | $1,000.00 | $1,025.40 | 2.49% | $12.68 |

Hypothetical+++(2) | $1,000.00 | $1,012.62 | 2.49% | $12.60 |

| * | Expenses are equal to the Fund’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| + | Excluding dividends and borrowing expense on securities sold short, your actual cost of investment in and your hypothetical cost of investment in The Merger Fund’s Investor Class would have been $7.15 and $7.15, respectively. |

| ++ | Excluding dividends and borrowing expense on securities sold short, your actual cost of investment in and your hypothetical cost of investment in The Merger Fund’s Institutional Class would have been $5.53 and $5.53, respectively. |

| +++ | Excluding dividends and borrowing expense on securities sold short, your actual cost of investment in and your hypothetical cost of investment in WCM Alternatives: Event-Driven Fund’s Institutional Class would have been $8.86 and $8.82, respectively. |

| (1) | Ending account values and expenses paid during the period based on a 1.68% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a hypothetical 5.00% annual return before expenses. |

| (3) | Ending account values and expenses paid during the period based on a 1.87% return. This actual return is net of expenses. |

| (4) | Ending account values and expenses paid during the period based on a 2.54% return. This actual return is net of expenses. |

The Merger Fund

SCHEDULE OF INVESTMENTS

December 31, 2016

| Shares | | | | Value | |

| | |

| LONG INVESTMENTS — 111.60% | |

| | |

| COMMON STOCKS — 81.54% | |

| | | | | | |

| | | AEROSPACE & DEFENSE — 1.26% | | | |

| | 611,882 | | B/E Aerospace, Inc. (e) | | $ | 36,829,178 | |

| | | | | | | | |

| | | | ALTERNATIVE CARRIERS — 1.40% | | | | |

| | 725,321 | | Level 3 Communications, Inc. (a) | | | 40,879,091 | |

| | | | | | | | |

| | | | APPLICATION SOFTWARE — 1.98% | | | | |

| | 1,563,644 | | Mentor Graphics Corporation (e) | | | 57,682,827 | |

| | | | | | | | |

| | | | ASSET MANAGEMENT & CUSTODY BANKS — 0.85% | | | | |

| | 1,659,877 | | NorthStar Asset Management Group, Inc. | | | 24,765,365 | |

| | | | | | | | |

| | | | AUTO PARTS & EQUIPMENT — 0.09% | | | | |

| | 43,260 | | Adient plc (a)(b) | | | 2,535,036 | |

| | | | | | | | |

| | | | AUTOMOBILE MANUFACTURERS — 0.05% | | | | |

| | 38,800 | | General Motors Company | | | 1,351,792 | |

| | | | | | | | |

| | | | BROADCASTING — 1.50% | | | | |

| | 458,200 | | CBS Corporation Class B | | | 29,150,684 | |

| | 773,207 | | Media General, Inc. (a)(e) | | | 14,559,488 | |

| | | | | | | 43,710,172 | |

| | | | | | | | |

| | | | BUILDING PRODUCTS — 0.61% | | | | |

| | 432,600 | | Johnson Controls International plc (b) | | | 17,818,794 | |

| | | | | | | | |

| | | | CABLE & SATELLITE — 0.77% | | | | |

| | 655,765 | | Liberty Media Corporation-Liberty | | | | |

| | | | SiriusXM Class A (a)(e) | | | 22,637,008 | |

| | | | | | | | |

| | | | CASINOS & GAMING — 0.18% | | | | |

| | 219,187 | | Isle of Capri Casinos, Inc. (a)(e) | | | 5,411,727 | |

| | | | | | | | |

| | | | CONSUMER ELECTRONICS — 3.54% | | | | |

| | 928,857 | | Harman International Industries, Inc. (e) | | | 103,251,744 | |

| | | | | | | | |

| | | | DIVERSIFIED CHEMICALS — 2.41% | | | | |

| | 1,231,231 | | The Dow Chemical Company | | | 70,451,038 | |

| | | | | | | | |

| | | | DRUG RETAIL — 0.49% | | | | |

| | 1,722,324 | | Rite Aid Corporation (a) | | | 14,191,950 | |

| | | | | | | | |

| | | | FERTILIZERS & AGRICULTURAL CHEMICALS — 4.00% | | | | |

| | 412,600 | | Monsanto Company (e) | | | 43,409,646 | |

| | 927,336 | | Syngenta AG — ADR (e) | | | 73,305,911 | |

| | | | | | | 116,715,557 | |

| | | | | | | | |

| | | | FINANCIAL EXCHANGES & DATA — 0.29% | | | | |

| | 252,437 | | Bats Global Markets, Inc. (e) | | | 8,459,164 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2016

