UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-3445

The Merger Fund

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Roy Behren and Michael T. Shannon

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

1-800-343-8959

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

Item 1. Reports to Stockholders.

| |

| THE MERGER FUND |

| A Westchester Capital Fund |

| |

| |

ANNUAL REPORT

December 31, 2013

Dear Fellow Shareholders:

The Merger Fund® advanced by 1.37% during the fourth quarter, bringing its calendar-year gain to 3.61%, providing an excess return of 351 basis points versus 6-month Treasury Bills’ 0.10% performance.1 This performance is in line with our expectations given the current market environment. We are proud to mention that the Fund provided its 81st gain in the 100 quarters since its 1989 inception.

Equity markets relentlessly slogged ahead like the Walking Dead, oblivious to macroeconomic issues and fueled by the Fed’s apparent final quarter of full-scale quantitative easing.

| AVERAGE ANNUALIZED TOTAL RETURN AS OF 12/31/2013 | |

| | | | | | | | | | | | | | | | | | | | | Since | |

| | | 3-month | | | YTD | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | Inception* | |

The Merger Fund® (MERFX) | | | 1.37 | % | | | 3.61 | % | | | 3.61 | % | | | 2.96 | % | | | 4.14 | % | | | 3.54 | % | | | 6.81 | % |

| Citi 6-Month T-Bills | | | 0.02 | % | | | 0.10 | % | | | 0.10 | % | | | 0.12 | % | | | 0.20 | % | | | 1.73 | % | | | 3.66 | % |

| HFRX Absolute Return Index | | | 1.72 | % | | | 3.58 | % | | | 3.58 | % | | | 0.20 | % | | | -0.63 | % | | | -0.04 | % | | | ** | |

| Barclays Aggregate Bond Index | | | -0.14 | % | | | -2.02 | % | | | -2.02 | % | | | 3.26 | % | | | 4.44 | % | | | 4.55 | % | | | 6.79 | % |

| MSCI World Index | | | 8.11 | % | | | 27.37 | % | | | 27.37 | % | | | 12.13 | % | | | 15.68 | % | | | 7.56 | % | | | 7.21 | % |

| S&P 500 Index | | | 10.51 | % | | | 32.39 | % | | | 32.39 | % | | | 16.18 | % | | | 17.94 | % | | | 7.41 | % | | | 9.99 | % |

| ** | The information is not available because the index’s life is less than the period shown. |

3-month performance is not annualized. Performance data quoted represents past performance; past performance does not guarantee future results. The performance results portrayed herein reflect the reinvestment of all interest, dividends and distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data included herein for periods prior to 2011 reflect that of Westchester Capital Management, Inc., the Fund’s prior investment advisor. Messrs. Behren and Shannon, the Fund’s current portfolio managers, have served as co-portfolio managers of the Fund since 2007. Performance data current to the most recent month-end may be obtained by calling (800) 343-8959 or by visiting www.westchestercapitalfunds.com. As of the May 1, 2013 prospectus, the total annual operating expense ratio of the Fund was 1.87%. The expense ratio may differ from the more recent expense ratio reported in the Financial Highlights. After applicable fee waivers (which may be terminated before May 1, 2014 only with approval of the Board of Trustees), total annual operating expenses were 1.74%, and after applicable fee waivers and before investment-related expenses (including acquired fund fees and expenses), total annual operating expenses were 1.27%.

The S&P 500 continued to astonish the disbelievers, tacking on another 10.51% for the quarter and bringing its year-to-date gain to 32.39%. Remarkably, the S&P 500 has not been positive in all four quarters of the same calendar year in 17 years – since 1997. Equities worldwide were as happy as Honeymooners, with the MSCI World Index increasing 8.11% during the period.

__________

| 1 | 6-month T-Bills are used as a proxy for the risk-free rate of return because it is a rough approximation of the Fund’s typical holding period for a merger arbitrage investment. |

Fixed-income markets appear to be in Jeopardy in light of the nascent rising interest-rate environment, as the Barclays Aggregate Bond Index backtracked by 0.14%, increasing its 2013 loss to -2.02%. This is noteworthy in that it is a reflection of our Fund’s negative correlation with bond prices (our three year beta to the Barclays Aggregate Bond Index is -0.18), which will be important should interest rates lift. Our hedge fund peers in the HFRX Absolute Return Index also performed well in Q4, adding 1.72%, bringing their calendar year performance up to 3.58%. However, our outperformance relative to the HFRX Absolute Return Index remained in place for the past 1, 3, 5 and 10 year periods.2

Our correlation and volatility again remained below that of our peer indices. The Fund continued to exhibit roughly one-fifth the “risk” (volatility) of the S&P and the MSCI World Index3 and the beta correlation with equity indices remained at approximately 0.13. Our beta to the HFRX Absolute Return index is 0.83, which makes sense since we are not employing the Leverage that many of the hedge fund index components can utilize. If an investment’s returns are higher and our volatility is lower than an alternative investment option, then pursuant to “Modern Portfolio Theory,” it should be considered an attractive substitute for both the Barclays Aggregate Bond Index as well as the HFRX Absolute Return index.4 Accordingly, we believe that the Fund can be inserted into the equity “silo” of an investor’s portfolio or as a fixed income substitute.

As for our portfolio, the Fund held 113 investments during the quarter and experienced one terminated merger, consistent with our historic deal-selection success rate. Reflecting a 7:1 ratio of winners to losers, 99 of our positions were flat or positive and 14 performed negatively, roughly consistent with the prior period. We invested in 24 new situations during the quarter, through both equities and fixed income, and as of the end of December we were 83% invested across 92 positions. Particularly at the end of a calendar year, the percentage invested may vary and will be affected by deals closing towards the end of the quarter, with proceeds occasionally awaiting redeployment.

Twenty-one mergers with target market values exceeding $1.3 billion were completed during the quarter. Michael Dell’s attempt to keep his eponymous company All in the Family succeeded when he closed his hotly contested $16 billion Leveraged buy-out for the company, based just south of Dallas, in late October. NYSE Euronext’s $13 billion acquisition by Intercontinental Exchange Group, Inc. was completed in November; Berkshire Hathaway’s $10 billion dollar purchase of NV Energy Inc. went down to The Wire but closed in late December, as did biotech pioneer Elan Corporation plc’s acquisition by Perrigo Co.; dual $9 billion pharmaceutical deals to buy Warner Chilcott PLC and Onyx Pharmaceuticals by Actavis plc and Amgen, respectively drew Cheers from their investors when both deals closed on October 1. Another example of our investment process involved a portfolio manager visit to meet with executives of Shufflemaster and experience their technology in an attempt to Get Smart about the strategic rationale for its $1.5 billion merger with Bally Technologies.Newly announced transactions were plentiful during the fourth quarter although many did not offer rates of return attractive enough for us to incur the deal or timing risk. We felt like Mad Men as we invested in U.S.-based advertiser Omnicom Group’s $16 billion dollar merger with French communications specialist Publicis Group. Although not a new investment, we added to our position in England’s Vodafone Plc. Longtime Friends with Verizon Corp. through its Verizon Wireless joint venture, it finally agreed to sell its interest back to Verizon for $130 billion (which was

| 2 | See Total Return chart above |

| 3 | Three-year trailing standard deviation for The Merger Fund® was 2.63% versus 12.11% for the S&P 500 Index and 13.71% for the MSCI World Index. |

| 4 | http://onlinelibrary.wiley.com/doi/10.1111/j.1540-6261.1952.tb01525.x/abstract |

so large that it skewed industry deal values for the quarter). In another large transaction, Silicon Valley’s Applied Materials was the Survivor in a $10 billion merger with Japanese semiconductor manufacturer Tokyo Electron Limited. Going the other direction was American LSI Corporation’s $6 billion acquisition by Avago Technology of Singapore. In yet another technology transaction, China-based Tsinghua University agreed to buy China-based but U.S.-traded semiconductor manufacturer RDA Microelectronics. Readers may recall that the Fund had an investment in Spreadtrum Communications, which was purchased by Tsinghua as well. RDA shareholders approved the deal shortly after the Spreadtrum transaction closed in late December and the transaction is currently awaiting Chinese Homeland antitrust approval by MOFCOM.

The Fund entered Spin City via its investments in Novartis, Starwood Property Trust, and Northstar Realty Trust, all of which are spinning off significant subsidiaries; Consul Energy announced that it was exploring options which include selling or separating its coal and gas business into two separate publicly traded entities. Oil and gas company Hess Corp. demonstrated its Dexterity by selling billions of dollars of assets as well as filing for a tax-free spinoff of its retail gas station network.

Finally, the Fund took a position, through both bonds and stock, in AMR Corporation, the parent of American Airlines. This could have turned into an American Horror Story, as AMR had filed for bankruptcy and was having difficulty reorganizing, but it fortunately was able to agree to a $4 billion merger with US Airways Group, which became effective upon AMR’s emergence from bankruptcy. The senior notes we purchased, secured by equipment (planes) and landing slot rights, were redeemed for cash. Other AMR bonds that we purchased were exchanged for shares of preferred securities which were ultimately convertible into shares of the combined company’s stock. The AMR stock that we purchased was also converted into shares of the new American Airlines plus some potential free optionality on over-reserved bankruptcy claims.