| Shares | | | | Value | |

| | | | | | |

| | | HEALTH CARE EQUIPMENT — 3.95% | | | |

| | 1,439,097 | | St. Jude Medical, Inc. (e) | | $ | 115,401,188 | |

| | | | | | | | |

| | | | HEALTH CARE SERVICES — 0.04% | | | | |

| | 17,364 | | Envision Healthcare Corporation (a) | | | 1,098,968 | |

| | | | | | | | |

| | | | HOTELS, RESORTS & CRUISE LINES — 2.22% | | | | |

| | 2,382,900 | | Hilton Worldwide Holdings, Inc. | | | 64,814,880 | |

| | | | | | | | |

| | | | HOUSEWARES & SPECIALTIES — 4.36% | | | | |

| | 2,025,678 | | Jarden Corporation (a)(d)(g)(j) | | | 127,184,421 | |

| | | | | | | | |

| | | | INTERNET SOFTWARE & SERVICES — 4.87% | | | | |

| | 3,672,930 | | Yahoo!, Inc. (a)(e) | | | 142,032,203 | |

| | | | | | | | |

| | | | MOVIES & ENTERTAINMENT — 2.72% | | | | |

| | 823,075 | | Time Warner, Inc. (e) | | | 79,451,430 | |

| | | | | | | | |

| | | | MULTI-LINE INSURANCE — 2.49% | | | | |

| | 1,111,200 | | American International Group, Inc. | | | 72,572,472 | |

| | | | | | | | |

| | | | OIL & GAS & CONSUMABLE FUELS — 0.70% | | | | |

| | 568,786 | | Energy Transfer Partners LP | | | 20,368,227 | |

| | | | | | | | |

| | | | OIL & GAS EQUIPMENT & SERVICES — 3.95% | | | | |

| | 907,100 | | Baker Hughes, Inc. | | | 58,934,287 | |

| | 1,572,327 | | FMC Technologies, Inc. (a)(e)(f) | | | 56,366,351 | |

| | | | | | | 115,300,638 | |

| | | | | | | | |

| | | | OIL & GAS REFINING & MARKETING — 0.19% | | | | |

| | 604,197 | | Showa Shell Sekiyu K.K. (b) | | | 5,619,355 | |

| | | | | | | | |

| | | | OIL & GAS STORAGE & TRANSPORTATION — 3.14% | | | | |

| | 2,276,354 | | Columbia Pipeline Group, Inc. (a)(d)(g)(j) | | | 58,539,425 | |

| | 1,924,990 | | Columbia Pipeline Partners LP (e) | | | 33,013,579 | |

| | | | | | | 91,553,004 | |

| | | | | | | | |

| | | | PACKAGED FOODS & MEATS — 1.29% | | | | |

| | 593,773 | | Lamb Weston Holdings, Inc. (e) | | | 22,474,308 | |

| | 271,825 | | The WhiteWave Foods Company (a) | | | 15,113,470 | |

| | | | | | | 37,587,778 | |

| | | | | | | | |

| | | | PERSONAL PRODUCTS — 0.06% | | | | |

| | 93,059 | | Coty, Inc. Class A | | | 1,703,910 | |

| | | | | | | | |

| | | | REGIONAL BANKS — 2.20% | | | | |

| | 1,185,900 | | CIT Group, Inc. | | | 50,614,212 | |

| | 249,371 | | PrivateBancorp, Inc. | | | 13,513,414 | |

| | | | | | | 64,127,626 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2016

| Shares | | | | Value | |

| | | | | | |

| | | REINSURANCE — 2.85% | | | |

| | 898,624 | | Endurance Specialty Holdings Ltd. (b)(e) | | $ | 83,032,858 | |

| | | | | | | | |

| | | | REITs — 0.98% | | | | |

| | 1,267,886 | | NorthStar Realty Finance Corporation | | | 19,208,473 | |

| | 424,863 | | Starwood Property Trust, Inc. | | | 9,325,743 | |

| | | | | | | 28,534,216 | |

| | | | | | | | |

| | | | RESTAURANTS — 1.28% | | | | |

| | 418,300 | | Yum China Holdings, Inc. (a) | | | 10,925,996 | |

| | 418,300 | | Yum! Brands, Inc. | | | 26,490,939 | |

| | | | | | | 37,416,935 | |

| | | | | | | | |

| | | | SEMICONDUCTORS — 6.54% | | | | |

| | 803,480 | | Intersil Corporation Class A (e) | | | 17,917,604 | |

| | 1,322,866 | | Linear Technology Corporation (e) | | | 82,480,695 | |

| | 923,657 | | NXP Semiconductors NV (a)(b)(e) | | | 90,527,622 | |

| | | | | | | 190,925,921 | |

| | | | | | | | |

| | | | SPECIAL PURPOSE ACQUISITION COMPANY — 0.14% | | | | |

| | 395,952 | | KLR Energy Acquisition Corporation Class A (a) | | | 4,098,103 | |

| | | | | | | | |

| | | | SPECIALTY CHEMICALS — 7.24% | | | | |

| | 657,600 | | Ashland Global Holdings, Inc. (e) | | | 71,869,104 | |

| | 1,843,059 | | Chemtura Corporation (a)(e) | | | 61,189,559 | |

| | 753,632 | | The Valspar Corporation (e) | | | 78,083,811 | |

| | | | | | | 211,142,474 | |

| | | | | | | | |

| | | | SPECIALTY STORES — 2.69% | | | | |

| | 1,339,896 | | Cabela’s, Inc. (a)(e) | | | 78,450,911 | |

| | | | | | | | |

| | | | SYSTEMS SOFTWARE — 1.09% | | | | |

| | 578,680 | | Dell Technologies, Inc. Class V (a) | | | 31,810,040 | |

| | | | | | | | |

| | | | TECHNOLOGY HARDWARE, | | | | |

| | | | STORAGE & PERIPHERALS — 2.53% | | | | |

| | 3,188,600 | | Hewlett Packard Enterprise Company (e) | | | 73,784,204 | |

| | | | | | | | |

| | | | THRIFTS & MORTGAGE FINANCE — 2.01% | | | | |

| | 3,011,064 | | EverBank Financial Corporation (e) | | | 58,565,195 | |

| | | | | | | | |

| | | | TOBACCO — 2.59% | | | | |

| | 1,350,779 | | Reynolds American, Inc. (e) | | | 75,697,655 | |

| | | | TOTAL COMMON STOCKS (Cost $2,314,979,439) | | | 2,378,965,055 | |

| | | | | | | | |

| CLOSED-END FUNDS — 3.26% |

| | 5,297,159 | | American Capital Ltd. (a)(e) | | | 94,925,089 | |

| | | | TOTAL CLOSED-END FUNDS (Cost $87,626,887) | | | 94,925,089 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2016