As far as attribution, no deal swung performance more than 20 basis points. The red list was topped by the one broken deal of the quarter. Archer Daniels Midland’s failed acquisition of Australian grain storage, shipping and processing firm Graincorp, cost the Fund 0.20% and was our Biggest Loser. In a Twilight Zone development, the transaction was blocked by the Australian government even after the ACCC (Australian Competition and Consumer Commission) declared that it would not oppose the transaction. National Treasurer Joe Hockey, however, ruled that Law and Order required him to block the transaction. He declared it “against the national interest” rather than anti-competitive, since ADM, a foreign corporation, would own a “key Australian business.” The next largest loser was our market hedge, which detracted 0.14% from performance. The top ten winners on the Blacklist contributed from 0.11% to 0.06%, led by Vodafone, and followed by Celesio, American International Group, Leap Wireless, Lender Processing Services, and Lamar Advertising Company (which is in the process of converting into a REIT and is awaiting IRS approval).

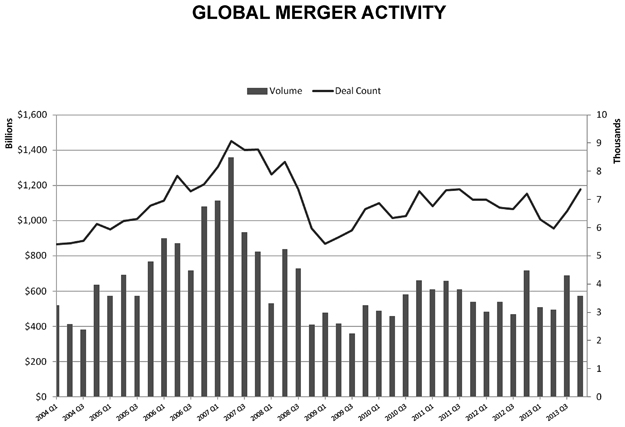

Global M & A activity (by target value) was relatively flat versus 2012; however when looked at in depth by region, the statistics shed a different light.5 U.S. volume increased by $75 billion, but without the $130 billion Verizon Wireless deal, the largest acquisition transaction in a decade, would have been down from the prior year. Aside from Canadian activity, which was down by 30%, volume in several other regions, which started from a small base, picked up significantly in Q4 to end the year on a positive note. Here are other comparables: U.K. -29%, Germany +37%,

__________

| 5 | All statistics in this paragraph are provided by Bloomberg Global Financial Advisory Mergers & Acquisitions Rankings, 2013 Annual report. |

France +72% (coming out of a terrible year and ending notably with the $19 bln Omnicom/Publicis deal and Vivendi’s spin-off of SFR and $8.5 bln sale of its Activision stake), China +36% (as it continues its quest for natural resources and technology companies, China is beginning to get the hang of global capital markets), and Hong Kong +63%. Finally, despite the optimism generated by Abenomics, Japan’s transaction capabilities appear to be Breaking Badly, with 2013 volumes down by 35% versus 2012.

The types of transactions varied, but common structures included large corporations streamlining their operations in order to focus on core businesses. Whether as a result of internal or shareholder pressure, we have seen a multitude of spin-offs, split-offs and division sales. No corporation these days can be a Fugitive for long from activist shareholder demands. Yet at the same time, once the Gunsmoke from the divestiture transactions clears, many of these “stripped down” companies have been attempting to grow their core businesses through complementary acquisitions, a trend that we expect to continue. We have also seen several companies begin the process of converting to Real Estate Investment Trust structures in order to provide a more tax efficient exposure to their shareholders. The IRS, and no doubt the West Wing of the White House, is currently considering whether these tax-advantaged activities should be curtailed. We expect the IRS to receive guidance from its REIT working group shortly. Additionally, leveraged private transactions accounted for 632 deals in 2013, valued at $399 billion. We expect that low interest rates and approximately $1 trillion in uncommitted capital should drive continued private equity activity in 2014.

In an encouraging reversal of long-term trends, recent transactions have been received positively by investors. Last year, stock prices of U.S. companies announcing acquisitions greater than $1 billion rose, on average, more than 4% on the first day. The increase is the largest ever recorded by Dealogic, and nearly 50% higher than the previous year. In fact, each year between 1996 and 2011, acquirers’ average stock price fell within the first 24 hours of the announcement. “Investors love to see organic growth, but when they can’t get it, they are going to reward those companies that use acquisitions to grow,” a prominent merger and acquisitions lawyer observed.6

As far as developments at Westchester Capital go, we now manage a total of four SEC-registered mutual funds. Our Modern Family of funds includes The Merger Fund and The Merger Fund VL, which utilizes the same investment strategy for Variable Life and Annuity investors; the Dunham Monthly Distribution Fund (which we manage as a sub-adviser), which provides an alternative market-neutral profile to The Merger Fund® with an income-oriented slant; and as of January, our newest member, the WCM Alternatives: Event-Driven Fund (symbol: WCEIX). It is a complementary product to our other vehicles, which invests in the more aggressive event-driven space. WCEIX has a broader mandate than either The Merger Fund® or the Dunham Fund, will not provide a monthly distribution, and will be positioned for a higher level of volatility and possibly higher returns as well. As hinted at in our last letter, many of our investors have requested such a selection, and we view this as a natural extension of our business model of providing dependable, liquid, alternative investment products to investors wishing to diversify their portfolio of otherwise correlated investments. We are available at your convenience to discuss the full range of our products.

As usual, quarterly statistical summaries are provided within two weeks of the end of the quarter, approximately one month prior to the release of the quarterly letter. They are available electronically on our website, and we would be happy to arrange for an automatic email within

| 6 | Financial Times, January 22, 2014 “Companies buoyed by investors’ deal hunger” |

60 Minutes of the data becoming available. Going forward, we will generate a single letter for the Westchester Funds family that will include performance as well as commentary. We welcome your comments and suggestions.

For convenience, investors can arrange for e-alerts of important Fund communications. Through our website at www.westchestercapitalfunds.com, you can check account balances, make purchases and sales, and sign up for notification of trade confirmations, statements and shareholder communications via e-mail.

Thanks again for your support,

|  |

| Roy Behren | Mike Shannon |

IMPORTANT DISCLOSURES

Before investing in the Dunham Monthly Distribution Fund, carefully consider its investment objectives, risks, charges and expenses. The Merger Fund VL is available through variable products offered by third-party insurance companies. For a prospectus containing information for any variable annuity or variable life product that invests in The Merger Fund VL, contact your financial advisor or the offering insurance company for a contract prospectus and prospectus for the underlying funds. To obtain a prospectus for WCM Alternatives: Event-Driven Fund, please call (800) 343-8959. Please read it carefully before investing. To obtain a prospectus for the Dunham Monthly Distribution Fund, please visit www.dunham.com. Please read it carefully before investing.

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. Merger‐arbitrage and event‐driven investing involves the risk that the adviser’s evaluation of the outcome of a proposed event, whether it be a merger, reorganization, regulatory issue or other event, will prove incorrect and that the Fund’s return on the investment will be negative. Investments in foreign companies may entail political, cultural, regulatory, legal, and tax risks different from those associated with comparable transactions in the United States. The frequency of the Fund’s transactions will vary from year to year, though merger arbitrage portfolios typically have higher turnover rates than portfolios of typical long‐only funds. Increased portfolio turnover may result in higher brokerage commissions, dealer mark‐ups and other transaction costs. The higher costs associated with increased portfolio turnover may offset gains in the Fund’s performance. The Fund may enter into short sale transactions for, among other reasons, purposes of protecting against a decline in the market value of the acquiring company’s shares prior to the acquisition completion. If the price of a security sold short increases between the time of the short sale and the time the Fund covers its short position, the Fund will incur a loss. The amount of a potential loss on an uncovered short sale transaction is theoretically unlimited. Debt securities may fluctuate in value due to, among other things, changes in interest rates, general economic conditions, industry fundamentals, market sentiment and the financial condition of the issuer, including the issuer’s credit rating or financial performance. Derivatives may create leverage which will amplify the effect of the performance of those instruments on the Fund and may produce significant losses. The Fund’s hedging strategy will be subject to the Fund’s investment adviser’s ability to assess correctly the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged.

References to other mutual funds do not construe an offer of those securities. Active investing has higher management fees because of the manager’s increased level of involvement while passive investing has lower management and operating fees. Investing in both actively and passively managed mutual funds involves risk and principal loss is possible. Both actively and passively managed mutual funds generally have daily liquidity. There are no guarantees regarding the performance of actively and passively managed mutual funds. Actively managed mutual funds may have higher portfolio turnover than passively managed funds. Excessive turnover can limit returns and can incur capital gains.

Any tax or legal information provided is merely a summary of our understanding and interpretation of some of the current income tax regulations and is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Fund nor any of its representatives may give legal or tax advice

The views expressed are as of December 31, 2013 and are a general guide to the views of Westchester Capital Management, are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. This document does not replace portfolio and fund-specific materials.

For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) As of December 31, 2013, The Merger Fund® was rated against the following numbers of U.S.-domiciled Market Neutral funds over the following time periods: 82 funds in the last three years, 52 funds in the last five years, and 24 funds in the last ten years. With respect to these Market Neutral funds, The Merger Fund® received a Morningstar Rating of 4 stars, 4 stars and 4 stars for the three-, five- and ten-year periods, respectively. © 2013 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Definitions: The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general; The MSCI World Index is a free float-adjusted market capitalization index designed to measure the equity market performance of developed economies; The Barclays Aggregate Bond Index is an intermediate term index comprised of investment grade bonds; Citi 6-Month T-Bills measures monthly return equivalents of yield averages that are not marked to market. The 6-month Treasury Bill Indexes consist of the last three six-month Treasury bill issues. The indices are unmanaged and not available for direct investment. The HFRX Absolute Return Index is designed to be representative of the overall composition of the hedge fund universe. Standard Deviation is the degree by which returns vary relative to the average return. The higher the standard deviation, the greater the variability of the investment; Beta is a measure of the fund’s sensitivity to market movements. A portfolio with a beta greater than 1 is more volatile than the market and a portfolio with a beta less than 1 is less volatile than the market; A basis point (often denoted as bp) is a unit equal to 1/100 of a percentage point and can be summarized as follows: 1% change = 100 basis points and 0.01% = 1 basis point; Correlation is calculated using R-Squared; which is a measure that represents the percentage of a fund’s movements that can be explained by movements in a benchmark index. A fund with low R-squared doesn’t act much like the index; Alpha is a measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a mutual fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund’s alpha; A leveraged buyout (LBO) is when a company or single asset (e.g., a real estate property) is purchased with a combination of equity plus significant amounts of borrowed money — structured in such a way that the target’s cash flows or assets are used as the collateral (or, “leverage”) to secure and repay the money borrowed to purchase the target-company/asset; MOFCOM is The Ministry of Commerce of the Government of the People’s Republic of China is an executive agency of the State Council of China. It is responsible for formulating policy on foreign trade, export and import regulations, foreign direct investments, consumer protection, market competition and negotiating bilateral and multilateral trade agreements.

This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

The SEC does not endorse, indemnify, approve nor disapprove of any security.

The Merger Fund® and WCM Alternatives: Event-Driven Fund are distributed by Quasar Distributors, LLC. The Merger VL is available through variable products offered by third-party insurance companies and is not affiliated with Quasar Distributors, LLC. The Dunham Monthly Distribution Fund, which is sub-advised by Westchester Capital Management, LLC, is distributed by Dunham and Associates Investment Counsel, which have no affiliation with Quasar Distributors, LLC.

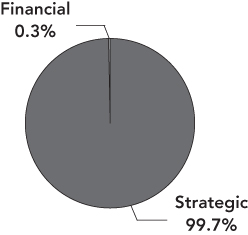

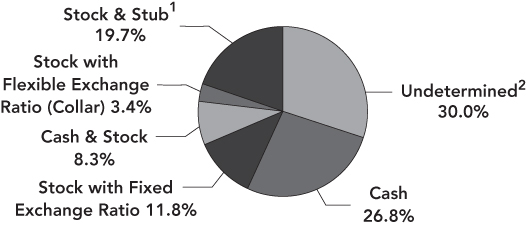

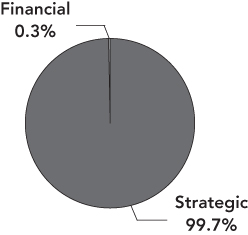

| Chart 1 | Chart 2 |

| | |

| PORTFOLIO COMPOSITION | PORTFOLIO COMPOSITION |

| By Type of Deal* | By Type of Buyer* |

| | |

|  |

| | |

| | |

| Chart 3 |

| | |

| PORTFOLIO COMPOSITION |

| By Deal Terms* |

| |

|

| |

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of December 31, 2013. |

| 1 | “Stub” includes assets other than cash and stock (e.g., escrow notes). |

| 2 | The compensation is undetermined because the compensation to be received (e.g., stock, cash, escrow notes, other) will be determined at a later date, potentially at the option of the Fund’s investment adviser. |

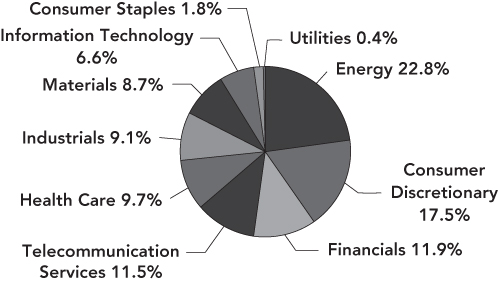

Chart 4

PORTFOLIO COMPOSITION

By Sector*

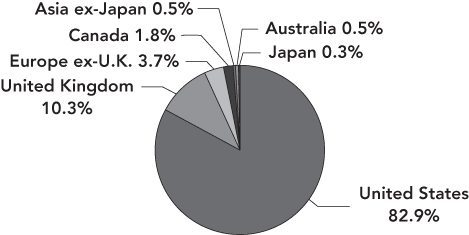

Chart 5

PORTFOLIO COMPOSITION

By Region*

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of December 31, 2013. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

GLOBAL MERGER ACTIVITY

Quarterly volume of announced global mergers

and acquisitions January 2004 – December 2013

Source: Bloomberg, Global Financial Advisory Mergers & Acquisitions Rankings 2013

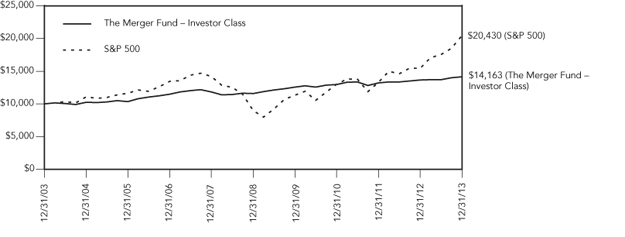

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT

IN THE MERGER FUND AND S&P 500

| | | Average |

| | | Annual Total Return |

| | 1 Yr. | 3 Yr. | 5 Yr. | 10 Yr. |

| The Merger Fund – Investor Class | 3.61% | 2.96% | 4.14% | 3.54% |

| The Standard & Poor’s 500 Index | 32.39% | 16.18% | 17.94% | 7.41% |

| | Since Inception |

| | (8/1/2013) |

| The Merger Fund – Institutional Class | 2.20% |

| The Standard & Poor’s 500 Index | 9.30% |

The Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on December 31, 2003. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Merger Fund

EXPENSE EXAMPLE

December 31, 2013

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs as described below and (2) ongoing costs, including management fees, distribution and/or service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 for the period 7/1/13 to 12/31/13 for Investor Class shares and 8/1/13 (commencement of operations) to 12/31/13 for Institutional Class shares.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Although the Fund charges no sales load or transaction fees, you will be assessed transaction-related fees for outgoing wire transfers, returned checks and stop- payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, a $15.00 fee will be charged by the Fund’s transfer agent. IRAs will be charged a $15.00 annual maintenance fee. These expenses are not included in the example below, but if they were, such expenses would lower the “Ending Account Value” below. The example below includes, among other fees, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that

EXPENSE EXAMPLE

December 31, 2013

(Unaudited)

the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period |

| | Value 7/1/13 | Value 12/31/13 | 7/1/13-12/31/13 |

| Investor Class | | | |

Actual+(1) | $1,000.00 | $1,032.80 | $7.33* |

Hypothetical++(2) | $1,000.00 | $1,018.00 | $7.27* |

| | | | |

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period |

| | Value 8/1/13 | Value 12/31/13 | 8/1/13-12/31/13 |

| Institutional Class | | | |

Actual+++(3) | $1,000.00 | $1,022.00 | $5.04** |

Hypothetical++++(2) | $1,000.00 | $1,015.97 | $5.03** |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.43%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | Expenses are equal to the Fund’s annualized expense ratio of 1.19%, multiplied by the average account value over the period, multiplied by 152/365 (to reflect the period). |

| + | Excluding dividends on securities sold short and borrowing expense on securities sold short, your actual cost of investment in the Fund would be $6.35. |

| ++ | Excluding dividends on securities sold short and borrowing expense on securities sold short, your hypothetical cost of investment in the Fund would be $6.31. |

| +++ | Excluding dividends on securities sold short and borrowing expense on securities sold short, your actual cost of investment in the Fund would be $4.24. |

| ++++ | Excluding dividends on securities sold short and borrowing expense on securities sold short, your hypothetical cost of investment in the Fund would be $4.23. |

| (1) | Ending account values and expenses paid during the period based on a 3.28% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

| (3) | Ending account values and expenses paid during the period based on a 2.20% return which is calculated for the period of 8/1/13 (commencement of operations) to 12/31/13. This actual return is net of expenses. |

SCHEDULE OF INVESTMENTS

December 31, 2013

| Shares | | | | Value | |

| | | | |

| COMMON STOCKS — 71.26% | | | |

| | | | | | |

| | | ADVERTISING — 6.90% | | | |

| | 2,887,800 | | Lamar Advertising Company Class A (a)(f) | | $ | 150,887,550 | |

| | 2,654,625 | | Omnicom Group, Inc. (d)(j) | | | 195,168,030 | |

| | | | | | | 346,055,580 | |

| | | | | | | | |

| | | | AIRLINES — 0.04% | | | | |

| | 82,742 | | American Airlines Group, Inc. (a) | | | 2,089,244 | |

| | | | | | | | |

| | | | AUTO PARTS & EQUIPMENT — 0.11% | | | | |

| | 70,000 | | Visteon Corporation (a) | | | 5,732,300 | |

| | | | | | | | |

| | | | AUTOMOBILE MANUFACTURERS — 2.62% | | | | |

| | 3,220,200 | | General Motors Company (a)(f) | | | 131,609,574 | |

| | | | | | | | |

| | | | BROADCASTING & CABLE TV — 0.34% | | | | |

| | 201,754 | | Discovery Communications, Inc. Class C (a)(e) | | | 16,919,090 | |