| Shares | | | | Value | |

| CONTINGENT VALUE RIGHTS — 0.03% | |

| | 1,713,496 | | Casa Ley, S.A. de C.V. (a)(g) | | $ | 599,723 | |

| | 77,699 | | Leap Wireless International, Inc. (a)(g) | | | 244,752 | |

| | 1,713,496 | | Property Development Centers LLC (a)(g) | | | 85,675 | |

| | | | TOTAL CONTINGENT VALUE RIGHTS (Cost $0) | | | 930,150 | |

| | | | | | | | |

| Principal Amount | | | | | | |

| CORPORATE BONDS — 4.30% (f) | |

| | | | Aeropuertos Dominicanos Siglo XXI, S.A. | | | | |

| $ | 3,385,000 | | 9.250%, 11/13/2019 (b)(i) | | | 3,537,325 | |

| | | | Alere, Inc. | | | | |

| | 4,496,000 | | 6.500%, 6/15/2020 | | | 4,451,040 | |

| | | | Change Healthcare Holdings, Inc. | | | | |

| | 16,141,000 | | 11.000%, 12/31/2019 | | | 16,669,618 | |

| | | | Energy Future Intermediate Holding Company LLC | | | | |

| | 10,065,404 | | 11.000%, 10/1/2021 (h) | | | 13,487,641 | |

| | 30,940,446 | | 11.750%, 3/1/2022 (h)(i) | | | 42,233,709 | |

| | | | FairPoint Communications, Inc. | | | | |

| | 13,596,000 | | 8.750%, 8/15/2019 (i) | | | 14,207,820 | |

| | | | LIN Television Corporation | | | | |

| | 6,991,000 | | 5.875%, 11/15/2022 | | | 7,148,298 | |

| | | | Northern Tier Energy LLC / Northern | | | | |

| | | | Tier Finance Corporation | | | | |

| | 4,453,000 | | 7.125%, 11/15/2020 | | | 4,647,819 | |

| | | | Rite Aid Corporation | | | | |

| | 3,812,000 | | 6.125%, 4/1/2023 (i) | | | 4,112,195 | |

| | | | Team Health, Inc. | | | | |

| | 2,285,000 | | 7.250%, 12/15/2023 (i) | | | 2,604,900 | |

| | | | Western Refining, Inc. | | | | |

| | 11,876,000 | | 6.250%, 4/1/2021 | | | 12,351,040 | |

| | | | TOTAL CORPORATE BONDS (Cost $114,196,527) | | | 125,451,405 | |

| | | | | | | | |

Contracts (100 shares per contract) | |

| PURCHASED CALL OPTIONS — 0.00% | |

| | | | Rockwell Collins, Inc. | | | | |

| | 321 | | Expiration: January 2017, Exercise Price: $100.00 | | | 18,297 | |

| | | | SPDR S&P 500 ETF Trust | | | | |

| | 1,576 | | Expiration: February 2017, Exercise Price: $237.00 | | | 29,944 | |

| | | | | | | 48,241 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2016

Contracts (100 shares per contract) | | Value | |

| | |

| PURCHASED PUT OPTIONS — 0.12% | |

| | | American International Group, Inc. | | | |

| | 2,247 | | Expiration: February 2017, Exercise Price: $57.50 | | $ | 89,880 | |

| | 8,865 | | Expiration: February 2017, Exercise Price: $62.50 | | | 1,028,340 | |

| | | | Ashland Global Holdings, Inc. | | | | |

| | 2,722 | | Expiration: January 2017, Exercise Price: $95.00 | | | 47,635 | |

| | 3,921 | | Expiration: January 2017, Exercise Price: $100.00 | | | 88,222 | |

| | | | Baker Hughes, Inc. | | | | |

| | 4,553 | | Expiration: January 2017, Exercise Price: $60.00 | | | 163,908 | |

| | 4,518 | | Expiration: February 2017, Exercise Price: $57.50 | | | 259,785 | |

| | | | CBS Corporation Class B | | | | |

| | 2,731 | | Expiration: January 2017, Exercise Price: $50.00 | | | 25,944 | |

| | 461 | | Expiration: January 2017, Exercise Price: $52.50 | | | 2,766 | |

| | 4,582 | | Expiration: January 2017, Exercise Price: $57.00 | | | 71,021 | |

| | | | CIT Group, Inc. | | | | |

| | 1,665 | | Expiration: January 2017, Exercise Price: $31.00 | | | 15,817 | |

| | 10,195 | | Expiration: January 2017, Exercise Price: $39.00 | | | 193,705 | |