| | | | | | | | |

| | | | CABLE & SATELLITE TV — 3.08% | | | | |

| | 362,726 | | Comcast Corporation Special Class A (e) | | | 18,092,773 | |

| | 554,100 | | DISH Network Corporation Class A (a)(f) | | | 32,093,472 | |

| | 189,806 | | Liberty Global plc Series C (a)(b)(e) | | | 16,004,442 | |

| | 652,900 | | Time Warner Cable, Inc. (f) | | | 88,467,950 | |

| | | | | | | 154,658,637 | |

| | | | COAL & CONSUMABLE FUELS — 1.08% | | | | |

| | 1,421,300 | | CONSOL Energy, Inc. (f) | | | 54,066,252 | |

| | | | | | | | |

| | | | CONSUMER FINANCE — 1.30% | | | | |

| | 2,479,000 | | SLM Corporation (f) | | | 65,148,120 | |

| | | | | | | | |

| | | | DATA PROCESSING & OUTSOURCED SERVICES — 1.95% | | | | |

| | 2,613,098 | | Lender Processing Services, Inc. | | | 97,677,603 | |

| | | | | | | | |

| | | | DIVERSIFIED CHEMICALS — 4.17% | | | | |

| | 647,500 | | Dow Chemical Company (f) | | | 28,749,000 | |

| | 947,700 | | E.I. Du Pont de Nemours & Company (f) | | | 61,572,069 | |

| | 4,830,804 | | Huntsman Corporation (f) | | | 118,837,778 | |

| | | | | | | 209,158,847 | |

| | | | | | | | |

| | | | DIVERSIFIED METALS & MINING — 0.01% | | | | |

| | 310,134 | | Pilot Gold, Inc. (a)(b) | | | 251,085 | |

| | | | | | | | |

| | | | DIVERSIFIED SUPPORT SERVICES — 0.35% | | | | |

| | 575,616 | | Iron Mountain, Inc. | | | 17,469,946 | |

| | | | | | | | |

| | | | DRUG RETAIL — 0.72% | | | | |

| | 655,267 | | Shoppers Drug Mart Corporation (b)(j) | | | 35,885,697 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2013

| Shares | | | | Value | |

| | | | | | |

| | | FOOD RETAIL — 0.22% | | | |

| | 340,600 | | Safeway, Inc. | | $ | 11,093,342 | |

| | | | | | | | |

| | | | GAS UTILITIES — 0.23% | | | | |

| | 187,800 | | ONEOK, Inc. | | | 11,677,404 | |

| | | | | | | | |

| | | | HEALTH CARE FACILITIES — 0.57% | | | | |

| | 2,179,855 | | Health Management Associates, Inc. Class A (a)(e) | | | 28,556,100 | |

| | | | | | | | |

| | | | INDUSTRIAL MACHINERY — 1.94% | | | | |

| | 128,481 | | Allegion plc (a)(b) | | | 5,677,575 | |

| | 278,500 | | Dover Corporation | | | 26,886,390 | |

| | 383,933 | | Ingersoll-Rand plc (b) | | | 23,650,273 | |

| | 749,800 | | The Timken Company (f) | | | 41,291,486 | |

| | | | | | | 97,505,724 | |

| | | | | | | | |

| | | | INTEGRATED OIL & GAS — 4.33% | | | | |

| | 849,000 | | BP plc — ADR (f) | | | 41,269,890 | |

| | 1,244,000 | | Hess Corporation (f) | | | 103,252,000 | |

| | 143,000 | | Murphy Oil Corporation | | | 9,277,840 | |

| | 35,750 | | Murphy USA, Inc. (a) | | | 1,485,770 | |

| | 650,300 | | Occidental Petroleum Corporation (f) | | | 61,843,530 | |

| | | | | | | 217,129,030 | |

| | | | | | | | |

| | | | INTEGRATED TELECOMMUNICATION SERVICES — 0.05% | | | | |

| | 77,300 | | AT&T, Inc. | | | 2,717,868 | |

| | | | | | | | |

| | | | INTERNET SOFTWARE & SERVICES — 1.51% | | | | |

| | 2,700 | | Chegg, Inc. (a) | | | 22,977 | |

| | 427,100 | | Equinix, Inc. (a)(f) | | | 75,788,895 | |

| | | | | | | 75,811,872 | |

| | | | | | | | |

| | | | IT CONSULTING & OTHER SERVICES — 0.24% | | | | |

| | 1,648,393 | | Pactera Technology International, Ltd. — ADR (a) | | | 11,786,010 | |

| | | | | | | | |

| | | | LIFE SCIENCES TOOLS & SERVICES — 3.58% | | | | |

| | 2,365,798 | | Life Technologies Corporation (a)(e) | | | 179,327,488 | |

| | | | | | | | |

| | | | MOVIES & ENTERTAINMENT — 1.33% | | | | |

| | 1,000 | | SFX Entertainment, Inc. (a) | | | 12,000 | |

| | 1,924,208 | | Twenty-First Century Fox, Inc. Class B (e) | | | 66,577,597 | |

| | | | | | | 66,589,597 | |

| | | | | | | | |

| | | | MULTI-LINE INSURANCE — 2.74% | | | | |

| | 2,687,600 | | American International Group, Inc. (f) | | | 137,201,980 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2013

| Shares | | | | Value | |

| | | | | | |

| | | OIL & GAS DRILLING — 2.33% | | | |

| | 2,310,600 | | Noble Corporation plc (b)(f) | | $ | 86,578,182 | |

| | 616,500 | | Transocean, Ltd. (b)(f) | | | 30,467,430 | |

| | | | | | | 117,045,612 | |

| | | | | | | | |

| | | | OIL & GAS EQUIPMENT & SERVICES — 3.72% | | | | |

| | 252,200 | | Halliburton Company | | | 12,799,150 | |

| | 1,089,100 | | National Oilwell Varco, Inc. (f) | | | 86,616,123 | |

| | 854,600 | | Oil States International, Inc. (a)(f) | | | 86,929,912 | |

| | | | | | | 186,345,185 | |

| | | | | | | | |

| | | | OIL & GAS EXPLORATION & PRODUCTION — 3.81% | | | | |

| | 986,700 | | Anadarko Petroleum Corporation (f) | | | 78,265,044 | |

| | 1,494,096 | | LinnCo LLC (f) | | | 46,033,105 | |

| | 2,184,600 | | QEP Resources, Inc. (f) | | | 66,957,990 | |

| | | | | | | 191,256,139 | |

| | | | | | | | |

| | | | OIL & GAS REFINING & MARKETING — 0.32% | | | | |

| | 314,100 | | Valero Energy Corporation | | | 15,830,640 | |

| | | | | | | | |

| | | | OIL & GAS STORAGE & TRANSPORTATION — 1.91% | | | | |

| | 1,056,161 | | PAA Natural Gas Storage, LP (j) | | | 24,331,467 | |

| | 151,784 | | PVR Partners, LP | | | 4,072,365 | |

| | 1,752,100 | | Williams Companies, Inc. (f) | | | 67,578,497 | |

| | | | | | | 95,982,329 | |

| | | | | | | | |

| | | | PAPER PRODUCTS — 1.20% | | | | |

| | 1,228,000 | | International Paper Company (f) | | | 60,208,840 | |

| | | | | | | | |

| | | | PERSONAL PRODUCTS — 0.10% | | | | |

| | 6,316,122 | | Magic Holdings International, Ltd. (b) | | | 5,001,224 | |

| | | | | | | | |

| | | | PHARMACEUTICALS — 2.70% | | | | |

| | 229,700 | | Eli Lilly & Company | | | 11,714,700 | |

| | 386,400 | | Endo Health Solutions, Inc. (a) | | | 26,066,544 | |

| | 453,900 | | Novartis AG — ADR (f) | | | 36,484,482 | |

| | 1,873,869 | | Pfizer, Inc. (f) | | | 57,396,608 | |

| | 69,966 | | ViroPharma, Inc. (a) | | | 3,487,805 | |

| | | | | | | 135,150,139 | |

| | | | | | | | |

| | | | REGIONAL BANKS — 1.20% | | | | |

| | 262,952 | | CapitalSource, Inc. | | | 3,778,620 | |

| | 1,658,043 | | Sterling Financial Corporation (e) | | | 56,506,106 | |

| | | | | | | 60,284,726 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2013

| Shares | | | | Value | |

| | | | | | |

| | | REITS — 2.79% | | | |

| | 699,777 | | Cole Real Estate Investments, Inc. | | $ | 9,824,869 | |

| | 1,172,540 | | CommonWealth REIT (f) | | | 27,331,908 | |

| | 3,567,678 | | NorthStar Realty Finance Corporation (f) | | | 47,985,269 | |

| | 1,231,403 | | Starwood Property Trust, Inc. | | | 34,109,863 | |

| | 657,500 | | Weyerhaeuser Company | | | 20,757,275 | |

| | | | | | | 140,009,184 | |

| | | | | | | | |

| | | | SECURITY & ALARM SERVICES — 0.60% | | | | |

| | 933,207 | | Corrections Corporation of America (f) | | | 29,927,949 | |

| | | | | | | | |

| | | | SEMICONDUCTOR EQUIPMENT — 0.24% | | | | |

| | 858,186 | | Tokyo Electron Limited — ADR | | | 11,868,712 | |

| | | | | | | | |

| | | | SEMICONDUCTORS — 0.90% | | | | |

| | 3,650,679 | | LSI Corporation | | | 40,230,482 | |

| | 287,645 | | RDA Microelectronics, Inc. — ADR | | | 5,143,093 | |

| | | | | | | 45,373,575 | |

| | | | | | | | |

| | | | SPECIALTY CHEMICALS — 1.73% | | | | |

| | 654,800 | | Ashland, Inc. (f) | | | 63,541,792 | |

| | 836,000 | | Chemtura Corporation (a) | | | 23,341,120 | |

| | | | | | | 86,882,912 | |

| | | | | | | | |

| | | | THRIFTS & MORTGAGE FINANCE — 1.74% | | | | |

| | 9,239,441 | | Hudson City Bancorp, Inc. | | | 87,127,928 | |

| | | | | | | | |

| | | | WIRELESS TELECOMMUNICATION SERVICES — 6.56% | | | | |

| | 3,067,863 | | Leap Wireless International, Inc. (a)(f) | | | 53,380,816 | |

| | 2,948,206 | | Sprint Corporation (a)(f) | | | 31,693,215 | |

| | 4,060,050 | | T-Mobile U.S., Inc. (a)(f) | | | 136,580,082 | |

| | 2,731,054 | | Vodafone Group plc — ADR (f) | | | 107,357,733 | |

| | | | | | | 329,011,846 | |

| | | | TOTAL COMMON STOCKS (Cost $3,259,141,916) | | | 3,573,425,330 | |

| | | | | |

| PREFERRED STOCKS — 0.30% | | | | |

| | 577,544 | | American Airlines Group, Inc., 6.250%, Series A (a) | | | 14,969,941 | |

| | | | TOTAL PREFERRED STOCKS (Cost $14,971,240) | | | 14,969,941 | |

| | | | | |

| WARRANTS — 0.00% | | | | |

| | 142,642 | | Kinross Gold Corporation (a)(b) | | | 2,014 | |

| | | | TOTAL WARRANTS (Cost $540,029) | | | 2,014 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2013

| Principal Amount | | Value | |

| CORPORATE BONDS — 4.14% | | | |

| | | American Airlines Group, Inc. | | | |

| $ | 34,371,000 | | 7.500%, 3/15/2016 (Acquired 1/25/13 | | | |

| | | | through 11/21/13, cost $35,211,702) (i) | | $ | 35,831,768 | |

| | | | Cricket Communications, Inc. | | | | |

| | 40,137,000 | | 7.750%, 10/15/2020 | | | 45,906,694 | |

| | | | Health Management Associates, Inc. | | | | |

| | 28,673,000 | | 7.375%, 1/15/2020 | | | 32,221,284 | |

| | | | Lender Processing Services, Inc. | | | | |

| | 26,175,000 | | 5.750%, 4/15/2023 | | | 27,222,000 | |

| | | | MetroPCS Wireless, Inc. | | | | |

| | 10,338,000 | | 6.625%, 11/15/2020 | | | 10,997,047 | |

| | | | Oil States International, Inc. | | | | |

| | 38,377,000 | | 5.125%, 1/15/2023 | | | 43,461,952 | |

| | | | Petrominerales, Ltd. | | | | |

| | 12,200,000 | | 3.250%, 6/12/2017 (b) | | | 12,139,000 | |

| | | | TOTAL CORPORATE BONDS | | | | |

| | | | (Cost $207,330,502) | | | 207,779,745 | |

| MUNICIPAL BONDS — 0.12% | | | | |

| | | | Louisiana Public Facilities | | | | |

| | 5,984,000 | | 9.750%, 8/1/2014 | | | 6,001,114 | |

| | | | TOTAL MUNICIPAL BONDS | | | | |

| | | | (Cost $5,984,000) | | | 6,001,114 | |

| | | | | | | | |

| Contracts (100 shares per contract) | | | | |

| PURCHASED PUT OPTIONS — 0.46% | | | | |

| | | | American Airlines Group, Inc. | | | | |

| | 6,814 | | Expiration: February 2014, Exercise Price: $30.00 | | | 3,611,420 | |

| | 5,927 | | Expiration: March 2014, Exercise Price: $30.00 | | | 3,378,390 | |

| | | | American International Group, Inc. | | | | |

| | 6,997 | | Expiration: January 2014, Exercise Price: $42.00 | | | 20,991 | |

| | 7,389 | | Expiration: January 2014, Exercise Price: $44.00 | | | 25,862 | |

| | 10,514 | | Expiration: February 2014, Exercise Price: $40.00 | | | 120,911 | |

| | | | Andarko Petroleum Corporation | | | | |

| | 633 | | Expiration: February 2014, Exercise Price: $70.00 | | | 42,411 | |

| | 3,840 | | Expiration: February 2014, Exercise Price: $75.00 | | | 637,440 | |

| | 5,394 | | Expiration: February 2014, Exercise Price: $80.00 | | | 1,995,780 | |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS (continued)

December 31, 2013

| Contracts (100 shares per contract) | | Value | |

| | | Ashland, Inc. | | | |

| | 5,271 | | Expiration: January 2014, Exercise Price: $75.00 | | $ | 39,533 | |

| | 955 | | Expiration: April 2014, Exercise Price: $80.00 | | | 74,012 | |

| | | | AT&T, Inc. | | | | |

| | 618 | | Expiration: January 2014, Exercise Price: $31.00 | | | 1,854 | |

| | | | BP plc — ADR | | | | |

| | 3,274 | | Expiration: February 2014, Exercise Price: $41.00 | | | 19,644 | |

| | 2,482 | | Expiration: February 2014, Exercise Price: $43.00 | | | 29,784 | |

| | | | Chemtura Corporation | | | | |

| | 1,410 | | Expiration: March 2014, Exercise Price: $20.00 | | | 17,625 | |

| | 5,277 | | Expiration: March 2014, Exercise Price: $22.50 | | | 145,118 | |

| | | | CommonWealth REIT | | | | |

| | 9,603 | | Expiration: January 2014, Exercise Price: $17.50 | | | 76,824 | |

| | 2,122 | | Expiration: January 2014, Exercise Price: $20.00 | | | 15,915 | |

| | | | CONSOL Energy, Inc. | | | | |

| | 9,474 | | Expiration: January 2014, Exercise Price: $33.00 | | | 80,529 | |

| | 4,739 | | Expiration: April 2014, Exercise Price: $32.00 | | | 331,730 | |

| | | | Corrections Corporation of America | | | | |

| | 805 | | Expiration: January 2014, Exercise Price: $31.00 | | | 16,100 | |

| | 970 | | Expiration: March 2014, Exercise Price: $27.00 | | | 19,400 | |

| | 5,360 | | Expiration: March 2014, Exercise Price: $28.00 | | | 147,400 | |

| | | | DISH Network Corporation Class A | | | | |

| | 2,079 | | Expiration: January 2014, Exercise Price: $40.00 | | | 10,395 | |

| | 2,943 | | Expiration: March 2014, Exercise Price: $45.00 | | | 169,222 | |

| | | | Dover Corporation | | | | |

| | 2,785 | | Expiration: March 2014, Exercise Price: $80.00 | | | 122,540 | |

| | | | The Dow Chemical Company | | | | |

| | 5,827 | | Expiration: March 2014, Exercise Price: $33.00 | | | 87,405 | |

| | | | E.I. Du Pont de Nemours & Company | | | | |

| | 1,637 | | Expiration: January 2014, Exercise Price: $50.00 | | | 5,730 | |

| | 6,427 | | Expiration: January 2014, Exercise Price: $52.50 | | | 32,135 | |

| | 1,319 | | Expiration: April 2014, Exercise Price: $52.50 | | | 35,613 | |

| | | | Eli Lilly & Company | | | | |

| | 1,840 | | Expiration: January 2014, Exercise Price: $43.00 | | | 7,360 | |

| | 366 | | Expiration: April 2014, Exercise Price: $44.00 | | | 11,712 | |

| | | | Endo Health Solutions, Inc. | | | | |

| | 2,574 | | Expiration: April 2014, Exercise Price: $40.00 | | | 115,830 | |

| | 1,290 | | Expiration: April 2014, Exercise Price: $50.00 | | | 161,250 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2013

| Contracts (100 shares per contract) | | Value | |

| | | Equinix, Inc. | | | |

| | 574 | | Expiration: January 2014, Exercise Price: $140.00 | | $ | 15,498 | |

| | 1,687 | | Expiration: January 2014, Exercise Price: $160.00 | | | 160,265 | |

| | 1,810 | | Expiration: March 2014, Exercise Price: $145.00 | | | 389,150 | |

| | | | Financial Select Sector SPDR Fund | | | | |

| | 1,403 | | Expiration: February 2014, Exercise Price: $22.00 | | | 71,553 | |

| | | | General Motors Company | | | | |

| | 19,865 | | Expiration: March 2014, Exercise Price: $33.00 | | | 536,355 | |

| | 2,970 | | Expiration: March 2014, Exercise Price: $34.00 | | | 106,920 | |

| | 7,253 | | Expiration: March 2014, Exercise Price: $37.00 | | | 638,264 | |

| | | | Halliburton Company | | | | |

| | 21 | | Expiration: January 2014, Exercise Price: $50.00 | | | 1,323 | |

| | 10 | | Expiration: January 2014, Exercise Price: $52.50 | | | 2,105 | |

| | 2,242 | | Expiration: February 2014, Exercise Price: $47.00 | | | 143,488 | |

| | | | Hess Corporation | | | | |

| | 3,766 | | Expiration: January 2014, Exercise Price: $70.00 | | | 35,777 | |

| | 8,447 | | Expiration: February 2014, Exercise Price: $70.00 | | | 228,069 | |

| | | | Huntsman Corporation | | | | |

| | 20,165 | | Expiration: January 2014, Exercise Price: $14.00 | | | 50,412 | |

| | 28,967 | | Expiration: February 2014, Exercise Price: $18.00 | | | 144,835 | |

| | 17,797 | | Expiration: February 2014, Exercise Price: $19.00 | | | 133,477 | |