| | | | The Dow Chemical Company | | | | |

| | 5,084 | | Expiration: January 2017, Exercise Price: $50.00 | | | 61,008 | |

| | | | General Motors Company | | | | |

| | 388 | | Expiration: January 2017, Exercise Price: $29.00 | | | 1,552 | |

| | | | Hewlett Packard Enterprise Company | | | | |

| | 2,372 | | Expiration: January 2017, Exercise Price: $18.00 | | | 5,930 | |

| | 16,717 | | Expiration: January 2017, Exercise Price: $19.00 | | | 41,792 | |

| | 12,559 | | Expiration: January 2017, Exercise Price: $21.00 | | | 94,193 | |

| | | | Hilton Worldwide Holdings, Inc. | | | | |

| | 1,604 | | Expiration: January 2017, Exercise Price: $19.00 | | | 8,020 | |

| | 603 | | Expiration: January 2017, Exercise Price: $20.00 | | | 1,508 | |

| | 21,555 | | Expiration: February 2017, Exercise Price: $22.00 | | | 215,550 | |

| | | | Johnson Controls International plc | | | | |

| | 6,143 | | Expiration: January 2017, Exercise Price: $40.00 | | | 30,715 | |

| | | | Lamb Weston Holdings, Inc. | | | | |

| | 5,908 | | Expiration: January 2017, Exercise Price: $30.00 | | | 88,620 | |

| | | | SPDR S&P 500 ETF Trust | | | | |

| | 1,583 | | Expiration: January 2017, Exercise Price: $227.00 | | | 695,729 | |

| | 394 | | Expiration: February 2017, Exercise Price: $226.00 | | | 201,137 | |

| | | | Yum! Brands, Inc. | | | | |

| | 881 | | Expiration: January 2017, Exercise Price: $72.50 | | | 22,466 | |

| | 3,302 | | Expiration: January 2017, Exercise Price: $80.00 | | | 66,040 | |

| | | | | | | 3,521,283 | |

| | | | TOTAL PURCHASED OPTIONS (Cost $4,835,765) | | | 3,569,524 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2016

| Principal Amount | | | | Value | |

| ESCROW NOTES — 0.06% | |

| $ | 1,243,406 | | AMR Corporation (a)(d)(g) | | $ | 1,678,598 | |

| | | | TOTAL ESCROW NOTES (Cost $679,555) | | | 1,678,598 | |

| | | | | | | | |

| Shares | | | | | | |

| SHORT-TERM INVESTMENTS — 22.29% | |

| | 142,935,000 | | First American Government Obligations Fund, | | | | |

| | | | Institutional Share Class, 0.42% (c) | | | 142,935,000 | |

| | 142,935,000 | | First American Treasury Obligations Fund, | | | | |

| | | | Institutional Share Class, 0.40% (c) | | | 142,935,000 | |

| | 142,935,000 | | Invesco Government & Agency Portfolio, | | | | |

| | | | Institutional Share Class, 0.43% (c) | | | 142,935,000 | |

| | 142,935,000 | | Morgan Stanley Institutional Liquidity | | | | |

| | | | Funds — Government Portfolio, | | | | |

| | | | Institutional Share Class, 0.44% (c) | | | 142,935,000 | |

| | 78,584,270 | | Invesco Treasury Portfolio, | | | | |

| | | | Institutional Share Class, 0.37% (c) | | | 78,584,270 | |

| | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | (Cost $650,324,270) | | | 650,324,270 | |

| | | | TOTAL LONG INVESTMENTS | | | | |

| | | | (Cost $3,172,642,443) — 111.60% | | | 3,255,844,091 | |

| | | | | | | | |

| | |

| SHORT INVESTMENTS — (16.11)% | |

| | |

| COMMON STOCKS — (14.66)% | |

| | | | | | | | |

| | | | AEROSPACE & DEFENSE — (0.41)% | | | | |

| | (128,503 | ) | Rockwell Collins, Inc. | | | (11,919,938 | ) |

| | | | | | | | |

| | | | AIRLINES — (0.10)% | | | | |

| | (65,211 | ) | American Airlines Group, Inc. | | | (3,044,702 | ) |

| | | | | | | | |

| | | | BROADCASTING — (0.21)% | | | | |

| | (96,486 | ) | Nexstar Broadcasting Group, Inc. Class A | | | (6,107,564 | ) |