| | | | Ingersoll-Rand plc | | | | |

| | 3,257 | | Expiration: January 2014, Exercise Price: $52.50 | | | 16,285 | |

| | | | International Paper Company | | | | |

| | 12,280 | | Expiration: January 2014, Exercise Price: $40.00 | | | 55,260 | |

| | | | Iron Mountain, Inc. | | | | |

| | 12,933 | | Expiration: January 2014, Exercise Price: $17.50 | | | 32,333 | |

| | 9,640 | | Expiration: January 2014, Exercise Price: $20.00 | | | 48,200 | |

| | 4,955 | | Expiration: April 2014, Exercise Price: $20.00 | | | 86,712 | |

| | | | Lamar Advertising Company Class A | | | | |

| | 3,667 | | Expiration: January 2014, Exercise Price: $39.00 | | | 36,670 | |

| | 16,394 | | Expiration: January 2014, Exercise Price: $40.00 | | | 163,940 | |

| | 8,120 | | Expiration: April 2014, Exercise Price: $43.00 | | | 791,700 | |

| | | | LinnCo LLC | | | | |

| | 4,446 | | Expiration: February 2014, Exercise Price: $45.00 | | | 166,725 | |

| | | | Materials Select Sector SPDR Trust | | | | |

| | 317 | | Expiration: March 2014, Exercise Price: $45.00 | | | 27,103 | |

| | | | Murphy Oil Corporation | | | | |

| | 1,416 | | Expiration: January 2014, Exercise Price: $55.00 | | | 7,080 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2013

| Contracts (100 shares per contract) | | Value | |

| | | National Oilwell Varco, Inc. | | | |

| | 2,170 | | Expiration: January 2014, Exercise Price: $70.00 | | $ | 14,105 | |

| | 4,876 | | Expiration: February 2014, Exercise Price: $67.50 | | | 109,710 | |

| | 1,982 | | Expiration: February 2014, Exercise Price: $70.00 | | | 69,370 | |

| | 944 | | Expiration: May 2014, Exercise Price: $70.00 | | | 118,000 | |

| | | | Noble Corporation plc | | | | |

| | 1,048 | | Expiration: March 2014, Exercise Price: $33.00 | | | 59,736 | |

| | 14,946 | | Expiration: March 2014, Exercise Price: $34.00 | | | 1,135,896 | |

| | | | Novartis AG | | | | |

| | 4,539 | | Expiration: April 2014, Exercise Price: $70.00 | | | 226,950 | |

| | | | Occidental Petroleum Corporation | | | | |

| | 2,189 | | Expiration: January 2014, Exercise Price: $87.50 | | | 43,780 | |

| | 1,045 | | Expiration: February 2014, Exercise Price: $85.00 | | | 55,385 | |

| | 3,269 | | Expiration: February 2014, Exercise Price: $87.50 | | | 281,134 | |

| | | | Oil States International, Inc. | | | | |

| | 6,295 | | Expiration: March 2014, Exercise Price: $85.00 | | | 550,812 | |

| | 1,770 | | Expiration: March 2014, Exercise Price: $90.00 | | | 265,500 | |

| | | | ONEOK, Inc. | | | | |

| | 12 | | Expiration: January 2014, Exercise Price: $40.00 | | | 90 | |

| | 1,866 | | Expiration: January 2014, Exercise Price: $47.50 | | | 18,660 | |

| | | | Pfizer, Inc. | | | | |

| | 2,901 | | Expiration: March 2014, Exercise Price: $26.00 | | | 33,361 | |

| | 15,515 | | Expiration: March 2014, Exercise Price: $27.00 | | | 248,240 | |

| | | | QEP Resources, Inc. | | | | |

| | 22,500 | | Expiration: March 2014, Exercise Price: $25.00 | | | 843,750 | |

| | | | Safeway, Inc. | | | | |

| | 3,406 | | Expiration: January 2014, Exercise Price: $28.00 | | | 25,545 | |

| | | | SLM Corporation | | | | |

| | 2,543 | | Expiration: January 2014, Exercise Price: $18.00 | | | 2,543 | |

| | 20,873 | | Expiration: January 2014, Exercise Price: $20.00 | | | 31,310 | |

| | 3,917 | | Expiration: April 2014, Exercise Price: $20.00 | | | 54,838 | |

| | | | SPDR S&P 500 ETF Trust | | | | |

| | 4,186 | | Expiration: January 2014, Exercise Price: $184.00 | | | 590,226 | |

| | 7,485 | | Expiration: February 2014, Exercise Price: $174.00 | | | 628,740 | |

| | | | Sprint Corporation | | | | |

| | 25,879 | | Expiration: February 2014, Exercise Price: $5.00 | | | 64,698 | |

| | | | Time Warner Cable, Inc. | | | | |

| | 1,001 | | Expiration: January 2014, Exercise Price: $125.00 | | | 55,055 | |

| | 743 | | Expiration: February 2014, Exercise Price: $120.00 | | | 103,277 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2013

| Contracts (100 shares per contract) | | Value | |

| | 1,222 | | Expiration: April 2014, Exercise Price: $110.00 | | $ | 106,925 | |

| | 365 | | Expiration: April 2014, Exercise Price: $115.00 | | | 54,750 | |

| | 750 | | Expiration: April 2014, Exercise Price: $120.00 | | | 168,750 | |

| | | | The Timken Company | | | | |

| | 3,564 | | Expiration: March 2014, Exercise Price: $47.50 | | | 267,300 | |

| | | | T-Mobile U.S., Inc. | | | | |

| | 19,577 | | Expiration: January 2014, Exercise Price: $20.00 | | | 19,577 | |

| | 9,380 | | Expiration: February 2014, Exercise Price: $20.00 | | | 9,380 | |

| | 5,657 | | Expiration: February 2014, Exercise Price: $21.00 | | | 8,486 | |

| | 5,610 | | Expiration: February 2014, Exercise Price: $22.00 | | | 42,075 | |

| | 9,786 | | Expiration: February 2014, Exercise Price: $24.00 | | | 127,218 | |

| | | | Transocean, Ltd. | | | | |

| | 2,068 | | Expiration: February 2014, Exercise Price: $38.00 | | | 23,782 | |

| | 6,146 | | Expiration: February 2014, Exercise Price: $43.00 | | | 144,431 | |

| | | | Valero Energy Corporation | | | | |

| | 7,987 | | Expiration: January 2014, Exercise Price: $29.00 | | | 7,987 | |

| | 1,515 | | Expiration: March 2014, Exercise Price: $32.00 | | | 10,605 | |

| | 661 | | Expiration: March 2014, Exercise Price: $42.00 | | | 36,355 | |

| | | | Visteon Corporation | | | | |

| | 560 | | Expiration: March 2014, Exercise Price: $65.00 | | | 33,600 | |

| | | | Vivendi SA | | | | |

| | 10,151 | | Expiration: January 2014, Exercise Price: EUR 15.00 (j) | | | 13,968 | |

| | | | Vodafone Group plc — ADR | | | | |

| | 2,096 | | Expiration: January 2014, Exercise Price: $26.00 | | | 5,240 | |

| | 6,413 | | Expiration: January 2014, Exercise Price: $29.00 | | | 16,033 | |

| | 5,381 | | Expiration: January 2014, Exercise Price: $33.00 | | | 13,452 | |

| | 3,362 | | Expiration: April 2014, Exercise Price: $30.00 | | | 33,620 | |

| | 5,372 | | Expiration: April 2014, Exercise Price: $33.00 | | | 134,300 | |

| | | | Weyerhaeuser Company | | | | |

| | 6,575 | | Expiration: April 2014, Exercise Price: $24.00 | | | 98,625 | |

| | | | Williams Companies, Inc. | | | | |

| | 2,597 | | Expiration: January 2014, Exercise Price: $30.00 | | | 15,582 | |

| | 14,924 | | Expiration: February 2014, Exercise Price: $30.00 | | | 119,392 | |

| | | | TOTAL PURCHASED PUT OPTIONS (Cost $50,373,482) | | | 22,839,508 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2013

| Principal Amount | | Value | |

| ESCROW NOTES — 0.39% | | | |

| $ | 1,243,406 | | AMR Corporation (a)(d)(k) | | $ | 16,667,124 | |

| | 13,887,000 | | Dallas Fort Worth Texas International Airport (a)(d)(k) | | | 3,033,238 | |

| | | | TOTAL ESCROW NOTES (Cost $15,954,063) | | | 19,700,362 | |

| Shares | | | | | | |

| SHORT-TERM INVESTMENTS — 25.82% | | | | |

| | 283,000,000 | | BlackRock Liquidity Funds TempFund | | | | |

| | | | Portfolio Institutional Share Class, 0.05% (c)(h) | | | 283,000,000 | |

| | 283,000,000 | | Fidelity Institutional Government | | | | |

| | | | Portfolio Institutional Share Class, 0.03% (c)(f) | | | 283,000,000 | |

| | 161,139,106 | | Fidelity Institutional Money Market | | | | |

| | | | Portfolio Institutional Share Class, 0.01% (c)(f) | | | 161,139,106 | |

| | 283,000,000 | | Goldman Sachs Financial Square Money | | | | |

| | | | Market Fund Institutional Share Class, 0.06% (c)(g) | | | 283,000,000 | |

| | 285,000,000 | | The Liquid Asset Portfolio | | | | |

| | | | Institutional Share Class, 0.07% (c)(g) | | | 285,000,000 | |

| | | | TOTAL SHORT-TERM INVESTMENTS (Cost $1,295,139,106) | | | 1,295,139,106 | |

| | | | TOTAL INVESTMENTS (Cost $4,849,434,338) — 102.49% | | $ | 5,139,857,120 | |

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

EUR – Euro

plc – Public Limited Company

REIT – Real Estate Investment Trust

| (a) | Non-income producing security. |

| (c) | The rate quoted is the annualized seven-day yield as of December 31, 2013. |

| (d) | Security fair valued by the Adviser in good faith in accordance with the policies adopted by the Board of Trustees. |

| (e) | All or a portion of the shares have been committed as collateral for open securities sold short. |

| (f) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (g) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (h) | All or a portion of the shares have been committed as collateral for forward currency exchange contracts. |

| (i) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of December 31, 2013, these securities represented 0.71% of total net assets. |

| (j) | Level 2 security. Please see Note 2 on the Notes to the Financial Statements. |

| (k) | Level 3 security. Please see Note 2 on the Notes to the Financial Statements. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Funds Services, LLC.

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF SECURITIES SOLD SHORT

December 31, 2013

| Shares | | | | Value | |

| COMMON STOCKS | | | |

| | 764,784 | | American Realty Capital Properties, Inc. | | $ | 9,835,122 | |

| | 697,275 | | Applied Materials, Inc. | | | 12,334,795 | |

| | 362,725 | | Comcast Corporation Class A | | | 18,849,005 | |

| | 147,626 | | Community Health Systems, Inc. | | | 5,797,273 | |

| | 201,754 | | Discovery Communications, Inc. Class A | | | 18,242,597 | |

| | 762,261 | | Fidelity National Financial, Inc. | | | 24,735,370 | |

| | 189,793 | | Liberty Global plc Class A (b) | | | 16,889,679 | |

| | 390,828 | | Loblaw Companies Ltd. (b)(c) | | | 15,599,900 | |

| | 776,580 | | M&T Bank Corporation | | | 90,409,443 | |

| | 74,599 | | PacWest Bancorp | | | 3,149,570 | |

| | 469,992 | | Plains All American Pipeline, LP | | | 24,331,486 | |

| | 155,460 | | Regency Energy Partners, LP | | | 4,082,379 | |

| | 1,924,208 | | Twenty-First Century Fox, Inc. Class A | | | 67,693,637 | |

| | 2,765,734 | | Umpqua Holdings Corporation | | | 52,936,149 | |

| | | | | | | 364,886,405 | |

| | | | | |

| CONTINGENT VALUE RIGHTS | | | | |

| | 2,179,854 | | Health Management Associates, Inc. (a)(d) | | | 217,985 | |

| | | | | |

| EXCHANGE-TRADED FUNDS | | | | |

| | 46,609 | | SPDR S&P 500 ETF Trust | | | 8,607,284 | |

| | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | (Proceeds $336,340,606) | | $ | 373,711,674 | |

ETF – Exchange-Traded Fund

plc – Public Limited Company

| (a) | Security fair valued by the Adviser in good faith in accordance with the policies adopted by the Board of Trustees. |

| (c) | Level 2 security. Please see Note 2 on the Notes to the Financial Statements. |

| (d) | Level 3 security. Please see Note 2 on the Notes to the Financial Statements. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN

December 31, 2013

| Contracts (100 shares per contract) | | Value | |

| CALL OPTIONS WRITTEN | | | |

| | | American Airlines Group, Inc. | | | |

| | 6,814 | | Expiration: February 2014, Exercise Price: $30.00 | | $ | 136,280 | |

| | 5,927 | | Expiration: March 2014, Exercise Price: $30.00 | | | 237,080 | |

| | 4,294 | | Expiration: April 2014, Exercise Price: $24.00 | | | 1,223,790 | |

| | | | American International Group, Inc. | | | | |

| | 3,500 | | Expiration: January 2014, Exercise Price: $46.00 | | | 1,767,500 | |

| | 5,473 | | Expiration: January 2014, Exercise Price: $47.00 | | | 2,243,930 | |

| | 7,389 | | Expiration: January 2014, Exercise Price: $50.00 | | | 1,078,794 | |

| | 10,514 | | Expiration: February 2014, Exercise Price: $47.00 | | | 4,810,155 | |

| | | | Andarko Petroleum Corporation | | | | |

| | 633 | | Expiration: February 2014, Exercise Price: $77.50 | | | 278,520 | |

| | 1,082 | | Expiration: February 2014, Exercise Price: $85.00 | | | 137,414 | |

| | 4,527 | | Expiration: February 2014, Exercise Price: $87.50 | | | 339,525 | |

| | 3,596 | | Expiration: February 2014, Exercise Price: $90.00 | | | 154,628 | |

| | | | Ashland, Inc. | | | | |

| | 5,487 | | Expiration: January 2014, Exercise Price: $85.00 | | | 6,666,705 | |

| | 1,061 | | Expiration: April 2014, Exercise Price: $90.00 | | | 1,007,950 | |

| | | | AT&T, Inc., | | | | |

| | 773 | | Expiration: January 2014, Exercise Price: $35.00 | | | 28,215 | |

| | | | BP plc — ADR | | | | |

| | 252 | | Expiration: January 2014, Exercise Price: $42.00 | | | 166,950 | |

| | 3,274 | | Expiration: February 2014, Exercise Price: $45.00 | | | 1,227,750 | |

| | 4,964 | | Expiration: February 2014, Exercise Price: $47.00 | | | 992,800 | |

| | | | Chemtura Corporation | | | | |

| | 8,359 | | Expiration: March 2014, Exercise Price: $25.00 | | | 2,925,650 | |

| | | | CommonWealth REIT | | | | |

| | 11,725 | | Expiration: January 2014, Exercise Price: $22.50 | | | 1,231,125 | |

| | | | CONSOL Energy, Inc. | | | | |

| | 9,474 | | Expiration: January 2014, Exercise Price: $36.00 | | | 2,160,072 | |

| | 4,739 | | Expiration: April 2014, Exercise Price: $36.00 | | | 1,765,278 | |

| | | | Corrections Corporation of America | | | | |

| | 805 | | Expiration: January 2014, Exercise Price: $33.00 | | | 18,113 | |

| | 1,213 | | Expiration: March 2014, Exercise Price: $32.00 | | | 169,820 | |

| | 6,700 | | Expiration: March 2014, Exercise Price: $33.00 | | | 636,500 | |

| | | | DISH Network Corporation Class A | | | | |

| | 2,079 | | Expiration: January 2014, Exercise Price: $45.00 | | | 2,692,305 | |

| | 3,462 | | Expiration: March 2014, Exercise Price: $50.00 | | | 3,254,280 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN (continued)

December 31, 2013

| Contracts (100 shares per contract) | | Value | |

| | | Dover Corporation | | | |

| | 2,785 | | Expiration: March 2014, Exercise Price: $90.00 | | $ | 2,228,000 | |

| | | | The Dow Chemical Company | | | | |

| | 6,475 | | Expiration: March 2014, Exercise Price: $37.00 | | | 5,050,500 | |

| | | | E.I. Du Pont de Nemours & Company | | | | |

| | 1,402 | | Expiration: January 2014, Exercise Price: $57.50 | | | 1,058,510 | |

| | 6,427 | | Expiration: January 2014, Exercise Price: $60.00 | | | 3,277,770 | |

| | 1,649 | | Expiration: April 2014, Exercise Price: $60.00 | | | 934,983 | |

| | | | Eli Lilly & Company | | | | |

| | 1,840 | | Expiration: January 2014, Exercise Price: $48.00 | | | 570,400 | |

| | 457 | | Expiration: April 2014, Exercise Price: $49.00 | | | 131,159 | |

| | | | Endo Health Solutions, Inc. | | | | |

| | 2,574 | | Expiration: April 2014, Exercise Price: $55.00 | | | 3,729,726 | |

| | 1,290 | | Expiration: April 2014, Exercise Price: $60.00 | | | 1,354,500 | |

| | | | Equinix, Inc. | | | | |

| | 574 | | Expiration: January 2014, Exercise Price: $160.00 | | | 1,027,460 | |

| | 1,687 | | Expiration: January 2014, Exercise Price: $180.00 | | | 527,188 | |

| | 2,010 | | Expiration: March 2014, Exercise Price: $165.00 | | | 3,547,650 | |

| | | | General Motors Company | | | | |

| | 19,865 | | Expiration: March 2014, Exercise Price: $37.00 | | | 9,137,900 | |

| | 12,337 | | Expiration: March 2014, Exercise Price: $40.00 | | | 3,244,631 | |

| | | | Halliburton Company | | | | |

| | 31 | | Expiration: January 2014, Exercise Price: $55.00 | | | 279 | |

| | 2,242 | | Expiration: February 2014, Exercise Price: $50.00 | | | 531,354 | |

| | | | Hess Corporation | | | | |

| | 3,766 | | Expiration: January 2014, Exercise Price: $80.00 | | | 1,327,515 | |

| | 8,678 | | Expiration: February 2014, Exercise Price: $77.50 | | | 5,705,785 | |

| | | | Huntsman Corporation | | | | |

| | 38 | | Expiration: January 2014, Exercise Price: $18.00 | | | 25,080 | |

| | 28,967 | | Expiration: February 2014, Exercise Price: $21.00 | | | 11,007,460 | |

| | 17,797 | | Expiration: February 2014, Exercise Price: $22.00 | | | 4,983,160 | |

| | | | Ingersoll-Rand plc | | | | |

| | 3,840 | | Expiration: January 2014, Exercise Price: $60.00 | | | 6,270,720 | |

| | | | International Paper Company | | | | |

| | 12,280 | | Expiration: January 2014, Exercise Price: $44.00 | | | 6,232,100 | |

| | | | Iron Mountain, Inc. | | | | |

| | 5,755 | | Expiration: April 2014, Exercise Price: $25.00 | | | 3,510,550 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN (continued)