| | | | | | | | |

| | | | CABLE & SATELLITE — (0.94)% | | | | |

| | (6,174,406 | ) | Sirius XM Holdings, Inc. | | | (27,476,107 | ) |

| | | | | | | | |

| | | | CASINOS & GAMING — (0.09)% | | | | |

| | (150,791 | ) | Eldorado Resorts, Inc. | | | (2,555,907 | ) |

| | | | | | | | |

| | | | CONSTRUCTION MACHINERY & | | | | |

| | | | HEAVY TRUCKS — (0.17)% | | | | |

| | (181,174 | ) | Joy Global, Inc. | | | (5,072,872 | ) |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2016

| Shares | | | | Value | |

| | | | | | |

| | | DIVERSIFIED BANKS — (0.26)% | | | |

| | (91,195 | ) | Canadian Imperial Bank of Commerce (b) | | $ | (7,441,512 | ) |

| | | | | | | | |

| | | | DIVERSIFIED CHEMICALS — (1.42)% | | | | |

| | (563,801 | ) | E. I. Du Pont de Nemours and Company | | | (41,382,993 | ) |

| | | | | | | | |

| | | | FINANCIAL EXCHANGES & DATA — (0.20)% | | | | |

| | (80,754 | ) | CBOE Holdings, Inc. | | | (5,966,913 | ) |

| | | | | | | | |

| | | | HEALTH CARE EQUIPMENT — (1.65)% | | | | |

| | (1,249,845 | ) | Abbott Laboratories | | | (48,006,546 | ) |

| | | | | | | | |

| | | | HEALTH CARE SERVICES — (0.04)% | | | | |

| | (17,364 | ) | Envision Healthcare Corporation | | | (1,098,968 | ) |

| | | | | | | | |

| | | | INTEGRATED TELECOMMUNICATION | | | | |

| | | | SERVICES — (0.42)% | | | | |

| | (40,947 | ) | AT&T, Inc. | | | (1,741,476 | ) |

| | (439,433 | ) | CenturyLink, Inc. | | | (10,449,717 | ) |

| | | | | | | (12,191,193 | ) |

| | | | | | | | |

| | | | INTERNET SOFTWARE & SERVICES — (3.92)% | | | | |

| | (1,303,096 | ) | Alibaba Group Holding Ltd. — ADR | | | (114,424,860 | ) |

| | | | | | | | |

| | | | OIL & GAS & CONSUMABLE FUELS — (0.70)% | | | | |

| | (853,148 | ) | Sunoco Logistics Partners LP | | | (20,492,615 | ) |

| | | | | | | | |

| | | | OIL & GAS REFINING & MARKETING — (0.28)% | | | | |

| | (302,009 | ) | Idemitsu Kosan Company, Ltd. (b) | | | (8,023,426 | ) |

| | | | | | | | |

| | | | REITs — (1.45)% | | | | |

| | (2,085,101 | ) | Colony Capital, Inc. Class A | | | (42,223,295 | ) |

| | | | | | | | |

| | | | SEMICONDUCTORS — (0.76)% | | | | |

| | (307,035 | ) | Analog Devices, Inc. | | | (22,296,882 | ) |

| | | | | | | | |

| | | | SOFTWARE — (1.40)% | | | | |

| | (519,243 | ) | VMware, Inc. Class A | | | (40,880,001 | ) |

| | | | | | | | |

| | | | TOBACCO — (0.24)% | | | | |

| | (62,686 | ) | British American Tobacco PLC — ADR | | | (7,062,832 | ) |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Proceeds $395,547,849) | | | (427,669,126 | ) |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2016

| Shares | | | | Value | |

| CLOSED-END FUNDS — (1.45)% | |

| | (2,558,528 | ) | Ares Capital Corporation | | $ | (42,190,127 | ) |

| | | | TOTAL CLOSED-END FUNDS | | | | |

| | | | (Proceeds $38,548,531) | | | (42,190,127 | ) |

| | | | TOTAL SHORT INVESTMENTS | | | | |

| | | | (Proceeds $434,096,380) — (16.11)% | | | (469,859,253 | ) |

| | | | TOTAL NET INVESTMENTS | | | | |

| | | | (Cost $2,738,546,063) — 95.49% | | | 2,785,984,838 | |

| | | | OTHER ASSETS IN EXCESS OF LIABILITIES — 4.51% | | | 131,521,602 | |

| | | | TOTAL NET ASSETS — 100.00% | | $ | 2,917,506,440 | |

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

plc – Public Limited Company

REITs – Real Estate Investment Trusts

| (a) | Non-income producing security. |

| (b) | Foreign security. |

| (c) | The rate quoted is the annualized seven-day yield as of December 31, 2016. |

| (d) | Security fair valued by the Valuation Group in good faith in accordance with the policies adopted by the Board of Trustees. |

| (e) | All or a portion of the shares have been committed as collateral for open securities sold short, written option contracts, swap contacts, and forward currency exchange contracts. |

| (f) | Level 2 Security. Please see Note 2 in the Notes to the Financial Statements for more information. |

| (g) | Level 3 Security. Please see Note 2 in the Notes to the Financial Statements for more information. |

| (h) | Default or other conditions exist and the security is not presently accruing income. |

| (i) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of December 31, 2016, these securities represent 2.29% of total net assets. |

| (j) | Restricted security. Please see Note 2 in the Notes to the Financial Statements for more information. As of December 31, 2016, these securities represent 6.37% of total net assets. |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF INVESTMENTS

December 31, 2016

| Shares | | | | Value | |

| | |

| LONG INVESTMENTS — 95.88% | |

| | |

| COMMON STOCKS — 74.32% | |

| | | | | | |

| | | AEROSPACE & DEFENSE — 1.55% | | | |

| | 29,049 | | B/E Aerospace, Inc. (d) | | $ | 1,748,459 | |

| | | | | | | | |

| | | | ALTERNATIVE CARRIERS — 1.71% | | | | |

| | 34,170 | | Level 3 Communications, Inc. (a)(d) | | | 1,925,821 | |

| | | | | | | | |

| | | | APPLICATION SOFTWARE — 1.11% | | | | |

| | 34,063 | | Mentor Graphics Corporation | | | 1,256,584 | |

| | | | | | | | |

| | | | ASSET MANAGEMENT & CUSTODY BANKS — 0.99% | | | | |

| | 75,057 | | NorthStar Asset Management Group, Inc. (d) | | | 1,119,850 | |

| | | | | | | | |

| | | | AUTO PARTS & EQUIPMENT — 0.34% | | | | |

| | 6,470 | | Adient plc (a)(b) | | | 379,147 | |

| | | | | | | | |

| | | | BROADCASTING — 2.17% | | | | |

| | 27,200 | | CBS Corporation Class B | | | 1,730,464 | |

| | 38,266 | | Media General, Inc. (a)(d) | | | 720,549 | |

| | | | | | | 2,451,013 | |

| | | | | | | | |

| | | | BUILDING PRODUCTS — 2.36% | | | | |

| | 64,700 | | Johnson Controls International plc (b)(d) | | | 2,664,993 | |

| | | | | | | | |

| | | | CABLE & SATELLITE — 2.60% | | | | |

| | 84,942 | | Liberty Media Corporation-Liberty | | | | |

| | | | SiriusXM Class A (a)(d) | | | 2,932,198 | |

| | | | | | | | |

| | | | CASINOS & GAMING — 3.28% | | | | |

| | 29,538 | | Isle of Capri Casinos, Inc. (a)(d) | | | 729,293 | |

| | 103,200 | | MGM Resorts International (a)(d) | | | 2,975,256 | |

| | | | | | | 3,704,549 | |

| | | | | | | | |

| | | | COMMODITY CHEMICALS — 0.07% | | | | |

| | 3,521 | | Valvoline, Inc. (d) | | | 75,701 | |

| | | | | | | | |

| | | | CONSUMER ELECTRONICS — 3.70% | | | | |

| | 37,572 | | Harman International Industries, Inc. (d) | | | 4,176,503 | |

| | | | | | | | |