December 31, 2013

| Contracts (100 shares per contract) | | Value | |

| | | Koninklijke KPN NV | | | |

| | 72,960 | | Expiration: February 2014, Exercise Price: EUR 2.20 (a) | | $ | 1,907,028 | |

| | 71,219 | | Expiration: February 2014, Exercise Price: EUR 2.30 (a) | | | 1,175,683 | |

| | | | Lamar Advertising Company Class A | | | | |

| | 13,485 | | Expiration: January 2014, Exercise Price: $46.00 | | | 8,765,250 | |

| | 8,817 | | Expiration: April 2014, Exercise Price: $48.00 | | | 5,202,030 | |

| | 6,576 | | Expiration: April 2014, Exercise Price: $49.00 | | | 3,288,000 | |

| | | | Leap Wireless International, Inc. | | | | |

| | 24,084 | | Expiration: January 2014, Exercise Price: $16.00 | | | 3,468,096 | |

| | 3,904 | | Expiration: January 2014, Exercise Price: $17.00 | | | 175,680 | |

| | 275 | | Expiration: April 2014, Exercise Price: $16.00 | | | 44,000 | |

| | | | LinnCo LLC | | | | |

| | 8,892 | | Expiration: February 2014, Exercise Price: $50.00 | | | 2,356,380 | |

| | | | Murphy Oil Corporation | | | | |

| | 1,416 | | Expiration: January 2014, Exercise Price: $65.00 | | | 1,482,552 | |

| | | | National Oilwell Varco, Inc. | | | | |

| | 2,468 | | Expiration: January 2014, Exercise Price: $77.50 | | | 624,404 | |

| | 1,219 | | Expiration: February 2014, Exercise Price: $77.50 | | | 463,220 | |

| | 3,962 | | Expiration: February 2014, Exercise Price: $80.00 | | | 935,032 | |

| | 1,982 | | Expiration: February 2014, Exercise Price: $82.50 | | | 265,588 | |

| | 1,260 | | Expiration: May 2014, Exercise Price: $77.50 | | | 661,500 | |

| | | | Noble Corporation plc | | | | |

| | 1,309 | | Expiration: March 2014, Exercise Price: $35.00 | | | 425,425 | |

| | 8,592 | | Expiration: March 2014, Exercise Price: $36.00 | | | 2,251,104 | |

| | 8,596 | | Expiration: March 2014, Exercise Price: $37.00 | | | 1,753,584 | |

| | | | NorthStar Realty Finance Corporation | | | | |

| | 10,675 | | Expiration: March 2014, Exercise Price: $11.00 | | | 2,615,375 | |

| | 11,433 | | Expiration: March 2014, Exercise Price: $12.50 | | | 1,349,094 | |

| | | | Novartis AG – ADR | | | | |

| | 4,539 | | Expiration: April 2014, Exercise Price: $75.00 | | | 2,564,535 | |

| | | | Occidental Petroleum Corporation | | | | |

| | 2,189 | | Expiration: January 2014, Exercise Price: $95.00 | | | 400,587 | |

| | 1,045 | | Expiration: February 2014, Exercise Price: $92.50 | | | 485,925 | |

| | 3,269 | | Expiration: February 2014, Exercise Price: $95.00 | | | 1,062,425 | |

| | | | Oil States International, Inc. | | | | |

| | 1,024 | | Expiration: March 2014, Exercise Price: $95.00 | | | 962,560 | |

| | 6,631 | | Expiration: March 2014, Exercise Price: $100.00 | | | 3,978,600 | |

| | 891 | | Expiration: March 2014, Exercise Price: $105.00 | | | 338,580 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN (continued)

December 31, 2013

| Contracts (100 shares per contract) | | Value | |

| | | ONEOK, Inc. | | | |

| | 12 | | Expiration: January 2014, Exercise Price: $50.00 | | $ | 14,640 | |

| | 1,866 | | Expiration: January 2014, Exercise Price: $52.50 | | | 1,806,288 | |

| | | | Pfizer, Inc. | | | | |

| | 3,223 | | Expiration: March 2014, Exercise Price: $30.00 | | | 377,091 | |

| | 15,515 | | Expiration: March 2014, Exercise Price: $31.00 | | | 985,202 | |

| | | | QEP Resources, Inc. | | | | |

| | 21,515 | | Expiration: March 2014, Exercise Price: $30.00 | | | 4,733,300 | |

| | | | Safeway, Inc. | | | | |

| | 3,406 | | Expiration: January 2014, Exercise Price: $32.00 | | | 374,660 | |

| | | | SLM Corporation | | | | |

| | 20,873 | | Expiration: January 2014, Exercise Price: $25.00 | | | 2,932,656 | |

| | 3,917 | | Expiration: April 2014, Exercise Price: $25.00 | | | 736,396 | |

| | | | Sprint Corporation | | | | |

| | 9,929 | | Expiration: February 2014, Exercise Price: $6.00 | | | 4,716,275 | |

| | 18,168 | | Expiration: February 2014, Exercise Price: $7.00 | | | 6,903,840 | |

| | | | Time Warner Cable, Inc. | | | | |

| | 1,112 | | Expiration: January 2014, Exercise Price: $130.00 | | | 711,680 | |

| | 743 | | Expiration: February 2014, Exercise Price: $135.00 | | | 393,790 | |

| | 2,443 | | Expiration: April 2014, Exercise Price: $125.00 | | | 3,268,734 | |

| | 2,231 | | Expiration: April 2014, Exercise Price: $130.00 | | | 2,175,225 | |

| | | | The Timken Company | | | | |

| | 3,749 | | Expiration: March 2014, Exercise Price: $52.50 | | | 1,612,070 | |

| | 925 | | Expiration: March 2014, Exercise Price: $55.00 | | | 263,625 | |

| | | | T-Mobile U.S., Inc. | | | | |

| | 9,787 | | Expiration: January 2014, Exercise Price: $23.00 | | | 10,413,368 | |

| | 7,803 | | Expiration: February 2014, Exercise Price: $24.00 | | | 7,522,092 | |

| | 9,122 | | Expiration: February 2014, Exercise Price: $25.00 | | | 7,958,945 | |

| | 2,135 | | Expiration: February 2014, Exercise Price: $26.00 | | | 1,705,865 | |

| | 11,754 | | Expiration: February 2014, Exercise Price: $28.00 | | | 6,876,090 | |

| | | | Transocean, Ltd. | | | | |

| | 2 | | Expiration: February 2014, Exercise Price: $43.00 | | | 1,300 | |

| | 2,080 | | Expiration: February 2014, Exercise Price: $47.00 | | | 644,800 | |

| | 4,066 | | Expiration: February 2014, Exercise Price: $48.00 | | | 1,008,368 | |

| | | | Umpqua Holdings Corporation | | | | |

| | 46 | | Expiration: March 2014, Exercise Price: $15.00 | | | 19,044 | |

| | | | Valero Energy Corporation | | | | |

| | 30 | | Expiration: January 2014, Exercise Price: $33.00 | | | 52,275 | |

| | 46 | | Expiration: January 2014, Exercise Price: $34.00 | | | 75,555 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN (continued)

December 31, 2013

| Contracts (100 shares per contract) | | Value | |

| | | Valero Energy Corporation (continued) | | | |

| | 2,331 | | Expiration: March 2014, Exercise Price: $36.00 | | $ | 3,384,612 | |

| | 734 | | Expiration: March 2014, Exercise Price: $45.00 | | | 466,824 | |

| | | | Verizon Communications, Inc. | | | | |

| | 1,730 | | Expiration: April 2014, Exercise Price: $43.00 | | | 1,062,220 | |

| | | | Visteon Corporation | | | | |

| | 700 | | Expiration: March 2014, Exercise Price: $75.00 | | | 616,000 | |

| | | | Vivendi SA | | | | |

| | 10,151 | | Expiration: January 2014, Exercise Price: EUR 17.50 (a) | | | 2,374,014 | |

| | | | Vodafone Group plc — ADR | | | | |

| | 12 | | Expiration: January 2014, Exercise Price: $31.00 | | | 9,972 | |

| | 68 | | Expiration: January 2014, Exercise Price: $34.00 | | | 36,108 | |

| | 2,523 | | Expiration: January 2014, Exercise Price: $35.00 | | | 1,092,459 | |

| | 5,381 | | Expiration: January 2014, Exercise Price: $37.00 | | | 1,264,535 | |

| | 2,709 | | Expiration: April 2014, Exercise Price: $36.00 | | | 1,097,145 | |

| | 9,375 | | Expiration: April 2014, Exercise Price: $37.00 | | | 3,093,750 | |

| | | | Weyerhaeuser Company | | | | |

| | 6,575 | | Expiration: April 2014, Exercise Price: $29.00 | | | 2,005,375 | |

| | | | Williams Companies, Inc. | | | | |

| | 2,597 | | Expiration: January 2014, Exercise Price: $34.00 | | | 1,212,799 | |

| | 14,924 | | Expiration: February 2014, Exercise Price: $34.00 | | | 7,238,140 | |

| | | | | | �� | 255,004,873 | |

| PUT OPTIONS WRITTEN | | | | |

| | | | American Realty Capital Properties, Inc. | | | | |

| | 1,529 | | Expiration: April 2014, Exercise Price: $12.50 | | | 107,030 | |

| | | | SPDR S&P 500 ETF Trust | | | | |

| | 2,807 | | Expiration: January 2014, Exercise Price: $174.00 | | | 67,368 | |

| | 5,614 | | Expiration: February 2014, Exercise Price: $169.00 | | | 286,314 | |

| | | | | | | 460,712 | |

| | | | TOTAL OPTIONS WRITTEN | | | | |

| | | | (Premiums received $185,389,161) | | $ | 255,465,585 | |

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

EUR – Euro

plc – Public Limited Company

REIT – Real Estate Investment Trust

| (a) | Level 2 security. Please see Note 2 on the Notes to the Financial Statements. |

The accompanying notes are an integral part of these financial statements.